Dear Shareholder,

“The longer the bull market lasts the more severely investors will be affected with amnesia; after five years or so, many people no longer believe that bear markets are possible.”

− Benjamin Graham and David L. Dodd, Security Analysis, 1934

The Hussman Funds continue to adhere to a historically-informed, value-conscious investment discipline focused on the complete market cycle. While our commitment to that investment discipline remains as strong as it was in market cycles prior to the advancing half-cycle that began in 2009, the current segment of this market cycle has remained challenging, because it reflects unusual tension between what can properly be considered investment and what can only be considered speculation.

Performance horizons that capture a trough-to-peak movement in the major indices are typically unkind to hedged-equity strategies, both because the performance of value-oriented stocks can lag the market during mature bull market advances, particularly at extreme valuations, and also because any hedging against downside risk will not have been rewarded.

The one-year period ended June 30, 2017 featured an extension of already extreme market valuations, coupled with generally tepid market action among value-oriented stocks. This combination was difficult for our hedged equity strategies, with losses of -15.53% in Strategic Growth Fund (also partially attributable to decay in the time-value of index put options), -2.32% in Strategic Value Fund, and -4.24% in Strategic International Fund. Meanwhile, both Treasury bonds and precious metals shares declined during this period, contributing to a -3.50% loss in Strategic Total Return Fund.

Our patience with the discomfort of not participating, and even losing value, during the recent market advance can only be understood in the context of the historical consequences of similar speculative episodes (and the returns that were often possible by avoiding them). It is a discipline that we have needed to exercise before, and it is a rather lonely place to be, at least at similar points in the market cycle. As I observed in our June 30, 2007 Annual Report, shortly before the Standard & Poor’s 500 Index lost more than -55% of its value:

“My unwillingness to speculate by accepting market risk in these richly valued and overextended conditions has demanded your patience, for which I am apologetic, and your trust, for which I am grateful. I believe that it remains the correct action to adhere to a disciplined, well-tested, value- conscious investment strategy... It is appropriate to

5

The Hussman Funds |

Letter to Shareholders (continued) |

avoid speculative risk in environments where speculative risk has historically produced poor average returns, even if speculative risk turns out to be rewarding in a specific instance. Similarly, it is appropriate to avoid the purchase of investments whose price is not well supported by an expected and reasonably predictable stream of cash flows, even if such investments turn out to be rewarding in a speculative environment. There are many speculative vehicles available for investors who choose to accept such risks. There is little reason to add the Hussman Funds to that list.”

Evidence from a century of market cycles suggests that investors should be skeptical about score-keeping at points where market valuations deviate dramatically from historical norms. When valuations are deeply depressed, past market returns typically appear dismal, and encourage investors to abandon market risk exactly when they should embrace it. Conversely, when valuations are extremely elevated, past returns typically appear glorious, and encourage investors to embrace market risk exactly when they should abandon it.

Prospective market losses over the complete cycle

“Investors have turned the market into a carnival, where everybody ‘knows’ that the new rides are the good rides, and the old rides just don’t work. Where the carnival barkers seem to hand out free money for just showing up. Unfortunately, this business is not that kind - it has always been true that in every pyramid, in every easy-money sure-thing, the first ones to get out are the only ones to get out... One of the things that you may have noticed is that our downside targets for the market don’t simply slide up in parallel with the market. Most analysts have an ingrained ‘15% correction’ mentality, such that no matter how high prices advance, the probable maximum downside risk is just 15% or so (and that would be considered bad). Factually speaking, however, that’s not the way it works... The inconvenient fact is that valuation ultimately matters. That has led to the rather peculiar risk projections that have appeared in this letter in recent months. Trend uniformity helps to postpone that reality, but in the end, there it is... Over time, price/revenue ratios come back into line. Currently, that would require an 83% plunge in tech stocks (recall the 1969-70 tech massacre). The plunge may be muted to about 65% given several years of revenue growth. If you understand values and market history, you know we’re not joking.”

− John P. Hussman, Ph.D., Hussman Econometrics, March 7, 2000

There is no assurance that my concerns about current extremes will be validated as strongly as those I expressed in 2000 or 2007, nor do we require a market collapse as a prerequisite for a constructive or aggressive market outlook. Still, the most reliable measures of valuation we identify (those most strongly correlated with

6

The Hussman Funds |

Letter to Shareholders (continued) |

actual subsequent 10-12 year market returns) currently stand between 140-170% above historical norms that have been approached or breached by the completion of nearly every market cycle in history, including the most recent cycle that ended with the 2009 lows.

Across numerous valuation measures we have studied over time, the most reliable ones share a common feature: they focus on identifying “sufficient statistics” for the very, very long-term stream of cash flows that stocks can be expected to deliver into the hands of investors over time. Because profit margins vary considerably over time (largely reflecting shorter-run differences between productivity growth and real wage growth), market valuation measures that are linked to revenues typically show a stronger correlation with actual subsequent market returns than measures based on current or year-ahead earnings.

The price/revenue ratio of the S&P 500 currently stands at the highest level ever observed, with the exception of the 2000 market peak. Notably, the median price/revenue ratio across individual S&P 500 component stocks has already surpassed every prior top, extending more than 50% beyond its peak in 2000, and over 40% beyond its peak in 2007. This elevation reflects a profoundly broad valuation extreme compared with the 2000 and 2007 peaks and extends far beyond any narrow subset of stocks. Grouping S&P 500 component stocks into deciles according to their price/revenue ratios, we find that over the completion of prior market cycles, the median loss of stocks in each decile has been closely related to the median price/revenue ratio of that decile, relative to its own respective norm.

For example, at the March 2000 bubble peak, the extreme valuation of the S&P 500 Index was largely driven by a single decile of stocks, primarily comprising large-capitalization companies in the technology industry. At that time, an understanding of market history (including the outcomes of prior speculative episodes) enabled the seemingly preposterous but accurate estimate that large-cap technology stocks faced potential losses of approximately -83% over the completion of the market cycle. At the same time, however, the prospective loss for the least expensive half of S&P 500 component stocks was only about -25%. That difference allowed investors to mitigate much of the damage from the 2000-2002 market collapse, provided they were not heavily invested in technology stocks, and were willing to deviate considerably from a capitalization-weighted portfolio.

At the 2007 market peak, by contrast, stocks were generally overvalued enough to indicate prospective losses of about -55% for all but the very lowest price/revenue decile. That risk was realized in the form of widespread and indiscriminate losses

7

The Hussman Funds |

Letter to Shareholders (continued) |

across all sectors during the market collapse that followed, even though financial stocks were hardest hit. By the 2009 market low, all ten price/revenue deciles ended the cycle at multiples below their respective historical norms.

In my view, investors are vastly underestimating the prospects for market losses over the completion of this cycle; are overestimating the availability of “safe” stocks or sectors that might avoid the damage; and are overestimating both the likelihood and the need for some recognizable “catalyst” to emerge before severe market losses unfold. We presently estimate median losses of about -63% in S&P 500 component stocks over the completion of the current market cycle. There is not a single decile of stocks for which we expect market losses of less than about -54% over the completion of the current market cycle, and we estimate that the richest deciles could lose about -67% to -69% of their market capitalization. As in 2000 and 2007, I believe that investors are mistaking a wildly reckless world for a permanently changed one, and that their reeducation in the concept that valuations matter is likely to be predictably brutal.

Even a brief return to historically run-of-the-mill valuations would presently require a market loss in the S&P 500 Index on the order of -63%. No market cycle in history, including those featuring very low interest rates, has failed to bring these valuation measures to about 60% of present levels or lower, implying that a -40% market loss expectation would be conservative. Neither outcome would bring the S&P 500 Index below its historical valuation norms on the most reliable measures we identify. I believe that investors should allow for a decline in the S&P 500 Index to less than half of its current level over the completion of the current market cycle, quite possibly moving below the 1000 level. While my corresponding estimates of likely market losses for the major indices in 2000 and 2007 may have appeared equally preposterous, they were ultimately accurate.

Investment merit and speculative merit

One of the central lessons from market cycles across history is that valuation – the price of a security relative to the stream of future cash flows expected to be delivered into investors’ hands over time – is the primary driver of long-term and full-cycle investment returns. Indeed, we observe correlations near 90% between several reliable measures of valuation and actual subsequent 10-12 year total returns in the S&P 500 Index. Based on the consensus of these measures, current equity market valuations now exceed every point in history except the extreme reached during the single week of March 24, 2000, at the peak of the technology bubble.

8

The Hussman Funds |

Letter to Shareholders (continued) |

Among scores of valuation measures we have tested or introduced over time, the ratio of nonfinancial market capitalization to corporate gross value-added, including estimated foreign revenues (MarketCap/GVA), has a stronger relationship with subsequent market returns than any alternative we have examined, including popular measures such as market capitalization/GDP, Robert Shiller’s cyclically-adjusted price/earnings ratio, the S&P 500 price/earnings ratio using forward operating earnings, and the S&P 500 forward operating earnings yield divided by the 10-year Treasury yield (the so called “Fed Model”). Based on this measure, we currently estimate prospective S&P 500 nominal total returns averaging just 0.3% annually over the coming-12 year period.

Put simply, valuations exert an enormous impact on the full-cycle and long-term returns that investors can expect from equity market investments.

At the same time, value-conscious investors also need to recognize the tendency for speculation to dominate market behavior over shorter segments of the market cycle. Confronted with this fact during the late-1990’s technology bubble, many investors appeared to discard valuations entirely. I believed that a better question was “what distinguishes an overvalued market that continues to advance from an overvalued market that drops like a rock?” Examining market cycles across history, the distinction between those two outcomes had little to do with the level valuation, and instead typically depended on certain features of market action; particularly what I termed the “uniformity” of price behavior across a wide range of securities, industries, sectors, and security-types. Essentially, when investors are inclined to speculate, they tend to be indiscriminate about it. In contrast, when an overvalued market shows signs of dispersion across various sectors and security-types, it typically becomes most vulnerable to steep losses.

The respected value investor Ben Graham once observed, “The distinction between investment and speculation in common stocks has always been a useful one and its disappearance is a cause for concern.” I believe that it remains useful to make that distinction explicit. Investment merit is based on valuation, while speculative merit is based on market action, including the uniformity of internals across a wide range of securities, which we take as a signal of the psychological preference of investors to speculate. We find that stocks have historically become vulnerable to steep losses when our measures of both valuation and market action are unfavorable. In contrast, we find that the strongest market return/risk profiles in market cycles across history typically emerge when a material retreat in valuations is joined by an early improvement in our measures of market action.

9

The Hussman Funds |

Letter to Shareholders (continued) |

Why “this time” was different

The distinction between the “investment merit” of favorable valuation, and “speculative merit” of favorable market action served us well until 2009. While we anticipated the 2007-2009 market downturn, the severe economic fallout during the crisis was wholly “out of sample” from the standpoint of post-war data on which our existing methods were based. This led me to insist on stress-testing our methods of classifying market return/risk profiles against Depression-era data. The period since then has been unusually challenging for our investment discipline. While we can’t go back in time and repeat this period with the lessons we’ve drawn from it, my impression is that the best way to explain our enthusiasm and commitment toward our investment discipline is to discuss this period, and its implications for future market cycles.

As we worked to increase the robustness of our methods in Depression-era data, I discussed the effort as our “two data sets problem,” and in the midst of that ambiguity, we missed a substantial market rebound that both our pre-2009 methods and our current methods could have captured. The resulting “ensemble” methods performed better across every data set than our existing methods, and strengthened our confidence in the usefulness of combining valuations and market action when classifying return/risk conditions. But they also captured a historical regularity that turned out to be our Achilles Heel in the face of the Federal Reserve’s zero interest rate policy.

In prior market cycles across history, extreme “overvalued, overbought, overbullish” features of market action were regularly accompanied or quickly followed by a shift toward risk-aversion among investors (which we infer from the uniformity of internals across a wide range of securities and security types). Because of that overlap, these “overvalued, overbought, overbullish” syndromes, in and of themselves, could historically be taken as reliable warnings of likely air-pockets, panics, or crashes.

Unfortunately, the Federal Reserve’s zero interest rate policies disrupted that overlap. With the relentless encouragement of the Fed, investors came to believe that there was no alternative to speculating in stocks, and even obscene valuations and overextended conditions were followed by further speculation, without any shift toward risk-aversion. In the face of zero interest rates, it was necessary to wait until market internals deteriorated explicitly before adopting a hard-negative market outlook.

Clearly, our persistent defensiveness in response to overvalued, overbought, overbullish conditions was wrong in the face of zero interest rate policy. Still, correcting that wrong revealed a great deal about the underlying truth. The lesson to be learned was not that the Fed’s policies of quantitative easing and zero interest rates were omnipotent in supporting stock prices. The lesson was not that valuations were

10

The Hussman Funds |

Letter to Shareholders (continued) |

irrelevant, or that “this time was different” in ways that investors could not comprehend. The lesson was not that low interest rates made stocks “cheap” at any price. Rather, the lesson was that in the presence of zero interest rates, yield-seeking speculation could persist even in the face of obscene valuations and recklessly overextended conditions. In the presence of zero interest rates, one can take a neutral market outlook, but one has to defer a negative market outlook until the uniformity of market internals deteriorates explicitly.

We implemented that restriction to our approach in 2014. It is a fair question, then, to ask why our challenges in this half-cycle have continued beyond 2014. Part of the answer relates to what we view as an extended, late-stage top formation in stocks. While the major indices experienced a moderate correction in early-2016, fresh rounds of speculation followed both the British vote to exit the European Union and the U.S. election results, extending the bull market advance to what is now the second-longest in history. Market action during this period has recruited far less uniformity among market internals than was observed prior to mid-2014; a situation that continues to leave recent gains vulnerable to steep and abrupt losses.

Still, one of the principal challenges for value-conscious investment strategies since mid-2104, including our own, has emerged not because of extreme valuations, but because of an exodus among investors to “passive indexing” strategies, focused on replicating the portfolio composition of the S&P 500 Index, regardless of the valuation of the underlying components. This has been coupled with a concentration of gains among a small number of large-capitalization companies in the internet sector.

As I observed approaching the 2007 market peak, performance gaps between value-centric portfolios and the major indices tend to occur when the major indices themselves are at points of steep overvaluation and record highs. This tendency has recently been evident in our own stock-selection disciplines as well. In Strategic Growth Fund, for example, excluding the impact of hedging transactions, the portfolio of stocks held by the Fund enjoyed a total return of 266.78% in the period from July 24, 2000 through June 30, 2014, compared with a total return of 75.21% in the S&P 500. However, from June 30, 2014 through June 30, 2017, the stock-selections of the Fund had a total return of just 12.64%, compared with a total return of 31.70% in the S&P 500. Since Strategic Growth Fund typically hedges market risk with offsetting short sales in a combination of market indices, this difference in performance contributed to a loss for the Fund. The same tendency has been true in Strategic Value Fund, where the cumulative total return of stocks held by the Fund since June 30, 2014 has been 10.76%, lagging the performance of the S&P 500, which is the Fund’s primary hedging vehicle.

11

The Hussman Funds |

Letter to Shareholders (continued) |

While this behavior has clearly created challenges for value-conscious investors, I believe that it can also create opportunities. In our study of numerous effective stock-selection approaches across history, all of them have experienced periods when their performance has lagged the performance of the major indices, sometimes for a span of a few years. The reversal of these performance gaps is not assured, but they can often represent opportunities for disciplined investors. Indeed, the primary driver of strong performance in Strategic Growth Fund during the 2000-2002 market collapse was its value-conscious focus on stocks that did not closely mirror the composition of the major indices.

Extremes in two pendulums

There are two conclusions to be drawn from our experience in the advancing half-cycle since 2009. First, much of our difficulty prior to mid-2014 was an inadvertent consequence of our 2009 stress-testing efforts, coupled with extraordinary Federal Reserve policies that encouraged persistent speculation well after the emergence of “overvalued, overbought, overbullish” syndromes, which had reliably signaled heightened risk in prior market cycles across history. This difficulty was addressed by the adaptations that we introduced in 2014. In the presence of zero interest rate conditions, even the most extreme overvalued, overbought, overbullish conditions must be joined by an explicit deterioration in our measures of market internals before adopting a strongly negative market outlook. I believe that our 2014 adaptations will likely enable us better to navigate the Funds through future market cycles, even if similarly extraordinary monetary policies become a regular feature of the financial markets.

Second, the challenges since mid-2014 have been due partly to extremely overvalued market conditions that have not yet resolved (despite the present dispersion we observe in market internals), and partly to what appears to be valuation-insensitive performance-chasing in capitalization-weighted indices such as the S&P 500. While we can’t identify the point when this behavior will reverse, we’ve observed similar periods of transitory underperformance in numerous historically effective stock-selection approaches. Our adherence to a value-conscious stock selection approach remains grounded in historically-informed discipline rather than any specific expectation for a near-term reversal.

I believe that our pre-2014 challenges have been addressed, and that the more recent ones will prove transitory, as they have in prior market cycles. On both fronts, I remain convinced that our investment discipline is well-suited to navigate the completion of the current market cycle and future ones, combining value-conscious stock selection with pursuit of strong full-cycle market returns and reduced exposure to

12

The Hussman Funds |

Letter to Shareholders (continued) |

major market downturns. The effectiveness of our investment discipline in navigating complete market cycles was clearly evident prior to the advancing half-cycle that began in 2009. Our challenges since then have reflected extremes in two pendulums, one relating to general market valuations, and the other relating to performance-chasing in capitalization-weighted indices.

Profit margins, interest rates, and economic growth

Three considerations regarding the financial and economic landscape are worth noting. The first relates to profit margins. Despite the notion that recent record profit margins will be sustained indefinitely, it is useful to recognize that fluctuations in U.S. profit margins move hand-in-hand with fluctuations in real unit labor costs, which essentially measure the cost of labor as a fraction of the price per unit of output. Notably, the sustained trend toward falling labor costs quietly reversed several years ago, as did the sustained ascent of nonfinancial profit margins in the U.S. economy. Operating profit margins for the S&P 500 Index also peaked in the third quarter of 2014. Profit margins are likely to remain elevated only to the extent that the sum of price inflation and productivity growth materially outpaces wage inflation. In a tightening labor market with chronically low productivity growth, this prospect has diminished.

The second consideration relates to interest rates. While Wall Street has placed a great deal of faith in the notion that low interest rates “justify” elevated market valuations, we observe precious little analysis to quantify this impact. Investors often misinterpret the form, reliability, and magnitude of the relationship between valuations and interest rates, and become confused about when interest rate information is needed and when it is not. Specifically, given a set of expected future cash flows and the current price of the security, one does not need any information about interest rates at all to estimate the long-term return on that security. The price of the security and the cash flows are sufficient statistics to estimate the expected return. At that point, we can compare it with competing returns on bonds, to judge whether we think it is adequate, but no knowledge of interest rates is required to “adjust” the arithmetic.

On the other hand, given a set of expected cash flows, the level of interest rates can be used to help investors decide what level of returns to demand, and to then calculate the price they are willing to pay. Consider the effect of a given departure of interest rates from normal levels. Suppose investors believe that market valuations should be tightly related to the level of interest rates (the correlation actually goes the wrong way outside of the 1970-1998 period, but suppose we assume otherwise). One can show using any discounted cash flow approach that if interest rates are expected to be say, 3% below average for the entire decade ahead, then market

13

The Hussman Funds |

Letter to Shareholders (continued) |

valuations ought to be roughly 30% higher than historical norms (essentially 3% x 10 years), in order to reduce market returns commensurately. Unfortunately, the most reliable valuation measures (those most tightly correlated with actual subsequent market returns in cycles across history) are currently between 140-170% above their respective historical norms.

The third consideration relates to economic growth. Even in the absence of a recession, demographic and savings-investment conditions limit the likely trend of U.S. real GDP growth to less than 2% annually in years ahead, even in the absence of an outright recession. Real GDP growth is driven by the sum of labor force growth and productivity. As of July 2017, the U.S. labor force stood at 160.5 million workers. Based on population and demographic factors, the U.S. Bureau of Labor Statistics projects that the U.S. labor force will reach 163.8 million workers by 2024. Even if the unemployment rate remains at its current level of just 4.3%, the resulting contribution to GDP growth would average just 0.3% annually. Any further increase in GDP must come from productivity growth. Over the past decade, productivity growth has declined from a post-war average of 2% to a growth rate of just 1% annually, with growth of just 0.6% annually over the past 5 years.

These considerations highlight the difficulty with current valuation levels. As matter of asset pricing, lower interest rates “justify” higher valuation multiples for stocks only if the growth rate of future cash flows is held constant. The effect of a higher valuation multiple is to reduce the prospective future return on stocks to a level more aligned with interest rates. However, if lower interest rates are matched by lower growth rates, the prospective future returns of the market fall, in alignment with those lower interest rates, but no increase in valuation multiples is required.

If lower interest rates are matched by lower growth rates, it is profoundly mistaken to drive valuation multiples higher, because future market returns are then effectively penalized twice. This is my impression of what investors have actually done. Worse, because investors are paying rich multiples of earnings that are already elevated by cyclically-high profit margins, we presently expect negative S&P 500 nominal annual total returns over the coming decade, with total returns averaging just 0.3% annually over the coming 12-year horizon, and interim losses on the order of -63%.

Meanwhile, although many international markets presently appear less steeply overvalued than the U.S. markets, international stocks tend to amplify, rather than diversify, portfolio losses during periods where the U.S. markets decline. In Strategic International Fund, we expect to remove or reduce our hedges against international equity market risk at the point where the estimated return/risk profile for U.S. markets becomes at least somewhat more constructive.

14

The Hussman Funds |

Letter to Shareholders (continued) |

With the 10-year Treasury bond yield at 2.2%, even a modest further normalization of short–term interest rates would be expected to produce similar returns from a sequence of Treasury bill investments over the coming decade. Accordingly, Strategic Total Return Fund currently maintains a fairly short duration of about 2 years in its bond holdings. As usual, the Fund tends to boost its exposure to long-term bonds opportunistically, in response to higher yields and other factors such as indications of economic weakness. The Fund’s allocation to stocks of companies in the precious metals industry was recently increased to slightly more than 12% of net assets in response to price weakness in these stocks, coupled with other factors including a decline in the value of the U.S. dollar.

Fund Performance

For the fiscal year ended June 30, 2017, Strategic Growth Fund lost -15.53%, attributable to a difference in performance of the stocks held by the Fund, compared with the capitalization-weighted indices the Fund uses to hedge, combined with decay in the time-value of index put options held by the Fund. Strategic Total Return Fund lost -3.50% for the same period, attributable to price declines in both the Treasury bond and precious metals markets. Strategic International Fund lost -4.24% for the same period, and Strategic Value Fund lost -2.32% for the same period, both attributable to modest underperformance of the stocks held by these Funds, relative to the capitalization-weighted indices used to hedge market risk.

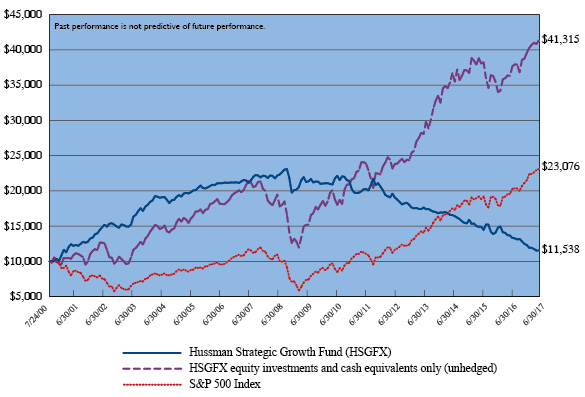

From the inception of Strategic Growth Fund on July 24, 2000 through June 30, 2017, the Fund had an average annual total return of 0.85%, compared with an average annual total return of 5.06% for the S&P 500 Index. An initial $10,000 investment in the Fund on July 24, 2000 would have grown to $11,538, compared with $23,076 for the same investment in the S&P 500 Index. The deepest loss experienced by the Fund since inception was -51.27%. The majority of this loss occurred after the Federal Reserve expanded its policy of quantitative easing (mid-2010) and when we adapted our investment methods to reduce our defensive response to “overvalued, overbought, overbullish” conditions in periods of zero interest rates where market internals had not deteriorated explicitly (mid-2014). The deepest loss experienced by the S&P 500 Index since the inception of the Fund was -55.25%.

From the inception of Strategic Total Return Fund on September 12, 2002 through June 30, 2017, the Fund had an average annual total return of 4.63%, compared with an average annual total return of 4.29% for the Bloomberg Barclays U.S. Aggregate Bond Index. An initial $10,000 investment in the Fund on September 12, 2002 would have grown to $19,539, compared with $18,629 for the same investment in the Bloomberg Barclays U.S. Aggregate Bond Index. The deepest loss

15

The Hussman Funds |

Letter to Shareholders (continued) |

experienced by the Fund since inception was -11.52%, compared with a maximum loss of -5.08% for the Bloomberg Barclays U.S. Aggregate Bond Index during the same period.

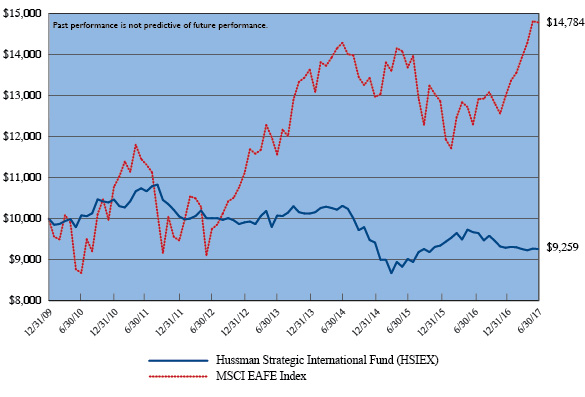

From the inception of Strategic International Fund on December 31, 2009 through June 30, 2017, the Fund had an average annual total return of -1.02%, compared with an average annual total return of 5.35% for the MSCI EAFE Index. An initial $10,000 investment in the Fund on December 31, 2009 would be worth $9,259, compared with $14,784 for the same investment in the MSCI EAFE Index. The deepest loss experienced by the Fund since inception was -21.77%, compared with a maximum loss of -26.48% for the MSCI EAFE Index during the same period.

From the inception of Strategic Value Fund on February 6, 2012 through June 30, 2017, the Fund had an average annual total return of -0.40%, compared with an average annual total return of 13.95% for the S&P 500 Index. An initial $10,000 investment in the Fund on February 6, 2012 would be worth $9,787, compared with $20,239 for the same investment in the S&P 500 Index. The deepest loss experienced by the Fund since inception was -12.20%, compared with a maximum loss of -12.96% for the S&P 500 Index during the same period.

Portfolio Notes

Strategic Growth Fund

The stock selection approach of Strategic Growth Fund has outperformed the S&P 500 Index by an average of 3.67% (367 basis points) annually since the inception of the Fund. During the fiscal year ended June 30, 2017, the stock market displayed substantial dispersion across individual stocks and sectors and the Fund’s stock selections gained 13.81%. The indices that the Fund uses to hedge also displayed strong performance, with the S&P 500 Index, Russell 2000 Index, and Nasdaq 100 Index achieving total returns of 17.90%, 24.60%, and 25.86%, respectively.

Market action during the past year has featured continued dispersion in market internals, as measured by price behavior across a wide range of individual stocks, industries, sectors, and security types, including debt securities of varying credit risk. As this internal dispersion has persisted, the performance of capitalization-weighted indices has become dominated by a handful of the very largest stocks in those indices; a characteristic that was also evident at the 2000 and 2007 market peaks. The Fund was fully-hedged during the past year, and in the face of extreme valuations coupled with deteriorating market internals, the Fund held higher-strike put options as part of its hedge, typically with a less aggressive hedge when various trend-following

16

The Hussman Funds |

Letter to Shareholders (continued) |

measures were favorable (even if our broader measures of market internals were not). We expect that the most reasonable opportunity to reduce hedges and establish a more constructive investment stance will emerge at the point that a material retreat in market valuations is coupled with a firming of market action after such a retreat.

Strategic Total Return Fund

During the fiscal year ended June 30, 2017, Strategic Total Return Fund held a relatively conservative position in bonds, with a duration typically ranging between 1-4 years (meaning that a 100 basis point move in interest rates would be expected to affect Fund value by about 1-4% on the basis of bond price fluctuations). The -3.50% loss during this period was attributable to general market declines in the prices of Treasury bonds and shares of companies engaged in the mining of precious metals.

Strategic International Fund

During the fiscal year ended June 30, 2017, Strategic International Fund was fully hedged against the impact of general market fluctuations. The Fund’s -4.24% loss during this period was attributable to underperformance of stocks held by the Fund, relative to the MSCI EAFE Index. Because of high correlations that occur between international equity markets during steep declines in U.S. markets, we expect the Fund to maintain a relatively defensive stance until our assessment of U.S. market risk becomes more favorable than is presently the case. In the absence of extreme market risk, the Fund will have substantially greater opportunity to establish a constructive investment stance based on valuation, market action and other investment considerations specific to the equity markets of individual countries.

Strategic Value Fund

During the fiscal year ended June 30, 2017, Strategic Value Fund was fully hedged against the impact of general market fluctuations. The Fund’s -2.32% loss during this period was attributable to underperformance of stocks held by the Fund, relative to the S&P 500 Index. As noted above, the largest peak-to-trough drawdown in Strategic Value to date has been -12.20%, compared with a loss of -12.96% in the S&P 500 Index. The volatility of the Fund’s returns (based on daily standard deviation) has been 4.56%, versus 12.40% for that benchmark. Much of this lower drawdown and volatility can be attributed to the hedge held by the Fund against the impact of market fluctuations. The companies in the Fund’s portfolio also tend to have lower variability in sales, earnings, and profit margins, combined with an emphasis on balance sheet stability,

17

The Hussman Funds |

Letter to Shareholders (continued) |

dividend coverage, and favorable estimated valuations relative to the general market. In our view, these characteristics have contributed to lower volatility in the Fund’s stock holdings relative to the S&P 500 Index.

Portfolio Composition

As of June 30, 2017, Strategic Growth Fund had net assets of $375,466,515, and held 113 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were information technology (37.6%), health care (14.1%), industrials (10.7%), consumer discretionary (10.5%), consumer staples (10.0%), materials (5.5%) and energy (4.6%). The smallest sector weights were in financials (3.6%), utilities (2.6%) and telecommunications (1.2%).

Strategic Growth Fund’s holdings of individual stocks as of June 30, 2017 were valued at $376,935,366. Against these stock positions, the Fund also held 1,000 option combinations (long put option/short call option) on the S&P 500 Index, 500 option combinations on the Russell 2000 Index and 100 option combinations on the Nasdaq 100 Index. Each option combination behaves as a short sale on the underlying index, with a notional value of $100 times the index value. On June 30, 2017, the S&P 500 Index closed at 2,423.41, while the Russell 2000 Index and the Nasdaq 100 Index closed at 1,415.359 and 5,646.918, respectively. The Fund’s total hedge therefore represented a short position of $369,578,120, thereby hedging 98.0% of the dollar value of the Fund’s long investment positions in individual stocks.

Though the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following equity holdings achieved gains in excess of $5 million during the year ended June 30, 2017: Masimo, NVIDIA, Ulta Beauty, Cirrus Logic, II-VI, Universal Forest Products, Ebix and Mastec, Barrick Gold, Amazon, Newmont Mining and Inphi. Equity holdings with losses in excess of $3 million during this same period were Depomed, Express and First Solar.

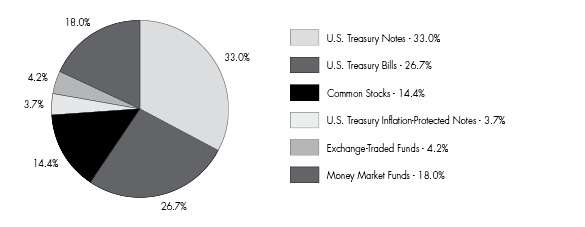

As of June 30, 2017, Strategic Total Return Fund had net assets of $372,501,795. Treasury bills, Treasury notes, Treasury Inflation-Protected Securities (TIPS) and investments in money market funds represented 81.4% of the Fund’s net assets. Shares of exchange-traded funds, precious metals shares and utility shares accounted for 4.2%, 14.1% and 0.3% of net assets, respectively.

In Strategic Total Return Fund, during the year ended June 30, 2017, portfolio gains in excess of $2 million were achieved in U.S. Treasury Inflation-Protected Note (2.50%, due 1/15/2029), U.S. Treasury Note (2.50%, due 8/15/2023), U.S. Treasury

18

The Hussman Funds |

Letter to Shareholders (continued) |

Note (2.50%, due 5/15/2024) and U.S. Treasury Note (1.50%, due 1/31/2019). Holdings with losses in excess of $1 million during this same period were U.S. Treasury Note (1.50%, due 8/15/2026) and U.S. Treasury Note (1.625%, due 5/15/2026).

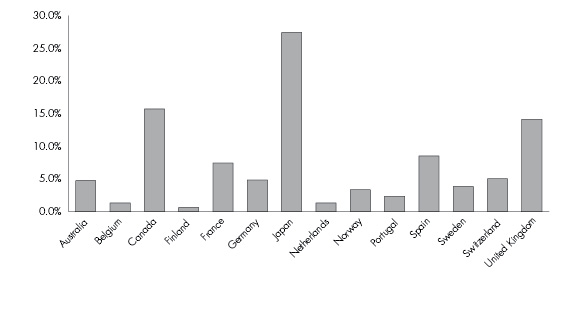

As of June 30, 2017, Strategic International Fund had net assets of $30,493,884 and held 68 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were in consumer discretionary (25.4%), information technology (15.5%), industrials (14.8%), financials (14.6%), health care (6.4%), energy (4.8%) and materials (3.9%). The smallest sector weights were in telecommunication services (2.0%), consumer staples (1.3%) and utilities (1.1%). Investments in money market funds accounted for 2.0% of net assets.

In order to hedge the impact of general market fluctuations, as of June 30, 2017, Strategic International Fund was short 285 futures on the Mini MSCI EAFE Index. The notional value of this hedge was $26,926,800, hedging 98.3% of the dollar value of equity investments held by the Fund. When the Fund is in a hedged investment position, the primary driver of Fund returns is the difference in performance between the stocks owned by the Fund and the indices that are used to hedge.

While the investment portfolio of Strategic International Fund is widely diversified and its performance is affected by numerous investment positions, the hedging strategy of the Fund was primarily responsible for the reduced sensitivity of the Fund to market fluctuations from the Fund’s inception through June 30, 2017. Individual equity holdings having portfolio gains in excess of $500,000 during the year ended June 30, 2017 included ABC-Mart and Fujitsu General. The only equity holding with a portfolio loss in excess of $200,000 during this period was Enagas S.A.

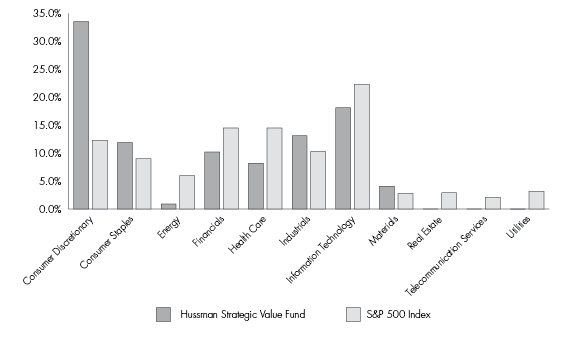

As of June 30, 2017, Strategic Value Fund had net assets of $6,882,792, and held 77 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were consumer discretionary (32.9%), information technology (17.7%), industrials (12.8%), consumer staples (11.7%), financials (10.0%) and health care (8.0%). The smallest sector weight was in materials (4.0%) and energy (0.9%). The Fund held no investments in the utility or telecommunications sectors.

Strategic Value Fund’s holdings of individual stocks as of June 30, 2017 were valued at $6,747,241. Against these stock positions, the Fund also held 27 option combinations (long put option/short call option) on the S&P 500 Index. The notional value of this hedge was $6,543,207, hedging 97.0% of the dollar value of equity investments held by the Fund.

19

The Hussman Funds |

Letter to Shareholders (continued) |

In Strategic Value Fund, during the year ended June 30, 2017, an individual equity portfolio gain in excess of $100,000 was achieved in Intel. Equity holdings with portfolio losses in excess of $100,000 during this same period were Kinder Morgan, Gap and Staples.

Supplementary information including quarterly returns and equity-only performance of the Funds is available on the Hussman Funds website: www.hussmanfunds.com.

Current Outlook

I recognize how frustrating our performance during the advancing half-cycle since 2009 has been, particularly for our strategic equity funds. From a full-cycle perspective, I remain convinced that the adaptations we made in 2014 addressed the underlying issue in a way that will allow us to navigate future cycles without the same challenges. Both our present and pre-2009 methods of classifying market return/risk profiles could have effectively navigated this half-cycle without the inadvertent detour that followed our 2009 stress-testing efforts. Still, neither method encourages us to embrace market risk in the current environment. Given the similarity of current market conditions to 2000 and 2007, this should not be a surprise.

The stark contrast between our performance during the recent half-cycle and our performance in prior market cycles is a source of disappointment, but I believe it is also a basis for optimism. Having addressed the primary source of difficulty in this half-cycle, we have retained a value-conscious, historically-informed discipline that has supported all of our most effective investment decisions over time, and has been adapted to avoid our least effective ones. Our experience in this half-cycle certainly weakened our inclination to respond to “overvalued, overbought, overbullish” features of market action in isolation, but it has markedly strengthened our confidence in other features of market action. Our ongoing research has also allowed us to construct increasingly effective measures of valuation. I believe that all of these will prove useful in identifying major opportunities and risks in the market cycles ahead.

Meanwhile, it is important to emphasize that the Hussman Funds are investment vehicles that adhere to specific investment objectives and strategies. As such, they are not intended to pursue, speculate, or capitalize on market outcomes that are inconsistent with those investment disciplines. For example, if an investor believes that the value-insensitive exodus into passive indexes will continue indefinitely, the Funds may not be suitable investments, because they will continue to adhere to a value-conscious stock-selection discipline. Likewise, if an investor believes that extreme valuations will persist forever, and that the markets have become immune to future downturns, the Funds may not be suitable investments, because their historically-informed, full-cycle investment discipline is inconsistent with those expectations. Investors should choose holdings that are aligned with their own

20

The Hussman Funds |

Letter to Shareholders (continued) |

goals, perspectives, and tolerance for risk. For my part, nearly all of my investments remain in the Hussman Funds. Amid opposing extremes that I view as temporary both for the market and our own discipline, I am looking forward to the years ahead.

I remain grateful, as always, for your trust.

Sincerely,

John P. Hussman, Ph.D.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares of the Funds, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted.

Weekly updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website www.hussmanfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based on the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 Index reflect valuation methods focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle.

This Letter to Shareholders seeks to describe some of the adviser’s current opinions and views of the financial markets. Although the adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in this Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Funds’ adviser with respect to those securities may change at any time.

21

Hussman Strategic Growth Fund Portfolio Information |

| June 30, 2017 (Unaudited) |

Sector Allocation (% of Common Stocks)

Hussman Strategic Total Return Fund Portfolio Information |

| June 30, 2017 (Unaudited) |

Asset Allocation (% of Net Assets)

22

Hussman Strategic International Fund

Portfolio Information |

| June 30, 2017 (Unaudited) |

Sector Allocation (% of Common Stocks)

Country Allocation (% of Common Stocks)

23

Hussman Strategic Value Fund

Portfolio Information |

| June 30, 2017 (Unaudited) |

Sector Allocation (% of Common Stocks)

24

Hussman Strategic Growth Fund Schedule of Investments |

| June 30, 2017 |

| COMMON STOCKS — 100.4% | | Shares | | | Value | |

| Consumer Discretionary — 10.5% | | | | | | |

| Auto Components — 2.0% | | | | | | |

| Gentex Corp. | | | 200,000 | | | $ | 3,794,000 | |

| Lear Corp. | | | 25,000 | | | | 3,552,000 | |

| | | | | | | | 7,346,000 | |

| Hotels, Restaurants & Leisure — 1.5% | | | | | | | | |

Chipotle Mexican Grill, Inc. (a) | | | 7,500 | | | | 3,120,750 | |

| Jack in the Box, Inc. | | | 25,000 | | | | 2,462,500 | |

| | | | | | | | 5,583,250 | |

| Household Durables — 1.9% | | | | | | | | |

| Garmin Ltd. | | | 50,000 | | | | 2,551,500 | |

| KB Home | | | 200,000 | | | | 4,794,000 | |

| | | | | | | | 7,345,500 | |

| Leisure Products — 0.3% | | | | | | | | |

| Mattel, Inc. | | | 50,000 | | | | 1,076,500 | |

| | | | | | | | | |

| Media — 3.9% | | | | | | | | |

| CBS Corp. - Class B | | | 100,000 | | | | 6,378,000 | |

| Comcast Corp. - Class A | | | 75,000 | | | | 2,919,000 | |

| Regal Entertainment Group - Class A | | | 150,000 | | | | 3,069,000 | |

| Sirius XM Holdings, Inc. | | | 400,000 | | | | 2,188,000 | |

| | | | | | | | 14,554,000 | |

| Specialty Retail — 0.9% | | | | | | | | |

| Aaron's, Inc. | | | 88,000 | | | | 3,423,200 | |

| | | | | | | | | |

| Consumer Staples — 10.0% | | | | | | | | |

| Food & Staples Retailing — 4.6% | | | | | | | | |

United Natural Foods, Inc. (a) | | | 150,000 | | | | 5,505,000 | |

| Walgreens Boots Alliance, Inc. | | | 50,000 | | | | 3,915,500 | |

| Wal-Mart Stores, Inc. | | | 50,000 | | | | 3,784,000 | |

| Whole Foods Market, Inc. | | | 100,000 | | | | 4,211,000 | |

| | | | | | | | 17,415,500 | |

| Food Products — 4.2% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 150,000 | | | | 6,207,000 | |

| Bunge Ltd. | | | 50,000 | | | | 3,730,000 | |

| Sanderson Farms, Inc. | | | 50,000 | | | | 5,782,500 | |

| | | | | | | | 15,719,500 | |

| Household Products — 1.2% | | | | | | | | |

| Procter & Gamble Co. (The) | | | 50,000 | | | | 4,357,500 | |

25

Hussman Strategic Growth Fund Schedule of Investments (continued) |

| June 30, 2017 |

| COMMON STOCKS — 100.4% (continued) | | Shares | | | Value | |

| Energy — 4.6% | | | | | | |

| Energy Equipment & Services — 1.1% | | | | | | |

| Halliburton Co. | | | 75,000 | | | $ | 3,203,250 | |

| Nabors Industries Ltd. | | | 100,000 | | | | 814,000 | |

| | | | | | | | 4,017,250 | |

| Oil, Gas & Consumable Fuels — 3.5% | | | | | | | | |

| Apache Corp. | | | 50,000 | | | | 2,396,500 | |

| Boardwalk Pipeline Partners, L.P. | | | 32,000 | | | | 576,320 | |

| Chevron Corp. | | | 50,000 | | | | 5,216,500 | |

| Cosan Ltd. - Class A | | | 250,000 | | | | 1,602,500 | |

| Devon Energy Corp. | | | 50,000 | | | | 1,598,500 | |

| Golar LNG Partners, L.P. | | | 100,000 | | | | 2,007,000 | |

| | | | | | | | 13,397,320 | |

| Financials — 3.6% | | | | | | | | |

| Capital Markets — 1.2% | | | | | | | | |

| State Street Corp. | | | 50,000 | | | | 4,486,500 | |

| | | | | | | | | |

| Consumer Finance — 1.7% | | | | | | | | |

| American Express Co. | | | 75,000 | | | | 6,318,000 | |

| | | | | | | | | |

| Insurance — 0.7% | | | | | | | | |

| Prudential Financial, Inc. | | | 25,000 | | | | 2,703,500 | |

| | | | | | | | | |

| Health Care — 14.1% | | | | | | | | |

| Biotechnology — 2.1% | | | | | | | | |

Biogen, Inc. (a) | | | 10,000 | | | | 2,713,600 | |

| Gilead Sciences, Inc. | | | 25,000 | | | | 1,769,500 | |

United Therapeutics Corp. (a) | | | 25,000 | | | | 3,243,250 | |

| | | | | | | | 7,726,350 | |

| Health Care Equipment & Supplies — 2.8% | | | | | | | | |

| Baxter International, Inc. | | | 50,000 | | | | 3,027,000 | |

Cardiovascular Systems, Inc. (a) | | | 200,000 | | | | 6,446,000 | |

Varex Imaging Corp. (a) | | | 4,000 | | | | 135,200 | |

Varian Medical Systems, Inc. (a) | | | 10,000 | | | | 1,031,900 | |

| | | | | | | | 10,640,100 | |

| Health Care Providers & Services — 8.2% | | | | | | | | |

Centene Corp. (a) | | | 50,000 | | | | 3,994,000 | |

HCA Healthcare, Inc. (a) | | | 75,000 | | | | 6,540,000 | |

| HealthSouth Corp. | | | 150,000 | | | | 7,260,000 | |

| Quest Diagnostics, Inc. | | | 75,000 | | | | 8,337,000 | |

26

Hussman Strategic Growth Fund Schedule of Investments (continued) |

| June 30, 2017 |

| COMMON STOCKS — 100.4% (continued) | | Shares | | | Value | |

| Health Care — 14.1% (continued) | | | | | | |

| Health Care Providers & Services — 8.2% (continued) | | | | | | |

| UnitedHealth Group, Inc. | | | 25,000 | | | $ | 4,635,500 | |

| | | | | | | | 30,766,500 | |

| Life Sciences Tools & Services — 0.6% | | | | | | | | |

| Luminex Corp. | | | 70,000 | | | | 1,478,400 | |

QIAGEN N.V. (a) | | | 25,000 | | | | 838,250 | |

| | | | | | | | 2,316,650 | |

| Pharmaceuticals — 0.4% | | | | | | | | |

Depomed, Inc. (a) | | | 150,000 | | | | 1,611,000 | |

| | | | | | | | | |

| Industrials — 10.7% | | | | | | | | |

| Aerospace & Defense — 0.7% | | | | | | | | |

DigitalGlobe, Inc. (a) | | | 75,000 | | | | 2,497,500 | |

| | | | | | | | | |

| Air Freight & Logistics — 0.8% | | | | | | | | |

| Expeditors International of Washington, Inc. | | | 50,000 | | | | 2,824,000 | |

| | | | | | | | | |

| Airlines — 0.4% | | | | | | | | |

| Delta Air Lines, Inc. | | | 25,000 | | | | 1,343,500 | |

| | | | | | | | | |

| Commercial Services & Supplies — 2.5% | | | | | | | | |

| Cintas Corp. | | | 25,000 | | | | 3,151,000 | |

Copart, Inc. (a) | | | 200,000 | | | | 6,358,000 | |

| | | | | | | | 9,509,000 | |

| Construction & Engineering — 0.8% | | | | | | | | |

| Argan, Inc. | | | 25,000 | | | | 1,500,000 | |

Quanta Services, Inc. (a) | | | 50,000 | | | | 1,646,000 | |

| | | | | | | | 3,146,000 | |

| Industrial Conglomerates — 0.6% | | | | | | | | |

| Siemens AG - ADR | | | 34,000 | | | | 2,351,100 | |

| | | | | | | | | |

| Machinery — 1.5% | | | | | | | | |

| Donaldson Co., Inc. | | | 75,000 | | | | 3,415,500 | |

| Trinity Industries, Inc. | | | 75,000 | | | | 2,102,250 | |

| | | | | | | | 5,517,750 | |

| Professional Services — 0.2% | | | | | | | | |

FTI Consulting, Inc. (a) | | | 25,000 | | | | 874,000 | |

27

Hussman Strategic Growth Fund Schedule of Investments (continued) |

| June 30, 2017 |

| COMMON STOCKS — 100.4% (continued) | | Shares | | | Value | |

| Industrials — 10.7% (continued) | | | | | | |

| Road & Rail — 2.2% | | | | | | |

| Landstar System, Inc. | | | 50,000 | | | $ | 4,280,000 | |

Swift Transportation Co. (a) | | | 150,000 | | | | 3,975,000 | |

| | | | | | | | 8,255,000 | |

| Trading Companies & Distributors — 1.0% | | | | | | | | |

| GATX Corp. | | | 60,000 | | | | 3,856,200 | |

| | | | | | | | | |

| Information Technology — 37.6% | | | | | | | | |

| Communications Equipment — 9.8% | | | | | | | | |

| ADTRAN, Inc. | | | 100,000 | | | | 2,065,000 | |

| Cisco Systems, Inc. | | | 200,000 | | | | 6,260,000 | |

F5 Networks, Inc. (a) | | | 35,000 | | | | 4,447,100 | |

Finisar Corp. (a) | | | 225,000 | | | | 5,845,500 | |

| InterDigital, Inc. | | | 50,000 | | | | 3,865,000 | |

| Juniper Networks, Inc. | | | 50,000 | | | | 1,394,000 | |

NetScout Systems, Inc. (a) | | | 50,000 | | | | 1,720,000 | |

Oclaro, Inc. (a) | | | 200,000 | | | | 1,868,000 | |

| Plantronics, Inc. | | | 75,000 | | | | 3,923,250 | |

Ubiquiti Networks, Inc. (a) | | | 100,000 | | | | 5,197,000 | |

| | | | | | | | 36,584,850 | |

| Electronic Equipment, Instruments & Components — 9.2% | | | | | | | | |

| Corning, Inc. | | | 250,000 | | | | 7,512,500 | |

| Dolby Laboratories, Inc. - Class A | | | 75,000 | | | | 3,672,000 | |

II-VI, Inc. (a) | | | 100,000 | | | | 3,430,000 | |

| Jabil, Inc. | | | 100,000 | | | | 2,919,000 | |

Sanmina Corp. (a) | | | 100,000 | | | | 3,810,000 | |

ScanSource, Inc. (a) | | | 50,000 | | | | 2,015,000 | |

TTM Technologies, Inc. (a) | | | 200,000 | | | | 3,472,000 | |

Zebra Technologies Corp. - Class A (a) | | | 75,000 | | | | 7,539,000 | |

| | | | | | | | 34,369,500 | |

| Internet Software & Services — 3.2% | | | | | | | | |

Akamai Technologies, Inc. (a) | | | 50,000 | | | | 2,490,500 | |

Baidu, Inc. - ADR (a) | | | 10,000 | | | | 1,788,600 | |

eBay, Inc. (a) | | | 100,000 | | | | 3,492,000 | |

| LogMeIn, Inc. | | | 12,888 | | | | 1,346,796 | |

Yelp, Inc. (a) | | | 100,000 | | | | 3,002,000 | |

| | | | | | | | 12,119,896 | |

| IT Services — 1.6% | | | | | | | | |

| International Business Machines Corp. | | | 40,000 | | | | 6,153,200 | |

28

Hussman Strategic Growth Fund Schedule of Investments (continued) |

| June 30, 2017 |

| COMMON STOCKS — 100.4% (continued) | | Shares | | | Value | |

| Information Technology — 37.6% (continued) | | | | | | |

| Semiconductors & Semiconductor Equipment — 6.0% | | | | | | |

Amkor Technology, Inc. (a) | | | 300,000 | | | $ | 2,931,000 | |

Cirrus Logic, Inc. (a) | | | 50,000 | | | | 3,136,000 | |

Lattice Semiconductor Corp. (a) | | | 400,000 | | | | 2,664,000 | |

Qorvo, Inc. (a) | | | 25,000 | | | | 1,583,000 | |

| QUALCOMM, Inc. | | | 100,000 | | | | 5,522,000 | |

| Skyworks Solutions, Inc. | | | 20,000 | | | | 1,919,000 | |

| Xilinx, Inc. | | | 75,000 | | | | 4,824,000 | |

| | | | | | | | 22,579,000 | |

| Software — 5.7% | | | | | | | | |

Cadence Design Systems, Inc. (a) | | | 75,000 | | | | 2,511,750 | |

Citrix Systems, Inc. (a) | | | 50,000 | | | | 3,979,000 | |

Gigamon, Inc. (a) | | | 50,000 | | | | 1,967,500 | |

| Microsoft Corp. | | | 50,000 | | | | 3,446,500 | |

Qualys, Inc. (a) | | | 25,000 | | | | 1,020,000 | |

Varonis Systems, Inc. (a) | | | 50,000 | | | | 1,860,000 | |

VMware, Inc. - Class A (a) | | | 75,000 | | | | 6,557,250 | |

| | | | | | | | 21,342,000 | |

| Technology Hardware, Storage & Peripherals — 2.1% | | | | | | | | |

| NetApp, Inc. | | | 100,000 | | | | 4,005,000 | |

| Seagate Technology plc | | | 100,000 | | | | 3,875,000 | |

| | | | | | | | 7,880,000 | |

| Materials — 5.5% | | | | | | | | |

| Chemicals — 3.4% | | | | | | | | |

| Braskem S.A. - ADR | | | 300,000 | | | | 6,216,000 | |

| FMC Corp. | | | 25,000 | | | | 1,826,250 | |

| Monsanto Co. | | | 25,000 | | | | 2,959,000 | |

| Westlake Chemical Corp. | | | 25,000 | | | | 1,655,250 | |

| | | | | | | | 12,656,500 | |

| Metals & Mining — 2.1% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 50,000 | | | | 2,256,000 | |

| Barrick Gold Corp. | | | 150,000 | | | | 2,386,500 | |

| Newmont Mining Corp. | | | 100,000 | | | | 3,239,000 | |

| | | | | | | | 7,881,500 | |

| Telecommunication Services — 1.2% | | | | | | | | |

| Diversified Telecommunication Services — 1.2% | | | | | | | | |

| AT&T, Inc. | | | 125,000 | | | | 4,716,250 | |

29

Hussman Strategic Growth Fund Schedule of Investments (continued) |

| June 30, 2017 |

| COMMON STOCKS — 100.4% (continued) | | Shares | | | Value | |

| Utilities — 2.6% | | | | | | |

| Electric Utilities — 1.0% | | | | | | |

| Exelon Corp. | | | 100,000 | | | $ | 3,607,000 | |

| | | | | | | | | |

| Independent Power and Renewable Electricity Producers — 1.6% | | | | | | | | |

| AES Corp. | | | 150,000 | | | | 1,666,500 | |

| Ormat Technologies, Inc. | | | 75,000 | | | | 4,401,000 | |

| | | | | | | | 6,067,500 | |

| | | | | | | | | |

Total Common Stocks (Cost $355,719,079) | | | | | | $ | 376,935,366 | |

| PUT OPTION CONTRACTS — 1.8% | | Contracts | | | Value | |

| Nasdaq 100 Index Option, 09/15/2017 at $5,650 | | | 100 | | | $ | 1,681,000 | |

| Russell 2000 Index Option, 09/15/2017 at $1,400 | | | 500 | | | | 1,533,000 | |

| S&P 500 Index Option, 09/15/2017 at $2,400 | | | 1,000 | | | | 3,750,000 | |

Total Put Option Contracts (Cost $7,007,342) | | | | | | $ | 6,964,000 | |

| | | | | | | | | |

Total Investments at Value — 102.2% (Cost $362,726,421) | | | | | | $ | 383,899,366 | |

| MONEY MARKET FUNDS — 51.9% | | Shares | | | Value | |

Federated U.S. Treasury Cash Reserves Fund - Institutional Shares, 0.76% (b) | | | 63,051,928 | | | $ | 63,051,928 | |

First American Treasury Obligations Fund - Class Y, 0.57% (b) | | | 131,776,167 | | | | 131,776,167 | |

Total Money Market Funds (Cost $194,828,095) | | | | | | $ | 194,828,095 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 154.1% | | | | | | | | |

| (Cost $557,554,516) | | | | | | $ | 578,727,461 | |

| | | | | | | | | |

| Written Call Option Contracts — (54.2%) | | | | | | | (203,614,700 | ) |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.1% | | | | | | | 353,754 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 375,466,515 | |

| ADR - American Depositary Receipt. |

| |

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of June 30, 2017. |

| | |

| See accompanying notes to financial statements. |

30

Hussman Strategic Growth Fund Schedule of Open Written Option Contracts |

| June 30, 2017 |

| WRITTEN CALL OPTION CONTRACTS | | Contracts | | | Value of Options | | | Premiums Received | |

| Nasdaq 100 Index Option, | | | | | | | | | |

| 09/15/2017 at $3,000 | | | 100 | | | $ | (26,429,700 | ) | | $ | (28,738,852 | ) |

| Russell 2000 Index Option, | | | | | | | | | | | | |

| 09/15/2017 at $700 | | | 500 | | | | (35,628,000 | ) | | | (34,887,133 | ) |

| S&P 500 Index Option, | | | | | | | | | | | | |

| 09/15/2017 at $1,000 | | | 1,000 | | | | (141,557,000 | ) | | | (138,698,657 | ) |

| Total Written Call Option Contracts | | | | | | $ | (203,614,700 | ) | | $ | (202,324,642 | ) |

| See accompanying notes to financial statements. |

31

Hussman Strategic Total Return Fund

Schedule of Investments |

| June 30, 2017 |

| COMMON STOCKS — 14.4% | | Shares | | | Value | |

Energy — 0.0% (a) | | | | | | |

Oil, Gas & Consumable Fuels — 0.0% (a) | | | | | | |

| NuStar Energy, L.P. | | | 1,000 | | | $ | 46,630 | |

| ONEOK Partners, L.P. | | | 1,000 | | | | 51,070 | |

| Williams Partners, L.P. | | | 866 | | | | 34,735 | |

| | | | | | | | 132,435 | |

| Materials — 14.1% | | | | | | | | |

| Metals & Mining — 14.1% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 150,000 | | | | 6,768,000 | |

| AngloGold Ashanti Ltd. - ADR | | | 450,000 | | | | 4,374,000 | |

| Barrick Gold Corp. | | | 900,000 | | | | 14,319,000 | |

Coeur Mining, Inc. (b) | | | 25,000 | | | | 214,500 | |

| Compania de Minas Buenaventura S.A. - ADR | | | 25,000 | | | | 287,500 | |

| Goldcorp, Inc. | | | 450,000 | | | | 5,809,500 | |

| Newmont Mining Corp. | | | 450,000 | | | | 14,575,500 | |

| Pan American Silver Corp. | | | 5,000 | | | | 84,100 | |

| Randgold Resources Ltd. - ADR | | | 50,000 | | | | 4,423,000 | |

| Royal Gold, Inc. | | | 10,000 | | | | 781,700 | |

| Sibanye Gold Ltd. - ADR | | | 171,475 | | | | 793,929 | |

| Wheaton Precious Metals Corp | | | 5,000 | | | | 99,450 | |

| | | | | | | | 52,530,179 | |

| Utilities — 0.3% | | | | | | | | |

| Electric Utilities — 0.2% | | | | | | | | |

| American Electric Power Co., Inc. | | | 1,000 | | | | 69,470 | |

| Duke Energy Corp. | | | 333 | | | | 27,836 | |

| Edison International | | | 1,000 | | | | 78,190 | |

| Entergy Corp. | | | 1,000 | | | | 76,770 | |

| Exelon Corp. | | | 1,000 | | | | 36,070 | |

| FirstEnergy Corp. | | | 1,000 | | | | 29,160 | |

| NextEra Energy, Inc. | | | 1,000 | | | | 140,130 | |

| Pinnacle West Capital Corp. | | | 1,000 | | | | 85,160 | |

| PPL Corp. | | | 1,000 | | | | 38,660 | |

| | | | | | | | 581,446 | |

| Multi-Utilities — 0.1% | | | | | | | | |

| Ameren Corp. | | | 1,000 | | | | 54,670 | |

| Dominion Energy, Inc. | | | 1,000 | | | | 76,630 | |

| DTE Energy Co. | | | 1,000 | | | | 105,790 | |

| PG&E Corp. | | | 1,000 | | | | 66,370 | |

| Public Service Enterprise Group, Inc. | | | 1,000 | | | | 43,010 | |

32

Hussman Strategic Total Return Fund

Schedule of Investments (continued) |

| June 30, 2017 |

| COMMON STOCKS — 14.4% (continued) | | Shares | | | Value | |

| Utilities — 0.3% (continued) | | | | | | |

| Multi-Utilities — 0.1% (continued) | | | | | | |

| SCANA Corp. | | | 1,000 | | | $ | 67,010 | |

| | | | | | | | 413,480 | |

| | | | | | | | | |

Total Common Stocks (Cost $57,457,364) | | | | | | $ | 53,657,540 | |

| U.S. TREASURY OBLIGATIONS — 63.4% | | Par Value | | | Value | |

U.S. Treasury Bills (c) — 26.7% | | | | | | |

| 0.89%, due 09/28/2017 | | $ | 50,000,000 | | | $ | 49,878,550 | |

| 1.02%, due 03/29/2018 | | | 50,000,000 | | | | 49,582,150 | |

| | | | | | | | 99,460,700 | |

| U.S. Treasury Inflation-Protected Notes — 3.7% | | | | | | | | |

| 2.50%, due 01/15/2029 | | | 11,388,000 | | | | 13,707,041 | |

| | | | | | | | | |

| U.S. Treasury Notes — 33.0% | | | | | | | | |

| 0.75%, due 10/31/2018 | | | 50,000,000 | | | | 49,619,150 | |

| 1.50%, due 08/15/2026 | | | 25,000,000 | | | | 23,388,675 | |

| 2.25%, due 02/15/2027 | | | 50,000,000 | | | | 49,776,350 | |

| | | | | | | | 122,784,175 | |

| | | | | | | | | |

Total U.S. Treasury Obligations (Cost $233,843,225) | | | | | | $ | 235,951,916 | |

| EXCHANGE-TRADED FUNDS — 4.2% | | Shares | | | Value | |

CurrencyShares British Pound Sterling Trust (b) | | | 50,000 | | | $ | 6,341,000 | |

CurrencyShares Euro Trust (b) | | | 50,000 | | | | 5,524,000 | |

CurrencyShares Japanese Yen Trust (b) | | | 1,000 | | | | 85,530 | |

CurrencyShares Swedish Krona Trust (b) | | | 10,000 | | | | 1,138,383 | |

CurrencyShares Swiss Franc Trust (b) | | | 15,000 | | | | 1,484,550 | |

iShares 1-3 Year International Treasury Bond ETF (b) | | | 1,000 | | | | 81,810 | |

iShares Gold Trust (b) | | | 25,000 | | | | 298,500 | |

| iShares International Treasury Bond ETF | | | 1,000 | | | | 95,680 | |

| SPDR Bloomberg Barclays International Treasury Bond ETF | | | 2,000 | | | | 55,260 | |

SPDR Bloomberg Barclays Short Term International Treasury Bond ETF (b) | | | 1,000 | | | | 31,360 | |

| SPDR Citi International Government Inflation-Protected Bond ETF | | | 1,000 | | | | 55,560 | |

SPDR Gold Shares (b) | | | 5,000 | | | | 590,100 | |

Total Exchange-Traded Funds (Cost $15,396,347) | | | | | | | 15,781,733 | |

| | | | | | | | | |

Total Investments at Value — 82.0% (Cost $306,696,936) | | | | | | $ | 305,391,189 | |

33

Hussman Strategic Total Return Fund

Schedule of Investments (continued) |

| June 30, 2017 |

| MONEY MARKET FUNDS — 18.0% | | Shares | | | Value | |

Federated U.S. Treasury Cash Reserves Fund - Institutional Shares, 0.76% (d) | | | 20,259,904 | | | $ | 20,259,904 | |

First American Treasury Obligations Fund - Class Y, 0.57% (d) | | | 46,932,874 | | | | 46,932,874 | |

Total Money Market Funds (Cost $67,192,778) | | | | | | $ | 67,192,778 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 100.0% | | | | | | | | |

| (Cost $373,889,714) | | | | | | $ | 372,583,967 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.0%)(a) | | | | | | | (82,172 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 372,501,795 | |

| ADR - American Depositary Receipt |

| |

(a) | Percentage rounds to less than 0.1%. |

(b) | Non-income producing security. |

(c) | Rate shown is the annualized yield at time of purchase, not a coupon rate. |

(d) | The rate shown is the 7-day effective yield as of June 30, 2017. |

| | |

| See accompanying notes to financial statements. |

34

Hussman Strategic International Fund Schedule of Investments |

| June 30, 2017 |

| COMMON STOCKS — 89.8% | | Shares | | | Value | |

| Australia — 4.2% | | | | | | |

Crown Resorts Ltd. (a) | | | 50,000 | | | $ | 471,888 | |

JB Hi-Fi Ltd. (a) | | | 23,000 | | | | 413,107 | |

SEEK Ltd. (a) | | | 30,000 | | | | 389,855 | |

| | | | | | | | 1,274,850 | |

| Belgium — 1.2% | | | | | | | | |

AGFA-Gevaert NV (b) | | | 75,000 | | | | 364,934 | |

| | | | | | | | | |

| Canada — 14.1% | | | | | | | | |

Air Canada (b) | | | 30,000 | | | | 402,085 | |

Celestica, Inc. (b) | | | 40,000 | | | | 543,517 | |

CGI Group, Inc. - Class A (b) | | | 6,000 | | | | 306,584 | |

| IGM Financial, Inc. | | | 18,000 | | | | 558,292 | |

| Industrial Alliance Insurance and Financial Services, Inc. | | | 13,000 | | | | 564,015 | |

| Manulife Financial Corp. | | | 29,000 | | | | 543,663 | |

| Power Corp. of Canada | | | 23,000 | | | | 524,654 | |

| Royal Bank of Canada | | | 7,500 | | | | 544,597 | |

| ShawCor Ltd. | | | 15,000 | | | | 306,307 | |

| | | | | | | | 4,293,714 | |

| Finland — 0.5% | | | | | | | | |

| Tikkurila Oyj | | | 7,200 | | | | 155,678 | |

| | | | | | | | | |

| France — 6.6% | | | | | | | | |

Edenred (a) | | | 23,000 | | | | 599,987 | |

Elecnor S.A. (a) | | | 2,163 | | | | 29,969 | |

Eutelsat Communications S.A. (a) | | | 9,000 | | | | 229,645 | |

| IPSOS | | | 15,000 | | | | 562,821 | |

Neopost S.A. (a) | | | 13,000 | | | | 603,737 | |

| | | | | | | | 2,026,159 | |

| Germany — 4.4% | | | | | | | | |

Hugo Boss AG (a) | | | 4,500 | | | | 315,475 | |

| SAP SE - ADR | | | 6,000 | | | | 628,020 | |

SHW AG (a) | | | 9,000 | | | | 383,190 | |

| | | | | | | | 1,326,685 | |

| Japan — 24.6% | | | | | | | | |

CyberAgent, Inc. (a) | | | 16,000 | | | | 496,927 | |

Daiwabo Holdings Co. Ltd. (a) | | | 175,000 | | | | 609,889 | |

en-japan, Inc. (a) | | | 19,000 | | | | 495,112 | |

EPS Holdings, Inc. (a) | | | 30,000 | | | | 470,560 | |

Fudo Tetra Corp. (a) | | | 175,000 | | | | 280,573 | |

35

Hussman Strategic International Fund Schedule of Investments (continued) |

| June 30, 2017 |

| COMMON STOCKS — 89.8% (continued) | | Shares | | | Value | |

| Japan — 24.6% (continued) | | | | | | |

Fujibo Holdings, Inc. (a),(b) | | | 13,000 | | | $ | 365,189 | |

Isuzu Motors Ltd. (a) | | | 28,000 | | | | 347,702 | |

Kanagawa Chuo Kotsu Co. Ltd. (a) | | | 62,000 | | | | 405,040 | |

Kurimoto Ltd. (a) | | | 15,000 | | | | 272,324 | |

Misawa Homes Co. Ltd. (a) | | | 42,000 | | | | 377,687 | |

Mixi, Inc. (a) | | | 10,000 | | | | 556,518 | |

NuFlare Technology, Inc. (a)(b) | | | 6,000 | | | | 358,577 | |

Panasonic Corp. (a) | | | 30,000 | | | | 408,776 | |

SBI Holdings, Inc. (a) | | | 25,000 | | | | 339,981 | |

Shinnihon Corp. (a) | | | 52,000 | | | | 423,345 | |

SoftBank Group Corp. (a) | | | 7,500 | | | | 609,703 | |

SRG Takamiya Co. Ltd. (a) | | | 25,000 | | | | 125,969 | |

Toshiba Corp. (a) | | | 230,000 | | | | 557,179 | |

| | | | | | | | 7,501,051 | |

| Netherlands — 1.2% | | | | | | | | |

PostNL NV (a) | | | 75,000 | | | | 350,020 | |

| | | | | | | | | |

| Norway — 2.9% | | | | | | | | |

Ocean Yield ASA (a) | | | 25,000 | | | | 195,424 | |

Statoil ASA (a) | | | 27,000 | | | | 447,690 | |

| Stolt-Nielsen Ltd. | | | 18,000 | | | | 253,316 | |

| | | | | | | | 896,430 | |

| Portugal — 2.0% | | | | | | | | |

Altri SGPS S.A. (a) | | | 50,000 | | | | 230,288 | |

Jeronimo Martins SGPS S.A. (a) | | | 20,000 | | | | 390,494 | |

| | | | | | | | 620,782 | |

| Spain — 7.6% | | | | | | | | |

Amadeus IT Group S.A. (a) | | | 8,000 | | | | 478,229 | |

Endesa S.A. (a) | | | 15,000 | | | | 346,045 | |

Grupo Catalana Occidente S.A. (a) | | | 10,000 | | | | 421,564 | |

| Mapfre S.A. | | | 100,000 | | | | 349,286 | |

| Miquel y Costas & Miquel S.A. | | | 6,000 | | | | 219,303 | |

Tecnicas Reunidas S.A. (a) | | | 13,000 | | | | 503,767 | |

| | | | | | | | 2,318,194 | |

| Sweden — 3.4% | | | | | | | | |

Concentric AB (a) | | | 5,813 | | | | 94,980 | |

Granges AB (a) | | | 35,000 | | | | 321,940 | |

Modern Times Group MTG AB - Class B (a) | | | 18,000 | | | | 619,439 | |

| | | | | | | | 1,036,359 | |

36

Hussman Strategic International Fund Schedule of Investments (continued) |

| June 30, 2017 |

| COMMON STOCKS — 89.8% (continued) | | Shares | | | Value | |

| Switzerland — 4.5% | | | | | | |

Kudelski S.A. (a) | | | 25,000 | | | $ | 426,678 | |

Sonova Holding AG (a) | | | 3,500 | | | | 569,333 | |

| Tamedia AG | | | 2,324 | | | | 370,312 | |

| | | | | | | | 1,366,323 | |

| United Kingdom — 12.6% | | | | | | | | |

Burberry Group plc (a) | | | 28,000 | | | | 605,942 | |

| esure Group plc | | | 150,000 | | | | 589,481 | |

GlaxoSmithKline plc (a) | | | 26,000 | | | | 553,522 | |

Hays plc (a) | | | 200,000 | | | | 432,462 | |

| J.D. Wetherspoon plc | | | 50,000 | | | | 635,331 | |

Merlin Entertainments plc (a) | | | 40,000 | | | | 250,419 | |

Pagegroup plc (a)(b) | | | 50,000 | | | | 310,372 | |

| Smart Metering Systems plc | | | 29,310 | | | | 201,392 | |

| SThree plc | | | 65,484 | | | | 262,717 | |

| Utilitywise plc | | | 13,861 | | | | 12,909 | |

| | | | | | | | 3,854,547 | |

| | | | | | | | | |

Total Investments at Value — 89.8% (Cost $23,807,606) | | | | | | $ | 27,385,726 | |

| MONEY MARKET FUNDS — 2.0% | | Shares | | | Value | |

Northern Institutional Treasury Portfolio, 0.86% (c) (Cost $596,961) | | | 596,961 | | | $ | 596,961 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 91.8% | | | | | | | | |

| (Cost $24,404,567) | | | | | | $ | 27,982,687 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 8.2% | | | | | | | 2,511,197 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 30,493,884 | |

| ADR - American Depositary Receipt |

| |

(a) | Foreign fair value priced (Note 1). Foreign fair valued securities totaled $18,486,512 at June 30, 2017, representing 60.6% of net assets. |

(b) | Non-income producing security. |

(c) | The rate shown is the 7-day effective yield as of June 30, 2017. |

| | |

| See accompanying notes to financial statements. |

37

Hussman Strategic International Fund Schedule of Investments (continued) |

| June 30, 2017 |

| Sector/Industry | % of Net Assets |

| Consumer Discretionary — 25.4% | |

| Auto Components | 2.6% |

| Automobiles | 1.1% |

| Hotels, Restaurants & Leisure | 4.4% |

| Household Durables | 2.6% |

| Media | 9.1% |

| Specialty Retail | 1.4% |

| Textiles, Apparel & Luxury Goods | 4.2% |

| Consumer Staples — 1.3% | |

| Food & Staples Retailing | 1.3% |

| Energy — 4.8% | |

| Energy Equipment & Services | 3.3% |

| Oil, Gas & Consumable Fuels | 1.5% |

| Financials — 14.6% | |

| Banks | 1.8% |

| Capital Markets | 3.0% |

| Insurance | 9.8% |

| Health Care — 6.4% | |

| Health Care Equipment & Supplies | 1.9% |

| Health Care Technology | 1.2% |

| Pharmaceuticals | 3.3% |

| Industrials — 14.8% | |

| Air Freight & Logistics | 1.2% |

| Airlines | 1.3% |

| Commercial Services & Supplies | 2.0% |

| Construction & Engineering | 2.4% |

| Industrial Conglomerates | 1.8% |

| Machinery | 0.3% |

| Marine | 0.8% |

| Professional Services | 4.6% |

| Trading Companies & Distributors | 0.4% |

| Information Technology — 15.5% | |

| Electronic Equipment, Instruments & Components | 5.8% |

| Internet Software & Services | 1.8% |

| IT Services | 2.6% |

| Semiconductors & Semiconductor Equipment | 1.2% |

| Software | 2.1% |

| Technology Hardware, Storage & Peripherals | 2.0% |

38

Hussman Strategic International Fund Schedule of Investments (continued) |

| June 30, 2017 |

| Sector/Industry | % of Net Assets |

| Materials — 3.9% | |

| Chemicals | 0.5% |

| Metals & Mining | 1.9% |

| Paper & Forest Products | 1.5% |

| Telecommunication Services — 2.0% | |

| Wireless Telecommunication Services | 2.0% |

| Utilities — 1.1% | |