UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

(Amendment No. 1)

(Mark One)

£ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THESECURITIES EXCHANGE ACT OF 1934

OR

X ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 30, 2010

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

OR

£ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

COMMISSION FILE NUMBER: 000-30087

ADIRA ENERGY LTD. |

(Exact name of Registrant as specified in its charter)

Not applicable |

(Translation of Registrant's name into English)

Canada |

(Jurisdiction of incorporation or organization)

120 Adelaide Street West, Suite 1204

Toronto, Ontario, Canada, M4V 3A1 |

(Address of principal executive offices) |

Gadi Levin

120 Adelaide Street West, Suite 1204

Toronto, Ontario, Canada, M5H 1T1

Telephone: +1 416 250 1955

Facsimile: +1 416 250 6330

E-mail: glevin@adiraenergy.com |

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to section 12(b) of the Act:

Title of each Class

None | | Name of each exchange on which registered

Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

The number of outstanding shares of each of the issuer's classes of capital or common stock as of September 30, 2010 was 62,640,001 common shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of theSecurities Act.

Yes£ NoT

If this report is an annual or a transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of theSecurities Exchange Act of 1934.

Yes£ NoT

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of theSecurities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YesT No£

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of theSecurities Exchange Act. (Check one):

Large accelerated filer£ Accelerated filer£ Non-accelerated filerT

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | £ | International Financial Reporting Standards as issued by the International Accounting Standards Board£ | Other | T |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17T Item 18£

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of theSecurities Exchange Act).

Yes£ NoT

-2-

TABLE OF CONTENTS

| | Page No |

EXPLANATORY NOTE | 4 |

GENERAL | 4 |

ITEM 3. KEY INFORMATION | 5 |

ITEM 4. INFORMATION ON THE COMPANY | 18 |

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 34 |

ITEM 15. CONTROLS AND PROCEDURES | 43 |

ITEM 17. FINANCIAL STATEMENTS | 44 |

ITEM 19. EXHIBITS | 78 |

__________

-3-

EXPLANATORY NOTE

This Annual Report on Form 20-F/A ("Amended Form 20-F") is being filed as Amendment No. 1 to our Annual Report on Form 20-F for the year ended September 30, 2010, which was filed with the Securities and Exchange Commission on February 3, 2011 (the "Original Filing"). This Amended Form 20-F is a technical amendment to add under Item 17, in Part III, the following audited financial statements of Adira Energy Israel Ltd. ("Adira Israel"), an Israel corporation, which we determined subsequent to the date of the Original Filing to be a predecessor entity of our Company:

(A) Balance sheet as at April 7, 2009;

(B) Statement of changes in equity for the 164-day period from incorporation (October 26, 2008) to April 7, 2009; and

(C) Notes to financial statements.

The referenced financial statements were inadvertently omitted from the Original Filing.

In addition, this Amended Form 20-F amends the Original Filing to remove from Item 3 all references to financial information of our Company for the years ended September 30, 2008, 2007 and 2006, which relate to the period prior to our acquisition of Adira Energy Corp. ("Adira Energy"). Our Company's share exchange with Adira Energy resulted in a reverse takeover transaction by Adira Energy of the Company. As the shareholders of Adira Energy obtained control of the Company, the share exchange was a capital transaction, rather than a business combination. Based on the substance of the transaction, the transaction is a reverse recapitalization, equivalent to the issuance of shares by the private company (Adira Energy) for the net monetary assets of the public shell company (AMG), accompanied by a recapitalization. As a result, the financial statements of Adira Energy became the financial statements of our Company as of August 31, 2009.

We have not modified or updated other disclosures presented in our Original Filing. Accordingly, this Amended Form 20-F does not reflect events occurring after the filing of our Original Filing and does not modify or update those disclosures affected by subsequent events. Information not affected by this amendment is unchanged and reflects the disclosures made at the time of the Original Filing. Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended, the complete texts of Items 3, 4, 5, 15, 17 and 19, as amended, are repeated in this Amended Form 20-F. In addition, for convenience of reference, the following disclosure from the Original Filing, under the heading "General," is included in this Amended Form 20-F.

This Amended 20-F consists solely of the preceding cover page, this explanatory note, the following disclosure under the heading "General," amended Items 3, 4, 5, 15, 17 and 19, the signature page, and restated exhibits 12.1, 12.3, 13.1 and 13.2.

GENERAL

This Form 20-F/A is filed as an amendment to an annual report under the Exchange Act.

In this Form 20-F/A, references to:

"Adira"meansAdira Energy Ltd, a Canadian federal corporation (formerly AMG Oil Ltd.)

"Adira Group" means Adira Energy Ltd (formerly AMG Oil Ltd.) together with its wholly owned subsidiaries Adira Energy Holdings Corp., Adira Energy Israel Ltd.,Adira Energy Israel Services Ltd. and Adira Oil Technologies Ltd. and its 60% subsidiary, Adira Geo-Global Ltd.

"Adira Energy" means Adira Energy Holdings Corp., an Ontario corporation (formerly Adira Energy Corp.)

"Adira Israel" means Adira Energy Israel Ltd., an Israeli corporation

"Adira Services" means Adira Energy Israel Services Ltd., an Israel corporation

"We", "us", "our", and the "Company" means Adira Group

-4-

"AMG" refers to AMG Oil Ltd. which was the name of the Company prior to its change of name to Adira Energy Ltd on December 17, 2009

Adira has historically used U.S. dollar as its reporting currency. Adira Energy has historically used Canadian dollars as its reporting currency. All references in this document to "dollars" or "$" are to United States dollars and all references to "CDN$" are to Canadian dollars, unless otherwise indicated.

Except as noted, the information set forth in this Form 20-F is as of September 30, 2010 and all information included in this document should only be considered correct as of such date.

ITEM 3 KEY INFORMATION

A. Selected Financial Data

Adira Energy

On August 31, 2009, Adira acquired Adira Energy by issuing 39,040,001 common shares of Adira to Adira Energy's shareholders on a one for one basis. As the shareholders of Adira Energy obtained control of Adira, the share exchange is considered to be a reverse takeover transaction. Accordingly, for accounting purposes Adira Energy is the acquirer.

The selected historical information presented in the table below for the year ended September 30, 2010 is derived from the audited consolidated financial statements of Adira for such period. The selected historical financial information presented in the table below for the 175-day period ended September 30, 2009,comprises the operating data of Adira Energy and its subsidiary companies from April 8, 2009 (date of incorporation of Adira Energy) and that of Adira (formerly AMG Oil Ltd) from September 1, 2009. The selected financial information presented below should be read in conjunction with the audited consolidated financial statements and the notes thereto of Adira Group, and with the information appearing under the headings, "Information on the Company" and "Operating and Financial Review and Prospects".

Under Canadian GAAP (in US$)

| | As at September 30, |

| | 2010

$ | 2009

$ |

Balance Sheet Data | | |

Cash and Cash Equivalents | 357,560 | 2,354,628 |

Working Capital | 851,996 | 2,250,066 |

Total Assets | 1,857,039 | 2,756,305 |

Total Liabilities | 588,056 | 126,977 |

Total Shareholders'Equity | 1,268,983 | 2,629,328 |

-5-

| | Year ended September, 30 | 175-Day Period Ended September, 30 |

| | 2010 | 2009 |

| | $ | $ |

Operating Data | | |

Revenues | 912,597 | - |

| | |

Expenses | 2,939,868 | (1,383,335) |

Other Items | (5,822) | 14,708 |

Net Loss from Continuing Operations | (2,033,093) | (1,368,627) |

Net and Comprehensive Loss | (2,033,093) | (1,368,627) |

Basic Loss per Share | | |

- From Continuing Operations | (0.05) | (0.05) |

- From Discontinued Operations | (0.00) | (0.00) |

We have never declared or paid any cash or other dividends.

Adira Israel

Adira Energy's predecessor is Adira Israel, which was incorporated in Israel on October 26, 2008. In order to facilitate tax planning, all of the issued and outstanding shares of Adira Israel were registered in the name of Adira Africa Corp. ("Adira Africa"), a privately-owned Canadian corporation, as a trustee for and on behalf of a corporation to be incorporated in Ontario - namely, Adira Energy, which was subsequently incorporated on April 8, 2009 - pursuant to a Declaration of Trust dated November 16, 2008 (the "Declaration of Trust"). In December 2008, upon application to Ministry of National Infrastructures of the State of Israel, Adira Israel obtained Eitan License No. 356, covering 31,060 acres (125.7 sq. km.) in the Hula Valley in Northern Israel (the "Eitan License"), for no consideration other than the payment of a nominal stamp duty in the amount of US$3,544. Upon the incorporation of Adira Energy on April 8, 2009, Adira Africa transferred the shares of Adira Israel to Adira Energy for no consideration, as contemplated by the Declaration of Trust.

The only activity undertaken in Adira Israel from December 2008 to April 8, 2009 was the application for, and the receipt of, the Eitan License, and, pursuant to the Declaration of Trust, Adira Energy is in substance treated as the owner of the Adira Israel shares since the inception of Adira Israel. Further, the carrying amount of the single asset owned by Adira Israel, the Eitan license (there were no material liabilities), was recorded in the accounts of Adira Israel as of April 8, 2009 in its nominal amount of the stamp duty. Therefore, under International Financial Reporting Standards, the carrying amount of the Adira Israel shares transferred to Adira Energy on that date was of the same nominal amount.

The selected balance sheet data presented in the table below for Adira Israel as of April 7, 2009, and the related changes in equity for the 164-day period from its incorporation (October 26, 2008) to April 7, 2009, are derived from the audited financial statements of Adira Israel for such period, which are included in this Amended Form 20-F. Adira Israel's financial statements do not include a statement of operations and statement of cash flows for the 164-day period ended April 7, 2009, as there were no revenues, expenses or cash transactions during this period. Subsequent to April 7, 2009, all activities of the Company are reflected in the consolidated financial statements of Adira. The selected financial information presented below should be read in conjunction with the audited financial statements and the notes thereto of Adira Israel, and with the information appearing under the headings, "Information on the Company" and "Operating and Financial Review and Prospects".

-6-

Under Israeli GAAP (in US$)

| | As at April 7 |

| | 2009

$ |

Balance Sheet Data | |

Exploration and evaluation asset | 3,544 |

Total Assets | 3,544 |

Total Liabilities | 3,541 |

Total Shareholders'Equity | 3 |

Changes in Equity | | Share Capital | | Total |

| | | Number | | Amount | | Equity |

Balance at October 26, 2008 (date of incorporation) | | - | | $ - | | $ - |

Shares issued | | 1,000 | | 3 | | 3 |

Balance at April 7, 2009 | | 1,000 | | $ 3 | | $ 3 |

As noted in Note 4 to the audited financial statements of Adira Israel which are included in this Amended Form 20-F, there are no differences between Israeli GAAP and US GAAP in respect of the financial position and results of operations of Adira Israel for the period presented.

Exchange Rate

The exchange rate between the Canadian dollar and the U.S. dollar was CDN$0.9970 per US$1.00 (or US$1.003 per CDN$1.00) as of February 2, 2011.

The average exchange rates for the financial years listed above (based on the average exchange rate for each period using the average of the exchange rates on the last day of each month during the period in accordance with the exchange rates provided by the Bank of Canada, are as follows:

| 2010 | 2009 | 2008 | 2007 | 2006 |

Year End | 1.029 | 1.0722 | 1.2180 | 0.9913 | 1.1654 |

Average | 1.0331 | 1.1788 | 1.0660 | 1.0748 | 1.1341 |

High | 1.0848 | 1.3000 | 1.3008 | 1.1878 | 1.1794 |

Low | 0.9931 | 1.0338 | 0.9711 | 0.9066 | 1.0948 |

The high and low exchange rates between the Canadian dollar and the U.S. dollar for the past six months (provided by the Bank of Canada) are as follows:

Month | Exchange rate

CDN$ per US$1.00 |

| | High | Low |

January 2011 | 1.0131 | 0.9993 |

December 2010 | 1.0216 | 0.9931 |

November 2010 | 1.0286 | 0.998 |

October 2010 | 1.0374 | 0.9986 |

September 2010 | 1.0604 | 1.0126 |

August 2010 | 1.0674 | 1.0108 |

-7-

B. Capitalization and Indebtedness

Not Applicable

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our Securities is highly speculative and involves a high degree of risk. Our Company may face a variety of risks that may affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing in our Company's Securities Investors should carefully consider the following risks. If any of the following risks actually occurs, our Company's business, prospects, financial condition and results of operations could be materially adversely affected. In that case, investors may lose all or a part of their investment.

Risks Associated with the Company

Our independent auditors have referred to circumstances which might result in doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Adira incurred a net loss of $1,982,097 for the period ended September 30, 2010. At September 30, 2010, Adira had an accumulated deficit of $3,350,724. These circumstances raise doubt about our ability to continue as a going concern, as described in the Note 1 to our consolidated financial statements for the period ended September 30, 2010, which are included herein. Although our consolidated financial statements refer to circumstances which might raise doubt about our ability to continue as a going concern, they do not reflect any adjustments that might result if we are unable to continue our business.

We are an early-stage oil and gas exploration company without revenues. Our ability to continue in business depends upon our continued ability to obtain significant financing from external sources and the success of our exploration efforts and any production efforts resulting therefrom, none of which can be assured.

We are an early-stage oil and gas exploration company without any revenues, and there can be no assurance of our ability to develop and operate our projects profitably. We have historically depended entirely upon capital infusion from the issuance of equity securities to provide the cash needed to fund our operations, but we cannot assure you that we will be able to continue to do so. Our ability to continue in business depends upon our continued ability to obtain significant financing from external sources and the success of our exploration efforts and any production efforts resulting therefrom. Any reduction in our ability to raise equity capital in the future would force us to reallocate funds from other planned uses and could have a significant negative effect on our business plans and operations, including our ability to continue our current exploration activities.

While we may in the future generate additional working capital through the development, operation, sale or possible syndication of our current property or any future properties, there is no assurance that our Company will be successful in generating positive cash flow, or if successful, that any such funds will be available for distribution to shareholders or to fund further exploration and development programs.

We have had negative cash flows from operations, and there is no assurance that our current resources will be sufficient to fund our operations on an ongoing basis. Our business operations may fail if our actual cash requirements exceed our estimates and we are not able to obtain further financing.

We will require significant capital to complete our seismic surveys, drill test wells, and to build the necessary infrastructure to commence operations if our exploration activities result in the discovery of sufficient oil and gas reserves to justify their exploitation and development.

Our Company has had negative cash flows from operations. Since inception, we have not earned any significant revenues from operations, and due to the length of time between the discovery of oil and gas reserves and their exploitation and development, we do not anticipate earning significant revenues from operation in the near future. We have incurred and will continue to incur significant expenses. As at September 30, 2010, we had cash and equivalents on hand of $ 357,560. We have sufficient funds to complete preliminary exploration on our Hula property in Israel, as outlined in the plan of operations described herein as well as to commence preliminary exploration on all of our offshore licenses. However, we anticipate that we will have to seek additional financing to fund the advanced

-8-

exploration on our assets, if warranted. Further, we cannot assure you that our actual cash requirements will not exceed our estimates, and in any case we will require additional financing to bring our interests into commercial operation, finance working capital, meet our contractual minimum expenditures and pay for operating expenses and capital requirements until we achieve a positive cash flow. Additional capital also may be required in the event we incur any significant unanticipated expenses.

In light of our operating history, and under the current capital and credit market conditions, we may not be able to obtain additional equity or debt financing on acceptable terms if and when we need it. Even if financing is available, it may not be available on terms that are favorable to us or in sufficient amounts to satisfy our requirements.

If we require, but are unable to obtain, additional financing in the future, we may be unable to implement our business plan and our growth strategies, respond to changing business or economic conditions, withstand adverse operating results, and compete effectively. More importantly, if we are unable to raise further financing when required, our planned exploration activities may have to be scaled down or even ceased, and our ability to generate revenues in the future would be negatively affected.

Our lack of diversification increases the risk of an investment in us, and our financial condition and results of operations may deteriorate if we fail to diversify.

Our business focus is on oil and gas exploration on a limited number of properties in Israel. As a result, we lack diversification, in terms of both the nature and geographic scope of our business. We will likely be impacted more acutely by factors affecting our industry or the regions in which we operate than we would if our business were more diversified. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

We may not effectively manage the growth necessary to execute our business plan.

Our business plan anticipates a significant increase in the number of our contractors, strategic partners and equipment suppliers. This growth will place significant strain on our current personnel, systems and resources. We expect that we will be required to hire qualified consultants and employees to help us manage our growth effectively. We believe that we will also be required to improve our management, technical, information and accounting systems, controls and procedures. We may not be able to maintain the quality of our operations, control our costs, continue complying with all applicable regulations and expand our internal management, technical information and accounting systems to support our desired growth. If we fail to manage our anticipated growth effectively, our business could be adversely affected.

All of our assets are outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or some of our directors or officers.

All of our assets are located outside the United States. In addition, some of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons' assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against us or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under United States federal securities laws against them.

As a holding company, our ability to make payments depends on the cash flows of our subsidiaries and our ability to raise financing

We are a holding company and conduct substantially all of our operations through subsidiaries incorporated outside North America. We have no direct operations and no significant assets other than the shares of our subsidiaries. Therefore, we are dependent on the cash flows of such subsidiaries to meet our obligations, including payment of principal and interest on any debt we incur. The ability of our subsidiaries to provide us with payments may be constrained by the following factors:

- the cash flows generated by operations, investment activities and financing activities;

- the level of taxation, particularly corporate profits and withholding taxes, in Israel; and

- the introduction of exchange controls and repatriation restrictions or the availability of hard currency to be repatriated.

If we are unable to receive sufficient cash from our subsidiaries, we may be required to refinance any indebtedness we incur, raise funds in a public or private equity or debt offering or sell some or all of our assets. We can provide no assurances that an offering of our debt or equity or a refinancing of our debt can or will be completed on satisfactory

-9-

terms or that it would be sufficient to enable us to make payment with respect to our debt. The foregoing events could have an adverse impact on our future cash flows, earnings, results of operations and financial condition.

We have agreed to indemnify our directors against liabilities incurred by them as directors.

We have agreed to indemnify our directors from and against all costs, charges and expenses reasonably incurred by them in respect of any civil, criminal or administrative action or proceeding to which they are made a party or with which they are threatened by reason of being or having been a director of the Company, provided that (i) they have acted honestly and in good faith with a view to the best interests of the Company; and (ii) in the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, they had reasonable grounds for believing that their conduct was lawful. This indemnity may reduce the likelihood of derivative litigation against our directors and may discourage or deter our shareholders from suing our directors.

We may be adversely affected by current global financial conditions.

Current global financial conditions have been characterized by increased volatility and several financial institutions have either gone into bankruptcy or have had to be rescued by governmental authorities. Access to public financing and bank credit has been negatively impacted by both the rapid decline in value of sub-prime mortgages and the liquidity crisis affecting the asset-backed commercial paper market. These and other factors may affect our ability to obtain equity or debt financing in the future on favorable terms. Additionally, these factors, as well as other related factors, may cause decreases in our asset values that may be other than temporary, which may result in impairment losses. If such increased levels of volatility and market turmoil continue, or if more extensive disruptions of the global financial markets occur, our operations could be adversely impacted and the market value of our Common Shares may be adversely affected.

Currency fluctuations could have an adverse effect on our business.

Our earnings and cash flow may also be affected by fluctuations in the exchange rate between the U.S. dollar and other currencies, such as the New Israeli Shekel, the Canadian dollar and to a limited extent, the Euro. Our consolidated financial statements are expressed in U.S. dollars. Our sales of oil and gas, if any, will be denominated in U.S. dollars, while exploration costs and operating costs are, in part, denominated in Israel Shekels, U.S. dollars and Canadian dollars

Fluctuations in exchange rates between the U.S. dollar and other currencies may give rise to foreign exchange currency exposures, both favorable and unfavorable, which have materially impacted and in the future may materially impact our future financial results. We do not utilize a hedging program to limit the adverse effects of foreign exchange rate fluctuations.

Conditions in Israel may affect our operations.

Our subsidiaries conduct their principal operations in Israel, and therefore are directly affected by the political, economic, and military conditions affecting Israel and the Middle East. Armed conflicts between Israel and its neighboring countries and territories occur periodically and a protracted state of hostility, varying in degree and intensity over time, has in the past led to security and economic difficulties for Israel. These hostilities, any escalation thereof or any future armed conflict or violence in the region, could adversely affect our subsidiaries' operations. In addition, we could be adversely affected by other events or factors affecting Israel such as the interruption or curtailment of trade between Israel and its present trading partners, a significant downturn in the economic or financial condition of Israel, a significant downgrading of Israel's international credit rating, labor disputes and strike actions and political instability.

Certain of the Company's Exploration Areas are subject to Contractual Agreements with Land Lessors.

Certain of the areas on which the Company conducts exploration, such as the Kibbutz Neot Mordechai portion of the Eitan License area, are subject to contractual agreements with landowners. These agreements are subject to governmental approval (See Risk Factor on ability to maintain necessary licenses) and certain terms and conditions imposed by the lessor. In the event that a discovery of oil and gas is made, the owner has the ability to negotiate terms further which could increase costs to the Company and could prevent viable extraction.

-10-

Our financial reporting may be subject to weaknesses in internal controls.

Internal controls over financial reporting are procedures designed to provide reasonable assurance that transactions are properly authorized, assets are safeguarded against unauthorized or improper use, and transactions are properly recorded and reported. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance with respect to the reliability of financial reporting and financial statement preparation. As an early-stage company, our internal controls may be less formal and easier to bypass than those of more established corporations.

We cannot be certain that current expected expenditures and completion/testing programs will be realized.

We believe that the costs used to prepare internal budgets are reasonable, however, there are assumptions, uncertainties, and risk that may cause our allocated funds on a per well basis to change as a result of having to alter certain activities from those originally proposed or programmed to reduce and mitigate uncertainties and risks. These assumptions, uncertainties, and risks are inherent in the completion and testing of wells and can include but are not limited to: pipe failure, casing collapse, unusual or unexpected formation pressure, environmental hazards, and other operating or production risk intrinsic in oil and or gas activities. Any of the above may cause a delay in the Company's completion program and its ability to determine reserve potential.

Risks Associated with Our Business

We have not discovered any oil and gas reserves, and we cannot assure you that that we or our venture ever will.

We are in the business of exploring for oil and natural gas, and the development and exploitation of any significant reserves that are found. Oil and gas exploration involves a high degree of risk that the exploration will not yield positive results. These risks are more acute in the early stages of exploration. We have not discovered any reserves, and we cannot guarantee you that we ever will. Even if we succeed in discovering oil or gas reserves, these reserves may not be in commercially viable quantities or locations. Until we discover such reserves, we will not be able to generate any revenues from their exploitation and development. If we are unable to generate revenues from the development and exploitation of oil and gas reserves, we will be forced to change our business or cease operations.

We might incur additional debt in order to fund our exploration and development activities, which would continue to reduce our financial flexibility and could have a material adverse effect on our business, financial condition or results of operation.

It is possible that we might incur debt in order to fund its exploration and development activities, which would continue to reduce our financial flexibility and could have a material adverse effect on our business, operations and results of operations and financial condition. General economic conditions, oil and gas prices and financial, business and other factors affect our operations and future performance. Many of these factors are beyond our control. No assurances can be made that we will be able to generate sufficient cash flow to pay the interest on its debt or that future working capital, borrowings or equity financing will be available to pay or refinance such debt. Factors that will affect its ability to raise cash through an offering of Common Shares or other types of equity securities, or a refinancing of debt include financial market conditions, the value of its assets and performance at the time we need capital. No assurances can be made that we will have sufficient funds to make such payments. If we do not have sufficient funds and are otherwise unable to negotiate renewals of our borrowings or arrange new financing, we might be required to sell significant assets. Any such sale could have a material adverse effect on our business, financial condition and results of operations.

Our assets and operations are subject to government regulation in Israel.

Our interests and operations in Israel may be affected in varying degrees by government regulations relating to the oil and gas industry. Any changes in regulations or shifts in political conditions are beyond the control of the Company may adversely affect our business. Our operations may be affected in varying degrees by new government regulations and changes to existing regulations, including those with respect to restrictions on exploration and production, price controls, export controls, income taxes, employment, land use, water use, environmental legislation and safety regulations. The recent recommendations of the Sheshinski Committee, a government appointed committee in Israel were published on how to tax oil and gas exploitation in Israel. They include increasing the aggregate government take from future oil and gas revenues from approximately 30% today to between 50%-63% including royalties which will remain unchanged at 12.5%. If these recommendations are ultimately adopted by the Israeli Knesset, it could have a material adverse effect on our business, financial condition and results of operations.

-11-

Our future success depends upon our ability to find, develop and acquire additional oil and natural gas reserves that are economically recoverable.

In the event that we are able to find and develop oil and natural gas reserves which are economically recoverable, the rate of production from those reservoirs will decline as reserves are depleted. As a result, we must locate and develop or acquire new oil and natural gas reserves to replace those being depleted by production. We must do this even during periods of low oil and natural gas prices when it is difficult to raise the capital necessary to finance activities. Without successful exploration or acquisition activities, our reserves and revenues will decline. We may not be able to find and develop or acquire additional reserves at an acceptable cost or have necessary financing for these activities.

Oil and natural gas drilling is a high-risk activity.

Our future success will depend on the success of our exploration and drilling programs. In addition to the numerous operating risks described in more detail below, these activities involve the risk that no commercially productive oil or natural gas reservoirs will be discovered. In addition, we are uncertain as to the future cost or timing of drilling, completing and producing wells. Furthermore, our drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including, but not limited to, the following:

- unexpected drilling conditions;

- pressure or irregularities in formations;

- equipment failures or accidents;

- adverse weather conditions;

- inability to comply with governmental requirements; and

- shortages or delays in the availability of drilling rigs and the delivery of equipment.

If we experience any of these problems, our ability to conduct operations could be adversely affected.

We might not be able to determine reserve potential, identify liabilities associated with the properties or obtain protection from sellers against them, which could cause us to incur losses.

Although we believe we have reviewed and evaluated our properties in Israel in a manner consistent with industry practices, such review and evaluation might not necessarily reveal all existing or potential problems. This is also true for any future acquisitions made by us. Inspections may not always be performed on every well, and environmental problems, such as groundwater contamination, are not necessarily observable even when an inspection is undertaken. Even when problems are identified, a seller may be unwilling or unable to provide effective contractual protection against all or part of those problems, and we often assume environmental and other risks and liabilities in connection with the acquired properties.

You should not place undue reliance on reserve information because reserve information represents estimates, and our seismic surveying is still in the preliminary stages.

There are numerous uncertainties inherent in estimating quantities of proved reserves and cash flows from such reserves, including factors beyond our control and the control of engineers. Reserve engineering is a subjective process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact manner. The accuracy of an estimate of quantities of reserves, or of cash flows attributable to these reserves, is a function of many factors, including, but not limited to, the following:

- available data;

- assumptions regarding future oil and natural gas prices;

- estimates of future production rates;

- expenditures for future development and exploitation activities; and

- engineering and geological interpretation and judgment.

Reserves and future cash flows may also be subject to material downward or upward revisions based upon production history, development and exploitation activities and oil and natural gas prices. Actual future production, revenue, taxes, development expenditures, operating expenses, quantities of recoverable reserves and value of cash flows from those reserves may vary significantly from the estimates. In addition, reserve engineers may make different estimates of reserves and cash flows based on the same available data.

The nature of oil and gas exploration makes the estimates of costs uncertain, and our operations may be adversely affected if we underestimate such costs.

It is difficult to project the costs of implementing an exploratory drilling program. Complicating factors include the inherent uncertainties of drilling in unknown formations, the costs associated with encountering various drilling

-12-

conditions, such as over-pressured zones and tools lost in the hole, and changes in drilling plans and locations as a result of prior exploratory wells or additional seismic data and interpretations thereof. If we underestimate the costs of such programs, we may be required to seek additional funding, shift resources from other operations or abandon such programs.

Factors beyond our control affect our ability to market oil and gas.

Our ability to market oil and natural gas from our wells depends upon numerous factors beyond our control. These factors include, but are not limited to, the following:

- the level of domestic production and imports of oil and gas;

- the volatility of both oil and natural gas pricing;

- the proximity of natural gas production to natural gas facilities, pipelines and other means of transportation;

- the availability of pipeline capacity or other means of transportation;

- the demand for oil and natural gas by utilities and other end users;

- the availability of alternate fuel sources;

- the effect of inclement weather; and

- government regulation of oil and natural gas marketing.

If these factors were to change dramatically, our ability to market oil and natural gas or obtain favorable prices for our oil and natural gas could be adversely affected.

Prices and markets for oil are unpredictable and tend to fluctuate significantly, which could reduce profitability, growth and the value of our business if we or our venture ever begin exploitation of reserves.

Our future financial condition, results of operations and the carrying value of our oil and natural gas properties depend primarily upon the prices we receive for our oil and natural gas production, if any. Oil and natural gas prices historically have been volatile and likely will continue to be volatile in the future, especially given current world economic conditions. Significant changes in long-term price outlooks for crude oil could by the time that we start exploiting oil and gas reserves, if we ever discover and exploit such reserves, could have a material adverse effect on revenues as well as the value of licenses or other assets.

Our future cash flow from operations, if any, will be highly dependent on the prices that we receive for oil and natural gas. This price volatility also affects the amount of our cash flow available for capital expenditures and our ability to borrow money or raise additional capital. The prices for oil and natural gas are subject to a variety of additional factors that are beyond our control. These factors include:

- the level of consumer demand for oil and natural gas;

- the domestic and foreign supply of oil and natural gas;

- the ability of the members of the Organization of Petroleum Exporting Countries to agree to and maintain oil price and production controls;

- the price of foreign oil and natural gas;

- the price and availability of alternative fuel sources;

- governmental regulations;

- weather conditions;

- market uncertainty;

- political conditions in oil and natural gas producing regions, including Israel and the Middle East;

- war, or the threat of war, in oil producing regions; and

- worldwide economic conditions.

These factors and the volatility of the energy markets generally make it extremely difficult to predict future oil and natural gas price movements with any certainty. Also, oil and natural gas prices do not necessarily move in tandem. Declines in oil and natural gas prices would not only reduce revenue, but could reduce the amount of oil and natural gas that we can produce economically and, as a result, could have a material adverse effect upon our financial condition, cash flows, results of operations, oil and natural gas reserves, the carrying values of our oil and natural gas properties and the amounts we can borrow under any bank credit facilities we may obtain in the future.

Even if we discover and then develop oil and gas reserves, we may have difficulty distributing our production.

If our exploration activities result in the discovery of oil and gas reserves, and if we are able to successfully develop and exploit such reserves, we will have to make arrangements for storage and distribution of oil and gas. We would have to rely on local infrastructure and the availability of transportation for storage and shipment of oil and gas products, but any readily available infrastructure and storage and transportation facilities may be insufficient or not available at

-13-

commercially acceptable terms. The marketability of our production depends in part upon the availability, proximity, and capacity of oil and natural gas pipelines, crude oil trucking, natural gas gathering systems and processing facilities. This could be particularly problematic to the extent that operations are conducted in remote areas that are difficult to access, such as areas that are distant from shipping or pipeline facilities. Furthermore, weather conditions or natural disasters, actions by companies doing business in one or more of the areas in which we or our venture will operate, or labor disputes may impair the distribution of oil and gas. In addition, Israel has little or no storage capacity and the currently available distribution infrastructure is limited.These factors may affect the ability to explore and develop properties and to store and transport oil and gas and may increase our expenses to a degree that has a material adverse effect on operations.

Our inability to obtain necessary facilities could hamper our operations.

Oil and gas exploration activities depend on the availability of equipment, transportation, power and technical support in the particular areas where these activities will be conducted, and our access to these facilities may be limited. Demand for such limited equipment and other facilities or access restrictions may affect the availability of such equipment to us and may delay exploration and development activities. The quality and reliability of necessary facilities may also be unpredictable and we may be required to make efforts to standardize our facilities, which may entail unanticipated costs and delays. Shortages or the unavailability of necessary equipment or other facilities will impair our activities, either by delaying our activities, increasing our costs or otherwise.

Our success depends on our ability to attract and retain qualified personnel

Recruiting and retaining qualified personnel is critical to our success. The number of persons skilled in the acquisition, exploration and development of oil and gas properties is limited and competition for such persons is intense. As our business activity grows, it will require additional key financial, administrative and mining personnel as well as additional operations staff. Although we believe that we will be successful in attracting, training and retaining qualified personnel, there can be no assurance of such success. If we are not successful in attracting and training qualified personnel, the efficiency of our operations could be affected, which could have an adverse impact on our future cash flows, earnings, results of operations and financial condition. Our development now and in the future will also depend on the efforts of key management figures. The loss of any of these key people could have a material adverse effect on our business. We do not currently maintain key-man life insurance on any of our key employees.

We face strong competition from other energy companies that may negatively affect our ability to carry on operations.

We operate in the highly competitive areas of oil and natural gas exploration, development and production. Factors which affect our ability to successfully compete in the marketplace include, but are not limited to, the following:

- the availability of funds and information relating to a property;

- the standards established by us for the minimum projected return on investment;

- the availability of alternate fuel sources; and

- the intermediate transportation of gas.

Our competitors include major integrated oil companies, substantial independent energy companies, affiliates of major interstate and intrastate pipelines, and national and local natural gas gatherers. Many of these competitors possess greater financial and other resources than we do.

Operating hazards may adversely affect our ability to conduct business.

Our future operations, if any, will be subject to risks inherent in the oil and natural gas industry, including, but not limited to, the following:

- blowouts;

- cratering;

- explosions;

- uncontrollable flows of oil, natural gas or well fluids;

- fires;

- pollution; and

- other environmental risks.

These risks could result in substantial losses to us from injury and loss of life, damage to and destruction of property and equipment, pollution and other environmental damage and suspension of operations. Governmental regulations may impose liability for pollution damage or result in the interruption or termination of operations.

-14-

Losses and liabilities arising from uninsured or under-insured hazards could have a material adverse effect on our business.

If we develop and exploit oil and gas reserves, those operations will be subject to the customary hazards of recovering, transporting and processing hydrocarbons, such as fires, explosions, gaseous leaks, migration of harmful substances, blowouts and oil spills. An accident or error arising from these hazards might result in the loss of equipment or life, as well as injury, property damage or other liability. We cannot assure you that we will obtain insurance on reasonable terms or that any insurance we may obtain will be sufficient to cover any such accident or error. Our operations could be interrupted by natural disasters or other events beyond our control. Losses and liabilities arising from uninsured or under-insured events could have a material adverse effect on our business, financial condition and results of operations.

Compliance with environmental and other government regulations could be costly and could negatively impact production.

All phases of the oil and gas business present environmental risks and hazards and are subject to environmental regulation pursuant to a variety of laws and regulations. Our operations are subject to laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection. The recent trend toward stricter standards in environmental legislation and regulation is likely to continue. The enactment of stricter legislation or the adoption of stricter regulation could have a significant impact on our operating costs, as well as on the oil and natural gas industry in general.

Our existing property, and any future properties that we may acquire, may be subject to pre-existing environmental liabilities.

Pre-existing environmental liabilities may exist on the property in which we currently hold an interest or on properties that may be subsequently acquired by us which are unknown to the Company and which have been caused by previous or existing owners or operators of the properties. In such event, we may be required to remediate these properties and the costs of remediation could be substantial. Further, in such circumstances, we may not be able to claim indemnification or contribution from other parties. In the event we were required to undertake and fund significant remediation work, such event could have a material adverse effect upon the Company and the value of our common shares.

Our business will suffer if we cannot obtain or maintain necessary licenses.

Our operations require licenses, permits and in some cases renewals of licenses and permits from various governmental authorities. Specifically, the licenses awarded to us by the Government of Israel have terms of three years and must be renewed in order to extend the license beyond this initial term. Among other factors, our ability to obtain, sustain or renew such licenses and permits on acceptable terms is subject to change in regulations and policies and to the discretion of the applicable governments. Our inability to obtain, maintain or acquire extensions for these licenses or permits could hamper our ability to produce revenues from operations. Other oil and gas companies may seek to acquire property leases and licenses that we will need to operate our business. This competition has become increasingly intense as the price of oil on the commodities markets has risen in recent years. This competition may prevent us from obtaining licenses we deem necessary for our business, or it may substantially increase the cost of obtaining these licenses.

Penalties we may incur could impair our business.

Failure to comply with government regulations could subject us to civil and criminal penalties, could require us or our venture to forfeit property rights or licenses, and may affect the value of our assets. We may also be required to take corrective actions, such as installing additional equipment, which could require substantial capital expenditures. We could also be required to indemnify our employees in connection with any expenses or liabilities that they may incur individually in connection with regulatory action against them. As a result, our future business prospects could deteriorate due to regulatory constraints, and our profitability could be impaired by our obligation to provide such indemnification to our employees.

Strategic relationships upon which we may rely are subject to change, which may diminish our ability to conduct our operations.

Our ability to successfully acquire additional licenses, to discover reserves, to participate in drilling opportunities and to identify and enter into commercial arrangements depends on developing and maintaining close working relationships with industry participants and government officials and on our ability to select and evaluate suitable properties and to consummate transactions in a highly competitive environment. We may not be able to establish these strategic

-15-

relationships, or if established, we may not be able to maintain them. In addition, the dynamics of our relationships with strategic partners may require us to incur expenses or undertake activities we would not otherwise be inclined to undertake in order to fulfill our obligations to these partners or maintain our relationships. If our strategic relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

Political instability or fundamental changes in the leadership or in the structure of the governments in the jurisdictions in which the Company operates could have a material negative impact on the Company.

Our interests may be affected by political and economic upheavals. Although we currently operate in jurisdictions that welcome foreign investment and are generally stable, there is no assurance that the current economic and political situation in these jurisdictions will not change drastically in coming years. Local, regional and world events could cause the jurisdictions in which we operate to change the mining laws, tax laws, foreign investment laws, or to revise their policies in a manner that renders our current and future projects non-economic.

We may enter into hedging agreements but may not be able to hedge against all such risks.

If we are able to discover commercially exploitable quantities of oil or gas and is able to enter into commercial production, from time to time we may enter into agreements to receive fixed or a range of prices on its oil and natural gas production to offset the risk of revenue losses if commodity prices decline; however, if commodity prices increase beyond the levels set in such agreements, we will not benefit from such increases. Similarly, from time to time we may enter into agreements to fix the exchange rate of certain currencies to US dollars in order to offset the risk of revenue losses if the other currencies increase in value compared to the US dollar; however, if other currencies decline in value compared to the US dollar, we will not benefit from the fluctuating exchange rate. In addition to the potential of experiencing an opportunity cost, other potential costs or losses associated with hedging include the risk that the other party to a hedge transaction does not perform its obligations under a hedge agreement, the hedge is imperfect or our hedging policies and procedures are not followed.

The Company is incorporated in Canada.

The Company is a Canadian corporation governed under theCanada Business Corporations Actand as such, its corporate structure, the rights and obligations of shareholders and its corporate bodies may be different from those of the home countries of international investors. Furthermore, non-Canadian residents may find it more difficult and costly to exercise shareholder rights. International investors may also find it costly and difficult to effect service of process and enforce their civil liabilities against the Company or some of its directors, controlling persons and officers.

To the extent that we establish natural gas and oil reserves, we will be required to replace, maintain or expand these natural gas and oil reserves in order to prevent reserves and production from declining, which could adversely affect cash flows and income.

In general, production from natural gas and oil properties declines over time as reserves are depleted, with the rate of decline depending on reservoir characteristics. If we establish reserves, of which there is no assurance, and is not successful in its subsequent exploration and development activities or in subsequently acquiring properties containing proved reserves, its proved reserves will decline as reserves are produced. Our future natural gas and oil production is highly dependent upon its ability to economically find, develop or acquire reserves in commercial quantities.

To the extent cash flow from operations is reduced, either by a decrease in prevailing production volume prices for natural gas and oil or an increase in finding and development costs, and external sources of capital become limited or unavailable, our ability to make the necessary capital investment to maintain or expand its asset base of natural gas and oil reserves would be impaired. Even with sufficient available capital, its future exploration and development activities may not result in additional proved reserves, and we might not be able to drill productive wells at acceptable costs.

Risks Associated with our Common Shares

We may be classified in the future as a passive foreign investment company, or PFIC, for United States tax purposes, which will have adverse tax consequences for all United States holders of our shares.

We do not believe that we are a PFIC in 2010. However, wemay, in the future, be classified for United States income tax purposes as a passive foreign investment company. This means that any dividends we pay you will be taxed as ordinary income and not at preferential qualifying dividend tax rates, and upon any sale of our Common Shares, any capital gain will be taxed as ordinary income and not at preferential capital gains rates. This will continue to be true

-16-

even after we commence active operations. See discussion in Item 10E "United States Tax Consequences".The exercise of all or any number of outstanding warrants or stock options, the issuance of any annual bonus shares, the award of any additional options, bonus shares or other stock-based awards or any issuance of shares to raise funds or acquire a business may dilute your Common Shares.

We may in the future grant to some or all of our directors, officers, insiders, and key employees options to purchase our Common Shares, bonus shares and other stock based awards as non-cash incentives to those persons. We may grant these options and other stock based awards at exercise prices equal to or less than market prices, and we may grant them when the market for our securities is depressed. The issuance of any equity securities could, and the issuance of any additional shares will, cause our existing shareholders to experience dilution of their ownership interests.

Any additional issuance of shares or decision to enter into joint ventures with other parties to raise financing or acquire other businesses through the sale of equity securities, may dilute our investors' interests in the Company, and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. Such issuance may cause a reduction in the proportionate ownership and voting power of all other shareholders. The dilution may result in a decline in the price of our Common Shares or a change in the control of the Company.

We do not expect to pay dividends for the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, investors will not receive any funds unless they sell their Common Shares, and shareholders may be unable to sell their shares on favorable terms or at all. We cannot assure you of a positive return on investment or that you will not lose the entire amount of your investment in our Common Shares. Prospective investors seeking or needing dividend income or liquidity should not purchase our Common Shares.

An investment in our Company will likely be diluted.

We may issue a substantial number of our common shares without investor approval to raise additional financing and we may consolidate the current outstanding common shares. Any such issuance or consolidation of our securities in the future could reduce an investor's ownership percentage and voting rights in the Company and further dilute the value of your investment.

The value of securities issued by us might be affected by matters not related to own operating performance for reasons that include the following:

- general economic conditions in Canada, the US, Israel and globally;

- industry conditions, including fluctuations in the price of oil and natural gas;

- governmental regulation of the oil and gas industry, including environmental regulation;

- fluctuation in foreign exchange or interest rates;

- liabilities inherent in oil and natural gas operations;

- geological, technical, drilling and processing problems;

- unanticipated operating events which can reduce production or cause production to be shut-in or delayed;

- failure to obtain industry partner and other third party consents and approvals, when required;

- stock market volatility and market valuations;

- competition for, among other things, capital, acquisition of reserves, undeveloped land and skilled personnel;

- the need to obtain required approvals from regulatory authorities;

- worldwide supplies and prices of and demand for natural gas and oil;

- political conditions and developments in Israel, Canada, the US, and globally;

- political conditions in natural gas and oil producing regions;

- revenue and operating results failing to meet expectations in any particular period;

- investor perception of the oil and gas industry;

- limited trading volume of the Common Shares;

- change in environmental and other governmental regulations;

- announcements relating to the Company's business or the business of its competitors;

- the Company's liquidity; and

- the Company's ability to raise additional funds.

-17-

In the past, companies that have experienced volatility in their value have been the subject of securities class action litigation. The Company might become involved in securities class action litigation in the future. Such litigation often results in substantial costs and diversion of management's attention and resources and could have a material adverse effect on the Company's business, financial condition and results of operation.

ITEM 4 INFORMATION ON THE COMPANY

We are a Canadian corporation governed under theCanada Business Corporations Act (the "CBCA") which conducts business as an oil and gas exploration company with operations in the State of Israel. We have been granted the following petroleum licenses from the State of Israel:

- Eitan License No. 356, or Eitan License- covering 31,060 acres (125.7 sq.km.) in the Hula Valley located in Northern Israel. The license was issued in December, 2008 for an initial three year period and may be renewed upon fulfillment of certain conditions for a further four year period;

- Gabriella License No. 378 or Gabriella License - covering 97,000 acres (392 sq. km.) approx. 10km offshore Israel between Netanya and Ashdod. The license was issued in July, 2009 for an initial three year period and may be renewed upon fulfillment of certain conditions for a further four year period;

- Yitzhak License No.380 or Yitzhak License- covering 31,555 acres (127.7 sq.km) approx. 17km offshore Israel between Hadera and Netanya, directly to the North of and contiguous to Gabriella. The license was issued in October, 2009 for an initial three year period and may be renewed upon fulfillment of certain conditions for a further four year period; and

- Samuel License No. 388, or Samuel License - covering 16,740 acres (359 sq. km) approx.17 km offshore Israel adjacent to the shoreline between the City of Ashkelon in the South and the City of Rison Le'tziyon in the North. The license was issued on August 1, 2010 to a consortium led by us (through our subsidiaries, Adira Oil Technologies Ltd. (100% owned) and Adira Geo-Global Ltd (60% owned - the remaining 40% is held by GeoglobalResourses (Barbados) Inc., an unrelated party).

Our Gabriella License, Yitzhak and Samuel Licenses are collectively referred to as our "Offshore Licenses".

All of the licenses are subject to 12.5% royalty payable to the government of Israel.

In addition, we have a right to farm in to 70% of the Notera License which is approximately 19,000 acres and contiguous and directly to the south of the Eitan License and as well as an option to acquire a 5% participating interest in each of the Myra and Sara Licenses, both offshore Israel licenses.

For more information, see Item 4 B below "Onshore Licences" and Offshore Licences".

Our business plan is to carry out exploration activities on our Eitan License in order to assess the existence of commercially exploitable quantities of natural gas. In addition, we also plan to conduct evaluation work on each of the Offshore Licenses to establish whether exploration is justified. We presently do not produce any oil or gas and do not earn any significant revenues.

A. History and Development of the Company

Name

Our legal and commercial name is Adira Energy Ltd.

Principal Office

Our principal office is located at 120 Adelaide Street West, Suite 1204S, Toronto, Ontario, Canada, M4V 3A1. Our telephone number is (416) 250-6500.

Incorporation and Continuation

We are a Canadian corporation governed under theCanada Business Corporations Act (the "CBCA").

We were incorporated on February 20, 1997 under the name "Trans New Zealand Oil Company" by filing our Articles of Incorporation with the Secretary of State of Nevada. We changed our name to "AMG Oil Ltd." on July 27, 1998. On December 17, 2009, we changed our name to "Adira Energy Ltd." Our fiscal year end is September 30.

-18-

On November 25, 2008, the Company's shareholders approved the change of our jurisdiction of incorporation from the State of Nevada to the Canadian federal jurisdiction under the CBCA by way of continuation. The Company completed the filing of its Articles of Conversion with the Nevada Secretary of State on November 25, 2008, and the Company's Articles of Continuance were accepted for filing by Industry Canada effective November 27, 2008. The effect of these filings was to transfer the jurisdiction of incorporation of the Company from the State of Nevada to the Canadian federal jurisdiction under the CBCA. Copies of the Articles of Conversion, Articles of Continuance, Certificate of Continuance and By-Laws, are incorporated by reference to this Form 20-F as exhibits.

The Company's common shares remain registered under Section 12(g) of the Exchange Act after completion of the continuation as a result of the operation of Rule 12g-3 of the Exchange Act. The Company's current trading symbol on the OTCBB is "ADENF". The Company's current trading symbol on the TSXV is "ADL".

Acquisition of Adira Energy

We completed the acquisition of Adira Energy, a company incorporated in the Province of Ontario, on August 31, 2009. As a result of the completion of this acquisition, we are now the owner of all the issued and outstanding shares of Adira Energy and we have ceased to be a "shell company", as defined in Rule 12b-2 of the Exchange Act. The acquisition was completed pursuant to a securities exchange agreement dated August 4, 2009 among Adira, Adira Energy and Dennis Bennie, Ilan Diamond and Alan Friedman, as principal shareholders, and concurrent securities exchange agreements among Adira and each of the minority shareholders of Adira Energy. We issued an aggregate of 39,040,001 common shares to the shareholders of Adira Energy as consideration for the acquisition of Adira Energy.

Immediately prior the acquisition, Adira Energy completed a private placement ("Adira Energy Private Placement") of 7,600,000 units ("Units") at a price of $0.25 per Unit. Sandfire Securities Inc. acted as lead agent to Adira Energy in connection with the Adira Energy Private Placement. Each Unit was comprised of one common share of Adira Energy and one-half of one share purchase warrant. The common shares and share purchase warrants issued by Adira Energy were exchanged concurrently with the closing of the Acquisition. Each resulting share purchase warrant entitles the holder to purchase one additional common share of the Company at the exercise price of $0.50 per share for a two year period following closing, expiring on August 31, 2011. In connection with the Adira Energy Private Placement, 500,770 compensation warrants were issued to agents who will entitle the holders thereof to purchase an equal amount of common shares of the Company at the exercise price of $0.25 per common share for a two year period following closing expiring on August 31, 2011.

Concurrent with the completion of the Acquisition, Michael Hart, Michael Murphy and John Campbell, resigned from the board of Adira and Dennis Bennie (Chair), Glen Perry, Alan Friedman and Ilan Diamond (CEO) were appointed as the new directors of Adira.

In September 2009, Adira completed a private placement of an additional 400,000 Units on a non-brokered basis (the "September Private Placement") at a price of $0.25 per Unit. Each Unit comprised of one common share of Adira Energy and one-half of one share purchase warrant. After deducting commissions payable in connection with the September Private Placement, we raised an aggregate of $100,000in the September Private Placement.

On September 23, 2009, we completed a private placement of an additional 400,000 Units on a non-brokered basis at a price of $0.25 per Unit for aggregate gross proceeds of $100,000. Each Unit comprised of one common share of Adira Energy and one-half of one share purchase warrant

On November 22, 2010 we completed a financing for gross proceeds of $11,000,000 ("Adira Financing"). Pursuant to the Adira Financing, we issued 27,500,000 subscription receipts which upon fulfillment of certain conditions were automatically exercised into 27,500,000 Common Shares and 13,750,000 warrants. Each whole warrant will be exercisable for a term of three years from the date of issuance at an exercise price of $0.55. In addition, we issued warrants to certain parties in conjunction with the Adira Financing. Each such warrant is exercisable into one Common Share for up to three years from the date of closing of the Adira Financing at an exercise price of $0.40.BRM Group Ltd., or BRM, invested $4,000,000 as part of the Adira Financing.

On December 2, 2010, our common shares commenced trading on the TSX Venture Exchange (the "TSXV") following approval of its listing in November 2010.

Prior Operations of Adira

We were previously engaged in the acquisition and, formerly, exploration of resource properties.

We were inactive for approximately four years prior to our acquisition of Adira Energy in 2009 and were considered a "shell" company within the meaning assigned to that term in Rule 12b-2 of the Exchange Act because we had no

-19-

operations and our assets consisted solely of cash. Prior to this four-year period, we had conducted oil and gas exploration activities in New Zealand but withdrew from the permit and assigned our interest to other participants in the permit during the 2003 fiscal year.

We do not receive any revenue from our discontinued oil and gas operations in New Zealand and had no significant assets, tangible or intangible except for cash on hand. We have no history of earnings and there is no assurance that our business will be profitable. We expect to continue incurring operating losses and accumulating deficits in future periods.

Reporting Issuer Status under Canadian Securities Laws

On February 1, 2006, the British Columbia Securities Commission granted our application to be designated as a reporting issuer under theSecurities Act (British Columbia). Accordingly, we and our insiders became subject to the continuous disclosure requirements under the securities laws of the Province of British Columbia, Canada. The Company received final approval for listing on the TSXV on December 1, 2010 and on December 2, 2010, our common shares commenced trading on the TSXV.

Capital Expenditures and Divestitures

During the last three fiscal years ended September 30, 2010, we incurred capital expenditures in the amount of $848,945.These anticipated expenditures related mainly to our drilling exploration program in connection with our Hula Valley property in Israel.

We do not expect any significant purchases of plant and equipment or the hiring of employees within the next twelve months, unless acquired in connection with the acquisition of a business opportunity which may be identified.

Takeover Offers

We are not aware of any indication of any public takeover offers by third parties in respect of our common shares during our last and current financial years.

B. Business Overview

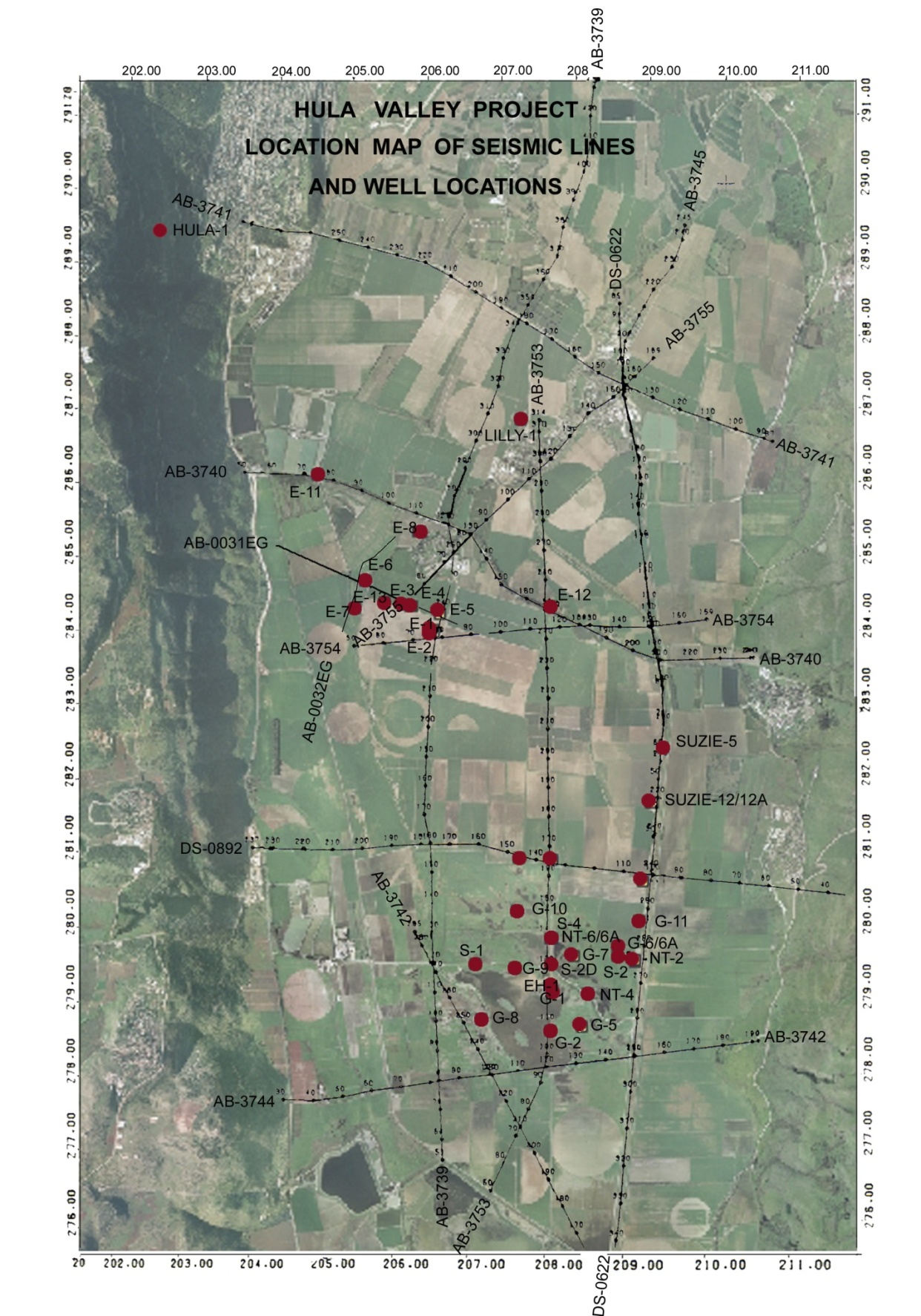

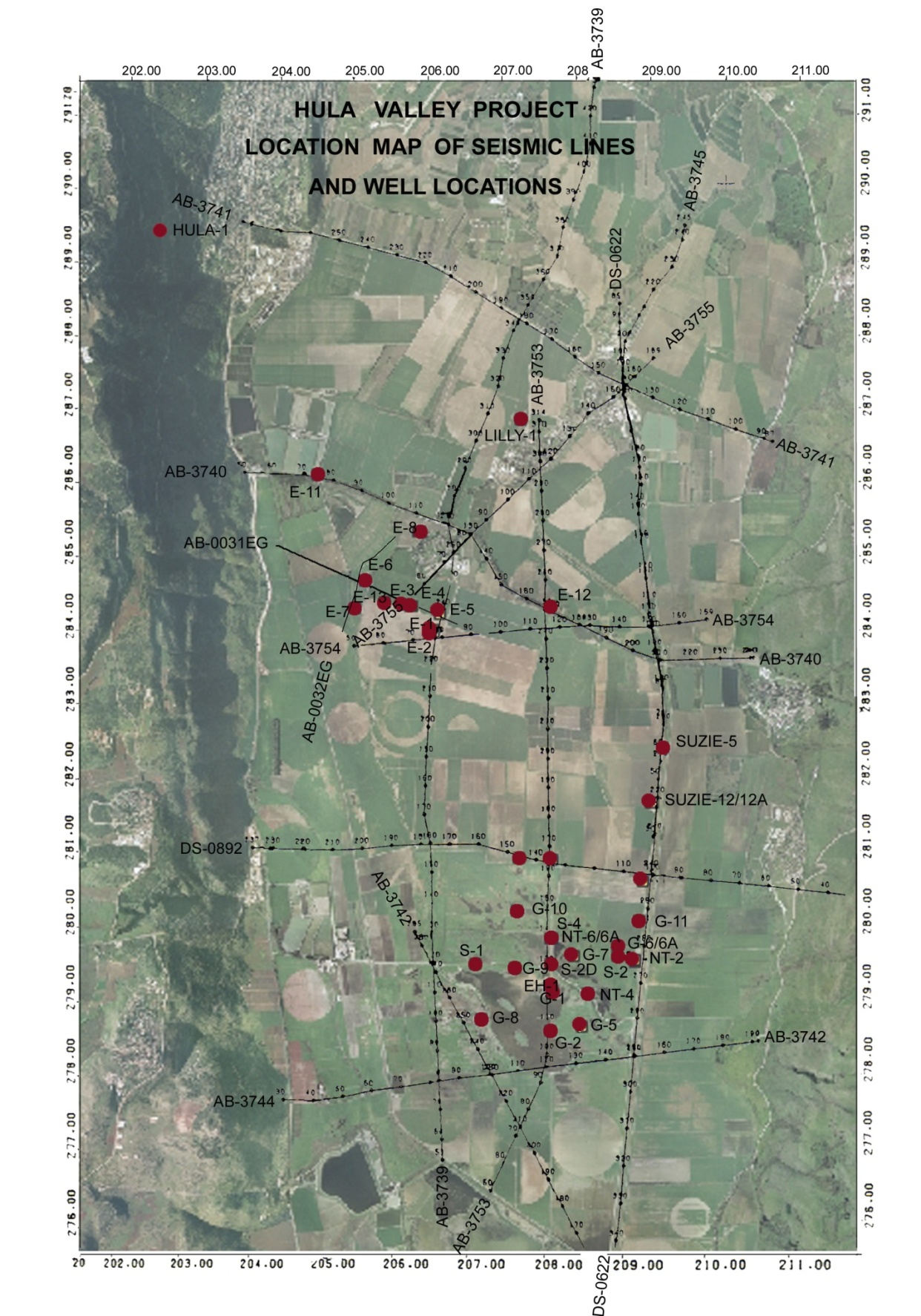

Below is a map showing the location of our Onshore and Offshore Licences.

-20-

Onshore Licences

Eitan License

In December 2008, upon application to the Ministry of National Infrastructures of the State of Israel, Adira Israel obtained the Eitan License, for no consideration other than the payment of a nominal stamp duty. At that time, for tax planning purposes, all of the issued and outstanding shares of Adira Israel were registered in the name of Adira Africa, a privately-owned Canadian corporation, as a trustee for and on behalf of a corporation to be incorporated in Ontario - namely, Adira Energy, which was subsequently incorporated on April 8, 2009 - pursuant to a Declaration of Trust dated November 16, 2008. Upon the incorporation of Adira Energy on April 8, 2009, Adira Africa transferred the shares of Adira Israel to Adira Energy for no consideration, as contemplated by the Declaration of Trust. Accordingly, Adira Energy was in substance treated as the owner of the Adira Israel shares since Adira Israel's inception on October 26, 2008. The only activity undertaken in Adira Israel from December 2008 to April 8, 2009 was the application for, and the receipt of, the Eitan License.

As indicated above, the original term of the Eitan License is three years; however, the term is may be extended for an additional four years under Israeli Petroleum Law, 5712 - 1952, or the Petroleum Law. The area of the permit is approximately 125.7 square kilometers. We have a 100% working interest in the Eitan License and all wells.

The Eitan License area is situated in the Hula Valley in the upper Galilee in Israel and is land owned by the State of Israel. The Hula Valley is located in Northern Israel near the head of the Jordan River Valley. The valley is bordered on the west by the Naftali Mountains, to the east by the Golan Heights, to the north by the Metulla High, and to the south by the Korazim High. The Hula Valley is some 25 km long and 6 km wide providing an area of 150 km2 (37,065 acres) at an elevation of approximately 60 meters to 70 meters above sea level. The subject permit area is 125.7 km2.

The Hula Valley area in which the Eitan License is located has experienced some minor shallow gas exploration but with no commercial discovery of any gas field. There are 142 line kilometers of seismic data available for review.

According to the Petroleum Law, where state land is reasonably required by the holder of a petroleum right for a petroleum purpose, such holder may make a demand from the Israel Lands Authority that the land or any right therein be leased to such holder on the conditions prescribed by the Petroleum Law and the regulations under the Petroleum Law.

-21-