As filed with the Securities and Exchange Commission on March 4, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09303 & 811-09923

Kinetics Mutual Funds, Inc. & Kinetics Portfolios Trust

(Exact name of registrant as specified in charter)

470 Park Avenue South

New York, NY 10016

(Address of principal executive offices) (Zip code)

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(800) 930-3828

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2015

Date of reporting period: December 31, 2015

Item 1. Report to Stockholders.

| KINETICS MUTUAL FUNDS, INC. |

| Table of Contents |

| December 31, 2015 |

| Page | |

| Shareholders' Letter | 2 |

| Year 2015 Annual Investment Commentary | 5 |

| KINETICS MUTUAL FUNDS, INC. — FEEDER FUNDS | |

| Growth of $10,000 Investment | 11 |

| Expense Example | 22 |

| Statements of Assets & Liabilities | 28 |

| Statements of Operations | 32 |

| Statements of Changes in Net Assets | 36 |

| Notes to Financial Statements | 47 |

| Financial Highlights | 64 |

| Report of Independent Registered Public Accounting Firm | 93 |

| KINETICS PORTFOLIOS TRUST — MASTER INVESTMENT PORTFOLIOS | |

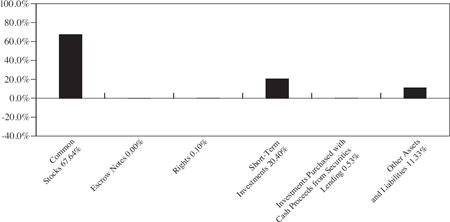

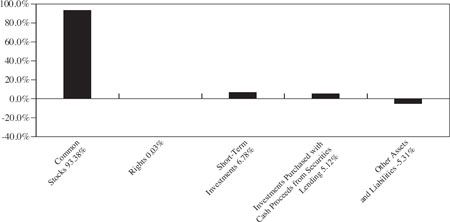

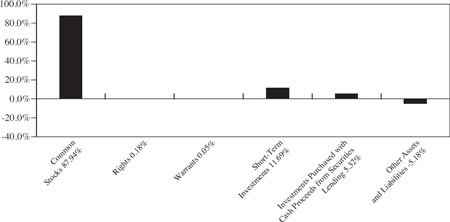

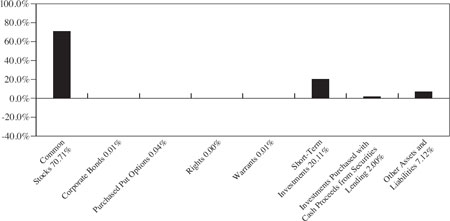

| Allocation of Portfolio Assets | 94 |

| Portfolio of Investments — The Internet Portfolio | 102 |

| Portfolio of Investments — The Global Portfolio | 106 |

| Portfolio of Investments — The Paradigm Portfolio | 110 |

| Portfolio of Investments — The Medical Portfolio | 115 |

| Portfolio of Investments — The Small Cap Opportunities Portfolio | 118 |

| Portfolio of Investments — The Market Opportunities Portfolio | 123 |

| Portfolio of Investments — The Alternative Income Portfolio | 127 |

| Portfolio of Investments — The Multi-Disciplinary Income Portfolio | 133 |

| Portfolio of Options Written — The Alternative Income Portfolio | 140 |

| Statements of Assets & Liabilities | 149 |

| Statements of Operations | 153 |

| Statements of Changes in Net Assets | 157 |

| Notes to Financial Statements | 161 |

| Report of Independent Registered Public Accounting Firm | 190 |

| Management of the Funds and the Portfolios | 191 |

| Privacy Policy | 199 |

1

| KINETICS MUTUAL FUNDS, INC. |

| Shareholders' Letter |

Dear Fellow Shareholders:

We are pleased to present the Kinetics Mutual Funds ("Funds") Annual Report for the twelve-month period ended December 31, 2015. The past year was a challenging environment for equity investors, particularly value investors with a focus on small and mid-capitalization companies. In fact, nearly all indexes that track small, mid and value companies experienced losses for the year, despite the narrow gain achieved by the S&P 500 Index ("S&P 500"). However, this does not paint the full picture, as the S&P 500's returns were driven primarily by its highest growth and largest constituents, with most other companies experiencing declines for the year. These market leading companies are generally not owned by the Funds, simply due to the commanding valuations. Proponents of investing in these companies cite fundamental improvement as a driver of returns for the year, but the metrics used to make this case are often non-GAAP or not even directly attributable to shareholder value, and the valuations are still intrepid even when applying these liberal metrics and extrapolating from trailing growth rates. Accordingly, the Funds generated suboptimal returns during the year (No-Load Class): The Internet Fund -5.42%, The Global Fund -13.83%, The Paradigm Fund -8.33%, The Medical Fund +6.59%, The Small Cap Opportunities Fund -12.26%, The Market Opportunities Fund -9.11%, The Alternative Income Fund +2.94% and The Multi-Disciplinary Income Fund -2.17%. This compares to returns of +1.38% for the S&P 500 and -2.36% for the MSCI All Country World Index.

We have maintained a constructive long-term stance on our portfolios dating back to the global financial crisis—our logic was simply that, based on the eventual resumption of normalized earnings, we believed that we could earn very attractive long-term returns from prevailing prices (valuations). This has largely come to fruition over the past seven years, resulting in attractive returns for those who remained invested and/or added capital. However, during the latter half of this year, we became far less constructive on the basis of the same logic. The potential for earnings growth is still encouraging for most of our companies, but future returns would be lower if current valuations are contingent upon these future figures. The projected cash flows for many companies are now using discounted rates that we believe are far too low to adequately compensate investors for the risk that those future cash flows would be below expectations. In other words, investors appear to be applying discount rates that imply a very high likelihood, even a certainty, that these future cash flows will be realized. This is not an environment for

2

generating attractive long-term returns; therefore, we have raised cash balances across the Funds.

Cash balances are a vastly underappreciated tool of portfolio managers; in fact, many regard the practice of maintaining a cash position as undesirable, given the near zero returns currently offered on short-term deposits and in money market accounts. However, the point is not to achieve a return on the cash. Rather, we see the opportunity cost of holding cash to be minimal, particularly compared to future opportunities to deploy cash when valuations become more attractive. An inescapable truth of investing is that future returns are dependent on purchase prices and growth rates—only the former is within the control of the investor.

Despite what we see as widespread overvaluation in equity markets, which has even spread into the realm of the eclectic securities in which we invest, there continue to be companies that we believe will achieve excellent long-term returns. In most cases, the asset values and future cash flows of such companies are fairly visible and are not overly sensitive to external factors (macroeconomic, among others). Thus, if we apply reasonable discount rates to future values and arrive at prices that are well above current prices, we would be remiss in selling these companies at this time. However, we are dealing with public markets, which have a tendency to overshoot fair value on both the upside and downside, resulting in excess risk at one extreme and excess opportunity at the other. We believe that markets have largely already overshot on the downside on many of the companies that we own, but external factors lead us to believe that there is a reasonable chance that we have not yet reached a nadir.

In theory, public equity market transactions represent an exchange between a willing buyer and seller, both with equal access to information, and with the market setting the marginal transaction price based on all available information. In reality, this scenario more closely mirrors private market transactions, where investors assuming control positions set the marginal prices. We are convinced that our companies would never exchange hands at current levels in private markets. However, the "informed" buyers and sellers setting marginal prices in our companies are not control shareholders, and often act more due to emotion and superficial perception than due to reality. Thus, with current valuations in less widely held companies falling, this is enough for some marginal owners to

3

sell. In and of itself, this is not a problem; volatility often shakes out the weakest holders. The larger issue has to do with the lack of near term buyers to compensate for the capitulating sellers. Owning companies that are outside of indexation and institutional coverage subjects us to this risk. We expect broad markets to re-adjust prices to reflect more realistic, lower future growth rates, and as a result near term buying interest for our companies may be limited. We view this potential volatility as an opportunity to add capital to our core positions.

In closing, we do not necessarily envision a GDP-defined recession in the foreseeable future. Rather, we expect a combination of a low growth and earnings recession, with nominal growth rates depressed and S&P 500 earnings perhaps declining year over year. This is not a calamity in and of itself, but equity investors must account for this potential when valuing businesses. Broad market valuations simply do not reconcile with this reality, hence our caution. Companies with niche growth potential are generally overpriced, but to the extent that we find such companies at attractive valuations, we continue to hold such positions. It will likely be rewarding to own/hold such companies at present, but the greater opportunity will be in deploying cash when prices become more attractive across a larger array of companies.

4

| KINETICS MUTUAL FUNDS, INC. |

| Investment Commentary |

Dear Fellow Shareholders:

The investment team at Kinetics Asset Management LLC, the investment adviser to the Kinetics Mutual Funds, approaches equity investing with the mindset that we are purchasing an interest in an entire business, not simply a fractional ownership certificate that fluctuates in value along with the company and broader market. This results in a much higher hurdle rate for companies to meet our investment criteria, because we require a sustained rate of return over several years of ownership, which is consistent with the outright ownership of a company. Liquid public markets allow us the luxury of buying and selling quickly in the event that valuations or fundamentals change, but the preponderance of our investment performance will result from buying companies with depressed valuations on lower cash flow levels, then selling these companies years later when cash flows are optimized and reflected in the valuations. This is important, because an outright owner of a business isn't overly concerned with the market- determined valuations of assets, and instead focuses on the cash flows that are generated by the underlying business. We believe that many investors are losing focus on the intrinsic values of businesses in the current market, while being overly focused on current market prices.

We will discuss two extremes of dysfunctional investor behavior that are currently deeply influencing equity prices: growth at any price, and quality at any price. There will always be individual businesses and sectors that experience outsized growth relative to the local and global economies; such is the nature of business cycles. The higher growth businesses are subsequently valued at higher trailing valuation multiples to reflect this higher growth. However, almost without exception, these businesses are bid up in value to reflect totally unrealistic long-term growth rates. The valuations simply cannot be reconciled to any reasonable cash flow forecast. Many investors attempt to own these companies until the growth slows or disappoints and earn a return riding the valuation ever higher. This is not how we invest, but a small minority of investors have done this successfully over extended periods of time. The current valuations of growth stocks have taken this dynamic to an extreme, where investors seemingly aren't even concerned with shareholder value. For example, companies are evaluated based simply on the business model and the total addressable market; these factors are then extrapolated into infinity. The issue that we have is that while many of these companies are generating large sums of revenue, they are earning very little, if any, net income. This practice of

5

valuing companies on their "potential" rather than on actual results was rather common slightly less than two decades ago, in the late 1990s.

Early warning signs emerged in late 2014, with confirming data points throughout the past year, indicating that global economic growth was slowing. In spite of this, many companies have sustained intrepid valuations that imply robust growth, much of which is contingent on growing global consumption and a continued flow of inexpensive capital. Throughout much of 2015, we witnessed a shake- out of valuations for more cyclical, leveraged and smaller companies. This was likely an appropriate revaluation for well over 95% of the companies; we hope to identify and benefit from the remaining 5%. As a result, investors flocked to growth companies, which are thought to be immune from the macroeconomic factors affecting other businesses (they aren't!). Other investors flocked to admittedly high quality, albeit, low growth companies with non-cyclical businesses (consumer staples). This would be prudent, except that, just as the growth crowd is ignoring shareholder value, so too are these quality investors when they are paying high growth multiples for low or no growth companies. Let's examine one example of such a company that generates over $50 billion of annual revenues and has grown profit margins to reach the high teens. This company is hardly growing, even if one accounts for currency impacts, and is currently trading at approximately 22x next year's estimated earnings (which are likely optimistic). These aren't encouraging data points, but the company pays a dividend yield of slightly greater than 3%. Therefore, investors (not, by our definition, long-term company owners) are buying these companies, hoping to earn the dividend and escape market turmoil. This rationale mirrors the logic of fixed income investing, not equity investing; in fact, some managers have compared investing in these companies to buying high quality bonds. Here is the problem: bonds have set maturity dates and coupons; therefore, even in an adverse environment, an investor can likely recoup the principal, while collecting the coupon. However, an equity dividend is at the discretion of the board of directors and can fluctuate significantly (said company pays out approximately 75% of free cash flow in dividends). Furthermore, the principal paid to acquire the stock can also fluctuate considerably, particularly if earnings decline and/or markets contract. This can be a permanent or very long-term contraction, with no maturity date to act as a floor. Collecting 3% dividends under these dynamics is not, in our view, analogous to buying "AA" rated bonds.

6

Company "renters," as we refer to these types of investors, have decided to react to the market data with these variant short-term strategies intended to weather the storm. Meanwhile, we have raised cash in order to capitalize upon new opportunities as more company valuations revert to fundamentals, but we are not deterred by recent volatility or economic data when we believe in the ultimate values of our core holdings. We acknowledge that the prices of our holdings may fall further before rising, but the ultimate values appear to be stable despite external factors. Accordingly, we are not going to sell when the companies are inordinately inexpensive due to broader market malaise and investor/capital market behavior. This is exactly how a strategic owner of an entire business would react; you don't see high quality private businesses with attractive long-term prospects being sold at attractive valuations right now. Of course, there is capital raising seen in the markets that is bordering on desperation, and there are start-ups trying to catch the last breath of the IPO cycle, but the solid businesses with value drivers in place are not moving, and neither are we.

Shareholders can continue to access additional information from our website, www.kineticsfunds.com. This website provides a broad array of information, including recent portfolio holdings, quarterly investment commentaries, conference call transcripts, newsflashes, recent performance data, and online access to account information.

Kinetics offers the following funds to investors:

The Paradigm Fund focuses on companies that we believe are valued attractively and currently have, or are expected to soon have, sustainable high business returns. The Fund has produced attractive risk adjusted returns since its inception, while maintaining amongst the lowest turnover rates in the industry. The Paradigm Fund is Kinetics' flagship fund.

The Multi-Disciplinary Income Fund seeks to utilize stock options and fixed-income investments in order to provide investors with equity-like returns, but with more muted volatility. At times, the options strategies of the Fund may cause the manager to purchase equity securities.

The Small Cap Opportunities Fund focuses on undervalued and special situation small capitalization equities that we believe have the potential for

7

rewarding long-term investment results. The same investment fundamentals employed by The Paradigm Fund are used to identify such opportunities.

The Medical Fund is a sector fund, offering an investment in scientific discovery within the promising field of medical research, particularly in the development of cancer treatments and therapies. As a sector fund, The Medical Fund is likely to have heightened volatility.

The Internet Fund is a sector fund that focuses on companies engaged in the evolution of Internet-related developments. As such, this Fund has been, and is likely to continue to be, quite volatile. The Internet Fund is not designed to be a major component of one's equity exposure. More recently, this Fund has been focusing on content companies, which we believe will be the winners in the next generation of Internet development.

The Global Fund's mandate is focused on selecting long life cycle international companies that we believe can generate long-term wealth through their business operations. This Fund is presently identifying exciting opportunities in the more developed markets.

The Market Opportunities Fund focuses on those companies that benefit from increasing transactional volume or throughput, such as publicly-traded exchanges and credit card processors, or companies that act as facilitators, such as gaming companies, airports and publicly-traded toll roads.

The Alternative Income Fund seeks to provide current income and gains, with a secondary objective of obtaining long-term growth of capital. The Fund utilizes stock options and fixed-income investments and seeks to generate a total return that exceeds most short-term U.S. fixed income indexes, with limited market value variability.

8

Disclosure

This material is intended to be reviewed in conjunction with a current prospectus, which includes all fees and expenses that apply to a continued investment, as well as information regarding the risk factors, policies and objectives of the Funds. Read it carefully before investing.

Mutual Fund investing involves risk. Principal loss is possible. Because The Internet Fund, The Medical Fund and The Market Opportunities Fund invest in a single industry or geographic region, their shares are subject to a higher degree of risk than funds with a higher level of diversification. Internet, biotechnology and certain capital markets or gaming stocks are subject to a rate of change in technology, obsolescence and competition that is generally higher than that of other industries, hence they may experience extreme price and volume fluctuations.

International investing [for all Funds] presents special risks including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Accordingly, the share prices for these Funds are expected to be more volatile than that of U.S.-only funds. Past performance is no guarantee of future performance.

Because smaller companies [for The Small Cap Opportunities Fund] often have narrower markets and limited financial resources, they present more risk than larger, more well established, companies.

Non-investment grade debt securities [for all Funds], i.e., junk bonds, are subject to greater credit risk, price volatility and risk of loss than investment grade securities.

Further, options contain special risks including the imperfect correlation between the value of the option and the value of the underlying asset. Investments [for The Multi- Disciplinary Income Fund and The Alternative Income Fund] in futures, swaps and other derivative instruments may result in loss as derivative instruments may be illiquid, difficult to price and leveraged so that small changes may produce disproportionate losses to the Funds. To the extent the Funds segregate assets to cover derivative positions, they may impair their ability to meet current obligations, to honor requests for redemption and to manage the investments in a manner consistent with their respective investment objectives. Purchasing and writing put and call

9

options and, in particular, writing "uncovered" options are highly specialized activities that entail greater than ordinary investment risk.

As non-diversified Funds, except The Global Fund, The Alternative Income Fund and The Multi-Disciplinary Income Fund, the value of Fund shares may fluctuate more than shares invested in a broader range of industries and companies. Unlike other investment companies that directly acquire and manage their own portfolios of securities, The Kinetics Mutual Funds pursue their investment objectives by investing all of their investable assets in a corresponding portfolio series of the Kinetics Portfolios Trust.

The information concerning the Funds included in the shareholder report contains certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management's predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

The MSCI All Country World Index (MSCI ACWI) and the Standard & Poor's 500 Index (S&P 500) each represent an unmanaged, broad-basket of stocks. They are typically used as a proxy for overall market performance.

Distributor: Kinetics Funds Distributor LLC is not an affiliate of Kinetics Mutual Funds, Inc. Kinetics Funds Distributor LLC is an affiliate of Kinetics Asset Management LLC, Investment Adviser to Kinetics Mutual Funds, Inc.

For more information, log onto www.kineticsfunds.com. January 1, 2016 — Kinetics Asset Management LLC®

10

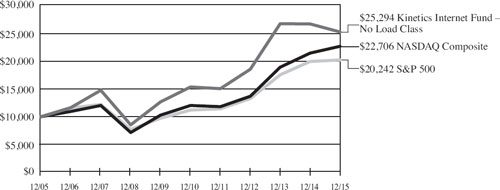

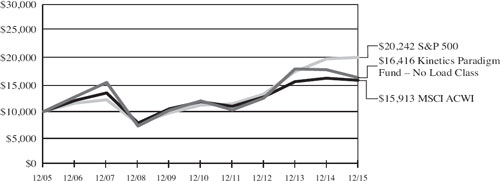

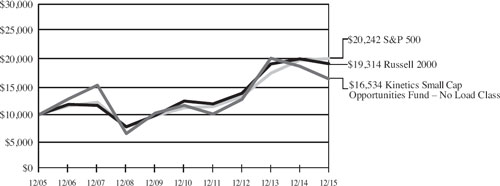

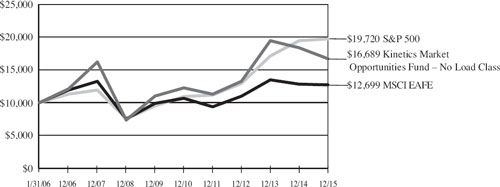

How a $10,000 Investment Has Grown:

The charts show the growth of a $10,000 investment in the Feeder Funds as compared to the performance of two or more representative market indices. The tables below the charts show the average annual total returns on an investment over various periods. Returns for periods greater than one year are average annual total returns. The annual returns assume the reinvestment of all dividends and distributions, however, the graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is not predictive of future performance. Current performance may be lower or higher than the returns quoted below. The performance data reflects voluntary fee waivers and expense reimbursements made by the Adviser and the returns would have been lower if these waivers and expense reimbursements were not in effect. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original costs.

The S&P 500 Index — is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. The S&P 500 is unmanaged and includes the reinvestment of dividends and does not reflect the payments of transaction costs and advisory fees associated with an investment in the Funds. The securities that comprise the S&P 500 may differ substantially from the securities in the Funds' portfolios. It is not possible to directly invest in an index.

The NASDAQ Composite Index — is a broad-based capitalization-weighted index of all NASDAQ stocks. The NASDAQ Composite is unmanaged and does not include the reinvestment of dividends and does not reflect the payment of transaction costs or advisory fees associated with an investment in the Funds. The securities that comprise the NASDAQ Composite may differ substantially from the securities in the Funds' portfolios. It is not possible to directly invest in an index.

The MSCI ACWI (All Country World Index) Index — is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2, 2014, the MSCI ACWI consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom

11

and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. The securities that compromise the MSCI ACWI may differ substantially from the securities in the Funds' portfolios. It is not possible to directly invest in an index.

The Russell 2000® Index — is a subset of the Russell 3000 Index® representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The securities that compromise the Russell 2000 may differ substantially from the securities in the Funds' portfolio. It is not possible to directly invest in an index.

The MSCI EAFE® Index (Europe, Australasia, Far East) — is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. As of June 2, 2014, the MSCI EAFE® Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The securities that compromise the MSCI EAFE® may differ substantially from the securities in the Funds' portfolio. It is not possible to directly invest in an index.

The Barclays U.S. 1-3 Year Credit Index — measures the performance of investment grade corporate debt and sovereign, supranational, local authority and non-U.S. agency bonds that are U.S. dollar denominated and have a remaining maturity of greater than or equal to one year and less than three years. The securities that compromise the Barclays U.S. 1-3 Year Credit Index may differ substantially from the securities in the Funds' portfolio. It is not possible to directly invest in an index.

The Barclays U.S. Aggregate Bond Index — covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The Index includes multiple types of government and corporate-issued bonds, some of which are asset-backed. The securities that

12

compromise the Barclays U.S. Aggregate Bond Index may differ substantially from the securities in the Funds' portfolio. It is not possible to directly invest in an index.

The Barclays U.S. Corporate High Yield Bond Index — The Barclays U.S. Corporate High Yield Bond Index is composed of fixed-rate, publicly issued, non-investment grade debt. The securities that comprise the Barclays U.S. Corporate High Yield Bond Index may differ substantially from the securities in the Funds' portfolio. It is not possible to directly invest in an index.

13

The Internet Fund

December 31, 2005 — December 31, 2015

December 31, 2005 — December 31, 2015

| Ended 12/31/2015 | |||||||||||||||||||

| Advisor | Advisor | ||||||||||||||||||

| No Load | Class A | Class A | Advisor | NASDAQ | |||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500 | Composite | ||||||||||||||

| One Year | -5.42 | % | -5.65 | % | -11.08 | % | -6.14 | % | 1.38 | % | 5.73 | % | |||||||

| Five Years | 10.48 | % | 10.21 | % | 8.91 | % | 9.67 | % | 12.57 | % | 13.55 | % | |||||||

| Ten Years | 9.72 | % | 9.53 | % | 8.88 | % | N/A | 7.31 | % | 8.55 | % | ||||||||

| Since Inception | |||||||||||||||||||

| No Load Class | |||||||||||||||||||

| (10/21/96) | 14.21 | % | N/A | N/A | N/A | 7.64 | % | 7.56 | % | ||||||||||

| Since Inception | |||||||||||||||||||

| Advisor Class A | |||||||||||||||||||

| (4/26/01) | N/A | 6.77 | % | 6.35 | % | N/A | 5.57 | % | 6.33 | % | |||||||||

| Since Inception | |||||||||||||||||||

| Advisor Class C | |||||||||||||||||||

| (2/16/07) | N/A | N/A | N/A | 8.15 | % | 6.16 | % | 8.16 | % | ||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

14

The Global Fund

December 31, 2005 — December 31, 2015

December 31, 2005 — December 31, 2015

| Ended 12/31/2015 | |||||||||||||||||||

| Advisor | Advisor | ||||||||||||||||||

| No Load | Class A | Class A | Advisor | MSCI | |||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500 | ACWI | ||||||||||||||

| One Year | -13.83 | % | -13.89 | % | -18.78 | % | -14.48 | % | 1.38 | % | -2.36 | % | |||||||

| Five Years | 0.34 | % | 0.17 | % | -1.03 | % | -0.38 | % | 12.57 | % | 6.09 | % | |||||||

| Ten Years | 2.06 | % | N/A | N/A | N/A | 7.31 | % | 4.75 | % | ||||||||||

| Since Inception | |||||||||||||||||||

| No Load Class | |||||||||||||||||||

| (12/31/99) | -3.28 | % | N/A | N/A | N/A | 4.06 | % | 2.90 | % | ||||||||||

| Since Inception | |||||||||||||||||||

| Advisor Class A | |||||||||||||||||||

| (5/19/08) | N/A | 0.89 | % | 0.10 | % | N/A | 7.15 | % | 2.25 | % | |||||||||

| Since Inception | |||||||||||||||||||

| Advisor Class C | |||||||||||||||||||

| (5/19/08) | N/A | N/A | N/A | 0.27 | % | 7.15 | % | 2.25 | % | ||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

15

The Paradigm Fund

December 31, 2005 — December 31, 2015

December 31, 2005 — December 31, 2015

| Ended 12/31/2015 | ||||||||||||||||||||||

| Advisor | Advisor | |||||||||||||||||||||

| No Load | Class A | Class A | Advisor | Institutional | MSCI | |||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500 | ACWI | ||||||||||||||||

| One Year | -8.33 | % | -8.57 | % | -13.83 | % | -9.00 | % | -8.16 | % | 1.38 | % | -2.36 | % | ||||||||

| Five Years | 6.47 | % | 6.20 | % | 4.95 | % | 5.67 | % | 6.67 | % | 12.57 | % | 6.09 | % | ||||||||

| Ten Years | 5.08 | % | 4.81 | % | 4.19 | % | 4.28 | % | 5.27 | % | 7.31 | % | 4.75 | % | ||||||||

| Since Inception | ||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||

| (12/31/99) | 8.04 | % | N/A | N/A | N/A | N/A | 4.06 | % | 2.90 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||

| (4/26/01) | N/A | 8.19 | % | 7.76 | % | N/A | N/A | 5.57 | % | 4.76 | % | |||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||

| (6/28/02) | N/A | N/A | N/A | 8.23 | % | N/A | 7.68 | % | 6.68 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||

| (5/27/05) | N/A | N/A | N/A | N/A | 6.13 | % | 7.40 | % | 5.58 | % | ||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

16

The Medical Fund

December 31, 2005 — December 31, 2015

December 31, 2005 — December 31, 2015

| Ended 12/31/2015 | |||||||||||||||||||

| Advisor | Advisor | ||||||||||||||||||

| No Load | Class A | Class A | Advisor | NASDAQ | |||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500 | Composite | ||||||||||||||

| One Year | 6.59 | % | 6.34 | % | 0.23 | % | 5.81 | % | 1.38 | % | 5.73 | % | |||||||

| Five Years | 16.21 | % | 15.92 | % | 14.56 | % | 15.34 | % | 12.57 | % | 13.55 | % | |||||||

| Ten Years | 11.25 | % | 10.99 | % | 10.33 | % | N/A | 7.31 | % | 8.55 | % | ||||||||

| Since Inception | |||||||||||||||||||

| No Load Class | |||||||||||||||||||

| (9/30/99) | 10.23 | % | N/A | N/A | N/A | 4.89 | % | 3.77 | % | ||||||||||

| Since Inception | |||||||||||||||||||

| Advisor Class A | |||||||||||||||||||

| (4/26/01) | N/A | 6.61 | % | 6.19 | % | N/A | 5.57 | % | 6.33 | % | |||||||||

| Since Inception | |||||||||||||||||||

| Advisor Class C | |||||||||||||||||||

| (2/16/07) | N/A | N/A | N/A | 9.62 | % | 6.16 | % | 8.16 | % | ||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

17

The Small Cap Opportunities Fund

December 31, 2005 — December 31, 2015

December 31, 2005 — December 31, 2015

| Ended 12/31/2015 | ||||||||||||||||||||||

| Advisor | Advisor | |||||||||||||||||||||

| No Load | Class A | Class A | Advisor | Institutional | Russell | |||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | 2000 | S&P 500 | ||||||||||||||||

| One Year | -12.26 | % | -12.47 | % | -17.49 | % | -12.92 | % | -12.06 | % | -4.41 | % | 1.38 | % | ||||||||

| Five Years | 7.25 | % | 6.99 | % | 5.73 | % | 6.45 | % | 7.47 | % | 9.19 | % | 12.57 | % | ||||||||

| Ten Years | 5.16 | % | 4.89 | % | 4.28 | % | N/A | 5.35 | % | 6.80 | % | 7.31 | % | |||||||||

| Since Inception | ||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||

| (3/20/00) | 8.58 | % | N/A | N/A | N/A | N/A | 6.11 | % | 4.16 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||

| (12/31/01) | N/A | 6.59 | % | 6.14 | % | N/A | N/A | 7.63 | % | 6.33 | % | |||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||

| (2/16/07) | N/A | N/A | N/A | 1.33 | % | N/A | 5.21 | % | 6.16 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||

| (8/12/05) | N/A | N/A | N/A | N/A | 5.47 | % | 6.80 | % | 7.25 | % | ||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

18

The Market Opportunities Fund

January 31, 2006 — December 31, 2015

January 31, 2006 — December 31, 2015

| Ended 12/31/2015 | ||||||||||||||||||||||

| Advisor | Advisor | |||||||||||||||||||||

| No Load | Class A | Class A | Advisor | Institutional | MSCI | |||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500 | EAFE | ||||||||||||||||

| One Year | -9.11 | % | -9.34 | % | -14.55 | % | -9.79 | % | -8.93 | % | 1.38 | % | -0.81 | % | ||||||||

| Five Years | 6.41 | % | 6.16 | % | 4.90 | % | 5.63 | % | 6.64 | % | 12.57 | % | 3.60 | % | ||||||||

| Since Inception | ||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||

| (1/31/06) | 5.30 | % | N/A | N/A | N/A | N/A | 7.09 | % | 2.44 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||

| (1/31/06) | N/A | 5.04 | % | 4.42 | % | N/A | N/A | 7.09 | % | 2.44 | % | |||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||

| (2/16/07) | N/A | N/A | N/A | 2.07 | % | N/A | 6.16 | % | 0.26 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||

| (5/19/08) | N/A | N/A | N/A | N/A | 2.80 | % | 7.15 | % | -0.47 | % | ||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

19

The Alternative Income Fund

June 29, 2007 — December 31, 2015

June 29, 2007 — December 31, 2015

| Ended 12/31/2015 | ||||||||||||||||||||||

| Barclays | Barclays | |||||||||||||||||||||

| Advisor | Advisor | U.S. 1-3 | U.S. | |||||||||||||||||||

| No Load | Class A | Class A | Advisor | Institutional | Year | Aggregate | ||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | Credit | Bond | ||||||||||||||||

| One Year | 2.94 | % | 2.63 | % | -3.27 | % | 2.15 | % | 3.09 | % | 0.85 | % | 0.55 | % | ||||||||

| Five years | 2.82 | % | 2.55 | % | 1.34 | % | 2.05 | % | 3.08 | % | 1.77 | % | 3.25 | % | ||||||||

| Since Inception | ||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||

| (6/29/07) | -0.23 | % | N/A | N/A | N/A | N/A | 3.31 | % | 4.68 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||

| (6/29/07) | N/A | -0.48 | % | -1.17 | % | N/A | N/A | 3.31 | % | 4.68 | % | |||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||

| (6/29/07) | N/A | N/A | N/A | -0.96 | % | N/A | 3.31 | % | 4.68 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||

| (6/29/07) | N/A | N/A | N/A | N/A | 0.02 | % | 3.31 | % | 4.68 | % | ||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

20

The Multi-Disciplinary Income Fund

February 11, 2008 — December 31, 2015

February 11, 2008 — December 31, 2015

| Ended 12/31/2015 | ||||||||||||||||||||||

| Barclays | ||||||||||||||||||||||

| Barclays | U.S. | |||||||||||||||||||||

| Advisor | Advisor | U.S. | Corporate | |||||||||||||||||||

| No Load | Class A | Class A | Advisor | Institutional | Aggregate | High | ||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | Bond | Yield Bond | ||||||||||||||||

| One Year | -2.17 | % | -2.46 | % | -8.10 | % | -2.84 | % | -1.96 | % | 0.55 | % | -4.47 | % | ||||||||

| Five Years | 3.87 | % | 3.62 | % | 2.39 | % | 3.10 | % | 4.07 | % | 3.25 | % | 5.04 | % | ||||||||

| Since Inception | ||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||

| (2/11/08) | 4.18 | % | N/A | N/A | N/A | N/A | 4.07 | % | 7.47 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||

| (2/11/08) | N/A | 3.92 | % | 3.15 | % | N/A | N/A | 4.07 | % | 7.47 | % | |||||||||||

| Since Inception | ||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||

| (2/11/08) | N/A | N/A | N/A | 3.41 | % | N/A | 4.07 | % | 7.47 | % | ||||||||||||

| Since Inception | ||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||

| (2/11/08) | N/A | N/A | N/A | N/A | 4.38 | % | 4.07 | % | 7.47 | % | ||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

21

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Expense Example |

| December 31, 2015 |

Shareholders incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvestments of dividends or other distributions made by a Fund, redemption fees, and exchange fees, and (2), ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. This example is intended to help investors understand the ongoing costs (in dollars) of investing in a series of Kinetics Mutual Funds, Inc. (each a "Feeder Fund" and collectively the "Feeder Funds"), and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on July 1, 2015 and held for the entire period from July 1, 2015 to December 31, 2015.

Actual Expenses

The first line items of the table below provides information about actual account values and actual expenses before and after expense reimbursement. Unlike other mutual funds that directly acquire and manage their own portfolio securities, each Feeder Fund invests all or generally all of its investable assets in a corresponding series of The Kinetics Portfolios Trust (each, a "Master Portfolio", and together the "Master Portfolios"), a separately registered investment company. The Master Portfolio, in turn, invests in securities. With this type of organization, expenses can accrue specifically to the Master Portfolio or the Feeder Fund or both. Each Feeder Fund records its proportionate share of the Master Portfolio's expenses, including directed brokerage credits, on a daily basis. Any expense reductions include Fund-specific expenses as well as the expenses allocated from the Master Portfolio.

The Feeder Funds will charge shareholder fees for outgoing wire transfers, returned checks, and exchanges executed by telephone between a Feeder Fund and any other Feeder Fund. The Feeder Funds' transfer agent charges a $5.00 transaction fee to shareholder accounts for telephone exchanges between any two Feeder Funds. The Feeder Funds' transfer agent does not charge a transaction fee for written exchange requests. IRA accounts are assessed a $15.00 annual fee. Finally, as a disincentive to market-timing transactions, the Feeder Funds will assess a 2.00% fee on the redemption or exchange of Fund shares held for less than 30 days. These fees will be paid to the Feeder Funds to help offset transaction costs. The Feeder Funds reserve the right to waive the redemption fee, subject to their sole discretion, in instances deemed not to be disadvantageous to the Feeder Funds or shareholders as described in the Feeder Funds' prospectus.

22

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2015 |

You may use the information provided in the first line, together with the amounts you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line item of the table below provides information about hypothetical account values and hypothetical expenses before and after expense reimbursements based on the Feeder Funds' actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Feeder Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses one paid for the period. You may use this information to compare the ongoing costs of investing in the Feeder Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight one's ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help one determine the relative total costs of owning different funds. If these transactional costs had been included, one's costs would have been higher.

23

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2015 |

| Expenses Paid | |||||||||||||

| Beginning | Ending | During | |||||||||||

| Account | Account | Annualized | Period* | ||||||||||

| Value | Value | Expense | (7/1/15 to | ||||||||||

| (7/1/15) | (12/31/15) | Ratio | 12/31/15) | ||||||||||

| The Internet Fund | |||||||||||||

| No Load Class Actual | $ | 1,000.00 | $ | 940.00 | 1.83 | % | $ | 8.95 | |||||

| No Load Class Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,015.97 | 1.83 | % | $ | 9.30 | |||||

| Advisor Class A Actual | $ | 1,000.00 | $ | 938.70 | 2.08 | % | $ | 10.16 | |||||

| Advisor Class A Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,014.71 | 2.08 | % | $ | 10.56 | |||||

| Advisor Class C Actual | $ | 1,000.00 | $ | 936.30 | 2.58 | % | $ | 12.59 | |||||

| Advisor Class C Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,012.19 | 2.58 | % | $ | 13.09 | |||||

| The Global Fund | �� | ||||||||||||

| No Load Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 838.10 | 1.39 | % | $ | 6.44 | |||||

| No Load Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,018.19 | 1.39 | % | $ | 7.07 | |||||

| Advisor Class A Actual - after expense reimbursement | $ | 1,000.00 | $ | 837.50 | 1.64 | % | $ | 7.60 | |||||

| Advisor Class A Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | |||||

| Advisor Class C Actual - after expense reimbursement | $ | 1,000.00 | $ | 835.70 | 2.14 | % | $ | 9.90 | |||||

| Advisor Class C Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,014.41 | 2.14 | % | $ | 10.87 |

24

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2015 |

| Expenses Paid | |||||||||||||

| Beginning | Ending | During | |||||||||||

| Account | Account | Annualized | Period* | ||||||||||

| Value | Value | Expense | (7/1/15 to | ||||||||||

| (7/1/15) | (12/31/15) | Ratio | 12/31/15) | ||||||||||

| The Paradigm Fund | |||||||||||||

| No Load Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 888.00 | 1.64 | % | $ | 7.80 | |||||

| No Load Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | |||||

| Advisor Class A Actual - after expense reimbursement | $ | 1,000.00 | $ | 886.70 | 1.89 | % | $ | 8.99 | |||||

| Advisor Class A Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | |||||

| Advisor Class C Actual - after expense reimbursement | $ | 1,000.00 | $ | 884.50 | 2.39 | % | $ | 11.35 | |||||

| Advisor Class C Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | |||||

| Institutional Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 888.40 | 1.44 | % | $ | 6.85 | |||||

| Institutional Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | |||||

| The Medical Fund | |||||||||||||

| No Load Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 955.60 | 1.39 | % | $ | 6.85 | |||||

| No Load Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,018.19 | 1.39 | % | $ | 7.07 | |||||

| Advisor Class A Actual - after expense reimbursement | $ | 1,000.00 | $ | 954.50 | 1.64 | % | $ | 8.08 | |||||

| Advisor Class A Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | |||||

| Advisor Class C Actual - after expense reimbursement | $ | 1,000.00 | $ | 951.90 | 2.14 | % | $ | 10.53 | |||||

| Advisor Class C Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,014.41 | 2.14 | % | $ | 10.87 |

25

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2015 |

| Expenses Paid | |||||||||||||

| Beginning | Ending | During | |||||||||||

| Account | Account | Annualized | Period* | ||||||||||

| Value | Value | Expense | (7/1/15 to | ||||||||||

| (7/1/15) | (12/31/15) | Ratio | 12/31/15) | ||||||||||

| The Small Cap Opportunities Fund | |||||||||||||

| No Load Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 836.50 | 1.64 | % | $ | 7.59 | |||||

| No Load Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | |||||

| Advisor Class A Actual - after expense reimbursement | $ | 1,000.00 | $ | 835.40 | 1.89 | % | $ | 8.74 | |||||

| Advisor Class A Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | |||||

| Advisor Class C Actual - after expense reimbursement | $ | 1,000.00 | $ | 833.20 | 2.39 | % | $ | 11.04 | |||||

| Advisor Class C Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | |||||

| Institutional Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 837.50 | 1.44 | % | $ | 6.67 | |||||

| Institutional Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | |||||

| The Market Opportunities Fund | |||||||||||||

| No Load Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 888.10 | 1.64 | % | $ | 7.80 | |||||

| No Load Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | |||||

| Advisor Class A Actual - after expense reimbursement | $ | 1,000.00 | $ | 886.80 | 1.89 | % | $ | 8.99 | |||||

| Advisor Class A Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | |||||

| Advisor Class C Actual - after expense reimbursement | $ | 1,000.00 | $ | 884.70 | 2.39 | % | $ | 11.35 | |||||

| Advisor Class C Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | |||||

| Institutional Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 888.40 | 1.44 | % | $ | 6.85 | |||||

| Institutional Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 |

26

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2015 |

| Expenses Paid | |||||||||||||

| Beginning | Ending | During | |||||||||||

| Account | Account | Annualized | Period* | ||||||||||

| Value | Value | Expense | (7/1/15 to | ||||||||||

| (7/1/15) | (12/31/15) | Ratio | 12/31/15) | ||||||||||

| The Alternative Income Fund | |||||||||||||

| No Load Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 1,003.50 | 0.95 | % | $ | 4.80 | |||||

| No Load Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,020.41 | 0.95 | % | $ | 4.84 | |||||

| Advisor Class A Actual - after expense reimbursement | $ | 1,000.00 | $ | 1,001.90 | 1.20 | % | $ | 6.06 | |||||

| Advisor Class A Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,019.15 | 1.20 | % | $ | 6.11 | |||||

| Advisor Class C Actual - after expense reimbursement | $ | 1,000.00 | $ | 999.40 | 1.70 | % | $ | 8.57 | |||||

| Advisor Class C Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,016.63 | 1.70 | % | $ | 8.64 | |||||

| Institutional Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 1,004.30 | 0.75 | % | $ | 3.79 | |||||

| Institutional Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,021.42 | 0.75 | % | $ | 3.82 | |||||

| The Multi-Disciplinary Income Fund | |||||||||||||

| No Load Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 962.50 | 1.49 | % | $ | 7.37 | |||||

| No Load Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,017.69 | 1.49 | % | $ | 7.58 | |||||

| Advisor Class A Actual - after expense reimbursement | $ | 1,000.00 | $ | 960.80 | 1.74 | % | $ | 8.60 | |||||

| Advisor Class A Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,016.43 | 1.74 | % | $ | 8.84 | |||||

| Advisor Class C Actual - after expense reimbursement | $ | 1,000.00 | $ | 959.20 | 2.24 | % | $ | 11.06 | |||||

| Advisor Class C Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,013.91 | 2.24 | % | $ | 11.37 | |||||

| Institutional Class Actual - after expense reimbursement | $ | 1,000.00 | $ | 963.60 | 1.29 | % | $ | 6.38 | |||||

| Institutional Class Hypothetical (5% return before expenses) - after expense reimbursement | $ | 1,000.00 | $ | 1,018.70 | 1.29 | % | $ | 6.56 |

| Note: | Each Feeder Fund records its proportionate share of the respective Master Portfolio's expenses on a daily basis. Any expense reductions include Feeder Fund-specific expenses as well as the expenses allocated for the Master Portfolio. | |

| * | Expenses are equal to the Feeder Fund's annualized expense ratio after expense reimbursement multiplied by the average account value over the period, multiplied by 184/365. | |

27

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Assets & Liabilities |

| December 31, 2015 |

| The Internet | The Global | ||||||

| Fund | Fund | ||||||

| ASSETS: | |||||||

| Investments in the Master Portfolio, at value* | $ | 126,228,278 | $ | 6,727,661 | |||

| Receivable from Adviser | — | 9,657 | |||||

| Receivable for Master Portfolio interest sold | 141,775 | 17,095 | |||||

| Receivable for Fund shares sold | 24,775 | — | |||||

| Prepaid expenses and other assets | 19,145 | 16,766 | |||||

| Total Assets | 126,413,973 | 6,771,179 | |||||

| LIABILITIES: | |||||||

| Payable to Directors | 2,753 | 160 | |||||

| Payable to Chief Compliance Officer | 169 | 7 | |||||

| Payable for Fund shares repurchased | 166,550 | 17,094 | |||||

| Payable for shareholder servicing fees | 27,292 | 1,454 | |||||

| Payable for distribution fees | 1,160 | 1,042 | |||||

| Accrued expenses and other liabilities | 58,057 | 16,045 | |||||

| Total Liabilities | 255,981 | 35,802 | |||||

| Net Assets | $ | 126,157,992 | $ | 6,735,377 | |||

| NET ASSETS CONSIST OF: | |||||||

| Paid in capital | $ | 76,129,158 | $ | 6,572,894 | |||

| Accumulated net investment income | 169,841 | 20,652 | |||||

| Accumulated net realized gain (loss) on investments and foreign currency | 3,140,695 | (84,208 | ) | ||||

| Net unrealized appreciation on: | |||||||

| Investments and foreign currency | 46,718,298 | 226,039 | |||||

| Net Assets | $ | 126,157,992 | $ | 6,735,377 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | |||||||

| Net Assets | $ | 122,332,109 | $ | 4,745,471 | |||

| Shares outstanding | 2,935,071 | 1,033,844 | |||||

| Net asset value per share (offering price and redemption price) | $ | 41.68 | $ | 4.59 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | |||||||

| Net Assets | $ | 2,978,346 | $ | 376,384 | |||

| Shares outstanding | 74,334 | 82,448 | |||||

| Net asset value per share (redemption price) | $ | 40.07 | $ | 4.57 | |||

| Offering price per share ($40.07 divided by .9425 and $4.57 divided by .9425) | $ | 42.51 | $ | 4.85 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | |||||||

| Net Assets | $ | 847,537 | $ | 1,613,522 | |||

| Shares outstanding | 22,740 | 365,772 | |||||

| Net asset value per share (offering price and redemption price) | $ | 37.27 | $ | 4.41 |

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds' financial statements. |

The accompanying notes are an integral part of these financial statements.

28

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Assets & Liabilities — (Continued) |

| December 31, 2015 |

| The Paradigm | The Medical | ||||||

| Fund | Fund | ||||||

| ASSETS: | |||||||

| Investments in the Master Portfolio, at value* | $ | 838,362,480 | $ | 29,104,821 | |||

| Receivable from Adviser | 24,332 | 14,725 | |||||

| Receivable for Master Portfolio interest sold | 1,663,324 | 48,590 | |||||

| Receivable for Fund shares sold | 799,606 | 9,711 | |||||

| Prepaid expenses and other assets | 38,817 | 16,683 | |||||

| Total Assets | 840,888,559 | 29,194,530 | |||||

| LIABILITIES: | |||||||

| Payable to Directors | 19,707 | 565 | |||||

| Payable to Chief Compliance Officer | 1,309 | 32 | |||||

| Payable for Fund shares repurchased | 2,462,930 | 58,301 | |||||

| Payable for shareholder servicing fees | 130,886 | 6,155 | |||||

| Payable for distribution fees | 189,716 | 3,032 | |||||

| Accrued expenses and other liabilities | 224,301 | 20,622 | |||||

| Total Liabilities | 3,028,849 | 88,707 | |||||

| Net Assets | $ | 837,859,710 | $ | 29,105,823 | |||

| NET ASSETS CONSIST OF: | |||||||

| Paid in capital | $ | 1,264,708,932 | $ | 18,644,443 | |||

| Accumulated net investment loss | (6,856,178 | ) | 22,011 | ||||

| Accumulated net realized loss on investments and foreign currency | (621,603,546 | ) | (66,811 | ) | |||

| Net unrealized appreciation on: | �� | ||||||

| Investments and foreign currency | 201,610,502 | 10,506,180 | |||||

| Net Assets | $ | 837,859,710 | $ | 29,105,823 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | |||||||

| Net Assets | $ | 292,014,316 | $ | 22,257,027 | |||

| Shares outstanding | 9,348,691 | 726,826 | |||||

| Net asset value per share (offering price and redemption price) | $ | 31.24 | $ | 30.62 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | |||||||

| Net Assets | $ | 129,707,471 | $ | 6,240,604 | |||

| Shares outstanding | 4,248,674 | 211,057 | |||||

| Net asset value per share (redemption price) | $ | 30.53 | $ | 29.57 | |||

| Offering price per share ($30.53 divided by .9425 and $29.57 divided by .9425) | $ | 32.39 | $ | 31.37 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | |||||||

| Net Assets | $ | 114,007,804 | $ | 608,192 | |||

| Shares outstanding | 3,930,368 | 21,104 | |||||

| Net asset value per share (offering price and redemption price) | $ | 29.01 | $ | 28.82 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS: | |||||||

| Net Assets | $ | 302,130,119 | N/A | ||||

| Shares outstanding | 9,651,365 | N/A | |||||

| Net asset value per share (offering price and redemption price) | $ | 31.30 | N/A |

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds' financial statements. |

The accompanying notes are an integral part of these financial statements.

29

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Assets & Liabilities — (Continued) |

| December 31, 2015 |

| The Small Cap | The Market | ||||||

| Opportunities | Opportunities | ||||||

| Fund | Fund | ||||||

| ASSETS: | |||||||

| Investments in the Master Portfolio, at value* | $ | 220,077,553 | $ | 42,170,950 | |||

| Receivable from Adviser | 8,151 | 10,865 | |||||

| Receivable for Master Portfolio interest sold | 1,323,620 | 239,804 | |||||

| Receivable for Fund shares sold | 153,937 | — | |||||

| Prepaid expenses and other assets | 21,780 | 25,740 | |||||

| Total Assets | 221,585,041 | 42,447,359 | |||||

| LIABILITIES: | |||||||

| Payable to Directors | 5,749 | 946 | |||||

| Payable to Chief Compliance Officer | 404 | 63 | |||||

| Payable for Fund shares repurchased | 1,477,557 | 239,804 | |||||

| Payable for shareholder servicing fees | 39,935 | 8,783 | |||||

| Payable for distribution fees | 248 | 7,243 | |||||

| Accrued expenses and other liabilities | 73,748 | 24,242 | |||||

| Total Liabilities | 1,597,641 | 281,081 | |||||

| Net Assets | $ | 219,987,400 | $ | 42,166,278 | |||

| NET ASSETS CONSIST OF: | |||||||

| Paid in capital | $ | 357,384,483 | $ | 55,789,194 | |||

| Accumulated net investment loss | (4,080,361 | ) | (587,426 | ) | |||

| Accumulated net realized loss on investments and foreign currency | (97,615,963 | ) | (16,812,806 | ) | |||

| Net unrealized appreciation (depreciation) on: | |||||||

| Investments and foreign currency | (35,700,759 | ) | 3,777,316 | ||||

| Net Assets | $ | 219,987,400 | $ | 42,166,278 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | |||||||

| Net Assets | $ | 145,032,476 | $ | 31,230,073 | |||

| Shares outstanding | 4,443,185 | 2,060,015 | |||||

| Net asset value per share (offering price and redemption price) | $ | 32.64 | $ | 15.16 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | |||||||

| Net Assets | $ | 14,857,194 | $ | 4,502,241 | |||

| Shares outstanding | 465,994 | 299,332 | |||||

| Net asset value per share (redemption price) | $ | 31.88 | $ | 15.04 | |||

| Offering price per share ($31.88 divided by .9425 and $15.04 divided by .9425) | $ | 33.82 | $ | 15.96 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | |||||||

| Net Assets | $ | 8,839,984 | $ | 4,078,894 | |||

| Shares outstanding | 286,228 | 278,516 | |||||

| Net asset value per share (offering price and redemption price) | $ | 30.88 | $ | 14.65 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS: | |||||||

| Net Assets | $ | 51,257,746 | $ | 2,355,070 | |||

| Shares outstanding | 1,551,802 | 153,984 | |||||

| Net asset value per share (offering price and redemption price) | $ | 33.03 | $ | 15.29 |

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds' financial statements. |

The accompanying notes are an integral part of these financial statements.

30

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Assets & Liabilities — (Continued) |

| December 31, 2015 |

| The Multi- | |||||||

| The Alternative | Disciplinary | ||||||

| Income | Income | ||||||

| Fund | Fund | ||||||

| ASSETS: | |||||||

| Investments in the Master Portfolio, at value* | $ | 27,739,822 | $ | 90,312,922 | |||

| Receivable from Adviser | 16,072 | 31,308 | |||||

| Receivable for Master Portfolio interest sold | — | 97,315 | |||||

| Receivable for Fund shares sold | 9,411 | 72,217 | |||||

| Prepaid expenses and other assets | 16,085 | 35,591 | |||||

| Total Assets | 27,781,390 | 90,549,353 | |||||

| LIABILITIES: | |||||||

| Payable for Master Portfolio interest purchased | 1,096 | — | |||||

| Payable to Directors | 642 | 2,312 | |||||

| Payable to Chief Compliance Officer | 42 | 178 | |||||

| Payable for Fund shares repurchased | 8,315 | 169,531 | |||||

| Payable for shareholder servicing fees | 2,461 | 8,484 | |||||

| Payable for distribution fees | 2,519 | 3,956 | |||||

| Accrued expenses and other liabilities | 20,946 | 38,090 | |||||

| Total Liabilities | 36,021 | 222,551 | |||||

| Net Assets | $ | 27,745,369 | $ | 90,326,802 | |||

| NET ASSETS CONSIST OF: | |||||||

| Paid in capital | $ | 33,967,893 | $ | 98,264,337 | |||

| Accumulated net investment income | 18,812 | 40,102 | |||||

| Accumulated net realized loss on investments, foreign currency and written option contracts | (6,346,435 | ) | (453,275 | ) | |||

| Net unrealized appreciation (depreciation) on: | |||||||

| Investments and foreign currency | (119,720 | ) | (7,524,362 | ) | |||

| Written option contracts | 224,819 | — | |||||

| Net Assets | $ | 27,745,369 | $ | 90,326,802 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | |||||||

| Net Assets | $ | 4,569,944 | $ | 6,108,026 | |||

| Shares outstanding | 49,844 | 591,838 | |||||

| Net asset value per share (offering price and redemption price) | $ | 91.68 | $ | 10.32 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | |||||||

| Net Assets | $ | 1,564,510 | $ | 8,753,632 | |||

| Shares outstanding | 17,189 | 852,204 | |||||

| Net asset value per share (redemption price) | $ | 91.02 | $ | 10.27 | |||

| Offering price per share ($91.02 divided by .9425 and $10.27 divided by .9425) | $ | 96.57 | $ | 10.90 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | |||||||

| Net Assets | $ | 1,355,897 | $ | 9,265,672 | |||

| Shares outstanding | 15,327 | 910,586 | |||||

| Net asset value per share (offering price and redemption price) | $ | 88.46 | $ | 10.18 | |||

| CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS: | |||||||

| Net Assets | $ | 20,255,018 | $ | 66,199,472 | |||

| Shares outstanding | 218,161 | 6,404,289 | |||||

| Net asset value per share (offering price and redemption price) | $ | 92.84 | $ | 10.34 | |||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds' financial statements. |

The accompanying notes are an integral part of these financial statements.

31

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Operations |

| For the Year Ended December 31, 2015 |

| The Internet | The Global | ||||||

| Fund | Fund | ||||||

| INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Dividends† | $ | 398,305 | $ | 70,299 | |||

| Interest | 3,706 | 3,326 | |||||

| Income from securities lending | 37,076 | 17,705 | |||||

| Expenses allocated from Master Portfolio | (1,948,361 | ) | (140,453 | ) | |||

| Net investment loss from Master Portfolio | (1,509,274 | ) | (49,123 | ) | |||

| EXPENSES: | |||||||

| Distribution fees — Advisor Class A | 10,544 | 1,149 | |||||

| Distribution fees — Advisor Class C | 7,558 | 13,095 | |||||

| Shareholder servicing fees — Advisor Class A | 10,544 | 1,149 | |||||

| Shareholder servicing fees — Advisor Class C | 2,519 | 4,365 | |||||

| Shareholder servicing fees — No Load Class | 346,195 | 15,278 | |||||

| Transfer agent fees and expenses | 135,978 | 19,726 | |||||

| Reports to shareholders | 29,725 | 2,019 | |||||

| Administration fees | 50,658 | 4,677 | |||||

| Professional fees | 16,658 | 8,419 | |||||

| Directors' fees | 10,471 | 602 | |||||

| Chief Compliance Officer fees | 2,113 | 116 | |||||

| Registration fees | 44,298 | 41,147 | |||||

| Fund accounting fees | 7,222 | 412 | |||||

| Other expenses | 5,884 | 357 | |||||

| Total expenses | 680,367 | 112,511 | |||||

| Less, expense reimbursement | — | (123,114 | ) | ||||

| Net expenses | 680,367 | (10,603 | ) | ||||

| Net investment loss | (2,189,641 | ) | (38,520 | ) | |||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Net realized gain (loss) on: | |||||||

| Investments and foreign currency | 29,301,430 | (13,187 | ) | ||||

| Net change in unrealized depreciation of: | |||||||

| Investments and foreign currency | (34,664,097 | ) | (1,093,822 | ) | |||

| Net loss on investments | (5,362,667 | ) | (1,107,009 | ) | |||

| Net decrease in net assets resulting from operations | $ | (7,552,308 | ) | $ | (1,145,529 | ) | |

| † Net of foreign taxes withheld of: | $ | 986 | $ | 4,805 |

The accompanying notes are an integral part of these financial statements.

32

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Operations — (Continued) |

| For the Year Ended December 31, 2015 |

| The Paradigm | The Medical | ||||||

| Fund | Fund | ||||||

| INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Dividends† | $ | 5,543,973 | $ | 468,709 | |||

| Interest | 62,666 | 363 | |||||

| Income from securities lending | 1,853,915 | 16,105 | |||||

| Expenses allocated from Master Portfolio | (14,032,871 | ) | (413,704 | ) | |||

| Net investment income (loss) from Master Portfolio | (6,572,317 | ) | 71,473 | ||||

| EXPENSES: | |||||||

| Distribution fees — Advisor Class A | 401,417 | 13,989 | |||||

| Distribution fees — Advisor Class C | 983,241 | 4,938 | |||||

| Shareholder servicing fees — Advisor Class A | 401,417 | 13,989 | |||||

| Shareholder servicing fees — Advisor Class C | 327,747 | 1,646 | |||||

| Shareholder servicing fees — No Load Class | 1,024,473 | 58,257 | |||||

| Shareholder servicing fees — Institutional Class | 675,739 | — | |||||

| Transfer agent fees and expenses | 286,404 | 27,147 | |||||

| Reports to shareholders | 164,145 | 5,357 | |||||

| Administration fees | 369,943 | 10,348 | |||||

| Professional fees | 72,006 | 9,670 | |||||

| Directors' fees | 76,573 | 2,155 | |||||

| Chief Compliance Officer fees | 15,518 | 431 | |||||

| Registration fees | 71,652 | 41,943 | |||||

| Fund accounting fees | 52,085 | 1,481 | |||||

| Other expenses | 43,940 | 1,042 | |||||

| Total expenses | 4,966,300 | 192,393 | |||||

| Less, expense waiver for Institutional Class shareholder servicing fees | (506,804 | ) | — | ||||

| Less, expense reimbursement | (738,527 | ) | (176,332 | ) | |||

| Net expenses | 3,720,969 | 16,061 | |||||

| Net investment income (loss) | (10,293,286 | ) | 55,412 | ||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Net realized gain on: | |||||||

| Investments and foreign currency | 126,371,030 | 1,638,460 | |||||

| Net change in unrealized depreciation of: | |||||||

| Investments and foreign currency | (195,382,777 | ) | (49,483 | ) | |||

| Net gain (loss) on investments | (69,011,747 | ) | 1,588,977 | ||||

| Net increase (decrease) in net assets resulting from operations | $ | (79,305,033 | ) | $ | 1,644,389 | ||

| † Net of foreign taxes withheld of: | $ | 170,651 | $ | 15,355 |

The accompanying notes are an integral part of these financial statements.

33

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Operations — (Continued) |

| For the Year Ended December 31, 2015 |

| The Small Cap | The Market | ||||||

| Opportunities | Opportunities | ||||||

| Fund | Fund | ||||||

| INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Dividends† | $ | 1,400,052 | $ | 342,510 | |||

| Interest | 9,227 | 1,853 | |||||

| Income from securities lending | 719,890 | 18,941 | |||||

| Expenses allocated from Master Portfolio | (4,104,675 | ) | (691,830 | ) | |||

| Net investment loss from Master Portfolio | (1,975,506 | ) | (328,526 | ) | |||

| EXPENSES: | |||||||

| Distribution fees — Advisor Class A | 51,953 | 16,292 | |||||

| Distribution fees — Advisor Class C | 89,611 | 36,141 | |||||

| Shareholder servicing fees — Advisor Class A | 51,953 | 16,292 | |||||

| Shareholder servicing fees — Advisor Class C | 29,870 | 12,047 | |||||

| Shareholder servicing fees — No Load Class | 505,042 | 88,497 | |||||

| Shareholder servicing fees — Institutional Class | 140,358 | 5,562 | |||||

| Transfer agent fees and expenses | 80,156 | 27,525 | |||||

| Reports to shareholders | 54,886 | 6,763 | |||||

| Administration fees | 108,463 | 19,248 | |||||

| Professional fees | 26,726 | 10,872 | |||||

| Directors' fees | 22,538 | 3,585 | |||||

| Chief Compliance Officer fees | 4,551 | 739 | |||||

| Registration fees | 90,403 | 51,718 | |||||

| Fund accounting fees | 15,376 | 2,457 | |||||

| Other expenses | 12,987 | 2,102 | |||||

| Total expenses | 1,284,873 | 299,840 | |||||

| Less, expense waiver for Institutional Class shareholder servicing fees | (105,268 | ) | (4,172 | ) | |||

| Less, expense reimbursement | (282,313 | ) | (128,541 | ) | |||

| Net expenses | 897,292 | 167,127 | |||||

| Net investment loss | (2,872,798 | ) | (495,653 | ) | |||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Net realized gain on: | |||||||

| Investments and foreign currency | 40,425,317 | 5,054,165 | |||||

| Net change in unrealized depreciation of: | |||||||

| Investments and foreign currency | (72,350,360 | ) | (8,992,319 | ) | |||

| Net loss on investments | (31,925,043 | ) | (3,938,154 | ) | |||

| Net decrease in net assets resulting from operations | $ | (34,797,841 | ) | $ | (4,433,807 | ) | |

| † Net of foreign taxes withheld of: | $ | 24,541 | $ | 14,701 |

The accompanying notes are an integral part of these financial statements.

34

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Operations — (Continued) |

| For the Year Ended December 31, 2015 |

| The Multi- | |||||||

| The Alternative | Disciplinary | ||||||

| Income | Income | ||||||

| Fund | Fund | ||||||

| INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Dividends | $ | 101,594 | $ | 964,310 | |||

| Interest | 225,748 | 5,263,212 | |||||

| Income from securities lending | — | 18,691 | |||||

| Expenses allocated from Master Portfolio | (395,072 | ) | (1,755,569 | ) | |||

| Net investment income (loss) from Master Portfolio | (67,730 | ) | 4,490,644 | ||||

| EXPENSES: | |||||||

| Distribution fees — Advisor Class A | 3,952 | 29,003 | |||||

| Distribution fees — Advisor Class C | 10,730 | 76,021 | |||||

| Shareholder servicing fees — Advisor Class A | 3,952 | 29,003 | |||||

| Shareholder servicing fees — Advisor Class C | 3,577 | 25,340 | |||||

| Shareholder servicing fees — No Load Class | 15,185 | 21,615 | |||||

| Shareholder servicing fees — Institutional Class | 50,172 | 195,626 | |||||

| Transfer agent fees and expenses | 25,368 | 40,027 | |||||

| Reports to shareholders | 5,121 | 26,880 | |||||

| Administration fees | 13,728 | 47,587 | |||||

| Professional fees | 10,091 | 16,246 | |||||

| Directors' fees | 2,593 | 9,765 | |||||

| Chief Compliance Officer fees | 532 | 1,994 | |||||

| Registration fees | 54,534 | 62,618 | |||||

| Fund accounting fees | 1,821 | 6,838 | |||||

| Other expenses | 1,487 | 4,730 | |||||

| Total expenses | 202,843 | 593,293 | |||||

| Less, expense waiver for Institutional Class shareholder servicing fees | (37,629 | ) | (146,719 | ) | |||

| Less, expense reimbursement | (271,150 | ) | (382,621 | ) | |||

| Net expenses | (105,936 | ) | 63,953 | ||||

| Net investment income | 38,206 | 4,426,691 | |||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |||||||

| ALLOCATED FROM MASTER PORTFOLIOS: | |||||||

| Net realized gain (loss) on: | |||||||

| Investments and foreign currency | (3,116 | ) | (2,803,110 | ) | |||