UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09913

AIM Counselor Series Trust

(Invesco Counselor Series Trust)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 8/31

Date of reporting period: 8/31/20

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Letters to Shareholders

| | |

Andrew Schlossberg | | Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period. Investors faced unprecedented economic events and market volatility during the reporting period as a global pandemic gripped the world and equities experienced some of the most extreme price swings in history. In the fall of 2019, the onset of the reporting period, markets were relatively calm despite US-China trade concerns and signs of slowing global growth. In the final months of 2019, better-than-expected third quarter corporate earnings and initial agreement of the phase one US-China trade deal provided a favorable backdrop for equities and impressive fourth quarter global equity returns. As 2020 dawned, US investors were treated to equity gains culminating in record highs on February 19, 2020. The first half of the quarter, however, belied the impact that the coronavirus (COVID-19) would have on markets in a world faced with shuttered businesses and global lockdowns. Equity markets began to |

|

|

|

sell off in late February and plummeted in March. The speed and depth of market declines and reversals during the month made March 2020 one of the most volatile months on record. While equities languished, government bonds largely performed as expected as central banks cut interest rates, which lowered bond yields but sent bond prices soaring. Like equities, however, corporate bond prices fell due to the impact of diminished corporate profits. In response to the financial and economic hardships caused by the pandemic, central banks and governments around the world responded with fiscal and monetary stimulus. The US Federal Reserve cut interest rates to near zero (0.00-0.25%) and announced an unprecedented quantitative easing program. The US administration also passed a $2.2 trillion economic-relief package – the largest in US history. Most major economies outside of the US provided liquidity in the bond and equity markets in the form of fiscal policy and quantitative easing.

Massive global fiscal and monetary responses prompted a remarkable global stock market rebound in the second quarter of 2020. All 11 sectors of the S&P 500 Index were positive for the quarter with the index recording its best quarterly performance since 1998. Technology stocks led the way pushing the Nasdaq Composite Index to record highs. The yield on the 10-year US Treasury stabilized after its large decline in the first quarter. Despite macroeconomic data that illustrated the enormous economic cost of the shutdowns – millions of US workers lost their jobs and the US economy contracted at a 5.0% annualized rate for the first quarter of 2020 – the overall tone of economic data improved during the second quarter, offsetting some of the pandemic fears. Retail sales rebounded in May, as did automobile sales, and the unemployment rate continued to drop.

The final months of the reporting period provided further evidence that economic activity, post lockdowns, had improved. Despite the announcement that US GDP decreased at an annual rate of 31.7% in the second quarter of 2020 (second estimate), investors were more focused on recovery of economic data. The housing market rebounded sharply off its spring lows and companies reported better-than-expected Q2 earnings. The possibility of a COVID-19 vaccine by year-end also encouraged investors. In this context, the S&P 500 Index turned positive year-to-date through July and set new record highs in August. Comparatively, international equities, both developed and emerging, were also largely positive but lagged US stocks.

As markets and investors attempt to adapt to a new normal, we’ll see how the interplay of interest rates, economic data, geopolitics and a host of other factors affect US and overseas equity and fixed income markets.

Investor uncertainty and market volatility, such as we witnessed during the reporting period, are unfortunate facts of life when it comes to investing. That’s why Invesco encourages investors to work with professional financial advisers. They can offer a long-term perspective when markets are volatile and time-tested advice and guidance when your financial situation or investment goals change.

Visit our website for more information on your investments

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. To do so, select “Log In” on the right side of the homepage, and then select “Register for Individual Account Access.”

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets and the economy by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Finally, I’m pleased to share with you Invesco’s commitment to both the Principles for Responsible Investment and to considering environmental, social and governance issues in our robust investment process. I invite you to learn more at invesco.com/esg.

Have questions?

For questions about your account, contact an Invesco client services representative at 800 959 4246.

All of us at Invesco look forward to serving your investment management needs. Thank you for investing with us.

Sincerely,

Andrew Schlossberg

Head of the Americas,

Senior Managing Director, Invesco Ltd.

2 Invesco American Franchise Fund

| | |

Bruce Crockett | | Dear Shareholders: Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: ∎ Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. ∎ Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions. ∎ Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus. |

| ∎ | | Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive. |

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper, Inc. (a subsidiary of Broadridge Financial Solutions, Inc.), an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

3 Invesco American Franchise Fund

Management’s Discussion of Fund Performance

| | | | |

| | | Performance summary |

| | For the fiscal year ended August 31, 2020, Class A shares of Invesco American Franchise Fund (the Fund), at net asset value (NAV), outperformed the Russell 1000 Growth Index, the Fund’s style-specific benchmark. |

| | Your Fund’s long-term performance appears later in this report. |

| | | Fund vs. Indexes |

| | Total returns, 8/31/19 to 8/31/20, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. |

| | | Class A Shares | | 45.42% |

| | | Class C Shares | | 44.30 |

| | | Class R Shares | | 45.00 |

| | | Class Y Shares | | 45.74 |

| | | Class R5 Shares | | 45.85 |

| | | Class R6 Shares | | 45.93 |

| | | S&P 500 Indexq (Broad Market Index) | | 21.94 |

| | | Russell 1000 Growth Indexq (Style-Specific Index) | | 44.34 |

| | | Lipper Large-Cap Growth Funds Index ∎ (Peer Group Index) | | 43.09 |

| | Source(s): qRIMES Technologies Corp.; ∎Lipper Inc. | | |

Market conditions and your Fund

Macroeconomic issues that concerned investors in the third quarter of 2019 mostly abated during the fourth quarter, providing the backdrop for strong equity market returns. During its September and October meetings, the US Federal Reserve (the Fed) cut interest rates by 0.25% each time, based on business investment and exports remaining weak.¹ Investors were also encouraged by a resilient US economy and corporate earnings, putting the US equity market on track for its largest annual rise since 2013.

During the first quarter of 2020, as the spread of the new coronavirus (COVID-19) disrupted travel and suppressed consumer activity, investors became increasingly concerned about the global economy. At the same time, oil prices fell sharply as a price war between Saudi Arabia and Russia threatened to boost supply even as demand was falling. Beginning in late February, equity markets declined sharply and quickly, ushering in the first bear market since the financial crisis of 2008. Though the equity market stabilized somewhat toward the end of March, all sectors declined during the downturn. In response to the major collapse in demand and to help facilitate liquidity, the Fed cut interest rates two times in March by 0.50% and 1.00%, ending with a target range of 0.00% to 0.25%.1

In April, US unemployment numbers continued to climb and the initial gross domestic product (GDP) estimates for the first quarter of 2020 saw the economy shrink by 5%, the sharpest drop since the 2008 financial crisis.² However, during the second and into the third quarter of 2020, US stocks largely shrugged off economic uncertainty, social unrest and a resurgence in coronavirus infections to rally from the market bottom. The rally followed a sharp economic decline

caused by global shutdowns to slow the spread of COVID-19. Investor sentiment improved in response to trillions of dollars in economic stimulus, progress on a coronavirus vaccine and a gradual reopening of many US regions. After oil futures contracts turned negative in early April, oil prices doubled in June, which supported struggling energy companies and millions of energy sector employees. In July, the Fed extended its emergency stimulus programs, originally scheduled to end in September, to year-end, which provided support to equities. Additionally, optimism about a vaccine, and better than anticipated US economic data and corporate earnings also boosted stocks. Most economists believe the US economy hit a low in April; however, in late August revised second quarter GDP fell by 31.7%, a record decline.2 Despite the extreme drop in the economy, the S&P 500 Index not only erased all its losses from the first quarter but ended the fiscal year with record highs.

In this environment, the Fund’s Class A shares at NAV, produced a double-digit return and outperformed the style-specific benchmark for the fiscal year. The leading contributor to relative results was the Fund’s overweight exposure to the consumer discretionary sector, which was among the best performing sectors during the fiscal year. Stock selection in the communication services and health care sectors was also a notable contributor to the Fund’s relative outperformance. Finally, the Fund’s lack of exposure to the real estate sector was a tailwind for Fund performance as well.

At the stock level, ecommerce leader Amazon.com was the foremost contributor to Fund performance on an absolute and relative basis. Early in the fiscal year, Amazon’s share price came under pressure due to higher costs to support volume strength, increasing investment related to its move to

one-day shipping for Prime customers and other holiday-related shipping initiatives. Subsequently, the online retail giant reported strong consecutive quarters and guidance as COVID-19 has driven significant adoption of ecommerce to accommodate social distancing measures. Additionally, Amazon.com has seen an increase in users and broadening usage in underpenetrated categories such as food and consumables.

Microsoft was also a key absolute contributor to Fund performance during the fiscal year. The software company’s cloud-based product, Azure, continued to grow rapidly and gain market share. Microsoft was awarded the $10 billion Joint Enterprise Defense Infrastructure (JEDI) contract from the US Department of Defense, further strengthening its competitive position. The company’s improved margins combined with strong growth in core server tools also fueled its continued strong performance.

Within the communication services sector, Facebook was the leading absolute contributor to Fund performance. Despite Facebook’s increased anti-trust scrutiny and some head-winds from reduced advertising budgets, the social media giant reported strong user growth, revenue and margins throughout the fiscal year. In addition, COVID-19 drove acceleration in user growth and engagement as social distancing measures required increased reliance on digital tools for socializing.

Alternatively, stock selection in and underweight exposure to the information technology (IT) sector was the only detractor from relative Fund results compared to the style-specific benchmark during the fiscal year. This was primarily attributable to the Fund’s underweight exposure to Apple relative to the benchmark.

The Fund’s underweight exposure to Apple resulted in it being the leading relative detractor from Fund performance compared to the Fund’s style-specific benchmark during the fiscal year, although it was among the main contributors to Fund performance on an absolute basis. Despite geopolitical trade concerns and slowing global growth, the technology company beat lowered expectations, reported better margins and modestly raised its forward-looking guidance. The anticipation of the 2020 iPhone cycle, which is expected to include 5G capabilities, also helped push Apple’s share price higher during the fiscal year. Investors increasingly view the hardware business as a more stable, recurring revenue stream. Apple has also benefitted from flows into index instruments.

The leading detractor on an absolute basis from Fund performance was Royal Caribbean Cruises. Despite strong bookings going into 2020, the pandemic completely shut down the cruise industry. It’s expected to recover but at a very slow pace. The industry is waiting on the CDC to grant permission to resume operations. Once the ships are operating again, there will be constraints on the number

4 Invesco American Franchise Fund

of passengers, which will likely impact revenue to the downside. We exited our position during the fiscal year due to a potentially very slow and uncertain recovery.

Within the industrials sector, the leading absolute detractor from Fund performance during the fiscal year was Airbus. Early in the fiscal year and heading into the COVID-19 crisis, Airbus boasted an unparalleled position in aerospace with healthy demand for its core A320 family, strong competitive position and liquidity. Once COVID-19 impacted travel, nearly half of the global aircraft fleet was parked, and the remainder operated at often single-digit load factors. Airlines were forced to use excess cash and sought government assistance. Airbus was eliminated from the portfolio during the fiscal year because we believe overcapacity of commercial aircraft, combined with weak airline balance sheets, will negatively affect aircraft demand for years to come.

At the end of the fiscal year, the Fund’s largest overweight positions relative to the style-specific benchmark were to the consumer discretionary, communication services and financials sectors. The Fund’s largest underweight exposures relative to the style-specific benchmark were in the IT, consumer staples and health care sectors.

At the close of the fiscal year, the rise of the coronavirus had shaken investor confidence and we believe will likely disrupt economic growth over at least the next several months. In response to this rapidly evolving situation, central banks around the world are taking action to provide economic support through monetary stimulus. We view the COVID-19 outbreak as a transitory event that has brought market volatility, but also attractive valuations for many equities as we look out beyond this event and on to its impact. We believe several of our larger themes are also well positioned for the current disruptions to social contact. In the months ahead, we expect continued volatility and aim to remain nimble and take advantage of price dislocations. We believe change is the fuel for growth. Our deep fundamental research seeks to identify “share-takers,” which are companies that can gain market share through technology-enabled advantages in their business models and with offerings that benefit from the continued disruptive shifts in consumer behavior that we expect.

Thank you for your commitment to the Invesco American Franchise Fund and for sharing our long-term investment horizon.

1 Source: US Federal Reserve

2 Source: US Bureau of Economic Analysis

Portfolio managers:

Ido Cohen

Erik Voss - Lead

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors

such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

5 Invesco American Franchise Fund

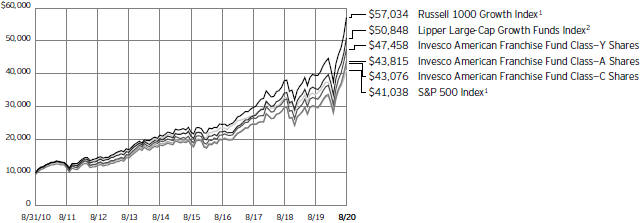

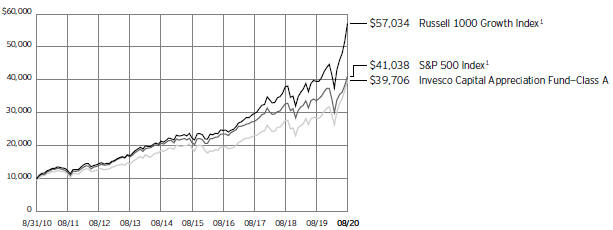

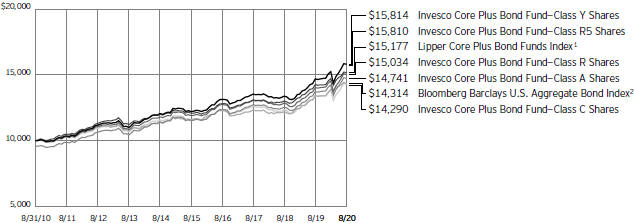

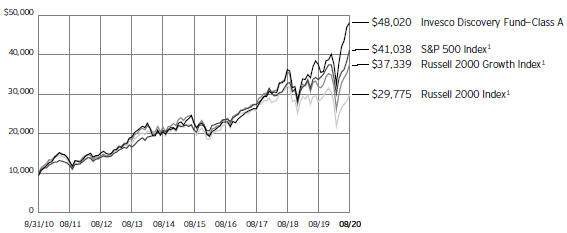

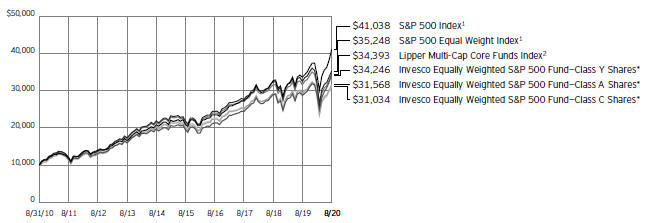

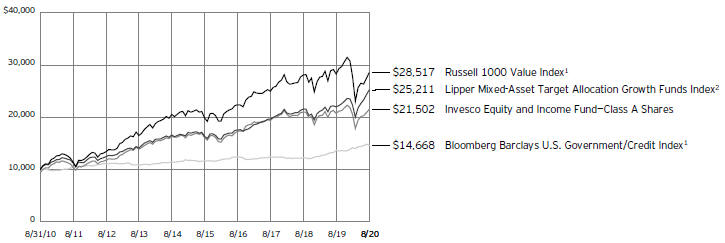

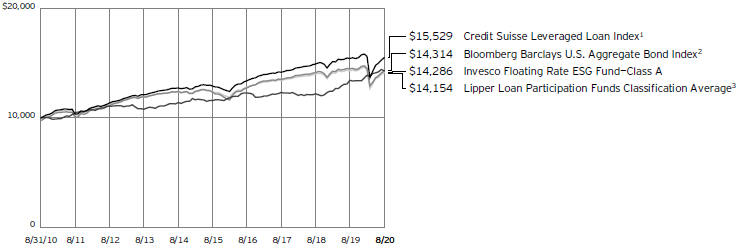

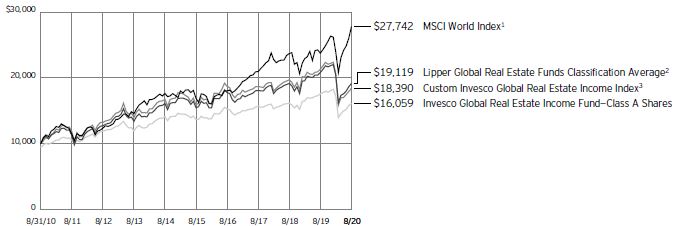

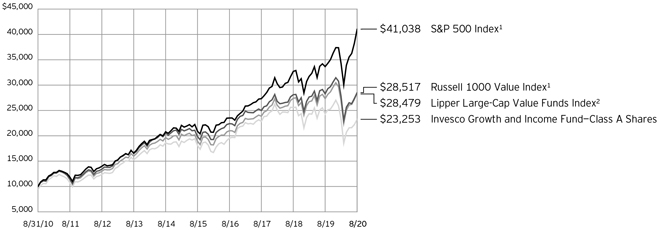

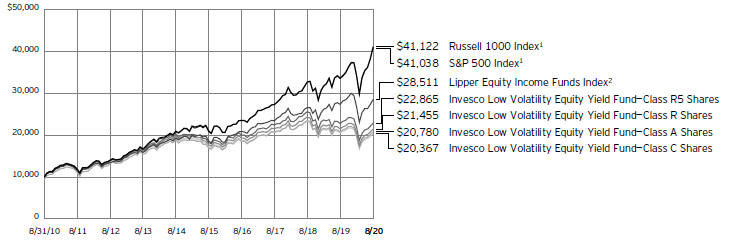

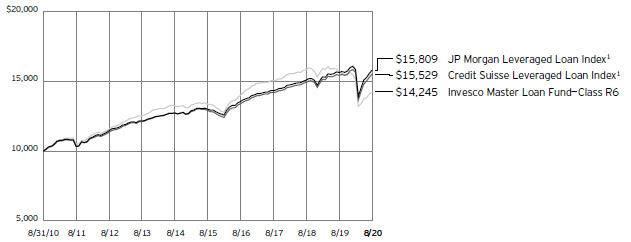

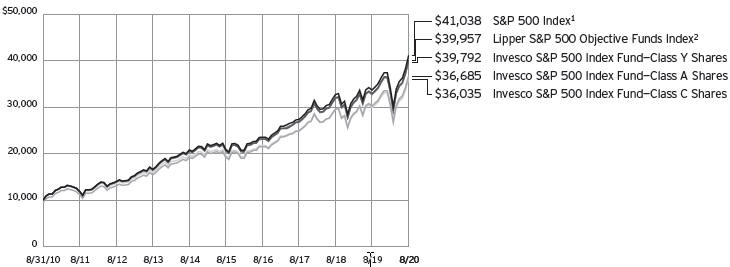

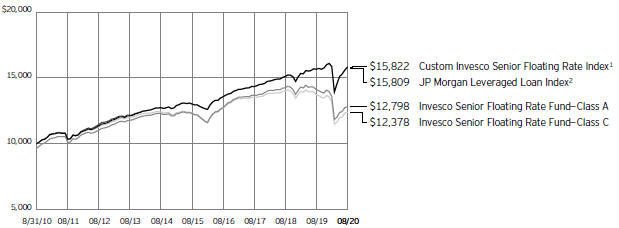

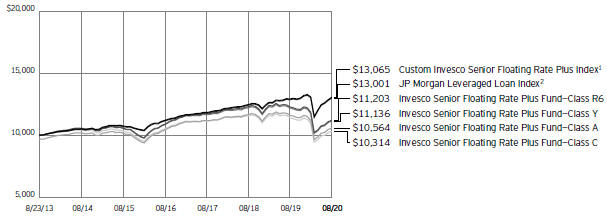

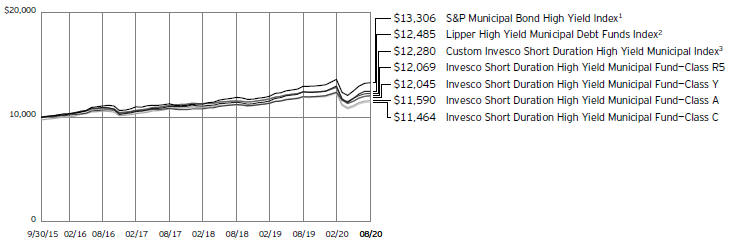

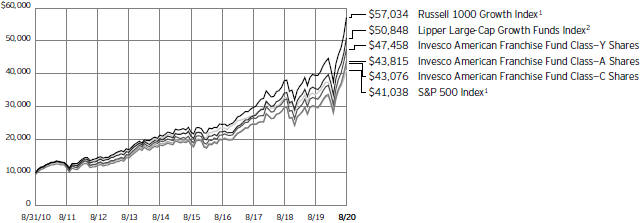

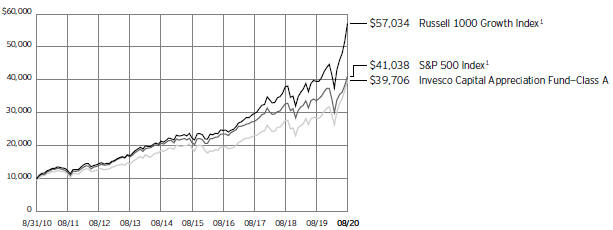

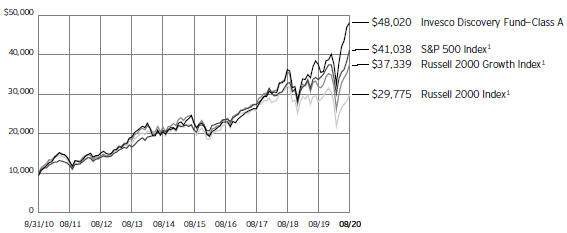

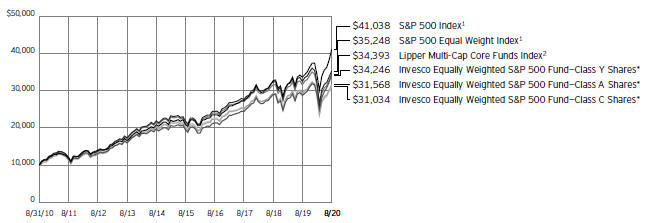

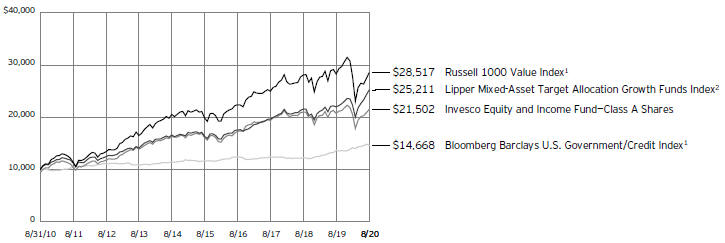

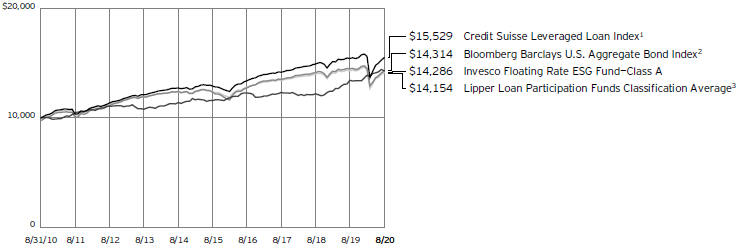

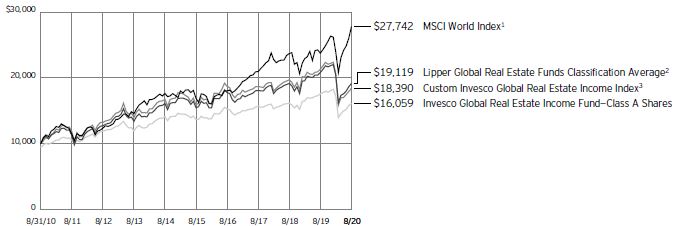

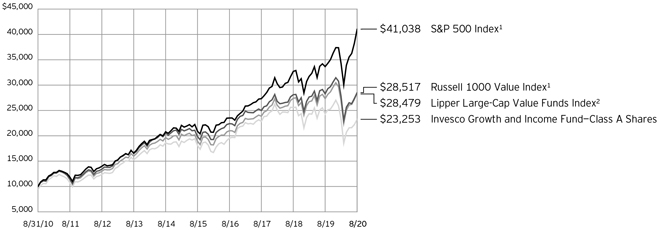

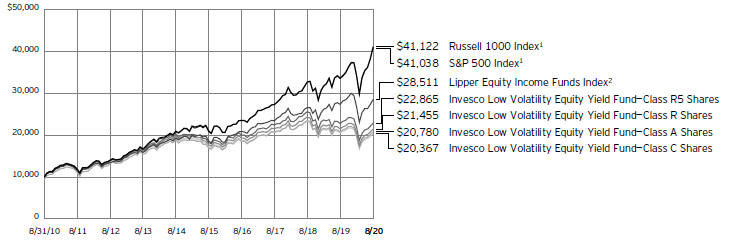

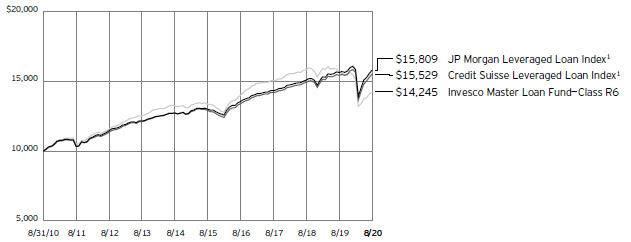

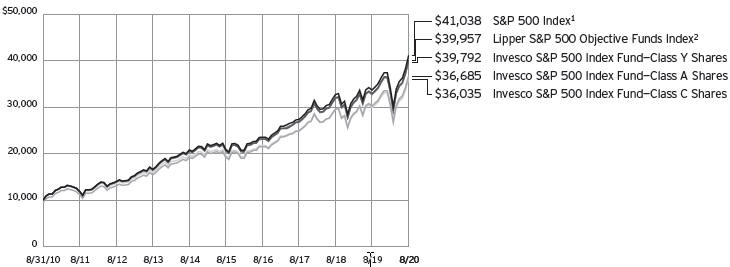

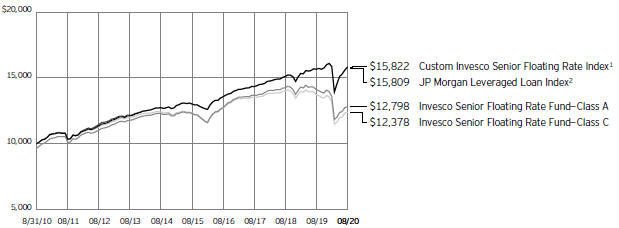

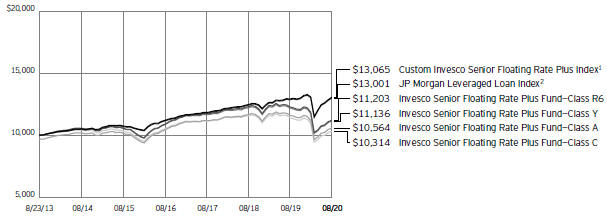

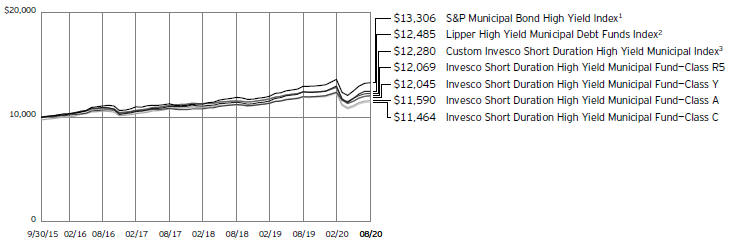

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 8/31/10

1 Source: RIMES Technologies Corp.

2 Source: Lipper Inc.

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management

fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

6 Invesco American Franchise Fund

| | | | |

Average Annual Total Returns | |

| As of 8/31/20, including maximum applicable sales charges | |

Class A Shares | | | | |

| | | | |

Inception (6/23/05) | | | 10.98 | % |

| | | | |

10 Years | | | 15.92 | |

5 Years | | | 17.54 | |

1 Year | | | 37.41 | |

| | | | |

Class C Shares | | | | |

| | | | |

Inception (6/23/05) | | | 10.86 | % |

| | | | |

10 Years | | | 15.72 | |

| | | | |

5 Years | | | 17.99 | |

| | | | |

1 Year | | | 43.30 | |

| | | | |

Class R Shares | | | | |

| | | | |

10 Years | | | 16.28 | % |

| | | | |

5 Years | | | 18.59 | |

| | | | |

1 Year | | | 45.00 | |

| | | | |

Class Y Shares | | | | |

| | | | |

Inception (6/23/05) | | | 11.65 | % |

| | | | |

10 Years | | | 16.85 | |

| | | | |

5 Years | | | 19.18 | |

| | | | |

1 Year | | | 45.74 | |

| | | | |

Class R5 Shares | | | | |

| | | | |

10 Years | | | 16.96 | % |

| | | | |

5 Years | | | 19.27 | |

| | | | |

1 Year | | | 45.85 | |

| | | | |

Class R6 Shares | | | | |

| | | | |

10 Years | | | 16.97 | % |

| | | | |

5 Years | | | 19.37 | |

| | | | |

1 Year | | | 45.93 | |

Effective June 1, 2010, Class A, Class C and Class I shares of the predecessor fund, Van Kampen American Franchise Fund, advised by Van Kampen Asset Management were reorganized into Class A, Class C and Class Y shares, respectively, of Invesco Van Kampen American Franchise Fund (renamed Invesco American Franchise Fund). Returns shown above, prior to June 1, 2010, for Class A, Class C and Class Y shares are those for Class A, Class C and Class I shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

Class R shares incepted on May 23, 2011. Performance shown prior to that date is that of the Fund’s Class A shares at net asset value, restated to reflect the higher 12b-1 fees applicable to Class R shares.

Class R5 shares incepted on December 22, 2010. Performance shown prior to that date is that of the Fund’s Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares.

Class R6 shares incepted on September 24, 2012. Performance shown prior to that date is that of the Fund’s Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be

lower or higher. Please visit invesco.com/ performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 5.50% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

7 Invesco American Franchise Fund

Invesco American Franchise Fund’s investment objective is to seek long-term capital appreciation.

| ∎ | | Unless otherwise stated, information presented in this report is as of August 31, 2020, and is based on total net assets. |

| ∎ | | Unless otherwise noted, all data provided by Invesco. |

| ∎ | | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | | The S&P 500® Index is an unmanaged index considered representative of the US stock market. |

| ∎ | | The Russell 1000® Growth Index is an unmanaged index considered representative of large-cap growth stocks. The Russell 1000 Growth Index is a trademark/ service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. |

| ∎ | | The Lipper Large-Cap Growth Funds Index is an unmanaged index considered representative of large-cap growth funds tracked by Lipper. |

| ∎ | | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Liquidity Risk Management Program

The Securities and Exchange Commission has adopted Rule 22e-4 under the Investment Company Act of 1940 (the “Liquidity Rule”) in order to promote effective liquidity risk management throughout the open-end investment company industry, thereby reducing the risk that funds will be unable to meet their redemption obligations and mitigating dilution of the interests of fund shareholders. The Fund has adopted and implemented a liquidity risk management program in accordance with the Liquidity Rule (the “Program”). The Program is reasonably designed to assess and manage the Fund’s liquidity risk, which is the risk that the Fund could not meet redemption requests without significant dilution of remaining investors’ interests in the Fund. The Board of Trustees of the Fund (the “Board”) has appointed Invesco Advisers, Inc. (“Invesco”), the Fund’s investment adviser, as the Program’s administrator, and Invesco has delegated oversight of the Program to the Liquidity Risk Management Committee (the “Committee”), which is composed of senior representatives

from relevant business groups at Invesco.

As required by the Liquidity Rule, the Program includes policies and procedures providing for an assessment, no less frequently than annually, of the Fund’s liquidity risk that takes into account, as relevant to the Fund’s liquidity risk: (1) the Fund’s investment strategy and liquidity of portfolio investments during both normal and reasonably foreseeable stressed conditions; (2) short-term and long-term cash flow projections for the Fund during both normal and reasonably foreseeable stressed conditions; and (3) the Fund’s holdings of cash and cash equivalents and any borrowing arrangements. The Liquidity Rule also requires the classification of the Fund’s investments into categories that reflect the assessment of their relative liquidity under current market conditions. The Fund classifies its investments into one of four categories defined in the Liquidity Rule: “Highly Liquid,” “Moderately Liquid,” “Less Liquid” and “Illiquid.” Funds that are not invested primarily in “Highly Liquid Investments” that are assets (cash or investments that are reasonably expected to be convertible into cash within three business days without significantly changing the market value of the investment) are required to establish a “Highly Liquid Investment Minimum” (“HLIM”), which is the minimum percentage of net assets that must be invested in Highly Liquid Investments. Funds with HLIMs have procedures for addressing HLIM shortfalls, including reporting to the Board and the SEC (on a non-public basis) as required by the Program and the Liquidity Rule. In addition, the Fund may not acquire an investment if, immediately after the acquisition, over 15% of the Fund’s net assets would consist of “Illiquid Investments” that are assets (an investment that cannot reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment). The Liquidity Rule and the Program also require reporting to the Board and the SEC (on a non-public basis) if a Fund’s holdings of Illiquid Investments exceed 15% of the Fund’s assets.

At a meeting held on March 30-April 1, 2020, the Committee presented a report to the Board that addressed the operation of the Program and assessed the Program’s adequacy and effectiveness of implementation (the “Report”). The Report covered the period from December 1, 2018 through December 31, 2019 (the “Program Reporting Period”).

The Report stated, in relevant part, that during the Program Reporting Period:

| ∎ | | The Program, as adopted and implemented, remained reasonably designed to assess and manage the Fund’s liquidity risk and was operated effectively to achieve that goal; |

| ∎ | | The Fund’s investment strategy remained appropriate for an open-end fund; |

| ∎ | | The Fund was able to meet requests for redemption without significant dilution of remaining investors’ interests in the Fund; |

| ∎ | | The Fund did not breach the 15% limit on Illiquid Investments; and |

| ∎ | | The Fund primarily held Highly Liquid Investments and therefore has not adopted an HLIM. |

| | |

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. | | |

| | | |

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

8 Invesco American Franchise Fund

Fund Information

| | | | |

| Portfolio Composition | | |

| |

By sector | | % of total net assets |

Information Technology | | 33.65% |

Consumer Discretionary | | 23.95 |

Communication Services | | 16.76 |

Health Care | | 11.41 |

Industrials | | 5.27 |

Financials | | 5.00 |

Consumer Staples | | 2.45 |

Other Sectors, Each Less than 2% of Net Assets | | 1.42 |

Money Market Funds Plus Other Assets Less Liabilities | | 0.09 |

| |

| Top 10 Equity Holdings* | | |

| | |

| | | | | % of total net assets |

| 1. | | Amazon.com, Inc. | | 10.87% |

| 2. | | Facebook, Inc., Class A | | 5.19 |

| 3. | | Microsoft Corp. | | 5.10 |

| 4. | | Alphabet, Inc., Class A | | 4.75 |

| 5. | | Alibaba Group Holding Ltd., ADR | | 4.37 |

| 6. | | Apple, Inc. | | 3.56 |

| 7. | | Lowe’s Cos., Inc. | | 3.26 |

| 8. | | Visa, Inc., Class A | | 3.03 |

| 9. | | PayPal Holdings, Inc. | | 2.88 |

| 10. | | salesforce.com, inc. | | 2.80 |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

* Excluding money market fund holdings, if any.

Data presented here are as of August 31, 2020.

9 Invesco American Franchise Fund

Schedule of Investments(a)

August 31, 2020

| | | | | | | | |

| | | Shares | | | Value | |

| |

Common Stocks & Other Equity Interests–99.92% | |

Aerospace & Defense–0.78% | |

L3Harris Technologies, Inc. | | | 121,601 | | | $ | 21,978,165 | |

| |

Textron, Inc. | | | 2,325,677 | | | | 91,701,444 | |

| |

| | | | | | | 113,679,609 | |

| |

|

Application Software–7.75% | |

Adobe, Inc.(b) | | | 366,506 | | | | 188,160,515 | |

| |

RingCentral, Inc., Class A(b) | | | 511,939 | | | | 148,856,503 | |

| |

salesforce.com, inc.(b) | | | 1,499,192 | | | | 408,754,699 | |

| |

Splunk, Inc.(b) | | | 911,097 | | | | 199,830,905 | |

| |

Synopsys, Inc.(b) | | | 762,783 | | | | 168,803,878 | |

| |

Zoom Video Communications, Inc., Class A(b) | | | 49,014 | | | | 15,934,451 | |

| |

| | | | | | | 1,130,340,951 | |

| |

|

Asset Management & Custody Banks–3.61% | |

Apollo Global Management, Inc. | | | 5,608,254 | | | | 262,858,865 | |

| |

KKR & Co., Inc., Class A | | | 7,344,908 | | | | 263,094,605 | |

| |

| | | | | | | 525,953,470 | |

| |

|

Automotive Retail–0.50% | |

CarMax, Inc.(b) | | | 678,715 | | | | 72,574,995 | |

| |

|

Biotechnology–1.54% | |

Alnylam Pharmaceuticals,

Inc.(b) | | | 377,315 | | | | 50,047,062 | |

| |

Argenx SE, ADR

(Netherlands)(b) | | | 158,793 | | | | 36,724,057 | |

| |

BeiGene Ltd., ADR (China)(b) | | | 417,457 | | | | 100,845,087 | |

| |

BioNTech SE, ADR

(Germany)(b)(c) | | | 441,135 | | | | 27,019,519 | |

| |

Ionis Pharmaceuticals, Inc.(b) | | | 24,455 | | | | 1,332,797 | |

| |

Moderna, Inc.(b) | | | 127,720 | | | | 8,287,751 | |

| |

| | | | | | | 224,256,273 | |

| |

|

Construction Machinery & Heavy Trucks–0.13% | |

Nikola Corp.(b)(c) | | | 464,216 | | | | 18,944,655 | |

| |

|

Consumer Electronics–0.88% | |

Sony Corp. (Japan) | | | 1,639,800 | | | | 128,318,027 | |

| |

| | |

Copper–0.68% | | | | | | | | |

Freeport-McMoRan, Inc. | | | 6,336,476 | | | | 98,912,390 | |

| |

|

Data Processing & Outsourced Services–7.93% | |

Fiserv, Inc.(b) | | | 653,724 | | | | 65,097,836 | |

FleetCor Technologies, Inc.(b) | | | 293,700 | | | | 73,850,865 | |

| |

Mastercard, Inc., Class A | | | 432,811 | | | | 155,028,572 | |

| |

PayPal Holdings, Inc.(b) | | | 2,059,716 | | | | 420,470,424 | |

| |

Visa, Inc., Class A | | | 2,082,254 | | | | 441,417,026 | |

| |

| | | | | | | 1,155,864,723 | |

| |

|

Diversified Support Services–0.49% | |

Cintas Corp. | | | 212,460 | | | | 70,800,170 | |

| |

|

Education Services–0.28% | |

Chegg, Inc.(b) | | | 553,860 | | | | 40,841,636 | |

| |

|

Environmental & Facilities Services–0.45% | |

GFL Environmental, Inc. (Canada) | | | 2,115,977 | | | | 38,616,580 | |

| |

Republic Services, Inc. | | | 290,511 | | | | 26,936,180 | |

| |

| | | | | | | 65,552,760 | |

| |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Financial Exchanges & Data–0.30% | | | | | |

London Stock Exchange Group PLC (United Kingdom) | | | 60,349 | | | $ | 7,099,095 | |

| |

S&P Global, Inc. | | | 99,387 | | | | 36,417,384 | |

| |

| | | | | | | 43,516,479 | |

| |

Food Distributors–1.01% | |

US Foods Holding Corp.(b) | | | 6,043,946 | | | | 147,170,085 | |

| |

|

Health Care Equipment–4.57% | |

Abbott Laboratories | | | 338,136 | | | | 37,015,748 | |

| |

DexCom, Inc.(b) | | | 349,228 | | | | 148,565,083 | |

| |

Intuitive Surgical, Inc.(b) | | | 214,344 | | | | 156,651,169 | |

| |

Teleflex, Inc. | | | 481,201 | | | | 189,087,933 | |

| |

Zimmer Biomet Holdings, Inc. | | | 958,344 | | | | 135,011,503 | |

| |

| | | | | | | 666,331,436 | |

| |

|

Health Care Supplies–0.22% | |

West Pharmaceutical Services, Inc. | | | 112,957 | | | | 32,075,270 | |

| |

|

Health Care Technology–0.09% | |

Teladoc Health, Inc.(b) | | | 61,468 | | | | 13,258,033 | |

| |

|

Home Improvement Retail–3.26% | |

Lowe’s Cos., Inc. | | | 2,890,033 | | | | 475,959,535 | |

| |

|

Industrial Conglomerates–0.57% | |

Roper Technologies, Inc. | | | 194,963 | | | | 83,286,244 | |

| |

|

Industrial Gases–0.43% | |

Air Products and Chemicals, Inc. | | | 216,600 | | | | 63,303,516 | |

| |

|

Interactive Home Entertainment–5.35% | |

Activision Blizzard, Inc. | | | 4,030,932 | | | | 336,663,440 | |

| |

Electronic Arts, Inc.(b) | | | 1,024,873 | | | | 142,939,037 | |

| |

Nintendo Co. Ltd. (Japan) | | | 481,700 | | | | 257,663,358 | |

| |

Take-Two Interactive Software, Inc.(b) | | | 247,231 | | | | 42,323,475 | |

| |

| | | | | | | 779,589,310 | |

| |

|

Interactive Media & Services–10.48% | |

Alphabet, Inc., Class A(b) | | | 424,775 | | | | 692,183,606 | |

| |

Facebook, Inc., Class A(b) | | | 2,580,680 | | | | 756,655,376 | |

| |

ZoomInfo Technologies, Inc., Class A(b) | | | 2,055,911 | | | | 79,810,465 | |

| |

| | | | | | | 1,528,649,447 | |

| |

|

Internet & Direct Marketing Retail–19.03% | |

Alibaba Group Holding Ltd., ADR (China)(b) | | | 2,220,281 | | | | 637,287,255 | |

| |

Amazon.com, Inc.(b) | | | 459,100 | | | | 1,584,335,736 | |

| |

Booking Holdings, Inc.(b) | | | 178,961 | | | | 341,896,043 | |

| |

Farfetch Ltd., Class A (United Kingdom)(b) | | | 4,587,481 | | | | 127,027,349 | |

| |

HelloFresh SE (Germany)(b)(c) | | | 1,620,072 | | | | 83,270,303 | |

| |

| | | | | | | 2,773,816,686 | |

| |

|

Life & Health Insurance–1.10% | |

Athene Holding Ltd., Class A(b) | | | 4,371,713 | | | | 159,829,827 | |

| |

|

Life Sciences Tools & Services–3.07% | |

Avantor, Inc.(b) | | | 6,645,335 | | | | 149,985,211 | |

| |

Illumina, Inc.(b) | | | 123,612 | | | | 44,156,679 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco American Franchise Fund

| | | | | | | | |

| | | Shares | | | Value | |

| |

Life Sciences Tools & Services–(continued) | |

IQVIA Holdings, Inc.(b) | | | 934,958 | | | $ | 153,099,372 | |

| |

Thermo Fisher Scientific, Inc. | | | 233,151 | | | | 100,017,116 | |

| |

| | | | | | | 447,258,378 | |

| |

|

Managed Health Care–1.06% | |

UnitedHealth Group, Inc. | | | 496,358 | | | | 155,136,693 | |

| |

| | |

Movies & Entertainment–0.93% | | | | | | | | |

Netflix, Inc.(b) | | | 256,095 | | | | 135,617,668 | |

| |

| |

Oil & Gas Equipment & Services–0.12% | | | | | |

Baker Hughes Co., Class A | | | 1,182,420 | | | | 16,884,958 | |

| |

|

Packaged Foods & Meats–0.81% | |

Tyson Foods, Inc., Class A | | | 1,875,332 | | | | 117,770,850 | |

| |

| | |

Pharmaceuticals–0.86% | | | | | | | | |

MyoKardia, Inc.(b) | | | 365,315 | | | | 39,980,074 | |

| |

Reata Pharmaceuticals, Inc., Class A(b) | | | 343,814 | | | | 36,083,279 | |

| |

Zoetis, Inc. | | | 310,127 | | | | 49,651,333 | |

| |

| | | | | | | 125,714,686 | |

| |

| | |

Railroads–0.34% | | | | | | | | |

Union Pacific Corp. | | | 258,268 | | | | 49,701,094 | |

| |

|

Research & Consulting Services–0.59% | |

CoStar Group, Inc.(b) | | | 100,930 | | | | 85,649,198 | |

| |

|

Semiconductor Equipment–2.19% | |

Applied Materials, Inc. | | | 4,253,201 | | | | 261,997,182 | |

| |

ASML Holding N.V., New York Shares (Netherlands) | | | 155,191 | | | | 58,069,368 | |

| |

| | | | | | | 320,066,550 | |

| |

| | |

Semiconductors–4.38% | | | | | | | | |

NVIDIA Corp. | | | 609,777 | | | | 326,218,500 | |

| |

QUALCOMM, Inc. | | | 2,619,871 | | | | 312,026,636 | |

| |

| | | | | | | 638,245,136 | |

| |

| | |

Specialty Chemicals–0.18% | | | | | | | | |

Sherwin-Williams Co. (The) | | | 39,771 | | | | 26,688,330 | |

| |

| | |

Systems Software–7.84% | | | | | | | | |

Microsoft Corp. | | | 3,296,379 | | | | 743,432,356 | |

| |

Palo Alto Networks, Inc.(b) | | | 808,395 | | | | 208,088,957 | |

| |

ServiceNow, Inc.(b) | | | 397,136 | | | | 191,427,494 | |

| |

| | | | | | | 1,142,948,807 | |

| |

Investment Abbreviations:

ADR – American Depositary Receipt

| | | | | | | | |

| | | Shares | | | Value | |

| |

Technology Hardware, Storage & Peripherals–3.56% | |

Apple, Inc. | | | 4,023,352 | | | $ | 519,173,342 | |

| |

|

Tobacco–0.64% | |

Philip Morris International, Inc. | | | 1,163,835 | | | | 92,862,395 | |

| |

|

Trading Companies & Distributors–1.12% | |

Fastenal Co. | | | 1,305,101 | | | | 63,767,235 | |

| |

United Rentals, Inc.(b) | | | 566,662 | | | | 100,327,507 | |

| |

| | | | | | | 164,094,742 | |

| |

| | |

Trucking–0.80% | | | | | | | | |

J.B. Hunt Transport Services, Inc. | | | 243,349 | | | | 34,200,268 | |

| |

Knight-Swift Transportation Holdings, Inc. | | | 735,444 | | | | 33,433,284 | |

| |

Lyft, Inc., Class A(b) | | | 996,080 | | | | 29,553,694 | |

| |

Uber Technologies, Inc.(b) | | | 577,581 | | | | 19,424,049 | |

| |

| | | | | | | 116,611,295 | |

| |

Total Common Stocks & Other Equity Interests

(Cost $6,270,680,304) | | | | 14,567,249,649 | |

| |

|

Money Market Funds–0.00% | |

Invesco Liquid Assets Portfolio,Institutional Class, 0.12% (Cost $201,198)(d)(e) | | | 201,359 | | | | 201,480 | |

| |

TOTAL INVESTMENTS IN SECURITIES (excluding investments purchased with cash collateral from securities on loan)-99.92%

(Cost $6,270,881,502) | | | | 14,567,451,129 | |

| |

Investments Purchased with Cash Collateral from Securities on Loan | |

Money Market Funds–0.19% | |

Invesco Private Government Fund, 0.03%(d)(e)(f) | | | 21,410,510 | | | | 21,410,510 | |

| |

Invesco Private Prime Fund, 0.14%(d)(e)(f) | | | 7,071,026 | | | | 7,072,440 | |

| |

Total Investments Purchased with Cash Collateral

from Securities on Loan (Cost $28,482,950) | | | | 28,482,950 | |

| |

TOTAL INVESTMENTS IN SECURITIES–100.11%

(Cost $6,299,364,452) | | | | 14,595,934,079 | |

| |

OTHER ASSETS LESS LIABILITIES–(0.11)% | | | | (16,675,319 | ) |

| |

NET ASSETS–100.00% | | | | | | $ | 14,579,258,760 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco American Franchise Fund

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | All or a portion of this security was out on loan at August 31, 2020. |

| (d) | Affiliated issuer. The issuer and/or the Fund is a wholly-owned subsidiary of Invesco Ltd., or is affiliated by having an investment adviser that is under common control of Invesco Ltd. The table below shows the Fund’s transactions in, and earnings from, its investments in affiliates for the fiscal year ended August 31, 2020. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value August 31, 2019 | | Purchases at Cost | | Proceeds from Sales | | Change in Unrealized Appreciation | | Realized Gain (Loss) | | Value August 31, 2020 | | Dividend Income |

| Investments in Affiliated Money Market Funds: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class | | | $ | 21,433,977 | | | | $ | 655,816,742 | | | | $ | (677,250,719 | ) | | | $ | - | | | | $ | - | | | | $ | - | | | | $ | 142,721 | |

Invesco Liquid Assets Portfolio, Institutional Class | | | | 15,309,984 | | | | | 478,973,196 | | | | | (494,049,385 | ) | | | | 282 | | | | | (32,597 | ) | | | | 201,480 | | | | | 148,676 | |

Invesco Treasury Portfolio, Institutional Class | | | | 24,495,974 | | | | | 751,768,646 | | | | | (776,264,620 | ) | | | | - | | | | | - | | | | | - | | | | | 152,389 | |

Investments Purchased with Cash Collateral from Securities on Loan: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Invesco Government & Agency Portfolio, Institutional Class | | | | 24,171,283 | | | | | 90,708,433 | | | | | (114,879,716 | ) | | | | - | | | | | - | | | | | - | | | | | 80,699 | * |

Invesco Liquid Assets Portfolio, Institutional Class | | | | 8,057,094 | | | | | 17,787,833 | | | | | (25,845,503 | ) | | | | - | | | | | 576 | | | | | - | | | | | 29,373 | * |

Invesco Private Government Fund | | | | - | | | | | 192,354,548 | | | | | (170,944,038 | ) | | | | - | | | | | - | | | | | 21,410,510 | | | | | 1,529 | * |

Invesco Private Prime Fund | | | | - | | | | | 51,174,749 | | | | | (44,102,395 | ) | | | | - | | | | | 86 | | | | | 7,072,440 | | | | | 1,255 | * |

Total | | | $ | 93,468,312 | | | | $ | 2,238,584,147 | | | | $ | (2,303,336,376 | ) | | | $ | 282 | | | | $ | (31,935 | ) | | | $ | 28,684,430 | | | | $ | 556,642 | |

| | * | Represents the income earned on the investment of cash collateral, which is included in securities lending income on the Statement of Operations. Does not include rebates and fees paid to lending agent or premiums received from borrowers, if any. |

| (e) | The rate shown is the 7-day SEC standardized yield as of August 31, 2020. |

| (f) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 1I. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco American Franchise Fund

Statement of Assets and Liabilities

August 31, 2020

| | | | |

Assets: | | | | |

Investments in securities, at value

(Cost $6,270,680,304)* | | $ | 14,567,249,649 | |

| |

Investments in affiliated money market funds, at value

(Cost $28,684,148) | | | 28,684,430 | |

| |

Foreign currencies, at value (Cost $8,354) | | | 8,390 | |

| |

Receivable for:

| | | | |

Investments sold | | | 101,367,530 | |

| |

Fund shares sold | | | 6,241,146 | |

| |

Dividends | | | 5,687,802 | |

| |

Investment for trustee deferred compensation and retirement plans | | | 2,510,097 | |

| |

Other assets | | | 206,861 | |

| |

Total assets | | | 14,711,955,905 | |

| |

| |

Liabilities: | | | | |

Payable for:

| | | | |

Investments purchased | | | 85,290,716 | |

| |

Dividends | | | 568 | |

| |

Fund shares reacquired | | | 7,667,071 | |

| |

Amount due custodian | | | 333,881 | |

| |

Collateral upon return of securities loaned | | | 28,482,950 | |

| |

Accrued fees to affiliates | | | 7,179,879 | |

| |

Accrued trustees’ and officers’ fees and benefits | | | 33,857 | |

| |

Accrued other operating expenses | | | 1,003,253 | |

| |

Trustee deferred compensation and retirement plans | | | 2,704,970 | |

| |

Total liabilities | | | 132,697,145 | |

| |

Net assets applicable to shares outstanding | | $ | 14,579,258,760 | |

| |

| |

Net assets consist of: | | | | |

Shares of beneficial interest | | $ | 5,381,924,135 | |

| |

Distributable earnings | | | 9,197,334,625 | |

| |

| | $ | 14,579,258,760 | |

| |

| | | | |

Net Assets: | | | | |

Class A | | $ | 13,733,417,378 | |

| |

Class C | | $ | 185,176,792 | |

| |

Class R | | $ | 50,218,563 | |

| |

Class Y | | $ | 496,756,825 | |

| |

Class R5 | | $ | 43,711,959 | |

| |

Class R6 | | $ | 69,977,243 | |

| |

|

Shares outstanding, no par value, with an unlimited number of shares authorized: | |

Class A | | | 475,281,342 | |

| |

Class C | | | 7,205,695 | |

| |

Class R | | | 1,789,701 | |

| |

Class Y | | | 16,664,796 | |

| |

Class R5 | | | 1,461,162 | |

| |

Class R6 | | | 2,319,688 | |

| |

Class A:

| | | | |

Net asset value per share | | $ | 28.90 | |

| |

Maximum offering price per share

(Net asset value of $28.90 ÷ 94.50%) | | $ | 30.58 | |

| |

Class C:

| | | | |

Net asset value and offering price per share | | $ | 25.70 | |

| |

Class R:

| | | | |

Net asset value and offering price per share | | $ | 28.06 | |

| |

Class Y:

| | | | |

Net asset value and offering price per share | | $ | 29.81 | |

| |

Class R5:

| | | | |

Net asset value and offering price per share | | $ | 29.92 | |

| |

Class R6: | | | | |

Net asset value and offering price per share | | $ | 30.17 | |

| |

| * | At August 31, 2020, securities with an aggregate value of $27,590,564 were on loan to brokers. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

13 Invesco American Franchise Fund

Statement of Operations

For the year ended August 31, 2020

| | | | |

Investment income: | | | | |

Dividends (net of foreign withholding taxes of $858,518) | | $ | 97,530,222 | |

| |

Dividends from affiliated money market funds (includes securities lending income of $570,805) | | | 1,014,591 | |

| |

Total investment income | | | 98,544,813 | |

| |

| |

Expenses: | | | | |

Advisory fees | | | 66,918,906 | |

| |

Administrative services fees | | | 1,586,197 | |

| |

Custodian fees | | | 355,870 | |

| |

Distribution fees:

Class A | | | 27,136,849 | |

| |

Class C | | | 1,420,836 | |

| |

Class R | | | 187,103 | |

| |

Transfer agent fees – A, C, R and Y | | | 15,548,531 | |

| |

Transfer agent fees – R5 | | | 31,809 | |

| |

Transfer agent fees – R6 | | | 12,176 | |

| |

Trustees’ and officers’ fees and benefits | | | 140,165 | |

| |

Registration and filing fees | | | 169,245 | |

| |

Reports to shareholders | | | 976,561 | |

| |

Professional services fees | | | 104,388 | |

| |

Other | | | 168,082 | |

| |

Total expenses | | | 114,756,718 | |

| |

Less: Fees waived and/or expense offset arrangement(s) | | | (164,154 | ) |

| |

Net expenses | | | 114,592,564 | |

| |

Net investment income (loss) | | | (16,047,751 | ) |

| |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain (loss) from:

| | | | |

Investment securities (includes net gains (losses) from securities sold to affiliates of $(84,247)) | | | 1,076,616,644 | |

| |

Foreign currencies | | | (192,031 | ) |

| |

| | | 1,076,424,613 | |

| |

Change in net unrealized appreciation of:

| | | | |

Investment securities | | | 3,574,018,458 | |

| |

Foreign currencies | | | 12,344 | |

| |

| | | 3,574,030,802 | |

| |

Net realized and unrealized gain | | | 4,650,455,415 | |

| |

Net increase in net assets resulting from operations | | $ | 4,634,407,664 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 Invesco American Franchise Fund

Statement of Changes in Net Assets

For the years ended August 31, 2020 and 2019

| | | | | | | | |

| | | 2020 | | | 2019 | |

| |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | (16,047,751 | ) | | $ | (4,440,942 | ) |

| |

Net realized gain | | | 1,076,424,613 | | | | 710,273,764 | |

| |

Change in net unrealized appreciation (depreciation) | | | 3,574,030,802 | | | | (629,508,256 | ) |

| |

Net increase in net assets resulting from operations | | | 4,634,407,664 | | | | 76,324,566 | |

| |

| | |

Distributions to shareholders from distributable earnings: | | | | | | | | |

Class A | | | (701,335,215 | ) | | | (804,913,487 | ) |

| |

Class C | | | (10,077,941 | ) | | | (33,225,403 | ) |

| |

Class R | | | (2,377,517 | ) | | | (3,005,915 | ) |

| |

Class Y | | | (24,274,327 | ) | | | (27,603,239 | ) |

| |

Class R5 | | | (2,137,993 | ) | | | (6,608,373 | ) |

| |

Class R6 | | | (9,085,814 | ) | | | (10,724,224 | ) |

| |

Total distributions from distributable earnings | | | (749,288,807 | ) | | | (886,080,641 | ) |

| |

| | |

Share transactions–net: | | | | | | | | |

Class A | | | (27,866,651 | ) | | | 297,930,110 | |

| |

Class C | | | (1,280,083 | ) | | | (200,992,890 | ) |

| |

Class R | | | 3,111,764 | | | | (1,216,256 | ) |

| |

Class Y | | | 17,283,240 | | | | 6,407,551 | |

| |

Class R5 | | | (43,385,976 | ) | | | (5,226,299 | ) |

| |

Class R6 | | | (98,940,374 | ) | | | (1,969,306 | ) |

| |

Net increase (decrease) in net assets resulting from share transactions | | | (151,078,080 | ) | | | 94,932,910 | |

| |

Net increase (decrease) in net assets | | | 3,734,040,777 | | | | (714,823,165 | ) |

| |

Net assets: | | | | | | | | |

Beginning of year | | | 10,845,217,983 | | | | 11,560,041,148 | |

| |

End of year | | $ | 14,579,258,760 | | | $ | 10,845,217,983 | |

| |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

15 Invesco American Franchise Fund

Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset value, beginning of period | | Net

investment

income

(loss)(a) | | Net gains

(losses) on securities (both

realized and unrealized) | | Total from investment operations | | Distributions from net realized gains | | Net asset

value, end of period | | Total

return (b) | | Net assets, end of period (000’s omitted) | | Ratio of expenses to average net assets with fee waivers and/or expenses absorbed | | Ratio of expenses to average net

assets without fee waivers and/or expenses absorbed | | Ratio of net investment income (loss) to average net assets | | Portfolio turnover (c) |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 08/31/20 | | | $ | 21.27 | | | | $ | (0.03 | ) | | | $ | 9.17 | | | | $ | 9.14 | | | | $ | (1.51 | ) | | | $ | 28.90 | | | | | 45.42 | % | | | $ | 13,733,417 | | | | | 1.00 | %(d) | | | | 1.00 | %(d) | | | | (0.15 | )%(d) | | | | 52 | % |

Year ended 08/31/19 | | | | 23.12 | | | | | (0.01 | ) | | | | (0.04 | ) | | | | (0.05 | ) | | | | (1.80 | ) | | | | 21.27 | | | | | 1.21 | | | | | 10,115,813 | | | | | 1.01 | | | | | 1.01 | | | | | (0.04 | ) | | | | 43 | |

Year ended 08/31/18 | | | | 20.25 | | | | | (0.04 | ) | | | | 3.97 | | | | | 3.93 | | | | | (1.06 | ) | | | | 23.12 | | | | | 20.30 | | | | | 10,524,889 | | | | | 1.01 | | | | | 1.01 | | | | | (0.17 | ) | | | | 44 | |

Year ended 08/31/17 | | | | 16.96 | | | | | (0.03 | ) | | | | 3.99 | | | | | 3.96 | | | | | (0.67 | ) | | | | 20.25 | | | | | 24.19 | | | | | 9,333,084 | | | | | 1.06 | | | | | 1.06 | | | | | (0.15 | ) | | | | 48 | |

Year ended 08/31/16 | | | | 16.49 | | | | | (0.01 | ) | | | | 1.30 | | | | | 1.29 | | | | | (0.82 | ) | | | | 16.96 | | | | | 7.99 | | | | | 8,253,739 | | | | | 1.08 | | | | | 1.08 | | | | | (0.04 | ) | | | | 59 | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 08/31/20 | | | | 19.21 | | | | | (0.18 | ) | | | | 8.18 | | | | | 8.00 | | | | | (1.51 | ) | | | | 25.70 | | | | | 44.30 | | | | | 185,177 | | | | | 1.75 | (d) | | | | 1.75 | (d) | | | | (0.90 | )(d) | | | | 52 | |

Year ended 08/31/19 | | | | 21.23 | | | | | (0.15 | ) | | | | (0.07 | ) | | | | (0.22 | ) | | | | (1.80 | ) | | | | 19.21 | | | | | 0.46 | | | | | 139,839 | | | | | 1.76 | | | | | 1.76 | | | | | (0.79 | ) | | | | 43 | |

Year ended 08/31/18 | | | | 18.81 | | | | | (0.18 | ) | | | | 3.66 | | | | | 3.48 | | | | | (1.06 | ) | | | | 21.23 | | | | | 19.43 | | | | | 401,863 | | | | | 1.76 | | | | | 1.76 | | | | | (0.92 | ) | | | | 44 | |

Year ended 08/31/17 | | | | 15.92 | | | | | (0.15 | ) | | | | 3.71 | | | | | 3.56 | | | | | (0.67 | ) | | | | 18.81 | | | | | 23.23 | | | | | 370,960 | | | | | 1.81 | | | | | 1.81 | | | | | (0.90 | ) | | | | 48 | |

Year ended 08/31/16 | | | | 15.64 | | | | | (0.12 | ) | | | | 1.22 | | | | | 1.10 | | | | | (0.82 | ) | | | | 15.92 | | | | | 7.18 | | | | | 367,233 | | | | | 1.83 | | | | | 1.83 | | | | | (0.79 | ) | | | | 59 | |

Class R | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 08/31/20 | | | | 20.75 | | | | | (0.09 | ) | | | | 8.91 | | | | | 8.82 | | | | | (1.51 | ) | | | | 28.06 | | | | | 45.00 | | | | | 50,219 | | | | | 1.25 | (d) | | | | 1.25 | (d) | | | | (0.40 | )(d) | | | | 52 | |

Year ended 08/31/19 | | | | 22.65 | | | | | (0.06 | ) | | | | (0.04 | ) | | | | (0.10 | ) | | | | (1.80 | ) | | | | 20.75 | | | | | 0.99 | | | | | 34,114 | | | | | 1.26 | | | | | 1.26 | | | | | (0.29 | ) | | | | 43 | |

Year ended 08/31/18 | | | | 19.91 | | | | | (0.09 | ) | | | | 3.89 | | | | | 3.80 | | | | | (1.06 | ) | | | | 22.65 | | | | | 19.99 | | | | | 38,537 | | | | | 1.26 | | | | | 1.26 | | | | | (0.42 | ) | | | | 44 | |

Year ended 08/31/17 | | | | 16.72 | | | | | (0.07 | ) | | | | 3.93 | | | | | 3.86 | | | | | (0.67 | ) | | | | 19.91 | | | | | 23.93 | | | | | 34,479 | | | | | 1.31 | | | | | 1.31 | | | | | (0.40 | ) | | | | 48 | |

Year ended 08/31/16 | | | | 16.31 | | | | | (0.05 | ) | | | | 1.28 | | | | | 1.23 | | | | | (0.82 | ) | | | | 16.72 | | | | | 7.70 | | | | | 28,686 | | | | | 1.33 | | | | | 1.33 | | | | | (0.29 | ) | | | | 59 | |

Class Y | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 08/31/20 | | | | 21.85 | | | | | 0.03 | | | | | 9.44 | | | | | 9.47 | | | | | (1.51 | ) | | | | 29.81 | | | | | 45.74 | | | | | 496,757 | | | | | 0.75 | (d) | | | | 0.75 | (d) | | | | 0.10 | (d) | | | | 52 | |

Year ended 08/31/19 | | | | 23.63 | | | | | 0.04 | | | | | (0.02 | ) | | | | 0.02 | | | | | (1.80 | ) | | | | 21.85 | | | | | 1.50 | | | | | 350,473 | | | | | 0.76 | | | | | 0.76 | | | | | 0.21 | | | | | 43 | |

Year ended 08/31/18 | | | | 20.62 | | | | | 0.02 | | | | | 4.05 | | | | | 4.07 | | | | | (1.06 | ) | | | | 23.63 | | | | | 20.63 | | | | | 368,991 | | | | | 0.76 | | | | | 0.76 | | | | | 0.08 | | | | | 44 | |

Year ended 08/31/17 | | | | 17.22 | | | | | 0.02 | | | | | 4.05 | | | | | 4.07 | | | | | (0.67 | ) | | | | 20.62 | | | | | 24.47 | | | | | 264,309 | | | | | 0.81 | | | | | 0.81 | | | | | 0.10 | | | | | 48 | |

Year ended 08/31/16 | | | | 16.69 | | | | | 0.04 | | | | | 1.31 | | | | | 1.35 | | | | | (0.82 | ) | | | | 17.22 | | | | | 8.26 | | | | | 147,246 | | | | | 0.83 | | | | | 0.83 | | | | | 0.21 | | | | | 59 | |

Class R5 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 08/31/20 | | | | 21.91 | | | | | 0.04 | | | | | 9.48 | | | | | 9.52 | | | | | (1.51 | ) | | | | 29.92 | | | | | 45.85 | | | | | 43,712 | | | | | 0.70 | (d) | | | | 0.70 | (d) | | | | 0.15 | (d) | | | | 52 | |

Year ended 08/31/19 | | | | 23.68 | | | | | 0.05 | | | | | (0.02 | ) | | | | 0.03 | | | | | (1.80 | ) | | �� | | 21.91 | | | | | 1.54 | | | | | 75,149 | | | | | 0.71 | | | | | 0.71 | | | | | 0.26 | | | | | 43 | |

Year ended 08/31/18 | | | | 20.66 | | | | | 0.03 | | | | | 4.05 | | | | | 4.08 | | | | | (1.06 | ) | | | | 23.68 | | | | | 20.64 | | | | | 86,177 | | | | | 0.71 | | | | | 0.71 | | | | | 0.13 | | | | | 44 | |

Year ended 08/31/17 | | | | 17.23 | | | | | 0.03 | | | | | 4.07 | | | | | 4.10 | | | | | (0.67 | ) | | | | 20.66 | | | | | 24.63 | | | | | 67,740 | | | | | 0.72 | | | | | 0.72 | | | | | 0.19 | | | | | 48 | |

Year ended 08/31/16 | | | | 16.68 | | | | | 0.05 | | | | | 1.32 | | | | | 1.37 | | | | | (0.82 | ) | | | | 17.23 | | | | | 8.39 | | | | | 53,789 | | | | | 0.71 | | | | | 0.71 | | | | | 0.33 | | | | | 59 | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended 08/31/20 | | | | 22.07 | | | | | 0.05 | | | | | 9.56 | | | | | 9.61 | | | | | (1.51 | ) | | | | 30.17 | | | | | 45.93 | | | | | 69,977 | | | | | 0.62 | (d) | | | | 0.62 | (d) | | | | 0.23 | (d) | | | | 52 | |

Year ended 08/31/19 | | | | 23.81 | | | | | 0.07 | | | | | (0.01 | ) | | | | 0.06 | | | | | (1.80 | ) | | | | 22.07 | | | | | 1.66 | | | | | 129,831 | | | | | 0.62 | | | | | 0.62 | | | | | 0.35 | | | | | 43 | |

Year ended 08/31/18 | | | | 20.75 | | | | | 0.05 | | | | | 4.07 | | | | | 4.12 | | | | | (1.06 | ) | | | | 23.81 | | | | | 20.75 | | | | | 139,584 | | | | | 0.62 | | | | | 0.62 | | | | | 0.22 | | | | | 44 | |

Year ended 08/31/17 | | | | 17.29 | | | | | 0.05 | | | | | 4.08 | | | | | 4.13 | | | | | (0.67 | ) | | | | 20.75 | | | | | 24.72 | | | | | 130,807 | | | | | 0.64 | | | | | 0.64 | | | | | 0.27 | | | | | 48 | |

Year ended 08/31/16 | | | | 16.72 | | | | | 0.07 | | | | | 1.32 | | | | | 1.39 | | | | | (0.82 | ) | | | | 17.29 | | | | | 8.49 | | | | | 120,754 | | | | | 0.63 | | | | | 0.63 | | | | | 0.42 | | | | | 59 | |

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Does not include sales charges and is not annualized for periods less than one year, if applicable. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

| (d) | Ratios are based on average daily net assets (000’s omitted) of $10,854,740, $142,084, $37,421, $382,919, $35,069 and $131,211 for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares, respectively. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

16 Invesco American Franchise Fund

Notes to Financial Statements

August 31, 2020

NOTE 1—Significant Accounting Policies

Invesco American Franchise Fund (the “Fund”) is a series portfolio of AIM Counselor Series Trust (Invesco Counselor Series Trust) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company authorized to issue an unlimited number of shares of beneficial interest. Information presented in these financial statements pertains only to the Fund. Matters affecting the Fund or each class will be voted on exclusively by the shareholders of the Fund or each class.

The Fund’s investment objective is to seek long-term capital appreciation.

The Fund currently consists of six different classes of shares: Class A, Class C, Class R, Class Y, Class R5 and Class R6. Class Y shares are available only to certain investors. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met. Under certain circumstances, load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class R, Class Y, Class R5 and Class R6 shares are sold at net asset value. Class C shares held for ten years after purchase are eligible for automatic conversion into Class A shares of the same Fund (the “Conversion Feature”). The automatic conversion pursuant to the Conversion Feature will generally occur at the end of the month following the tenth anniversary after a purchase of Class C shares. Effective November 30, 2020, the automatic conversion pursuant to the Conversion Feature will change from ten years to eight years. The first conversion of Class C shares to Class A shares would occur at the end of December 2020 for all Class C shares that were held for more than eight years as of November 30, 2020.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations — Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Pricing services generally value debt obligations assuming orderly transactions of institutional round lot size, but a fund may hold or transact in the same securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the investment adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general market conditions which are not specifically related to the particular issuer, such as real or perceived adverse economic conditions, changes in the general outlook for revenues or corporate earnings, changes in interest or currency rates, regional or global instability, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism or adverse investor sentiment generally and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income — Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on an accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

17 Invesco American Franchise Fund

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination — For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions – Distributions from net investment income and net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| E. | Federal Income Taxes – The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.