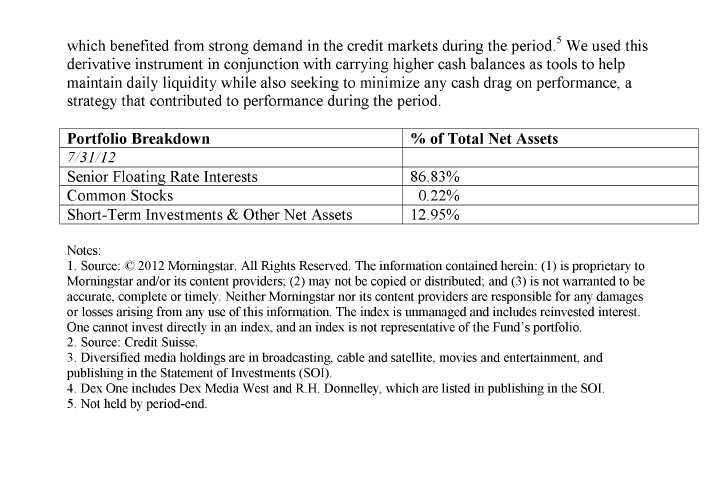

Franklin Floating Rate Master Series Annual Report

Manager's Discussion of Fund Performance

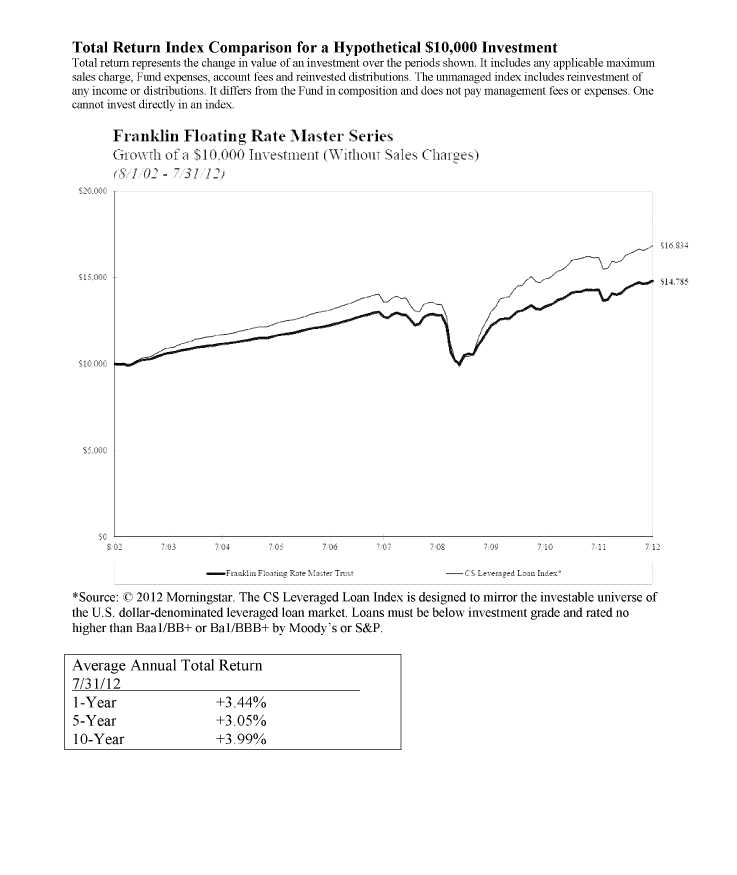

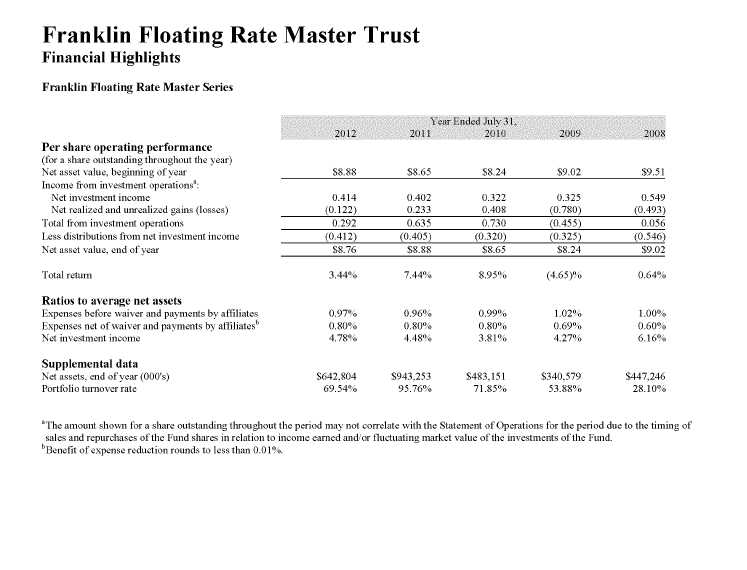

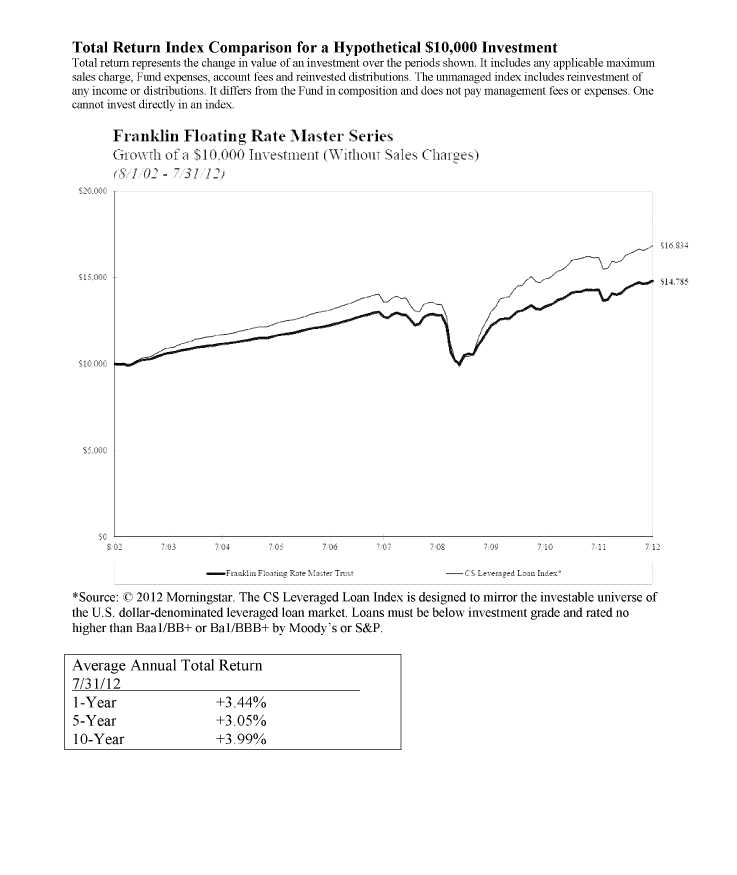

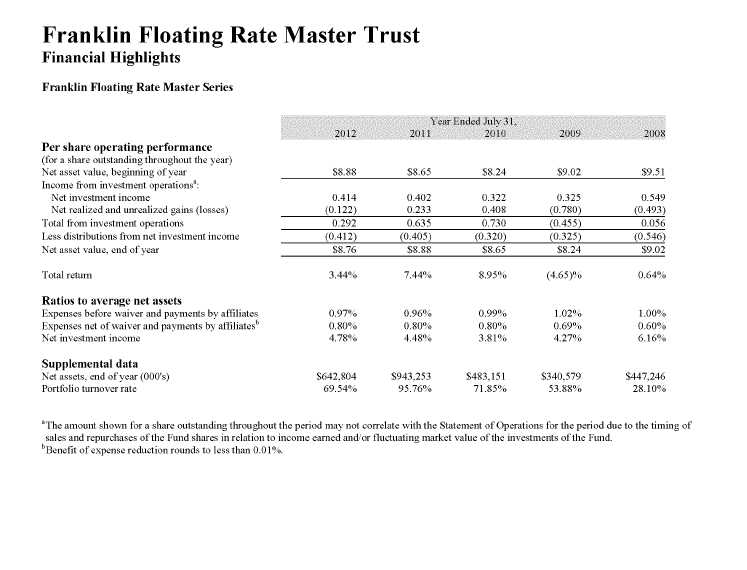

During the fiscal year ended July 31,2012, the Fund delivered a +3.44% total return,

underperforming the +4.16% total return of its benchmark, the Credit Suisse (CS)

Leveraged Loan Index (LLI), which is designed to mirror the investable universe of the

US. dollar -denominated leveraged loan market. 1 Although our higher credit quality focus

(in BB-rated loans) and overall defensive positioning contributed to the Fund's

performance earlier in the period when higher risk credits (B-rated loans and below)

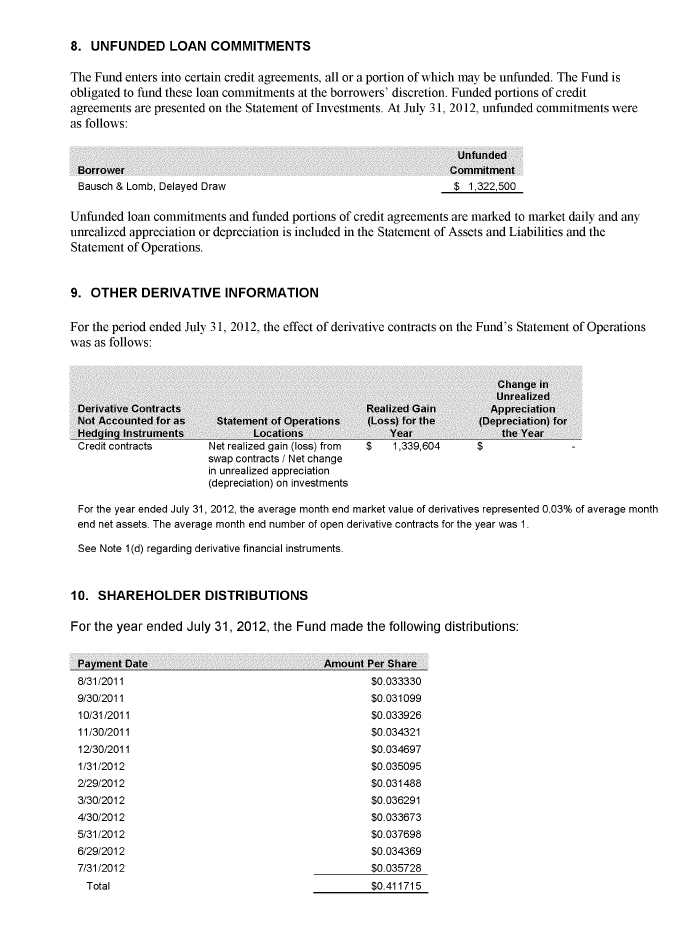

underperformed, our higher credit quality focus detracted from overall performance as

lower rated loans rebounded in the second half of the period. For the one-year period ended

July 31,2012, BB-rated loans returned +4.49%, B- rated loans returned +5.16%, and

CCC/Split CCC had a -1.21 % total return, as measured by the CS LLI.2 The Fund's

underperformance relative to the CS LLI was also partly the result of forced selling to

maintain liquidity for shareholder redemptions.

The Fund's one-year performance was also negatively affected by individual loan selection

particularly within the diversified media industry, with term loans of Dex One, a print and

online marketing provider, declining in value for the period.3, 4 Dex One's term loans were

among our highest yielding investments, but they fell in value during the period's first half

amid a continued downward trend in advertising sales and worries over the company's

long-term prospects. However, Dex One's term loans recovered and were among the top

performance contributors in the period's second half as the company continued to generate

free cash flow and pay down debt. The company also benefited from an amendment that

allowed the purchase of its existing debt at a deep discount, which gave a floor to loan

valuations and additional headroom with regard to managing its debt service and liquidity.

Within the diversified media industry, the Fund also benefited from its investment during

the period in the 2013 term loan of Media General, a communications company that owns

several southeastern US. newspapers and television stations, along with associated digital

and mobile media services.5 The Fund invested in the term loan at a meaningful discount

to par with the expectation of the company's possible term-loan refinancing, taking

encouragement from the term loan's asset coverage from its collateral, particularly the

valuation of the company's television stations. Our investment in the term loan was among

the top performers for the Fund during the period. Our investment thesis played out as the

company sold its newspaper division, with the exception of the Tampa group, to Berkshire

Hathaway (not a Fund holding) and also received a line of credit to repay all existing bank

loans at par.

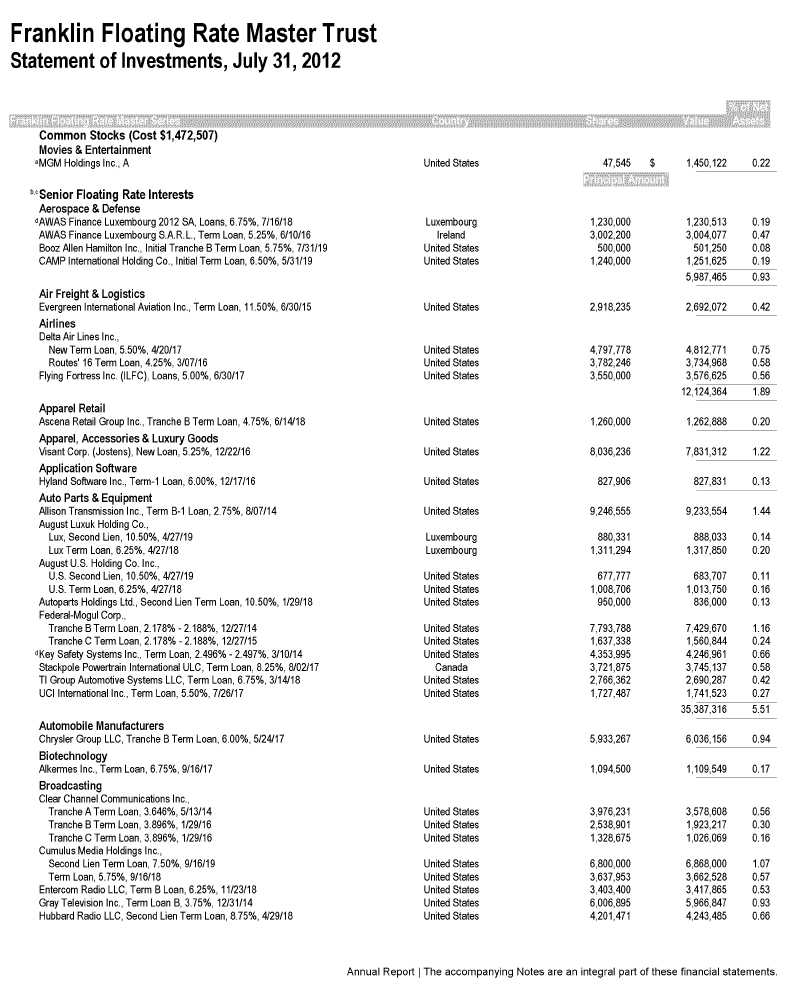

Other key contributors were generally the more liquid and higher beta loans that continued

to rebound sharply after being oversold, in our view, by the broader market at the

beginning of the period. They included term loans of Cumulus Media, the second-largest

owner of radio stations in the US., and Caesars Entertainment Operating Co., the primary

subsidiary of Caesars Entertainment, one of the world's largest casino operators. Further

boosting performance was our position in the Markit CDX North American High Yield

Index, a tradable index of 100 equally weighted high yield bond credit default swaps,

Your Fund's Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases, if any; and

- Ongoing Fund costs, including management fees, distribution and service (l2b-l) fees, if any, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) listed in the table provides actual account values and expenses. The "Ending Account Value" is derived from the Fund's actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

1. Divide your account value by $1,000.

If an account had an $8,600 value, then $8,600 7- $1, 000 = 8.6.

2. Multiply the result by the number under the heading "Expenses Paid During Period."

If Expenses Paid During Period were $7.50, then 8.6 x$7.50 = $64.50.

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical "Ending Account Value" is based on the Fund's actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund's actual return. The figure under the heading "Expenses Paid During Period" shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

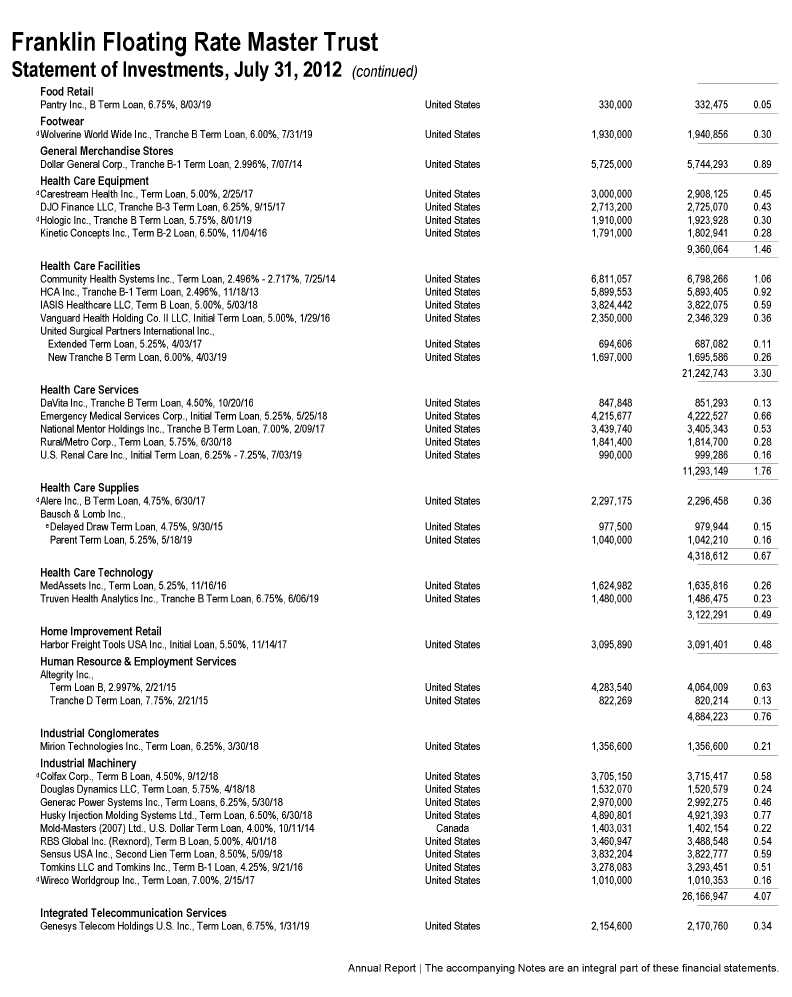

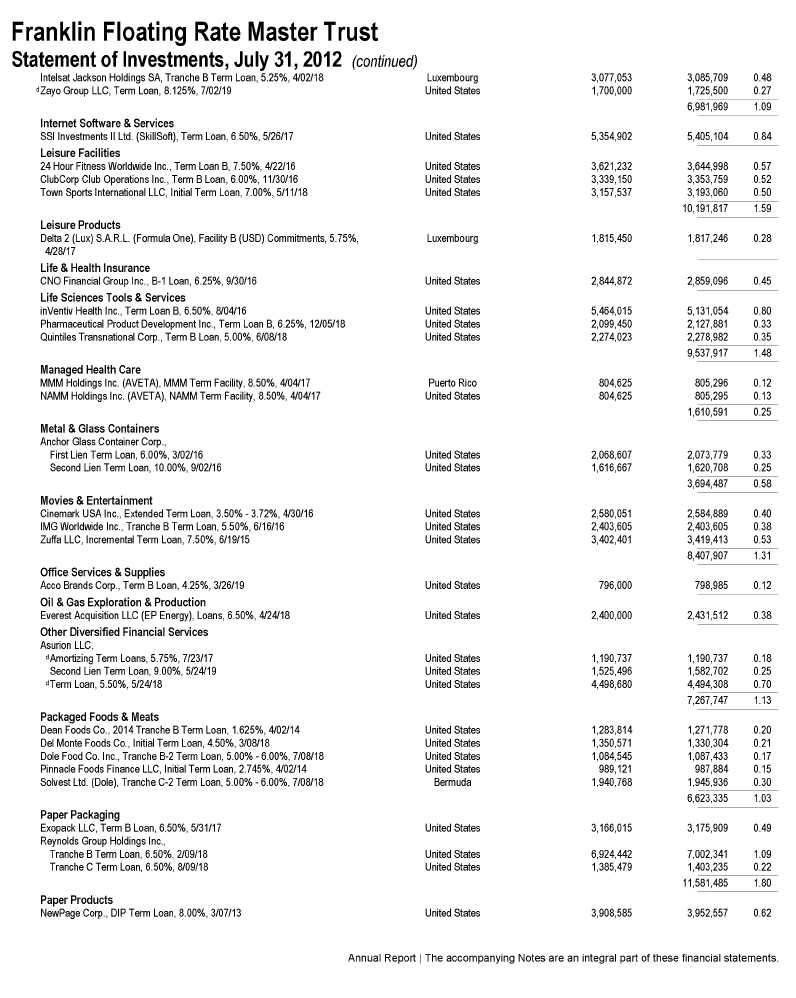

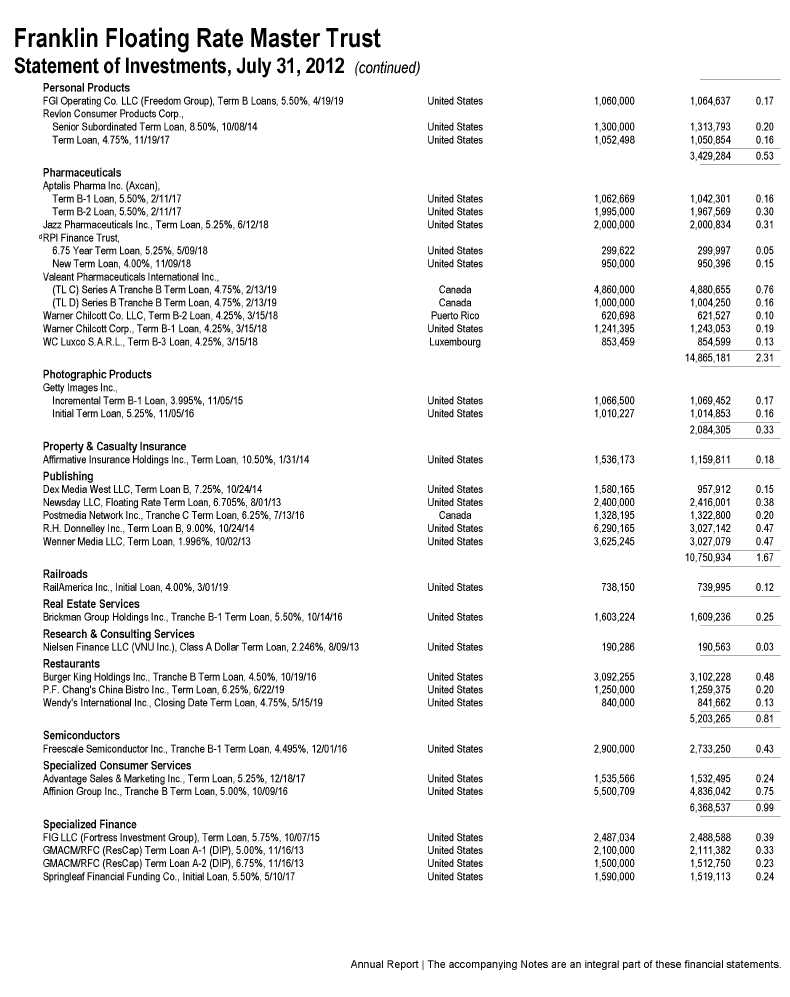

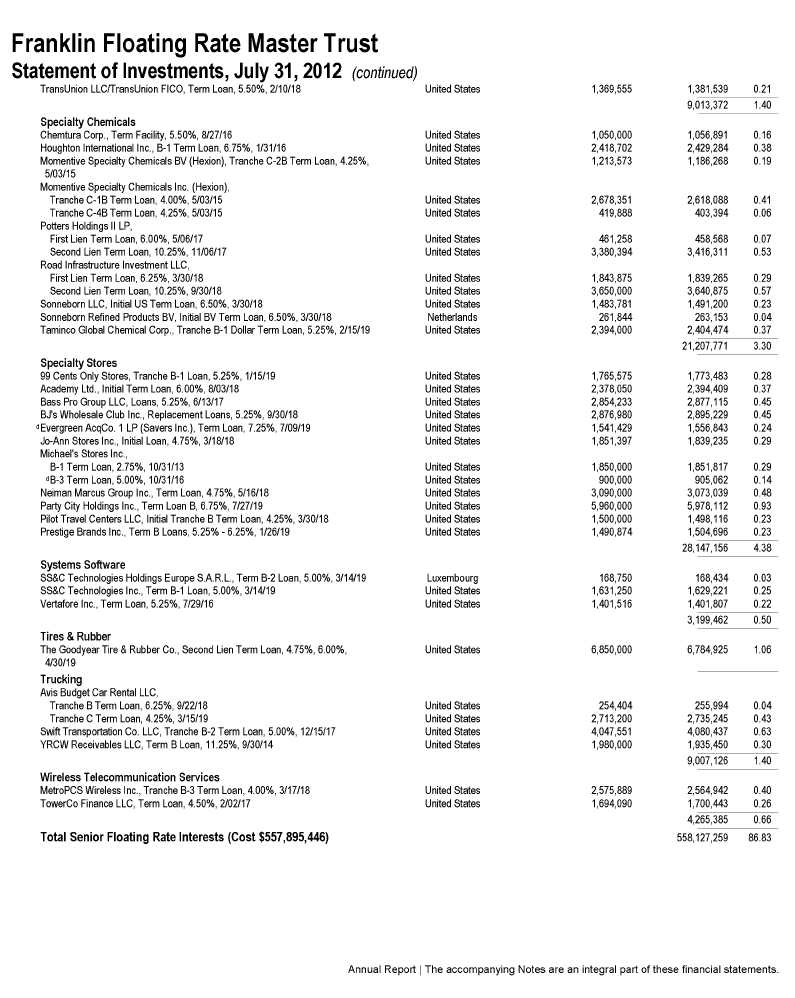

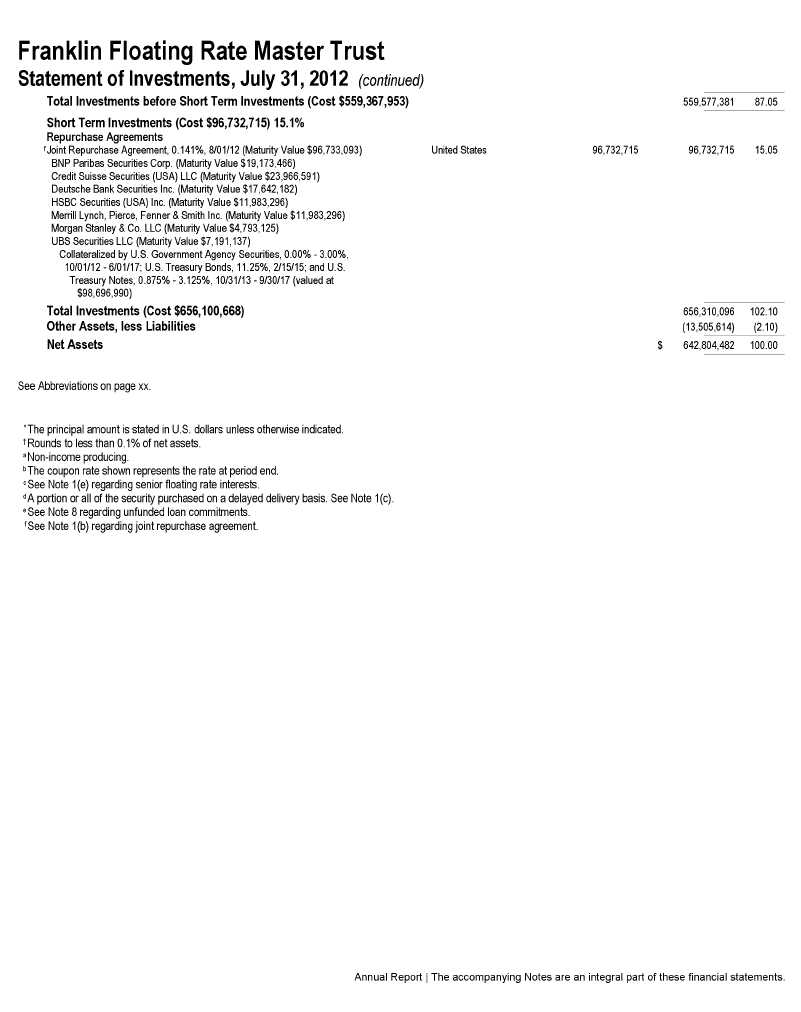

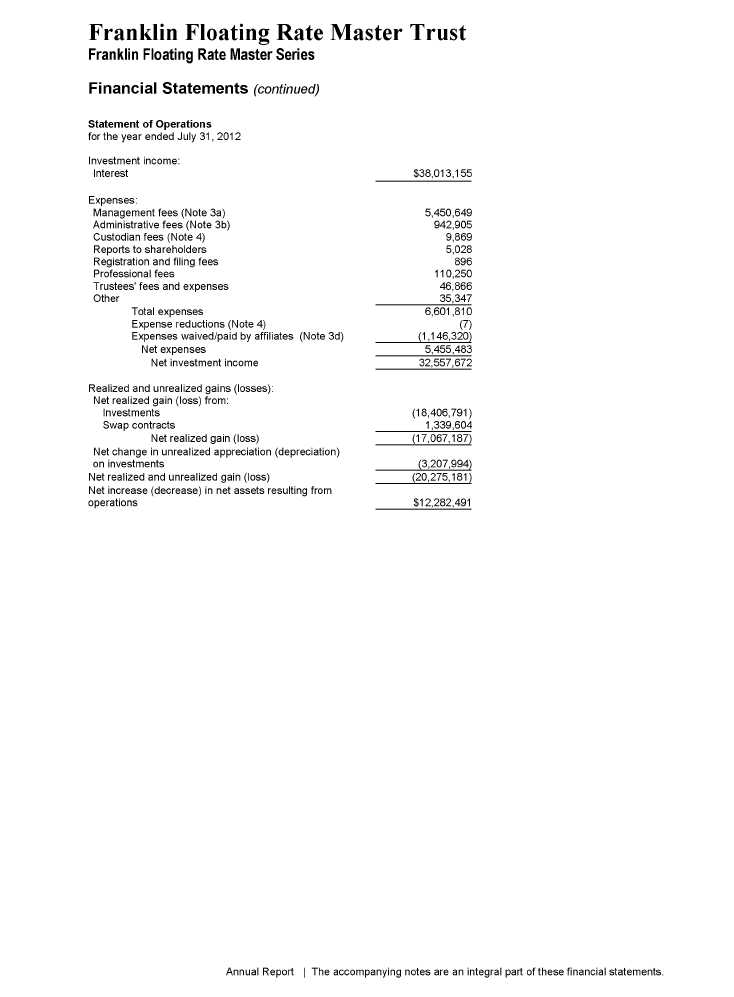

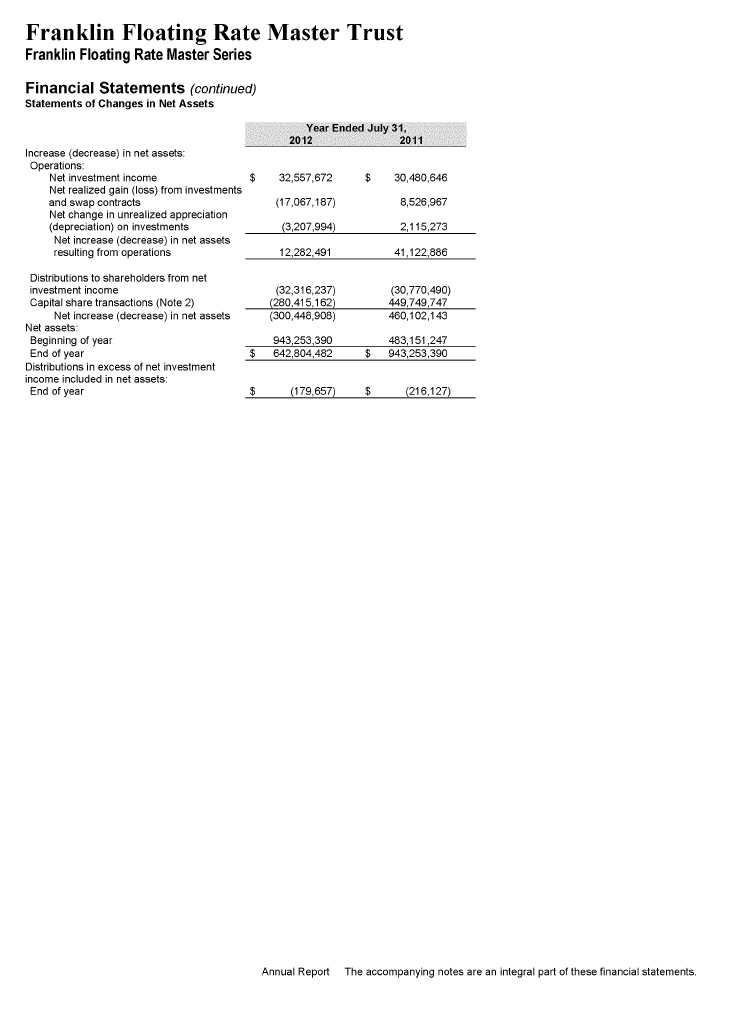

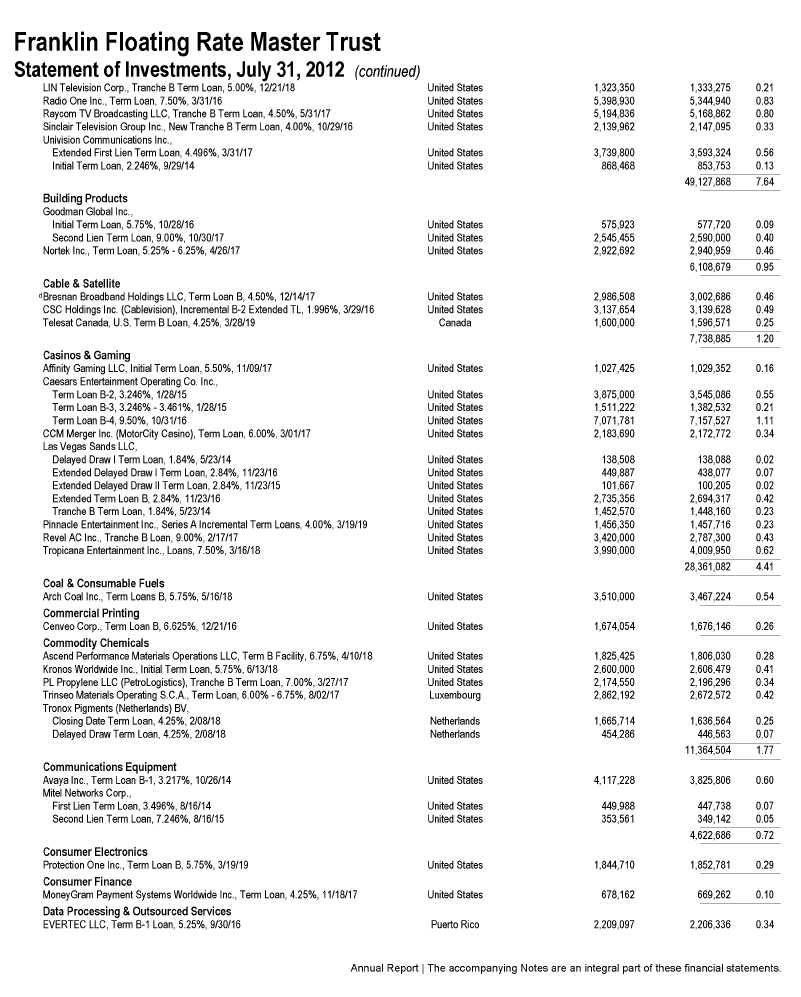

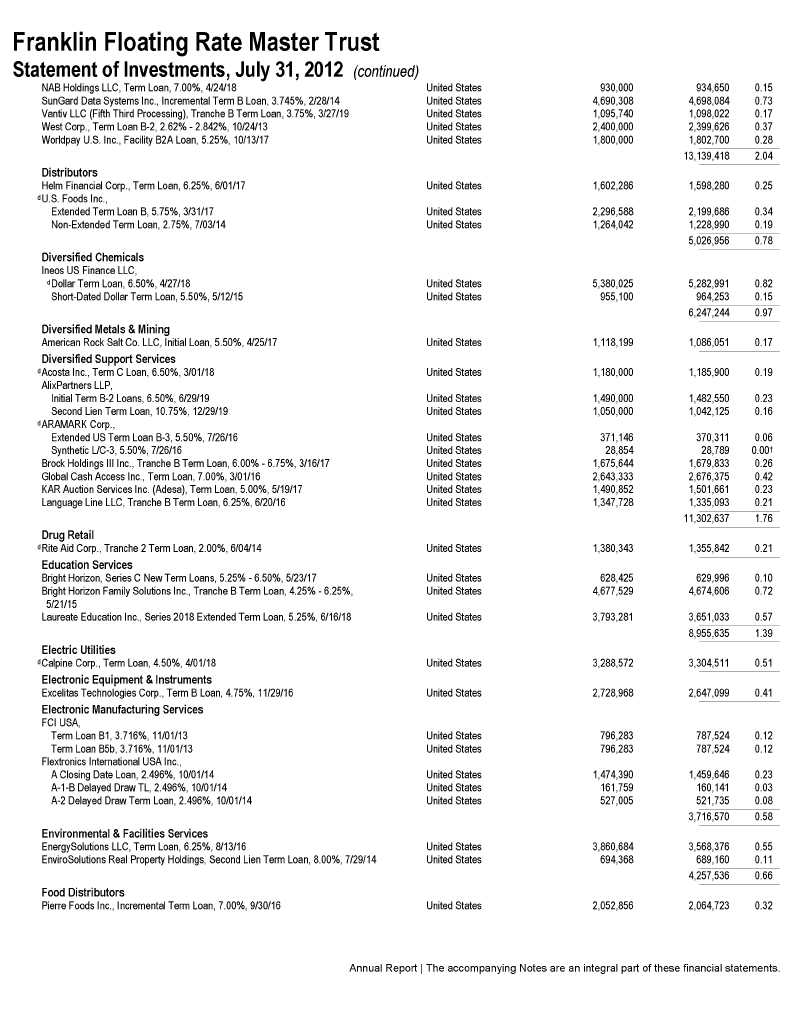

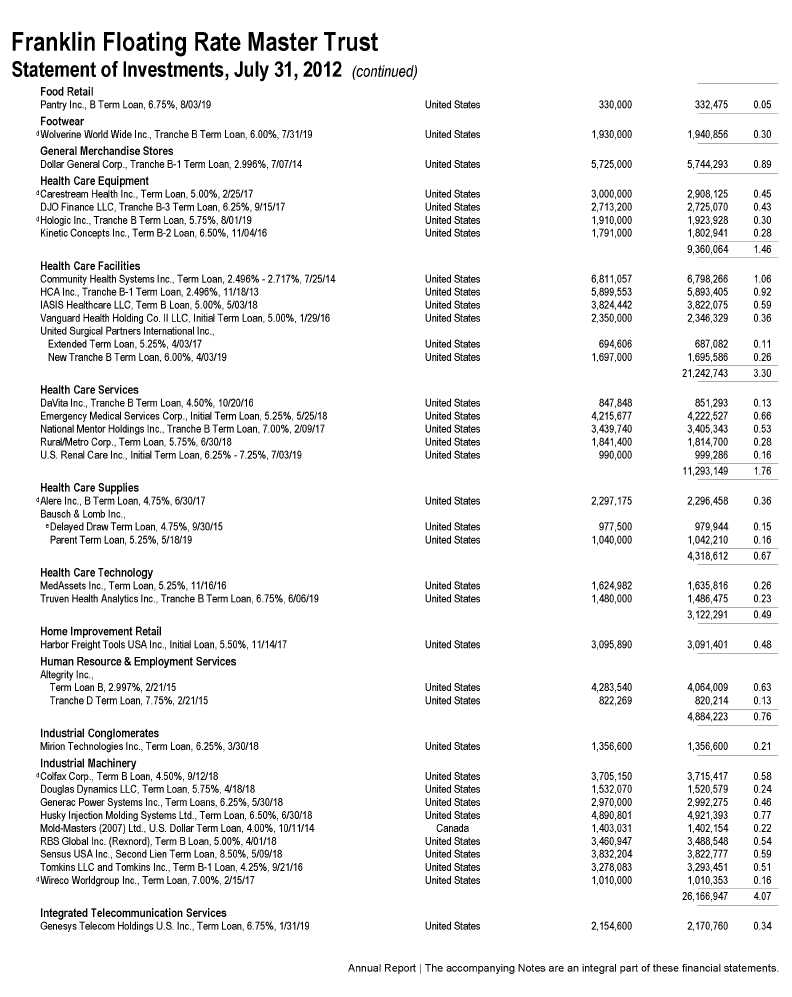

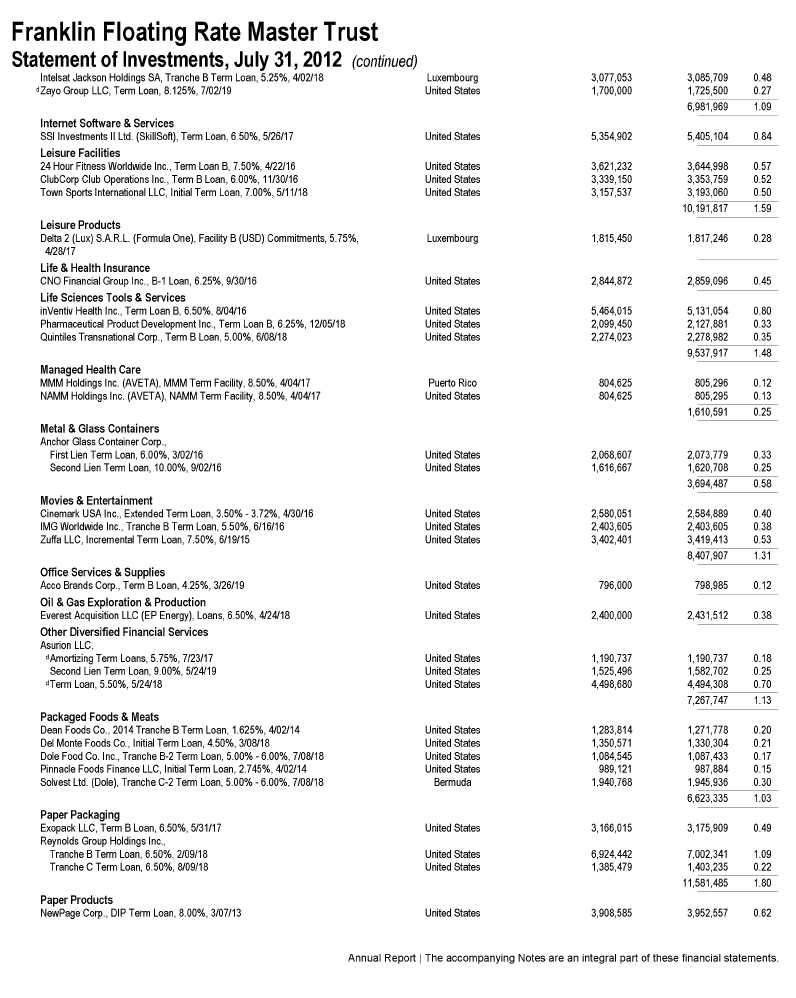

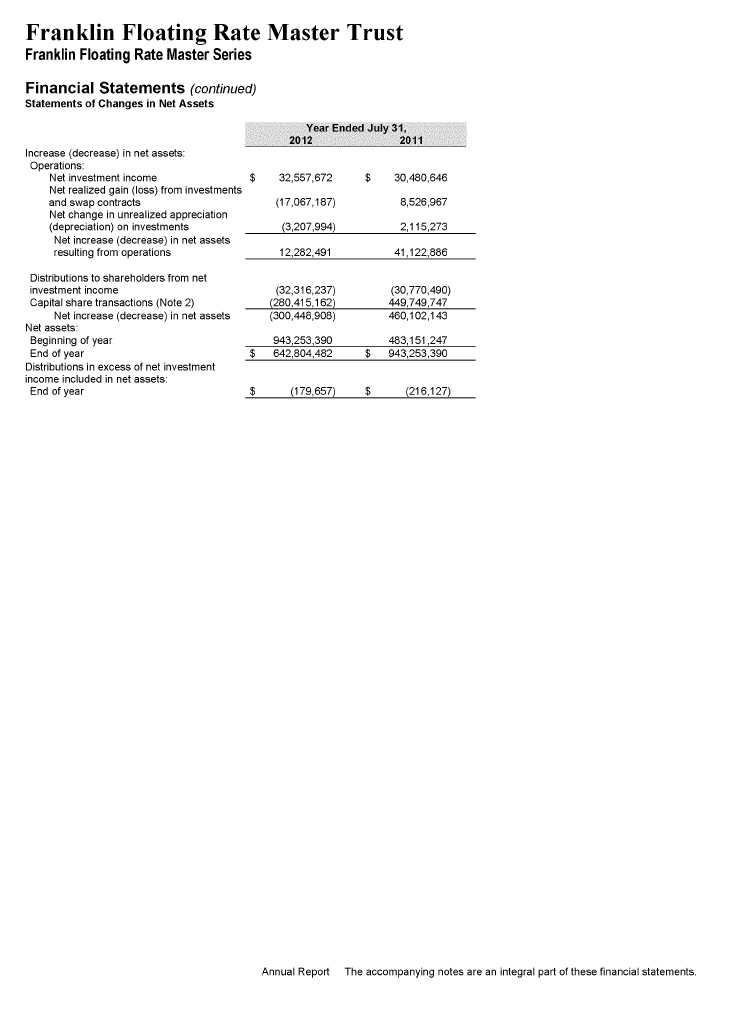

Annual Report I The accompanying Notes are an integral part of these financial statements.

Franklin Floating Rate Master Trust

Franklin Floating Rate Master Series

Notes to Financial Statements

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The Franklin Floating Rate Master Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of one fund, the Franklin Floating Rate Master Series (Fund). The shares are exempt from registration under the Securities Act of 1933.

The following sununarizes the Fund's significant accounting policies.

a. Financial Instrument Valuation

The Fund's investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust's Board of Trustees (the Board), the Fund's administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund's valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instnnnent dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities.

Debt securities generally trade in the OTC market rather than on a securities exchange. The Fund's pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market -based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instnnnents and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market -based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such

investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

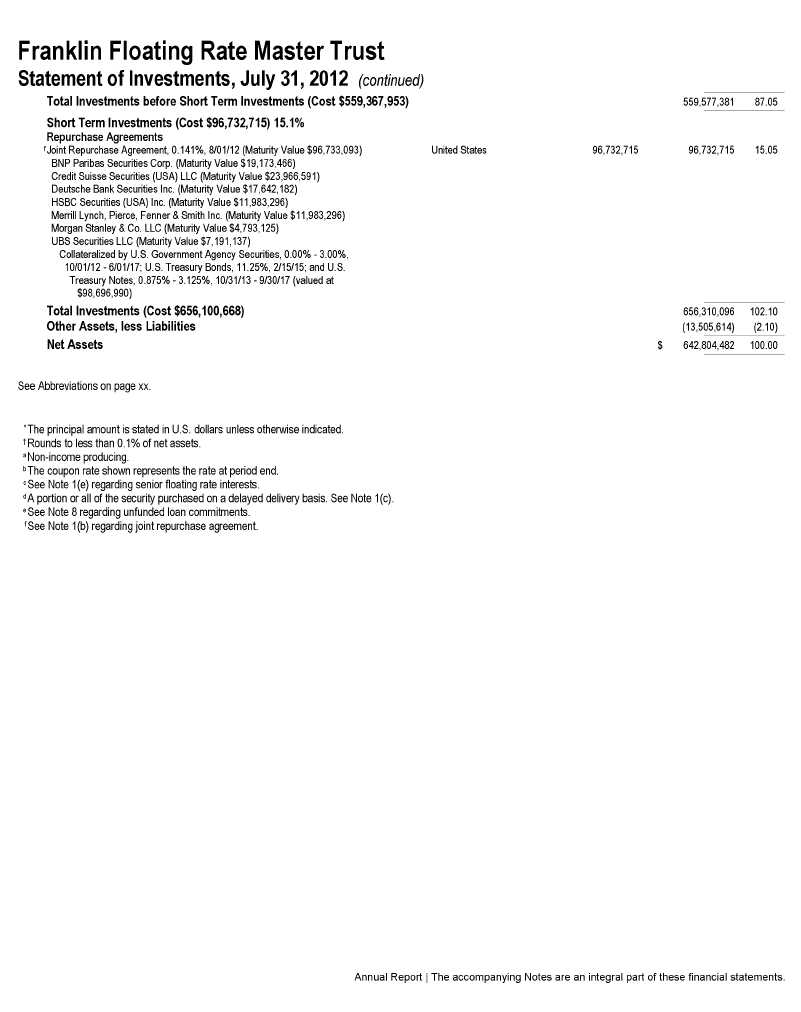

b. Joint Repurchase Agreement

The Fund enters into a joint repurchase agreement whereby its uninvested cash balance is deposited into a joint cash account with other funds managed by the investment manager or an affiliate of the investment manager and is used to invest in one or more repurchase agreements. The value and face amount of the joint repurchase agreement are allocated to the funds based on their pro-rata interest. A repurchase agreement is accounted for as a loan by the fund to the seller, collateralized by securities which are delivered to the fund's custodian. The market value, including accrued interest, of the initial collateralization is required to be at least 102% of the dollar amount invested by the funds, with the value of the underlying securities marked to market daily to maintain coverage of at least 100%. The joint repurchase agreement held by the Fund at year end had been entered into on July 31, 2012.

c. Securities Purchased on a Delayed Delivery Basis

The Fund purchases securities on a delayed delivery basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Although the Fund will generally purchase these securities with the intention of holding the securities, it may sell the securities before the settlement date. Sufficient assets have been segregated for these securities.

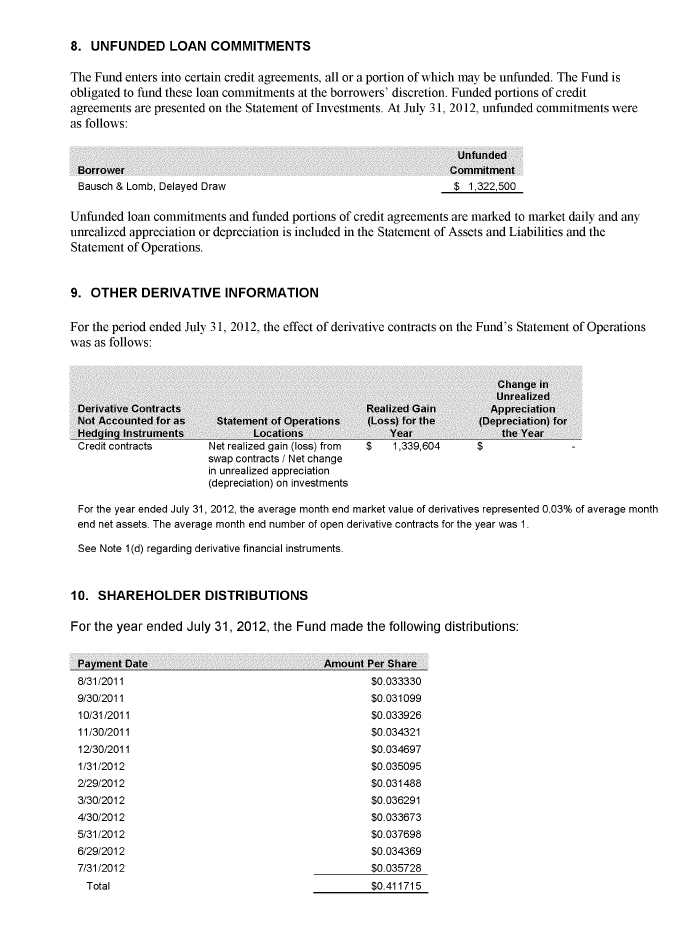

d. Derivative Financial Instruments

The Fund invested in derivatives in order to manage risk or gain exposure to various other investments or markets. Derivatives are financial contracts based on an underlying or notional amount, require no initial investment or an initial net investment that is smaller than would normally be required to have a similar response to changes in market factors, and require or permit net settlement. Derivatives contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and/or the potential for market movements which expose the Fund to gains or losses in excess of the amounts shown on the Statement of Assets and Liabilities. Realized gain and loss and unrealized appreciation and depreciation on these contracts for the period are included in the Statement of Operations.

The Fund entered into OTC credit default swap contracts primarily to manage and/or gain exposure to credit risk. A credit default swap is an agreement between the Fund and a counterparty whereby the buyer of the contract receives credit protection and the seller of the contract guarantees the credit worthiness of a referenced debt obligation. The underlying referenced debt obligation may be a single issuer of corporate or sovereign debt, a credit index, or a tranche of a credit index. In the event of a default of the underlying referenced debt obligation, the buyer is entitled to receive the notional amount of the credit default swap contract from the seller in exchange for the referenced debt obligation, a net settlement amount equal to the notional amount of the credit default swap less the recovery value of the referenced debt obligation, or other agreed upon amount. Over the term of the contract, the buyer pays the seller a periodic stream of payments, provided that no event of default has occurred. Such periodic payments are accrued daily as an unrealized appreciation or depreciation until the payments are made, at which time they are realized. Payments received or paid to initiate a credit default swap contract are reflected on the Statement of Assets and Liabilities and represent compensating factors between stated terms of the credit default swap agreement and prevailing market conditions (credit spreads and other relevant factors). These upfront payments are amortized over the term of the contract as a realized gain or loss on the Statement of Operations. Pursuant to the terms of the credit default swap contract, cash or securities may be required to be deposited as collateral. Unrestricted cash may be invested according to the Fund's investment objectives. At July 31,2012, the Fund had no exposure to credit default swaps.

See Note 9 regarding other derivative information.

e. Senior Floating Rate Interests

The Fund invests in senior secured corporate loans that pay interest at rates which are periodically reset by reference to a base lending rate plus a spread. These base lending rates are generally the prime rate offered by a designated US. bank or the London InterBank Offered Rate (LIBOR). Senior secured corporate loans often require prepayment of principal from excess cash flows or at the discretion of the borrower. As a result, actual maturity may be substantially less than the stated maturity.

Senior secured corporate loans in which the Fund invests are generally readily marketable, but may be subject to some restrictions on resale.

f. Income Taxes

No provision has been made for income taxes because all income, expenses, gains and losses are allocated to the non -US. beneficial owner for inclusion in their individual income tax returns as applicable.

The Fund has reviewed the tax positions, taken on federal income tax returns, for each of the open tax years and as of July 31,2012, and has determined that no provision for income tax is required in the Fund's financial statements.

Prior to December 23,2009, the Fund was treated as a partnership for US. income tax purposes. On December 23,2009, Franklin Advisers, Inc. and Templeton Investment Counsel redeemed their interests in the Fund, terminating the partnership status for US. tax purposes. The Fund has elected to be treated as a disregarded entity for US. income tax purposes, effective December 23,2009.

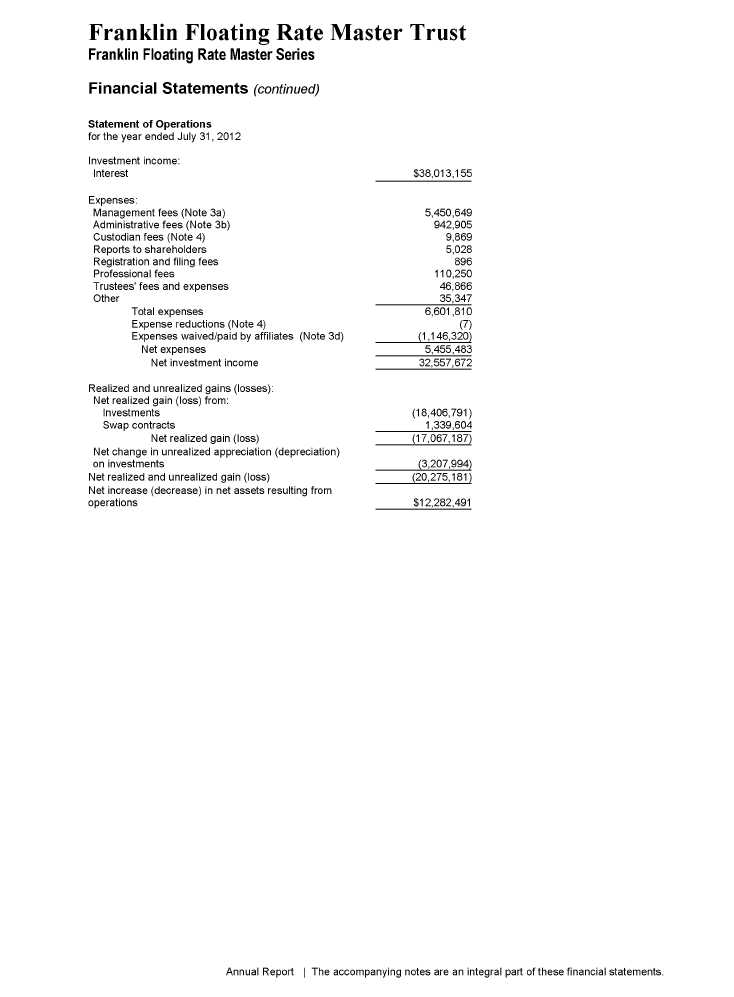

g. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Facility fees are recognized as income over the expected term of the loan. Each Fund's net investment income is proportionately allocated to the owner daily and paid monthly. Net capital gains (or losses) realized by the Fund will be allocated proportionately to each owner and will not be distributed. Distributions to owner are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

h. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

i. Guarantees and Indemnifications

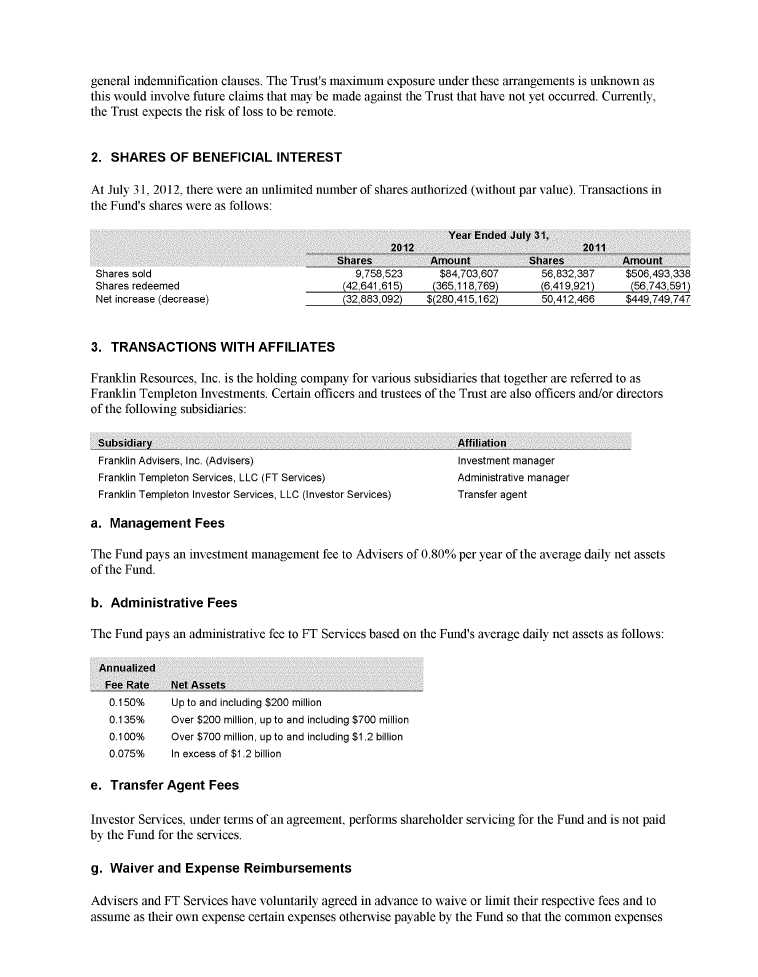

Under the Trust's organizational documents, its officers and trustees are indenmified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Fund, enters into contracts with service providers that contain

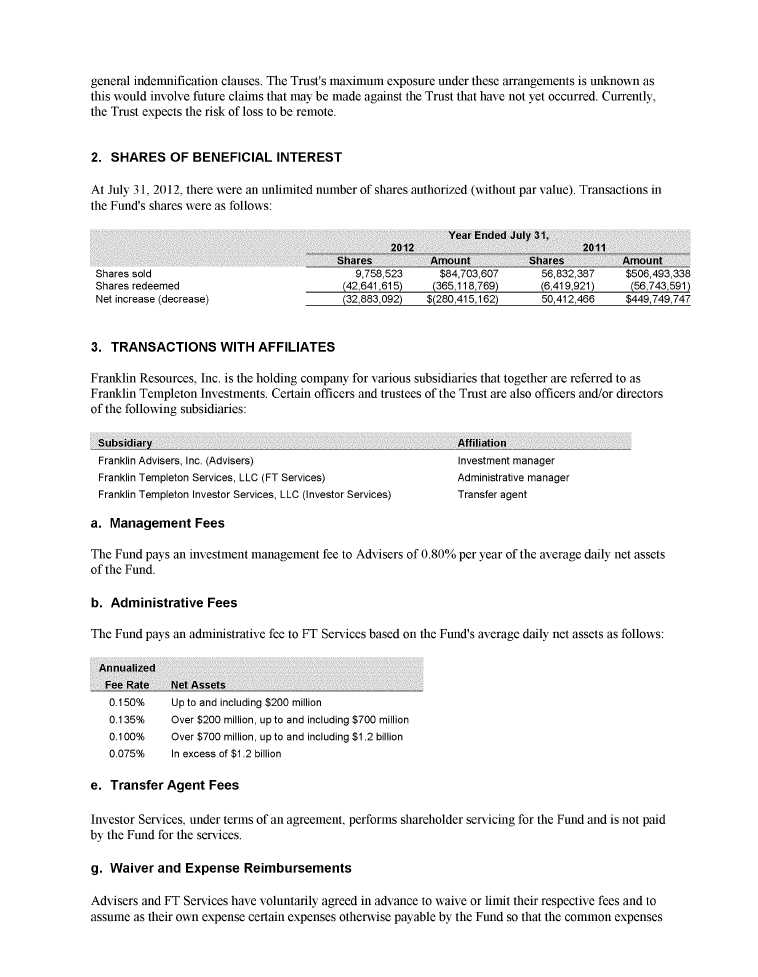

11. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $1.5 billion (Global Credit Facility) which matures on January 18,2013. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.08% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the year ended July 31, 2012, the Fund did not use the Global Credit Facility.

12. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund's own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund's financial instruments and are summarized in the following fair value hierarchy:

- Level 1 - quoted prices in active markets for identical financial instruments

- Level 2 - other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.)

- Level 3 - significant unobservable inputs (including the Fund's own assumptions in determining the fair value of financial instruments)

The inputs or methodology used for valuing financial instruments are not an indication of the risk associated with investing in those financial instruments.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

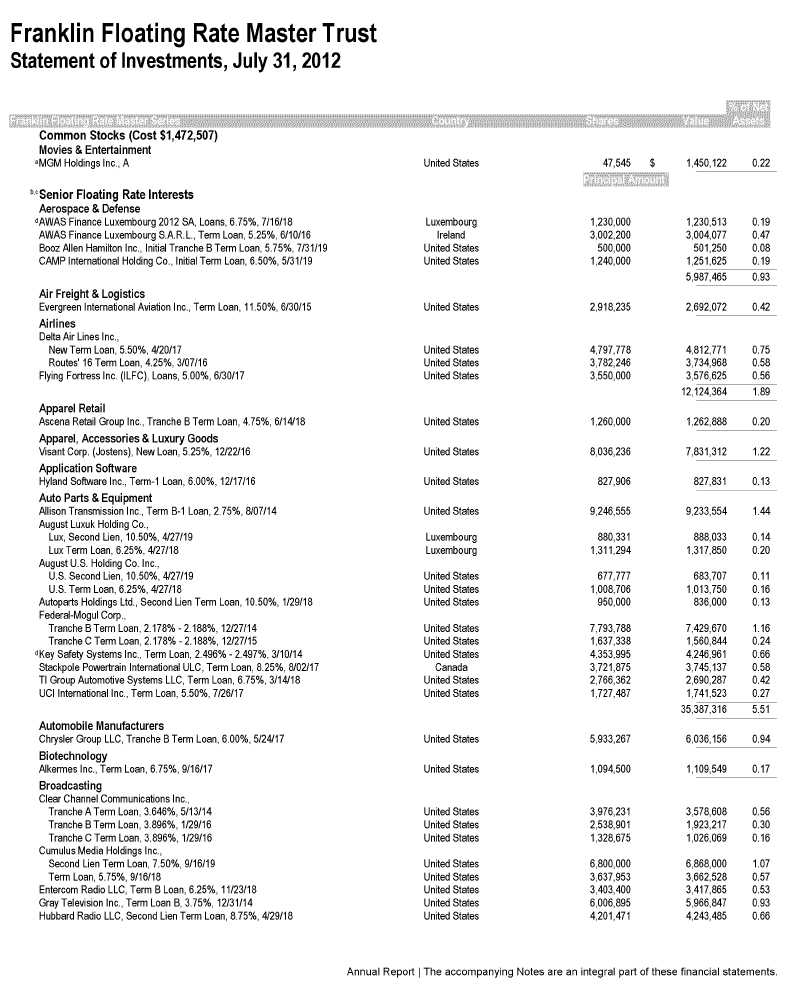

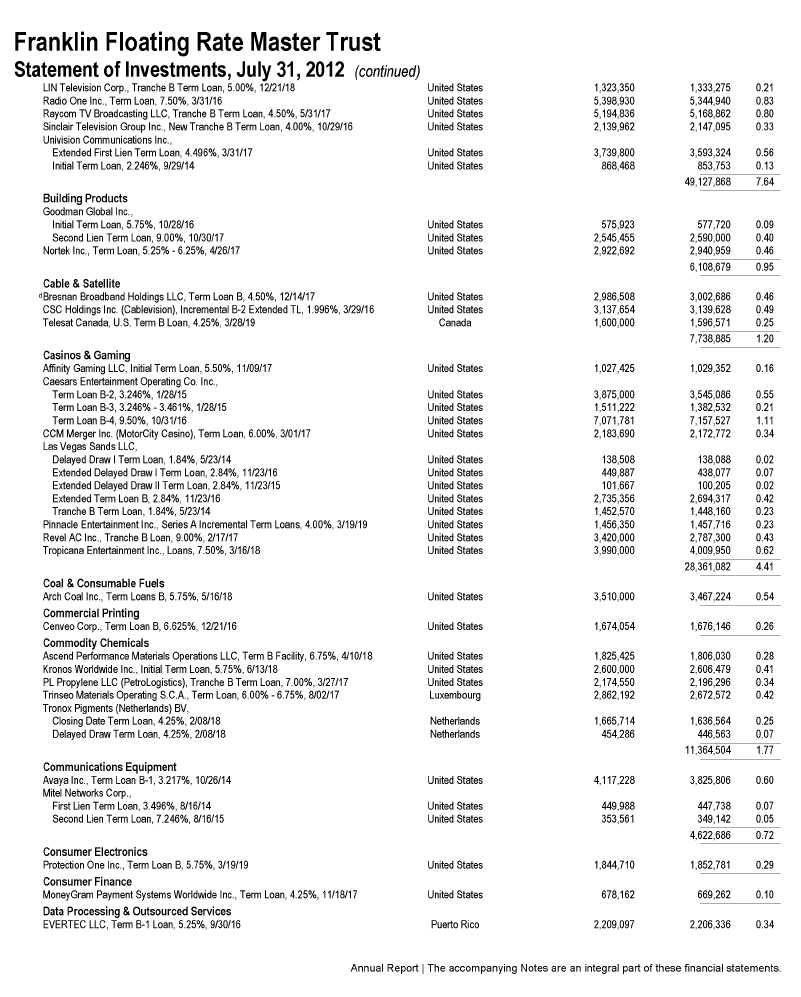

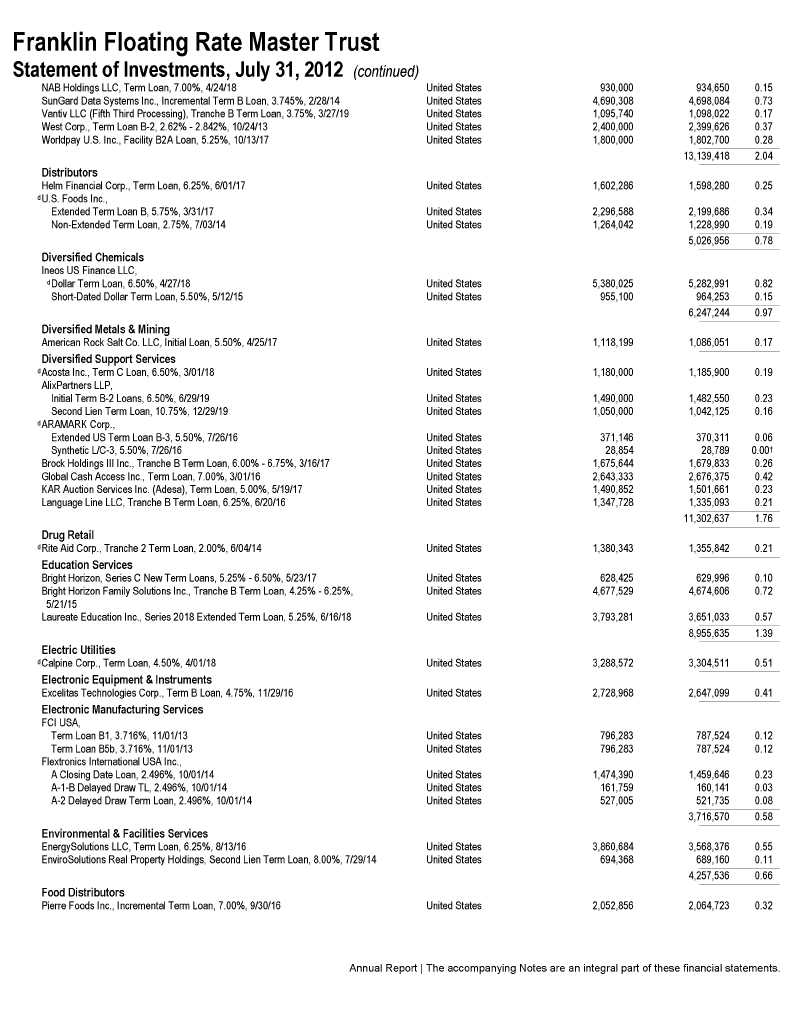

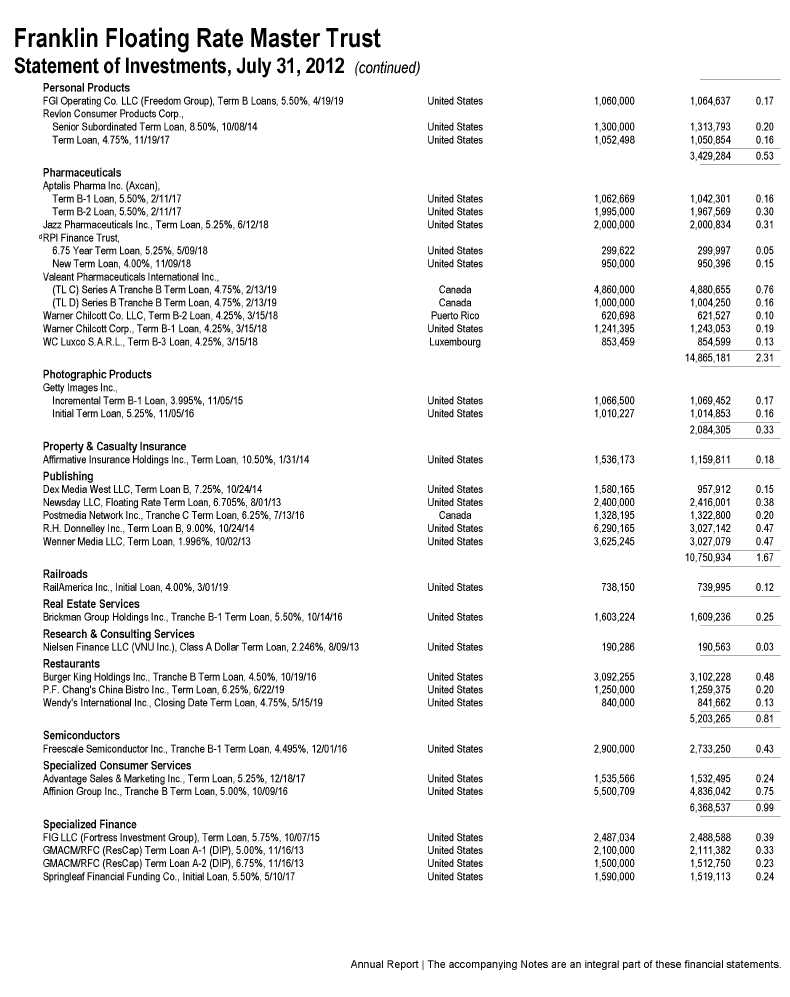

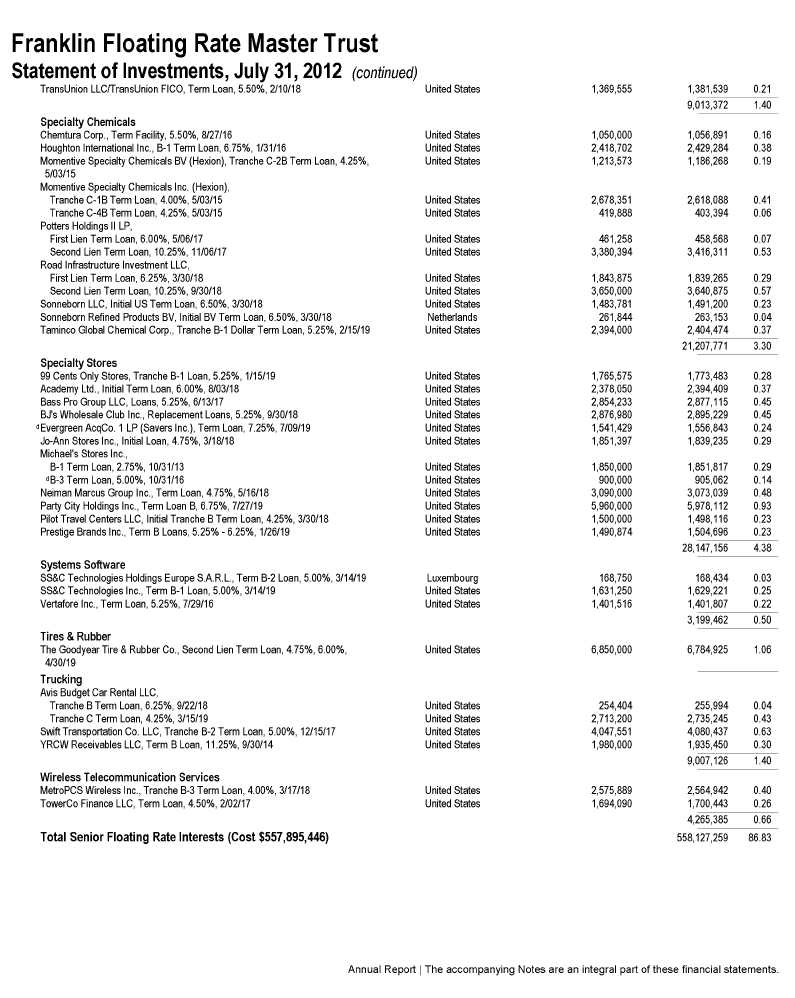

At July 31, 2012, all of the Fund's investments in financial instruments carried at fair value were valued using Level 2 inputs. For detailed categories, see the accompanying Statement of Investments.

13. NEW ACCOUNTING

PRONOUNCEMENTS

In December 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-11, Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities. The amendments in the ASU enhance disclosures about offsetting of financial assets and liabilities to enable investors to understand the effect of these arrangements on a fund's financial position. The ASU is effective for interim and annual reporting periods beginning on or after January 1, 2013. The Fund believes the adoption of this ASU will not have a material impact on its financial statements.

14. SUBSEQUENT

EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Franklin Floating Rate Master Series

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Franklin Floating Rate Master Series (the "Fund") at July 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at July 31,2012 by correspondence with the custodian and brokers, provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

Shareholder Information

Proxy Voting Policies and Procedures

The Fund's investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund's complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Fund's proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission's website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U. S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission's website at sec.gov. The filed form may also be viewed and copied at the Commission's Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

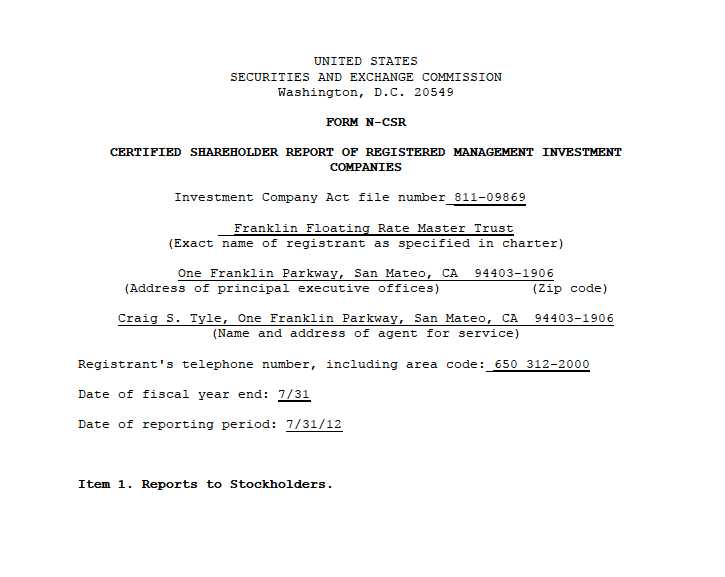

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

| (c) | N/A |

| (d) | N/A |

| (f) | Pursuant to Item 12(a)(1), the Registrant is attaching as an |

exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

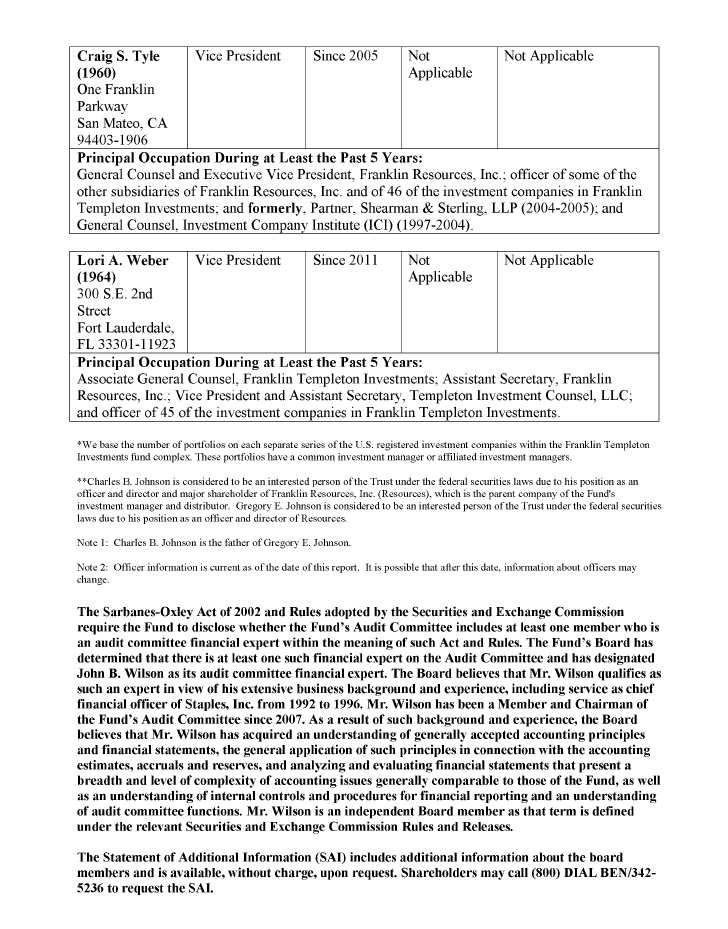

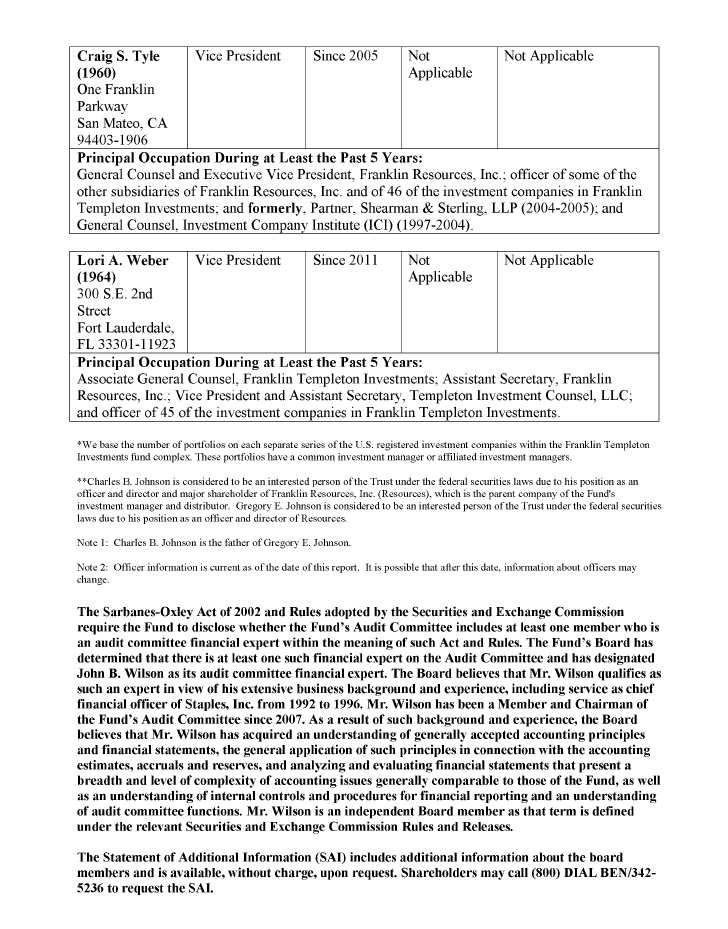

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is John B. Wilson and he is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant for the audit of the registrant s annual financial statements or for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements were $66,788 for the fiscal year ended July 31, 2012 and $76,992 for the fiscal year ended July 31, 2011.

(b) Audit-Related Fees

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant that are reasonably related to the performance of the audit of the registrant's financial statements and are not reported under paragraph (a) of Item 4.

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant's investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant that are reasonably related to the performance of the audit of their financial statements.

(c) Tax Fees

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant for tax compliance, tax advice and tax planning were $0 for the fiscal year ended July 31, 2012 and $13,250 for the fiscal year ended July 31, 2011. The services for which these fees were paid included preparation of Federal and State partnership tax returns.

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant for tax compliance, tax advice and tax planning were $50,000 for the fiscal year ended July 31, 2012 and $85,000 for the fiscal year ended July 31, 2011. The services for which these fees were paid included technical tax consultation for capital gain tax reporting to foreign governments, application of local country tax laws to investments and licensing securities with local country offices.

(d) All Other Fees

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant not reported in paragraphs (a)-(c) of Item 4 were $235 for the fiscal year ended July 31, 2012 and $185 for the fiscal year ended July 31, 2011. The services for which these fees were paid included review of materials provided to the fund Board in connection with the investment management contract renewal process.

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant, other than services reported in paragraphs (a)-(c) of Item 4 were $152,215 for the fiscal year ended July 31, 2012 and $144,615 for the fiscal year ended July 31, 2011. The services for which these fees were paid included review of materials provided to the fund Board in connection with the investment management contract renewal process.

(e) (1) The registrant s audit committee is directly responsible for approving the services to be provided by the auditors, including:

provided to the Fund by the auditors;

(iii) pre-approval of all non-audit related services to be provided to the registrant by the auditors to the registrant s investment adviser or to any entity that controls, is controlled by or is under common control with the registrant s investment adviser and that provides ongoing services to the registrant where the non-audit services relate directly to the operations or financial reporting of the registrant; and

(iv) establishment by the audit committee, if deemed necessary or appropriate, as an alternative to committee pre-approval of services to be provided by the auditors, as required by paragraphs (ii) and (iii) above, of policies and procedures to permit such services to be pre-approved by other means, such as through establishment of guidelines or by action of a designated member or members of the committee; provided the policies and procedures are detailed as to the particular service and the committee is informed of

each service and such policies and procedures do not include delegation of audit committee responsibilities, as contemplated under the Securities Exchange Act of 1934, to management; subject, in the case of (ii) through (iv), to any waivers, exceptions or exemptions that may be available under applicable law or rules.

(e) (2) None of the services provided to the registrant described in paragraphs (b)-(d) of Item 4 were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of regulation S-X.

| (f) | No disclosures are required by this Item 4(f). |

| (g) | The aggregate non-audit fees paid to the principal accountant for |

services rendered by the principal accountant to the registrant and the registrant s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant were $202,450 for the fiscal year ended July 31, 2012 and $243,050 for the fiscal year ended July 31, 2011.

(h) The registrant s audit committee of the board has considered whether the provision of non-audit services that were rendered to the registrant s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant s independence.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees that would require disclosure herein.

Item 11. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant s filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is accumulated and communicated to the Registrant s management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant s management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Shareholder Report on Form N-CSR, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant s management, including the Registrant s principal executive officer and the Registrant s principal financial officer, of the effectiveness of the design and operation of the Registrant s disclosure controls and procedures. Based on such evaluation, the Registrant s principal executive officer and principal financial officer concluded that the Registrant s disclosure controls and procedures are effective.

(b) Changes in Internal Controls. There have been no significant changes in the Registrant s internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Shareholder Report on Form N-CSR.

Item 12. Exhibits.

| (a) | (1) Code of Ethics |

| (a) | (2) Certifications pursuant to Section 302 of the Sarbanes-Oxley |

Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.