Exhibit 1.3

SIERRA WIRELESS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the Fiscal Year Ended December 31, 2014

DATED February 27, 2015

MANAGEMENT’S DISCUSSION AND ANALYSIS

Table of Contents

|

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | |

| OVERVIEW | |

| Business Overview | |

| Our Strategy | |

| Annual Overview - Financial Highlights | |

| Outlook | |

| Disposition of AirCard Business | |

| CONSOLIDATED ANNUAL RESULTS OF OPERATIONS | |

| Fiscal Year 2014 compared to Fiscal Year 2013 | |

| Fiscal Year 2013 compared to Fiscal Year 2012 | |

| SEGMENTED INFORMATION | |

| FOURTH QUARTER OVERVIEW | |

| SUMMARY OF QUARTERLY RESULTS OF OPERATIONS | |

| LIQUIDITY AND CAPITAL RESOURCES | |

| NON-GAAP FINANCIAL MEASURES | |

| OFF-BALANCE SHEET ARRANGEMENTS | |

| TRANSACTIONS BETWEEN RELATED PARTIES | |

| CRITICAL ACCOUNTING POLICIES AND ESTIMATES | |

| OUTSTANDING SHARE DATA | |

| IMPACT OF ACCOUNTING PRONOUNCEMENTS AFFECTING CURRENT PERIOD | |

| IMPACT OF ACCOUNTING PRONOUNCEMENTS AFFECTING FUTURE PERIODS | |

| DISCLOSURE CONTROLS AND PROCEDURES | |

| INTERNAL CONTROL OVER FINANCIAL REPORTING | |

| LEGAL PROCEEDINGS | |

| RISKS AND UNCERTAINTIES | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) provides information for the years ended December 31, 2014, 2013 and 2012 and up to and including February 27, 2015. This MD&A should be read together with our audited consolidated financial statements and the accompanying notes for the year ended December 31, 2014 (“the consolidated financial statements”). The consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). Except where otherwise specifically indicated, all amounts in this MD&A are expressed in United States dollars.

We have prepared this MD&A with reference to National Instrument 51-102 “Continuous Disclosure Obligations” of the Canadian Securities Administrators. Under the U.S./Canada Multijurisdictional Disclosure System, we are permitted to prepare this MD&A in accordance with the disclosure requirements of Canada, which requirements are different than those of the United States.

Certain statements in this MD&A constitute forward-looking statements or forward-looking information within the meaning of applicable securities laws. You should carefully read “Cautionary Note Regarding Forward-looking Statements” in this MD&A and should not place undue reliance on any such forward-looking statements.

Throughout this document, references are made to certain non-GAAP financial measures that are not measures of performance under U.S. GAAP. Management believes that these non-GAAP financial measures provide useful information to investors regarding the Company’s results of operations as they provide additional measures of its performance and assist in comparisons from one period to another. These non-GAAP financial measures do not have any standardized meaning prescribed by U.S. GAAP and are therefore unlikely to be comparable to similar measures presented by other issuers. These non-GAAP financial measures are defined and reconciled to their nearest GAAP measure in “Non-GAAP Financial Measures”.

In this MD&A, unless the context otherwise requires, references to "the Company", "Sierra Wireless", "we", "us" and "our" refer to Sierra Wireless, Inc. and its subsidiaries.

Additional information about the Company, including our most recent consolidated financial statements and our Annual Information Form, is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Cautionary Note Regarding Forward-looking Statements

Certain statements and information in this MD&A are not based on historical facts and constitute forward-looking statements or forward-looking information within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and Canadian securities laws (“forward-looking statements”), including our business outlook for the short and longer term and statements regarding our strategy, plans and future operating performance. Forward-looking statements are provided to help you understand our views of our short and longer term plans, expectations and prospects. We caution you that forward-looking statements may not be appropriate for other purposes. We do not intend to update or revise our forward-looking statements unless we are required to do so by securities laws. Forward-looking statements:

| |

| • | Typically include words and phrases about the future such as “outlook”, "will", “may”, “estimates”, “intends”, “believes”, “plans”, “anticipates” and “expects”; |

| |

| • | Are not promises or guarantees of future performance. They represent our current views and may change significantly; |

| |

| • | Are based on a number of material assumptions, including those listed below, which could prove to be significantly incorrect: |

| |

| ▪ | Our ability to develop, manufacture and sell new products and services that meet the needs of our customers and gain commercial acceptance; |

| |

| ▪ | Our ability to continue to sell our products and services in the expected quantities at the expected prices and expected times; |

| |

| ▪ | Expected cost of goods sold; |

| |

| ▪ | Expected component supply constraints; |

| |

| ▪ | Our ability to “win” new business; |

| |

| ▪ | Expected deployment of next generation networks by wireless network operators; |

| |

| ▪ | Our operations not being adversely disrupted by component shortages or other development, operating or regulatory risks; and |

| |

| ▪ | Expected tax rates and foreign exchange rates; |

| |

| • | Are subject to substantial known and unknown material risks and uncertainties. Many factors could cause our actual results, achievements and developments in our business to differ significantly from those expressed or implied by our forward-looking statements, including, without limitation, the following factors and others which are discussed in greater detail under “Risks and Uncertainties” and in our other regulatory filings with the U.S. Securities and Exchange Commission (the “SEC”) in the United States and the provincial securities commissions in Canada: |

| |

| ▪ | Actual sales volumes or prices for our products and services may be lower than we expect for any reason including, without limitation, continuing uncertain economic conditions, price and product competition, different product mix, the loss of any of our significant customers, or competition from new or established wireless communication companies; |

| |

| ▪ | Higher than anticipated costs; disruption of, and demands on, our ongoing business; and diversion of management’s time and attention in connection with acquisitions or divestitures; |

| |

| ▪ | The cost of products sold may be higher than planned or necessary component supplies may not be available, may be delayed or may not be available on commercially reasonable terms; |

| |

| ▪ | We may be unable to enforce our intellectual property rights or may be subject to litigation that has an adverse outcome; |

| |

| ▪ | The development and timing of the introduction of our new products may be later than we expect or may be indefinitely delayed; |

| |

| ▪ | Transition periods associated with the migration to new technologies may be longer than we expect; and |

| |

| ▪ | Unanticipated costs associated with litigation or settlements associated with intellectual property matters. |

Investors are cautioned not to place undue reliance on these forward-looking statements. No forward-looking statement is a guarantee of future results.

OVERVIEW

Business Overview

Sierra Wireless is building the Internet of Things ("IoT") with intelligent wireless solutions that empower organizations to innovate in the connected world. We offer the industry’s most comprehensive portfolio of second generation ("2G"), third generation ("3G") and fourth generation ("4G") embedded modules and gateways, seamlessly integrated with our secure cloud and connectivity services. OEMs and enterprises worldwide trust our innovative solutions to get their connected products and services to market faster.

We operate the Company under two reportable segments: OEM Solutions and Enterprise Solutions.

Our OEM Solutions segment includes cellular embedded modules, software and tools for OEM customers to integrate wireless cellular connectivity into products and solutions across a broad range of industries, including automotive, transportation, enterprise networking, energy, sales and payment, mobile computing, security, industrial monitoring, field services, and healthcare. Within our OEM Solutions segment, the AirPrime® Embedded Wireless Modules product portfolio spans 2G, 3G, and 4G cellular technologies and includes remote device management capability, as well as support for on-board embedded applications using the OpenAT® application framework and the company's new open source, Linux-based application framework called Legato.

Our Enterprise Solutions segment includes intelligent gateways, modems and tools for enterprise customers, including a cloud-based platform for deploying and managing IoT applications. This integrated solution enables enterprise customers to accelerate deployment of their IoT applications. Within our Enterprise Solutions segment, the AirLink® product portfolio includes 2G, 3G and 4G LTE gateways. AirLink devices are intelligent wireless gateways that provide plug-and-play mission-critical connectivity. The gateways and modems are designed for use where reliability and security are essential, and are used in transportation, public safety, field services, energy, industrial, and enterprise networking applications worldwide. AirLink gateways can be easily configured for specific customer applications, and also support on-board embedded applications using the company's ALEOS application framework.

Also included in our Enterprise Solutions segment is our AirVantage® Cloud and Connectivity services which provide a secure, scalable platform for IoT applications. The AirVantage Enterprise Platform can be used to collect and store machine data, and process and schedule events from any number of devices, across any network operator around the world. IoT solution developers can use the latest cloud application programming interface standards to quickly integrate machine data with their own enterprise applications and back-end systems. The AirVantage Management Service can be used to centrally deploy and monitor IoT devices at the end of the network, including configuring device settings, delivering firmware and embedded application updates over the air, and administering airtime subscriptions across global networks.

Early in 2014 we completed the acquisition of all the shares of In Motion Technology Inc. ("In Motion") for net cash consideration of $23.9 million. In Motion is a leader in mobile enterprise solutions, providing rugged in-vehicle mobile routers that are integrated with a security system and a powerful management and application platform. In Motion's solutions are used by public safety, transit and utility fleets across the United States and Canada. This acquisition strengthened our position in key market segments and broadened our Enterprise Solutions product portfolio.

As of January 16, 2015, with the acquisition of Wireless Maingate AB ("Maingate"), our Enterprise Solutions segment also includes connectivity and data management services. We acquired substantially all of the outstanding shares of Maingate for $91.6 million, including working capital, subject to certain post-closing adjustments. Maingate is based in Karlskrona, Sweden and is one of the leading providers of managed connectivity services in Europe. Maingate has its own core network and is a fully licensed mobile network operator with its own SIMs, billing and other capabilities. The acquisition of Maingate enhances our device to cloud solution by adding managed connectivity and data management services.

We continue to seek opportunities to acquire or invest in businesses, products and technologies that expand, complement or otherwise relate to our business.

Our Strategy

The IoT market is expected to grow significantly over the next decade. Enterprises, governments, and consumers are gaining a broader understanding of the benefits of collecting, storing and delivering data from machines and assets at the edge of the network to enable detailed analysis, monitoring, and enhanced services. New IoT applications are helping people and organizations to increase productivity, save energy costs, create new business models, and provide value-added services to their customers. An integral factor in the growth of IoT applications is cellular connectivity - transmitting data from embedded modules and gateways, through advanced mobile networks and cloud services, to the enterprise or consumer. This technology reliably enables things such as the connected car, the connected home, the connected enterprise, as well as smart cities and the smart grid. Adoption of IoT solutions is driven by a number of important trends, such as lower wireless connectivity costs, higher wireless connection speeds, new devices and tools to simplify application development and increased focus and investment from many large ecosystem players.

We believe these factors will continue to create a substantial growth opportunity for the Company going forward. Based on third-party industry data, we are the global leader in embedded wireless modules with 34% global market share (source: ABI Research, July 2014) and are widely recognized as the innovation leader as well. We are also a leading provider of gateway and router solutions for industrial, enterprise and mobile applications. We have also developed a cloud service platform that is highly integrated with our devices, gateways, and embedded application software. As we have indicated in the last several years, our corporate strategy is to expand our business across the IoT value chain by:

| |

• | Solidifying and growing our leadership position in cellular embedded modules; |

| |

• | Enhancing our gateways and modems business with new products and selective acquisitions that strengthen our position; |

| |

| • | Continuing to innovate and execute to expand into more IoT segments and geographical markets; |

| |

| • | Leveraging our leading position to build our device-to-cloud solutions platform, providing our customers with simple, scalable and secure solutions that include wireless connectivity services; and |

| |

• | Accelerating revenue and improving the operating leverage in our business model, to increase profitability and enhance shareholder value. |

Over the past three years we significantly advanced our strategy by:

| |

| • | Generating higher revenues across our business through organic growth and successful integration of acquisitions; |

| |

| • | Acquiring, in August 2012, the M2M business of Sagemcom ("Sagemcom") which included 2G and 3G wireless modules, as well as industry-leading rugged terminals for railway applications. The acquisition extended our leadership position in the growing IoT market and offered a significantly enhanced market position for us in key segments, including payment, transportation, and railways, as well as new geographical expansion into Brazil; |

| |

| • | Completing the sale of substantially all of the assets and operations related to our AirCard business in April 2013 (refer to the section on “Disposition of AirCard business” for additional details); and |

| |

| • | Completing, in October 2013, the acquisition of the M2M modules and modem assets of AnyData Corporation ("AnyData") which included 3G and 4G wireless modules and modems which are sold mainly in Korea. This acquisition extended our global leadership position in the growing IoT market and provided us with a leading position in Korea. |

In 2014, we continued to deliver on our corporate strategy by:

| |

| • | Generating higher revenues across our business through organic growth in sales, which increased 18% year-over-year in 2014; |

| |

| • | Successfully acquiring and integrating new businesses into the company, which we achieved with the acquisition of In Motion and the integration of AnyData; both businesses drove profitability growth in 2014; |

| |

| • | Continuing to secure new design wins with global OEMs that are operating in key vertical markets; |

| |

| • | Driving growth in value-added services by expanding our AirVantage cloud platform customer base and building out our solutions offering in Enterprise Solutions; |

| |

| • | Adding wireless connectivity services to our device-to-cloud platform through the successful acquisition of Maingate and a partnership with Wireless Logic Limited for our AirLink Enterprise Connect solution; |

| |

| • | Significantly improving our profitability through revenue growth and strong operating leverage as indicated by significantly improved adjusted EBITDA (increased 89% year-over-year), non-GAAP earnings from operations (up 351% year-over-year) and cash generated from operations ($48.7 million in 2014); and |

| |

| • | Building our broader organizational capability and processes in order to support our continued growth. |

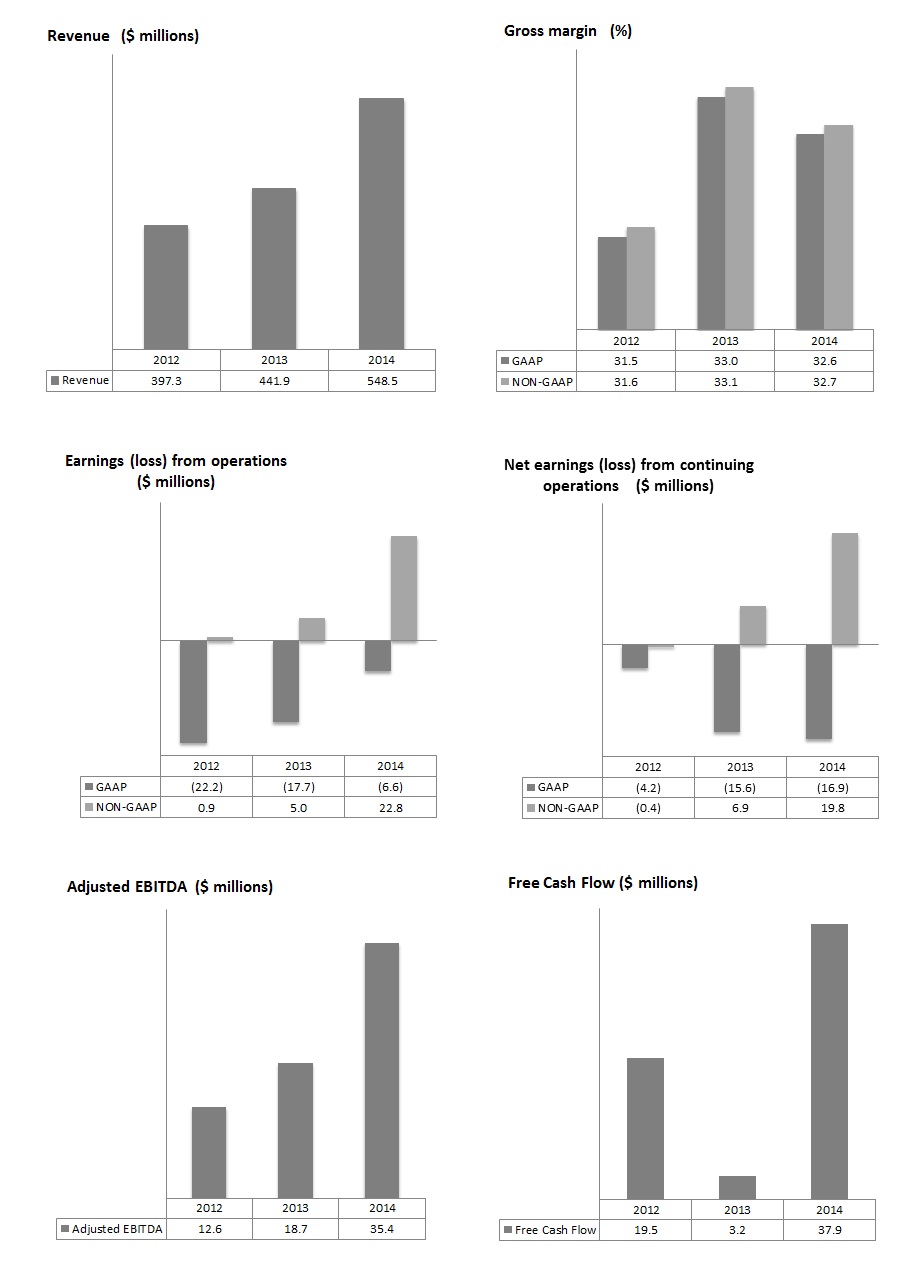

Annual Overview — Financial highlights

In 2014, our revenue increased by 24.1% to $548.5 million compared to 2013. This strong revenue result was driven by a combination of organic growth and contributions from acquisitions. Our OEM Solutions segment revenues grew by 24.8% to $476.6 million compared to 2013 while our Enterprise Solutions segment revenues grew by 20.1% to $71.9 million compared to 2013.

GAAP

| |

| • | 2014 revenue increased by $106.6 million, or 24.1%, compared to 2013 and reflects strong growth in both of our operating segments. |

| |

| • | Gross margin was 32.6%, down 0.4% from 2013 mainly due to increased volume of lower margin products sold in 2014. Gross margin improved sequentially throughout 2014 to 33.5% in the fourth quarter driven mainly by certain product cost reductions negotiated during the year. |

| |

| • | Operating loss from continuing operations decreased by $11.1 million, or 62.7%, compared to 2013, largely due to revenue growth and product cost reductions, partially offset by increases in operating expenses driven mainly by costs added as a result of our recent acquisitions. |

| |

| • | Net loss from continuing operations increased by $1.3 million, or 8.4%, from 2013 due to higher foreign exchange losses partially offset by lower operating losses in 2014. |

| |

| • | Cash and cash equivalents were $207.1 million at the end of the year, an increase of $27.2 million compared to 2013. This reflects $48.7 million of cash generated by operating activities and receipt of $13.8 million previously held in escrow from the sale of the AirCard business in 2013 partially offset by $23.9 million net cash used to acquire In Motion and $10.8 million for capital expenditures. |

Non-GAAP

| |

| • | Gross margin was 32.7%, down 0.4% from 2013, mainly due to increased volume of lower margin products sold in 2014. |

| |

| • | Operating earnings improved by $17.8 million, or 351.1% compared to 2013, as a result of revenue growth and associated gross margin partially offset by higher operating expenses driven mainly by costs added as a result of our recent acquisitions. |

| |

| • | Adjusted EBITDA increased by $16.7 million, or 89.3% compared to fiscal 2013, reflecting revenue growth in both of our operating segments. |

| |

| • | Net earnings from continuing operations increased by $12.9 million, or 185.9% compared to 2013, mainly due to improved operating earnings partially offset by higher income tax expenses. |

| |

| • | See section on "Non-GAAP Financial Measures". |

Selected Annual Financial information:

|

| | | | | | | | | | | | |

| (in thousands of U.S. dollars, except where otherwise stated) | | 2014 |

| | 2013 |

| | 2012 |

|

| Statement of Operations data: | | |

| | |

| | |

|

| Revenue | | $ | 548,523 |

| | $ | 441,860 |

| | $ | 397,321 |

|

| | | | | | | |

| Gross Margin | | |

| | |

| | |

|

| - GAAP | | $ | 178,979 |

| | $ | 145,641 |

| | $ | 125,274 |

|

- Non-GAAP (1) | | 179,534 |

| | 146,047 |

| | 125,578 |

|

| | | | | | | |

| Gross Margin % | | |

| | |

| | |

|

| - GAAP | | 32.6 | % | | 33.0 | % | | 31.5 | % |

- Non-GAAP (1) | | 32.7 | % | | 33.1 | % | | 31.6 | % |

| | | | | | | |

| Earnings (loss) from operations | | |

| | |

| | |

|

| - GAAP | | $ | (6,594 | ) | | $ | (17,664 | ) | | $ | (22,206 | ) |

- Non-GAAP (1) | | 22,794 |

| | 5,053 |

| | 898 |

|

| | | | | | | |

| Adjusted EBITDA | | $ | 35,411 |

| | $ | 18,702 |

| | $ | 12,645 |

|

| | | | | | | |

| Net earnings (loss) from continuing operations | | |

| | |

| | |

|

| - GAAP | | $ | (16,853 | ) | | $ | (15,550 | ) | | $ | (4,202 | ) |

- Non-GAAP (1) | | 19,848 |

| | 6,942 |

| | (444 | ) |

| | | | | | | |

| Net earnings from discontinued operations | | |

| | |

| | |

|

| - GAAP | | $ | — |

| | $ | 70,588 |

| | $ | 31,401 |

|

- Non-GAAP (1) | | — |

| | 4,420 |

| | 33,796 |

|

| | | | | | | |

| Net earnings (loss) | | |

| | |

| | |

|

| - GAAP | | $ | (16,853 | ) | | $ | 55,038 |

| | $ | 27,199 |

|

- Non-GAAP (1) | | 19,848 |

| | 11,362 |

| | 33,352 |

|

| | | | | | | |

| Revenue by Segment: | | | | | | |

| OEM Solutions | | $ | 476,650 |

| | $ | 382,016 |

| | $ | 346,543 |

|

| Enterprise Solutions | | 71,873 |

| | 59,844 |

| | 50,778 |

|

| | | | | | | |

| Share and per share data: | | |

| | |

| | |

|

| Basic and diluted earnings (loss) from continuing operations per share (in dollars) | | | | | | |

| - GAAP | | $ | (0.53 | ) | | $ | (0.50 | ) | | $ | (0.14 | ) |

- Non-GAAP (1) | | $ | 0.63 |

| | $ | 0.23 |

| | $ | (0.01 | ) |

| | | | | | | |

| Basic and diluted earnings (loss) per share (in dollars) | | |

| | |

| | |

|

| - GAAP | | $ | (0.53 | ) | | $ | 1.79 |

| | $ | 0.88 |

|

- Non-GAAP (1) | | $ | 0.63 |

| | $ | 0.37 |

| | $ | 1.08 |

|

| | | | | | | |

| Common shares (in thousands) | | |

| | |

| | |

|

| At period-end | | 31,869 |

| | 31,098 |

| | 30,592 |

|

| Weighed average - basic and diluted | | 31,512 |

| | 30,771 |

| | 30,788 |

|

| | | | | | | |

| Balance sheet data (end of period): | | |

| | |

| | |

|

| Cash and cash equivalents and short-term investments | | $ | 207,062 |

| | $ | 179,886 |

| | $ | 63,646 |

|

| Total assets | | 515,364 |

| | 512,000 |

| | 464,763 |

|

| Total long-term liabilities | | 27,061 |

| | 21,677 |

| | 26,826 |

|

| | | | | | | |

(1) Non-GAAP results exclude the impact of stock-based compensation expense and related social taxes, acquisition amortization, impairment, gain on sale of AirCard business, acquisition and disposition costs, integration costs, restructuring costs, foreign exchange gains or losses on foreign currency contracts and translation of balance sheet accounts, and certain tax adjustments. Refer to the section on “Non-GAAP financial measures” for additional details.

See discussion under “Consolidated Annual Results of Operations” for factors that have caused period to period variations.

Other key business highlights for the year ended December 31, 2014:

| |

| ◦ | We celebrated a major achievement in our company history with the shipment of our 100 millionth connected device. We have connected devices operating on more than 80 networks worldwide since developing the world's first embedded module in 1997. |

| |

| ◦ | We received an award for Smart Grid Communications from the publishers of FierceEnergy and FierceSmartGrid. The energy innovation award was for an integrated solution that includes our AirPrime WP Series Embedded Module, Legato open-sourced embedded application platform and AirVantage Cloud service. |

OEM Solutions

| |

| ◦ | We announced the launch of our AirPrime EM7340 and EM7345 embedded wireless modules for 4G LTE networks. These devices are based on Intel chipsets and designed for integration into notebook computers and tablets, using a standardized M.2 form factor ideal for small, thin devices. |

| |

| ◦ | We introduced the Legato™ platform, an open source embedded platform built on Linux and designed to simplify the development of IoT applications. Legato includes Wind River Linux, a commercial-grade Linux distribution with a rich set of capabilities based on the latest open source technologies, along with a fully integrated application framework and feature-rich tools. Legato™ makes IoT application development quicker, easier and more flexible by providing a tested and validated solution on an established, well-supported open source foundation with built-in connectivity, security, and management. |

| |

| ◦ | Our AirPrime embedded wireless modules were selected by Philips CityTouch to provide connectivity for the new CityTouch LightWave remote lighting management system that includes intelligent "plug and play" outdoor lighting fixtures. |

| |

| ◦ | We announced that Itron Inc. has selected our AirPrime 2G, 3G, and 4G LTE embedded wireless modules for Itron's OpenWay smart grid solutions worldwide. Itron selected Sierra Wireless for our 4G LTE leadership, strong relationships with mobile network operators and our global support with pre-certified modules. |

| |

| ◦ | We announced our collaboration with Octo Telematics to provide connectivity for Octo's innovative usage-based insurance (UBI) solution in Europe. Octo's Super Easy Telematics Box is powered by our AirPrime smart module which has an innovative architecture that integrates cellular wireless connectivity and an application processor into a single device, providing a highly cost optimized solution. |

| |

| ◦ | Recently, we introduced four new AirPrime embedded modules, the first to support LTE-Advanced networks worldwide (LTE-A). LTE-A is the latest generation of 4G LTE network standards, aimed at improving network capacity, throughput, data speed and operational cost-efficiency. |

Enterprise Solutions

| |

| ◦ | We announced the launch of the AirLink ES440 4G LTE gateway and terminal server. Designed for the distributed enterprise market, the Airlink ES440 provides mission-critical connectivity using 4G LTE networks when primary wireline internet connections are unavailable. It also supports a best-in-class business continuity strategy by enabling IT administrators to remotely troubleshoot and repair network equipment, reducing downtime and site visits. |

| |

| ◦ | We announced the launch of AirLink Enterprise Connect, a unique bundled solution for retail and branch office locations in the United Kingdom, France, and Germany. AirLink Enterprise Connect comprises an |

AirLink ES440 Gateway, pre-integrated and provisioned with 4G LTE service and access to the AirVantage Management Service, all bundled into one solution.

| |

| ◦ | We announced that the Regional Transportation District of Denver, Colorado has deployed our InMotion Solutions products to support mobile broadband access for automatic vehicle location and smart card fare payments aboard more than 1,100 buses. |

| |

| ◦ | We announced that the Westminster, Colorado Police Department selected our InMotion oMG mobile gateway which enables in-vehicle wired and wireless connectivity for tablets and laptops, providing officers with access to all their applications. |

| |

| ◦ | More recently, we announced the launch of our next generation of AirLink gateways. The AirLink GX450 4G mobile gateway and the AirLink ES450 4G enterprise gateway offer support for a broader array of LTE frequency bands, making them compatible with networks worldwide. |

Outlook

In the first quarter of 2015, including Maingate, we expect consolidated revenue and gross margin percentage to be slightly lower compared to the fourth quarter of 2014, reflecting normal seasonality. We expect operating expenses to increase modestly compared to the fourth quarter of 2014.

We believe that the market for wireless IoT solutions has strong long-term growth prospects. We anticipate strong growth in the number and type of devices being wirelessly connected, driven by a number of enablers, such as lower wireless connectivity costs, faster wireless connection speeds, new devices and tools to simplify the development of IoT applications, and increased focus and investment from large ecosystem players. More importantly, we see strong customer demand emerging in many of our target verticals driven by increasing recognition of the value created by deploying IoT solutions, such as new revenue streams and cost efficiencies.

Key factors that we expect will affect our results in the near term are:

| |

| • | the strength of our competitive position in the market; |

| |

| • | the timely ramp up of sales of our new products recently launched or currently under development; |

| |

| • | the level of success our OEM customers achieve with sales of connected solutions to end users; |

| |

| • | our ability to secure future design wins with both existing and new customers; |

| |

| • | wireless technology transitions and the timing of deployment of new, higher speed networks by wireless operators; |

| |

| • | the availability of components from key suppliers; |

| |

| • | contributions from acquisitions; |

| |

| • | general economic conditions in the markets we serve; and |

We expect that product and price competition from other wireless device manufacturers will continue to play a role in the IoT market. As a result of these factors, we may experience volatility in our results on a quarter-to-quarter basis. Gross margin percentage may fluctuate from quarter-to-quarter depending on product and customer mix, competitive selling prices and product costs.

See "Cautionary Note Regarding Forward-Looking Statements"

Disposition of AirCard Business

On April 2, 2013, we completed the sale of substantially all of the assets and operations related to our AirCard business to Netgear, Inc. (“Netgear”). Proceeds on disposition, after final inventory adjustments, were $136.6 million plus assumed liabilities and comprised of cash proceeds of $122.8 million, funds previously held in escrow of $13.8 million and assumed liabilities. After transaction costs of $2.8 million, we recorded an after tax gain on disposal of $70.2 million. On April 3, 2014, we received the full $13.8 million cash proceeds previously held in escrow for realized net cash proceeds of $127.8 million from the divestiture after giving consideration to related taxes and transaction costs.

In accordance with U.S. GAAP, the results of operations and the gain on sale of the AirCard business have been presented as discontinued operations in our consolidated statements of operations for the years ended December 31, 2013 and 2012. The historical consolidated statements of operations and related selected financial information have been retrospectively adjusted to distinguish between continuing operations and discontinued operations.

Summarized results from discontinued operations for the years ended December 31 were as follows:

|

| | | | | | | | | | |

| (in thousands of U.S. dollars) | | 2013 |

| | | 2012 |

| |

| Revenue | | $ | 46,701 |

| | | $ | 246,845 |

| |

| Cost of goods sold | | 32,978 |

| | | 177,147 |

| |

| Gross margin | | 13,723 |

| | | 69,698 |

| |

| Expenses | | 12,918 |

| | | 36,653 |

| |

| Earnings from operations | | 805 |

| | | 33,045 |

| |

| Income tax expense | | 399 |

| | | 1,644 |

| |

| Earnings from operations, net of taxes | | 406 |

| | | 31,401 |

| |

| Gain on sale of AirCard business, net of taxes | | 70,182 |

| | | — |

| |

| Net earnings from discontinued operations | | $ | 70,588 |

| | | $ | 31,401 |

| |

CONSOLIDATED ANNUAL RESULTS OF OPERATIONS

|

| | | | | | | | | | | | | | | | | | | | |

| (in thousands of U.S. dollars, except where otherwise stated) | | 2014 | | | 2013 | | | 2012 |

| | | $ | | % of Revenue |

| | | $ | | % of Revenue |

| | | $ | | % of Revenue |

|

| Revenue | | 548,523 |

| | 100.0 | % | | | 441,860 |

| | 100.0 | % | | | 397,321 |

| | 100.0 | % |

| Cost of goods sold | | 369,544 |

| | 67.4 | % | | | 296,219 |

| | 67.0 | % | | | 272,047 |

| | 68.5 | % |

| Gross margin | | 178,979 |

| | 32.6 | % | | | 145,641 |

| | 33.0 | % | | | 125,274 |

| | 31.5 | % |

| Expenses | | |

| | |

| | | |

| | |

| | | |

| | |

|

| Sales and marketing | | 50,476 |

| | 9.2 | % | | | 42,182 |

| | 9.6 | % | | | 37,067 |

| | 9.3 | % |

| Research and development | | 80,937 |

| | 14.8 | % | | | 73,112 |

| | 16.5 | % | | | 61,785 |

| | 15.6 | % |

| Administration | | 37,027 |

| | 6.7 | % | | | 35,164 |

| | 8.0 | % | | | 32,777 |

| | 8.2 | % |

| Restructuring | | 1,598 |

| | 0.3 | % | | | 171 |

| | — | % | | | 2,251 |

| | 0.6 | % |

| Acquisition and Integration | | 2,670 |

| | 0.5 | % | | | 535 |

| | 0.1 | % | | | 3,182 |

| | 0.8 | % |

| Impairment | | 3,756 |

| | 0.7 | % | | | — |

| | — | % | | | — |

| | — | % |

| Amortization | | 9,109 |

| | 1.6 | % | | | 12,141 |

| | 2.8 | % | | | 10,418 |

| | 2.6 | % |

| | | 185,573 |

| | 33.8 | % | | | 163,305 |

| | 37.0 | % | | | 147,480 |

| | 37.1 | % |

| Loss from operations | | (6,594 | ) | | (1.2 | )% | | | (17,664 | ) | | (4.0 | )% | | | (22,206 | ) | | (5.6 | )% |

| Foreign exchange gain (loss) | | (12,390 | ) | | | | | 3,823 |

| | | | | 3,326 |

| | |

|

| Other income (expense) | | 854 |

| | | | | (98 | ) | | | | | (196 | ) | | |

|

| Loss before income taxes | | (18,130 | ) | | | | | (13,939 | ) | | | | | (19,076 | ) | | |

|

| Income tax expense (recovery) | | (1,277 | ) | | | | | 1,611 |

| | | | | (14,874 | ) | | |

|

| Net loss from continuing operations | | (16,853 | ) | | | | | (15,550 | ) | | | | | (4,202 | ) | | |

|

| Net earnings from discontinued operations | | — |

| | | | | 70,588 |

| | | | | 31,401 |

| | |

|

| Net earnings (loss) | | (16,853 | ) | | | | | 55,038 |

| | | | | 27,199 |

| | |

|

| | | | | | | | | | | | | | | |

| Net earnings (loss) per share - Basic and diluted (in dollars) | | | | | | | | | | | | | | |

|

| Continuing operations | | (0.53 | ) | | | | | (0.50 | ) | | | | | (0.14 | ) | | |

| Discontinued operations | | — |

| | | | | 2.29 |

| | | | | 1.02 |

| | |

| | | (0.53 | ) | | | | | 1.79 |

| | | | | 0.88 |

| | |

| | | | | | | | | | | | | | | |

Fiscal Year 2014 Compared to Fiscal Year 2013

Revenue

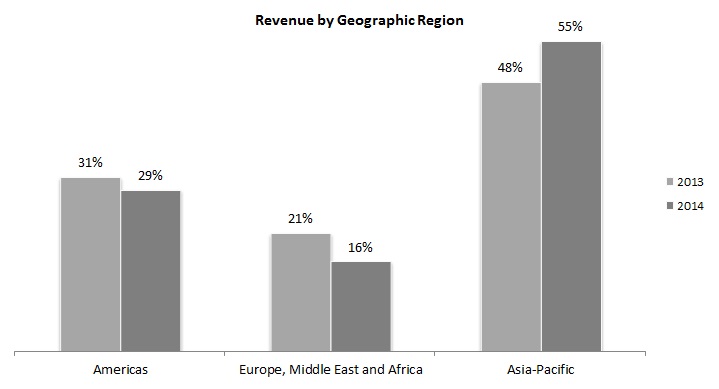

Revenue increased by $106.6 million, or 24.1%, in 2014, compared to 2013. The increase was largely driven by growth in OEM Solutions, with particular strength in 3G and 4G sales, including solid contributions from automotive, field services, energy, networking and mobile computing customers. In addition, there was strong contribution in Enterprise Solutions from the acquired In Motion products.

Our geographic revenue mix for the years ended December 31, 2014 and 2013 was as follows:

Gross margin

Gross margin was 32.6% of revenue in 2014, compared to 33.0% in 2013. The decrease in gross margin was primarily related to the increased volume of lower margin products sold by our OEM Solutions segment in 2014 compared to 2013. Gross margin improved sequentially throughout 2014 to 33.5% in the fourth quarter driven mainly by certain product cost reductions negotiated during the year. Gross margin included stock-based compensation expense and related social taxes of $0.6 million in 2014, compared to $0.4 million in 2013.

Sales and marketing

Sales and marketing expenses increased $8.3 million, or 19.7%, in 2014, compared to 2013 primarily due to the additional sales and marketing expenses from In Motion beginning in March 2014, as well as targeted investments in our go-to-market capability and higher incentive compensation due to higher revenues. Sales and marketing expenses included stock-based compensation and related social taxes of $2.2 million in 2014, compared to $1.9 million in 2013.

Research and development

Research and development (“R&D”) expenses increased by $7.8 million, or 10.7%, in 2014, compared to 2013. The increase in R&D expenses related primarily to additional costs associated with the acquired businesses of AnyData and In Motion along with the impact of lower R&D tax credits received in 2014 compared to 2013.

R&D expenses included stock-based compensation and related social taxes of $2.1 million in 2014, compared to $1.4 million in 2013. R&D expenses also included acquisition amortization of $5.7 million in 2014, compared to $5.5 million in 2013.

Administration

Administration expenses increased by $1.9 million, or 5.3%, in 2014, compared to 2013, primarily due to additional expenses associated with the acquired AnyData and In Motion businesses and a specific bad debt provision. Administration expenses included stock-based compensation expense and related social taxes of $5.6 million in 2014, compared to $4.3 million in 2013.

Restructuring

Restructuring costs increased by $1.4 million in 2014, compared to 2013, primarily related to severance and benefit payments to employees impacted by the staff reductions related to the Company's decision to reduce the scope of 2G chipset development activities.

Acquisition and integration

Acquisition and integration costs increased by $2.1 million in 2014, compared to 2013, primarily reflecting the costs incurred to acquire and integrate In Motion into our operations and $0.6 million incurred through December 31, 2014 to acquire Maingate.

Impairment

In the second quarter of 2014, we made a decision to reduce the scope of 2G chipset development activities, which resulted in a $3.8 million impairment. Management evaluated the recoverability of costs and determined that the future cash flows expected to be generated were lower than the carrying value of the assets associated with this project. No such impairment was recorded in 2013.

Amortization

Amortization expense decreased by $3.0 million, or 25.0%, in 2014, primarily due to lower acquisition related amortization. Amortization expense in 2014 included $5.2 million of acquisition amortization compared to $8.2 million in 2013.

Foreign exchange gain (loss)

Foreign exchange loss was $12.4 million in 2014, compared to a gain of $3.8 million in 2013. Foreign exchange loss in 2014 includes an unrealized loss of $7.4 million on revaluation of an intercompany loan to a self-sustaining subsidiary, primarily driven by the decline in the Euro relative to the U.S. dollar. Foreign exchange gain in 2013 includes an unrealized gain of $2.7 million on revaluation of the intercompany loan.

Foreign exchange rate changes also impacted our Euro and Canadian dollar denominated revenue and operating expenses. We estimate that net changes in exchange rates between 2014 and 2013 positively impacted our 2014 gross margin by approximately $0.4 million and our operating expenses by approximately $3.4 million.

Income tax expense (recovery)

Income tax recovery was $1.3 million in 2014, compared to an income tax expense of $1.6 million in 2013. The recovery in 2014 was related to a combination of changes in deferred income tax assets and the release of a FASB Interpretation No. 48 provision relating to accounting for uncertainty in income taxes which had become statute barred.

Net loss from continuing operations

Net loss from continuing operations increased by $1.3 million in 2014, compared to 2013. The increase reflected an increase in foreign exchange loss partially offset by an increase in operating earnings and income tax recoveries.

Net loss from continuing operations in 2014 included stock-based compensation expense and related social taxes of $10.5 million and acquisition amortization of $10.9 million. Net loss from continuing operations in 2013 included stock-based compensation expense of $8.0 million and acquisition amortization of $13.7 million.

Net earnings (loss)

Net loss was $16.9 million in 2014, compared to net earnings of $55.0 million in 2013. The 2014 net loss includes after-tax foreign exchange losses compared to after-tax foreign exchange gains in 2013. Net earnings in 2013 includes the $70.2 million after-tax gain on sale of the AirCard business, combined with the absence of earnings from discontinued operations.

Weighted average number of shares

The weighted average basic and diluted number of shares outstanding was 31.5 million for the year ended December 31, 2014 and was 30.8 million for the year ended December 31, 2013.

The number of shares outstanding was 31.9 million at December 31, 2014, compared to 31.1 million at December 31, 2013. The increase in number of shares outstanding was primarily due to the issuance of common shares as a result of stock option exercises.

Fiscal Year 2013 Compared to Fiscal Year 2012

Revenue

Revenue in 2013 increased by $44.6 million, or 11.2%, to $441.9 million, compared to 2012. The year-over-year revenue increase was driven by continued growth in both our Enterprise Solutions and OEM Solutions segments, including a full year contribution from Sagemcom .

Our geographic revenue mix for the years ended December 31, 2013 and 2012 was as follows:

Gross margin

Gross margin was 33.0% of revenue in 2013, compared to 31.5% in 2012. The increase in gross margin was primarily related to favorable product mix and product cost reductions. Gross margin included $0.4 million of stock-based compensation expense in 2013, compared to $0.3 million in 2012.

Sales and marketing

Sales and marketing expenses increased $5.1 million, or 13.8% in 2013, compared to 2012. The increase in sales and marketing expenses was primarily due to additional costs following the Sagemcom acquisition , as well as investment in additional resources to support our go-to-market strategy. Sales and marketing expenses included $1.9 million of stock-based compensation expense in 2013, compared to $1.2 million in 2012.

Research and development

R&D expenses increased by $11.3 million, or 18.3% in 2013, compared to 2012. The increase in R&D expenses was primarily related to the additional R&D expenses we incurred following the Sagemcom acquisition, as well as higher certification costs on new products launched during the year and other net product development costs.

R&D expenses in 2013 included stock-based compensation expense of $1.4 million and acquisition amortization of $5.5 million. R&D expenses in 2012 included stock-based compensation expense of $1.3 million and acquisition amortization of $5.6 million.

Administration

Administration expenses increased by $2.4 million, or 7.3% in 2013, compared to 2012, due to higher professional fees, bad debt expense and other personnel related costs. Administration expenses included stock-based compensation expense of $4.3 million and $3.0 million in 2013 and 2012, respectively.

Acquisition

Acquisition costs of $0.5 million in 2013 related to the acquisition of AnyData and In Motion. Acquisition costs of $3.2 million in 2012 related to the Sagemcom acquisition.

Amortization

Amortization expense increased by $1.7 million, or 16.5% in 2013, primarily due to the Sagemcom acquisition. Amortization expense in 2013 included $8.2 million of acquisition amortization compared to $6.3 million in 2012.

Foreign exchange gain (loss)

Foreign exchange gain was $3.8 million in 2013 compared to a gain of $3.3 million in 2012. Foreign exchange gain in 2013 and 2012 included a net foreign exchange gain of $2.7 million on revaluation of an intercompany loan to a self-sustaining subsidiary. Foreign exchange gain in 2012 was partially offset by a loss of $1.8 million related to the settlement of foreign currency forward exchange contracts that we entered in connection with the acquisition of the M2M business of Sagemcom.

Foreign exchange rate changes also impacted our Euro and Canadian dollar denominated revenue and operating expenses. We estimate that net changes in exchange rates between 2013 and 2012 positively impacted our 2013 revenues by approximately $1.0 million. We estimate that the negative impact on operating expenses during 2013 was approximately $0.5 million.

Income tax expense (recovery)

Income tax expense increased by $16.5 million to $1.6 million, compared to 2012. This was driven by recognition of certain tax assets in 2012 that were realized upon the sale of the AirCard business, resulting in a substantial income tax recovery in 2012.

Net loss from continuing operations

Net loss from continuing operations was $15.6 million, an increase of $11.3 million, compared to 2012. Improved operating earnings, driven by higher revenues and gross margin were more than offset by the absence of significant tax recoveries in 2013 compared to 2012, associated with the sale of the AirCard business.

Net loss from continuing operations in 2013 included stock-based compensation expense of $8.0 million and acquisition amortization of $13.7 million. Net loss from continuing operations in 2012 included stock-based compensation expense of $5.8 million and acquisition amortization of $11.9 million.

Net earnings (loss)

Net earnings attributable to the Company were $55 million, an increase of $27.8 million, compared to 2012. The after-tax gain of $70.2 million on the sale of our AirCard business was partially offset by higher net loss from continuing operations.

Weighted average number of shares

The weighted average basic and diluted number of shares outstanding was 30.8 million for each of the years ended December 31, 2013 and 2012.

The number of shares outstanding was 31.1 million at December 31, 2013, compared to 30.6 million at December 31, 2012. The increase in number of shares outstanding was primarily due to issuance of common shares as a result of stock option exercises partially offset by purchases of 510,439 of the Company’s common shares on the Toronto Stock Exchange (“TSX”) and NASDAQ under our normal course issuer bid, which was approved on February 6, 2013 and expired in February 2014.

SEGMENTED INFORMATION

OEM Solutions

|

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | % change |

| (in thousands of U.S. dollars, except where otherwise stated) | | 2014 |

| | 2013 |

| | 2012 |

| | 2014 vs 2013 |

| | 2013 vs 2012 |

|

| Revenue | | $ | 476,650 |

| | $ | 382,016 |

| | $ | 346,543 |

| | 24.8 | % | | 10.2 | % |

| Cost of goods sold | | 336,132 |

| | 266,867 |

| | 246,284 |

| | 26.0 | % | | 8.4 | % |

| Gross margin | | $ | 140,518 |

| | $ | 115,149 |

| | $ | 100,259 |

| | 22.0 | % | | 14.9 | % |

| Gross margin % | | 29.5 | % | | 30.1 | % | | 28.9 | % | | | | |

| | | | | | | | | | | |

Fiscal Year 2014 compared to 2013

Revenue increased by $94.6 million, or 24.8%, in 2014, compared to 2013. This increase was due to solid contributions from automotive, field services, energy and mobile computing customers. Gross margin percentage decreased in 2014 primarily driven by customer mix within the OEM Solutions segment favoring high volume, lower margin customers, partially offset by product cost reductions.

Fiscal Year 2013 compared to 2012

Revenue increased by $35.5 million, or 10.2%, to $382.0 million in 2013, compared to 2012. This increase was primarily due to a full year contribution from the M2M business of Sagemcom acquired on August 1, 2012, along with strong organic sales in certain market segments. Gross margin percentage improved in 2013 as a result of product cost reductions and the addition of higher margin GSMR products acquired from Sagemcom, partially offset by greater mix of other lower margin embedded modules.

Enterprise Solutions

|

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | % change |

| (in thousands of U.S. dollars, except where otherwise stated) | | 2014 |

| | 2013 |

| | 2012 |

| | 2014 vs 2013 |

| | 2013 vs 2012 |

|

| Revenue | | $ | 71,873 |

| | $ | 59,844 |

| | $ | 50,778 |

| | 20.1 | % | | 17.9 | % |

| Cost of goods sold | | 33,412 |

| | 29,352 |

| | 25,763 |

| | 13.8 | % | | 13.9 | % |

| Gross margin | | $ | 38,461 |

| | $ | 30,492 |

| | $ | 25,015 |

| | 26.1 | % | | 21.9 | % |

| Gross margin % | | 53.5 | % | | 51.0 | % | | 49.3 | % | | | | |

| | | | | | | | | | | |

Fiscal Year 2014 compared to 2013

Revenue increased by $12.0 million, or 20.1%, in 2014, compared to 2013. The increase was driven by revenue contribution from the acquired In Motion business, partially offset by lower demand for AirLink products. Gross margin percentage improved in 2014, driven primarily by a combination of favorable product mix, including the acquired In Motion products, and lower product warranty costs compared to 2013.

Fiscal Year 2013 compared to 2012

Revenue increased by $9.1 million, or 17.9%, to $59.9 million in 2013, compared to 2012. The increase was largely driven by strong sales growth of our new 4G products. Gross margin percentage improved in 2013, driven primarily by strong growth in new higher margin 3G and 4G products, as well as product cost reductions.

During the years ended December 31, 2014 and 2013, no customer accounted for more than 10% of our aggregated revenue, from continuing and discontinued operations. During the year ended December 31, 2012, Sprint and AT&T each accounted for more than 10% of our aggregated revenue, from continuing and discontinued operations, and on a combined basis, accounted for 25% of the aggregated revenue.

FOURTH QUARTER OVERVIEW

Consolidated Results of Operations:

|

| | | | | | | | | | | | | | |

| | | Three months ended December 31, | |

| (in thousands of U.S. dollars, except where otherwise stated) | | 2014 | | | 2013 | |

| | | | | % of |

| | | | | % of |

| |

| | | $ | | Revenue |

| | | $ | | Revenue |

| |

| Revenue | | 149,078 |

| | 100.0 | % | | | 118,608 |

| | 100.0 | % | |

| Cost of goods sold | | 99,072 |

| | 66.5 | % | | | 80,165 |

| | 67.6 | % | |

| Gross margin | | 50,006 |

| | 33.5 | % | | | 38,443 |

| | 32.4 | % | |

| Expenses | | |

| | |

| | | |

| | |

| |

| Sales and marketing | | 12,682 |

| | 8.5 | % | | | 10,693 |

| | 9.0 | % | |

| Research and development | | 21,012 |

| | 14.1 | % | | | 19,074 |

| | 16.1 | % | |

| Administration | | 9,008 |

| | 6.0 | % | | | 8,841 |

| | 7.5 | % | |

| Restructuring | | 540 |

| | 0.4 | % | | | 14 |

| | — | % | |

| Acquisition and integration | | 1,273 |

| | 0.9 | % | | | 369 |

| | 0.3 | % | |

| Amortization | | 2,092 |

| | 1.4 | % | | | 2,999 |

| | 2.5 | % | |

| | | 46,607 |

| | 31.3 | % | | | 41,990 |

| | 35.4 | % | |

| Earnings (loss) from operations | | 3,399 |

| | 2.3 | % | | | (3,547 | ) | | (3.0 | )% | |

| Foreign exchange gain (loss) | | (3,852 | ) | | | | | 1,921 |

| | |

| |

| Other income | | 246 |

| | | | | 26 |

| | |

| |

| Earnings (loss) before income taxes | | (207 | ) | | | | | (1,600 | ) | | |

| |

| Income tax expense | | 1,494 |

| | | | | 345 |

| | |

| |

| Net earnings (loss) from continuing operations | | (1,701 | ) | | | | | (1,945 | ) | | |

| |

| Net earnings from discontinued operations | | — |

| | | | | 1,078 |

| | |

| |

| Net earnings (loss) | | (1,701 | ) | | | | | (867 | ) | | |

| |

| Net earnings (loss) per share - Basic and diluted (in dollars) | | | | |

| | | | | |

| |

| Continuing operations | | (0.05 | ) | | | | | (0.06 | ) | | | |

| Discontinued operations | | — |

| | |

| | | 0.03 |

| | |

| |

| | | (0.05 | ) | | |

| | | (0.03 | ) | | |

| |

| | | | | | | | | | | |

GAAP:

| |

| • | Our fourth quarter revenue increased sequentially by $5.8 million, or 4.1%, compared to the third quarter of 2014 and increased by $30.5 million, or 25.7%, compared to the fourth quarter of 2013. The increase was a result of strong organic growth within our OEM Solutions segment. |

| |

| • | Gross margin was 33.5%, compared to 32.8% in the third quarter of 2014 and 32.4% in the fourth quarter of 2013. This improvement was primarily attributable to lower component and manufacturing costs. |

| |

| • | Earnings from operations increased by $0.5 million, compared to the third quarter of 2014 and increased by $6.9 million compared to the fourth quarter of 2013. The increase was attributable to higher gross margin partially offset by higher operating expenses in the fourth quarter of 2014. |

| |

| • | Net loss from continuing operations improved by $1.2 million, compared to the third quarter of 2014 due to higher operating income and lower foreign exchange losses partially offset by higher income tax expenses. Net loss from continuing operations improved by $0.2 million, compared to the fourth quarter of 2013 due to higher operating income offset by foreign exchange losses in the fourth quarter of 2014, compared to foreign exchange gains in the fourth quarter of 2013 and higher income tax expense in the fourth quarter of 2014 compared to the fourth quarter of 2013. |

| |

| • | Cash and cash equivalents at the end of the fourth quarter of 2014 were $207.1 million, an increase of $11.0 million, compared to the end of the third quarter of 2014. Cash generated from operations during the fourth quarter of 2014 was $11.3 million. |

NON-GAAP:

| |

| • | Gross margin was 33.6%, compared to 32.9% in the third quarter of 2014 and 32.5% in the fourth quarter of 2013. |

| |

| • | Earnings from operations increased by $1.7 million, compared to the third quarter of 2014 and increased by $7.4 million compared to the fourth quarter of 2013. The increase was attributable to higher gross margin partially offset by higher operating expenses in the fourth quarter of 2014. |

| |

| • | Adjusted EBITDA increased by $1.0 million, compared to the third quarter of 2014 and by $6.6 million compared to the fourth quarter of 2013. These increases reflect revenue and associated earnings growth in both of our operating segments. |

| |

| • | Net earnings from continuing operations increased by $1.4 million, compared to the third quarter of 2014 and increased by $6.0 million, compared to the fourth quarter of 2013. These increases were the result of higher operating profits partially offset by higher income tax expenses. |

| |

| • | See section on "Non-GAAP Financial Measures". |

SUMMARY OF QUARTERLY RESULTS OF OPERATIONS

The following tables highlight selected financial information for each of the eight most recent quarters that, in management’s opinion, have been prepared on a basis consistent with the audited consolidated financial statements for the year ended December 31, 2014. The selected financial information presented below reflects all adjustments, consisting primarily of normal recurring adjustments, which are, in the opinion of management, necessary for a fair presentation of results for the interim periods. These results are not necessarily indicative of results for any future period. You should not rely on these results to predict future performance.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands of U.S. dollars, except where otherwise stated) | | 2014 | | | 2013 |

| | Q4 | | Q3 | | Q2 | | Q1 | | | Q4 | | Q3 | | Q2 | | Q1 |

| Revenue | | $ | 149,078 |

| | $ | 143,270 |

| | $ | 135,012 |

| | $ | 121,163 |

| | | $ | 118,608 |

| | $ | 112,262 |

| | $ | 109,589 |

| | $ | 101,401 |

|

| Cost of goods sold | | 99,072 |

| | 96,215 |

| | 91,691 |

| | 82,566 |

| | | 80,165 |

| | 74,916 |

| | 73,115 |

| | 68,023 |

|

| Gross margin | | 50,006 |

| | 47,055 |

| | 43,321 |

| | 38,597 |

| | | 38,443 |

| | 37,346 |

| | 36,474 |

| | 33,378 |

|

| Gross margin % | | 33.5 | % | | 32.8 | % | | 32.1 | % | | 31.9 | % | | | 32.4 | % | | 33.3 | % | | 33.3 | % | | 32.9 | % |

| Expenses | | |

| | |

| | |

| | |

| | | |

| | |

| | |

| | |

|

| Sales and marketing | | 12,682 |

| | 12,633 |

| | 12,795 |

| | 12,366 |

| | | 10,693 |

| | 10,452 |

| | 10,681 |

| | 10,356 |

|

| Research and development | | 21,012 |

| | 19,887 |

| | 20,021 |

| | 20,017 |

| | | 19,074 |

| | 17,806 |

| | 17,869 |

| | 18,363 |

|

| Administration | | 9,008 |

| | 9,006 |

| | 9,680 |

| | 9,333 |

| | | 8,841 |

| | 9,297 |

| | 8,903 |

| | 8,123 |

|

| Restructuring costs | | 540 |

| | 71 |

| | 987 |

| | — |

| | | 14 |

| | 14 |

| | 26 |

| | 117 |

|

| Acquisition and integration | | 1,273 |

| | 356 |

| | 71 |

| | 970 |

| | | 369 |

| | 139 |

| | — |

| | 27 |

|

| Impairment | | — |

| | — |

| | 3,756 |

| | — |

| | | — |

| | — |

| | — |

| | — |

|

| Amortization | | 2,092 |

| | 2,159 |

| | 2,275 |

| | 2,583 |

| | | 2,999 |

| | 2,939 |

| | 2,927 |

| | 3,276 |

|

| | | 46,607 |

| | 44,112 |

| | 49,585 |

| | 45,269 |

| | | 41,990 |

| | 40,647 |

| | 40,406 |

| | 40,262 |

|

| Operating income (loss) from continuing operations | | 3,399 |

| | 2,943 |

| | (6,264 | ) | | (6,672 | ) | | | (3,547 | ) | | (3,301 | ) | | (3,932 | ) | | (6,884 | ) |

| Foreign exchange gain (loss) | | (3,852 | ) | | (8,039 | ) | | (891 | ) | | 392 |

| | | 1,921 |

| | 2,563 |

| | 1,709 |

| | (2,370 | ) |

| Other income (expense) | | 246 |

| | 317 |

| | 265 |

| | 26 |

| | | 26 |

| | (26 | ) | | 34 |

| | (132 | ) |

| Loss from continuing operations before income tax | | (207 | ) | | (4,779 | ) | | (6,890 | ) | | (6,254 | ) | | | (1,600 | ) | | (764 | ) | | (2,189 | ) | | (9,386 | ) |

| Income tax expense (recovery) | | 1,494 |

| | (1,875 | ) | | 1,353 |

| | (2,249 | ) | | | 345 |

| | (1,839 | ) | | 4,553 |

| | (1,448 | ) |

| Net earnings (loss) from continuing operations | | (1,701 | ) | | (2,904 | ) | | (8,243 | ) | | (4,005 | ) | | | (1,945 | ) | | 1,075 |

| | (6,742 | ) | | (7,938 | ) |

| Net earnings (loss) from discontinued operations | | — |

| | — |

| | — |

| | — |

| | | 1,078 |

| | (505 | ) | | 68,152 |

| | 1,863 |

|

| Net earnings (loss) | | $ | (1,701 | ) | | $ | (2,904 | ) | | $ | (8,243 | ) | | $ | (4,005 | ) | | | $ | (867 | ) | | $ | 570 |

| | $ | 61,410 |

| | $ | (6,075 | ) |

| Earnings (loss) per share - GAAP in dollars | | |

| | |

| | |

| | |

| | | |

| | |

| | |

| | |

|

| Basic | | $ | (0.05 | ) | | $ | (0.09 | ) | | $ | (0.26 | ) | | $ | (0.13 | ) | | | $ | (0.03 | ) | | $ | 0.02 |

| | $ | 2.00 |

| | $ | (0.20 | ) |

| Diluted | | $ | (0.05 | ) | | $ | (0.09 | ) | | $ | (0.26 | ) | | $ | (0.13 | ) | | | $ | (0.03 | ) | | $ | 0.02 |

| | $ | 2.00 |

| | $ | (0.20 | ) |

| Weighted average number of shares (in thousands) | | |

| | |

| | |

| | |

| | | |

| | |

| | |

| | |

|

| Basic | | 31,759 |

| | 31,582 |

| | 31,466 |

| | 31,235 |

| | | 30,804 |

| | 30,688 |

| | 30,768 |

| | 30,695 |

|

| Diluted | | 31,759 |

| | 31,582 |

| | 31,466 |

| | 31,235 |

| | | 30,804 |

| | 31,176 |

| | 30,768 |

| | 30,695 |

|

| | | | | | | | | | | | | | | | | | |

Our quarterly results may fluctuate from quarter-to-quarter, driven by variation in sales volume, product mix and the combination of variable and fixed operating expenses. The impact of significant items incurred during the first three interim periods of the year ended December 31, 2014 are discussed in more detail and disclosed in our quarterly reports and management’s discussion and analysis. Factors affecting our quarterly results in 2014 were as follows:

In the first quarter of 2014, net earnings from continuing operations decreased $2.1 million, or $0.07 per common share, to a net loss of $4.0 million, compared to the fourth quarter of 2013. The decrease was largely related to higher operating expenses as a result of targeted investments in our go-to-market capability, additional costs relating to the acquired AnyData and In Motion businesses and lower foreign exchange gains, partially offset by higher income tax recoveries in the first quarter of 2014.

In the second quarter of 2014, net loss from continuing operations increased by $4.2 million, or $0.13 per common share, to a loss of $8.2 million, compared to the first quarter of 2014 driven by an impairment in the quarter, higher foreign exchange losses and income tax expenses partially offset by higher gross margin.

In the third quarter of 2014, net loss from continuing operations decreased by $5.3 million, or $0.17 per common share, to a loss of $2.9 million, compared to the second quarter of 2014, driven by a combination of higher gross margin, lower operating expenses and an income tax recovery partially offset by foreign exchange losses.

In the fourth quarter of 2014, net loss from continuing operations decreased by $1.2 million, or $0.04 per common share, to a loss of $1.7 million, compared to the third quarter of 2014, primarily due to a lower foreign exchange loss partially offset by an income tax expense in the fourth quarter compared to an income tax recovery in the third quarter.

LIQUIDITY AND CAPITAL RESOURCES

Selected Financial Information:

|

| | | | | | | | | | | | | | | |

| (in thousands of U.S. dollars) | | 2014 |

| | | 2013 |

| | | 2012 |

| |

| Cash flows provided before changes in non-cash working capital: | | $ | 27,380 |

| | | $ | 13,257 |

| | | $ | 46,589 |

| |

| Changes in non-cash working capital | | |

| | | |

| | | |

| |

| Accounts receivable | | (5,180 | ) | | | 10,897 |

| | | (616 | ) | |

| Inventories | | (8,949 | ) | | | 11,908 |

| | | (4,019 | ) | |

| Prepaid expense and other | | 25,421 |

| | | (7,254 | ) | | | (14,543 | ) | |

| Accounts payable and accrued liabilities | | 10,538 |

| | | (13,139 | ) | | | 10,997 |

| |

| Deferred revenue and credits | | (510 | ) | | | 1,147 |

| | | (422 | ) | |

| | | 21,320 |

| | | 3,559 |

| | | (8,603 | ) | |

| Cash flows provided by (used in): | | |

| | | |

| | | |

| |

| Operating activities | | $ | 48,700 |

| | | $ | 16,816 |

| | | $ | 37,986 |

| |

| | | | | | | | | | |

| Investing activities | | $ | (22,336 | ) | | | $ | 98,754 |

| | | $ | (64,184 | ) | |

| Net proceeds from sale of AirCard business | | 13,800 |

| | | 119,958 |

| | | — |

| |

| Acquisition of In Motion | | (23,853 | ) | | | — |

| | | — |

| |

| Acquisition of M2M business of AnyData | | — |

| | | (5,196 | ) | | | — |

| |

| Acquisition of M2M business of Sagemcom | | — |

| | | — |

| | | (55,218 | ) | |

| Capital expenditures and increase in intangible assets | | (10,829 | ) | | | (13,570 | ) | | | (18,452 | ) | |

| Net change in short-term investments and other assets | | (1,584 | ) | | | (2,470 | ) | | | 9,347 |

| |

| | | | | | | | | | |

| Financing activities | | $ | 22 |

| | | $ | (925 | ) | | | $ | (9,298 | ) | |

| Issue of common shares | | 6,404 |

| | | 8,106 |

| | | 436 |

| |

| Repurchase of common shares for cancellation | | — |

| | | (5,772 | ) | | | (6,312 | ) | |

| Purchase of treasury shares for RSU distribution | | (5,955 | ) | | | (3,433 | ) | | | (2,489 | ) | |

| | | | | | | | | | |

Free Cash Flow:

|

| | | | | | | | | | | | | | |

| (in thousands of U.S. dollars) | | 2014 |

| | | 2013 |

| | | 2012 |

|

| Cash flows from operating activities | | $ | 48,700 |

| | | $ | 16,816 |

| | | $ | 37,986 |

|

| Capital expenditures and increase in intangible assets | | (10,829 | ) | | | (13,570 | ) | | | (18,452 | ) |

Free Cash Flow (1) | | 37,871 |

| | | 3,246 |

| | | 19,534 |

|

| | | | | | | | | |

(1) See section on "Non-GAAP Financial Measures"

Operating Activities

Cash provided by operating activities increased by $31.9 million year-over-year, primarily due to improved operating results and lower working capital requirements driven by the drawdown of inventory prepayments as a result of improved commercial terms from one of our contract manufacturers and other initiatives to improve working capital.

Investing Activities

Cash used in investing activities in 2014 was primarily attributable to the acquisition of In Motion in March 2014 and capital expenditures offset by the receipt of escrow funds from the sale of the AirCard business. The inflow of cash in 2013 was due to the proceeds from the sale of the AirCard business in April 2013.

Cash used for the purchase of capital equipment was primarily for production and tooling equipment, research and development equipment, and computer equipment and software, while cash used for intangible assets was driven primarily by patent registration costs and software licensing costs.

Financing Activities

Cash provided by financing activities increased $0.9 million year-over-year, primarily due to the absence of share repurchases under the Company's share repurchase program, which expired in February 2014. In 2014, we received $6.4 million from the issuance of common shares and used $6.0 million to purchase 311,333 common shares to satisfy obligations under our restricted share unit plan.

Cash Requirements

Our near-term cash requirements are primarily related to funding our operations, capital expenditures, intellectual property (“IP”) licenses, and other obligations discussed below. We continue to believe our cash, cash equivalents and short term investments balance of $207.1 million at December 31, 2014 and cash generated from continuing operations will be sufficient to fund our expected working capital requirements for at least the next twelve months and for the purchase of Maingate on January 16, 2015. Subsequent to year-end we utilized approximately $91.6 million for the acquisition of Maingate. Our capital expenditures during the first quarter of 2015 are expected to be primarily for R&D equipment, tooling, leasehold improvements, software licenses and patents. However, we cannot be certain that our actual cash requirements will not be greater than we currently expect.

The following table presents the aggregate amount of future cash outflows for contractual obligations as of December 31, 2014.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Payments due by period (In thousands of dollars) | | 2015 |

| | 2016 |

| | 2017 |

| | 2018 |

| | 2019 |

| | Thereafter |

|

| Operating lease obligations | | $ | 5,364 |

| | $ | 4,850 |

| | $ | 4,591 |

| | $ | 3,455 |

| | $ | 2,831 |

| | $ | 3,705 |

|

| Capital lease obligations | | 283 |

| | 152 |

| | 75 |

| | 34 |

| | — |

| | — |

|

Purchase obligations (1) | | 85,192 |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Other long-term liabilities (2) | | — |

| | 23,967 |

| | — |

| | — |

| | — |

| | 2,383 |

|

| Total | | $ | 90,839 |

| | $ | 28,969 |

| | $ | 4,666 |

| | $ | 3,489 |

| | $ | 2,831 |

| | $ | 6,088 |

|

| | | | | | | | | | | | | |

(1) Purchase obligations represent obligations with certain contract manufacturers to buy a minimum amount of designated products between January 2015 and March 2015. In certain of these arrangements, we may be required to acquire and pay for such products up to the prescribed minimum or forecasted purchases.

(2) Other long-term liabilities include the long-term portions of accrued royalties.

Capital Resources

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2014 | | | 2013 |

| (In thousands of dollars) | | Dec 31 | | Sept 30 | | June 30 | | Mar 31 | | | Dec 31 | | Sept 30 | | June 30 | | Mar 31 |

| Cash and cash equivalents | | $ | 207,062 |

| | $ | 196,086 |

| | $ | 168,418 |

| | $ | 151,339 |

| | | $ | 177,416 |

| | $ | 183,220 |

| | $ | 166,573 |

| | $ | 55,923 |

|

| Short-term investments | | — |

| | — |

| | — |

| | — |

| | | 2,470 |

| | 5,221 |

| | 10,000 |

| | — |

|

| | | 207,062 |

| | 196,086 |

| | 168,418 |

| | 151,339 |

| | | 179,886 |

| | 188,441 |

| | 176,573 |

| | 55,923 |

|

| Unused credit facilities | | 10,000 |

| | 10,000 |

| | 10,000 |

| | 10,000 |

| | | 10,000 |

| | 10,000 |

| | 10,000 |

| | 50,000 |

|

| Total | | $ | 217,062 |

| | $ | 206,086 |

| | $ | 178,418 |

| | $ | 161,339 |

| | | $ | 189,886 |

| | $ | 198,441 |

| | $ | 186,573 |

| | $ | 105,923 |

|

| | | | | | | | | | | | | | | | | | |

Credit Facilities

We have a $10 million revolving term credit facility ("Revolving Facility") with Toronto Dominion Bank and the Canadian Imperial Bank of Commerce expiring on October 31, 2015. The Revolving Facility is for working capital requirements, is secured by a pledge against all of our assets and is subject to borrowing base limitations. As at December 31, 2014, there were no borrowings under the Revolving Facility.

Letters of Credit

We have access to a revolving standby letter of credit facility of $10 million from Toronto Dominion Bank. The credit facility is used for the issuance of letters of credit for project related performance guarantees and is guaranteed by Export Development Canada. As of December 31, 2014, there were no letters of credit issued against the revolving standby letter of credit facility.

NON-GAAP FINANCIAL MEASURES

Our consolidated financial statements are prepared in accordance with U.S. GAAP on a basis consistent for all periods presented. In addition to results reported in accordance with U.S. GAAP, we use non-GAAP financial measures as supplemental indicators of our operating performance. The term “non-GAAP financial measure” is used to refer to a numerical measure of a company’s historical or future financial performance, financial position or cash flows that: (i) excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with U.S. GAAP in a company’s statement of earnings, balance sheet or statement of cash flows; or (ii) includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented.

Our non-GAAP financial measures include non-GAAP gross margin, non-GAAP earnings (loss) from operations, Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) and non-GAAP diluted earnings (loss) per share, respectively. We disclose non-GAAP amounts as we believe that these measures provide useful information on actual operating results and assist in comparisons from one period to another. Readers are cautioned that non-GAAP financial measures do not have any standardized meaning prescribed by U.S. GAAP and therefore may not be comparable to similar measures presented by other companies. Non-GAAP results exclude the impact of stock-based compensation expense, amortization related to acquisitions, acquisition and disposition costs, restructuring costs, integration costs, impairment, foreign exchange gains or losses on foreign currency contracts and translation of balance sheet accounts and certain tax adjustments.

Adjusted EBITDA as defined equates earnings (loss) from operations plus stock-based compensation and related social taxes, acquisition and integration, restructuring, integration, amortization and impairment. Adjusted EBITDA can also be calculated as non-GAAP earnings (loss) from operations plus amortization excluding acquisition related amortization.

Free cash flow as defined equates cash flow from operating activities less capital expenditures and increases in intangibles.

The following table provides a reconciliation of the non-GAAP financial measures to our most directly comparable U.S. GAAP results for years ended December 31:

|

| | | | | | | | | | | | |

| (in thousands of U.S. dollars, except where otherwise stated) | | 2014 |

| | 2013 |

| | 2012 |

|

| | | | | | | |

| Gross margin - GAAP | | $ | 178,979 |

| | $ | 145,641 |

| | $ | 125,274 |

|

| Stock-based compensation and related social taxes | | 555 |

| | 406 |

| | 304 |

|

| Gross margin - Non-GAAP | | $ | 179,534 |

| | $ | 146,047 |

| | $ | 125,578 |

|

| | | | | | | |

| Loss from operations - GAAP | | $ | (6,594 | ) | | $ | (17,664 | ) | | $ | (22,206 | ) |

| Stock-based compensation and related social taxes | | 10,464 |

| | 7,990 |

| | 5,781 |

|

| Acquisition and integration | | 2,670 |

| | 535 |

| | 3,182 |

|

| Restructuring | | 1,598 |

| | 171 |

| | 2,251 |

|

| Impairment | | 3,756 |

| | 280 |

| | — |

|

| Acquisition related amortization | | 10,900 |

| | 13,741 |

| | 11,890 |

|

| Earnings from operations - Non-GAAP | | $ | 22,794 |

| | $ | 5,053 |

| | $ | 898 |

|

| Amortization (excluding acquisition related amortization) | | 12,617 |

| | 13,649 |

| | 11,747 |

|

| Adjusted EBITDA | | $ | 35,411 |

| | $ | 18,702 |

| | $ | 12,645 |

|

| | | | | | | |

| Net loss from continuing operations - GAAP | | $ | (16,853 | ) | | $ | (15,550 | ) | | $ | (4,202 | ) |

| Stock-based compensation and related social taxes, restructuring, impairment, acquisition, integration, and acquisition related amortization, net of tax | | 29,337 |

| | 22,620 |

| | 22,241 |

|

| Unrealized foreign exchange loss (gain) | | 12,285 |

| | (3,912 | ) | | (3,139 | ) |

| Income tax adjustments | | (4,921 | ) | | 3,784 |

| | (15,344 | ) |

| Net earnings (loss) from continuing operations - Non-GAAP | | $ | 19,848 |

| | $ | 6,942 |

| | $ | (444 | ) |

| | | | | | | |

| Net earnings from discontinued operations - GAAP | | $ | — |

| | $ | 70,588 |

| | $ | 31,401 |

|

| Stock-based compensation and disposition costs | | — |

| | 4,014 |

| | 2,395 |

|

| Gain on sale of AirCard business | | — |

| | (70,182 | ) | | — |

|

| Net earnings from discontinued operations - Non-GAAP | | $ | — |

| | $ | 4,420 |

| | $ | 33,796 |

|

| | | | | | | |