As filed with the Securities and Exchange Commission on March 7, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09303 & 811-09923

Kinetics Mutual Funds, Inc. & Kinetics Portfolios Trust

(Exact name of registrant as specified in charter)

555 Taxter Road, Suite 175

Elmsford, NY 10523

(Address of principal executive offices) (Zip code)

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(800) 930-3828

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2011

Date of reporting period: December 31, 2011

Item 1. Report to Stockholders.

December 31, 2011 www.kineticsfunds.com | ||

| Annual Report | ||

The Internet Fund | ||

The Global Fund | ||

The Paradigm Fund | ||

The Medical Fund | ||

The Small Cap Opportunities Fund | ||

The Market Opportunities Fund | ||

The Water Infrastructure Fund | ||

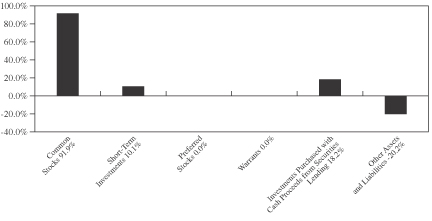

The Multi-Disciplinary Fund | ||

| Page | ||||

| 2 | ||||

| 5 | ||||

KINETICS MUTUAL FUNDS, INC. — FEEDER FUNDS | ||||

| 11 | ||||

| 21 | ||||

| 30 | ||||

| 34 | ||||

| 38 | ||||

| 49 | ||||

| 64 | ||||

| 96 | ||||

KINETICS PORTFOLIOS TRUST — MASTER INVESTMENT PORTFOLIOS | ||||

| 97 | ||||

| 105 | ||||

| 110 | ||||

| 115 | ||||

| 120 | ||||

Portfolio of Investments — The Small Cap Opportunities Portfolio | 124 | |||

Portfolio of Investments — The Market Opportunities Portfolio | 129 | |||

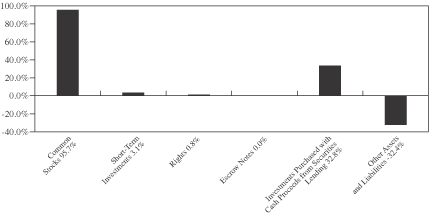

Portfolio of Investments — The Water Infrastructure Portfolio | 133 | |||

| 136 | ||||

Portfolio of Options Written — The Water Infrastructure Portfolio | 140 | |||

Portfolio of Options Written — The Multi-Disciplinary Portfolio | 143 | |||

| 167 | ||||

| 171 | ||||

| 175 | ||||

| 179 | ||||

| 203 | ||||

| 205 | ||||

| 210 | ||||

1

Dear Fellow Shareholders:

We are pleased to present the Kinetics Mutual Funds’ Annual Report for the fiscal year ended December 31, 2011. On balance, the Kinetics Family of Mutual Funds had disappointing investment results for 2011, with returns of (14.27)% for The Paradigm Fund, (13.65)% for the Small-Cap Opportunities Fund, (7.85)% for the Market Opportunities Funds, (1.98)% for the Internet Fund, 5.11% for the Medical Fund, (15.41)% for The Global Fund, 0.24% for the Multi-Disciplinary Fund, and (4.88)% for the Water Infrastructure Fund. This compares with the 2011 returns of 2.11% and (1.80)% for the S&P 500 Index(1) and for the NASDAQ Composite Index(2), respectively. The comparison of our funds to these two indices is merely for illustrative purposes and is not an indication that we are trying to replicate or exceed the performance of a specific index during a discrete short timeframe. Our investment goal is to provide you with commendable investment results, regardless of how an index is positioned relative to our Funds. We encourage you to use whatever index you feel appropriate for your own comparison purposes.

We have never strayed from our value based investment approach, dating back to the inception of the Funds. In most years, this has been advantageous and rewarding as measured by absolute performance. The past year is an example of a period during which value investing simply did not deliver the types of returns to which we and our shareholders have become accustomed. The fact that a strategy that has been successful for many investors over many years should underperform over a given calendar year should not come as a surprise. However it is never easy to endure the episodic irrationality that markets can display, as they did in 2011. We remain comforted by the strong operating results and heavily discounted trading prices of our portfolio companies. While it is impossible to prognosticate when markets will again appreciate the value of these securities, the margin of safety to invest is amongst the highest that we have encountered in markets that are not consumed by panic. In the fullness of time, we expect our Funds to revert to the rates of return that have been historically achieved.

We continue to inform our shareholders through our website, www.kineticsfunds.com. This website provides a broad array of information, including recent portfolio holdings, quarterly investment commentaries, news flashes, recent performance data, and online access to account information.

2

Kinetics offers the following funds to investors:

The Paradigm Fund focuses on undervalued companies that currently have, or which should soon have, sustainable high returns on equity without the excessive use of leverage. The Fund has produced attractive returns since its inception in an environment that should be described as difficult for equity investors. The Paradigm Fund is Kinetics’ flagship fund. For those who are interested in a product with the potential for lower volatility, we encourage you to examine our Multi-Disciplinary Fund, listed below.

The Small Cap Opportunities Fund focuses on undervalued small capitalization companies that have the potential for rewarding long-term investment results. The investment and portfolio construction processes are similar to those of the Paradigm Fund, but are focused on small and mid capitalization businesses.

The Market Opportunities Fund focuses on those companies that benefit from increasing transactional volume or throughput, such as publicly-traded exchanges, or that act as facilitators, such as airports and publicly-traded toll roads. These businesses are often able to increase sales with no or low reinvestment costs, resulting in high margins and increasing free cash flow.

The Internet Fund is a sector fund that focuses on companies engaged in Internet-related developments. As such, the returns of this Fund have been, and are likely to continue to be, quite volatile. The Internet Fund is not designed to be a major component of one’s equity exposure. More recently, this Fund has been focusing on digital content companies, which we believe will be amongst the beneficiaries in the next generation of Internet development.

The Medical Fund is a sector fund, offering an investment in scientific discovery within the promising field of medical research, particularly in the development of cancer treatments and therapies. The Fund may be invested across a variety of medical related companies including biotechnology and pharmaceuticals.

3

The Global Fund’s mandate was changed in early April 2008 to an emphasis on global investments. This Fund is truly a go-anywhere fund designed to allocate capital to the markets with the best overall risk adjusted investment opportunities. As such, the Fund is presently positioned to benefit from opportunities in the more developed world markets. The investment and portfolio construction processes are similar to those of the Paradigm Fund, but are focused on global opportunities.

The Multi-Disciplinary Fund seeks to utilize stock options and fixed-income investments in order to provide investors with equity-like returns, but with more muted volatility. At times, the options strategies of the Fund may require the manager to temporarily hold equity securities.

The Water Infrastructure Fund is a sector fund that invests in global companies engaged in water infrastructure and water-specific natural resources, as well as related activities. To supplement the equity investments, the Fund also utilizes the Multi-Disciplinary Fund’s options strategy employed upon water businesses. This provides the Fund equity exposure and exposure to the water industry, complemented by income from put options.

Peter B. Doyle

President

Kinetics Mutual Funds, Inc.

| (1) | The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. You cannot invest directly in an index. |

| (2) | The NASDAQ Composite Index is a market capitalization-weighted index that is designed to represent the performance of the National Market System which includes over 5,000 stocks traded only over-the-counter and not on an exchange. You cannot invest directly in an index. |

4

Dear Shareholders:

The S&P 500 Index completed 2011 returning 2.11%, while the NASDAQ Composite returned (1.80)% over the same period. However modest these returns may appear, when viewed in isolation, the annual changes in these primary indexes fail to accurately express the high levels of market volatility experienced episodically over the year. This volatility, and the reaction to it by investors, resulted in a year in which we believe business fundamentals were largely overlooked in terms of security price fluctuations. As such, the Funds suffered and experienced (No-Load Class) returns of (14.27)% in the Paradigm Fund, (13.65)% in the Small Cap Opportunities Fund, (7.85)% in the Market Opportunities Fund, 5.11% in the Medical Fund, (1.98)% in the Internet Fund, 0.24% in the Multi-Disciplinary Fund, (15.41)% in the Global Fund and (4.88)% in the Water Infrastructure Fund.

Over the past year, more than in any year in recent memory, markets were focused on political and macro events, while largely disregarding business fundamentals. Concerns over European nations’ sovereign debts escalated and resulted in the dismissal of incumbent leaders in Greece, Italy and Spain. Markets surged and retreated with increasing vigor depending on the latest statement, press release or rumor regarding the stability of the euro zone. Meanwhile, political gridlock in the United States took the country to the brink of default as the debt ceiling debate lasted into the final hours. Even these concerns pale in comparison to the political instability and upheaval experienced in various Middle Eastern countries including Libya and Egypt. While it is no surprise that investors and corporate leaders were generally hesitant to invest amid such uncertainty, we view the enthusiasm with which investors have embraced passive investment strategies (namely index ETFs) to re-enter the market as very surprising. This behavior, coupled with more generalized risk aversion, has resulted in a divergence between the prices of so called “popular” securities and “unpopular” securities. The investment team at Horizon Kinetics has historically benefitted from sourcing investment ideas from unique, idiosyncratic businesses. However, 2011 has left us with very disappointing price performance in such businesses, though even greater future potential.

The performance of the Paradigm Fund can be attributed in part to allocations to “owner-operator” businesses. These are companies where active management has a sizeable equity investment alongside shareholders. Owner-operator businesses can be found in every country and every sector, thus our exposures

5

are not concentrated based on this emphasis. The Paradigm Fund suffered the largest negative contribution for the year from allocations to owner-operator holding companies and real estate companies based in the Unites States. Each of these businesses has a strong financial position and high net asset value relative to market capitalization. These underperforming businesses are scarcely included in any major indexes (hence ETFs) and are trading at a discount to or near book value. The Fund benefitted from unique, company specific allocations to energy, consumer and financial service companies.

The Small Cap Opportunities Fund also sources a variety of investment ideas from owner-operator businesses. Counter-intuitively, included in the largest performance detractors for the Fund are a real estate development company and a holding company that are traded at amongst the largest discounts to fair value that we have come across. Additional allocations in the Fund to businesses exposed to mainland China hampered performance as share prices slid in reaction to government tightening measures. We believe that substantial returns will be had in Hong Kong and China as this cycle concludes. An allocation to a gold royalty company was amongst the highest contributions, followed by a unique land trust and an ETF provider. These companies each continue to represent distinctive business models at attractive valuations.

The Market Opportunities Fund suffered as a result of exposures to the controversial financial sector in 2011. Market participants did little to differentiate between high risk, leveraged financial companies loathed by the media and the high return on equity, low debt load businesses owned by the Fund. We believe that these companies have considerable barriers to entry and long-term predictable cash flows with minimal reinvestment needs. Thus, the various exchanges, asset managers and banks that contributed negatively to the Fund over the past year are priced at increasingly attractive levels. The capital markets related companies that contributed positively to performance include financial service companies that serve niche markets and provide value added services.

Performance of the Internet Fund was primarily driven by media content and media distribution companies. Advances in the speed and capacity of the internet over the past several years have resulted

6

in the ability to stream high definition video programming via a land based or wireless internet connection. As a result of this, the Fund increased investments in media companies that own the content that will be distributed to consumers. On an aggregate basis, this allocation detracted from performance for the year; however, included in this allocation was a company that was among the Fund’s top contributors. Media distribution companies experienced a volatile year, with satellite communications detracting from the Fund while web based search businesses in Asia contributed to performance.

The Global Fund maintained an overweight positioning in Asian securities through much of the year, resulting in a large portion of the negative Fund performance. In particular, consumer and financial businesses in Japan experienced sharp declines in share price, which more than offset the appreciation of the Japanese yen. Exposure to global gaming companies also negatively impacted performance despite the fact that these companies reported strong sequential revenues. In spite of broader declines across Asian financial companies and European industrials, Fund allocations to these areas produced positive contributions to performance.

The Multi-Disciplinary Fund succeeded in providing the downside protection that it was designed to achieve. However, despite high premiums embedded in the options prices of many portfolio companies, our value oriented investment philosophy suffered in 2011. Company specific options in consumer discretionary, financial and international businesses led to the Fund returning less than we anticipated. However, the Fund is now positioned with option premiums that are higher yet, despite more attractive values (share prices).

Various components of the medical field experienced strong investment returns for 2011 led by major pharmaceutical companies. The Medical Fund was overweight biotechnology companies, which included both the Funds’ top and bottom contributors for the year. Top detractors include a U.S. based biotechnology company involved in the research and development of cancer treatments, while top contributors included a U.S. based biotechnology company dedicated to the treatment of severe neurological diseases. We continue to view many investment opportunities as very attractive despite continued uncertainty regarding government regulations and federal spending.

7

Performance of the Water Infrastructure Fund was disappointing relative to S&P 500 in 2011; however, it was strong when compared to various water indexes and water related ETFs. The Fund approached 2011 with a risk averse stance and utilized a put writing strategy similar to that of the Multi-Disciplinary Fund. Water utility companies created a performance drag on the Fund while water environmental service and pump companies contributed positively.

Peter B. Doyle

Chief Investment Strategist

8

Disclosure

This material is intended to be reviewed in conjunction with a current prospectus, which includes all fees and expenses that apply to a continued investment program, as well as information regarding the risk factors, policies and objectives of the Funds. Read it carefully before investing.

Mutual Fund investing involves risk. Principal loss is possible. Because The Internet Fund, The Medical Fund and The Water Infrastructure Fund invest in a single industry or geographic region, their shares are subject to a higher degree of risk than funds with a higher level of diversification. Internet and biotechnology stocks are subject to a rate of change in technology, obsolescence and competition that is generally higher than that of other industries and have experienced extreme price and volume fluctuations. International investing [for The Global Fund, The Water Infrastructure Fund, The Paradigm Fund, The Market Opportunities Fund, The Small Cap Opportunities Fund and The Internet Fund] presents special risks including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Accordingly, the share price for these Funds is expected to be more volatile than that of a U.S.-only fund. Past performance is no guarantee of future performance.

Because smaller companies [for The Global Fund, The Small Cap Opportunities Fund and the Water Infrastructure Fund] often have narrower markets and limited financial resources, they present more risk than larger, more well established, companies.

Non-investment grade debt securities [for all Funds], i.e., junk bonds, are subject to greater credit risk, price volatility and risk of loss than investment grade securities. Further, options contain special risks including the imperfect correlation between the value of the option and the value of the underlying asset. Investments [for the Multi-Disciplinary Fund] in futures, swaps and other derivative instruments may result in loss as derivative instruments may be illiquid, difficult to price and leveraged so that small changes may produce disproportionate losses to the Fund. To the extent the Funds segregate assets to cover derivative positions,

9

they may impair their ability to meet current obligations, to honor requests for redemption and to manage the Funds in a manner consistent with their respective investment objectives. Purchasing and writing put and call options and, in particular, writing “uncovered” options are highly specialized activities that entail greater than ordinary investment risk.

As non-diversified Funds, the value of Fund shares may fluctuate more than shares invested in a broader range of industries and companies.

Unlike other investment companies that directly acquire and manage their own portfolios of securities, The Kinetics Mutual Funds pursue their investment objectives by investing all of their investable assets in a corresponding portfolio series of Kinetics Portfolios Trust.

The information concerning the Funds included in the shareholder report contains certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

The Nasdaq Composite (NASDAQ) and the Standard & Poor’s 500 Index (S&P 500) each represent an unmanaged, broad-basket of stocks. They are typically used as a proxy for overall market performance.

Distributor: Kinetics Funds Distributor LLC is not an affiliate of Kinetics Mutual Funds, Inc. Kinetics Funds Distributor LLC is an affiliate of Kinetics Asset Management LLC Investment Adviser to Kinetics Mutual Funds, Inc.

For more information, log onto www.kineticsfunds.com.

January 1, 2012 — Kinetics Asset Management LLC

10

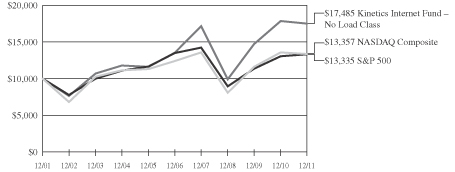

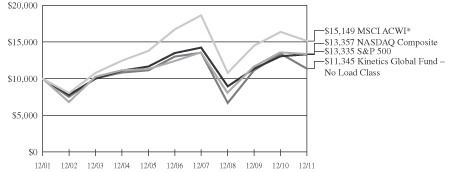

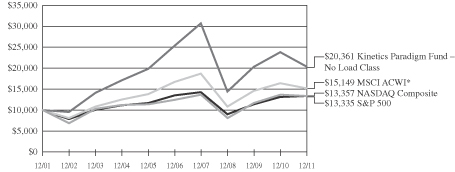

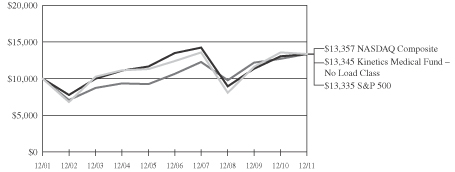

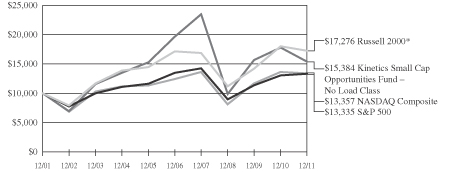

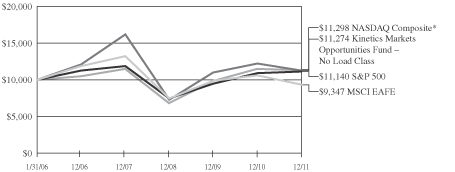

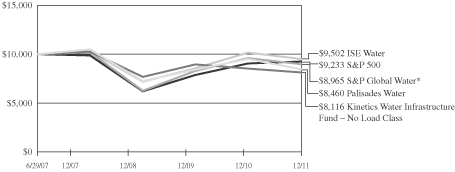

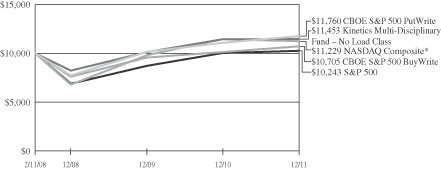

How a $10,000 Investment Has Grown:

The charts show the growth of a $10,000 investment in the Feeder Funds as compared to the performance of two or more representative market indices. The tables below the charts show the average annual total returns on an investment over various periods. Returns for periods greater than one year are average annual total returns. The annual returns assume the reinvestment of all dividends and distributions, however, the graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is not predictive of future performance. Current performance may be lower or higher than the returns quoted below. The performance data reflects voluntary fee waivers and expense reimbursements made by the Adviser and the returns would have been lower if these waivers and expense reimbursements were not in effect. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original costs.

S&P 500 Index — The S&P 500 Index is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. The S&P 500 is unmanaged and includes the reinvestment of dividends and does not reflect the payments of transaction costs and advisory fees associated with an investment in the Funds. The securities that comprise the S&P 500 may differ substantially from the securities in the Funds��� portfolios. It is not possible to directly invest in an index.

NASDAQ Composite Index — The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ stocks. The NASDAQ Composite is unmanaged and does not include the reinvestment of dividends and does not reflect the payment of transaction costs or advisory fees associated with an investment in the Funds. The securities that comprise the NASDAQ Composite may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index.

CBOE S&P 500 BuyWrite Index (BXM) — The CBOE S&P 500 BuyWrite Index (BXM) is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index. The securities that comprise the CBOE S&P 500 BuyWrite Index may differ substantially from the securities in The Multi-Disciplinary Fund’s portfolio. It is not possible to directly invest in an index.

CBOE S&P 500 PutWrite Index (PUT) — The CBOE S&P 500 Put-Write Index (PUT) is a benchmark index designed to track the performance of a

11

passive program that sells near-term, at-the-money S&P 500 Index puts. The securities that comprise the CBOE S&P 500 Put-Write Index may differ substantially from the securities in The Multi-Disciplinary Fund’s portfolio. It is not possible to directly invest in an index.

MSCI ACWI Index — The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices

MSCI EAFE Index — The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

RUSSELL 2000 Index — The Russell 2000 Index is is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe

ISE Water Index — The ISE Water Index includes companies engaged in water distribution, water filtration, flow technology, and other water solutions.

Palisades Water Index — The Palisades Water Index is a modified equal-dollar weighted index comprised of companies publicly traded in the United States that are positioned to benefit significantly from the escalating global demand for water and the ecological imperative of sustainable water resource governance. Accordingly, the Index serves as a proxy for measuring the increasing value of water resulting from the impact of temporal and spatial scarcity on the relationship between human health, ecological sustainability and economic growth.

S&P Global Water Index — The S&P Global Water Index is comprised of fifty of the largest publicly traded companies in water-related businesses that meet specific investability requirements. The index is designed to provide liquid exposure to the leading publicly listed companies in the global water industry, from both developed markets and emerging markets. The securities that comprise the S&P Global Water Index may differ substantially from the securities in The Water Infrastructure Fund’s portfolio. It is not possible to directly invest in an index.

12

The Internet Fund

December 31, 2001 — December 31, 2011

| Ended 12/31/2011 | ||||||||||||||||||||||||

| No Load Class | Advisor Class A (No Load) | Advisor Class A (Load Adjusted)(1) | Advisor Class C | S&P 500 | NASDAQ Composite | |||||||||||||||||||

One Year | –1.98 | % | –2.20 | % | –7.82 | % | –2.67 | % | 2.11 | % | –1.80 | % | ||||||||||||

Five Years | 5.28 | % | 5.16 | % | 3.92 | % | N/A | –0.25 | % | 1.52 | % | |||||||||||||

Ten Years | 5.75 | % | 5.45 | % | 4.83 | % | N/A | 2.92 | % | 2.94 | % | |||||||||||||

Since Inception | 14.31 | % | N/A | N/A | N/A | 5.70 | % | 5.03 | % | |||||||||||||||

Since Inception Advisor Class A | N/A | 4.34 | % | 3.77 | % | N/A | 2.13 | % | 2.34 | % | ||||||||||||||

Since Inception Advisor Class C (2/16/07) | N/A | N/A | N/A | 4.34 | % | –0.84 | % | 0.88 | % | |||||||||||||||

| (1) | Reflects front-end sales charge of 5.75%. |

| Returns | for periods greater than one year are average annual total returns. |

13

The Global Fund

December 31, 2001 — December 31, 2011

| Ended 12/31/2011 | ||||||||||||||||||||||||||||

| No Load Class | Advisor Class A (No Load) | Advisor Class A | Advisor Class C | S&P 500 | MSCI | NASDAQ Composite | ||||||||||||||||||||||

One Year | –15.41 | % | –15.59 | % | –20.52 | % | –15.94 | % | 2.11 | % | –7.35 | % | –1.80 | % | ||||||||||||||

Five Years | –2.69 | % | N/A | N/A | N/A | –0.25 | % | –1.93 | % | 1.52 | % | |||||||||||||||||

Ten Years | 1.27 | % | N/A | N/A | N/A | 2.92 | % | 4.24 | % | 2.94 | % | |||||||||||||||||

Since Inception | –5.81 | % | N/A | N/A | �� | N/A | 0.55 | % | 0.71 | % | –3.65 | % | ||||||||||||||||

Since Inception | N/A | –3.01 | % | –4.59 | % | N/A | –1.24 | % | –5.44 | % | 0.97 | % | ||||||||||||||||

Since Inception | N/A | N/A | N/A | –3.64 | % | –1.24 | % | –5.44 | % | 0.97 | % | |||||||||||||||||

| (1) | Reflects front-end sales charge of 5.75%. |

Returns for periods greater than one year are average annual total returns.

| * | Effective April 30, 2011, the MSCI ACWI Index replaced the NASDAQ Composite Index as a more appropriate comparative benchmark for The Global Fund. |

14

The Paradigm Fund

December 31, 2001 — December 31, 2011

| Ended 12/31/2011 | ||||||||||||||||||||||||||||||||

| No Load Class | Advisor Class A (No Load) | Advisor Adjusted)(1) | Advisor Class C | Institutional Class | S&P 500 | MSCI ACWI* | NASDAQ Composite | |||||||||||||||||||||||||

One Year | –14.27 | % | –14.49 | % | –19.41 | % | –14.90 | % | –14.13 | % | 2.11 | % | –7.35 | % | –1.80 | % | ||||||||||||||||

Five Years | –4.25 | % | –4.49 | % | –5.61 | % | –4.98 | % | –4.07 | % | –0.25 | % | –1.93 | % | 1.52 | % | ||||||||||||||||

Ten Years | 7.37 | % | 7.07 | % | 6.43 | % | N/A | N/A | 2.92 | % | 4.24 | % | 2.94 | % | ||||||||||||||||||

Since Inception | 6.63 | % | N/A | N/A | N/A | N/A | 0.55 | % | 0.71 | % | –3.65 | % | ||||||||||||||||||||

Since Inception Advisor Class A (4/26/01) | N/A | 6.76 | % | 6.17 | % | N/A | N/A | 2.13 | % | 2.96 | % | 2.34 | % | |||||||||||||||||||

Since Inception Advisor Class C (6/28/02) | N/A | N/A | N/A | 6.86 | % | N/A | 4.61 | % | 5.42 | % | 6.25 | % | ||||||||||||||||||||

Since Inception Institutional Class | N/A | N/A | N/A | N/A | 2.38 | % | 2.85 | % | 3.13 | % | 3.50 | % | ||||||||||||||||||||

| (1) | Reflects front-end sales charge of 5.75%. |

Returns for periods greater than one year are average annual total returns.

| * | Effective April 30, 2011, the MSCI ACWI Index replaced the NASDAQ Composite Index as a more appropriate comparative benchmark for The Paradigm Fund. |

15

The Medical Fund

December 31, 2001 — December 31, 2011

| Ended 12/31/2011 | ||||||||||||||||||||||||

| No Load Class | Advisor Class A (No Load) | Advisor Class A (Load Adjusted)(1) | Advisor Class C | S&P 500 | NASDAQ Composite | |||||||||||||||||||

One Year | 5.11 | % | 4.79 | % | –1.22 | % | 4.32 | % | 2.11 | % | –1.80 | % | ||||||||||||

Five Years | 4.63 | % | 4.40 | % | 3.17 | % | N/A | –0.25 | % | 1.52 | % | |||||||||||||

Ten Years | 2.93 | % | 2.63 | % | 2.02 | % | N/A | 2.92 | % | 2.94 | % | |||||||||||||

Since Inception | 7.46 | % | N/A | N/A | N/A | 1.68 | % | –0.43 | % | |||||||||||||||

Since Inception | N/A | 2.35 | % | 1.79 | % | N/A | 2.13 | % | 2.34 | % | ||||||||||||||

Since Inception | N/A | N/A | N/A | 3.00 | % | –0.84 | % | 0.88 | % | |||||||||||||||

| (1) | Reflects front-end sales charge of 5.75%. |

Returns for periods greater than one year are average annual total returns.

16

The Small Cap Opportunities Fund

December 31, 2001 — December 31, 2011

| Ended 12/31/2011 | ||||||||||||||||||||||||||||||||

| No Load Class | Advisor Class A (No Load) | Advisor Class A (Load Adjusted)(1) | Advisor Class C | Institutional Class | S&P 500 | Russell 2000* | NASDAQ Composite | |||||||||||||||||||||||||

One Year | –13.65 | % | –13.85 | % | –18.80 | % | –14.29 | % | –13.51 | % | 2.11 | % | –4.18 | % | –1.80 | % | ||||||||||||||||

Five Years | –4.76 | % | –5.00 | % | –6.12 | % | N/A | –4.58 | % | –0.25 | % | 0.15 | % | 1.52 | % | |||||||||||||||||

Ten Years | 4.40 | % | 4.15 | % | 3.54 | % | N/A | N/A | 2.92 | % | 5.62 | % | 2.94 | % | ||||||||||||||||||

Since Inception | 7.05 | % | N/A | N/A | N/A | N/A | 0.61 | % | 3.93 | % | –4.73 | % | ||||||||||||||||||||

Since Inception Advisor Class A (12/31/01) | N/A | 4.15 | % | 3.54 | % | N/A | N/A | 2.92 | % | 5.62 | % | 2.94 | % | |||||||||||||||||||

Since Inception Advisor Class C (2/16/07) | N/A | N/A | N/A | –6.93 | % | N/A | –0.84 | % | –0.65 | % | 0.88 | % | ||||||||||||||||||||

Since Inception Institutional Class (8/12/05) | N/A | N/A | N/A | N/A | 0.76 | % | 2.47 | % | 3.19 | % | 3.00 | % | ||||||||||||||||||||

| (1) | Reflects front-end sales charge of 5.75%. |

Returns for periods greater than one year are average annual total returns.

| * | Effective April 30, 2011, the Russell 2000 Index replaced the NASDAQ Composite Index as a more appropriate comparative benchmark for The Small Cap Opportunities Fund. |

17

The Market Opportunities Fund

January 31, 2006 — December 31, 2011

| Ended 12/31/2011 | ||||||||||||||||||||||||||||||||

| No Load Class | Advisor Class A (No Load) | Advisor Class A (Load Adjusted)(1) | Advisor Class C | Institutional Class | S&P 500 | MSCI EAFE | NASDAQ Composite* | |||||||||||||||||||||||||

One Year | –7.85 | % | –8.08 | –13.38 | % | –8.51 | % | –7.71 | % | 2.11 | % | –12.14 | % | –1.80 | % | |||||||||||||||||

Five Years | –1.38 | % | –1.65 | % | –2.80 | % | N/A | N/A | –0.25 | % | –4.72 | % | 1.52 | % | ||||||||||||||||||

Since Inception | 2.05 | % | N/A | N/A | N/A | N/A | 1.84 | % | –1.14 | % | 2.08 | % | ||||||||||||||||||||

Since Inception Advisor Class A (1/31/06) | N/A | 1.79 | % | 0.77 | % | N/A | N/A | 1.84 | % | –1.14 | % | 2.08 | % | |||||||||||||||||||

Since Inception Advisor Class C (2/16/07) | N/A | N/A | N/A | –3.65 | % | N/A | –0.84 | % | –5.66 | % | 0.88 | % | ||||||||||||||||||||

Since Inception Institutional Class (5/19/08) | N/A | N/A | N/A | N/A | –5.16 | % | –1.24 | % | –9.03 | % | 0.97 | % | ||||||||||||||||||||

| (1) | Reflects front-end sales charge of 5.75%. |

Returns for periods greater than one year are average annual total returns.

| * | Effective December 31, 2011, the NASDAQ Composite Index is no longer an appropriate comparative benchmark for The Market Opportunities Fund. |

18

The Water Infrastructure Fund

June 29, 2007 — December 31, 2011

| Ended 12/31/2011 | ||||||||||||||||||||||||||||||||||||

| No Load Class | Advisor Class A (No Load) | Advisor Class A (Load Adjusted)(1) | Advisor Class C | Institutional Class | S&P 500 | ISE Water | Palisades | S&P Global Water* | ||||||||||||||||||||||||||||

One Year | –4.88 | % | –5.08 | % | –10.55 | % | –5.51 | % | –4.43 | % | 2.11 | % | –6.27 | % | –10.94 | –6.74 | % | |||||||||||||||||||

Since Inception | –4.52 | % | N/A | N/A | N/A | N/A | –1.75 | % | –1.13 | % | –3.64 | % | –2.39 | % | ||||||||||||||||||||||

Since Inception Advisor Class A (6/29/07) | N/A | –4.74 | % | –5.98 | % | N/A | N/A | –1.75 | % | –1.13 | % | –3.64 | % | –2.39 | % | |||||||||||||||||||||

Since Inception Advisor Class C (6/29/07) | N/A | N/A | N/A | –5.20 | % | N/A | –1.75 | % | –1.13 | % | –3.64 | % | –2.39 | % | ||||||||||||||||||||||

Since Inception Institutional | N/A | N/A | N/A | N/A | –4.23 | % | –1.75 | % | –1.13 | % | –3.64 | % | –2.39 | % | ||||||||||||||||||||||

| (1) | Reflects front-end sales charge of 5.75%. |

Returns for periods greater than one year are average annual total returns.

| * | Effective December 31, 2011, the ISE Water Index and the Palisades Water Index replaced the S&P Global Water Index as more appropriate comparative benchmarks for The Water Infrastructure Fund. |

19

The Multi-Disciplinary Fund

February 11, 2008 — December 31, 2011

| Ended 12/31/2011 | ||||||||||||||||||||||||||||||||||||

| No Load Class | Advisor Class A (No Load) | Advisor Class A (Load Adjusted)(1) | Advisor Class C | Institutional Class | S&P 500 | CBOE S&P 500 BuyWrite | CBOE S&P 500 Put/Write | NASDAQ Composite* | ||||||||||||||||||||||||||||

One Year | 0.24 | % | –0.01 | % | –5.79 | % | –0.49 | % | 0.42 | % | 2.11 | % | 5.72 | % | 6.17 | % | –1.80 | % | ||||||||||||||||||

Since Inception No Load Class (2/11/08) | 3.55 | % | N/A | N/A | N/A | N/A | 0.62 | % | 1.77 | % | 4.26 | % | 3.03 | % | ||||||||||||||||||||||

Since Inception Advisor Class A (2/11/08) | N/A | 3.28 | % | 1.72 | % | N/A | N/A | 0.62 | % | 1.77 | % | 4.26 | % | 3.03 | % | |||||||||||||||||||||

Since Inception Advisor Class C (2/11/08) | N/A | N/A | N/A | 2.78 | % | N/A | 0.62 | % | 1.77 | % | 4.26 | % | 3.03 | % | ||||||||||||||||||||||

Since Inception Institutional Class | N/A | N/A | N/A | N/A | 3.74 | % | 0.62 | % | 1.77 | % | 4.26 | % | 3.03 | % | ||||||||||||||||||||||

| (1) | Reflects front-end sales charge of 5.75%. |

Returns for periods greater than one year are average annual total returns.

| * | Effective December 31, 2011, the NASDAQ Composite Index is no longer an appropriate comparative benchmark for The Multi-Disciplinary Fund. |

20

Shareholders incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvestments of dividends or other distributions made by a Fund, redemption fees, and exchange fees, and (2), ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. This example is intended to help investors understand the ongoing costs (in dollars) of investing in the Feeder Funds, as defined below, and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on July 1, 2011 and held for the entire period from July 1, 2011 to December 31, 2011.

Actual Expenses

The first line and second line items of the table below provide information about actual account values and actual expenses before and after expense reimbursement. Unlike other mutual funds that directly acquire and manage their own portfolio securities, each Feeder Fund invests all or generally all of its investable assets in a corresponding series of The Kinetics Portfolios Trust (each, a “Master Portfolio”, and together the “Master Portfolios”), a separately registered investment company. The Master Portfolio, in turn, invests in securities. With this type of organization, expenses can accrue specifically to the Master Portfolio or the Feeder Fund or both. The Adviser for the Master Portfolios has directed a certain amount of the Master Portfolio’s trades to brokers believed to provide the best execution and, as a result, the Master Portfolios have generated direct brokerage credits to reduce certain service provider fees. Each Feeder Fund records its proportionate share of the Master Portfolio’s expenses, including directed brokerage credits, on a daily basis. Any expense reductions include Fund-specific expenses as well as the expenses allocated from the Master Portfolio.

The Feeder Funds will charge shareholder fees for outgoing wire transfers, returned checks, and exchanges executed by telephone between the Feeder Fund and any other series of Kinetics Mutual Funds, Inc. The Feeder Funds’ transfer agent charges a $5.00 transaction fee to shareholder accounts for telephone exchanges between any two series of Kinetics Mutual Funds, Inc. The Feeder Funds’ transfer agent does not charge a transaction fee for written exchange requests. IRA accounts are assessed a $15.00 annual fee. Finally, as a disincentive to market-timing transactions, the Feeder Funds will assess a 2.00% fee on the redemption or exchange of Fund shares held for less than 30 days. These fees will be paid to the Feeder Funds to help offset transaction

21

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Expense Example — (Continued)

December 31, 2011

costs. The Feeder Funds reserve the right to waive the redemption fee, subject to their sole discretion, in instances deemed not to be disadvantageous to the Feeder Funds or shareholders as described in the Feeder Funds’ prospectus.

You may use the information provided in the first line, together with the amounts you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The third and fourth line items of the table below provide information about hypothetical account values and hypothetical expenses before and after expense reimbursements based on the Feeder Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which are not the Feeder Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses one paid for the period. You may use this information to compare the ongoing costs of investing in the Feeder Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight one’s ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help one determine the relative total costs of owning different funds. In if these transactional costs were included, one’s costs would have been higher.

22

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Expense Example — (Continued)

December 31, 2011

| Beginning Account Value (7/1/11) | Ending Account Value (12/31/11) | Annualized Expense Ratio | Expenses Paid During Period* (7/1/11 to 12/31/11) | |||||||||||||

The Internet Fund | ||||||||||||||||

No Load Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 883.10 | 1.94 | % | $ | 9.21 | ||||||||

No Load Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 883.10 | 1.89 | % | $ | 8.97 | ||||||||

No Load Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,015.42 | 1.94 | % | $ | 9.86 | ||||||||

No Load Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

Advisor Class A Actual — before expense reimbursement | $ | 1,000.00 | $ | 882.10 | 2.19 | % | $ | 10.39 | ||||||||

Advisor Class A Actual — after expense reimbursement | $ | 1,000.00 | $ | 882.10 | 2.14 | % | $ | 10.15 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,014.16 | 2.19 | % | $ | 11.12 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,014.41 | 2.14 | % | $ | 10.87 | ||||||||

Advisor Class C Actual — before expense reimbursement | $ | 1,000.00 | $ | 880.10 | 2.69 | % | $ | 12.75 | ||||||||

Advisor Class C Actual — after expense reimbursement | $ | 1,000.00 | $ | 880.10 | 2.64 | % | $ | 12.51 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | �� | $ | 1,011.64 | 2.69 | % | $ | 13.64 | |||||||

Advisor Class C Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,011.89 | 2.64 | % | $ | 13.39 | ||||||||

The Global Fund | ||||||||||||||||

No Load Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 862.50 | 4.01 | % | $ | 18.83 | ||||||||

No Load Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 862.50 | 1.39 | % | $ | 6.53 | ||||||||

No Load Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,004.99 | 4.01 | % | $ | 20.27 | ||||||||

No Load Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,018.19 | 1.39 | % | $ | 7.07 | ||||||||

Advisor Class A Actual — before expense reimbursement | $ | 1,000.00 | $ | 862.50 | 4.26 | % | $ | 20.00 | ||||||||

23

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Expense Example — (Continued)

December 31, 2011

| Beginning Account Value (7/1/11) | Ending Account Value (12/31/11) | Annualized Expense Ratio | Expenses Paid During Period* (7/1/11 to 12/31/11) | |||||||||||||

Advisor Class A Actual — after expense reimbursement | $ | 1,000.00 | $ | 862.50 | 1.64 | % | $ | 7.70 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,003.72 | 4.26 | % | $ | 21.52 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

Advisor Class C Actual — before expense reimbursement | $ | 1,000.00 | $ | 861.00 | 4.76 | % | $ | 22.33 | ||||||||

Advisor Class C Actual — after expense reimbursement | $ | 1,000.00 | $ | 861.00 | 2.14 | % | $ | 10.04 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,001.20 | 4.76 | % | $ | 24.01 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,014.41 | 2.14 | % | $ | 10.87 | ||||||||

The Paradigm Fund | ||||||||||||||||

No Load Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 845.00 | 1.78 | % | $ | 8.28 | ||||||||

No Load Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 845.00 | 1.64 | % | $ | 7.63 | ||||||||

No Load Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,016.23 | 1.78 | % | $ | 9.05 | ||||||||

No Load Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

Advisor Class A Actual — before expense reimbursement | $ | 1,000.00 | $ | 843.70 | 2.03 | % | $ | 9.43 | ||||||||

Advisor Class A Actual — after expense reimbursement | $ | 1,000.00 | $ | 843.70 | 1.89 | % | $ | 8.78 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,014.97 | 2.03 | % | $ | 10.31 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

Advisor Class C Actual — before expense reimbursement | $ | 1,000.00 | $ | 841.50 | 2.53 | % | $ | 11.74 | ||||||||

Advisor Class C Actual — after expense reimbursement | $ | 1,000.00 | $ | 841.50 | 2.39 | % | $ | 11.09 | ||||||||

24

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Expense Example — (Continued)

December 31, 2011

| Beginning Account Value (7/1/11) | Ending Account Value (12/31/11) | Annualized Expense Ratio | Expenses Paid During Period* (7/1/11 to 12/31/11) | |||||||||||||

Advisor Class C Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,012.45 | 2.53 | % | $ | 12.83 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

Institutional Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 845.60 | 1.73 | % | $ | 8.05 | ||||||||

Institutional Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 845.60 | 1.44 | % | $ | 6.70 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,016.48 | 1.73 | % | $ | 8.79 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

The Medical Fund | ||||||||||||||||

No Load Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 907.60 | 2.07 | % | $ | 9.95 | ||||||||

No Load Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 907.60 | 1.39 | % | $ | 6.68 | ||||||||

No Load Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,014.76 | 2.07 | % | $ | 10.51 | ||||||||

No Load Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,018.19 | 1.39 | % | $ | 7.07 | ||||||||

Advisor Class A Actual — before expense reimbursement | $ | 1,000.00 | $ | 906.60 | 2.32 | % | $ | 11.15 | ||||||||

Advisor Class A Actual — after expense reimbursement | $ | 1,000.00 | $ | 906.60 | 1.64 | % | $ | 7.88 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,013.50 | 2.32 | % | $ | 11.77 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

Advisor Class C Actual — before expense reimbursement | $ | 1,000.00 | $ | 904.40 | 2.82 | % | $ | 13.54 | ||||||||

Advisor Class C Actual — after expense reimbursement | $ | 1,000.00 | $ | 904.40 | 2.14 | % | $ | 10.27 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,010.98 | 2.82 | % | $ | 14.29 | ||||||||

25

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Expense Example — (Continued)

December 31, 2011

| Beginning Account Value (7/1/11) | Ending Account Value (12/31/11) | Annualized Expense Ratio | Expenses Paid During Period* (7/1/11 to 12/31/11) | |||||||||||||

Advisor Class C Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,014.41 | 2.14 | % | $ | 10.87 | ||||||||

The Small Cap Opportunities Fund | ||||||||||||||||

No Load Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 869.10 | 1.91 | % | $ | 9.00 | ||||||||

No Load Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 869.10 | 1.64 | % | $ | 7.73 | ||||||||

No Load Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,015.57 | 1.91 | % | $ | 9.70 | ||||||||

No Load Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

Advisor Class A Actual — before expense reimbursement | $ | 1,000.00 | $ | 867.90 | 2.16 | % | $ | 10.17 | ||||||||

Advisor Class A Actual — after expense reimbursement | $ | 1,000.00 | $ | 867.90 | 1.89 | % | $ | 8.90 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) —before expense reimbursement | $ | 1,000.00 | $ | 1,014.31 | 2.16 | % | $ | 10.97 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

Advisor Class C Actual — before expense reimbursement | $ | 1,000.00 | $ | 865.90 | 2.66 | % | $ | 12.51 | ||||||||

Advisor Class C Actual — after expense reimbursement | $ | 1,000.00 | $ | 865.90 | 2.39 | % | $ | 11.24 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,011.79 | 2.66 | % | $ | 13.49 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

Institutional Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 869.70 | 1.86 | % | $ | 8.77 | ||||||||

Institutional Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 869.70 | 1.44 | % | $ | 6.79 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,015.82 | 1.86 | % | $ | 9.45 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

26

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Expense Example — (Continued)

December 31, 2011

| Beginning Account Value (7/1/11) | Ending Account Value (12/31/11) | Annualized Expense Ratio | Expenses Paid During Period* (7/1/11 to 12/31/11) | |||||||||||||

The Market Opportunities Fund | ||||||||||||||||

No Load Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 895.00 | 1.92 | % | $ | 9.17 | ||||||||

No Load Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 895.00 | 1.64 | % | $ | 7.83 | ||||||||

No Load Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,015.52 | 1.92 | % | $ | 9.75 | ||||||||

No Load Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

Advisor Class A Actual — before expense reimbursement | $ | 1,000.00 | $ | 893.40 | 2.17 | % | $ | 10.36 | ||||||||

Advisor Class A Actual — after expense reimbursement | $ | 1,000.00 | $ | 893.40 | 1.89 | % | $ | 9.02 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,014.26 | 2.17 | % | $ | 11.02 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

Advisor Class C Actual — before expense reimbursement | $ | 1,000.00 | $ | 891.20 | 2.67 | % | $ | 12.73 | ||||||||

Advisor Class C Actual — after expense reimbursement | $ | 1,000.00 | $ | 891.20 | 2.39 | % | $ | 11.39 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,011.74 | 2.67 | % | $ | 13.54 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

Institutional Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 895.60 | 1.88 | % | $ | 8.98 | ||||||||

Institutional Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 895.60 | 1.44 | % | $ | 6.88 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,015.72 | 1.88 | % | $ | 9.55 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

The Water Infrastructure Fund | ||||||||||||||||

No Load Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 928.00 | 2.32 | % | $ | 11.27 | ||||||||

27

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Expense Example — (Continued)

December 31, 2011

| Beginning Account Value (7/1/11) | Ending Account Value (12/31/11) | Annualized Expense Ratio | Expenses Paid During Period* (7/1/11 to 12/31/11) | |||||||||||||

No Load Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 928.00 | 1.64 | % | $ | 7.97 | ||||||||

No Load Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,013.50 | 2.32 | % | $ | 11.77 | ||||||||

No Load Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,016.93 | 1.64 | % | $ | 8.34 | ||||||||

Advisor Class A Actual — before expense reimbursement | $ | 1,000.00 | $ | 927.00 | 2.57 | % | $ | 12.48 | ||||||||

Advisor Class A Actual — after expense reimbursement | $ | 1,000.00 | $ | 927.00 | 1.89 | % | $ | 9.18 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,012.24 | 2.57 | % | $ | 13.03 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,015.67 | 1.89 | % | $ | 9.60 | ||||||||

Advisor Class C Actual — before expense reimbursement | $ | 1,000.00 | $ | 924.80 | 3.07 | % | $ | 14.89 | ||||||||

Advisor Class C Actual — after expense reimbursement | $ | 1,000.00 | $ | 924.80 | 2.39 | % | $ | 11.60 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,009.72 | 3.07 | % | $ | 15.55 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,013.15 | 2.39 | % | $ | 12.13 | ||||||||

Institutional Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 928.20 | 2.27 | % | $ | 11.03 | ||||||||

Institutional Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 928.20 | 1.44 | % | $ | 7.00 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,013.76 | 2.27 | % | $ | 11.52 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,017.94 | 1.44 | % | $ | 7.32 | ||||||||

The Multi-Disciplinary Fund | ||||||||||||||||

No Load Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 941.30 | 2.25 | % | $ | 11.01 | ||||||||

No Load Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 941.30 | 1.49 | % | $ | 7.29 | ||||||||

28

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Expense Example — (Continued)

December 31, 2011

| Beginning Account Value (7/1/11) | Ending Account Value (12/31/11) | Annualized Expense Ratio | Expenses Paid During Period* (7/1/11 to 12/31/11) | |||||||||||||

No Load Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,013.86 | 2.25 | % | $ | 11.42 | ||||||||

No Load Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,017.69 | 1.49 | % | $ | 7.58 | ||||||||

Advisor Class A Actual — before expense reimbursement | $ | 1,000.00 | $ | 940.40 | 2.50 | % | $ | 12.23 | ||||||||

Advisor Class A Actual — after expense reimbursement | $ | 1,000.00 | $ | 940.40 | 1.74 | % | $ | 8.51 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,012.60 | 2.50 | % | $ | 12.68 | ||||||||

Advisor Class A Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,016.43 | 1.74 | % | $ | 8.84 | ||||||||

Advisor Class C Actual — before expense reimbursement | $ | 1,000.00 | $ | 937.60 | 3.00 | % | $ | 14.65 | ||||||||

Advisor Class C Actual — after expense reimbursement | $ | 1,000.00 | $ | 937.60 | 2.24 | % | $ | 10.94 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,010.08 | 3.00 | % | $ | 15.20 | ||||||||

Advisor Class C Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,013.91 | 2.24 | % | $ | 11.37 | ||||||||

Institutional Class Actual — before expense reimbursement | $ | 1,000.00 | $ | 942.40 | 2.20 | % | $ | 10.77 | ||||||||

Institutional Class Actual — after expense reimbursement | $ | 1,000.00 | $ | 942.40 | 1.29 | % | $ | 6.32 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — before expense reimbursement | $ | 1,000.00 | $ | 1,014.11 | 2.20 | % | $ | 11.17 | ||||||||

Institutional Class Hypothetical (5% return before expenses) — after expense reimbursement | $ | 1,000.00 | $ | 1,018.70 | 1.29 | % | $ | 6.56 | ||||||||

| Note: | Each Feeder Fund records its proportionate share of the respective Master Portfolio’s expenses, including directed brokerage credits, on a daily basis. Any expense reductions includes Feeder Fund-specific expenses as well as the expenses allocated for the Master Portfolio. |

| * | Expenses are equal to the Feeder Fund’s annualzied expense ratio before expense reimbursement and after expense reimbursement multiplied by the average account value over the period, multiplied by 184/365. |

29

| The Internet Fund | The Global Fund | |||||||

ASSETS: | ||||||||

Investments in the Master Portfolio, at value* | $ | 105,045,572 | $ | 4,115,533 | ||||

Receivable from Adviser | 3,576 | 16,860 | ||||||

Receivable for Master Portfolio interest sold | 18,832 | 127,671 | ||||||

Receivable for Fund shares sold | 47,458 | 3,300 | ||||||

Prepaid expenses and other assets | 24,456 | 16,944 | ||||||

|

|

|

| |||||

Total Assets | 105,139,894 | 4,280,308 | ||||||

|

|

|

| |||||

LIABILITIES: | ||||||||

Payable to Directors and Officers | 2,272 | 91 | ||||||

Payable for Fund shares repurchased | 66,290 | 130,971 | ||||||

Payable for shareholder servicing fees | 22,262 | 922 | ||||||

Payable for distribution fees | 392 | 153 | ||||||

Accrued expenses and other liabilities | 68,556 | 14,238 | ||||||

|

|

|

| |||||

Total Liabilities | 159,772 | 146,375 | ||||||

|

|

|

| |||||

Net Assets | $ | 104,980,122 | $ | 4,133,933 | ||||

|

|

|

| |||||

NET ASSETS CONSIST OF: | ||||||||

Paid in capital | $ | 84,171,801 | $ | 4,983,145 | ||||

Accumulated net investment loss | (76,659 | ) | (14,339 | ) | ||||

Accumulated net realized gain (loss) on investments and foreign currency | 2,848,315 | (461,715 | ) | |||||

Net unrealized appreciation (depreciation) on: | ||||||||

Investments and foreign currency | 18,036,665 | (373,158 | ) | |||||

|

|

|

| |||||

Net Assets | $ | 104,980,122 | $ | 4,133,933 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | ||||||||

Net Assets | $ | 103,827,873 | $ | 3,631,076 | ||||

Shares outstanding | 2,863,528 | 925,864 | ||||||

Net asset value per share (offering price and redemption price) | $ | 36.26 | $ | 3.92 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | ||||||||

Net Assets | $ | 1,049,692 | $ | 392,189 | ||||

Shares outstanding | 29,460 | �� | 99,998 | |||||

Net asset value per share (redemption price) | $ | 35.63 | $ | 3.92 | ||||

|

|

|

| |||||

Offering price per share ($35.63 divided by .9425 and $3.92 divided by .9425) | $ | 37.80 | $ | 4.16 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | ||||||||

Net Assets | $ | 102,557 | $ | 110,668 | ||||

Shares outstanding | 2,966 | 28,613 | ||||||

Net asset value per share (offering price and redemption price) | $ | 34.58 | $ | 3.87 | ||||

|

|

|

| |||||

* Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Fund’s financial statements. |

| |||||||

The accompanying notes are an integral part of these financial statements.

30

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Statements of Assets & Liabilities — (Continued)

December 31, 2011

| The Paradigm Fund | The Medical Fund | |||||||

ASSETS: | ||||||||

Investments in the Master Portfolio, at value* | $ | 814,738,481 | $ | 20,189,751 | ||||

Receivable from Adviser | 113,776 | 16,972 | ||||||

Receivable for Master Portfolio interest sold | 1,903,347 | 18,548 | ||||||

Receivable for Fund shares sold | 607,442 | 8,899 | ||||||

Prepaid expenses and other assets | 87,012 | 18,437 | ||||||

|

|

|

| |||||

Total Assets | 817,450,058 | 20,252,607 | ||||||

|

|

|

| |||||

LIABILITIES: | ||||||||

Payable to Directors and Officers | 21,060 | 567 | ||||||

Payable for Fund shares repurchased | 2,510,789 | 27,447 | ||||||

Payable for shareholder servicing fees | 156,464 | 5,099 | ||||||

Payable for distribution fees | 161,707 | 1,561 | ||||||

Accrued expenses and other liabilities | 289,136 | 20,951 | ||||||

|

|

|

| |||||

Total Liabilities | 3,139,156 | 55,625 | ||||||

|

|

|

| |||||

Net Assets | $ | 814,310,902 | $ | 20,196,982 | ||||

|

|

|

| |||||

NET ASSETS CONSIST OF: | ||||||||

Paid in capital | $ | 1,724,451,476 | $ | 20,739,576 | ||||

Accumulated net investment income (loss) | (13,044,636 | ) | 27,668 | |||||

Accumulated net realized gain (loss) on investments and foreign currency | (813,392,233 | ) | 1,458,411 | |||||

Net unrealized depreciation on: | ||||||||

Investments and foreign currency | (83,703,705 | ) | (2,028,673 | ) | ||||

|

|

|

| |||||

Net Assets | $ | 814,310,902 | $ | 20,196,982 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | ||||||||

Net Assets | $ | 430,528,413 | $ | 16,376,374 | ||||

Shares outstanding | 21,737,811 | 873,430 | ||||||

Net asset value per share (offering price and redemption price) | $ | 19.81 | $ | 18.75 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | ||||||||

Net Assets | $ | 146,939,353 | $ | 3,240,272 | ||||

Shares outstanding | 7,556,429 | 177,158 | ||||||

Net asset value per share (redemption price) | $ | 19.45 | $ | 18.29 | ||||

|

|

|

| |||||

Offering price per share ($19.45 divided by .9425 and $18.29 divided by .9425) | $ | 20.64 | $ | 19.41 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | ||||||||

Net Assets | $ | 102,533,855 | $ | 580,336 | ||||

Shares outstanding | 5,466,256 | 31,978 | ||||||

Net asset value per share (offering price and redemption price) | $ | 18.76 | $ | 18.15 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS: | ||||||||

Net Assets | $ | 134,309,281 | N/A | |||||

Shares outstanding | 6,788,251 | N/A | ||||||

Net asset value per share (offering price and redemption price) | $ | 19.79 | N/A | |||||

|

|

|

| |||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Fund’s financial statements. |

The accompanying notes are an integral part of these financial statements.

31

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Statements of Assets & Liabilities — (Continued)

December 31, 2011

| The Small Cap Opportunities Fund | The Market Opportunities Fund | |||||||

ASSETS: | ||||||||

Investments in the Master Portfolio, at value* | $ | 83,008,769 | $ | 43,205,029 | ||||

Receivable from Adviser | 20,074 | 10,515 | ||||||

Receivable for Master Portfolio interest sold | 298,875 | – | ||||||

Receivable for Fund shares sold | 10,553 | 240,572 | ||||||

Prepaid expenses and other assets | 26,164 | 29,357 | ||||||

|

|

|

| |||||

Total Assets | 83,364,435 | 43,485,473 | ||||||

|

|

|

| |||||

LIABILITIES: | ||||||||

Payable for Master Portfolio interest purchased | – | 58,800 | ||||||

Payable to Directors and Officers | 2,173 | 953 | ||||||

Payable for Fund shares repurchased | 309,427 | 179,772 | ||||||

Payable for shareholder servicing fees | 17,342 | 9,208 | ||||||

Payable for distribution fees | 4,863 | 5,442 | ||||||

Accrued expenses and other liabilities | 45,112 | 22,270 | ||||||

|

|

|

| |||||

Total Liabilities | 378,917 | 276,445 | ||||||

|

|

|

| |||||

Net Assets | $ | 82,985,518 | $ | 43,209,028 | ||||

|

|

|

| |||||

NET ASSETS CONSIST OF: | ||||||||

Paid in capital | $ | 255,149,084 | $ | 76,845,891 | ||||

Accumulated net investment loss | (810,693 | ) | (2,147,929 | ) | ||||

Accumulated net realized loss on investments and foreign currency | (168,967,873 | ) | (33,146,160 | ) | ||||

Net unrealized appreciation (depreciation) on: | ||||||||

Investments and foreign currency | (2,385,000 | ) | 1,657,226 | |||||

|

|

|

| |||||

Net Assets | $ | 82,985,518 | $ | 43,209,028 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | ||||||||

Net Assets | $ | 67,797,750 | $ | 30,190,688 | ||||

Shares outstanding | 3,414,671 | 2,889,986 | ||||||

Net asset value per share (offering price and redemption price) | $ | 19.85 | $ | 10.45 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: |

| |||||||

Net Assets | $ | 7,249,668 | $ | 8,599,530 | ||||

Shares outstanding | 370,111 | 824,391 | ||||||

Net asset value per share (redemption price) | $ | 19.59 | $ | 10.43 | ||||

|

|

|

| |||||

Offering price per share ($19.59 divided by .9425 and $10.43 divided by .9425) | $ | 20.79 | $ | 11.07 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: |

| |||||||

Net Assets | $ | 2,440,323 | $ | 4,232,622 | ||||

Shares outstanding | 126,081 | 410,165 | ||||||

Net asset value per share (offering price and redemption price) | $ | 19.36 | $ | 10.32 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS: |

| |||||||

Net Assets | $ | 5,497,777 | $ | 186,188 | ||||

Shares outstanding | 275,804 | 17,792 | ||||||

Net asset value per share (offering price and redemption price) | $ | 19.93 | $ | 10.46 | ||||

|

|

|

| |||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Fund’s financial statements. |

The accompanying notes are an integral part of these financial statements.

32

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Statements of Assets & Liabilities — (Continued)

December 31, 2011

| The Water Infrastructure Fund | The Multi- Fund | |||||||

ASSETS: | ||||||||

Investments in the Master Portfolio, at value* | $ | 13,283,272 | $ | 23,615,085 | ||||

Receivable from Adviser | 9,567 | 12,727 | ||||||

Receivable for Master Portfolio interest sold | 16,735 | 1,735 | ||||||

Receivable for Fund shares sold | 3,614 | 39,283 | ||||||

Prepaid expenses and other assets | 16,827 | 34,460 | ||||||

|

|

|

| |||||

Total Assets | 13,330,015 | 23,703,290 | ||||||

|

|

|

| |||||

LIABILITIES: | ||||||||

Payable to Directors and Officers | 341 | 289 | ||||||

Payable for Fund shares repurchased | 20,349 | 41,018 | ||||||

Payable for shareholder servicing fees | 2,729 | 4,297 | ||||||

Payable for distribution fees | 3,442 | 1,795 | ||||||

Accrued expenses and other liabilities | 17,098 | 17,914 | ||||||

|

|

|

| |||||

Total Liabilities | 43,959 | 65,313 | ||||||

|

|

|

| |||||

Net Assets | $ | 13,286,056 | $ | 23,637,977 | ||||

|

|

|

| |||||

NET ASSETS CONSIST OF: | ||||||||

Paid in capital | $ | 22,676,292 | $ | 24,651,762 | ||||

Accumulated net investment loss | (108,858 | ) | (133,086 | ) | ||||

Accumulated net realized gain (loss) on investments, foreign currency and written option contracts | (8,627,123 | ) | 518,140 | |||||

Net unrealized appreciation (depreciation) on: | ||||||||

Investments and foreign currency | (725,331 | ) | (1,334,490 | ) | ||||

Written option contracts | 71,076 | (64,349 | ) | |||||

|

|

|

| |||||

Net Assets | $ | 13,286,056 | $ | 23,637,977 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: |

| |||||||

Net Assets | $ | 5,613,439 | $ | 13,389,019 | ||||

Shares outstanding | 720,605 | 1,326,698 | ||||||

Net asset value per share (offering price and redemption price) | $ | 7.79 | $ | 10.09 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: |

| |||||||

Net Assets | $ | 4,558,865 | $ | 4,725,528 | ||||

Shares outstanding | 586,256 | 470,035 | ||||||

Net asset value per share (redemption price) | $ | 7.78 | $ | 10.05 | ||||

|

|

|

| |||||

Offering price per share ($7.78 divided by .9425 and $10.05 divided by .9425) | $ | 8.25 | $ | 10.66 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: |

| |||||||

Net Assets | $ | 2,315,804 | $ | 1,645,130 | ||||

Shares outstanding | 301,720 | 164,513 | ||||||

Net asset value per share (offering price and redemption price) | $ | 7.68 | $ | 10.00 | ||||

|

|

|

| |||||

CALCULATION OF NET ASSET VALUE PER SHARE — INSTITUTIONAL CLASS: |

| |||||||

Net Assets | $ | 797,948 | $ | 3,878,300 | ||||

Shares outstanding | 101,659 | 383,178 | ||||||

Net asset value per share (offering price and redemption price) | $ | 7.85 | $ | 10.12 | ||||

|

|

|

| |||||

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio. The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Fund’s financial statements. |

The accompanying notes are an integral part of these financial statements.

33

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

For the Year Ended December 31, 2011

| The Internet Fund | The Global Fund | |||||||

INVESTMENT INCOME (LOSS) ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

Dividends† | $ | 985,114 | $ | 133,750 | ||||

Interest | 165 | 23 | ||||||

Income from securities lending | 116,537 | 11,490 | ||||||

Expenses allocated from Master Portfolio | (1,605,460 | ) | (113,965 | ) | ||||

|

|

|

| |||||

Net investment income (loss) from Master Portfolio | (503,644 | ) | 31,298 | |||||

|

|

|

| |||||

EXPENSES: | ||||||||

Distribution fees — Advisor Class A | 3,268 | 1,940 | ||||||

Distribution fees — Advisor Class C | 1,012 | 647 | ||||||

Shareholder servicing fees — Advisor Class A | 3,268 | 1,940 | ||||||

Shareholder servicing fees — Advisor Class C | 338 | 216 | ||||||

Shareholder servicing fees — No Load Class | 286,584 | 10,679 | ||||||

Transfer agent fees and expenses | 164,978 | 19,503 | ||||||

Reports to shareholders | 67,770 | 3,548 | ||||||

Administration fees | 44,115 | 1,985 | ||||||

Professional fees | 14,948 | 8,579 | ||||||

Directors’ and Officers’ fees and expenses | 9,513 | 405 | ||||||

Registration fees | 44,102 | 41,053 | ||||||

Fund accounting fees | 5,824 | 256 | ||||||

Other expenses | 5,268 | 215 | ||||||

|

|

|

| |||||

Total expenses | 650,988 | 90,966 | ||||||

Less, expense reimbursement | (58,333 | ) | (130,978 | ) | ||||

|

|

|

| |||||

Net expenses | 592,655 | (40,012 | ) | |||||

|

|

|

| |||||

Net investment income (loss) | (1,096,299 | ) | 71,310 | |||||

|

|

|

| |||||

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

Net realized gain (loss) on: | ||||||||

Investments and foreign currency | 27,593,691 | (78,534 | ) | |||||

Net change in unrealized depreciation of: | ||||||||

Investments and foreign currency | (28,535,697 | ) | (940,717 | ) | ||||

|

|

|

| |||||

Net loss on investments | (942,006 | ) | (1,019,251 | ) | ||||

|

|

|

| |||||

Net decrease in net assets resulting from operations | $ | (2,038,305 | ) | $ | (947,941 | ) | ||

|

|

|

| |||||

† Net of Foreign Taxes Withheld of: | $ | 15,002 | $ | 15,117 | ||||

|

|

|

| |||||

The accompanying notes are an integral part of these financial statements.

34

KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS

Statements of Operations — (Continued)

For the Year Ended December 31, 2011

| The Paradigm Fund | The Medical Fund | |||||||

INVESTMENT INCOME ALLOCATED FROM MASTER PORTFOLIOS: | ||||||||

Dividends† | $ | 15,089,535 | $ | 616,665 | ||||

Interest | 368,450 | 125 | ||||||

Income from securities lending | 3,460,690 | 46,480 | ||||||

Expenses allocated from Master Portfolio | (14,865,260 | ) | (410,471 | ) | ||||

|

|

|

| |||||

Net investment income from Master Portfolio | 4,053,415 | 252,799 | ||||||

|

|

|

| |||||

EXPENSES: | ||||||||

Distribution fees — Advisor Class A | 491,316 | 9,949 | ||||||

Distribution fees — Advisor Class C | 1,010,991 | 5,283 | ||||||

Shareholder servicing fees — Advisor Class A | 491,316 | 9,949 | ||||||

Shareholder servicing fees — Advisor Class C | 336,997 | 1,761 | ||||||

Shareholder servicing fees — No Load Class | 1,502,522 | 61,758 | ||||||

Shareholder servicing fees — Institutional Class | 301,806 | – | ||||||

Transfer agent fees and expenses | 577,445 | 31,241 | ||||||

Reports to shareholders | 280,145 | 10,886 | ||||||

Administration fees | 413,148 | 11,021 | ||||||

Professional fees | 115,651 | 8,645 | ||||||

Directors’ and Officers’ fees and expenses | 88,836 | 2,400 | ||||||

Registration fees | 72,047 | 42,772 | ||||||

Fund accounting fees | 54,837 | 1,465 | ||||||

Other expenses | 55,795 | 1,384 | ||||||

|

|

|

| |||||

Total expenses | 5,792,852 | 198,514 | ||||||