As filed with the Securities and Exchange Commission on March 10, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09303 & 811-09923

Kinetics Mutual Funds, Inc. & Kinetics Portfolios Trust

(Exact name of registrant as specified in charter)

470 Park Avenue South

New York, NY 10016

(Address of principal executive offices) (Zip code)

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(800) 930-3828

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2014

Date of reporting period: December 31, 2014

Item 1. Report to Stockholders.

| KINETICS MUTUAL FUNDS, INC. |

| Table of Contents |

| December 31, 2014 |

| Page | |

| Shareholders’ Letter | 2 |

| Year 2014 Annual Investment Commentary | 5 |

| KINETICS MUTUAL FUNDS, INC. — FEEDER FUNDS | |

| Growth of $10,000 Investment | 9 |

| Expense Example | 20 |

| Statements of Assets & Liabilities | 26 |

| Statements of Operations | 30 |

| Statements of Changes in Net Assets | 34 |

| Notes to Financial Statements | 45 |

| Financial Highlights | 60 |

| Report of Independent Registered Public Accounting Firm | 89 |

| KINETICS PORTFOLIOS TRUST — MASTER INVESTMENT PORTFOLIOS | |

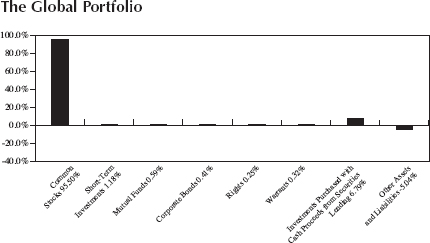

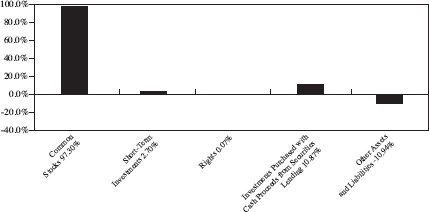

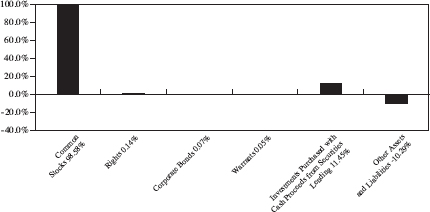

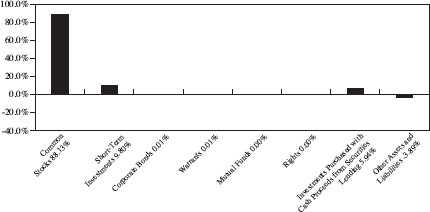

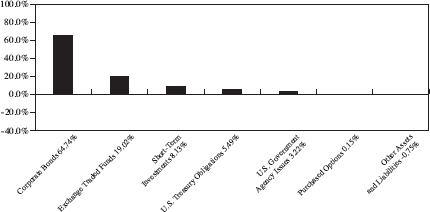

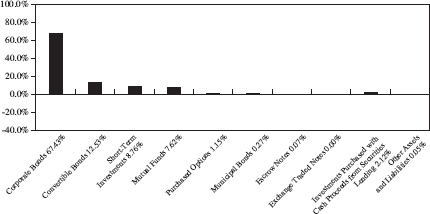

| Allocation of Portfolio Assets | 90 |

| Portfolio of Investments — The Internet Portfolio | 98 |

| Portfolio of Investments — The Global Portfolio | 103 |

| Portfolio of Investments — The Paradigm Portfolio | 108 |

| Portfolio of Investments — The Medical Portfolio | 115 |

| Portfolio of Investments — The Small Cap Opportunities Portfolio | 118 |

| Portfolio of Investments — The Market Opportunities Portfolio | 123 |

| Portfolio of Investments — The Alternative Income Portfolio | 128 |

| Portfolio of Investments — The Multi-Disciplinary Income Portfolio | 139 |

| Portfolio of Options Written — The Alternative Income Portfolio | 150 |

| Portfolio of Options Written — The Multi-Disciplinary Income Portfolio | 184 |

| Statements of Assets & Liabilities | 194 |

| Statements of Operations | 198 |

| Statements of Changes in Net Assets | 202 |

| Notes to Financial Statements | 206 |

| Report of Independent Registered Public Accounting Firm | 234 |

| Management of the Funds and the Portfolios | 235 |

| Privacy Policy | 243 |

1

| KINETICS MUTUAL FUNDS, INC. |

| Shareholders’ Letter |

Dear Fellow Shareholders:

We are pleased to present the Kinetics Mutual Funds (“Funds”) Annual Report for the twelve-month period ended December 31, 2014. Equity markets continued to advance in 2014, marking the sixth consecutive annual gain for the S&P 500 Index (“S&P 500”), with gains in excess of 10% in five of those six years. Incremental improvement in company fundamentals and the U.S. economy surely contributed to the positive return; however, that is not to say that the fundamentals of the average S&P 500 company actually improved by this magnitude. To the contrary, we believe that valuation multiples expanded less as a function of business improvement, and more as the result of increased investor desire for perceived stability or safety. Our belief is supported by the fact that large cap stocks (as measured by the S&P 500) outperformed small cap stocks (as measured by the Russell 2000 Index) by nearly 900 basis points for the year. Horizon Kinetics LLC, parent company to Kinetics Asset Management LLC (“Kinetics”), tends to source investment ideas in higher growth companies; these tend not to be amongst the largest corporations in the economy. Thus, the market’s apparent desire for safety in 2014 was to the detriment of our annual returns. The Funds generated returns as follows during the year (No Load Class): The Paradigm Fund -0.79%, The Multi-Disciplinary Income Fund +2.46%, The Small Cap Opportunities Fund -7.28%, The Market Opportunities Fund -5.55%, The Internet Fund -0.16%, The Medical Fund +16.44%, The Alternative Income Fund +1.50% and The Global Fund -11.89%. This compares to returns of +13.69% for the S&P 500, +4.89% for the Russell 2000 Index, +1.12% for the Barclays 1-3 year U.S. Credit Bond Index, +5.97% for the Barclays U.S. Aggregate Bond Index, and +4.16% for the MSCI All Country World Index.

We attempt to achieve long-term investment returns that are attractive on an absolute basis, while also outperforming our respective peer investors and reference benchmarks. In order to accomplish these objectives, we utilize a repeatable investment process that we believe will unearth excellent companies that are trading at inexpensive valuations. However, unlike many of our peer investors, we do not begin our investment search by evaluating the benchmark index constituents. In fact, we believe that there is considerable value in looking beyond such companies. Our process has been very effective over the long term, but no single investment strategy can reasonably be expected to outperform during every environment. The current environment has proven to be challenging for our strategies, but we view the factors driving this dislocation as temporary in nature. Accordingly, we have

2

no intention of altering our process, and we continue to believe in the investments of our Funds.

The trend toward passive investment continues unabated: in 2014, investors withdrew $55 billion from conventional mutual funds while investing $140 billion into exchange-traded funds (“ETFs”). In the short term, these fund flows result in inflated valuations for the companies that comprise the respective indexes. To the extent that the redeemed active managers own companies that are not included in the indexes, the process also has the result of compressing the valuations of those companies. Of course, there is a natural temptation to follow these trends and ride the index companies higher. However; the duration, magnitude and timing of this trend remain to be seen. In our opinion, the largest weights in many of the major indexes appear to be trading at extended valuations which, though supported by flows into ETFs in the near term, do not seem to be sustainable in the face of slowing top-line growth, among other obstacles. Timing the markets is not a viable strategy, in our view. Furthermore, we are comfortable investing where others are not; in fact, that is our preference. We are happy to allocate assets to companies that we believe will compound shareholder value over an extended horizon, though patience may be required for the stock price of such companies to reflect their intrinsic value.

Shareholders can continue to access additional information from our website, www.kineticsfunds.com. This website provides a broad array of information, including recent portfolio holdings, quarterly investment commentaries, conference call transcripts, newsflashes, recent performance data, and online access to account information.

Kinetics offers the following funds to investors:

The Paradigm Fund focuses on companies that we believe are valued attractively and currently have, or are expected to soon have, sustainable high business returns. The Fund has produced attractive risk adjusted returns since its inception, while maintaining amongst the lowest turnover rates in the industry. The Fund is Kinetics’ flagship fund.

The Multi-Disciplinary Income Fund seeks to utilize stock options and fixed-income investments in order to provide investors with equity-like returns, but

3

with more muted volatility. At times, the options strategies of the Fund may cause the manager to purchase equity securities.

The Small Cap Opportunities Fund focuses on undervalued and special situation small capitalization equities that we believe have the potential for rewarding long-term investment results. The same investment fundamentals employed by The Paradigm Fund are used to identify such opportunities.

The Medical Fund is a sector fund, offering an investment in scientific discovery within the promising field of medical research, particularly in the development of cancer treatments and therapies. As a sector fund, the Fund is likely to have heightened volatility.

The Internet Fund is a sector fund that focuses on companies engaged in the evolution of internet-related developments. As such, this Fund has been, and is likely to continue to be, quite volatile. The Fund is not designed to be a major component of one’s equity exposure. More recently, this Fund has been focusing on content companies, which we believe will be the winners in the next generation of Internet development.

The Global Fund is focused on selecting long life cycle international companies that we believe can generate long-term wealth through their business operations. This Fund is presently identifying exciting opportunities in the more developed markets.

The Market Opportunities Fund focuses on those companies that benefit from increasing transactional volume or throughput, such as publicly-traded exchanges and credit card processors, or companies that act as facilitators, such as gaming companies, airports and publicly-traded toll roads.

The Alternative Income Fund seeks to provide current income and gains, with a secondary objective of obtaining long-term growth of capital. The Fund utilizes stock options and fixed-income investments and seeks to generate a total return that exceeds most short-term U.S. fixed income indexes, with limited market value variability.

The Kinetics Investment Team

4

| KINETICS MUTUAL FUNDS, INC. |

| Investment Commentary |

Dear Fellow Shareholders,

The aggregate amount of resources that investors allocate to equity investing is ostensibly limitless. Consider that Blackrock, Inc., the largest asset management company in the world, oversees more than $4.5 trillion of capital, has a market capitalization of over $80 billion and has over 12,000 employees. Over the twelve-month period ended September 30, 2014, Blackrock recorded nearly $7 billion of expenses related to its asset management business. If investment returns were determined simply by the amount of resources dedicated to the process, there would be no reason to look beyond Blackrock. However, time has shown that size and resources are not very predictive of superior investment returns. In fact, many of the largest managers, with the greatest amount of resources available, tend to generate returns that are not materially different from their respective benchmark indexes. This is logical, as most managers begin their investment process by evaluating the reference benchmark and selecting from companies within it for investment. This is particularly true for managers that cater to large institutions. There is very little potential for these managers to add value by attempting to emulate more traditional investment processes. The same applies within the context of lower cost exchange traded fund (ETF) alternatives, which provide very similar exposure to their benchmarks, as well as to the indexes which they seek to track. An investor who tries to outperform a benchmark by selecting amongst its components is all but guaranteed to have very high correlation to said benchmark and is unlikely to deviate in any material way in terms of performance. Perhaps this is a sound business strategy for asset retention, but surely not for superior investment results.

Why would we wish to emulate an index that can be recreated at nearly zero cost, or attempt to compete with managers the size of Blackrock? A far more attractive alternative, in our opinion, is to find securities that are not included in the indexes, and hence, are largely ignored by most investors. As a function of not belonging to an index, many of these businesses are priced at material discounts to comparable companies included in the indexes. To the extent that fundamentals—not fund flows or sentiment—drive long-term security prices, we believe that the discounts at which these companies trade are not permanent. It seems all but certain that other investors recognize this valuation divide, but most ignore the opportunity that we are embracing due to the lack of a perceived catalyst. We believe that the uncertainty regarding the timing of an investment’s payout is critical to the undervaluation of its shares; we refer to this as the “equity yield curve.” Historically, our portfolios have been populated by companies that are at various stages of the equity yield curve; hence, performance is smoother than one might expect. However, there are periods when these dynamics do not materialize smoothly; hence, we can experience considerable deviations from index returns (both positive and negative).

5

Horizon Kinetics LLC, parent company to Kinetics Asset Management LLC, has followed, through its subsidiary investment advisers, a very similar investment process dating back to its subsidiaries’ inception over 20 years ago. This is important, as the process has not changed as a result of indexation, but it has always led us to investments in companies that are overlooked by most investors. For example, spin-off securities have historically traded at a discount because institutional investors did not care to understand the spun-off business and simply sold without any analysis. One might hypothesize that this opportunity is no longer available as investors have become more sophisticated and information more widely disseminated, but we believe the inverse is true; spin-off pricing remains inefficient due to index rules that tend to underweight or exclude spin-offs. Owner-operators are a similar example, as these companies are undervalued due to a limited share float, making the companies unattractive to indexes and large institutional investors. Prior to the recent market share gains by ETFs and index investing, owner operators were frequently valued at a premium to the overall market, and deservedly so. Why not pay a premium for a superior capital allocator? Though such companies have always been represented in the portfolios, we would have owned more of them historically had they been available at the low valuation multiples that exist now.

Ultimately, the investment team at Horizon Kinetics attempts to purchase good or great businesses at a fair or low valuation multiple. However, good and great businesses are seldom available at attractive prices; thus, we look for areas that are prone to structural, inefficient pricing. The previously mentioned owner-operators and spin-offs are but two examples of many predictive attributes for such mispricing and future performance. As a result of investing so differently from common practice, we recognize that there will be periods of both considerable outperformance and underperformance, but we believe that over the long term, our cumulative performance will be superior to any reference benchmark. In our belief, it is very hard to foresee a scenario where the large and fully valued S&P 500 Index constituent companies outperform our portfolios over the long term, and we view the current performance as an anomaly and a buying opportunity.

We believe that our investment process, complete with conservative assessments and high discount rates, embeds an attractive risk/reward profile in the investments. For investors who may be even more risk averse (compared to our high hurdle discount rates), we urge these individuals to consider our option income strategies, which seek to provide equity-like returns, with lowered realized volatility and greater downside protection. In our opinion, these strategies offer benefits compared to conventional yield-oriented strategies such as traditional bonds, leveraged loans, real estate investment trusts, and master limited partnerships.

6

Disclosure

This material is intended to be reviewed in conjunction with a current prospectus, which includes all fees and expenses that apply to a continued investment, as well as information regarding the risk factors, policies and objectives of the Funds. Read it carefully before investing.

Mutual Fund investing involves risk. Principal loss is possible. Because The Internet Fund, The Medical Fund and The Market Opportunities Fund invest in a single industry or geographic region, their shares are subject to a higher degree of risk than funds with a higher level of diversification. Internet, biotechnology and certain capital markets or gaming stocks are subject to a rate of change in technology, obsolescence and competition that is generally higher than that of other industries, hence they may experience extreme price and volume fluctuations.

International investing [for all Funds] presents special risks including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Accordingly, the share prices for these Funds are expected to be more volatile than that of U.S.-only funds. Past performance is no guarantee of future performance.

Because smaller companies [for The Small Cap Opportunities Fund] often have narrower markets and limited financial resources, they present more risk than larger, more well established, companies.

Non-investment grade debt securities [for all Funds], i.e., junk bonds, are subject to greater credit risk, price volatility and risk of loss than investment grade securities.

Further, options contain special risks including the imperfect correlation between the value of the option and the value of the underlying asset. Investments [for The Multi-Disciplinary Income Fund and The Alternative Income Fund] in futures, swaps and other derivative instruments may result in loss as derivative instruments may be illiquid, difficult to price and leveraged so that small changes may produce disproportionate losses to the Funds. To the extent the Funds segregate assets to cover derivative positions, they may impair their ability to meet current obligations, to honor requests for redemption and to manage the investments in a manner consistent with their respective investment objectives. Purchasing and writing put and call

7

options and, in particular, writing “uncovered” options are highly specialized activities that entail greater than ordinary investment risk.

As non-diversified Funds [except The Global Fund and The Multi-Disciplinary Income Fund] the value of Fund shares may fluctuate more than shares invested in a broader range of industries and companies. Unlike other investment companies that directly acquire and manage their own portfolios of securities, The Kinetics Mutual Funds pursue their investment objectives by investing all of their investable assets in a corresponding portfolio series of the Kinetics Portfolios Trust.

The information concerning the Funds included in the shareholder report contains certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

The Nasdaq Composite (NASDAQ) and the Standard & Poor’s 500 Index (S&P 500) each represent an unmanaged, broad-basket of stocks. They are typically used as a proxy for overall market performance.

Distributor: Kinetics Funds Distributor LLC is not an affiliate of Kinetics Mutual Funds, Inc. Kinetics Funds Distributor LLC is an affiliate of Kinetics Asset Management LLC, Investment Adviser to Kinetics Mutual Funds, Inc.

For more information, log onto www.kineticsfunds.com. January 1, 2015 — Kinetics Asset Management LLC®

8

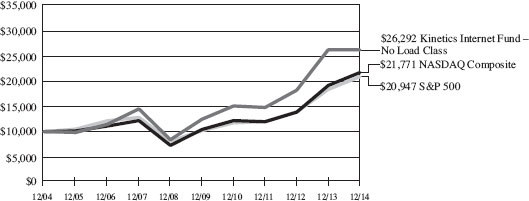

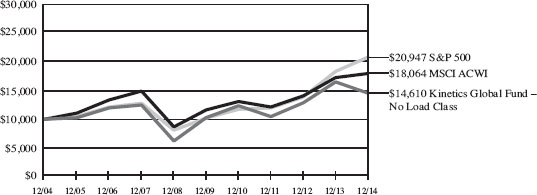

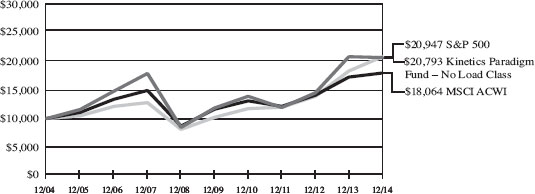

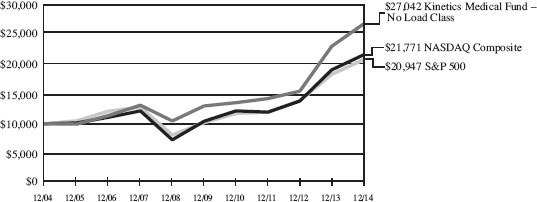

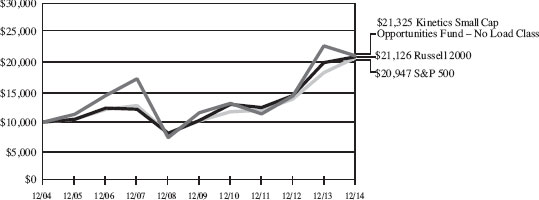

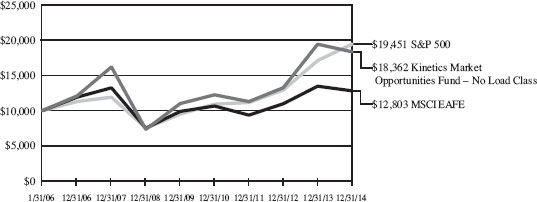

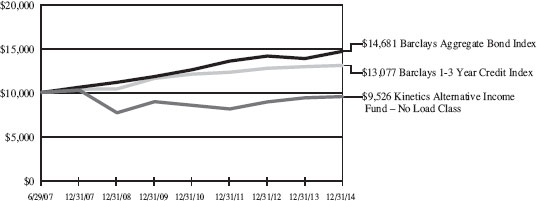

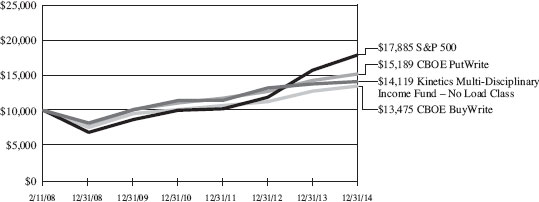

| How a $10,000 Investment Has Grown: | |

| The charts show the growth of a $10,000 investment in the Feeder Funds as compared to the performance of two or more representative market indices. The tables below the charts show the average annual total returns on an investment over various periods. Returns for periods greater than one year are average annual total returns. The annual returns assume the reinvestment of all dividends and distributions, however, the graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is not predictive of future performance. Current performance may be lower or higher than the returns quoted below. The performance data reflects voluntary fee waivers and expense reimbursements made by the Adviser and the returns would have been lower if these waivers and expense reimbursements were not in effect. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original costs. | |

The S&P 500 Index — is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. The S&P 500 is unmanaged and includes the reinvestment of dividends and does not reflect the payments of transaction costs and advisory fees associated with an investment in the Funds. The securities that comprise the S&P 500 may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index. | |

The NASDAQ Composite Index — is a broad-based capitalization-weighted index of all NASDAQ stocks. The NASDAQ is unmanaged and does not include the reinvestment of dividends and does not reflect the payment of transaction costs or advisory fees associated with an investment in the Funds. The securities that comprise the NASDAQ Composite may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index. | |

The MSCI ACWI (All Country World Index) Index — is a free float- adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2, 2014, the MSCI ACWI consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The | |

9

| emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. The securities that compromise the MSCI ACWI may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index. | |

The Russell 2000® Index — is a subset of the Russell 3000 Index® representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The securities that compromise the Russell 2000 may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index. | |

The MSCI EAFE® Index (Europe, Australasia, Far East) — is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. As of June 2, 2014, the MSCI EAFE® Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The securities that compromise the MSCI EAFE® may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index. | |

The Barclays U.S. 1-3 Year Credit Index — measures the performance of investment grade corporate debt and sovereign, supranational, local authority and non-U.S. agency bonds that are U.S. dollar denominated and have a remaining maturity of greater than or equal to one year and less than three years. The securities that compromise the Barclays U.S. 1-3 Year Credit Index may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index. | |

The Barclays U.S. Aggregate Bond Index — covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The Index includes multiple types of government and corporate-issued bonds, some of which are asset-backed. The securities that compromise the Barclays U.S. Aggregate Bond Index may differ substantially from the securities in the Funds’ portfolio. It is not possible to directly invest in an index. | |

10

CBOE S&P 500 BuyWrite Index (BXM) — is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500. The securities that comprise the CBOE S&P 500 BuyWrite Index may differ substantially from the securities in the Fund’s portfolio. It is not possible to directly invest in an index. | |

CBOE S&P 500 PutWrite Index (PUT) — is a benchmark index designed to track the performance of a passive program that sells near-term, at-the-money S&P 500 Index puts. The securities that comprise the CBOE S&P 500 PutWrite Index may differ substantially from the securities in the Fund’s portfolio. It is not possible to directly invest in an index. | |

11

The Internet Fund

December 31, 2004 — December 31, 2014

| Ended 12/31/2014 | ||||||||||||||||||||||||

| Advisor | Advisor | |||||||||||||||||||||||

| No Load | Class A | Class A | Advisor | NASDAQ | ||||||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500 | Composite | |||||||||||||||||||

| One Year | -0.16 | % | -0.41 | % | -6.14 | % | -0.86 | % | 13.69 | % | 13.40 | % | ||||||||||||

| Five Years | 16.09 | % | 15.81 | % | 14.45 | % | 15.24 | % | 15.45 | % | 15.85 | % | ||||||||||||

| Ten Years | 10.15 | % | 9.99 | % | 9.34 | % | N/A | 7.67 | % | 8.09 | % | |||||||||||||

| Since Inception | ||||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||||

| (10/21/96) | 15.40 | % | N/A | N/A | N/A | 8.00 | % | 7.66 | % | |||||||||||||||

| Since Inception | ||||||||||||||||||||||||

| Advisor | ||||||||||||||||||||||||

| Class A | ||||||||||||||||||||||||

| (4/26/01) | N/A | 7.74 | % | 7.28 | % | N/A | 5.88 | % | 6.37 | % | ||||||||||||||

| Since Inception | ||||||||||||||||||||||||

| Advisor | ||||||||||||||||||||||||

| Class C | ||||||||||||||||||||||||

| (2/16/07) | N/A | N/A | N/A | 10.12 | % | 6.78 | % | 8.48 | % | |||||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

12

The Global Fund

December 31, 2004 — December 31, 2014

| Ended 12/31/2014 | ||||||||||||||||||||||||

| Advisor | Advisor | |||||||||||||||||||||||

| No Load | Class A | Class A | Advisor | |||||||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500 | MSCI ACWI | |||||||||||||||||||

| One Year | -11.89 | % | -11.93 | % | -17.02 | % | -12.53 | % | 13.69 | % | 4.16 | % | ||||||||||||

| Five Years | 7.26 | % | 7.05 | % | 5.79 | % | 6.46 | % | 15.45 | % | 9.17 | % | ||||||||||||

| Ten Years | 3.86 | % | N/A | N/A | N/A | 7.67 | % | 6.09 | % | |||||||||||||||

| Since Inception | ||||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||||

| (12/31/99) | -2.53 | % | N/A | N/A | N/A | 4.24 | % | 3.26 | % | |||||||||||||||

| Since Inception | ||||||||||||||||||||||||

| Advisor | ||||||||||||||||||||||||

| Class A | ||||||||||||||||||||||||

| (5/19/08) | N/A | 3.33 | % | 2.41 | % | N/A | 8.04 | % | 2.96 | % | ||||||||||||||

| Since Inception | ||||||||||||||||||||||||

| Advisor | ||||||||||||||||||||||||

| Class C | ||||||||||||||||||||||||

| (5/19/08) | N/A | N/A | N/A | 2.71 | % | 8.04 | % | 2.96 | % | |||||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

13

The Paradigm Fund

December 31, 2004 — December 31, 2014

| Ended 12/31/2014 | ||||||||||||||||||||||||||||

| Advisor | Advisor | |||||||||||||||||||||||||||

| No Load | Class A | Class A | Advisor | Institutional | ||||||||||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500 | MSCI ACWI | ||||||||||||||||||||||

| One Year | -0.79 | % | -1.04 | % | -6.73 | % | -1.54 | % | -0.61 | % | 13.69 | % | 4.16 | % | ||||||||||||||

| Five Years | 11.86 | % | 11.59 | % | 10.28 | % | 11.02 | % | 12.07 | % | 15.45 | % | 9.17 | % | ||||||||||||||

| Ten Years | 7.60 | % | 7.29 | % | 6.66 | % | 6.75 | % | N/A | 7.67 | % | 6.09 | % | |||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||||||||

| (12/31/99) | 9.23 | % | N/A | N/A | N/A | N/A | 4.24 | % | 3.26 | % | ||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||||||||

| (4/26/01) | N/A | 9.53 | % | 9.06 | % | N/A | N/A | 5.88 | % | 5.30 | % | |||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||||||||

| (6/28/02) | N/A | N/A | N/A | 9.74 | % | N/A | 8.20 | % | 7.44 | % | ||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||||||

| (5/27/05) | N/A | N/A | N/A | N/A | 7.74 | % | 8.05 | % | 6.44 | % | ||||||||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

14

The Medical Fund

December 31, 2004 — December 31, 2014

| Ended 12/31/2014 | ||||||||||||||||||||||||

| Advisor | Advisor | |||||||||||||||||||||||

| No Load | Class A | Class A | Advisor | NASDAQ | ||||||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500 | Composite | |||||||||||||||||||

| One Year | 16.44 | % | 16.15 | % | 9.48 | % | 15.54 | % | 13.69 | % | 13.40 | % | ||||||||||||

| Five Years | 15.71 | % | 15.43 | % | 14.07 | % | 14.84 | % | 15.45 | % | 15.85 | % | ||||||||||||

| Ten Years | 10.46 | % | 10.21 | % | 9.55 | % | N/A | 7.67 | % | 8.09 | % | |||||||||||||

| Since Inception | ||||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||||

| (9/30/99) | 10.47 | % | N/A | N/A | N/A | 5.12 | % | 3.64 | % | |||||||||||||||

| Since Inception | ||||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||||

| (4/26/01) | N/A | 6.63 | % | 6.18 | % | N/A | 5.88 | % | 6.37 | % | ||||||||||||||

| Since Inception | ||||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||||

| (2/16/07) | N/A | N/A | N/A | 10.12 | % | 6.78 | % | 8.48 | % | |||||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

15

The Small Cap Opportunities Fund

December 31, 2004 — December 31, 2014

| Ended 12/31/2014 | ||||||||||||||||||||||||||||

| Advisor | Advisor | |||||||||||||||||||||||||||

| No Load | Class A | Class A | Advisor | Institutional | ||||||||||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | Russell 2000 | S&P 500 | ||||||||||||||||||||||

| One Year | -7.28 | % | -7.54 | % | -12.85 | % | -7.97 | % | -7.12 | % | 4.89 | % | 13.69 | % | ||||||||||||||

| Five Years | 12.99 | % | 12.71 | % | 11.38 | % | 12.15 | % | 13.21 | % | 15.55 | % | 15.45 | % | ||||||||||||||

| Ten Years | 7.87 | % | 7.59 | % | 6.95 | % | N/A | N/A | 7.77 | % | 7.67 | % | ||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||||||||

| (3/20/00) | 10.16 | % | N/A | N/A | N/A | N/A | 6.86 | % | 4.35 | % | ||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||||||||

| (12/31/01) | N/A | 8.22 | % | 7.73 | % | N/A | N/A | 8.61 | % | 6.72 | % | |||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||||||||

| (2/16/07) | N/A | N/A | N/A | 3.30 | % | N/A | 6.50 | % | 6.78 | % | ||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||||||

| (8/12/05) | N/A | N/A | N/A | N/A | 7.54 | % | 8.07 | % | 7.89 | % | ||||||||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

16

The Market Opportunities Fund

January 31, 2006 — December 31, 2014

| Ended 12/31/2014 | ||||||||||||||||||||||||||||

| Advisor | Advisor | |||||||||||||||||||||||||||

| No Load | Class A | Class A | Advisor | Institutional | ||||||||||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500 | MSCI EAFE | ||||||||||||||||||||||

| One Year | -5.55 | % | -5.74 | % | -11.14 | % | -6.24 | % | -5.36 | % | 13.69 | % | -4.90 | % | ||||||||||||||

| Five Years | 10.81 | % | 10.56 | % | 9.26 | % | 10.01 | % | 11.05 | % | 15.45 | % | 5.33 | % | ||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||||||||

| (1/31/06) | 7.05 | % | N/A | N/A | N/A | N/A | 7.75 | % | 2.81 | % | ||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||||||||

| (1/31/06) | N/A | 6.79 | % | 6.09 | % | N/A | N/A | 7.75 | % | 2.81 | % | |||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||||||||

| (2/16/07) | N/A | N/A | N/A | 3.68 | % | N/A | 6.78 | % | 0.39 | % | ||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||||||

| (5/19/08) | N/A | N/A | N/A | N/A | 4.70 | % | 8.04 | % | -0.42 | % | ||||||||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

17

The Alternative Income Fund

June 29, 2007 — December 31, 2014

| Ended 12/31/2014 | ||||||||||||||||||||||||||||

| Barclays | ||||||||||||||||||||||||||||

| U.S. 1-3 | Barclays | |||||||||||||||||||||||||||

| Advisor | Advisor | Year | U.S. | |||||||||||||||||||||||||

| No Load | Class A | Class A | Advisor | Institutional | Credit | Aggregate | ||||||||||||||||||||||

| Class | (No Load) | (Load Adjusted)(1) | Class C | Class | Index | Bond Index | ||||||||||||||||||||||

| One Year | 1.50 | % | 1.24 | % | -4.57 | % | 0.74 | % | 1.72 | % | 1.12 | % | 5.97 | % | ||||||||||||||

| Five Years | 1.27 | % | 1.02 | % | -0.17 | % | 0.55 | % | 1.54 | % | 2.42 | % | 4.45 | % | ||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||||||||

| (6/29/07) | -0.64 | % | N/A | N/A | N/A | N/A | 3.64 | % | 5.25 | % | ||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||||||||

| (6/29/07) | N/A | -0.88 | % | -1.66 | % | N/A | N/A | 3.64 | % | 5.25 | % | |||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||||||||

| (6/29/07) | N/A | N/A | N/A | -1.37 | % | N/A | 3.64 | % | 5.25 | % | ||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||||||

| (6/29/07) | N/A | N/A | N/A | N/A | -0.38 | % | 3.64 | % | 5.25 | % | ||||||||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

18

The Multi-Disciplinary Income Fund

February 11, 2008 — December 31, 2014

| Ended 12/31/2014 | ||||||||||||||||||||||||||||||||

| Advisor | ||||||||||||||||||||||||||||||||

| Advisor | Class A | |||||||||||||||||||||||||||||||

| No Load | Class A | (Load | Advisor | Institutional | S&P | CBOE | CBOE | |||||||||||||||||||||||||

| Class | (No Load) | Adjusted)(1) | Class C | Class | 500 | Buy | PUT | |||||||||||||||||||||||||

| One Year | 2.46 | % | 2.17 | % | -3.71 | % | 1.61 | % | 2.61 | % | 13.69 | % | 5.64 | % | 6.38 | % | ||||||||||||||||

| Five Years | 6.91 | % | 6.65 | % | 5.39 | % | 6.10 | % | 7.11 | % | 15.45 | % | 7.09 | % | 8.37 | % | ||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||||||

| No Load Class | ||||||||||||||||||||||||||||||||

| (2/11/08) | 5.14 | % | N/A | N/A | N/A | N/A | 8.81 | % | 4.42 | % | 6.26 | % | ||||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||||||

| Advisor Class A | ||||||||||||||||||||||||||||||||

| (2/11/08) | N/A | 4.88 | % | 3.99 | % | N/A | N/A | 8.81 | % | 4.42 | % | 6.26 | % | |||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||||||

| Advisor Class C | ||||||||||||||||||||||||||||||||

| (2/11/08) | N/A | N/A | N/A | 4.35 | % | N/A | 8.81 | % | 4.42 | % | 6.26 | % | ||||||||||||||||||||

| Since Inception | ||||||||||||||||||||||||||||||||

| Institutional Class | ||||||||||||||||||||||||||||||||

| (2/11/08) | N/A | N/A | N/A | N/A | 5.34 | % | 8.81 | % | 4.42 | % | 6.26 | % | ||||||||||||||||||||

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average total returns.

19

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Expense Example |

| December 31, 2014 |

Shareholders incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvestments of dividends or other distributions made by a Fund, redemption fees, and exchange fees, and (2), ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. This example is intended to help investors understand the ongoing costs (in dollars) of investing in a series of Kinetics Mutual Funds, Inc. (each a “Feeder Fund” and collectively the “Feeder Funds”), and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on July 1, 2014 and held for the entire period from July 1, 2014 to December 31, 2014.

Actual Expenses

The first line item of the table below provides information about actual account values and actual expenses before and after expense reimbursement. Unlike other mutual funds that directly acquire and manage their own portfolio securities, each Feeder Fund invests all or generally all of its investable assets in a corresponding series of The Kinetics Portfolios Trust (each, a “Master Portfolio”, and together the “Master Portfolios”), a separately registered investment company. The Master Portfolio, in turn, invests in securities. With this type of organization, expenses can accrue specifically to the Master Portfolio or the Feeder Fund or both. Each Feeder Fund records its proportionate share of the Master Portfolio’s expenses, including directed brokerage credits, on a daily basis. Any expense reductions include Fund-specific expenses as well as the expenses allocated from the Master Portfolio.

The Feeder Funds will charge shareholder fees for outgoing wire transfers, returned checks, and exchanges executed by telephone between a Feeder Fund and any other Feeder Fund. The Feeder Funds’ transfer agent charges a $5.00 transaction fee to shareholder accounts for telephone exchanges between any two Feeder Funds. The Feeder Funds’ transfer agent does not charge a transaction fee for written exchange requests. IRA accounts are assessed a $15.00 annual fee. Finally, as a disincentive to market-timing transactions, the Feeder Funds will assess a 2.00% fee on the redemption or exchange of Fund shares held for less than 30 days. These fees will be paid to the Feeder Funds to help offset transaction costs. The Feeder Funds reserve the right to waive the redemption fee, subject to their sole discretion, in instances deemed not to be disadvantageous to the Feeder Funds or shareholders as described in the Feeder Funds’ prospectus.

20

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2014 |

You may use the information provided in the first line, together with the amounts you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line item of the table below provides information about hypothetical account values and hypothetical expenses before and after expense reimbursements based on the Feeder Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Feeder Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses one paid for the period. You may use this information to compare the ongoing costs of investing in the Feeder Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight one’s ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help one determine the relative total costs of owning different funds. If these transactional costs had been included, one’s costs would have been higher.

21

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2014 |

| Expenses Paid | ||||||||||||||||

| Beginning | Ending | During | ||||||||||||||

| Account | Account | Annualized | Period* | |||||||||||||

| Value | Value | Expense | (7/1/14 to | |||||||||||||

| (7/1/14) | (12/31/14) | Ratio | 12/31/14) | |||||||||||||

| The Internet Fund | ||||||||||||||||

| No Load Class Actual | $ | 1,000.00 | $ | 1,022.70 | 1.79 | % | $ | 9.13 | ||||||||

| No Load Class Hypothetical (5% return | ||||||||||||||||

| before expenses) | $ | 1,000.00 | $ | 1,016.18 | 1.79 | % | $ | 9.10 | ||||||||

| Advisor Class A Actual | $ | 1,000.00 | $ | 1,021.30 | 2.04 | % | $ | 10.39 | ||||||||

| Advisor Class A Hypothetical (5% return | ||||||||||||||||

| before expenses) | $ | 1,000.00 | $ | 1,014.92 | 2.04 | % | $ | 10.36 | ||||||||

| Advisor Class C Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,019.40 | 2.54 | % | $ | 12.93 | ||||||||

| Advisor Class C Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,012.40 | 2.54 | % | $ | 12.88 | ||||||||

| The Global Fund | ||||||||||||||||

| No Load Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 857.00 | 1.39 | % | $ | 6.51 | ||||||||

| No Load Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,018.19 | 1.39 | % | $ | 7.07 | ||||||||

| Advisor Class A Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 856.50 | 1.64 | % | $ | 7.67 | ||||||||

| Advisor Class A Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

| Advisor Class C Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 854.40 | 2.14 | % | $ | 10.00 | ||||||||

| Advisor Class C Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,014.41 | 2.14 | % | $ | 10.87 | ||||||||

22

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2014 |

| Expenses Paid | ||||||||||||||||

| Beginning | Ending | During | ||||||||||||||

| Account | Account | Annualized | Period* | |||||||||||||

| Value | Value | Expense | (7/1/14 to | |||||||||||||

| (7/1/14) | (12/31/14) | Ratio | 12/31/14) | |||||||||||||

| The Paradigm Fund | ||||||||||||||||

| No Load Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 948.00 | 1.64 | % | $ | 8.05 | ||||||||

| No Load Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

| Advisor Class A Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 946.70 | 1.89 | % | $ | 9.27 | ||||||||

| Advisor Class A Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

| Advisor Class C Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 944.00 | 2.39 | % | $ | 11.71 | ||||||||

| Advisor Class C Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

| Institutional Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 948.80 | 1.44 | % | $ | 7.07 | ||||||||

| Institutional Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

| The Medical Fund | ||||||||||||||||

| No Load Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,061.80 | 1.39 | % | $ | 7.22 | ||||||||

| No Load Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,018.19 | 1.39 | % | $ | 7.07 | ||||||||

| Advisor Class A Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,060.50 | 1.64 | % | $ | 8.52 | ||||||||

| Advisor Class A Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

| Advisor Class C Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,057.90 | 2.14 | % | $ | 11.10 | ||||||||

| Advisor Class C Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,014.41 | 2.14 | % | $ | 10.87 | ||||||||

23

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2014 |

| Expenses Paid | ||||||||||||||||

| Beginning | Ending | During | ||||||||||||||

| Account | Account | Annualized | Period* | |||||||||||||

| Value | Value | Expense | (7/1/14 to | |||||||||||||

| (7/1/14) | (12/31/14) | Ratio | 12/31/14) | |||||||||||||

| The Small Cap Opportunities Fund | ||||||||||||||||

| No Load Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 893.20 | 1.64 | % | $ | 7.83 | ||||||||

| No Load Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

| Advisor Class A Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 892.00 | 1.89 | % | $ | 9.01 | ||||||||

| Advisor Class A Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

| Advisor Class C Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 889.60 | 2.39 | % | $ | 11.38 | ||||||||

| Advisor Class C Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

| Institutional Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 894.10 | 1.44 | % | $ | 6.87 | ||||||||

| Institutional Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

| The Market Opportunities Fund | ||||||||||||||||

| No Load Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 939.70 | 1.64 | % | $ | 8.02 | ||||||||

| No Load Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

| Advisor Class A Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 938.90 | 1.89 | % | $ | 9.24 | ||||||||

| Advisor Class A Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

| Advisor Class C Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 936.60 | 2.39 | % | $ | 11.67 | ||||||||

| Advisor Class C Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

| Institutional Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 940.60 | 1.44 | % | $ | 7.04 | ||||||||

| Institutional Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

24

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2014 |

| Expenses Paid | ||||||||||||||||

| Beginning | Ending | During | ||||||||||||||

| Account | Account | Annualized | Period* | |||||||||||||

| Value | Value | Expense | (7/1/14 to | |||||||||||||

| (7/1/14) | (12/31/14) | Ratio | 12/31/14) | |||||||||||||

| The Alternative Income Fund | ||||||||||||||||

| No Load Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 988.70 | 0.95 | % | $ | 4.76 | ||||||||

| No Load Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,020.41 | 0.95 | % | $ | 4.84 | ||||||||

| Advisor Class A Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 987.30 | 1.20 | % | $ | 6.01 | ||||||||

| Advisor Class A Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,019.15 | 1.20 | % | $ | 6.11 | ||||||||

| Advisor Class C Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 985.00 | 1.70 | % | $ | 8.51 | ||||||||

| Advisor Class C Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,016.63 | 1.70 | % | $ | 8.64 | ||||||||

| Institutional Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 989.80 | 0.75 | % | $ | 3.76 | ||||||||

| Institutional Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,021.42 | 0.75 | % | $ | 3.82 | ||||||||

| The Multi-Disciplinary Income Fund | ||||||||||||||||

| No Load Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 976.80 | 1.49 | % | $ | 7.42 | ||||||||

| No Load Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,017.69 | 1.49 | % | $ | 7.58 | ||||||||

| Advisor Class A Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 975.30 | 1.74 | % | $ | 8.66 | ||||||||

| Advisor Class A Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,016.43 | 1.74 | % | $ | 8.84 | ||||||||

| Advisor Class C Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 972.90 | 2.24 | % | $ | 11.14 | ||||||||

| Advisor Class C Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,013.91 | 2.24 | % | $ | 11.37 | ||||||||

| Institutional Class Actual — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 977.40 | 1.29 | % | $ | 6.43 | ||||||||

| Institutional Class Hypothetical (5% return | ||||||||||||||||

| before expenses) — after | ||||||||||||||||

| expense reimbursement | $ | 1,000.00 | $ | 1,018.70 | 1.29 | % | $ | 6.56 | ||||||||

| Note: | Each Feeder Fund records its proportionate share of the respective Master Portfolio’s expenses on a daily basis. Any expense reductions include Feeder Fund-specific expenses as well as the expenses allocated for the Master Portfolio. | |

| * | Expenses are equal to the Feeder Fund’s annualized expense ratio before expense reimbursement and after expense reimbursement multiplied by the average account value over the period, multiplied by 184/365. | |

25

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Assets & Liabilities |

| December 31, 2014 |

| The Internet | The Global | |||||||

| Fund | Fund | |||||||

| ASSETS: | ||||||||

| Investments in the Master Portfolio, at value* | $ | 157,526,615 | $ | 8,872,053 | ||||

| Receivable from Adviser | — | 7,861 | ||||||

| Receivable for Master Portfolio interest sold | 215,488 | — | ||||||

| Receivable for Fund shares sold | 24,774 | 37 | ||||||

| Prepaid expenses and other assets | 20,535 | 15,070 | ||||||

| Total Assets | 157,787,412 | 8,895,021 | ||||||

| LIABILITIES: | ||||||||

| Payable for Master Portfolio interest purchased | — | 36 | ||||||

| Payable to Directors | 2,560 | 165 | ||||||

| Payable to Chief Compliance Officer | 192 | 14 | ||||||

| Payable for Fund shares repurchased | 240,262 | — | ||||||

| Payable for shareholder servicing fees | 33,586 | 1,895 | ||||||

| Payable for distribution fees | 3,654 | 2,715 | ||||||

| Accrued expenses and other liabilities | 59,049 | 13,532 | ||||||

| Total Liabilities | 339,303 | 18,357 | ||||||

| Net Assets | $ | 157,448,109 | $ | 8,876,664 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid in capital | $ | 72,348,653 | $ | 7,617,222 | ||||

| Accumulated net investment income | 153,826 | 15,403 | ||||||

| Accumulated net realized gain (loss) on investments and foreign currency | 3,563,235 | (75,822 | ) | |||||

| Net unrealized appreciation on: | ||||||||

| Investments and foreign currency | 81,382,395 | 1,319,861 | ||||||

| Net Assets | $ | 157,448,109 | $ | 8,876,664 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | ||||||||

| Net Assets | $ | 151,199,801 | $ | 6,770,943 | ||||

| Shares outstanding | 2,696,030 | 1,271,135 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 56.08 | $ | 5.33 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | ||||||||

| Net Assets | $ | 5,142,847 | $ | 497,376 | ||||

| Shares outstanding | 94,340 | 93,650 | ||||||

| Net asset value per share (redemption price) | $ | 54.51 | $ | 5.31 | ||||

| Offering price per share ($54.51 divided by .9425 and $5.31 divided by .9425) | $ | 57.84 | $ | 5.63 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | ||||||||

| Net Assets | $ | 1,105,461 | $ | 1,608,345 | ||||

| Shares outstanding | 21,338 | 311,813 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 51.81 | $ | 5.16 | ||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |

The accompanying notes are an integral part of these financial statements.

26

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Assets & Liabilities — (Continued) |

| December 31, 2014 |

| The Paradigm | The Medical | |||||||

| Fund | Fund | |||||||

| ASSETS: | ||||||||

| Investments in the Master Portfolio, at value* | $ | 1,176,068,317 | $ | 27,084,066 | ||||

| Receivable from Adviser | 20,839 | 13,566 | ||||||

| Receivable for Master Portfolio interest sold | 3,382,941 | 12,495 | ||||||

| Receivable for Fund shares sold | 1,405,661 | 552 | ||||||

| Prepaid expenses and other assets | 41,796 | 14,189 | ||||||

| Total Assets | 1,180,919,554 | 27,124,868 | ||||||

| LIABILITIES: | ||||||||

| Payable to Directors | 19,797 | 401 | ||||||

| Payable to Chief Compliance Officer | 1,340 | 33 | ||||||

| Payable for Fund shares repurchased | 4,788,602 | 13,047 | ||||||

| Payable for shareholder servicing fees | 194,889 | 5,749 | ||||||

| Payable for distribution fees | 375,380 | 3,840 | ||||||

| Accrued expenses and other liabilities | 237,076 | 16,681 | ||||||

| Total Liabilities | 5,617,084 | 39,751 | ||||||

| Net Assets | $ | 1,175,302,470 | $ | 27,085,117 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid in capital | $ | 1,533,328,312 | $ | 16,189,992 | ||||

| Accumulated net investment income (loss) | (7,237,393 | ) | 67,272 | |||||

| Accumulated net realized gain (loss) on investments and foreign currency | (747,781,728 | ) | 272,190 | |||||

| Net unrealized appreciation on: | ||||||||

| Investments and foreign currency | 396,993,279 | 10,555,663 | ||||||

| Net Assets | $ | 1,175,302,470 | $ | 27,085,117 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | ||||||||

| Net Assets | $ | 521,737,954 | $ | 21,876,078 | ||||

| Shares outstanding | 15,310,812 | 713,265 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 34.08 | $ | 30.67 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | ||||||||

| Net Assets | $ | 171,958,387 | $ | 4,578,294 | ||||

| Shares outstanding | 5,150,425 | 154,099 | ||||||

| Net asset value per share (redemption price) | $ | 33.39 | $ | 29.71 | ||||

| Offering price per share ($33.39 divided by .9425 and $29.71 divided by .9425) | $ | 35.43 | $ | 31.52 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | ||||||||

| Net Assets | $ | 135,332,700 | $ | 630,745 | ||||

| Shares outstanding | 4,244,622 | 21,637 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 31.88 | $ | 29.15 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS: | ||||||||

| Net Assets | $ | 346,273,429 | N/A | |||||

| Shares outstanding | 10,159,663 | N/A | ||||||

| Net asset value per share (offering price and redemption price) | $ | 34.08 | N/A | |||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. | |

The accompanying notes are an integral part of these financial statements.

27

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Assets & Liabilities — (Continued) |

| December 31, 2014 |

| The Small Cap | The Market | |||||||

| Opportunities | Opportunities | |||||||

| Fund | Fund | |||||||

| ASSETS: | ||||||||

| Investments in the Master Portfolio, at value* | $ | 353,117,149 | $ | 54,360,074 | ||||

| Receivable from Adviser | 32,303 | 12,667 | ||||||

| Receivable for Master Portfolio interest sold | — | 91,206 | ||||||

| Receivable for Fund shares sold | 1,860,621 | 10,005 | ||||||

| Prepaid expenses and other assets | 49,719 | 27,295 | ||||||

| Total Assets | 355,059,792 | 54,501,247 | ||||||

| LIABILITIES: | ||||||||

| Payable for Master Portfolio interest purchased | 748,964 | — | ||||||

| Payable to Directors | 6,355 | 983 | ||||||

| Payable to Chief Compliance Officer | 445 | 62 | ||||||

| Payable for Fund shares repurchased | 1,111,657 | 101,211 | ||||||

| Payable for shareholder servicing fees | 65,981 | 11,254 | ||||||

| Payable for distribution fees | 27,013 | 15,005 | ||||||

| Accrued expenses and other liabilities | 78,890 | 21,122 | ||||||

| Total Liabilities | 2,039,305 | 149,637 | ||||||

| Net Assets | $ | 353,020,487 | $ | 54,351,610 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid in capital | $ | 455,787,003 | $ | 63,750,870 | ||||

| Accumulated net investment loss | (1,564,310 | ) | (616,233 | ) | ||||

| Accumulated net realized loss on investments and foreign currency | (137,851,807 | ) | (21,552,662 | ) | ||||

| Net unrealized appreciation on: | ||||||||

| Investments and foreign currency | 36,649,601 | 12,769,635 | ||||||

| Net Assets | $ | 353,020,487 | $ | 54,351,610 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | ||||||||

| Net Assets | $ | 251,109,571 | $ | 37,317,873 | ||||

| Shares outstanding | 6,749,305 | 2,237,115 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 37.21 | $ | 16.68 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | ||||||||

| Net Assets | $ | 25,591,125 | $ | 8,816,721 | ||||

| Shares outstanding | 702,431 | 531,386 | ||||||

| Net asset value per share (redemption price) | $ | 36.43 | $ | 16.59 | ||||

| Offering price per share ($36.43 divided by .9425 and $16.59 divided by .9425) | $ | 38.65 | $ | 17.60 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | ||||||||

| Net Assets | $ | 12,928,160 | $ | 5,108,596 | ||||

| Shares outstanding | 364,493 | 314,646 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 35.47 | $ | 16.24 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS: | ||||||||

| Net Assets | $ | 63,391,631 | $ | 3,108,420 | ||||

| Shares outstanding | 1,687,279 | 185,079 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 37.57 | $ | 16.80 | ||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. | |

The accompanying notes are an integral part of these financial statements.

28

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Assets & Liabilities — (Continued) |

| December 31, 2014 |

| The Multi- | ||||||||

| The Alternative | Disciplinary | |||||||

| Income | Income | |||||||

| Fund | Fund | |||||||

| ASSETS: | ||||||||

| Investments in the Master Portfolio, at value* | $ | 38,115,285 | $ | 135,378,346 | ||||

| Receivable from Adviser | 29,176 | 35,614 | ||||||

| Receivable for Master Portfolio interest sold | — | 73,373 | ||||||

| Receivable for Fund shares sold | 147,652 | 258,269 | ||||||

| Prepaid expenses and other assets | 17,314 | 31,113 | ||||||

| Total Assets | 38,309,427 | 135,776,715 | ||||||

| LIABILITIES: | ||||||||

| Payable for Master Portfolio interest purchased | 80,473 | — | ||||||

| Payable to Directors | 536 | 1,924 | ||||||

| Payable to Chief Compliance Officer | 23 | 100 | ||||||

| Payable for Fund shares repurchased | 67,179 | 331,642 | ||||||

| Payable for shareholder servicing fees | 3,716 | 11,431 | ||||||

| Payable for distribution fees | 5,300 | 20,695 | ||||||

| Accrued expenses and other liabilities | 16,395 | 31,329 | ||||||

| Total Liabilities | 173,622 | 397,121 | ||||||

| Net Assets | $ | 38,135,805 | $ | 135,379,594 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid in capital | $ | 45,287,894 | $ | 138,223,503 | ||||

| Accumulated net investment loss | — | (845,286 | ) | |||||

| Accumulated net realized gain (loss) on investments and foreign currency | (7,588,529 | ) | 623,497 | |||||

| Net unrealized appreciation (depreciation) on: | ||||||||

| Investments and foreign currency | (95,442 | ) | (3,625,646 | ) | ||||

| Written option contracts | 531,882 | 1,003,526 | ||||||

| Net Assets | $ | 38,135,805 | $ | 135,379,594 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | ||||||||

| Net Assets | $ | 8,201,899 | $ | 10,105,374 | ||||

| Shares outstanding | 92,091 | 936,406 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 89.06 | $ | 10.79 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | ||||||||

| Net Assets | $ | 1,554,083 | $ | 12,281,404 | ||||

| Shares outstanding | 17,523 | 1,142,852 | ||||||

| Net asset value per share (redemption price) | $ | 88.69 | $ | 10.75 | ||||

| Offering price per share ($88.69 divided by .9425 and $10.75 divided by .9425) | $ | 94.10 | $ | 11.41 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | ||||||||

| Net Assets | $ | 1,505,632 | $ | 10,402,692 | ||||

| Shares outstanding | 17,386 | 976,618 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 86.60 | $ | 10.65 | ||||

| CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS: | ||||||||

| Net Assets | $ | 26,874,191 | $ | 102,590,124 | ||||

| Shares outstanding | 298,133 | 9,482,593 | ||||||

| Net asset value per share (offering price and redemption price) | $ | 90.14 | $ | 10.82 | ||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. | |

The accompanying notes are an integral part of these financial statements.

29

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Operations |

| For the Year Ended December 31, 2014 |

| The Internet | The Global | |||||||

| Fund | Fund | |||||||

| INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

| Dividends† | $ | 689,583 | $ | 74,932 | ||||

| Interest | 948 | 454 | ||||||

| Income from securities lending | 39,420 | 39,953 | ||||||

| Expenses allocated from Master Portfolio | (2,211,086 | ) | (171,423 | ) | ||||

| Net investment loss from Master Portfolio | (1,481,135 | ) | (56,084 | ) | ||||

| EXPENSES: | ||||||||

| Distribution fees — Advisor Class A | 12,828 | 3,180 | ||||||

| Distribution fees — Advisor Class C | 8,362 | 12,080 | ||||||

| Shareholder servicing fees — Advisor Class A | 12,828 | 3,180 | ||||||

| Shareholder servicing fees — Advisor Class C | 2,788 | 4,027 | ||||||

| Shareholder servicing fees — No Load Class | 397,634 | 19,604 | ||||||

| Transfer agent fees and expenses | 146,328 | 20,472 | ||||||

| Reports to shareholders | 32,820 | 2,806 | ||||||

| Administration fees | 54,438 | 5,210 | ||||||

| Professional fees | 17,177 | 8,545 | ||||||

| Directors’ fees | 7,099 | 558 | ||||||

| Chief Compliance Officer fees | 2,000 | 136 | ||||||

| Registration fees | 46,139 | 43,206 | ||||||

| Fund accounting fees | 8,272 | 578 | ||||||

| Other expenses | 7,898 | 467 | ||||||

| Total expenses | 756,611 | 124,049 | ||||||

| Less, expense reimbursement | — | (131,153 | ) | |||||

| Net expenses | 756,611 | (7,104 | ) | |||||

| Net investment loss | (2,237,746 | ) | (48,980 | ) | ||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

| Net realized gain on: | ||||||||

| Investments and foreign currency | 10,595,537 | 318,071 | ||||||

| Net change in unrealized depreciation of: | ||||||||

| Investments and foreign currency | (9,484,952 | ) | (1,488,285 | ) | ||||

| Net gain (loss) on investments | 1,110,585 | (1,170,214 | ) | |||||

| Net decrease in net assets resulting from operations | $ | (1,127,161 | ) | $ | (1,219,194 | ) | ||

| † Net of foreign taxes withheld of: | $ | 1,416 | $ | 11,796 | ||||

The accompanying notes are an integral part of these financial statements.

30

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Operations — (Continued) |

| For the Year Ended December 31, 2014 |

| The Paradigm | The Medical | |||||||

| Fund | Fund | |||||||

| INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

| Dividends† | $ | 5,712,887 | $ | 443,645 | ||||

| Interest | 42,724 | 195 | ||||||

| Income from securities lending | 2,045,419 | 44,575 | ||||||

| Expenses allocated from Master Portfolio | (16,826,951 | ) | (371,663 | ) | ||||

| Net investment income (loss) from Master Portfolio | (9,025,921 | ) | 116,752 | |||||

| EXPENSES: | ||||||||

| Distribution fees — Advisor Class A | 499,393 | 11,364 | ||||||

| Distribution fees — Advisor Class C | 1,052,238 | 4,324 | ||||||

| Shareholder servicing fees — Advisor Class A | 499,393 | 11,364 | ||||||

| Shareholder servicing fees — Advisor Class C | 350,746 | 1,441 | ||||||

| Shareholder servicing fees — No Load Class | 1,449,572 | 53,095 | ||||||

| Shareholder servicing fees — Institutional Class | 682,664 | — | ||||||

| Transfer agent fees and expenses | 310,790 | 26,646 | ||||||

| Reports to shareholders | 176,724 | 4,683 | ||||||

| Administration fees | 416,215 | 8,618 | ||||||

| Professional fees | 81,996 | 9,429 | ||||||

| Directors’ fees | 61,109 | 1,219 | ||||||

| Chief Compliance Officer fees | 15,698 | 325 | ||||||

| Registration fees | 83,897 | 43,165 | ||||||

| Fund accounting fees | 64,756 | 1,339 | ||||||

| Other expenses | 52,960 | 1,105 | ||||||

| Total expenses | 5,798,151 | 178,117 | ||||||

| Less, expense waiver for Institutional Class shareholder servicing fees | (511,998 | ) | — | |||||

| Less, expense reimbursement | (560,155 | ) | (167,683 | ) | ||||

| Net expenses | 4,725,998 | 10,434 | ||||||

| Net investment income (loss) | (13,751,919 | ) | 106,318 | |||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

| Net realized gain on: | ||||||||

| Investments and foreign currency | 36,331,414 | 723,512 | ||||||

| Net change in unrealized appreciation (depreciation) of: | ||||||||

| Investments and foreign currency | (31,558,560 | ) | 3,048,505 | |||||

| Net gain on investments | 4,772,854 | 3,772,017 | ||||||

| Net increase (decrease) in net assets resulting from operations | $ | (8,979,065 | ) | $ | 3,878,335 | |||

| † Net of foreign taxes withheld of: | $ | 211,076 | $ | 32,954 | ||||

The accompanying notes are an integral part of these financial statements.

31

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Operations — (Continued) |

| For the Year Ended December 31, 2014 |

| The Small Cap | The Market | |||||||

| Opportunities | Opportunities | |||||||

| Fund | Fund | |||||||

| INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

| Dividends† | $ | 2,161,951 | $ | 604,699 | ||||

| Interest | 5,315 | 1,044 | ||||||

| Income from securities lending | 874,397 | 82,356 | ||||||

| Expenses allocated from Master Portfolio | (5,412,883 | ) | (876,989 | ) | ||||

| Net investment loss from Master Portfolio | (2,371,220 | ) | (188,890 | ) | ||||

| EXPENSES: | ||||||||

| Distribution fees — Advisor Class A | 74,524 | 26,085 | ||||||

| Distribution fees — Advisor Class C | 91,411 | 41,972 | ||||||

| Shareholder servicing fees — Advisor Class A | 74,524 | 26,085 | ||||||

| Shareholder servicing fees — Advisor Class C | 30,470 | 13,991 | ||||||

| Shareholder servicing fees — No Load Class | 795,055 | 111,730 | ||||||

| Shareholder servicing fees — Institutional Class | 90,523 | 4,982 | ||||||

| Transfer agent fees and expenses | 94,681 | 27,886 | ||||||

| Reports to shareholders | 69,091 | 7,619 | ||||||

| Administration fees | 132,079 | 22,288 | ||||||

| Professional fees | 33,435 | 11,630 | ||||||

| Directors’ fees | 23,543 | 2,990 | ||||||

| Chief Compliance Officer fees | 5,367 | 760 | ||||||

| Registration fees | 108,700 | 59,800 | ||||||

| Fund accounting fees | 21,613 | 3,207 | ||||||

| Other expenses | 12,963 | 2,766 | ||||||

| Total expenses | 1,657,979 | 363,791 | ||||||

| Less, expense waiver for Institutional Class shareholder servicing fees | (67,891 | ) | (3,737 | ) | ||||

| Less, expense reimbursement | (280,908 | ) | (137,265 | ) | ||||

| Net expenses | 1,309,180 | 222,789 | ||||||

| Net investment loss | (3,680,400 | ) | (411,679 | ) | ||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

| Net realized gain on: | ||||||||

| Investments and foreign currency | 22,542,735 | 4,069,744 | ||||||

| Net change in unrealized depreciation of: | ||||||||

| Investments and foreign currency | (47,300,796 | ) | (7,185,651 | ) | ||||

| Net loss on investments | (24,758,061 | ) | (3,115,907 | ) | ||||

| Net decrease in net assets resulting from operations | $ | (28,438,461 | ) | $ | (3,527,586 | ) | ||

| † Net of foreign taxes withheld of: | $ | 22,574 | $ | 16,987 | ||||

The accompanying notes are an integral part of these financial statements.

32

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Statements of Operations — (Continued) |

| For the Year Ended December 31, 2014 |

| The Multi- | ||||||||

| The Alternative | Disciplinary | |||||||

| Income | Income | |||||||

| Fund | Fund | |||||||

| INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

| Dividends | $ | 67,123 | $ | 927,945 | ||||

| Interest | 181,096 | 4,106,230 | ||||||

| Income from securities lending | 5,066 | 30,997 | ||||||

| Expenses allocated from Master Portfolio | (378,101 | ) | (1,566,194 | ) | ||||

| Net investment income (loss) from Master Portfolio | (124,816 | ) | 3,498,978 | |||||

| EXPENSES: | ||||||||

| Distribution fees — Advisor Class A | 7,673 | 57,683 | ||||||

| Distribution fees — Advisor Class C | 11,679 | 84,928 | ||||||

| Shareholder servicing fees — Advisor Class A | 7,673 | 57,683 | ||||||

| Shareholder servicing fees — Advisor Class C | 3,893 | 28,309 | ||||||

| Shareholder servicing fees — No Load Class | 30,889 | 47,913 | ||||||