| | OMB APPROVAL |

| | OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-09911 | |

| Hussman Investment Trust |

| (Exact name of registrant as specified in charter) |

| 6021 University Boulevard, Suite 490 Ellicott City, Maryland | 21043 |

| (Address of principal executive offices) | (Zip code) |

John F. Splain

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | June 30, 2020 | |

| | | |

| Date of reporting period: | June 30, 2020 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

HUSSMAN INVESTMENT TRUST

HUSSMAN STRATEGIC GROWTH FUND

HUSSMAN STRATEGIC ALLOCATION FUND

HUSSMAN STRATEGIC TOTAL RETURN FUND

HUSSMAN STRATEGIC INTERNATIONAL FUND

ANNUAL REPORT

June 30, 2020

Beginning on January 1, 2021, and as permitted by a rule adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent to you by mail, unless you specifically request that the Funds or your financial intermediary (i.e., the broker-dealer or bank through which you own your shares) send you paper copies. Instead, shareholder reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications from the Funds by contacting the Funds at 1-800-487-7626 or, if you own your shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future shareholder reports of the Funds in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at 1-800-487-7626. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to the reports of each of the Funds and, if you own shares through a financial intermediary, to the reports of each of the Funds and all other funds that you own through your financial intermediary.

Table of Contents

| | |

Performance Information | |

Hussman Strategic Growth Fund | 1 |

Hussman Strategic Allocation Fund | 2 |

Hussman Strategic Total Return Fund | 3 |

Hussman Strategic International Fund | 4 |

Letter to Shareholders | 5 |

Portfolio Information | 19 |

Schedules of Investments | |

Hussman Strategic Growth Fund | 22 |

Hussman Strategic Allocation Fund | 33 |

Hussman Strategic Total Return Fund | 41 |

Hussman Strategic International Fund | 45 |

Statements of Assets and Liabilities | 51 |

Statements of Operations | 53 |

Statements of Changes in Net Assets | |

Hussman Strategic Growth Fund | 55 |

Hussman Strategic Allocation Fund | 56 |

Hussman Strategic Total Return Fund | 57 |

Hussman Strategic International Fund | 58 |

Financial Highlights | |

Hussman Strategic Growth Fund | 59 |

Hussman Strategic Allocation Fund | 60 |

Hussman Strategic Total Return Fund | 61 |

Hussman Strategic International Fund | 62 |

Notes to Financial Statements | 63 |

Report of Independent Registered Public Accounting Firm | 89 |

About Your Funds’ Expenses | 91 |

Board of Trustees and Officers | 93 |

Other Information | 95 |

Federal Tax Information | 95 |

Approval of Investment Advisory Agreements | 96 |

Discussion of Liquidity Risk Management Program | 104 |

Hussman Strategic Growth Fund

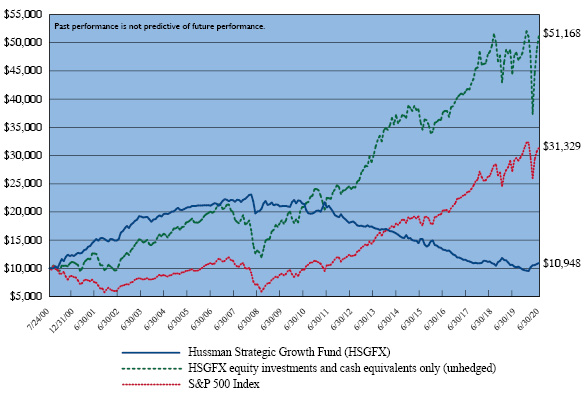

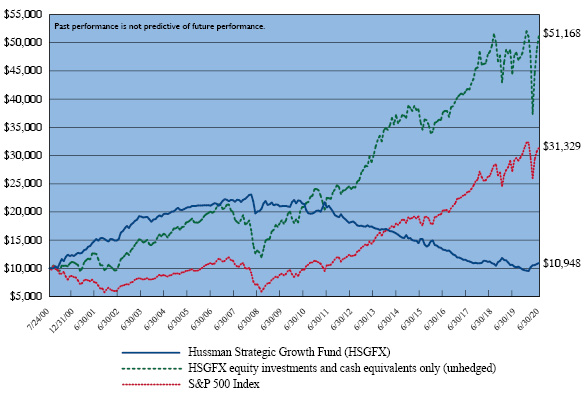

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic Growth Fund versus the S&P 500 Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended June 30, 2020 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic Growth Fund(c)(d) | 6.17% | (1.73%) | (5.98%) | (6.80%) | 0.46% | |

S&P 500 Index | 7.51% | 10.73% | 10.73% | 13.99% | 5.90% | |

(a) | Hussman Strategic Growth Fund invests primarily in stocks listed on the New York, American, and NASDAQ exchanges and varies its investment exposure to market fluctuations depending on market conditions. The S&P 500 Index is an index of large capitalization stocks. However, the Fund may invest in securities that are not included in the S&P 500 Index and there are no restrictions as to the market capitalization of companies in which the Fund invests. “HSGFX equity investments and cash equivalents only (unhedged)” reflects the performance of the Fund’s stock investments and modest day-to-day cash balances, after fees and expenses, and does not reflect the impact of hedging transactions on the Fund’s overall investment performance. The Fund’s unhedged equity investments do not represent a separately available portfolio, and their performance is presented solely for purposes of comparison and performance attribution. |

(b) | The Fund commenced operations on July 24, 2000. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2020 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.15% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund for the year ended June 30, 2020 would have been 1.26%. |

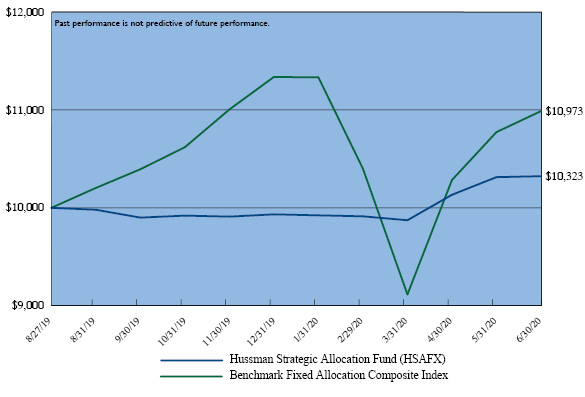

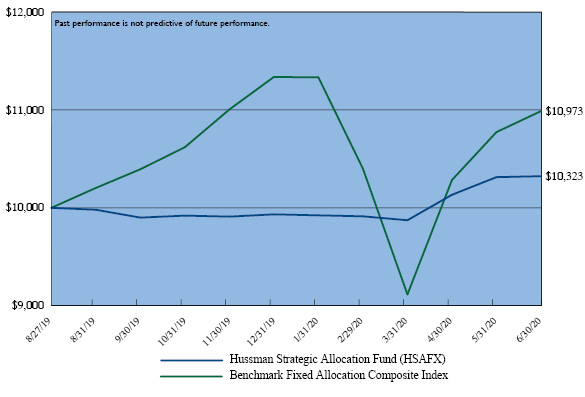

Hussman Strategic Allocation Fund

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Allocation Fund

versus Benchmark Fixed Allocation Composite(a) (Unaudited)

Total Returns For Period Ended June 30, 2020 |

| | Since

Inception(b) | |

Hussman Strategic Allocation Fund(c)(d) | 3.23% | |

Benchmark Fixed Allocation Composite | 9.73% | |

(a) | Benchmark Fixed Allocation Composite represents the gross investment performance of a portfolio that is invested in securities included in three separate indices, weighted as follows: 60% S&P 500 Index, 30% Bloomberg Barclays U.S. Treasury Unhedged Index and 10% Bloomberg Barclays Treasury Bills Index and represents an investment approach that invests a fixed percentage of assets in stocks, bonds, and money-market securities, with little or no variation. The Fund may invest in securities that are not included in the indices that comprise the composite. |

(b) | The Fund commenced operations on August 27, 2019. |

(c) | Returns do no reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemptions of Fund shares. |

(d) | The Advisor has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2022 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.25% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund (annualized) for the period ended June 30, 2020 would have been 4.67%. |

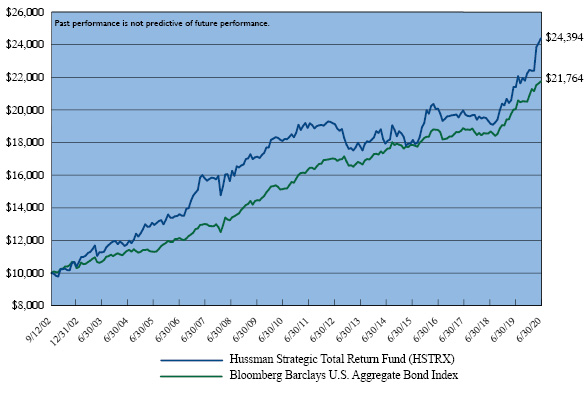

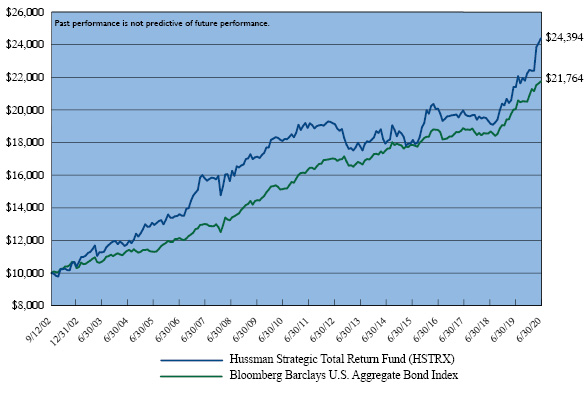

Hussman Strategic Total Return Fund

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Total Return Fund

versus the Bloomberg Barclays U.S. Aggregate Bond Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended June 30, 2020 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic Total Return Fund(c)(d) | 14.00% | 7.68% | 5.86% | 3.26% | 5.14% | |

Bloomberg Barclays U.S. Aggregate Bond Index | 8.74% | 5.32% | 4.30% | 3.82% | 4.47% | |

(a) | The Bloomberg Barclays U.S. Aggregate Bond Index covers the U.S. investment grade fixed rate bond market, with index components for U.S. government, agency and corporate securities. The Fund does not invest solely in securities included in the Bloomberg Barclays U.S. Aggregate Bond Index and may invest in other types of bonds, as well as common stocks, exchange-traded funds and other securities. |

(b) | The Fund commenced operations on September 12, 2002. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2020 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 0.75% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund for the year ended June 30, 2020 would have been 0.81%. |

Hussman Strategic International Fund

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic International Fund versus the MSCI EAFE Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended June 30, 2020 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic International Fund(c)(d) | 1.08% | (1.18%) | (0.18%) | (1.20%) | (1.07%) | |

MSCI EAFE Index | (5.13%) | 0.81% | 2.05% | 5.73% | 4.04% | |

(a) | The MSCI EAFE (Europe, Australasia, and Far East) Index is a free float-adjusted weighted capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of June 30, 2020, the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The Fund is not required to invest in each of the countries represented in the MSCI EAFE Index and may invest in securities that are not included in the MSCI EAFE Index. In addition, the Fund varies its exposure to market fluctuations depending on market conditions. |

(b) | The Fund commenced operations on December 31, 2009. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2020 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 2.00% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund for the year ended June 30, 2020 would have been 3.43%. |

The Hussman Funds

|

Letter to Shareholders | August 14, 2020 |

Dear Shareholder,

“It’s useful to remember that long-term returns represent not only trough-to-peak advances, but peak-to-trough resolutions as well. Buy-and-hold investors don’t get the trough-to-peak return. They get the full cycle return. Not surprisingly, the higher the valuation at the bull market peak, the longer the subsequent period of disappointing returns, in several instances extending more than a decade, though not without intermittent failure-prone bull market rallies to add excitement. This is what I often call ‘going nowhere in an interesting way.’”

– John P. Hussman, Ph.D., Risk Management is Generous, December 2004

From May 1995 through March 2009, despite two intervening speculative bubbles, the total return of the Standard & Poor’s 500 Index lagged the total return of risk-free Treasury bills. This was also true for the period from August 1959 through August 1982, as well as the period from August 1929 to August 1945. Indeed, during the 80-year period from 1929 to 2009, the S&P 500 took three long, interesting trips to nowhere, accounting for 53 of those years (1929-1945, 1959-1982, and 1995-2009), underperforming risk-free Treasury bills after all was said and done.

The singular feature of these very long trips to nowhere is that they either begin from elevated valuations, end at depressed valuations, or both. Periods that begin at extremely elevated valuations are particularly notable, because this defining feature is already in place and can be readily observed in real-time. Not surprisingly, the total return of the S&P 500 lagged the total return of risk-free Treasury bills for more than 13 years following the March 24, 2000 bubble peak. That outcome was consistent with estimates I published at the time, along with a projection of an 83% loss in technology stocks over the completion of the market cycle; which was subsequently realized by the technology-heavy Nasdaq 100 Index. No precision in “catching” the 2000 peak was necessary. By March 2009, the total return of the S&P 500 had lagged Treasury bills all the way back to May 1995.

Presently, the market valuation measures that we find most strongly correlated with actual subsequent S&P 500 total returns are again at extremes that rival or exceed the 1929 and 2000 extremes. This is not a statement about near-term returns or immediate market direction, but it is a rather emphatic statement about the likely long-term investment prospects for passive investors in U.S. stocks, and the potential depth of market losses over the completion of the current market cycle.

Investors sometimes assume that if the market continues to advance despite rich valuations, then valuations must somehow be failing. This is not how valuations work. If overvaluation itself was enough to drive prices lower, one could never observe

The Hussman Funds

|

Letter to Shareholders (continued) |

extremes like 1929, 2000, and today, because the market would have been weighed down by far lesser extremes. The importance of valuations is that they strongly inform our expectations about long-term market returns and the extent of potential market losses over the completion of the market cycle.

When it comes to overvalued assets, investors cannot have their cake and eat it too. If investors hope to preserve overvalued prices, they also have to accept meager long-term returns. This is the situation that we presently observe in the U.S. equity market. Based on our most reliable valuation measures, we presently estimate that the nominal total returns of the S&P 500 are likely to be negative on a 12-year horizon.

Fortunately, this extended period of uninspiring long-term S&P 500 total returns is likely to include a wide range of market fluctuations over shorter segments of the market cycle, including alternating periods of speculation and risk-aversion, and alternating periods of extreme valuations and run-of-the-mill or depressed ones. This is the “interesting” part of markets that go “nowhere in an interesting way.” Not every one of these fluctuations will provide an investment opportunity, but we expect a wide range of opportunities to emerge over time, as we have observed across a century of market history.

In the face of a U.S. unemployment rate that remains higher than the worst levels of the 2008-2009 global financial crisis, and a steep economic downturn in which credit strains have been addressed largely by boosting investor confidence and deferring payment obligations, it seems perplexing that the S&P 500 has recently recovered to the most extreme level in history, and to valuations that again rival the 1929 and 2000 extremes. A large part of this recovery reflects extraordinary confidence among investors that Federal Reserve actions will defend them against any material market loss in the future. It also reflects extraordinary confidence in a “V-shaped economic recovery” driven by federal deficit spending (outlays in excess of receipts) in an amount exceeding 40% of real U.S. second-quarter GDP.

As we observed early in both the 2000-2002 and 2007-2009 market collapses, the ingrained “buy the dip” mentality of investors, despite clear economic headwinds and emerging credit strains, is likely to be disastrous. Still, we have absolutely no need to make predictions or to rule out the possibility that everything will come up roses. What is necessary is simply to align our investment outlook with observable market conditions as they change over time.

While our investment discipline considers a broad range of factors, two considerations are most important:

| | 1) | Valuations, which drive our expectations for long-term market returns; |

The Hussman Funds

|

Letter to Shareholders (continued) |

| | 2) | Market action, largely reflecting the behavior of prices and trading volume, and in particular, the uniformity or divergence of this behavior across thousands of individual securities, sectors, industries, and security-types, including debt securities of varying creditworthiness. |

The central lesson to draw from both our successes (particularly navigating complete market cycles prior to 2010) and our challenges (particularly in the period between 2010 and 2017), is that it is best to identify and flexibly respond to prevailing conditions as they change over time, without assuming that there is any well-defined “limit” to either the speculative exuberance or the risk-averse fear of investors.

Over any limited segment of the market cycle, it does not appear to matter whether the beliefs of investors are well-informed or wildly misguided. Over short horizons, it is important to consider whether investor psychology is inclined toward speculation or toward risk-aversion, and we find that this is best gauged by the uniformity or divergence of market internals. Put simply, when investors are inclined toward speculation, they tend to be indiscriminate about it. When they are inclined toward risk-aversion, they tend to be selective and tenuous.

In contrast, over the long-term, and over complete market cycles, an understanding of valuations is critical. Human nature is subject to both optimism and pessimism; to both greed and fear. As a result, periods of extreme overvaluation at one point in time eventually give way to periods of normal or depressed valuations at other points in time.

Both valuations and the analysis of market internals are essential components of our value-conscious, full-cycle investment discipline. These factors help to shape our investment outlook, and also place certain limits on our investment stance.

The ability to properly value securities, to estimate the long-term returns embedded into their prices, and to gauge the potential downside risk of the market over the completion of a given cycle, affects how aggressively or conservatively we respond to shorter waves of speculation or risk-aversion. Likewise, the ability to gauge investor psychology affects how aggressively or conservatively we respond to valuations and changes in long-term expected returns.

Since late-2017, our investment discipline has required explicit deterioration in market internals in order to establish or amplify a negative market outlook. In sufficiently overvalued markets, we may adopt a neutral outlook, but a bearish one requires unfavorable internals, indicating that investors have become inclined toward risk-aversion.

The Hussman Funds

|

Letter to Shareholders (continued) |

Conversely, in markets that are undervalued, we believe that fully invested, unhedged, or leveraged investment positions are best confined to periods when our measures of market internals are uniformly favorable, indicating that investors have become inclined toward speculation. In my view, the most favorable market conditions are those that combine reasonable or attractive valuations with emerging improvement in market internals.

Because the gap between current valuation extremes and run-of-the-mill valuations is as wide as it was in 1929 and 2000, I expect the S&P 500 to lose roughly two-thirds of its value at some point over the completion of the current market cycle. Still, it is wholly unnecessary to make such projections. It is enough to align our investment outlook with the observable conditions that prevail at each point in time.

The most negative market conditions we identify are those that combine extremely rich valuations with ragged or divergent market internals, particularly if the market has also enjoyed an overextended short-term advance. This is a combination that we observed in both May 2001 and May 2008, and one that currently prevails as of early-August 2020. My previous comments during the 2000-2002 and 2007-2009 bear markets capture those concerns.

“In an overvalued market lacking trend uniformity, investors are skittish. The market may very well rally strongly for a while, but the underlying structure of the market is vulnerable. In that kind of environment, seemingly irrelevant items of news can cause large and sudden price declines. In historical data, we’ve seen too many examples of seemingly powerful bear market rallies suddenly launching into vertical declines. We do believe that the U.S. is already in recession, and that stocks remain in a bear market likely to generate much more serious losses.” – May 14, 2001

“Overbought conditions in unfavorable Market Climates tend to be rare. The steepest bear market losses tend to follow immediately on the heels of such overbought conditions.” – December 10, 2007

“In recent weeks, investors have chased stock prices higher (on relatively dull volume and narrow, cyclical leadership) like kids riding their bikes up a board they’ve laid over a pile of bricks to take a sweet jump. Once in the air, the question is ‘what now?’” – May 19, 2008

The Hussman Funds

|

Letter to Shareholders (continued) |

Fund Performance

Strategic Growth Fund

In the fiscal year ended June 30, 2020, Strategic Growth Fund gained 6.17%. During the same period, the S&P 500 gained 7.51%. The hedging stance of the Fund has varied between a strongly defensive position (particularly before mid-March 2020) and a more neutral near-term outlook (particularly after the mid-March 2020 market low). In recent months, the Fund has maintained a flexible response to market conditions, particularly valuations and measures of market internals. During the 2020 fiscal year, the hedging strategy of the Fund contributed notably to a reduction in overall risk, as the deepest interim loss experienced by the Fund during this period was -12.76%, compared with an interim loss of -33.79% for the S&P 500 Index.

The stock selection approach of Strategic Growth Fund has outperformed the S&P 500 Index by an average of 2.63% (263 basis points) annually since the inception of the Fund. During the fiscal year ended June 30, 2020, the performance of the Fund’s stock selections, excluding the impact of hedging, slightly lagged the index, realizing a gain of 7.18% versus a 7.51% gain in the S&P 500 Index, largely reflecting our continued emphasis of value-conscious selection. As at other market extremes such as 2000, this approach periodically avoids large holdings in high-weight components of the S&P 500 that we consider to be overvalued speculative “glamour” stocks.

From the inception of Strategic Growth Fund on July 24, 2000 through June 30, 2020, the Fund had an average annual total return of 0.46%, compared with an average annual total return of 5.90% for the S&P 500 Index. An initial $10,000 investment in the Fund at its inception on July 24, 2000 would have grown to $10,948, compared with $31,329 for the same investment in the S&P 500 Index. The deepest loss experienced by the Fund since inception was -60.36%. The deepest loss experienced by the S&P 500 Index since the inception of the Fund was -55.25%.

In late-2017, largely in response to novel Federal Reserve policies that have the effect of amplifying yield-seeking speculation, we adapted our investment discipline to limit the defensiveness of the Fund when our measures of market internals are uniformly favorable. It is notable that from the inception of the Fund on July 24, 2000 through the market low on March 9, 2009, Strategic Growth Fund gained 105.57% (an 8.71% average annual total return) compared with a -45.99% loss in the S&P 500 (a -6.89% average annual loss). The deepest loss experienced by the Fund during this period was -21.45%, compared with a -55.25% loss in the S&P 500.

The Hussman Funds

|

Letter to Shareholders (continued) |

While there is no assurance that the future performance of the Fund, relative to the S&P 500, will be similar to that of the 2000-2009 period, we believe that the late-2017 adaptation to our investment discipline fully addressed the main challenge that we faced during the 2009-2017 segment of the recent market cycle, which was responsible for the departure of the Fund’s performance from our full-cycle expectations.

Strategic Total Return Fund

In the fiscal year ended June 30, 2020, Strategic Total Return Fund had a total return of 14.00%. During the same period, the Bloomberg Barclay’s U.S. Aggregate Bond Index had a total return of 8.74%. Strategic Total Return Fund held a moderately constructive position in long-term bonds, during this period, with a duration typically ranging between 2-3 years (meaning that a 100 basis point move in interest rates would be expected to affect Fund value by about 2-3% on the basis of bond price fluctuations). The Fund benefited from holdings in shares of companies engaged in the mining of precious metals, as well as utilities, largely by varying the size of its investment positions in response to periods of strength and weakness in these sectors. The deepest interim loss experienced by the Fund during this period was -7.18%, compared with an interim loss of -6.30% for the Bloomberg Barclay’s U.S. Aggregate Bond Index.

From the inception of Strategic Total Return Fund on September 12, 2002 through June 30, 2020, the Fund had an average annual total return of 5.14%, compared with an average annual total return of 4.47% for the Bloomberg Barclay’s U.S. Aggregate Bond Index. An initial $10,000 investment in the Fund on September 12, 2002 would have grown to $24,394, compared with $21,764 for the same investment in the Bloomberg Barclays U.S. Aggregate Bond Index. The deepest loss experienced by the Fund since inception was -11.52%, compared with a maximum loss of -6.30% for the Bloomberg Barclay’s U.S. Aggregate Bond Index during the same period.

Strategic International Fund

In the fiscal year ended June 30, 2020, Strategic International Fund had a total return of 1.08%. During the same period, the MSCI EAFE Index lost -5.13%. Strategic International Fund remained fully hedged against the impact of general market fluctuations during the 2020 fiscal year. While the equity positions and cash equivalents of the Fund lost -3.68% during this period, the Fund’s hedging strategy contributed 4.76%, resulting in the Fund’s overall gain during this period. The deepest interim loss in Strategic International Equity Fund during this period was -10.26%, compared with an interim loss of -33.90% for the MSCI EAFE Index.

The Hussman Funds

|

Letter to Shareholders (continued) |

Because international stock markets tend to become highly correlated during steep declines in the U.S. stock market, the downside risk that we observe in the U.S. market exists in international equity markets as well. A material improvement in U.S. conditions, particularly in our measures of market internals, would likely encourage a constructive stance in the international markets as well. Without the elevated level of market risk that we currently observe, the Fund will have substantially greater opportunity to establish a constructive investment stance based on individual country valuations, market action and other local considerations.

From the inception of Strategic International Fund on December 31, 2009 through June 30, 2020, the Fund had an average annual total return of -1.07%, compared with an average annual total return of 4.04% for the MSCI EAFE Index. An initial $10,000 investment in the Fund on December 31, 2009 would be worth $8,936, compared with $15,147 for the same investment in the MSCI EAFE Index. The deepest loss experienced by the Fund since inception was -22.87%, compared with a maximum loss of -34.12% for the MSCI EAFE Index during the same period.

Strategic Allocation Fund

In August 2019, we launched Hussman Strategic Allocation Fund. The Fund seeks to achieve total return through a combination of income and capital appreciation. It pursues this objective by investing its assets primarily in stocks, bonds, and cash equivalents in consideration of prevailing valuations and estimated expected returns in these markets, with added emphasis on risk-management to adjust the Fund’s investment exposure in market conditions that, in the view of the investment adviser, suggest risk-aversion or speculation by market participants. From the inception of Strategic Allocation Fund on August 27, 2019 through June 30, 2020, the total return of the Fund was 3.23%, reflecting a portfolio that was largely hedged against market fluctuations during this period.

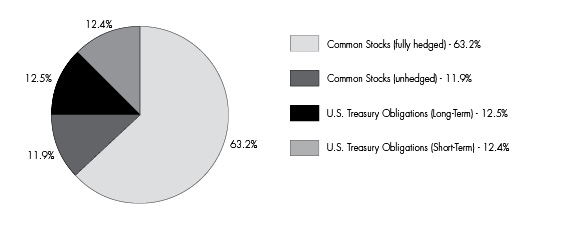

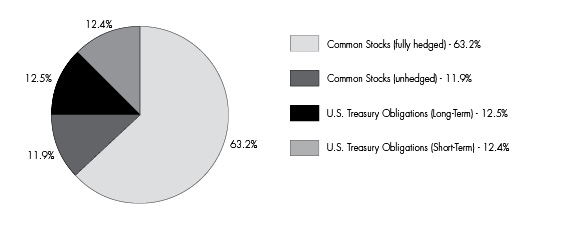

Portfolio Composition

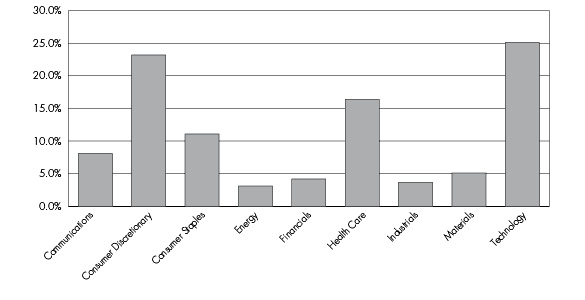

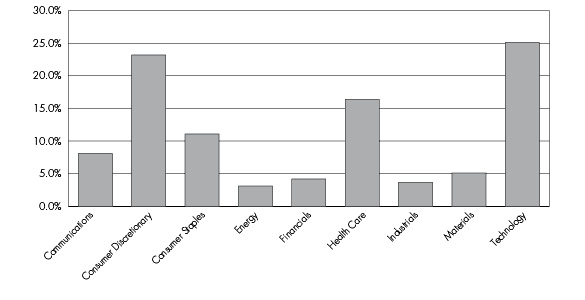

As of June 30, 2020, Strategic Growth Fund had net assets of $308,774,101, and held 206 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were consumer discretionary (24.1%), technology (22.2%), health care (18.2%), communications (7.8%), consumer staples (7.5%) industrials (6.3%) and materials (5.3%). The smallest sector holdings were in energy (4.9%), financials (4.6%) and utilities (0.7%).

The Hussman Funds

|

Letter to Shareholders (continued) |

Strategic Growth Fund’s holdings of individual stocks as of June 30, 2020 were valued at $313,647,074. Against these stock positions, the Fund also held 575 option combinations (long put option/short call option) on the S&P 500 Index and 900 option combinations on the Russell 2000 Index. Each option combination behaves as a short sale on the underlying index, with a notional value of $100 times the index value. On June 30, 2020, the S&P 500 Index closed at 3,100.29, while the Russell 2000 Index closed at 1,441.365. The Fund’s total hedge therefore represented a short position of $307,989,525, thereby hedging 98.2% of the dollar value of the Fund’s long investment positions in individual stocks.

Although the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following equity holdings achieved gains in excess of $1.5 million during the fiscal year ended June 30, 2020: Vaxart, Newmont, SolarEdge Technologies, Barrick Gold and Generac Holdings. Equity holdings with a loss in excess of $1.5 million during this same period were Discover Financial Services, ANI Pharmaceuticals, Lantheus Holdings and AMC Networks.

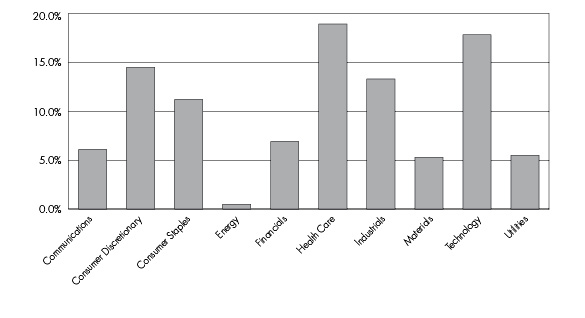

As of June 30, 2020, Strategic Allocation Fund had net assets of $8,093,059 and held 139 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were technology (18.9%), consumer discretionary (17.4%), health care (12.3%), consumer staples (8.4%) and communications (6.1%). The smallest sector weights were materials (3.8%), financials (3.1%), industrials (2.8%) and energy (2.3%). Treasury notes, Treasury bills and investments in money market funds represented 45.4% of the Fund’s net assets.

Strategic Allocation Fund’s holdings of individual stocks as of June 30, 2020 were valued at $6,077,368. Against these stock positions, the Fund also held 10 option combinations (long put option/short call option) on the S&P 500 and 14 option combinations on the Russell 2000 Index. The notional value of this hedge was $5,118,201, hedging 84.2% of the value of equity investments held by the Fund.

In Strategic Allocation Fund, during the period ended June 30, 2020, individual equity portfolio gains in excess of $30,000 were achieved in 10x Genomics, Installed Building Products and Amazon. Individual equity portfolio losses in excess of $30,000 during this same period were recognized in Ulta Beauty, J2 Global and Discover Financial Services.

The Hussman Funds

|

Letter to Shareholders (continued) |

As of June 30, 2020, Strategic Total Return Fund had net assets of $290,129,187. Treasury notes, Treasury Inflation-Protected Securities (TIPS) and investments in money market funds represented 80.1% of the Fund’s net assets. Shares of exchange-traded funds, precious metals shares and energy and utilities shares accounted for 3.2%, 15.0% and 6.8% of net assets, respectively.

In Strategic Total Return Fund, during the fiscal year ended June 30, 2020, portfolio gains in excess of $1.5 million were achieved in Newmont, Barrick Gold, U.S Treasury Note (1.50%, due 8/15/2026) and Agnico Eagle Mines. The only portfolio loss in excess of $1 million during this same period was United States Oil Fund LP.

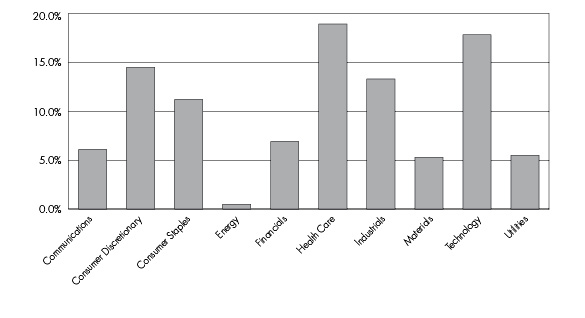

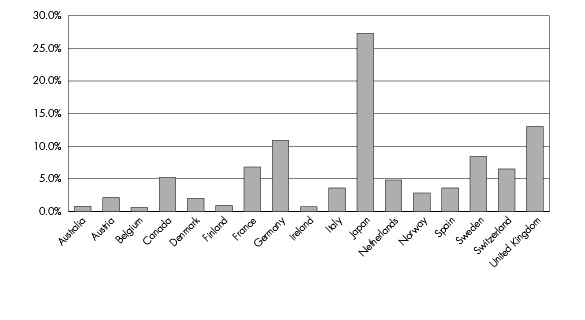

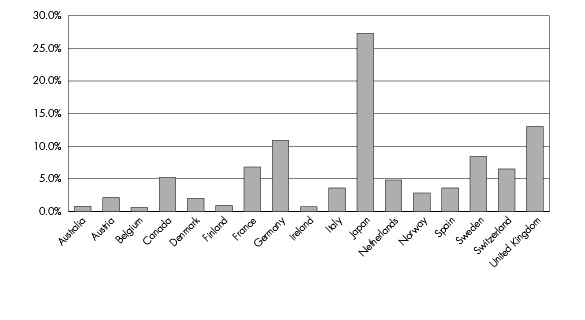

As of June 30, 2020, Strategic International Fund had net assets of $14,994,565 and held 94 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were in health care (15.2%), technology (14.3%), consumer discretionary (11.7%), industrials (10.7%), consumer staples (9.0%) and financials (5.6%). The smallest sector holdings were in communications (4.9%), utilities (4.4%), materials (4.3%) and energy (0.4%).

In order to hedge the impact of general market fluctuations, as of June 30, 2020, Strategic International Fund was short 90 futures on the Mini MSCI EAFE Index and long 12 puts on the S&P 500 Index. The notional value of this hedge was $11,723,148, hedging 98.1% of the dollar value of equity investments held by the Fund. When the Fund is in a hedged investment position, the primary driver of Fund returns is the difference in performance between the stocks owned by the Fund and the indices that are used to hedge.

While the investment portfolio of Strategic International Fund is widely diversified and its performance is affected by numerous investment positions, the hedging strategy of the Fund was primarily responsible for the reduced sensitivity of the Fund to market fluctuations from the Fund’s inception through June 30, 2020. Individual equity holdings having a portfolio gain in excess of $100,000 during the fiscal year ended June 30, 2020 were achieved in Advantest, Nuflare Technology, Ingenico Group and Mycronic. Only one equity holding, Granges AB, recognized a portfolio loss in excess of $100,000 during this period.

Supplementary information including quarterly returns and equity-only performance of the Funds is available on the Hussman Funds website: www.hussmanfunds.com.

The Hussman Funds

|

Letter to Shareholders (continued) |

Current Outlook

Over the completion of every market cycle, there is a very strong tendency for reliable valuation measures to retreat to levels near or below their long-term historical norms. This tendency was the basis on which we projected the likely extent of the 2000-2002 and 2007-2009 collapses in the S&P 500 Index (in both cases, the market proved us to be slightly optimistic). A similar retreat to run-of-the-mill historical valuation norms would presently require a decline in the S&P 500 Index of about -65%, resulting in a loss in the index of roughly two-thirds from August 2020 levels.

Arguably, the current low level of interest rates should be associated with similarly dismal long-term expected returns on stocks, which is why Wall Street analysts often argue that low interest rates “justify” higher valuation multiples than those observed across history. The higher valuation multiples, in this argument, are precisely what is required to produce those dismal long-term expected returns.

However, this argument assumes that the growth rate of corporate cash flows has been held constant. Instead, there is strong evidence to suggest that the level of interest rates largely mirrors the growth rate of nominal GDP and nominal corporate revenues. This means that today’s lower-than-normal interest rates are already matched by lower than normal growth rates in corporate cash flows.

Indeed, over the past 12 years, the average yield on U.S. Treasury securities has been about 3% lower than historical norms, but so too has been the average annual growth rate of nominal GDP and S&P 500 revenues. This is important, because it means that higher valuation levels are not required in order to make stocks “competitive” with bonds. Low nominal growth rates in corporate cash flows already reduce the long-term expected return of stocks, even without any valuation premium.

When Wall Street analysts say “well, stock valuations are high, but high valuations are justified by low interest rates,” they are actually arguing that passive investors face the worst of all possible worlds. The statement amounts to saying “well, future stock returns are likely to be dismal, but dismal returns on stocks are justified because you’re going to get dismal returns on bonds too.” Saying that extreme stock market valuations are “justified” by low interest rates is like saying that poking yourself in the eye is “justified” by smashing your thumb with a hammer.

Unfortunately, all of this leaves us in a situation where current S&P 500 valuations are three times their relevant historical norms, and long-term expected returns on stocks would be somewhat below-average even if those norms were restored.

The Hussman Funds

|

Letter to Shareholders (continued) |

Emphatically, nothing in our investment discipline requires the market to approach or breach these norms. Appropriate valuation levels simply create greater opportunities. Even at the low of the initial market retreat in March 2020, in response to the emerging SARS-CoV-2 epidemic, our most reliable valuation measures stood at levels remained over twice their historical norms, bringing our estimate of likely 10-year S&P 500 total returns to just 2.6%. The subsequent rebound has driven that estimate back below zero. Still, the opportunity was sufficient, even without an improvement in our measures of market internals, to modify our investment stance in a way that enabled all of the Hussman Funds to achieve and retain positive returns in the fiscal year ended June 30, 2020.

Part of the current enthusiasm of investors seems to be the idea that the stock market typically reaches its low before the economy does (although this was certainly not true of the 2001 recession). On the idea that the second quarter of 2020 was the low point for the economy, there is a superficial sensibility in “looking over the valley.” The problem is that post-recession bull markets typically begin at below-average valuations that are less than one-third of those we observe at present. As a result of the recent market rebound, our most reliable measures of stock market valuation again rival levels that marked the 1929 and 2000 market peaks.

Frankly, my view is that investors have become overconfident in the idea that easy money can support extreme market valuations, regardless of the surrounding economic environment. U.S. equity market capitalization exceeds $40 trillion. The U.S. Treasury has allocated $25 billion of CARES economic support funds for the Federal Reserve to purchase outstanding, uncollateralized corporate bonds from private investors. Even if the Fed was to “leverage” this amount, in violation of CARES 4003(c)(3)(B) “terms and conditions” relating to collateral requirements and taxpayer protection, and even if these funds were entirely diverted to stock purchases, the Fed could absorb less than 1% of U.S. equity market capitalization.

To address the human and economic aspects of the SARS-CoV-2 (COVID-19) epidemic, I’ve included extended public health notes since February in my monthly comments at www.hussmanfunds.com, along with a discussion of economic policy responses. With regard to the implications of the epidemic for the financial markets, there is little reason to believe that the very long-term stream of corporate cash flows will be affected, despite the likelihood of additional “cyclical” economic challenges. Still, the same has typically been true for recessions in general. Recessions don’t dramatically alter the likely stream of very long-term corporate cash flows, which is why we find that corporate revenues have historically been more reliable measures of market valuation than corporate earnings.

The Hussman Funds

|

Letter to Shareholders (continued) |

The larger issue for both stocks and corporate bonds is that the epidemic creates significant potential for near-term economic disruption and credit defaults, in a market that is priced for neither. These “cyclical” disruptions, and the anxiety they produce, are why U.S. economic recessions, large or small, have historically driven our most reliable measures of S&P 500 valuation to less than half of their present levels. Extraordinary Federal Reserve interventions have certainly blunted the concern of investors, by creating a perception that large investment losses will somehow “not be allowed.” My impression is that this is a credulous article of faith.

Still, it is worth repeating that it does not matter, in the short run, whether the beliefs of investors are well-informed or wildly misguided. Over any given segment of the market cycle, it is important to consider whether investors are inclined toward speculation or risk-aversion. If our measures of market internals improve, our near-term outlook will also shift to a more neutral outlook. While current valuation extremes would require some sort of hedge in order to provide a safety net against extended market losses, sufficient improvements relating to market internals, economic data, public health, and other factors could even encourage a moderately constructive outlook, despite our long-term and full-cycle concerns.

For now, both our immediate and full-cycle investment outlooks remain negative.

The current situation is reminiscent of May 2008, after Bear Stearns had already failed, after strains in the subprime loan market were fully recognized, and after the Federal Reserve and the U.S. Treasury had already launched unprecedented interventions. The S&P 500 advanced within 9% of its October 2007 peak on the notion that all of the bad news had been “discounted,” yet lost 53% of its value from that point.

On March 17, 2008, the Associated Press published an article discussing the extraordinary interventions by the Federal Reserve in response to the failure of Bear Stearns. Those interventions included Fed Chair Ben Bernanke’s creation of “Maiden Lane” shell companies to absorb bad mortgage-backed debt (which at least represented collateralized debt, unlike the uncollateralized corporate debt the Fed is purchasing today). The article quoted Richard Fuld, who argued that Fed intervention, “from my perspective, takes the liquidity issue for the entire industry off the table.” At that time, Fuld was the CEO of Lehman Brothers.

It is sometimes said that “risk happens fast.��� Yet the underlying damage often has a long and quiet incubation period, which is why Hemingway, in The Sun Also Rises, described bankruptcy as occurring “gradually and then suddenly.” It is also why early

The Hussman Funds

|

Letter to Shareholders (continued) |

in 2008, AIG admitted that it could not “reliably quantify” its losses, leading me to title one of my commentaries “How canst thou know thy counterparty when thou knowest not thine self?”

The same sort of slow incubation characterized the financial markets in May 2001. An economic recession had already started two months earlier, and the S&P 500 had been in a bear market for over a year. But as the S&P 500 rebounded within 14% of the March 2000 bubble peak, the Wall Street Journal observed “Though economists are expecting this year to be the economy’s worst since 1991, only a tiny percentage think the economy is in a recession.” The S&P 500 would lose an additional 40% of its value by October 2002, and the technology-heavy Nasdaq 100 would lose an additional 60% of its value, bringing its overall bear market loss to 83%.

Despite the recent rebound in economic activity (supported by the highest quarterly federal deficit as a share of GDP in history), my sense is that further economic disruptions will emerge “gradually and then suddenly.” It is important to allow for that possibility, but nothing in our investment discipline relies on that outcome. It is enough to simply align our investment stance with prevailing, observable conditions – primarily valuations and market internals – and to shift our outlook as the evidence shifts.

I remain grateful, as always, for your trust.

Sincerely,

John P. Hussman, Ph.D.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares of the Funds, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted.

Weekly updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website: www.hussmanfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

The Hussman Funds

|

Letter to Shareholders (continued) |

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based on the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 Index reflect valuation methods focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle.

This Letter to Shareholders seeks to describe some of the adviser’s current opinions and views of the financial markets. Although the adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly, from those expected or expressed. The securities held by the Funds that are discussed in this Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Funds’ adviser with respect to those securities may change at any time.

Hussman Strategic Growth Fund

Portfolio Information |

June 30, 2020 (Unaudited) |

Sector Allocation (% of Common Stocks)

Hussman Strategic Allocation Fund

Portfolio Information |

June 30, 2020 (Unaudited) |

Asset Allocation (% of Net Assets)

Hussman Strategic Allocation Fund

Portfolio Information (continued) |

June 30, 2020 (Unaudited) |

Sector Allocation* (% of Common Stocks)

* | As of June 30, 2020, the Fund held no securities in the Utilities sector. |

Hussman Strategic Total Return Fund

Portfolio Information |

June 30, 2020 (Unaudited) |

Asset Allocation (% of Net Assets)

Hussman Strategic International Fund

Portfolio Information |

June 30, 2020 (Unaudited) |

Sector Allocation (% of Common Stocks)

Country Allocation (% of Common Stocks)

Hussman Strategic Growth Fund

Schedule of Investments |

June 30, 2020 |

COMMON STOCKS — 101.6% | | Shares | | | Value | |

Communications — 7.8% | | | | | | | | |

Media — 5.8% | | | | | | | | |

Alphabet, Inc. - Class C (a) | | | 1,000 | | | $ | 1,413,610 | |

AMC Entertainment Holdings, Inc. - Class A | | | 75,000 | | | | 321,750 | |

AMC Networks, Inc. - Class A (a) | | | 60,000 | | | | 1,403,400 | |

Cardlytics, Inc. (a) | | | 10,000 | | | | 699,800 | |

Comcast Corporation - Class A | | | 50,000 | | | | 1,949,000 | |

Facebook, Inc. - Class A (a) | | | 5,000 | | | | 1,135,350 | |

Gray Television, Inc. (a) | | | 175,000 | | | | 2,441,250 | |

Meredith Corporation | | | 35,000 | | | | 509,250 | |

Shutterstock, Inc. | | | 30,000 | | | | 1,049,100 | |

Sirius XM Holdings, Inc. | | | 400,000 | | | | 2,348,000 | |

Stamps.com, Inc. (a) | | | 15,000 | | | | 2,755,350 | |

TEGNA, Inc. | | | 50,000 | | | | 557,000 | |

Twitter, Inc. (a) | | | 15,000 | | | | 446,850 | |

Yelp, Inc. (a) | | | 35,000 | | | | 809,550 | |

| | | | | | | | 17,839,260 | |

Telecom — 2.0% | | | | | | | | |

AT&T, Inc. | | | 100,000 | | | | 3,023,000 | |

CenturyLink, Inc. | | | 60,000 | | | | 601,800 | |

Switch, Inc. - Class A | | | 75,000 | | | | 1,336,500 | |

Verizon Communications, Inc. | | | 25,000 | | | | 1,378,250 | |

| | | | | | | | 6,339,550 | |

Consumer Discretionary — 24.1% | | | | | | | | |

Apparel & Textile Products — 0.8% | | | | | | | | |

Gildan Activewear, Inc. | | | 50,000 | | | | 774,500 | |

Hanesbrands, Inc. | | | 150,000 | | | | 1,693,500 | |

| | | | | | | | 2,468,000 | |

Automotive — 1.2% | | | | | | | | |

Gentex Corporation | | | 100,000 | | | | 2,577,000 | |

Methode Electronics, Inc. | | | 35,000 | | | | 1,094,100 | |

| | | | | | | | 3,671,100 | |

Commercial Services — 1.2% | | | | | | | | |

ASGN, Inc. (a) | | | 15,000 | | | | 1,000,200 | |

Cimpress plc (a) | | | 30,000 | | | | 2,290,200 | |

H&R Block, Inc. | | | 35,000 | | | | 499,800 | |

| | | | | | | | 3,790,200 | |

Consumer Services — 0.9% | | | | | | | | |

2U, Inc. (a) | | | 60,000 | | | | 2,277,600 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 101.6% (continued) | | Shares | | | Value | |

Consumer Discretionary — 24.1% (continued) | | | | | | | | |

Consumer Services — 0.9% (continued) | | | | | | | | |

WW International, Inc. (a) | | | 25,000 | | | $ | 634,500 | |

| | | | | | | | 2,912,100 | |

Distributors — 0.2% | | | | | | | | |

LKQ Corporation (a) | | | 25,000 | | | | 655,000 | |

| | | | | | | | | |

Gaming, Lodging & Restaurants — 3.6% | | | | | | | | |

Brinker International, Inc. | | | 75,000 | | | | 1,800,000 | |

Denny’s Corporation (a) | | | 50,000 | | | | 505,000 | |

Domino’s Pizza, Inc. | | | 3,000 | | | | 1,108,320 | |

Dunkin’ Brands Group, Inc. | | | 35,000 | | | | 2,283,050 | |

InterContinental Hotels Group plc - ADR | | | 25,000 | | | | 1,109,000 | |

Starbucks Corporation | | | 40,000 | | | | 2,943,600 | |

Waitr Holdings, Inc. (a) | | | 500,000 | | | | 1,315,000 | |

| | | | | | | | 11,063,970 | |

Home & Office Products — 1.8% | | | | | | | | |

ACCO Brands Corporation | | | 75,000 | | | | 532,500 | |

Century Communities, Inc. (a) | | | 75,000 | | | | 2,299,500 | |

Taylor Morrison Home Corporation (a) | | | 75,000 | | | | 1,446,750 | |

Toll Brothers, Inc. | | | 35,000 | | | | 1,140,650 | |

| | | | | | | | 5,419,400 | |

Hotels, Restaurants & Leisure — 0.6% | | | | | | | | |

Bloomin’ Brands, Inc. | | | 100,000 | | | | 1,066,000 | |

Ruth’s Hospitality Group, Inc. | | | 75,000 | | | | 612,000 | |

| | | | | | | | 1,678,000 | |

Household Durables — 1.6% | | | | | | | | |

D.R. Horton, Inc. | | | 25,000 | | | | 1,386,250 | |

LGI Homes, Inc. (a) | | | 15,000 | | | | 1,320,450 | |

Turtle Beach Corporation (a) | | | 150,000 | | | | 2,208,000 | |

| | | | | | | | 4,914,700 | |

Leisure Products — 0.7% | | | | | | | | |

Malibu Boats, Inc. - Class A (a) | | | 15,000 | | | | 779,250 | |

YETI Holdings, Inc. (a) | | | 35,000 | | | | 1,495,550 | |

| | | | | | | | 2,274,800 | |

Multiline Retail — 1.2% | | | | | | | | |

Big Lots, Inc. | | | 70,000 | | | | 2,940,000 | |

Nordstrom, Inc. | | | 50,000 | | | | 774,500 | |

| | | | | | | | 3,714,500 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 101.6% (continued) | | Shares | | | Value | |

Consumer Discretionary — 24.1% (continued) | | | | | | | | |

Passenger Transportation — 0.3% | | | | | | | | |

Southwest Airlines Company | | | 30,000 | | | $ | 1,025,400 | |

| | | | | | | | | |

Retail - Consumer Staples — 0.6% | | | | | | | | |

Target Corporation | | | 15,000 | | | | 1,798,950 | |

| | | | | | | | | |

Retail - Discretionary — 7.8% | | | | | | | | |

Amazon.com, Inc. (a) | | | 200 | | | | 551,764 | |

American Eagle Outfitters, Inc. | | | 100,000 | | | | 1,090,000 | |

Designer Brands, Inc. - Class A | | | 50,000 | | | | 338,500 | |

Dick’s Sporting Goods, Inc. | | | 75,000 | | | | 3,094,500 | |

eBay, Inc. | | | 30,000 | | | | 1,573,500 | |

Group 1 Automotive, Inc. | | | 35,000 | | | | 2,308,950 | |

Hibbett Sports, Inc. (a) | | | 125,000 | | | | 2,617,500 | |

Home Depot, Inc. (The) | | | 10,000 | | | | 2,505,100 | |

Kohl’s Corporation | | | 75,000 | | | | 1,557,750 | |

Sleep Number Corporation (a) | | | 60,000 | | | | 2,498,400 | |

Ulta Beauty, Inc. (a) | | | 12,500 | | | | 2,542,750 | |

Urban Outfitters, Inc. (a) | | | 25,000 | | | | 380,500 | |

Williams-Sonoma, Inc. | | | 15,000 | | | | 1,230,150 | |

Zumiez, Inc. (a) | | | 65,000 | | | | 1,779,700 | |

| | | | | | | | 24,069,064 | |

Specialty Retail — 1.1% | | | | | | | | |

Gap, Inc. (The) | | | 100,000 | | | | 1,262,000 | |

L Brands, Inc. | | | 60,000 | | | | 898,200 | |

Sally Beauty Holdings, Inc. (a) | | | 100,000 | | | | 1,253,000 | |

| | | | | | | | 3,413,200 | |

Textiles, Apparel & Luxury Goods — 0.5% | | | | | | | | |

PVH Corporation | | | 10,000 | | | | 480,500 | |

Skechers U.S.A., Inc. - Class A (a) | | | 35,000 | | | | 1,098,300 | |

| | | | | | | | 1,578,800 | |

Consumer Staples — 7.5% | | | | | | | | |

Consumer Products — 1.9% | | | | | | | | |

B&G Foods, Inc. | | | 50,000 | | | | 1,219,000 | |

Campbell Soup Company | | | 25,000 | | | | 1,240,750 | |

General Mills, Inc. | | | 10,000 | | | | 616,500 | |

Kellogg Company | | | 30,000 | | | | 1,981,800 | |

PepsiCo, Inc. | | | 5,000 | | | | 661,300 | |

| | | | | | | | 5,719,350 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 101.6% (continued) | | Shares | | | Value | |

Consumer Staples — 7.5% (continued) | | | | | | | | |

Food & Staples Retailing — 3.2% | | | | | | | | |

Kroger Company (The) | | | 75,000 | | | $ | 2,538,750 | |

PriceSmart, Inc. | | | 35,000 | | | | 2,111,550 | |

Rite Aid Corporation (a) | | | 150,000 | | | | 2,559,000 | |

United Natural Foods, Inc. (a) | | | 150,000 | | | | 2,731,500 | |

| | | | | | | | 9,940,800 | |

Retail - Consumer Staples — 2.4% | | | | | | | | |

Ingles Markets, Inc. - Class A | | | 65,000 | | | | 2,799,550 | |

Sprouts Farmers Market, Inc. (a) | | | 100,000 | | | | 2,559,000 | |

Walgreens Boots Alliance, Inc. | | | 50,000 | | | | 2,119,500 | |

| | | | | | | | 7,478,050 | |

Energy — 4.9% | | | | | | | | |

Oil, Gas & Coal — 1.0% | | | | | | | | |

Cosan Ltd. - Class A | | | 75,000 | | | | 1,129,500 | |

Marathon Petroleum Corporation | | | 50,000 | | | | 1,869,000 | |

| | | | | | | | 2,998,500 | |

Renewable Energy — 3.9% | | | | | | | | |

Canadian Solar, Inc. (a) | | | 150,000 | | | | 2,890,500 | |

First Solar, Inc. (a) | | | 20,000 | | | | 990,000 | |

FuelCell Energy, Inc. (a) | | | 200,000 | | | | 452,000 | |

JinkoSolar Holding Company Ltd. - ADR (a) | | | 125,000 | | | | 2,213,750 | |

Plug Power, Inc. (a) | | | 150,000 | | | | 1,231,500 | |

SolarEdge Technologies, Inc. (a) | | | 10,000 | | | | 1,387,800 | |

SunPower Corporation (a) | | | 375,000 | | | | 2,872,500 | |

| | | | | | | | 12,038,050 | |

Financials — 4.6% | | | | | | | | |

Asset Management — 0.6% | | | | | | | | |

Federated Hermes, Inc. | | | 80,000 | | | | 1,896,000 | |

| | | | | | | | | |

Banking — 0.6% | | | | | | | | |

Fifth Third Bancorp | | | 35,000 | | | | 674,800 | |

Signature Bank | | | 10,000 | | | | 1,069,200 | |

| | | | | | | | 1,744,000 | |

Insurance — 0.5% | | | | | | | | |

Principal Financial Group, Inc. | | | 35,000 | | | | 1,453,900 | |

| | | | | | | | | |

Real Estate — 0.3% | | | | | | | | |

Sabra Health Care REIT, Inc. | | | 75,000 | | | | 1,082,250 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 101.6% (continued) | | Shares | | | Value | |

Financials — 4.6% (continued) | | | | | | | | |

Specialty Finance — 2.6% | | | | | | | | |

AerCap Holdings N.V. (a) | | | 20,000 | | | $ | 616,000 | |

Air Lease Corporation | | | 10,000 | | | | 292,900 | |

American Express Company | | | 20,000 | | | | 1,904,000 | |

Discover Financial Services | | | 50,000 | | | | 2,504,500 | |

Navient Corporation | | | 75,000 | | | | 527,250 | |

Synchrony Financial | | | 100,000 | | | | 2,216,000 | |

| | | | | | | | 8,060,650 | |

Health Care — 18.2% | | | | | | | | |

Biotech & Pharma — 11.8% | | | | | | | | |

10X Genomics, Inc. - Class A (a) | | | 20,000 | | | | 1,786,200 | |

AbbVie, Inc. | | | 25,000 | | | | 2,454,500 | |

Agenus, Inc. (a) | | | 150,000 | | | | 589,500 | |

Alexion Pharmaceuticals, Inc. (a) | | | 10,000 | | | | 1,122,400 | |

ANI Pharmaceuticals, Inc. (a) | | | 35,000 | | | | 1,131,900 | |

Arena Pharmaceuticals, Inc. (a) | | | 15,000 | | | | 944,250 | |

Arrowhead Pharmaceuticals, Inc. (a) | | | 60,000 | | | | 2,591,400 | |

Biogen, Inc. (a) | | | 17,500 | | | | 4,682,125 | |

Corcept Therapeutics, Inc. (a) | | | 175,000 | | | | 2,943,500 | |

CRISPR Therapeutics AG (a) | | | 15,000 | | | | 1,102,350 | |

Editas Medicine, Inc. (a) | | | 100,000 | | | | 2,958,000 | |

Exelixis, Inc. (a) | | | 75,000 | | | | 1,780,500 | |

ImmunoGen, Inc. (a) | | | 100,000 | | | | 460,000 | |

Ionis Pharmaceuticals, Inc. (a) | | | 25,000 | | | | 1,474,000 | |

Jazz Pharmaceuticals plc (a) | | | 20,000 | | | | 2,206,800 | |

Lannett Company, Inc. (a) | | | 7,500 | | | | 54,450 | |

Mylan N.V. (a) | | | 60,000 | | | | 964,800 | |

Neurocrine Biosciences, Inc. (a) | | | 10,000 | | | | 1,220,000 | |

Organogenesis Holdings, Inc. (a) | | | 200,000 | | | | 768,000 | |

Pulmatrix, Inc. (a) | | | 200,000 | | | | 344,000 | |

Regeneron Pharmaceuticals, Inc. (a) | | | 4,000 | | | | 2,494,600 | |

Selecta Biosciences, Inc. (a) | | | 75,000 | | | | 213,000 | |

Supernus Pharmaceuticals, Inc. (a) | | | 15,000 | | | | 356,250 | |

Vaxart, Inc. (a) | | | 200,000 | | | | 1,770,000 | |

| | | | | | | | 36,412,525 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 101.6% (continued) | | Shares | | | Value | |

Health Care — 18.2% (continued) | | | | | | | | |

Health Care Facilities & Services — 0.6% | | | | | | | | |

NeoGenomics, Inc. (a) | | | 20,000 | | | $ | 619,600 | |

Syneos Health, Inc. (a) | | | 20,000 | | | | 1,165,000 | |

| | | | | | | | 1,784,600 | |

Health Care Providers & Services — 3.5% | | | | | | | | |

AmerisourceBergen Corporation | | | 20,000 | | | | 2,015,400 | |

Cigna Corporation | | | 10,000 | | | | 1,876,500 | |

CVS Health Corporation | | | 50,000 | | | | 3,248,500 | |

Owens & Minor, Inc. | | | 125,000 | | | | 952,500 | |

Select Medical Holdings Corporation (a) | | | 125,000 | | | | 1,841,250 | |

Tenet Healthcare Corporation (a) | | | 50,000 | | | | 905,500 | |

| | | | | | | | 10,839,650 | |

Medical Equipment & Devices — 2.3% | | | | | | | | |

Alpha Pro Tech Ltd. (a) | | | 75,000 | | | | 1,327,500 | |

Exact Sciences Corporation (a) | | | 10,000 | | | | 869,400 | |

Inogen, Inc. (a) | | | 50,000 | | | | 1,776,000 | |

Lantheus Holdings, Inc. (a) | | | 150,000 | | | | 2,145,000 | |

Luminex Corporation | | | 35,000 | | | | 1,138,550 | |

| | | | | | | | 7,256,450 | |

Industrials — 6.3% | | | | | | | | |

Aerospace & Defense — 0.4% | | | | | | | | |

TransDigm Group, Inc. | | | 2,500 | | | | 1,105,125 | |

| | | | | | | | | |

Commercial Services & Supplies — 0.1% | | | | | | | | |

Herman Miller, Inc. | | | 20,000 | | | | 472,200 | |

| | | | | | | | | |

Electrical Equipment — 2.2% | | | | | | | | |

Allegion plc | | | 25,000 | | | | 2,555,500 | |

Atkore International Group, Inc. (a) | | | 65,000 | | | | 1,777,750 | |

Generac Holdings, Inc. (a) | | | 20,000 | | | | 2,438,600 | |

| | | | | | | | 6,771,850 | |

Engineering & Construction Services — 2.3% | | | | | | | | |

frontdoor, inc. (a) | | | 25,000 | | | | 1,108,250 | |

MasTec, Inc. (a) | | | 65,000 | | | | 2,916,550 | |

Quanta Services, Inc. | | | 75,000 | | | | 2,942,250 | |

| | | | | | | | 6,967,050 | |

Home & Office Products — 0.5% | | | | | | | | |

Fortune Brands Home & Security, Inc. | | | 25,000 | | | | 1,598,250 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 101.6% (continued) | | Shares | | | Value | |

Industrials — 6.3% (continued) | | | | | | | | |

Industrial Services — 0.2% | | | | | | | | |

Fastenal Company | | | 15,000 | | | $ | 642,600 | |

| | | | | | | | | |

Machinery — 0.2% | | | | | | | | |

Proto Labs, Inc. (a) | | | 6,000 | | | | 674,820 | |

| | | | | | | | | |

Transportation & Logistics — 0.4% | | | | | | | | |

United Parcel Service, Inc. - Class B | | | 10,000 | | | | 1,111,800 | |

| | | | | | | | | |

Materials — 5.3% | | | | | | | | |

Chemicals — 0.8% | | | | | | | | |

Livent Corporation (a) | | | 100,000 | | | | 616,000 | |

Valvoline, Inc. | | | 100,000 | | | | 1,933,000 | |

| | | | | | | | 2,549,000 | |

Containers & Packaging — 0.6% | | | | | | | | |

Greif, Inc. - Class A | | | 25,000 | | | | 860,250 | |

Packaging Corporation of America | | | 10,000 | | | | 998,000 | |

| | | | | | | | 1,858,250 | |

Metals & Mining — 3.9% | | | | | | | | |

Agnico Eagle Mines Ltd. | | | 25,000 | | | | 1,601,500 | |

AngloGold Ashanti Ltd. - ADR | | | 35,000 | | | | 1,032,150 | |

Barrick Gold Corporation | | | 125,000 | | | | 3,367,500 | |

Compass Minerals International, Inc. | | | 20,000 | | | | 975,000 | |

Kinross Gold Corporation (a) | | | 100,000 | | | | 722,000 | |

Newmont Corporation | | | 55,000 | | | | 3,395,700 | |

Royal Gold, Inc. | | | 6,000 | | | | 745,920 | |

| | | | | | | | 11,839,770 | |

Technology — 22.2% | | | | | | | | |

Design, Manufacturing & Distribution — 1.5% | | | | | | | | |

Fabrinet (a) | | | 15,000 | | | | 936,300 | |

Jabil, Inc. | | | 75,000 | | | | 2,406,000 | |

SYNNEX Corporation | | | 10,000 | | | | 1,197,700 | |

| | | | | | | | 4,540,000 | |

Hardware — 5.8% | | | | | | | | |

Apple, Inc. | | | 1,000 | | | | 364,800 | |

Ciena Corporation (a) | | | 40,000 | | | | 2,166,400 | |

F5 Networks, Inc. (a) | | | 10,000 | | | | 1,394,800 | |

Infinera Corporation (a) | | | 200,000 | | | | 1,184,000 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 101.6% (continued) | | Shares | | | Value | |

Technology — 22.2% (continued) | | | | | | | | |

Hardware — 5.8% (continued) | | | | | | | | |

Lumentum Holdings, Inc. (a) | | | 15,000 | | | $ | 1,221,450 | |

Maxar Technologies, Inc. | | | 150,000 | | | | 2,694,000 | |

Seagate Technology plc | | | 50,000 | | | | 2,420,500 | |

Super Micro Computer, Inc. (a) | | | 75,000 | | | | 2,129,250 | |

TTM Technologies, Inc. (a) | | | 100,000 | | | | 1,186,000 | |

Ubiquiti, Inc. | | | 17,500 | | | | 3,054,800 | |

| | | | | | | | 17,816,000 | |

Semiconductors — 5.4% | | | | | | | | |

Amkor Technology, Inc. (a) | | | 100,000 | | | | 1,231,000 | |

Applied Materials, Inc. | | | 50,000 | | | | 3,022,500 | |

Cirrus Logic, Inc. (a) | | | 20,000 | | | | 1,235,600 | |

Intel Corporation | | | 50,000 | | | | 2,991,500 | |

KLA Corporation | | | 10,000 | | | | 1,944,800 | |

Lam Research Corporation | | | 500 | | | | 161,730 | |

Photronics, Inc. (a) | | | 100,000 | | | | 1,113,000 | |

Power Integrations, Inc. | | | 20,000 | | | | 2,362,600 | |

QUALCOMM, Inc. | | | 20,000 | | | | 1,824,200 | |

Rambus, Inc. (a) | | | 65,000 | | | | 988,000 | |

| | | | | | | | 16,874,930 | |

Software — 4.5% | | | | | | | | |

Akamai Technologies, Inc. (a) | | | 25,000 | | | | 2,677,250 | |

Citrix Systems, Inc. | | | 15,000 | | | | 2,218,650 | |

GlobalSCAPE, Inc. | | | 60,000 | | | | 585,000 | |

j2 Global, Inc. (a) | | | 30,000 | | | | 1,896,300 | |

Microsoft Corporation | | | 1,000 | | | | 203,510 | |

Oracle Corporation | | | 20,000 | | | | 1,105,400 | |

Schrodinger, Inc. (a) | | | 5,000 | | | | 457,850 | |

VMware, Inc. - Class A (a) | | | 20,000 | | | | 3,097,200 | |

Xperi Holding Corporation | | | 125,000 | | | | 1,845,000 | |

| | | | | | | | 14,086,160 | |

Technology Services — 5.0% | | | | | | | | |

Cognizant Technology Solutions Corporation - Class A | | | 25,000 | | | | 1,420,500 | |

CSG Systems International, Inc. | | | 50,000 | | | | 2,069,500 | |

EVERTEC, Inc. | | | 25,000 | | | | 702,500 | |

Genpact Ltd. | | | 75,000 | | | | 2,739,000 | |

Infosys Ltd. - ADR | | | 250,000 | | | | 2,415,000 | |

International Business Machines Corporation | | | 5,000 | | | | 603,850 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 101.6% (continued) | | Shares | | | Value | |

Technology — 22.2% (continued) | | | | | | | | |

Technology Services — 5.0% (continued) | | | | | | | | |

MAXIMUS, Inc. | | | 25,000 | | | $ | 1,761,250 | |

NIC, Inc. | | | 100,000 | | | | 2,296,000 | |

Sykes Enterprises, Inc. (a) | | | 50,000 | | | | 1,383,000 | |

| | | | | | | | 15,390,600 | |

Utilities — 0.7% | | | | | | | | |

Utilities — 0.7% | | | | | | | | |

Ormat Technologies, Inc. | | | 10,000 | | | | 634,900 | |

TerraForm Power, Inc. - Class A | | | 75,000 | | | | 1,383,000 | |

| | | | | | | | 2,017,900 | |

| | | | | | | | | |

Total Common Stocks (Cost $311,689,423) (b) | | | | | | $ | 313,647,074 | |

EXCHANGE-TRADED PUT OPTION CONTRACTS — 3.0% | | Contracts | | | Notional

Amount | | | Value | |

Russell 2000 Index Option, 08/21/2020 at $1,350 | | | 900 | | | $ | 129,722,850 | | | $ | 4,114,800 | |

S&P 500 Index Option, 08/21/2020 at $3,000 | | | 575 | | | | 178,266,675 | | | | 5,042,750 | |

Total Put Option Contracts (Premiums paid $14,494,001) | | | | | | $ | 307,989,525 | | | $ | 9,157,550 | |

| | | | | | | | | | | | | |

Total Investments at Value — 104.6% (Cost $326,183,424) | | | | | | | | | | $ | 322,804,624 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2020 |

MONEY MARKET FUNDS — 45.3% | | Shares | | | Value | |

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.08% (c) (Cost $139,965,391) | | | 139,965,391 | | | $ | 139,965,391 | |

| | | | | | | | | |

Total Investments and Money Market Funds at Value — 149.9% (Cost $466,148,815) | | | | | | $ | 462,770,015 | |

| | | | | | | | | |

Written Call Option Contracts — (51.0%) | | | | | | | (157,564,000 | ) |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 1.1% | | | | | | | 3,568,086 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 308,774,101 | |

ADR - American Depositary Receipt. |

(a) | Non-income producing security. |

(b) | Common stocks owned by the Fund are held in escrow by the Fund’s custodian (or by a securities depository) to secure the Fund’s obligations to settle outstanding call option contracts it has written (Note 1). |

(c) | The rate shown is the 7-day effective yield as of June 30, 2020. |

See accompanying notes to financial statements. |

Hussman Strategic Growth Fund

Schedule of Open Written Option Contracts |

June 30, 2020 |

EXCHANGE-TRADED WRITTEN CALL OPTION CONTRACTS | | Contracts | | | Notional

Amount | | | Strike

Price | | | Expiration

Date | | | Value of

Options | |

Call Option Contracts |

Russell 2000 Index Option | | | 900 | | | $ | 129,722,850 | | | $ | 700 | | | | 09/18/2020 | | | $ | 66,334,500 | |

S&P 500 Index Option | | | 575 | | | | 178,266,675 | | | | 1,500 | | | | 09/18/2020 | | | | 91,229,500 | |

Total Written Call Option Contracts (Premiums received $125,519,812) | | | | | | $ | 307,989,525 | | | | | | | | | | | $ | 157,564,000 | |

See accompanying notes to financial statements. |

Hussman Strategic Allocation Fund

Schedule of Investments |

June 30, 2020 |

COMMON STOCKS — 75.1% | | Shares | | | Value | |

Communications — 6.1% | | | | | | | | |

Media — 3.8% | | | | | | | | |

Alphabet, Inc. - Class C (a) | | | 20 | | | $ | 28,272 | |

Comcast Corporation - Class A | | | 1,200 | | | | 46,776 | |

Facebook, Inc. - Class A (a) | | | 100 | | | | 22,707 | |

Gray Television, Inc. (a) | | | 4,000 | | | | 55,800 | |

Shutterstock, Inc. | | | 1,000 | | | | 34,970 | |

Sirius XM Holdings, Inc. | | | 8,000 | | | | 46,960 | |

Stamps.com, Inc. (a) | | | 300 | | | | 55,107 | |

Twitter, Inc. (a) | | | 500 | | | | 14,895 | |

| | | | | | | | 305,487 | |

Telecom — 2.3% | | | | | | | | |

AT&T, Inc. | | | 3,000 | | | | 90,690 | |

CenturyLink, Inc. | | | 2,000 | | | | 20,060 | |

Switch, Inc. - Class A | | | 2,000 | | | | 35,640 | |

Verizon Communications, Inc. | | | 750 | | | | 41,348 | |

| | | | | | | | 187,738 | |

Consumer Discretionary — 17.4% | | | | | | | | |

Apparel & Textile Products — 0.1% | | | | | | | | |

Hanesbrands, Inc. | | | 1,000 | | | | 11,290 | |

| | | | | | | | | |

Automotive — 0.7% | | | | | | | | |

Gentex Corporation | | | 1,000 | | | | 25,770 | |

Methode Electronics, Inc. | | | 1,000 | | | | 31,260 | |

| | | | | | | | 57,030 | |

Commercial Services — 0.8% | | | | | | | | |

Cimpress plc (a) | | | 800 | | | | 61,072 | |

| | | | | | | | | |

Consumer Services — 1.0% | | | | | | | | |

2U, Inc. (a) | | | 1,500 | | | | 56,940 | |

WW International, Inc. (a) | | | 1,000 | | | | 25,380 | |

| | | | | | | | 82,320 | |

Distributors — 0.3% | | | | | | | | |

LKQ Corporation (a) | | | 1,000 | | | | 26,200 | |

| | | | | | | | | |

Gaming, Lodging & Restaurants — 1.9% | | | | | | | | |

Brinker International, Inc. | | | 1,500 | | | | 36,000 | |

Dunkin’ Brands Group, Inc. | | | 500 | | | | 32,615 | |

Starbucks Corporation | | | 750 | | | | 55,192 | |

Hussman Strategic Allocation Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 75.1% (continued) | | Shares | | | Value | |

Consumer Discretionary — 17.4% (continued) | | | | | | | | |

Gaming, Lodging & Restaurants — 1.9% (continued) | | | | | | | | |

Waitr Holdings, Inc. (a) | | | 10,000 | | | $ | 26,300 | |

| | | | | | | | 150,107 | |

Home & Office Products — 1.0% | | | | | | | | |

ACCO Brands Corporation | | | 2,000 | | | | 14,200 | |

Century Communities, Inc. (a) | | | 2,250 | | | | 68,985 | |

| | | | | | | | 83,185 | |

Hotels, Restaurants & Leisure — 0.6% | | | | | | | | |

Bloomin’ Brands, Inc. | | | 3,000 | | | | 31,980 | |

Ruth’s Hospitality Group, Inc. | | | 2,000 | | | | 16,320 | |

| | | | | | | | 48,300 | |

Household Durables — 0.9% | | | | | | | | |

LGI Homes, Inc. (a) | | | 350 | | | | 30,811 | |

Turtle Beach Corporation (a) | | | 3,000 | | | | 44,160 | |

| | | | | | | | 74,971 | |

Multiline Retail — 1.3% | | | | | | | | |

Big Lots, Inc. | | | 2,000 | | | | 84,000 | |

Nordstrom, Inc. | | | 1,500 | | | | 23,235 | |

| | | | | | | | 107,235 | |

Passenger Transportation — 0.3% | | | | | | | | |

Southwest Airlines Company | | | 750 | | | | 25,635 | |

| | | | | | | | | |

Retail - Consumer Staples — 0.7% | | | | | | | | |

Target Corporation | | | 500 | | | | 59,965 | |

| | | | | | | | | |

Retail - Discretionary — 6.5% | | | | | | | | |

Amazon.com, Inc. (a) | | | 10 | | | | 27,588 | |

Dick’s Sporting Goods, Inc. | | | 2,000 | | | | 82,520 | |

eBay, Inc. | | | 750 | | | | 39,338 | |

Group 1 Automotive, Inc. | | | 750 | | | | 49,478 | |

Hibbett Sports, Inc. (a) | | | 2,500 | | | | 52,350 | |

Home Depot, Inc. (The) | | | 250 | | | | 62,627 | |

Kohl’s Corporation | | | 1,000 | | | | 20,770 | |

Sleep Number Corporation (a) | | | 1,250 | | | | 52,050 | |

Ulta Beauty, Inc. (a) | | | 300 | | | | 61,026 | |

Williams-Sonoma, Inc. | | | 400 | | | | 32,804 | |

Zumiez, Inc. (a) | | | 1,500 | | | | 41,070 | |

| | | | | | | | 521,621 | |

Hussman Strategic Allocation Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 75.1% (continued) | | Shares | | | Value | |

Consumer Discretionary — 17.4% (continued) | | | | | | | | |

Specialty Retail — 1.1% | | | | | | | | |

Gap, Inc. (The) | | | 2,000 | | | $ | 25,240 | |

L Brands, Inc. | | | 1,500 | | | | 22,455 | |

Sally Beauty Holdings, Inc. (a) | | | 3,000 | | | | 37,590 | |

| | | | | | | | 85,285 | |

Textiles, Apparel & Luxury Goods — 0.2% | | | | | | | | |

PVH Corporation | | | 300 | | | | 14,415 | |

| | | | | | | | | |

Consumer Staples — 8.4% | | | | | | | | |

Consumer Products — 2.6% | | | | | | | | |

B&G Foods, Inc. | | | 1,500 | | | | 36,570 | |

Campbell Soup Company | | | 1,000 | | | | 49,630 | |

General Mills, Inc. | | | 500 | | | | 30,825 | |

Kellogg Company | | | 750 | | | | 49,545 | |

PepsiCo, Inc. | | | 300 | | | | 39,678 | |

| | | | | | | | 206,248 | |

Food & Staples Retailing — 3.4% | | | | | | | | |

Kroger Company (The) | | | 2,000 | | | | 67,700 | |

Natural Grocers by Vitamin Cottage, Inc. | | | 500 | | | | 7,440 | |

PriceSmart, Inc. | | | 1,000 | | | | 60,330 | |

Rite Aid Corporation (a) | | | 4,000 | | | | 68,240 | |

United Natural Foods, Inc. (a) | | | 4,000 | | | | 72,840 | |

| | | | | | | | 276,550 | |

Retail - Consumer Staples — 2.4% | | | | | | | | |

Ingles Markets, Inc. - Class A | | | 1,650 | | | | 71,066 | |

Sprouts Farmers Market, Inc. (a) | | | 2,750 | | | | 70,372 | |

Walgreens Boots Alliance, Inc. | | | 1,250 | | | | 52,987 | |

| | | | | | | | 194,425 | |

Energy — 2.3% | | | | | | | | |

Renewable Energy — 2.3% | | | | | | | | |

Canadian Solar, Inc. (a) | | | 3,600 | | | | 69,372 | |

First Solar, Inc. (a) | | | 400 | | | | 19,800 | |

JinkoSolar Holding Company Ltd. - ADR (a) | | | 3,000 | | | | 53,130 | |

SolarEdge Technologies, Inc. (a) | | | 150 | | | | 20,817 | |

SunPower Corporation (a) | | | 3,500 | | | | 26,810 | |

| | | | | | | | 189,929 | |

Hussman Strategic Allocation Fund

Schedule of Investments (continued) |

June 30, 2020 |

COMMON STOCKS — 75.1% (continued) | | Shares | | | Value | |

Financials — 3.1% | | | | | | | | |

Asset Management — 0.5% | | | | | | | | |