UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☐ | Definitive Proxy Statement |

| | |

| ☒ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material under Rule 14a-12 |

| Illumina, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

| | | |

On April 27, 2023, Illumina, Inc. (“Illumina”) issued an investor presentation in connection with Illumina’s 2023 Annual Meeting of Stockholders. A copy of the investor presentation can be found below.

© 2023 Illumina, Inc. All rights reserved. April 2023 Support Illumina’s Strategy for Creating Long-Term Value for All Shareholders

Forward Looking Statements 2 This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding mandates, the future, business plans and other statements that are not historical in nature. These statements are made on the basis of Illumina’s views and assumptions regarding future events and business performance and plans as of the time the statements are made. These forward-looking statements may be accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “target,” “will” and other words and terms of similar meaning. Illumina does not undertake any obligation to update these statements unless required by applicable laws or regulations, and you should not place undue reliance on forward-looking statements. Among the important factors to which our business is subject that could cause actual results to differ materially from those in any forward-looking statements are: (i) changes in the rate of growth in the markets we serve; (ii) the volume, timing and mix of customer orders among our products and services; (iii) our ability to adjust our operating expenses to align with our revenue expectations; (iv) our ability to manufacture robust instrumentation and consumables; (v) the success of products and services competitive with our own; (vi) challenges inherent in developing, manufacturing, and launching new products and services, including expanding or modifying manufacturing operations and reliance on third-party suppliers for critical components; (vii) the impact of recently launched or pre-announced products and services on existing products and services; (viii) our ability to modify our business strategies to accomplish our desired operational goals; (ix) our ability to realize the anticipated benefits from prior or future actions to streamline and improve our R&D processes, reduce our operating expenses and maximize our revenue growth; (x) our ability to further develop and commercialize our instruments, consumables, and products, including Galleri™, the cancer screening test developed by GRAIL, to deploy new products, services, and applications, and to expand the markets for our technology platforms; (xi) the risks and costs associated with our ongoing inability to integrate GRAIL due to the interim measures imposed on us by the European Commission as a result of their prohibition of our acquisition of GRAIL; (xii) the risks and costs associated with the integration of GRAIL’s business if we are ultimately able to integrate GRAIL; (xiii) the risk that disruptions from the consummation of our acquisition of GRAIL and associated legal or regulatory proceedings, including related appeals, or obligations will harm our business, including current plans and operations; (xiv) the risk of incurring fines associated with the consummation of our acquisition of GRAIL and the possibility that we may be required to divest all or a portion of the assets or equity interests of GRAIL on terms that could be materially worse than the terms on which we acquired GRAIL; (xv) our ability to obtain approval by third-party payors to reimburse patients for our products; (xvi) our ability to obtain regulatory clearance for our products from government agencies; (xvii) our ability to successfully partner with other companies and organizations to develop new products, expand markets, and grow our business; (xviii) uncertainty, or adverse economic and business conditions, including as a result of slowing or uncertain economic growth, COVID-19 pandemic mitigation measures, or armed conflict; (xix) the application of generally accepted accounting principles, which are highly complex and involve many subjective assumptions, estimates, and judgments and (xx) legislative, regulatory and economic developments, together with the factors set forth in Illumina’s Annual Report on Form 10-K for the year ended January 1, 2023 under the caption “Risk Factors”, in information disclosed in public conference calls, the date and time of which are released beforehand, and in filings with the Securities and Exchange Commission (the SEC) including, among others, quarterly reports on Form 10-Q. Additional Information and Where to Find It Illumina has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for Illumina’s 2023 Annual Meeting of Stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY ILLUMINA AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Illumina free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Illumina are also available free of charge by accessing Illumina’s website at www.illumina.com. Participants Illumina, its directors and executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation by Illumina. Information about Illumina’s executive officers and directors, including information regarding the direct or indirect interests, by security holdings or otherwise, is available in Illumina’s definitive proxy statement for its 2023 Annual Meeting, which was filed with the SEC on April 20, 2023. To the extent holdings by our directors and executive officers of Illumina securities reported in the proxy statement for the 2023 Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at www.sec.gov. Note Regarding GRAIL The European Commission adopted an order on September 6, 2022, prohibiting Illumina’s acquisition of GRAIL. We have filed an appeal of the Commission’s decision. The Commission has also adopted an order requiring Illumina and GRAIL to be held and operated as distinct and separate entities for an interim period. Compliance with the order is monitored by an independent Monitoring Trustee. During this period, Illumina and GRAIL are not permitted to share confidential business information unless legally required, and GRAIL must be run independently, exclusively in the best interests of GRAIL. Commercial interactions between the two companies must be undertaken at arm’s length. Use of Non-GAAP Measures See Slides 51-52 for important information regarding the use of Non-GAAP financial measures in this presentation.

Table of Contents 2 Executive Summary 4 Illumina Delivers Value through Genomics 5 - 8 Illumina’s Results Continue to Be Best-in-Class Against a Challenging Backdrop 9 - 19 GRAIL is a Growth Engine with Unprecedented Potential 20 - 26 Illumina’s Board is Highly Qualified with Deep Industry Experience and Expertise 27 - 32 Carl Icahn’s Nominees are Not Right for Illumina’s Board 33 - 44 Key Takeaways 45 - 47 Appendix 48 - 52

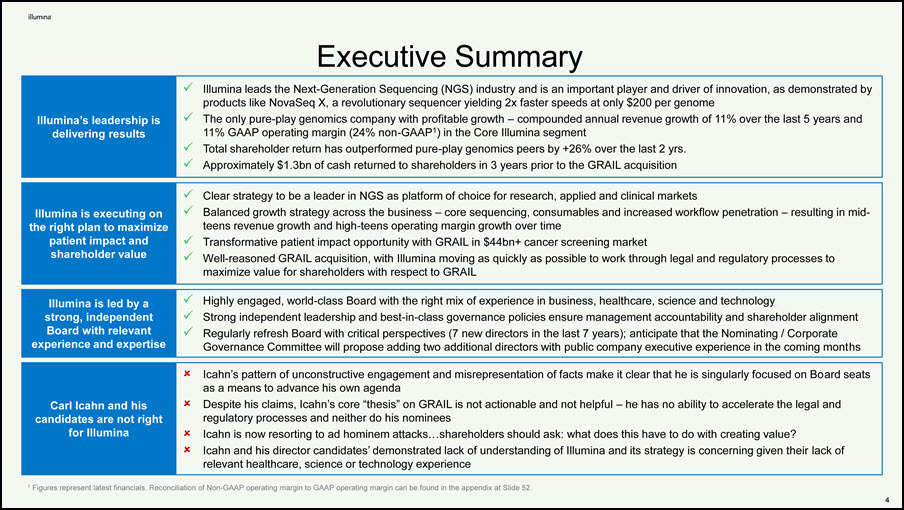

Executive Summary Illumina’s leadership is delivering results Illumina leads the Next-Generation Sequencing (NGS) industry and is an important player and driver of innovation, as demonstrated by products like NovaSeq X, a revolutionary sequencer yielding 2x faster speeds at only $200 per genome The only pure-play genomics company with profitable growth – compounded annual revenue growth of 11% over the last 5 years and 11% GAAP operating margin (24% non-GAAP1) in the Core Illumina segment Total shareholder return has outperformed pure-play genomics peers by +26% over the last 2 yrs. Approximately $1.3bn of cash returned to shareholders in 3 years prior to the GRAIL acquisition Illumina is executing on the right plan to maximize patient impact and shareholder value Clear strategy to be a leader in NGS as platform of choice for research, applied and clinical markets Balanced growth strategy across the business – core sequencing, consumables and increased workflow penetration – resulting in mid- teens revenue growth and high-teens operating margin growth over time Transformative patient impact opportunity with GRAIL in $44bn+ cancer screening market Well-reasoned GRAIL acquisition, with Illumina moving as quickly as possible to work through legal and regulatory processes to maximize value for shareholders with respect to GRAIL Illumina is led by a strong, independent Board with relevant experience and expertise Highly engaged, world-class Board with the right mix of experience in business, healthcare, science and technology Strong independent leadership and best-in-class governance policies ensure management accountability and shareholder alignment Regularly refresh Board with critical perspectives (7 new directors in the last 7 years); anticipate that the Nominating / Corporate Governance Committee will propose adding two additional directors with public company executive experience in the coming months Carl Icahn and his candidates are not right for Illumina Icahn’s pattern of unconstructive engagement and misrepresentation of facts make it clear that he is singularly focused on Board seats as a means to advance his own agenda Despite his claims, Icahn’s core “thesis” on GRAIL is not actionable and not helpful – he has no ability to accelerate the legal and regulatory processes and neither do his nominees Icahn is now resorting to ad hominem attacks…shareholders should ask: what does this have to do with creating value? Icahn and his director candidates’ demonstrated lack of understanding of Illumina and its strategy is concerning given their lack of relevant healthcare, science or technology experience 2 1 Figures represent latest financials. Reconciliation of Non-GAAP operating margin to GAAP operating margin can be found in the appendix at Slide 52.

Illumina Delivers Value through Genomics 2

6 2022 Core Revenue $4.6B Global Leader in Genetic Sequencing 1 Core Gross Margin vs. 43% peer median 68% Operating Margin vs. unprofitable peers 15% Customers >9,500 Patents Worldwide >8,800 Covered Lives Globally IVD / EUA Product Registrations >1,200 Countries with Regulatory Approvals 62 Installed Base of Sequencing Systems ~23K Commercial Strength Clinical Leadership Technological Innovation 2012-2022 Core Revenue CAGR Illumina is the Leading Pure-Play Genomics Company + + >1B Illumina enables clinicians and researchers to comprehensively understand and leverage the genome Proven track record of profitable growth, driven by investment in innovation and operational excellence Significant opportunities in large, growing, and underpenetrated markets supporting mid-teens core revenue growth Economies of scale, disciplined pricing and strategic cost management facilitating high-teens operating profit growth over the long-term Disciplined capital allocation framework with a focus on both organic and inorganic investments to build sustainable leadership and unlock new applications 24% Non-GAAP 11% GAAP 1 Figures represent latest financials. Reconciliation of Non-GAAP operating margin to GAAP operating margin can be found in the appendix at Slide 52. Note: Peers include 10x Genomics, Adaptive, Nanostring, Oxford Nanopore, PacBio, and Singular Genomics.

7 Illumina’s Technology Innovations Expand the Genomics Diagnostic Tools Market and Our Leadership Position Source: NHS, NSF, NIH, UN, WHO, and additional publicly available sources, primary market research, secondary reports, Illumina internal estimates. I l lumina’s Consistent Innovation Enables New Applications Genetic Disease Microbiology Genotyping Single Cell Cancer Research Whole Genome / Exome Cell & Molecular Biology Genetic Disease Spatial Drug Discovery Proteomics Therapy Selection Infectious Disease Testing Early Cancer Screening Newborn Screening Oncology Monitoring CLINICAL TRANSLATIONAL RESEARCH I l lumina is Innovating Across Multiple Vectors – Expanding the Market Massive, Growing and Under- penetrated Market NIPT Screening Rare Genetic Disease Minimal Residual Disease Cancer Therapy Selection 14% 2022 Market Penetration: 7% 2005 ~$5B 2014 ~$20B 2027 ~$120B Total Addressable Market I l lumina is a Leader in a Genome Analyzer MiSeq HiSeq NextSeq NovaSeq NovaSeq X Consistent improvement in throughput, cost per sample, and sensitivity enable Illumina’s innovations in research, translation, and clinical applications Selected Examples (cancer screening) (proteomics) (non-invasive prenatal testing) TruSight Oncology (cancer therapy selection)

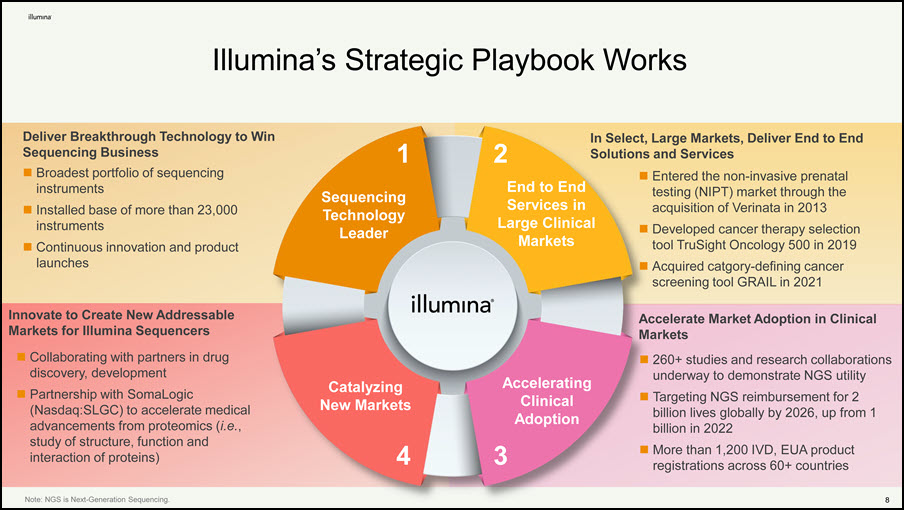

8 Illumina’s Strategic Playbook Works Large Clinical Markets Catalyzing New Markets 1 Sequencing Technology Leader 2 End to End Services in 4 Accelerating Clinical Adoption 3 Note: NGS is Next-Generation Sequencing. Deliver Breakthrough Technology to Win Sequencing Business Broadest portfolio of sequencing instruments Installed base of more than 23,000 instruments Continuous innovation and product launches In Select, Large Markets, Deliver End to End Solutions and Services Entered the non-invasive prenatal testing (NIPT) market through the acquisition of Verinata in 2013 Developed cancer therapy selection tool TruSight Oncology 500 in 2019 Acquired catgory-defining cancer screening tool GRAIL in 2021 Accelerate Market Adoption in Clinical Markets 260+ studies and research collaborations underway to demonstrate NGS utility Targeting NGS reimbursement for 2 billion lives globally by 2026, up from 1 billion in 2022 More than 1,200 IVD, EUA product registrations across 60+ countries Innovate to Create New Addressable Markets for Illumina Sequencers Collaborating with partners in drug discovery, development Partnership with SomaLogic (Nasdaq:SLGC) to accelerate medical advancements from proteomics (i.e., study of structure, function and interaction of proteins)

9 Illumina’s Results Continue to Be Best-in-Class Against a Challenging Backdrop

10 $0.0 $0.0 $0.0 $0.1 $0.1 $0.2 $0.4 $0.6 $0.7 $0.9 $1.1 $1.1 $1.4 $1.9 $2.2 $2.4 $2.8 $3.3 $3.5 $3.2 $4.5 $4.6 – $1 $2 $3 $4 $5 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $0 $20 $40 $60 $80 Over Two Decades and Multiple Market Inflections, Illumina’s Innovation Engine Has Delivered Value to Shareholders M AR K E T C AP I TAL I Z AT I O N AN D R E V E NU E E V O L U T I O N ( $ b n ) Source: FactSet, company filings as of 10-Mar-2023. Market Cap ($bn) Rev. ($bn) $0.2 $0.1 $0.2 $0.4 $1.3 $2.4 $4.4 $4.4 $6.0 $7.8 $5.8 $9.6 $24.1 $28.5 $22.2 $26.8 Avg. EV ($bn) $41.6 $44.3 $46.1 $61.2 $40.2 $0.0 $0.1 $0.1 $0.2 $0.4 $0.6 $0.8 $0.9 $1.2 $1.2 $1.4 $1.9 $2.4 $2.7 $2.9 $3.4 $3.9 $3.9 $4.4 $5.3 Avg. NTM Rev. $0.0 ($bn) $0.1 $0.0 YoY Rev. Growth NM NM 80% 45% NM 99% 56% 16% 35% 17% 9% 24% 31% 19% 8% 15% 21% 6% (9%) 40% 1% NM Founded in 1998 Launch of BeadLab, first SNP genotyping system (2002) Acquisition of Solexa for $600mm (2006) TAM of ~$5bn in 2005 +1,582% growth 2002 – 2006 +916% growth 2006 – 2016 Commercialization of Illumina Genome Analyzer (2007) Launch of GAII (2008) Launch of iScan System (2008) Launch of HiSeq 2000 and HiSeq 1000 (2010) Launch of MiSeq (2011) Launch of HiSeq 2500 (2012) Acquisition of Verinata Health for up to $450mm (2013) Launch of NextSeq 500 and HiSeqX Ten (2014) cuts price of genomic sequencing to $1,000 Launch of HiSeq X Five, HiSeq 3000/4000, NextSeq 550 (2015) Launch of MiniSeq (2016) TAM of ~$20bn in 2014 with incremental ~$20-40bn from GRAIL by 2016 Launch of NovaSeq Series (2017) Launch of iSeq 100 (2018) Launch of NextSeq 1000 and Next Seq 2000 (2020) Acquisition of GRAIL for $8bn (2021) Launch of NovaSeq X Series (2022) cuts price of genomic sequencing to $200 $120bn TAM by 2027 +312% growth 2016 – Peak; +64% growth 2016 – Current

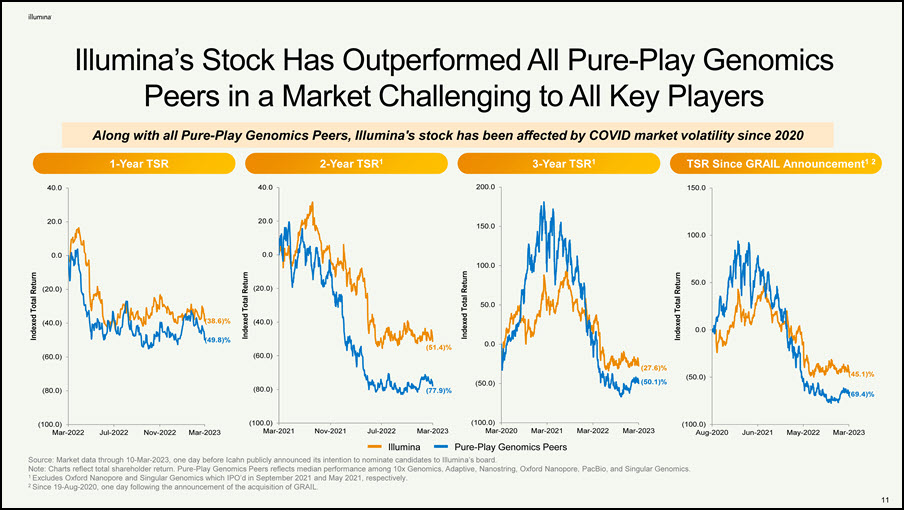

Illumina’s Stock Has Outperformed All Pure-Play Genomics Peers in a Market Challenging to All Key Players Source: Market data through 10-Mar-2023, one day before Icahn publicly announced its intention to nominate candidates to Illumina’s board. Note: Charts reflect total shareholder return. Pure-Play Genomics Peers reflects median performance among 10x Genomics, Adaptive, Nanostring, Oxford Nanopore, PacBio, and Singular Genomics. 1 Excludes Oxford Nanopore and Singular Genomics which IPO’d in September 2021 and May 2021, respectively. 2 Since 19-Aug-2020, one day following the announcement of the acquisition of GRAIL. (38.6)% (49.8)% (100.0) (80.0) (60.0) (40.0) (20.0) 0.0 20.0 40.0 Mar-2022 Jul-2022 Nov-2022 Mar-2023 Indexed Total Return (50.0) 0.0 50.0 100.0 150.0 Mar-2023 Indexed Total Return (27.6)% (50.1)% (100.0) (80.0) (60.0) (40.0) (20.0) 0.0 20.0 Mar-2021 Nov-2021 Jul-2022 Mar-2023 Indexed Total Return (77.9)% (51.4)% (100.0) (50.0) 0.0 50.0 100.0 1-Year TSR 2-Year TSR1 3-Year TSR1 TSR Since GRAIL Announcement1 2 40.0 200.0 150.0 Aug-2020 Jun-2021 May-2022 Mar-2023 Indexed Total Return (69.4)% (45.1)% Along with all Pure-Play Genomics Peers, Illumina's stock has been affected by COVID market volatility since 2020 Illumina (100.0) Mar-2020 Mar-2021 Mar-2022 Pure-Play Genomics Peers 12

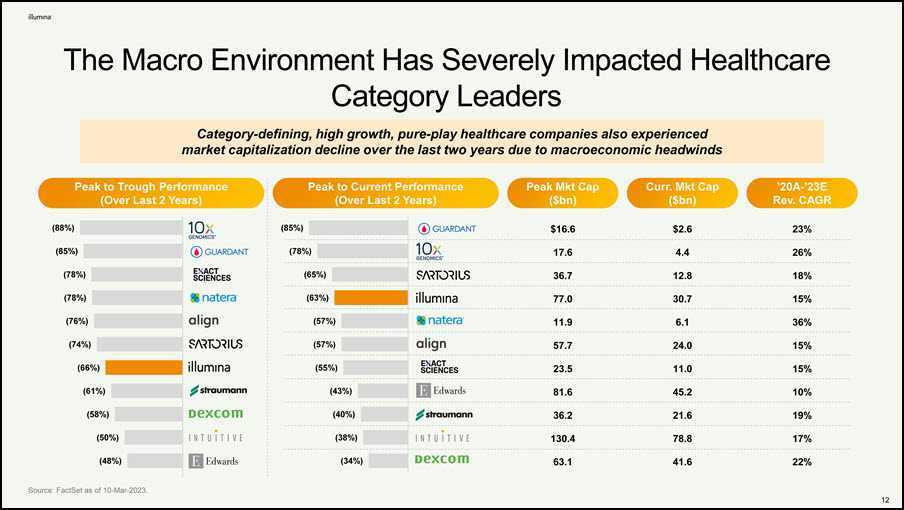

The Macro Environment Has Severely Impacted Healthcare Category Leaders Peak to Current Performance (Over Last 2 Years) Peak Mkt Cap ($bn) ’20A-’23E Rev. CAGR Curr. Mkt Cap ($bn) Category-defining, high growth, pure-play healthcare companies also experienced market capitalization decline over the last two years due to macroeconomic headwinds Peak to Trough Performance (Over Last 2 Years) (88%) (85%) (78%) (78%) (76%) (74%) (66%) (61%) (58%) (50%) (48%) Source: FactSet as of 10-Mar-2023. 85%) $16.6 $2.6 23% (78%) 17.6 4.4 26% (65%) 36.7 12.8 18% (63%) 77.0 30.7 15% (57%) 11.9 6.1 36% (57%) 57.7 24.0 15% (55%) 23.5 11.0 15% (43%) 81.6 45.2 10% (40%) 36.2 21.6 19% (38%) 130.4 78.8 17% (34%) 63.1 41.6 22% ( 12

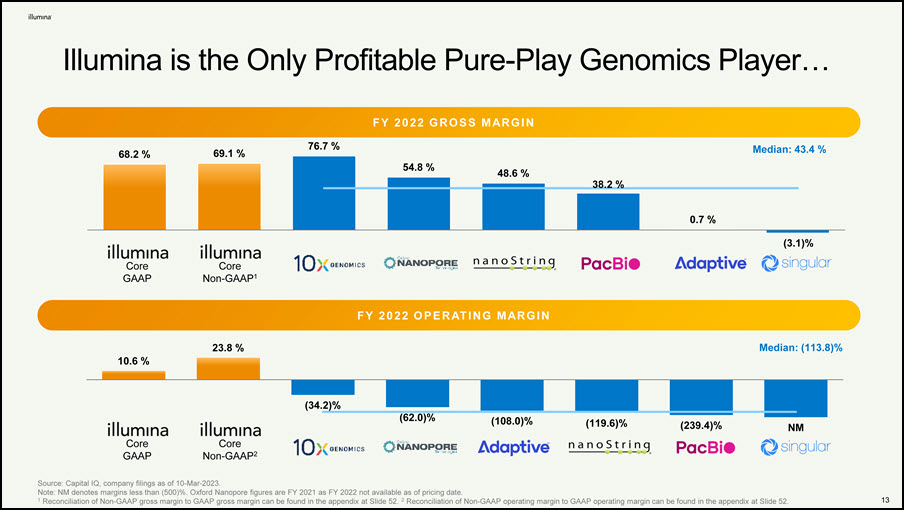

13 Illumina is the Only Profitable Pure-Play Genomics Player… F Y 2 0 22 G R O S S M AR G I N Source: Capital IQ, company filings as of 10-Mar-2023. Note: NM denotes margins less than (500)%. Oxford Nanopore figures are FY 2021 as FY 2022 not available as of pricing date. 1 Reconciliation of Non-GAAP gross margin to GAAP gross margin can be found in the appendix at Slide 52. 2 Reconciliation of Non-GAAP operating margin to GAAP operating margin can be found in the appendix at Slide 52. Core Non-GAAP1 Core GAAP F Y 2 0 22 O P E R AT I N G M AR G I N 68.2 % 69.1 % 76.7 % 54.8 % 48.6 % 38.2 % 0.7 % (3.1)% Median: 43.4 % Core Non-GAAP2 Core GAAP 10.6 % 23.8 % (34.2)% (62.0)% (108.0)% (119.6)% (239.4)% NM Median: (113.8)%

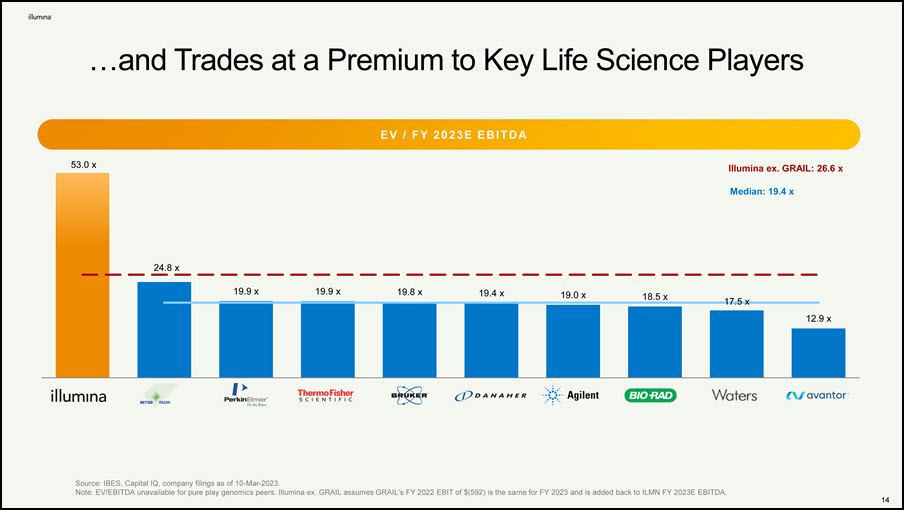

…and Trades at a Premium to Key Life Science Players E V / F Y 2 0 23 E E B I T D A Source: IBES, Capital IQ, company filings as of 10-Mar-2023. Note: EV/EBITDA unavailable for pure play genomics peers. Illumina ex. GRAIL assumes GRAIL’s FY 2022 EBIT of $(592) is the same for FY 2023 and is added back to ILMN FY 2023E EBITDA. 53.0 x 14 24.8 x 19.9 x 19.9 x 19.8 x 19.4 x 19.0 x 18.5 x 17.5 x 12.9 x Median: 19.4 x Illumina ex. GRAIL: 26.6 x

Illumina’s Strategy is Delivering Compelling Financial Results Increased installed base of instruments Recurring revenue from consumables and services was 80%+ of revenue for past six years Growth resulted from demand elasticity, in both research and clinical markets around the globe $2.8 $3.3 $3.5 $3.2 $4.5 $4.6 FY17 FY18 FY19 FY20 FY21 FY22 Exceeded Revenue & EPS Consensus 10 of 11 Quarters since GRAIL acquisition announced D r i ve rs o f R e ve n u e G r o w t h R e ve n u e ( $ b n ) 14

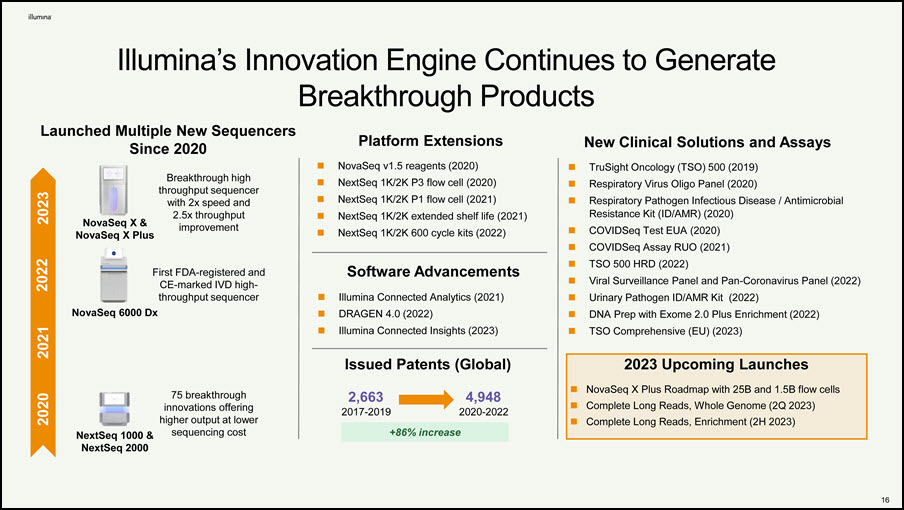

Illumina’s Innovation Engine Continues to Generate Breakthrough Products First FDA-registered and CE-marked IVD high- throughput sequencer NovaSeq 6000 Dx 2023 2021 2020 NovaSeq X & NovaSeq X Plus Breakthrough high throughput sequencer with 2x speed and 2.5x throughput improvement 75 breakthrough innovations offering higher output at lower sequencing cost Launched Multiple New Sequencers Since 2020 2022 NextSeq 1000 & NextSeq 2000 Platform Extensions NovaSeq v1.5 reagents (2020) NextSeq 1K/2K P3 flow cell (2020) NextSeq 1K/2K P1 flow cell (2021) NextSeq 1K/2K extended shelf life (2021) NextSeq 1K/2K 600 cycle kits (2022) Software Advancements Illumina Connected Analytics (2021) DRAGEN 4.0 (2022) Illumina Connected Insights (2023) New Clinical Solutions and Assays TruSight Oncology (TSO) 500 (2019) Respiratory Virus Oligo Panel (2020) Respiratory Pathogen Infectious Disease / Antimicrobial Resistance Kit (ID/AMR) (2020) COVIDSeq Test EUA (2020) COVIDSeq Assay RUO (2021) TSO 500 HRD (2022) Viral Surveillance Panel and Pan-Coronavirus Panel (2022) Urinary Pathogen ID/AMR Kit (2022) DNA Prep with Exome 2.0 Plus Enrichment (2022) TSO Comprehensive (EU) (2023) 2023 Upcoming Launches NovaSeq X Plus Roadmap with 25B and 1.5B flow cells Complete Long Reads, Whole Genome (2Q 2023) Complete Long Reads, Enrichment (2H 2023) Issued Patents (Global) 2,663 2017-2019 4,948 2020-2022 +86% increase 14

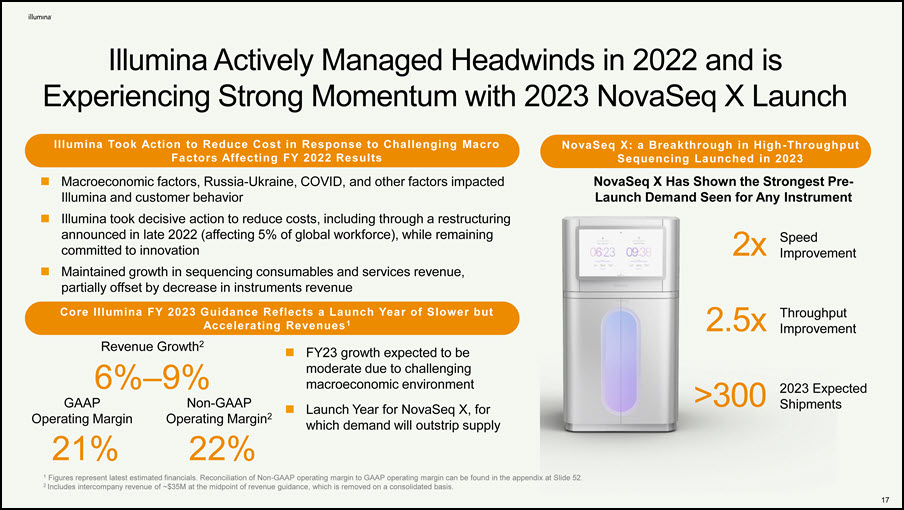

Illumina Actively Managed Headwinds in 2022 and is Experiencing Strong Momentum with 2023 NovaSeq X Launch FY23 growth expected to be moderate due to challenging macroeconomic environment Launch Year for NovaSeq X, for which demand will outstrip supply Illumina Took Action to Reduce Cost in Response to Challenging Macro Factors Affecting FY 2022 Results Macroeconomic factors, Russia-Ukraine, COVID, and other factors impacted Illumina and customer behavior Illumina took decisive action to reduce costs, including through a restructuring announced in late 2022 (affecting 5% of global workforce), while remaining committed to innovation Maintained growth in sequencing consumables and services revenue, partially offset by decrease in instruments revenue Core Illumina FY 2023 Guidance Reflects a Launch Year of Slower but Accelerating Revenues 1 14 Revenue Growth2 6%–9% Operating Margin2 22% 1 Figures represent latest estimated financials. Reconciliation of Non-GAAP operating margin to GAAP operating margin can be found in the appendix at Slide 52. 2 Includes intercompany revenue of ~$35M at the midpoint of revenue guidance, which is removed on a consolidated basis. 2x Speed Improvement 2.5x Throughput Improvement >300 2023 Expected Shipments GAAP Non-GAAP Operating Margin 21% NovaSeq X: a Breakthrough in High-Throughput Sequencing Launched in 2023 NovaSeq X Has Shown the Strongest Pre- Launch Demand Seen for Any Instrument

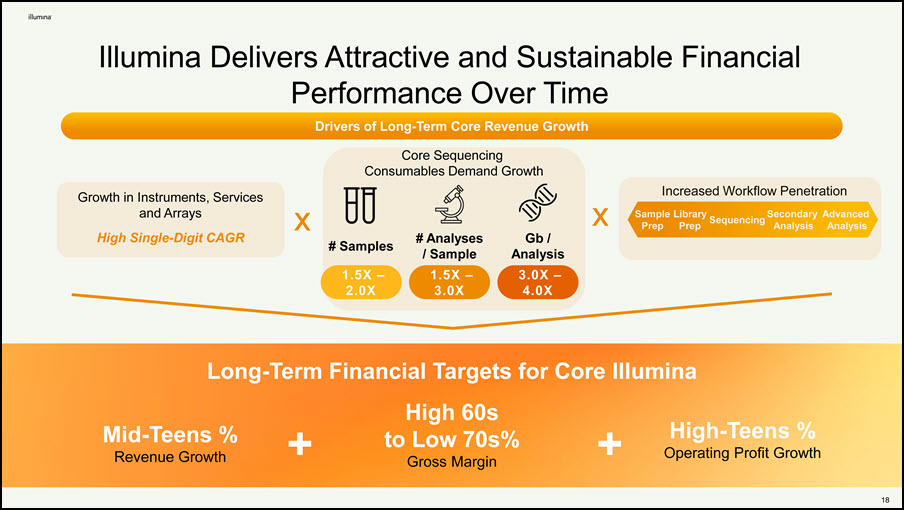

Increased Workflow Penetration Sample Library Sequencing Secondary Advanced Prep Prep Analysis Analysis # Samples Gb / Analysis 3.0X – 4.0X 1.5X – 2.0X # Analyses / Sample 1.5X – 3.0X Growth in Instruments, Services and Arrays High Single-Digit CAGR Mid-Teens % Revenue Growth to Low 70s% Gross Margin Operating Profit Growth + + Long-Term Financial Targets for Core Illumina High 60s High-Teens % Illumina Delivers Attractive and Sustainable Financial Performance Over Time Drivers of Long-Term Core Revenue Growth Core Sequencing Consumables Demand Growth 14 x x

19 Illumina is Taking Further Action to Reduce Costs on Top of the Steps Announced in November 2022 Reducing Annualized Run-Rate Expenses by More Than $100M in CY 2023 Product Commercialization Process / Organization Global Footprint Modularization of innovation and development Utilize new technology to lower costs and accelerate time to market Rationalize real estate portfolio and vendor spend Accelerate IT optimization efforts Relocate activities to more cost- effective hubs 2022 11% 24% GAAP Non-GAAP Note: Reconciliation of Non-GAAP operating margin to GAAP operating margin for 2022 and 2023 can be found in the appendix at Slide 52. Illumina only provides non-GAAP measures for operating margin targets because of the difficulty of projecting with reasonable certainty the financial impact of specific GAAP operating adjustments. More information can be found in the appendix at Slide 51. 1 FY2023 Guidance. 2023 21% 22% GAAP1 Non-GAAP1 2024 25% Non-GAAP 2025 27% Non-GAAP Commitment to Increasing Core Operating Margins Implementation of Cost Reductions to Accelerate Margin Improvement Calendar Year Cost savings will free up capital to increase investment in high growth areas

GRAIL is a Growth Engine with Unprecedented Potential 22

GRAIL’s Path Forward Holds Enormous Value and Illumina is Leading the Way 1◼ GRAIL Continues a Strategy of Platform-Enhancing Acquisitions 2◼ GRAIL Has Incredible Long-Term Value with the Only Commercial Multi-Cancer Early Detection Test in a $44B Addressable Market 3◼ Illumina’s Integration of GRAIL Would Accelerate Commercialization and Drive Efficiencies 4◼ Illumina’s Decision to Close the GRAIL Transaction was Well-Reasoned and Supported by Robust, Independent, External Legal and Regulatory Advice 5◼ Illumina’s Path is the Only One that Maximizes Shareholder Value – Will Conclude Legal Process by Early 2024 22

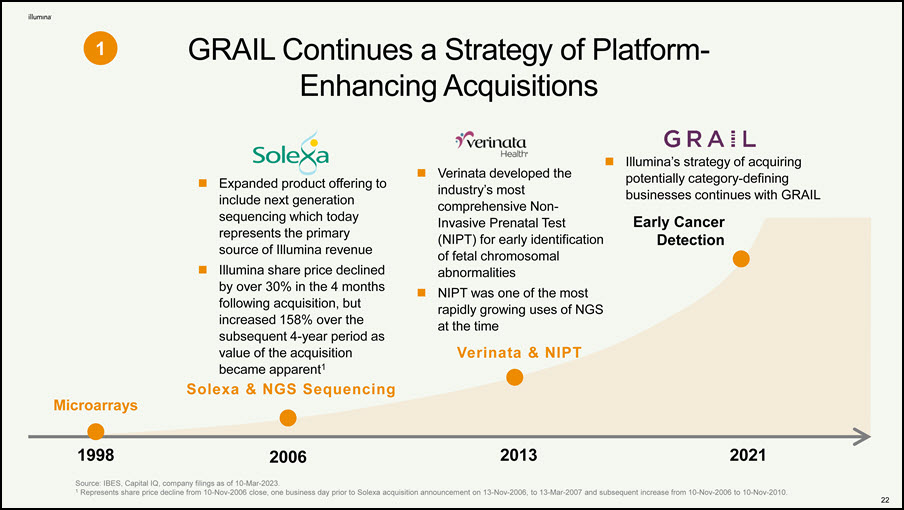

GRAIL Continues a Strategy of Platform- Enhancing Acquisitions Source: IBES, Capital IQ, company filings as of 10-Mar-2023. 1 Represents share price decline from 10-Nov-2006 close, one business day prior to Solexa acquisition announcement on 13-Nov-2006, to 13-Mar-2007 and subsequent increase from 10-Nov-2006 to 10-Nov-2010. 2006 1998 2013 2021 Solexa & NGS Sequencing Microarrays Expanded product offering to include next generation sequencing which today represents the primary source of Illumina revenue Illumina share price declined by over 30% in the 4 months following acquisition, but increased 158% over the subsequent 4-year period as value of the acquisition became apparent1 Verinata developed the industry’s most comprehensive Non- Invasive Prenatal Test (NIPT) for early identification of fetal chromosomal abnormalities NIPT was one of the most rapidly growing uses of NGS at the time Verinata & NIPT Illumina’s strategy of acquiring potentially category-defining businesses continues with GRAIL Early Cancer Detection 1 22

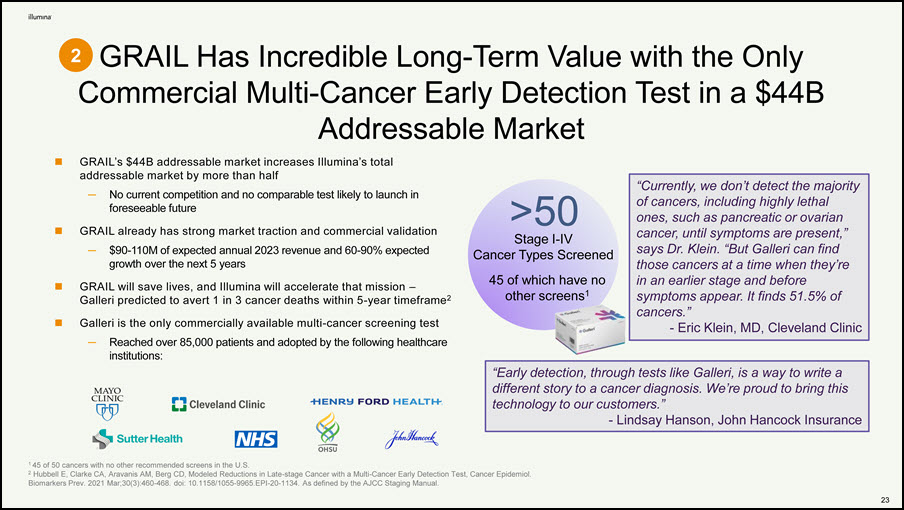

GRAIL Has Incredible Long-Term Value with the Only Commercial Multi-Cancer Early Detection Test in a $44B Addressable Market 1 45 of 50 cancers with no other recommended screens in the U.S. 2 Hubbell E, Clarke CA, Aravanis AM, Berg CD, Modeled Reductions in Late-stage Cancer with a Multi-Cancer Early Detection Test, Cancer Epidemiol. Biomarkers Prev. 2021 Mar;30(3):460-468. doi: 10.1158/1055-9965.EPI-20-1134. As defined by the AJCC Staging Manual. >50 Stage I-IV Cancer Types Screened 45 of which have no other screens1 GRAIL’s $44B addressable market increases Illumina’s total addressable market by more than half — No current competition and no comparable test likely to launch in foreseeable future GRAIL already has strong market traction and commercial validation — $90-110M of expected annual 2023 revenue and 60-90% expected growth over the next 5 years GRAIL will save lives, and Illumina will accelerate that mission – Galleri predicted to avert 1 in 3 cancer deaths within 5-year timeframe2 Galleri is the only commercially available multi-cancer screening test — Reached over 85,000 patients and adopted by the following healthcare institutions: “Early detection, through tests like Galleri, is a way to write a different story to a cancer diagnosis. We’re proud to bring this technology to our customers.” - Lindsay Hanson, John Hancock Insurance 2 “Currently, we don’t detect the majority of cancers, including highly lethal ones, such as pancreatic or ovarian cancer, until symptoms are present,” says Dr. Klein. “But Galleri can find those cancers at a time when they’re in an earlier stage and before symptoms appear. It finds 51.5% of cancers.” - Eric Klein, MD, Cleveland Clinic 22

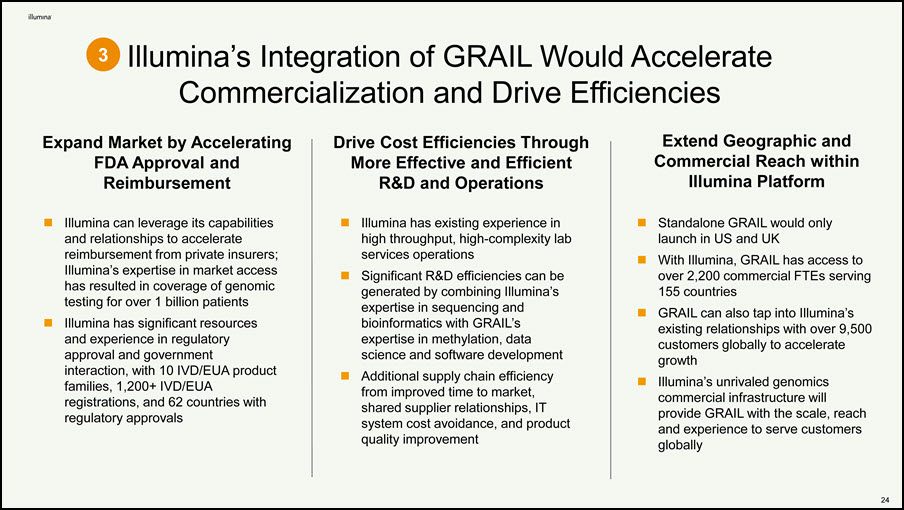

Illumina’s Integration of GRAIL Would Accelerate Commercialization and Drive Efficiencies 3 Expand Market by Accelerating FDA Approval and Reimbursement Illumina can leverage its capabilities and relationships to accelerate reimbursement from private insurers; Illumina’s expertise in market access has resulted in coverage of genomic testing for over 1 billion patients Illumina has significant resources and experience in regulatory approval and government interaction, with 10 IVD/EUA product families, 1,200+ IVD/EUA registrations, and 62 countries with regulatory approvals Drive Cost Efficiencies Through More Effective and Efficient R&D and Operations Illumina has existing experience in high throughput, high-complexity lab services operations Significant R&D efficiencies can be generated by combining Illumina’s expertise in sequencing and bioinformatics with GRAIL’s expertise in methylation, data science and software development Additional supply chain efficiency from improved time to market, shared supplier relationships, IT system cost avoidance, and product quality improvement Extend Geographic and Commercial Reach within Illumina Platform 22 Standalone GRAIL would only launch in US and UK With Illumina, GRAIL has access to over 2,200 commercial FTEs serving 155 countries GRAIL can also tap into Illumina’s existing relationships with over 9,500 customers globally to accelerate growth Illumina’s unrivaled genomics commercial infrastructure will provide GRAIL with the scale, reach and experience to serve customers globally

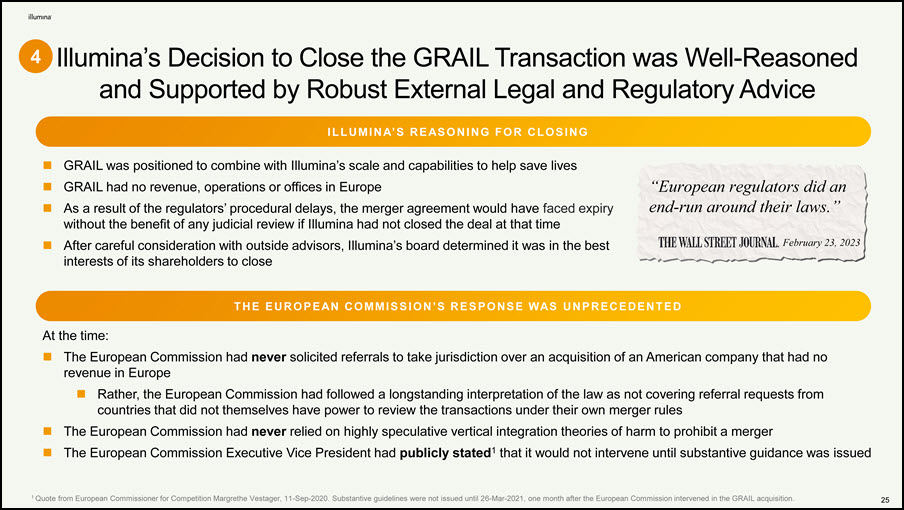

25 Illumina’s Decision to Close the GRAIL Transaction was Well-Reasoned and Supported by Robust External Legal and Regulatory Advice At the time: The European Commission had never solicited referrals to take jurisdiction over an acquisition of an American company that had no revenue in Europe Rather, the European Commission had followed a longstanding interpretation of the law as not covering referral requests from countries that did not themselves have power to review the transactions under their own merger rules The European Commission had never relied on highly speculative vertical integration theories of harm to prohibit a merger The European Commission Executive Vice President had publicly stated1 that it would not intervene until substantive guidance was issued I L L U M I N A’ S R E AS O N I N G F O R C L O S I N G T H E E U R O P EAN C O M M I S S I ON ’ S R E S P O NSE WAS U N P R EC EDEN T ED 1 Quote from European Commissioner for Competition Margrethe Vestager, 11-Sep-2020. Substantive guidelines were not issued until 26-Mar-2021, one month after the European Commission intervened in the GRAIL acquisition. GRAIL was positioned to combine with Illumina’s scale and capabilities to help save lives GRAIL had no revenue, operations or offices in Europe As a result of the regulators’ procedural delays, the merger agreement would have faced expiry without the benefit of any judicial review if Illumina had not closed the deal at that time After careful consideration with outside advisors, Illumina’s board determined it was in the best interests of its shareholders to close “European regulators did an end-run around their laws.” February 23, 2023 4

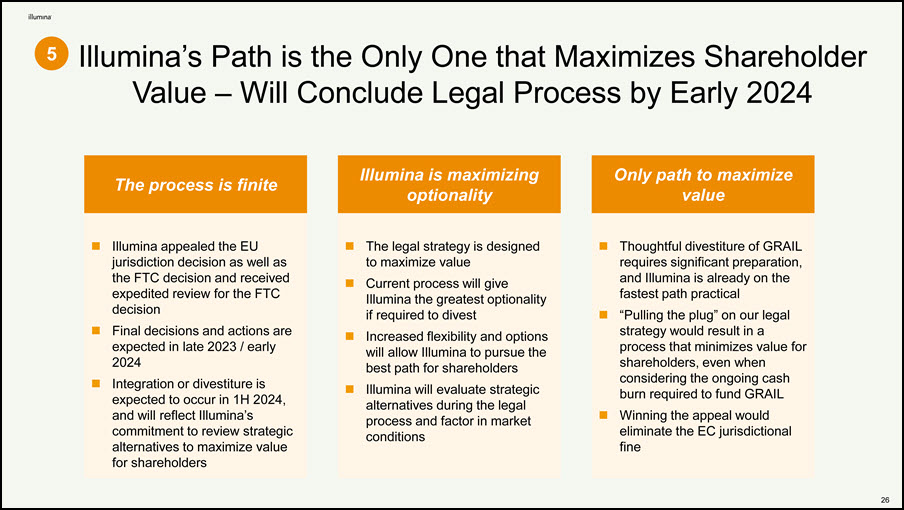

Illumina’s Path is the Only One that Maximizes Shareholder Value – Will Conclude Legal Process by Early 2024 5 32 The process is finite Only path to maximize value Illumina is maximizing optionality Illumina appealed the EU jurisdiction decision as well as the FTC decision and received expedited review for the FTC decision Final decisions and actions are expected in late 2023 / early 2024 Integration or divestiture is expected to occur in 1H 2024, and will reflect Illumina’s commitment to review strategic alternatives to maximize value for shareholders The legal strategy is designed to maximize value Current process will give Illumina the greatest optionality if required to divest Increased flexibility and options will allow Illumina to pursue the best path for shareholders Illumina will evaluate strategic alternatives during the legal process and factor in market conditions Thoughtful divestiture of GRAIL requires significant preparation, and Illumina is already on the fastest path practical “Pulling the plug” on our legal strategy would result in a process that minimizes value for shareholders, even when considering the ongoing cash burn required to fund GRAIL Winning the appeal would eliminate the EC jurisdictional fine

Illumina’s Board is Highly Qualified with Deep Industry Experience and Expertise 32

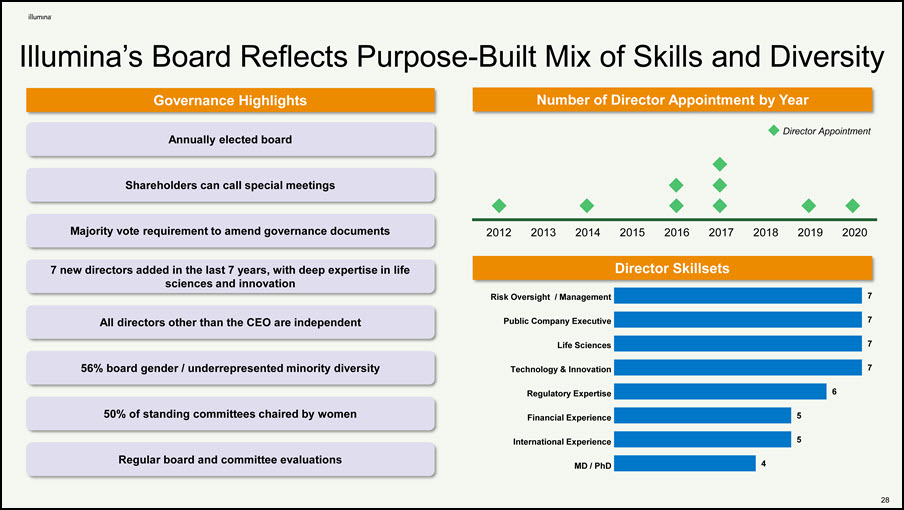

Illumina’s Board Reflects Purpose-Built Mix of Skills and Diversity Governance Highlights Risk Oversight / Management Number of Director Appointment by Year Public Company Executive Life Sciences Technology & Innovation Regulatory Expertise Financial Experience International Experience MD / PhD 2012 2013 2014 2015 2016 2017 2018 2019 2020 Director Appointment Director Skillsets 7 7 7 7 6 5 5 4 Annually elected board Shareholders can call special meetings Majority vote requirement to amend governance documents 7 new directors added in the last 7 years, with deep expertise in life sciences and innovation All directors other than the CEO are independent 56% board gender / underrepresented minority diversity 50% of standing committees chaired by women Regular board and committee evaluations 32

29 Philip Schiller Adds expertise from an extensive career in bringing world class products to market with Apple, where he led product marketing, developer relations, business marketing, education marketing, international marketing, and App Store programs in the period when Apple created and launched the Mac, iPod, iTunes, iPhone, the App Store, Apple TV, and the Apple Watch. Susan Siegel B rings extensive experience identifying and implementing industry shaping innovation, including transforming Affymetrix from an early startup to a multibillion dollar publicly listed global genomics leader; VC investing in tools and clinical diagnostics companies; and creating and leading GE Ventures, leading GE Business Innovations, and serving as GE’s first Chief Innovation Officer. John Thompson Chairman of the Board B rings significant executive leadership and transformation experience from his ten year tenure as CEO of Symantec, where he transformed the company into an industry leader and grew revenue from $0.6bn to $ Robert Epstein, M.D. Brings unique customer focus from >35 years’ experience in securing reimbursement for diagnostics and drugs in the US and EU as well as two decades leading clinical epidemiology studies tied to genomics, most recently as President of Medco UBC, a global clinical research services organization. Gary Guthart , Ph. Contributes deep industry experience as well as scientific and operational acumen from his tenure as CEO of Intuitive Surgical and his previous experience developing foundation technology for computer enhanced surgery at SRI International (formerly Stanford Research Institute). Frances Arnold, Ph.D. Adds a broad and powerful scientific perspective to the Board's analysis of Illumina’s business and its opportunities, developed over her Nobel Prize winning career making breakthroughs in enzyme development which have led to significant advancements in medicine. Caroline Dorsa Enhances Board oversight with extensive financial acumen and corporate leadership developed over a career in various financial and operational roles at Merck & Co, and public company CFO r oles at Public Service Enterprise Group Inc, Gilead Sciences, and Avaya. Illumina’s Success Derives from the Extensive, Deep, and Highly Relevant Expertise of Our Board Francis deSouza Chief Executive Officer Leveraged his technical, scientific, and entrepreneurial business expertise to expand Illumina’s scale and scope, growing revenue from $ 2.2bn to $4.6bn since becoming CEO in 2016. Audit Science & Technology Nominating/Corporate Governance Compensation Scott Gottlieb, M.D. Adds essential healthcare regulatory experience from his tenure as the 23rd Commissioner of the U.S. Food and Drug Administration (FDA), as well as his career focus on developing and implementing innovative approaches to improving medical outcomes, reshaping healthcare delivery, and expanding consumer choice and safety. Board Committees:

Illumina’s Thorough Nomination Process Yields a Board of Exemplary Skills and Experience Risk Management Public Company Executive Life Sciences Technology & Innovation Regulatory Experience Financial Expertise International Experience MD / PhD Frances Arnold Francis deSouza Caroline Dorsa Robert Epstein Scott Gottlieb Gary Guthart Philip Schiller Susan Siegel John Thompson Total 7 / 9 7 / 9 7 / 9 7 / 9 6 / 9 5 / 9 5 / 9 4 / 9 32

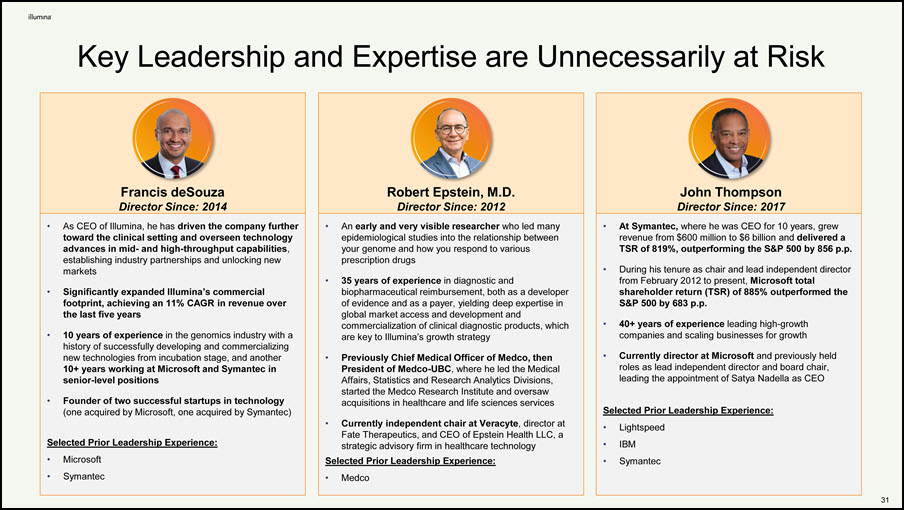

Key Leadership and Expertise are Unnecessarily at Risk At Symantec, where he was CEO for 10 years, grew revenue from $600 million to $6 billion and delivered a TSR of 819%, outperforming the S&P 500 by 856 p.p. During his tenure as chair and lead independent director from February 2012 to present, Microsoft total shareholder return (TSR) of 885% outperformed the S&P 500 by 683 p.p. 40+ years of experience leading high-growth companies and scaling businesses for growth Currently director at Microsoft and previously held roles as lead independent director and board chair, leading the appointment of Satya Nadella as CEO As CEO of Illumina, he has driven the company further toward the clinical setting and overseen technology advances in mid- and high-throughput capabilities, establishing industry partnerships and unlocking new markets Significantly expanded Illumina’s commercial footprint, achieving an 11% CAGR in revenue over the last five years 10 years of experience in the genomics industry with a history of successfully developing and commercializing new technologies from incubation stage, and another 10+ years working at Microsoft and Symantec in senior-level positions Founder of two successful startups in technology (one acquired by Microsoft, one acquired by Symantec) John Thompson Director Since: 2017 Francis deSouza Director Since: 2014 Robert Epstein, M.D. Director Since: 2012 Selected Prior Leadership Experience: Microsoft Symantec An early and very visible researcher who led many epidemiological studies into the relationship between your genome and how you respond to various prescription drugs 35 years of experience in diagnostic and biopharmaceutical reimbursement, both as a developer of evidence and as a payer, yielding deep expertise in global market access and development and commercialization of clinical diagnostic products, which are key to Illumina’s growth strategy Previously Chief Medical Officer of Medco, then President of Medco-UBC, where he led the Medical Affairs, Statistics and Research Analytics Divisions, started the Medco Research Institute and oversaw acquisitions in healthcare and life sciences services Currently independent chair at Veracyte, director at Fate Therapeutics, and CEO of Epstein Health LLC, a strategic advisory firm in healthcare technology Selected Prior Leadership Experience: Medco 32 Selected Prior Leadership Experience: Lightspeed IBM Symantec

Illumina’s Compensation Program Promotes Executive Alignment with Shareholder Interests Compensation Program Design CEO Compensation Base Salary (4%) Performance Based Cash Incentive Long-Term Equity1 At-Risk (96%) 50% 50% Pre-set corporate revenue goals Pre-set corporate operating income goals 75% PSUs earned based on achievement of pre-set EPS and, beginning in 2023, relative TSR targets (100% performance based) 4% 5% 91% One-time special grant of stock options was awarded to NEOs in order to further align their interests with our stockholders, provide an additional incentive to drive the developments critical to our future success, and provide a retention incentive in a highly competitive talent environment Stock options will only realize value if incremental stockholder value is created - should the stock price not exceed the exercise price, the options would be forfeited at the end of the option term. Long-Term Equity Compensation Performance Based Cash Incentive Base Salary At-Risk Compensation 96% 32 of CEO compensation is at-risk 25% RSUs awarded vest over a 4-year period 1 2022 annual long-term equity awards for three NEOs were entirely comprised of PSUs. No PSUs vest for relative 3-year TSR < 25th percentile Payment capped at target if absolute 3-year TSR is negative

Carl Icahn’s Nominees are Not Right for Illumina’s Board 32

34 Icahn is Unwilling to Consider Any Other Resolution; “My Guys Answer to Me” 1 Per Icahn’s nomination notice. 2 Per 02-Mar-2023 conversation between Illumina and Carl Icahn. 3 Per 23-Feb-2023, 02-Mar-2023, 08-Mar-2023, 09-Mar-2023 conversations between Illumina and Carl Icahn and 14-Mar-2023 CNBC interview. February 13, 2023 Icahn purchased his first share in Illumina1 February 20, 2023 Illumina received Icahn’s nomination questionnaire request without any prior communications February 23, 2023 Illumina held preliminary discussions with Icahn during which Icahn disclosed intent to nominate a slate of 3 directors. Icahn later emailed his nomination notice to Illumina on the same day March 2, 2023 Illumina met with Icahn at his offices where Icahn proclaimed that he “would not even support Jesus Christ” as an independent candidate over his own nominees March 7 - 8, 2023 Illumina’s Nominating and Corporate Governance Committee interviewed Icahn’s nominees After Icahn’s initial outreach, Illumina engaged with Icahn in good faith and attempted multiple times to reach a solution that was amenable to both parties and in the best interest of all shareholders, including offering to appoint one of Icahn’s nominees alongside a mutually agreed independent director known to Icahn March 8 - 9, 2023 Illumina attempted to reach a mutually agreeable solution with Icahn that is in the best interest of all shareholders – Icahn declined all proposed options (including one he originally suggested) and stated he is not wiling to consider anything less than the appointment of all 3 of his current or former employees When Illumina did not accede to Icahn’s demand that Illumina accept all three of his nominees as directors, he chose to launch a costly and distracting proxy contest Icahn has made it clear - his campaign is about getting his “guys” on the Board in order to exert control on behalf of Icahn, not all shareholders (“My guys answer to me”)2 Icahn has repeatedly noted that he has not developed an investment thesis, does not know how to run the business and believes the business is well run3 March 13, 2023 Icahn issued public letter and launched proxy contest

Icahn is Correct; He Does Not Understand Illumina NO actionable plan to accelerate the resolution of GRAIL NO qualified director candidates NO plan to enhance Illumina’s core operations 1 Per 02-Mar-2023 conversation between Illumina and Icahn. 2 Per CNBC interview on 14-Mar-2023. GRAIL is “the best equipment”2 “not saying Icahn Associates knows what to do with this company”1 Supportive in private, but “that’s not what I would say if this thing goes public” 1 “I’m not getting into that because I’m not a lawyer. I haven’t really studied it” 2 Across public appearances and private conversations, Icahn’s comments imply he has nothing to add to Illumina’s business or strategy Carl Icahn has… 39

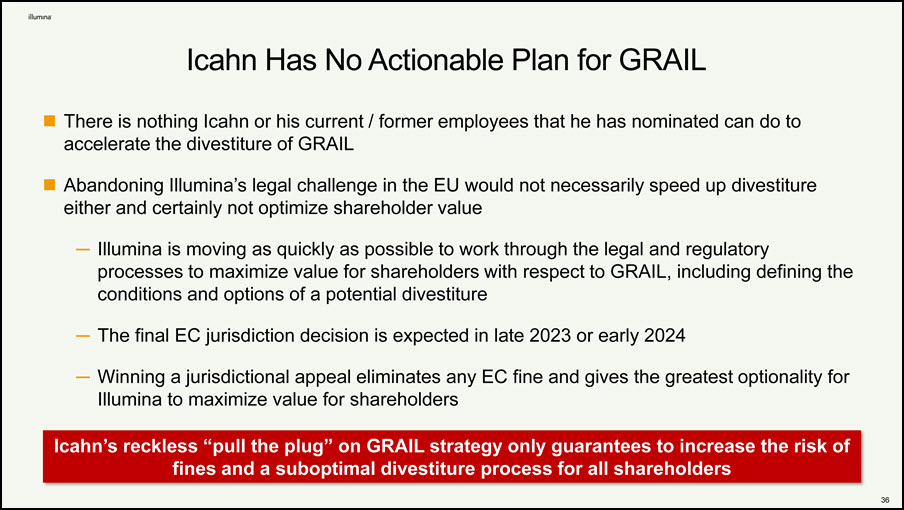

Icahn Has No Actionable Plan for GRAIL There is nothing Icahn or his current / former employees that he has nominated can do to accelerate the divestiture of GRAIL Abandoning Illumina’s legal challenge in the EU would not necessarily speed up divestiture either and certainly not optimize shareholder value Illumina is moving as quickly as possible to work through the legal and regulatory processes to maximize value for shareholders with respect to GRAIL, including defining the conditions and options of a potential divestiture The final EC jurisdiction decision is expected in late 2023 or early 2024 Winning a jurisdictional appeal eliminates any EC fine and gives the greatest optionality for Illumina to maximize value for shareholders Icahn’s reckless “pull the plug” on GRAIL strategy only guarantees to increase the risk of fines and a suboptimal divestiture process for all shareholders 39

Ad Hominem Attacks are Not a Plan Private Demands Supportive of the company, management and the plan “Just want my three guys to fix this GRAIL thing”1 Threatens proxy contest and personal attacks Public Pressure TV “interviews” focused on GRAIL Weekly letters attacking the company Goes Public with Personal Attacks Goes after management by name Private investigators and shadow tactics Shareholders should ask… … what does any of this have to do with creating value? Illumina’s board values its ongoing dialogue with shareholders – there is no monopoly on good ideas… …But Icahn has no ideas for value creation, just increasingly aggressive attacks 39 1 Per 02-Mar-2023 conversation between Illumina and Icahn.

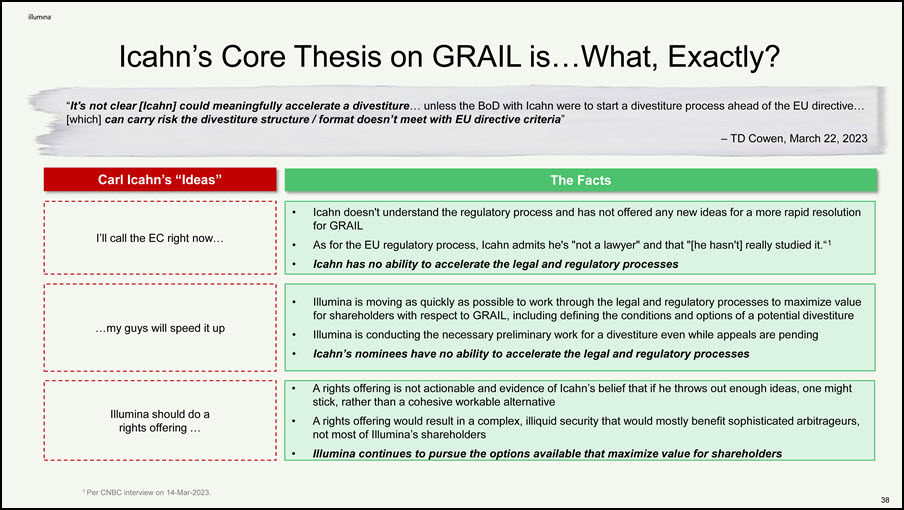

Icahn’s Core Thesis on GRAIL is…What, Exactly? The Facts Carl Icahn’s “Ideas” 39 I’ll call the EC right now… …my guys will speed it up Icahn doesn't understand the regulatory process and has not offered any new ideas for a more rapid resolution for GRAIL As for the EU regulatory process, Icahn admits he's "not a lawyer" and that "[he hasn't] really studied it.“1 Icahn has no ability to accelerate the legal and regulatory processes “It's not clear [Icahn] could meaningfully accelerate a divestiture… unless the BoD with Icahn were to start a divestiture process ahead of the EU directive… [which] can carry risk the divestiture structure / format doesn’t meet with EU directive criteria” – TD Cowen, March 22, 2023 Illumina is moving as quickly as possible to work through the legal and regulatory processes to maximize value for shareholders with respect to GRAIL, including defining the conditions and options of a potential divestiture Illumina is conducting the necessary preliminary work for a divestiture even while appeals are pending Icahn’s nominees have no ability to accelerate the legal and regulatory processes Illumina should do a rights offering … A rights offering is not actionable and evidence of Icahn’s belief that if he throws out enough ideas, one might stick, rather than a cohesive workable alternative A rights offering would result in a complex, illiquid security that would mostly benefit sophisticated arbitrageurs, not most of Illumina’s shareholders Illumina continues to pursue the options available that maximize value for shareholders 1 Per CNBC interview on 14-Mar-2023.

Icahn’s Campaign Reads like Good Fiction, but the Facts are Better 1 Peers include Singular Genomics, Oxford Nanopore, PacBio, 10X Genomics, Berkeley Lights and NanoString 2 Per CNBC interview on 14-Mar-2023. 3 Based on close price as of 17-Apr-2023 (excluding stock options). Illumina has lost $50 billion in value since August 2021 My nominees can fix GRAIL Illumina’s Board and Management made a mistake acquiring GRAIL when there are regulatory prohibitions Illumina is taking on debt in order to fund GRAIL Myth: Icahn’s Narrative The Facts Illumina has declined in market cap by a lower percentage than the peer median and average over the time period Icahn cites1 – Illumina is not unique in facing these industry headwinds and has outperformed peers despite macro environment challenges Icahn’s nominees have no additive experience or expertise to expedite a resolution for GRAIL and bringing them onto the board risks damaging Illumina’s existing value creation strategy. GRAIL has tremendous long-term value creation potential – Carl Icahn himself agrees that GRAIL is Illumina’s “best equipment”2 The Board’s decision to close on GRAIL was carefully considered and informed by thorough analysis – at the time, the EC had never challenged an acquisition of an American company that had no revenue in Europe Illumina has committed to reduce its leverage over the next year through the pay down of $500 million of debt. Timing and requirements of the EC's divestiture order could affect whether any incremental leverage is required – another reason to not "pull the plug" on the legal strategy Management and directors have no problem dragging out the GRAIL divestiture given their de minimis stock ownership Company has been clear in its next steps with GRAIL and obligation to follow EC legal decisions; Management and Directors have an average of ~$2.7 million3 at stake in Illumina, and key executives hold stock options that only have value if the stock price increases 39

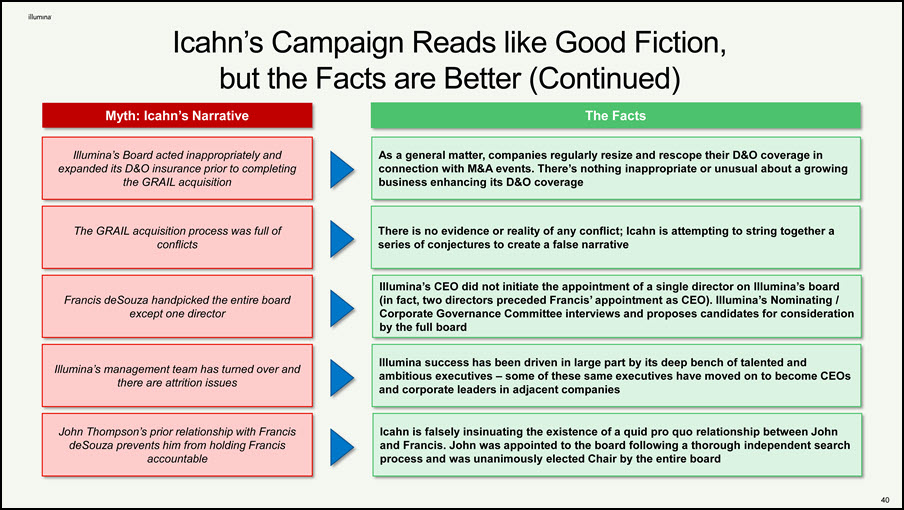

Icahn’s Campaign Reads like Good Fiction, but the Facts are Better (Continued) Illumina’s Board acted inappropriately and expanded its D&O insurance prior to completing the GRAIL acquisition The GRAIL acquisition process was full of conflicts Francis deSouza handpicked the entire board except one director Illumina’s management team has turned over and there are attrition issues As a general matter, companies regularly resize and rescope their D&O coverage in connection with M&A events. There’s nothing inappropriate or unusual about a growing business enhancing its D&O coverage There is no evidence or reality of any conflict; Icahn is attempting to string together a series of conjectures to create a false narrative Illumina’s CEO did not initiate the appointment of a single director on Illumina’s board (in fact, two directors preceded Francis’ appointment as CEO). Illumina’s Nominating / Corporate Governance Committee interviews and proposes candidates for consideration by the full board Illumina success has been driven in large part by its deep bench of talented and ambitious executives – some of these same executives have moved on to become CEOs and corporate leaders in adjacent companies John Thompson’s prior relationship with Francis deSouza prevents him from holding Francis accountable Icahn is falsely insinuating the existence of a quid pro quo relationship between John and Francis. John was appointed to the board following a thorough independent search process and was unanimously elected Chair by the entire board Myth: Icahn’s Narrative The Facts 39

41 Icahn is Not a Healthcare Investor Pre-2011 Lead life sciences portfolio manager left Icahn in 2011 to found Sarissa Source: FactSet, public filings. 1 Adjusted stock price return to date subtracts S&P 500 returns from company stock price performance. Enzon adjusted stock price return reflects return after Alex Denner’s departure from Enzon Board on 20-Nov-2013. Some healthcare volume and some success Of three healthcare investments, two resulted in value destruction (218%) 1 (81%) 1 Icahn has had very little experience and a poor track record in healthcare investments over the past decade Past Decade

42 Icahn and His Nominees Want to Set Strategy at Illumina – Do They Have Any Relevant Experience? Icahn has no experience in genomics or sequencing, and very little in healthcare generally Among Icahn’s 50 shareholder activism campaigns since 1996, ~70% have been at natural resources, industrials and consumer companies None of Icahn’s 3 nominees have any scientific or technical knowledge In his current public equity portfolio, only ~2% of all positions are comprised of healthcare investments1 1 FactSet as of April 2023. 2 Per 23-Feb-2023 conversation between Illumina and Carl Icahn. Overview of Icahn’s Prior Campaigns Even Icahn Acknowledges His Slate is Suboptimal 2 Healthcare / Genomics Public Company Leadership Regulatory Experience Independent of Icahn O O O O O O O O O O O O Jesse Lynn General Counsel of Icahn Enterprises LP Andrew Teno Portfolio Manager at Icahn Capital LP Vincent Intrieri Former Sr. Managing Director of Icahn Capital LP Icahn’s nominees’ only qualification appears to be their allegiance to Icahn Why couldn’t he find more qualified nominees?

After Illumina Interviewed Icahn’s Nominees, it is Clear They Provide NO Additive Skills, NO Industry Experience, and NO Independence from Icahn Jesse Lynn Andrew Teno Vincent Intrieri No biotech experience as an executive or a director Already overboarded with 4 public board directorships No additive skills that the Illumina Board does not already have – Lynn’s “broad business, legal and administration experience, experience as a public company director and experience in a variety of industries” do not bring anything new or fill any gaps in experiences for Illumina’s Board Icahn’s current employee No biotech experience as an executive or a director Would be overboarded with 4 public board directorships if elected at Illumina No additive skills that the Illumina Board does not already have – Teno’s “broad business and investment experience, experience as a public company director, including as an Audit Committee member and familiarity with national and international business matters” do not bring anything new or fill any gaps in experiences for Illumina’s Board Icahn’s current employee No biotech experience as an executive or a director No additive skills that the Illumina Board does not already have – Intrieri’s “expertise in finance and accounting, international operations, strategy and public company governance” do not bring anything new or fill any gaps in experiences for Illumina’s Board Icahn’s former employee Icahn is trying to replace our highly qualified board with his unqualified nominees 43

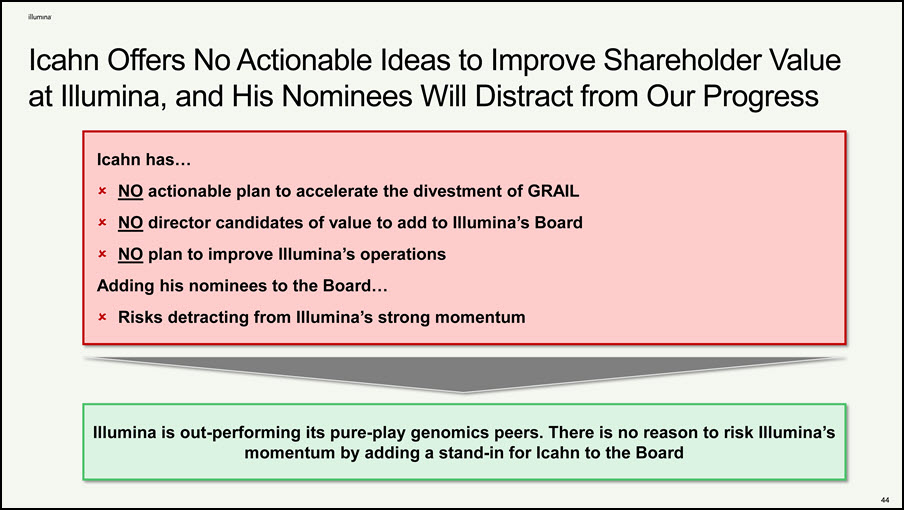

Icahn Offers No Actionable Ideas to Improve Shareholder Value at Illumina, and His Nominees Will Distract from Our Progress Icahn has… NO actionable plan to accelerate the divestment of GRAIL NO director candidates of value to add to Illumina’s Board NO plan to improve Illumina’s operations Adding his nominees to the Board… Risks detracting from Illumina’s strong momentum Illumina is out-performing its pure-play genomics peers. There is no reason to risk Illumina’s momentum by adding a stand-in for Icahn to the Board 43

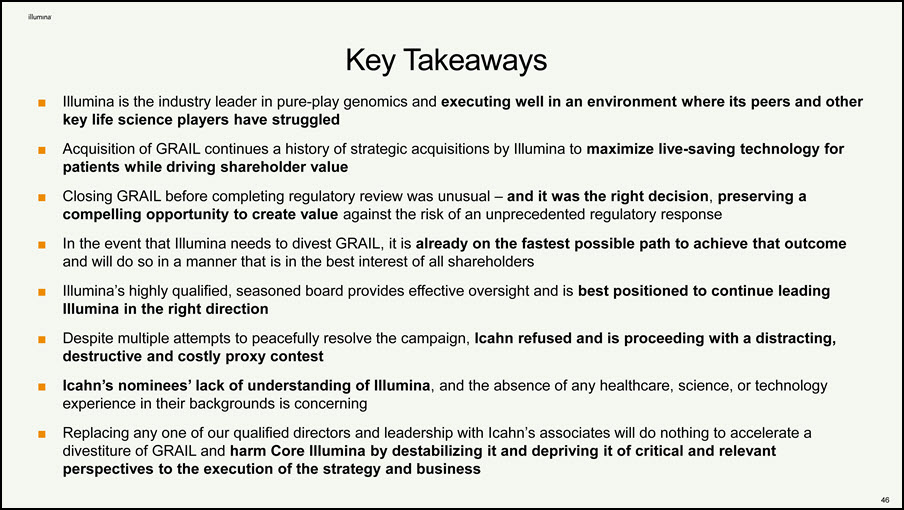

Key Takeaways 43 Illumina is the industry leader in pure-play genomics and executing well in an environment where its peers and other key life science players have struggled Acquisition of GRAIL continues a history of strategic acquisitions by Illumina to maximize live-saving technology for patients while driving shareholder value Closing GRAIL before completing regulatory review was unusual – and it was the right decision, preserving a compelling opportunity to create value against the risk of an unprecedented regulatory response In the event that Illumina needs to divest GRAIL, it is already on the fastest possible path to achieve that outcome and will do so in a manner that is in the best interest of all shareholders Illumina’s highly qualified, seasoned board provides effective oversight and is best positioned to continue leading Illumina in the right direction Despite multiple attempts to peacefully resolve the campaign, Icahn refused and is proceeding with a distracting, destructive and costly proxy contest Icahn’s nominees’ lack of understanding of Illumina, and the absence of any healthcare, science, or technology experience in their backgrounds is concerning Replacing any one of our qualified directors and leadership with Icahn’s associates will do nothing to accelerate a divestiture of GRAIL and harm Core Illumina by destabilizing it and depriving it of critical and relevant perspectives to the execution of the strategy and business

Vote “FOR ALL” of Illumina’s Director Nominees on the WHITE Proxy Card Today

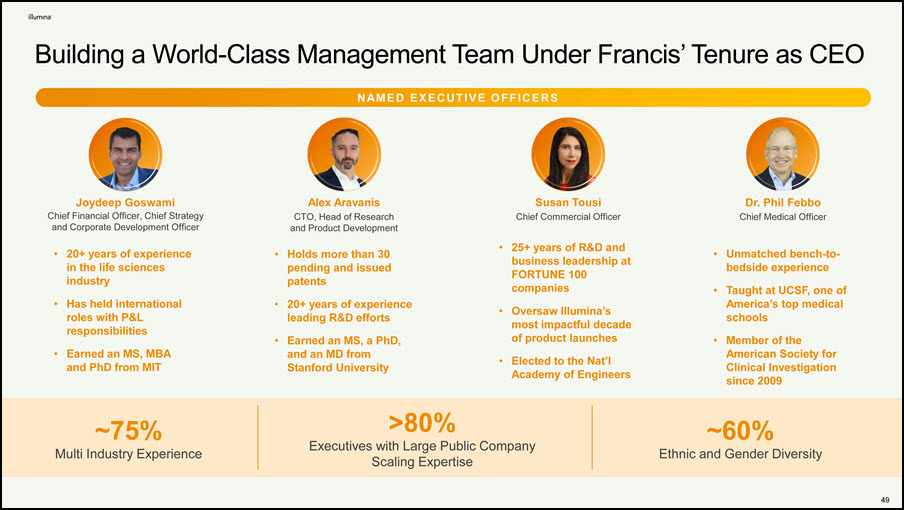

Building a World-Class Management Team Under Francis’ Tenure as CEO Joydeep Goswami Chief Financial Officer, Chief Strategy and Corporate Development Officer Alex Aravanis CTO, Head of Research and Product Development Holds more than 30 pending and issued patents 20+ years of experience leading R&D efforts Earned an MS, a PhD, and an MD from Stanford University 20+ years of experience in the life sciences industry Has held international roles with P&L responsibilities Earned an MS, MBA and PhD from MIT Susan Tousi Chief Commercial Officer 25+ years of R&D and business leadership at FORTUNE 100 companies Oversaw Illumina’s most impactful decade of product launches Elected to the Nat’l Academy of Engineers Dr. Phil Febbo Chief Medical Officer Unmatched bench-to- bedside experience Taught at UCSF, one of America’s top medical schools Member of the American Society for Clinical Investigation since 2009 N AM E D E X E C UT I VE O F F I C E R S ~75% Multi Industry Experience ~60% Ethnic and Gender Diversity >80% Executives with Large Public Company Scaling Expertise 48

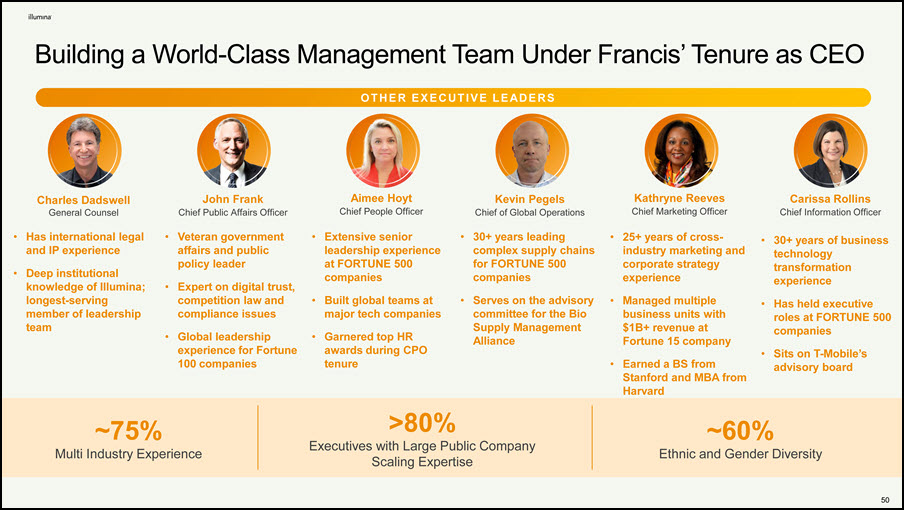

Building a World-Class Management Team Under Francis’ Tenure as CEO ~75% Multi Industry Experience ~60% Ethnic and Gender Diversity >80% Executives with Large Public Company Scaling Expertise Kevin Pegels Chief of Global Operations Aimee Hoyt Chief People Officer Kathryne Reeves Chief Marketing Officer Carissa Rollins Chief Information Officer Extensive senior leadership experience at FORTUNE 500 companies Built global teams at major tech companies Garnered top HR awards during CPO tenure 30+ years leading complex supply chains for FORTUNE 500 companies Serves on the advisory committee for the Bio Supply Management Alliance 25+ years of cross- industry marketing and corporate strategy experience Managed multiple business units with $1B+ revenue at Fortune 15 company Earned a BS from Stanford and MBA from Harvard 30+ years of business technology transformation experience Has held executive roles at FORTUNE 500 companies Sits on T-Mobile’s advisory board John Frank Chief Public Affairs Officer Charles Dadswell General Counsel Has international legal and IP experience Deep institutional knowledge of Illumina; longest-serving member of leadership team Veteran government affairs and public policy leader Expert on digital trust, competition law and compliance issues Global leadership experience for Fortune 100 companies O T H E R E X E C UT I VE L E AD E R S 48

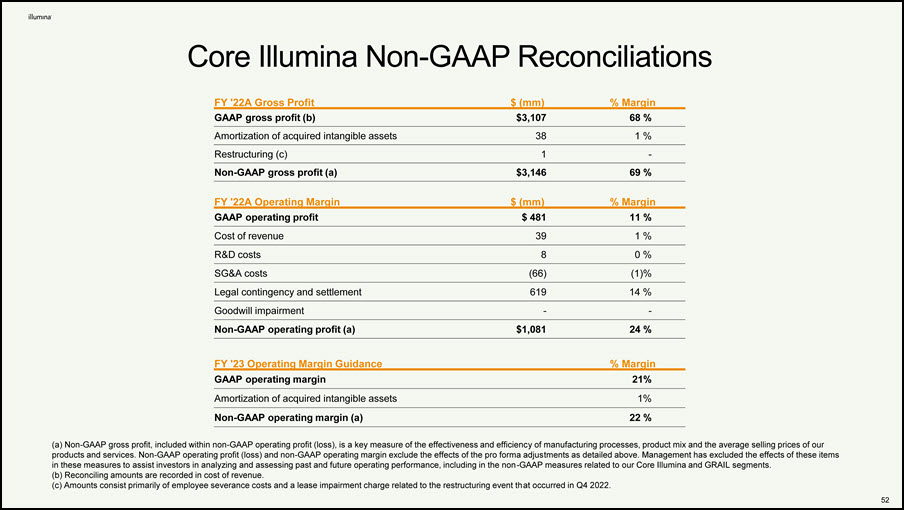

Statement regarding use of non-GAAP financial measures 48 The company reports non-GAAP results for diluted earnings per share, net income, gross margin, operating expenses, including research and development expense, selling general and administrative expense, legal contingencies and settlement, and goodwill impairment, operating income (loss), operating margin, gross profit (loss), other income (expense), tax provision, constant currency revenue growth, and free cash flow (on a consolidated and, as applicable, segment basis for our Core Illumina and GRAIL segments) in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The company’s financial measures under GAAP include substantial charges such as amortization of acquired intangible assets among others that are listed in the itemized reconciliations between GAAP and non-GAAP financial measures included in this press release, as well as the effects of currency translation. Management has excluded the effects of these items in non-GAAP measures to assist investors in analyzing and assessing past and future operating performance, including in the non- GAAP measures related to our Core Illumina and GRAIL segments. Additionally, non-GAAP net income and diluted earnings per share are key components of the financial metrics utilized by the company’s board of directors to measure, in part, management’s performance and determine significant elements of management’s compensation. The company only provides non‐GAAP measures for operating margin targets because of the difficulty of projecting with reasonable certainty the financial impact of specific GAAP operating adjustments, such as acquisition‐related expenses, gains and losses from our strategic investments, fair value adjustments related to contingent consideration and contingent value rights, potential future asset impairments, restructuring activities, and the ultimate outcome of pending litigation without unreasonable effort. These items are uncertain, inherently difficult to predict, depend on various factors, and could have a material impact on GAAP measures for the operating margin target periods. For the same reasons, the company is unable to address the significance of the unavailable information, which could be material to future results. The company encourages investors to carefully consider its results under GAAP, as well as its supplemental non-GAAP information and the reconciliation between these measures, to more fully understand its business. Reconciliations between GAAP and non-GAAP results are presented in the following tables of this presentation.

Core Illumina Non-GAAP Reconciliations 48 FY '22A Gross Profit $ (mm) % Margin GAAP gross profit (b) $3,107 68 % Amortization of acquired intangible assets 38 1 % Restructuring (c) 1 - Non-GAAP gross profit (a) $3,146 69 % FY '22A Operating Margin $ (mm) % Margin GAAP operating profit $ 481 11 % Cost of revenue 39 1 % R&D costs 8 0 % SG&A costs (66) (1)% Legal contingency and settlement 619 14 % Goodwill impairment - - Non-GAAP operating profit (a) $1,081 24 % FY '23 Operating Margin Guidance % Margin GAAP operating margin 21% Amortization of acquired intangible assets 1% Non-GAAP operating margin (a) 22 % Non-GAAP gross profit, included within non-GAAP operating profit (loss), is a key measure of the effectiveness and efficiency of manufacturing processes, product mix and the average selling prices of our products and services. Non-GAAP operating profit (loss) and non-GAAP operating margin exclude the effects of the pro forma adjustments as detailed above. Management has excluded the effects of these items in these measures to assist investors in analyzing and assessing past and future operating performance, including in the non-GAAP measures related to our Core Illumina and GRAIL segments. Reconciling amounts are recorded in cost of revenue. Amounts consist primarily of employee severance costs and a lease impairment charge related to the restructuring event that occurred in Q4 2022.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding mandates, the future, business plans and other statements that are not historical in nature. These statements are made on the basis of Illumina’s views and assumptions regarding future events and business performance and plans as of the time the statements are made. These forward-looking statements may be accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “target,” “will” and other words and terms of similar meaning. Illumina does not undertake any obligation to update these statements unless required by applicable laws or regulations, and you should not place undue reliance on forward-looking statements. Among the important factors to which our business is subject that could cause actual results to differ materially from those in any forward-looking statements are: (i) changes in the rate of growth in the markets we serve; (ii) the volume, timing and mix of customer orders among our products and services; (iii) our ability to adjust our operating expenses to align with our revenue expectations; (iv) our ability to manufacture robust instrumentation and consumables; (v) the success of products and services competitive with our own; (vi) challenges inherent in developing, manufacturing, and launching new products and services, including expanding or modifying manufacturing operations and reliance on third-party suppliers for critical components; (vii) the impact of recently launched or pre-announced products and services on existing products and services; (viii) our ability to modify our business strategies to accomplish our desired operational goals; (ix) our ability to realize the anticipated benefits from prior or future actions to streamline and improve our R&D processes, reduce our operating expenses and maximize our revenue growth; (x) our ability to further develop and commercialize our instruments, consumables, and products, including Galleri™, the cancer screening test developed by GRAIL, to deploy new products, services, and applications, and to expand the markets for our technology platforms; (xi) the risks and costs associated with our ongoing inability to integrate GRAIL due to the interim measures imposed on us by the European Commission as a result of their prohibition of our acquisition of GRAIL; (xii) the risks and costs associated with the integration of GRAIL’s business if we are ultimately able to integrate GRAIL; (xiii) the risk that disruptions from the consummation of our acquisition of GRAIL and associated legal or regulatory proceedings, including related appeals, or obligations will harm our business, including current plans and operations; (xiv) the risk of incurring fines associated with the consummation of our acquisition of GRAIL and the possibility that we may be required to divest all or a portion of the assets or equity interests of GRAIL on terms that could be materially worse than the terms on which we acquired GRAIL; (xv) our ability to obtain approval by third-party payors to reimburse patients for our products; (xvi) our ability to obtain regulatory clearance for our products from government agencies; (xvii) our ability to successfully partner with other companies and organizations to develop new products, expand markets, and grow our business; (xviii) uncertainty, or adverse economic and business conditions, including as a result of slowing or uncertain economic growth, COVID-19 pandemic mitigation measures, or armed conflict; (xix) the application of generally accepted accounting principles, which are highly complex and involve many subjective assumptions, estimates, and judgments and (xx) legislative, regulatory and economic developments, together with the factors set forth in Illumina’s Annual Report on Form 10-K for the year ended January 1, 2023 under the caption “Risk Factors”, in information disclosed in public conference calls, the date and time of which are released beforehand, and in filings with the Securities and Exchange Commission (the SEC) including, among others, quarterly reports on Form 10-Q.

Additional Information and Where to Find It

Illumina has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for Illumina’s 2023 Annual Meeting of Stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY ILLUMINA AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Illumina free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Illumina are also available free of charge by accessing Illumina’s website at www.illumina.com.

Participants

Illumina, its directors and executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation by Illumina. Information about Illumina’s executive officers and directors, including information regarding the direct or indirect interests, by security holdings or otherwise, is available in Illumina’s definitive proxy statement for its 2023 Annual Meeting, which was filed with the SEC on April 20, 2023. To the extent holdings by our directors and executive officers of Illumina securities reported in the proxy statement for the 2023 Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at www.sec.gov.