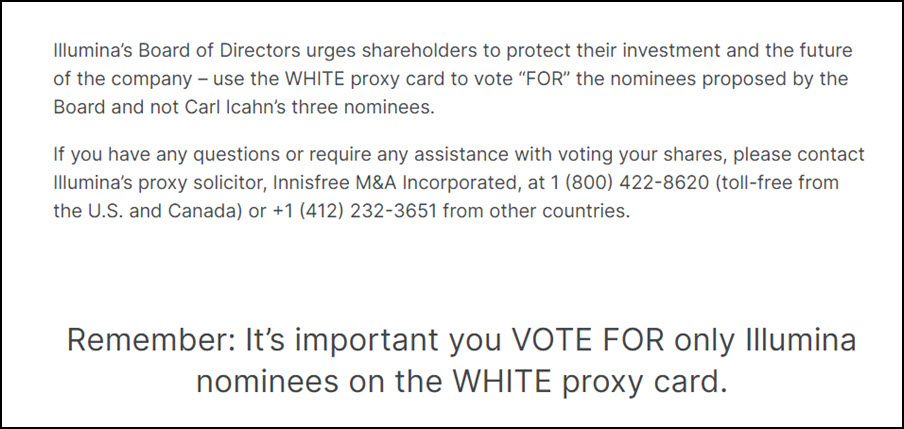

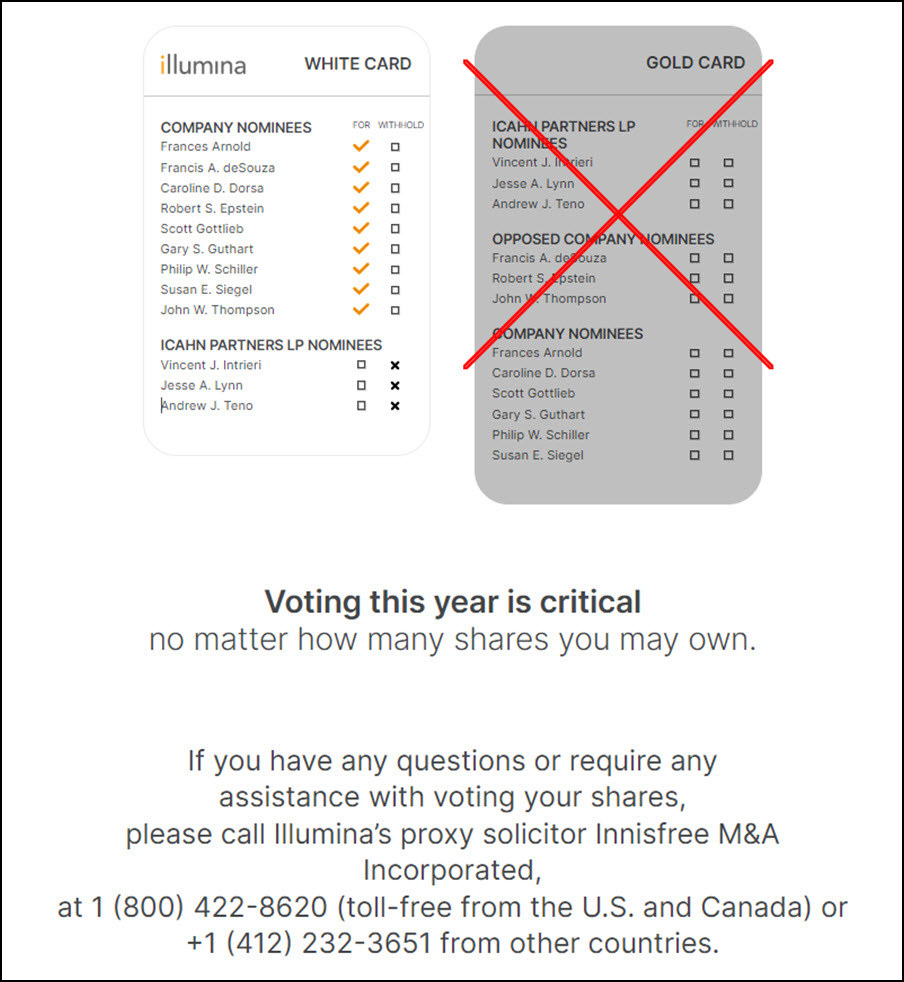

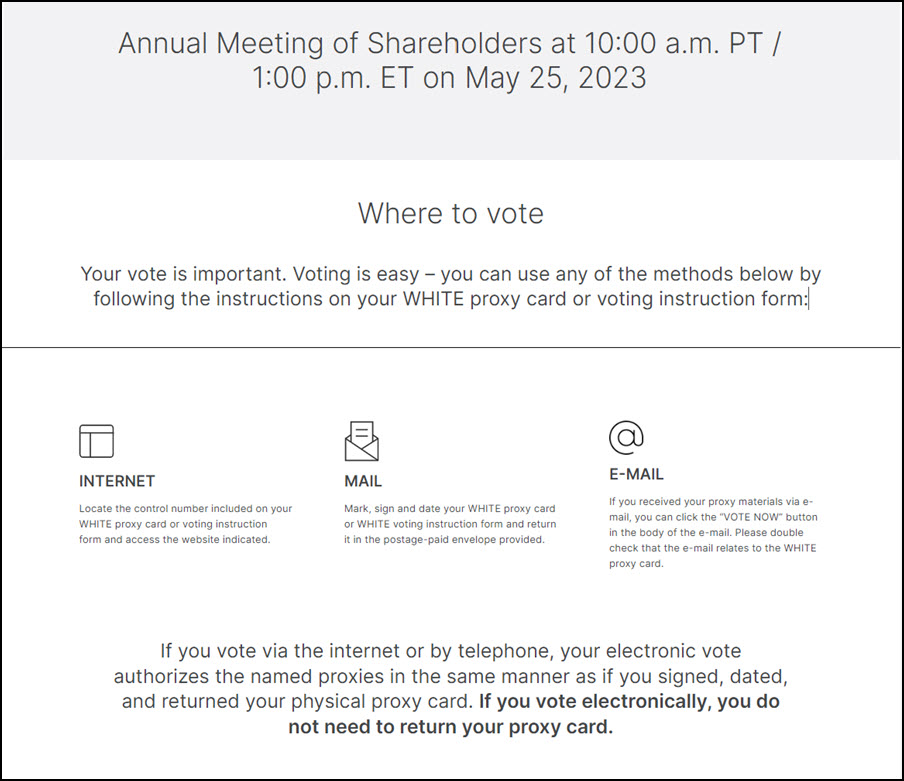

Illumina Forward At Illumina, our goal is to apply innovative technologies to the analysis of genetic variation and function, making studies possible that were not even imaginable just a few years ago. It is mission critical for us to deliver innovative, flexible, and scalable solutions to meet the needs of our customers. As a global company that places high value on collaborative interactions, rapid delivery of solutions, and providing the highest level of quality, we strive to meet this challenge. Illumina innovative sequencing and array technologies are fueling groundbreaking advancements in life science research, translational and consumer genomics, and molecular diagnostics. All trademarks are the property of Illumina, Inc. or their respective owners. Cookies Illumina Forward Innovation GRAIL Materials Commentary Contacts How to vote Copyright © 2023 Purple Group All rights reserved.

Yahoo! Finance: Icahn proxy fight is ‘distraction’ for Illumina outlook: RBC analyst

Anjalee Khemlani

April 3, 2023

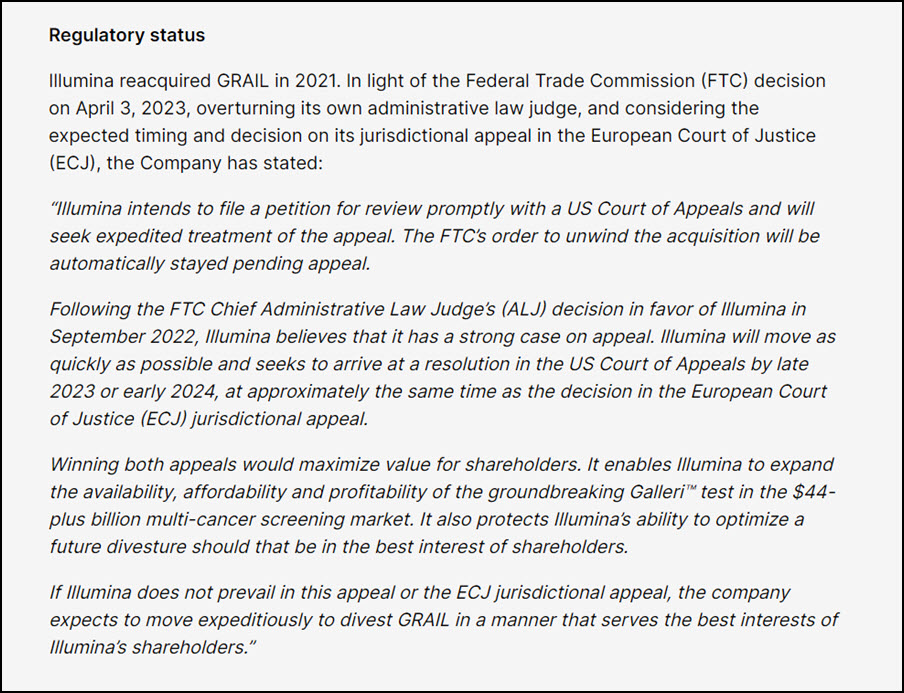

Carl Icahn’s proxy fight with Illumina (ILMN) escalated Monday with a new open letter as well as from a decision from the Federal Trade Commission (FTC).

The FTC is now ordering the biotech to unwind its $8 billion deal with cancer testing company Grail, saying that its ownership would restrict competition in developing cancer tests.

Icahn, who has a 1.4% stake in Illumina, wants to appoint three members to the company’s board as well as bring back a former CEO to help with this task, to right-size what he sees as a failing trajectory.

“After speaking with numerous shareholders, we believe it is unconscionable that the board of directors still entrusts [current CEO, Francis] deSouza with running our potentially great company. During his tenure, not only has the company lost $50 billion of shareholder value but many of his talented executives have left or are in the process of leaving,” Icahn wrote in a letter Monday.

The letter is the fifth Icahn has published since launching the proxy fight for control of the board last month, after months of private negotiations fell apart.

The FTC decision to bar the acquisition of Grail, which Illumina completed last year, follows a similar ruling late last year from the European Commission. Both regulators have warned the company could face fines that would result in billions in losses if it doesn’t comply.

Illumina is already appealing the decision in Europe, and said Monday it would seek the same for the FTC. The company believes it has strong case since an FTC judge already sided with the company in September.

But in its statement Monday, Illumina added that if it does not prevail in the EU or with the FTC, “the company expects to move expeditiously to divest Grail.”

Ultimately, that’s what Icahn wants the company to do, according to RBC Biotech Analyst Conor McNamara.

“Some of his concerns are shared by shareholders, that GRAIL has been a distraction,” McNamara said of the $8 billion deal.

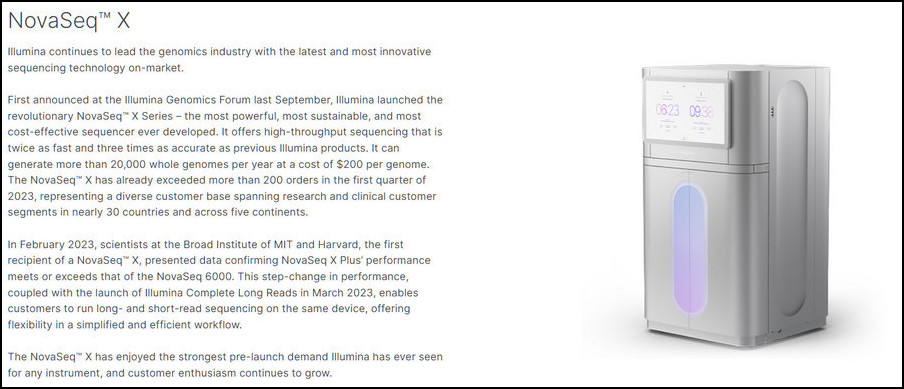

He said that the proxy fight is taking attention away from Illumina’s product launch of a new testing system NovaSeq X.

“This product, its our view, its going to lead to a series of revenue beats, earnings beats and revenue acceleration. Because of this distraction that Icahn is causing, people aren’t really focusing on that,” McNamara said.

The product is part of a growing space in biotech estimated to be a $40-plus billion market by 2030, according to the company.

McNamara says he believes Icahn is missing the growth projections for the company. In his original letter in March, Icahn has focused on the regulatory battles and $50 billion loss of shareholder value.

“If Illumina continues on its current path, the cost of fighting powerful regulators, especially when they obviously believe strongly in their position, will become extremely expensive no matter what happens,” Icahn said.

Illumina, Inc. (ILMN)

“Illumina’s share price performance, and the $50 billion of value destruction that has occurred since the GRAIL deal was closed, clearly shows that shareholders have lost faith in Illumina’s management team and board of directors,” he added.

Icahn instead wants to appoint three members of his firm to the board and unwind the GRAIL deal ahead of any appeal decision by regulators. He also wants to bring back former CEO Jay Flatley, Icahn recently told the Wall Street Journal.

Illumina countered with one board seat before negotiations broke down last month.

McNamara said the timing, right as a product is launching, bodes poorly for the company, but could also indicate a lack of knowledge about the industry on Icahn’s part.

“I think that’s the primary reason that Illumina can’t give up three board seats. This is a long term growth company in a market that they dominate and that isn’t fully understood by all investors,” McNamara said.

So to give up the board would “be a mistake,” he added.

This is the second time Illumina has struggled with an acquisition. The company first tried to acquire PacBio (Pacific Biosciences of California), which the FTC challenged in 2019. Illumina terminated that $1.2 billion merger agreement in early 2020.

Illumina, Inc. (ILMN) Presents at 43rd Annual TD Cowen Health Care Conference (Transcript)

March 7, 2023 9:50 AM ET

Company Participants

Joydeep Goswami - Chief Financial Officer & Chief Executive Officer

Salli Schwartz - Investor Relations

Conference Call Participants

Dan Brennan - Cowen and Company

Dan Brennan

Greetings, Day two of TD Cowen Healthcare Conference. I’m Dan Brennan. One of the tools analysts here. Really pleased to be joined with me on stage senior management team of Illumina. So to my left, we have Joydeep Goswami, who is the newly appointed permanent CFO, so congrats -- and COO. And we also have to his left, we have Salli Schwartz, who’s lead IR at Illumina.

So first off, I’ll welcome Joydeep and Salli.

Joydeep Goswami

Thank you, Dan.

Salli Schwartz

Thank you.

Question-and-Answer Session

Q - Dan Brennan

Awesome. So maybe a high-level way to kind of kick this off here. On the one hand, Illumina is at the very beginning stages of your latest high throughput product cycle, possibly the most impressive one technologically in your history. You have new markets for NGS are opening up, stock has lagged, hence the upside opportunity is significant. At the same time, competition has arguably never been more material, there’s been notable pressure on your clinical customers and it’s not clear when that lifts, and you’re dealing with material uncertainty of the GRAIL deal.

So given you just took the CFO role, I would be interested to hear how you think of the current and future setup for Illumina, should investors be worried about some of these headwinds or rather more excited for the opportunity?

Joydeep Goswami

It’s a long question, but let me try to parse that down. Look, when I look out and stepping into the role as part of Illumina’s leadership team, we’re incredibly excited, and I’m personally incredibly excited of the opportunities, right? So the reality is we are in a large TAM $120 billion by 2027. That’s very underpenetrated, give or take about 7% penetration. NGS uniquely offers the opportunity to enhance the understanding of biology at a scale and at a speed that no other technology in the history of this field allows, right? And it isn’t just about DNA anymore.

It’s about DNA and RNA and increasingly proteomics, coupled with things like single cell and spatial that really allow you to understand biology at scale and in context. So incredibly excited about that market, incredibly excited about -- you talked about the new innovations that we are introducing that make -- that improved the utility of sequencing, but also drive down total cost of ownership, drive down -- drive of the simplicity, drive down complexity of workflows of post sequencing analysis, pre- sequencing prep time, et cetera.

So -- and coupled with things like Ambient shipped. So there’s a lot of things that are opening up the market and further catalyzed a lot of what you’re already seeing was happening in the field, right? So single cell spatial liquid biopsy, multiomics are not new things, but what NGS and our innovations do is they accelerate the adoption of that both from a cost standpoint, but also from a workflow and analytics, bio formatics point of view. So really excited about that and the opportunities that it opens up both research and clinical fields.

Dan Brennan

Thing you talk about competition. Look, the reality is that we’ve always had competition, right? At every point in our existence, whether it’s arrays or sequencing, and a lot of the players like BGI or Thermo Fisher have existed. We have competed with them especially outside the United States as for BGI. So, we know how to do that. We have the playbooks. And even after the announcements of all the players from last year, we continue to have record interest in our platforms, record sales of our mid-throughput portfolio into the second half of the year. In fact, we had record sales of NextSeq 1000/2000 even in Q4, right?

So that does indicate that customers believe in the value that Illumina brings to them, again, beyond just the one thing that people highlighted is around cost per GB, but that’s only very small part of the equation. There’s many others in terms of reliability, service support, ability to move towards clinical diagnostics, ability to have that level of continued and collaborative innovation. So we feel good about that. We continue to invest in those dimensions and will continue going forward as well.

Dan Brennan

Great. Maybe thinking about the guidance, I love some insight into the seven to nine top line guidance. Core Illumina, I think it’s six to nine, you called out a COVID headwind of about two points, right? So, I guess, if you normalize it 9x to 11x COVID. So I guess, 8 to 11 core. Do you have easy comps. You have the X launch, which I think most of us most of us expected something maybe stronger on the guide, given your LRP was 15% and you have the benefit of, again, this big one. So maybe give us a little color why we deviated and then I can follow up on something there.

Joydeep Goswami

Sure. So, the guide was 7 to 10 consolidated and 6 to 9, as you pointed out on the core. Yes, that was somewhat lower than initially what we were expecting around 10, but there are a few reasons, and we go through that. A lot of that is things that we had pointed out earlier. So first, 2023 is a transition year for us and the transition year really comes from the introduction of the X, right?

So we do -- we will see, at least in the first half of the year, a reduction in the number of 6,000 -- NovaSeq 6,000 sold as people transition towards the X. You see that both in terms of the instrument sales, but also in terms of some of the consumable sales, right, ex-consumer don’t really ramp up until the second half of the year once people have brought on the instruments and done there initial validation.

So that’s one part of it. And also we have said and is normal with any large instrument introduction. The first year, we will be somewhat supply constrained, right? So we had -- already had as of the Q1 earnings call. We had about 155 orders, right?

And then about 250 late-stage pipeline opportunities, which really means that customers have definitive interest and have funding lined up to buy the instrument in 2023. And we expect that number to end the year way ahead of the 300-plus instruments that we expect to be able to supply this year. So that’s one part of the transition.

The other part of the transition is a little bit of a story that you’re hearing from a lot of players in the life sciences field, right? But this is a somewhat back loaded year as you come into it. And for us, there are a few reasons for that.

In some of the macroeconomic headwinds will persist, we feel, at least through the first half of the year. We -- that includes some of the FX headwinds, which are more severe in the first half of the year, the COVID surveillance impact, which is about $100 million or two percentage points. That is also more front-loaded than not.

And then China COVID is another one, right, where we do expect that, that is more prevalent in the first part of the year as they move away from zero COVID tolerance to something that is more sustainable and they open up the market.

So that essentially says along with the transition of the X, our second half of the year is going to be meaningfully stepped up from the first part of the year. And you do see a step-up in each quarter both in terms of revenue and in terms of overall profitability, both from a gross margin standpoint and of course, from an operating margin standpoint.

Dan Brennan

All right. So typically, you go back with the NovaSeq and year two was a lot stronger than year one to your point. So presumably, we should be looking at the exit rate this year when we think about ‘24. But fair to say, clearly, at this point, ‘24 should be, we would assume a much stronger year than ‘23 absent anything uncertain changing in the market.

Joydeep Goswami

Yes, that’s, I think, a good way to think about ‘24 having completed the initial transition and placement of the Xs. You start to see pull-through in the X consumables. And -- and this is something we’re working on in particular. It is a lot about demand elasticity and catalyzing some of the newer applications, the increased pull-through on some of the newer applications that people are talking about, both in terms of the research and the clinical side of things.

Dan Brennan

So, how do we think about the plus? Your guidance is 300-plus placements for ‘23. What are the key factors here dictating how many you place? Is it actual demand? Is your ability to manufacture and install? Or is your interest to smooth out the launch or other?

Joydeep Goswami

It’s definitely about the last one. It’s really more in terms of scaling up manufacturing, right? So we have said, we -- we’re going to start off the year with in Q1, about 40 to 50 instruments and then we’ll continue to step up manufacturing from there. So, at the -- in fourth quarter, we expect at this point to roughly be at steady state, right? So as many orders come in, we should be able to get out the door. But it will take us into next year to clear all of the backlog of the orders that we get in 2023.

Dan Brennan

And manufacturing wise, you guys feel pretty good kind of where things were guided to and the ability to scale and kind of be on that ramp pace?

Joydeep Goswami

Yes. We don’t tend to announce new instrument launch, we are confident that we can supply the instrument. There’s a lot that goes into that in terms of both the instrument capabilities, the software capabilities and the consumables capabilities. So, we are -- where we need to be on that path at this point. We have shipped out as we announced at HVTN on our earnings call that we shipped the first instrument -- and we’ve -- we continue to make shipments as the quarter goes on.

Dan Brennan

Yes, the broad said this morning, just -- we host them. They said they have one, and they’re waiting for the next four. So they’re waiting. They’re ready to roll. So given grants take a while to move, what early kinds of new projects you’re hearing from customers that are being enabled by XLEAP chemistry? And what confidence does that give you in your outlook for ‘24?

Joydeep Goswami

Yes. So, let me break that down into research and clinical. And just to step back, right? I mean, the initial order book surprised us, of course, in the strength of it, right, but also in the makeup of it. So what we’ve said previously about 35% of the orders have come from clinical customers, which is a little bit higher than where we had expected it from a percentage basis at this point.

About -- we’ve seen about a 4x jump in the number of countries that have already placed orders with a similar time frame from where NovaSeq 6000 was. And we’ve seen about 15% of the orders that have come from new to sequencing or new to high- throughput customers. So again, that’s a little bit of a surprise and a larger percentage. They are all reasons that they have given us, and they’re consistent with the innovations that have gone into the X.

But let me come to the kinds of things that we are seeing, right? So first, from the research side, from some of the pop gen customers, we are hearing a lot more into, hey, we want to go from -- we’ve done whole genome sequencing. We want to go to whole transcriptome sequencing and the samples that are already there and increasingly look at proteomics on a much bigger scale than we have done before, right?

So, the good news about some of these is, yes, they’ll need to secure funding, but the funding becomes more cost effective, if were to look at larger cohorts. But you don’t need to collect samples, right? I mean you have samples insist in they’re biobanks already. So, it’s a little bit of a faster time scale there.

We are hearing also on the research side, especially around single cell and spatial a lot more interest in doing more, right? So, more cells going from thousands to tens of thousands to some talk even of millions of cells per run. So that’s exciting and that -- although it’s the same sample, it’s actually more samples because you’re looking at individual sales at that point.

And we have had very strong interest in pharma taking a much bigger look at genomics and multiomics and drug discovery, right? So part of it is things like Nash Bio, where the cohort exists and they’re using this opportunity to move more towards sequencing these and combining that information. And as you can imagine, right, the first step is doing DNA sequencing on a whole genome basis. But very quickly after that, it will move as they get answers to diving deeper into proteomics or transcriptomics as it were.

So that’s on the research side of things. On the clinical side, again, as I mentioned, this was surprising to see this level of interest And the dynamics in clinical are -- with the existing assays that have been validated, they will continue on the 6,000, right? We don’t see an immediate switch over on that.

In fact, there will be some fleet additions on the 6,000 on those. What we are seeing is the next generation of assays that require either bigger panels or deeper analysis or both, right? Moving to the X directly. And they’ll start with the XMDs. Obviously, the economics for them are better, but they can also move faster on clinical studies and more broadly from that angle.

So, that’s encouraging, right? And we are seeing also so that there’s, of course, a huge amount of interest on the oncology side. But we are also seeing some early kind of interest in having more holistic and deeper panels, larger panels, maybe all the way towards whole genome sequencing on things like cardiovascular and very early on the neuro side, right?

So encouraged by that, encouraged by the conversations getting accelerated, but some of these -- especially on the non-oncology thing, they will take time, but I think it’s interesting to see some of the clinical activity and the average generation we had started.

Salli Schwartz

On oncology, this totals really nicely with the whole discussion you’re probably hearing around the conference on MRD and liquid biopsy. So, there’s a multitude of pieces that we’re hearing.

Dan Brennan

Just kind of related to clinical since it kind of dovetails what the question on the -- kind of on the guide for ‘23. So like have you guys seen like this clinical destock and kind of it’s -- we heard it from some other players as well, but that’s been a headwind for you guys in the back half of ‘22, and presumably, that was one of the factors that you baked in to 23, I would think. But just kind of how do we think about that clinical destock and maybe some of it’s due to belt tightening, some of it’s due to the X coming out? Just kind of where do we stand there?

Joydeep Goswami

Yes. So it’s a good question. So there were two things that happened on the clinical side last year, right? So there was one which was related to capital push out and just conservatives in the market, conservatism in the market that delayed some projects at our customers’ ends, right? And part of it, again, if you remember early in the year, it was that plus there were some issues with supply chain, not related to NGS, but other things.

So that I think we’ve been a little bit more cautious this year and not factoring in everything that customers are have told us about we’ll scale up to a certain extent. And you’re right. Some of that actually, as I mentioned earlier, has moved from the 6,000 of the excess. And I think that’s a good thing. It’s more sustainable. They actually ramp up the amount of sequencing they’re doing.

What we did see towards the -- as we progress towards through the second half of 2022 is the amount of inventory destocking that happened with both research and clinical customers, was slowing down towards the end of the year, right? So, the amount of destocking went down. And I think that was a trend we had expected to see. Our best guess at this point is some bit of it continues into Q1.

And as we get into Q2, especially latter part of Q2, that starts reflecting more of the underlying demand, which we get a good insight to that because we have connected instruments that represent lease North America and Europe, more than 60% of the instruments out there, especially in high throughput and the throughput. So, we’re a pretty good idea of what the underlying utilization is, and that has continued very strong on clinical -- and we saw a little bit of a pick up again towards the end of the year.

Dan Brennan

Great. Maybe just one on competition. There’s a lot of attention on the high throughput part of the market. But from a commercial perspective, the throughput is where there’s more viable competition today with singular Element, BGI, MGI. What does your guide assume for the mid-throughput part of the market in terms of market growth and share loss? And what’s been your experience so far?

Joydeep Goswami

So the experience so far has been very encouraging, actually. We -- as I mentioned earlier, we continued very strong sales of our mid-throughput portfolio, especially on the NovaSeq 1000, 2000, which were the newer instruments we introduced, I guess, but we continue to have record sales overall in the mid-throughput category in 2022. And more specifically, we exited 2022 in Q4 with record sales again in the quarter for our NexSeq 1000, 2000 instruments.

So despite all the noise about competition coming in, the reality is that customers are assessing this more holistically, right? So what value does Illumina bring in terms of total cost of ownership in fact, that 1000, 2000 continue to be the only instruments with DRAGEN on board, so the analytics gets a lot easier and a lot more cost effective again. The workflows are easier and with the introduction of the longer cycles and the actual chemistry on the NextSeq 1000, 2000, which is just a transition of flow cells. It doesn’t require any changes to the instruments.

There’s a lot of interest and continued interest in pent-up demand on the mid- throughput side. I think people always overlook the fact that reliability of supply, reliability to support our instruments over the long run regardless of which continent you’re on is a big deal for customers, right? They’re not getting into the technology for one of experiments and getting out, that reliability and the fact that we are by far, the only company that has the kind of infrastructure, both from a supply chain and the service and support capability, whether you’re in research or in clinical is an important part of why people continue to choose Illumina over other instruments that are out there.

Dan Brennan

Great. Okay. Maybe switching over to GRAIL. So from our conversations at least, most of the investors we speak with would prefer to have GRAIL separated. They’d love to get access to the core Illumina and as ratably, this product cycle without kind of the uncertainty in the near term significant dilution and burn, although ultimately grow could be a home run opportunity. It just kind of really makes it difficult to get access to that core Illumina business.

So net-net, I’m just wondering, the management team, Francis has been significantly very positive, enthusiastic about the deal. But given the ongoing regulatory pleasure plus the margin cash solution, like where does management stand today on GRAIL?

Joydeep Goswami

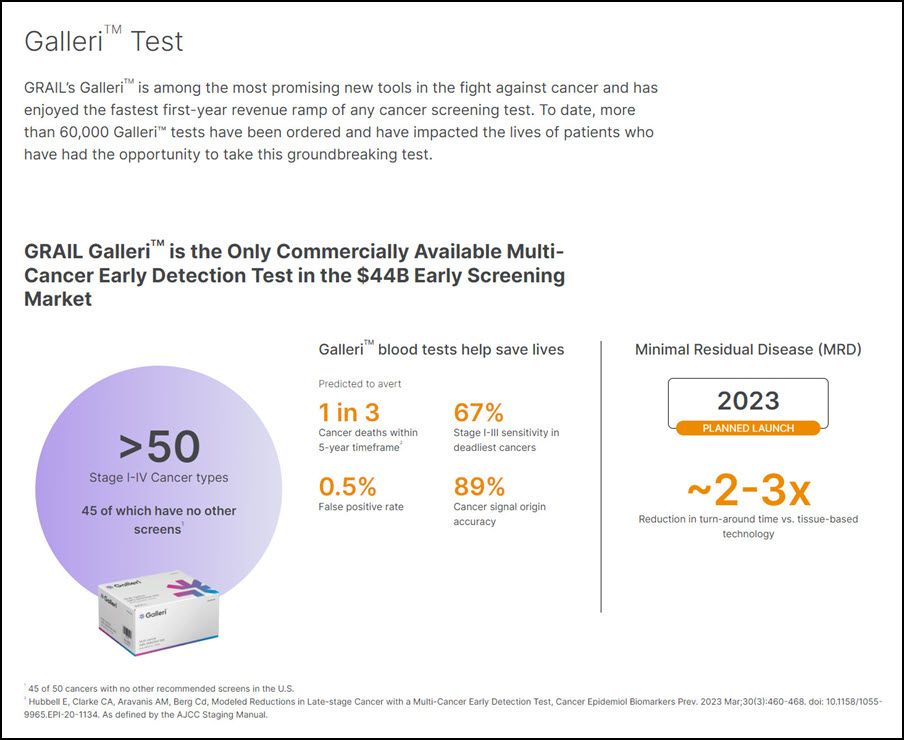

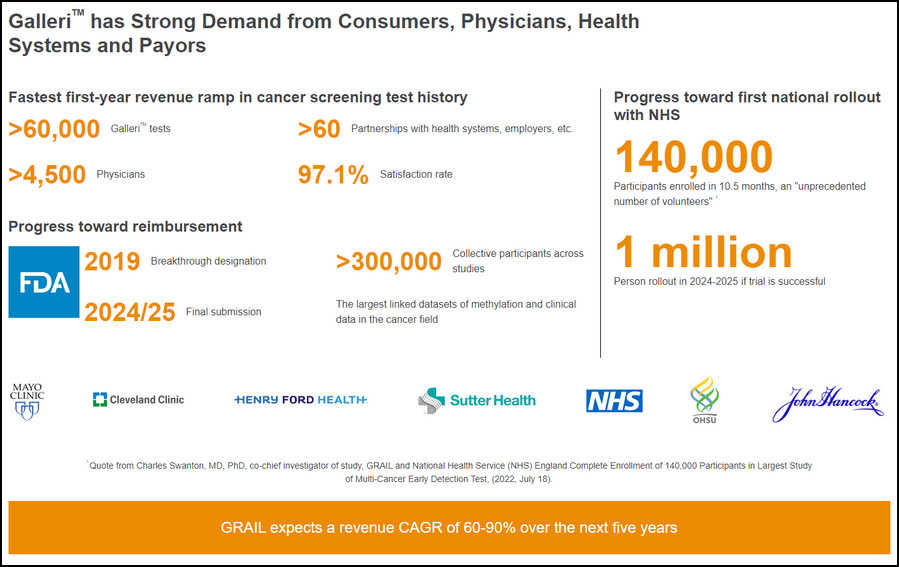

Yes. So you’re right, right, GRAIL, I want to continue expressing. It’s a good asset. It’s proven and sell-out. So, a little thing, and I’ll go to where do we go from here. And GRAIL is still the only multi-cancer early detection test on the market and the only one with any line of sight to introduction on a multi-cancer basis, right?

More than 50 cancers detected of which 45 plus have no other screening tests available at this point, right? So it’s a huge, huge impact on patient lives and the potential of the save lives. It’s the only test where real-world data with this point, more than 40,000 patients absolutely corroborate the clinical trial data, which was already extensive to begin with.

The only one which actually pinpoints where in your body to cancer is which is absolutely essential for any liquid biopsy test to be able to be actionable. So all those are positives, right? But at the same time, I think we have been fairly clear that look, we did not anticipate the regulatory challenges that this vertical merger is facing. We will be pragmatic in terms of our next steps going forward, right, regardless of how good the asset is and how much we believe in it.

So how does that play out? We expect the divestment order to come from the EU in and when we get that that provides the guardrails for how a divestiture is to be affected. And we will immediately begin the -- we’ll immediately move towards divestiture at that point, right? So that starts the clock on that.

Now we expect that to do this right, whatever the guidelines are takes us towards the end of 2023 or early into 2024. So, that’s one piece, right, where we are committing to begin -- to immediately move on the divestiture order.

Now at the end of this year or early next year, we also expect to have the jurisdictional trial that really looks at the ability for the European Union or European Commission to really stop a merger of a company that did not have any revenues in Europe never plan to have any revenues in Europe and application of Article 22, which was retroactively applied despite them clearly saying that they wouldn’t do so, right?

The reason I’m bringing it up is this trial plays out in a time frame where we would continue to work on the divestiture. So, we’re not waiting for the trial. It just happens that the timing of the trial happens to be in that.

Now the trial is important because it’s a binary result, right? There is no appeals to it, either for us nor for the European Commission. If we win the trial, then we immediately get to integrate well. There is no -- as you know, the FTC removed its injunction. So, there’s no hurdles from the FTC in closing the deal or integrating the deal. We’ve already closed it.

So that then allows us to begin realizing the revenue and cost synergies that we knew we had in GRAIL and it reverses any fines that are paid to the European Commission as a result of closing open. So that’s one potential outcome. Again, in that time frame of end of the year or early next year.

The other outcome is we lose the case, and we lose the trial. Let me just proceed with finishing off the divestiture as we have been planning anyways, right? So that’s a -- again, there are obviously stays that give us more flexibility and when exactly and to make sure we get the best value for our shareholders. But there’s no further elongation of release divestiture process beyond that time frame that I just don’t mind.

Dan Brennan

And is there an expectation, I was thinking 1Q, but it’s more Q2 now. That’s what you’re hearing on the director divestiture.

Joydeep Goswami

Yes, that’s what they have. And again, this is out of our control. They need to process, what they need to do process at their right? But that’s what we are hearing.

Dan Brennan

And is it a six-month time table they’re going to give you to do this for 12 months?

Joydeep Goswami

We don’t know. It’s -- that will depend on the order that comes out. And I think what they are trying to do is be reasonable in terms of whatever time frame they give us.

Dan Brennan

So, Francis mentioned on the 3Q call that you would seek strategic partners to invest in GRAIL on a multistep process to a potential IPO. So, just maybe one comment on that like just any elaboration on kind of what that is?

Joydeep Goswami

No. That is one of the options as we have done some pre-work on this, that’s one set of options. Again, I want to make sure you understand, right? It depends a lot on what the EU comes back with. And as we outlined in our Q1 earnings call, right, we will come back to you right after the order with more clarity on what’s in the order, what we expect to do moving forward, right? So give us the time to get you information rather than me speaking and hypotheticals about that.

Dan Brennan

Got it. Okay. So switching gears here to your margin guidance. Looking at your ‘23 guidance, we were 22% core Illumina EBIT, right, even with high 60s gross margin. Just kind of I think that surprised some people, just the degradation in that margin, you kind of explained some of the factors there. But maybe can you just elaborate a bit on the step down in margins and kind of what supports that margin degradation and kind of as we think through, in fact, ‘24 season nice step-up in growth kind of where the margins go as we cycle past ‘23.

Joydeep Goswami

Yes. So look, let me start with that last part, right? So we’re absolutely committed. I mean, at Investor Day, we said, hey, we do expect margin expansion and actually operating profit growth to exceed revenue growth. So we’re absolutely committed to that. And you will see that happening as early as 2024, right? So you’re absolutely right about that, and we remain committed to that.

So 2023, why are margins at 22%, right? So there are a few factors which are transitionary and are very specific. And so first, we had expected a lot more growth in 2022 when we started the year and even looking at the first quarter and most of the second quarter, right? We had been tooling up and investing to -- in our key innovations to support that. So part of the ‘23 margin you see is an overhang on some of that investment that we have provided. We had taken action again in the second half of the year. We reduced our hiring. We actually had a reduction in force of about 5%.

So all of that is already in there, and we had taken action to slow down some of that OpEx increase when it didn’t match our growth expectations weren’t met. Now ‘23, a few things happen, right? First of all, the revenue growth because of the transition or the factors that I talked about earlier, there -- there is a little bit of -- the margins will improve in the second half of the year, but not in the first half because of some of the headwinds.

Gross margin, while it’s still within our range is towards the lower end of the range. And again, all of that is dictated by X, right? When you launch a new instrument and new consumables, the margins in that first year tend to be lower because you’re investing and you’re not fully at scale.

As you move through the year, first scale just improves those margins again you should expect margins in the second half of the year to be better than much better actually than the first half of the year. And then the second part of it is, as you move on into ‘24 and beyond, you’ll see the normal productivity on COGS product that you would expect from us on any instrument, right, but you’ll see a lot of that come through.

And then for ‘23, the one thing on the operating margin side. And in fact, all of the -- the increase in operating expense is really from a normalization of our variable comp, right? So last year, because we didn’t hit our numbers, we didn’t pay much where it will come to our employees. This year, we expect to meet our targets. So we are accruing at 100% of the same kind of pay policies.

And so that puts in a one-year kind of comp that accounts for any of the OpEx increase that we have seen in 2023. So again, going next year, we won’t see that kind of a normalization. So, we’re very confident that our operating margin will turn back into -- in the long term, getting into that 25% to 30% range.

Dan Brennan

Particularly if you beat numbers this year and your comp goes up a lot and the base will be -- then you’ll have no, okay. So with that -- thank you. Joydeep, Salli for being here.

Thank you for one in the room, and have to give rest at the conference.

Joydeep Goswami

Thank you. Appreciate it.

Financial Times: Has DNA sequencing expert Illumina taken the wrong path in search of holy grail?

Jamie Smyth and Javier Espinoza

January 29, 2023

In September, the world’s biggest genome sequencing company hosted Barack Obama, Bill Gates and other luminaries at its annual forum in San Diego, predicting its latest generation of machines would help “change the world”.

Illumina could make the case that it had already done so with its existing technology. It provided the machines that in 2020 decoded the genetic sequence of the virus that causes Covid-19, enabling researchers to develop vaccines and drugs in record time.

Surging demand for its technology and a pandemic-era biotech investment boom caused the market capitalisation of the company — which has an 80 per cent share of the sequencing market — to peak at about $75bn in August 2021.

But as chief executive Francis deSouza took the stage in San Diego to introduce his guests and Illumina’s new NovaSeq X Series there were signs the outlook was darkening.

In August it reported a quarterly loss, weighed down by the legal costs of an unsuccessful patent battle with Chinese rival BGI group, which is now free to enter the US market. A month later the EU blocked Illumina’s $8bn acquisition of Grail, a cancer test developer that was initially founded by Illumina but spun off in 2017.

Since then, the company has downgraded its profit forecasts and announced it is cutting 5 per cent of its 10,000 workers. And within the next few weeks Brussels is expected to hit it with a fine of up to 10 per cent of revenues or about $450mn, for closing the Grail deal despite opposition from regulators.

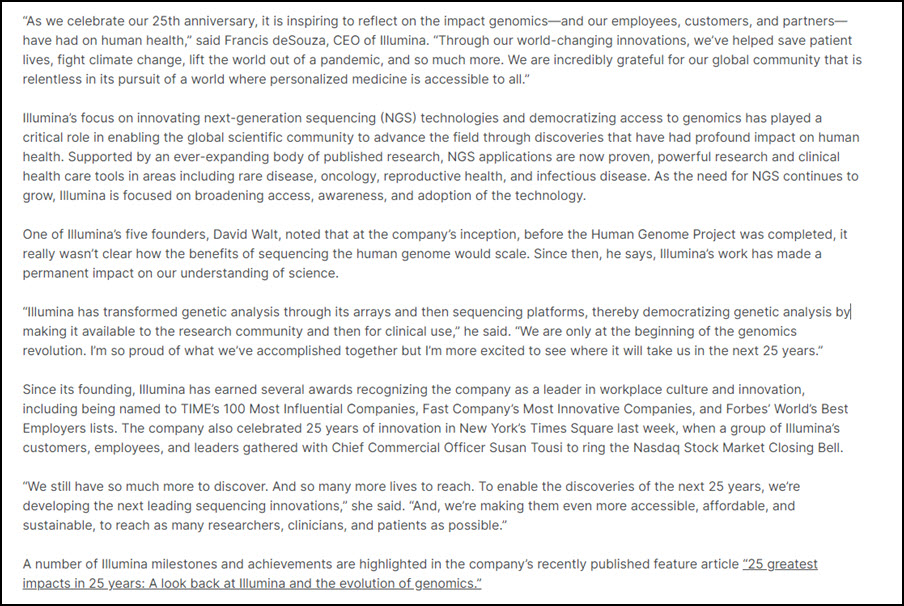

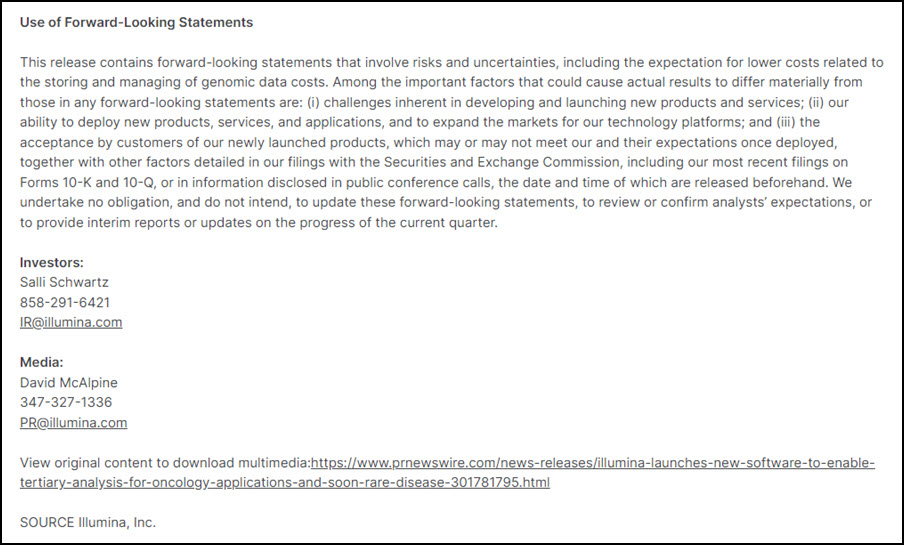

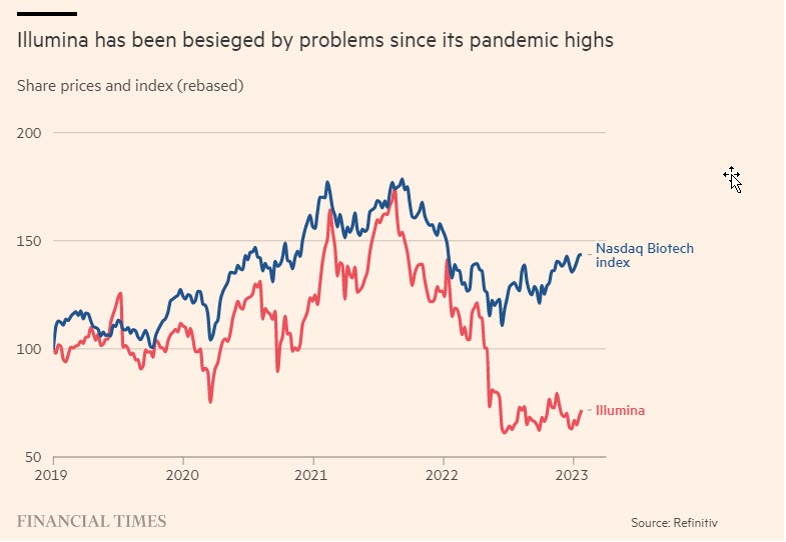

Illumina has been besieged by problems since its pandemic highs Share prices and index (rebased) 200 150 100 50 Nasdaq Biotech index 2019 2020 2021 2022 2023 Illumina Financial Times Source: Refinitiv

Analysts say the bad news is prompting investors to question the company’s strategy of buying Grail, which Illumina forecasts will generate an operating loss of $670mn in 2023 on revenues of $90-110mn. Illumina shares are hovering near five-year lows and it is now worth $33bn.

Dan Brennan, analyst at Cowen, an investment bank, said many investors are not “fans of the deal” and it came up in almost every conversation he had with them.

He said Illumina has over the past decade been an attractive, high-growth investment because it sells its sequencers at high prices (up to $1.25mn each) and has recurring revenues from the reagents and other products required to operate them. Grail is a riskier business because it is burning lots of cash and there is uncertainty about whether its technology will be a commercial success, said Brennan.

Grail, which counted Jeff Bezos and Gates among its early backers, has developed one of the world’s first early detection blood tests. The test, which it named Galleri, aims to detect up to 50 different types of cancer, including many that are not part of national screening programmes. It is currently being tested in trials, including a UK National Health Service study involving 140,000 people.

In an interview with the Financial Times, deSouza said Illumina was right to buy Grail and press ahead with completion of the deal, adding it was “in the interests” of shareholders because of its high growth potential.

“The stakes are really high here in terms of human lives. This isn’t just another deal: if Illumina prevails it can bring Grail’s life-saving test to countries beyond just the US and the UK, which is what Grail is planning to do,” he said.

DeSouza said Illumina has a “huge amount of respect” for regulators but insists it will fight the EU’s order blocking the merger in court, arguing Brussels has no jurisdiction as Grail has no revenues in the bloc. Any EU fine for “gun jumping” — closing the deal despite opposition from regulators — would likely be similar to the $300mn break fee in the merger contract it signed with Grail, he said.

But Illumina’s course of action angered senior EU officials, including competition commissioner Margrethe Vestager, who said at the time: “Companies have to respect our competition rules and procedures.”

The EU’s prohibition of the merger is a test case for regulators, which are seeking to expand their powers against “killer acquisitions” — where big companies buy small innovative rivals before they become serious contenders, thereby undermining competition.

Grail’s competitors argue the deal would leave them unable to compete on fair terms with a combined Illumina/Grail, because they are reliant on its DNA sequencing technology. Illumina has said the deal is not a killer acquisition because Illumina and Grail are not rivals. It also said it has no plans to cut off rivals from its sequencing technologies.

Critics say Illumina’s dogged pursuit of Grail is misguided because it is soaking up management attention at a time when competition in its core business is rising and the high cost of funding the cancer test company is having an effect on earnings. This month, the company forecast profits will be between $1.25 and $1.50 a share this year, well below Wall Street forecasts of $2.53.

Illumina’s former CEO Jay Flatley also questioned the economics of the $8bn takeover, which was negotiated in 2020 near the top of the market.

“If they had waited a year then it would have been a $2bn acquisition,” said Flatley, who was chief executive for 17 years until 2016 and then chair until 2021.

“In retrospect, it would have been better to wait and realise that the market was sizzling hot at the time and therefore it was overpriced.”

Flatley, who persuaded deSouza to join Illumina in 2013, told the Financial Times he did not think the deal was a “strategic mistake” but operationally it had not gone the way management had hoped. It is a “huge disappointment” and investors want it spun back out, he said.

“Some investors frankly don’t care how much Illumina is going to get for it. In some ways it’s kind of a sunk cost. If they can spit it back out, then the earnings numbers get back to where they should be,” he said.

“If nothing happens on this in the next year, I think the grumbling will probably get louder . . . Francis is at the point of that spear.”

DeSouza said Illumina would be pragmatic. “I think Grail continues to represent a unique opportunity and delivers an important product in arguably the largest genomics market we’ll see over the next decade. But we still have to work through the regulatory process.”

It is not the first time Illumina has been tripped up by its M&A strategy. In January 2020, it was forced to abandon its $1.2bn takeover of rival Pacific Biosciences following opposition from regulators.

The departure of Sam Samad, Illumina’s former chief financial officer, has also unnerved some investors, analysts said. Joydeep Goswami, Illumina’s chief strategy and corporate development officer, has done the job in the interim since July, while the company seeks a replacement.

Four of Illumina’s largest investors — Baillie Clifford, Vanguard, BlackRock and Edgewood — all declined a request for comment.

One investor, who spoke on condition of anonymity, said Grail was a “natural extension” of Illumina’s technology and worth pursuing. Another said the company was “blindsided” by the EU and would likely be forced to spin off Grail.

A final EU court ruling on the Grail takeover could take years. In the meantime, abandoning it would be challenging for Grail in particular. It scrapped a planned initial public offering at a time when markets were booming following Illumina’s approach in 2020.

Raising money in the current environment to fund research is far tougher for firms without strong revenue streams. But there is also pressure on Illumina to diversify. It is launching the NovaSeq X into a market that is attracting new entrants at a good rate.

At a JPMorgan healthcare conference this month Element Biosciences, a company founded by several former Illumina executives, announced its sequencers can read a whole human genome for as little as $200.

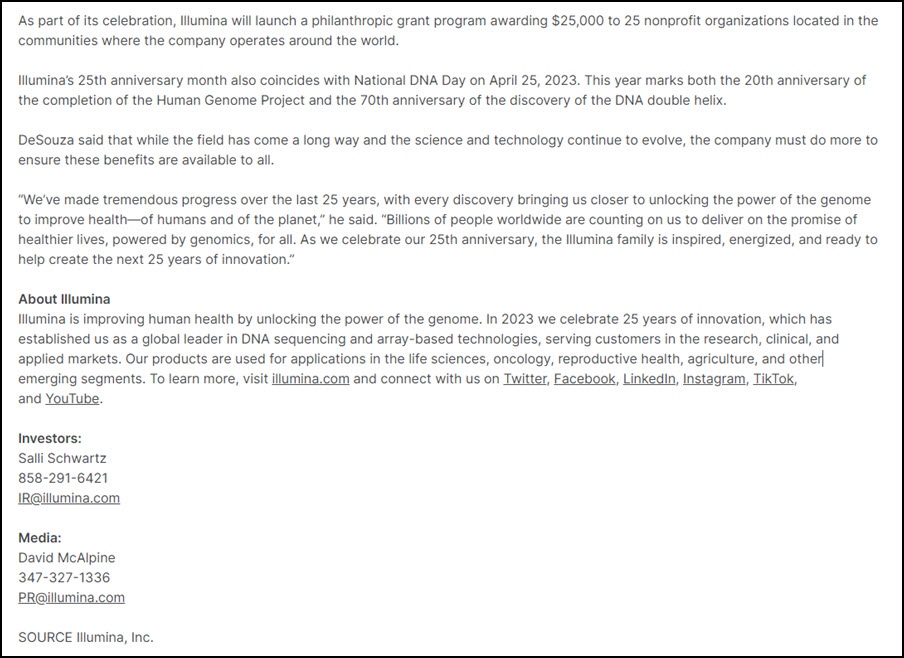

Illumina’s deal to reunite with Grail after it was spun off has yet to pay off Operating income ($mn) Core Illumina Grail and other* 1000 500 0 -500 -1000 2015 2016 2017 2018 2019 2020 2021 Financial Times Source: company * *Includes genetics sequencing company Helix which the company

Twelve years ago, the process cost around $10,000. Illumina’s benchmark in 2020 was around $600 but it plans to reduce this to $200 with its new machine.

Another early-stage company Ultima Genomics has said it can cut sequencing costs to $100. MGI, which was spun out from BGI last year through an IPO, has begun selling its sequencers in the US market following the expiration of key Illumina patents last year.

“Illumina has really been dominating the market for more than a decade and customers need competition,” said Molly He, a former Illumina executive who is chief executive and founder of Element Biosciences.

She said Illumina started offering Element customers big discounts when the company entered the market last year. But Element has also benefited from increased interest in its products from Grail competitors that use DNA sequencing, she added.

“They [customers] are obviously worried about what is going to happen after Illumina acquires Grail: would they still have access to high quality, low cost sequencing?”

Illumina said discounting was a standard business practice and rejected any suggestion that its ownership of Grail would influence its relationship with customers of its DNA sequencing business. But this was a key concern highlighted by European authorities when they blocked the Illumina/Grail merger.

Vijay Kumar, analyst at Evercore ISI, an investment bank, said it was a “big, bold and aggressive” move by Illumina to acquire Grail because Illumina was paying $8bn for a company with very little revenues at the time. But the decision to close the Grail acquisition despite opposition from Brussels was a gamble, he said.

“Francis bet big on this,” Kumar said. “Ultimately the buck has to stop with the CEO.”

THE WALL STREET JOURNAL

Monday, April 3, 2023 | © 2023 Dow Jones & Co. Inc. |

Opinion | Review & Outlook

The FTC’s Unholy Antitrust Grail

The agency overrules its own law judge to block Illumina’s acquisition.

By The Editorial Board

The Federal Trade Commission on Monday overruled its own in-house judge and ordered gene-sequencing giant Illumina to divest cancer blood-test startup Grail. FTC Chair Lina Khan is showing that the agency’s administrative trials are a sham. Heads the agency wins, tails businesses lose.

A FTC judge in September issued a 203-page opinion rejecting the agency’s complaint that alleged the Grail acquisition would harm potential competitors in the embryonic market for multi-cancer early detection tests. Grail currently has no competitors, and the FTC complaint.

Illumina makes the platforms that are used to run Grail and other genetic screening tests. Its scientists developed Grail’s technology before the company spun off the startup in 2016. As the Grail test improved and became commercially viable, Illumina sought to reacquire Grail and closed its acquisition in August 2021.

Grail claims its test can detect the 12 most deadly cancers with 76% accuracy and has a false positive rate of less than 1%. Earlier detection of aggressive cancers could save thousand of lives a year. Illumina says it can bring the test to market faster owing to its relationships with insurers and reduce the price, now about $949 out of pocket.

But some companies that were interested in buying Grail or that were developing their own cancer tests complained to the FTC that Illumina would thwart rivals. This was the gist of the FTC complaint, which the agency’s in-house judge dismissed after a detailed analysis of the facts. Administrative law judges are rarely so scathing.

“The Clayton Act protects competition, not competitors”, FTC chief administrative law judge D. Michael Chappel wrote, emphasizing that antitrust theory and speculation cannot trump facts. He concluded that the FTC had failed to prove its case that Illumina had the ability and incentive to help Grail to the disadvantage of alleged rivals.

For Illumina to divert sales from multi-cancer early detection rivals to Grail, other test developers would have to have sales in the first place, he explained. But none do. He also noted that Illumina had offered a contractual commitment to provide access to its products to all of its future oncology testing customers equivalent to that it provides to Grail.

The FTC commissioners disagreed with the judge 4-0 and ordered Illumina to unwind its Grail acquisition. Republican Commissioner Christine Wilson wrote in a concurrence that she disagreed with some of her colleagues’ legal analysis, but she didn’t believe Illumina had met its burden of proof to show the government’s competition theory was improbable.

Ms. Khan seems to be trying to make an example out of Illumina by ordering the company to pay “transition assistance to Grail’s next acquirer plus expenses of a government-appointed special monitor to ensure that it complies with the divestiture order. The tacit message to other businesses is don’t dare consummate a merger that the agency challenges.

The FTC could have gone to federal court to try to stop the acquisition. Instead, it challenged the deal in its administrative tribunal where it no doubt believed it was more likely to win because it almost always does. Yet after losing, it has now overruled its own judge. What was the purpose of the administrative trial if the FTC could ignore the judge’s findings and do whatever it wants anyway?

That’s a good question for the independent federal courts. Illumina plans to appeal the divestiture order in federal court where it will have the opportunity to raise several constitutional challenges to the FTC’s authority and administrative proceeding that it had earlier raised before the commission. This could get interesting, and the FTC may come to regret its hell-bent effort to stop mergers by whatever means possible.

© 2023 Dow Jones & Co. Inc.

Licensed Use: Web Post and organic social media

Licensed to: Brunswick Group

Expiration Date: 4/12/2024

The Publisher’s sale of this reprint does not constitute or imply any endorsement or sponsorship of any product, service, company or organization.

Custom Reprints 800.803.9100 www.djreprints.com

Do not edit or alter reprint/reproductions not permitted 2386526

ay? That’s a good question for the independent federal courts. Illumina plans to appeal the divestiture order in federal court where it will have the opportunity to raise several constitutional challenges to the FTC’s authority and administrative proceeding that it had earlier raised before the commission. This could get interesting, and the FTC may come to regret its hell-bent effort to stop mergers by whatever means possible. © 2023 Dow Jones & Co. Inc. Licensed Use: Web Post and organic social media Licensed to: Brunswick Group Expiration Date: 4/12/2024 The Publisher’s sale of this reprint does not constitute or imply any endorsement or sponsorship of any product, service, company or organization. Custom Reprints 800.803.9100 www.djreprints.com Do not edit or alter reprint/reproductions not permitted 2386526

Semafor: The FTC is wrong about Illumina

April 4, 2023

Joshua Wright is a professor at Antonin Scalia Law School at George Mason University, executive director of the Global Antitrust Institute at Scalia Law School, and a former Republican FTC commissioner.

As the FTC’s own administrative courts ruled last year, the Illumina/Grail deal is a classic example of a vertical merger with obvious economic and consumer benefits — the kind of deal that ordinarily would have been approved by prior administrations from both parties.

Grail and Illumina do not compete. Grail has developed a novel cancer detection blood test. Illumina is a much larger company that provides inputs into Grail’s tests. To bring its blood test to market more quickly, in higher quantities, and at lower cost to patients, Grail needs manufacturing, operations, and supply chain efficiencies, as well as experience working with regulators like the FDA — all things Illumina can and will provide if the companies are allowed to merge.

The FTC’s theory of harm is that, sometime in the future, Illumina will be able to disadvantage potential rivals who are developing tests that compete with Grail because these rivals might also need Illumina’s devices to perform their tests, and Illumina is the only provider of the devices.

The Commission’s theory is totally speculative: there are no such rivals, and there won’t be for years. Second, even if these rivals did exist now (or in the reasonably foreseeable future), Illumina has already offered a long-term agreement to allow other oncology companies access to Illumina’s technology on the same terms as Grail.

There is now no hope that the FTC itself will come to its senses and understand that bringing life-saving cancer screenings to market faster and in higher quantities is more important than this administration’s overly simplistic belief that most mergers are bad. All hope now lies with the Court of Appeals.

Financial Times: Illumina battle with regulators threatens cancer breakthrough, warn Grail alumni

Jamie Smyth and Javier Espinoza

April 4, 2023

Founding directors say political wrangling causing delays to potentially life-saving blood test

Two of Grail’s founding directors have warned Illumina’s battles with antitrust regulators and activist investor Carl Icahn over its ownership of the cancer screening company threaten to hamper access to potentially life-saving oncology tests.

Jeff Huber, former founding chief executive of Grail, and Meredith Halks-Miller, an Illumina scientist whose discovery led to development of its blood test that detects 50 types of cancer, said political wrangling was causing delays and funding concerns.

“One of the disappointing aspects of the European Union and Federal Trade Commission regulatory issues and now the Icahn proxy battle is that Grail is moving more slowly than it should,” Huber told the Financial Times.

“There is real cost with the delay from the regulatory scrutiny and over-reach. Grail isn’t broadly accessible now because of it, and we are missing many opportunities now to detect people’s cancers early. The very real cost is lives lost with every day of delay.”

Illumina spun off Grail in 2016 to raise funding to develop Galleri, which the company has billed as the world’s first blood test capable of detecting multiple cancers at an early stage. The test works by using genetic sequencing and artificial intelligence to scan a certain type of DNA (cell- free DNA) found in people’s blood for changes caused by cancer cells.

Grail raised $2bn from investors including billionaires Bill Gates and Jeff Bezos and was about to undertake an initial public offering in September 2020 when Illumina offered $8bn to buy it back. The subsequent takeover sparked a battle with regulators, which argued Illumina would have an incentive to cut off Grail’s rivals from using its sequencing technology and so stifle innovation in the cancer testing market.

Illumina rejects this claim.

Last year Brussels blocked the deal and is expected to fine Illumina 10 per cent of annual turnover for closing it without approval. On Monday the FTC ordered the San Diego-based company to divest Grail, reversing an earlier ruling by a US administrative judge in favour of the acquisition.

Illumina has said it will appeal against the order.

The controversy has prompted activist investor Icahn to wage a proxy battle at Illumina , which he alleges squandered $50bn by closing the deal without regulatory approval. Illumina’s market capitalisation has dropped from $75bn in August 2021 when it acquired Grail to just over $30bn last month.

Icahn wants to appoint three new directors to the board and remove Illumina chief executive Francis deSouza and chair John Thompson. On Monday he doubled down on his criticism, asking how the board could justify paying deSouza $27mn last year, an 87 per cent increase on 2021.

Illumina continues to run Grail separately while it battles an EU divestment order. If it had full control, Illumina claims it could roll out Grail’s tests much faster and to more countries than planned.

Huber, who lost his wife to cancer shortly before joining Grail in 2016, said the company was “stuck” because Illumina was restricted from moving forward and “scaling the product and reducing cost” of Galleri tests until the EU issues were resolved.

Halks-Miller, who left Illumina to join Grail as its founding laboratory director, said her big concern was that the “political wrangling” with the EU and Icahn could cause Grail to struggle for funding following any forced divestment by Illumina .

“The current economic climate with banks failing and a poor IPO situation could raise questions about how Grail sustains itself if Illumina is forced to divest. Raising money is difficult now,” she said. “I would hate to see Grail just sort of get passed around like a hot potato to people who don’t know how to manage or take care of it.”

Halks-Miller, who retired in 2020, said the Galleri test had huge potential but needed a lot of money to fund the clinical trials and development required to improve and roll out tests at prices everyone can afford.

Grail is forecast to lose $670mn in 2023 as it funds the largest ever clinical study of a multicancer detection test in the UK. It has partnered with the NHS, which has enrolled 140,000 people aged 50-77 to determine whether Galleri can detect cancers early, when they are usually easier to treat.

The NHS has said it may buy 1mn Galleri tests if the results are positive.

But the success of Galleri and several other early detection tests for cancer under development is far from guaranteed. Some health experts warn there is scant data to demonstrate their effectiveness and the NHS trial is not set up to measure improvement in mortality rates.

Paul Pharoah, professor of cancer epidemiology at Cedars-Sinai, a non-profit healthcare organisation in Los Angeles, said early detection tests had been “overhyped”, as there was still no proof they could detect most early-stage cancers or that their use could improve survival rates.

He said the tests raised other potential problems, including overdiagnosis and overtreatment for cancers that for some people may never have become life-threatening. Chasing up false positives could also cost health systems money and cause stress for patients, said Pharoah, adding much more comprehensive studies were required before roll out.

Grail rejects these criticisms.

A trial measuring Galleri’s impact on mortality would require a much larger study that would take a decade or more to complete, the company said. It said a smaller-scale study had already validated its tests and it felt a great sense of responsibility and urgency to address a “Covid-size pandemic” in cancer every year.

Last year Grail published data showing Galleri flagged 92 potential cancers from blood tests drawn from 6,662 people. Some 35 participants in the study were diagnosed with cancer. All but 10 of these diagnoses were for cancers that did not have routine cancer screening programmes in place. Fifty-seven were false positives, almost a third of which prompted an invasive procedure to rule out a cancer diagnosis.

Grail is selling Galleri to US consumers for about $950 as a “laboratory developed test” — a category that does not require approval from the US Food and Drug Administration and is not widely reimbursed by insurers. The company expects to generate between $90mn-$110mn in sales this year but must win approval before it will be adopted widely.

“We need commercial payers to be able to pay for [Galleri]. Many of them are going to wait for FDA approval to do that,” said Josh Ofman, Grail president. “We also need to get Medicare to have the authority to be able to pay for a test like this, which they do not have.”

Ofman said he was confident the tests could provide a big public health benefit by identifying cancers — pancreatic, bowel, head, neck and many others — earlier than at present. Grail’s existing work programme had not been delayed by the legal battle with Brussels or Icahn, Ofman said, adding that management remained confident in its business model.

Some analysts say it is Illumina rather than Grail that faces the biggest near-term risks given the terms of a holding agreement imposed by EU regulators on the company before they issue a final divestment order.

Under this agreement Illumina cannot immediately sell Grail, even if it decides to reverse course because of pressure from Icahn. The agreement also imposes funding obligations on Illumina for Grail.

“ Illumina is being forced to fund Grail at $700mn a year but has no control over the asset and may be forced to divest,” said Vijay Kumar, analyst at Evercore ISI.

This high cash burn rate is out of step with the market environment following the biotech crash and could pose unintended consequences for Grail following a divestment, he said.

“Can Grail right size its cost structure when capital markets have tempered? We hope the Grail saga comes to a conclusion sooner rather than later.”

Semafor: A big test for Biden’s antitrust cops

Liz Hoffman

April 4, 2023

THE NEWS

Genetic-sequencing company Illumina plans to appeal a U.S. regulatory order to unwind its 2021 takeover of a cancer-test developer, setting up a high-stakes court fight with implications for antitrust cops, patients, and corporate dealmaking.

Reversing an administrative law judge ruling, the Federal Trade Commission said yesterday that Illumina’s $7.1 billion purchase of Grail, which screens snippets of genetic code for early warnings of cancer, would stifle innovation. Regulators worry that Illumina might make its machines exclusive to Grail, whose tests run on them, strangling any potential upstart competitors.

Illumina has made a binding promise that any startups could use its machines at the same prices and the same time as Grail. That failed to satisfy the FTC, which under Chair Lina Khan has been aggressively swatting down corporate mergers.

The uncertainty has weighed on Illumina’s stock price, which is down by 37% over the past year, trailing peers like Bio-Rad and Thermo Fisher. And it has given activist investor Carl Icahn, who is waging a fight for board seats, more ammunition in his campaign.

LIZ’S VIEW

There’s a reason most corporate mergers wait until the government signs off.

When Illumina closed the deal, it knew that regulators didn’t like it. The FTC had already sued in federal court to block the transaction. European antitrust officials had signaled they would block it (and later did).

For technical reasons, delaying would have restarted a separate FTC clock and added time and costs. But fair or not, the legal deck in merger challenges is stacked in favor of regulators, and Illumina’s decision to plow ahead has proven to be a costly miscalculation. If ordered to unwind the deal, Illumina would be a forced seller in a tough market, and could face up to $458 million in fines in Europe for getting ahead of competition approvals there.

The whole affair has handed fresh ammunition to Icahn, who has accused Illumina of “brazenly thumb[ing] their noses” at regulators and throwing good money after bad to defend the deal. He also seized on a nearly 90% pay bump for Illumina’s CEO, which was disclosed last week in an almost comical bout of bad timing.

While not known for his deep technical analysis, the octogenarian investor is good at reading a room. The albatross of the Grail deal has been a sore spot for Illumina shareholders for a while now.

“The Commission’s theory is totally speculative: there are no such rivals, and there won’t be for years,” Joshua Wright, a former Republican FTC commissioner who now teaches at George Mason University, wrote in an op-ed for Semafor. (You can read the full piece below.)

Antitrust law assumes that companies are economic animals, driven more or less solely by a desire to make money. The argument here assumes that Illumina wouldn’t have an incentive to cut off Grail rivals because it would ignore a huge source of potential revenue — namely, licensing its technology to others willing to pay for it.

It’s similar to the argument the FTC is making against the sale of video-game maker Activision to Microsoft, which regulators worry would take Activision’s most popular games off of a competing console, Sony’s PlayStation. But PlayStation accounted for 15% of Activision’s sales over the past three years, more than $1 billion a year, according to securities filings. It’s hard to imagine a company turning its back on that kind of money.

NOTABLE

Carl Icahn’s blistering critique of Illumina’s executives and board. FTC ex-Commissioner Christine Wilson, an outspoken critic of Chair Lina Khan’s merger crackdown whose resignation in protest was effective last week, supported the decision to block the Grail deal. She explains her reasons here.

The New York Times: Carl Icahn and Jesus

Andrew Ross Sorkin, Ravi Mattu, Bernhard Warner, Sarah Kessler, Michael J. de la Merced, Lauren Hirsch and Ephrat Livni

March 31, 2023

Illumina, the DNA sequencing company, stepped up its fight with the activist investor Carl Icahn on Thursday, pushing back against his efforts to secure three board seats and force it to spin off Grail, a maker of cancer-detection tests that it bought for $8 billion. But it is a reference to Jesus that the company says he made that is garnering much attention.

The company said that it had nearly reached a settlement with Mr. Icahn before their fight went public, in a preliminary proxy statement. It added that he had no plan for the company beyond putting his nominees on the board.

But Illumina also said Mr. Icahn told its executives that he “would not even support Jesus Christ” as an independent candidate over one of his own nominees because “my guys answer to me.”

Experts say Mr. Icahn’s comments could be used against him in future fights. Board members are supposed to act as stewards of a company, not agents for a single investor. “If any disputes along these lines arise for public companies where Icahn has nominees on the board, shareholders are going to use this as exhibit A for allegations that the directors followed Icahn rather than their own judgment,” said Ann Lipton, a professor of law at Tulane University.

Mr. Icahn doesn’t seem to care. He said the comments were “taken out of context” and the company broke an agreement to keep negotiations private.

“It was a very poor choice of words and he is usually much smarter than that,” said John Coffee, a corporate governance professor at Columbia Law School. “But he can always say that he was misinterpreted and recognizes that directors owe their duties to all the shareholders.”

John Hancock expands access to Galleri®, GRAIL’s breakthrough cancer screening technology

February 23, 2023

Carrier previously became the first life insurer to offer access to the Galleri test through a pilot in 2022

BOSTON (February 23, 2023) – Today, John Hancock, a unit of Manulife (NYSE: MFC), announced it will expand access to GRAIL’s Galleri® multi-cancer early detection test to eligible life insurance customers participating in the John Hancock Vitality PLUS program, a significant milestone in John Hancock’s ongoing efforts to help customers live longer, healthier, better lives. The expanded access comes after John Hancock became the first life insurance carrier to make the breakthrough screening technology available to a pilot group of customers in September 2022.

Galleri is the first-of-a-kind test available for detection of a shared cancer signal across more than 50 cancer types that can be localized to specific tissues or organs to help clinicians focus their diagnostic evaluation. For the majority of these cancer types, there are no alternative screening options available. According to the American Cancer Society (ACS), cancer is the second leading cause of death in the United States with 610,000 deaths estimated to occur in 2023. The ACS cites better early detection, among other advances, as a driving factor in reducing the death rate by a third since 19911.

“The initial pilot exceeded our expectations in terms of the number of tests requested, validating our hypothesis that our customers want access to this level of insight into their health. It was always our intention to expand beyond the pilot phase and we are thrilled to see this vision come to life,” said Brooks Tingle, President and CEO of John Hancock Insurance. “However, our work with GRAIL runs much deeper than just making Galleri accessible to our customers. We believe there is a critical need to expand awareness of and access to this type of groundbreaking technology. As a life insurer, we are deeply committed to helping our customers live longer, healthier, better lives and we know that preventative care and early detection are key components of that mission.”

The John Hancock Vitality Program combines life insurance with a technology-enabled program that offers education, support, incentives, and rewards designed to help and encourage customers to live healthier lives. The program covers a broad spectrum of activities — including exercise, nutrition, sleep and mindfulness — and rewards customers for the steps they take to stay healthy.

Based on the successful customer uptake during the pilot, John Hancock decided to expand access to the Galleri test, following a similar model, to all eligible John Hancock Vitality PLUS customers, while exploring other potential expansions for the future.

“Every day counts for cancer patients and their families,” said Lindsay Hanson, Vice President, Head of Behavioral Insurance, Global Strategy and Delivery. “Early detection, through tests like Galleri, is a way to write a different story to a cancer diagnosis. We’re proud to bring this technology to our customers.”

“The expansion of this first-of-its-kind program shows the benefits of bringing together two industries that share a common goal of improving health outcomes,” said Bob Ragusa, Chief Executive Officer at GRAIL. “We are thrilled to see the success of the pilot program and look forward to continuing to work with the leadership at John Hancock as it expands its multi-cancer early detection offering, with the goal of ultimately reducing the burden of cancer and keeping cancer from claiming even more lives.”

Offering access to the Galleri test builds on existing Vitality program features that encourage customers to take part in recommended preventative care, including mammograms and other cancer screenings, annual physical exams, dental visits, and more. The John Hancock Vitality Program is constantly growing and evolving with advances in science to make cutting-edge technology and information available to customers to help them live longer, healthier, better lives.

Abbott, B. (2023, January 12). U.S. Cancer Death Rate Has Dropped by a Third Since 1991. The Wall Street Journal. https://www.wsj.com/articles/u-s-cancer-death-rate-has-dropped-by-a-third-since-1991-11673535327

Disclaimer

Galleri is a registered trademark of GRAIL, LLC (“GRAIL”). The test is manufactured and distributed by GRAIL. John Hancock is not an affiliate of GRAIL. John Hancock does not provide medical advice, is not involved in the design or manufacture of the Galleri test and is not responsible for the accuracy or performance of the Galleri test. There is no coordination between John Hancock and any other health plan you may be enrolled in. You may incur additional costs for diagnostic screenings recommended by your healthcare provider.

John Hancock does not receive any individual test results from GRAIL. It will only receive aggregate, anonymized data to understand the success of the offering.

Galleri is not a test to confirm or rule out genetic or other conditions that may indicate a predisposition to cancer. It is important to underscore that Galleri does not detect all cancers and is not a means of diagnosis, but rather a tool to help individuals screen for cancer earlier.

The Galleri test does not replace recommended routine cancer screenings. The Galleri test has not been cleared or approved by the Food and Drug Administration but has received a breakthrough device designation by the FDA. GRAIL’s clinical laboratory is certified under the Clinical Laboratory Improvement Amendments of 1988 (CLIA) and accredited by the College of American Pathologists (CAP). As GRAIL pursues FDA approval, they have launched Galleri as a Laboratory Developed Test in compliance with applicable regulatory requirements, backed by evidence.

The Galleri test is only available to registered John Hancock Vitality PLUS members who are 50 years of age or older, have completed the Vitality Health Review (VHR) for the current program year. For eligible policies with coverage amounts of $500,000 or greater, 100% of the cost of the test will be subsidized. For policies with less than $500,000 in coverage, 50% of the cost of the test will be subsidized.

The Galleri test through The John Hancock Vitality Program is not currently available in New York, Idaho or Guam. The offer of discounted access to the Galleri test is subject to change.

Insurance products are issued by: John Hancock Life Insurance Company (U.S.A.), Boston, MA 02116 (not licensed in New York) and John Hancock Life Insurance Company of New York, Valhalla, NY 10595

Vitality is the provider of the John Hancock Vitality Program in connection with policies issued by John Hancock. John Hancock Vitality Program rewards and discounts are available only to the person insured under the eligible life insurance policy, may vary based on the type of insurance policy purchased and the state where the policy was issued, are subject to change and are not guaranteed to remain the same for the life of the policy. Life insurance policies and/or associated riders and features may not be available in all states.

Important Safety Information

The Galleri test is recommended for use in adults with an elevated risk for cancer, such as those aged 50 or older. The Galleri test does not detect all cancers and should be used in addition to routine cancer screening tests recommended by a healthcare provider. Galleri is intended to detect cancer signals and predict where in the body the cancer signal is located. Use of Galleri is not recommended in individuals who are pregnant, 21 years old or younger, or undergoing active cancer treatment.

Results should be interpreted by a healthcare provider in the context of medical history, clinical signs and symptoms. A test result of “Cancer Signal Not Detected” does not rule out cancer. A test result of “Cancer Signal Detected” requires confirmatory diagnostic evaluation by medically established procedures (e.g., imaging) to confirm cancer.

If cancer is not confirmed with further testing, it could mean that cancer is not present or testing was insufficient to detect cancer, including due to the cancer being located in a different part of the body. False-positive (a cancer signal detected when cancer is not present) and false-negative (a cancer signal not detected when cancer is present) test results do occur. Rx only.

About John Hancock and Manulife

John Hancock is a unit of Manulife Financial Corporation, a leading international financial services provider that helps people make their decisions easier and lives better by providing financial advice, insurance, and wealth and asset management solutions. Manulife Financial Corporation trades as MFC on the TSX, NYSE, and PSE, and under 945 on the SEHK. Manulife can be found at manulife.com.

One of the largest life insurers in the United States, John Hancock supports more than ten million Americans with a broad range of financial products, including life insurance and annuities. John Hancock also supports US investors by bringing leading investment capabilities and retirement planning and administration expertise to individuals and institutions. Additional information about John Hancock may be found at johnhancock.com.

About Vitality

Guided by a core purpose of making people healthier, Vitality is the leader in improving health to unlock outcomes that matter. By blending industry-leading smart tech, data, incentives, and behavioral science, we inspire healthy changes in individuals and their organizations. As one of the largest wellness companies in the world, Vitality brings a dynamic and diverse perspective through successful partnerships with the most forward-thinking insurers and employers. More than 30 million people in 40 markets engage in the Vitality program. For more information, visit vitalitygroup.com or follow us on Twitter and LinkedIn.

About GRAIL

GRAIL is a healthcare company whose mission is to detect cancer early, when it can be cured. GRAIL is focused on alleviating the global burden of cancer by developing pioneering technology to detect and identify multiple deadly cancer types early. The company is using the power of next-generation sequencing, population-scale clinical studies, and state-of-the-art computer science and data science to enhance the scientific understanding of cancer biology, and to develop its multi-cancer early detection blood test. GRAIL is headquartered in Menlo Park, CA with locations in Washington, D.C., North Carolina, and the United Kingdom. GRAIL, LLC, is a subsidiary of Illumina, Inc. (NASDAQ:ILMN) currently held separate from Illumina Inc. under the terms of the Interim Measures Order of the European Commission.

For more information, visit grail.com.

About Galleri®

The earlier that cancer is detected, the higher the chance of successful outcomes. The Galleri multi-cancer early detection test can detect a shared cancer signal across more than 50 types of cancer, as defined by the American Joint Committee on Cancer Staging Manual, through a routine blood draw. When a cancer signal is detected, the Galleri test predicts the cancer signal origin, or where the cancer is located in the body, with high accuracy to help guide the next steps to diagnosis. The Galleri test requires a prescription from a licensed health care provider and should be used in addition to recommended cancer screenings such as mammography, colonoscopy, prostate-specific antigen (PSA) test, or cervical cancer screening. It is intended for use in people with an elevated risk of cancer, such as those aged 50 or older.

For more information about Galleri, visit galleri.com.

MLINY022223337-1