Basel, 3 April 2012

Roche disappointed by Illumina, Inc.’s Board of Directors’ rejection

By not engaging with Roche, Illumina reinforces notion of an entrenched Board

Roche (SIX: RO, ROG; OTCQX: RHHBY) released the following statement in response to the announcement by Illumina, Inc. (NASDAQ: ILMN) that its Board of Directors has recommended that shareholders not tender their shares to Roche’s increased offer.

“We are disappointed that Illumina’s Board of Directors has rejected Roche’s increased $51.00 cash offer and continues to rebuff our attempts to engage in substantive discussions,” said Severin Schwan, CEO of Roche Group. Schwan continued, “Roche’s increased offer is highly attractive. By not engaging with Roche, Illumina reinforces the notion that its Board and management are determined to preserve their positions rather than maximize shareholder value. We expect that Illumina shareholders will see the substantial value in our increased offer, conclude that there is absolutely no justification for Illumina’s current directors’ refusal to begin discussions with Roche and vote their shares for the Roche director nominees.”

About the Offer

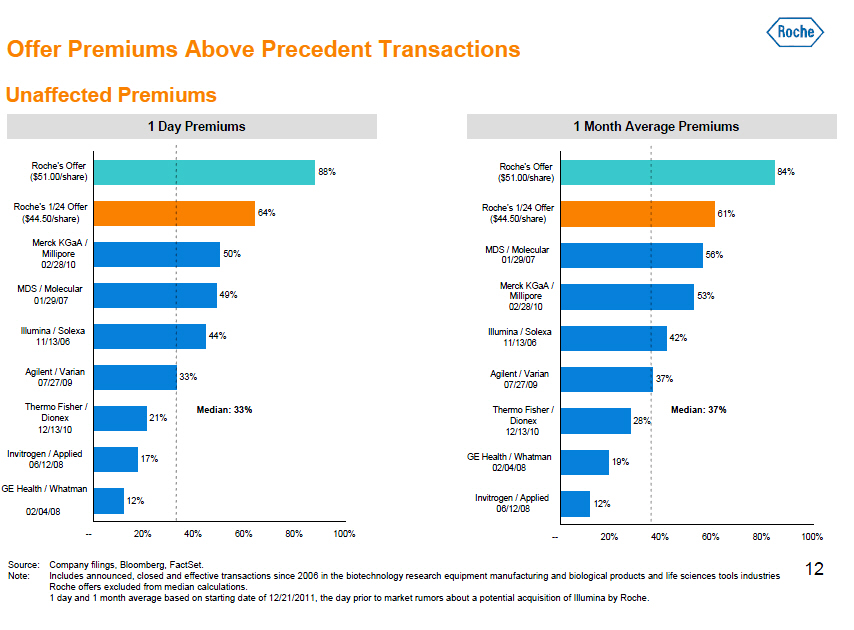

On January 27, 2012, Roche commenced a tender offer to acquire all outstanding shares of Illumina for $44.50 per share in cash and increased its offer on March 29, 2012 to $51.00 per share in cash for an aggregate of approximately $6.7 billion on a fully diluted basis. The increased offer represents a substantial premium to Illumina’s unaffected market prices: a premium of 88% over Illumina’s closing stock price on December 21, 2011 – the day before market rumors about a potential transaction between Roche and Illumina drove Illumina’s stock price significantly higher – and an 84% premium over the one-month historical average and a 64% premium over the three-month historical average of Illumina’s share price, both as of December 21, 2011.

In addition to its cash tender offer, Roche has nominated a slate of highly qualified, independent candidates for election to Illumina’s Board of Directors and proposed certain other matters for the

| F. Hoffmann-La Roche Ltd | 4070 Basel | Group Communications | Tel. +41 61 688 88 88 |

| | Switzerland | Roche Group Media Relations | Fax +41 61 688 27 75 |

| | | | www.roche.com |

consideration of Illumina’s shareholders at Illumina’s 2012 annual meeting, which if adopted, would result in Roche-nominated directors comprising a majority of the Illumina board.

About Roche

Headquartered in Basel, Switzerland, Roche is a leader in research-focused healthcare with combined strengths in pharmaceuticals and diagnostics. Roche is the world’s largest biotech company with truly differentiated medicines in oncology, virology, inflammation, metabolism and CNS. Roche is also the world leader in in-vitro diagnostics, tissue-based cancer diagnostics and a pioneer in diabetes management. Roche’s personalized healthcare strategy aims at providing medicines and diagnostic tools that enable tangible improvements in the health, quality of life and survival of patients. In 2011, Roche had over 80’000 employees worldwide and invested over 8 billion Swiss francs in R&D. The Group posted sales of 42.5 billion Swiss francs. Genentech, United States, is a wholly owned member of the Roche Group. Roche ha s a majority stake in Chugai Pharmaceutical, Japan. For more information: www.roche.com.

All trademarks used or mentioned in this release are protected by law.

Additional information

Additional detail regarding the offer can be found on www.transactioninfo.com/Roche.

Roche Group Media Relations

Phone: +41 -61 688 8888 / e-mail: basel.mediaoffice@roche.com

| - | Alexander Klauser (Head) |

Brunswick Group (for U.S. media)

Phone: +1 212 333 3810

MacKenzie Partners (Information Agent for the offer)

Phone: +1 212 929 5500 or +1 800 322 2885 (toll-free)

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

THIS ANNOUNCEMENT CONTAINS CERTAIN FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS MAY BE IDENTIFIED BY WORDS SUCH AS “BELIEVES”, “EXPECTS”, “ANTICIPATES”, “PROJECTS”, “INTENDS”, “SHOULD”, “SEEKS”, “ESTIMATES”, “FUTURE” OR SIMILAR EXPRESSIONS OR BY DISCUSSION OF, AMONG OTHER THINGS, STRATEGY, GOALS, PLANS OR INTENTIONS. VARIOUS FACTORS MAY CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY IN THE FUTURE FROM THOSE REFLECTED IN FORWARD-LOOKING STATEMENTS CONTAINED IN THIS DOCUMENT, AMONG OTHERS: (1) ECONOMIC AND CURRENCY CONDITIONS; (2) COMPETITIVE AND TECHNOLOGICAL FACTORS; AND (3) RISKS AND UNCERTAINTIES RELATING TO THE PROPOSED TRANSACTION.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

THIS ANNOUNCEMENT IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL ILLUMINA COMMON STOCK. THE TENDER OFFER IS BEING MADE PURSUANT TO A TENDER OFFER STATEMENT ON SCHEDULE TO (INCLUDING THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND OTHER RELATED TENDER OFFER MATERIALS) FILED BY ROCHE WITH THE SECURITIES AND EXCHANGE COMMISSION (SEC) ON JANUARY 27, 2012. THESE MATERIALS, AS THEY MAY BE AMENDED FROM TIME TO TIME, CONTAIN IMPORTANT INFORMATION, INCLUDING THE TERMS AND CONDITIONS OF THE OFFER, THAT SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. INVESTORS AND SECURITY HOLDERS MAY OBTAIN A FREE COPY OF THESE MATERIALS AND OTHER DOCUMENTS FILED BY ROCHE WITH THE SEC AT THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV. THE OFFER TO PURCHA SE AND RELATED MATERIALS MAY ALSO BE OBTAINED FOR FREE BY CONTACTING THE INFORMATION AGENT FOR THE TENDER OFFER, MACKENZIE PARTNERS, AT (212) 929-5500 OR (800) 322-2885 (TOLL-FREE).

ROCHE HAS FILED A PROXY STATEMENT ON SCHEDULE 14A AND OTHER RELEVANT DOCUMENTS WITH THE SEC IN CONNECTION WITH ITS SOLICITATION OF PROXIES FOR THE 2012 ANNUAL MEETING OF ILLUMINA (THE “PROXY STATEMENT"). ROCHE HAS MAILED THE PROXY STATEMENT AND A PROXY CARD TO EACH ILLUMINA STOCKHOLDER ENTITLED TO VOTE AT THE 2012 ANNUAL MEETING. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT CAREFULLY AND IN ITS ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION. INVESTORS AND SECURITY HOLDERS MAY OBTAIN A FREE COPY OF THESE MATERIALS AND OTHER DOCUMENTS FILED BY ROCHE WITH THE SEC AT THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV. THE PROXY STATEMENT AND RELATED MATERIALS MAY ALSO BE OBTAINED FOR FREE BY CONTACTING THE INFORMATION AGENT FOR THE TENDER OFFER, MACKENZIE PARTNERS, AT (212) 929-5500 OR (800) 322-2885 (TOLL-FREE).

ROCHE HOLDING LTD, CKH ACQUISITION CORPORATION AND THE INDIVIDUALS NOMINATED BY CKH ACQUISITION CORPORATION FOR ELECTION TO ILLUMINA’S BOARD OF DIRECTORS (THE “ROCHE NOMINEES") MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES FROM ILLUMINA STOCKHOLDERS FOR USE AT THE 2012 ANNUAL MEETING OF STOCKHOLDERS, OR AT ANY ADJOURNMENT OR POSTPONEMENT THEREOF. INFORMATION REGARDING THE DIRECTORS AND EXECUTIVE OFFICERS OF ROCHE HOLDING LTD AND CKH ACQUISITION CORPORATION WHO MAY BE PARTICIPANTS IN THE SOLICITATION OF PROXIES CAN BE FOUND IN THE DEFINITIVE PROXY STATEMENT. NO ADDITIONAL COMPENSATION WILL BE PAID TO SUCH DIRECTORS AND EXECUTIVE OFFICERS FOR SUC H SERVICES. INVESTORS AND SECURITY HOLDERS CAN OBTAIN ADDITIONAL INFORMATION REGARDING THE DIRECT AND INDIRECT INTERESTS OF THE ROCHE NOMINEES AND OTHER PARTICIPANTS BY READING THE DEFINITIVE PROXY STATEMENT.

|

[GRAPHIC OMITTED]

Roche's Offer to Acquire Illumina

Response to Illumina's Key Claims April 2012

[GRAPHIC OMITTED]

|

|

This presentation contains certain forward-looking statements. These

forward-looking [GRAPHIC OMITTED] statements may be identified by words such as

`believes', `expects', `anticipates', `projects', `intends', `should', `seeks',

`estimates', `future' or similar expressions or by discussion of, among other

things, strategy, goals, plans or intentions. Various factors may cause actual

results to differ materially in the future from those reflected in

forward-looking statements contained in this presentation, among others:

1 pricing and product initiatives of competitors;

2 legislative and regulatory developments and economic conditions;

3 delay or inability in obtaining regulatory approvals or bringing products

to market;

4 fluctuations in currency exchange rates and general financial market

conditions;

5 uncertainties in the discovery, development or marketing of new products or

new uses of existing products, including without limitation negative

results of clinical trials or research projects, unexpected side-effects of

pipeline or marketed products;

6 increased government pricing pressures;

7 interruptions in production;

8 loss of or inability to obtain adequate protection for intellectual

property rights;

9 litigation;

10 loss of key executives or other employees; and

11 adverse publicity and news coverage.

Any statements regarding earnings per share growth is not a profit forecast and

should not be interpreted to mean that Roche's earnings or earnings per share

for this year or any subsequent period will necessarily match or exceed the

historical published earnings or earnings per share of Roche.

For marketed products discussed in this presentation, please see full

prescribing information on our website - www.roche.com

All mentioned trademarks are legally protected.

2

|

|

Situation Update

o On April 2, Illumina released an investor presentation explaining why it

believed Roche's offer to purchase all shares of the company for $51.00 per

share was inadequate

o However, Illumina did not offer any quantitative evidence why Roche's offer

is not full and fair

- Nor did Illumina provide any quantitative evidence why its shares are

worth more than Roche's offer

- Roche would welcome the opportunity to learn more about what in

Illumina's outlook supports a higher valuation

o On April 2, Illumina also announced estimated revenue for Q1 2012

- Its preliminary estimate of $270 million was slightly (~5%) greater

than analyst consensus for the quarter ($257 million per I/B/E/S

consensus)

- The preliminary estimate for Q1 implies annual revenue in line with

the company's original guidance of $1.0-$1.075 billion in revenue for

the full year 2012

- Research analysts used this revenue guidance to formulate their

price targets, which were at a median of $34.00 per share before

Roche made its offer public

- Again, Illumina did not publicize any changes to its outlook or

business model that would substantiate additional value beyond levels

offered by investors and research analysts prior to the transaction

3

|

|

Key Claims

--------------------------------------------------------------------------------

Key Claims Made in Illumina Investor

Presentation

--------------------------------------------------------------------------------

o Roche's tender offer bid is "timed to take advantage of a temporary

dislocation in Illumina's stock price"

--------------------------------------------------------------------------------

Roche Response

--------------------------------------------------------------------------------

o Over two of the past three years, Illumina traded in line or below an index

of its peers and the broader market, which suggests that the

out-performance was the actual dislocation

o This short period of out-performance was driven by unsustainable growth

expectations. These expectations moderated during 2011, causing Illumina's

share price to revert to its peers and the broader market

- Prior to Roche's public offer, research analyst price targets were

$34.00 per share

o Illumina's own actions suggest a bearish view of the stock price

- In Q4 2011, with its stock trading at extremely low levels, Illumina

could have continued its stock buybacks or retired its outstanding

warrants

- To do so would have been an opportunistic and value-enhancing use of

the $1.1 billion of cash on its balance sheet

- However, Illumina did neither of these things, calling into question

management's belief that the stock price dislocation was temporary

o Quantitative metrics show that Roche's offer is highly attractive

- Implied multiples of 21.6x LTM EBITDA and 6.5x LTM revenue are highly

attractive relative to precedent life science tools transactions

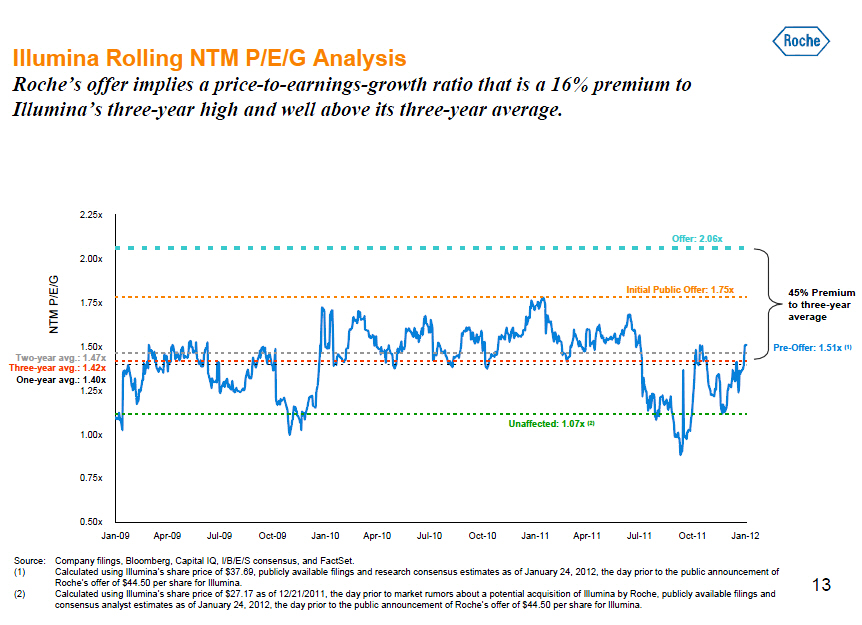

- Implied multiples of 34.2x 2012E earnings and 2.06x 2012E P/E/G are

highly attractive relative to the trading levels of other life science

tools companies

- Illumina has never offered any quantitative evidence that Roche's

offer is inadequate compared to its pre-transaction trading valuation

or precedent life science tools transactions

Source: SEC filings, FactSet, Capital IQ, I/B/E/S consensus, Bloomberg.

Note: LTM as of 12/31/2011

4

|

|

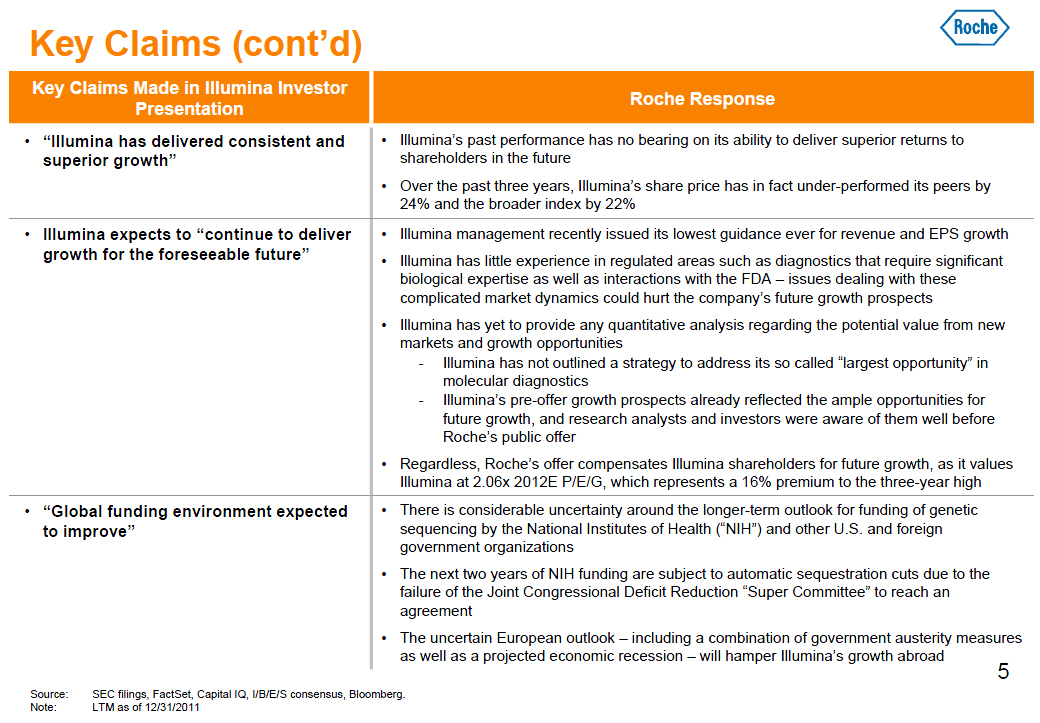

Key Claims (cont'd)

--------------------------------------------------------------------------------

Key Claims Made in Illumina Investor

Presentation

--------------------------------------------------------------------------------

o "Illumina has delivered consistent and superior growth"

--------------------------------------------------------------------------------

Roche Response

--------------

o Illumina's past performance has no bearing on its ability to deliver

superior returns to shareholders in the future

o Over the past three years, Illumina's share price has in fact

under-performed its peers by 24% and the broader index by 22%

--------------------------------------------------------------------------------

Key Claims Made in Illumina Investor

Presentation

--------------------------------------------------------------------------------

o Illumina expects to "continue to deliver growth for the foreseeable future"

--------------------------------------------------------------------------------

Roche Response

--------------

o Illumina management recently issued its lowest guidance ever for revenue

and EPS growth

o Illumina has little experience in regulated areas such as diagnostics that

require significant biological expertise as well as interactions with the

FDA - issues dealing with these complicated market dynamics could hurt the

company's future growth prospects

o Illumina has yet to provide any quantitative analysis regarding the

potential value from new markets and growth opportunities

- Illumina has not outlined a strategy to address its so called "largest

opportunity" in molecular diagnostics

- Illumina's pre-offer growth prospects already reflected the ample

opportunities for future growth, and research analysts and investors

were aware of them well before Roche's public offer

o Regardless, Roche,s offer compensates Illumina shareholders for future

growth, as it values Illumina at 2.06x 2012E P/E/G, which represents a 16%

premium to the three-year high

--------------------------------------------------------------------------------

Key Claims Made in Illumina Investor

Presentation

--------------------------------------------------------------------------------

Roche Response

--------------

o "Global funding environment expected to improve"

o There is considerable uncertainty around the longer-term outlook for

funding of genetic sequencing by the National Institutes of Health ("NIH")

and other U.S. and foreign government organizations

o The next two years of NIH funding are subject to automatic sequestration

cuts due to the failure of the Joint Congressional Deficit Reduction "Super

Committee" to reach an agreement

o The uncertain European outlook - including a combination of government

austerity measures as well as a projected economic recession - will hamper

Illumina's growth abroad

Source: SEC filings, FactSet, Capital IQ, I/B/E/S consensus, Bloomberg.

Note: LTM as of 12/31/2011

5

|

|

ADDITIONAL INFORMATION AND WHERE TO FIND IT

THESE MATERIALS ARE FOR INFORMATIONAL PURPOSES ONLY AND DO NOT CONSTITUTE AN

OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL ILLUMINA COMMON STOCK.

THE TENDER OFFER IS BEING MADE PURSUANT TO A TENDER OFFER STATEMENT ON SCHEDULE

TO (INCLUDING THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND OTHER RELATED

TENDER OFFER MATERIALS) FILED BY ROCHE WITH THE SECURITIES AND EXCHANGE

COMMISSION (SEC) ON JANUARY 27, 2012. THESE MATERIALS, AS THEY MAY BE AMENDED

FROM TIME TO TIME, CONTAIN IMPORTANT INFORMATION, INCLUDING THE TERMS AND

CONDITIONS OF THE OFFER, THAT SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS

MADE WITH RESPECT TO THE TENDER OFFER. INVESTORS AND SECURITY HOLDERS MAY OBTAIN

A FREE COPY OF THESE MATERIALS AND OTHER DOCUMENTS FILED BY ROCHE WITH THE SEC

AT THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV. THE OFFER TO PURCHASE AND

RELATED MATERIALS MAY ALSO BE OBTAINED FOR FREE BY CONTACTING THE INFORMATION

AGENT FOR THE TENDER OFFER, MACKENZIE PARTNERS, AT (212) 929-5500 OR (800)

322-2885 (TOLL-FREE).

ROCHE HAS FILED A PROXY STATEMENT ON SCHEDULE 14A AND OTHER RELEVANT DOCUMENTS

WITH THE SEC IN CONNECTION WITH ITS SOLICITATION OF PROXIES FOR THE 2012 ANNUAL

MEETING OF ILLUMINA (THE "PROXY STATEMENT"). ROCHE HAS MAILED THE PROXY

STATEMENT AND A PROXY CARD TO EACH ILLUMINA STOCKHOLDER ENTITLED TO VOTE AT THE

2012 ANNUAL MEETING. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY

STATEMENT CAREFULLY AND IN ITS ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS FILED

WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION. INVESTORS AND SECURITY

HOLDERS MAY OBTAIN A FREE COPY OF THESE MATERIALS AND OTHER DOCUMENTS FILED BY

ROCHE WITH THE SEC AT THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV. THE

PROXY STATEMENT AND RELATED MATERIALS MAY ALSO BE OBTAINED FOR FREE BY

CONTACTING THE INFORMATION AGENT FOR THE TENDER OFFER, MACKENZIE PARTNERS, AT

(212) 929-5500 OR (800) 322-2885 (TOLL-FREE).

ROCHE HOLDING LTD, CKH ACQUISITION CORPORATION AND THE INDIVIDUALS NOMINATED BY

CKH ACQUISITION CORPORATION FOR ELECTION TO ILLUMINA'S BOARD OF DIRECTORS (THE

"ROCHE NOMINEES") MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF

PROXIES FROM ILLUMINA STOCKHOLDERS FOR USE AT THE 2012 ANNUAL MEETING OF

STOCKHOLDERS, OR AT ANY ADJOURNMENT OR POSTPONEMENT THEREOF. INFORMATION

REGARDING THE DIRECTORS AND EXECUTIVE OFFICERS OF ROCHE HOLDING LTD AND CKH

ACQUISITION CORPORATION WHO MAY BE PARTICIPANTS IN THE SOLICITATION OF PROXIES

CAN BE FOUND IN THE DEFINITIVE PROXY STATEMENT. NO ADDITIONAL COMPENSATION WILL

BE PAID TO SUCH DIRECTORS AND EXECUTIVE OFFICERS FOR SUCH SERVICES. INVESTORS

AND SECURITY HOLDERS CAN OBTAIN ADDITIONAL INFORMATION REGARDING THE DIRECT AND

INDIRECT INTERESTS OF THE ROCHE NOMINEES AND OTHER PARTICIPANTS BY READING THE

DEFINITIVE PROXY STATEMENT. 6

|

|

--------------------------------------------------------------------------------

Roche

--------------------------------------------------------------------------------

We Innovate Healthcare

7

|

Roche's Offer to Acquire Illumina

Presentation to Investors

April 2012

HIPPE

1. We have a slide presentation which we will give to you and take you through

briefly, but first I would like to give some background to put things in

context.

2. Because of our interest in Illumina's business, and its relationship to

Roche's businesses, we have been trying to have a dialogue with Illumina's

board and management since November 1, 2011 - which is when we first called

them.

3. Although conversations in our half-dozen calls have always been polite,

their response has always been to delay and then to ask us to go away. It

took six weeks to arrange a brief meeting in San Diego, and then the

responses progressed from "we'll get back to you" to "we're in Christmas

season and I can't get people together" to "please sign a two year

standstill" to "we are not interested in discussing a sale" to "your price

is too low to justify a discussion".

4. It became clear to us that they were trying to delay past the time to

nominate directors so they would not have to talk to us or face a

shareholder vote on the issue

- and that we would then give up and go away.

5. To induce a real discussion we made a public offer and nominated director

candidates with superb credentials, and no connection to Roche, whose only

commitment to us will be to listen and do whatever is best for Illumina

shareholders. Based on public information, which is all that we have, our

offer is very strong by every measurement.

6. We strongly believe, and hope you will agree that our candidates are well

qualified and independent and that our offer price --- especially at the

current increased level - is more than sufficient to require the

commencement of a dialogue.

7. Turn discussion to substantive (slide) presentation and/or questions.

| | |

This presentation contains certain forward-looking statements. These

forward-looking statements may be identified by words such as `believes',

`expects', `anticipates', `projects', `intends', `should', `seeks', `estimates',

`future' or similar expressions or by discussion of, among other things,

strategy, goals, plans or intentions. Various factors may cause actual results

to

differ materially in the future from those reflected in forward-looking

statements contained in this presentation, among others:

1 pricing and product initiatives of competitors;

2 legislative and regulatory developments and economic conditions;

3 delay or inability in obtaining regulatory approvals or bringing products

to market;

4 fluctuations in currency exchange rates and general financial market

conditions;

5 uncertainties in the discovery, development or marketing of new products or

new uses of existing products, including without limitation negative

results of clinical trials or research projects, unexpected side-effects of

pipeline or marketed products; 6 increased government pricing pressures;

7 interruptions in production;

8 loss of or inability to obtain adequate protection for intellectual

property rights;

9 litigation;

10 loss of key executives or other employees; and

11 adverse publicity and news coverage.

Any statements regarding earnings per share growth is not a profit forecast and

should not be interpreted to mean that Roche's earnings or earnings per share

for this year or any subsequent period will necessarily match or exceed the

historical published earnings or earnings per share of Roche. For marketed

products discussed in this presentation, please see full prescribing information

on our website - www.roche.com

All mentioned trademarks are legally protected. 2

| | |

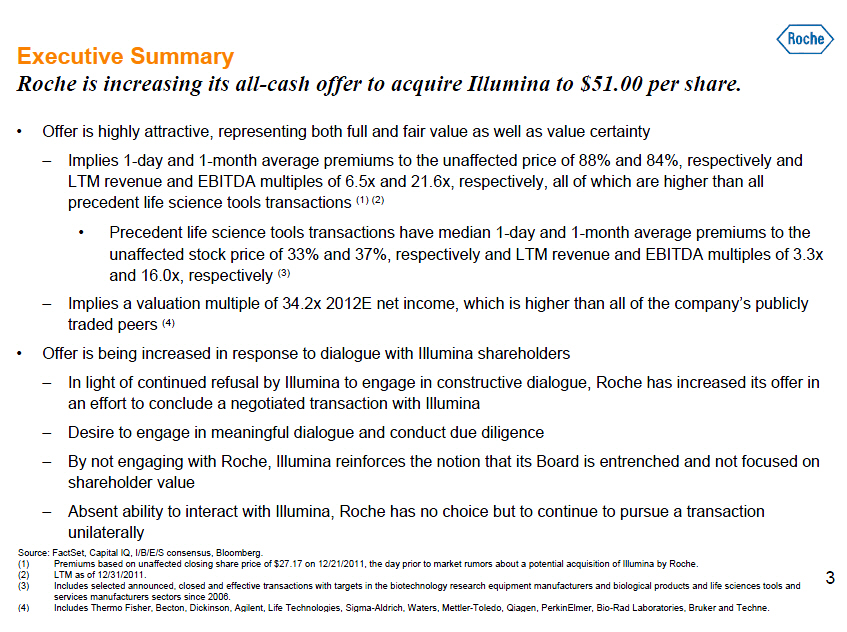

Executive Summary

Roche is increasing its all-cash offer to acquire Illumina to $51.00 per share.

o Offer is highly attractive, representing both full and fair value as well

as value certainty

- Implies 1-day and 1-month average premiums to the unaffected price of 88% and

84%, respectively and LTM revenue and EBITDA multiples of 6.5x and 21.6x,

respectively, all of which are higher than all precedent life science tools

transactions (1) (2)

o Precedent life science tools transactions have median 1-day and 1-month

average premiums to the unaffected stock price of 33% and 37%, respectively

and LTM revenue and EBITDA multiples of 3.3x and 16.0x, respectively (3)

- Implies a valuation multiple of 34.2x 2012E net income, which is higher than

all of the company's publicly traded peers (4) o Offer is being increased in

response to dialogue with Illumina shareholders

- In light of continued refusal by Illumina to engage in constructive dialogue,

Roche has increased its offer in an effort to conclude a negotiated transaction

with Illumina

- Desire to engage in meaningful dialogue and conduct due diligence

- By not engaging with Roche, Illumina reinforces the notion that its Board is

entrenched and not focused on shareholder value

- Absent ability to interact with Illumina, Roche has no choice but to

continue to pursue a transaction unilaterally

Source: FactSet, Capital IQ, I/B/E/S consensus, Bloomberg.

(1) Premiums based on unaffected closing share price of $27.17 on 12/21/2011,

the day prior to market rumors about a potential acquisition of Illumina by

Roche. 3

(2) LTM as of 12/31/2011.

(3) Includes selected announced, closed and effective transactions with targets

in the biotechnology research equipment manufacturers and biological

products and life sciences tools and services manufacturers sectors since

2006.

(4) Includes Thermo Fisher, Becton, Dickinson, Agilent, Life Technologies,

Sigma-Aldrich, Waters, Mettler-Toledo, Qiagen, PerkinElmer, Bio-Rad

Laboratories, Bruker and Techne.

| | |

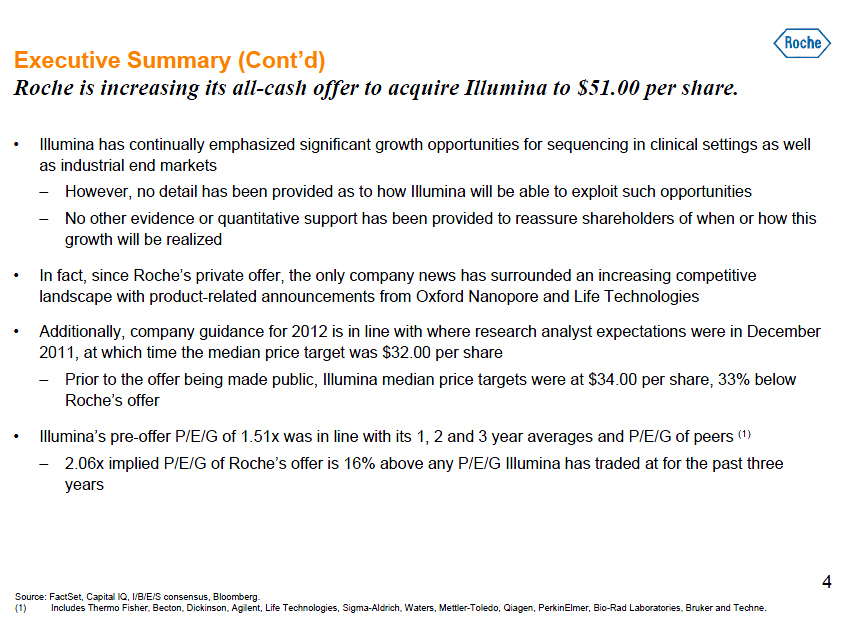

Executive Summary (Cont'd)

Roche is increasing its all-cash offer to acquire Illumina to $51.00 per share.

o _______ Illumina has continually emphasized significant growth

opportunities for sequencing in clinical settings as well as industrial end

markets - However, no detail has been provided as to how Illumina will be

able to exploit such opportunities

- No other evidence or quantitative support has been provided to reassure

shareholders of when or how this growth will be realized

o In fact, since Roche's private offer, the only company news has surrounded

an increasing competitive landscape with product-related announcements from

Oxford Nanopore and Life Technologies

o _______ Additionally, company guidance for 2012 is in line with where

research analyst expectations were in December 2011, at which time the

median price target was $32.00 per share - Prior to the offer being made

public, Illumina median price targets were at $34.00 per share, 33% below

Roche's offer

o Illumina's pre-offer P/E/G of 1.51x was in line with its 1, 2 and 3 year

averages and P/E/G of peers (1)

- 2.06x implied P/E/G of Roche's offer is 16% above any P/E/G Illumina has

traded at for the past three years

4

Source: FactSet, Capital IQ, I/B/E/S consensus, Bloomberg.

(1) Includes Thermo Fisher, Becton, Dickinson, Agilent, Life Technologies,

Sigma-Aldrich, Waters, Mettler-Toledo, Qiagen, PerkinElmer, Bio-Rad

Laboratories, Bruker and Techne.

| | |

Situation Update

o On April 2, Illumina released an investor presentation explaining why it

believed Roche's offer to purchase all shares of the company for $51.00 per

share was inadequate

o However, Illumina did not offer any quantitative evidence why Roche's offer

is not full and fair

- Nor did Illumina provide any quantitative evidence why its shares are worth

more than Roche's offer

- Roche would welcome the opportunity to learn more about what in Illumina's

outlook supports a higher valuation

o On April 2, Illumina also announced estimated revenue for Q1 2012

- Its preliminary estimate of $270 million was slightly (~5%) greater than

analyst consensus for the quarter

($257 million per I/B/E/S consensus)

- The preliminary estimate for Q1 implies annual revenue in line with the

company's original guidance of $1.0-$1.075 billion in revenue for the full

year 2012

- Research analysts used this revenue guidance to formulate their price

targets, which were at a median of $34.00 per share before Roche made its

offer public

- Again, Illumina did not publicize any changes to its outlook or business

model that would substantiate additional value beyond levels offered by

investors and research analysts prior to the transaction

| | |

Key Claims

Key Claims Made in Illumina Investor Roche Response

Presentation

o Roche's tender offer bid is "timed to take advantage of a temporary

dislocation in Illumina's stock price"

o Over two of the past three years, Illumina traded in line or below an index

of its peers and the broader market, which suggests that the

out-performance was the actual dislocation

o _______ This short period of out-performance was driven by unsustainable

growth expectations. These expectations moderated during 2011, causing

Illumina's share price to revert to its peers and the broader market - Prior to

Roche's public offer, research analyst price targets were $34.00 per share

o Illumina's own actions suggest a bearish view of the stock price

- _______ In Q4 2011, with its stock trading at extremely low levels, Illumina

could have continued its stock buybacks or retired its outstanding warrants - To

do so would have been an opportunistic and value-enhancing use of the $1.1

billion of cash on its balance sheet - However, Illumina did neither of these

things, calling into question management's belief that the stock price

dislocation was temporary

o Quantitative metrics show that Roche's offer is highly attractive

- _______ Implied multiples of 21.6x LTM EBITDA and 6.5x LTM revenue are highly

attractive relative to precedent life science tools transactions - Implied

multiples of 34.2x 2012E earnings and 2.06x 2012E P/E/G are highly attractive

relative to the trading levels of other life science tools companies - Illumina

has never offered any quantitative evidence that Roche's offer is inadequate

compared to its pre-transaction trading valuation or precedent life science

tools transactions

Source: SEC filings, FactSet, Capital IQ, I/B/E/S consensus, Bloomberg. Note: LTM as of 12/31/2011

| | |

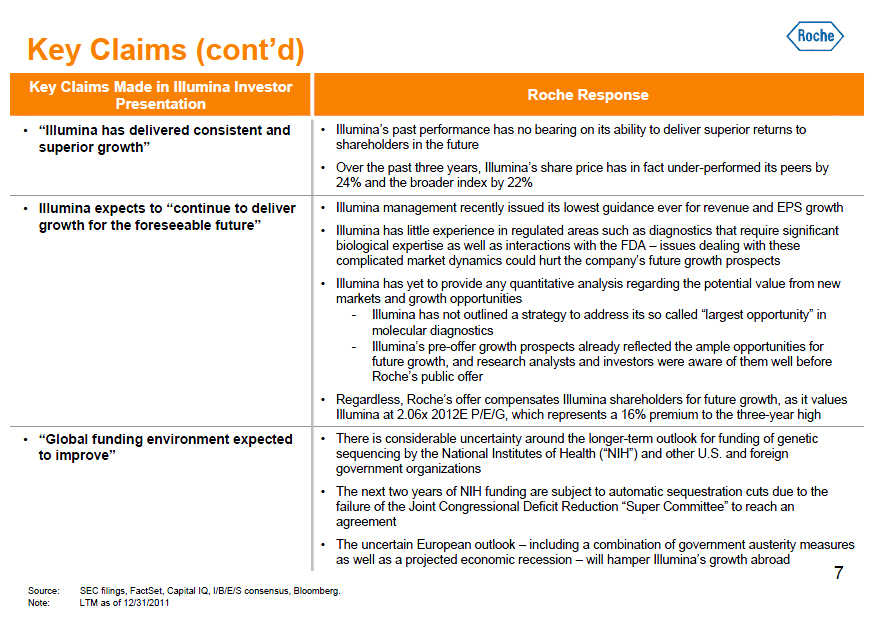

Key Claims (cont'd)

Key Claims Made in Illumina Investor Roche Response

Presentation

o "Illumina has delivered consistent and

o Illumina's past performance has no bearing on its ability to deliver

superior returns to superior growth" shareholders in the future

o Over the past three years, Illumina's share price has in fact

under-performed its peers by 24% and the broader index by 22%

o Illumina expects to "continue to deliver o _______ Illumina management

recently issued its lowest guidance ever for revenue and EPS growth growth

for the foreseeable future" ______ o Illumina has little experience in

regulated areas such as diagnostics that require significant

biological expertise as well as interactions with the

FDA - issues dealing with these complicated market

dynamics could hurt the company's future growth

prospects

o Illumina has yet to provide any quantitative analysis

regarding the potential value from new markets and

growth opportunities - Illumina has not outlined a

strategy to address its so called "largest opportunity"

in molecular diagnostics - Illumina's pre-offer growth

prospects already reflected the ample opportunities for

future growth, and research analysts and investors were

aware of them well before Roche's public offer

o Regardless, Roche's offer compensates Illumina

shareholders for future growth, as it values Illumina at

2.06x 2012E P/E/G, which represents a 16% premium to the

three-year high

o "Global funding environment expected o There is considerable uncertainty

around the longer-term outlook for funding of genetic to improve"

sequencing by the National Institutes of Health ("NIH") and other U.S. and

foreign government organizations

o The next two years of NIH funding are subject to

automatic sequestration cuts due to the failure of the

Joint Congressional Deficit Reduction "Super Committee"

to reach an agreement

o The uncertain European outlook - including a combination

of government austerity measures as well as a projected

economic recession - will hamper Illumina's growth

abroad 7

Source: SEC filings, FactSet, Capital IQ, I/B/E/S consensus, Bloomberg.

Note: LTM as of 12/31/2011

| | |

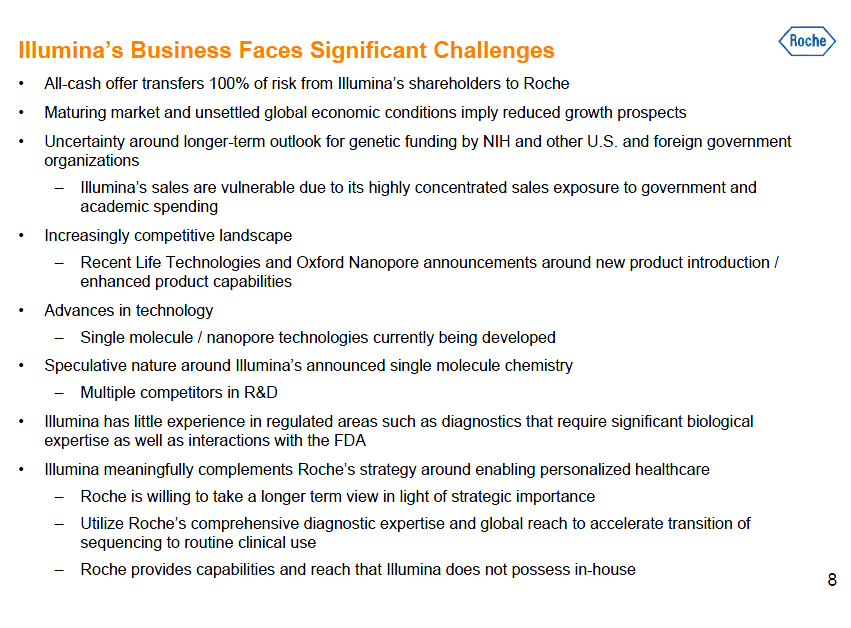

Illumina's Business Faces Significant Challenges

o All-cash offer transfers 100% of risk from Illumina's shareholders to Roche

o Maturing market and unsettled global economic conditions imply reduced

growth prospects

o Uncertainty around longer-term outlook for genetic funding by NIH and other

U.S. and foreign government organizations

- Illumina's sales are vulnerable due to its highly concentrated sales

exposure to government and academic spending

o Increasingly competitive landscape

- Recent Life Technologies and Oxford Nanopore announcements around new product

introduction / enhanced product capabilities

o Advances in technology

- Single molecule / nanopore technologies currently being developed

o Speculative nature around Illumina's announced single molecule chemistry

- Multiple competitors in R[AND]D

o Illumina has little experience in regulated areas such as diagnostics that

require significant biological expertise as well as interactions with the FDA

o Illumina meaningfully complements Roche's strategy around enabling

personalized healthcare

- Roche is willing to take a longer term view in light of strategic importance

- Utilize Roche's comprehensive diagnostic expertise and global reach to

accelerate transition of sequencing to routine clinical use - Roche provides

capabilities and reach that Illumina does not possess in-house

| | |

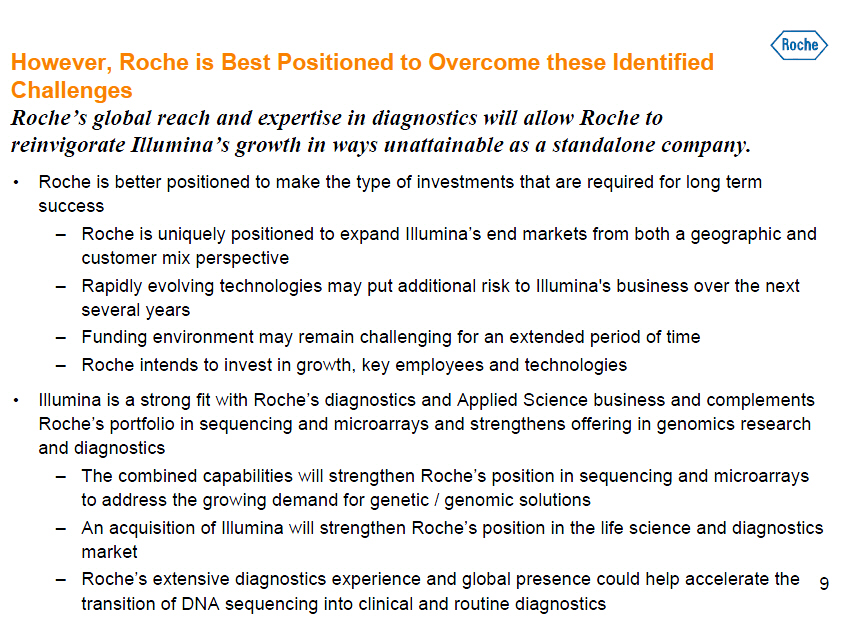

However, Roche is Best Positioned to Overcome these Identified Challenges

Roche's global reach and expertise in diagnostics will allow Roche to

reinvigorate Illumina's growth in ways unattainable as a standalone company.

o _______ Roche is better positioned to make the type of investments that are

required for long term success - Roche is uniquely positioned to expand

Illumina's end markets from both a geographic and customer mix perspective

- Rapidly evolving technologies may put additional risk to Illumina's

business over the next several years - Funding environment may remain

challenging for an extended period of time

- Roche intends to invest in growth, key employees and technologies

o Illumina is a strong fit with Roche's diagnostics and Applied Science

business and complements Roche's portfolio in sequencing and microarrays

and strengthens offering in genomics research and diagnostics

- The combined capabilities will strengthen Roche's position in sequencing

and microarrays to address the growing demand for genetic / genomic

solutions - An acquisition of Illumina will strengthen Roche's position in

the life science and diagnostics market - Roche's extensive diagnostics

experience and global presence could help accelerate the _______ 9

transition of DNA sequencing into clinical and routine diagnostics

| | |

Offer Multiples Above All Peers

Roche's offer values Illumina well above any of its peers based upon a P/E

multiple. Even after adjusting for growth, the P/E/G multiple is well above the

peer median P/E/G.

2012E P/E

34. 2x 29 .6x

25.3x

20 .5x 20 .3x 18.6x 18.4x 18.2x

Illumina Illumina (2) Illumina TECH MTD SIAL

(1) (3)

(Offer) (1/24 Offer) (Pre-Offer)

2012E P/E/G

2.06x 1.79x 2.04x 1.94x 1.93x 1.77x

1.73x

1.51x

Illumina Illumina SIAL BIO TECH QGEN BDX

(Offer) (1) (1/24 Offer) (2)

18.0x 16.5x 16.4x

13.9x 13.8x 13.7x Median: 16.4x

12.6x 12.3x

BIO WAT Illumina QGEN BRKR BDX A PKI TMO LIFE

(4)

(Unaffected)

1.51x

1.41x 1.30x Median: 1.46x

1.24x

1.10x 1.07x 1.03x

0.98x

WAT Illumina MTD LIFE PKI BRKR Illumina TMO A

(Pre-Offer)(3) (Unaffected)(4)

Source: Company filings, Bloomberg, Capital IQ, I/B/E/S consensus, analyst

research as of 3/28/2012.

Note: All Illumina statistics excluded from median calculations. Financials have

been calendarized to 12/31 FYE.

(1) Represents an offer price of $51.00 per share.

(2) Represents an offer price of $44.50 per share. 10

(3) Calculated using Illumina's share price of $37.69, publicly available

filings and I/B/E/S consensus estimates as of January 24, 2012, the day

prior to the public announcement of Roche's offer of $44.50 per share for

Illumina.

(4) Calculated using Illumina's share price of $27.17 on December 21, 2011, the

day prior to market rumors about a potential acquisition of Illumina by

Roche, and publicly available filings and I/B/E/S consensus estimates as of

January 24, 2012.

| | |

Offer Multiples Above Precedents

Roche's offer is at the high end of valuation multiples paid in recent precedent

life science tools transactions.

Enterprise Value / LTM Revenue

7.0x 6.5x

6.0x 5.6x 4.9x

5.0x 4.3x

4.0x 3.3x 3.3x Median: 3.3x

3.0x 2.9x

2.0x 1.5x

1.0x

--

Roche's Offer Roche's 1/24 OfferThermo Fisher / Dionex

($51.00/share) ($44.50/share) 12/13/10 02/28/10

Enterprise Value / LTM EBITDA

25.0x 20.6x

21.6x

18.5x 18.1x 17.6x

20.0x Median: 16.0x

14.3x

15.0x 13.3x 11.7x

10.0x

5.0x

--

Roche's Offer Roche's 1/24 Offer Thermo Fisher / Dionex

($51.00/share) ($44.50/share) 12/13/10 02/28/10

Merck KGaA / Millipore GE Health / Whatman MDS / Molecular Invitrogen / Applied Agilent / Varian

02/04/08 01/29/07 06/12/08 07/27/09

Merck KGaA / Millipore MDS / Molecular Invitrogen / Applied GE Health / Whatman Agilent / Varian

01/29/07 06/12/08 02/04/08 07/27/09

Source: Company filings, Bloomberg, Capital IQ, I/B/E/S consensus. 11

Note: Includes selected announced, closed and effective transactions since 2006

in the biotechnology research equipment manufacturing and biological products

and life sciences tools industries. Roche offer excluded from median

calculations. LTM Illumina statistics as of 12/31/2011.

| | |

Offer Premiums Above Precedent Transactions

Unaffected Premiums

1 Day Premiums

88%

Roche's Offer

($51.00/share)

Roche's 1/24 Offer 64%

($44.50/share)

Merck KGaA /

Millipore 50%

02/28/10

MDS / Molecular 49%

01/29/07

Illumina / Solexa 44%

11/13/06

Agilent / Varian 33%

07/27/09

Thermo Fisher / Median: 33%

Dionex 21%

12/13/10

Invitrogen / Applied

17%

06/12/08

GE Health / Whatman 12%

02/04/08

-- 20% 40% 60% 80% 100%

1 Month Average Premiums

84%

Roche's Offer

($51.00/share)

Roche's 1/24 Offer 61%

($44.50/share)

MDS / Molecular

56%

01/29/07

Merck KGaA /

Millipore 53%

02/28/10

Illumina / Solexa 42%

11/13/06

Agilent / Varian 37%

07/27/09

Thermo Fisher / Median: 37%

Dionex 28%

12/13/10

GE Health / Whatman

19%

02/04/08

Invitrogen / Applied

12%

06/12/08

20% 40% 60% 80% 100%

--

Source: Company filings, Bloomberg, FactSet. 12

Note: Includes announced, closed and effective transactions since 2006 in the

biotechnology research equipment manufacturing and biological products

and life sciences tools industries Roche offers excluded from median

calculations. 1 day and 1 month average based on starting date of

12/21/2011, the day prior to market rumors about a potential acquisition

of Illumina by Roche.

| | |

Illumina Rolling NTM P/E/G Analysis

Roche's offer implies a price-to-earnings-growth ratio that is a 16% premium to

Illumina's three-year high and well above its three-year average.

2.25x

2.00x

P/E/G

1.75x

NTM

1.50x

Two-year avg.: 1.47x

Three-year avg.: 1.42x

One-year avg.: 1.40x

1.25x

1.00x

0.75x

0.50x

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10

Offer: 2.06x

Initial Public Offer: 1.75x 45% Premium

to three-year

average

Pre-Offer: 1.51x (1)

Unaffected: 1.07x (2)

Jan-11 Apr-11 Jul-11 Oct-11 Jan-12

Source: Company filings, Bloomberg, Capital IQ, I/B/E/S consensus, and FactSet.

(1) Calculated using Illumina's share price of $37.69, publicly available

filings and research consensus estimates as of January 24, 2012, the day

prior to the public announcement of 13 Roche's offer of $44.50 per share

for Illumina.

(2) Calculated using Illumina's share price of $27.17 as of 12/21/2011, the day

prior to market rumors about a potential acquisition of Illumina by Roche,

publicly available filings and consensus analyst estimates as of January

24, 2012, the day prior to the public announcement of Roche's offer of

$44.50 per share for Illumina.

| | |

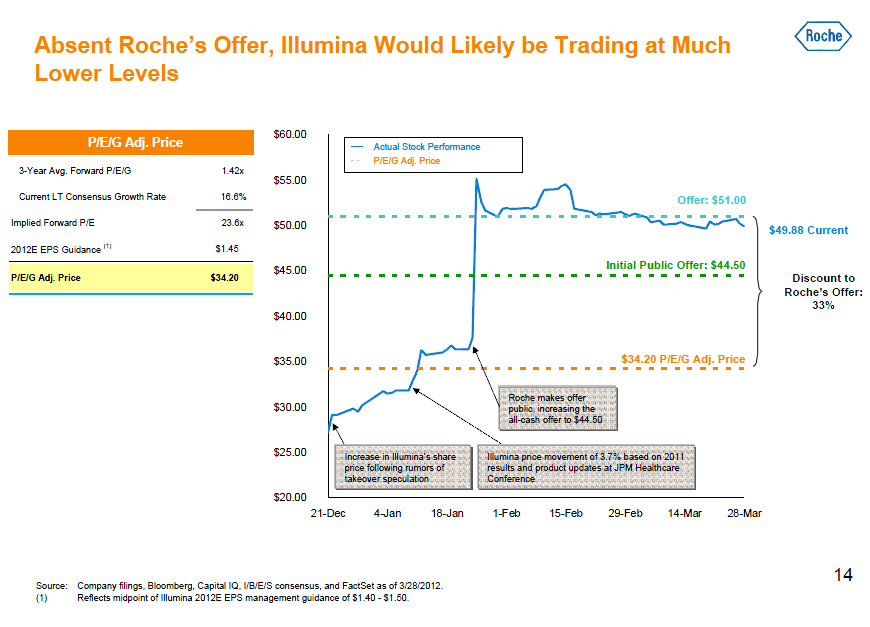

Absent Roche's Offer, Illumina Would Likely be Trading at Much

Lower Levels

P/E/G Adj. Price $60.00 Actual Stock Performance

3-Year Avg. Forward P/E/G 1.42x P/E/G Adj. Price

$55.00

Current LT Consensus Growth Rate 16.6% Offer: $51.00

Implied Forward P/E 23.6x $50.00 $49.88 Current

2012E EPS Guidance (1) $1.45

$45.00 Initial Public Offer: $44.50

P/E/G Adj. Price $34.20 Discount to

Roche's Offer:

$40.00 33%

$35.00 $34.20 P/E/G Adj. Price

$30.00 Roche makes offer

public, increasing the

all-cash offer to $44.50

$25.00 Increase in Illumina's share Illumina price movement of

3.7% based on 2011 price following rumors of _______

results and product updates at JPM Healthcare takeover

speculation ____________ Conference

$20.00

21-Dec 4-Jan 18-Jan 1-Feb 15-Feb 29-Feb 14-Mar 28-Mar

14

Source: Company filings, Bloomberg, Capital IQ, I/B/E/S consensus, and FactSet

as of 3/28/2012.

(1) Reflects midpoint of Illumina 2012E EPS management guidance of $1.40 -

$1.50.

| | |

Roche's Offer Represents Value Certainty Amidst Significant

Headwinds

o $51.00 all-cash offer provides attractive value today for Illumina

shareholders

- Roche to hold all risk related to increasing competitive pressures and

tightening fiscal policy related to government funding - Removes execution

risk around shift in customer and geographic focus

o _______ Illumina has little experience in regulated areas such as

diagnostics that require significant biological expertise as well as

interactions with the FDA

- Not contingent on financing

- Roche stands ready, willing, and able to engage in substantive dialogue

with Illumina o Can move quickly through accelerated due diligence to reach

a negotiated agreement

o Extensive team from Roche and its advisors ready to engage

15

| | |

Path Forward

Show support for Roche's proposals by voting your shares for Roche's proposals

and director nominees.

Vote the Gold Proxy Card

o 2012 annual meeting to be held on April 18th, 2012

- If you hold shares in your name: vote today by phone, Internet or by

signing, dating and returning the proxy card

- If you hold shares in "street name": use your instruction form to tell your

bank or broker to vote for the nominees

- If you have any questions or need assistance in voting your shares, please

call our proxy solicitor, MacKenzie Partners, at (212) 929 -5500 (call

collect), or toll-free at 1-800-322-2885

16

| | |

ADDITIONAL INFORMATION AND WHERE TO FIND IT

THESE MATERIALS ARE FOR INFORMATIONAL PURPOSES ONLY AND DO NOT CONSTITUTE AN

OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL ILLUMINA COMMON STOCK.

THE TENDER OFFER IS BEING MADE PURSUANT TO A TENDER OFFER STATEMENT ON SCHEDULE

TO (INCLUDING THE OFFER TO PURCHASE, LETTER OF TRANSMITTAL AND OTHER RELATED

TENDER OFFER MATERIALS) FILED BY ROCHE WITH THE SECURITIES AND EXCHANGE

COMMISSION (SEC) ON JANUARY 27, 2012. THESE MATERIALS, AS THEY MAY BE AMENDED

FROM TIME TO TIME, CONTAIN IMPORTANT INFORMATION, INCLUDING THE TERMS AND

CONDITIONS OF THE OFFER, THAT SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS

MADE WITH RESPECT TO THE TENDER OFFER. INVESTORS AND SECURITY HOLDERS MAY OBTAIN

A FREE COPY OF THESE MATERIALS AND OTHER DOCUMENTS FILED BY ROCHE WITH THE SEC

AT THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV. THE OFFER TO PURCHASE AND

RELATED MATERIALS MAY ALSO BE OBTAINED FOR FREE BY CONTACTING THE INFORMATION

AGENT FOR THE TENDER OFFER, MACKENZIE PARTNERS, AT (212) 929-5500 OR (800)

322-2885 (TOLL-FREE).

ROCHE HAS FILED A PROXY STATEMENT ON SCHEDULE 14A AND OTHER RELEVANT DOCUMENTS

WITH THE SEC IN CONNECTION WITH ITS SOLICITATION OF PROXIES FOR THE 2012 ANNUAL

MEETING OF ILLUMINA (THE "PROXY STATEMENT"). ROCHE HAS MAILED THE PROXY

STATEMENT AND A PROXY CARD TO EACH ILLUMINA STOCKHOLDER ENTITLED TO VOTE AT THE

2012 ANNUAL MEETING. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY

STATEMENT CAREFULLY AND IN ITS ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS FILED

WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION. INVESTORS AND SECURITY

HOLDERS MAY OBTAIN A FREE COPY OF THESE MATERIALS AND OTHER DOCUMENTS FILED BY

ROCHE WITH THE SEC AT THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV. THE

PROXY STATEMENT AND RELATED MATERIALS MAY ALSO BE OBTAINED FOR FREE BY

CONTACTING THE INFORMATION AGENT FOR THE TENDER OFFER, MACKENZIE PARTNERS, AT

(212) 929-5500 OR (800) 322-2885 (TOLL-FREE).

ROCHE HOLDING LTD, CKH ACQUISITION CORPORATION AND THE INDIVIDUALS NOMINATED BY

CKH ACQUISITION CORPORATION FOR ELECTION TO ILLUMINA'S BOARD OF DIRECTORS (THE

"ROCHE NOMINEES") MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF

PROXIES FROM ILLUMINA STOCKHOLDERS FOR USE AT THE 2012 ANNUAL MEETING OF

STOCKHOLDERS, OR AT ANY ADJOURNMENT OR POSTPONEMENT THEREOF. INFORMATION

REGARDING THE DIRECTORS AND EXECUTIVE OFFICERS OF ROCHE HOLDING LTD AND CKH

ACQUISITION CORPORATION WHO MAY BE PARTICIPANTS IN THE SOLICITATION OF PROXIES

CAN BE FOUND IN THE DEFINITIVE PROXY STATEMENT. NO ADDITIONAL COMPENSATION WILL

BE PAID TO SUCH DIRECTORS AND EXECUTIVE OFFICERS FOR SUCH SERVICES. INVESTORS

AND SECURITY HOLDERS CAN OBTAIN ADDITIONAL INFORMATION REGARDING THE DIRECT AND

INDIRECT INTERESTS OF THE ROCHE NOMINEES AND OTHER PARTICIPANTS BY READING THE

DEFINITIVE PROXY STATEMENT.

17

| | |