FINANCIAL HIGHLIGHTS

| (In U.S. Dollars Thousands, Except Number of Shares and Per Share Data) | | Year Ended December 31 | | Year Ended December 31 | | |

| CONSOLIDATED STATEMENT OF OPERATIONS | | 2013 | | 2012 | | % Change |

| Revenue | | $ | 197,522 | | | $ | 231,740 | | | | (15 | ) |

| Sales costs | | | 61,958 | | | | 80,354 | | | | 23 | |

| Event production | | | 24,403 | | | | 26,250 | | | | 7 | |

| Community and content | | | 27,481 | | | | 32,696 | | | | 16 | |

| General and administrative | | | 50,272 | | | | 44,281 | | | | (14 | ) |

| Information and technology | | | 12,729 | | | | 13,188 | | | | 3 | |

| Profit on sale of property | | | 15,410 | | | | - | | | | 100 | |

| Profit from operations | | | 36,089 | | | | 34,971 | | | | 3 | |

| Interest income | | | 1,472 | | | | 1,044 | | | | 41 | |

| Gain on sale of available-for-sale securities | | | 64 | | | | - | | | | 100 | |

| Share of loss of associate | | | - | | | | 24 | | | | 100 | |

| Impairment loss on investment in associate | | | - | | | | 302 | | | | 100 | |

| Income tax expense | | | 4,753 | | | | 2,744 | | | | (73 | ) |

| | | | | | | | | | | | | |

| Net profit | | | 32,872 | | | | 32,945 | | | | 0 | |

| | | | | | | | | | | | | |

| Net profit attributable to non-controlling interests | | | 137 | | | | 739 | | | | 81 | |

| Net profit attributable to the Company’s shareholders | | $ | 32,735 | | | $ | 32,206 | | | | 2 | |

| Diluted earnings per share | | $ | 0.91 | | | $ | 0.90 | | | | 1 | |

| Shares used in diluted net profit per share calculations | | | 36,068,326 | | | | 35,742,495 | | | | 1 | |

| | | | | | | | | | | | | |

| BALANCE SHEET HIGHLIGHTS | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 137,359 | | | $ | 104,631 | | | | 31 | |

| Term deposits with banks | | | 106 | | | | 4,184 | | | | (97 | ) |

| Financial assets, available-for-sale | | | 6,367 | | | | 7,472 | | | | (15 | ) |

| Current assets | | | 176,394 | | | | 147,108 | | | | 20 | |

| Property and equipment | | | 49,701 | | | | 30,442 | | | | 63 | |

| Investment properties | | | 89,615 | | | | 97,377 | | | | (8 | ) |

| Total assets | | | 339,097 | | | | 311,169 | | | | 9 | |

| Current liabilities | | | 115,284 | | | | 118,705 | | | | 3 | |

| Total liabilities | | | 125,535 | | | | 133,857 | | | | 6 | |

| Total Company shareholders’ equity | | | 203,980 | | | | 165,920 | | | | 23 | |

| | | | | | | | | | | | | |

| OTHER INFORMATION | | | | | | | | | | | | |

| Net cash generated from operating activities | | $ | 31,055 | | | $ | 31,277 | | | | (1 | ) |

| Capital expenditures | | | 27,047 | | | | 1,371 | | | | (1,873 | ) |

| Stock price | | $ | 8.13 | (1) | | $ | 6.48 | (1) | | | 25 | |

| (1) | Stock price is based on last trading day of the year. |

Fellow Shareholders,

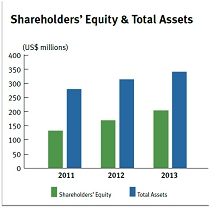

2013 was a challenging year for Global Sources. Retail demand for consumer products was slow in most major markets, our advertisers and exhibitors experienced significant cost increases and overall ad spending in our markets declined. However, beginning in the fourth quarter we began to see signs of improvement, which is encouraging for the coming year. We have also maintained a very strong balance sheet with no short- or long-term debt.

Operationally, we continued to integrate our online and trade show services with the aim of delivering unique and enhanced value to our respective buyer and supplier communities. For export markets, we announced the launch of new China Sourcing Fairs for the new vertical of Mobile and Wireless and just recently, for the new location of Jakarta, Indonesia. During 2013, we also announced an acquisition that enhanced our position in the machinery industry and expanded our footprint in China’s domestic B2B market.

Financial Highlights for 2013

We achieved the following 2013 results compared to 2012, reported in accordance with the International Financial Reporting Standards (IFRS):

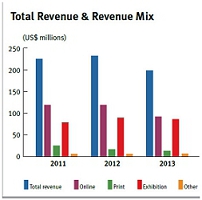

| • | Revenue was $197.5 million, down 15% as compared to $231.7 million; |

| - | Online revenue was $91.4 million, down 23%; |

| - | Exhibitions revenue was $85.6 million, down 4%; and |

| - | China grew to represent 83% of total revenue, up from 82%. |

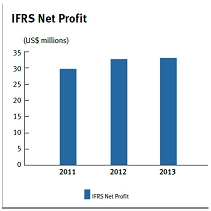

| • | Net profit was $32.7 million, or $0.91 per diluted share, as compared to $32.2 million, or $0.90 per diluted share. |

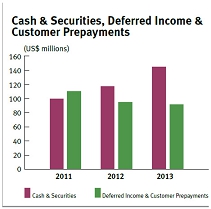

| • | Cash and securities as of December 31st, 2013 totaled $143.8 million. |

Merle A. Hinrichs

Executive Chairman

Letter to shareholders 1

Key Industry Trends

2013 was a year of substantial economic uncertainty with weak consumer demand in key developed markets, while the emerging markets generally continued to grow in importance. The overall weakness continued into the early part of 2014 with China’s exports showing a slight decline over the previous year. However, outside of the macro issues, there are several key trends that we see shaping our future.

A big factor impacting our industry is the ongoing importance of trade shows. They help buyers overcome the “trust” issues inherent in online-only environments and give them early access to the industry’s most carefully selected products.

Trade show attendees, who include many trade show "fans" who rarely or never use online services, are a primary segment of our buyer community and account for a major portion of the buying power. In addition, these "Verified Buyers" are even more attractive to suppliers because they are "in-market" buyers who are actively sourcing

Trade shows are also very important because of who participates. By exhibiting, a supplier demonstrates their size, existence and commitment to exporting. Accordingly, most buyers consider them to be more qualified than the average supplier they find online.

Similarly, the buyers have made a significant financial investment to travel to the show, a much larger commitment than simply going online and sending an inquiry. Accordingly, it is no surprise that our trade show attendees have much larger buying power than the average online user.

Both trade show and online media are necessary – but insufficient on their own. On the one hand, online marketplaces are valuable because they are fast, comprehensive and searchable. On the other hand, trade shows are essential for many buyers because they can personally evaluate products and suppliers, negotiate, and place orders. To source more safely, confidently and profitably, many buyers want to take advantage of both trade shows and online services.

Another big driver of trends, services and buyer behavior in our business is the sheer quantity of “products” and “exporters” that can be found online. This makes it riskier and more difficult than ever to find the right suppliers.

2 Letter to shareholders

Buyers can find more than one million “export” suppliers online and many millions of products. However, the challenge for buyers becomes clearer when you realize that there are likely fewer than 150,000 suppliers of consumer goods in China who have a background that would qualify them as a legitimate potential supplier for a volume import buyer.

Given the overwhelming quantity of suppliers and products that can be found online, finding the right suppliers is riskier and more difficult than ever.

Business and Growth Strategy

Our overall growth strategy has four primary components:

| • | Penetration of the market for our export media; |

| • | New product and market development; |

| • | Expansion into China’s domestic B2B market; and |

| • | Acquisitions, joint ventures and alliances |

In our primary business, our focus is on serving the professional segment. By being an essential provider of information and services to buyers, we are able to be an important marketing partner for suppliers.

We give suppliers access to a community of buyers that is highly qualified, influential and exclusive – including Verified Buyers who have all been qualified face-to-face at our trade shows. To help suppliers win orders and establish profitable, long-term customers, we offer an integrated, multi- channel solution that includes the industry’s leading services for helping suppliers differentiate and boost their image or brand.

Connecting our communities

To connect global buyers with suppliers in China and throughout Asia, we have two broad underlying initiatives. One is to provide a unique combination of online and trade show services, and the other is to match the right buyers with the right suppliers.

Letter to shareholders 3

Our primary strategy is to offer services that integrate the best of online with the best of trade shows. ThisFind Them and Meet Theminitiative is boosting value for all four of our major constituencies: buyers who attend our shows; buyers who use our online services; exhibitors; and online advertisers.

Global Sources’Find Them and Meet Theminitiative aims to provide buyers with the best of online media integratedwith the best of trade shows. The goal is to overcome limitations of online-only environments and provide unique and essential sourcing content and services.

For example, our Product Showcases at the trade shows feature carefully selected products from hundreds of suppliers who do not have booths at the particular show. In addition, we are connecting more suppliers with show attendees using unique matching services like ourPersonal Shortlisting Service. As another example, for the April 2014China Sourcing Fairsin Hong Kong we had more than 130,000 products online for buyers to view before the shows began.

The other key objective we are focused on is helping buyers find the right suppliers from among more than a million that they can find online. With GlobalSources.com we have proprietary systems that strive to include only those suppliers who have evidence of a background that would make them potential suppliers to the buyers we serve. Accordingly, this validated group of suppliers excludes the many thousands of other higher-risk suppliers.

We also help buyers find the right suppliers by providing vital data on suppliers’ customers, credentials and compliances within our search results – and with our focus on featuring exclusive products from Verified Suppliers and trade show exhibitors.

4 Letter to shareholders

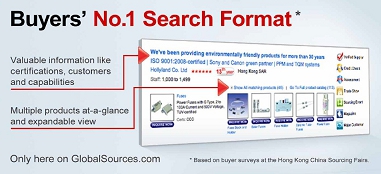

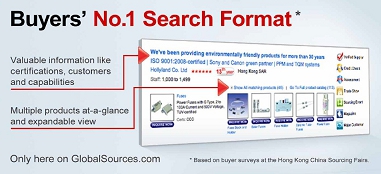

Global Sources’ unique user interface provides the most content-rich row of search results in the industry. The “headline” features a primary buyer benefit and the search result also features an expandable product catalog and details about the suppliers credentials and capabilities.

Expanding our markets

For our export trade shows, we are focused on further penetrating the market including looking at opportunities in new verticals and for new trade shows. For example, ourElectronicsshows are a very strong franchise that we intend to continue developing. Booth sales for future shows are strong, and we have various expansion plans underway including launching a new show for theMobile and Wirelesscategory. In addition, we recently announced thatChina Sourcing Fairswill be launched in Jakarta, Indonesia later in 2014.

The domestic B2B market in mainland China is also an important growth opportunity where we will continue to develop existing properties and look for new opportunities. We have been steadily building our presence and plan to continue in this direction.

In recent years, much of our growth in the China domestic market has been driven by acquisitions. The most recent example was in 2013, when we entered into an agreement to acquire an interest in theShenzhen International Machinery Manufacturing Industry Exhibitionand its related shows, also called theSIMMevents. The 2014SIMMevents took place in March and featured more than 4,000 booths. These events give us a strong presence in the machinery industry, which is a large and growing market sector and one of the

The largestChina Sourcing Fairsare held each spring and fall in Hong Kong and regional shows are scheduled this year in Johannesburg, Sao Paulo, Miami and Jakarta.

Letter to shareholders 5

Trade shows for the China domestic B2B market encompass mobile & wireless, semiconductors, fashion, optoelectronics, and machinery.

strategic pillars of mainland China’s national economy. It is also the foundation of the manufacturing sector, supporting a wide scope of industrial production such as automobiles, computers and electronics.

Outlook

While we expect the challenging environment to continue in 2014, we have a very strong team and a long track record of uninterrupted profitability.

Our future opportunities are numerous and are based on the large and attractive markets around China’s exports and domestic B2B market. We have an excellent set of products and services upon which to build, and a large and influential customer base. In addition, our balance sheet gives us the flexibility to explore a wide variety of options to grow our business and strengthen our competitive position.

Since we became a public company in 2000, we have been recognized numerous times for our excellence in corporate operations. In 2013 we were recognized again, this time withThe Asset’sGold corporate award for excellence in management and corporate governance.

Finally, I want to thank our Chief Executive Officer Spenser Au, our Board of Directors, and all of our team members for their contributions. I also want to thank all of our customers for choosing Global Sources, and all of our shareholders for your continued support.

Sincerely,

Merle A. Hinrich

Executive Chairman

April, 2014

6 Letter to shareholders

Management

| | Merle A. Hinrich, Executive Chairman

Mr. Hinrich has been a director since April 2000 and is currently our Executive Chairman. He was our Chief Executive officer from April 2000 to August 2011. A co-founder of the business, he was the principal executive officer of our predecessor company, Trade Media Holdings Limited, a Cayman Islands corporation wholly owned by us (“Trade Media”), from 1971 through 1993 and resumed that position in September 1999. From 1994 to August 1999, Mr. Hinrich was chairman of the ASM Group, which included Trade Media. Mr. Hinrich is a director of Trade Media and has also been the Chairman of the Board of Trade Media. Mr. Hinrich graduated from the University of Nebraska and the Thunderbird School of Global Management (“Thunderbird”). Mr. Hinrich is a founder and former chairman of the Society of Hong Kong Publishers. He is a member of the board of trustees of Thunderbird and is a board member of the Economic Strategy Institute. He is also an investment Promotion Ambassador with Invest Hong Kong and established the Hinrich Foundation with the mission of promoting sustainable global trade. His term as director expires in 2015. |

| | |

| | Spenser Au, Chief Executive Officer

Mr. Au was appointed as our Chief Executive officer in August, 2011. Mr. Au first became a team member in 1978 as an account executive for Asian Sources Electronics magazine. The positions through which he advanced to senior management included regional sales manager in 1988, associate publisher in 1991, publisher in 1992 and president of Asian Sales in 1999. Mr. Au has a deep knowledge of Greater China and other markets where the company operates. Mr. Au received a Diploma in Business Management in 1977 from the Hong Kong Baptist University. |

| | |

| | Brent Barnes, Chief Operating Officer

Mr. Barnes was appointed as our Chief Operating Officer in January 2012. Mr. Barnes is responsible for the company’s worldwide operations, including community development, content development, human resources and administration. Mr. Barnes began his career handling operations for a group of lobbyists in Austin, Texas. Later, he moved to Mexico City, where he designed and delivered training programs for executives at Ford Motor Co. and Mercedes-Benz. Upon completion of his MBA, Mr. Barnes spent a year working as a Market Analyst for Global Sources in Phoenix, Arizona before moving to Hong Kong to become Executive Assistant to the Chairman & CEO in June of 2000. Since 2003 he has spent time managing each of the core operational departments and assumed the role of General Manager of Content & Community Development in December 2009. Mr. Barnes holds a Bachelor of Arts degree from the University of Texas at Austin and an MBA from the Thunderbird School of Global Management. |

| | |

| | Connie Lai, Chief Financial Officer

Ms. Lai was appointed as our Chief Financial Officer effective August 2010. Ms. Lai joined Global Sources in June 2007 as financial controller, Hong Kong & China. Prior to joining Global Sources, she was Chief Financial Officer and an Executive Director of HC International, Inc., a Hong Kong listed company. Earlier in her career, she spent over four years with PricewaterhouseCoopers (“PwC”) Hong Kong. Ms. Lai graduated from the Chinese University of Hong Kong with a bachelor’s degree in professional accountancy. She is also a Member of the Hong Kong Institute of Certified Public Accountants and a Fellow Member of the Association of Chartered Certified Accountants in the United Kingdom. |

| | |

| | Peter Zapf, Chief Information Officer

Mr. Zapf was appointed as our Chief Information Officer in January 2012. Mr. Zapf began his career in software project management with the United States Air Force. He then joined Global Sources in Phoenix, Arizona, working on the development, sales and marketing of the company’s early software and e-commerce products. Later, he worked as a research analyst at Bear Stearns in New York, focusing on the business-to-business market, after which he joined Hong Kong-based AsiaCommerce, a startup incubator, as Chief Executive Officer. He rejoined Global Sources in 2001, and was Chief Operating Officer from January 2011 to December 2011. Mr. Zapf holds a BS in Electrical Engineering and Engineering and Public Policy from Carnegie Mellon University, an MS in Computer Science from Troy State University, and an MBA from Thunderbird, the American Graduate School of International Management. |

(Note: * indicates independent director)

Letter to shareholders 7

GLOBAL SOURCES LTD. AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS

For the year ended December 31, 2013

| Contents | Page |

| | |

| Report of Independent Registered Public Accounting Firm | 9 |

| | |

| Consolidated Income Statements | 10 |

| | |

| Consolidated Statements of Comprehensive Income | 11 |

| | |

| Consolidated Balance Sheets | 12 |

| | |

| Consolidated Statements of Changes in Equity | 13 |

| | |

| Consolidated Statements of Cash Flows | 14 |

| | |

| Notes to the Consolidated Financial Statements | 15 - 52 |

| | |

| Report of Management on Internal Control Over Financial Reporting | 53 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders

In our opinion, the accompanying consolidated balance sheets and the related consolidated income statements and statements of comprehensive income, changes in equity and cash flows present fairly, in all material respects, the financial position of Global Sources Ltd. (the ‘Company’) and its subsidiaries at December 31, 2013, and December 31, 2012 and the results of their operations and their cash flows for each of the three years ended December 31, 2013 in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as at December 31, 2013, based on criteria established inInternal Control - Integrated Framework 1992issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company’s management is responsible for these financial statements, for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Report of Management on Internal Control over Financial Reporting.

Our responsibility is to express opinions on these financial statements and on the Company’s internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

/s/ PricewaterhouseCoopers LLP

Singapore

April 2, 2014

GLOBAL SOURCES LTD. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

| | | Year Ended December 31, |

| | | 2013 | | 2012 | | 2011 |

| Revenue: | | | | | | | | | | | | |

| Online and other media services | | $ | 104,629 | | | $ | 136,101 | | | $ | 141,475 | |

| Exhibitions | | | 85,636 | | | | 88,782 | | | | 77,973 | |

| Miscellaneous | | | 7,257 | | | | 6,857 | | | | 5,617 | |

| | | | 197,522 | | | | 231,740 | | | | 225,065 | |

| Operating Expenses: | | | | | | | | | | | | |

| Sales | | | 61,958 | | | | 80,354 | | | | 81,363 | |

| Event production | | | 24,403 | | | | 26,250 | | | | 24,637 | |

| Community and content | | | 27,481 | | | | 32,696 | | | | 34,078 | |

| General and administrative | | | 50,272 | | | | 44,281 | | | | 40,660 | |

| Information and technology | | | 12,729 | | | | 13,188 | | | | 12,607 | |

| Total Operating Expenses | | | 176,843 | | | | 196,769 | | | | 193,345 | |

| Profit on sale of property | | | 15,410 | | | | - | | | | - | |

| Profit from Operations | | | 36,089 | | | | 34,971 | | | | 31,720 | |

| Interest income | | | 1,472 | | | | 1,044 | | | | 360 | |

| Share of loss of associate | | | - | | | | (24 | ) | | | - | |

| Gain on sale of available-for-sale securities | | | 64 | | | | - | | | | - | |

| Impairment loss on investment in associate | | | - | | | | (302 | ) | | | - | |

| Profit before income taxes | | | 37,625 | | | | 35,689 | | | | 32,080 | |

| Income tax expense | | | (4,753 | ) | | | (2,744 | ) | | | (1,613 | ) |

| Net profit | | | 32,872 | | | | 32,945 | | | | 30,467 | |

| Net profit attributable to non-controlling interests | | | (137 | ) | | | (739 | ) | | | (991 | ) |

| Net profit attributable to the Company’s shareholders | | $ | 32,735 | | | $ | 32,206 | | | $ | 29,476 | |

| Basic net profit per share attributable to the Company’s shareholders | | $ | 0.95 | | | $ | 0.95 | | | $ | 0.87 | |

| Shares used in basic net profit per share calculations | | | 34,426,468 | | | | 34,017,730 | | | | 33,742,648 | |

| Diluted net profit per share attributable to the Company’s shareholders | | $ | 0.91 | | | $ | 0.90 | | | $ | 0.83 | |

| Shares used in diluted net profit per share calculations | | | 36,068,326 | | | | 35,742,495 | | | | 35,385,218 | |

The notes on pages 15 to 52 are an integral part of these consolidated financial statements.

GLOBAL SOURCES LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

| | | Year ended December 31, |

| | | 2013 | | 2012 | | 2011 |

| Net profit | | $ | 32,872 | | | $ | 32,945 | | | $ | 30,467 | |

Other comprehensive income that may be reclassified

subsequently to profit or loss: | | | | | | | | | | | | |

| Currency translation differences arising from consolidation | | | 3,170 | | | | 1,623 | | | | 3,212 | |

| Financial assets, available-for-sale: | | | | | | | | | | | | |

| Fair value gains | | | 61 | | | | 52 | | | | - | |

| Reclassification to income statements on disposal | | | (64 | ) | | | - | | | | - | |

| Other comprehensive income for the year, net of tax of $nil | | | 3,167 | | | | 1,675 | | | | 3,212 | |

| Total comprehensive income for the year | | | 36,039 | | | | 34,620 | | | | 33,679 | |

| Total comprehensive income attributable to the Company’s shareholders | | | 35,806 | | | | 33,812 | | | | 32,573 | |

| Total comprehensive income attributable to non-controlling interests | | | 233 | | | | 808 | | | | 1,106 | |

| Total comprehensive income for the year | | $ | 36,039 | | | $ | 34,620 | | | $ | 33,679 | |

The notes on pages 15 to 52 are an integral part of these consolidated financial statements.

GLOBAL SOURCES LTD. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

| | | As at December 31, |

| | | | 2013 | | | | 2012 | |

| ASSETS | | | | | | | | |

| | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 137,359 | | | $ | 104,631 | |

| Term deposits with banks | | | 106 | | | | 4,184 | |

| Financial assets, available-for-sale | | | 6,367 | | | | 7,472 | |

| Accounts receivables, net | | | 3,122 | | | | 4,242 | |

| Receivables from sales representatives | | | 10,630 | | | | 7,773 | |

| Inventories | | | 266 | | | | 410 | |

| Prepaid expenses and other current assets | | | 18,544 | | | | 18,396 | |

| | | | 176,394 | | | | 147,108 | |

| Non-current assets: | | | | | | | | |

| Property and equipment | | | 49,701 | | | | 30,442 | |

| Investment properties | | | 89,615 | | | | 97,377 | |

| Intangible assets | | | 21,423 | | | | 33,136 | |

| Long term investment | | | 100 | | | | 100 | |

| Deferred income tax assets | | | 98 | | | | 244 | |

| Other non-current assets | | | 1,766 | | | | 2,762 | |

| | | | 162,703 | | | | 164,061 | |

| Total assets | | $ | 339,097 | | | $ | 311,169 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 8,779 | | | $ | 12,531 | |

| Deferred income and customer prepayments | | | 84,704 | | | | 84,540 | |

| Accrued liabilities | | | 19,166 | | | | 20,409 | |

| Income taxes liabilities | | | 2,635 | | | | 1,225 | |

| | | | | | | | | |

| Non-current liabilities: | | | 115,284 | | | | 118,705 | |

| Deferred income and customer prepayments | | | 5,660 | | | | 9,062 | |

| Deferred income tax liabilities | | | 4,591 | | | | 6,090 | |

| | | | 10,251 | | | | 15,152 | |

| Total liabilities | | | 125,535 | | | | 133,857 | |

| | | | | | | | | |

| Commitments and contingencies (note 25 and 26) | | | | | | | | |

| | | | | | | | | |

| Equity attributable to Company’s shareholders: | | | | | | | | |

| Common shares | | | 525 | | | | 521 | |

| Treasury shares | | | (150,089 | ) | | | (150,089 | ) |

| Other reserves | | | 161,950 | | | | 156,629 | |

| Retained earnings | | | 191,594 | | | | 158,859 | |

| Total Company shareholders’ equity | | | 203,980 | | | | 165,920 | |

| Non-controlling interests | | | 9,582 | | | | 11,392 | |

| Total equity | | $ | 213,562 | | | $ | 177,312 | |

| Total liabilities and equity | | $ | 339,097 | | | $ | 311,169 | |

The notes on pages 15 to 52 are an integral part of these consolidated financial statements.

GLOBAL SOURCES LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

| | | Attributable to Company’s shareholders | | | | |

| | | | | | | | | | | | | Non- | | |

| | | Common | | Treasury | | Other | | Retained | | | | controlling | | Total |

| | | shares | | shares | | reserves | | earnings | | Total | | interests | | equity |

| Balance at January 1, 2011 | | $ | 516 | | | $ | (150,089 | ) | | $ | 146,691 | | | $ | 97,177 | | | $ | 94,295 | | | $ | 8,165 | | | $ | 102,460 | |

| Total comprehensive income for the year | | | - | | | | - | | | | 3,097 | | | | 29,476 | | | | 32,573 | | | | 1,106 | | | | 33,679 | |

| Transaction with owners: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividend issued by a subsidiary to non-controlling interest | | | - | | | | - | | | | - | | | | - | | | | - | | | | (390 | ) | | | (390 | ) |

| Fair value of non-cash compensation expense | | | - | | | | - | | | | 2,777 | | | | - | | | | 2,777 | | | | - | | | | 2,777 | |

| Capitalization of intangible assets relating to share grants for non-compete agreements | | | - | | | | - | | | | 28 | | | | - | | | | 28 | | | | - | | | | 28 | |

| Issue of new shares | | | 2 | | | | - | | | | (2 | ) | | | - | | | | - | | | | - | | | | - | |

| Balance at December 31, 2011 | | $ | 518 | | | $ | (150,089 | ) | | $ | 152,591 | | | $ | 126,653 | | | $ | 129,673 | | | $ | 8,881 | | | $ | 138,554 | |

| Total comprehensive income for the year | | | - | | | | - | | | | 1,606 | | | | 32,206 | | | | 33,812 | | | | 808 | | | | 34,620 | |

| Transaction with owners: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair value of non-controlling interest in business acquisition | | | - | | | | - | | | | - | | | | - | | | | - | | | | 3,006 | | | | 3,006 | |

| Dividend issued by subsidiaries to non-controlling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,303 | ) | | | (1,303 | ) |

| Fair value of non-cash compensation expense | | | - | | | | - | | | | 2,409 | | | | - | | | | 2,409 | | | | - | | | | 2,409 | |

| Capitalization of intangible assets relating to share grants for non-compete agreements | | | - | | | | - | | | | 26 | | | | - | | | | 26 | | | | - | | | | 26 | |

| Issue of new shares | | | 3 | | | | - | | | | (3 | ) | | | - | | | | - | | | | - | | | | - | |

| Balance at December 31, 2012 | | $ | 521 | | | $ | (150,089 | ) | | $ | 156,629 | | | $ | 158,859 | | | $ | 165,920 | | | $ | 11,392 | | | $ | 177,312 | |

| Total comprehensive income for the year | | | - | | | | - | | | | 3,071 | | | | 32,735 | | | | 35,806 | | | | 233 | | | | 36,039 | |

| Transaction with owners: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividend issued by subsidiaries to non-controlling interests | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,043 | ) | | | (2,043 | ) |

| Fair value of non-cash compensation expense | | | - | | | | - | | | | 2,170 | | | | - | | | | 2,170 | | | | - | | | | 2,170 | |

| Capitalization of intangible assets relating to share grants for non-compete agreements | | | - | | | | - | | | | 84 | | | | - | | | | 84 | | | | - | | | | 84 | |

| Issue of new shares | | | 4 | | | | - | | | | (4 | ) | | | - | | | | - | | | | - | | | | - | |

| Balance at December 31, 2013 | | $ | 525 | | | $ | (150,089 | ) | | $ | 161950 | | | $ | 191,594 | | | $ | 203,980 | | | $ | 9,582 | | | $ | 213,562 | |

The notes on pages 15 to 52 are an integral part of these consolidated financial statements.

GLOBAL SOURCES LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

| | | Year Ended December 31, |

| | | 2013 | | 2012 | | 2011 |

| Cash flows from operating activities: | | | | | | | | | | | | |

| Net Profit | | $ | 32,872 | | | $ | 32,945 | | | $ | 30,467 | |

| Adjustments for: | | | | | | | | | | | | |

| Income tax expense | | | 4,753 | | | | 2,744 | | | | 1,613 | |

| Depreciation and amortization | | | 9,029 | | | | 9,112 | | | | 6,785 | |

| (Profit)/loss on sale of property and equipment and investment property | | | (15,410 | ) | | | (6 | ) | | | 12 | |

| Gain on sale of available-for-sale securities | | | (64 | ) | | | - | | | | - | |

| Interest income | | | (1,472 | ) | | | (1,044 | ) | | | (360 | ) |

| Provision for impairment of receivables | | | 30 | | | | 229 | | | | 25 | |

| Non-cash compensation expense | | | 2,170 | | | | 2,409 | | | | 2,777 | |

| Equipment written off | | | 65 | | | | 48 | | | | 5 | |

| Share of loss of associate | | | - | | | | 24 | | | | - | |

| Impairment loss on investment in associate | | | - | | | | 302 | | | | - | |

| Impairment of intangible assets | | | 8,525 | | | | 1,389 | | | | 670 | |

| Net foreign exchange differences | | | (15 | ) | | | (12 | ) | | | 87 | |

| Changes in working capital (excluding the effects of acquisition and exchange differences on consolidation): | | | | | | | | | | | | |

| Accounts receivable | | | 1,106 | | | | 264 | | | | (325 | ) |

| Receivables from sales representatives | | | (2,880 | ) | | | (1,251 | ) | | | 1,716 | |

| Inventories | | | 144 | | | | (180 | ) | | | 205 | |

| Prepaid expenses and other current assets | | | (171 | ) | | | 2,528 | | | | (379 | ) |

| Other non-current assets | | | 990 | | | | (204 | ) | | | 21 | |

| Accounts payable | | | 594 | | | | 464 | | | | (2,008 | ) |

| Accrued liabilities | | | (1,202 | ) | | | 2,337 | | | | 2,984 | |

| Deferred income and customer prepayments | | | (3,299 | ) | | | (18,142 | ) | | | 12,592 | |

| Cash generated from operations | | | 35,765 | | | | 33,956 | | | | 56,887 | |

| Income tax paid | | | (4,710 | ) | | | (2,679 | ) | | | (1,656 | ) |

| Net cash generated from operating activities | | | 31,055 | | | | 31,277 | | | | 55,231 | |

| Cash flows from investing activities: | | | | | | | | | | | | |

| Acquisition of subsidiary, net of cash acquired | | | (4,387 | ) | | | (11,359 | ) | | | (3,423 | ) |

| Investment in associate | | | - | | | | (326 | ) | | | - | |

| Purchase of property and equipment and investment property | | | (27,047 | ) | | | (1,371 | ) | | | (56,667 | ) |

| Proceeds from sale of property and equipment and investment property, net of transaction costs | | | 27,907 | | | | 6 | | | | 12 | |

| Placement of term deposits with banks | | | (1,762 | ) | | | (5,012 | ) | | | (3,526 | ) |

| Proceeds from matured term deposits with banks | | | 5,840 | | | | 3,632 | | | | 2,198 | |

| Purchase of available-for-sale financial assets | | | (63 | ) | | | (12,611 | ) | | | (18,247 | ) |

| Proceeds from sale of available-for-sale securities | | | 1,294 | | | | 18,441 | | | | 4,999 | |

| Interest received | | | 1,472 | | | | 1,004 | | | | 334 | |

| Net cash generated from (used in) investing activities | | | 3,254 | | | | (7,596 | ) | | | (74,320 | ) |

| Cash flows from financing activities: | | | | | | | | | | | | |

| Dividend paid to non-controlling interest | | | (2,043 | ) | | | (1,303 | ) | | | (390 | ) |

| Net cash used in financing activities | | | (2,043 | ) | | | (1,303 | ) | | | (390 | ) |

| Net increase (decrease) in cash and cash equivalents | | | 32,266 | | | | 22,378 | | | | (19,479 | ) |

| Cash and cash equivalents, beginning of the year | | | 104,631 | | | | 81,903 | | | | 101,298 | |

| Effect of exchange rate changes on cash and cash equivalents | | | 462 | | | | 350 | | | | 84 | |

| Cash and cash equivalents, end of the year | | $ | 137,359 | | | $ | 104,631 | | | $ | 81,903 | |

The notes on pages 15 to 52 are an integral part of these consolidated financial statements.

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

Global Sources Ltd. (the ‘Company’) and its subsidiaries’ (together ‘Group’) principal business is to provide services that allow global buyers to identify suppliers and products, and enable suppliers to market their products to a large number of buyers. The Group’s primary online service is creating and hosting marketing websites that present suppliers’ product and company information in a consistent, easily searchable manner on Global Sources Online. Complementing this service are various trade magazines. The Group launched China Sourcing Fairs exhibitions in 2003. These exhibitions offer international buyers direct access to China and other Asian manufacturers. The Group’s businesses are conducted primarily through Trade Media Limited, its wholly owned subsidiary, which was incorporated in October 1984 under the laws of Cayman Islands. Through certain other wholly owned subsidiaries, the Group also organizes China Sourcing Fairs exhibitions, conferences and exhibitions on technology related issues, licenses Asian Sources/Global Sources Online and offers catalog services.

The Company was incorporated in Bermuda. The Company’s registered office address is Canon’s Court, 22 Victoria Street, Hamilton, HM 12, Bermuda.

These financial statements were authorized for issue by the executive committee of the Board of Directors on April 2, 2014.

| 2. | Summary of significant accounting policies |

The principal accounting policies applied in the preparation of these consolidated financial statements are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated.

The consolidated financial statements of Global Sources Ltd. have been prepared in accordance with International Financial Reporting Standards (‘IFRS’) and International Financial Reporting Interpretations Committee (‘IFRIC’) interpretations as issued by the International Accounting Standards Board (‘IASB’).

The consolidated financial statements have been prepared under the historical cost convention, except as disclosed in the accounting policies below.

The preparation of financial statements in conformity with IFRS requires the use of certain critical accounting estimates. It also requires management to exercise its judgment in the process of applying the Group’s accounting policies. The areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the consolidated financial statements are disclosed in note 4. Actual results could differ from those estimates and such differences could affect the results of operations reported in future periods.

New and amended standards adopted by the Group:

The following standards have been adopted by the Group for the first time from the financial year beginning on January 1, 2013:

| • | Amendment to IAS 1, ‘Financial statement presentation’ regarding other comprehensive income. The main change resulting from these amendments is a requirement for entities to group items presented in other comprehensive income on the basis of whether they are potentially reclassifiable to profit or loss subsequently. The adoption of this standard did not have a significant impact on the Group’s financial statements. |

| • | IFRS 10, ‘Consolidated financial statements’ builds on existing principles by identifying the concept of control as the determining factor in whether an entity should be included within the consolidated financial statements of the parent company. The standard provides additional guidance to assist in the determination of control where this is difficult to assess. The adoption of this standard did not have a significant impact on the Group’s financial statements. |

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

| • | IFRS 11 replaces the guidance on ‘Joint ventures’ in IAS 31 – Interests in Joint Ventures and SIC 13 – Jointly Controlled Entities – Non-Monetary Contributions by Venturers. The new standard introduces a principles- based approach to accounting for joint arrangements that requires a party to a joint arrangement to recognize its rights and obligations arising from the arrangement. The new standard requires that joint ventures be accounted for under the equity method thus eliminating the option to proportionally consolidate such ventures. There was no impact on the Group’s financial statements upon adoption. |

| • | IFRS 12, ‘Disclosures of interests in other entities’ includes the disclosure requirements for all forms of interests in other entities, including joint arrangements, associates, special purpose vehicles and other off balance sheet vehicles. The adoption of this standard did not result in a significant impact on the Group’s financial statements as it affects only the disclosures. None of the subsidiaries in the Group has non-controlling interests that are material to the Group as at and for the year ended December 31, 2013. |

| • | IFRS 13, ‘Fair value measurement’, aims to improve consistency and reduce complexity by providing a precise definition of fair value and a single source of fair value measurement and disclosure requirements for use across IFRSs. The requirements, which are largely aligned between IFRSs and US GAAP, do not extend the use of fair value accounting but provide guidance on how it should be applied where its use is already required or permitted by other standards within IFRSs or US GAAP. The adoption of this standard did not have a significant impact on the Group’s financial statements. |

The consolidated financial statements comprise the financial statements of the Company and its majority owned or otherwise controlled subsidiaries.

Subsidiaries are all entities (including structured entities) over which the Group has control. The Group controls an entity when the Group is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are deconsolidated from the date that control ceases.

The Group uses the acquisition method of accounting to account for business combinations. The consideration transferred for the acquisition of a subsidiary is the fair value of the assets transferred, the liabilities incurred and the equity interests issued by the Group. The consideration transferred includes the fair value of any asset or liability resulting from a contingent consideration arrangement. Acquisition-related costs are expensed as incurred. Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the acquisition date. On an acquisition-by-acquisition basis, the Group recognizes any non-controlling interest in the acquiree either at fair value or at the non-controlling interest’s proportionate share of the acquiree’s net assets.

The excess of the consideration transferred, the amount of any non-controlling interest in the acquiree and the acquisition-date fair value of any previous equity interest in the acquiree over the fair value of the Group’s share of the identifiable net assets acquired is recorded as goodwill. If this is less than the fair value of the net assets of the subsidiary acquired in the case of a bargain purchase, the difference is recognized directly in the consolidated income statement.

Investments in subsidiaries are accounted for at cost less impairment by the Company. Cost is adjusted to reflect changes in consideration arising from contingent consideration amendments. Cost also includes direct attributable costs of investment.

| (b) Transactions with non-controlling interests |

The Group treats transactions with non-controlling interests as transactions with equity owners of the Group. For purchases from non-controlling interests, the difference between any consideration paid and the relevant share

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

acquired of the carrying value of net assets of the subsidiary is recorded in equity. Gains or losses on disposals to non-controlling interests are also recorded in equity.

When the Group ceases to have control or significant influence, any retained interest in the entity is re-measured to its fair value, with the change in carrying amount recognized in the consolidated income statement.

Associates are all entities over which the Group has significant influence but not control, generally accompanying a shareholding of between 20% and 50% of the voting rights. Investments in associates are accounted for using the equity method of accounting. Under the equity method, the investment is initially recognized at cost, and the carrying amount is increased or decreased to recognize the investor’s share of the profit or loss of the investee after the date of acquisition. The Group’s investment in associates includes goodwill identified on acquisition. The Group’s share of post-acquisition profit or loss is recognized in the consolidated income statement, and its share of post-acquisition movements in other comprehensive income is recognized in other comprehensive income with a corresponding adjustment to the carrying amount of the investment.

The Group determines at each reporting date whether there is any objective evidence that the investment in the associate is impaired. If this is the case, the Group calculates the amount of impairment as the difference between the recoverable amount of the associate and its carrying value and recognizes the amount adjacent to ’share of loss of associate’, on the face of the consolidated income statement.

Operating segments are reported in a manner consistent with the internal reporting provided to chief operating decision-maker, which is the Company’s Board of Directors. The chief operating decision maker assesses the Group’s performance and makes decisions about resources to be allocated to each segment.

| 2.4 Foreign currency translation |

| | (a) Functional and presentation currency |

Items included in the financial statements of each of the Group’s entities are measured using the currency of the primary economic environment in which the entity operates (‘the functional currency’). The Company’s functional currency is United States dollar (’$’ or ‘USD’). The consolidated financial statements are presented in USD, which is the Group’s presentation currency.

| | (b) Transactions and balances |

Transactions in currencies other than the functional currency are measured and recorded in the functional currency using the exchange rate in effect on the date of the transaction. As at the balance sheet date, monetary assets and liabilities that are denominated in currencies other than the functional currency are translated using the exchange rate at the balance sheet date. All gains and losses arising from foreign currency transactions and translation of foreign currency denominated accounts are recognized in the consolidated income statement.

Non-monetary items measured at fair values in foreign currencies are translated using the exchange rates at the date when the fair values are determined.

The financial statements of the subsidiaries reported in their respective local currencies are translated into USD for consolidation as follows:

| (i) | assets and liabilities at the closing exchange rate as at the balance sheet date, |

| (ii) | shareholders’ equity at the historical rates of exchange, |

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

| (iii) | income and expense amounts at the average monthly exchange rates (unless this average is not a reasonable approximation of the cumulative effect of the rates prevailing on the transaction dates, in which case income and expenses are translated at the rate on the dates of the transactions), |

| (iv) | all resulting translation differences are recorded in other comprehensive income and accumulated in ‘currency translation reserve’ within equity. |

Goodwill and fair value adjustments arising on the acquisition of foreign operations on or after January 1, 2009 (the Group’s date of transition to IFRS) are treated as assets and liabilities of the foreign operations and translated at the closing rates at the reporting date.

| | 2.5 Property and equipment |

Property and equipment are stated at cost less accumulated depreciation and accumulated impairment losses (note 2.8). Cost represents the purchase price of the asset and other costs incurred to bring the asset into its existing use. Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Group and the cost of the item can be measured reliably. The carrying amount of the replaced part is derecognized. All other repairs and maintenance are charged to the consolidated income statement during the year in which they are incurred.

Depreciation on property and equipment is calculated on a straight-line basis over their estimated useful lives as follows:

| Buildings | | Over the remaining lease period

or 50 years, whichever is shorter |

| Leasehold improvements | | 5 years |

| Computer equipment and software | | 3 years |

| Fixtures, fittings and office equipment | | 5 years |

| Reusable trade show booths | | 2 years |

| Motor vehicles | | 5 years |

No depreciation was recognized for capital work-in-progress.

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at the end of each reporting period. Gains and losses on disposals are determined by comparing the proceeds with the carrying amount and are recognized in the consolidated income statement.

| | 2.6 Investment properties |

Investment properties include those portions of buildings that are held either to earn rental income or capital appreciation or both in the short to medium term. The portions of building and its associated land use rights are, together, classified as investment property if the components are not separable. Investment properties are initially recognized at cost and subsequently carried at cost less accumulated depreciation and accumulated impairment losses. The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at the end of each reporting period. Depreciation is calculated using a straight line method to allocate the depreciable amounts over the estimated lives of 50 years or over the remaining lease period whichever is shorter. Gains and losses on disposals are determined by comparing the proceeds with the carrying amount and are recognized in the consolidated income statement.

Transfers to, or from, investment properties are made when there is a change in the Company’s intention with respect to the use of the property.

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

Goodwill on acquisition of subsidiaries on or after January 1, 2009 (the Group’s date of transition to IFRS) represents the excess of the consideration transferred, the amount of any non-controlling interest in the acquiree and the acquisition date fair value of any previous equity interest in the acquiree over the fair value of the net identifiable assets acquired. Goodwill on acquisitions of subsidiaries is included in ‘intangible assets’. Goodwill is carried at cost less accumulated impairment losses. Impairment losses on goodwill are not reversed. Gains and losses on the disposal of an entity include the carrying amount of goodwill relating to the entity sold.

Goodwill is allocated to cash-generating units (CGU) for the purpose of impairment testing. The allocation is made to those CGUs or groups of CGUs that are expected to benefit from the business combination in which the goodwill arose, identified according to operating segment.

Trademarks acquired in a business combination are recognized at fair value at the acquisition date. Trademarks have a finite useful life and are carried at cost less accumulated amortization. Amortization is calculated using the straight-line method over their estimated useful lives of 6 to 14 years. The useful lives are reviewed, and adjusted if appropriate, at the end of each reporting period. The Group has reviewed the useful life of intangible asset and the change in useful life is disclosed under note 13.

| | (c) Contractual backlog and others |

Contractual backlog and others acquired in a business combination mainly relates to customer relationships which are recognized at fair value at the acquisition date. The contractual customer relationships have a finite useful life and are carried at cost less accumulated amortization. Amortization is calculated using the straight-line method over the expected life of the customer relationship of 5 to 12 months.

The databases acquired are measured on initial recognition at cost being the fair value as at the date of acquisition. Following initial recognition, databases are carried at cost less any accumulated amortization and any accumulated impairment losses. Databases are amortized over a period of one year beginning on the date of acquisition. The amortization expense on databases is recognized in the consolidated income statement.

| | (e) Non-compete agreements |

Intangible assets relating to non-compete agreements with the Group’s former employees and consultants and to the former employees of third party service providers are recorded at fair values at the date the respective agreements are entered into and are carried at cost less accumulated amortization. Amortization is calculated using a straight-line basis over the non-compete period of 5 years. The fair values are estimated based on the cash flow valuation model whereby valuation inputs include an estimate of future cash flows expected to be generated by the asset (note 2.15 (b)).

| | 2.8 Impairment of non-financial assets |

Assets that have an indefinite useful life – for example, goodwill, are not subject to amortization and are tested at least annually for impairment or more frequently if events or changes in circumstances indicate a potential impairment. Assets that are subject to amortization are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognized for the amount by which the asset’s carrying amount exceeds its recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows (cash-generating units). Non-financial assets other than goodwill that suffered impairment are reviewed for possible reversal of the impairment at each reporting date.

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

2.9.1 Classification

The Group classifies its financial assets in the following categories: loans and receivables, and available-for-sale. The classification depends on the purpose for which the financial assets were acquired. Management determines the classification of its financial assets at initial recognition.

(a) Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are included in current assets, except for maturities greater than 12 months after the end of the reporting period, which are classified as non-current assets. The Group’s loans and receivables comprise ‘accounts receivables’, ‘receivables from sales representatives’, ‘term deposits with banks’, ‘cash and cash equivalents’ and assets other than ‘prepaid expenses’, ‘deferred expenses’ and ‘club memberships’ included in the ‘prepaid expenses and other current assets’ and ‘other non-current assets’ in the balance sheet.

(b) Financial assets, available-for-sale

Financial assets, available-for-sale are non-derivatives that are either designated in this category or not classified as loans and receivables, held-to-maturity investments or financial assets at fair value through profit or loss. They are included in non-current assets unless the investment matures or management intends to dispose of it within 12 months of the end of the reporting period.

2.9.2 Recognition and measurement

Regular purchases and sales of financial assets are recognized on the trade-date – the date on which the Group commits to purchase or sell the asset. Investments are initially recognized at fair value plus transaction costs. Financial assets are derecognized when the rights to receive cash flows from the investments have expired or have been transferred and the Group has transferred substantially all risks and rewards of ownership. Available- for-sale financial assets are subsequently carried at fair value. Loans and receivables are subsequently carried at amortized cost using the effective interest method, less provision for impairment. A provision for impairment is established when there is objective evidence that the Group will not be able to collect all amounts due according to the original terms of the receivables (note 2.9.3).

Changes in the fair value of available-for-sale securities are recognized in other comprehensive income and accumulated in ‘fair value reserve’ within equity.

When securities classified as available-for-sale are sold or impaired, the accumulated fair value adjustments recognized in equity are included in the consolidated income statement.

Interest on available-for-sale securities calculated using the effective interest method is recognized in the consolidated income statement.

Investment in equity instruments that do not have a quoted market price in an active market and whose fair values cannot be reliably measured are measured at cost less provision for impairment in value.

2.9.3 Impairment of financial assets

The Group assesses at the end of each reporting period whether there is objective evidence that a financial asset or a group of financial assets is impaired. A financial asset or a group of financial assets is impaired and impairment losses are incurred only if there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition of the asset (a ‘loss event’) and that loss event (or events) has an impact on the estimated future cash flows of the financial asset or group of financial assets that can be reliably estimated.

The criteria that the Group uses to determine that there is objective evidence of an impairment loss include:

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

| • | significant financial difficulty of the issuer or obligor; |

| • | a breach of contract, such as a default or delinquency in interest or principal payments; |

| • | the Group, for economic or legal reasons relating to the borrower’s financial difficulty, granting to the borrower a concession that the lender would not otherwise consider; |

| • | it becomes probable that the borrower will enter bankruptcy or other financial reorganization; |

| • | the disappearance of an active market for that financial asset because of financial difficulties; or |

| • | observable data indicating that there is a measurable decrease in the estimated future cash flows from a portfolio of financial assets since the initial recognition of those assets, although the decrease cannot yet be identified with the individual financial assets in the portfolio. |

For loans and receivables, the Group estimates the collectability of the trade receivables based on the analysis of trade receivables, historical bad debts, customer credit-worthiness and current economic trends and maintains adequate impairment allowance. The amount of allowance is the difference between the receivables’ carrying amount and the present value of estimated future cash flows, discounted at the original effective interest rate. The carrying amount of the receivables is reduced through the use of an allowance account, and the amount of the loss is recognized in the consolidated income statement. When a receivable is uncollectible, it is written off against the allowance account for receivables. Subsequent recoveries of amounts previously written off are credited to the consolidated income statement.

In the case of equity investments classified as available-for-sale, a significant or prolonged decline in the fair value of the security below its cost is also evidence that the assets are impaired. If any such evidence exists for available-for-sale financial assets, the cumulative loss – measured as the difference between the acquisition cost and the current fair value, less any impairment loss on that financial asset previously recognized in profit or loss – is removed from equity and recognized in the consolidated income statement. Impairment losses recognized in the consolidated income statement on equity instruments are not reversed through the consolidated income statement. If, in a subsequent period, the fair value of a debt instrument classified as available for sale increases and the increase can be objectively related to an event occurring after the impairment loss was recognized in the consolidated income statement, the impairment loss is reversed through the consolidated income statement.

2.9.4 Offsetting financial instruments

Financial assets and liabilities are offset and the net amount reported in the balance sheet when there is a legally enforceable right to offset the recognized amounts and there is an intention to settle on a net basis or realize the asset and settle the liability simultaneously.

2.10 Inventories

Inventories are stated at the lower of cost and net realizable value. Cost is determined on the first-in, first-out basis. Cost includes the purchase cost and the delivery costs incurred in bringing the inventory to the warehouse. Net realizable value is the estimated selling price in the ordinary course of business, less applicable variable selling expenses.

2.11 Cash and cash equivalents

In the consolidated statements of cash flows, cash and cash equivalents includes cash in hand, deposits held at call with banks and other short-term highly liquid investments with original maturities of three months or less with insignificant risk of change in value.

2.12 Share capital

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new ordinary shares are shown in equity as a deduction, net of tax, from the proceeds.

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

Where any group company purchases the Company’s equity share capital (treasury shares), the consideration paid, including any directly attributable incremental costs (net of income taxes) is deducted from equity attributable to the Company’s equity holders until the shares are cancelled or reissued. Where such ordinary shares are subsequently reissued, any consideration received, net of any directly attributable incremental transaction costs and the related income tax effects, is included in equity attributable to the Company’s equity holders.

2.13 Current and deferred income tax

The tax expense for the period comprises current and deferred tax. Tax is recognized in the income statement, except to the extent that it relates to items recognized in other comprehensive income or directly in equity. In this case, the tax is also recognized in other comprehensive income or directly in equity, respectively.

The current income tax charge is calculated on the basis of tax laws enacted or substantively enacted at the balance sheet date in the countries where the Company’s subsidiaries operate and generate taxable income. Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax regulation is subject to interpretation. It establishes provisions where appropriate on the basis of amounts expected to be paid to the tax authorities.

Deferred income tax is recognized, using the asset and liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements. However, the deferred income tax is not accounted for if it arises from initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction affects neither accounting nor taxable profit or loss. Deferred income tax is determined using tax rates (and laws) that have been enacted or substantively enacted by the balance sheet date and are expected to apply when the related deferred income tax asset is realized or the deferred income tax liability is settled.

Deferred income tax assets are recognized only to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilized.

Deferred income tax is provided on temporary differences arising on investments in subsidiaries, except where the timing of the reversal of the temporary difference is controlled by the Group and it is probable that the temporary difference will not reverse in the foreseeable future.

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities and when the deferred income taxes assets and liabilities relate to income taxes levied by the same taxation authority on either the same taxable entity or different taxable entities where there is an intention to settle the balances on a net basis.

2.14 Employee benefits

(a) Retirement contribution plans

Group companies operate a number of retirement contribution plans. The Group pays contributions to privately administered retirement contribution plans or government authorities on a mandatory, contractual or voluntary basis based on a percentage of each eligible employee’s salary. Employees working in a jurisdiction where there is no statutory provision for retirement contributions are covered by the Company’s plans. Once the contributions have been paid, the Group has no legal or constructive obligations to pay further contributions if the fund does not hold sufficient assets to pay all employees the benefits relating to employee service in the current and prior periods. The contributions are recognized as employee benefit expense when they are due.

2.15 Non-cash compensation expenses

(a) Share grants to employees and team members

The Group operates a number of equity-settled compensation plans, under which the Group receives services

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

from employees, and consultants and employees of third party service providers (collectively known as ‘team members’) as consideration for equity instruments of the Group. The Group’s employee and team member equity compensation plans are share grants without any exercise price or exercise period. Therefore, the fair value of the share grants at the date of grant approximates the intrinsic value. The fair value of the employee or team member services received in exchange for the grant of the shares is recognized as an expense in the income statement with a corresponding increase in ‘capital reserve’ within equity.

Non-market vesting conditions are included in assumptions about the number of share grants that are expected to vest. The total expense is recognized over the vesting period, which is the period over which all of the specified vesting conditions are to be satisfied. At the end of each reporting period, the entity revises its estimates of the number of shares that are expected to vest based on the non-market vesting conditions. It recognizes the impact of the revision to original estimates, if any, in the consolidated income statement, with a corresponding adjustment to equity.

The Group made share awards to its directors under The Global Sources Directors Share Grant Award Plan. These awards are share grants without any exercise price or exercise period. Therefore, the fair value of the share grants at the date of grant approximates the intrinsic value. The Group recognizes the compensation costs associated with share awards with cliff vesting to directors on a straight-line basis over the vesting period.

(b) Share grants for non-compete agreements

The Group issues share grants to former employees, and former consultants and the former employees of third party service providers when they resign or retire from their respective employment or consultancy service. Under these plans, the share grants vest over a five-year period with a percentage of shares vesting each year. The grantee is subject to the non-compete terms stipulated in the plan. There is no other vesting condition other than the non- compete terms.

Where the Group has the ability to enforce the non-compete agreement and the grantees are entitled to the shares, an intangible asset is recognized in relation to the non-compete provisions of these awards at the fair value of the respective award. The intangible asset is amortized over the non-compete period on a straight-line basis (note 2.7 (e)).

2.16 Revenue recognition

The Group derives its revenue from advertising fees in its published trade magazines and websites, sales of trade magazines and reports, fees from licensing its trade and service marks, and organizing exhibitions and business seminars.

Revenue comprises the fair value of the consideration received or receivable for the sale of goods and services in the ordinary course of the Group’s activities. Revenue is shown excluding value added taxes, net of discounts and after eliminating sales within the Group. The Group presents the sales taxes imposed on revenue generating transactions on a gross basis in ’sales costs’.

The Group recognizes revenue when the amount of revenue can be reliably measured, it is probable that future economic benefits will flow to the entity and when specific criteria have been met for each of the Group’s activities as described below.

Revenue from advertising in trade magazines and websites, net of discounts, are recognized ratably over the period in which the advertisement is displayed. Revenue from sales of trade magazines and reports is recognized upon delivery of the magazine/report. Magazine subscriptions received in advance are deferred and recognized as revenue upon delivery of the magazine. Revenue from organizing exhibitions and business seminars is recognized at the conclusion of the event and the related direct event production costs are deferred and recognized as expenses upon conclusion of the event. When multiple deliverables are contracted under a single arrangement, the Group allocates the total consideration to each unit of accounting based on its relative percentage of the total fair value

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

of all units of accounting included in the arrangement. Where the Group is unable to determine the fair value of each of the unit in an arrangement, total consideration is allocated by estimating the stand-alone selling price for one performance obligation if a directly observable price exists.

Barter transactions are recorded at the fair value of the merchandise or services received. Where the fair value of the merchandise or services received cannot be measured reliably, the revenue is measured at the fair value of the services rendered.

Rental income arising from operating leases on investment properties is recognized on a straight-line basis over the lease term. The aggregate costs of incentives provided to lessees are recognized as a reduction of rental income over the lease term on a straight-line basis.

Interest income is recognized using the effective interest method.

2.17 Leases

Leases in which a significant portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases. The Group leases certain office facilities and exhibition venues under cancelable and non- cancellable operating leases, generally with an option to renew upon expiry of the lease term. Rentals under operating leases (net of any incentives received from the lessor) are expensed on a straight-line basis over the life of the leases.

2.18 Advertising Expenses

Advertising and promotion expenses are expensed as incurred.

2.19 Transactions with Sales Representatives

The Group utilizes sales representatives in various territories to promote the Group’s products and services. Under these arrangements, these sales representatives are entitled to commissions as well as marketing fees. Commission expenses are expensed as incurred. For online and other media services, the commission expense is incurred when the associated revenue is recognized or when the associated accounts receivable are paid, whichever is earlier. For exhibitions, the commission expense is incurred when the associated revenue is recognized, upon conclusion of the event.

These third party sales representatives, which are mainly corporate entities, handle collections from clients on behalf of the Group. Included in receivables from these sales representatives are amounts collected on behalf of the Group.

2.20 Accounts payable

Accounts payable are obligations to pay for goods or services that have been acquired in the ordinary course of business from suppliers. Accounts payable are classified as current liabilities if payment is due within one year or less (or in the normal operating cycle of the business if longer). If not, they are presented as non-current liabilities.

Accounts payable are recognized initially at fair value and subsequently measured at amortized cost using the effective interest method.

2.21 Dividend distribution

Dividend distribution to the Company’s shareholders is recognized as a liability in the Group’s financial statements in the period in which the dividends are approved by the Company’s shareholders.

| 3. | Financial risk management |

The Group’s activities expose it to a variety of financial risks: market risk (including currency risk, fair value interest rate risk, and cash flow interest rate risk), credit risk and liquidity risk. The Group’s overall risk management

GLOBAL SOURCES LTD. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In U.S. Dollars Thousands, Except Number of Shares and Per Share Data)

program focuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the Group’s financial performance.

Risk management is carried out by a group of senior management personnel. This particular group identifies, evaluates and takes appropriate measures to alleviate financial risks in close co-operation with the Group’s operating units. The Board of Directors provide direction for overall risk management, covering specific areas, such as foreign exchange risk, interest rate risk, credit risk, use of derivative financial instruments and non- derivative financial instruments, and investment of excess liquidity.

(a) Market risk

(i) Foreign exchange risk