UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-09911 | |

Hussman Investment Trust

(Exact name of registrant as specified in charter)

6021 University Boulevard, Suite 490 Ellicott City, Maryland | 21043 |

| (Address of principal executive offices) | (Zip code) |

David K. James

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | June 30 | |

| | | |

| Date of reporting period: | December 31, 2023 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

HUSSMAN INVESTMENT TRUST

HUSSMAN STRATEGIC GROWTH FUND

HUSSMAN STRATEGIC ALLOCATION FUND

HUSSMAN STRATEGIC TOTAL RETURN FUND

SEMI-ANNUAL REPORT

December 31, 2023

(Unaudited)

Table of Contents

| | |

Performance Information | |

Hussman Strategic Growth Fund | 1 |

Hussman Strategic Allocation Fund | 2 |

Hussman Strategic Total Return Fund | 3 |

Letter to Shareholders | 4 |

Portfolio Information | 17 |

Schedules of Investments | |

Hussman Strategic Growth Fund | 19 |

Hussman Strategic Allocation Fund | 29 |

Hussman Strategic Total Return Fund | 40 |

Statements of Assets and Liabilities | 43 |

Statements of Operations | 44 |

Statements of Changes in Net Assets | |

Hussman Strategic Growth Fund | 46 |

Hussman Strategic Allocation Fund | 47 |

Hussman Strategic Total Return Fund | 48 |

Financial Highlights | |

Hussman Strategic Growth Fund | 49 |

Hussman Strategic Allocation Fund | 50 |

Hussman Strategic Total Return Fund | 51 |

Notes to Financial Statements | 52 |

About Your Funds’ Expenses | 72 |

Other Information | 74 |

Privacy Notice | 75 |

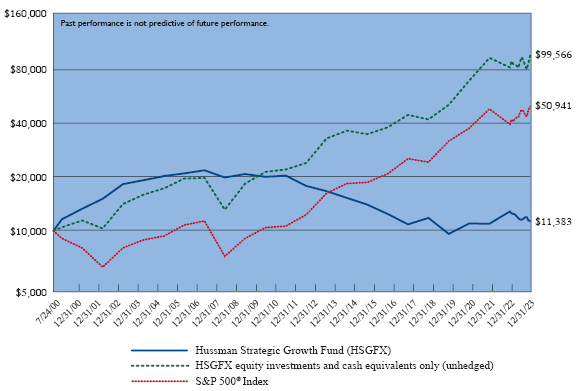

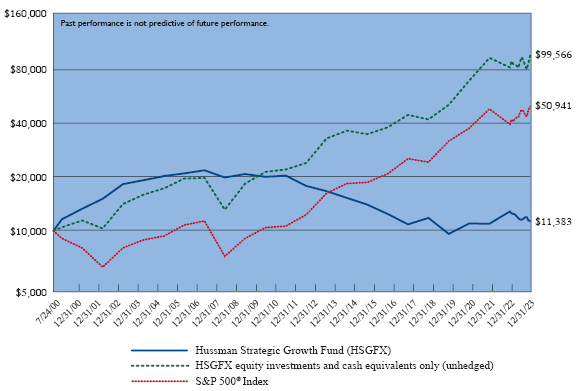

Hussman Strategic Growth Fund

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic Growth Fund versus the S&P 500® Index(a) (Unaudited)

Average Annual Total Returns For the Periods Ended December 31, 2023 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic Growth Fund(c)(d) | -11.61% | 1.14% | -0.78% | -3.82% | 0.55% | |

S&P 500® Index | 26.29% | 10.00% | 15.69% | 12.03% | 7.19% | |

(a) | Hussman Strategic Growth Fund invests primarily in stocks listed on the New York, American, and NASDAQ exchanges and varies its investment exposure to market fluctuations depending on market conditions. The S&P 500® Index is an index of large capitalization stocks. However, the Fund may invest in securities that are not included in the S&P 500® Index and there are no restrictions as to the market capitalization of companies in which the Fund invests. “HSGFX equity investments and cash equivalents only (unhedged)” reflects the performance of the Fund’s stock investments and modest day-to-day cash balances, after fees and expenses, and does not reflect the impact of hedging transactions on the Fund’s overall investment performance. The Fund’s unhedged equity investments do not represent a separately available portfolio, and their performance is presented solely for purposes of comparison and performance attribution. Performance data presented using log scale. Each segment on the vertical axis represents an equivalent percentage change. |

(b) | The Fund commenced operations on July 24, 2000. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2024 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.15% annually of the Fund’s average daily net assets. Absent this arrangement and past fee recoveries, the expense ratio of the Fund (annualized) for the six months ended December 31, 2023 would have been 1.14%. |

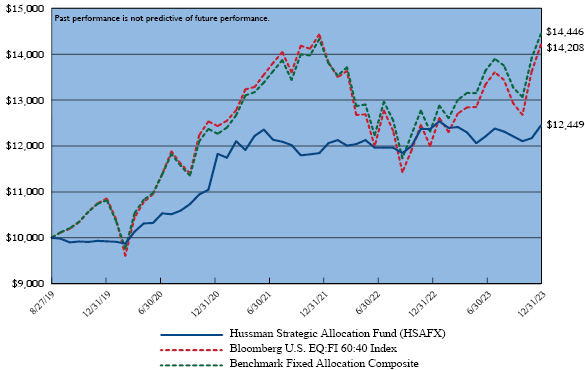

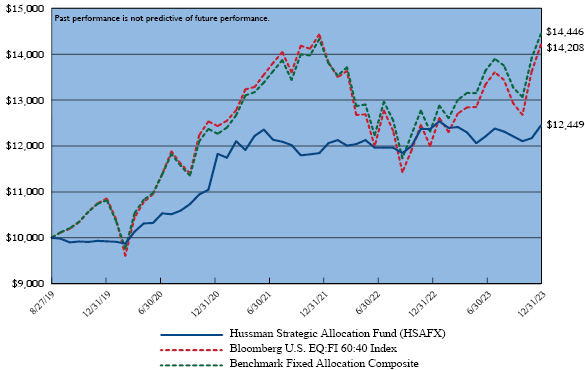

Hussman Strategic Allocation Fund

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Allocation Fund versus the Bloomberg U.S. EQ:FI 60:40 Index(a) (Unaudited) and Benchmark Fixed Allocation Composite(a) (Unaudited)

Average Annual Total Returns For the Periods Ended December 31, 2023 |

| | 1 Year | 3 Years | Since

Inception(b) |

Hussman Strategic Allocation Fund(c)(d) | 0.65% | 4.06% | 5.17% |

Bloomberg U.S. EQ:FI 60:40 Index | 18.40% | 4.26% | 8.41% |

Benchmark Fixed Allocation Composite | 17.29% | 5.30% | 8.83% |

(a) | The Bloomberg U.S. EQ:FI 60:40 Index is designed to measure cross-asset market performance in the U.S. The index rebalances monthly to 60% equities and 40% fixed income. The equity and fixed income allocation is represented by Bloomberg U.S. Large Cap Index and U.S. Aggregate Bond Index. Benchmark Fixed Allocation Composite represents the gross investment performance of a portfolio that is invested in securities included in three separate indices, weighted as follows: 60% S&P 500® Index, 30% Bloomberg U.S. Treasury Unhedged Index and 10% Bloomberg U.S. Treasury Bills Index. The S&P 500 Index is an index of the 500 largest U.S. large capitalization stocks. The Bloomberg U.S. Treasury Unhedged Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury. The Bloomberg U.S. Treasury Bills Index tracks the market for treasury bills with 1 to 2.9999 months to maturity issued by the U.S. government. |

(b) | The Fund commenced operations on August 27, 2019. |

(c) | Returns do no reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemptions of Fund shares. |

(d) | The Advisor has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2024 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.25% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund (annualized) for the six months ended December 31, 2023 would have been 2.09%. |

Hussman Strategic Total Return Fund

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Total Return Fund

versus the Bloomberg U.S. Aggregate Bond Index(a) (Unaudited)

Average Annual Total Returns For the Periods Ended December 31, 2023 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception(b) | |

Hussman Strategic Total Return Fund(c)(d) | 6.04% | 0.21% | 4.56% | 3.60% | 4.39% | |

Bloomberg U.S. Aggregate Bond Index | 5.53% | -3.31% | 1.10% | 1.81% | 3.29% | |

(a) | The Bloomberg U.S. Aggregate Bond Index covers the U.S. investment grade fixed rate bond market, with index components for U.S. government, agency and corporate securities. The Fund does not invest solely in securities included in the Bloomberg U.S. Aggregate Bond Index and may invest in other types of bonds, as well as common stocks, exchange-traded funds and other securities. |

(b) | The Fund commenced operations on September 12, 2002. |

(c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(d) | The Adviser has contractually agreed to waive its investment advisory fees and/or absorb Fund expenses until at least November 1, 2024 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 0.75% annually of the Fund’s average daily net assets. Absent this arrangement, the expense ratio of the Fund for the six months ended December 31, 2023 would have been 0.80%. |

The Hussman Funds

|

Letter to Shareholders | February 9, 2024 |

Dear Shareholder,

“By relentlessly depriving investors of risk-free return, the Federal Reserve has spawned an all-asset speculative bubble that we estimate will provide investors little but return-free risk. From a valuation standpoint, there is no ‘tradeoff’ between return and risk. Rather, depressed valuations tend to be followed by both strong long-term returns and modest subsequent losses, while extreme valuations tend to be followed by both poor long-term returns and deep subsequent losses. Recall that the S&P 500 lagged Treasury bills from 1929-1947, 1966-1985, and 2000-2013. 50 years out of an 84-year period. When the investment horizon begins at extreme valuations, and doesn’t end at the same extremes, the retreat in valuations acts as a headwind that consumes the return that would otherwise be provided by dividends and growth in fundamentals.”

– John P. Hussman, Ph.D., Return-Free Risk, January 2022

The U.S. stock market is two years into what we expect to be a very long, interesting trip to nowhere. We believe the strongest stock market returns in the coming decade, perhaps longer, are likely to emerge during advances that attempt to recover losses and catch up to the cumulative return of risk-free Treasury bills. Indeed, in the two-year period from December 31, 2021 to December 31, 2023, both the Strategic Growth Fund and 3-month Treasury bills outperformed the total return of the Standard & Poor’s 500 Index.

We view the recent two-year period not as a bear market followed by a durable new bull market, but instead as the extended top-formation of one of the three great speculative bubbles in U.S. history. The chart below shows the valuation measure we find best-correlated with actual subsequent returns in market cycles across history: the ratio of nonfinancial market capitalization to gross value-added, including estimated foreign revenues (MarketCap/GVA).

The Hussman Funds

|

Letter to Shareholders (continued) |

The current level of MarketCap/GVA is 3.03, slightly below the early 2022 market extreme, but beyond any level observed prior to April 2021, except for a 4-week period surrounding the 1929 peak. Historically, a level of about 1.0 has been associated with run-of-the-mill subsequent S&P 500 total returns averaging 10% annually. That is about 67% below current levels. Even restricting the data to the period since the late-1990’s, the level associated with subsequent 10% annual returns is only about 1.2.

It seems counterintuitive, but it’s true – lower expected market returns go hand-in-hand with higher risk of loss; higher expected market returns go hand-in-hand with lower risk of loss. That proposition seems to run counter to what’s taught in finance, but that is because the concept of “inefficient risk” is not discussed carefully enough. For example, if a portfolio is poorly diversified, one can typically find another portfolio that can target a higher level of expected return for the same amount of risk, or a lower level of risk for the same expected return. Likewise, in a wildly overvalued market, investors should expect not only poor returns but also higher prospective risk. Put simply, investors are not somehow rewarded for accepting higher levels of what Ben Graham described as “unintelligent” risk.

Nothing in our discipline requires market valuations to revisit their historical norms, but measured from the current extreme, we do expect that 10-12 year S&P 500 total returns may be unusually weak, even negative, and that potential market losses may be unusually deep. This is arithmetic. Over the past 10, 20, and 30 years,

The Hussman Funds

|

Letter to Shareholders (continued) |

U.S. nonfinancial gross value-added has grown at an average annual rate of 4.3%. The dividend yield of the S&P 500 is presently just 1.4%. Holding valuations at a “permanently high plateau,” the same growth and dividend yield would imply long-term stock market returns of 0.043+0.014 = 5.7%.

But allow MarketCap/GVA to retreat in the coming decade from 3.03 to the level of 1.67 it briefly reached in March 2020 – still higher than 80% of valuations observed across history – and the estimated total return of U.S. stocks in the coming decade would be 1.043*(1.67/3.03)^(1/10)-1+0.014 = -0.3% annually. As I observed at the 2000 bubble peak, “At current valuations, even optimistic assumptions lead to the conclusion that a long-term buy-and-hold approach will underperform Treasury bills during the next decade and perhaps beyond.” The S&P 500 lagged T-bills for the next 13 years.

In most bull market advances, the market action of individual stocks, industries, and sectors quickly displays very broad uniformity (what we describe as favorable “market internals”). In contrast, the market rebound of 2023 featured striking divergence within the broad market, with speculation concentrated heavily among seven large capitalization “glamour” stocks: Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla (dubbed the “Magnificent Seven”). For the year ended December 31, 2023, the S&P 500 had a total return of 26.26%. Yet excluding those seven stocks, the index gained only 12.49%. Weighting all components of the S&P 500 equally, rather than by market capitalization, S&P 500 Index components gained 13.84%. This performance gap between capitalization-weighted indices and broadly diversified individual stocks was a headwind for hedged-equity strategies in 2023.

Our investment discipline is to align our outlook with prevailing, observable market conditions, particularly valuations and market internals, and to shift our outlook as these conditions shift. In 2017, and more fully in 2021, we introduced adaptations to restore our strategic flexibility even in the face of persistent speculation and historically extreme valuations. These adaptations do not ensure that our discipline will participate in every market advance or avoid every market decline. Yet we do know that since we introduced our gauge of market internals into our discipline in 1998, the overall total return of the S&P 500 has concentrated in periods when market internals were favorable, while the steepest losses have emerged when they were not. We also know that the strongest market returns on a 10-12 year horizon have emerged from periods of depressed rather than elevated valuations. Put simply, we continue to believe that a focus on valuations and market internals will be essential in navigating the completion of what we see as an unresolved speculative bubble.

The Hussman Funds

|

Letter to Shareholders (continued) |

Valuations and passive investing

After the 1929-1932 market collapse, Graham & Dodd detailed the arguments that had lulled investors to turn their attention away from valuations in favor of passive investing: “This gospel was based on a certain amount of research, showing that diversified lists of common stocks had regularly increased in value over stated intervals of time for many years past… It was only necessary to buy ‘good’ stocks, regardless of price, and then to let nature take her upward course. The results of such a doctrine could not fail to be tragic.” Today, investors have again abandoned concern about valuations, embracing “passive” strategies in the belief that losses will always be recovered quickly.

One basic historical feature determines whether a period of time is dominated by the success of “passive,” “buy-and-hold,” “price-insensitive,” “performance stock” investing, or whether it is instead dominated by the success of “buy-low, sell-high,” “full cycle,” “risk-managed,” “flexible,” “margin-of-safety” investment disciplines. That feature is valuation.

An investment security is nothing but a claim to a stream of future cash flows that will be delivered to investors over time. Changes in valuation don’t change the future cash flows. Instead, changes in valuation are a kind of “transformation” between expected future returns and realized past returns. Rising valuations transform expected future returns into realized past returns. Falling valuations transform realized past returns into expected future returns. The cash flows are the same, but the level of valuation at any given time determines whether the returns are in the future or in the past.

Unfortunately, securities do not force their owners to examine valuations and do math. In the short term, the price is simply whatever investors collectively choose the price to be. In the long term, the cash flows must still arrive, and the relationship between initial price, future cash flows, and long-term return is just arithmetic.

Passive investing gains popularity during “secular” advances in valuation – starting from historically depressed valuations that gradually move to historically extreme levels. An extended period of rising valuations means, by definition, that prices must grow faster than fundamentals. Investors mistakenly come to believe that it is enough to buy stocks, regardless of price, “and then to let nature take her upward course.” They gradually imagine that market cycles no longer exist, and that new highs are always restored quickly. The reality is that those increasingly rich valuations have quietly transformed future returns into past returns. The moment that past market returns look the most glorious is the same moment that likely future returns are the most dismal.

The Hussman Funds

|

Letter to Shareholders (continued) |

In contrast, risk-managed investing gains popularity during “secular” retreats in valuation – starting from extreme valuations that gradually move toward or below their historical norms, typically over the course of several market cycles. An extended period of even modestly declining valuations means, by definition, that prices must grow slower than fundamentals. That is what creates those “long, interesting trips to nowhere.” Along the way, investors begin seeing magazine covers like Business Week’s August 1979 issue, “The Death of Equities.” The reality is that while declining valuations can take away past returns, they also quietly transform those losses into likely future returns. The moment that past market returns look the most dismal is the same moment that likely future returns are the most glorious.

Amid a market advance driven by the collective fear of missing out on an expected “Fed pivot,” it is easy to overlook that the total return of the S&P 500 has already lagged Treasury bills over the past two years. Our own investment discipline has also outperformed the S&P 500 during this period, with substantially less risk, despite last year’s frustrating two-tiered market behavior between “glamour” large-cap stocks and the broad market.

Taken together, a significant portion of U.S. market history consists of episodes when the cumulative total return of the S&P 500 lagged the cumulative total return of Treasury bills for periods of a decade or more. Those lagging returns had the same source – extreme starting valuations. These extremes were observable in 1929, 1968 and 2000, as they are today.

The fact that we expect another long, interesting 10-20 year trip to nowhere for the S&P 500 – measured from current valuations – does not mean that we believe that the market will be “uninvestable” for 10-20 years. To the contrary, the deepest market losses typically emerge a few years into these periods of revaluation. Once valuations approach or breach their historical norms, typical long-term expected returns are restored. Even in the 2000-2013 period, adequate valuations were restored by late-2002, encouraging us to remove the majority of our hedges in early 2003. Still, the overvaluation of the 2000 bubble was not fully resolved until the market collapse of 2008-2009 drove the S&P 500 below its 2002 trough.

Again, nothing in our investment discipline relies on valuations to approach or breach their run-of-the-mill historical norms. Even if valuations never revisit their historical norms, shifts in the uniformity and divergence of market internals alone should provide sufficient opportunities to change our investment outlook, possibly even in the coming quarters. Still, the strongest market return/risk profiles generally emerge when a material retreat in valuations is joined by an improvement in the uniformity of market action. While I believe that a loss of about 42% in the S&P 500 would be a fairly

The Hussman Funds

|

Letter to Shareholders (continued) |

minimal expectation over the completion of this cycle, and that a loss of 67% would be required to restore historically run-of-the-mill expected market returns, nothing in our discipline relies on these outcomes.

We expect that the coming years will regularly bring periods of constructive and even aggressive investment opportunities in stocks. However, these opportunities will most likely involve “segments” of the market cycle. The constructive opportunities will most likely emerge in periods when our main gauge of market internals is uniformly favorable, though with safety nets and position limits when valuations are extreme. The aggressive opportunities will typically emerge when material declines in valuation are joined by favorable market internals. Presently, we observe neither. That will change.

Market internals and extraordinary monetary policies

I regularly discuss our difficulty in the face of the Federal Reserve’s unprecedented and experimental monetary interventions – quantitative easing (QE) and zero interest rate policy (ZIRP) – because it is essential for investors to learn the right lesson from the recent bubble. The only thing truly “different” about this bubble is that zero interest rate policy disabled historically reliable “limits” to speculation. In previous market cycles across history, these limits could be gauged by extreme syndromes of “overvalued, overbought, overbullish” market action. Because of that reliability, these syndromes gained priority in our discipline when we stress-tested our methods against Depression-era data in 2009-2010.

Once interest rates hit zero, and the quantity of zero-interest liquidity exceeded the previous historical extreme of 16% of GDP (on its way to 36% in 2022), investors – taken together – were forced to tolerate enormous discomfort. Someone had to hold the stuff (there are no “sidelines”) and nobody wanted to. Every dollar a buyer puts “into” the market immediately comes “out” in the hands of a seller. The discomfort of holding 16-36% of GDP in zero-interest hot potatoes led investors to embrace the mantra “there is no alternative” (TINA) other than speculation. In previous market cycles, it was correct to respond bearishly to historically-reliable “limits.” Amid QE and ZIRP, our bearish response proved detrimental except when market internals had deteriorated explicitly.

In late-2017, we abandoned our bearish response to these overextended syndromes in periods when market internals were still favorable. Still, refraining from a bearish outlook isn’t the same as adopting a constructive one. In 2021, we expanded our willingness to adopt a constructive outlook even amid hypervalued market conditions (with position limits and safety nets of course) when internals are favorable – something Benjamin Graham might describe as “intelligent speculation.”

The Hussman Funds

|

Letter to Shareholders (continued) |

Though our gauge of market internals does not capture every individual market advance or decline, internals did beautifully in the recent market cycle, as they have in previous complete cycles. Likewise, valuations have remained well-correlated with subsequent market returns even in recent decades. Ignoring valuations and market internals would be the wrong lesson to draw from this bubble. These are exactly the tools that allowed us to admirably navigate decades of complete market cycles, prior to the Federal Reserve’s deranged policy experiment with zero interest rates.

Put simply, our difficulty during the recent, decidedly incomplete half-cycle bubble was not the result of our attention to valuations or market internals, but rather, our belief that speculation still had well-defined limits. In the face of QE and ZIRP, those limits became unreliable. Giving priority to the condition of market internals addresses that issue.

Valuations largely determine long-term returns and full-cycle risks. Internals gauge the speculative and risk-averse psychology that drives valuations higher or lower. Once you know the starting valuation and the likely pressures on valuation, arithmetic tells you the expected total return. TINA, ZIRP and QE disabled historically reliable “limits” to speculation – provided that speculative pressures were dominant, which we gauge based on the uniformity of market internals. We have adapted accordingly. Even if the future holds endless amounts of TINA, ZIRP, and QE, nothing in our discipline will encourage us to adopt a bearish outlook when market internals are favorable.

Fund Performance

All of the Hussman Funds pursue a value-conscious, historically-informed, risk-managed, full-cycle investment discipline. While each of the Hussman Funds outperformed its respective benchmark for the two-year period ended December 31, 2023, the narrowness of speculation in the market rebound of the past year was a headwind for our hedged-equity strategies

Strategic Growth Fund maintained a generally defensive stance toward market risk during the year ended December 31, 2023, and had a total return of -11.61%, compared with a total return of 26.29% for the S&P 500 Index. The primary driver of the Fund’s loss in 2023 was the difference in performance between the capitalization-weighted S&P 500 Index, which is the primary index used by the Fund to hedge market risk, and the performance of the Fund’s equity holdings and cash equivalents, which gained 17.28%. We believe that this performance gap is a temporary feature of a late-stage speculative bubble, and we remain committed to our disciplined, value-conscious stock selection approach. From the inception of Strategic Growth Fund

The Hussman Funds

|

Letter to Shareholders (continued) |

on July 24, 2000 through December 31, 2023, the Fund’s equity holdings and cash equivalents had an average annual total return of 10.30%, compared with an average annual total return of 7.19% for the S&P 500 Index.

Strategic Allocation Fund also maintained a generally defensive investment stance during the year ended December 31, 2023, and had a total return of 0.65%, compared with a total return of 18.40% for the Bloomberg U.S. EQ:FI 60:40 Index. Again, the primary headwind in 2023 was the difference in performance between the broadly diversified equity holdings of the Fund, and the capitalization-weighted indices used by the Fund to hedge market risk.

Strategic Total Return Fund maintained an unhedged but modest exposure to interest rate volatility during the year, typically ranging between 2-3 years in duration, and had a total return of 6.04%, compared with a total return of 5.53% for the Bloomberg U.S. Aggregate Bond Index.

Portfolio Composition

As of December 31, 2023, Strategic Growth Fund had net assets of $377,208,056, and held 192 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were technology (21.9%), health care (15.5%), consumer discretionary (15.0%), consumer staples (14.4%), communications (10.1%), materials (8.0%), energy (7.3%) and industrials (7.1%). The smallest sector holdings as a percent of net assets were financials (2.1%) and utilities (0.9%).

Strategic Growth Fund’s holdings of individual stocks as of December 31, 2023 were valued at $385,643,792. Against these stock positions, the Fund also held 488 option combinations (long put option/short call option) on the S&P 500 Index and 740 option combinations on the Russell 2000 Index. Each option combination behaves inversely to the underlying index, and has a notional value of $100 times the index value. On December 31, 2023, the S&P 500 Index closed at 4,769.83, while the Russell 2000 Index closed at 2,027.074. The Fund’s total hedge represented a notional value of $382,771,180, hedging 99.3% of the dollar value of the Fund’s investment positions in individual stocks.

Though the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following equity holdings achieved gains in excess of $1 million during the six months ended December 31, 2023: Customers Bancorp, Hibbett Sports, Nutanix, Alphabet, Super Micro Computer, Symbotic,

The Hussman Funds

|

Letter to Shareholders (continued) |

Qualcomm, Sprouts Farmers Market, VMware and Amazon. Equity holdings with portfolio losses in excess of $1 million during this period were Canadian Solar, Ebix, Clearfield, SolarEdge Technologies, Allegro Microsystems and Array Tech.

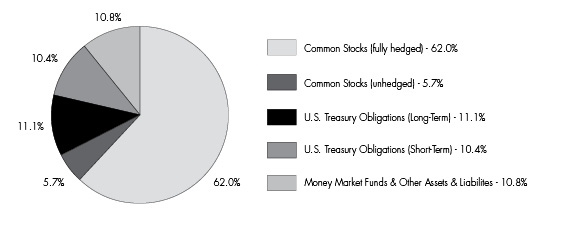

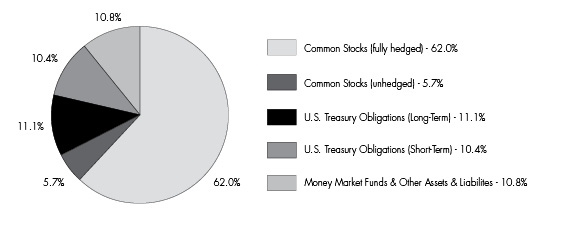

As of December 31, 2023, Strategic Allocation Fund had net assets of $28,514,380 and held 192 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were technology (14.5%), health care (10.2%), consumer discretionary (10.1%), consumer staples (9.5%), communications (6.7%), materials (5.3%), energy (4.8%) and industrials (4.7%). The smallest sector weights were financials (1.3%) and utilities (0.6%). Treasury bills, Treasury notes and money market funds represented 44.8% of the Fund’s net assets.

Strategic Allocation Fund’s holdings of individual stocks as of December 31, 2023 were valued at $19,289,802, representing 67.7% of the Fund’s net assets. Against these stock positions, the Fund also held 23 option combinations (long put option/short call option) on the S&P 500 and 33 option combinations on the Russell 2000 Index. The notional value of this hedge was $17,659,953, hedging 91.6% of the value of equity investments held by the Fund. The Fund’s holdings in long-term Treasury obligations represented 9.0% of the Fund’s net assets.

In Strategic Allocation Fund, during the six months ended December 31, 2023, the following equity holdings achieved gains in excess of $50,000: Nutanix, Hibbett Sports, Customers Bancorp, Alphabet, Qualcomm, Symbotic, Sprouts Farmers Market and Amazon. Equity holdings with portfolio losses in excess of $50,000 during this period were Canadian Solar, Ebix, SolarEdge Technologies, Clearfield, Allegro Microsystems and Array Tech.

As of December 31, 2023, Strategic Total Return Fund had net assets of $201,204,685. Treasury bills, Treasury notes, Treasury Inflation-Protected Securities (TIPS) and money market funds represented 82.8% of the Fund’s net assets. Sector holdings of equities as a percent of net assets were precious metals shares (13.4%), energy (1.4%), exchange-traded funds (1.7%) and utilities (1.0%).

In Strategic Total Return Fund, during the six months ended December 31, 2023, the following holdings achieved portfolio gains in excess of $250,000: Agnico Eagle Mines, Barrick Gold, NRG Energy, Newmont, SM Energy and a two U.S. Treasury Notes maturing in 2024 and 2025. There were no portfolio holdings with a loss in excess of $250,000 during this period.

Supplementary performance information for the Funds is available on the Hussman Funds website: www.hussmanfunds.com

The Hussman Funds

|

Letter to Shareholders (continued) |

Current Outlook

Presently, our most reliable valuation measures are again beyond every extreme in U.S. history prior to April 2021, apart from 4 weeks surrounding the 1929 market peak. Meanwhile, our most reliable gauge of market internals remains unfavorable as the result of persistent divergences across individual securities and sectors.

Although the stock market has lagged Treasury bills for more than two years, my impression is that investors feel an almost excruciating “fear of missing out” amid nominal record highs in the S&P 500 and Nasdaq 100, enthusiasm about an economic “soft landing,” and an expected “pivot” to lower interest rates. In my view, abandoning systematic investment discipline amid the most extreme market conditions in history would be a costly way to buy a fleeting sigh of relief.

We know that valuations are informative about long-term returns and full-cycle losses, but not about short-term outcomes. The only way the market could reach valuations as extreme as today was to advance, unfazed, through every lesser extreme. The consequences of rich valuations are often deferred when investors are inclined to speculate. Still, the deferral of consequences should not be confused with the absence of consequences. Presently, it is not only extreme valuations, but the full combination of extreme valuations, divergent market internals, and a fresh preponderance of speculative warning flags that holds us to a defensive outlook.

We estimate that current market conditions now “cluster” among the worst 0.1% instances in history – more similar to major market peaks and dissimilar to major market lows than 99.9% of all post-war periods. The handful of similarly extreme instances, most notably in 1972, 1987, 1998, 2000, 2018, 2020, and 2022, were typically followed by abrupt market losses over a handful of weeks, often seeing deeper follow-through later. I treat these outcomes as “regularities” rather than “forecasts.” Our primary focus, as always, is to align our investment outlook with prevailing, observable market conditions. No forecasts are required.

With regard to the mega-cap glamour stocks dubbed the “Magnificent Seven,” it seems that investors have largely ignored a decade of progressive slowing in their total revenue growth and narrowing of their aggregate operating profit margins. Among the things that investors often forget about mega-cap growth stocks is that both growth rates and operating margins tend to decline as companies become dominant. An emerging growth company with 100% year-over-year growth, sustainable prospects for continued growth, and operating margins of 40% might fetch a price/revenue

The Hussman Funds

|

Letter to Shareholders (continued) |

multiple in the range of 15-20. Two or three years later, year-over-year growth might be down to 50%, operating margins down to 30%, and a proper discounted cash flow calculation might justify a price/revenue multiple in the 5-10 range.

Several years later, the company might be enormous in terms of total revenues and profits, but progressively slowing to growth of 10% annually or less, with operating margins down to 25%. By then, the justified price/revenue multiple might be only 2. Yet investors might still be paying a multiple of 5-10 times revenues because they ignore a central feature of investment analysis: growth rates and operating margins are not fixed numbers, but trajectories. Ignoring this process is how steep losses happen.

In the bond market, we would characterize the prevailing 4.2% yield on 10-year Treasury bonds as “reasonable but inadequate.” Based on prevailing Treasury bill yields, core inflation, and nominal GDP growth, our benchmark for 10-year Treasury bond yields (below which 10-year Treasury bonds have historically lagged Treasury bills) presently stands at about 5.2%. Again, this is not a forecast, but simply a benchmark of what we would view as an adequate yield, relative to prevailing T-bill yields. As always, this benchmark will change as market and economic conditions change.

Our view of precious metals shares is generally favorable at present. Historically, the shares of precious metals companies tend to perform most strongly when real interest rates and the U.S. dollar are falling, particularly amid weak economic conditions when nominal Treasury yields are falling as well. As usual, our investment position at any time is a reflection of observable market conditions, and will change as those conditions change.

Amid the enthusiasm and now nearly unanimous consensus that U.S. recession risk is behind us, we view the data as consistent with a U.S. economy at the borderline of recession, though we would need more evidence to expect that outcome with confidence. Among our continuing concerns is the progressive weakening in leading measures of production, income, and employment. For example, the Conference Board Leading Economic Index has never experienced a year-over-year decline in excess of 7% except in the context of recession. While real U.S. Gross Domestic Product grew by 3.1% in 2023, real U.S. Gross Domestic Income, which measures the same economic activity in a different way, contracted by -0.1%, a disparity previously observed only in the third quarter of 2007, prior to the 2008-2009 recession.

Similarly, the level of new orders and order backlogs reported in regional and national purchasing managers and Federal Reserve surveys has declined to levels consistent with oncoming recession. While U.S. job creation appears robust on the

The Hussman Funds

|

Letter to Shareholders (continued) |

surface, we also observe a decline in both aggregate hours worked and the number of full-time workers, while the number of workers classified as “part-time for economic reasons” is increasing. Overall, we view the data as more consistent with the borderline of recession than an assured “soft landing” or continued expansion.

Emphatically, our investment outlook will change as market conditions change. A favorable shift in market internals would encourage us to adopt a neutral or constructive outlook (albeit with position limits and safety nets) even amid current speculative extremes. We made those constructive adaptations to our investment discipline in 2017 and 2021, and we are serious about adhering to that discipline. For now, however, we are equally serious about the downside risk, and frankly, the crash risk, implied by prevailing extremes.

Though we believe that a passive investment approach in the S&P 500 is likely to encounter depressed returns and steep risk in the coming years, investors need not commit themselves to an “either, or” approach to investing. For investors with passive exposure to the S&P 500, we believe that Strategic Growth Fund – particularly with the adaptations of recent years – can serve as a risk-managed diversifier, as our investment discipline effectively served in previous, complete market cycles prior to the recent speculative half-cycle. Likewise, Strategic Allocation Fund is well-suited, in our view, as a diversifier for conventional, balanced investment strategies such as 60% equity / 40% fixed-income portfolios. Finally, Strategic Total Return Fund can serve as an effective diversifier for the fixed-income segment of investor portfolios, having outperformed the Bloomberg U.S. Aggregate Bond Index since its inception on September 12, 2002, and for the 1, 3, 5, 7, and 10-year periods ended December 31, 2023.

Faced with valuations that rival the historic extremes of 1929 and 2022, coupled with divergent market internals and a preponderance of syndromes that characterize extreme speculation, our recent defensive investment outlook in the stock market has been very much intended. That outlook will also change. The strongest estimated return/risk profiles emerge when a material retreat in valuations is joined by an improvement in market internals. Still, an improvement in market internals would be welcome enough. We believe that our disciplined, value-conscious, strategic response to changing market conditions will be essential in navigating the uncertainties ahead.

As always, I remain grateful for your trust.

Sincerely,

John P. Hussman, Ph.D.

The Hussman Funds

|

Letter to Shareholders (continued) |

Past performance is not predictive of future performance. There is no assurance that the Hussman Funds will achieve their investment objectives. Investment results and principal value will fluctuate so that shares of the Funds, when redeemed, may be worth more or less than their original cost. It is possible to lose money when investing in securities. Current performance may be higher or lower than the performance data quoted.

Periodic updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website www.hussmanfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

Estimates of prospective return and risk for equities, bonds and other financial markets are forward-looking statements based the analysis and reasonable beliefs of Hussman Strategic Advisors (the “Adviser”), which serves as the investment adviser of the Funds. They are not a guarantee of future performance and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 reflect valuation methods focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle.

This Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for the opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in this Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Adviser with respect to those securities may change at any time.

Hussman Strategic Growth Fund

Portfolio Information |

December 31, 2023 (Unaudited) |

Sector Allocation (% of Common Stocks)

Hussman Strategic Allocation Fund

Portfolio Information |

December 31, 2023 (Unaudited) |

Asset Allocation (% of Net Assets)

Hussman Strategic Allocation Fund

Portfolio Information (continued) |

December 31, 2023 (Unaudited) |

Sector Allocation (% of Common Stocks)

Hussman Strategic Total Return Fund

Portfolio Information |

December 31, 2023 (Unaudited) |

Asset Allocation (% of Net Assets)

Hussman Strategic Growth Fund

Schedule of Investments |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 102.3% | | Shares | | | Value | |

Communications — 10.1% | | | | | | | | |

Advertising & Marketing — 0.2% | | | | | | | | |

Omnicom Group, Inc. (a) | | | 10,000 | | | $ | 865,100 | |

| | | | | | | | | |

Cable & Satellite — 1.2% | | | | | | | | |

Comcast Corporation - Class A (a) | | | 80,000 | | | | 3,508,000 | |

Sirius XM Holdings, Inc. (a) | | | 200,000 | | | | 1,094,000 | |

| | | | | | | | 4,602,000 | |

Entertainment Content — 0.9% | | | | | | | | |

AMC Networks, Inc. - Class A (a)(b) | | | 50,000 | | | | 939,500 | |

AppLovin Corporation - Class A (a)(b) | | | 60,000 | | | | 2,391,000 | |

| | | | | | | | 3,330,500 | |

Internet Media & Services — 5.7% | | | | | | | | |

Alphabet, Inc. - Class C (a)(b) | | | 74,000 | | | | 10,428,820 | |

Booking Holdings, Inc. (a)(b) | | | 400 | | | | 1,418,888 | |

Meta Platforms, Inc. - Class A (a)(b) | | | 15,000 | | | | 5,309,400 | |

Netflix, Inc. (a)(b) | | | 1,000 | | | | 486,880 | |

Shutterstock, Inc. (a) | | | 80,000 | | | | 3,862,400 | |

| | | | | | | | 21,506,388 | |

Publishing & Broadcasting — 0.7% | | | | | | | | |

Gray Television, Inc. | | | 100,000 | | | | 896,000 | |

Nexstar Media Group, Inc. (a) | | | 10,000 | | | | 1,567,500 | |

| | | | | | | | 2,463,500 | |

Telecommunications — 1.4% | | | | | | | | |

Verizon Communications, Inc. (a) | | | 140,000 | | | | 5,278,000 | |

| | | | | | | | | |

Consumer Discretionary — 15.0% | | | | | | | | |

Apparel & Textile Products — 2.0% | | | | | | | | |

Carter’s, Inc. (a) | | | 60,000 | | | | 4,493,400 | |

Crocs, Inc. (a)(b) | | | 15,000 | | | | 1,401,150 | |

Tapestry, Inc. (a) | | | 50,000 | | | | 1,840,500 | |

| | | | | | | | 7,735,050 | |

Automotive — 1.0% | | | | | | | | |

BorgWarner, Inc. (a) | | | 60,000 | | | | 2,151,000 | |

Harley-Davidson, Inc. (a) | | | 40,000 | | | | 1,473,600 | |

| | | | | | | | 3,624,600 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 102.3% (continued) | | Shares | | | Value | |

Consumer Discretionary — 15.0% (continued) |

Consumer Services — 0.3% | | | | | | | | |

Perdoceo Education Corporation (a) | | | 60,000 | | | $ | 1,053,600 | |

| | | | | | | | | |

E-Commerce Discretionary — 2.2% | | | | | | | | |

Amazon.com, Inc. (a)(b) | | | 40,000 | | | | 6,077,600 | |

Etsy, Inc. (a)(b) | | | 30,000 | | | | 2,431,500 | |

| | | | | | | | 8,509,100 | |

Home & Office Products — 0.4% | | | | | | | | |

Tempur Sealy International, Inc. (a) | | | 30,000 | | | | 1,529,100 | |

| | | | | | | | | |

Home Construction — 0.8% | | | | | | | | |

Century Communities, Inc. (a) | | | 20,000 | | | | 1,822,800 | |

Forestar Group, Inc. (a)(b) | | | 35,000 | | | | 1,157,450 | |

| | | | | | | | 2,980,250 | |

Leisure Facilities & Services — 2.0% | | | | | | | | |

Brinker International, Inc. (a)(b) | | | 60,000 | | | | 2,590,800 | |

Starbucks Corporation (a) | | | 30,000 | | | | 2,880,300 | |

Sweetgreen, Inc. - Class A (a)(b) | | | 200,000 | | | | 2,260,000 | |

| | | | | | | | 7,731,100 | |

Leisure Products — 0.4% | | | | | | | | |

Winnebago Industries, Inc. (a) | | | 20,000 | | | | 1,457,600 | |

| | | | | | | | | |

Retail - Discretionary — 5.5% | | | | | | | | |

AutoNation, Inc. (a)(b) | | | 4,000 | | | | 600,720 | |

Big 5 Sporting Goods Corporation (a) | | | 80,000 | | | | 507,200 | |

Buckle, Inc. (The) (a) | | | 30,000 | | | | 1,425,600 | |

Dick’s Sporting Goods, Inc. (a) | | | 20,000 | | | | 2,939,000 | |

Hibbett, Inc. (a) | | | 40,000 | | | | 2,880,800 | |

Kohl’s Corporation (a) | | | 40,000 | | | | 1,147,200 | |

Macy’s, Inc. (a) | | | 100,000 | | | | 2,012,000 | |

Sally Beauty Holdings, Inc. (b) | | | 200,000 | | | | 2,656,000 | |

Ulta Beauty, Inc. (a)(b) | | | 9,000 | | | | 4,409,910 | |

Urban Outfitters, Inc. (a)(b) | | | 60,000 | | | | 2,141,400 | |

| | | | | | | | 20,719,830 | |

Wholesale - Discretionary — 0.4% | | | | | | | | |

LKQ Corporation (a) | | | 20,000 | | | | 955,800 | |

ScanSource, Inc. (a)(b) | | | 10,000 | | | | 396,100 | |

| | | | | | | | 1,351,900 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 102.3% (continued) | | Shares | | | Value | |

Consumer Staples — 14.4% | | | | | | | | |

Beverages — 2.0% | | | | | | | | |

Coca-Cola Company (The) (a) | | | 40,000 | | | $ | 2,357,200 | |

PepsiCo, Inc. (a) | | | 30,000 | | | | 5,095,200 | |

| | | | | | | | 7,452,400 | |

Food — 6.9% | | | | | | | | |

Campbell Soup Company (a) | | | 100,000 | | | | 4,323,000 | |

Flowers Foods, Inc. (a) | | | 40,000 | | | | 900,400 | |

Fresh Del Monte Produce, Inc. | | | 20,000 | | | | 525,000 | |

General Mills, Inc. (a) | | | 60,000 | | | | 3,908,400 | |

Hershey Company (The) (a) | | | 14,000 | | | | 2,610,160 | |

Ingredion, Inc. (a) | | | 20,000 | | | | 2,170,600 | |

J.M. Smucker Company (The) (a) | | | 20,000 | | | | 2,527,600 | |

Kellanova (a) | | | 60,000 | | | | 3,354,600 | |

Kraft Heinz Company (The) (a) | | | 40,000 | | | | 1,479,200 | |

Lamb Weston Holdings, Inc. (a) | | | 40,000 | | | | 4,323,600 | |

| | | | | | | | 26,122,560 | |

Household Products — 1.4% | | | | | | | | |

Colgate-Palmolive Company (a) | | | 20,000 | | | | 1,594,200 | |

Kimberly-Clark Corporation (a) | | | 30,000 | | | | 3,645,300 | |

| | | | | | | | 5,239,500 | |

Retail - Consumer Staples — 3.3% | | | | | | | | |

BJ’s Wholesale Club Holdings, Inc. (a)(b) | | | 30,000 | | | | 1,999,800 | |

Kroger Company (The) (a) | | | 60,000 | | | | 2,742,600 | |

Natural Grocers by Vitamin Cottage, Inc. (a) | | | 85,000 | | | | 1,360,000 | |

Sprouts Farmers Market, Inc. (b) | | | 40,000 | | | | 1,924,400 | |

Target Corporation (a) | | | 20,000 | | | | 2,848,400 | |

Walgreens Boots Alliance, Inc. (a) | | | 60,000 | | | | 1,566,600 | |

| | | | | | | | 12,441,800 | |

Wholesale - Consumer Staples — 0.8% | | | | | | | | |

Andersons, Inc. (The) (a) | | | 20,000 | | | | 1,150,800 | |

United Natural Foods, Inc. (a)(b) | | | 120,000 | | | | 1,947,600 | |

| | | | | | | | 3,098,400 | |

Energy — 7.3% | | | | | | | | |

Oil & Gas Producers — 3.9% | | | | | | | | |

APA Corporation (a) | | | 40,000 | | | | 1,435,200 | |

California Resources Corporation (a) | | | 40,000 | | | | 2,187,200 | |

Civitas Resources, Inc. (a) | | | 20,000 | | | | 1,367,600 | |

Coterra Energy, Inc. (a) | | | 40,000 | | | | 1,020,800 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 102.3% (continued) | | Shares | | | Value | |

Energy — 7.3% (continued) |

Oil & Gas Producers — 3.9% (continued) |

Diamondback Energy, Inc. (a) | | | 10,000 | | | $ | 1,550,800 | |

Exxon Mobil Corporation (a) | | | 20,000 | | | | 1,999,600 | |

Marathon Petroleum Corporation (a) | | | 16,000 | | | | 2,373,760 | |

Range Resources Corporation (a) | | | 40,000 | | | | 1,217,600 | |

SM Energy Company (a) | | | 20,000 | | | | 774,400 | |

Vital Energy, Inc. (a)(b) | | | 20,000 | | | | 909,800 | |

| | | | | | | | 14,836,760 | |

Renewable Energy — 3.4% | | | | | | | | |

Array Technologies, Inc. (a)(b) | | | 200,000 | | | | 3,360,000 | |

Canadian Solar, Inc. (a)(b) | | | 250,000 | | | | 6,557,500 | |

SolarEdge Technologies, Inc. (a)(b) | | | 30,000 | | | | 2,808,000 | |

| | | | | | | | 12,725,500 | |

Financials — 2.1% | | | | | | | | |

Asset Management — 0.2% |

Federated Hermes, Inc. (a) | | | 20,000 | | | | 677,200 | |

| | | | | | | | | |

Banking — 1.0% | | | | | | | | |

Associated Banc-Corp (a) | | | 30,000 | | | | 641,700 | |

Customers Bancorp, Inc. (a)(b) | | | 40,000 | | | | 2,304,800 | |

New York Community Bancorp, Inc. (a) | | | 80,000 | | | | 818,400 | |

| | | | | | | | 3,764,900 | |

Insurance — 0.9% | | | | | | | | |

Old Republic International Corporation | | | 40,000 | | | | 1,176,000 | |

Unum Group (a) | | | 48,000 | | | | 2,170,560 | |

| | | | | | | | 3,346,560 | |

Health Care — 15.5% | | | | | | | | |

Biotech & Pharma — 10.1% | | | | | | | | |

ACADIA Pharmaceuticals, Inc. (a)(b) | | | 40,000 | | | | 1,252,400 | |

Amgen, Inc. (a) | | | 6,000 | | | | 1,728,120 | |

Biogen, Inc. (a)(b) | | | 6,000 | | | | 1,552,620 | |

Bristol-Myers Squibb Company (a) | | | 30,000 | | | | 1,539,300 | |

Catalyst Pharmaceuticals, Inc. (a)(b) | | | 150,000 | | | | 2,521,500 | |

Corcept Therapeutics, Inc. (a)(b) | | | 50,000 | | | | 1,624,000 | |

Dynavax Technologies Corporation (a)(b) | | | 80,000 | | | | 1,118,400 | |

Exelixis, Inc. (a)(b) | | | 140,000 | | | | 3,358,600 | |

Gilead Sciences, Inc. | | | 40,000 | | | | 3,240,400 | |

Halozyme Therapeutics, Inc. (a)(b) | | | 30,000 | | | | 1,108,800 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 102.3% (continued) | | Shares | | | Value | |

Health Care — 15.5% (continued) |

Biotech & Pharma — 10.1% (continued) |

Harmony Biosciences Holdings, Inc. (a)(b) | | | 20,000 | | | $ | 646,000 | |

Incyte Corporation (a)(b) | | | 30,000 | | | | 1,883,700 | |

Innoviva, Inc. (a)(b) | | | 100,000 | | | | 1,604,000 | |

Ironwood Pharmaceuticals, Inc. (a)(b) | | | 60,000 | | | | 686,400 | |

Johnson & Johnson (a) | | | 10,000 | | | | 1,567,400 | |

Neurocrine Biosciences, Inc. (a)(b) | | | 10,000 | | | | 1,317,600 | |

Pacira BioSciences, Inc. (a)(b) | | | 20,000 | | | | 674,800 | |

Pfizer, Inc. (a) | | | 120,000 | | | | 3,454,800 | |

Regeneron Pharmaceuticals, Inc. (a)(b) | | | 4,000 | | | | 3,513,160 | |

Supernus Pharmaceuticals, Inc. (a)(b) | | | 72,000 | | | | 2,083,680 | |

Vertex Pharmaceuticals, Inc. (a)(b) | | | 3,000 | | | | 1,220,670 | |

Voyager Therapeutics, Inc. (a)(b) | | | 50,000 | | | | 422,000 | |

| | | | | | | | 38,118,350 | |

Health Care Facilities & Services — 2.6% | | | | | | | | |

CVS Health Corporation (a) | | | 20,000 | | | | 1,579,200 | |

HCA Healthcare, Inc. (a) | | | 10,000 | | | | 2,706,800 | |

NeoGenomics, Inc. (a)(b) | | | 25,000 | | | | 404,500 | |

Patterson Companies, Inc. (a) | | | 100,000 | | | | 2,845,000 | |

Universal Health Services, Inc. - Class B (a) | | | 14,000 | | | | 2,134,160 | |

| | | | | | | | 9,669,660 | |

Medical Equipment & Devices — 2.8% | | | | | | | | |

Align Technology, Inc. (b) | | | 14,000 | | | | 3,836,000 | |

Exact Sciences Corporation (a)(b) | | | 30,000 | | | | 2,219,400 | |

Illumina, Inc. (a)(b) | | | 10,000 | | | | 1,392,400 | |

Penumbra, Inc. (a)(b) | | | 2,000 | | | | 503,080 | |

Shockwave Medical, Inc. (a)(b) | | | 10,000 | | | | 1,905,600 | |

Zynex, Inc. (a)(b) | | | 60,000 | | | | 653,400 | |

| | | | | | | | 10,509,880 | |

Industrials — 7.1% | | | | | | | | |

Commercial Support Services — 0.2% | | | | | | | | |

H&R Block, Inc. (a) | | | 20,000 | | | | 967,400 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 102.3% (continued) | | Shares | | | Value | |

Industrials — 7.1% (continued) |

Electrical Equipment — 1.7% | | | | | | | | |

Atkore, Inc. (a)(b) | | | 10,000 | | | $ | 1,600,000 | |

Bloom Energy Corporation - Class A (a)(b) | | | 60,000 | | | | 888,000 | |

Sensata Technologies Holding plc (a) | | | 70,000 | | | | 2,629,900 | |

Vontier Corporation (a) | | | 40,000 | | | | 1,382,000 | |

| | | | | | | | 6,499,900 | |

Engineering & Construction — 0.7% | | | | | | | | |

Primoris Services Corporation (a) | | | 80,000 | | | | 2,656,800 | |

| | | | | | | | | |

Industrial Support Services — 0.4% | | | | | | | | |

MSC Industrial Direct Company, Inc. - Class A (a) | | | 14,000 | | | | 1,417,640 | |

| | | | | | | | | |

Machinery — 1.5% | | | | | | | | |

AGCO Corporation (a) | | | 20,000 | | | | 2,428,200 | |

Symbotic, Inc. (a)(b) | | | 60,000 | | | | 3,079,800 | |

| | | | | | | | 5,508,000 | |

Transportation & Logistics — 2.3% | | | | | | | | |

C.H. Robinson Worldwide, Inc. (a) | | | 20,000 | | | | 1,727,800 | |

FedEx Corporation (a) | | | 15,000 | | | | 3,794,550 | |

Heartland Express, Inc. (a) | | | 40,000 | | | | 570,400 | |

Southwest Airlines Company (a) | | | 30,000 | | | | 866,400 | |

United Parcel Service, Inc. - Class B (a) | | | 10,000 | | | | 1,572,300 | |

| | | | | | | | 8,531,450 | |

Transportation Equipment — 0.3% | | | | | | | | |

Allison Transmission Holdings, Inc. (a) | | | 20,000 | | | | 1,163,000 | |

| | | | | | | | | |

Materials — 8.0% | | | | | | | | |

Chemicals — 2.2% | | | | | | | | |

AdvanSix, Inc. (a) | | | 50,000 | | | | 1,498,000 | |

Ingevity Corporation (a)(b) | | | 30,000 | | | | 1,416,600 | |

LyondellBasell Industries N.V. - Class A (a) | | | 20,000 | | | | 1,901,600 | |

Mosaic Company (The) (a) | | | 100,000 | | | | 3,573,000 | |

| | | | | | | | 8,389,200 | |

Containers & Packaging — 0.6% | | | | | | | | |

International Paper Company (a) | | | 20,000 | | | | 723,000 | |

O-I Glass, Inc. (a)(b) | | | 100,000 | | | | 1,638,000 | |

| | | | | | | | 2,361,000 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 102.3% (continued) | | Shares | | | Value | |

Materials — 8.0% (continued) |

Metals & Mining — 4.6% | | | | | | | | |

Agnico Eagle Mines Ltd. (a) | | | 80,000 | | | $ | 4,388,000 | |

Anglogold Ashanti plc (a) | | | 70,000 | | | | 1,308,300 | |

Barrick Gold Corporation (a) | | | 260,000 | | | | 4,703,400 | |

Encore Wire Corporation (a) | | | 8,000 | | | | 1,708,800 | |

Kinross Gold Corporation (a) | | | 40,000 | | | | 242,000 | |

Newmont Corporation (a) | | | 80,000 | | | | 3,311,200 | |

Royal Gold, Inc. (a) | | | 12,000 | | | | 1,451,520 | |

| | | | | | | | 17,113,220 | |

Steel — 0.6% | | | | | | | | |

Nucor Corporation (a) | | | 12,000 | | | | 2,088,480 | |

| | | | | | | | | |

Technology — 21.9% | | | | | | | | |

Semiconductors — 6.9% | | | | | | | | |

ACM Research, Inc. - Class A (a)(b) | | | 150,000 | | | | 2,931,000 | |

Allegro MicroSystems, Inc. (a)(b) | | | 60,000 | | | | 1,816,200 | |

Applied Materials, Inc. (a) | | | 15,000 | | | | 2,431,050 | |

Axcelis Technologies, Inc. (a)(b) | | | 10,000 | | | | 1,296,900 | |

Broadcom, Inc. (a) | | | 200 | | | | 223,250 | |

Cirrus Logic, Inc. (a)(b) | | | 24,000 | | | | 1,996,560 | |

Diodes, Inc. (a)(b) | | | 20,000 | | | | 1,610,400 | |

Intel Corporation (a) | | | 20,000 | | | | 1,005,000 | |

NVE Corporation (a) | | | 20,000 | | | | 1,568,600 | |

NVIDIA Corporation (a) | | | 2,000 | | | | 990,440 | |

Photronics, Inc. (a)(b) | | | 20,000 | | | | 627,400 | |

QUALCOMM, Inc. (a) | | | 20,000 | | | | 2,892,600 | |

Skyworks Solutions, Inc. (a) | | | 30,000 | | | | 3,372,600 | |

Universal Display Corporation (a) | | | 4,000 | | | | 765,040 | |

Vishay Intertechnology, Inc. (a) | | | 100,000 | | | | 2,397,000 | |

| | | | | | | | 25,924,040 | |

Software — 3.7% | | | | | | | | |

Akamai Technologies, Inc. (b) | | | 4,000 | | | | 473,400 | |

Bandwidth, Inc. - Class A (a)(b) | | | 140,000 | | | | 2,025,800 | |

C3.ai, Inc. - Class A (a)(b) | | | 30,000 | | | | 861,300 | |

Dynatrace, Inc. (a)(b) | | | 10,000 | | | | 546,900 | |

Fastly, Inc. - Class A (a)(b) | | | 160,000 | | | | 2,848,000 | |

Fortinet, Inc. (b) | | | 20,000 | | | | 1,170,600 | |

Gen Digital, Inc. (a) | | | 40,000 | | | | 912,800 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 102.3% (continued) | | Shares | | | Value | |

Technology — 21.9% (continued) |

Software — 3.7% (continued) | | | | | | | | |

Immersion Corporation (a) | | | 80,000 | | | $ | 564,800 | |

IonQ, Inc. (a)(b) | | | 150,000 | | | | 1,858,500 | |

Microsoft Corporation (a) | | | 400 | | | | 150,416 | |

Nutanix, Inc. - Class A (a)(b) | | | 20,000 | | | | 953,800 | |

Palantir Technologies, Inc. - Class A (a)(b) | | | 20,000 | | | | 343,400 | |

Salesforce, Inc. (a)(b) | | | 1,000 | | | | 263,140 | |

Samsara, Inc. - Class A (a)(b) | | | 10,000 | | | | 333,800 | |

Schrodinger, Inc. (a)(b) | | | 20,000 | | | | 716,000 | |

| | | | | | | | 14,022,656 | |

Technology Hardware — 8.0% |

Apple, Inc. (a) | | | 600 | | | | 115,518 | |

Arrow Electronics, Inc. (a)(b) | | | 24,000 | | | | 2,934,000 | |

Avnet, Inc. (a) | | | 40,000 | | | | 2,016,000 | |

Ciena Corporation (a)(b) | | | 20,000 | | | | 900,200 | |

Cisco Systems, Inc. (a) | | | 80,000 | | | | 4,041,600 | |

Clearfield, Inc. (a)(b) | | | 40,000 | | | | 1,163,200 | |

InterDigital, Inc. (a) | | | 26,000 | | | | 2,822,040 | |

Juniper Networks, Inc. (a) | | | 100,000 | | | | 2,948,000 | |

NetApp, Inc. (a) | | | 24,000 | | | | 2,115,840 | |

Super Micro Computer, Inc. (a)(b) | | | 24,000 | | | | 6,822,240 | |

Ubiquiti, Inc. (a) | | | 30,000 | | | | 4,186,800 | |

| | | | | | | | 30,065,438 | |

Technology Services — 3.3% | | | | | | | | |

Block, Inc. - Class A (a)(b) | | | 8,000 | | | | 618,800 | |

Cognizant Technology Solutions Corporation - Class A (a) | | | 60,000 | | | | 4,531,800 | |

FleetCor Technologies, Inc. (a)(b) | | | 10,000 | | | | 2,826,100 | |

Infosys Ltd. - ADR (a) | | | 120,000 | | | | 2,205,600 | |

Maximus, Inc. (a) | | | 8,000 | | | | 670,880 | |

PayPal Holdings, Inc. (a)(b) | | | 30,000 | | | | 1,842,300 | |

| | | | | | | | 12,695,480 | |

Utilities — 0.9% | | | | | | | | |

Electric Utilities — 0.9% | | | | | | | | |

Fluence Energy, Inc. (b) | | | 60,000 | | | | 1,431,000 | |

NRG Energy, Inc. (a) | | | 40,000 | | | | 2,068,000 | |

| | | | | | | | 3,499,000 | |

| | | | | | | | | |

Total Common Stocks (Cost $373,198,878) | | | | | | $ | 385,643,792 | |

Hussman Strategic Growth Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

WARRANTS — 0.0%(c) | | Shares | | | Value | |

Energy — 0.0% (c) | | | | | | | | |

Oil & Gas Services & Equipment — 0.0% (c) | | | | | | | | |

Nabors Industries Ltd., expires 06/11/2026 (Cost $0) | | | 8,000 | | | $ | 84,000 | |

EXCHANGE-TRADED PUT OPTION CONTRACTS — 2.0% | | Contracts | | | Notional

Amount | | | Value | |

Russell 2000® Index Option, 02/16/2024 at $2,050 | | | 740 | | | $ | 150,003,180 | | | $ | 4,731,560 | |

S&P 500® Index Option, 02/16/2024 at $4,750 | | | 488 | | | | 232,767,704 | | | | 2,918,240 | |

Total Put Option Contracts (Cost $7,206,328) | | | | | | $ | 382,770,884 | | | $ | 7,649,800 | |

| | | | | | | | | | | | | |

Total Investments at Value — 104.3% (Cost $380,405,206) | | | | | | | | | | $ | 393,377,592 | |

MONEY MARKET FUNDS — 44.0% | | Shares | | | Value | |

Invesco Treasury Portfolio - Institutional Class, 5.26% (d) (Cost $165,973,350) | | | 165,973,350 | | | $ | 165,973,350 | |

| | | | | | | | | |

Total Investments and Money Market Funds at Value — 148.3% (Cost $546,378,556) | | | | | | $ | 559,350,942 | |

| | | | | | | | | |

Written Call Option Contracts — (47.2%) | | | | | | | (177,915,980 | ) |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (1.1%) | | | | | | | (4,226,906 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 377,208,056 | |

ADR - American Depositary Receipt. |

(a) | All or portion of the security is used as collateral to cover written call options. The total value of the securities held as collateral as of December 31, 2023 was $85,643,792. |

(b) | Non-income producing security. |

(c) | Percentage rounds to less than 0.1%. |

(d) | The rate shown is the 7-day effective yield as of December 31, 2023. |

See accompanying notes to financial statements. |

Hussman Strategic Growth Fund

Schedule of Open Written Option Contracts |

December 31, 2023 (Unaudited) |

EXCHANGE-TRADED WRITTEN CALL OPTION CONTRACTS | | Contracts | | | Notional

Amount | | | Strike

Price | | | Expiration

Date | | | Value of

Options | |

Call Option Contracts |

Russell 2000® Index Option | | | 740 | | | $ | 150,003,180 | | | $ | 1,200 | | | | 03/15/2024 | | | $ | 61,725,620 | |

S&P 500® Index Option | | | 488 | | | | 232,767,704 | | | | 2,400 | | | | 03/15/2024 | | | | 116,190,360 | |

Total Written Call Option Contracts (Premiums received $157,638,734) | | | | | | $ | 382,770,884 | | | | | | | | | | | $ | 177,915,980 | |

See accompanying notes to financial statements. |

Hussman Strategic Allocation Fund

Schedule of Investments |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 67.7% | | Shares | | | Value | |

Communications — 6.7% | | | | | | | | |

Advertising & Marketing — 0.2% | | | | | | | | |

Omnicom Group, Inc. (a) | | | 500 | | | $ | 43,255 | |

| | | | | | | | | |

Cable & Satellite — 0.8% | | | | | | | | |

Comcast Corporation - Class A (a) | | | 4,000 | | | | 175,400 | |

Sirius XM Holdings, Inc. (a) | | | 10,000 | | | | 54,700 | |

| | | | | | | | 230,100 | |

Entertainment Content — 0.6% | | | | | | | | |

AMC Networks, Inc. - Class A (a)(b) | | | 2,500 | | | | 46,975 | |

AppLovin Corporation - Class A (a)(b) | | | 3,000 | | | | 119,550 | |

| | | | | | | | 166,525 | |

Internet Media & Services — 3.8% | | | | | | | | |

Alphabet, Inc. - Class C (a)(b) | | | 3,700 | | | | 521,441 | |

Booking Holdings, Inc. (a)(b) | | | 20 | | | | 70,944 | |

Meta Platforms, Inc. - Class A (a)(b) | | | 750 | | | | 265,470 | |

Netflix, Inc. (a)(b) | | | 50 | | | | 24,344 | |

Shutterstock, Inc. (a) | | | 4,000 | | | | 193,120 | |

| | | | | | | | 1,075,319 | |

Publishing & Broadcasting — 0.4% | | | | | | | | |

Gray Television, Inc. (a) | | | 5,000 | | | | 44,800 | |

Nexstar Media Group, Inc. (a) | | | 500 | | | | 78,375 | |

| | | | | | | | 123,175 | |

Telecommunications — 0.9% | | | | | | | | |

Verizon Communications, Inc. (a) | | | 7,000 | | | | 263,900 | |

| | | | | | | | | |

Consumer Discretionary — 10.1% | | | | | | | | |

Apparel & Textile Products — 1.4% | | | | | | | | |

Carter’s, Inc. (a) | | | 3,000 | | | | 224,670 | |

Crocs, Inc. (a)(b) | | | 750 | | | | 70,058 | |

Tapestry, Inc. (a) | | | 2,500 | | | | 92,025 | |

| | | | | | | | 386,753 | |

Automotive — 0.6% | | | | | | | | |

BorgWarner, Inc. (a) | | | 3,000 | | | | 107,550 | |

Harley-Davidson, Inc. (a) | | | 2,000 | | | | 73,680 | |

| | | | | | | | 181,230 | |

Consumer Services — 0.2% | | | | | | | | |

Perdoceo Education Corporation (a) | | | 3,000 | | | | 52,680 | |

Hussman Strategic Allocation Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 67.7% (continued) | | Shares | | | Value | |

Consumer Discretionary — 10.1% (continued) | | | | | | | | |

E-Commerce Discretionary — 1.5% | | | | | | | | |

Amazon.com, Inc. (a)(b) | | | 2,000 | | | $ | 303,880 | |

Etsy, Inc. (a)(b) | | | 1,500 | | | | 121,575 | |

| | | | | | | | 425,455 | |

Home & Office Products — 0.3% | | | | | | | | |

Tempur Sealy International, Inc. (a) | | | 1,500 | | | | 76,455 | |

| | | | | | | | | |

Home Construction — 0.4% | | | | | | | | |

Century Communities, Inc. (a) | | | 1,000 | | | | 91,140 | |

Forestar Group, Inc. (a)(b) | | | 1,000 | | | | 33,070 | |

| | | | | | | | 124,210 | |

Leisure Facilities & Services — 1.4% | | | | | | | | |

Brinker International, Inc. (a)(b) | | | 3,000 | | | | 129,540 | |

Starbucks Corporation (a) | | | 1,500 | | | | 144,015 | |

Sweetgreen, Inc. - Class A (a)(b) | | | 10,000 | | | | 113,000 | |

| | | | | | | | 386,555 | |

Leisure Products — 0.5% | | | | | | | | |

Winnebago Industries, Inc. (a) | | | 2,000 | | | | 145,760 | |

| | | | | | | | | |

Retail - Discretionary — 3.6% | | | | | | | | |

AutoNation, Inc. (a)(b) | | | 200 | | | | 30,036 | |

Big 5 Sporting Goods Corporation (a) | | | 4,000 | | | | 25,360 | |

Buckle, Inc. (The) | | | 1,500 | | | | 71,280 | |

Dick’s Sporting Goods, Inc. (a) | | | 1,000 | | | | 146,950 | |

Hibbett, Inc. (a) | | | 2,000 | | | | 144,040 | |

Kohl’s Corporation (a) | | | 2,000 | | | | 57,360 | |

Macy’s, Inc. (a) | | | 5,000 | | | | 100,600 | |

Sally Beauty Holdings, Inc. (a)(b) | | | 10,000 | | | | 132,800 | |

Ulta Beauty, Inc. (a)(b) | | | 450 | | | | 220,495 | |

Urban Outfitters, Inc. (a)(b) | | | 3,000 | | | | 107,070 | |

| | | | | | | | 1,035,991 | |

Wholesale - Discretionary — 0.2% | | | | | | | | |

LKQ Corporation (a) | | | 1,000 | | | | 47,790 | |

ScanSource, Inc. (a)(b) | | | 500 | | | | 19,805 | |

| | | | | | | | 67,595 | |

Hussman Strategic Allocation Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 67.7% (continued) | | Shares | | | Value | |

Consumer Staples — 9.5% |

Beverages — 1.3% | | | | | | | | |

Coca-Cola Company (The) (a) | | | 2,000 | | | $ | 117,860 | |

PepsiCo, Inc. (a) | | | 1,500 | | | | 254,760 | |

| | | | | | | | 372,620 | |

Food — 4.6% | | | | | | | | |

Campbell Soup Company (a) | | | 5,000 | | | | 216,150 | |

Flowers Foods, Inc. (a) | | | 2,000 | | | | 45,020 | |

Fresh Del Monte Produce, Inc. (a) | | | 1,000 | | | | 26,250 | |

General Mills, Inc. (a) | | | 3,000 | | | | 195,420 | |

Hershey Company (The) (a) | | | 700 | | | | 130,508 | |

Ingredion, Inc. (a) | | | 1,000 | | | | 108,530 | |

J.M. Smucker Company (The) (a) | | | 1,000 | | | | 126,380 | |

Kellanova (a) | | | 3,000 | | | | 167,730 | |

Kraft Heinz Company (The) (a) | | | 2,000 | | | | 73,960 | |

Lamb Weston Holdings, Inc. (a) | | | 2,000 | | | | 216,180 | |

| | | | | | | | 1,306,128 | |

Household Products — 0.9% | | | | | | | | |

Colgate-Palmolive Company (a) | | | 1,000 | | | | 79,710 | |

Kimberly-Clark Corporation (a) | | | 1,500 | | | | 182,265 | |

| | | | | | | | 261,975 | |

Retail - Consumer Staples — 2.1% | | | | | | | | |

BJ’s Wholesale Club Holdings, Inc. (a)(b) | | | 1,500 | | | | 99,990 | |

Kroger Company (The) (a) | | | 3,000 | | | | 137,130 | |

Natural Grocers by Vitamin Cottage, Inc. (a) | | | 3,000 | | | | 48,000 | |

Sprouts Farmers Market, Inc. (b) | | | 2,000 | | | | 96,220 | |

Target Corporation (a) | | | 1,000 | | | | 142,420 | |

Walgreens Boots Alliance, Inc. (a) | | | 3,000 | | | | 78,330 | |

| | | | | | | | 602,090 | |

Wholesale - Consumer Staples — 0.6% | | | | | | | | |

Andersons, Inc. (The) (a) | | | 1,000 | | | | 57,540 | |

United Natural Foods, Inc. (a)(b) | | | 6,000 | | | | 97,380 | |

| | | | | | | | 154,920 | |

Energy — 4.8% | | | | | | | | |

Oil & Gas Producers — 2.6% | | | | | | | | |

APA Corporation (a) | | | 2,000 | | | | 71,760 | |

California Resources Corporation (a) | | | 2,000 | | | | 109,360 | |

Civitas Resources, Inc. (a) | | | 1,000 | | | | 68,380 | |

Coterra Energy, Inc. (a) | | | 2,000 | | | | 51,040 | |

Hussman Strategic Allocation Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 67.7% (continued) | | Shares | | | Value | |

Energy — 4.8% (continued) |

Oil & Gas Producers — 2.6% (continued) |

Diamondback Energy, Inc. (a) | | | 500 | | | $ | 77,540 | |

Exxon Mobil Corporation (a) | | | 1,000 | | | | 99,980 | |

Marathon Petroleum Corp. (a) | | | 800 | | | | 118,688 | |

Range Resources Corporation (a) | | | 2,000 | | | | 60,880 | |

SM Energy Company (a) | | | 1,000 | | | | 38,720 | |

Vital Energy, Inc. (a)(b) | | | 1,000 | | | | 45,490 | |

| | | | | | | | 741,838 | |

Renewable Energy — 2.2% | | | | | | | | |

Array Technologies, Inc. (a)(b) | | | 10,000 | | | | 168,000 | |

Canadian Solar, Inc. (a)(b) | | | 12,500 | | | | 327,875 | |

SolarEdge Technologies, Inc. (a)(b) | | | 1,500 | | | | 140,400 | |

| | | | | | | | 636,275 | |

Financials — 1.3% | | | | | | | | |

Asset Management — 0.1% |

Federated Hermes, Inc. (a) | | | 1,000 | | | | 33,860 | |

| | | | | | | | | |

Banking — 0.6% | | | | | | | | |

Associated Banc-Corp (a) | | | 1,000 | | | | 21,390 | |

Customers Bancorp, Inc. (a)(b) | | | 2,000 | | | | 115,240 | |

New York Community Bancorp, Inc. (a) | | | 4,000 | | | | 40,920 | |

| | | | | | | | 177,550 | |

Insurance — 0.6% | | | | | | | | |

Old Republic International Corporation (a) | | | 2,000 | | | | 58,800 | |

Unum Group (a) | | | 2,400 | | | | 108,528 | |

| | | | | | | | 167,328 | |

Health Care — 10.2% | | | | | | | | |

Biotech & Pharma — 6.7% | | | | | | | | |

ACADIA Pharmaceuticals, Inc. (a)(b) | | | 2,000 | | | | 62,620 | |

Amgen, Inc. (a) | | | 300 | | | | 86,406 | |

Biogen, Inc. (a)(b) | | | 300 | | | | 77,631 | |

Bristol-Myers Squibb Company (a) | | | 1,500 | | | | 76,965 | |

Catalyst Pharmaceuticals, Inc. (a)(b) | | | 7,500 | | | | 126,075 | |

Corcept Therapeutics, Inc. (b) | | | 2,500 | | | | 81,200 | |

Dynavax Technologies Corporation (a)(b) | | | 4,000 | | | | 55,920 | |

Exelixis, Inc. (a)(b) | | | 7,000 | | | | 167,930 | |

Gilead Sciences, Inc. (a) | | | 2,000 | | | | 162,020 | |

Halozyme Therapeutics, Inc. (a)(b) | | | 1,500 | | | | 55,440 | |

Hussman Strategic Allocation Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 67.7% (continued) | | Shares | | | Value | |

Health Care — 10.2% (continued) |

Biotech & Pharma — 6.7% (continued) | | | | | | | | |

Harmony Biosciences Holdings, Inc. (a)(b) | | | 1,000 | | | $ | 32,300 | |

Incyte Corporation (a)(b) | | | 1,500 | | | | 94,185 | |

Innoviva, Inc. (b) | | | 5,000 | | | | 80,200 | |

Ironwood Pharmaceuticals, Inc. (a)(b) | | | 3,000 | | | | 34,320 | |

Johnson & Johnson (a) | | | 500 | | | | 78,370 | |

Neurocrine Biosciences, Inc. (a)(b) | | | 500 | | | | 65,880 | |

Pacira BioSciences, Inc. (a)(b) | | | 1,000 | | | | 33,740 | |

Pfizer, Inc. (a) | | | 6,000 | | | | 172,740 | |

Regeneron Pharmaceuticals, Inc. (a)(b) | | | 200 | | | | 175,658 | |

Supernus Pharmaceuticals, Inc. (a)(b) | | | 3,600 | | | | 104,184 | |

Vertex Pharmaceuticals, Inc. (b) | | | 150 | | | | 61,033 | |

Voyager Therapeutics, Inc. (a)(b) | | | 2,500 | | | | 21,100 | |

| | | | | | | | 1,905,917 | |

Health Care Facilities & Services — 1.7% | | | | | | | | |

CVS Health Corporation (a) | | | 1,000 | | | | 78,960 | |

HCA Healthcare, Inc. (a) | | | 500 | | | | 135,340 | |

NeoGenomics, Inc. (a)(b) | | | 1,250 | | | | 20,225 | |

Patterson Companies, Inc. (a) | | | 5,000 | | | | 142,250 | |

Universal Health Services, Inc. - Class B (a) | | | 700 | | | | 106,708 | |

| | | | | | | | 483,483 | |

Medical Equipment & Devices — 1.8% | | | | | | | | |

Align Technology, Inc. (a)(b) | | | 700 | | | | 191,800 | |

Exact Sciences Corporation (a)(b) | | | 1,500 | | | | 110,970 | |

Illumina, Inc. (a)(b) | | | 500 | | | | 69,620 | |

Penumbra, Inc. (a)(b) | | | 100 | | | | 25,154 | |

Shockwave Medical, Inc. (a)(b) | | | 500 | | | | 95,280 | |

Zynex, Inc. (a)(b) | | | 3,000 | | | | 32,670 | |

| | | | | | | | 525,494 | |

Industrials — 4.7% | | | | | | | | |

Commercial Support Services — 0.2% | | | | | | | | |

H&R Block, Inc. (a) | | | 1,000 | | | | 48,370 | |

| | | | | | | | | |

Electrical Equipment — 1.1% | | | | | | | | |

Atkore, Inc. (a)(b) | | | 500 | | | | 80,000 | |

Bloom Energy Corporation - Class A (a)(b) | | | 3,000 | | | | 44,400 | |

Sensata Technologies Holding plc (a) | | | 3,500 | | | | 131,495 | |

Hussman Strategic Allocation Fund

Schedule of Investments (continued) |

December 31, 2023 (Unaudited) |

COMMON STOCKS — 67.7% (continued) | | Shares | | | Value | |

Industrials — 4.7% (continued) |

Electrical Equipment — 1.1% (continued) |

Vontier Corporation | | | 2,000 | | | $ | 69,100 | |

| | | | | | | | 324,995 | |

Engineering & Construction — 0.5% | | | | | | | | |

Primoris Services Corporation (a) | | | 4,000 | | | | 132,840 | |

| | | | | | | | | |

Industrial Support Services — 0.2% | | | | | | | | |

MSC Industrial Direct Company, Inc. - Class A (a) | | | 700 | | | | 70,882 | |

| | | | | | | | | |

Machinery — 1.0% | | | | | | | | |

AGCO Corporation (a) | | | 1,000 | | | | 121,410 | |

Symbotic, Inc. (a)(b) | | | 3,000 | | | | 153,990 | |

| | | | | | | | 275,400 | |

Transportation & Logistics — 1.5% | | | | | | | | |

C.H. Robinson Worldwide, Inc. (a) | | | 1,000 | | | | 86,390 | |

FedEx Corporation (a) | | | 750 | | | | 189,728 | |

Heartland Express, Inc. (a) | | | 2,000 | | | | 28,520 | |

Southwest Airlines Company (a) | | | 1,500 | | | | 43,320 | |

United Parcel Service, Inc. - Class B (a) | | | 500 | | | | 78,615 | |

| | | | | | | | 426,573 | |

Transportation Equipment — 0.2% | | | | | | | | |

Allison Transmission Holdings, Inc. (a) | | | 1,000 | | | | 58,150 | |