| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM N-CSR |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

Investment Company Act file number 811-09903

| Mellon Funds Trust |

| (Exact name of Registrant as specified in charter) |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| Mark N. Jacobs, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

Registrant's telephone number, including area code: (212) 922-6000

Date of fiscal year end: 8/31

Date of reporting period: 8/31/04

FORM N-CSR

Item 1. Reports to Stockholders.

The Mellon Funds

| Mellon Large Cap Stock Fund |

| Mellon Income Stock Fund |

| Mellon Mid Cap Stock Fund |

| Mellon Small Cap Stock Fund |

| Mellon International Fund |

| Mellon Emerging Markets Fund |

| Mellon Balanced Fund |

ANNUAL REPORT August 31, 2004

| Contents | ||

| The Funds | ||

| Letter from the President | 2 | |

| Discussion of Funds’ Performance | ||

| Mellon Large Cap Stock Fund | 3 | |

| Mellon Income Stock Fund | 6 | |

| Mellon Mid Cap Stock Fund | 9 | |

| Mellon Small Cap Stock Fund | 12 | |

| Mellon International Fund | 15 | |

| Mellon Emerging Markets Fund | 18 | |

| Mellon Balanced Fund | 21 | |

| Understanding Your Fund’s Expenses | 24 | |

| Comparing Your Fund’s Expenses | ||

| With Those of Other Funds | 25 | |

| Statements of Investments | 26 | |

| Statements of Assets and Liabilities | 49 | |

| Statements of Operations | 51 | |

| Statements of Changes in Net Assets | 53 | |

| Financial Highlights | 58 | |

| Notes to Financial Statements | 73 | |

| Report of Independent Registered | ||

| Public Accounting Firm | 83 | |

| Important Tax Information | 84 | |

| Board Members Information | 86 | |

| Officers of the Trust | 88 | |

For More Information

| Back cover |

| The views expressed herein are current to the |

| date of this report. These views and the |

| composition of the funds’ portfolios are subject |

| to change at any time based on market and |

| other conditions. |

- Not FDIC-Insured

- Not Bank-Guaranteed

- May Lose Value

The Funds

| LETTER FROM THE PRESIDENT |

| Dear Shareholder: |

This annual report for The Mellon Funds covers the period from September 1, 2003, through August 31, 2004. Inside, you’ll find valuable information about how the funds were managed during the reporting period, including discussions with each fund manager.

Although strong performance during the closing months of 2003 contributed to generally attractive equity returns for the reporting period overall, stock prices have retreated modestly so far in 2004. In contrast, bond market sectors have remained relatively strong, despite higher short-term interest rates. Investors apparently have revised their expectations of U.S. economic growth downward in response to ongoing geopolitical tensions, high energy prices and some persistently disappointing labor statistics.

In these challenging times, we believe it remains critical to keep focused on a long-term wealth management strategy. The broad range of asset classes represented by The Mellon Funds provides an excellent opportunity to position your portfolio for all market environments and your portfolio manager welcomes the opportunity to work with you in meeting your overall wealth management objectives.

Thank you for your continued confidence in Mellon.

| Lawrence P. Keblusek President Mellon Funds Trust September 15, 2004 |

| DISCUSSION OF FUND PERFORMANCE |

Mellon Private Wealth Management Group’s Equity Management Team, Portfolio Manager

How did Mellon Large Cap Stock Fund perform relative to its benchmark?

For the 12-month period ended August 31, 2004, the fund’s Class M shares produced a total return of 7.95% while its Investor shares produced a total return of 7.88% .1 In comparison, the total return of the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), the fund’s benchmark, was 11.45% for the same period.2

We attribute these results to broadly based market strength during the first half of the reporting period, which was driven by greater U.S. economic growth and improving business fundamentals. Stocks generally declined during the second half of the reporting period in response to geopolitical and economic uncertainties, but on average, they held onto the majority of earlier gains.The fund’s returns underper-formed its benchmark, largely due to weakness in the technology and services sectors.

What is the fund’s investment approach?

The fund seeks investment returns consisting of capital appreciation and income that are consistently superior to those of the S&P 500 Index.To pursue its goal, the fund normally invests at least 80% of its assets in stocks of large-cap companies. Stocks are chosen through a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management.

When selecting securities, we use a computer model to identify and rank stocks within an industry or sector, based on:

- Value, or how a stock is priced relative to its per- ceived intrinsic worth;

- Growth, in this case the sustainability or growth of earnings; and

- Financial profile, which measures the financial health of the company.

Next, a team of experienced analysts examines the fundamentals of the higher-ranked securities.The portfolio managers then decide which stocks to purchase and whether any current holdings should be sold.

We also attempt to manage the risks by diversifying across companies and industries.The fund is structured so that its sector weightings and risk characteristics are similar to those of the S&P 500 Index.

Effective on or about December 31, 2004, the fund’s new investment objective will be to seek capital appreciation.To pursue its new investment objective, the fund will continue to employ a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management.

What other factors influenced the fund’s performance?

The fund achieved gains across a wide range of investment sectors during the reporting period, most notably in the energy, health care and utilities areas. Returns benefited from the fund’s slightly overweighted position in the energy sector, where limited supplies and strong industrial demand drove prices higher. Strong individual stock selections further boosted returns among the fund’s energy holdings. Top performers included refinery consolidator Valero Energy and diversified producers Occidental Petroleum and ConocoPhillips.

In the health care sector, the fund emphasized services providers such as Aetna and UnitedHealth Group, which delivered steady earnings growth. Gains in these and other holdings such as medical device maker Boston Scientific more than made up for declines in drug maker Wyeth, which we believe was hurt by product-related lawsuits. Utilities holdings generated strong returns as well, particularly during the second half of the reporting period, when the market favored traditionally defensive, dividend-paying stocks. The fund focused on regional electric utilities, such as Exelon, PPL and Entergy that were insulated from rising fuel prices by their nuclear generation capacity.

The Funds 3

DISCUSSION OF FUND PERFORMANCE (continued)

Other market sectors delivered more mixed results. Among consumer staples stocks, Kimberly-Clark and Procter & Gamble rose on the strength of consistent earnings growth and effective management. However, most consumer staples stocks produced weak returns due to declining consumer confidence. In the financial sector, mortgage lender Freddie Mac recovered from earlier accounting difficulties to post robust gains, and regional bank SouthTrust rose on the strength of an attractive takeover offer. On the other hand, insurer St. Paul Travelers Cos. suffered declines when the company encountered post-merger difficulties.

The market’s sharpest losses occurred in the technology sector. Several technology companies reported seasonal weakness and an uncertain outlook, and the fund’s technology losses proved relatively steep, led by semiconductor companies such as Intel, Xilinx and Agilent Technologies and accompanied by other hardware and software holdings such as EMC and Veritas Software. Media holdings further undermined the fund’s relative performance. News and entertainment companies, such as Viacom and The News Corporation Ltd., were hurt by weak advertising revenues, while Comcast and Walt Disney faced company-specific difficulties that pushed their stock prices lower.

What is the fund’s current strategy?

As of the end of the reporting period, persistent economic and political uncertainties have prompted us to adopt generally neutral positions in most investment sectors, with the exception of energy, where the fund continues to maintain slightly greater exposure than does the benchmark.Within the various market sectors, we have emphasized what we believe are high-quality, dividend-paying stocks with good earnings visibility. In our view, stocks with these characteristics should be well-positioned to weather further volatility in an uncertain investment environment.

| September 15, 2004 |

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 SOURCE: LIPPER INC. — Reflects the monthly reinvestment of dividends and, where applicable, capital gain distributions.The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted, unmanaged index of U.S. stock market performance.

| 4 |

| FUND PERFORMANCE |

| Average Annual Total Returns | as of 8/31/04 | |||||||||

| Inception | From | |||||||||

| Date | 1 Year | 5 Years | 10 Years | Inception | ||||||

| Class M shares | 7.95% | (3.75)% | 9.40% | |||||||

| Investor shares | 7/11/01 | 7.88% | — | — | (3.16)% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The above graph compares a $10,000 investment made in Class M shares of Mellon Large Cap Stock Fund on 8/31/94 to a $10,000 investment made in the Standard & Poor’s 500 Composite Stock Price Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested.

Before the fund commenced operations, substantially all of the assets of a predecessor common trust fund (CTF) that, in all material respects, had the same investment objective, policies, guidelines and restrictions as the fund (and those of another CTF) were transferred to the fund. Please note that the performance of the fund’s Class M shares represents the performance of the predecessor CTF through October 1, 2000, adjusted to reflect the fund’s fees and expenses, by subtracting from the actual performance of the CTF the expenses of the fund’s Class M shares as they were estimated prior to the conversion of the CTF into the fund, and the performance of the fund’s Class M shares thereafter.The predecessor CTF was not registered under the Investment Company Act of 1940, as amended, and therefore was not subject to certain investment restrictions that might have adversely affected performance. In addition, the expenses of the fund’s Class M shares may be higher than those estimated prior to the conversion of the CTF into the fund, which would lower the performance shown in the above line graph.

Effective July 11, 2001, existing fund shares were designated as Class M shares and the fund began offering a second class of shares designated as Investor shares, which are subject to a Shareholder Services Plan. Performance for Investor shares will vary from the performance of Class M shares shown above because of the differences in charges and expenses.

The fund’s performance shown in the line graph takes into account all applicable fees and expenses for Class M shares only.The Index is a widely accepted, unmanaged index of U.S. stock market performance.The Index does not take into account charges, fees and other expenses. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The Funds 5

DISCUSSION OF FUND PERFORMANCE (continued)

| DISCUSSION OF FUND PERFORMANCE |

D. Gary Richardson, Portfolio Manager

How did Mellon Income Stock Fund perform relative to its benchmark?

For the 12-month period ended August 31, 2004, the fund’s Class M shares produced a total return of 14.68%, and its Investor shares produced a total return of 14.26% .1 In comparison, the Russell 1000 Value Index, the fund’s benchmark,provided a total return of 17.52% .2

We attribute these results to a strong rise in equity securities during the first half of the reporting period, driven by accelerating U.S. economic growth and improving business fundamentals. Although the market generally declined during the second half of the reporting period, value-oriented stocks performed relatively well. However, the fund’s performance trailed the benchmark due to the fund’s emphasis on dividend-paying stocks during the first half of the reporting period, when the market favored more speculative stocks, and the fund’s underweighted position in interest-sensitive financial stocks during the second half of the reporting period, when interest rates unexpectedly remained low.

What is the fund’s investment approach?

The fund seeks to exceed the total return performance of the Russell 1000 Value Index over time.To pursue its goal, the fund normally invests at least 80% of its assets in stocks. The fund seeks to invest primarily in dividend-paying stocks. Stocks are chosen through a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management. Because the fund seeks to invest primarily in dividend-paying stocks, it generally emphasizes stocks with value characteristics, although it may also purchase growth stocks.

When selecting securities, we use a computer model to identify and rank stocks within an industry or sector, based on:

- Value, or how a stock is priced relative to its per- ceived intrinsic worth;

- Growth, in this case the sustainability or growth of earnings; and

- Financial profile, which measures the financial health of the company.

Next, based on fundamental analysis, we generally select the most attractive of the higher-ranked securities.The portfolio manager then decides which stocks to purchase and whether any current holdings should be sold. We also attempt to manage the risks by diversifying broadly across companies and industries, limiting the potential adverse impact of any one stock or industry on the overall portfolio. In an attempt to earn higher yields, the fund may at times invest a higher percentage of assets than its benchmark in certain industry sectors.

Effective on or about December 31, 2004, the fund’s new investment objective will be to seek total return (consisting of capital appreciation and income). To pursue its new investment objective, the fund will continue to employ a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management.

What other factors influenced the fund’s performance?

Although investors appeared to look forward to better business conditions and a stronger U.S. economy during the first half of the reporting period, they became less optimistic during the second half of the reporting period,

| 6 |

as renewed inflationary pressures, higher interest rates and ongoing international and domestic political concerns threatened the economic recovery. Indeed, the Federal Reserve Board raised short-term interest rates twice toward the end of the reporting period.

In this environment, the fund generated particularly strong gains in the energy sector due to a slightly overweighted position and good individual stock selections. Holdings such as ChevronTexaco, ConocoPhillips and Sunoco benefited from rising oil and gas prices. Among producer goods stocks, strong levels of industrial activity and a robust housing market spurred gains in home improvement companies such as Stanley Works and Sherwin-Williams, specialty chemical concerns such as Monsanto, and rail transportation providers including Norfolk Southern. The utilities sector produced strong returns as well, particularly during the second half of the reporting period when the market favored traditionally defensive, dividend-paying stocks. Top performers included telecommunications service providers SBC Communications and Verizon Communications, and regional electric utilities Exelon and PPL.

Most other market sectors produced mixed results. For example, health insurer Aetna and pharmaceutical giant Novartis enjoyed strong gains, while drug maker Wyeth declined under pressure from product-related lawsuits, and pharmaceutical producer Merck & Co. lost ground due to a weak product pipeline. Gains among consumer staples holdings, such as Reynolds American, Procter & Gamble, Kimberly-Clark and Sara Lee, were undermined by unfortunate timing in the fund’s sale of its position in Altria Group. Among interest-sensitive financials, the fund benefited from

the acquisition of holding FleetBoston Financial by a larger rival and gains in real estate investment trust Simon Property Group. However, St. Paul Travelers Cos. suffered declines when it encountered post-merger financial difficulties, and Citigroup was hurt by its exposure to the lackluster capital markets.

Finally, consumer cyclical stocks proved particularly weak. Retailers such as May Department Stores faced problems due to declining consumer confidence. Automobile and appliance manufacturers such as General Motors and Maytag were hurt by rising steel prices and Eastman Kodak was challenged by a difficult transition to digital photography.

What is the fund’s current strategy?

Recently heightened levels of investor caution and favorable changes in the tax code have created what we believe to be a more positive environment for the kinds of high-quality, high-dividend paying stocks on which the fund seeks to focus. Accordingly, we have continued to position the fund to benefit from this trend, emphasizing companies that generate free cash flow in the form of consistent and rising dividends.

| September 15, 2004 |

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, where applicable, capital gain distributions.The Russell 1000 Value Index is an unmanaged index that measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

The Funds 7

| FUND PERFORMANCE |

| Average Annual Total Returns | as of 8/31/04 | |||||||||

| Inception | From | |||||||||

| Date | 1 Year | 5 Years | 10 Years | Inception | ||||||

| Class M shares | 14.68% | (1.97)% | 9.71% | |||||||

| Investor shares | 7/11/01 | 14.26% | — | — | 0.13% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The above graph compares a $10,000 investment made in Class M shares of Mellon Income Stock Fund on 8/31/94 to a $10,000 investment made in the Russell 1000 Value Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested.

Before the fund commenced operations, substantially all of the assets of a predecessor common trust fund (CTF) that, in all material respects, had the same investment objective, policies, guidelines and restrictions as the fund (and those of another CTF) were transferred to the fund. Please note that the performance of the fund’s Class M shares represents the performance of the predecessor CTF through October 1, 2000, adjusted to reflect the fund’s fees and expenses, by subtracting from the actual performance of the CTF the expenses of the fund’s Class M shares as they were estimated prior to the conversion of the CTF into the fund, and the performance of the fund’s Class M shares thereafter.The predecessor CTF was not registered under the Investment Company Act of 1940, as amended, and therefore was not subject to certain investment restrictions that might have adversely affected performance. In addition, the expenses of the fund’s Class M shares may be higher than those estimated prior to the conversion of the CTF into the fund, which would lower the performance shown in the above line graph.

Effective July 11, 2001, existing fund shares were designated as Class M shares and the fund began offering a second class of shares designated as Investor shares, which are subject to a Shareholder Services Plan. Performance for Investor shares will vary from the performance of Class M shares shown above because of the differences in charges and expenses.

The fund’s performance shown in the line graph takes into account all applicable fees and expenses for Class M shares only.The Index does not take into account charges, fees and other expenses. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| 8 |

| DISCUSSION OF FUND PERFORMANCE |

Anthony J. Galise, Portfolio Manager

How did Mellon Mid Cap Stock Fund perform relative to its benchmark?

For the 12-month period ended August 31, 2004, the fund produced total returns of 11.33% for its Class M shares, 11.02% for its Investor shares and 10.31% for its Dreyfus Premier shares.1 In comparison, the Standard & Poor’s MidCap 400 Index (“S&P 400 Index”), the fund’s benchmark, produced a total return of 12.42% for the same period.2 In addition, the average total return produced by the funds reported in the Lipper Mid-Cap Core Funds category was 10.59% .3

Midcap stocks as a whole fared relatively well in a recovering economy over the reporting period, despite periodic weakness during the spring and summer of 2004.The fund’s returns trailed the S&P 400 Index, primarily because of underperformance in the health care, services and technology sectors. However, because of strong stock selections in the producer goods, energy and interest-sensitive market sectors, the fund’s Class M and Investor shares outperformed its Lipper category average while the fund’s Dreyfus Premier shares were in line with its Lipper category average.

What is the fund’s investment approach?

The fund seeks investment returns consisting of capital appreciation and income that are consistently superior to those of the S&P 400 Index.To pursue its goal, the fund normally invests at least 80% of its assets in stocks of midcap domestic companies, whose market capitalizations generally range between $1 billion and $8 billion at the time of purchase. Stocks are chosen through a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management.

When selecting securities, we use a computer model to identify and rank stocks within each industry or sector, based on:

- Value, or how a stock is priced relative to its per- ceived intrinsic worth;

- Growth, in this case the sustainability or growth of earnings; and

- Financial profile, which measures the financial health of the company.

Next, based on fundamental analysis, we generally select the most attractive of the higher-ranked securities, drawing on a variety of sources, including Wall Street research and company management. Finally, we use portfolio construction techniques to manage sector and industry risks. Our goal is to keep those risks at levels that are similar to those of the S&P 400 Index. For example, if the S&P 400 Index has a 10% weighting in a particular industry sector, about 10% of the fund’s assets will also normally be invested in that sector.

Effective on or about December 31, 2004, the fund’s new investment objective will be to seek capital appreciation. To pursue its new investment objective, the fund will continue to employ a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management.

What other factors influenced the fund’s performance?

Midcap stocks were influenced during the reporting period by investors’ shifting expectations of U.S. economic growth and business conditions. Stocks generally rallied during the first half of the reporting period as investors looked forward to stronger economic growth, and they gave back some of those gains during

The Funds 9

DISCUSSION OF FUND PERFORMANCE (continued)

the second half of the reporting period, when renewed inflationary pressures, higher interest rates and geopolitical instability took a toll on investor confidence.

In this changing market environment, the fund scored a number of successes in the producer goods area. Chemical companies such as Ashland and IMC Global benefited from the effects of stronger economic growth as well as company-specific factors. Investors rewarded Ashland with a higher stock price after the company sold its refinery operations and strengthened its balance sheet, and IMC Global saw its stock price rise after the announcement of a merger with a competitor. Metals producers including U.S. Steel, copper producer Freeport-McMoRan Copper & Gold and nickel miner Inco also gained value amid rising global demand for basic materials.

In the energy sector, several midcap stocks helped boost the fund’s returns. We focused on companies that we believed to be leveraged to rising oil and gas prices, such as oil services companies and refineries.Winners in the energy area included Southwestern Energy, the fund’s top performer during the reporting period.

The fund’s interest-sensitive holdings were helped by holdings such as the Chicago Mercantile Exchange, which benefited from greater futures and options trading in the volatile stock market.While the fund avoided the sharp decline of benchmark holding New York Community Bancorp, we added the stock after it had fallen to a price we considered oversold.

Holdings of health care companies, including pharmaceutical firms, biotechnology companies and medical services providers, proved disappointing during the reporting period. In the media industry, weak advertising revenues hurt the stocks of two holdings in the radio business. Finally, several technology holdings saw their share prices fall when they cautioned analysts that their earnings might not meet expectations.

What is the fund’s current strategy?

As the economic recovery has progressed, our disciplined investment process led us to reduce the fund’s overall sensitivity to market volatility by focusing more on value-oriented stocks. For example, we recently have added several positions in stocks that we believe became attractively valued after a period of price weakness. As a result, the fund ended the reporting period with slightly greater exposure to the producer goods and energy sectors than does the benchmark, and less exposure to the technology area.

| September 15, 2004 |

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital gain distributions.The Standard & Poor’s MidCap 400 Index is a widely accepted, unmanaged total return index measuring the performance of the midsize company segment of the U.S. stock market.

3 Source: Lipper Inc.

| 10 |

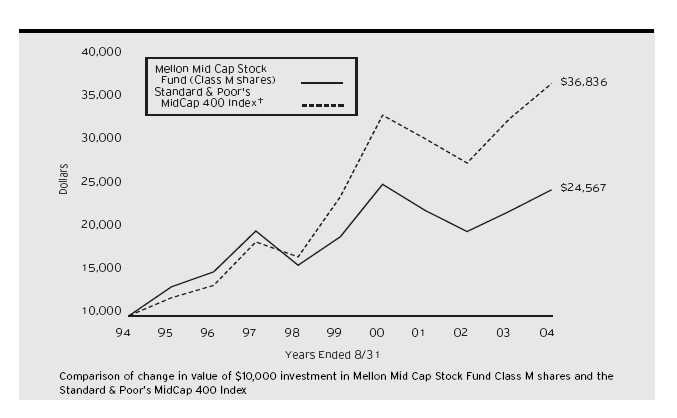

| FUND PERFORMANCE |

| Average Annual Total Returns | as of 8/31/04 | |||||||||

| Inception | From | |||||||||

| Date | 1 Year | 5 Years | 10 Years | Inception | ||||||

| Class M shares | 11.33% | 5.16% | 9.40% | |||||||

| Investor shares | 7/11/01 | 11.02% | — | — | 2.64% | |||||

| Dreyfus Premier shares | ||||||||||

| with applicable redemption †† | 9/6/02 | 6.31% | — | — | 9.25% | |||||

| without redemption | 9/6/02 | 10.31% | — | — | 11.07% | |||||

| † |

Source: Lipper Inc.

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The above graph compares a $10,000 investment made in Class M shares of Mellon Mid Cap Stock Fund on 8/31/94 to a $10,000 investment made in the Standard & Poor’s MidCap 400 Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested.

Before the fund commenced operations, substantially all of the assets of a predecessor common trust fund (CTF) that, in all material respects, had the same investment objective, policies, guidelines and restrictions as the fund were transferred to the fund. Please note that the performance of the fund’s Class M shares represents the performance of the predecessor CTF through October 1, 2000, adjusted to reflect the fund’s fees and expenses, by subtracting from the actual performance of the CTF the expenses of the fund’s Class M shares as they were estimated prior to the conversion of the CTF into the fund, and the performance of the fund’s Class M shares thereafter.The predecessor CTF was not registered under the Investment Company Act of 1940, as amended, and therefore was not subject to certain investment restrictions that might have adversely affected performance. In addition, the expenses of the fund’s Class M shares may be higher than those estimated prior to the conversion of the CTF into the fund, which would lower the performance shown in the above line graph.

Effective July 11, 2001, existing fund shares were designated as Class M shares and the fund began offering a second class of shares designated as Investor shares, which are subject to a Shareholder Services Plan. Performance for Investor shares will vary from the performance of Class M shares shown above because of the differences in charges and expenses.

The fund’s performance shown in the line graph takes into account all applicable fees and expenses for Class M shares only.The Index is a widely accepted, unmanaged total return index measuring the performance of the midsize company segment of the U.S. stock market.The Index does not take into account charges, fees and other expenses. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The maximum contingent deferred sales charge for Dreyfus Premier shares is 4%.After six years Dreyfus Premier shares convert to Investor shares.

The Funds 11

DISCUSSION OF FUND PERFORMANCE (continued)

| DISCUSSION OF FUND PERFORMANCE |

Gene F. Cervi and Dwight Cowden, Portfolio Managers

How did Mellon Small Cap Stock Fund perform relative to its benchmark?

For the 12-month period ended August 31, 2004, the fund’s Class M shares produced a total return of 13.29%, and its Investor shares produced a total return of 13.00% .1 In comparison, the fund’s benchmark, the Standard & Poor’s SmallCap 600 Index (“S&P 600 Index”), produced a total return of 14.86% for the same period.2

Small-cap stocks benefited from a recovering U.S. economy during the first half of the reporting period, but terrorism concerns, rising interest rates and political factors caused investor sentiment to shift toward larger, higher-quality stocks in the second half of the reporting period.After a strong start, the fund’s returns trailed that of the S&P 600 Index, primarily because of better performance among lower-quality, more speculative stocks included in the benchmark but not held by the fund.

What is the fund’s investment approach?

The fund seeks investment returns consisting of capital appreciation and income that surpass those of the S&P 600 Index.To pursue its goal, the fund normally invests at least 80% of its assets in stocks of small capitalization companies whose market capitalizations generally range between $100 million and $2 billion at the time of purchase. Stocks are chosen through a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management.

When selecting securities, we use a computer model to identify and rank stocks within an industry or sector, based on:

- Value, or how a stock is priced relative to its perceived intrinsic worth;

- Growth, which measures the sustainability and rate of growth of earnings; and

- Financial profile, which measures the financial health of the company.

Next, we examine the fundamentals of the higher-ranked securities. Using these insights, we select what we believe are the most attractive securities identified by the model. Finally, we use portfolio construction techniques to manage sector and industry risks. We attempt to keep those risks at levels that are similar to those of the S&P 600 Index. For example, if the S&P 600 Index has a 10% weighting in a particular sector, about 10% of the fund’s assets will also normally be invested in that sector.

Effective on or about December 31, 2004, the fund’s new investment objective will be to seek capital appreciation. To pursue its new investment objective, the fund will continue to employ a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management.

What other factors influenced the fund’s performance?

We attribute the fund’s lagging performance relative to the S&P 600 Index primarily to market weakness in January and April 2004, when investors favored micro-cap and low-quality stocks over their higher-quality, small-cap counterparts. The fund underperformed its benchmark during those months and the reporting period overall because our disciplined investment process focuses on higher-quality stocks.

However, the fund enjoyed strong results from a number of industry groups. In the health care sector, ophthalmic products manufacturer Advanced Medical Optics saw its stock price rise after several positive earning surprises and an acquisition that was accretive to the company’s earnings, and fast-growing HMO Sierra Health Services benefited from improving pricing and profit margins. In the energy area, higher oil and gas prices aided a number of holdings, including Southwestern Energy, Petroleum Development and Plains Exploration and Production. In the producer goods industry group, the fund’s performance was helped by holdings with exposure to the booming housing, construction and raw materials markets worldwide, including scrap metal

| 12 |

recycler Schnitzer Steel Industries, mining equipment producer Joy Global and construction services provider Building Materials Holding.

On the other hand, the fund’s returns were eroded by disappointments in the technology sector, where a number of companies were hurt by earnings shortfalls and lower-than-expected sales. For example, semiconductor systems supplier Standard Microsystems and network security company SafeNet announced reduced earnings outlooks, which caused them to rank among the larger detractors from the fund’s overall performance. Some of the fund’s interest-sensitive financial holdings also encountered weakness, including the initial public offering of a real estate investment trust, Government Properties Trust. While small banks produced better results, the fund’s relatively light exposure to the area prevented it from participating fully in the banking industry’s relative strength.

What is the fund’s current strategy?

We recently have maintained a relatively cautious investment stance due to heightened market tensions caused by terrorism concerns, uncertainty surrounding the U.S. presidential elections and a deceleration in the profits cycle. As a result, we currently expect investors to favor companies with higher earnings quality and better balance sheets over the more speculative businesses that were more in favor early in the reporting period.

Accordingly, as of the end of the reporting period, we have attempted to reduce the fund’s sensitivity to market volatility while emphasizing the quality factors considered by our quantitative stock selection process. We recently reduced the fund’s overweighted position in the energy sector, where we believe oil and gas prices may have peaked. Instead, we have redeployed those assets to areas such as producer goods and utilities that we believe are more attractively valued and, in our judgment, are likely to benefit from rising consumer and industrial demand in the United States, China and the emerging markets.

| September 15, 2004 |

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

Part of the fund’s recent performance is attributable to positive returns from its initial public offering (IPO) investments.There can be no guarantee that IPOs will have or continue to have a positive effect on the fund’s performance.

2 SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, where applicable, capital gain distributions.The Standard & Poor’s SmallCap 600 Index is a broad-based index and a widely accepted, unmanaged index of overall small-cap stock market performance.

The Funds 13

| FUND PERFORMANCE |

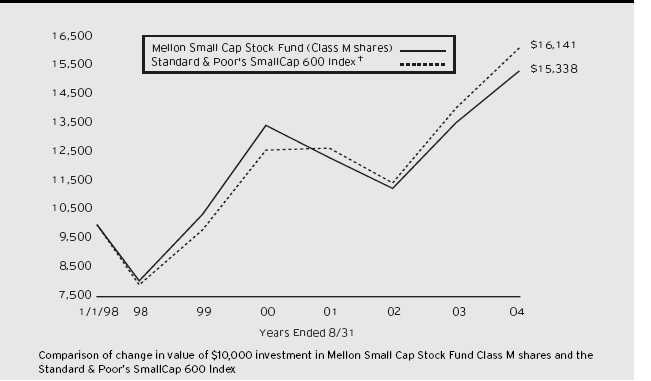

† Source: Lipper Inc.

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Part of the fund’s recent performance is attributable to positive returns from its initial public offering (IPO) investments.There can be no guarantee that IPOs will have or continue to have a positive effect on the fund’s performance.

The above graph compares a $10,000 investment made in Class M shares of Mellon Small Cap Stock Fund on 1/1/98 (inception date) to a $10,000 investment made in the Standard & Poor’s SmallCap 600 Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested.

Before the fund commenced operations, substantially all of the assets of a predecessor common trust fund (CTF) that, in all material respects, had the same investment objective, policies, guidelines and restrictions as the fund were transferred to the fund. Please note that the performance of the fund’s Class M shares represents the performance of the predecessor CTF through October 1, 2000, adjusted to reflect the fund’s fees and expenses, by subtracting from the actual performance of the CTF the expenses of the fund’s Class M shares as they were estimated prior to the conversion of the CTF into the fund, and the performance of the fund’s Class M shares thereafter.The predecessor CTF was not registered under the Investment Company Act of 1940, as amended, and therefore was not subject to certain investment restrictions that might have adversely affected performance. In addition, the expenses of the fund’s Class M shares may be higher than those estimated prior to the conversion of the CTF into the fund, which would lower the performance shown in the above line graph.

Effective July 11, 2001, existing fund shares were designated as Class M shares and the fund began offering a second class of shares designated as Investor shares, which are subject to a Shareholder Services Plan. Performance for Investor shares will vary from the performance of Class M shares shown above because of the differences in charges and expenses.

The fund’s performance shown in the line graph takes into account all applicable fees and expenses for Class M shares only.The Index is a widely accepted, unmanaged index of overall small-cap stock market performance which does not take into account charges, fees and other expenses. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| 14 |

| DISCUSSION OF FUND PERFORMANCE |

D. Kirk Henry, Portfolio Manager

How did Mellon International Fund perform relative to its benchmark?

For the 12-month period ended August 31, 2004, the fund’s Class M shares produced a total return of 23.15%, and its Investor shares produced a total return of 22.28% .1 The fund’s benchmark, the Morgan Stanley Capital International Europe, Australasia, Far East Index (“MSCI EAFE Index”), produced a total return of 22.64% for the same period.2

We attribute the fund’s returns to improved global economic conditions, greater merger and acquisition activity, higher levels of consumer and business confidence and rising corporate earnings.The fund’s returns were in line with the benchmark, due primarily to the success of our individual stock selection strategy. A wide range of holdings contributed to the fund’s added value.

What is the fund’s investment approach?

The fund seeks long-term capital growth. To pursue this goal, the fund normally invests at least 65% of its total assets in equity securities of foreign issuers. The fund also invests primarily in companies that we consider to be value companies.The fund normally invests in companies in a broad range of countries and generally limits its investments in any single company to no more than 5% of its assets at the time of purchase.

The fund’s investment approach is value-oriented, research-driven and risk-averse.When selecting stocks, we identify potential investments through extensive quantitative and fundamental research. Emphasizing individual stock selection over economic or industry trends, the fund focuses on three key factors:

- Value, or how a stock is priced relative to tradi- tional business performance measures;

- Business health, or overall efficiency and profitabil- ity as measured by return on assets and return on equity; and

- Business momentum, or the presence of a catalyst such as corporate restructuring or changes in man- agement that may potentially trigger a price increase in the near- to midterm.

The fund typically sells a stock when it is no longer considered a value company, appears less likely to benefit from the current market and economic environments, shows deteriorating fundamentals or declining momentum, or falls short of our expectations.

What other factors influenced the fund’s performance?

For the second consecutive 12-month reporting period, the international stock markets posted generally impressive gains, largely due to strong economic growth around the world, an increase in merger and acquisition activity and rising corporate earnings. However, a number of factors led to greater market volatility over the more recent reporting period, including shifts in consumer confidence and spending, rising oil prices, persistent geopolitical uncertainty, the war in Iraq and questions regarding the sustainability of China’s industrial growth.

After many years of a deflationary recession, Japan appears to have turned the corner toward economic growth, benefiting many of the fund’s Japanese holdings. Credit card companies Credit Saison and AIFUL benefited from an increase in transaction fees and lower loan loss provisions. Diligent cost cutting and expectations for a rebound in consumer spending benefited Skylark, a restaurant chain. Soaring exports led to strong earnings growth for Yamaha Motor.

Although economic growth in Europe was less robust than in other parts of the world, the fund’s performance benefited from its holdings of Aventis, the French pharmaceutical company, whose stock price rose sharply after an unsolicited bid for the company by rival Sanofi-Synthelabo, which the fund did not own. French tire manufacturer Michelin also fared well amid strong auto sales and higher earnings. In the

The Funds 15

DISCUSSION OF FUND PERFORMANCE (continued)

United Kingdom, the fund’s performance also was helped by several consumer discretionary stocks, most notably department store retailer Marks & Spencer, beverage company Allied Domecq, and candy and soft drink maker Cadbury Schweppes, which benefited from the acquisition of chewing gum manufacturer Adams.

Other positive contributors to the fund’s performance included several financial holdings, such as international banking and insurance provider Fortis, which is based in the Netherlands, and two retail banks, Belgium’s Dexia and Singapore’s DBS.Within the energy sector, a variety of oil producers benefited from rising oil prices, as did Saipem, an Italian oilfield services company.

On the other hand, we may have been too early in purchasing consumer stocks in Germany, which is the world’s third largest economy.While we considered valuations of various German retailers, consumer electronic companies and auto manufacturers to be compelling, consumer spending has not increased as we expected. In addition, the fund received generally disappointing returns from its holdings in information technology due to heavy profit-taking.

What is the fund’s current strategy?

As of the end of the reporting period, we have increased the fund’s exposure to the telecommunications services sector, where a number of companies have strengthened their balance sheets and raised their dividend rates. We also recently have favored European banks and insurance companies, some of which we believe are selling at depressed prices. Conversely, we have trimmed our holdings in a number of areas that have performed well recently, including Japanese credit card companies and consumer lenders.

| September 15, 2004 |

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 SOURCE: LIPPER INC. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions.The Morgan Stanley Capital International Europe,Australasia, Far East (MSCI EAFE) Index is an unmanaged index composed of a sample of companies representative of the market structure of European and Pacific Basin countries.

| 16 |

| FUND PERFORMANCE |

| Average Annual Total Returns | as of 8/31/04 | |||||||

| Inception | From | |||||||

| Date | 1 Year | 5 Years | Inception | |||||

| Class M shares | 7/15/98 | 23.15% | 3.83% | 4.05% | ||||

| Investor shares | 7/11/01 | 22.28% | — | 7.48% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The above graph compares a $10,000 investment made in Class M shares of Mellon International Fund on 7/15/98 (inception date) to a $10,000 investment made in the Morgan Stanley Capital International Europe,Australasia, Far East Index (the “Index”) on that date. For comparative purposes, the value of the Index on 7/31/98 is used as the beginning value on 7/15/98.All dividends and capital gain distributions are reinvested.

Before the fund commenced operations, substantially all of the assets of a predecessor common trust fund (CTF) that, in all material respects, had the same investment objective, policies, guidelines and restrictions as the fund (and those of another CTF) were transferred to the fund. Please note that the performance of the fund’s Class M shares represents the performance of the predecessor CTF through October 1, 2000, adjusted to reflect the fund’s fees and expenses, by subtracting from the actual performance of the CTF the expenses of the fund’s Class M shares as they were estimated prior to the conversion of the CTF into the fund, and the performance of the fund’s Class M shares thereafter.The predecessor CTF was not registered under the Investment Company Act of 1940, as amended, and therefore was not subject to certain investment restrictions that might have adversely affected performance. In addition, the expenses of the fund’s Class M shares may be higher than those estimated prior to the conversion of the CTF into the fund, which would lower the performance shown in the above line graph.

Effective July 11, 2001, existing fund shares were designated as Class M shares and the fund began offering a second class of shares designated as Investor shares, which are subject to a Shareholder Services Plan. Performance for Investor shares will vary from the performance of Class M shares shown above because of the differences in charges and expenses.

The fund’s performance shown in the line graph takes into account all applicable fees and expenses for Class M shares only.The Index is an unmanaged index composed of a sample of companies representative of the market structure of European and Pacific Basin countries and includes net dividends reinvested.The Index does not take into account charges, fees and other expenses. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The Funds 17

DISCUSSION OF FUND PERFORMANCE (continued)

| DISCUSSION OF FUND PERFORMANCE |

D. Kirk Henry, Portfolio Manager

How did Mellon Emerging Markets Fund perform relative to its benchmark?

For the 12-month period ended August 31, 2004, the fund’s Class M shares produced a total return of 22.93%, and the fund’s Investor shares produced a total return of 22.68% .1 In comparison, the Morgan Stanley Capital International Emerging Markets Free Index (“MSCI EMF Index”), the fund’s benchmark, provided a total return of 20.50% for the same period.2

We attribute the fund’s performance to the beneficial effects of a strengthening global economy, which was driven during much of the reporting period by increased demand from China for raw materials used in industrial production. The fund slightly outperformed its benchmark, due primarily to the success of our individual stock selection strategy in a number of different markets and industry groups.

What is the fund’s investment approach?

The fund seeks long-term capital growth.To pursue its goal, the fund invests at least 80% of its assets in equity securities of companies organized, or with a majority of assets or operations, in countries considered to be emerging markets. Normally, the fund will not invest more than 25% of its total assets in the securities of companies in any one emerging market country.

When choosing stocks, we use a value-oriented, research-driven approach. We identify potential investments through extensive quantitative and fundamental research. Emphasizing individual stock selection rather than economic and industry trends, we focus on three key factors:

- Value, or how a stock is priced relative to its intrin- sic worth based on traditional value measures;

- Business health, or overall efficiency and profitability as measured by return on assets and return on equity; and

- Business momentum, or the presence of catalyst such as corporate restructuring or changes in manage- ment that may potentially trigger a price increase in the near- to midterm.

We typically sell a stock when it is no longer considered a value company, appears less likely to benefit from the current market and economic environment, shows deteriorating fundamentals or declining momentum, or falls short of our expectations.

What other factors influenced the fund’s performance?

The emerging markets posted strong returns during the reporting period, due in large part to continued global economic growth, improved consumer spending and increased demand from industrial companies and manufacturers for raw materials.The growth of industry in China and the building of its infrastructure created greater demand for the basic materials that many developing countries produce. In addition, economic recoveries in the United States, the United Kingdom and select European markets helped support better business conditions in the emerging markets.

In this generally constructive environment, our successful stock selection strategy enabled the fund to produce stronger returns than did the fund’s benchmark. For example, the fund benefited from its focus on technology companies in Taiwan that produce higher-margin products. In addition, we added value by diversifying into other Taiwan industry groups, such as banks and a local grocery store chain. In South Korea, Samsung, a company that trades resources and capital equipment, performed well. In addition, emerging market

| 18 |

companies with exposure to oil, iron, copper, lumber and steel benefited from substantial exports to China.

Stocks in India, an area we have favored for some time now, contributed positively to the fund’s performance. Rising consumer spending helped support fund holdings such as a scooter manufacturer, a tobacco company and a large retail bank. South African metals and mining stocks also posted solid returns, as did Bidvest Group, a South African industrial company.

On the other hand, the fund’s returns were held back by its lack of exposure to certain areas. For example, the fund had little exposure to one of the major telecommunications companies in Mexico that performed well for the benchmark, causing the fund’s Mexico returns to lag those of the MSCI EMF Index. Limited participation in gains produced by banks in Turkey, which we avoided in favor of a Turkish energy company, also hurt the fund’s performance during the reporting period.

What is the fund’s current strategy?

We recently have been encouraged by higher corporate profits in the emerging markets, where companies appear to be focused both on sales and quality of earnings. In our judgment, many of these

companies are making great strides in becoming more financially sound and better managed businesses.

As of the end of the reporting period, we have added to the fund’s positions in consumer staple companies whose stocks have declined due to falling operating profitability.We also have added selectively to existing positions in technology companies that we believe have strong long-term prospects and whose stocks meet our valuation criteria, while liquidating those we deemed fully priced. We have also trimmed a selection of the fund’s holdings in other areas, including Asian financial service providers and consumer discretionary companies in India, taking profits after these stocks reached what we believed were more expensive valuations.

| September 15, 2004 |

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 SOURCE: LIPPER INC. — Reflects reinvestment of gross dividends and, where applicable, capital gain distributions.The Morgan Stanley Capital International Emerging Markets Free (MSCI EMF) Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America and the Pacific Basin.

| T h e F u n d s 19 |

| FUND PERFORMANCE |

| Average Annual Total Returns | as | of 8/31/04 | ||||||

| Inception | From | |||||||

| Date | 1 Year | Inception | ||||||

| Class M shares | 10/2/00 | 22.93% | 12.58% | |||||

| Investor shares | 7/11/01 | 22.68% | 16.74% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The above graph compares a $10,000 investment made in Class M shares of Mellon Emerging Markets Fund on 10/2/00 (inception date) to a $10,000 investment made in the Morgan Stanley Capital International Emerging Markets Free Index (the “Index”) on that date. For comparative purposes, the value of the Index on 9/30/00 is used as the beginning value on 10/2/00.All dividends and capital gain distributions are reinvested.

Effective July 11, 2001, existing fund shares were designated as Class M shares and the fund began offering a second class of shares designated as Investor shares, which are subject to a Shareholder Services Plan. Performance for Investor shares will vary from the performance of Class M shares shown above because of the differences in charges and expenses.

The fund’s performance shown in the line graph takes into account all applicable fees and expenses for Class M shares only.The Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America and the Pacific Basin.The Index excludes closed markets and those shares in otherwise free markets, which are not purchasable by foreigners.The Index includes gross dividends reinvested and does not take into account charges, fees and other expenses.These factors can contribute to the Index potentially outperforming the fund. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| 20 |

| DISCUSSION OF FUND PERFORMANCE |

D. Gary Richardson and Lawrence R. Dunn, Portfolio Managers

How did Mellon Balanced Fund perform relative to its benchmark?

For the 12-month period ended August 31, 2004, the fund’s Class M shares produced a total return of 9.13%, and its Investor shares produced a total return of 8.76% .1 In comparison, the fund’s benchmark, a blended index composed of 60% Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”) and 40% Lehman Brothers U.S. Aggregate Index, produced a 9.32% total return for the same period.2 Separately, the S&P 500 Index and the Lehman Brothers U.S. Aggregate Index produced total returns of 11.45% and 6.13%, respectively, for the same period.

Although stocks rallied early in the reporting period, driven by expectations of stronger economic growth, they later declined when economic and geopolitical concerns intensified. Bonds generally rallied modestly in a volatile market place. The fund’s returns were slightly lower than the blended index, primarily due to weakness in the technology and services sectors.

What is the fund’s investment approach?

The fund seeks long-term growth of principal in conjunction with current income. To pursue its goal, the fund may invest in equity securities, income-producing bonds, Mellon Small Cap Stock Fund, Mellon Mid Cap Stock Fund, Mellon International Fund and Mellon Emerging Markets Fund.The fund has established target allocations for its assets of 60% in the aggregate to equity securities and 40% to bonds and money market instruments. The fund may deviate from these targets within ranges of 15% above or below the target amount. The fund’s investments in each of Mellon Small Cap Stock Fund, Mellon Mid Cap Stock Fund, Mellon International Fund and Mellon Emerging Markets Fund are subject to a separate limit of 20% of the fund’s total assets, as is the fund’s investment in money market instruments.

With respect to the equity portion of the fund’s portfolio, individual stocks are chosen through a computer model, fundamental analysis and risk management. Our computer model identifies and ranks stocks within each industry or sector, based on a variety of criteria.A team of experienced analysts then examines the fundamentals of the higher-ranked candidates. Finally, the portfolio managers decide which stocks to purchase or sell.The equity portion of the fund’s portfolio is structured so that its allocations of assets to economic sectors are similar to those of the S&P 500 Index.

With respect to the fixed-income portion of the fund’s portfolio, the fund’s investments in debt securities must be of investment-grade quality at the time of purchase or, if unrated, deemed of comparable quality by the investment adviser. Generally, the fund’s average effective portfolio duration of bonds will not exceed eight years. We choose debt securities based on their yields, credit quality, the level of interest rates and inflation, general economic and financial trends and our outlook for the securities markets.

What other factors influenced the fund’s performance?

The fund’s stock portfolio enjoyed attractive gains from the energy sector, which benefited from rising oil and gas prices. Among producer goods stocks, strong levels of industrial activity and a robust housing market spurred gains in home improvement companies, specialty chemical concerns and rail transportation providers.The utilities sector also produced strong returns, led by telecommunications service providers and regional electric utilities.

On the other hand, other stock market sectors produced mixed results. For example, in the health care sector, insurer Aetna and pharmaceutical giant Novartis enjoyed strong gains, while drug makers Wyeth and Merck & Co. declined due to product-related lawsuits and a weak product pipeline, respectively. Gains among the fund’s consumer staples holdings were undermined

The Funds 21

DISCUSSION OF FUND PERFORMANCE (continued)

by unfortunate timing in the sale of Altria Group.Among financial stocks, the fund benefited from the acquisition of Banc One by a larger rival and gains in real estate investment trust Simon Property Group. However, St. Paul Travelers Cos. encountered post-merger difficulties, and Citigroup was hurt by its exposure to lackluster capital markets. Consumer cyclical stocks proved particularly weak as retailers faced declining consumer confidence, and rising steel prices hurt automobile and appliance manufacturers.

In the fund’s bond portfolio, returns were influenced by heightened market volatility caused by changing investor sentiment. In the spring of 2004, we began to reduce the fund’s exposure to corporate securities, which we believed had become more richly valued, and we maintained the fund’s relatively light holdings of U.S. Treasury securities due to their sensitivity to rising interest rates.We also moved to a slightly overweighted position in U.S. government agency debentures, which we regarded as attractively valued. This positioning helped the fund avoid the full brunt of weakness in Treasuries leading up to the Federal Reserve Board’s rate-hikes in June and August.

What is the fund’s current strategy?

Renewed investor caution and favorable changes in the tax code have created what we regard as a more positive environment for high-quality, dividend-paying stocks, and we have continued to emphasize companies with a history of consistent and rising dividends.Among bonds, we have continued to position the fund for what we believe will be moderate economic growth and rising short-term interest rates.

| September 15, 2004 |

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital gain distributions.The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted, unmanaged index of U.S. stock market performance.The Lehman Brothers U.S.Aggregate Index is a widely accepted, unmanaged total return index of corporate, U.S. government and U.S. government agency debt instruments, mortgage-backed securities and asset-backed securities with an average maturity of 1-10 years.

| 22 |

| FUND PERFORMANCE |

| Average Annual Total Returns | as | of 8/31/04 | ||||||

| Inception | From | |||||||

| Date | 1 Year | Inception | ||||||

| Class M shares | 10/2/00 | 9.13% | 0.94% | |||||

| Investor shares | 7/11/01 | 8.76% | 2.80% |

† Source: Lipper Inc.

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The above graph compares a $10,000 investment made in Class M shares of Mellon Balanced Fund on 10/2/00 (inception date) to a $10,000 investment made in three different indices: (1) the Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”), (2) the Lehman Brothers U.S.Aggregate Index (the “Lehman Index”) and (3) the Customized Blended Index on that date.The Customized Blended Index is calculated on a year-to-year basis. For comparative purposes, the value of each index on 9/30/00 is used as the beginning value on 10/2/00.All dividends and capital gain distributions are reinvested.

Effective July 11, 2001, existing fund shares were designated as Class M shares and the fund began offering a second class of shares designated as Investor shares, which are subject to a Shareholder Services Plan. Performance for Investor shares will vary from the performance of Class M shares shown above because of the differences in charges and expenses.

The fund’s performance shown in the line graph takes into account all applicable fees and expenses for Class M shares only.The S&P 500 Index is a widely accepted, unmanaged index of U.S. stock market performance.The Lehman Index is a widely accepted, unmanaged index of corporate, government and government agency debt instruments, mortgage-backed securities and asset-backed securities with an average maturity of 1-10 years.The indices do not take into account charges, fees and other expenses.The Customized Blended Index is composed of the S&P 500 Index, 55%, and the Lehman Index, 45%. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

The Funds 23

| UNDERSTANDING YOUR FUND’S EXPENSES |

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemptions fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in each class of each fund from March 1, 2004 to August 31, 2004. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | ||||||

| assuming actual returns for the six months ended August 31, 2004 | ||||||

| Dreyfus | ||||||

| Class M Shares | Investor Shares | Premier Shares | ||||

| Mellon Large Cap Stock Fund | ||||||

| Expenses paid per $1,000† | $3.93 | $5.21 | — | |||

| Ending value (after expenses) | $952.40 | $953.90 | — | |||

| Mellon Income Stock Fund | ||||||

| Expenses paid per $1,000† | $4.15 | $5.40 | — | |||

| Ending value (after expenses) | $990.90 | $988.70 | — | |||

| Mellon Mid Cap Stock Fund | ||||||

| Expenses paid per $1,000† | $4.48 | $5.71 | $9.38 | |||

| Ending value (after expenses) | $958.70 | $957.00 | $953.50 | |||

| Mellon Small Cap Stock Fund | ||||||

| Expenses paid per $1,000† | $5.04 | $6.22 | — | |||

| Ending value (after expenses) | $966.30 | $965.40 | — | |||

| Mellon International Fund | ||||||

| Expenses paid per $1,000† | $5.51 | $6.75 | — | |||

| Ending value (after expenses) | $994.40 | $990.60 | — | |||

| Mellon Emerging Markets Fund | ||||||

| Expenses paid per $1,000† | $7.33 | $9.20 | — | |||

| Ending value (after expenses) | $958.40 | $957.60 | — | |||

| Mellon Balanced Fund | ||||||

| Expenses paid per $1,000† | $2.93 | $4.22 | — | |||

| Ending value (after expenses) | $976.20 | $974.20 | —† | |||

† Expenses are equal to the Mellon Large Cap Stock Fund annualized expense ratio of .80% for Class M and 1.06% for Investor, Mellon Income Stock Fund .83% for

Class M and 1.08% for Investor, Mellon Mid Cap Stock Fund .91% for Class M, 1.16% for Investor and 1.91% for Dreyfus Premier, Mellon Small Cap Stock Fund 1.02% for Class M and 1.26% for Investor, Mellon International Fund 1.10% for Class M and 1.35% for Investor, Mellon Emerging Markets Fund 1.49% for Class M and 1.87% for Investor and Mellon Balanced Fund .59% for Class M and .85% for Investor, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| 24 |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS

| Using the SEC’s method to compare expenses |

The Securities and Exchange Commission (SEC) has established guidelines to help investores assess fund expenses.Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return.You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment | ||||||

| assuming a hypothetical 5% annualized return for the six months ended August 31, 2004 | ||||||

| Dreyfus | ||||||

| Class M Shares | Investor Shares | Premier Shares | ||||

| Mellon Large Cap Stock Fund | ||||||

| Expenses paid per $1,000† | $4.06 | $5.38 | — | |||

| Ending value (after expenses) | $1,021.11 | $1,019.81 | — | |||

| Mellon Income Stock Fund | ||||||

| Expenses paid per $1,000† | $4.22 | $5.48 | — | |||

| Ending value (after expenses) | $1,020.96 | $1,019.71 | — | |||

| Mellon Mid Cap Stock Fund | ||||||

| Expenses paid per $1,000† | $4.62 | $5.89 | $9.68 | |||

| Ending value (after expenses) | $1,020.56 | $1,019.30 | $1,015.53 | |||

| Mellon Small Cap Stock Fund | ||||||

| Expenses paid per $1,000† | $5.18 | $6.39 | — | |||

| Ending value (after expenses) | $1,020.01 | $1,018.80 | — | |||

| Mellon International Fund | ||||||

| Expenses paid per $1,000† | $5.58 | $6.85 | — | |||

| Ending value (after expenses) | $1,019.61 | $1,018.35 | — | |||

| Mellon Emerging Markets Fund | ||||||

| Expenses paid per $1,000† | $7.56 | $9.48 | — | |||

| Ending value (after expenses) | $1,017.65 | $1,015.74 | — | |||

| Mellon Balanced Fund | ||||||

| Expenses paid per $1,000† | $3.00 | $4.32 | — | |||

| Ending value (after expenses) | $1,022.17 | $1,020.86 | — | |||

† Expenses are equal to the Mellon Large Cap Stock Fund annualized expense ratio of .80% for Class M and 1.06% for Investor, Mellon Income Stock Fund .83% for Class M and 1.08% for Investor, Mellon Mid Cap Stock Fund .91% for Class M, 1.16% for Investor and 1.91% for Dreyfus Premier, Mellon Small Cap Stock Fund 1.02% for Class M and 1.26% for Investor, Mellon International Fund 1.10% for Class M and 1.35% for Investor, Mellon Emerging Markets Fund 1.49% for Class M and 1.87% for Investor and Mellon Balanced Fund .59% for Class M and .85% for Investor, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

The Funds 25

| STATEMENT OF INVESTMENTS August 31, 2004 |

| Mellon Large Cap Stock Fund | ||||||||||

| Common Stocks—98.4% | Shares | Value ($) | Shares | Value ($) | ||||||

| Consumer Cyclical—9.3% | Health Care—13.8% | |||||||||

| Bed Bath & Beyond | 363,900 a | 13,617,138 | Abbott Laboratories | 378,880 | 15,795,507 | |||||

| CVS | 248,130 | 9,925,200 | Aetna | 161,490 | 14,962,048 | |||||

| Dana | 406,320 | 7,667,258 | Amgen | 343,710 a | 20,378,566 | |||||

| GTECH Holdings | 170,390 b | 4,004,165 | Biogen Idec | 88,130 a | 5,228,753 | |||||

| Gap | 381,270 | 7,145,000 | Boston Scientific | 618,320 a | 22,092,574 | |||||

| Home Depot | 310,140 | 11,338,718 | Genzyme | 100,910 a | 5,449,140 | |||||

| Kohl’s | 331,100 a | 16,382,828 | Johnson & Johnson | 364,690 | 21,188,489 | |||||

| McDonald’s | 513,420 | 13,872,608 | Medtronic | 153,210 | 7,622,198 | |||||

| NIKE, Cl. B | 62,680 b | 4,720,431 | Merck & Co. | 354,720 | 15,951,758 | |||||

| Target | 330,150 | 14,718,087 | Novartis, ADR | 103,100 | 4,788,995 | |||||

| Wal-Mart Stores | 495,884 | 26,118,210 | Pfizer | 1,381,146 | 45,122,040 | |||||

| Walgreen | 391,300 | 14,262,885 | UnitedHealth Group | 283,020 | 18,716,113 | |||||

| 143,772,528 | Wyeth | 427,098 | 15,618,974 | |||||||

| Consumer Staples—8.5% | 212,915,155 | |||||||||

| Altria Group | 362,610 | 17,749,759 | Interest Sensitive—22.2% | |||||||

| Archer-Daniels-Midland | 324,580 | 5,183,543 | Allstate | 186,640 | 8,811,274 | |||||

| Coca-Cola | 472,940 | 21,145,147 | American Express | 268,590 | 13,434,872 | |||||

| Fortune Brands | 105,110 | 7,688,796 | American International Group | 484,920 | 34,545,701 | |||||

| General Mills | 134,840 | 6,371,190 | Bear Stearns Cos. | 79,960 | 7,030,083 | |||||

| Gillette | 217,880 | 9,259,900 | Capital One Financial | 142,370 | 9,646,991 | |||||

| Kimberly-Clark | 214,920 | 14,335,164 | Citigroup | 591,239 | 27,539,913 | |||||

| PepsiCo | 418,817 | 20,940,850 | Fannie Mae | 193,240 | 14,386,718 | |||||

| Procter & Gamble | 528,010 | 29,552,720 | Freddie Mac | 251,630 | 16,889,406 | |||||

| 132,227,069 | General Electric | 1,281,266 | 42,012,712 | |||||||

| Energy Related—7.9% | Goldman Sachs Group | 167,010 | 14,972,446 | |||||||

| Apache | 214,290 | 9,576,620 | J.P. Morgan Chase & Co. | 958,536 | 37,938,855 | |||||

| ConocoPhillips | 277,920 | 20,685,586 | Lehman Brothers Holdings | 124,730 | 9,216,300 | |||||

| Devon Energy | 217,386 | 14,088,787 | MBNA | 389,650 | 9,406,151 | |||||

| Exxon Mobil | 940,010 | 43,334,461 | Morgan Stanley | 156,900 | 7,959,537 | |||||

| GlobalSantaFe | 169,280 | 4,719,526 | New York Community Bancorp | 177,826 | 3,796,585 | |||||

| Halliburton | 161,990 | 4,725,248 | Radian Group | 78,250 | 3,466,475 | |||||

| Nabors Industries | 102,100 a | 4,502,610 | RenaissanceRe Holdings | 103,100 | 4,961,172 | |||||

| Occidental Petroleum | 308,210 | 15,919,047 | St. Paul Travelers Cos. | 495,150 | 17,176,754 | |||||

| XTO Energy | 162,990 | 4,570,240 | Simon Property Group | 138,100 | 7,726,695 | |||||

| 122,122,125 | SouthTrust | 198,180 | 8,194,743 | |||||||

| 26 |

| Mellon Large Cap Stock Fund (continued) | ||||||||||

| Common Stocks (continued) | Shares | Value ($) | Shares | Value ($) | ||||||

| Interest Sensitive (continued) | Services (continued) | |||||||||

| State Street | 193,530 | 8,735,944 | Time Warner | 483,080 a | 7,898,358 | |||||

| U.S. Bancorp | 449,269 | 13,253,436 | Univision | |||||||

| Wells Fargo | 389,240 | 22,867,850 | Communications Cl. A | 221,880 a,b | 7,322,040 | |||||

| 343,970,613 | Walt Disney | 979,330 | 21,985,958 | |||||||

| Producer Goods & Services—11.4% | 106,591,677 | |||||||||

| Air Products & Chemicals | 184,120 | 9,644,206 | Technology—14.1% | |||||||

| Boeing | 167,080 | 8,724,918 | Agilent Technologies | 509,330 a | 10,441,265 | |||||

| Burlington Northern Santa Fe | 187,900 | 6,726,820 | Cisco Systems | 1,196,134 a | 22,439,474 | |||||

| Companhia Vale do | Dell | 625,922 a | 21,807,122 | |||||||

| Rio Doce, ADR | 87,330 a | 5,045,054 | EMC | 814,840 a | 8,775,827 | |||||

| Cooper Industries, Cl. A | 105,700 | 5,836,754 | eBay | 100,510 a | 8,698,135 | |||||

| Deere & Co. | 155,400 | 9,832,158 | Intel | 1,101,078 | 23,441,951 | |||||

| E. I. du Pont de Nemours | 237,890 | 10,053,231 | International | |||||||

| Freeport-McMoRan | Business Machines | 180,270 | 15,267,066 | |||||||

| Copper & Gold, Cl. B | 225,870 | 8,499,488 | Lexmark International | 94,010 a | 8,315,185 | |||||

| General Dynamics | 79,550 | 7,767,262 | Linear Technology | 286,190 | 10,237,016 | |||||

| Honeywell International | 298,510 | 10,740,390 | Maxim Integrated Products | 228,698 | 9,932,354 | |||||