UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

T ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 28, 2009

£ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-30239

UNICO, INCORPORATED

(Exact name of small business issuer as specified in its charter)

| | |

Arizona | | 13-4171971 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

8880 Rio San Diego Drive, 8th Floor, San Diego, California 92108

(Address of principal executive offices)

(619) 209-6124

(Issuer’s telephone number)

| |

Securities registered under Section 12(b) of the Exchange Act: |

None (Title of each class) | N/A (Name of Exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes £ No T

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes £ No T

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes T No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K T

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer £ | Accelerated filer £ |

Non-accelerated filer £ | Smaller reporting company T |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No T

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the voting and non-voting common equity was last sold, or the average bid and asked price of such common equity as of the last business day of the registrant’s most recently completed second fiscal quarter. $21,267,729, based on the last sale price of $.15, as reported on the OTC bulletin board on August 29, 2008.

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. The Registrant had 141,784,859 shares of common stock, $0.001 par value, outstanding as of June 4, 2009.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) any annual report to security holders; (2) any proxy or information statement; and (3) any prospectus filed pursuant to Rule 424 (b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g. annual report to security holders for fiscal year ended December 24, 1980). None

EXPLANATORY NOTE: The annual report is being amended for the following purposes:

1. To correct the date of management’s conclusion about the effectiveness of internal control over financial reporting;

2. To include a reference from the auditors in their audit report that the inception-to-date information has been audited;

3.

To include restated financial statements that reflect a correction of an error in the way the Company’s convertible debentures are accounted for by basing the accounting on SFAS 150 of the Financial Accounting Standards Board (FASB). This resulted in changes in the restated financial statements, footnotes, and related management’s discussion and analysis of financial condition. This accounting correction eliminates the derivative liability, discount on debt, and the derivative loss. It adds a debenture payable for beneficial conversion, and an accrued interest payable for beneficial conversion, and it changes interest expense. As a result of this accounting correction, the Company’s accumulated deficit as of February 28, 2009 decreased by $4,008,674, and the Company’s net loss for the fiscal year ended February 28, 2009 decreased by $ 3,021,016.

1

TABLE OF CONTENTS

| |

PART I |

Page |

ITEM 1. BUSINESS | 3 |

ITEM 1A. RISK FACTORS ITEM 1B. UNRESOLVED STAFF COMMENTS ITEM 2. PROPERTIES | 13 15 16 |

ITEM 3. LEGAL PROCEEDINGS | 26 |

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 27 |

PART II |

|

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 27 |

ITEM 6. SELECTED FINANCIAL DATA | 29 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 29 |

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 31 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 31 |

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 31 31 |

ITEM 9A. CONTROLS AND PROCEDURES | 31 |

ITEM 9B. OTHER INFORMATION | 32 |

PART III |

|

ITEM 10. DIRECTORS EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 32 |

ITEM 11. EXECUTIVE COMPENSATION | 36 |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 38 |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 39 |

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES | 41 |

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 42 |

| |

| |

2

PART I

Forward Looking Statements

This document includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The Company would like to caution certain readers regarding certain forward-looking statements in this document and in all of its communications to shareholders and others, on management’s projections, estimates and all other communications. Statements that are based on management’s projections, estimates and assumptions are forward-looking statements. The words believe, expect, anticipate, intend and similar expressions generally identify forward-looking statements. While the Company believes in the veracity of all statements made herein, forward-looking statements are necessarily based upon a number of estimates, and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, econo mic and competitive uncertainties and contingencies and known and unknown risks. Many of the uncertainties and contingencies can affect events and the Company’s actual results and could cause its actual results to differ materially from this expressed in any forward-looking statements made by, or on behalf, of the Company.

Reverse Stock Split

On January 28, 2008 the stockholders of Unico, Incorporated approved a proposal to amend the Company’s Articles of Incorporation to authorize the Board of Directors, in its discretion, to effect a reverse stock split of the Company’s common stock at a ratio of up to one for five hundred during the six month period following the date of the Special Meeting of Shareholders. The Board of Directors approved a reverse stock split of the Company’s common stock which became effective June 30, 2008. This enabled the Company to increase the number of authorized, but unissued common shares, so as to permit the conversion of outstanding convertible debentures to shares of the Company’s common stock, and to enable the Company to raise additional needed capital. It has also enabled the Company to increase the trading price of the Company’s common stock to a level more acceptable to potential investors. All shar e numbers and price per share figures appearing in this Annual Report are expressed in numbers of post-reverse split shares, unless otherwise noted.

ITEM 1.

DESCRIPTION OF BUSINESS

General

Unico, Incorporated (“the Company”, “Unico” or “UNCN”) an Arizona corporation, was formed as an Arizona corporation on May 27, 1966. It was incorporated under the name of Red Rock Mining Co., Incorporated. It was later known as Industries International, Incorporated and I.I. Incorporated before the name was eventually changed to Unico, Incorporated in 1979.

On July 12, 2004, Unico filed an election with the U.S. Securities and Exchange Commission to become a business development company (“BDC”) pursuant to Section 54 of the Investment Company Act of 1940. On August 1, 2005, the Board of Directors unanimously approved a proposal to withdraw the Company’s election to be treated as a business development company as soon as practicable so that Unico could begin conducting business as an exploration company rather than as a business development company subject to the Investment Company Act. On October 11, 2005, a Special Meeting of the Unico shareholders was held to consider and vote upon a proposal to authorize the Company’s Board of Directors to withdraw the Company’s election to be treated as a BDC and the proposal was approved. On October 12, 2005 a Notification of Withdrawal was filed with the Securities and Exchange Commission so that U nico could begin conducting business as an exploration company rather than as a BDC subject to the Investment Company Act.

The exploration and testing at the Deer Trail Mine have been conducted through Unico's subsidiary, Deer Trail Mining Company, LLC (“Deer Trail Mining Company” or “DTMC”) since soon after DTMC was formed in late June, 2004.. Future exploration at the Silver Bell Mine will be conducted through Unico's subsidiary, Silver Bell Mining Company, Inc. ("SBMC").

Deer Trail Mining Company, LLC

On March 30, 1992, Unico, Incorporated entered into a Mining Lease and Option to Purchase agreement with Deer Trail Development Corporation, with headquarters in Dallas, Texas. Deer Trail Development Corporation is now known as Crown Mines, L.L.C. The lease was to run for a period of 10 years, and cover 28 patented claims, 5 patented mill sites and 171 unpatented claims located approximately 5 miles South of Marysvale, Utah. It includes mine workings known as the Deer Trail Mine, the PTH Tunnel and the Carisa and Lucky Boy mines. There are no known, proven or probable reserves on the property.

Effective December 1, 2001, a new lease agreement was entered into between the parties (“Deer Trail Lease”) covering the same property for a period of thirty (30) months. It was subsequently extended through a series of amendments.

3

In July 2007, Deer Trail Mining Company completed the purchase of the claims covered by the Deer Trail Lease. A total of $4,000,000 was paid to purchase the property over a period of approximately three years. The purchase of the claims also included the purchase of a fifty percent (50%) interest in Water Right No. 63-37, said fifty percent (50%) portion including a maximum flow of 0.125 cubic feet of water per second and a maximum annual diversion of 90.5 acre feet of water from Three Mile Spring for year-round mining purposes. The purchase of the claims also included a fifty percent (50%) interest in a contractual right to use water diverted under Water Right No. 63-3043 as evidenced and described in the Agreement between Cottonwood Irrigation Company and Deer Trail Development Corporation dated July 28, 1977. The fifty percent (50%) interest in the contractual water right allows Deer Trail Mining Company to truck not more than 2,500 gallons of water per week from the Cottonwood Creek to the Deer Trail Mine for mining activities during the irrigation season (April 15 to October 15), and possibly more during the remaining portion of each year.

Deer Trail Mining Company also obtained a lease from Crown Mines, L.L.C. of the remaining fifty percent (50%) interest in Water Right No. 63-37 and the remaining 50% interest in the contractual water right (Water Right 63-3043. The lease is for an initial term of 5 years for no rent. The lease may be terminated by Crown Mines, L.L.C. upon 12 months’ written notice if Crown Mines determines that the water rights covered by the lease are necessary for the operation and development of any of Crown Mines’ mining claims or for other permitted uses. The lease may be extended if Crown Mines determines that the water rights covered by the lease are not required for the operation and development of any of Crown Mines’ mining claims or for other permitted uses during the extension period, provided that the parties can agree on other terms including a price or rent for the extended term.

Crown Mines, L.L.C. retained a perpetual royalty interest on minerals taken from the claims purchased by Deer Trail Mining Company. The perpetual royalty is three percent (3.0%) of net smelter returns on minerals other than gold. The royalty rate for gold is three percent (3.0%) when the price of gold is less than or equal to $500 per troy ounce, four percent (4.0%) when the price of gold is more than $500 and less than or equal to $600 per troy ounce, and five percent (5.0%) when the price of gold is greater than $600 per troy ounce. Crown Mines, L.L.C. also retained an undivided three percent (3.0%) interest in any oil and gas and associated hydrocarbons produced from the claims.

Crown Mines, L.L.C. also retained an access easement and a water line pipeline easement across the claims sold to Deer Trail Mining Company.

Deer Trail Mining Company has agreed to provide Crown Mines, L.L.C. with information obtained as a result of Deer Trail Mining Company’s exploration activities on the claims, and Deer Trail Mining Company granted to Crown Mines, L.L.C. a right of first refusal to repurchase the claims or any portion thereof.

In August 2006, Deer Trail Mining Company entered into a Mining Lease with Joel Johnson covering the Clyde, Clyde Intermediate and Crown Point claims. These claims are located near the Deer Trail Mine. Deer Trail Mining Company has leased the claims for the purpose of conducting mine exploration, evaluation, and possible mining activities on the claims. The Mining Lease is for two years, with options to extend the lease for 50 additional one year periods. Under the terms of the Mining Lease, Deer Trail Mining Company paid initial down payments totaling $31,000 with $4,000 due in the second year of the lease. If Deer Trail Mining Company elects to extend the lease, it must pay $3,000 for the first extension year, and the annual lease extension payment increases ten percent (10%) per year thereafter. Additionally, Deer Trail Mining Company will pay three percent (3%) of the gross sale proceeds from the sale of any ore concentrates, or other mineral resources extracted from the claims.

In September 2006, Deer Trail Mining Company entered into a Non-Patented Mining Claims Lease covering approximately 70 additional claims covering approximately 1,500 acres in Piute County Utah for the purpose of exploration, evaluation and mining activities. In consideration for the rights under the agreement, the Deer Trail Mining Company agreed to pay the lease holders $7,000 per year for each of the first three years. Deer Trail Mining Company has the right to extend the lease for 50 additional one year periods. If extended by Deer Trail Mining Company, the annual lease payment is $10,000 in each of years four and five, and thereafter the annual lease payment increases by ten percent (10%) per year. In addition to the annual lease payments, Deer Trail Mining Company has also agreed to pay an amount equal to three percent (3%) of the gross sales proceeds from all ore, concentrates, and all other productions of mineral resources extracted from the claims. The agreement contains an option to purchase the claims exercisable at $350,000 during the five first years of the lease. The exercise price increases $50,000 per year thereafter. It may only be exercised while the lease is effective.

Following the formation of the Deer Trail Mining Company in June 2004, Unico assigned all of the various assets, liabilities and exploration activities associated with the Deer Trail Mine to Deer Trail Mining Company which has assumed responsibility for making payments under the Deer Trail Lease.

Since June 2004 Deer Trail Mining Company has assumed exploration activities, ownership and management control of the Deer Trail Mine. Deer Trail Mining Company presently has 18 full time employees, 1 part time employee and 4 consultants. The necessary permits to commence mining activities at the Deer Trail Mine have been acquired, provided that the surface disturbance from the

4

mining activities does not exceed 10 acres for both mine and mill. In early 2005, Unico and Deer Trail Mining Company received approval from the Utah Division of Oil, Gas and Mining of the Company's Large-Scale Mining Permit (file number 10311003) for the Deer Trail Mine in Marysvale, Utah. The State of Utah's Division of Oil, Gas and Mining granted approval of the Company's application to expand its existing small exploration project to a large mining exploration project, which is expected to significantly increase the area of activity and the capacity of the company's mill at the Deer Trail Mine. This Large-Scale permit takes the place of the previous two Small-Scale permits described above. In 2004, Unico filed to obtain a construction permit with the State of Utah Department of Environmental Quality (both the Utah Division of Air Quality a nd the Utah Division of Water Quality) for the Deer Trail Mine tailings impoundment pond no. 2.

Prior to June 2004, Unico worked to reopen the Deer Trail Mine. Unico commenced limited exploration activities in late March 2001 on the Deer Trail Mine. There were between 2 and 5 miners at various times working full time in the Deer Trail Mine on mine exploration work until approximately October 2003. Their efforts were concentrated in the 3400 Area of the mine, from which they removed approximately 1,000 tons of mineralized materials per month. The mineralized materials were stock-piled and some of it has been crushed. Some of the employees have worked on mine maintenance.

Unico completed a mill on site at the Deer Trail Mine. In November 2001, Unico began milling activities. Unico started screening and crushing old mineralized materials dumps on the upper Deer Trail Mine and moved the materials to the ball mill. The Deer Trail Mining Company has completed construction of the flotation circuit in the mill to enhance efficiency. In July 2006, Deer Trail Mining Company completed the upgrades to the screening plant and began screening the old mineralized material dumps at the upper Deer Trail Mine. Once screened, the material is moved to the mill facility and stockpiled for further processing. The Company anticipates running this material through its mill once reconstruction is complete.

On August 31, 2005, Deer Trail Mining Company entered into a five-year purchase contract with PGM, LLC of Los Angeles under which PGM will purchase precious metal bearing concentrates from the Deer Trail processing center. Most sales will not occur until the mill processing center is complete at the Deer Trail Mine. PGM has advanced Deer Trail Mining Company $25,000 for an initial shipment of concentrates that will be produced on a pilot plant basis. PGM has since requested that the contract be voided based on the fact that their process cannot effectively extract the minerals of the Company’s concentrate.

The Company is currently in contact with several smelters and a trading company to determine how best to sell the lead concentrates, and zinc concentrates which will be produced at the Deer Trail Mine. The concentrates can be transported by either rail or truck, and there are a variety of trucking companies that are willing and able to transport concentrates to smelters or other places designated by purchasers.

In September 2004, Deer Trail Mining Company completed its first phase of exploratory drilling at the Deer Trail Mine. The Deer Trail Mining Company contracted Lang Exploratory Drilling to complete the phase of drilling. Lang completed a total of 3,653 feet of reverse circulation drilling and finished 28 drill holes at specified targets located on the Upper Deer Trail Mine. 741 samples were safeguarded by Lang Exploratory Drilling during this phase and shipped to ALS Chemex at its Elko, Nevada facility for independent lab verification and analysis.

The first phase of exploration drilling was designed to identify near surface deposits, determine potential resources and define limits of mineralization south of the main tunnel previously mined at the Upper Deer Trail Mine. Historical data of the workings was sufficient to delineate the grade of mineralization remaining in the stopes, but no data was available to delineate the grade of mineralization outside the workings or how far that mineralization flowed into the surrounding formations. The initial phase of reverse circulation drilling serves as an adequate means to define the limits of mineralization south of the main tunnel, which is situated in the lower Toroweap formation, along the crest and down the northeast limb of the Deer Trail anticline.

This phase of drilling was accomplished with lower cost reverse circulation drill holes in order to establish the presence of mineralization at the Upper Deer Trail area. Once the limits of mineralization are established, work can begin to further define those zones by diamond core drilling..The reverse circulation drilling determined that more expensive diamond core drilling is necessary to further determine exact areas to be mined. Future plans for the complete drilling of this area have been determined but an exact timetable has not been determined.

The most upper holes RC-1 through RC-7 were placed well above the elevation of the known workings of the No. 2 Tunnel and slightly south of the northwesterly trending previously mined area. Significant mineralization was intercepted in holes RC-1 and RC-2, which were drilled in the area closest to the main tunnel. Drill holes RC-5, 6, 8, 9, 13 and 14 were all drilled well south of the historically delineated mineralization, and on the southern most up-side of a post mineral fault. It can be concluded that mineralization intercepted in these holes is not directly related to the mineralization of the main Upper Deer Trail tunnel.

5

| | | | | |

Hole | Interval From – to-- (ft) | Gold (grams/troy oz.) | Silver (grams/ Troy oz.) | Lead (%) | Zinc (%) |

| | | | | |

RC-1 | 190 -- 230 40 | 0.207 | 10.98 | 0.355 | 0.205 |

| | | | | |

RC-2 | 40 -- 45…. 5 | 0.364 | 95.36 | 3.61 | 0.390 |

| | | | | |

Includes | 175 -- 180 5 | 0.369 | 45.71 | 2.87 | 1.41 |

| | | | | |

RC-10 | 65-- 95 30 | 0.363 | 16.48 | 0.086 | 0.022 |

| | | | | |

RC-11 | 60 -- 70 10 | 1.36 | 52.25 | 0.758 | 0.191 |

| | | | | |

Includes | 65 -- 70 5 | 2.26 | 32.69 | 0.961 | 0.289 |

| | | | | |

RC-12 | 85 -- 90 5 | 0.460 | 137.14 | 3.94 | 1.00 |

| | | | | |

RC-17 | 55 -- 65 10 | 0.799 | 13.02 | 0.033 | 0.012 |

| | | | | |

RC-18 | 45 -- 50 5 | 1.54 | 40.77 | 0.154 | 0.018 |

| | | | | |

RC-19 | 0 -- 140 140 | 0.527 | 14.65 | 0.116 | 0.107 |

| | | | | |

Includes | 35 -- 45 10 | 2.64 | 14.11 | 0.840 | 1.26 |

| | | | | |

Includes | 35 -- 40 5 | 4.66 | 21.15 | 1.30 | 2.14 |

| | | | | |

Includes | 75 -- 120 45 | 0.930 | 34.86 | 0.135 | 0.021 |

| | | | | |

Includes | 95 -- 105 10 | 3.17 | 88.63 | 0.303 | 0.019 |

| | | | | |

Includes | 100 -- 105 5 | 4.78 | 151.02 | 0.682 | 0.008 |

| | | | | |

RC-20 | 95 – 100 5 | 1.92 | 62.02 | 0.218 | 0.030 |

| | | | | |

RC-21 | 95 - 110 15 | 0.899 | 74.29 | 0.145 | 0.014 |

| | | | | |

RC-22 | 110 - 120 10 | 1.77 | 18.14 | 0.074 | 0.024 |

| | | | | |

Includes | 115 - 120 5 | 3.25 | 27.52 | 0.079 | 0.014 |

In early 2005, Deer Trail Mining Company contracted with Connors Drilling to commence an underground diamond core drill program. This 2nd phase of exploratory drilling inside the PTH Tunnel of the Deer Trail Mine has been completed. The Phase II underground diamond core drilling program was primarily designed to target known horizons of mineralization and identify new mineralized horizons throughout the main tunnel of the Deer Trail Mine. The Company completed 7,235 feet of diamond core drilling and finished 13 underground drill holes. According to preliminary reports by the Company’s geologist, all of the holes drilled were reported to intersect mineralization within their designated targets. That report states that a total of approximately 514 feet of mineralization was intersected and consisted mostly of sulfide minerals (e.g. tetrahedrite, galena, pyrite, chalcopyrite and sphalerite). Other intercepts were encountered through oxidized mineral not reporte d in this total, as well as zones of subtly altered rock that may contain high mineral values and offer significant potential. The company is now working on final independent core logging and splitting verification. Once complete, it plans to ship its core samples to an independent lab for analysis.

6

In March 2006, Deer Trail Mining Company, LLC entered into an agreement with Behre Dolbear and Company (USA), Inc. to conduct geological services and consulting at Unico’s Deer Trail Mine in Marysvale, Utah. The focus of Behre Dolbear’s work is related to the underground diamond core drilling program undertaken at the Deer Trail Mine in 2005. Behre Dolbear is currently performing the geological core logging and spitting verification on the samples and overseeing the shipment of those samples to ALS Chemex for analysis. Behre Dolbear has also been contracted to report on the mineralization and provide additional technical advice on the project as desired by Deer Trail Mining Company, LLC.

Behre Dolbear and Company (USA) has issued the following information from the Interim Summary Report on their work completed thus far. The report from Behre Dolbear states:

“Unico, Incorporated drilled 7,235 feet of BQ diameter core at various inclinations and azimuths from four drill stations in the Patrick Thomas Henry (PTH) adit at the Deer Trail Mine from December 2004 to April 2005. At that time, the core was not logged in detail and no analyses were done. Table 1 summarizes the drilling statistics. The station locations are defined based on the approximate footage from the PTH adit portal.

Table 1

Unico Phase II Drill Holes

| | | | |

UDDH Drill Hole # | Station Location | Inclination (in degrees) | Azimuth | Total Length (Feet) |

1* | 4400 | -45 | 102 | 740 |

2 | 4400 | -40 | 102 | 648 |

3* | 4400 | -42 | 92 | 782 |

4* | 4400 | -42 | 150 | 554 |

5* | 4400 | -55 | 102 | 664 |

6 | 4400 | -45 | 21 | 409 |

7 | 4400 | -58 | 298 | 733 |

8 | 4400 | -75 | 300 | 565 |

9* | 4700 | -45 | 116 | 460 |

10 | 4900 | -75 | 0 | 460 |

11* | 3400 | +45 | 258 | 454 |

12* | 3400 | +45 | 162 | 355 |

13* | 3400 | -65 | 125 | 420 |

Total Footage | | | | 7,235 |

*Logged by Behre Dolbear

Behre Dolbear & Company (USA), Inc. (Behre Dolbear) contracted with Unico in March 2006 to geologically log the core, select intervals for analyses and assays, supervise the sawing of the selected intervals, submit those samples to a laboratory for analyses, opine on the mineralization observed, and provide technical advice to Unico. Between March 23, 2006 and October 6, 2006, Behre Dolbear logged in detail 4,429 feet of core from the eight holes indicated in Table1. A total of 550 samples totaling 611 feet of core containing trace to significant mineralization from six of the holes (UDDH 1, 5, 9, 11, 12, and 13) has been selected, sawed, submitted for analyses and assays, and the results received and evaluated. Analyses are pending from 228 samples from 385 feet of core in UDDH 3. UDDH 4 has been logged, but sample intervals have not been selected.

ALS Chemex (Chemex) did the analyses and assays at its laboratory in North Vancouver, British Columbia. Sample preparation, analyses, and assays were done as requested by Behre Dolbear using Chemex’s standard protocols. Gold was determined by fire assay with an atomic absorption spectrometry (AAS) finish. All samples were also analyzed for a 34-element suite of major and potentially significant trace elements using an aqua regia digestion and an emission spectrographic scan. Chemex’s quality control-quality assurance system complies with the requirements of the international standards ISO 90001:2000 and ISO17025:1999.

The Pennsylvanian Callville Limestone is the host of the mineralization in the holes logged by Behre Dolbear at the Deer Trail Mine. Behre Dolbear has logged over 4,400 feet of core that traverses the various lithologies of the upper +700 feet of that formation. This detailed logging has resulted in the recognition of ten previously unrecognized informal members and/or other subdivisions that will enable future work to place the mineralized horizons in the vicinity of the mine into stratigraphic perspective.

The mineralization in the Callville Limestone typically consists of stratabound narrow conformable bands of semi-massive to massive sulfides separated by relatively long intervals of weakly mineralized to barren rock. Minerals include sphalerite, galena, chalcopyrite, and tetrahedrite-tennantite. Where the significantly mineralized zones are thicker, the mineralized bands are closer together.

7

Based on the analytical results received to date, Behre Dolbear combined 33 continuous assay intervals from six holes into gross assay intervals ranging from 2.3 feet to 95 feet in length, uncorrected to true stratigraphic width. Intervals within the gross intervals were combined into 113 detailed intervals based on their grades.

The best intervals based on thickness and grades in multiple metals in the six holes from which analyses have been received are listed in Table 2.

Table 2 shows that significant mineralization in most of the holes is confined to relatively narrow intervals ranging from 1.0 feet to 10.6 feet. The thickest intercept with significant mineralization is in UDDH 12 at 55.2 feet. The intervals are uncorrected for the true widths of the intercepts and will all be thinner than stated, some possibly as much as fifty percent thinner. Overall, silver contributes the most value of the metals in Table 2 with zinc second and gold, copper, and lead contributing subordinate values. In some of the intervals, the silver and gold are high but the base metals are low. Copper contributes more value than zinc in some of these intervals. Only one of the intervals (UDDH 11 at 105.0 to 110.6 feet) has high values in all of the metals. The highest gold and silver values are in UDDH 1 (5.273 ppm Au=0.167oz/t Au; 366.9 ppm Ag= 10.71 oz/t Ag), and UDDH 11 (4.564 ppm Au= 0.133 oz /t Au; 585.1 ppm Ag= 17.08oz/t Ag).

Table 2

Best Interval from Each Analyzed Hole

| | | | | | | | |

UDDH | Analyzed From | Analyzed To | Interval (Feet) | Au (ppm) | Ag (ppm) | Cu (%) | Pb (%) | Zn (%) |

1 | 365.5 | 370.4 | 4.9 | 5.723 | 366.9 | 0.01 | 0.16 | 0.42 |

| 406.6 | 417.2 | 10.6 | 1.062 | 177.6 | 0.11 | 0.58 | 1.58 |

| 456.0 | 462.5 | 6.5 | 0.350 | 156.4 | 0.24 | 1.38 | 2.08 |

| | | | | | | | |

5 | 322.0 | 327.0 | 5.0 | 0.870 | 164.1 | 0.25 | 2.09 | 1.27 |

| 419.0 | 419.9 | 0.9 | 1.510 | 116.0 | 0.27 | 0.35 | 0.18 |

| | | | | | | | |

9 | 293.7 | 300.1 | 6.4 | 0.372 | 46.8 | 0.15 | 1.28 | 1.78 |

| 434.6 | 435.6 | 1.0 | 0.310 | 102.0 | 0.39 | 5.20 | 6.59 |

| | | | | | | | |

11 | 7.7 | 13.4 | 5.7 | 4.564 | 585.1 | 0.45 | 0.71 | 0.83 |

| 105.0 | 110.6 | 5.6 | 1.600 | 550.6 | 0.96 | 2.0 | 2.43 |

| | | | | | | | |

12 | 5.8 | 61.0 | 55.2 | 0.608 | 183.1 | 0.44 | 0.40 | 0.67 |

| 220.0 | 221.9 | 1.9 | 2.170 | 128.0 | 0.01 | 0.01 | 3.32 |

| | | | | | | | |

13 | 77.9 | 78.9 | 1.0 | 0.380 | 188.0 | 0.60 | 3.10 | 3.89 |

There is potential for an economic deposit at the Deer Trail Mine if the metals occur together in significant grades and in widths (generally greater than 10 feet) that are adequate for mining. Additional work is required to determine if those conditions exist. Before additional drilling is done, the results of the logging, analyses, and observations by Behre Dolbear should be combined with the data and results from previous work to develop a three-dimensional model of the deposit. Development of that model will require data from surface and underground mapping, previous mining, and drilling from this and previous campaigns. All of this data on lithologies, structures, mineralization, and alteration must be put together on maps and cross sections to build the model. Based on that model, the geometry (true widths and lateral extents) and grades of the mineral ization as currently known will be indicated and decisions can be made if additional drilling has the potential to define economically mineable mineralization. It has not been determined if there is adequate data available from previous work to construct a good model.”

In November 2006, Deer Trail Mining Company modified and expanded the agreement with Behre Dolbear and Company (USA), Inc. for geological services at Unico’s Deer Trail Mine. The new agreement and work order adds several new areas of consulting that will fall under Behre Dolbear’s scope of services on the Deer Trail project. Under these new revisions Behre Dolbear will assemble all the available data relating to the locations, volumes, and grades of the tailings that Deer Trail intends to process through the Project's mill. Based on the information available, Behre Dolbear will estimate the volumes, tonnages, and grades of those tailings and will, if needed, recommend a drilling program to better define those tonnages and grades. Behre Dolbear will summarize the results of the drill core logging completed to date and correlate those results with pertinent assays of material from those holes to determine the factors from the logging that relate to and facilitate the location of significant mineralization. With Deer Trail's assistance, Behre

8

Dolbear will assemble all the available data (mineralization, rock types, structure, alteration, etc.) from past drilling and mining, focusing on the 3100-3400 zone in the PTH adit, i.e., the 3400 East Stope and 3400 East Stope Extension, which is the zone most easily accessible for near-term mining. Behre Dolbear will correlate data from the extant logging effort and assays with the data from past drilling and mining to locate and model, to the extent possible, potentially mineable mineralization in the 3100-3400 zone. Behre Dolbear will determine if logging of the holes not yet logged in the 4400 zone of the PTH adit is warranted, based upon the logging to date of holes in that zone and any available data from past drilling and mining. Behre Dolbear will assist Deer Trail with judgments and potential approaches to exploitation of the Toroweap Sand stone in the 8600 area of the PTH adit. (It appears that this area has the greatest potential for hosting high grade, large tonnage mineralization at the Deer Trail Mine. That area is, however, the portion of the existing workings that is least accessible for mining in the near term.) The agreement calls for additional personnel and support for Behre Dolbear’s work at the Deer Trail Mine. Further, the modifications call for reorganizing and redirecting site efforts that have heretofore focused specifically on the logging, chemical analyses, and interpretation of the drill cores. Behre Dolbear will focus on those aspects of the expanded work scope that will most quickly lead to the definition and potential reporting of ore reserves in the form of mine tailings. They will also focus strongly on the development of mineralization models that facilitate judgments regarding the 3100-3400 area of the PTH adit and the timing of work in the 8600 area.

On May 14, 2008, Behre Dolbear & Company (USA), Inc. sent Unico, Inc. and Deer Trail Mining Company, LLC a proposed final report and appendices on Project J06-034 regarding the Relationship of Stratigraphy and Mineralization at the Lower (New) Deer Trail Mine. Upon approval by Unico, Inc and DTMC, LLC, submission of the report and appendices will complete the work relating to the core logging that Behre Dolbear, Unico and Deer Trail Mining Company have agreed upon in the Proposal and Consulting Agreement dated March 14, 2006 and the Work Change Order dated November 7, 2006. The report entitled Evaluation of the Deer Trail Tailings at the Deer Trail Mine, Piute County, Utah has been removed from the revised report and a Conclusions and Recommendations section will be added in the Executive Summary which will be revised accordingly by Behre Dolbear. Executives and Management of Unico and Deer Trail Mining Company are currently reviewing the report and expect to announce details of the report once completed.

In the early part of fiscal year 2010 the Company has determined to do a comprehensive channel sampling program throughout all three levels of the 3400 Area in planned concert with a partner in order to re-confirm the tenor and tonnage prior to establishing additional mine headings . This will be the next phase of exploration. Later in the fiscal year 2010 we plan to establish an indicated and/or measured reserve in the 8600 Area with underground or surface drilling. This would include the area beyond the 1980 working face as well as the untested interval of the projected Toroweap mineralized body between the PTH Tunnel and the terminal levels of the Upper Mine. Later in the fiscal year 2010 we also plan to test the potential in the Mississippian with a 6 to 10 hole program adjacent to known feeder structures in both the 3400 and 8600 Areas. Based on the size of the existing mineralized bodies it is anticipated that the size of this area will be many multiples of that of the original combined Toroweap mineralized body in the Upper Mine and 8600 Area of the Lower Mine.

In September 2007, Deer Trail Mining Company completed the construction of a new electrical substation that will supply power to the reconstructed mill and processing facility. The substation is designed to supply up to 2.5 megawatts of electrical power well beyond the estimated 1.5 megawatts estimated to run the mill and processing facility. Additional power is expected to be used for future mining activities and expansion plans on site. The Company recently completed the construction of a secondary substation to interface directly with the mill and processing facility and it is now energized.

In February, 2008, the Deer Trail Mining Company completed underground rehabilitation work up through to the 3400 level of the PTH tunnel of the Deer Trail Mine. The work was contracted through Atlas Mining Company to conduct initial underground maintenance including the replacement of timber sets, clean up of the main haulage way and installation of ground support where needed to the main PTH haulage tunnel.

In April, 2008, the Deer Trail Mining Company completed reconstruction work of the floatation circuit at the mill and processing facility at the Deer Trail Mine. Testing of the floatation circuit is currently underway utilizing screened material from the stockpiles on site.

Mill Tailings Current Extraction Plans

The grade and tonnage of the tailings and dumps present at the Upper Mine site will be re-confirmed by grid auger drilling. All economically prospective mill tailings and dumps existing on the property, as well as possibly from other nearby mines will be re-processed and the precious metals contained within them recovered. This will be accomplished when installation of the acid leach circuit at the Deer Trail Mill has been completed and is operational.

Exploration Time Table and Budget

Additional exploration has been planned but no time or budget has been established to complete this work.

9

Phased Program - Plan for Incremental Mine Development

The six-point plan listed below outlines our proposed plan of action. The bases of the plan is that profits from the easily established acid leach recovery of precious metals from the Upper Mine’s tailings and possibly backfill can be utilized to finance exploration and development of the 3400 Area and ultimately the 8600 Area as well as other potential targets in successive stages. Details on the grade, tonnage, and planned processing of the oxidized material present at the Upper Mine can be found in the Deer Trail Mining Company’s Mining Engineer’s summary reports (Appendix II).

1.

Complete the acid leach circuit and begin processing the 100,000 tons of mill tailings.

2.

Systematically sample the 100,000 tons of backfill in the Upper Mine.

3.

Systematically sample and, if warranted, drill the most prospective portions of the 3400 Area. Re-commence mining if warranted and up-grade equipment as necessary.

4.

Establish at indicated and/or measured reserves in the 8600 Area with underground or surface drilling. This would include the area beyond the 1980 working face as well as the untested interval of the projected Toroweap mineralized body between the PTH Tunnel and the terminal levels of the Upper Mine.

5.

Rehabilitate the 8600 Area workings including rails, timbers, electrical system, ventilation system, hoist, etc. Bore mandatory escape raise connecting the PTH Tunnel with the Upper Mine and re-commence mining in the 8600 Area.

6.

Test the potential in the Mississippian with a 6 to 10 hole program adjacent to known feeder structures in both the 3400 and 8600 Areas. Anticipated size is many multiples of that of the original combined Toroweap mineralized body in the Upper Mine and 8600 Area of the Lower Mine.

Plans to Conduct Exploration

The time and budget have not been established for this program.

Funding for Exploration Programs

It is anticipated that funding for most exploration programs will be generated through one or more of the following:

1.

Sale of Au-Ag-Zn-Pb-Cu concentrate.

2.

Acquiring joint venture partners.

3.

Private stock placements.

Silver Bell Mining Company, Inc.

Silver Bell Mining Company, Inc. was incorporated in the State of Utah on April 26, 1993. It has acquired 26 patented mining claims located in American Fork Canyon, Utah County, Utah, which is organized into three separate parcels. The claims contain mining properties that have not been mined for production since 1983. The properties were mined primarily for silver, lead and zinc. There are no known, proven or probable reserves on the property.

Silver Bell Mining Company conducted some exploration work on the Silver Bell Mine through 2004. Silver Bell Mining Company plans to conduct further exploration work to evaluate the claims prior to commencing any future mining activities on the claims. Silver Bell Mining Company anticipates that if there are any future mining activities at the Silver Bell Mine, materials mined will be transported to the Deer Trail Mine site where they can be crushed, milled and processed. Silver Bell Mining Company may also seek a joint venture mining partner to jointly develop the Silver Bell Mine, if exploration work suggests that future mining is commercially viable.

In August 2006, Silver Bell Mining Company reached a preliminary agreement for a joint venture with the Polymet Company, LLC for mining at the Silver Bell Mine and executed a letter of intent. A subsequent definitive agreement to finalize the details of the joint venture was expected to be signed by August 31, 2006. However, the parties failed to reach a definitive agreement, and the parties are no longer involved in negotiations.

10

Bromide Basin Mining Company, LLC

On July 20, 2001, Unico entered into a Mining Lease and Option to Purchase with Kaibab Industries, Inc., an Arizona corporation. The parties then entered into a Revised Mining Lease and Option to Purchase in April 2003 (the "Revised Kaibab Mining Lease"). Following the formation of the Bromide Basin Mining Company in June 2004, Unico assigned all of its assets, liabilities and exploration activities associated with the Bromide Basin Mines to Bromide Basin Mining Company. A Second Revised Mining Lease and Option to Purchase was entered into with Bromide Basin Mining Company in May 2005 which expired November 1, 2005. Effective May 1, 2006, the parties entered into a Third Revised Mining Lease and Option to Purchase (the “Third Revised Mining Lease”). At that time Unico paid approximately $63,592 to Kaibab Indutries, Inc. for past due lease payments, taxes and BLM fees. Under the Third Revised M ining Lease, Kaibab Industries, Inc. leased to Bromide Basin Mining Company certain mining claims located in the Henry Mountain Mining District in Garfield County, Utah containing approximately 400 acres, which included the Bromide Basin Mines. The Third Revised Mining Lease granted to Bromide Basin Mining Company the option to purchase six (6) fully permitted patented mining claims and twenty-one (21) located mining claims comprising in all over 400 acres of Bromide Basin in the Henry Mountain Mining District located in Garfield County, Utah. The option exercise price was $835,000 for all specified mining claims, mill sites and dumps being leased. The lease was extended until October 31, 2007 at which time it expired. The Company has chosen not to extend it or pursue the purchase option.

The primary purpose of the agreement was to allow Bromide Basin Mining Company access to the claims to conduct exploratory studies to evaluate the potential of the claims before exercising the purchase option from Kaibab Industries.

The Company has concluded its evaluation of the property, and has determined that the leased premises outlined under the Kaibab Mining Lease is not feasible for large scale mining activities by Bromide Basin Mining Company, and will not exercise its purchase option with Kaibab Industries.

Plan of Operation

During the next 12 months, the Company’s plan of operation is to raise approximately $2,500,000 for investment into two of its subsidiary companies: Deer Trail Mining Company and Silver Bell Mining Company. The funds are intended for the following purposes during the next twelve months:

·

Continue sampling and analyzing mineralized rock samples, stockpiles and dump material from the Deer Trail Mine to evaluate the most efficient means to conduct future mining and milling activities;

·

Expand metallurgical research department at the Deer Trail Mine and Mill Facility;

·

Purchase additional lab equipment for metallurgical purposes;

·

Upgrade mine infrastructure and begin underground mining activities including maintenance and rehabilitation work at the Deer Trail Mine;

·

Continue to upgrade and complete the re-construction project on the existing mill at the Deer Trail Mine;

·

Upgrade the crushing facility at the upper Deer Trail Mine and continue screening the mineralized material dumps;

·

Construct large tailings pond for large scale processing.

·

Begin milling and processing activities at the Deer Trail Mill and Processing Facility;

·

Acquire new mining equipment to improve exploration activities at the Deer Trail Mine;

·

Conduct additional survey and mapping work on the Clyde and Crown Point mining claims including improvements to the property and potentially underground and surface exploratory drilling on the claims; and

·

Commence exploration work to evaluate the potential of the mining claims at the Silver Bell Mine beginning in the Summer of 2009

Accomplishing the 12-month plan of operations is dependent on: (a) the Company raising approximately $2,500,000 in equity and/or debt financing during the next 12 months to be used for the Company’s operations, of which approximately $1,000,000 is needed in the next 120 days.

Smelting and Refining

All of the processing of concentrates generated from the mill will be processed on site or at a leaching plant in Phoenix owned by an unrelated party. Gold, silver and tellurium will be extracted from the concentrates. All base metals will be stored to be shipped later in rail car lots to smelters in Canada or Mexico.

11

Dependence on Metal Prices

Unico's activities will be largely dependent on metal prices. The prices may fluctuate on the world commodity markets and will be beyond the influence of Unico. A substantial reduction in the price of metals might impede Unico's ability to economically mine or to raise additional capital. Similarly, recent increases in precious metal prices have been beneficial to mining companies, and may increase Unico's ability to acquire new capital.

Competition

Unico competes with many mining exploration companies in the U.S. and throughout the world. The majority of Unico's competitors are much larger and better financed than Unico. Some of Unico's competitors have terminated mining exploration projects, and some mining companies have closed mining operations in past years due to low metal prices. Some exploration and mining operations have been consolidated through mergers or other acquisitions. Recent increases in metal prices have helped exploration and mining companies in expanding operations and in their efforts to acquire new capital.

Employees

During the fiscal year ended February 28, 2009 the Company and its subsidiaries had a total of 21 employees. Currently, the Company including subsidiaries has 15 full time employees, 1 part time employee and 4 consultants. The full time employees include a CEO, CFO, general manager, senior engineer/mine manager, metallurgist and geologist. Unico believes the number of employees may increase to approximately 30 within the next twelve months. In the event the exploration activities are successful, additional employees may be added in the future.

Governmental Regulation

Exploration, mining and/or processing activities are subject to numerous permitting and environmental laws and regulations administered by active federal, state, and local authorities, particularly the Utah Division of Oil, Gas and Mining. Although the permits necessary for exploration and mining operations on the patented and unpatented Deer Trail Mine claims and on the patented Silver Bell Mine claims have already been obtained, Unico may be required to expand such permitting in order to be able to fully develop the properties in the future. In order to obtain expanded permits, it may be necessary to gather and analyze baseline data, complete environmental assessments or environmental impact statements with appropriate steps to mitigate potential adverse impacts, and modify the proposed plans in order to accommodate environmental impacts, all of which may take an indeterminate amount of time to complete.

Exploration and mining operations are regulated under the jurisdiction of the Mine Safety and Health Administration or "MSHA" to some degree to insure safe operations. Without proper training of personnel and compliance to all MSHA rules, the mine could be subject to heavy fines and closure. Unico strives to comply with MSHA regulations and maintain a good working relationship with MSHA. The exploration activities are subject to periodic inspections by MSHA which, depending on the outcome of an inspection, could curtail exploration activities until any violations have been cured.

During approximately the last two years Unico has received some minor citations from MSHA and fines have been assessed. Unico is current on its payment obligations with respect to outstanding fines.

Cost and Effect of Compliance with Environmental Laws

Environmental regulations and guidelines have been established by state and federal agencies to insure that the environment is not permanently adversely impacted. Deer Trail Mining Company presently has $221,526 in reclamation bonds with the U.S. Forest Service and the Utah Division of Oil, Gas and Mining. As Unico expands its exploration activities it will become necessary to comply with further regulations for larger operations and more bonding will be required from time to time. Permitting will be an ongoing function of Unico's operations.

Compliance with the Sarbanes-Oxley Act of 2002

On July 30, 2002, President Bush signed into law the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act"). The Sarbanes-Oxley Act imposes a wide variety of new regulatory requirements on publicly held companies and their insiders. Many of these requirements will affect us. For example:

12

·

Our chief executive officer and chief financial officer must now certify the accuracy of the financial statements contained in our periodic reports;

·

Our periodic reports must disclose our conclusions about the effectiveness of our controls and procedures;

·

Our periodic reports must disclose whether there were significant changes in our internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses; and

·

We may not make any loan to any director or executive officer and we may not materially modify any existing loans.

The Sarbanes-Oxley Act has required us to review our current policies and procedures to determine whether we comply with the Sarbanes-Oxley Act and the new regulations promulgated thereunder. We will continue to monitor our compliance with all future regulations that are adopted under the Sarbanes-Oxley Act and will take actions necessary to ensure that we are in compliance therewith.

Code of Ethics and Audit Committee Charter

The Board of Directors of the Company adopted a Code of Ethics and an Audit Committee Charter.

The Code of Ethics applies to our principal executive officers, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The code of ethics is designed to deter wrongdoing and to promote:

·

Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

·

Full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with, or submits to, the Securities and Exchange Commission ("SEC") and in other public communications made by the Company;

·

Compliance with applicable governmental laws, rules and regulations;

·

The prompt internal reporting of violations of the Code; and

·

Accountability for adherence to the Code.

Unico’s code of ethics was filed as an exhibit to Form 10-KSB for the year ended February 28, 2006.

The primary responsibility of the Audit Committee is to oversee the Company's financial reporting process on behalf of the Company's Board of Directors and report the result of their activities to the Board. Such responsibilities shall exclude but shall not be limited to, the selection, and if necessary the replacement of the Company's independent auditors, review and discuss with such independent auditors and the Company's internal audit department (i) the overall scope and plans for the audit, (ii) the adequacy and effectiveness of the accounting and financial controls, including the Company's system to monitor and manage business risks, and legal and ethical programs, and (iii) the results of the annual audit, including the financial statements to be included in the Company's annual report on Form 10-K. Uinco’s audit committee charter was incorporated by reference from the Comp any’s Annual Report on Form 10-KSB for the Year Ended February 28, 2005 filed on June 20, 2005.

ITEM 1A.

RISK FACTORS

We are subject to various risks that may materially harm our business, financial condition and results of operations. You should carefully consider the risks and uncertainties described below and the other information in this filing before deciding to purchase our common stock. If any of these risks or uncertainties actually occurs, our business, financial condition or operating results could be materially harmed. In that case, the trading price of our common stock could decline and you could lose all or part of your investment.

We will need to raise additional capital to finance operations

Past operations have relied on monies generated from external financing to fund our operations. Even though, we anticipate that we will generate revenues in the coming year we will still need to raise substantial amounts of capital to provide for increased processing capacity. External financing will be required for future expansion as well. We cannot assure you that financing whether from external sources or related parties will be available if needed or on favorable terms. The sale of our common stock to raise capital may cause dilution to our existing shareholders. Our inability to obtain adequate financing may result in the need to curtail business operations. Any of these events would be materially harmful to our business and may result in a lower stock price.

13

There is substantial doubt about our ability to continue as a going concern due to recurring losses and working capital shortages, which means that we may not be able to continue operations unless we obtain additional funding

The report of our independent accountants on our February 28, 2009 financial statements included an explanatory paragraph indicating that there is substantial doubt about our ability to continue as a going concern due to recurring losses and working capital shortages. Our ability to continue as a going concern will be determined by our ability to obtain additional funding. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Most of our officers and directors lack previous mining experience; and this may affect the Company’s ability to succeed

It should be noted that not all of the officers and directors of Unico have technical training and experience with exploring for, starting, and/ or operating a mine, and as such may not be fully aware of many specific requirements and important factors related to this industry. Wayne Ash, the Company’s president, is the only officer or director with an extensive mining background. This lack of mining experience may affect decisions made by management, and ultimately the operations, and financial results of the Company.

We are not likely to succeed unless we can overcome the many obstacles we face

As an investor, you should be aware of the difficulties, delays and expenses we encounter, many of which are beyond our control, including unanticipated market trends, employment costs, and administrative expenses. We cannot assure our investors that our proposed business plans as described in this report will materialize or prove successful, or that we will ever be able to finalize development of our products or services or operate profitably. If we cannot operate profitably, you could lose your entire investment. As a result of the nature of our business, initially we expect to sustain substantial operating expenses without generating significant revenues.

We could fail to retain or attract key personnel

Our future success depends, in significant part, on the continued services of Mark A. Lopez, our Chief Executive Officer. We cannot assure you that we would be able to find an appropriate replacement for key personnel. Any loss or interruption of our key personnel's services could adversely affect our ability to develop our business plan. We have no employment agreements or life insurance on Mr. Lopez.

Our officers and directors have the ability to exercise significant influence over matters submitted for stockholder approval and their interests may differ from other stockholders

Our executive officers and directors have the opportunity, whether acting alone or together, to have significant influence in determining the outcome of any corporate transaction or other matter submitted to our Board for approval, including appointing officers, which could have a material impact on mergers, acquisitions, consolidations and the sale of all or substantially all of our assets. The interests of these board members may differ from the interests of the other stockholders.

Our common stock may be affected by limited trading volume and may fluctuate significantly

There has been a limited public market for our common stock and there can be no assurance that an active trading market for our common stock will develop. As a result, this could adversely affect our shareholders' ability to sell our common stock in short time periods, or possibly at all. Our common stock has experienced, and is likely to experience in the future, significant price and volume fluctuations that could adversely affect the market price of our common stock without regard to our operating performance. In addition, we believe that factors such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial markets could cause the price of our common stock to fluctuate substantially. Substantial fluctuations in our stock price could significantly reduce the price of our stock.

Our common stock is traded on the "over-the-counter bulletin board," which may make it more difficult for investors to resell their shares due to suitability requirements

Our common stock is currently traded on the Over the Counter Bulletin Board (OTCBB) where we expect it to remain for the foreseeable future. Broker-dealers often decline to trade in OTCBB stocks given that the market for such securities is often limited, the stocks are more volatile, and the risk to investors is greater. These factors may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of them. This could cause our stock price to decline.

14

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. Inasmuch as that the current bid and ask price of common stock is less than $5.00 per share, our shares are classified as “penny stock” under the rules of the SEC. For any transaction involving a penny stock, unless exempt, the rules require:

·

That a broker or dealer approve a person’s account for transactions in penny stocks; and

·

The broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

·

Obtain financial information and investment experience objectives of the person; and

·

Make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

·

Sets forth the basis on which the broker or dealer made the suitability determination; and

·

That the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks..

TEM 1B.

UNRESOLVED STAFF COMMENTS

There is an outstanding comment letter from the Securities and Exchange Commission relating to the Company’s Annual Report on Form 10-K for the fiscal year ended February 29, 2008 that has not been resolved. Since Unico is not an accelerated filer, a large accelerated filer or a well-known seasoned issuer, as those terms are defined in applicable rules, and since the comments were received less than 180 days before the end of the fiscal year covered by this Annual Report, Unico is not required to disclose the substance of any unresolved comments in this report. Nevertheless, Unico amended its Annual Report for the fiscal year ended February 29, 2008 in the effort to resolve the outstanding comments.

15

ITEM 2.

DESCRIPTION OF PROPERTY

Deer Trail Lease

On March 30, 1992, Deer Trail Mining Company, LLC entered into a Mining Lease and Option to Purchase agreement with Deer Trail Development Corporation, with headquarters in Dallas, Texas. Deer Trail Development Corporation is now known as Crown Mines, L.L.C. The lease was to run for a period of 10 years, and cover 28 patented claims, 5 patented mill sites and 171 unpatented claims located approximately 5 miles South of Marysvale, Utah. It included mine workings known as the Deer Trail Mine, the PTH Tunnel and the Carisa and Lucky Boy mines. The lease was extended several times prior to the Company’s purchase of the claims in July 2007.

In July 2007, Deer Trail Mining Company completed the purchase of the claims covered by the Deer Trail Lease. A total of $4,000,000 was paid to purchase the property over a period of approximately three years. The purchase of the claims also included the purchase of a fifty percent (50%) interest in Water Right No. 63-37, said fifty percent (50%) portion including a maximum flow of 0.125 cubic feet of water per second and a maximum annual diversion of 90.5 acre feet of water from Three Mile Spring for year-round mining purposes. The purchase of the claims also included a fifty percent (50%) interest in a contractual right to use water diverted under Water Right No. 63-3043 as evidenced and described in the Agreement between Cottonwood Irrigation Company and Deer Trail Development Corporation dated July 28, 1977. The fifty percent (50%) interest in the contractual water right allows Deer Trail Mining Company t o truck not more than 2,500 gallons of water per week from the Cottonwood Creek to the Deer Trail Mine for mining activities during the irrigation season (April 15 to October 15), and possibly more during the remaining portion of each year.

Deer Trail Mining Company also obtained a lease from Crown Mines, L.L.C. of the remaining fifty percent (50%) interest in Water Right No. 63-37 and the remaining 50% interest in the contractual water right (Water Right 63-3043. The lease is for an initial term of 5 years for no rent. The lease may be terminated by Crown Mines, L.L.C. upon 12 months’ written notice if Crown Mines determines that the water rights covered by the lease are necessary for the operation and development of any of Crown Mines’ mining claims or for other permitted uses. The lease may be extended if Crown Mines determines that the water rights covered by the lease are not required for the operation and development of any of Crown Mines’ mining claims or for other permitted uses during the extension period, provided that the parties can agree on other terms including a price or rent for the extended term.

Crown Mines, L.L.C. retained a perpetual royalty interest on minerals taken from the claims purchased by Deer Trail Mining Company. The perpetual royalty is three percent (3.0%) of net smelter returns on minerals other than gold. The royalty rate for gold is three percent (3.0%) when the price of gold is less than or equal to $500 per troy ounce, four percent (4.0%) when the price of gold is more than $500 and less than or equal to $600 per troy ounce, and five percent (5.0%) when the price of gold is greater than $600 per troy ounce. Crown Mines, L.L.C. also retained an undivided three percent (3.0%) interest in any oil and gas and associated hydrocarbons produced from the claims.

Crown Mines, L.L.C. also retained an access easement and a water line pipeline easement across the claims sold to Deer Trail Mining Company.

Deer Trail Mining Company has agreed to provide Crown Mines, L.L.C. with information obtained as a result of Deer Trail Mining Company’s exploration activities on the claims, and Deer Trail Mining Company granted to Crown Mines, L.L.C. a right of first refusal to repurchase the claims or any portion thereof.

In August 2006, Deer Trail Mining Company entered into a Mining Lease with Joel Johnson covering the Clyde, Clyde Intermediate and Crown Point claims. These claims are located near the Deer Trail Mine. Deer Trail Mining Company has leased the claims for the purpose of conducting mine exploration, evaluation, and possible mining activities on the claims. The Mining Lease is for two years, with options to extend the lease for 50 additional one year periods. Under the terms of the Mining Lease, Deer Trail Mining Company paid initial down payments totaling $31,000 with $4,000 due in the second year of the lease. If Deer Trail Mining Company elects to extend the lease, it must pay $3,000 for the first extension year, and the annual lease extension payment increases ten percent (10%) per year thereafter. Additionally, Deer Trail Mining Company will pay three percent (3%) of the gross sale proceeds from the sale of any ore concentrates, or other mineral resources extracted from the claims.

16

In September 2006, Deer Trail Mining Company entered into a Non-Patented Mining Claims Lease covering approximately 70 additional claims covering approximately 1,500 acres in Piute County Utah for the purpose of exploration, evaluation and mining activities. In consideration for the rights under the agreement, the Deer Trail Mining Company agreed to pay the lease holders $7,000 per year for each of the first three years. Deer Trail Mining Company has the right to extend the lease for 50 additional one year periods. If extended by Deer Trail Mining Company, the annual lease payment is $10,000 in each of years four and five, and thereafter the annual lease payment increases by ten percent (10%) per year. In addition to the annual lease payments, Deer Trail Mining Company has also agreed to pay an amount equal to three percent (3%) of the gross sales proceeds from all ore, concentrates, and all other productions of mineral resources extracted fr om the claims. The agreement contains an option to purchase the claims exercisable at $350,000 during the five first years of the lease. The exercise price increases $50,000 per year thereafter. It may only be exercised while the lease is effective.

The Deer Trail claims are located in the Tushar Mountains of East Central, Utah in the Mount Baldy and Ohio Mining districts. They are located on Deer Trail Mountain, approximately 5 miles South of Marysvale, Utah and are accessible by a gravel county road which is in good condition. There are no known, proven or probable reserves on the property.

The Deer Trail mineralized body was first discovered by deer hunters in 1878. The mineralized body originally cropped out at the surface. It is estimated that between 1878 and 1917, about 10,000 tons of mineralized materials were mined. A small mill was installed in 1918, and between 1918 and 1923 the mine produced about 138,000 tons of predominately oxidized mineralized materials averaging 1.38 opt gold, 11.49 opt silver and 3.26% lead. Zinc and copper were not recovered. In 1923, mining was suspended when the workings encountered a fault that cut off the mineralized materials, and for more than 20 years production was limited to drawing stopes and removing pillars. In 1945, the PTH tunnel was started to explore for the faulted extension of the Deer Trail mineralized body. The 3,400 mineralized body was encountered unexpectedly by this tunnel and a total of 5,000 tons of mineralized materials averaging 2.84% lead, 0.76% copper, 6.2 6% zinc, 15.17 opt silver and 0.19 opt gold were shipped. By 1964, the PTH tunnel had intersected the offset part of the Deer Trail mineralized body. From 1964 until 1981 this segment of the mineralized body produced over 100,000 tons of unoxidized sulfide mineralized materials averaging 5% lead, 0.6% copper, 12% zinc, 15 opt silver, and 0.10 opt gold. The present working face is still in mineralized material.

The PTH Tunnel penetrates more than 10,000 feet with a developed network of tunnels, shafts and raises at the 3,400 foot area and at the 8,000 foot area and was mined extensively for gold and silver for about 20 years. The timbered and ventilated tunnel includes more than two miles of track for ore cars accessed through a covered entrance structure.

The mine facilities also include ore cars, battery operated engines, an engine storage and charging house, an electric power substation, a miner's locker room, a compressor building, a 1,000 gallon underground gasoline storage tank with gas pump, two front end loaders, three dump trucks and a general office, a fully operational lab and a core sampling facility. Deer Trail Mining Company believes water is accessible to the site.

The Deer Trail mining property was developed by the Deer Trail Development Corporation, now known as Crown Mines, LLC, located in Dallas, Texas. The property has been leased out several times since production ceased in 1981 and is presently owned by Deer Trail Mining Company, LLC. Several major mining companies have explored the property. These include Noranda, Phelps Dodge and Goldfields. One smaller company drilled and analyzed the mill tailings from the upper Deer Trail Mine area in 1990. The results of the drilling and other tests were not conclusive, and at present there are no known proven or probable reserves on the claims.

Unico leased the property effective June 1, 1992. Unico has taken a few small lots of mineralized materials from the stopes in the 8600 area of the PTH tunnel for testing and evaluation purposes, and has identified several excellent targets within those workings. In April 2001, Unico began limited exploration activities which were concentrated in the 3400 area of the mine until underground exploration activities temporarily stopped in October 2003. Unico transferred all rights and obligations to the Deer Trail Mining Company in June 2004. Deer Trail Mining Company purchased the claims in July 2007, and is the current owner and operator of the Deer Trail Mine. Deer Trail Mining Company resumed underground exploration activities at the Deer Trail Mine in late 2004. Underground exploration activities have focused on infrastructure improvements during this past fiscal year along with continuing the exploration and testing of mineralized areas.

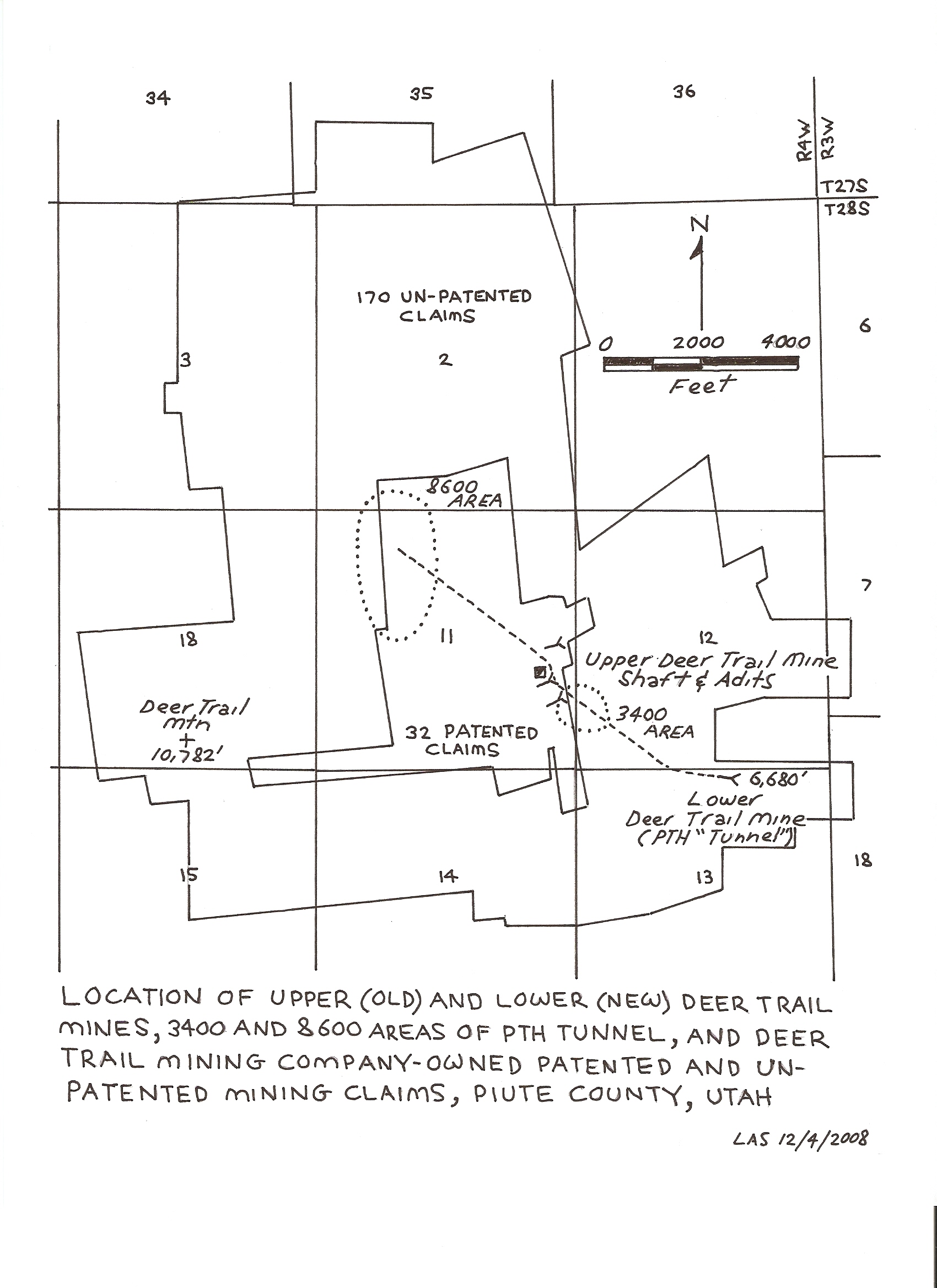

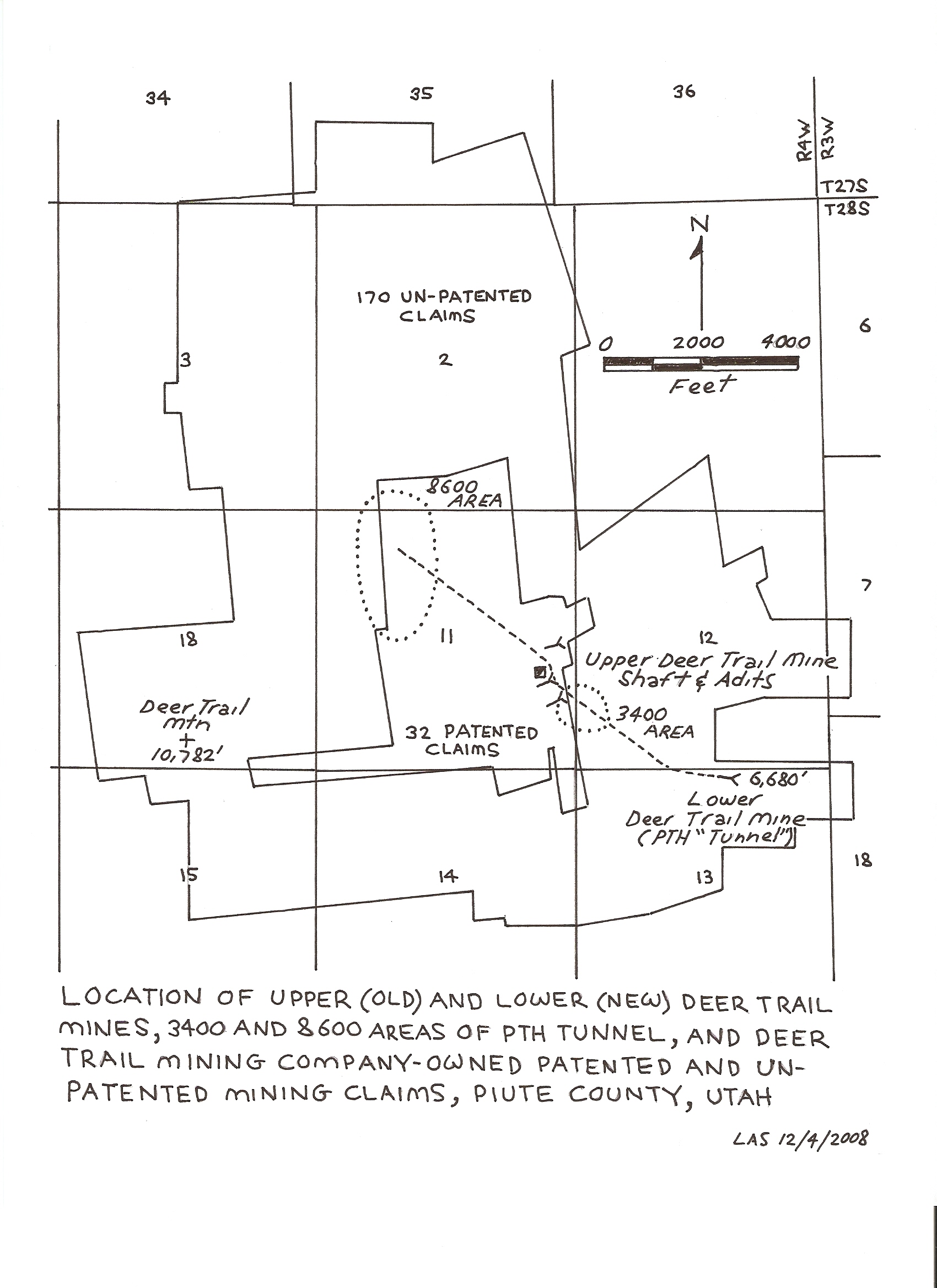

Following is a map of the area where the Deer Trail Mine is located along with a map of the claims owned by the Deer Trail Mining Company, LLC.

17

18

19

Deer Trail Mine Geological Information

The Deer Trail mine workings expose westerly dipping sedimentary rocks of three units: the Toroweap and Queantoweap Formations and the Callville Limestone. The Deer Trail mineralized area is in the lower part of the Toroweap Formation and consists of a nearly continuous group of semiconcordant replacement bodies flanking a central vein. About half of this mineralized area is exposed in the Old Deer Trail mine workings and is oxidized; the other half is located in the 8600 area workings and consists of unoxidized sulphide mineralized material. The Queantoweap Formation, which underlies the Toroweap, is a quartzite and hosts no known mantos. The underlying Callville Limestone contained the 3400 mineralized area.

The Toroweap Formation exposed in the 8600 area consists of a wide range of interbedded lithologies, including quartzite, limestone, dolomite, shale, and chert, which form 50 or more recognizable units ranging in thickness from a inch to several feet. In contrast, the underlying Queantoweap Sandstone consists of a fairly uniform medium-grained, well-sorted massive quartzite.