UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-09903 |

| |

| BNY Mellon Funds Trust | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Michael A. Rosenberg, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 8/31 | |

Date of reporting period: | 2/28/2011 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

|

| BNY Mellon Large Cap Stock Fund |

| BNY Mellon Large Cap Market Opportunities Fund |

| BNY Mellon Tax-Sensitive Large Cap Multi-Strategy Fund |

| BNY Mellon Income Stock Fund |

| BNY Mellon Mid Cap Stock Fund |

| BNY Mellon Small Cap Stock Fund |

| BNY Mellon U.S. Core Equity 130/30 Fund |

| BNY Mellon Focused Equity Opportunities Fund |

| BNY Mellon Small/Mid Cap Fund |

| BNY Mellon International Fund |

| BNY Mellon Emerging Markets Fund |

| BNY Mellon InternationalAppreciation Fund |

| BNY Mellon Balanced Fund |

The BNY Mellon Funds

| |

| SEMIANNUAL REPORT | February 28, 2011 |

Contents

| |

| The Funds | |

| |

| Letter from the President | 2 |

| Discussion of Funds’ Performance | |

| BNY Mellon Large Cap Stock Fund | 3 |

| BNY Mellon Large Cap | |

| Market Opportunities Fund | 5 |

| BNY Mellon Tax-Sensitive | |

| Large Cap Multi-Strategy Fund | 7 |

| BNY Mellon Income Stock Fund | 9 |

| BNY Mellon Mid Cap Stock Fund | 11 |

| BNY Mellon Small Cap Stock Fund | 13 |

| BNY Mellon U.S. Core | |

| Equity 130/30 Fund | 15 |

| BNY Mellon Focused Equity | |

| Opportunities Fund | 17 |

| BNY Mellon Small/Mid Cap Fund | 19 |

| BNY Mellon International Fund | 21 |

| BNY Mellon Emerging Markets Fund | 23 |

| BNY Mellon International | |

| Appreciation Fund | 25 |

| BNY Mellon Balanced Fund | 27 |

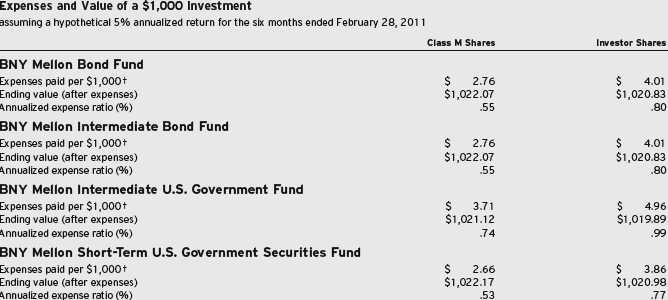

| Understanding Your Fund’s Expenses | 29 |

| Comparing Your Fund’s Expenses | |

| With Those of Other Funds | 31 |

| Statements of Investments | 33 |

| Statement of Options Written | 44,56 |

| Statement of Securities Sold Short | 53 |

| Statement of Financial Futures | 74 |

| Statements of Assets and Liabilities | 81 |

| Statements of Operations | 87 |

| Statement of Cash Flows | 91 |

| Statements of Changes in Net Assets | 92 |

| Financial Highlights | 100 |

| Notes to Financial Statements | 127 |

| |

| |

| |

| For More Information | |

| |

| Back cover | |

The views expressed herein are current to the date of this report. These views and the composition of the funds’ portfolios are subject to change at any time based on market and other conditions.

The Funds

LETTER FROM

THE PRESIDENT

Dear Shareholder:

We are pleased to present to you this semiannual report for the BNY Mellon Funds Trust, covering the reporting period ended February 28, 2011.

Equities throughout the world fared quite well over the past six months. International stock markets have rallied broadly since the fall, when new rounds of monetary stimulus from U.S. and foreign central banks gave investors confidence that the global economy was unlikely to slip back into recession. As a result, developed markets in Europe and Japan rebounded strongly from relatively depressed levels, while emerging markets added more moderately to their previous gains. Market sectors that tend to be sensitive to macroeconomic changes performed particularly well as commodity prices climbed and investors looked forward to better business conditions.

We currently expect the U.S. economy to gain a moderate degree of momentum over the remainder of 2011 as the latest unemployment figures and benign inflationary pressures appear favorable to equities over the near term. However, in the wake of recent gains, we believe that selectivity will become a more important determinant of investment success. We favor companies with higher growth potential, and we also are optimistic about the prospects of high-quality companies with ample cash reserves capable of generating dividend increases and share buybacks.As always, your portfolio manager can help you align your investment portfolio with the opportunities and challenges that 2011 has in store.

For information about how each fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance for each fund.

Thank you for your continued confidence and support.

|

| Christopher E. Sheldon |

| President |

| BNY Mellon Funds Trust |

| March 15, 2011 |

DISCUSSION OF

FUND PERFORMANCE

For the period of September 1, 2010, through February 28, 2011, as provided by Sean P. Fitzgibbon and Jeffrey D. McGrew, Portfolio Managers

Fund and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon Large Cap Stock Fund’s Class M shares produced a total return of 28.45%, and Investor shares returned 28.46%.1 In comparison, the total return of the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), the fund’s benchmark, was 27.73%.2

U.S. stocks rallied during the reporting period as the economic recovery gathered momentum. The fund produced higher returns than its benchmark, primarily due to the success of our stock selection strategy in the information technology and industrials sectors.

The Fund’s Investment Approach

The fund seeks capital appreciation.To pursue its goal, the fund normally invests at least 80% of its assets in stocks of large-cap companies.We choose stocks through a disciplined investment process that uses computer modeling techniques to identify and rank companies based on value, growth and other financial characteristics. Also, we use fundamental analysis, conducting independent research to select the most attractive of the higher-ranked securities. We also attempt to manage risks by diversifying the fund’s investments across companies and industries, maintaining weightings and risk characteristics that generally are similar to those of the S&P 500 Index.

Greater Economic Confidence Fueled a Market Rally

Despite a subpar U.S. economic recovery and a sovereign debt crisis in Europe, investor sentiment improved dramatically soon after the start of the reporting period when the Federal Reserve Board announced a new round of quantitative easing of U.S. monetary policy. This stimulative measure helped convince investors that the economy was unlikely to slip back into recession.A more optimistic investment outlook was reinforced by subsequent improvements in employment and consumer spending, as well as better-than-expected corporate earnings across a number of industry groups.

Later in the fall, the end of uncertainty surrounding U.S. midterm elections and the passage of fiscally stimulative tax legislation lent further support to the stock market rally. However, the rally was interrupted in February when a wave of political unrest in the Middle East led to sharply higher crude oil prices.

Cyclical Sectors Bolstered Relative Performance

The fund participated fully in the market rally over the reporting period, as our stock selection strategy proved especially effective in some of the market’s more economically sensitive industry groups, including the information technology, industrials and energy sectors. Among technology companies, we focused on businesses that we believed were poised to benefit from the trend toward “cloud computing,” in which enterprises access data and applications over

DISCUSSION OF FUND PERFORMANCE (continued)

the Internet.This trend helped lift the stocks of software developers Oracle and Informatica. In addition, communications equipment maker QUALCOMM benefited from the increased adoption of smartphones, while Apple enjoyed continued market leadership in both phones and tablets. Internet retailer Amazon.com also saw a strong holiday sales season fueled by the popularity of its Kindle e-reader.

In the industrials sector, we focused mainly on companies that traditionally have benefited from the later stages of the economic cycle. Heavy equipment maker Caterpillar encountered robust demand from the energy and materials end markets it serves, and new management at industrial conglomerate Dover raised investor confidence, as they implemented new operating efficiencies and made strategic acquisitions. Construction engineer Ingersoll-Rand saw increased demand for HVAC systems from new construction as well as upgrades in existing buildings that had been postponed during the downturn. In the energy sector, exploration-and-production companies advanced as oil and gas prices climbed, enabling longtime holdings Hess and Newfield Exploration to deliver better-than-expected earnings along with the more recent addition, Anadarko Petroleum.

Disappointments during the reporting period were most pronounced in the consumer discretionary sector. Strong results from retailers Nordstrom and Limited Brands were offset by unfortunate timing in the purchase of shares of Ford Motor, causing the fund to miss much of the automaker’s initial gains during the rally. In the telecommunications services sector, industry giant AT&T was undermined by concerns over the loss of its position as the exclusive carrier for the wildly popular iPhone. The fund’s results in the financials sector were hindered to a

degree by American Express, which lagged sector averages after reporting mixed financial results. Finally, the fund suffered shortfalls from diabetes drug specialist Amylin Pharmaceuticals, biotechnology firm Human Genome Sciences and beverage producer PepsiCo.

New Opportunities in a Recovering Economy

We expect the U.S. and global economic rebounds to persist, but going forward revenue improvement will be accompanied by rising expenses as companies resume spending and investment. In this environment, our stock selection process has identified potential opportunities in the consumer discretionary, energy and health care sectors, but has identified fewer opportunities in the consumer staples, materials, financials and telecommunications services sectors. While we believe that these modest tilts position the fund to benefit from further economic growth, we remain cautious regarding valuations and near-term volatility, and we have attempted to keep the fund’s risks roughly in line with those of the broader market.

March 15, 2011

| |

| | Please note, the position in any security highlighted with italicized typeface |

| | was sold during the reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. |

| | Past performance is no guarantee of future results. Share price and investment |

| | return fluctuate such that upon redemption, fund shares may be worth more or |

| | less than their original cost. |

| 2 | SOURCE: LIPPER INC. — Reflects the monthly reinvestment of |

| | dividends and, where applicable, capital gain distributions.The Standard & |

| | Poor’s 500 Composite Stock Price Index is a widely accepted, unmanaged |

| | index of U.S. stock market performance. Index return does not reflect fees and |

| | expenses associated with operating a mutual fund. Investors cannot invest |

| | directly in any index. |

4

DISCUSSION OF

FUND PERFORMANCE

For the period of September 1, 2010, through February 28, 2011, as provided by Christopher E. Sheldon, CFA, Portfolio Manager

Fund and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon Large Cap Market Opportunities Fund’s Class M shares produced a total return of 26.33%, and Investor shares returned 26.21%.1 In comparison, the total return of the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), the fund’s benchmark, was 27.73% for the same period.2

Large-cap stocks rallied strongly as the U.S. and global economic recoveries gained momentum. Although the fund participated to a substantial degree in the market’s gains, it produced lower returns than its benchmark due to mild shortfalls in two of the three underlying strategies in which it invested.

The Fund’s Investment Approach

The fund seeks long-term capital appreciation. To pursue its goal, the fund normally invests at least 80% of its assets in equity securities of large cap companies, currently defined to be those companies with total market capitalizations of $5 billion or more at the time of the purchase.The fund normally allocates its assets among multiple investment strategies, each employed by the fund’s investment adviser or its affiliates that invest primarily in equity securities issued by large-cap companies.The fund is designed to provide exposure to various large-cap equity portfolio managers and investment strategies and styles, including some or all of the following: the Focused Equity Strategy, U.S. Large Cap Equity Strategy, U.S. Core Equity 130/30 Strategy, Dynamic Large Cap Value Strategy, Large Cap Growth Strategy and U.S. Large Cap Growth Strategy, all as more particularly described in the fund’s prospectus.The fund invests directly in securities or in other mutual funds advised by the fund’s investment adviser or its affiliates.

The fund’s investment adviser determines the investment strategies, sets the target allocations, monitors portfolio trading activity within the investment strategies and executes all purchases and sales of portfolio securities of the fund.

Greater Economic Confidence Fueled a Market Rally

The reporting period began in the wake of a period of choppy stock market performance stemming from a subpar U.S. economic recovery and a sovereign debt crisis in Europe. However, investor sentiment soon improved dramatically when the Federal Reserve Board announced a new round of quantitative easing of U.S. monetary policy. This stimulative measure helped convince many investors that the U.S. economy was unlikely to slip back into recession, and they began to look forward to better business conditions for U.S. and multinational companies. A more optimistic investment outlook was reinforced by subsequent releases of economic data, which showed improvements in employment and consumer spending, as well as better-than-expected corporate earnings across a number of industry groups.

Later in the fall, the end of uncertainty surrounding U.S. midterm elections and the passage of fiscally stimulative tax legislation lent further support to the stock market rally. However, the rally was interrupted in February when a wave of political unrest in the Middle East led to sharply higher energy prices.

Focused Equities Strategy Bolstered Relative Results

Although the fund captured much of the broad-based market rally during the reporting period, its U.S. Core Equity 130/30 Strategy caused it to lag modestly behind the S&P 500 Index. In the U.S. Core Equity 130/30 Strategy, strong relative results in the health care and consumer discretionary sectors were not enough to offset the adverse effects of relative performance in the

DISCUSSION OF FUND PERFORMANCE (continued)

financials sector and underweighted exposure to the materials sector. In the U.S. Large Cap Equity Strategy, an underweighted position in the financials sector compared to the benchmark undermined the fund’s performance. Above-average returns stemming from overweighted exposure to the energy sector and underweighted positions in the traditionally defensive telecommunications services and utilities sectors helped offset the shortfall.

The Focused Equity Strategy produced better relative results, outperforming the S&P 500 Index on the strength of successful stock selections in the health care, industrials, materials and technology sectors. Relative performance in the health care sector was bolstered by its lack of exposure to large pharmaceutical companies, while industrial companies Caterpillar and Honeywell International, iron ore producer Cliffs Natural Resources and information technology firms Cognizant Technology Solutions, Baidu and Apple also helped drive the fund’s returns.

A Cyclical Bias in a Recovering Economy

Despite headwinds from resurgent oil prices and a moribund housing market, we believe the current economic recovery is likely to persist. Consequently, we have maintained the fund’s tilt toward more cyclical investments. For example, our allocation strategy has

maintained relatively heavy exposure to the energy and information technology sectors, and we have placed less emphasis on the traditionally defensive consumer staples, utilities and telecommunications services sectors. Of course, we are prepared to change the fund’s allocations among its underlying strategies as economic and market conditions evolve.

March 15, 2011

| |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| | The fund may use derivative instruments, such as options, futures and options |

| | on futures and swaps.A small investment in derivatives could have a |

| | potentially large impact on the fund’s performance.The use of derivatives |

| | involves risks different from, or possibly greater than, the risks associated with |

| | investing directly in the underlying assets. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. |

| | Past performance is no guarantee of future results. Share price and investment |

| | return fluctuate such that upon redemption, fund shares may be worth more or |

| | less than their original cost. Return figures provided reflect the absorption of |

| | certain fund expenses by BNY Mellon Fund Advisors pursuant to an |

| | agreement in effect until January 1, 2012, at which time it may be extended, |

| | terminated or modified. Had these expenses not been absorbed, the fund’s |

| | returns would have been lower. |

| 2 | SOURCE: LIPPER INC. — Reflects monthly reinvestment of dividends |

| | and, where applicable, capital gain distributions.The Standard & Poor’s 500 |

| | Composite Stock Price Index is a widely accepted, unmanaged index of U.S. |

| | stock market performance. Investors cannot invest directly in any index. |

6

DISCUSSION OF

FUND PERFORMANCE

For the period of September 1, 2010, through February 28, 2011, as provided by Christopher E. Sheldon, CFA, Portfolio Manager

Fund and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon Tax-Sensitive Large Cap Multi-Strategy Fund’s Class M shares produced a total return of 27.56%, and Investor shares returned 27.38%.1 In comparison, the total return of the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), the fund’s benchmark, was 27.73% for the same period.2

Large-cap stocks rallied strongly as the U.S. and global economic recoveries gained momentum. The fund produced returns that were roughly in line with its benchmark, as strong relative results from its Large Cap Core Strategy and Focused Equity Strategy offset shortfalls in the U.S. Large Cap Equity Strategy and U.S. Core Equity 130/30 Strategy.

The Fund’s Investment Approach

The fund seeks long-term capital appreciation.To pursue its goal, the fund normally invests at least 80% of its assets in equity securities of large cap companies, currently defined to be those companies with total market capitalizations of $5 billion or more at the time of purchase. The fund normally allocates its assets among multiple investment strategies, each employed by the fund’s investment adviser or its affiliates, that invest primarily in equity securities issued by large-cap companies.The fund is designed to provide exposure to various large-cap equity portfolio managers and investment strategies and styles, and uses tax-sensitive strategies to reduce the impact of federal and state income taxes on its after-tax returns.The fund apportions its assets among some or all of the following: the Large Cap Core Strategy, Large Cap Tax-Sensitive Strategy, Focused Equity Strategy, U.S. Large Cap Equity Strategy, U.S. Core Equity 130/30 Strategy,

Dynamic Large CapValue Strategy, Large Cap Growth Strategy and U.S. Large Cap Growth Strategy, all as more particularly described in the fund’s prospectus. The fund invests directly in securities or in other mutual funds advised by the fund’s investment adviser or its affiliates.

The fund’s investment adviser determines the investment strategies, sets the target allocations, monitors portfolio trading activity within the investment strategies and executes all purchases and sales of portfolio securities of the fund.

Greater Economic Confidence Fueled a Market Rally

Shortly after the start of the reporting period, investor sentiment improved dramatically when the Federal Reserve Board announced a new round of quantitative easing of U.S. monetary policy.A more optimistic outlook was reinforced by subsequent improvements in employment and consumer spending, as well as better-than-expected corporate earnings across most industry groups. Later in the fall, the end of uncertainty surrounding U.S. midterm elections and the passage of fiscally stimulative tax legislation lent further support to a rising stock market. However, the rally was interrupted in February when a wave of political unrest in the Middle East led to sharply higher energy prices.

Focused Equities and Large Cap Core Strategies Boosted Relative Results

In the fund’s Focused Equity Strategy, the health care sector benefited from lack of exposure to large pharmaceutical companies, while industrial companies Caterpillar and Honeywell International, iron ore producer Cliffs Natural Resources and information technology firms Cognizant Technology Solutions, Baidu and Apple also helped fuel the fund’s relative returns. Gains in the Large Cap Core Strategy were primarily driven by the information technology sec-

DISCUSSION OF FUND PERFORMANCE (continued)

tor, where a number of companies benefited from emerging trends such as “cloud computing” and the shift from personal computers to smartphones and tablet computers. The strategy also scored successes in industrial companies leveraged to the recovering global economy, including Caterpillar, Eaton and Honeywell.

On the other hand, the U.S. Core Equity 130/30 Strategy trailed the S&P 500 Index modestly. In the U.S. Core Equity 130/30 Strategy, strong results in the energy, materials and industrial sectors were reduced by lower returns in the utilities, telecom and staples sectors. The U.S. Large Cap Equity Strategy performed in line with the market. An underweighted position in the financials sector dampened the fund’s relative performance. Better returns stemming from overweighted exposure to the energy sector, more than offset lesser returns from underweighted positions in the traditionally defensive telecommunications services and utilities sectors.

The Large Cap Tax-Sensitive Strategy produced returns that were in line with market averages, as strong performance in the energy sector was balanced by lagging results among telecommunications services companies and utilities.

A Cyclical Bias in a Recovering Economy

Despite headwinds from resurgent oil prices and a moribund housing market, we believe the economic recovery is likely to persist. Consequently, we have maintained the

fund’s exposure to cyclical investments. For example, our allocation strategy has maintained relatively heavy exposure to the energy and information technology sectors, and we have placed less emphasis on the traditionally defensive consumer staples, utilities and telecommunications services sectors. Of course, we are prepared to change the fund’s allocations among its underlying strategies as economic and market conditions evolve.

March 15, 2011

| |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| | The fund may use derivative instruments, such as options, futures and options |

| | on futures and swaps.A small investment in derivatives could have a |

| | potentially large impact on the fund’s performance.The use of derivatives |

| | involves risks different from, or possibly greater than, the risks associated with |

| | investing directly in the underlying assets. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. |

| | Past performance is no guarantee of future results. Share price and investment |

| | return fluctuate such that upon redemption, fund shares may be worth more or |

| | less than their original cost. Return figures provided reflect the absorption of |

| | certain fund expenses by BNY Mellon Fund Advisors pursuant to an |

| | agreement in effect until January 1, 2012, at which time it may be extended, |

| | terminated or modified. Had these expenses not been absorbed, the fund’s |

| | returns would have been lower. |

| 2 | SOURCE: LIPPER INC. — Reflects monthly reinvestment of dividends |

| | and, where applicable, capital gain distributions.The Standard & Poor’s 500 |

| | Composite Stock Price Index is a widely accepted, unmanaged index of U.S. |

| | stock market performance. Investors cannot invest directly in any index. |

8

DISCUSSION OF

FUND PERFORMANCE

For the period of September 1, 2010, through February 28, 2011, as provided by Brian C. Ferguson, Portfolio Manager

Fund and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon Income Stock Fund’s Class M shares produced a total return of 27.27%, and its Investor shares returned 27.06%.1 The fund’s benchmark, the Russell 1000 Value Index, produced a total return of 26.30% for the same period.2

Stocks rallied strongly over the reporting period as the U.S. and global economic recoveries gained momentum. The fund produced higher returns than its benchmark, due to the success of our stock selection strategy in seven of the 10 industry groups represented in the Russell 1000Value Index.

The Fund’s Investment Approach

The fund seeks total return consisting of capital appreciation and income.To pursue its goal, the fund normally invests at least 80% of its assets in stocks.The fund seeks to focus on dividend-paying stocks and other investment techniques that produce income. We choose stocks through a disciplined investment process that combines quantitative modeling techniques, fundamental analysis and risk management.While we attempt to manage risks by diversifying broadly across companies and industries, the fund may at times overweight certain sectors in an attempt to earn higher yields. The fund may also use derivatives as a substitute for taking a position in an underlying asset, to increase returns or income, or as part of a hedging strategy.

Greater Economic Confidence Fueled a Market Rally

Despite a subpar U.S. economic recovery and a sovereign debt crisis in Europe, investor sentiment improved dramatically soon after the start of the reporting period when the Federal Reserve Board announced a new round of quantitative easing of U.S. monetary policy. This stimulative measure helped convince many investors that the U.S. economy was unlikely to slip back into recession, and they began to look forward to better business conditions for domestic and multinational companies. A more optimistic investment outlook was reinforced by subsequent improvements in employment and consumer spending, as well as better-than-expected corporate earnings across a number of industry groups.

Later in the fall, the end of uncertainty surrounding U.S. midterm elections and the passage of fiscally stimulative tax legislation lent further support to the stock market rally. However, the rally was interrupted in February when a wave of political unrest in the Middle East led to sharply higher crude oil prices.

Stock Selection Strategy Boosted Fund Results

The fund participated fully in the stock market’s gains over the reporting period. Returns were especially robust in the industrials sector. Capital goods producers encountered better business conditions in an improving global economy, supporting higher stock prices for heavy equipment maker Caterpillar and industrial conglomerates Dover and General Electric.

DISCUSSION OF FUND PERFORMANCE (continued)

In the consumer discretionary sector, overweighted exposure to media stocks lifted the fund’s relative performance, led by advertising agency holding company Omnicom Group. Automotive parts supplier Johnson Controls also advanced as car and truck sales continued to rebound from previously depressed levels.

The fund benefited from underweighted exposure to the utilities sector, the only segment of the benchmark that fell short of double-digit returns for the reporting period. Utilities generally did not meet our investment criteria due to their high valuations and low rates of earnings growth. Among individual stocks in other market sectors, energy services provider Schlumberger advanced due to rising demand for a limited supply of oil, and technology firm QUALCOMM benefited from the ongoing shift from personal computers to mobile and tablet devices. Lack of exposure to insurance holding company Berkshire Hathaway supported the fund’s relative performance in the financials sector.

Although the energy sector provided the fund’s highest absolute returns during the reporting period, the sector’s performance compared to the benchmark suffered as the fund did not own many of the large, integrated energy producers that benefited most from higher commodity prices. Conversely, the fund held overweighted positions in the telecommunications services sector due to its high dividend yields, but the sector generally lagged market averages as investors turned toward more economically sensitive investments. In the information technology sector, networking giant Cisco Systems did not participate as strongly as other companies in the growing trend toward “cloud computing,” in which businesses store and access data and applications over the Internet.

Positioned for a More Selective Market Environment

We expect the U.S. economic recovery to persist in 2011. Greater economic and political clarity may help convince business leaders to deploy some of their massive cash reserves for mergers-and-acquisitions, stock buybacks and other productive uses. However, a number of economic headwinds remain, including geopolitical turmoil, rising commodity prices and troubled U.S. housing markets.

We expect investors to become more selective in this environment, favoring companies that can grow consistently in a moderately expanding economy. Therefore, we have maintained overweighted positions among companies we believe tend to do well in cyclical recoveries.

March 15, 2011

| |

| | Please note, the position in any security highlighted with italicized typeface |

| | was sold during the reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. |

| | Past performance is no guarantee of future results. Share price and investment |

| | return fluctuate such that upon redemption, fund shares may be worth more or |

| | less than their original cost. |

| 2 | SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, |

| | where applicable, capital gain distributions.The Russell 1000 Value Index is |

| | an unmanaged index which measures the performance of those Russell 1000 |

| | companies with lower price-to-book ratios and lower forecasted growth values. |

| | Investors cannot invest directly in any index. |

10

DISCUSSION OF

FUND PERFORMANCE

For the period from September 1, 2010, through February 28, 2011, as provided by Stephen A. Mozur, Portfolio Manager

Fund and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon Mid Cap Stock Fund’s Class M shares produced a total return of 40.10%, Investor shares returned 39.83% and Dreyfus Premier shares returned 39.40%.1 In comparison, the Standard & Poor’s MidCap 400 Index (“S&P 400 Index”), the fund’s benchmark, produced a total return of 34.86% for the same period.2

Midcap stocks rallied over the reporting period as the economic recovery gained momentum.The fund produced returns that were higher than its benchmark, due primarily to an emphasis on companies with growth-oriented business models.

The Fund’s Investment Approach

The fund seeks capital appreciation by normally investing at least 80% of its assets in stocks of domestic companies with market capitalizations generally in the range of companies included in the S&P 400 Index at the time of purchase. The fund invests in growth and value stocks, which are chosen through a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management. Based on fundamental analysis, the investment adviser generally selects the most attractive securities, drawing on a variety of sources, including internal as well as Wall Street research, and company management. Finally, we manage risk by diversifying across companies and industries. Our goal is to keep those risks at levels that are similar to those of the S&P 400 Index.

Improved Economic Confidence Fueled a Market Rally

Despite a subpar U.S. economic recovery and a sovereign debt crisis in Europe, investor sentiment improved dramatically soon after the start of the reporting period when the Federal Reserve Board announced a new round of quantitative easing of U.S. monetary policy. A more optimistic investment outlook was reinforced by subsequent improvements in employment and consumer spending, as well as increased mergers-and-acquisitions activity and better-than-expected corporate earnings across a number of industry groups. Later in the fall, the end of uncertainty surrounding U.S. midterm elections and the passage of fiscally stimulative tax legislation lent further support to the stock market. However, the rally was interrupted in February when a wave of political unrest in the Middle East led to sharply higher crude oil prices.

In this generally favorable environment, midcap stocks produced substantially higher returns than large-cap stocks.

A Cyclical Bias Boosted Fund Results

The fund achieved above-average results in eight of the 10 economic sectors represented in the S&P 400 Index, scoring particularly strong returns from overweighted positions in economically sensitive industry groups. In the information technology sector, successful stock selections and an emphasis on high-growth communications equipment companies boosted relative performance. RiverbedTechnology more than doubled

DISCUSSION OF FUND PERFORMANCE (continued)

in value and Rackspace Hosting advanced strongly amid increasing demand for data center infrastructure and network optimization as companies transitioned to “cloud computing” for their data management needs. JDS Uniphase and Acme Packet produced higher earnings due to increased spending by telecommunications companies on optical components. Employee training software developer SuccessFactors gained value after reporting strong bookings and revenue growth.

In the financials sector, insurance holding company CNO Financial Group climbed after successfully restructuring its debt, which resulted in upgrades from major credit-rating agencies. Insurance provider Hartford Financial Services Group gained substantial value as credit losses eased and the company’s capital position and earnings outlook improved. Real estate investment trust Host Hotels & Resorts advanced amid improved occupancy rates and the announcement of several acquisitions. Rising commodity prices helped boost the energy sector, benefiting exploration-and-production companies Brigham Exploration and SandRidge Energy. In addition, coal producers International Coal Group and Massey Energy benefited from rising commodity prices and takeover speculation.

Disappointments proved relatively mild during the reporting period. In the health care sector, biopharmaceu-tical firm Inspire Pharmaceuticals fell sharply on the first trading day of 2011 due to negative trial data for a cystic fibrosis drug under development. Salix Pharmaceuticals fell when regulators delayed approval of a new drug treating irritable bowel syndrome. Thoratec slid due to competitive concerns regarding its heart pump products, and the company reported disappointing quarterly earnings in early 2011.

Positioned for More Economic Recovery

Despite headwinds from resurgent oil prices and a moribund housing market, we believe the economic recovery is likely to persist. Consequently, we have maintained the fund’s tilt toward cyclical companies with the potential for higher-than-average revenues and earnings growth. We have found a number of opportunities in the energy, industrials and information technology sectors, but we have found fewer opportunities in the traditionally defensive utilities and consumer staples sectors. We also have invested in midcap stocks that we believe will benefit from other investment themes, including a rebound in auto and truck sales, improving conditions in the airline industry, rising mergers-and-acquisitions activity, rising demand for wireless communications and higher commodity prices.

March 15, 2011

| |

| | Please note, the position in any security highlighted in italicized typeface was |

| | sold during the reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| | Stocks of small- and/or midcap companies often experience sharper price |

| | fluctuations than stocks of large-cap companies. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and |

| | does not take into consideration the contingent deferred sales charges imposed |

| | on redemptions in the case of Dreyfus Premier shares. Had these charges been |

| | reflected, returns would have been lower. Past performance is no guarantee of |

| | future results. Share price and investment return fluctuate such that upon |

| | redemption, fund shares may be worth more or less than their original cost. |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where |

| | applicable, capital gain distributions.The Standard & Poor’s MidCap 400 |

| | Index is a widely accepted, unmanaged total return index measuring the |

| | performance of the midsize company segment of the U.S. stock market. Index |

| | return does not reflect the fees and expenses associated with operating a mutual |

| | fund. Investors cannot invest directly in any index. |

12

DISCUSSION OF

FUND PERFORMANCE

For the period from September 1, 2010, through February 28, 2011, as provided by Stephen A. Mozur, Portfolio Manager

Fund and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon Small Cap Stock Fund’s Class M shares produced a total return of 37.81%, and its Investor shares produced a total return of 37.50%.1 In comparison, the fund’s benchmark, the Standard & Poor’s SmallCap 600 Index (the “Index”), produced a total return of 35.41% for the same period.2

Small-cap stocks rallied over the reporting period as the economic recovery gained momentum. The fund produced returns that were higher than its benchmark, due primarily to an emphasis on companies with growth-oriented business models.

The Fund’s Investment Approach

The fund seeks capital appreciation.To pursue its goal, the fund normally invests at least 80% of its assets in stocks of small-cap companies. We choose stocks through a disciplined investment process that uses computer modeling techniques to identify and rank companies based on value, growth and other financial characteristics. Also, we use fundamental analysis, conducting independent research to select the most attractive of the higher-ranked securities. We also attempt to manage risks by diversifying the fund’s investments across companies and industries, maintaining weightings and risk characteristics that generally are similar to those of the S&P 600 Index.

Improved Economic Confidence Fueled a Market Rally

The reporting period began in the wake of a period of choppy stock market performance stemming from a subpar U.S. economic recovery and a sovereign debt crisis in Europe. However, investor sentiment soon improved dramatically when the Federal Reserve Board

announced a new round of quantitative easing of U.S. monetary policy, and investors began to look forward to better business conditions. A more optimistic investment outlook was reinforced by subsequent releases of economic data, which showed improvements in employment and consumer spending, as well as better-than-expected corporate earnings across a number of industry groups.

Later in the fall, the end of uncertainty surrounding U.S. midterm elections and the passage of fiscally stimulative tax legislation lent further support to the stock market rally. However, the rally was interrupted in February when a wave of political unrest in the Middle East led to sharply higher crude oil prices.

In this generally favorable environment, small-cap stocks produced higher returns, on average, than their mid- and large-cap counterparts.

A Cyclical Bias Boosted Fund Results

The fund achieved above-average results in eight of the 10 economic sectors represented in the S&P 600 Index, scoring particularly strong returns from overweighted positions in economically sensitive industry groups. In the information technology sector, successful stock selections and an emphasis on high-growth communications equipment companies boosted relative performance. Riverbed Technology more than doubled in value amid increasing demand for data center infrastructure and network optimization as companies transitioned to “cloud computing” for their data management needs. Finisar and Acme Packet produced higher earnings due to increased spending by telecommunications companies on optical components. Storage solutions provider Compellent Technologies rose after receiving an acquisition offer from a major computer equipment manufacturer. Employee training software developer SuccessFactors gained value after reporting strong bookings and revenue growth.

DISCUSSION OF FUND PERFORMANCE (continued)

In the health care sector, Amarin Corp. climbed amid takeover speculation after receiving positive test results from a new drug under development, and medical products producer Cooper Companies gained market share in a strong overall market. Among industrial companies, Titan International benefited from strong demand for agriculture equipment, and Navistar International and WABCO Holdings encountered continuing strength in heavy duty truck orders. Baldor Electric advanced after receiving a takeover offer. Finally, in the energy sector, rising commodity prices helped boost Brigham Exploration and International Coal Group.

Disappointments proved relatively mild during the reporting period.The fund’s investments in the consumer discretionary sector produced positive absolute returns but lagged their respective benchmark components. We attribute most of the sector’s relative underperformance to gains in companies held by the benchmark but not the fund. In addition, Maidenform Brands declined when inventories grew much faster than sales, retailers Tuesday Morning and Talbots fell due to weaker-than-expected earnings, and footwear seller Skechers USA slid on concerns regarding increased competition.

Positioned for More Economic Recovery

Despite headwinds from resurgent oil prices and a moribund housing market, we believe the economic recovery is likely to persist. Consequently, we have maintained the fund’s tilt toward cyclical companies with the potential for

higher-than-average revenues and earnings growth. We have found a number of opportunities in the energy, materials, industrials and information technology sectors. We have found fewer opportunities in the traditionally defensive utilities and consumer staples sectors. We also have invested in small-cap stocks that we believe will benefit from other investment themes, including a rebound in auto and truck sales, improving conditions in the airline industry, an increase in mergers-and-acquisitions activity, rising demand for wireless communications and higher commodity prices.

March 15, 2011

| |

| | Please note, the position in any security highlighted in italicized typeface was |

| | sold during the reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. |

| | Past performance is no guarantee of future results. Share price and investment |

| | return fluctuate such that upon redemption, fund shares may be worth more or |

| | less than their original cost. Return figures provided reflect the absorption of |

| | certain fund expenses by BNY Mellon Fund Advisors pursuant to an |

| | agreement in effect through September 30, 2010, at which time it was |

| | terminated. Had these expenses not been absorbed, the fund’s returns would |

| | have been lower. |

| 2 | SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, |

| | where applicable, capital gain distributions.The Standard & Poor’s SmallCap |

| | 600 Index is a broad-based index and a widely accepted, unmanaged index of |

| | overall small-cap stock market performance.The index does not take into |

| | account fees and expenses to which the fund is subject. Investors cannot invest |

| | directly in any index. |

14

DISCUSSION OF

FUND PERFORMANCE

For the period of September 1, 2010, through February 28, 2011, as provided by Sean P. Fitzgibbon and Jeffrey D. McGrew, Portfolio Managers

Fund and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon U.S. Core Equity 130/30 Fund’s Class M shares produced a total return of 25.39%, and Investor shares returned 25.15%.1 In comparison, the total return of the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500 Index”), the fund’s benchmark, was 27.73%.2

U.S. stocks rallied during the reporting period as the economic recovery gathered momentum. The fund produced lower returns than its benchmark, primarily due to our short-selling strategy.

The Fund’s Investment Approach

The fund seeks capital appreciation, normally investing at least 80% of its assets in stocks of large-cap companies. We choose stocks through a disciplined investment process that uses computer modeling techniques to identify and rank companies based on value, growth and other financial characteristics. The portfolio managers supplement and confirm this information using fundamental analysis, and generally buy “long” the most attractive of the higher-ranked securities and sell “short” those stocks identified by the computer model and fundamental analysis as being likely to underperform. Normally, up to 130% of the fund’s assets will be in long positions, and approximately 30% of the fund’s assets will be in short positions. However, the fund’s short positions may range in value from approximately 25% to 35% of the fund’s assets.We also attempt to mitigate risks by diversifying the fund’s investments across companies

and industries, maintaining weightings and risk characteristics that generally are similar to those of the S&P 500 Index.

Greater Economic Confidence Fueled a Market Rally

Despite a subpar U.S. economic recovery and a sovereign debt crisis in Europe, investor sentiment improved dramatically soon after the start of the reporting period when the Federal Reserve Board announced a new round of quantitative easing of U.S. monetary policy. This stimulative measure helped convince investors that the economy was unlikely to slip back into recession. A more optimistic investment outlook was reinforced by subsequent improvements in employment and consumer spending, as well as better-than-expected corporate earnings across a number of industry groups.

Later in the fall, the end of uncertainty surrounding U.S. midterm elections and the passage of fiscally stimulative tax legislation lent further support to the stock market rally. However, the rally was interrupted in February when a wave of political unrest in the Middle East led to sharply higher crude oil prices.

Market Momentum Undermined Short Sales

Although the fund’s long positions generally produced strong returns, the fund’s relative performance was hindered by some of its short positions. In the consumer discretionary sector, a short position in retailer J. Crew Group proved counterproductive when the company was acquired. In addition, strong returns from Nordstrom and Limited Brands were offset by unfortunate timing in the purchase of shares of Ford Motor. Results in the financials sector were hindered by a short position in commodities exchange CBOE Holdings, which gained

DISCUSSION OF FUND PERFORMANCE (continued)

value amid takeover speculation. A long position in American Express also lagged sector averages after the company reported mixed financial results. Finally, the fund’s selection among electricity producers and exclusion of natural gas producers hurt its relative performance in that sector.

The fund achieved better results in the industrials sector, where heavy equipment maker Caterpillar encountered robust demand from the energy and materials end markets it serves, industrial conglomerate Dover showed positive results from management initiatives, and construction engineer Ingersoll-Rand saw increased demand for HVAC systems. Among technology companies, Internet retailer Amazon.com enjoyed a strong holiday season fueled by sales of its Kindle e-reader.We also focused on businesses that we believed would benefit from the trend toward “cloud computing,” in which enterprises access data and applications over the Internet.This trend helped lift software developers Oracle and Informatica. Communications equipment maker QUALCOMM benefited from the increased adoption of smartphones, while a short position in handset maker Nokia added value to the portfolio as Nokia continued to lose share in that market. In the health care sector, longstanding holding King Pharmaceuticals was acquired by Pfizer during the reporting period, and the fund benefited from underweighted exposure to industry giant Merck & Co. Finally, medical devices producer Covidien rebounded from earlier weakness, and the stock was further supported by its addition to the S&P 500 Index.

New Opportunities in a Recovering Economy

We expect the U.S. and global economic rebounds to persist, but corporate earnings may come under pressure as companies resume spending and investment. In this environment, our stock selection process has identified a number of potential opportunities in the consumer

discretionary, energy and health care sectors, but has identified fewer opportunities in the consumer staples, materials, financials and telecommunications services sectors.While we believe that these modest tilts position the fund to benefit from further economic growth, we remain cautious regarding valuations and near-term volatility, and we have attempted to keep the fund’s risks roughly in line with those of the broader market.

March 15, 2011

| |

| | Please note, the position in any security highlighted with italicized typeface |

| | was sold during the reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| | The use of leverage may magnify the fund’s gains or losses. For derivatives |

| | with a leveraging component, adverse changes in the value or level of the |

| | underlying asset can result in a loss that is much greater than the original |

| | investment in the derivative. |

| | Short sales involve selling a security the fund does not own in anticipation that |

| | the security’s price will decline. Short sales may involve substantial risk and |

| | leverage, and expose the fund to the risk that it will be required to buy the |

| | security sold short at a time when the security has appreciated in value, thus |

| | resulting in a loss to the fund. Short positions in stocks involve more risk than |

| | long positions in stocks because the maximum sustainable loss on a stock |

| | purchased is limited to the amount paid for the stock plus the transaction costs, |

| | whereas there is no maximum attainable price on the shorted stock. In theory, |

| | stocks sold short have unlimited risk. It is possible that the market value of |

| | securities the fund holds in long positions will decline at the same time that |

| | the market value of the securities in the fund has sold short increases, thereby |

| | increasing the fund’s potential volatility. Leveraging occurs when the fund |

| | increases its assets available for investment using borrowing or similar |

| | transactions. Short sales effectively leverage the fund’s assets.The use of leverage |

| | may magnify the fund’s gains or losses. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. |

| | Past performance is no guarantee of future results. Share price and investment |

| | return fluctuate such that upon redemption, fund shares may be worth more or |

| | less than their original cost. |

| 2 | SOURCE: LIPPER INC. — Reflects the monthly reinvestment of |

| | dividends and, where applicable, capital gain distributions.The Standard & |

| | Poor’s 500 Composite Stock Price Index is a widely accepted, unmanaged |

| | index of U.S. stock market performance. Index return does not reflect fees and |

| | expenses associated with operating a mutual fund. Investors cannot invest |

| | directly in any index. |

16

DISCUSSION OF

FUND PERFORMANCE

For the period from September 1, 2010, through February 28, 2011, as provided by Irene D. O’Neill, Portfolio Manager

Fund and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon Focused Equity Opportunities Fund’s Class M shares produced a total return of 31.36%, and Investor shares returned 31.24%.1 In comparison, the total return of the Russell 1000 Index (the “Index”), the fund’s benchmark, was 28.65% for the same period.2

U.S. stocks rallied over the reporting period as the economic recovery gained momentum.The fund produced returns that were higher than its benchmark, due primarily to successful stock selections in the health care, industrials, materials and technology sectors.

The Fund’s Investment Approach

The fund seeks capital appreciation.To pursue its goal, the fund normally invests at least 80% of its assets in equity securities. We begin with a top-down assessment of broad economic, political and social trends. We strive to determine those sectors and industries most likely to benefit from identified trends, focusing on areas we believe present the most attractive growth outlook.Within those sectors and industries, we then employ a bottom-up, fundamental approach to find individual companies with:

Unrecognized or underestimated earnings power

Sustainable revenues and cash flow

Positive operational or financial catalysts

Attractive valuations based on growth prospects

Strong or improving financial conditions

Finally, we select for investment the 25 to 30 best opportunities from the companies meeting these criteria.

Greater Economic Confidence Fueled a Market Rally

The reporting period began in the wake of a period of choppy stock market performance stemming from a subpar U.S. economic recovery and a sovereign debt crisis in Europe. However, investor sentiment soon improved markedly when the Federal Reserve Board announced a new round of quantitative easing of U.S. monetary policy. This stimulative measure helped convince many investors that the U.S. economy was unlikely to slip back into recession, and they began to look forward to better business conditions for U.S. and multinational companies. A more optimistic investment outlook was reinforced by subsequent releases of economic data, which showed improvements in employment and consumer spending, as well as better-than-expected corporate earnings across a number of industry groups.

Later in the fall, the end of uncertainty surrounding U.S. midterm elections and the passage of fiscally stimulative tax legislation lent further support to the stock market rally. However, the rally was interrupted in February when a wave of political unrest in the Middle East led to sharply higher crude oil prices.

Focused Stock Selection Strategy Boosted Fund Results

Our research-intensive approach to security selection enabled the fund to achieve particularly strong results in the health care sector, an area of the benchmark that

DISCUSSION OF FUND PERFORMANCE (continued)

generally lagged market averages during the reporting period.The fund’s relative performance in the sector was bolstered by its lack of exposure to large pharmaceutical companies, which suffered amid concerns regarding patent expirations on key products. Instead, the fund scored success with medical devices and supplies producer Covidien, which gained value after a successful restructuring in which the company shed slower-growing businesses and acquired faster-growing ones. Generic drug makerWatson Pharmaceuticals also fared well in anticipation of strong sales of the generic versions of cholesterol medicine Lipitor and ADHD drug Concerta.

The fund held only two stocks in the industrials sector, both of which produced above-average returns. Heavy equipment manufacturer Caterpillar advanced due to strong demand for construction and mining equipment in the emerging markets, and industrial conglomerate Honeywell International encountered rising capital spending on the process controls used in factory automation. Among materials stocks, iron ore producer Cliffs Natural Resources benefited from rising commodity prices. In the technology sector, the fund favored companies driving new technological trends, such as cloud computing. The reporting period’s winners in the technology sector included CognizantTechnology Solutions, which provides consulting and outsourcing services; Baidu, the dominant Chinese search engine; and electronics innovator Apple, maker of the wildly popular iPad tablet computer and iPhone smartphone.

Disappointments during the reporting period proved relatively mild. Consumer discretionary stock International Game Technology was hurt by delayed upgrades of slot machines by hotels and casinos, and an expected turnaround for consumer staples company Avon Products had not yet materialized. Both stocks were sold during the reporting period.

A Cyclical Bias in a Recovering Economy

Despite headwinds from resurgent oil prices and a moribund housing market, we believe the current economic recovery is likely to persist. Consequently, we have maintained the fund’s tilt toward more cyclical investments, and we have focused on companies that we believe are likely to benefit from higher revenues rather than those that have boosted earnings by cutting costs.We have found a number of growth opportunities in the energy sector, where demand continues to recover, and among technology companies at the cutting edge of new trends. We have found fewer opportunities meeting our criteria in the traditionally defensive consumer staples, utilities and telecommunications services sectors.

March 15, 2011

| |

| | Please note, the position in any security highlighted in italicized typeface was |

| | sold during the reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| | The fund is non-diversified, which means that a relatively high percentage of |

| | the fund’s assets may be invested in a limited number of issuers.Therefore, the |

| | fund’s performance may be more vulnerable to changes in the market value of |

| | a single issuer or group of issuers and more susceptible to risks associated with |

| | a single economic, political or regulatory occurrence than a diversified fund. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. |

| | Past performance is no guarantee of future results. Share price and investment |

| | return fluctuate such that upon redemption, fund shares may be worth more or |

| | less than their original cost.The fund’s returns reflect the absorption of certain |

| | fund expenses by BNY Mellon Fund Advisors pursuant to an agreement in |

| | effect until January 1, 2011, at which point it was terminated. Had these |

| | expenses not been absorbed, the fund’s returns would have been lower. |

| 2 | SOURCE: LIPPER INC. — Reflects the monthly reinvestment of |

| | dividends and, where applicable, capital gain distributions.The Russell 1000 |

| | Index is a widely accepted, unmanaged index of U.S. stock market |

| | performance. Index return does not reflect fees and expenses associated with |

| | operating a mutual fund. Investors cannot invest directly in any index. |

18

DISCUSSION OF

FUND PERFORMANCE

For the period from September 1, 2010, through February 28, 2011, as provided by John M. Chambers, Portfolio Manager

Fund and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon Small/Mid Cap Stock Fund’s Class M shares produced a total return of 38.69%, and Investor shares returned 38.52%.1 In comparison, the Russell 2500 Index (the “Index”), the fund’s benchmark, produced a total return of 36.04% for the same period.2

Small- and midcap stocks rallied over the reporting period as the economic recovery gained momentum. The fund produced returns that were higher than its benchmark, due primarily to an emphasis on companies with growth-oriented business models.

The Fund’s Investment Approach

The fund seeks capital appreciation.To pursue its goal, the fund normally invests at least 80% of its assets in equity securities of small-cap and midcap companies with total market capitalizations of between $200 million and $7 billion at the time of investment.The fund invests in growth and value stocks, which are chosen through a disciplined investment process that combines computer modeling techniques, fundamental analysis and risk management to identify and rank stocks within an industry or sector based on several characteristics, including value, growth and the company’s financial health. Using fundamental analysis, the investment adviser generally selects the most attractive securities. Finally, we seek to manage risk by diversifying across companies and industries.The fund is structured so that its sector weightings and risk characteristics are generally similar to those of the Russell 2500 Index.

Improved Economic Confidence Fueled a Market Rally

Despite a subpar U.S. economic recovery and a sovereign debt crisis in Europe, investor sentiment improved dramatically soon after the start of the reporting period when the Federal Reserve Board announced a new round of quantitative easing of U.S. monetary policy. A more optimistic investment outlook was reinforced by subsequent improvements in employment and consumer spending, as well as better-than-expected corporate earnings across a number of industry groups. Later in the fall, the end of uncertainty surrounding U.S. midterm elections and the passage of fiscally stimulative tax legislation lent further support to the stock market. However, the rally was interrupted in February when a wave of political unrest in the Middle East led to sharply higher crude oil prices.

In this generally favorable environment, small-cap stocks produced modestly higher returns than midcap stocks, and midcap stocks produced substantially higher returns than large-cap stocks.

A Cyclical Bias Boosted Fund Results

The fund achieved above-average results in eight of the 10 economic sectors represented in the Russell 2500 Index, achieving particularly strong returns from overweighted positions in economically sensitive industry groups. In the information technology sector, successful stock selections and an emphasis on high-growth communications equipment companies boosted the fund’s relative performance. Riverbed Technology more than doubled in value amid increasing demand for data center infrastructure and network optimization

DISCUSSION OF FUND PERFORMANCE (continued)

as companies transitioned to “cloud computing” for their data management needs. Finisar and Acme Packet produced higher earnings due to increased spending by telecommunications companies on optical components. Audio software developer Sonic Solutions and data storage solutions providers Compellent Technologies, Isilon Systems and Netezza rose after receiving acquisition offers from larger technology companies. Employee training software developer SuccessFactors gained value after reporting strong bookings and revenue growth.

In the health care sector, Amarin Corp. climbed amid takeover speculation after receiving positive test results from a new drug under development, and Savient Pharmaceuticals gained value after receiving regulatory approval for a new gout medicine. Among industrial companies, Titan International benefited from strong demand for agriculture equipment, and Navistar International and WABCO Holdings encountered continuing strength in heavy duty truck orders. Railroad Kansas City Southern moved higher along with rail freight demand. Rising commodity prices helped boost the energy sector, benefiting Brigham Exploration, SandRidge Energy, Energy XXI and International Coal.

Disappointments proved relatively mild during the reporting period.The fund’s investments in the consumer discretionary sector produced positive absolute returns but lagged their respective benchmark components. We attribute most of the sector’s relative underperformance to gains in companies held by the benchmark but not the fund. In addition, apparel retailer Talbots fell due to disappointing earnings amid delays in their turnaround strategy.

Positioned for More Economic Recovery

Despite headwinds from resurgent oil prices and a moribund housing market, we believe the economic recovery is likely to persist. Consequently, we have maintained the

fund’s tilt toward cyclical companies with the potential for higher-than-average revenues and earnings growth. We have found a number of opportunities in the information technology, industrials, energy and materials sectors. We have found fewer opportunities in the traditionally defensive utilities and consumer staples sectors. We also have invested in small- and midcap stocks that we believe will benefit from other investment themes, including a rebound in auto and truck sales, improving conditions in the airline industry, turnarounds in the lodging and advertising industries, rising demand for wireless communications and higher commodity prices.

March 15, 2011

| |

| | Please note, the position in any security highlighted in italicized typeface was |

| | sold during the reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| | Stocks of small- and/or midcap companies often experience sharper price |

| | fluctuations than stocks of large-cap companies. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. Past |

| | performance is no guarantee of future results. Share price and investment return |

| | fluctuate such that upon redemption, fund shares may be worth more or less |

| | than their original cost. Return figures provided reflect the absorption of certain |

| | fund expenses by BNY Mellon Fund Advisors pursuant to an agreement in |

| | effect until January 1, 2011, at which point it was terminated. Had these |

| | expenses not been absorbed, the fund’s returns would have been lower. |

| | Part of the fund’s recent performance is attributable to positive returns from its |

| | initial public offering (IPO) investments.There can be no guarantee that IPOs |

| | will have or continue to have a positive effect on fund performance. Currently, |

| | the fund is relatively small in asset size. IPOs tend to have a reduced effect on |

| | performance as a fund’s asset base grows. |

| 2 | SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, |

| | where applicable, capital gain distributions.The Russell 2500 Index is a |

| | widely accepted, unmanaged index, which measures the performance of those |

| | Russell 2500 companies with lower price-to-book ratios and lower forecasted |

| | growth value. Investors cannot invest directly in any index. |

20

DISCUSSION OF

FUND PERFORMANCE

For the period of September 1, 2010, through February 28, 2011, as provided by D. Kirk Henry, Sean P. Fitzgibbon and Mark A. Bogar, Portfolio Managers

Portfolio and Market Performance Overview

For the six-month period ended February 28, 2011, BNY Mellon International Fund’s Class M shares produced a total return of 25.34%, and Investor shares produced a total return of 25.08%.1 In comparison, the fund’s benchmark, the Morgan Stanley Capital International Europe, Australasia, Far East Index (the “MSCI EAFE Index”), produced a total return of 23.77% for the same period.2

International stocks rallied strongly as the global economic recovery gathered momentum. The fund’s returns were higher than its benchmark, primarily due to the success of our core investment style in Japan and Germany.

The Fund’s Investment Approach

The fund seeks long-term capital growth. To pursue this goal, the fund normally invests at least 65% of its total assets in equity securities of foreign issuers.

The fund allocates its assets between a core investment style and a value investment style at the discretion of the investment adviser.The fund is not managed to a specific target duration between these investment styles. However, under normal conditions, at least 30% of the fund’s assets will be invested in each of the core and value investment styles. Pursuant to the core investment style, under normal circumstances, at least 80% of the fund’s cash inflows allocated to this style are invested in equity securities of companies located in the foreign countries represented in the MSCI EAFE Index and Canada.

The fund will continue to invest in stocks that appear to be undervalued (as measured by their price/earnings ratios), but stocks purchased pursuant to the core investment style may have value and/or growth char-acteristics.The core investment style portfolio manager employs a “bottom-up” investment approach, which emphasizes individual stock selection. The core investment style stock selection process is designed to produce a diversified portfolio that, relative to the MSCI EAFE Index, has a below-average price/earnings ratio and an above-average earnings growth trend.

The fund’s investment approach for the portion of the fund using the value-oriented investment style is research-driven and risk-averse.When selecting stocks, we identify potential investments through valuation screening and extensive fundamental research. Emphasizing individual stock selection over economic or industry trends, the fund focuses on three key factors: value, business health and business momentum.

Greater Economic Confidence Supported Rallying Markets

The reporting period began in the wake of heightened volatility in international markets, as a sovereign debt crisis in Europe threatened an already sluggish regional rebound and Japan struggled with longstanding deflation-ary forces. However, it became apparent in September that these economic concerns probably were overblown. By the fall, most European banks had passed a series of “stress tests,” corporate earnings climbed, mergers-and-acquisitions activity intensified, commodity prices rose and major central banks implemented new programs to ease monetary policy. Greater clarity regarding fiscal and tax policies in the United States after the national midterm elections also supported global investor sentiment. The

DISCUSSION OF FUND PERFORMANCE (continued)

resulting rally in global equity markets persisted until February when political uprisings in the Middle East sparked a sharp increase in oil and gas prices.

Stock Selections Produced Mixed Results

The fund’s core investment style fared particularly well in the reporting period’s market rally, scoring successes in Japan including industrial conglomerate Mitsubishi and technology firm Hitachi.The fund’s investments in automobile manufacturers in Germany also fared well in the recovering economy, as robust sales of the luxury-oriented Audi and Porche brands drove shares of Volkswagen higher. German grocery chain Metro also rebounded from what we believed were previously oversold conditions.

The industrial sector provided the greatest contribution to the fund’s relative performance, as U.K.-based materials science company Cookson Group and Swedish construction-related firms Atlas Copco and Sandvik benefited from the global economic recovery and higher commodity prices.The energy sector rebounded strongly from earlier weakness as oil and gas prices climbed, boosting the stocks of exploration and production companies, such as offshore driller Transocean.

The fund’s value style achieved strong results from underweighted exposure to Spain, which was at the epicenter of Europe’s sovereign debt crisis. In addition, Spanish wind turbine maker Gamesa Corp Tecnologica and power utility Iberdrola rebounded sharply from previously depressed levels. However, these gains were offset by lagging results from several Spanish banks. The fund’s holdings in the Netherlands also disappointed, mainly due to weakness stemming from the restructuring of Koninklijke Philips

Electronics. From a sector perspective, health care companies in the United Kingdom were hurt by concerns regarding upcoming patent expirations.

Finding Value Among Companies with Catalysts for Growth

We have been encouraged by the rallies in the world’s developed markets, but a number of economic head-winds remain.Therefore, we intend to continue to focus primarily on what we believe are attractively valued, growing companies with the ability to reduce costs, employ proprietary technologies or provide significant exposure to faster-growing emerging markets.

March 15, 2011

| |

| | Please note, the position in any security highlighted with italicized typeface |

| | was sold during the reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, |

| | issuer and investment style risks, among other factors, to varying degrees, all of |

| | which are more fully described in the fund’s prospectus. |

| | The fund’s performance will be influenced by political, social and economic |

| | factors affecting investments in foreign companies. Special risks associated with |

| | investments in foreign companies include exposure to currency fluctuations, less |

| | liquidity, less developed or less efficient trading markets, lack of comprehensive |

| | company information, political instability and differing auditing and legal |

| | standards.These risks are enhanced in emerging market countries. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. |

| | Past performance is no guarantee of future results. Share price and investment |

| | return fluctuate such that upon redemption, fund shares may be worth more or |