| | OMB APPROVAL |

| | OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-09911 | |

| Hussman Investment Trust |

| (Exact name of registrant as specified in charter) |

| 6021 University Boulevard, Suite 490 Ellicott City, Maryland | 21043 |

| (Address of principal executive offices) | (Zip code) |

John F. Splain

| Ultimus Fund Solutions, LLC | 225 Pictoria Drive, Suite 450 | Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | June 30, 2021 | |

| Date of reporting period: | June 30, 2021 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

HUSSMAN INVESTMENT TRUST

HUSSMAN STRATEGIC GROWTH FUND

HUSSMAN STRATEGIC ALLOCATION FUND

HUSSMAN STRATEGIC TOTAL RETURN FUND

HUSSMAN STRATEGIC INTERNATIONAL FUND

ANNUAL REPORT

June 30, 2021

Table of Contents

| | |

Performance Information | |

Hussman Strategic Growth Fund | 1 |

Hussman Strategic Allocation Fund | 2 |

Hussman Strategic Total Return Fund | 3 |

Hussman Strategic International Fund | 4 |

Letter to Shareholders | 5 |

Portfolio Information | 18 |

Schedules of Investments | |

Hussman Strategic Growth Fund | 21 |

Hussman Strategic Allocation Fund | 34 |

Hussman Strategic Total Return Fund | 48 |

Hussman Strategic International Fund | 52 |

Statements of Assets and Liabilities | 61 |

Statements of Operations | 63 |

Statements of Changes in Net Assets | |

Hussman Strategic Growth Fund | 65 |

Hussman Strategic Allocation Fund | 66 |

Hussman Strategic Total Return Fund | 67 |

Hussman Strategic International Fund | 68 |

Financial Highlights | |

Hussman Strategic Growth Fund | 69 |

Hussman Strategic Allocation Fund | 70 |

Hussman Strategic Total Return Fund | 71 |

Hussman Strategic International Fund | 72 |

Notes to Financial Statements | 73 |

Report of Independent Registered Public Accounting Firm | 99 |

About Your Funds’ Expenses | 101 |

Board of Trustees and Officers | 103 |

Other Information | 105 |

Federal Tax Information | 105 |

Approval of Investment Advisory Agreements | 106 |

Discussion of Liquidity Risk Management Program | 114 |

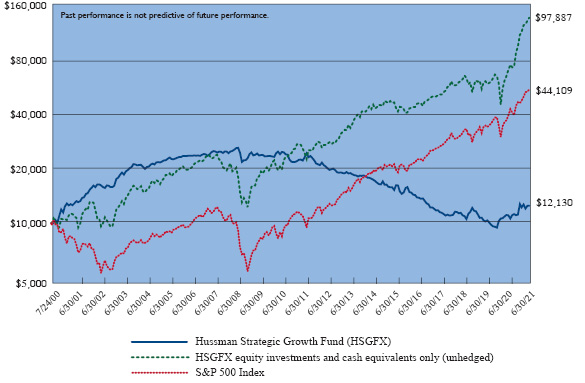

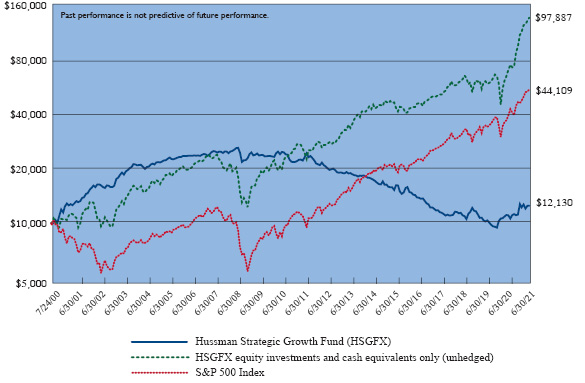

Hussman Strategic Growth Fund

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic Growth Fund versus the S&P 500 Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended June 30, 2021 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic Growth Fund(c)(d) | 10.80% | 2.65% | (2.35%) | (5.00%) | 0.93% | |

S&P 500 Index | 40.79% | 18.67% | 17.65% | 14.84% | 7.35% | |

(a) | Hussman Strategic Growth Fund invests primarily in stocks listed on the New York, American, and NASDAQ exchanges and varies its investment exposure to market fluctuations depending on market conditions. The S&P 500 Index is an index of large capitalization stocks. However, the Fund may invest in securities that are not included in the S&P 500 Index and there are no restrictions as to the market capitalization of companies in which the Fund invests. “HSGFX equity investments and cash equivalents only (unhedged)” reflects the performance of the Fund’s stock investments and modest day-to-day cash balances, after fees and expenses, and does not reflect the impact of hedging transactions on the Fund’s overall investment performance. The Fund’s unhedged equity investments do not represent a separately available portfolio, and their performance is presented solely for purposes of comparison and performance attribution. Performance data presented using log scale. Each segment on the vertical axis represents an equivalent percentage change. |

(b) | The Fund commenced operations on July 24, 2000. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2021 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.15% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund for the year ended June 30, 2021 would have been 1.19%. |

Hussman Strategic Allocation Fund

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Allocation Fund

versus Benchmark Fixed Allocation Composite(a) (Unaudited)

Average Annual Total Returns For Periods Ended June 30, 2021 |

| | 1 Year | Since

Inception(b) |

Hussman Strategic Allocation Fund(c)(d) | 19.70% | 12.16% |

Benchmark Fixed Allocation Composite | 21.96% | 17.12% |

(a) | Benchmark Fixed Allocation Composite represents the gross investment performance of a portfolio that is invested in securities included in three separate indices, weighted as follows: 60% S&P 500 Index, 30% Bloomberg U.S. Treasury Unhedged Index and 10% Bloomberg U.S. Treasury Bills Index. The Composite represents an investment approach that invests a fixed percentage of assets in stocks, bonds, and money-market securities, with little or no variation. The Fund may invest in securities that are not included in the indices that comprise the Composite. |

(b) | The Fund commenced operations on August 27, 2019. |

(c) | Returns do no reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemptions of Fund shares. |

(d) | The Advisor has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2022 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.25% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund for the year ended June 30, 2021 would have been 2.87%. |

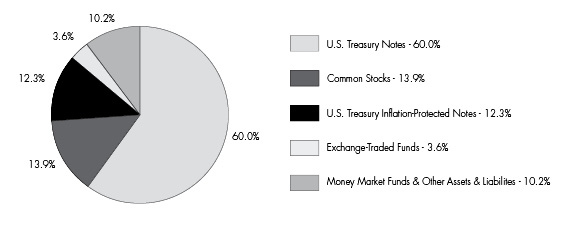

Hussman Strategic Total Return Fund

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Total Return Fund

versus the Bloomberg U.S. Aggregate Bond Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended June 30, 2021 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic Total Return Fund(c)(d) | 2.70% | 8.70% | 4.35% | 3.18% | 5.01% | |

Bloomberg U.S. Aggregate Bond Index | (0.33%) | 5.34% | 3.03% | 3.39% | 4.21% | |

(a) | The Bloomberg U.S. Aggregate Bond Index covers the U.S. investment grade fixed rate bond market, with index components for U.S. government, agency and corporate securities. The Fund does not invest solely in securities included in the Bloomberg U.S. Aggregate Bond Index and may invest in other types of bonds, as well as common stocks, exchange-traded funds and other securities. |

(b) | The Fund commenced operations on September 12, 2002. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2021 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 0.75% annually of the Fund’s average daily net assets. |

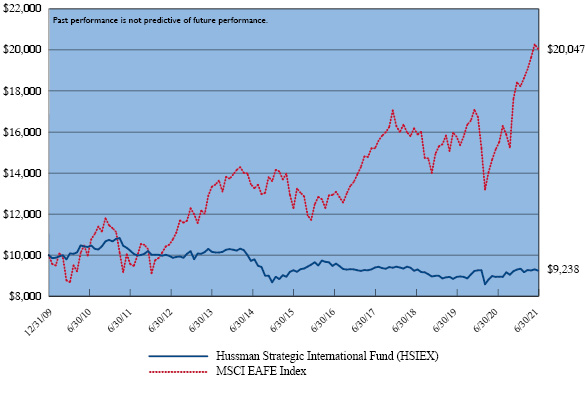

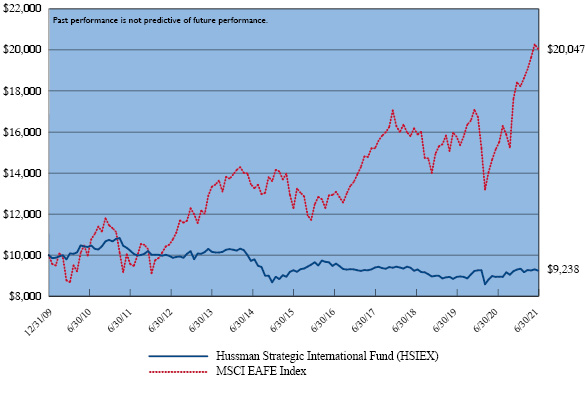

Hussman Strategic International Fund

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic International Fund versus the MSCI EAFE Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended June 30, 2021 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic International Fund(c)(d) | 3.38% | (0.52%) | (0.91%) | (1.43%) | (0.69%) | |

MSCI EAFE Index | 32.35% | 8.27% | 10.28% | 5.89% | 6.24% | |

(a) | The MSCI EAFE (Europe, Australasia, and Far East) Index is a free float-adjusted weighted capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of June 30, 2021, the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The Fund is not required to invest in each of the countries represented in the MSCI EAFE Index and may invest in securities that are not included in the MSCI EAFE Index. In addition, the Fund varies its exposure to market fluctuations depending on market conditions. |

(b) | The Fund commenced operations on December 31, 2009. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2021 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 2.00% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund for the year ended June 30, 2021 would have been 3.54%. |

The Hussman Funds

|

Letter to Shareholders | August 6, 2021 |

Dear Shareholder,

“It does not matter, in the short run, whether the beliefs of investors are well-informed or wildly misguided. Over any given segment of the market cycle, it is important to consider whether investors are inclined toward speculation or risk-aversion. If our measures of market internals improve, our near-term outlook will also shift to a more neutral outlook. While current valuation extremes would require some sort of hedge in order to provide a safety net against extended market losses, sufficient improvements relating to market internals, economic data, public health, and other factors could even encourage a moderately constructive outlook, despite our long-term and full-cycle concerns.”

– John P. Hussman, Ph.D., Hussman Funds 2020 Annual Report

We often describe our investment approach as a “value-conscious, historically-informed, full-cycle” investment discipline. Presently, every element of that discipline appears to be at odds with investor sentiment.

Current sentiment certainly does not appear value-conscious. Instead, we observe breathtaking extremes, beyond even 1929 and 2000 levels, in the valuation measures that we find best-correlated with actual subsequent total returns in the Standard & Poor’s 500 Index in market cycles across history.

Current sentiment certainly does not appear historically-informed. If anything, investors appear to be widely convinced that activist central bank interventions have created a “new reality.” According to this view, the only thing needed to avoid any downturn in the economy or the financial markets – regardless of any valuation extreme – is simply for the Federal Reserve to buy interest-bearing Treasury securities and replace them with zero-interest bank reserves.

Current sentiment certainly does not appear to consider full-cycles. Even the March 2020 market low early in the SARS-CoV-2 pandemic left the S&P 500 at twice the run-of-the-mill valuation levels that have been regularly visited or breached by the completion of other market cycles. Yet Wall Street somehow views the present moment as the early phase of a long bull market, despite already establishing the most speculative valuations in U.S. history.

Indeed, as of the fiscal year-end on June 30, 2021, the closest thing to a “full cycle” that we have observed in recent years is the period from the February 19, 2020 pre-pandemic peak in the S&P 500 Index to its subsequent record high on June 30, 2021, with a brief loss of -33.79% in the index in the interim. Market valuations at the trough certainly offered little that could be described as a “margin of safety” from a historical perspective.

The Hussman Funds

|

Letter to Shareholders (continued) |

It seems most appropriate to characterize the February-March 2020 decline as a “panic” or “crisis” rather than a “bear market.” Still, the intervening volatility did create enough dispersion across individual securities to pursue our value-conscious stock-selection discipline, and enough “compression” in short-term market action to justify maintaining a rather neutral market outlook for much of the period since March 2020.

In short, even the “mini-cycle” from the pre-pandemic market peak of February 19, 2020 to the subsequent record high at the June 30, 2021 fiscal year-end provided adequate opportunities for our risk-managed investment discipline. During this period:

Strategic Growth Fund gained 29.16%, compared with a total return of 29.86% for the S&P 500 Index. The deepest interim loss experienced by Strategic Growth Fund during this period was -6.98%, compared with an interim loss of -33.79% for the S&P 500.

Strategic Allocation Fund gained 23.66%, compared with a gain of 20.07% for a benchmark fixed- allocation portfolio invested 60% in the S&P 500, 30% in the Bloomberg U.S. Treasury Unhedged Index, and 10% in the Bloomberg U.S. Treasury Bills Index. The deepest interim loss experienced by Strategic Allocation Fund during this period was -2.81%, compared with -19.93% for the benchmark portfolio.

Strategic Total Return Fund gained 11.60%, compared with a gain of 3.71% in the Bloomberg U.S. Aggregate Bond Index. The deepest interim loss experienced by Strategic Total Return Fund during this period was -7.18%, compared with -6.30% for the Index.

Strategic International Fund lost -0.88%, compared with a gain of 18.27% for the MSCI EAFE Index. The deepest interim loss experienced by Strategic International Fund during this period was -10.26%, compared with -32.68% for the EAFE.

Attending to the drivers of total return

What distinguishes an overvalued market that continues higher from an overvalued market that drops like a rock? I asked that question over two decades ago during the technology bubble. The answer then remains the answer today. When investors are inclined to speculate, they tend to be indiscriminate about it. When investors move toward risk-aversion, they tend to become selective. So we find that the best measure of speculative psychology is the “uniformity” of market action across thousands of individual stocks, industries, sectors, and security-types, including debt securities of varying creditworthiness. In 1998, I described this feature of market action using the phrase “trend uniformity.” In more recent cycles, I’ve used the phrase “market internals.”

The Hussman Funds

|

Letter to Shareholders (continued) |

Market valuations provide an enormous amount of observable information about likely long-term investment returns. Yet over shorter segments of the market cycle, investment returns are far more dependent on whether valuations are being pressed higher or lower. Indeed, these two factors – the level of valuations and the pressure on valuations – are closely tied to the very definition of total return: income plus price change. Our investment discipline is intended to capture these central elements of total return by focusing primarily on two objects:

| | 1) | Prevailing market valuations, which are correlated with both dividend yields and long-term returns, and also provide a sense of how much distance there is between current valuations and their historical norms, and; |

| | 2) | The uniformity or divergence of market internals, which helps to gauge the extent to which speculative investor psychology is pressing valuations higher, or risk-averse psychology is pressing valuations lower. |

Aside from our stock selection discipline, the strongest driver of our investment success in previous complete market cycles was the ability to navigate those two elements, balancing careful attention to both valuations and market internals.

Historically, there was also a third very useful consideration. In prior market cycles, there was typically a “limit” to speculation, which one could identify based on a combination of “overvalued, overbought, overbullish” conditions. Once those features of market action emerged, a panic, air-pocket or crash would typically follow in short order. These outcomes suggested that one should respond pre-emptively, without waiting for deterioration in market internals.

In the 1950’s, psychologist Paul Meehl – an advocate of well-validated models in decision making – called this sort of consideration a “broken leg case”:

“If a sociologist were predicting whether Professor X would go to the movies on a certain night, he might have an equation involving age, academic specialty, and introversion score. The equation might yield a probability of .90 that Professor X will go to the movies tonight. But if the family doctor announced that Professor X had just broken his leg, no sensible sociologist would stick with the equation.”

– Paul Meehl, 1957, When Shall We Use our Heads Instead of the Formula?

Following the global financial crisis (which we correctly anticipated), my insistence on stress-testing our methods against Depression-era data strengthened our attention to “overvalued, overbought, overbullish” features of market action, because of their historical reliability. The Federal Reserve’s deranged experiment with zero interest rates

The Hussman Funds

|

Letter to Shareholders (continued) |

unfortunately created a perfect storm – it was like handing Professor X a handful of narcotics to kill the pain, to the point he would repeatedly hobble to the movies despite having a broken leg worse than Joe Theismann.

Our late-2017 adaptation did not require the introduction of clever or complex new elements. Instead, it required us to “unlearn” the warning signs that historically placed “limits” on speculation, and to instead prioritize valuations and market internals. We had to refrain from adopting a bearish market outlook in response to “overvalued, overbought, overbullish” broken leg conditions, until our measures of market internals also became unfavorable (as they are at present).

In short, we became content to gauge valuations, and the presence or absence of speculative or risk-averse investor psychology, without assuming that there is any well-defined “limit” to either. I certainly expect that we will periodically adopt a hard-negative outlook in hypervalued, overextended market conditions with deteriorating and divergent internals (as is presently the case). But faced with what we view as reckless monetary policies, we have learned to refrain from “fighting” even severely overextended speculation when the uniformity of internals suggests that investors still have the speculative bit in their teeth. The elements of our discipline that we continue to emphasize are also those that we consider to be directly related to the very definition of total return.

Fund Performance

Strategic Growth Fund

In the fiscal year ended June 30, 2021, Strategic Growth Fund gained 10.80%. During the same period, the S&P 500 gained 40.79%. Notably, this period reflects a general market advance during which our most reliable valuation measures averaged 2-3 times their historical norms. The Fund presently maintains a strongly defensive position reflective of extreme valuations and divergence in our measures of market internals. While an improvement in our measures of internals would encourage a more neutral investment outlook, we presently observe a combination of extremes that has often been resolved by sharp market declines – independent of recessions – as occurred in 1987 and 1998.

The hedging stance of the Fund since the beginning of 2020 has varied between a strongly defensive position (particularly before mid-March 2020) and a more neutral near-term outlook (particularly after the mid-March 2020 market low). In recent months, we have attempted to maintain a flexible response to market conditions, particularly valuations and measures of market internals. During the 2021 fiscal year, the hedging

The Hussman Funds

|

Letter to Shareholders (continued) |

strategy of the Fund contributed notably to a reduction in overall risk, as the deepest interim loss experienced by the Fund during this period was -6.70%, compared with an interim loss of -9.52% for the S&P 500 Index.

While recent market conditions have generally encouraged a neutral or defensive market outlook, the recent fiscal year did provide strong opportunities to establish hedged positions in individual stocks. The stock selection approach of Strategic Growth Fund has outperformed the S&P 500 Index by an average of 4.16% (416 basis points) annually since the inception of the Fund on July 24, 2000. During the fiscal year ended June 30, 2021, the performance of the Fund’s stock selections, excluding the impact of hedging, realized a gain of 91.31% versus a 40.79% gain in the S&P 500 Index, largely reflecting our continued emphasis of value-conscious selection. As at other market extremes such as 2000, our stock selection discipline presently avoids large holdings in high-weight components of the S&P 500 that we consider to be overvalued speculative “glamour” stocks.

It is undoubtedly tempting to imagine the ability to choose only the profitable side of a hedged equity position. Because this is not possible, our approach is to maintain a disciplined stock selection strategy at all times, regardless of market valuations, with the expectation that our hedging approach will both mitigate risk and add value over the complete market cycle. This was certainly our experience in complete market cycles prior to 2009. Despite valuations that remained two or three times historical norms, the total return of Strategic Growth Fund during the “mini-cycle” from the February 19, 2020 market peak to the subsequent peak on June 30, 2021 was nearly identical to that of the unhedged S&P 500. Yet neither the stock selection component nor the hedging component of our discipline would have been comfortable by itself. For example, excluding the impact of hedging, the Fund’s stock selections lost -39.64 from the market peak of February 19, 2020 to the market trough of March 23, 2020. The Fund’s hedging strategy instead enabled the Fund to gain 17.33% during that same period.

Our objective is certainly to be generally constructive during cyclical market advances and generally defensive during cyclical market declines. While there is no question that record market valuations weighed against adopting a constructive or unhedged position during the recent fiscal year, I do expect that such opportunities will emerge with adequate regularity over time, even if valuations never again retreat to their historical norms.

From the inception of Strategic Growth Fund on July 24, 2000 through June 30, 2021, the Fund had an average annual total return of 0.93%, compared with an average annual total return of 7.35% for the S&P 500 Index. Given that Strategic

The Hussman Funds

|

Letter to Shareholders (continued) |

Growth Fund outperformed the S&P 500 Index, with smaller periodic losses, from its July 24, 2000 inception through May 20, 2014, the current performance gap is distinctly the result of challenges that we encountered during the speculative bubble of recent years. In late-2017, we adapted our investment discipline in a way that leaves us content to gauge the presence or absence of speculative pressures, without assuming that they have a well-defined limit. We believe that this adaptation has addressed the primary reason behind this period of underperformance.

An initial $10,000 investment in the Fund at its inception on July 24, 2000 would have grown to $12,130, compared with $44,109 for the same investment in the S&P 500 Index. The deepest loss experienced by the Fund since inception was -60.36%. The deepest loss experienced by the S&P 500 Index since the inception of the Fund was -55.25%.

It is notable that from the inception of the Fund on July 24, 2000 through the market low on March 9, 2009, Strategic Growth Fund gained 105.57% (an 8.71% average annual total return) compared with a -45.99% loss in the S&P 500 (a -6.89% average annual loss). The deepest loss experienced by the Fund during this period was -21.45%, compared with a -55.25% loss in the S&P 500.

While there is no assurance that the future performance of the Fund, relative to the S&P 500, will be similar to that of the 2000-2009 period, we do believe that the late-2017 adaptation to our investment discipline addressed the aspect of our investment discipline that was responsible for the departure of the Fund’s performance from our full-cycle expectations in recent years.

Strategic Allocation Fund

In the fiscal year ended June 30, 2021, Strategic Allocation Fund had a total return of 19.70%, compared with a total return of 21.96% in the benchmark fixed allocation composite index which is weighted 60% S&P 500 Index, 30% Bloomberg U.S. Treasury Unhedged Index and 10% Bloomberg U.S. Treasury Bills Index. The Fund always holds unhedged positions of at least 5% in both equity and bond market investments, which has been beneficial during the recent advance to record market highs. The Fund presently holds an unhedged equity position representing approximately 7% of net assets, hedged equities representing approximately 60% of assets, bonds representing approximately 18% of assets, and the remaining assets in money market investments.

From the inception of the Strategic Allocation Fund on August 27, 2019 through June 30, 2021, the Fund had an average annual total return of 12.16%, compared with an average annual total return of 17.12% for the benchmark fixed allocation

The Hussman Funds

|

Letter to Shareholders (continued) |

composite index. An initial $10,000 investment in the Fund at its inception on August 27, 2019 would have grown to $12,357, compared with $13,383 for the same investment in the benchmark fixed allocation composite index. The deepest loss experienced by the Fund since inception was -2.81%. The deepest loss experienced by the benchmark fixed allocation composite index since the inception of the Fund was -19.93%.

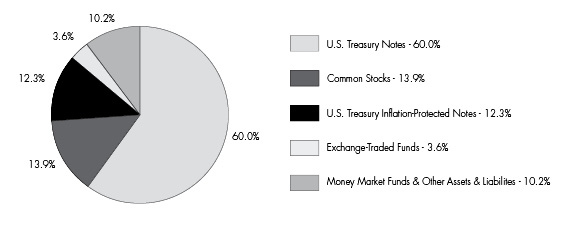

Strategic Total Return Fund

In the fiscal year ended June 30, 2021, Strategic Total Return Fund had a total return of 2.70%. During the same period, the Bloomberg U.S. Aggregate Bond Index had a total return of -0.33%. Strategic Total Return Fund held a moderately constructive position in long-term bonds during this period, with a duration typically ranging between 2-3 years (meaning that a 100 basis point move in interest rates would be expected to affect Fund value by about 2-3% on the basis of bond price fluctuations). The Fund currently holds 70% of net assets in Treasury securities, with 14% of assets in shares of companies in the precious metals, energy and utilities sectors. The remaining net assets are invested in money market investments. The Fund benefited from holdings in shares of companies engaged in the mining of precious metals, as well as utilities, largely by varying the size of its investment positions in response to periods of strength and weakness in these sectors. The deepest interim loss experienced by the Fund during this period was -3.56%, compared with an interim loss of -4.01% for the Bloomberg U.S. Aggregate Bond Index.

From the inception of Strategic Total Return Fund on September 12, 2002 through June 30, 2021, the Fund had an average annual total return of 5.01%, compared with an average annual total return of 4.21% for the Bloomberg U.S. Aggregate Bond Index. An initial $10,000 investment in the Fund on September 12, 2002 would have grown to $25,054, compared with $21,692 for the same investment in the Bloomberg U.S. Aggregate Bond Index. The deepest loss experienced by the Fund since inception was -11.52%, compared with a maximum loss of -6.30% for the Bloomberg U.S. Aggregate Bond Index during the same period.

Strategic International Fund

In the fiscal year ended June 30, 2021, Strategic International Fund had a total return of 3.38%. During the same period, the MSCI EAFE Index gained 32.35%. The Fund is currently fully hedged against the impact of market fluctuations. During the second half of 2020, the stock selections of the Fund modestly lagged the MSCI EAFE Index primarily due to differences in sector composition. The Fund held relatively low weightings in financial stocks and industrials, which outperformed the MSCI EAFE

The Hussman Funds

|

Letter to Shareholders (continued) |

Index. Meanwhile, the health care and consumer staples sectors, in which the Fund held moderately higher weightings relative to the Index, trailed the EAFE. The deepest interim loss in Strategic International Equity Fund during this period was -2.89%, compared with an interim loss of -7.28% for the MSCI EAFE Index.

Because international stock markets tend to become highly correlated during steep declines in the U.S. stock market, the downside risk that we observe in the U.S. market exists in international equity markets as well. A material improvement in U.S. conditions, particularly in our measures of market internals, would likely encourage a constructive stance in the international markets as well. Without the elevated level of market risk that we currently observe, the Fund will have substantially greater opportunity to establish a constructive investment stance based on individual country valuations and market action, along with other local considerations.

From the inception of Strategic International Fund on December 31, 2009 through June 30, 2021, the Fund had an average annual total return of -0.69%, compared with an average annual total return of 6.24% for the MSCI EAFE Index. An initial $10,000 investment in the Fund on December 31, 2009 would be worth $9,238, compared with $20,047 for the same investment in the MSCI EAFE Index. The deepest loss experienced by the Fund since inception was -22.87%, compared with a maximum loss of -34.12% for the MSCI EAFE Index during the same period.

Portfolio Composition

As of June 30, 2021, Strategic Growth Fund had net assets of $412,897,982, and held 288 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were consumer discretionary (23.9%), health care (15.7%), technology (13.9%), consumer staples (13.6%), financials (9.2%), communications (8.1%) and energy (5.4%). The smallest sector holdings were in industrials (4.7%), materials (4.3%), real estate (0.7%) and utilities (0.3%). Exchange-traded funds represented 0.5% of the Fund’s net assets.

Strategic Growth Fund’s holdings of individual stocks and exchange-traded funds as of June 30, 2021 were valued at $414,001,266. Against these stock positions, the Fund also held 540 option combinations (long put option/short call option) on the S&P 500 Index and 750 option combinations on the Russell 2000 Index. The Fund also held 10 long puts on the S&P 500 Index. Each option combination behaves as a short sale on the underlying index, with a notional value of $100 times the index value. On June 30, 2021, the S&P 500 Index closed at 4,297.50, while the Russell

The Hussman Funds

|

Letter to Shareholders (continued) |

2000 Index closed at 2,310.549. The Fund’s total hedge therefore represented a short position of $409,653,675, thereby hedging 98.9% of the dollar value of the Fund’s long investment positions in individual issues.

Although the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following equity holdings achieved gains in excess of $3.5 million during the fiscal year ended June 30, 2021: Gamestop (reflecting a small position purchased largely on the basis of valuation, which was later sold amid nearly absurd meme-related speculation), JinkoSolar Holding, Hibbett Sports, AMC Networks, Canadian Solar and Editas Medicine. The Fund did not realize any losses in excess of $1 million for equity holdings during this same period.

As of June 30, 2021, Strategic Allocation Fund had net assets of $19,881,242 and held 286 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were consumer discretionary (16.0%), health care (10.3%), technology (9.5%), consumer staples (9.1%), financials (5.9%) and communications (5.5%). The smallest sector weights were energy (3.6%), industrials (3.1%), materials (2.9%), real estate (0.5%) and utilities (0.2%). Exchange-traded funds represented 0.3% of the Fund’s net assets. Treasury securities with more than one year until maturity represented 12.6% of net assets. The remaining Fund assets were invested in shorter-term Treasury securities and money market funds.

Strategic Allocation Fund’s holdings of individual stocks and exchange-traded funds as of June 30, 2021 were valued at $13,311,737. Against these positions, the Fund also held 15 option combinations (long put option/short call option) on the S&P 500 and 24 option combinations on the Russell 2000 Index. The notional value of this hedge was $11,991,568, hedging 90.1% of the value of equity investments held by the Fund.

In Strategic Allocation Fund, during the period ended June 30, 2021, individual equity portfolio gains in excess of $100,000 were achieved in Gamestop, JinkoSolar Holding, Hibbett Sports, and AMC Networks. The Fund did not realize any losses in excess of $50,000 for equity holdings during this same period.

As of June 30, 2021, Strategic Total Return Fund had net assets of $316,538,886. Treasury notes, Treasury Inflation-Protected Securities (TIPS) and investments in money market funds represented 82.4% of the Fund’s net assets. Shares of exchange-traded funds accounted for 3.6% of net assets. Precious metals shares accounted for 6.5% of net assets, and shares in utilities and energy-related companies collectively accounted for 7.4% of net assets.

The Hussman Funds

|

Letter to Shareholders (continued) |

In Strategic Total Return Fund, during the fiscal year ended June 30, 2021, portfolio gains in excess of $1 million were achieved in SM Energy and Laredo Petroleum. The only portfolio losses in excess of $1 million during this same period were U.S. Treasury Note (1.50%, due 8/15/2026) and U.S. Treasury Note (0.625%, due 8/15/2030).

As of June 30, 2021, Strategic International Fund had net assets of $14,870,333 and held 173 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were in consumer discretionary (20.0%), communications (11.0%), consumer staples (10.6%), financials (10.6%), health care (9.6%), technology (9.2%), industrials (8.9%) and materials (5.7%). The smallest sector holdings were in utilities (2.4%), energy (0.8%) and real estate (0.4%).

In order to hedge the impact of general market fluctuations, as of June 30, 2021, Strategic International Fund was short 75 futures on the Mini MSCI EAFE Index and long 10 puts on the S&P 500 Index. The notional value of this hedge was $12,940,950, hedging 98.7% of the dollar value of equity investments held by the Fund. When the Fund is in a hedged investment position, the primary driver of Fund returns is the difference in performance between the stocks owned by the Fund and the indices that are used to hedge.

While the investment portfolio of Strategic International Fund is widely diversified and its performance is affected by numerous investment positions, the hedging strategy of the Fund was primarily responsible for the reduced sensitivity of the Fund to market fluctuations from the Fund’s inception through June 30, 2021. Individual equity holdings having a portfolio gain in excess of $100,000 during the fiscal year ended June 30, 2021 were achieved in Next and Softcat. The Fund did not realize any losses in excess of $50,000 for equity holdings during this same period.

Supplementary information including quarterly returns and equity-only performance of the Funds is available on the Hussman Funds website: www.hussmanfunds.com.

Current Outlook

Amid fresh deterioration in our measures of market internals, coupled with record valuations in the first quarter of 2021, our market outlook has recently become more negative. Among the valuation measures that we have found most reliable in market cycles across history, including the period since 2000, all of them currently stand at over 3.5 times their run-of-the-mill historical norms.

The Hussman Funds

|

Letter to Shareholders (continued) |

The backward-looking returns of passive investment strategies are always the most glorious when market overvaluation is the most extreme. Yet that is also precisely the moment when likely future returns are the most dismal. Indeed, the problem with a speculative bubble is that short-term market outcomes cannot become better without long-term outcomes becoming worse, and long-term market outcomes cannot become better without short-term outcomes becoming worse. All one faces is an unfortunate situation.

It is common, almost fashionable, to argue that current extreme valuations are “justified” by low interest rates. Yet it is critical for investors to understand what this argument actually means.

Given any set of future cash flows, the higher the price an investor pays today, the lower the long-term returns the investor can expect. Put simply, high valuations imply low returns. As a result, one can demonstrate in a century of data that even when high stock market valuations are accompanied by low interest rates, subsequent stock market returns are still low, on average. It’s just that the low stock market returns are accompanied by low bond market returns as well. To say that high stock market valuations are “justified” by low interest rates is simply to say that passive investors can expect low investment returns across the board.

Of course, there are periods when stock market valuations are rich, yet bond yields are quite reasonable. For example, at the peak of the 2000 “tech bubble,” stock market valuations were nearly as high as they are at present, yet bond yields were not far from their historical norms. Not surprisingly, the extreme stock market valuations were followed by over a decade of negative total returns for the S&P 500. Yet diversified investors had acceptable bond returns to offset the disappointment. Such is not the case at present. Indeed, based on valuation measures having a correlation of about 0.9 or higher with actual subsequent returns, we presently expect 12-year nominal total returns for a passive investment allocation invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills to average a loss of about -3.2% annually.

Across a century of market cycles, the relationship between valuations and subsequent 10-12 year market returns has been quite stable. The extent of overvaluation at the peak of a market cycle has also been a useful predictor of the depth of market losses of the completion of the cycle. For that reason, investors should not rule out a potential loss in the S&P 500 on the order of 60-70% in the coming years. Still, our current outlook does not require or even assume that valuations will approach their historical norms in the future. Our investment outlook at any point in time is a reflection of observable market conditions, particularly our gauges of valuations and market internals, and to a lesser extent, measures of overextension.

The Hussman Funds

|

Letter to Shareholders (continued) |

Investors appear to be equating the very reasonably expected post-pandemic “recovery” of private income and employment with an equally inevitable boom in U.S. gross domestic product, corporate earnings, and stock prices. The problem with this thesis is that both GDP and S&P 500 earnings are already at record highs. Meanwhile, the most reliable measures of S&P 500 valuation are easily beyond every prior historical extreme, including 1929 and 2000.

Over the past 18 months, the U.S. federal government has run the deepest fiscal deficit since World War II. Investors seem to be underestimating the extent to which a likely economic rebound will replace rather than augment the effect of trillions of dollars in pandemic relief programs, amounting to close to 20% of GDP, which preserved corporate revenues while subsidizing labor costs.

Investors have already driven the S&P 500 to the most extreme valuation multiples in history. But as Benjamin Graham and David Dodd observed after the 1929-1932 market collapse, rather than basing their expectations for future returns on historically reliable valuation measures, investors have transferred their attention almost exclusively to the trend. Investors view valuations as unimportant, because the trend of prices and earnings has advanced. Indeed, there is an almost universal expectation that a recovery in the private economy will augment fundamentals with enormous growth. This kind of double-counting ignores the enormous amount of private income and spending that will be needed simply to substitute for trillion dollar deficits that have pushed fundamentals above their pre-pandemic highs.

With the 10-year Treasury bond yield at just 1.3%, an increase in yield to just 1.5% would be more than sufficient to produce a negative one-year total return. With the S&P 500 dividend yield at just 1.35%, even an increase to the very low 2% median since 2000 would imply a price decline of nearly one-third. This illustrates the general principle that rich valuations are also associated with high sensitivity to small disappointments. In my view, even if the current extreme level of market valuations was to persist at a “permanently high plateau,” that outcome would likely be associated with steep periodic market losses, however quickly those losses might be recovered.

I certainly do not expect that sort of “plateau,” which Irving Fisher disastrously predicted when market valuations were at similar levels in 1929. Yet we also have no need for valuations to retreat to their historical norms, regardless of the fact that they have ultimately done so across history. What matters for us is to consistently pursue a value-conscious, historically-informed, risk-managed, full-cycle discipline – yet one that is tolerant even of deranged policies. The required adaptation in the recent market cycle was undoubtedly difficult: abandoning the notion that speculative recklessness had any “limit,” and instead being content simply to gauge its presence or absence. I believe

The Hussman Funds

|

Letter to Shareholders (continued) |

that we’ve restored our flexibility to changing market conditions, without any need to embrace speculative delusions that have historically ended in tears. In the meantime, I am pleased to again describe our overall performance with the phrase “as intended.”

I remain grateful, as always, for your trust.

Sincerely,

John P. Hussman, Ph.D.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares of the Funds, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted.

Periodic updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website: www.hussmanfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based on the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 Index reflect valuation methods focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle.

This Letter to Shareholders seeks to describe some of the adviser’s current opinions and views of the financial markets. Although the adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly, from those expected or expressed. The securities held by the Funds that are discussed in this Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Funds’ adviser with respect to those securities may change at any time.

Hussman Strategic Growth Fund

Portfolio Information |

June 30, 2021 (Unaudited) |

Sector Allocation (% of Common Stocks)

Hussman Strategic Allocation Fund

Portfolio Information |

June 30, 2021 (Unaudited) |

Asset Allocation (% of Net Assets)

Hussman Strategic Allocation Fund

Portfolio Information (continued) |

June 30, 2021 (Unaudited) |

Sector Allocation (% of Common Stocks)

Hussman Strategic Total Return Fund

Portfolio Information |

June 30, 2021 (Unaudited) |

Asset Allocation (% of Net Assets)

Hussman Strategic International Fund

Portfolio Information |

June 30, 2021 (Unaudited) |

Sector Allocation (% of Common and Preferred Stocks)

Country Allocation (% of Common and Preferred Stocks)

Hussman Strategic Growth Fund

Schedule of Investments |

June 30, 2021 |

COMMON STOCKS — 99.8% | | Shares | | | Value | |

Communications — 8.1% | | | | | | | | |

Cable & Satellite — 1.0% | | | | | | | | |

Comcast Corporation - Class A | | | 30,000 | | | $ | 1,710,600 | |

Sirius XM Holdings, Inc. | | | 360,000 | | | | 2,354,400 | |

| | | | | | | | 4,065,000 | |

Entertainment Content — 1.9% | | | | | | | | |

AMC Networks, Inc. - Class A (a) | | | 48,000 | | | | 3,206,400 | |

MSG Networks, Inc. - Class A (a) | | | 30,000 | | | | 437,400 | |

ViacomCBS, Inc. - Class B | | | 90,000 | | | | 4,068,000 | |

| | | | | | | | 7,711,800 | |

Internet Media & Services — 2.5% | | | | | | | | |

Alphabet, Inc. - Class C (a) | | | 600 | | | | 1,503,792 | |

Baidu, Inc. - ADR (a) | | | 15,000 | | | | 3,058,500 | |

Facebook, Inc. - Class A (a) | | | 600 | | | | 208,626 | |

fuboTV, Inc. (a) | | | 15,000 | | | | 481,650 | |

Pinterest, Inc. - Class A (a) | | | 9,000 | | | | 710,550 | |

Shutterstock, Inc. | | | 21,000 | | | | 2,061,570 | |

Stamps.com, Inc. (a) | | | 9,000 | | | | 1,802,610 | |

Twitter, Inc. (a) | | | 9,000 | | | | 619,290 | |

| | | | | | | | 10,446,588 | |

Media — 1.3% | | | | | | | | |

Discovery, Inc. - Series A (a) | | | 60,000 | | | | 1,840,800 | |

Nexstar Media Group, Inc. - Class A | | | 15,000 | | | | 2,218,200 | |

TEGNA, Inc. | | | 60,000 | | | | 1,125,600 | |

| | | | | | | | 5,184,600 | |

Publishing & Broadcasting — 1.0% | | | | | | | | |

Audacy, Inc. (a) | | | 120,000 | | | | 517,200 | |

Gray Television, Inc. | | | 120,000 | | | | 2,808,000 | |

Meredith Corporation (a) | | | 21,000 | | | | 912,240 | |

| | | | | | | | 4,237,440 | |

Telecommunications — 0.4% | | | | | | | | |

Consolidated Communications Holdings, Inc. (a) | | | 90,000 | | | | 791,100 | |

Verizon Communications, Inc. | | | 15,000 | | | | 840,450 | |

| | | | | | | | 1,631,550 | |

Consumer Discretionary — 23.9% | | | | | | | | |

Apparel & Textile Products — 0.1% | | | | | | | | |

Fossil Group, Inc. (a) | | | 28,000 | | | | 399,840 | |

| | | | | | | | | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Consumer Discretionary — 23.9% (continued) | | | | | | | | |

Automotive — 0.6% | | | | | | | | |

Arcimoto, Inc. (a) | | | 14,000 | | | $ | 240,660 | |

Harley-Davidson, Inc. | | | 24,000 | | | | 1,099,680 | |

Tenneco, Inc. - Class A (a) | | | 50,000 | | | | 966,000 | |

| | | | | | | | 2,306,340 | |

Consumer Services — 1.3% | | | | | | | | |

American Public Education, Inc. (a) | | | 7,000 | | | | 198,380 | |

Graham Holdings Company - Class B | | | 3,000 | | | | 1,901,700 | |

Matthews International Corporation - Class A | | | 15,000 | | | | 539,400 | |

Medifast, Inc. | | | 6,000 | | | | 1,697,880 | |

Perdoceo Education Corporation (a) | | | 35,000 | | | | 429,450 | |

WW International, Inc. (a) | | | 15,000 | | | | 542,100 | |

| | | | | | | | 5,308,910 | |

E-Commerce Discretionary — 2.0% | | | | | | | | |

Amazon.com, Inc. (a) | | | 450 | | | | 1,548,072 | |

eBay, Inc. | | | 36,000 | | | | 2,527,560 | |

Etsy, Inc. (a) | | | 18,000 | | | | 3,705,120 | |

PetMed Express, Inc. | | | 15,000 | | | | 477,750 | |

| | | | | | | | 8,258,502 | |

Home & Office Products — 2.2% | | | | | | | | |

Container Store Group, Inc. (The) (a) | | | 22,500 | | | | 293,400 | |

Hamilton Beach Brands Holding Company - Class A | | | 35,000 | | | | 779,450 | |

iRobot Corporation (a) | | | 36,000 | | | | 3,362,040 | |

Newell Brands, Inc. | | | 30,000 | | | | 824,100 | |

Tupperware Brands Corporation (a) | | | 60,000 | | | | 1,425,000 | |

Whirlpool Corporation | | | 12,000 | | | | 2,616,240 | |

| | | | | | | | 9,300,230 | |

Home Construction — 4.0% | | | | | | | | |

Century Communities, Inc. | | | 43,500 | | | | 2,894,490 | |

D.R. Horton, Inc. | | | 24,000 | | | | 2,168,880 | |

Forestar Group, Inc. (a) | | | 35,000 | | | | 731,850 | |

Lennar Corporation - Class A | | | 21,000 | | | | 2,086,350 | |

LGI Homes, Inc. (a) | | | 10,500 | | | | 1,700,370 | |

M/I Homes, Inc. (a) | | | 30,000 | | | | 1,760,100 | |

Meritage Homes Corporation (a) | | | 14,000 | | | | 1,317,120 | |

PulteGroup, Inc. | | | 20,000 | | | | 1,091,400 | |

Toll Brothers, Inc. | | | 15,000 | | | | 867,150 | |

TRI Pointe Homes, Inc. (a) | | | 84,000 | | | | 1,800,120 | |

| | | | | | | | 16,417,830 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Consumer Discretionary — 23.9% (continued) | | | | | | | | |

Leisure Facilities & Services — 1.3% | | | | | | | | |

Brinker International, Inc. (a) | | | 45,000 | | | $ | 2,783,250 | |

Domino’s Pizza, Inc. | | | 4,500 | | | | 2,099,205 | |

Waitr Holdings, Inc. (a) | | | 180,000 | | | | 320,400 | |

| | | | | | | | 5,202,855 | |

Leisure Products — 0.3% | | | | | | | | |

Mattel, Inc. (a) | | | 30,000 | | | | 603,000 | |

Nautilus, Inc. (a) | | | 45,000 | | | | 758,250 | |

| | | | | | | | 1,361,250 | |

Retail - Discretionary — 11.4% | | | | | | | | |

AutoZone, Inc. (a) | | | 900 | | | | 1,342,998 | |

Bed Bath & Beyond, Inc. (a) | | | 24,000 | | | | 798,960 | |

Big 5 Sporting Goods Corporation | | | 24,000 | | | | 616,320 | |

Buckle, Inc. (The) | | | 75,000 | | | | 3,731,250 | |

Chico’s FAS, Inc. (a) | | | 150,000 | | | | 987,000 | |

Designer Brands, Inc. - Class A (a) | | | 21,000 | | | | 347,550 | |

Dick’s Sporting Goods, Inc. | | | 36,000 | | | | 3,606,840 | |

Duluth Holdings, Inc. - Class B (a) | | | 154,000 | | | | 3,180,100 | |

Express, Inc. (a) | | | 390,000 | | | | 2,531,100 | |

Gap, Inc. (The) | | | 15,000 | | | | 504,750 | |

Genesco, Inc. (a) | | | 12,000 | | | | 764,160 | |

Hibbett, Inc. (a) | | | 35,000 | | | | 3,137,050 | |

Home Depot, Inc. (The) | | | 6,000 | | | | 1,913,340 | |

Kohl’s Corporation | | | 60,000 | | | | 3,306,600 | |

Lumber Liquidators Holdings, Inc. (a) | | | 90,000 | | | | 1,899,000 | |

Macy’s, Inc. (a) | | | 210,000 | | | | 3,981,600 | |

MarineMax, Inc. (a) | | | 30,000 | | | | 1,462,200 | |

O’Reilly Automotive, Inc. (a) | | | 2,500 | | | | 1,415,525 | |

Qurate Retail, Inc. - Series A | | | 140,000 | | | | 1,832,600 | |

Sally Beauty Holdings, Inc. (a) | | | 60,000 | | | | 1,324,200 | |

Signet Jewelers Ltd. (a) | | | 9,000 | | | | 727,110 | |

Sleep Number Corporation (a) | | | 30,000 | | | | 3,298,500 | |

Urban Outfitters, Inc. (a) | | | 28,000 | | | | 1,154,160 | |

Vera Bradley, Inc. (a) | | | 30,000 | | | | 371,700 | |

Williams-Sonoma, Inc. | | | 9,000 | | | | 1,436,850 | |

Zumiez, Inc. (a) | | | 28,000 | | | | 1,371,720 | |

| | | | | | | | 47,043,183 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Consumer Discretionary — 23.9% (continued) | | | | | | | | |

Specialty Retail — 0.5% | | | | | | | | |

Best Buy Company, Inc. | | | 9,000 | | | $ | 1,034,820 | |

Penske Automotive Group, Inc. | | | 15,000 | | | | 1,132,350 | |

| | | | | | | | 2,167,170 | |

Wholesale - Discretionary — 0.2% | | | | | | | | |

Educational Development Corporation | | | 60,000 | | | | 748,200 | |

| | | | | | | | | |

Consumer Staples — 13.6% | | | | | | | | |

Beverages — 0.5% | | | | | | | | |

National Beverage Corporation | | | 36,000 | | | | 1,700,280 | |

NewAge, Inc. (a) | | | 70,000 | | | | 156,100 | |

| | | | | | | | 1,856,380 | |

Consumer Products — 0.7% | | | | | | | | |

Colgate-Palmolive Company | | | 24,000 | | | | 1,952,400 | |

PepsiCo, Inc. | | | 6,000 | | | | 889,020 | |

| | | | | | | | 2,841,420 | |

Food — 4.6% | | | | | | | | |

B&G Foods, Inc. | | | 120,000 | | | | 3,936,000 | |

Campbell Soup Company | | | 56,000 | | | | 2,553,040 | |

General Mills, Inc. | | | 36,000 | | | | 2,193,480 | |

Herbalife Nutrition Ltd. (a) | | | 45,000 | | | | 2,372,850 | |

J.M. Smucker Company (The) | | | 15,000 | | | | 1,943,550 | |

Kellogg Company | | | 45,000 | | | | 2,894,850 | |

Kraft Heinz Company (The) | | | 36,000 | | | | 1,468,080 | |

LifeVantage Corporation (a) | | | 25,000 | | | | 183,750 | |

USANA Health Sciences, Inc. (a) | | | 14,000 | | | | 1,434,020 | |

| | | | | | | | 18,979,620 | |

Household Products — 1.6% | | | | | | | | |

Clearwater Paper Corporation (a) | | | 45,000 | | | | 1,303,650 | |

Clorox Company (The) | | | 10,000 | | | | 1,799,100 | |

Kimberly-Clark Corporation | | | 6,000 | | | | 802,680 | |

Nu Skin Enterprises, Inc. - Class A | | | 49,000 | | | | 2,775,850 | |

| | | | | | | | 6,681,280 | |

Retail - Consumer Staples — 6.2% | | | | | | | | |

Big Lots, Inc. | | | 60,000 | | | | 3,960,600 | |

Ingles Markets, Inc. - Class A | | | 28,000 | | | | 1,631,560 | |

Kroger Company (The) | | | 90,000 | | | | 3,447,900 | |

Murphy USA, Inc. | | | 21,000 | | | | 2,800,770 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Consumer Staples — 13.6% (continued) | | | | | | | | |

Retail - Consumer Staples — 6.2% (continued) | | | | | | | | |

Natural Grocers by Vitamin Cottage, Inc. | | | 90,000 | | | $ | 966,600 | |

Ollie’s Bargain Outlet Holdings, Inc. (a) | | | 30,000 | | | | 2,523,900 | |

Rite Aid Corporation (a) | | | 90,000 | | | | 1,467,000 | |

Sprouts Farmers Market, Inc. (a) | | | 120,000 | | | | 2,982,000 | |

United Natural Foods, Inc. (a) | | | 90,000 | | | | 3,328,200 | |

Walgreens Boots Alliance, Inc. | | | 36,000 | | | | 1,893,960 | |

Weis Markets, Inc. | | | 14,000 | | | | 723,240 | |

| | | | | | | | 25,725,730 | |

Energy — 5.4% | | | | | | | | |

Energy Equipment & Services — 0.6% | | | | | | | | |

American Superconductor Corporation (a) | | | 14,000 | | | | 243,460 | |

Nabors Industries Ltd. (a) | | | 20,000 | | | | 2,284,800 | |

| | | | | | | | 2,528,260 | |

Oil & Gas Producers — 1.6% | | | | | | | | |

Laredo Petroleum, Inc. (a) | | | 15,000 | | | | 1,391,850 | |

Ovintiv, Inc. | | | 30,000 | | | | 944,100 | |

Range Resources Corporation (a) | | | 90,000 | | | | 1,508,400 | |

SM Energy Company | | | 120,000 | | | | 2,955,600 | |

| | | | | | | | 6,799,950 | |

Renewable Energy — 3.2% | | | | | | | | |

Broadwind, Inc. (a) | | | 210,000 | | | | 951,300 | |

Canadian Solar, Inc. (a) | | | 75,000 | | | | 3,363,000 | |

CleanSpark, Inc. (a) | | | 45,000 | | | | 748,800 | |

First Solar, Inc. (a) | | | 3,500 | | | | 316,785 | |

JinkoSolar Holding Company Ltd. - ADR (a) | | | 75,000 | | | | 4,201,500 | |

Renewable Energy Group, Inc. (a) | | | 14,000 | | | | 872,760 | |

SunPower Corporation (a) | | | 45,000 | | | | 1,314,900 | |

Sunworks, Inc. (a) | | | 120,000 | | | | 1,261,200 | |

| | | | | | | | 13,030,245 | |

Financials — 9.2% | | | | | | | | |

Asset Management — 1.2% | | | | | | | | |

BrightSphere Investment Group, Inc. | | | 140,000 | | | | 3,280,200 | |

Federated Hermes, Inc. | | | 50,000 | | | | 1,695,500 | |

| | | | | | | | 4,975,700 | |

Banking — 1.3% | | | | | | | | |

Comerica, Inc. | | | 15,000 | | | | 1,070,100 | |

Customers Bancorp, Inc. (a) | | | 28,000 | | | | 1,091,720 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Financials — 9.2% (continued) | | | | | | | | |

Banking — 1.3% (continued) | | | | | | | | |

Hilltop Holdings, Inc. | | | 45,000 | | | $ | 1,638,000 | |

Investors Bancorp, Inc. | | | 70,000 | | | | 998,200 | |

Reliant Bancorp, Inc. | | | 17,500 | | | | 485,275 | |

| | | | | | | | 5,283,295 | |

Institutional Financial Services — 2.0% | | | | | | | | |

Cboe Global Markets, Inc. | | | 12,000 | | | | 1,428,600 | |

Evercore, Inc. - Class A | | | 21,000 | | | | 2,956,170 | |

StoneX Group, Inc. (a) | | | 30,000 | | | | 1,820,100 | |

Virtu Financial, Inc. - Class A | | | 70,000 | | | | 1,934,100 | |

| | | | | | | | 8,138,970 | |

Insurance — 2.9% | | | | | | | | |

Aflac, Inc. | | | 15,000 | | | | 804,900 | |

Allstate Corporation (The) | | | 15,000 | | | | 1,956,600 | |

Lincoln National Corporation | | | 30,000 | | | | 1,885,200 | |

MGIC Investment Corporation | | | 30,000 | | | | 408,000 | |

NMI Holdings, Inc. - Class A (a) | | | 30,000 | | | | 674,400 | |

Progressive Corporation (The) | | | 30,000 | | | | 2,946,300 | |

Unum Group | | | 120,000 | | | | 3,408,000 | |

| | | | | | | | 12,083,400 | |

Specialty Finance — 1.8% | | | | | | | | |

Alliance Data Systems Corporation | | | 14,000 | | | | 1,458,660 | |

Ally Financial, Inc. | | | 15,000 | | | | 747,600 | |

Essent Group Ltd. | | | 15,000 | | | | 674,250 | |

Navient Corporation | | | 75,000 | | | | 1,449,750 | |

PennyMac Financial Services, Inc. | | | 49,000 | | | | 3,024,280 | |

| | | | | | | | 7,354,540 | |

Health Care — 15.7% | | | | | | | | |

Biotech & Pharma — 10.3% | | | | | | | | |

AbbVie, Inc. | | | 15,000 | | | | 1,689,600 | |

Alexion Pharmaceuticals, Inc. (a) | | | 6,000 | | | | 1,102,260 | |

Alkermes plc (a) | | | 30,000 | | | | 735,600 | |

Amgen, Inc. | | | 9,000 | | | | 2,193,750 | |

Amneal Pharmaceuticals, Inc. (a) | | | 175,000 | | | | 896,000 | |

ANI Pharmaceuticals, Inc. (a) | | | 30,000 | | | | 1,051,500 | |

Beam Therapeutics, Inc. (a) | | | 3,500 | | | | 450,485 | |

Biocept, Inc. (a) | | | 70,000 | | | | 293,300 | |

Biogen, Inc. (a) | | | 3,000 | | | | 1,038,810 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Health Care — 15.7% (continued) | | | | | | | | |

Biotech & Pharma — 10.3% (continued) | | | | | | | | |

Blueprint Medicines Corporation (a) | | | 6,000 | | | $ | 527,760 | |

Catalyst Pharmaceutical, Inc. (a) | | | 120,000 | | | | 690,000 | |

Clovis Oncology, Inc. (a) | | | 50,000 | | | | 290,000 | |

Coherus Biosciences, Inc. (a) | | | 35,000 | | | | 484,050 | |

Corcept Therapeutics, Inc. (a) | | | 90,000 | | | | 1,980,000 | |

CRISPR Therapeutics AG (a) | | | 9,000 | | | | 1,457,010 | |

Editas Medicine, Inc. (a) | | | 30,000 | | | | 1,699,200 | |

electroCore, Inc. (a) | | | 35,000 | | | | 41,650 | |

Exelixis, Inc. (a) | | | 60,000 | | | | 1,093,200 | |

Innoviva, Inc. (a) | | | 120,000 | | | | 1,609,200 | |

Intra-Cellular Therapies, Inc. (a) | | | 30,000 | | | | 1,224,600 | |

Ionis Pharmaceuticals, Inc. (a) | | | 7,000 | | | | 279,230 | |

Jazz Pharmaceuticals plc (a) | | | 21,000 | | | | 3,730,440 | |

Jounce Therapeutics, Inc. (a) | | | 15,000 | | | | 102,000 | |

Neurocrine Biosciences, Inc. (a) | | | 15,000 | | | | 1,459,800 | |

Neuronetics, Inc. (a) | | | 36,000 | | | | 576,720 | |

Organogenesis Holdings, Inc. (a) | | | 30,000 | | | | 498,600 | |

Pacira Biosciences, Inc. (a) | | | 12,000 | | | | 728,160 | |

Sage Therapeutics, Inc. (a) | | | 72,000 | | | | 4,090,320 | |

Sangamo Therapeutics, Inc. (a) | | | 35,000 | | | | 418,950 | |

Supernus Pharmaceuticals, Inc. (a) | | | 90,000 | | | | 2,771,100 | |

United Therapeutics Corporation (a) | | | 7,000 | | | | 1,255,870 | |

Vanda Pharmaceuticals, Inc. (a) | | | 90,000 | | | | 1,935,900 | |

Vertex Pharmaceuticals, Inc. (a) | | | 9,000 | | | | 1,814,670 | |

Viatris, Inc. | | | 150,000 | | | | 2,143,500 | |

| | | | | | | | 42,353,235 | |

Health Care Facilities & Services — 2.0% | | | | | | | | |

Brookdale Senior Living, Inc. (a) | | | 70,000 | | | | 553,000 | |

Cigna Corporation | | | 6,000 | | | | 1,422,420 | |

Community Health Systems, Inc. (a) | | | 100,000 | | | | 1,544,000 | |

Fulget Genetics, Inc. (a) | | | 9,000 | | | | 830,070 | |

Laboratory Corporation of America Holdings (a) | | | 6,000 | | | | 1,655,100 | |

Patterson Companies, Inc. | | | 70,000 | | | | 2,127,300 | |

| | | | | | | | 8,131,890 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Health Care — 15.7% (continued) | | | | | | | | |

Health Care Providers & Services — 0.9% | | | | | | | | |

HCA Healthcare, Inc. | | | 6,000 | | | $ | 1,240,440 | |

Quest Diagnostics, Inc. | | | 18,000 | | | | 2,375,460 | |

| | | | | | | | 3,615,900 | |

Medical Equipment & Devices — 2.5% | | | | | | | | |

10X Genomics, Inc. - Class A (a) | | | 3,000 | | | | 587,460 | |

Accuray, Inc. (a) | | | 30,000 | | | | 135,600 | |

Alpha Pro Tech Ltd. (a) | | | 50,000 | | | | 428,500 | |

Co-Diagnostics, Inc. (a) | | | 35,000 | | | | 288,750 | |

Exact Sciences Corporation (a) | | | 12,000 | | | | 1,491,720 | |

Fluidigm Corporation (a) | | | 140,000 | | | | 862,400 | |

Hologic, Inc. (a) | | | 30,000 | | | | 2,001,600 | |

Meridian Bioscience, Inc. (a) | | | 140,000 | | | | 3,105,200 | |

OPKO Health, Inc. (a) | | | 140,000 | | | | 567,000 | |

Quidel Corporation (a) | | | 6,000 | | | | 768,720 | |

Retractable Technologies, Inc. (a) | | | 1,000 | | | | 11,560 | |

Sonoma Pharmaceuticals, Inc. (a) | | | 3,000 | | | | 22,020 | |

Vericel Corporation (a) | | | 6,000 | | | | 315,000 | |

| | | | | | | | 10,585,530 | |

Industrials — 4.7% | | | | | | | | |

Commercial Support Services — 1.0% | | | | | | | | |

H&R Block, Inc. | | | 36,000 | | | | 845,280 | |

Pitney Bowes, Inc. | | | 120,000 | | | | 1,052,400 | |

Quad/Graphics, Inc. (a) | | | 70,000 | | | | 290,500 | |

TriNet Group, Inc. (a) | | | 28,000 | | | | 2,029,440 | |

| | | | | | | | 4,217,620 | |

Diversified Consumer Services — 0.2% | | | | | | | | |

Hillenbrand, Inc. | | | 15,000 | | | | 661,200 | |

| | | | | | | | | |

Electrical Equipment — 0.7% | | | | | | | | |

Blink Charging Company (a) | | | 7,000 | | | | 288,190 | |

BWX Technologies, Inc. | | | 9,000 | | | | 523,080 | |

Capstone Green Energy Corporation (a) | | | 60,000 | | | | 337,200 | |

Carrier Global Corporation | | | 15,000 | | | | 729,000 | |

WidePoint Corporation (a) | | | 140,000 | | | | 1,016,400 | |

| | | | | | | | 2,893,870 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Industrials — 4.7% (continued) | | | | | | | | |

Engineering & Construction — 0.5% | | | | | | | | |

Infrastructure & Energy Alternatives, Inc. (a) | | | 21,000 | | | $ | 270,060 | |

Orbital Energy Group, Inc. (a) | | | 90,000 | | | | 393,300 | |

Primoris Services Corporation | | | 35,000 | | | | 1,030,050 | |

Tutor Perini Corporation (a) | | | 30,000 | | | | 415,500 | |

| | | | | | | | 2,108,910 | |

Industrial Intermediate Products — 0.3% | | | | | | | | |

Proto Labs, Inc. (a) | | | 14,000 | | | | 1,285,200 | |

| | | | | | | | | |

Industrial Support Services — 1.2% | | | | | | | | |

ARC Document Solutions, Inc. | | | 50,000 | | | | 107,500 | |

MSC Industrial Direct Company, Inc. - Class A | | | 30,000 | | | | 2,691,900 | |

Triton International Ltd. | | | 15,000 | | | | 785,100 | |

WESCO International, Inc. (a) | | | 12,000 | | | | 1,233,840 | |

| | | | | | | | 4,818,340 | |

Machinery — 0.3% | | | | | | | | |

Energy Recovery, Inc. (a) | | | 60,000 | | | | 1,366,800 | |

| | | | | | | | | |

Professional Services — 0.1% | | | | | | | | |

Insperity, Inc. | | | 7,000 | | | | 632,590 | |

| | | | | | | | | |

Transportation & Logistics — 0.4% | | | | | | | | |

Atlas Air Worldwide Holdings, Inc. (a) | | | 9,000 | | | | 612,990 | |

Expeditors International of Washington, Inc. | | | 8,000 | | | | 1,012,800 | |

| | | | | | | | 1,625,790 | |

Materials — 4.3% | | | | | | | | |

Chemicals — 1.5% | | | | | | | | |

AdvanSix, Inc. (a) | | | 15,000 | | | | 447,900 | |

Celanese Corporation | | | 6,000 | | | | 909,600 | |

Ingevity Corporation (a) | | | 9,000 | | | | 732,240 | |

Kronos Worldwide, Inc. | | | 30,000 | | | | 429,600 | |

Mosaic Company (The) | | | 60,000 | | | | 1,914,600 | |

Rayonier Advanced Materials, Inc. (a) | | | 50,000 | | | | 334,500 | |

Valvoline, Inc. | | | 45,000 | | | | 1,460,700 | |

Yield10 Bioscience, Inc. (a) | | | 6,000 | | | | 51,180 | |

| | | | | | | | 6,280,320 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Materials — 4.3% (continued) | | | | | | | | |

Metals & Mining — 2.4% | | | | | | | | |

Agnico Eagle Mines Ltd. | | | 15,000 | | | $ | 906,750 | |

AngloGold Ashanti Ltd. - ADR | | | 36,000 | | | | 668,880 | |

Barrick Gold Corporation | | | 120,000 | | | | 2,481,600 | |

Compass Minerals International, Inc. | | | 20,000 | | | | 1,185,200 | |

Kinross Gold Corporation | | | 108,000 | | | | 685,800 | |

Newmont Corporation | | | 45,000 | | | | 2,852,100 | |

Royal Gold, Inc. | | | 10,000 | | | | 1,141,000 | |

| | | | | | | | 9,921,330 | |

Paper & Forest Products — 0.4% | | | | | | | | |

Boise Cascade Company | | | 24,000 | | | | 1,400,400 | |

| | | | | | | | | |

Real Estate — 0.7% | | | | | | | | |

Real Estate Services — 0.4% | | | | | | | | |

eXp World Holdings, Inc. (a) | | | 24,000 | | | | 930,480 | |

Jones Lang LaSalle, Inc. (a) | | | 3,500 | | | | 684,110 | |

| | | | | | | | 1,614,590 | |

REITs — 0.3% | | | | | | | | |

Kimco Realty Corporation | | | 70,000 | | | | 1,459,500 | |

| | | | | | | | | |

Technology — 13.9% | | | | | | | | |

Semiconductors — 1.8% | | | | | | | | |

Intel Corporation | | | 45,000 | | | | 2,526,300 | |

QUALCOMM, Inc. | | | 18,000 | | | | 2,572,740 | |

Skyworks Solutions, Inc. | | | 12,000 | | | | 2,301,000 | |

| | | | | | | | 7,400,040 | |

Software — 3.1% | | | | | | | | |

AudioEye, Inc. (a) | | | 14,000 | | | | 235,060 | |

Ebix, Inc. | | | 75,000 | | | | 2,542,500 | |

Evolent Health, Inc. - Class A (a) | | | 35,000 | | | | 739,200 | |

j2 Global, Inc. (a) | | | 15,000 | | | | 2,063,250 | |

Microsoft Corporation | | | 500 | | | | 135,450 | |

NextGen Healthcare, Inc. (a) | | | 30,000 | | | | 497,700 | |

Oracle Corporation | | | 28,000 | | | | 2,179,520 | |

Qualys, Inc. (a) | | | 15,000 | | | | 1,510,350 | |

Synchronoss Technologies, Inc. (a) | | | 70,000 | | | | 251,300 | |

Vislink Technologies, Inc. (a) | | | 1 | | | | 3 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

COMMON STOCKS — 99.8% (continued) | | Shares | | | Value | |

Technology — 13.9% (continued) | | | | | | | | |

Software — 3.1% (continued) | | | | | | | | |

VMware, Inc. - Class A (a) | | | 12,000 | | | $ | 1,919,640 | |

Xperi Holding Corporation | | | 45,000 | | | | 1,000,800 | |

| | | | | | | | 13,074,773 | |

Technology Hardware — 6.3% | | | | | | | | |

Apple, Inc. | | | 3,000 | | | | 410,880 | |

Aviat Networks, Inc. (a) | | | 28,000 | | | | 917,560 | |

Cambium Networks Corporation (a) | | | 9,000 | | | | 435,150 | |

Casa Systems, Inc. (a) | | | 63,000 | | | | 558,810 | |

Clearfield, Inc. (a) | | | 60,000 | | | | 2,247,000 | |

Corning, Inc. | | | 30,000 | | | | 1,227,000 | |

F5 Networks, Inc. (a) | | | 14,000 | | | | 2,613,240 | |

Genasys, Inc. (a) | | | 35,000 | | | | 191,800 | |

HP, Inc. | | | 90,000 | | | | 2,717,100 | |

Infinera Corporation (a) | | | 30,000 | | | | 306,000 | |

Jabil, Inc. | | | 15,000 | | | | 871,800 | |

Maxar Technologies, Inc. | | | 30,000 | | | | 1,197,600 | |

NetApp, Inc. | | | 36,000 | | | | 2,945,520 | |

Plantronics, Inc. (a) | | | 28,000 | | | | 1,168,440 | |

Ribbon Communications, Inc. (a) | | | 180,000 | | | | 1,369,800 | |

Sonos, Inc. (a) | | | 30,000 | | | | 1,056,900 | |

Turtle Beach Corporation (a) | | | 60,000 | | | | 1,915,200 | |

Ubiquiti, Inc. | | | 12,000 | | | | 3,746,280 | |

| | | | | | | | 25,896,080 | |

Technology Services — 2.7% | | | | | | | | |

Cognizant Technology Solutions Corporation - Class A | | | 48,000 | | | | 3,324,480 | |

FactSet Research Systems, Inc. | | | 3,000 | | | | 1,006,830 | |

Infosys Ltd. - ADR | | | 150,000 | | | | 3,178,500 | |

International Business Machines Corporation | | | 6,000 | | | | 879,540 | |

MAXIMUS, Inc. | | | 15,000 | | | | 1,319,550 | |

Square, Inc. - Class A (a) | | | 6,000 | | | | 1,462,800 | |

| | | | | | | | 11,171,700 | |

Utilities — 0.3% | | | | | | | | |

Electric Utilities — 0.3% | | | | | | | | |

NRG Energy, Inc. | | | 35,000 | | | | 1,410,500 | |

| | | | | | | | | |

Total Common Stocks (Cost $362,206,378) (b) | | | | | | $ | 411,996,186 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

June 30, 2021 |

EXCHANGE-TRADED FUNDS — 0.5% | | Shares | | | Value | |

iShares Gold Trust (a) | | | 30,000 | | | $ | 1,011,300 | |

SPDR Gold Shares (a) | | | 6,000 | | | | 993,780 | |

Total Exchange-Traded Funds (Cost $2,132,507) | | | | | | $ | 2,005,080 | |

WARRANTS — 0.0% (c) | | | | | | |

Nabors Industries Ltd. (Cost $0) | | | 8,000 | | | $ | 80,000 | |

EXCHANGE-TRADED PUT OPTION CONTRACTS — 2.5% | | Contracts | | | Notional

Amount | | | Value | |

Russell 2000 Index Option, 09/17/2021 at $2,250 | | | 750 | | | $ | 173,291,175 | | | $ | 4,900,500 | |

S&P 500 Index Option, 09/17/2021 at $4,250 | | | 550 | | | | 236,362,500 | | | | 5,263,500 | |

Total Put Option Contracts (Cost $10,909,247) | | | | | | $ | 409,653,675 | | | $ | 10,164,000 | |

| | | | | | | | | | | | | |

Total Investments at Value — 102.8% (Cost $375,248,132) | | | | | | | | | | $ | 424,245,266 | |

MONEY MARKET FUNDS — 50.8% | | Shares | | | Value | |

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.01% (d) (Cost $209,818,056) | | | 209,818,056 | | | $ | 209,818,056 | |

| | | | | | | | | |

Total Investments and Money Market Funds at Value — 153.6% (Cost $585,066,188) | | | | | | $ | 634,063,322 | |

| | | | | | | | | |

Exchanged-Traded Written Call Option Contracts — (53.6%) | | | | | | | (221,385,090 | ) |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.0% (c) | | | | | | | 219,750 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 412,897,982 | |

ADR - American Depositary Receipt. |

(a) | Non-income producing security. |

(b) | Common stocks owned by the Fund are held in escrow by the Fund’s custodian (or by a securities depositary) to secure the Fund’s obligations to settle outstanding call option contracts it has written (Note 1). |

(c) | Percentage rounds to less than 0.1%. |

(d) | The rate shown is the 7-day effective yield as of June 30, 2021. |

See accompanying notes to financial statements. |

Hussman Strategic Growth Fund

Schedule of Open Written Option Contracts |

June 30, 2021 |

EXCHANGE-TRADED WRITTEN CALL OPTION CONTRACTS | | Contracts | | | Notional

Amount | | | Strike

Price | | | Expiration

Date | | | Value of

Options | |

Call Option Contracts |

Russell 2000 Index Option | | | 750 | | | $ | 173,291,175 | | | $ | 1,000 | | | | 09/17/2021 | | | $ | 97,956,750 | |

S&P 500 Index Option | | | 540 | | | | 232,065,000 | | | | 2,000 | | | | 09/17/2021 | | | | 123,428,340 | |

Total Written Call Option Contracts (Premiums received $209,810,955) | | | | | | $ | 405,356,175 | | | | | | | | | | | $ | 221,385,090 | |

See accompanying notes to financial statements. |

Hussman Strategic Allocation Fund

Schedule of Investments |

June 30, 2021 |

COMMON STOCKS — 66.6% | | Shares | | | Value | |

Communications — 5.5% | | | | | | | | |

Cable & Satellite — 0.7% | | | | | | | | |

Comcast Corporation - Class A | | | 1,000 | | | $ | 57,020 | |

Sirius XM Holdings, Inc. | | | 12,000 | | | | 78,480 | |

| | | | | | | | 135,500 | |

Entertainment Content — 1.3% | | | | | | | | |

AMC Networks, Inc. - Class A (a) | | | 1,600 | | | | 106,880 | |

MSG Networks, Inc. - Class A (a) | | | 1,000 | | | | 14,580 | |

ViacomCBS, Inc. - Class B | | | 3,000 | | | | 135,600 | |

| | | | | | | | 257,060 | |

Internet Media & Services — 1.7% | | | | | | | | |

Alphabet, Inc. - Class C (a) | | | 20 | | | | 50,126 | |

Baidu, Inc. - ADR (a) | | | 500 | | | | 101,951 | |

Facebook, Inc. - Class A (a) | | | 20 | | | | 6,954 | |

fuboTV, Inc. (a) | | | 500 | | | | 16,055 | |

Pinterest, Inc. - Class A (a) | | | 300 | | | | 23,685 | |

Shutterstock, Inc. | | | 700 | | | | 68,719 | |

Stamps.com, Inc. (a) | | | 300 | | | | 60,087 | |

Twitter, Inc. (a) | | | 300 | | | | 20,643 | |

| | | | | | | | 348,220 | |

Media — 0.9% | | | | | | | | |

Discovery, Inc. - Series A (a) | | | 2,000 | | | | 61,360 | |

Nexstar Media Group, Inc. - Class A | | | 500 | | | | 73,940 | |

TEGNA, Inc. | | | 2,000 | | | | 37,520 | |

| | | | | | | | 172,820 | |

Publishing & Broadcasting — 0.6% | | | | | | | | |

Audacy, Inc. (a) | | | 4,000 | | | | 17,240 | |

Gray Television, Inc. | | | 4,000 | | | | 93,600 | |

Meredith Corporation (a) | | | 300 | | | | 13,032 | |

| | | | | | | | 123,872 | |