| | OMB APPROVAL |

| | OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-09911 | |

| Hussman Investment Trust |

| (Exact name of registrant as specified in charter) |

| 6021 University Boulevard, Suite 490 Ellicott City, Maryland | 21043 |

| (Address of principal executive offices) | (Zip code) |

John F. Splain

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | June 30, 2021 | |

| | | |

| Date of reporting period: | December 31, 2020 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

HUSSMAN INVESTMENT TRUST

HUSSMAN STRATEGIC GROWTH FUND

HUSSMAN STRATEGIC ALLOCATION FUND

HUSSMAN STRATEGIC TOTAL RETURN FUND

HUSSMAN STRATEGIC INTERNATIONAL FUND

SEMI-ANNUAL REPORT

December 31, 2020

(Unaudited)

Table of Contents

| | |

Performance Information | |

Hussman Strategic Growth Fund | 1 |

Hussman Strategic Allocation Fund | 2 |

Hussman Strategic Total Return Fund | 3 |

Hussman Strategic International Fund | 4 |

Letter to Shareholders | 5 |

Portfolio Information | 21 |

Schedules of Investments | |

Hussman Strategic Growth Fund | 24 |

Hussman Strategic Allocation Fund | 35 |

Hussman Strategic Total Return Fund | 46 |

Hussman Strategic International Fund | 50 |

Statements of Assets and Liabilities | 58 |

Statements of Operations | 60 |

Statements of Changes in Net Assets | |

Hussman Strategic Growth Fund | 62 |

Hussman Strategic Allocation Fund | 63 |

Hussman Strategic Total Return Fund | 64 |

Hussman Strategic International Fund | 65 |

Financial Highlights | |

Hussman Strategic Growth Fund | 66 |

Hussman Strategic Allocation Fund | 67 |

Hussman Strategic Total Return Fund | 68 |

Hussman Strategic International Fund | 69 |

Notes to Financial Statements | 70 |

About Your Funds’ Expenses | 95 |

Other Information | 97 |

Change in Independent Auditor | 98 |

Privacy Notice | 99 |

Hussman Strategic Growth Fund

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic Growth Fund versus the S&P 500 Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2020 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic Growth Fund(c)(d) | 14.53% | 0.36% | (4.83%) | (5.93%) | 0.47% | |

S&P 500 Index | 18.40% | 14.18% | 15.22% | 13.88% | 6.79% | |

(a) | Hussman Strategic Growth Fund invests primarily in stocks listed on the New York, American, and NASDAQ exchanges and varies its investment exposure to market fluctuations depending on market conditions. The S&P 500 Index is an index of large capitalization stocks. However, the Fund may invest in securities that are not included in the S&P 500 Index and there are no restrictions as to the market capitalization of companies in which the Fund invests. “HSGFX equity investments and cash equivalents only (unhedged)” reflects the performance of the Fund’s stock investments and modest day-to-day cash balances, after fees and expenses, and does not reflect the impact of hedging transactions on the Fund’s overall investment performance. The Fund’s unhedged equity investments do not represent a separately available portfolio, and their performance is presented solely for purposes of comparison and performance attribution. Performance data presented using log scale. Each segment on the vertical axis represents an equivalent percentage change. |

(b) | The Fund commenced operations on July 24, 2000. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2021 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.15% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund (annualized) for the semi-annual period ended December 31, 2020 would have been 1.22%. |

Hussman Strategic Allocation Fund

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Allocation Fund

versus Benchmark Fixed Allocation Composite(a) (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2020 |

| | 1 Year | Since

Inception(b) |

Hussman Strategic Allocation Fund(c)(d) | 11.22% | 7.69% |

Benchmark Fixed Allocation Composite | 15.20% | 17.16% |

(a) | Benchmark Fixed Allocation Composite represents the gross investment performance of a portfolio that is invested in securities included in three separate indices, weighted as follows: 60% S&P 500 Index, 30% Bloomberg Barclays U.S. Treasury Unhedged Index and 10% Bloomberg Barclays Treasury Bills Index. The Composite represents an investment approach that invests a fixed percentage of assets in stocks, bonds, and money-market securities, with little or no variation. The Fund may invest in securities that are not included in the indices that comprise the Composite. |

(b) | The Fund commenced operations on August 27, 2019. |

(c) | Returns do no reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemptions of Fund shares. |

(d) | The Advisor has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2022 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.25% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund (annualized) for the semi-annual period ended December 31, 2020 would have been 3.86%. |

Hussman Strategic Total Return Fund

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Total Return Fund

versus the Bloomberg Barclays U.S. Aggregate Bond Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2020 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic Total Return Fund(c)(d) | 11.45% | 8.01% | 6.62% | 3.16% | 5.09% | |

Bloomberg Barclays U.S. Aggregate Bond Index | 7.51% | 5.34% | 4.44% | 3.84% | 4.41% | |

(a) | The Bloomberg Barclays U.S. Aggregate Bond Index covers the U.S. investment grade fixed rate bond market, with index components for U.S. government, agency and corporate securities. The Fund does not invest solely in securities included in the Bloomberg Barclays U.S. Aggregate Bond Index and may invest in other types of bonds, as well as common stocks, exchange-traded funds and other securities. |

(b) | The Fund commenced operations on September 12, 2002. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2021 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 0.75% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund (annualized) for the semi-annual period ended December 31, 2020 would have been 0.76%. |

Hussman Strategic International Fund

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic International Fund versus the MSCI EAFE Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2020 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic International Fund(c)(d) | 0.74% | (0.44%) | (0.11%) | (1.18%) | (0.67%) | |

MSCI EAFE Index | 7.82% | 4.28% | 7.45% | 5.51% | 5.71% | |

(a) | The MSCI EAFE (Europe, Australasia, and Far East) Index is a free float-adjusted weighted capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of December 31, 2020, the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The Fund is not required to invest in each of the countries represented in the MSCI EAFE Index and may invest in securities that are not included in the MSCI EAFE Index. In addition, the Fund varies its exposure to market fluctuations depending on market conditions. |

(b) | The Fund commenced operations on December 31, 2009. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2021 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 2.00% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund (annualized) for the semi-annual period ended December 31, 2020 would have been 3.64%. |

The Hussman Funds

|

Letter to Shareholders | February 12, 2021 |

Dear Shareholder,

For the calendar year ended December 31, 2020, the Hussman Funds performed as intended; neither extraordinary nor disappointing in the context of prevailing market conditions and our value-conscious, historically-informed, full-cycle investment discipline. The phrase, “as intended,” is one that I regularly chose to describe our performance in prior market cycles. I am pleased that I can do so again.

In a year that began at the most extreme stock market valuations in history, our intent in 2020 was to navigate changing market conditions and opportunities within the conservative investment stance demanded by those extremes. Though the market decline in the first quarter of 2020 brought our most reliable measures of valuation to levels that still exceeded 87% of historical observations, the volatility provided enough opportunities to enable all of the Hussman Funds to end the year with positive returns.

Strategic Growth Fund ended calendar year 2020 with a total return of 14.53%. The deepest peak-to-trough loss in the Fund during the year was -6.98%. By comparison, the S&P 500 had a total return of 18.40%. The deepest peak-to-trough loss in the S&P 500 during the year was -33.79%.

Strategic Allocation Fund ended calendar year 2020 with a total return of 11.22%. The deepest peak-to-trough loss in the Fund during the year was -2.70%. By comparison, a benchmark portfolio invested 60% in the S&P 500 Index, 30% in the Bloomberg Barclays U.S. Treasury Unhedged Total Return Index, and 10% in the Bloomberg Barclays U.S. Treasury Bills Index had a total return of 15.20% during 2020. The deepest peak-to-trough loss in this benchmark during the year was -19.93%.

Strategic Total Return Fund ended calendar year 2020 with a total return of 11.45%. The deepest peak-to-trough loss in the Fund during the year was -7.18%. By comparison, the Bloomberg Barclays U.S. Aggregate Bond Index had a total return of 7.51% during 2020. The deepest peak-to-trough loss in this benchmark during the year was -6.30%.

Strategic International Fund ended calendar year 2020 with a total return of 0.74%. The deepest peak-to-trough loss in the Fund during the year was -10.26%. By comparison, the MSCI EAFE Index had a total return of 7.82%. The deepest peak-to-trough loss in this benchmark during the year was -33.90%.

The Hussman Funds

|

Letter to Shareholders (continued) |

The most extremely overvalued market in U.S. history

“The most striking similarity between the 1920s and 1990s bull markets is the notion that traditional measures of stock valuation had become obsolete.”

– Edward Chancellor, Devil Take The Hindmost, 1999

Nothing so animates a speculative herd as a parabolic price advance in an asset detached from any standard of value. I am convinced that future generations will use the present moment to define the concept of a reckless speculative extreme, in the same way our generation looks back on 1929 and 2000. People will use us to teach lessons to their children.

As I write this letter, the S&P 500 has reached the highest valuations in U.S. history, eclipsing both the 1929 and 2000 extremes, based on the measures that we find best correlated with actual subsequent S&P 500 total returns. Unlike prior financial bubbles, however, the current speculative extreme has extended to every conventional asset class, and every subset of the equity market.

For example, at the peak of the 2000 technology bubble, the 10% of S&P 500 components with the highest price/revenue ratios had a median ratio of 13.7. In contrast, the median price/revenue ratio for the remaining components of the S&P 500 was just 1.2.

Presently, the 10% of S&P 500 components with the highest price/revenue ratios have a median ratio of 14.8, exceeding the 2000 extreme even for this decile. Yet the median price/revenue ratio for the remaining components of the S&P 500 is 2.8.

For the capitalization-weighted S&P 500 Index as a whole, the price/revenue ratio has now climbed to a historic extreme of 2.9. When one recognizes that the historical norm is only about 0.9 (a level that was breached even at the 2008-2009 market lows), and that one-quarter of U.S. history has seen that ratio below 0.6, it becomes clear that substantial long-term and full-cycle risk is built into present valuation extremes.

The situation might be of less concern if the most extreme valuations were isolated to relatively small components of the S&P 500. However, this is not the case. Among the 10% of S&P 500 components with the largest market capitalizations, the median price/revenue ratio is presently 5.7, easily eclipsing the 2000 extreme of 4.8 for this subgroup. Yet unlike 2000, even the smallest 10% of S&P 500 components are at extreme valuations, with a median price/revenue ratio of 1.8, compared with a median ratio of just 0.3 at the 2000 market peak.

The Hussman Funds

|

Letter to Shareholders (continued) |

Of course, valuations are extreme on measures that go well beyond price/revenue ratios. Even if one constructs the S&P 500 price/earnings multiple in a very optimistic way – dividing the S&P 500 by the highest level of earnings ever achieved to-date – the current multiple exceeds that observed at the 1929 peak, and at every point in history outside of the 1999-2000 market peak.

Across the set of valuation measures that we find most strongly correlated with actual subsequent 10-12 year total returns, the S&P 500 Index is presently between 3.3-3.8 times run-of-the-mill norms that have been restored or breached by the end of nearly every market cycle in history (including 2008-2009). We presently estimate that annual nominal total returns of the S&P 500 Index are likely to average -4.5% annually over the coming 12-year period.

As at previous pre-collapse market peaks such as 1929, 1972, 1987, 2000, and 2007, S&P 500 valuations imply likely returns below the prevailing yield on Treasury bonds. Because Treasury bond yields are also at dismally low levels, we estimate that the prospective 12-year average total return for a passive investment mix invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills is likely to be a loss of -2.2% annually.

The main source of potential error in these projections would be the sort of “permanently high plateau” that Irving Fisher disastrously projected at the 1929 market peak. If market valuations 10-12 years from today remain fixed at the highest level in U.S. history, while average nominal growth in the economy and corporate revenues maintains the same rate as in recent decades (about 4% annually), we would expect S&P 500 total returns, including dividends, to average about 5.4% annually. This would imply a 10-year projected total return of about 3.6% on a 60%-30%-10% mix of stocks, bonds, and cash.

However, the potential benefit of a “permanently high plateau” is vulnerable to even slight disappointments in those assumptions. If valuations were simply to retreat by 22%, to the highest extremes observed in 1929 and 2000, and even if it takes a decade to do so, we estimate that the resulting 10-year total return of the S&P 500 would likely average just 2.9% annually. All of these estimates are grounded in basic arithmetic. Even a 22% retreat in valuations over a decade implies a -2.5% drag on 10-year annual total returns. Higher inflation is also unlikely to help, because inflation generally does not benefit stocks when valuations are elevated. All of this is worth considering with valuations more than three times their historical norms.

The Hussman Funds

|

Letter to Shareholders (continued) |

Fortunately, the profile of expected returns for stocks, bonds, and other assets changes substantially as valuations change. I doubt there is any diversified passive investment that will help investors solve the problem created by an “everything bubble,” except perhaps a passive investment in an active discipline. That is precisely the role that the Hussman Funds are intended to serve as an “alternative” holding in the portfolios of our shareholders. All of the Hussman Funds adhere to value-conscious, historically-informed, full-cycle investment disciplines that respond to prevailing valuations and market conditions as they change over time. Indeed, even amid the most extreme valuations in history, we were able to maintain reasonable flexibility in our market outlook in response to market volatility during 2020.

“Nothing demands that investors ‘lock in’ the lowest investment prospects in history. The alternative that investors have is flexibility. The alternative investors have is the capacity to imagine a complete market cycle. The alternative investors have is discipline – the willingness to lean away from risk when it is richly valued and unsupported by uniformly favorable internals, and to lean toward risk when a material retreat in valuations is joined by an improvement in the uniformity of market internals. I have every expectation that we’ll observe such opportunities over the completion of this cycle.”

– John P. Hussman, Ph.D., January 2020

Fund Performance

Strategic Growth Fund

For the year ended December 31, 2020, the total return of Strategic Growth Fund was 14.53%, compared with a total return of 18.40% for the S&P 500 Index. While continued extremes in market valuation have required us to navigate the market within the context of a conservative and well-hedged position, the Fund benefited from a hedging stance that was more defensive during the first quarter than during the remainder of 2020, as well as stock selection performance that was more characteristic of our long-term experience. Excluding the impact of hedging, the stock selection approach of Strategic Growth Fund has outperformed the total return of the S&P 500 by an average of 329 basis points (3.29%) annually from its inception on July 24, 2000 through December 31, 2020.

Strategic Allocation Fund

For the year ended December 31, 2020, the total return of Strategic Allocation Fund was 11.22%, compared with a total return of 15.20% in the benchmark fixed allocation composite index which is weighted 60% S&P 500 Index, 30% Bloomberg

The Hussman Funds

|

Letter to Shareholders (continued) |

Barclays U.S. Treasury Unhedged Index and 10% Bloomberg Barclays U.S. Treasury Bills Index. The Fund’s largely hedged investment stance during 2020 resulted in substantially lower volatility than that of the unhedged benchmark. The deepest peak-to-trough loss experienced by the Fund during 2020 was -2.70%, compared with a -19.93% interim loss for the Fund’s 60%-30%-10% benchmark.

Strategic Total Return Fund

For the year ended December 31, 2020, the total return of Strategic Total Return Fund was 11.45%, compared with a total return of 7.51% for the Bloomberg Barclays U.S. Aggregate Bond Index. The Fund held a relatively conservative position in bonds during this time, with a duration typically ranging between 1-5 years (meaning that a 100 basis point move in interest rates would be expected to affect Fund value by about 1-5% on the basis of bond price fluctuations). During 2020, the yield on 10-year U.S. Treasury bonds fell from 1.92% to 0.92%, resulting in modest total returns for Treasury bonds. The Fund also held a moderate exposure to precious metals shares, which varied significantly during the year, generally between 6-20% of the Fund’s net assets, changing in response to prevailing market conditions in this sector, particularly valuations.

Strategic International Fund

For the year ended December 31, 2020, the total return of Strategic International Fund was 0.74%, compared with a total return of 7.82% in the MSCI EAFE Index. The Fund remained conservatively positioned during the year, holding a broadly diversified portfolio of international equities, with an offsetting hedge against market fluctuations, primarily using the MSCI EAFE Index. The small overall gain in Fund value was primarily attributable to a slightly more defensive hedging stance during the first quarter, compared to the remainder of 2020.

Portfolio Composition

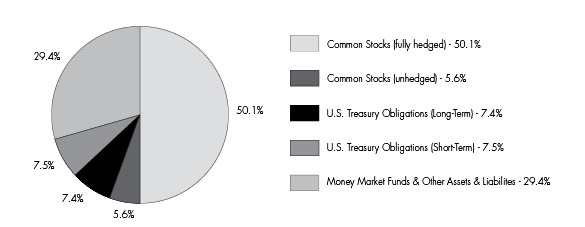

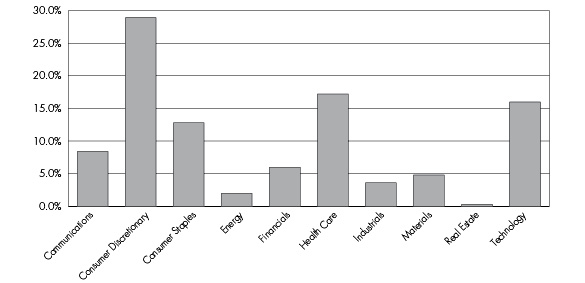

As of December 31, 2020, Strategic Growth Fund had net assets of $313,748,350, and held 218 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were consumer discretionary (29.5%), health care (17.3%), technology (16.9%), consumer staples (13.2%), communications (8.7%), financials (6.1%) and materials (5.2%). The smallest sector holdings as a percent of net assets were industrials (3.8%), energy (2.2%), and real estate (0.3%).

Strategic Growth Fund’s holdings of individual stocks as of December 31, 2020 were valued at $323,748,997. Against these stock positions, the Fund also held 480 option combinations (long put option/short call option) on the S&P 500 Index

The Hussman Funds

|

Letter to Shareholders (continued) |

and 700 option combinations on the Russell 2000 Index. Each option combination behaves as a short sale on the underlying index, with a notional value of $100 times the index value. On December 31, 2020, the S&P 500 Index closed at 3,756.07, while the Russell 2000 Index closed at 1,974.855. The Fund’s total hedge therefore represented a short position of $318,531,210, thereby hedging 98.4% of the dollar value of the Fund’s investment positions in individual stocks.

Though the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following equity holdings achieved gains in excess of $2.5 million during the six months ended December 31, 2020: JinkoSolar Holdings ADR, Editas Medicine, Canadian Solar, Hibbett Sports, Owens & Minor, Ubiquiti and Tupperware Brands. There were no equity holdings with a loss in excess of $1 million during this period.

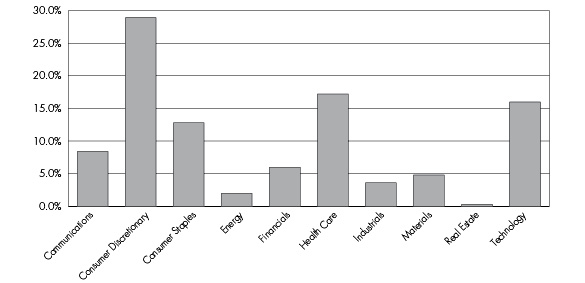

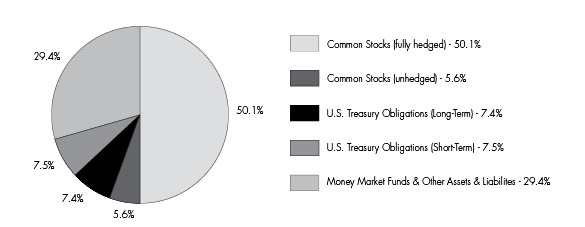

As of December 31, 2020, Strategic Allocation Fund had net assets of $13,412,292 and held 218 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were consumer discretionary (16.1%), health care (9.6%), technology (8.9%), consumer staples (7.2%), communications (4.7%) and financials (3.3%). The smallest sector weights were materials (2.7%), industrials (2.0%), energy (1.1%) and real estate (0.1%). Treasury notes and money market funds represented 58.5% of the Fund’s net assets.

Strategic Allocation Fund’s holdings of individual stocks as of December 31, 2020 were valued at $7,473,499, representing 55.7% of the Fund’s net assets. Against these stock positions, the Fund also held 10 option combinations (long put option/short call option) on the S&P 500 and 15 option combinations on the Russell 2000 Index. The notional value of this hedge was $6,718,352, hedging 89.9% of the value of equity investments held by the Fund. The Fund’s holdings in long-term Treasury obligations represented 7.4% of the Fund’s net assets.

In Strategic Allocation Fund, during the six months ended December 31, 2020, individual equity portfolio gains in excess of $50,000 were achieved in JinkoSolar Holdings ADR, Canadian Solar, Editas Medicine, Hibbett Sports, eXp World Holdings, Ubiquiti and Tupperware Brands. There were no individual equity portfolio losses in excess of $50,000 during this period.

As of December 31, 2020, Strategic Total Return Fund had net assets of $320,707,040. Treasury notes, Treasury Inflation-Protected Securities (TIPS) and money market funds represented 84.2% of the Fund’s net assets. Exchange-traded funds, precious metals shares, energy and utility shares accounted for 3.1%, 6.0%, 1.3%, and 5.2% of net assets, respectively.

The Hussman Funds

|

Letter to Shareholders (continued) |

In Strategic Total Return Fund, during the six months ended December 31, 2020, the following holdings achieved portfolio gains in excess of $250,000: AES, Agnico Eagle Mines, U.S. Treasury Inflation-Protected Note (2.50%, due 1/15/2029), U.S. Treasury Inflation-Protected Note (0.125%, due 1/15/2030) and Compania de Minas Buenaventura ADR. The only portfolio loss in excess of $250,000 during this period was U.S. Treasury Note (0.625%, due 8/15/2030).

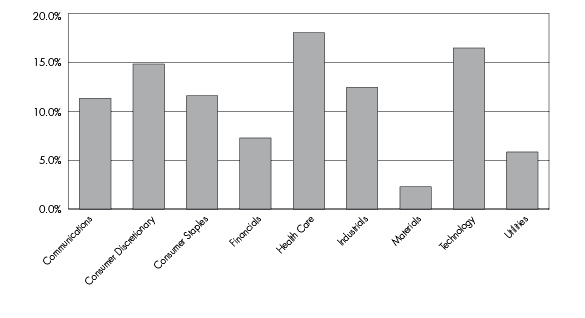

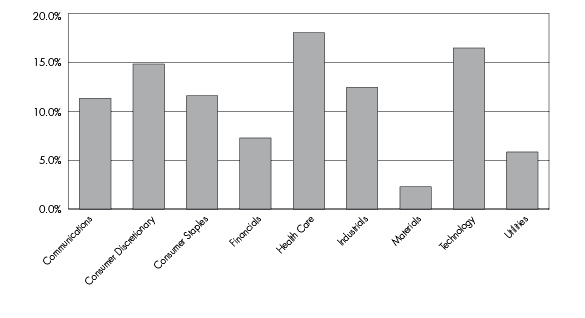

As of December 31, 2020, Strategic International Fund had net assets of $14,790,262 and held 135 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were health care (15.7%), technology (14.3%), consumer discretionary (12.9%), industrials (10.8%), consumer staples (10.1%), communications (9.8%) and financials (6.3%). The smallest sector weights were utilities (5.1%) and materials (2.0%). Investment in shares of money market funds accounted for 3.5% of net assets.

Strategic International Fund’s holdings of individual stocks as of December 31, 2020 were valued at $12,863,205. In order to hedge the impact of general market fluctuations, as of December 31, 2020, Strategic International Fund was long 12 put option contracts on the S&P 500 Index and short 75 futures on the Mini MSCI EAFE Index. The notional value of this hedge was $12,513,534, hedging 97.3% of the value of equity investments held by the Fund. When the Fund is in a hedged investment position, the primary driver of Fund returns is the difference in performance between the stocks owned by the Fund and the indices that are used to hedge.

While Strategic International Fund’s investment portfolio is diversified and the Fund’s performance is affected by numerous investment positions, the hedging strategy of the Fund was primarily responsible for the reduced sensitivity of the Fund to market fluctuations from the Fund’s inception through December 31, 2020. Individual equity holdings having portfolio gains in excess of $75,000 during the six months ended December 31, 2020 included Next plc, Siltronic AG and Mycronic AB. There were no equity holdings with portfolio losses in excess of $75,000 during this period.

Supplementary performance information for the Funds is available on the Hussman Funds website: www.hussmanfunds.com

The Hussman Funds

|

Letter to Shareholders (continued) |

Current Outlook

“The one reality that you can never change is that a higher-priced asset will produce a lower return than a lower-priced asset. You can’t have your cake and eat it. You can enjoy it now, or you can enjoy it steadily in the distant future, but not both – and the price we pay for having this market go higher and higher is a lower 10-year return from the peak.”

– Jeremy Grantham, CNBC, November 12, 2020

One of the central principles to remember about investing is that the higher the price one pays today, for a given stream of future cash flows, the lower the long-term returns one can expect over time. It is exactly when past returns are most glorious that future prospects are most dismal.

Still, it is also clear that if overvaluation alone was enough to drive prices lower, the market could never reach the sort of extreme hypervaluation we saw in 1929 and 2000, nor the dismal full-cycle outcomes those valuations created. So we have to distinguish between long-term returns, which are driven by valuations, and returns over shorter segments of the market cycle, which are driven by investor psychology.

There is enormous value in understanding that market valuations are the main drivers of long-term investment returns and the extent of potential market losses over the complete market cycle, while investor psychology typically matters more over shorter segments of the market cycle.

When investors are inclined toward speculation, they tend to be indiscriminate about it. In market cycles across history (including the most recent one), we’ve found that the most reliable gauge of whether investors are inclined toward “speculation” or “risk-aversion” is the uniformity of market internals across thousands of stocks, industries, sectors, and security-types, including debt securities of varying creditworthiness.

Yet in prior market cycles across history, there was also generally a “limit” to speculation. Once sufficiently extreme “overvalued, overbought, overbullish” conditions emerged, one could adopt a bearish outlook even if market internals were still favorable. Only this aspect of the recent bull market was truly “different” from history. Once the Federal Reserve drove interest rates to zero, even the most extreme and historically reliable “limits” to speculation became ineffective. Instead, yield-seeking speculation persisted long after speculative extremes had emerged.

The Hussman Funds

|

Letter to Shareholders (continued) |

Investors have now bid stock market valuations up to the point where we estimate that the S&P 500 is likely to produce zero or negative returns for a very long period of time – even if those returns are delivered in an “interesting” way, through a series of collapses and recoveries.

In late-2017, I finally threw up my hands and abandoned the idea that there remains any reliable “limit” to speculation at all. Instead of acting pre-emptively in response to extremely overextended conditions, we adapted our investment discipline to require deterioration in our measures of market internals before adopting a bearish outlook. While sufficiently extreme conditions can still justify a neutral market outlook, we no longer adopt or amplify a bearish outlook unless our measures of market internals are explicitly unfavorable.

Now, saying that the Fed has disabled previously reliable limits to speculation does not mean embracing risk regardless of observable market conditions. Rather, I expect that the most valuable aspect of our investment discipline over the completion of this cycle, and future ones, will be our ability and willingness to flexibly respond to changes in observable market conditions – particularly valuations and market internals – as they emerge. In my view, the strongest opportunities to embrace market risk will emerge at those points when a material retreat in valuations is joined by improvement in market internals.

“The notion that the desirability of a common stock was entirely independent of its prices seems incredibly absurd. Yet the new-era theory led directly to this thesis. An alluring corollary of this principle was that making money in the stock market was now the easiest thing in the world. It was only necessary to buy ‘good’ stocks, regardless of price, and then to let nature take her upward course. The results of such a doctrine could not fail to be tragic.”

– Benjamin Graham and David L. Dodd, Security Analysis, 1934

On Federal Reserve policy

In response to market losses in March, the Federal Reserve announced that it would be purchasing existing corporate bonds from investors (mainly through exchange-traded funds), using funds specifically allocated by the CARES Act for that purpose. While the Fed announced that it planned to “leverage” government funds beyond the amount allocated by the Treasury, members of Congress promptly questioned the legal authority on which the Fed believed it could do so. Ultimately, the Federal Reserve’s

The Hussman Funds

|

Letter to Shareholders (continued) |

purchases amounted to just $14 billion dollars of bonds, limited to funds specifically provided by the Treasury, as the purchase of uncollateralized corporate bonds by the Fed remains otherwise illegal under Section 13(3) of the Federal Reserve Act.

Nevertheless, the mere idea that the Fed was purchasing corporate securities triggered enough magical thinking among investors to drive the aggregate value of U.S. corporate equities to a record extreme that now stands at over $56 trillion. This is 2.63 times U.S. nominal GDP, compared with a historical norm of just 0.78. About $39 trillion of that market capitalization represents paper profits that could be wiped out without even bringing valuations below historical norms seen as recently as the 2009 cycle low. It is wholly unclear that investors understand how limited the Federal Reserve’s corporate bond purchases ultimately were, and how much the subsequent rebound has relied on speculative psychology.

Notably, in treating uncollateralized corporate debt as if it stood as its own 13(3) “collateral,” and reporting its purchases at book value rather than market value, the Federal Reserve revealed an inclination to interpret, as loosely as possible, its legal obligation to “protect taxpayers from losses.” For interventionists who advocate modifying the Federal Reserve Act to enable the Fed to buy stocks, with no collateral other than the stock shares themselves, my question is how much of the potential $39 trillion in paper losses should the public be forced to absorb on behalf of private speculators, in lieu of other budget priorities?

Could the Fed sustain this bubble forever? I certainly do not believe so, but given our late-2017 adaptation to our investment discipline, I expect we would tolerate that unlikely outcome just fine. Our discipline is flexible enough to shift as investor psychology does. We also know that when valuations are extreme, even very small changes in expected returns imply rather large price fluctuations. So even in the unlikely event of a “permanently high plateau,” I expect we will see enough volatility to navigate a broad range of opportunities.

Meanwhile, despite the confidence that investors have placed in the Federal Reserve, it is worth remembering how Federal Reserve policy actually “supports” the financial markets. Most asset purchases of the Fed simply replace interest-bearing Treasury bonds with zero-interest base money, which must be held by someone, at every moment in time, until that base money is retired. This zero-interest money behaves just like a “hot potato.” One can try to get rid of it by buying stocks, but the base money simply ends up in the hands of whoever sold those stocks.

The Hussman Funds

|

Letter to Shareholders (continued) |

When investors are inclined to speculate, safe liquidity is viewed as an “inferior” asset, so the desire to abandon these low-interest hot-potatoes can amplify speculation. However, when investors are inclined toward risk-aversion, low interest liquidity becomes a desirable asset rather than an “inferior” one, so creating more of the stuff does nothing to support the market. Recall that during the 2000-2002 and 2007-2009 collapses, the Fed aggressively and persistently eased monetary policy to absolutely no avail.

Ultimately, there is no way to sustain a bubble without making its consequences worse. While we can tolerate a world where monetary policy keeps the market at a “permanently high plateau,” I question the ability of these policies to successfully do so when investors become inclined toward risk-aversion. Even the steep market declines we’ve observed in recent years (early-2018, late-2018, early-2020) have occurred during periods when our measures of market internals were unfavorable. For that reason, even since 2017, I have viewed the combination of hypervaluation, price overextension, lopsided bullishness, and unfavorable market internals as a “trap door” situation.

“That the rate of interest will be lower when commerce languishes and when there is little demand for money, than when the energies of commerce are in full play and there is an active demand for money, is indisputable; but it is equally beyond doubt, that every speculative mania which has run its course of folly and disaster in this country has derived its original impulse from cheap money.”

– The Economist, 1858

Very long, interesting trips to nowhere

The stock market has experienced several long, interesting, but ultimately unprofitable trips to nowhere over the past century. These periods have either started at elevated valuations, ended at depressed valuations, or some combination of both. I have little doubt that measured from the present valuation extreme, investors will look back at some future date, more than a decade from now, and find that the S&P 500 has lagged even the depressed yields available on Treasury bills.

Recall that despite two intervening bubbles, the total return of the S&P 500 lagged Treasury bills for the full period from May 1995 to March 2009. What makes this long trip to nowhere “interesting” is that investors during this period had the benefit of two financial bubbles, only to watch every bit of total return over-and-above T-bills

The Hussman Funds

|

Letter to Shareholders (continued) |

wiped out. The total return of the S&P 500 also lagged T-bills from August 1929 to August 1945. Ditto for the full period from August 1959 to August 1982. Taken together, these periods comprise 53 years of the 80-year period from 1929 to 2009.

Of course, one can define other starting and ending points to demonstrate that a combination of elevated starting valuations or depressed ending valuations produce long, interesting trips to nowhere for passive investors. While one cannot know future valuations in advance, starting valuations are directly observable. Given that our most reliable measures of equity market valuation currently exceed the 1929 and 2000 market peaks, it is instructive to remember that the total return of the S&P 500 also lagged Treasury bills for the 13-year period between March 2000 and April 2013. Given that market valuations in April 2013 were among the highest 20% of valuations in history, it should be clear that our concerns about likely equity market returns in the coming years do not rely on the assumption that market valuations will return to levels anywhere near their historical norms.

Our most reliable valuation measures are presently over three times their run-of-the-mill historical norms (where we measure reliability based on correlation with actual subsequent market returns in market cycles across history). In order to simply touch those historical valuation norms, the S&P 500 would have to lose somewhere in the range of 60-70% over the completion of this market cycle – or possibly even over two cycles, as we observed between 2000 and 2009. In that context, it is worth noting that a 63% loss would wipe out the entire total return of the S&P 500 over-and-above Treasury bills since the March 2000 market peak.

I would not be terribly surprised if the completion of this cycle sheds every bit of total return that the S&P 500 has achieved in excess of T-bills since 2000. Fortunately, our investment discipline does not rely on that outcome. I expect that far less “interesting” market outcomes will provide sufficient opportunities for our value-conscious, historically-informed, full-cycle investment approach.

Notes on inflation

While I expect that our attention to valuations, market internals, overextended conditions and the like will help us to navigate the coming market cycles regardless of how the course of inflation unfolds, it is worth observing that inflation is not likely to benefit stocks at these valuations, or provide a meaningful offset to the downside risk we expect over the completion of the market cycle.

The Hussman Funds

|

Letter to Shareholders (continued) |

Across a century of U.S. data, the total return of the S&P 500 has lagged Treasury bills, on average, in periods when inflation has been anywhere above about 2% and rising. The comparison has been particularly hostile to the S&P 500 when market valuations have exceeded their historical norms and the year-over-year CPI inflation rate has advanced anywhere above about 3%.

Historically, the first casualties of rising inflation are market valuations. It is only after valuations have been driven to historically normal or below-average levels that the positive effect of inflation on nominal cash flows dominates the negative impact on valuations. So yes, if inflation is rapid enough, the effect on nominal values can eventually dominate. But given present valuation extremes, I believe that outcome would require the consumer price index to more than triple first.

The effect of inflation in boosting nominal stock market returns is more immediate if valuations begin at depressed levels, as they did in the early 1940’s. In contrast, the economy can sustain quite a bit of inflation without benefit to stocks if valuations begin at elevated levels, as they did in the early 1970’s. Regardless, when we examine the two 10-year periods having the highest trailing CPI inflation rates (the decades ending in March 1951 and September 1981), we find that the 10-year total return of the S&P 500 during those periods fell short of what could have been projected simply based on prevailing valuations at the beginning of those periods.

Put simply, U.S. stocks have actually earned their reputation as “inflation hedges” in periods when inflation is falling, starting valuations are depressed, or both. Once valuations have been crushed, stocks recover lost ground – particularly once the rate of inflation has peaked and begins to normalize. The combination of depressed starting valuations and falling inflation is exactly what contributed to the enormous stock market returns during the disinflationary period between the early 1980s and the 2000 bubble peak. The current environment could not be further from that set of conditions.

Inflation has an enormous psychological component. The Federal Reserve does not disrupt price stability simply by purchasing Treasury bonds and replacing them with base money (which is all that “quantitative easing” entails). Those transactions simply exchange one government liability for another. Nor do government deficits necessarily disrupt price stability. There is a very normal cyclical tendency for deficits to expand during economic recessions and contract during expansions.

The shift from price stability to inflation typically combines an expansion in fiscal deficits, well beyond those that would be “normal” given the position of the economy in the economic cycle, along with a willingness of the Federal Reserve to monetize those extraordinary deficits by purchasing new government debt and creating base money

The Hussman Funds

|

Letter to Shareholders (continued) |

in its place. Examine major episodes of inflation in the U.S. and internationally, and you will find that inflation typically reflects the monetization of what I call “cyclically excessive” government deficits, often in an environment where some supply disruption (energy, labor, productivity) has occurred.

Amid extreme market valuations and near-zero interest rates, we presently observe a combination of extraordinary fiscal deficits and weak monetary discipline. This combination increases the potential for “revulsion” toward government liabilities of all forms. Rising interest rates and inflation typically emerge hand-in-hand. If the Federal Reserve attempts to set a “cap” on long-term interest rates, as it did during World War II, it will likely invite the same sort of rapid inflation that emerged in 1948, and ultimately forced the Fed to abandon that policy.

None of this is a forecast, nor do we require any particular outcome for valuations, interest rates, inflation, or the economy. Our investment discipline requires only that we respond to market conditions as they change over time. We are as comfortable with changes in our exposure to inflation hedges as we are with changes to our stock and bond market exposures. Still, in contrast to Wall Street’s confidence in permanently high plateaus, we believe that it is worth allowing for the possibility that the future will not forever be limited to one familiar and wildly speculative state of the world.

In short, I do not believe that market cycles have ceased to exist. The problem in recent years was that the speculation encouraged by extraordinary monetary policies made historically reliable “limits” to speculation ineffective. As a result, we have become content to gauge the presence of speculation or risk-aversion, without immediately becoming bearish even when speculation has become outrageous. While sufficiently extreme conditions can still hold us to a neutral market outlook, the shift to a bearish outlook requires deterioration or divergence in our measures of market internals, which are our most reliable gauge of whether investor psychology is inclined toward speculation or toward risk-aversion.

Given the most extreme valuations in history, it is tempting to focus strictly on my expectation of a 60-70% market loss over the completion of this cycle, while ignoring the fact that nothing in our investment discipline actually requires that outcome. I believe that we are fully capable of navigating a world where market valuations never again ever visit historical norms. I just think that it is both misguided and unnecessary to rely on that idea.

The Hussman Funds

|

Letter to Shareholders (continued) |

Having adapted our approach to allow for even the most extraordinary policy interventions, we are content to pursue our value-conscious, historically-informed, full-cycle discipline, and to align our investment stance with market conditions as they change over time.

As always, I remain grateful for your trust.

Sincerely,

John P. Hussman, Ph.D.

Past performance is not predictive of future performance. There is no assurance that the Hussman Funds will achieve their investment objectives. Investment results and principal value will fluctuate so that shares of the Funds, when redeemed, may be worth more or less than their original cost. It is possible to lose money when investing in securities. Current performance may be higher or lower than the performance data quoted.

Periodic updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website www.hussmanfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

Estimates of prospective return and risk for equities, bonds and other financial markets are forward-looking statements based the analysis and reasonable beliefs of Hussman Strategic Advisors (the “Adviser”), which serves as the investment adviser of the Funds. They are not a guarantee of future performance and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 reflect valuation methods focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle.

The Hussman Funds

|

Letter to Shareholders (continued) |

This Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for the opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in this Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Adviser with respect to those securities may change at any time.

Hussman Strategic Growth Fund

Portfolio Information |

December 31, 2020 (Unaudited) |

Sector Allocation* (% of Common Stocks)

* | As of December 31, 2020, the Fund held no securities in the Utilities sector. |

Hussman Strategic Allocation Fund

Portfolio Information |

December 31, 2020 (Unaudited) |

Asset Allocation (% of Net Assets)

Hussman Strategic Allocation Fund

Portfolio Information (continued) |

December 31, 2020 (Unaudited) |

Sector Allocation* (% of Common Stocks)

* | As of December 31, 2020, the Fund held no securities in the Utilities sector. |

Hussman Strategic Total Return Fund

Portfolio Information |

December 31, 2020 (Unaudited) |

Asset Allocation (% of Net Assets)

Hussman Strategic International Fund

Portfolio Information |

December 31, 2020 (Unaudited) |

Sector Allocation (% of Common Stocks)

Country Allocation (% of Common Stocks)

Hussman Strategic Growth Fund

Schedule of Investments |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 103.2% | | Shares | | | Value | |

Communications — 8.7% | | | | | | | | |

Cable & Satellite — 0.5% | | | | | | | | |

Sirius XM Holdings, Inc. | | | 250,000 | | | $ | 1,592,500 | |

| | | | | | | | | |

Entertainment Content — 2.1% | | | | | | | | |

AMC Networks, Inc. - Class A (a) | | | 80,000 | | | | 2,861,600 | |

Electronic Arts, Inc. | | | 12,000 | | | | 1,723,200 | |

ViacomCBS, Inc. - Class B | | | 50,000 | | | | 1,863,000 | |

| | | | | | | | 6,447,800 | |

Internet Media & Services — 3.3% | | | | | | | | |

Alphabet, Inc. - Class C (a) | | | 500 | | | | 875,940 | |

Baidu, Inc. - ADR (a) | | | 8,000 | | | | 1,729,920 | |

Facebook, Inc. - Class A (a) | | | 2,000 | | | | 546,320 | |

GrubHub, Inc. (a) | | | 25,000 | | | | 1,856,750 | |

Shutterstock, Inc. | | | 30,000 | | | | 2,151,000 | |

Stamps.com, Inc. (a) | | | 15,000 | | | | 2,942,850 | |

TrueCar, Inc. (a) | | | 80,000 | | | | 336,000 | |

| | | | | | | | 10,438,780 | |

Publishing & Broadcasting — 1.4% | | | | | | | | |

Gray Television, Inc. (a) | | | 200,000 | | | | 3,578,000 | |

Meredith Corporation | | | 35,000 | | | | 672,000 | |

Urban One, Inc. (a) | | | 20,000 | | | | 84,200 | |

| | | | | | | | 4,334,200 | |

Telecommunications — 1.4% | | | | | | | | |

AT&T, Inc. | | | 75,000 | | | | 2,157,000 | |

CenturyLink, Inc. | | | 60,000 | | | | 585,000 | |

Consolidated Communications Holdings, Inc. (a) | | | 120,000 | | | | 586,800 | |

Verizon Communications, Inc. | | | 20,000 | | | | 1,175,000 | |

| | | | | | | | 4,503,800 | |

Consumer Discretionary — 29.5% | | | | | | | | |

Apparel & Textile Products — 1.0% | | | | | | | | |

Capri Holdings Ltd. (a) | | | 25,000 | | | | 1,050,000 | |

Hanesbrands, Inc. | | | 150,000 | | | | 2,187,000 | |

| | | | | | | | 3,237,000 | |

Automotive — 0.3% | | | | | | | | |

Tenneco, Inc. - Class A (a) | | | 75,000 | | | | 795,000 | |

| | | | | | | | | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 103.2% (continued) | | Shares | | | Value | |

Consumer Discretionary — 29.5% (continued) | | | | | | | | |

Consumer Services — 2.1% | | | | | | | | |

2U, Inc. (a) | | | 80,000 | | | $ | 3,200,800 | |

Medifast, Inc. | | | 2,500 | | | | 490,850 | |

Stride, Inc. (a) | | | 75,000 | | | | 1,592,250 | |

WW International, Inc. (a) | | | 50,000 | | | | 1,220,000 | |

| | | | | | | | 6,503,900 | |

E-Commerce Discretionary — 3.0% | | | | | | | | |

Amazon.com, Inc. (a) | | | 250 | | | | 814,232 | |

Chewy, Inc. - Class A (a) | | | 6,000 | | | | 539,340 | |

eBay, Inc. | | | 60,000 | | | | 3,015,000 | |

Etsy, Inc. (a) | | | 10,000 | | | | 1,779,100 | |

PetMed Express, Inc. | | | 100,000 | | | | 3,206,000 | |

| | | | | | | | 9,353,672 | |

Home & Office Products — 1.9% | | | | | | | | |

ACCO Brands Corporation | | | 75,000 | | | | 633,750 | |

iRobot Corporation (a) | | | 40,000 | | | | 3,211,600 | |

Tupperware Brands Corporation (a) | | | 65,000 | | | | 2,105,350 | |

| | | | | | | | 5,950,700 | |

Home Construction — 3.8% | | | | | | | | |

Century Communities, Inc. (a) | | | 75,000 | | | | 3,283,500 | |

D.R. Horton, Inc. | | | 20,000 | | | | 1,378,400 | |

Lennar Corporation - Class A | | | 20,000 | | | | 1,524,600 | |

LGI Homes, Inc. (a) | | | 10,000 | | | | 1,058,500 | |

M/I Homes, Inc. (a) | | | 25,000 | | | | 1,107,250 | |

Meritage Homes Corporation (a) | | | 10,000 | | | | 828,200 | |

PulteGroup, Inc. | | | 20,000 | | | | 862,400 | |

Toll Brothers, Inc. | | | 25,000 | | | | 1,086,750 | |

TRI Pointe Group, Inc. (a) | | | 50,000 | | | | 862,500 | |

| | | | | | | | 11,992,100 | |

Leisure Facilities & Services — 1.6% | | | | | | | | |

Brinker International, Inc. | | | 20,000 | | | | 1,131,400 | |

Domino’s Pizza, Inc. | | | 7,000 | | | | 2,684,220 | |

Waitr Holdings, Inc. (a) | | | 400,000 | | | | 1,112,000 | |

| | | | | | | | 4,927,620 | |

Leisure Products — 1.0% | | | | | | | | |

Malibu Boats, Inc. - Class A (a) | | | 40,000 | | | | 2,497,600 | |

Thor Industries, Inc. | | | 8,000 | | | | 743,920 | |

| | | | | | | | 3,241,520 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 103.2% (continued) | | Shares | | | Value | |

Consumer Discretionary — 29.5% (continued) | | | | | | | | |

Retail - Discretionary — 14.8% | | | | | | | | |

At Home Group, Inc. (a) | | | 75,000 | | | $ | 1,159,500 | |

Bed Bath & Beyond, Inc. | | | 80,000 | | | | 1,420,800 | |

Big 5 Sporting Goods Corporation | | | 150,000 | | | | 1,531,500 | |

Buckle, Inc. (The) | | | 25,000 | | | | 730,000 | |

Designer Brands, Inc. - Class A | | | 50,000 | | | | 382,500 | |

Dick’s Sporting Goods, Inc. | | | 55,000 | | | | 3,091,550 | |

Duluth Holdings, Inc. - Class B (a) | | | 140,000 | | | | 1,478,400 | |

GameStop Corporation - Class A (a) | | | 120,000 | | | | 2,260,800 | |

Gap, Inc. (The) | | | 25,000 | | | | 504,750 | |

Hibbett Sports, Inc. (a) | | | 80,000 | | | | 3,694,400 | |

Home Depot, Inc. (The) | | | 7,500 | | | | 1,992,150 | |

Kohl’s Corporation | | | 80,000 | | | | 3,255,200 | |

L Brands, Inc. | | | 25,000 | | | | 929,750 | |

Lumber Liquidators Holdings, Inc. (a) | | | 50,000 | | | | 1,537,000 | |

Macy’s, Inc. | | | 160,000 | | | | 1,800,000 | |

MarineMax, Inc. (a) | | | 50,000 | | | | 1,751,500 | |

Michaels Companies, Inc. (The) (a) | | | 200,000 | | | | 2,602,000 | |

Nordstrom, Inc. | | | 20,000 | | | | 624,200 | |

Sally Beauty Holdings, Inc. (a) | | | 200,000 | | | | 2,608,000 | |

Sleep Number Corporation (a) | | | 25,000 | | | | 2,046,500 | |

Sportman’s Warehouse Holdings, Inc. (a) | | | 50,000 | | | | 877,500 | |

Tractor Supply Company | | | 20,000 | | | | 2,811,600 | |

Ulta Beauty, Inc. (a) | | | 8,000 | | | | 2,297,280 | |

Urban Outfitters, Inc. (a) | | | 50,000 | | | | 1,280,000 | |

Williams-Sonoma, Inc. | | | 20,000 | | | | 2,036,800 | |

Zumiez, Inc. (a) | | | 50,000 | | | | 1,839,000 | |

| | | | | | | | 46,542,680 | |

Consumer Staples — 13.2% | | | | | | | | |

Food — 4.1% | | | | | | | | |

B&G Foods, Inc. | | | 100,000 | | | | 2,773,000 | |

Campbell Soup Company | | | 40,000 | | | | 1,934,000 | |

General Mills, Inc. | | | 35,000 | | | | 2,058,000 | |

J.M. Smucker Company (The) | | | 20,000 | | | | 2,312,000 | |

Kellogg Company | | | 25,000 | | | | 1,555,750 | |

LifeVantage Corporation (a) | | | 25,000 | | | | 233,000 | |

USANA Health Sciences, Inc. (a) | | | 25,000 | | | | 1,927,500 | |

| | | | | | | | 12,793,250 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 103.2% (continued) | | Shares | | | Value | |

Consumer Staples — 13.2% (continued) | | | | | | | | |

Household Products — 0.9% | | | | | | | | |

Clearwater Paper Corporation (a) | | | 15,000 | | | $ | 566,250 | |

Nu Skin Enterprises, Inc. - Class A | | | 40,000 | | | | 2,185,200 | |

| | | | | | | | 2,751,450 | |

Retail - Consumer Staples — 8.2% | | | | | | | | |

Big Lots, Inc. | | | 75,000 | | | | 3,219,750 | |

Dollar General Corporation | | | 4,000 | | | | 841,200 | |

Ingles Markets, Inc. - Class A | | | 65,000 | | | | 2,772,900 | |

Kroger Company (The) | | | 100,000 | | | | 3,176,000 | |

Natural Grocers by Vitamin Cottage, Inc. | | | 75,000 | | | | 1,030,500 | |

Ollie’s Bargain Outlet Holdings, Inc. (a) | | | 25,000 | | | | 2,044,250 | |

Rite Aid Corporation (a) | | | 175,000 | | | | 2,770,250 | |

Sprouts Farmers Market, Inc. (a) | | | 150,000 | | | | 3,015,000 | |

United Natural Foods, Inc. (a) | | | 200,000 | | | | 3,194,000 | |

Walgreens Boots Alliance, Inc. | | | 75,000 | | | | 2,991,000 | |

Weis Markets, Inc. | | | 16,000 | | | | 764,960 | |

| | | | | | | | 25,819,810 | |

Energy — 2.2% | | | | | | | | |

Renewable Energy — 2.2% | | | | | | | | |

Aemetis, Inc. (a) | | | 30,000 | | | | 74,700 | |

Broadwind, Inc. (a) | | | 65,000 | | | | 515,450 | |

Canadian Solar, Inc. (a) | | | 40,000 | | | | 2,049,600 | |

First Solar, Inc. (a) | | | 10,000 | | | | 989,200 | |

JinkoSolar Holding Company Ltd. - ADR (a) | | | 15,000 | | | | 928,050 | |

Renewable Energy Group, Inc. (a) | | | 10,000 | | | | 708,200 | |

SolarEdge Technologies, Inc. (a) | | | 2,000 | | | | 638,240 | |

Sunworks, Inc. (a) | | | 200,000 | | | | 1,024,000 | |

| | | | | | | | 6,927,440 | |

Financials — 6.1% | | | | | | | | |

Asset Management — 0.8% | | | | | | | | |

BrightSphere Investment Group, Inc. | | | 35,000 | | | | 674,800 | |

Federated Hermes, Inc. | | | 50,000 | | | | 1,444,500 | |

Ranpak Holdings Corporation (a) | | | 25,000 | | | | 336,000 | |

| | | | | | | | 2,455,300 | |

Banking — 0.4% | | | | | | | | |

Signature Bank | | | 10,000 | | | | 1,352,900 | |

| | | | | | | | | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 103.2% (continued) | | Shares | | | Value | |

Financials — 6.1% (continued) | | | | | | | | |

Institutional Financial Services — 1.6% | | | | | | | | |

State Street Corporation | | | 20,000 | | | $ | 1,455,600 | |

StoneX Group, Inc. (a) | | | 40,000 | | | | 2,316,000 | |

Virtu Financial, Inc. - Class A | | | 50,000 | | | | 1,258,500 | |

| | | | | | | | 5,030,100 | |

Insurance — 1.3% | | | | | | | | |

Allstate Corporation (The) | | | 12,000 | | | | 1,319,160 | |

Principal Financial Group, Inc. | | | 35,000 | | | | 1,736,350 | |

Progressive Corporation (The) | | | 10,000 | | | | 988,800 | |

| | | | | | | | 4,044,310 | |

Specialty Finance — 2.0% | | | | | | | | |

AerCap Holdings N.V. (a) | | | 16,000 | | | | 729,280 | |

Air Lease Corporation | | | 10,000 | | | | 444,200 | |

American Express Company | | | 4,000 | | | | 483,640 | |

Discover Financial Services | | | 12,000 | | | | 1,086,360 | |

Navient Corporation | | | 75,000 | | | | 736,500 | |

Synchrony Financial | | | 80,000 | | | | 2,776,800 | |

| | | | | | | | 6,256,780 | |

Health Care — 17.3% | | | | | | | | |

Biotech & Pharma — 9.2% | | | | | | | | |

ADMA Biologics, Inc. (a) | | | 80,000 | | | | 156,000 | |

Amgen, Inc. | | | 12,000 | | | | 2,759,040 | |

Amneal Pharmaceuticals, Inc. (a) | | | 120,000 | | | | 548,400 | |

ANI Pharmaceuticals, Inc. (a) | | | 30,000 | | | | 871,200 | |

Biogen, Inc. (a) | | | 12,000 | | | | 2,938,320 | |

Celldex Therapeutics, Inc. (a) | | | 25,000 | | | | 438,000 | |

Corcept Therapeutics, Inc. (a) | | | 140,000 | | | | 3,662,400 | |

CRISPR Therapeutics AG (a) | | | 10,000 | | | | 1,531,100 | |

Editas Medicine, Inc. (a) | | | 30,000 | | | | 2,103,300 | |

electroCore, Inc. (a) | | | 120,000 | | | | 187,200 | |

Exelixis, Inc. (a) | | | 100,000 | | | | 2,007,000 | |

Gilead Sciences, Inc. | | | 20,000 | | | | 1,165,200 | |

ImmunoGen, Inc. (a) | | | 80,000 | | | | 516,000 | |

Innoviva, Inc. (a) | | | 50,000 | | | | 619,500 | |

Jazz Pharmaceuticals plc (a) | | | 20,000 | | | | 3,301,000 | |

Jounce Therapeutics, Inc. (a) | | | 50,000 | | | | 350,000 | |

Lannett Company, Inc. (a) | | | 7,500 | | | | 48,900 | |

Pulmatrix, Inc. (a) | | | 200,000 | | | | 238,000 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 103.2% (continued) | | Shares | | | Value | |

Health Care — 17.3% (continued) | | | | | | | | |

Biotech & Pharma — 9.2% (continued) | | | | | | | | |

Supernus Pharmaceuticals, Inc. (a) | | | 50,000 | | | $ | 1,258,000 | |

United Therapeutics Corporation (a) | | | 10,000 | | | | 1,517,900 | |

Vanda Pharmaceuticals, Inc. (a) | | | 50,000 | | | | 657,000 | |

Vertex Pharmaceuticals, Inc. (a) | | | 5,000 | | | | 1,181,700 | |

Viatris, Inc. (a) | | | 40,000 | | | | 749,600 | |

| | | | | | | | 28,804,760 | |

Health Care Facilities & Services — 5.0% | | | | | | | | |

AdaptHealth Corporation (a) | | | 20,000 | | | | 751,200 | |

AmerisourceBergen Corporation | | | 20,000 | | | | 1,955,200 | |

Cigna Corporation | | | 12,000 | | | | 2,498,160 | |

Community Health Systems, Inc. (a) | | | 100,000 | | | | 743,000 | |

CVS Health Corporation | | | 40,000 | | | | 2,732,000 | |

Ontrak, Inc. (a) | | | 20,000 | | | | 1,235,800 | |

Owens & Minor, Inc. | | | 80,000 | | | | 2,164,000 | |

Patterson Companies, Inc. | | | 70,000 | | | | 2,074,100 | |

Tivity Health, Inc. (a) | | | 75,000 | | | | 1,469,250 | |

| | | | | | | | 15,622,710 | |

Medical Equipment & Devices — 3.1% | | | | | | | | |

Accuray, Inc. (a) | | | 80,000 | | | | 333,600 | |

Alpha Pro Tech Ltd. (a) | | | 100,000 | | | | 1,115,000 | |

Fluidigm Corporation (a) | | | 200,000 | | | | 1,200,000 | |

GenMark Diagnostics, Inc. (a) | | | 35,000 | | | | 511,000 | |

Inogen, Inc. (a) | | | 60,000 | | | | 2,680,800 | |

Luminex Corporation | | | 75,000 | | | | 1,734,000 | |

Meridian Bioscience, Inc. (a) | | | 125,000 | | | | 2,336,250 | |

| | | | | | | | 9,910,650 | |

Industrials — 3.8% | | | | | | | | |

Commercial Support Services — 1.3% | | | | | | | | |

ASGN, Inc. (a) | | | 10,000 | | | | 835,300 | |

Cimpress plc (a) | | | 30,000 | | | | 2,632,200 | |

H&R Block, Inc. | | | 35,000 | | | | 555,100 | |

| | | | | | | | 4,022,600 | |

Electrical Equipment — 0.4% | | | | | | | | |

Bloom Energy Corporation - Class A (a) | | | 28,000 | | | | 802,480 | |

WidePoint Corporation (a) | | | 50,000 | | | | 505,500 | |

| | | | | | | | 1,307,980 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 103.2% (continued) | | Shares | | | Value | |

Industrials — 3.8% (continued) | | | | | | | | |

Engineering & Construction — 0.4% | | | | | | | | |

Infrastructure & Energy Alternatives, Inc. (a) | | | 75,000 | | | $ | 1,242,750 | |

| | | | | | | | | |

Industrial Intermediate Products — 0.2% | | | | | | | | |

Proto Labs, Inc. (a) | | | 4,000 | | | | 613,600 | |

| | | | | | | | | |

Industrial Support Services — 0.3% | | | | | | | | |

MSC Industrial Direct Company, Inc. - Class A | | | 10,000 | | | | 843,900 | |

| | | | | | | | | |

Transportation & Logistics — 1.2% | | | | | | | | |

C.H. Robinson Worldwide, Inc. | | | 25,000 | | | | 2,346,750 | |

Cryoport, Inc. (a) | | | 10,000 | | | | 438,800 | |

Expeditors International of Washington, Inc. | | | 10,000 | | | | 951,100 | |

| | | | | | | | 3,736,650 | |

Materials — 5.2% | | | | | | | | |

Chemicals — 1.0% | | | | | | | | |

Ingevity Corporation (a) | | | 10,000 | | | | 757,300 | |

Kraton Corporation (a) | | | 40,000 | | | | 1,111,600 | |

Valvoline, Inc. | | | 50,000 | | | | 1,157,000 | |

| | | | | | | | 3,025,900 | |

Containers & Packaging — 1.2% | | | | | | | | |

Berry Global Group, Inc. (a) | | | 50,000 | | | | 2,809,500 | |

Silgan Holdings, Inc. | | | 30,000 | | | | 1,112,400 | |

| | | | | | | | 3,921,900 | |

Metals & Mining — 3.0% | | | | | | | | |

Agnico Eagle Mines Ltd. | | | 15,000 | | | | 1,057,650 | |

AngloGold Ashanti Ltd. - ADR | | | 25,000 | | | | 565,500 | |

Barrick Gold Corporation | | | 110,000 | | | | 2,505,800 | |

Compass Minerals International, Inc. | | | 20,000 | | | | 1,234,400 | |

Kinross Gold Corporation | | | 75,000 | | | | 550,500 | |

Newmont Corporation | | | 50,000 | | | | 2,994,500 | |

Royal Gold, Inc. | | | 4,000 | | | | 425,440 | |

| | | | | | | | 9,333,790 | |

Real Estate — 0.3% | | | | | | | | |

Real Estate Services — 0.3% | | | | | | | | |

eXp World Holdings, Inc. (a) | | | 15,000 | | | | 946,800 | |

| | | | | | | | | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 103.2% (continued) | | Shares | | | Value | |

Technology — 16.9% | | | | | | | | |

Semiconductors — 1.1% | | | | | | | | |

Intel Corporation | | | 70,000 | | | $ | 3,487,400 | |

| | | | | | | | | |

Software — 4.6% | | | | | | | | |

Akamai Technologies, Inc. (a) | | | 10,000 | | | | 1,049,900 | |

Citrix Systems, Inc. | | | 12,000 | | | | 1,561,200 | |

Cloudera, Inc. (a) | | | 80,000 | | | | 1,112,800 | |

Ebix, Inc. | | | 35,000 | | | | 1,328,950 | |

Evolent Health, Inc. - Class A (a) | | | 100,000 | | | | 1,603,000 | |

Fortinet, Inc. (a) | | | 6,000 | | | | 891,180 | |

Microsoft Corporation | | | 500 | | | | 111,210 | |

Oracle Corporation | | | 20,000 | | | | 1,293,800 | |

Qualys, Inc. (a) | | | 10,000 | | | | 1,218,700 | |

SciPlay Corporation - Class A (a) | | | 50,000 | | | | 692,500 | |

VirnetX Holding Corporation | | | 100,000 | | | | 504,000 | |

VMware, Inc. - Class A (a) | | | 15,000 | | | | 2,103,900 | |

Zoom Video Communications, Inc. - Class A (a) | | | 2,500 | | | | 843,300 | |

| | | | | | | | 14,314,440 | |

Technology Hardware — 7.7% | | | | | | | | |

Apple, Inc. | | | 4,000 | | | | 530,760 | |

Arista Networks, Inc. (a) | | | 4,000 | | | | 1,162,280 | |

Ciena Corporation (a) | | | 40,000 | | | | 2,114,000 | |

Cisco Systems, Inc. | | | 40,000 | | | | 1,790,000 | |

Clearfield, Inc. (a) | | | 34,500 | | | | 852,840 | |

F5 Networks, Inc. (a) | | | 8,000 | | | | 1,407,520 | |

Infinera Corporation (a) | | | 160,000 | | | | 1,676,800 | |

Juniper Networks, Inc. | | | 50,000 | | | | 1,125,500 | |

Maxar Technologies, Inc. | | | 40,000 | | | | 1,543,600 | |

NetApp, Inc. | | | 20,000 | | | | 1,324,800 | |

Plantronics, Inc. | | | 40,000 | | | | 1,081,200 | |

Ribbon Communications, Inc. (a) | | | 150,000 | | | | 984,000 | |

Seagate Technology plc | | | 10,000 | | | | 621,600 | |

Super Micro Computer, Inc. (a) | | | 75,000 | | | | 2,374,500 | |

SYNNEX Corporation | | | 10,000 | | | | 814,400 | |

Turtle Beach Corporation (a) | | | 125,000 | | | | 2,693,750 | |

Ubiquiti, Inc. | | | 8,000 | | | | 2,228,080 | |

| | | | | | | | 24,325,630 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 103.2% (continued) | | Shares | | | Value | |

Technology — 16.9% (continued) | | | | | | | | |

Technology Services — 3.5% | | | | | | | | |

Cognizant Technology Solutions Corporation - Class A | | | 32,500 | | | $ | 2,663,375 | |

FactSet Research Systems, Inc. | | | 2,500 | | | | 831,250 | |

Green Dot Corporation - Class A (a) | | | 20,000 | | | | 1,116,000 | |

Infosys Ltd. - ADR | | | 150,000 | | | | 2,542,500 | |

International Business Machines Corporation | | | 10,000 | | | | 1,258,800 | |

NIC, Inc. | | | 100,000 | | | | 2,583,000 | |

| | | | | | | | 10,994,925 | |

| | | | | | | | | |

Total Common Stocks (Cost $280,824,102) (b) | | | | | | $ | 323,748,997 | |

EXCHANGE-TRADED PUT OPTION CONTRACTS — 0.7% | | Contracts | | | Notional

Amount | | | Value | |

Russell 2000 Index Option, 03/19/2021 at $1,450 | | | 700 | | | $ | 138,239,850 | | | $ | 627,900 | |

S&P 500 Index Option, 03/19/2021 at $3,200 | | | 480 | | | | 180,291,360 | | | | 1,520,160 | |

Total Put Option Contracts (Cost $8,238,294) | | | | | | $ | 318,531,210 | | | $ | 2,148,060 | |

| | | | | | | | | | | | | |

Total Investments at Value — 103.9% (Cost $289,062,396) | | | | | | | | | | $ | 325,897,057 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

MONEY MARKET FUNDS — 44.0% | | Shares | | | Value | |

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.01% (c) (Cost $137,977,882) | | | 137,977,882 | | | $ | 137,977,882 | |

| | | | | | | | | |

Total Investments and Money Market Funds at Value — 147.9% (Cost $427,040,278) | | | | | | $ | 463,874,939 | |

| | | | | | | | | |

Written Call Option Contracts — (48.4%) | | | | | | | (151,798,180 | ) |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.5% | | | | | | | 1,671,591 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 313,748,350 | |

ADR - American Depositary Receipt. |

(a) | Non-income producing security. |

(b) | Common stocks owned by the Fund are held in escrow by the Fund’s custodian (or by a securities depository) to secure the Fund’s obligations to settle outstanding call option contracts it has written (Note 1). |

(c) | The rate shown is the 7-day effective yield as of December 31, 2020. |

See accompanying notes to financial statements. |

Hussman Strategic Growth Fund

Schedule of Open Written Option Contracts |

December 31, 2020 (Unaudited) |

EXCHANGE-TRADED WRITTEN CALL OPTION CONTRACTS | | Contracts | | | Notional

Amount | | | Strike

Price | | | Expiration

Date | | | Value of

Options | |

Call Option Contracts |

Russell 2000 Index Option | | | 700 | | | $ | 138,239,850 | | | $ | 1,000 | | | | 03/19/2021 | | | $ | 68,011,300 | |

S&P 500 Index Option | | | 480 | | | | 180,291,360 | | | | 2,000 | | | | 03/19/2021 | | | | 83,786,880 | |

Total Written Call Option Contracts (Premiums received $129,142,424) | | | | | | $ | 318,531,210 | | | | | | | | | | | $ | 151,798,180 | |

See accompanying notes to financial statements. |

Hussman Strategic Allocation Fund

Schedule of Investments |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 55.7% | | Shares | | | Value | |

Communications — 4.7% | | | | | | | | |

Cable & Satellite — 0.3% | | | | | | | | |

Sirius XM Holdings, Inc. | | | 6,000 | | | $ | 38,220 | |

| | | | | | | | | |

Entertainment Content — 1.1% | | | | | | | | |

AMC Networks, Inc. - Class A (a) | | | 2,000 | | | | 71,540 | |

Electronic Arts, Inc. | | | 300 | | | | 43,080 | |

ViacomCBS, Inc. - Class B | | | 1,000 | | | | 37,260 | |

| | | | | | | | 151,880 | |

Internet Media & Services — 1.6% | | | | | | | | |

Alphabet, Inc. - Class C (a) | | | 10 | | | | 17,519 | |

Baidu, Inc. - ADR (a) | | | 200 | | | | 43,248 | |

Facebook, Inc. - Class A (a) | | | 40 | | | | 10,926 | |

GrubHub, Inc. (a) | | | 500 | | | | 37,135 | |

Shutterstock, Inc. | | | 600 | | | | 43,020 | |

Stamps.com, Inc. (a) | | | 300 | | | | 58,857 | |

TrueCar, Inc. (a) | | | 2,000 | | | | 8,400 | |

| | | | | | | | 219,105 | |

Publishing & Broadcasting — 0.8% | | | | | | | | |

Gray Television, Inc. (a) | | | 5,000 | | | | 89,450 | |

Meredith Corporation | | | 700 | | | | 13,440 | |

Urban One, Inc. (a) | | | 500 | | | | 2,105 | |

| | | | | | | | 104,995 | |

Telecommunications — 0.9% | | | | | | | | |

AT&T, Inc. | | | 2,000 | | | | 57,520 | |

CenturyLink, Inc. | | | 2,000 | | | | 19,500 | |

Consolidated Communications Holdings, Inc. (a) | | | 3,000 | | | | 14,670 | |

Verizon Communications, Inc. | | | 400 | | | | 23,500 | |

| | | | | | | | 115,190 | |

Consumer Discretionary — 16.1% | | | | | | | | |

Apparel & Textile Products — 0.6% | | | | | | | | |

Capri Holdings Ltd. (a) | | | 500 | | | | 21,000 | |

Hanesbrands, Inc. | | | 3,750 | | | | 54,675 | |

| | | | | | | | 75,675 | |

Automotive — 0.1% | | | | | | | | |

Tenneco, Inc. - Class A (a) | | | 1,500 | | | | 15,900 | |

| | | | | | | | | |

Hussman Strategic Allocation Fund

Schedule of Investments (continued) |

December 31, 2020 (Unaudited) |

COMMON STOCKS — 55.7% (continued) | | Shares | | | Value | |

Consumer Discretionary — 16.1% (continued) | | | | | | | | |

Consumer Services — 1.1% | | | | | | | | |

2U, Inc. (a) | | | 2,000 | | | $ | 80,020 | |

Medifast, Inc. | | | 50 | | | | 9,817 | |

Stride, Inc. (a) | | | 1,500 | | | | 31,845 | |

WW International, Inc. (a) | | | 1,000 | | | | 24,400 | |

| | | | | | | | 146,082 | |

E-Commerce Discretionary — 1.8% | | | | | | | | |

Amazon.com, Inc. (a) | | | 6 | | | | 19,542 | |

Chewy, Inc. - Class A (a) | | | 150 | | | | 13,483 | |

eBay, Inc. | | | 1,500 | | | | 75,375 | |

Etsy, Inc. (a) | | | 250 | | | | 44,478 | |

PetMed Express, Inc. | | | 2,500 | | | | 80,150 | |

| | | | | | | | 233,028 | |

Home & Office Products — 1.1% | | | | | | | | |

ACCO Brands Corporation | | | 2,000 | | | | 16,900 | |

iRobot Corporation (a) | | | 1,000 | | | | 80,290 | |

Tupperware Brands Corporation (a) | | | 1,625 | | | | 52,634 | |

| | | | | | | | 149,824 | |

Home Construction — 2.0% | | | | | | | | |

Century Communities, Inc. (a) | | | 1,875 | | | | 82,088 | |

D.R. Horton, Inc. | | | 400 | | | | 27,568 | |

Lennar Corporation - Class A | | | 400 | | | | 30,492 | |

LGI Homes, Inc. (a) | | | 250 | | | | 26,462 | |

M/I Homes, Inc. (a) | | | 500 | | | | 22,145 | |

Meritage Homes Corporation (a) | | | 250 | | | | 20,705 | |

PulteGroup, Inc. | | | 500 | | | | 21,560 | |

Toll Brothers, Inc. | | | 500 | | | | 21,735 | |

TRI Pointe Group, Inc. (a) | | | 1,000 | | | | 17,250 | |

| | | | | | | | 270,005 | |

Leisure Facilities & Services — 0.8% | | | | | | | | |

Brinker International, Inc. | | | 500 | | | | 28,285 | |

Domino’s Pizza, Inc. | | | 140 | | | | 53,684 | |

Waitr Holdings, Inc. (a) | | | 10,000 | | | | 27,800 | |

| | | | | | | | 109,769 | |

Leisure Products — 0.6% | | | | | | | | |

Malibu Boats, Inc. - Class A (a) | | | 1,000 | | | | 62,440 | |

Thor Industries, Inc. | | | 200 | | | | 18,598 | |

| | | | | | | | 81,038 | |