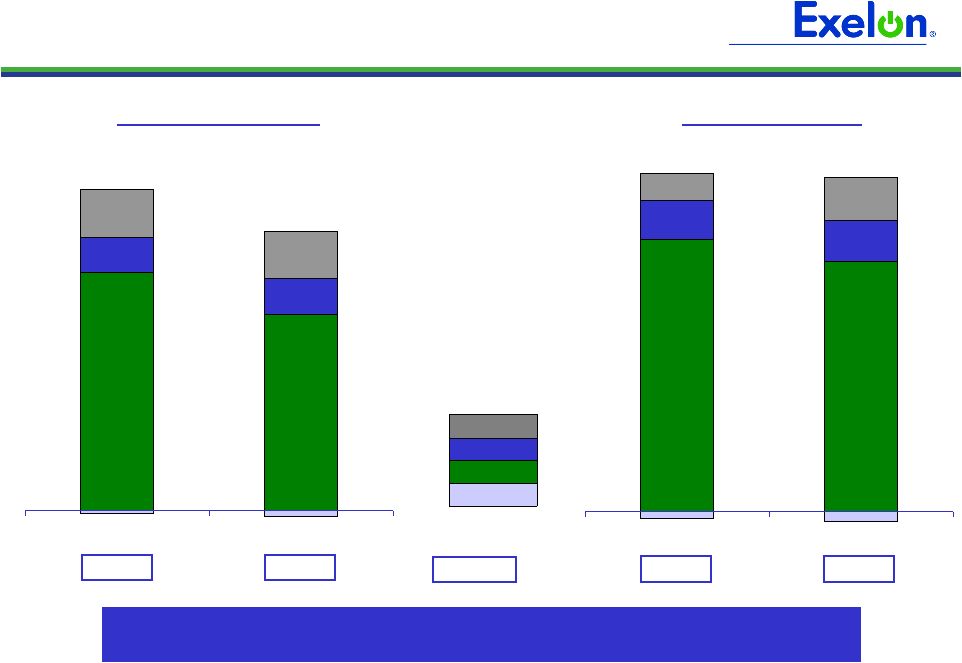

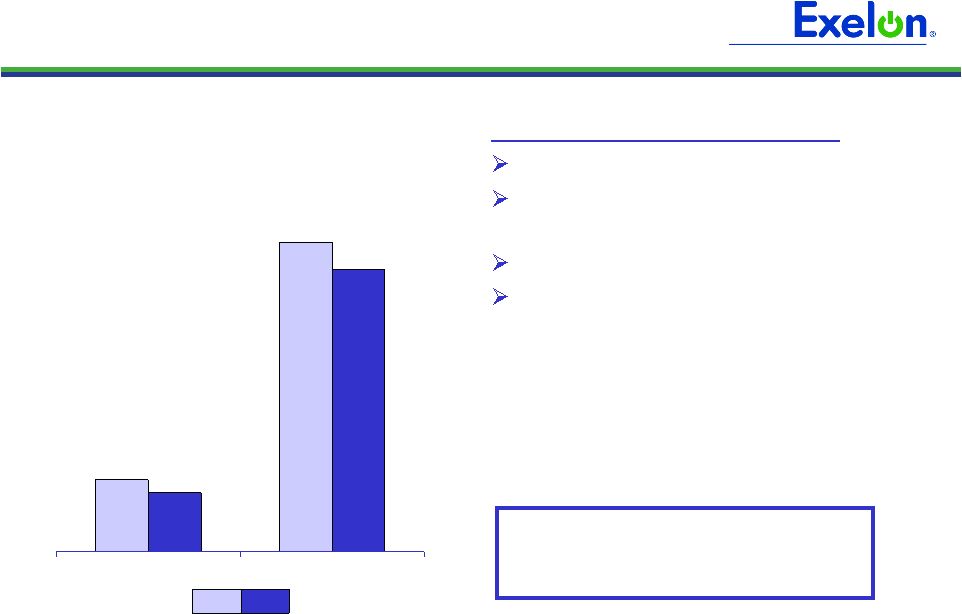

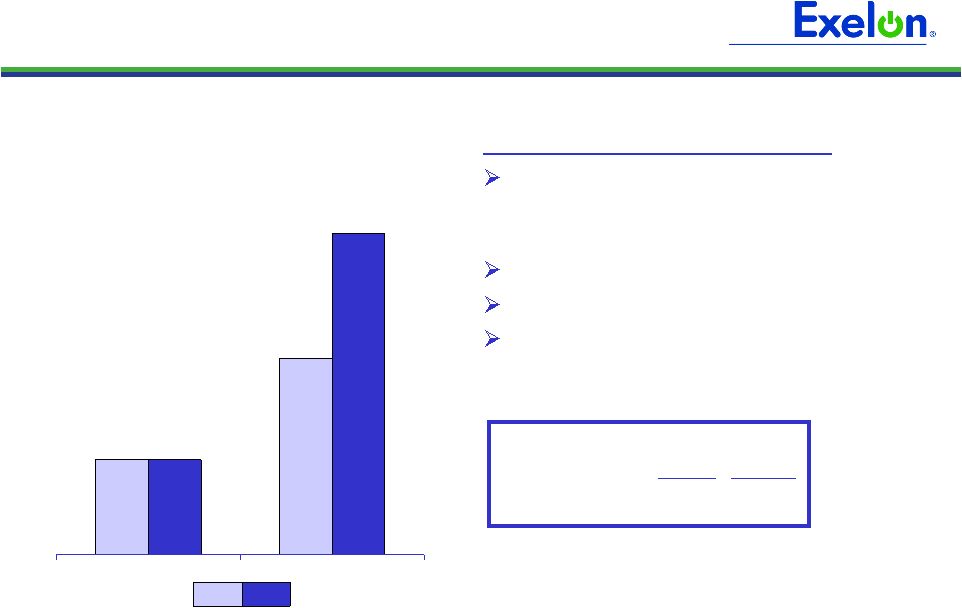

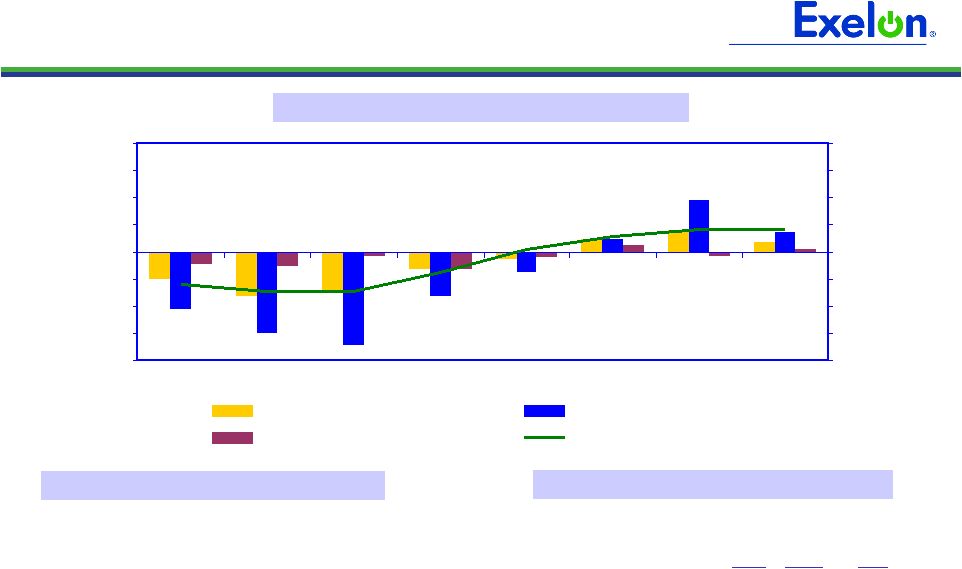

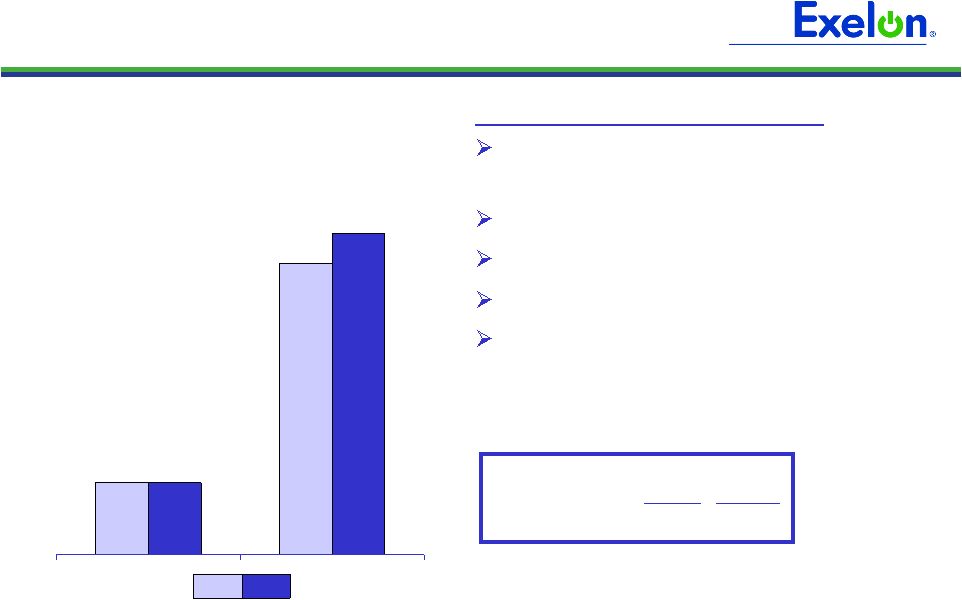

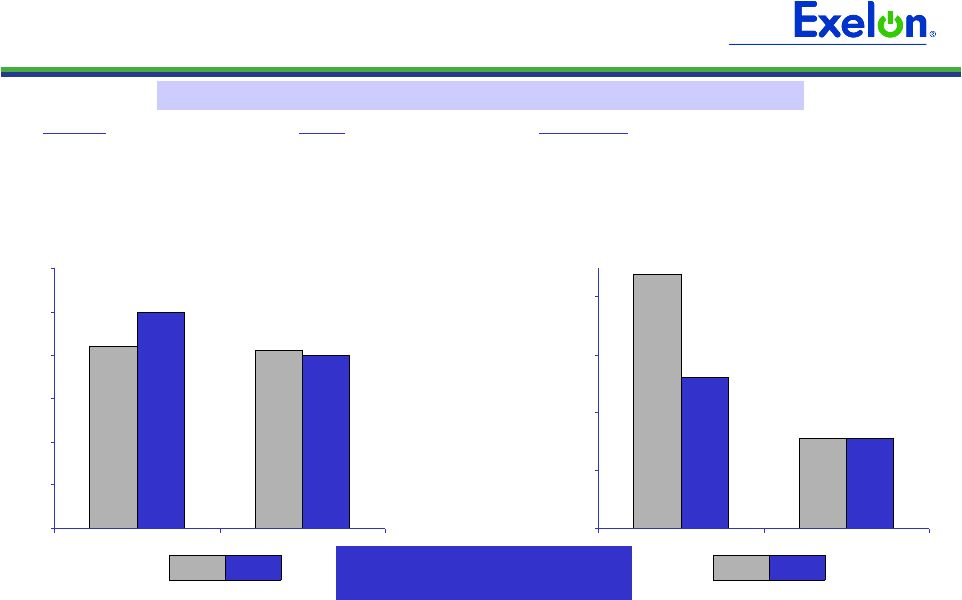

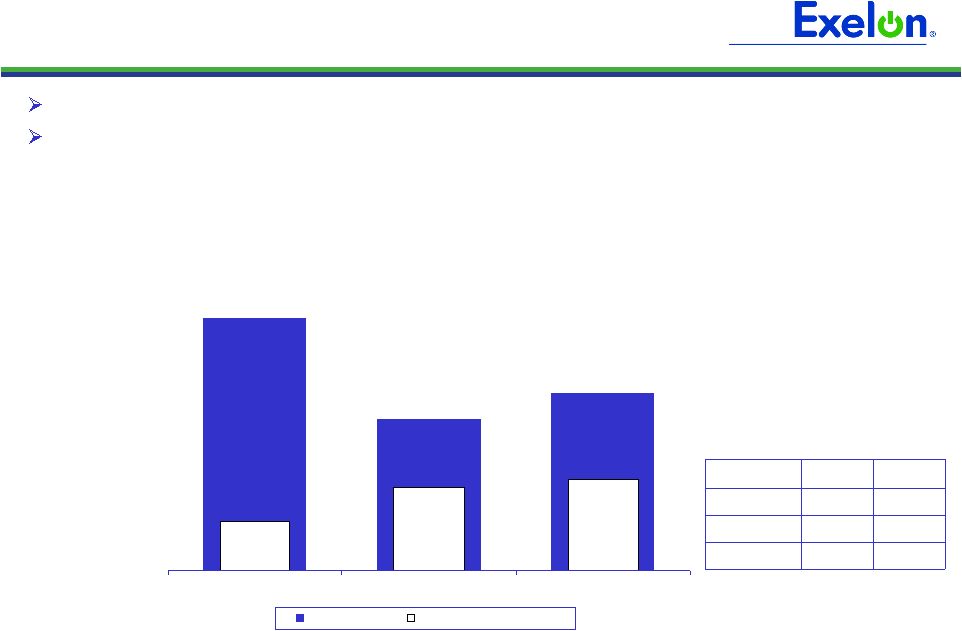

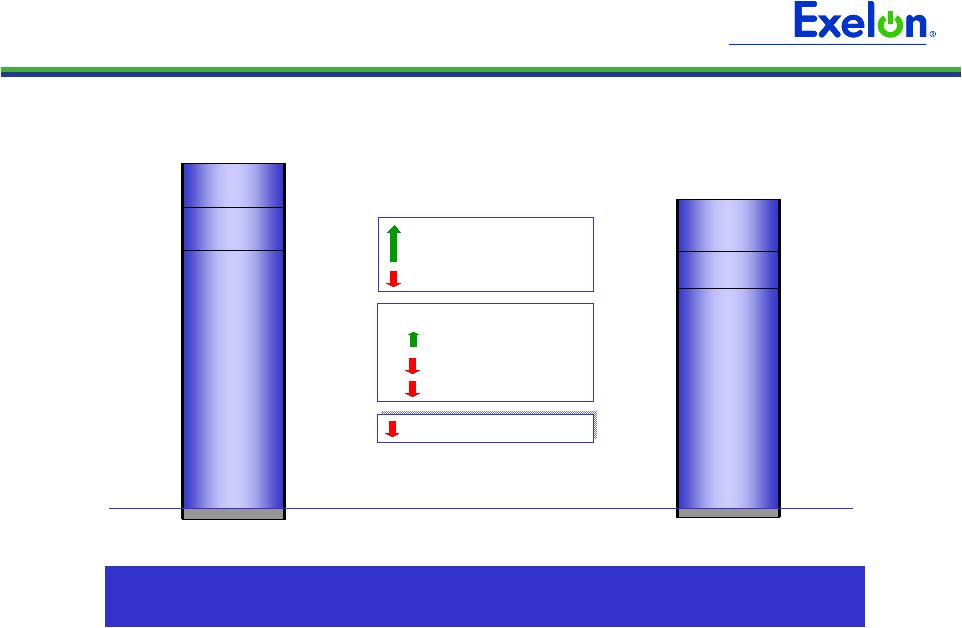

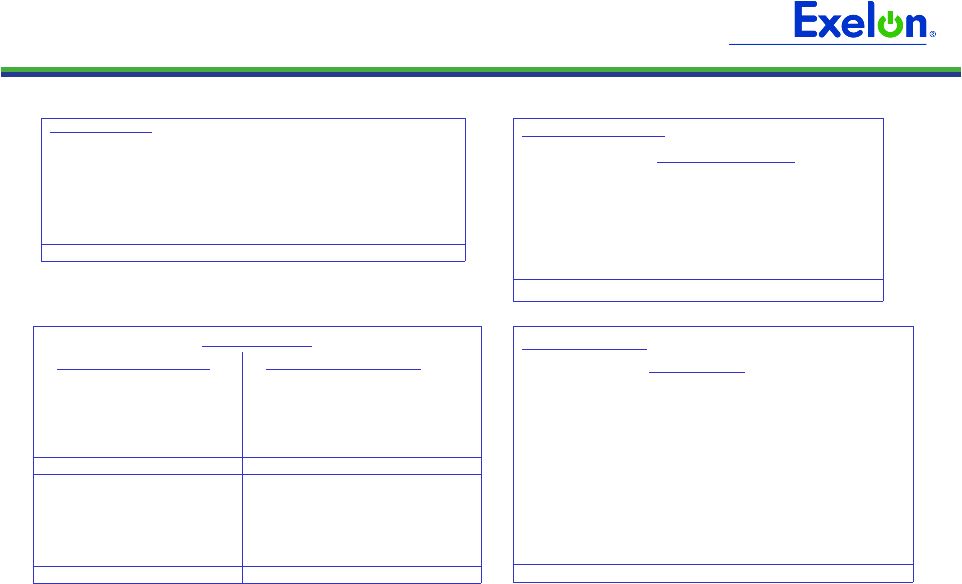

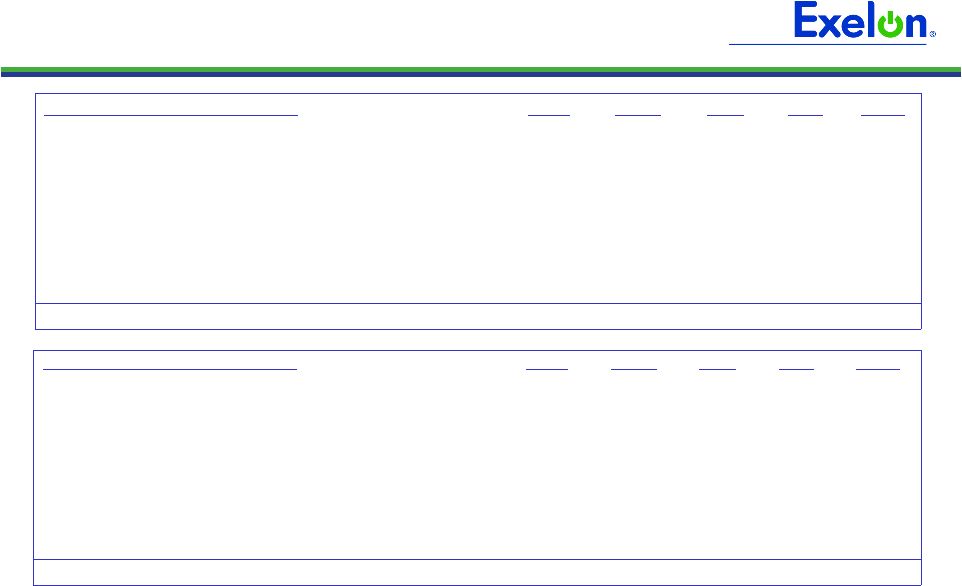

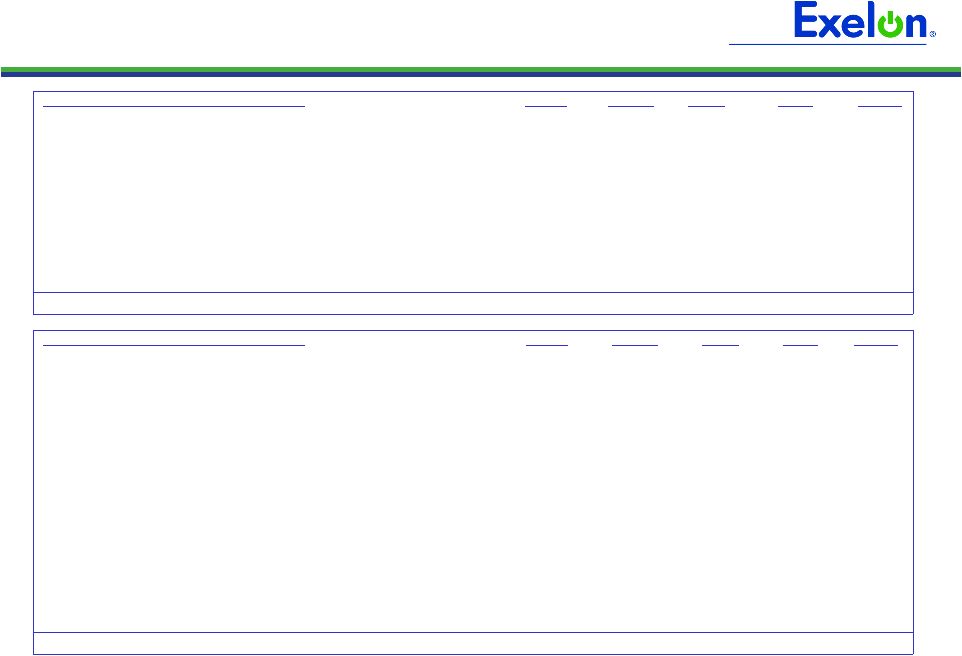

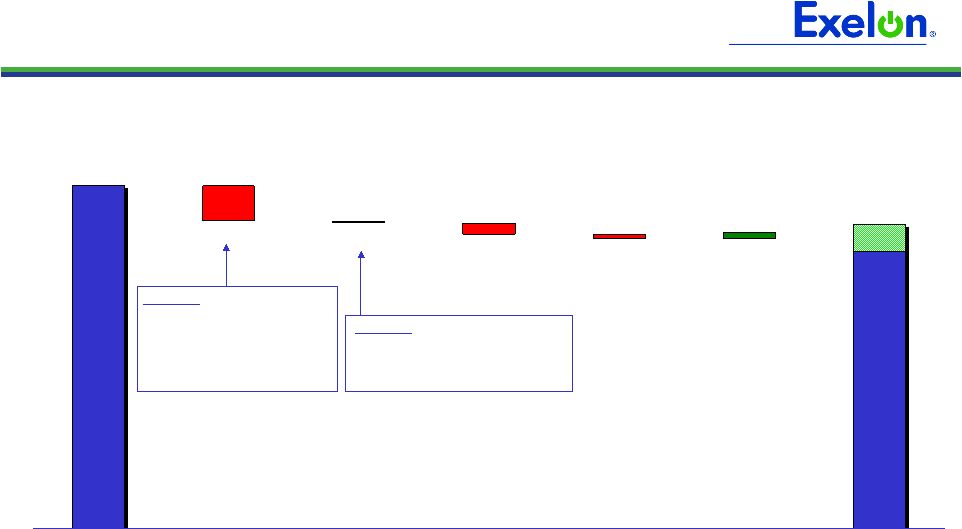

21 YTD GAAP EPS Reconciliation 0.16 - - - 0.16 Mark-to-market adjustments from economic hedging activities (0.05) - - - (0.05) Retirement of fossil generating units (0.01) - - (0.01) - City of Chicago settlement with ComEd (0.10) - - (0.01) (0.09) 2007 Illinois electric rate settlement (0.11) (0.04) - - (0.07) Costs associated with early debt retirements (0.20) - - - (0.20) Impairment of certain generating assets (0.03) - (0.00) (0.02) (0.01) 2009 severance charges 0.05 - - - 0.05 Nuclear decommissioning obligation reduction (0.03) (0.03) - - - NRG acquisition costs 0.19 - - - 0.19 Unrealized gains related to nuclear decommissioning trust funds 0.10 (0.02) - 0.06 0.06 Non-cash remeasurement of income tax uncertainties and reassessment of state deferred income taxes $4.09 $(0.21) $0.53 $0.56 $3.21 FY 2009 GAAP Earnings (Loss) Per Share $4.12 $(0.12) $0.54 $0.54 $3.16 2009 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share Exelon Other PECO ComEd ExGen Twelve Months Ended December 31, 2009 NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not add due to rounding. (0.02) - - (0.02) - City of Chicago settlement with ComEd (0.02) (0.02) - - - NRG acquisition costs 0.03 - - - 0.03 Settlement of tax matter at Generation related to Sithe 0.02 - - - 0.02 Decommissioning obligation reduction $4.13 $(0.10) $0.49 $0.30 $3.44 YTD 2008 GAAP Earnings (Loss) Per Share $4.20 $(0.08) $0.49 $0.33 $3.46 2008 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share (0.22) - - (0.01) (0.21) 2007 Illinois electric rate settlement 0.41 - - - 0.41 Mark-to-market adjustments from economic hedging activities (0.27) - - - (0.27) Unrealized losses related to nuclear decommissioning trust funds Exelon Other PECO ComEd ExGen Twelve Months Ended December 31, 2008 |