Global Sources Ltd.

Canon’s Court

22 Victoria Street

Hamilton HM 12, Bermuda

______________

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on June 20, 2014

______________

To Our Shareholders:

NOTICE IS HEREBY given that an annual general meeting (the “Annual General Meeting”) of the shareholders of Global Sources Ltd. (the “Company”) will be held on June 20, 2014 at the Board Room, 26th Floor, Tower B, Southmark, 11 Yip Hing Street, Wong Chuk Hang, Hong Kong Special Administrative Region of the People’s Republic of China, at 11:00 a.m., local time, for the following purposes:

| 1) | To re-elect as Directors Mr. David F. Jones, Mr. James A. Watkins and Mr. Yam Kam Hon Peter, members of the Board of Directors of the Company (the “Board”) who are retiring by rotation and, being eligible, offering themselves for re-election; |

| 2) | To fix the maximum number of Directors that comprise the whole Board at nine (9) persons, declare any vacancies on the Board to be casual vacancies and authorize the Board to fill these vacancies on the Board as and when it deems fit; and |

| 3) | To re-appoint PricewaterhouseCoopers LLP, an independent registered public accounting firm, as the Company’s independent auditors until the next annual general meeting of the Company. |

The foregoing matters are described more fully in the accompanying Proxy Statement. While this Notice and Proxy Statement and the enclosed form of proxy are being sent only to shareholders of record and beneficial owners of whom the Company is aware as of May 2, 2014, all shareholders of the Company of record on the date of the meeting are entitled to attend the Annual General Meeting. The Company’s audited financial statements for the year ended December 31, 2013, together with the auditor’s report in respect of the financial statements, are included with the mailing of this Notice and Proxy Statement.

We hope you will be represented at the Annual General Meeting by signing, dating and returning the enclosed proxy card in the accompanying envelope as promptly as possible, whether or not you expect to be present in person. Your vote is important- as is the vote of every shareholder- and the Board appreciates the cooperation of shareholders in directing proxies to vote at the Annual General Meeting.

Your proxy may be revoked at any time by following the procedures set forth in the accompanying Proxy Statement, and the giving of your proxy will not affect your right to vote in person if you attend the Annual General Meeting.

By order of the Board of Directors

Global Sources Ltd.

Chan Hoi Ching

Secretary

Dated: May 13, 2014

Hamilton, Bermuda

Global Sources Ltd.

Canon’s Court

22 Victoria Street

Hamilton HM 12, Bermuda

PROXY STATEMENT

For the Annual General Meeting of Shareholders

June 20, 2014

This proxy statement is being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Global Sources Ltd., an exempted company incorporated in Bermuda (the “Company”), for use at the annual general meeting of shareholders of the Company to be held at the Board Room, 26th Floor, Tower B, Southmark, 11 Yip Hing Street, Wong Chuk Hang, Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”), on June 20, 2014 at 11 a.m., local time, and at any adjournments or postponements thereof (the “Annual General Meeting”). Unless the context otherwise requires, references to the Company includes Global Sources Ltd. and its subsidiaries. The proxy is revocable by (i) filing a written revocation with the Secretary of the Company prior to the voting of such proxy; (ii) giving a later dated proxy; or (iii) attending the Annual General Meeting and voting in person. Shares represented by all properly executed proxies received prior to the Annual General Meeting will be voted at the meeting in the manner specified by the holders thereof.

Proxies that do not contain voting instructions will be voted (i) FOR re-electing as directors Mr. David F. Jones, Mr. James A. Watkins and Mr. Yam Kam Hon Peter, members of the Board who are retiring by rotation and, being eligible, offering themselves for re-election; (ii) FOR fixing the maximum number of Directors that comprise the whole Board at nine (9) persons, declaring any vacancies on the Board to be casual vacancies and authorizing the Board to fill these vacancies on the Board as and when it deems fit; and (iii) FOR re-appointing PricewaterhouseCoopers LLP, an independent registered public accounting firm, as the Company’s independent auditors until the next annual general meeting of the Company. In accordance with Section 84 of the Companies Act 1981 of Bermuda (as amended), the audited financial statements of the Company for the period from January 1, 2013 to December 31, 2013, together with the auditor’s report in respect of the financial statements, enclosed herewith, will be presented at the Annual General Meeting. These statements have been approved by the Board of the Company. There is no requirement under Bermuda law that shareholders approve such statements, and no such approval will be sought at the Annual General Meeting.

The Board has established May 2, 2014 as the date used to determine those record holders and beneficial owners of common shares, US$0.01 par value per share (the “Common Shares”), to whom notice of the Annual General Meeting will be sent (the “Record Date”). On the Record Date, there were 34,811,977 Common Shares issued and outstanding. The holders of the Common Shares are entitled to one vote for each Common Share held. The presence, in person or by proxy, at the Annual General Meeting of at least two (2) shareholders entitled to vote representing more than 50% of the issued and outstanding Common Shares as of the Record Date is necessary to constitute a quorum at the Annual General Meeting. All matters presented at the Annual General Meeting require approval by a simple majority of votes cast at the meeting. Only votes for or against a proposal count. Abstentions and broker non-votes count for quorum purposes only and not for voting purposes. Broker non-votes occur when a broker returns a proxy but does not have the authority to vote on a particular proposal. Brokers that do not receive instructions from the beneficial owners of Common Shares being voted are entitled to vote on the re-appointment of the auditors. Brokers that do not receive instructions from the beneficial owners of the shares being voted are NOT entitled to exercise discretionary voting power with respect to any other matter presented for shareholder approval at the Annual General Meeting.

We hope you will be represented at the Annual General Meeting by signing, dating and returning the enclosed proxy card in the accompanying envelope as promptly as possible, whether or not you expect to be present in person. Your vote is important- as is the vote of every shareholder- and the Board appreciates the cooperation of shareholders in directing proxies to vote at the Annual General Meeting.

This Notice, Proxy Statement and enclosed form of proxy are first being mailed on or about May 13, 2014.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information concerning beneficial ownership of Common Shares of the Company issued and outstanding as at February 28, 2014 by (i) each person known by the Company to be the beneficial owner of more than five percent of its issued and outstanding Common Shares, (ii) each director (and nominee for director) and executive officer of the Company and (iii) all directors and executive officers of the Company as a group. Unless otherwise indicated, the address of all directors and officers is: 22nd Floor, Vita Tower, 29 Wong Chuk Hang Road, Aberdeen, Hong Kong.

| Name and Address of Beneficial Owner (1) | | Shares Beneficially Owned | | | Percentage

Of

Class (2) | |

Merle Allan Hinrich

23/F, Vita Tower

29 Wong Chuk Hang Road

Aberdeen, Hong Kong | | | 16,296,309 | (3) | | | 46.93 | % |

| Spenser Au | | | * | | | | * | |

| Connie Lai | | | * | | | | * | |

| Peter Zapf | | | * | | | | * | |

| Eddie Heng Teng Hua | | | * | | | | * | |

| Sarah Benecke | | | * | | | | * | |

| David F Jones | | | * | | | | * | |

| Roderick Chalmers | | | * | | | | * | |

| James A Watkins | | | * | | | | * | |

| Yam Kam Hon Peter | | | * | | | | * | |

| Brent Barnes | | | * | | | | * | |

All Directors, Nominees for Directors and Executive Officers as a

Group (11 persons) | | | 16,882,564 | | | | 48.62 | % |

GAMCO Investors, Inc. et al

One Corporate Center

Rye, New York 10580-1435 | | | 1,736,475 | (4) | | | 5.00 | % |

_________________

| * | Indicates beneficial ownership of less than 1%. |

| (1) | Each shareholder has sole voting power and sole dispositive power with respect to all shares beneficially owned by him unless otherwise indicated. |

| (2) | Based upon 34,722,691 Common Shares issued and outstanding as of February 28, 2014. The percentage figures are calculated based on our total issued and outstanding Common Shares (and do not take into account that portion of our total issued Common Shares which are held as treasury shares). |

| (3) | As of February 28, 2014, Mr. Merle Hinrich has the sole power to vote and dispose of 14,773,547 Common Shares beneficially owned by him (representing approximately 42.55% of our total outstanding Common Shares), may be deemed to have shared power with his wife Miriam Hinrich to vote or direct to vote and dispose of 339,806 Common Shares owned by her (representing approximately 0.98% of our total outstanding Common Shares) and may be deemed to have shared power with Hinrich Investments Limited to vote or direct to vote and dispose of 1,182,956 Common Shares owned by Hinrich Investments Limited (representing approximately 3.40% of our total outstanding Common Shares). Hinrich Investments Limited is owned by a nominee company in trust for the Hinrich Foundation, of which Mr. Hinrich serves as the chairman of the |

council of members (the decision-making body), and of which he was the founder and the initial settlor.

Mr. Hinrich, who is our Executive Chairman, may therefore be deemed to beneficially own up to approximately 46.93% of our issued and outstanding Common Shares as of February 28, 2014 (as described above), and he is deemed our controlling shareholder.

| (4) | Based on Schedule 13D filed on October 31, 2013 by a group including GAMCO Investors, Inc., which includes Mario J. Gabelli and various entities which he directly or indirectly controls or for which he acts as chief investment officer. |

PROPOSAL NO. 1

RE-ELECTION OF DIRECTORS ELIGIBLE BY ROTATION

Pursuant to the Company’s Bye-Laws, one-third of the directors of the Company (or if their number is not three or a multiple of three, the number nearest to one-third) shall retire from office each year by rotation, with those who have been longest since their last appointment or reappointment retiring first. Those persons who became or were last appointed directors on the same day as those retiring shall (unless they otherwise agree among themselves) be determined by lot.

Mr. David F. Jones, Mr. James A. Watkins and Mr. Yam Kam Hon Peter are retiring at this year’s Annual General Meeting. Each has been nominated to be re-elected to the Board. Management has no reason to believe that any of the nominees will be unable or unwilling to serve as a director, if elected. Should any of the nominees not be a candidate at the time of the Annual General Meeting (a situation that is not now anticipated), proxies may be voted for a substitute nominee or nominees, as the case may be, selected by the Board.

Unless specifically instructed to vote against or abstain, proxies will be voted for the re-election and election of each of the nominees named below to serve for a three-year term expiring at the 2017 annual general meeting of shareholders of the Company and until his successor has been duly elected and has qualified. Directors shall be elected by a majority of the votes cast, in person or by proxy, at the Annual General Meeting.

Certain biographical information concerning the nominees is set forth below:

| Name | | | First Year Became

a Director | |

| | | | | |

| David F. Jones | | | 2000 | |

| | | | | |

| James A. Watkins | | | 2005 | |

| | | | | |

| Yam Kam Hon Peter | | | 2011 | |

Mr. Jones has been a director since April 2000. He is the CEO of the Australian Clean Energy Finance Fund, a solar energy financing business. From August 2011 to February 2013, Mr. Jones was with Better Place Inc., a global electric vehicle services provider, where he was Vice President Global Corporate Development and Strategy. He spent the previous 17 years in the private equity industry, and before that he was in management consulting, investment banking and general management. Mr. Jones was Managing Director of CHAMP Private Equity, a leading Australian buyout firm from 2002 to 2011. In 1999, he founded and, until 2002, led the development of UBS Capital’s Australian and New Zealand business. Prior to that, he spent four years with Macquarie Direct Investment, a venture capital firm in Sydney, Australia, and one year at BancBoston Capital in Boston, Massachusetts. Mr. Jones began his career as a consultant with McKinsey & Company in Australia and New Zealand. He left McKinsey to take the role of general manager of Butterfields Cheese Factors, of the King Island Dairies group. He is a director of EC English Pty Ltd, EMR Capital Pty Ltd and The National Museum of Australia. He was previously Chairman of the Australian Venture Capital Association Limited and a director of various listed and unlisted companies in Australia. Mr. Jones holds a Bachelor of Engineering (First Class Hons.) from the University of Melbourne and a Master of Business Administration from Harvard Business School.

Mr. Watkins was appointed as a casual director on February 28, 2005 and was elected as a director at our annual general meeting on May 9, 2005. Mr. Watkins was a director and group general counsel of the Jardine Matheson Group in Hong Kong from 1997 until 2003. He was group legal director of Schroders plc in 1996 to 1997 and of Trafalgar House plc from 1994 to 1996. He was previously a partner and solicitor in the London and Hong Kong offices of Linklaters from 1975 to 1994. He currently is a non-executive director of Mandarin Oriental International Ltd., Jardine Cycle & Carriage Ltd., Advanced

Semiconductor Manufacturing Corporation Ltd., IL&FS India Realty Fund II LLC, Asia Satellite Telecommunications Holdings Ltd. and Hongkong Land Holdings Ltd., and is a member of the audit committees of Jardine Cycle & Carriage Ltd. and Asia Satellite Telecommunications Holdings Ltd. and the chairman of the audit committee of Advanced Semiconductor Manufacturing Corporation Ltd. Mr. Watkins has a law degree from the University of Leeds (First Class Hons.).

Mr. Yam was first appointed as a director at our annual general meeting of shareholders on June 22, 2011. Mr. Yam joined Emerson (NYSE: EMR) in 1986 and is currently an advisor to Emerson Electric Asia-Pacific after he retired as president of Emerson Greater China and chairman of Emerson Electric (China) Holdings Co., Ltd in April 2008. For more than two decades, Mr. Yam played a key role in leading Emerson’s investments in China. Mr. Yam holds a bachelors degree in electrical engineering from the University of Hong Kong and an Executive MBA from the University of Chicago. He is currently an adjunct professor of The Chinese University of Hong Kong’s Faculty of Business Administration Department of Management, a member of the College Council and the Board of Governors of the Centennial College, Hong Kong and a council member of the Asian Corporate Governance Association. Mr. Yam was previously a member of the Suzhou Industrial Park International Advisory Committee from 2001 to 2008, a director of the Executive Committee of Foreign Investment Companies in Beijing from 2003 to 2008, a non-executive director of Sun Life Hong Kong Limited and affiliates from 2003 to 2010 and a member of the Board of Directors of the Hong Kong Science & Technology Parks Corporation from 2001 to 2006, and he also previously served as a vice-president of the American Chamber of Commerce in Hong Kong, a visiting professor of Nanjing University’s School of Business and a visiting professor of Jiangmen Polytechnic in China.

The names and certain biographical information of the directors of the Company whose terms expire at the 2015 and 2016 annual general meetings of shareholders of the Company are set forth below:

| Name | | | First Year Became

a Director | | | | Year Term

Expires | |

| | | | | | | | | |

| Merle Allan Hinrich | | | 2000 | | | | 2015 | |

| | | | | | | | | |

| Roderick Chalmers | | | 2000 | | | | 2015 | |

| | | | | | | | | |

| Eddie Heng Teng Hua | | | 2000 | | | | 2016 | |

| | | | | | | | | |

| Sarah Benecke | | | 2000 | | | | 2016 | |

Mr. Heng has been a director since April 2000. He joined us in August 1993 as deputy to the vice president of finance and was the Chief Financial Officer (previously titled vice president of finance) from 1994 until June 30, 2009. Mr. Heng returned to serve as Interim Chief Financial Officer from June 30, 2010 until August 1, 2010. He received an MBA from Schiller International University in London in 1993, is a Singapore Chartered Accountant, a member of the Institute of Singapore Chartered Accountants, and a Fellow Member of The Association of Chartered Certified Accountants in the United Kingdom. Mr. Heng is currently an audit committee member of Prison Fellowship Singapore, a Christian non-profit organization that provides counseling and skills training to prisoners and financial support to their families. Prior to joining us, he was the regional financial controller of Hitachi Data Systems, a joint venture between Hitachi and General Motors. His term as director expires in 2016.

Mr. Hinrich has been a director since April 2000 and is currently our Executive Chairman. He was our Chief Executive Officer from April 2000 to August 2011. A co-founder of the business, he was the principal executive officer of our predecessor company, Trade Media Holdings Limited, a Cayman Islands corporation wholly owned by us (“Trade Media”), from 1971 through 1993 and resumed that position in September 1999. From 1994 to August 1999, Mr. Hinrich was chairman of the ASM Group, which included Trade Media. Mr. Hinrich is a director of Trade Media and has also been the Chairman of the Board of Trade Media. Mr. Hinrich graduated from the University of Nebraska and the Thunderbird School

of Global Management (“Thunderbird”). Mr. Hinrich is a member of the Tsinghua University International Advisory Board for China’s first-ever English-language Global Business Journalism program and an advisor to the Hong Kong Baptist University. After 22 years of service, he retired from the board of trustees of Thunderbird. He is a board member of the Economic Strategy Institute in Washington, D.C., co-founder and former chairman of The Society of Hong Kong Publishers and the chairman of the council of members of the Hinrich Foundation. He is also an investment Promotion Ambassador with Invest Hong Kong. His term as director expires in 2015.

Ms. Beneckehas been a director since April 2000 and, since 1993, has been a director of Trade Media. Ms. Benecke was our principal executive officer from January 1994 through August 1999. She joined us in May 1980 and served in numerous positions, including publisher from 1988 to December 1992 and chief operating officer in 1993. From September 1999 to July 2010, Ms. Benecke served as a consultant to Publishers Representatives Ltd. (Hong Kong), a subsidiary of our company. Her consulting work focused largely on the launch, development and expansion of the “China Sourcing Fairs” in Shanghai, Hong Kong, Mumbai, Dubai, Singapore and Johannesburg. Ms Benecke is also on the boards of Australian media company, McPherson Media, and Hong Kong art show organizer, Asia Contemporary Art Ltd. She graduated with a B.A. from the University of New South Wales, Australia. Her term as director expires in 2016.

Mr. Chalmers has been a director since October 2000. He was chairman, Asia-Pacific, of PricewaterhouseCoopers LLP and a member of PwC’s Global Management Board from 1998 until his retirement in July 2000. He is a 30-year veteran with PwC’s merger partner Coopers & Lybrand with specialist experience in the financial services industry. He has at various times been a non-executive director of the Hong Kong SAR Securities and Futures Commission, a member of the Takeovers and Mergers Panel, and chairman of the Working Group on Financial Disclosure. He is currently a director of the Gasan Group Limited (Malta) and Simonds Farsons Cisk Limited (Malta). He was the Chairman of the Board of Directors of the Bank of Valletta plc from 2004 until his retirement from that position in 2012. His term as director expires in 2015.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RE-ELECTION OF MR. DAVID F. JONES, MR. JAMES A. WATKINS AND MR. YAM KAM HON PETER AS DIRECTORS OF THE COMPANY.

CORPORATE GOVERNANCE

The Company’s corporate governance practices are established and monitored by the Board. The Board regularly assesses the Company’s governance practices in light of legal requirements and governance best practices.

Committees of the Board

The Company has a separately-designated standing audit committee (the “Audit Committee”) established in accordance with Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended. The members of the Audit Committee are Roderick Chalmers (Chairman), David F Jones, James A Watkins and Eddie Heng Teng Hua. Mr. David F. Jones and Mr. James A. Watkins are standing for re-election to the Board at the Annual General Meeting. The Board has determined that Mr. Chalmers is an “audit committee financial expert” under Item 401(h)(2) of Regulation S-K. None of the Audit Committee members is an “affiliate” of the Company.

The Audit Committee’s charter, as amended, a copy of which is available on the Company’s website athttp://www.corporate.globalsources.com/IRS/COPGOV.HTM, provides that the Audit Committee shall consist of at least three members, all of whom shall, in the opinion of the Board, be “independent” in accordance with the requirements of the SEC and Nasdaq. Members of the Audit Committee shall be considered independent if (i) they have no relationship to the Company which, in the opinion of the Board, would interfere with the exercise of his or her judgment independent of the Company’s management, (ii) do not accept directly or indirectly any consulting, advisory, or other compensatory fee from the Company or any subsidiary of the Company, and (iii) are not affiliated persons of the Company or any subsidiary of the Company.

The primary functions of the Audit Committee consist of:

| 1. | Ensuring that the affairs of the Company are subject to effective internal and external independent audits and control procedures; |

| 2. | Approving the selection of internal and external independent auditors annually; |

| 3. | Reviewing all Forms 20-F, prior to their filing with the SEC; and |

| 4. | Conducting appropriate reviews of all related party transactions for potential conflict of interest situations on an ongoing basis and approving such transactions, if appropriate. |

The Audit Committee held 4 meetings in the fiscal year ended December 31, 2013.

The Company has a separately designated standing compensation committee (the “Compensation Committee”). The members of the Compensation Committee are Sarah Benecke (Chairman), Roderick Chalmers, David F Jones, James A Watkins, Yam Kam Hon Peter and Eddie Heng Teng Hua. Messrs. David F. Jones, James A. Watkins and Yam Kam Hon Peter are standing for re-election to the Board at the Annual General Meeting.

The Compensation Committee’s charter, a copy of which is attached as Annex A hereto, provides that the Compensation Committee shall consist of at least three members.

The primary function of the Compensation Committee is to approve compensation packages for each of the Company’s executive officers.

The Compensation Committee held 2 meetings in the fiscal year ended December 31, 2013.

The Board has also established an executive committee, and Merle Allan Hinrich, Eddie Heng Teng Hua and Sarah Benecke serve as the members thereof. The executive committee acts for the entire Board between Board meetings.

Board Meetings

The Board held a total of 4 meetings during the fiscal year ended December 31, 2013. None of the incumbent directors attended fewer than 75% of the Board meetings held in 2013 and the total number of meetings held by all committees of the Board on which he or she served. Members of the Board are encouraged to attend all of our shareholders meetings. However, we do not have a formal policy with respect to such attendance.

MANAGEMENT

Executive Officers of the Company

The names, positions and certain biographical information of the executive officers of the Company who are not directors are set forth below.

| Name | | Position |

| Spenser Au | | Chief Executive Officer |

| Brent Barnes | | Chief Operating Officer |

| Connie Lai | | Chief Financial Officer |

| Peter Zapf | | Chief Information Officer |

Mr. Au was appointed as our Chief Executive Officer in August, 2011. Mr. Au first became a team member in 1978 as an account executive for Asian Sources Electronics magazine. The positions through which he advanced to senior management included regional sales manager in 1988, associate publisher in 1991, publisher in 1992 and president of Asian Sales in 1999. Mr. Au has a deep knowledge of Greater China and other markets where the company operates. Mr. Au received a Diploma in Business Management in 1977 from the Hong Kong Baptist University.

Mr. Barnes was appointed as our chief operating officer in January 2012. Mr. Barnes is responsible for the company’s worldwide operations, including community development, content development, human resources and administration. Mr. Barnes began his career handling operations for a group of lobbyists in Austin, Texas. Later, he moved to Mexico City, where he designed and delivered training programs for executives at Ford Motor Co. and Mercedes-Benz. Upon completion of his MBA, Mr. Barnes spent a year working as a Market Analyst for Global Sources in Phoenix, Arizona before moving to Hong Kong to become Executive Assistant to the Chairman & CEO in June of 2000. Since 2003 he has spent time managing each of the core operational departments and assumed the role of General Manager of Content & Community Development in December 2009. Mr. Barnes holds a Bachelor of Arts degree from the University of Texas at Austin and an MBA from the Thunderbird School of Global Management.

Ms. Lai was appointed as our Chief Financial Officer effective August 2010. Ms. Lai joined Global Sources in June 2007 as financial controller, Hong Kong & China. Prior to joining Global Sources, she was chief financial officer and an executive director of HC International, Inc., a Hong Kong listed company. Earlier in her career, she spent over four years with PricewaterhouseCoopers (“PwC”) Hong Kong. Ms. Lai graduated from the Chinese University of Hong Kong with a bachelor’s degree in professional accountancy. She is also a Member of the Hong Kong Institute of Certified PublicAccountants and a Fellow Member of the Association of Chartered Certified Accountants in the United Kingdom.

Mr. Zapf was appointed as our chief information officer in January 2012. Mr. Zapf began his career in software project management with the United States Air Force. He then joined Global Sources in Phoenix, Arizona, working on the development, sales and marketing of the company’s early software and e-commerce products. Later, he worked as a research analyst at Bear Stearns in New York, focusing on the business-to-business market, after which he joined Hong Kong-based AsiaCommerce, a startup incubator, as Chief Executive Officer. He rejoined Global Sources in 2001, and was chief operating officer from

January 2011 to December 2011. Mr. Zapf holds a BS in Electrical Engineering and Engineering and Public Policy from Carnegie Mellon University, an MS in Computer Science from Troy State University, and an MBA from Thunderbird, the American Graduate School of International Management.

Compensation of Directors and Executive Officers

For the year ended December 31, 2013, the Company and its subsidiaries provided its directors and executive officers as a group aggregate remuneration, pension contributions, allowances and other benefits of $3,558,660 including the non-cash compensation of $998,371 associated with the equity compensation plans.

In 2013, the Company and its subsidiaries incurred $363,506 in costs to provide pension, retirement or similar benefits to their respective officers and directors pursuant to the Company’s retirement plan and pension plan.

Employment Agreements

We have employment agreements with Mr. Merle Allan Hinrich under which he serves as our Executive Chairman. The agreements contain covenants restricting Mr. Hinrich’s ability to compete with us during his term of employment and preventing him from disclosing any confidential information during the term of his employment agreement and for a further period of three years after the termination of his employment agreement. In addition, we retain the rights to all trademarks and copyrights acquired and any inventions or discoveries made or discovered by Mr. Hinrich in the course of his employment. Upon a change of control, if Mr. Hinrich is placed in a position of lesser stature than that of a senior executive officer, a significant change in the nature or scope of his duties is effected, Mr. Hinrich ceases to be a member of the Board or if there is a breach of those sections of his employment agreements relating to compensation, reimbursement, title and duties or termination, we are liable to pay Mr. Hinrich a lump sum cash payment equal to five times the sum of his base salary prior to the change of control and the bonus paid to him in the year preceding the change of control. The agreements may be terminated by either party by giving six months’ notice.

We have employment agreements with each of our other executive officers. Each employment agreement contains a non-competition provision, preventing the employee from undertaking or becoming involved in any business activity or venture during the term of employment without notice to us and our approval. The employee must keep all of our proprietary and private information confidential during the term of employment and for a period of three years after the termination of the agreement. We can assign the employee to work for another company if the employee’s duties remain similar. In addition, we retain the rights to all trademarks and copyrights acquired and any inventions or discoveries made or discovered by the employee during the employee’s term of employment. Each employment agreement contains a three- or six-months’ notice provision for termination, and does not have a set term of employment. Bonus provisions are determined on an individual basis.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

There were no material related party transactions during the year ended December 31, 2013.

PROPOSAL NO. 2

FIXING BOARD SIZE AND TREATMENT OF VACANCIES

Pursuant to Bye-law 89 of the Company’s Bye-Laws, the Company shall determine the minimum and maximum number of Directors at the Annual General Meeting of Shareholders.

Change of Size of the Board

The Company’s Bye-Laws currently provide for a minimum of two (2) Directors on the Board of Directors. In October 2000, the Company’s shareholders established the maximum size of the Board at nine (9) members. In each of the last thirteen years, the shareholders voted to maintain the number of Directors constituting the Board at nine (9) Directors. This proposal would continue to maintain the maximum number of Directors constituting the entire Board of the Company at nine (9) Directors.

The Company believes that having the ability to appoint nine (9) Directors is necessary to ensure that the Company is able to comply with the NASDAQ listing standards that generally require a listed company to maintain a majority of independent directors on its Board and certain of its committees, while retaining as Directors officers and members of the Company’s management who are familiar with the Company. Since the annual general meeting of the Company in October 2000, where the shareholders agreed to permit the Board to fill casual vacancies, the shareholders have continued to give the Board the authority to appoint additional Directors without a vote of shareholders.

Authorization of Directors to Fill Casual Vacancies

At the annual general meeting of the Company in October 2000, the shareholders approved a proposal to allow casual vacancies on the Board to be filled by the Board. This proposal was again approved in each of the last thirteen years. This proposal would allow the remaining vacant directorships to be casual vacancies and would authorize the Board to fill those vacancies as and when it deems fit.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE TO FIX THE MAXIMUM NUMBER OF DIRECTORS THAT COMPRISE THE WHOLE BOARD AT NINE (9) PERSONS, TO DECLARE THAT ANY VACANCIES ON THE BOARD BE CASUAL VACANCIES AND TO AUTHORIZE THE BOARD TO FILL THESE VACANCIES ON THE BOARD AS AND WHEN IT DEEMS FIT.

PROPOSAL NO. 3

APPOINTMENT OF INDEPENDENT AUDITORS

The Board has recommended that PricewaterhouseCoopers LLP, an independent registered public accounting firm, be appointed as the independent auditors of the Company to hold office until the close of the next annual general meeting at a remuneration to be negotiated by management and approved by the Audit Committee. PricewaterhouseCoopers LLP has served as the Company’s independent auditors since August 2008. A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual General Meeting and, if he/she so desires, will have the opportunity to make a statement, and in any event will be available to respond to appropriate questions. PricewaterhouseCoopers LLP has advised the Company that it does not have any direct or indirect financial interest in the Company, nor has such firm had any such interest in connection with the Company during the past fiscal year other than in its capacity as the Company’s independent auditors.

Audit Fees

Audit fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal years ended December 31, 2012 and 2013, for review of the Company’s annual financial statements and services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years, totaled approximately $1,033,002 and $1,004,697, respectively.

Audit-Related Fees

The audit-related fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2012, for assurance and related services, totaled approximately $28,651 and consisted of fees for professional services relating to accounting workshops and training conducted for the Company. The audit-related fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2013, for assurance and related services, totaled approximately $13,545 and consisted of fees for professional services relating to accounting workshops and training conducted for the Company.

Tax Fees

Tax fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2012, for tax compliance, tax advice and tax planning, totaled approximately $28,577 and consisted of review of tax returns for six subsidiaries of the Company and filing of quarterly value added tax returns for a subsidiary. Tax fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2013, for tax compliance, tax advice and tax planning, totaled approximately $59,764, and consisted of review of tax returns for six subsidiaries of the Company, filing of quarterly value added tax returns for a subsidiary, assistance with value added tax matters in a local jurisdiction and permissible tax advice to a subsidiary.

All Other Fees

There were no fees billed to the Company by PricewaterhouseCoopers LLP during the fiscal year ended December 31, 2012, for products and services not included in the foregoing categories. Fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2013, for products and services not included in the foregoing categories, totaled approximately $10,297 and consisted of permissible advice on a information technology vendor contract. The audit committee has approved 100% of the services described above under “Tax Fees”.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RE-APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP, AN INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM, AS THE COMPANY’S INDEPENDENT AUDITORS UNTIL THE NEXT ANNUAL GENERAL MEETING OF THE COMPANY.

SOLICITATION STATEMENT

The Company shall bear all expenses in connection with the solicitation of proxies. In addition to the use of the mails, solicitations may be made by the Company’s regular employees, by telephone, telegraph or personal contact, without additional compensation. The Company shall, upon their request, reimburse brokerage houses and persons holding Common Shares in the names of their nominees for their reasonable expenses in sending solicited material to their principals.

OTHER MATTERS

There is no business other than that described above to be presented for action by the shareholders at the Annual General Meeting.

SHAREHOLDER PROPOSALS

In order to be properly brought before the next annual general meeting of shareholders of the Company, any matter to be presented by a Shareholder at such meeting, including the nomination of a person to be appointed a Director, must be submitted to the Company between February 20, 2015 and March 22, 2015, provided, however, that if and only if the next annual general meeting is not scheduled to be held within a period that commences thirty days before and ends thirty days after June 20, 2015, any shareholder notice of any such proposal must be submitted to the Company by the later of (i) the close of business on the date ninety days prior to the actual date of such meeting or (ii) the close of business on the tenth day following the date on which the date of such meeting is first publicly announced or disclosed. Shareholder proposals may only be submitted by shareholders or nominee holders that hold of record at least 1% of the Company’s Common Shares entitled to vote on such matter.

AUDITED FINANCIAL STATEMENTS

The Company has sent, or is concurrently sending, all of its shareholders of record as of the Record Date a copy of its audited financial statements for the fiscal year ended December 31, 2013.

By Order of the Company,

Chan Hoi Ching

Secretary

Dated: May 13, 2014

Hamilton, Bermuda

Annex A

Compensation Committee Charter (the “Charter”)

for

Global Sources Ltd. (the “Company”)

The primary purposes of the Compensation Committee (the“Committee”) are to (i) assist the Board of Directors (the“Board”) in discharging its responsibilities with respect to compensation and benefits of the Company’s executive officers and directors, and (ii) approve awards under equity-based compensation plans in which the Company’s executive officers and directors participate.

| B. | Committee Membership and Qualifications |

The Committee shall consist of two or more persons each of whom shall be a member of the Board. Except as permitted by applicable rules of The Nasdaq Stock Market, Inc. (“Nasdaq”), each member of the Committee shall satisfy the independence criteria established by the applicable listing standards of Nasdaq and other applicable laws and regulations.

Committee members shall be elected by the Board at a meeting of the Board; members shall serve until their successors shall be duly elected and qualified. The Board may, at any time, remove any member of the Committee and fill the vacancy created by such removal. The Committee’s chairman shall be designated by the full Board, comprising a majority of independent directors, or the full Committee.

| C. | Committee Authority and Responsibilities |

The Committee shall have the power and authority of the Board to perform the following duties and to fulfill the following responsibilities:

| 1. | Determine all compensation for the Chief Executive Officer and all other executive officers of the Company, including incentive-based and equity-based compensation; |

| 2. | Review and approve corporate goals relevant to the compensation of the Chief Executive Officer and all other executive officers and evaluate the Chief Executive Officer’s and all other executive officers’ performance in light of these goals and objectives; |

| 3. | Consider, in determining the long-term incentive component of compensation for the Chief Executive Officer and all other executive officers, the Company’s performance and relative stockholder return, the value of similar incentive awards to chief executive officers and other executive officers at comparable companies, and the awards given to the Company’s Chief Executive Officer and other executive officers in past years; |

| 4. | Approve all employment, severance, or change-in-control agreements, special or supplemental benefits, or provisions including the same, applicable to the Chief Executive Officer and all other executive officers; |

| 5. | Periodically review and advise the Board concerning both regional and industry-wide compensation practices and trends in order to assess the adequacy and competitiveness of the Company’s compensation programs for the Chief Executive Officer and all other executive officers and directors relative to comparable companies in the Company’s industry; |

| 6. | Prepare an annual report on executive compensation for inclusion in the Company’s proxy statement for the annual meeting of stockholders, in accordance with applicable rules and regulations; |

| 7. | Review and establish appropriate coverage for the Company’s D&O insurance; |

| 8. | Update and advise the Board regarding potential and upcoming changes in SEC requirements and/or disclosures; |

| 9. | Annually review and reassess the adequacy of this charter and recommend any proposed changes to the Board for approval; and |

| 10. | Perform any other activities under this charter, the Company’s by-laws or governing law as the Committee or the Board deems appropriate. |

The Committee shall meet no less than once a year. Special meetings may be convened as required. A majority of the members of the Committee shall constitute a quorum for the transaction of business, and, if a quorum is present, any action approved by at least a majority of the members present shall represent the valid action of the Committee. The chairman of the Committee shall preside at each meeting and, in consultation with the other members of the Committee, shall set the frequency and length of each meeting and the agenda of items to be addressed at each meeting. The Committee may form subcommittees and delegate authority to them or to one or more of its members when appropriate.

The Chief Executive Officer may not be present during voting or deliberations relating to his or her compensation.

The Committee may, in its sole discretion, retain, terminate or obtain the advice of a compensation consultant, legal counsel or other adviser to assist the Committee in carrying out its responsibilities under this Charter. The Committee shall be directly responsible for the appointment, compensation and oversight of the work of any compensation consultant, legal counsel or other adviser retained by the Committee. The Company shall provide for appropriate funding, as determined by the Committee, for payment of reasonable compensation to a compensation consultant, legal counsel or any other adviser retained by the Committee and for the ordinary administrative expenses of the Committee. The Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the Committee, other than in-house legal counsel, only after taking into consideration the following factors:

| 1. | the provision of other services to the Company by the person that employs the compensation consultant, legal counsel or other adviser; |

| 2. | the amount of fees received from the Company by the person that employs the compensation consultant, legal counsel or other adviser, as a percentage of the total revenue of the person that employs the compensation consultant, legal counsel or other adviser; |

| 3. | the policies and procedures of the person that employs the compensation consultant, legal counsel or other adviser that are designed to prevent conflicts of interest; |

| 4. | any business or personal relationship of the compensation consultant, legal counsel or other adviser with a member of the Committee; |

| 5. | any stock of the Company owned by the compensation consultant, legal counsel or other adviser; and |

| 6. | any business or personal relationship of the compensation consultant, legal counsel, other adviser or the person employing the adviser with an executive officer of the Company. |

The Committee shall maintain written minutes of its meetings, which minutes shall be filed with the Company’s legal counsel.

Revised: July 1, 2013

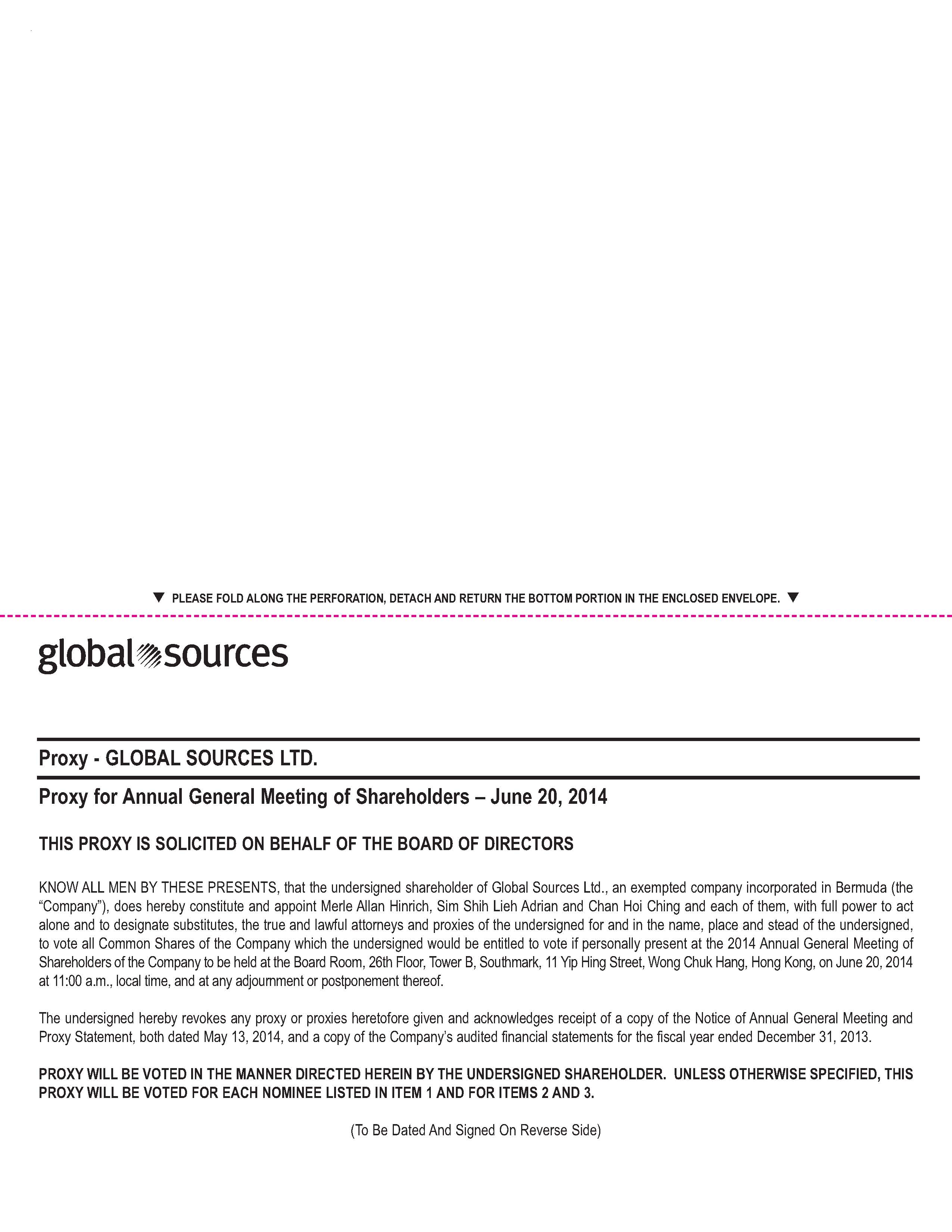

000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 1 8 8 0 2 3 1 MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND C 1234567890 J N T 000004 MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6 ENDORSEMENT_LINE______________ SACKPACK_____________ For Against Abstain For Against Abstain For Against Abstain ANNUAL GENERAL MEETING INFORMATION Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. X 01TYSB 1 U PX + q PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q Annual General Meeting Proxy Card . + A Proposals - The Board of Directors recommends a vote FOR each nominee listed in Proposal 1 and FOR Proposals 2 and 3. 01 - Mr. David F. Jones 02 - Mr. James A. Watkins 1. To re-elect three members of the Board of Directors of the Company (the "Board") who are retiring by rotation and, being eligible, offering themselves for re-election. C Authorized Signatures - This section must be completed for your vote to be counted. - Date and Sign Below NOTE: Your signature should appear the same as your name appears hereon. In signing as attorney, executor, administrator, trustee or guardian, please indicate the capacity in which signing. When signing as joint holders of share(s), all joint holders must sign. If the appointer is a corporation, the proxy shall be given either under its seal or under the hand of an officer, attorney or other person authorized to sign the same. No postage is required if mailed in the United States. Date (mm/dd/yyyy) - Please print date below. Signature 1 - Please keep signature within the box. Signature 2 - Please keep signature within the box. B Non-Voting Items Meeting Attendance Mark box to the right if you plan to attend the Annual General Meeting. Change of Address - Please print new address below. 2. To fix the maximum number of Directors that comprise the whole Board at nine (9) persons, declare any vacancies on the Board to be casual vacancies and authorize the Board to fill these vacancies on the Board as and when it deems fit. For Against Abstain 3. To re-appoint PricewaterhouseCoopers LLP, an independent registered public accounting firm, as the Company's independent auditors until the next annual general meeting of the Company. For Against Abstain 03 - Mr. Yam Kam Hon Peter

PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q Proxy for Annual General Meeting of Shareholders - June 20, 2014 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS KNOW ALL MEN BY THESE PRESENTS, that the undersigned shareholder of Global Sources Ltd., an exempted company incorporated in Bermuda (the "Company"), does hereby constitute and appoint Merle Allan Hinrich, Sim Shih Lieh Adrian and Chan Hoi Ching and each of them, with full power to act alone and to designate substitutes, the true and lawful attorneys and proxies of the undersigned for and in the name, place and stead of the undersigned, to vote all Common Shares of the Company which the undersigned would be entitled to vote if personally present at the 2014 Annual General Meeting of Shareholders of the Company to be held at the Board Room, 26th Floor, Tower B, Southmark, 11 Yip Hing Street, Wong Chuk Hang, Hong Kong, on June 20, 2014 at 11:00 a.m., local time, and at any adjournment or postponement thereof. The undersigned hereby revokes any proxy or proxies heretofore given and acknowledges receipt of a copy of the Notice of Annual General Meeting and Proxy Statement, both dated May 13, 2014, and a copy of the Company's audited financial statements for the fiscal year ended December 31, 2013. PROXY WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. UNLESS OTHERWISE SPECIFIED, THIS PROXY WILL BE VOTED FOR EACH NOMINEE LISTED IN ITEM 1 AND FOR ITEMS 2 AND 3. (To Be Dated And Signed On Reverse Side) . Proxy - GLOBAL SOURCES LTD.