UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant §240.14a-12

INTEGER HOLDINGS CORPORATION

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| ☑ | | No fee required. |

| | | |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

| | | | |

| ☐ | | Fee paid previously with preliminary materials. |

| | | | |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

Proxy Statement for

2021 Annual Meeting

of Stockholders

April 5, 2021

Dear Stockholder:

You are cordially invited to attend the 2021 Annual Meeting of Stockholders of Integer Holdings Corporation, which will be held on Wednesday, May 19, 2021 at 8:30 a.m., Central Daylight Time, at 5830 Granite Parkway, Suite 1150, Plano, Texas 75024.

Details of the business to be conducted at the Annual Meeting are given in the enclosed Notice of Annual Meeting and Proxy Statement. Included with the Proxy Statement is a copy of the company’s 2020 Annual Report. We encourage you to read this document. It includes information on the company’s operations, markets and products, as well as the company’s audited consolidated financial statements.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted. We are using the “Notice and Access” (Notice of Internet Availability) method of providing proxy materials to you via the Internet. We believe that this process should provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. We have mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice and Access Letter”) containing instructions on how to access our Proxy Statement and Annual Report and vote electronically on the Internet or by telephone. The Notice and Access Letter also contains instructions on how to receive a paper copy of the proxy materials.

Due to the public health impact of the coronavirus pandemic and to support the health, safety and well-being of our team members and stockholders, we will provide limited seating at the meeting. Attendees will be required to wear a mask, practice social distancing, and follow all CDC protocols.

We look forward to seeing you at the Annual Meeting.

Sincerely,

| | | | | | | | |

| /s/ Bill R. Sanford | |

| Bill R. Sanford | |

| Chairman of the Board | |

| | |

| | |

| /s/ Joseph W. Dziedzic | |

| Joseph W. Dziedzic | |

| President and Chief Executive Officer | |

| | |

INTEGER HOLDINGS CORPORATION

5830 GRANITE PARKWAY, SUITE 1150

PLANO, TEXAS 75024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2021 Annual Meeting of Stockholders of Integer Holdings Corporation will be held at 5830 Granite Parkway, Suite 1150, Plano, Texas 75024 on Wednesday, May 19, 2021 at 8:30 a.m., Central Daylight Time, for the following purposes:

1.To elect 12 directors for a one-year term until their successors have been elected and qualified;

2.To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm for Integer Holdings Corporation for fiscal year 2021;

3.To approve, on an advisory basis, the compensation of our named executive officers;

4.To approve the adoption of the Integer Holdings Corporation 2021 Omnibus Incentive Plan; and

5.To consider and act upon other matters that may properly come before the Annual Meeting and any adjournments thereof.

Stockholders of record at the close of business on March 29, 2021 are entitled to vote at the Annual Meeting.

By Order of the Board of Directors,

| | | | | | | | |

| /s/ Elizabeth K. Giddens | |

| Elizabeth K. Giddens | |

| Senior Vice President, | |

| General Counsel and Corporate Secretary | |

Plano, Texas

April 5, 2021

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THE ANNUAL MEETING. IF YOU RECEIVED A NOTICE AND ACCESS LETTER, YOU CAN VOTE YOUR SHARES BY PROXY VIA INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS FOUND IN THE NOTICE AND ACCESS LETTER. IF YOU RECEIVED PRINTED COPIES OF THE PROXY MATERIALS BY MAIL, YOU CAN VOTE YOUR SHARES BY PROXY VIA INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS FOUND ON THE PROXY CARD OR BY MARKING, SIGNING, DATING AND PROMPTLY RETURNING THE ENCLOSED PROXY CARD IN THE POSTAGE-PAID ENVELOPE FURNISHED FOR THAT PURPOSE. ANY PROXY MAY BE REVOKED IN THE MANNER DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT AT ANY TIME PRIOR TO ITS USE AT THE 2021 ANNUAL MEETING OF STOCKHOLDERS. ANY STOCKHOLDER PRESENT AT THE MEETING MAY WITHDRAW HIS OR HER PROXY AND VOTE PERSONALLY ON ANY MATTER PROPERLY BROUGHT BEFORE THE MEETING.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 19, 2021

INTEGER HOLDINGS CORPORATION’S 2021 PROXY STATEMENT AND 2020 ANNUAL REPORT

ARE AVAILABLE AT www.envisionreports.com/ITGR

TABLE OF CONTENTS

INTEGER HOLDINGS CORPORATION

PROXY STATEMENT

2021 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT SUMMARY

To assist you in reviewing the proxy statement for the 2021 Annual Meeting of Stockholders (the “Annual Meeting”), we call your attention to the following summary information, which highlights certain information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. References in this proxy statement to the “Company,” “we,” or “our” refer to Integer Holdings Corporation. The Notice and Access Letter is first being mailed, and this proxy statement and the accompanying form of proxy are first being made available, to Company’s stockholders beginning on or about April 5, 2021.

Information regarding our Annual Meeting

| | | | | |

| Date and Time | Wednesday, May 19, 2021 at 8:30 a.m., Central Daylight Time |

Place |

Integer Holdings Corporation Corporate Headquarters 5830 Granite Parkway, Suite 1150, Plano, Texas 75024

Due to the public health impact of the coronavirus pandemic and to support the health, safety and well-being of our team members and stockholders, we will provide limited seating at the meeting. Attendees will be required to wear a mask, practice social distancing, and follow all CDC protocols. |

| Record Date | March 29, 2021 |

Voting |

Stockholders as of the Record Date are entitled to vote their shares of common stock, $0.001 par value per share, at the Annual Meeting. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at the Annual Meeting. |

Matters to be Voted on at our Annual Meeting

| | | | | |

Proposal 1 - Election of 12 directors for a term of one year and until their successors have been elected and qualified. For more information, see page 7 of this proxy statement. |

The Board

recommends a

vote “FOR”

each director

nominee |

Proposal 2 - Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2021. For more information, see page 13 of this proxy statement. |

The Board

recommends a

vote “FOR”

Proposal 2 |

Proposal 3 - Non-binding advisory vote on the compensation of the Company’s named executive officers. For more information, see page 14 of this proxy statement. |

The Board

recommends a

vote “FOR”

Proposal 3 |

Proposal 4 - Approve the adoption of the Integer Holdings Corporation 2021 Omnibus Incentive Plan. For more information, see page 14 of this proxy statement. |

The Board

recommends a

vote “FOR”

Proposal 4 |

Performance Highlights for Fiscal Year 2020

Integer is among the world’s largest medical device outsource manufacturing companies, serving the cardiac, neuromodulation, vascular, portable medical, orthopedics and advanced surgical markets. We provide innovative, high-quality medical technologies that enhance the lives of patients worldwide. In addition to medical technologies, we develop batteries for high-end niche applications in energy, military, and environmental markets. Our common stock trades on the New York Stock Exchange under the symbol “ITGR.”

Our Company is on a Journey to Excellence. We began by establishing our portfolio and operational strategy centered around our customers, cost and culture. As part of the development of our strategy, we established three clear financial goals to measure our success: (i) to grow sales 200 basis points faster than the markets we serve; (ii) to deliver profit growth at twice the rate of sales growth; and (iii) to achieve debt leverage of 2.5 - 3.5 times adjusted EBITDA. These three objectives represent the financial measures of success for our strategy.

As we entered 2020, we had accomplished two of our three financial objectives. Earnings grew during 2019 at twice the rate of sales growth, and we managed our business to within the stated debt leverage ratio. However, with the global spread of the novel coronavirus at the beginning of 2020, our momentum shifted as we managed lower sales volume and the safety of our associates. Despite the pandemic, we remained focused on executing our strategy which starts by first taking care of our associates. In addition, we continued to deliver for our customers, adjusted costs with volume and protected our infrastructure in order to continue executing our operational strategic imperatives. We strengthened Integer in 2020 through the following operational initiatives:

•We invested in our culture in connection with our Leadership Capability and Performance Excellence imperatives. We improved our candidate selection process, developed more clear individual development plans and expanded our training programs. Our performance management process has been enhanced with rating tools, and we hired a senior leader to accelerate our diversity and inclusion efforts.

•Our Manufacturing Excellence imperative made significant progress in 2020. We have added LEAN resources and continuous improvement resources across the organization to provide the training and tools that empower our frontline associates.

Through these operational investments, strong expense management and strengthened customer relationships, we are making clear progress on our operational and financial objectives and delivering tangible improvements for our stockholders. Our strong cash flow has enabled us to continue investing in manufacturing capabilities and capacity needed to accelerate top line growth, including the following initiatives:

•We have initiated the next evolution of the Manufacturing Excellence strategy by making transformative investments in a manufacturing execution system and in mechatronics. Through the elimination of manual processes, collection of real time data and use of robotics and vision systems, we expect to drive continuous improvement in our quality and accelerate our operational efficiency to enable sustained manufacturing excellence.

•We have expanded our research and development footprint in 2020 with a new facility in Ireland in support of our customers demand for more product development work. In addition, we have begun the expansion of our implantable battery facility to support the increasing demand for lithium ion batteries.

The improvements and investments we are making in our quality system, service levels and manufacturing efficiency are being recognized by our customers. We now have 70% of our sales under multi-year agreements which demonstrates that we are being rewarded for our performance.

Highlights from our full-year 2020 financial results confirm our strategy is positioning Integer to win in the markets we serve:

•Sales decreased by 15% to $1.073 billion, commensurate with the COVID-related industry decline.

•Generated $181 million of cash flow from operating activities, an increase of 10% as compared to 2019.

•Reduced net total debt by 15%, or $123 million, demonstrating our continued strong focus on cash management.

•Diluted earnings per share from continuing operations decreased to $2.33 per share, from $2.92 per share in 2019.

We believe the Company’s results and investments are evidence we have a clear strategy and the financial health to resume our progress toward our long-term objectives. Our scale and global presence, supported by world-class manufacturing and quality, provides the necessary foundation to achieve our long-term growth strategy.

We are delivering on our commitments, including deleveraging, while investing for growth. As we continue on our Journey to Excellence, we see the potential for significant growth ahead for our associates, our customers, and our stockholders, all while achieving our vision to enhance the lives of patients worldwide by being our customers’ partner of choice for innovative technologies and services.

For further details on our fiscal year 2020 consolidated financial results, please see our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the Securities and Exchange Commission (“SEC”) on February 18, 2021. For more information on how our fiscal year 2020 business performance affected our named executive officers’ compensation, please see our Compensation Discussion and Analysis beginning on page 21 of this proxy statement.

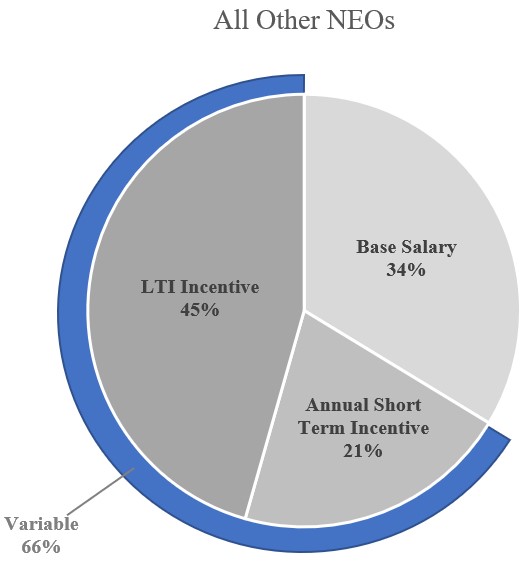

Executive Compensation Highlights

The Company’s compensation program is designed to provide a competitive compensation package that will attract, retain and motivate our executives to drive the Company’s success through high performance and innovation, to link our executives’ compensation to short- and long-term performance of the Company and to align our executives’ compensation with the interests of our stockholders. To do this, we:

•provide our named executive officers with a fixed level of cash compensation in the form of base salary that is consistent with their skill level, experience, knowledge, length of service with the Company and the level of responsibility and complexity of their position, and is generally targeted near the competitive market median of our peer group for base salary for the position;

•provide an annual short-term incentive program cash incentive award with the objective of providing a competitive level of performance-based annual compensation at the target achievement level, with the opportunity for significantly higher incentive compensation if stretch performance is achieved, and with metrics that focus on key measures of success that the executive team is able to impact over an annual timeframe; and

•provide a long-term incentive plan award that is the largest component of our executive officers’ total compensation and is designed to align management’s performance incentives with the interests of our stockholders by linking executive pay to stockholder value creation as the award consists of a combination of performance stock units (“PSUs”) that use organic sales growth as the performance metric (33.3% of the award), performance stock units that use relative total stockholder return versus our peer group as the performance metric (33.3% of the award), and time-based restricted stock units that vest over a three-year period (33.3% of the award).

During 2020, the Compensation and Organization Committee (the “Compensation Committee”) continued its stockholder supported philosophies to ensure alignment to market-based best practices and policies.

We implemented the following changes to our long-term incentive program beginning with the LTI awards granted in 2020:

•Raised the achievement level required to earn target payout for rTSR PSUs awarded from the 50th to the 55th percentile;

•Capped the maximum vesting and payout of rTSR PSUs at 400% of the closing stock price on the grant date; and

•Introduced a six-month holding period on shares received from the vesting of rTSR PSUs.

Below are some highlights of our compensation program:

| | | | | | | | | | | | | | |

| WHAT WE DO | | WHAT WE DON’T DO |

| ü | Align our executive pay with performance, resulting in a substantial portion of executive pay being at-risk and tied to objective performance goals | | û | Multi-year guarantees for salary increases, non-performance based bonuses or equity compensation |

| ü | Long-term incentive award grants that are predominantly performance-based and measured over multi-year periods, and short-term incentive plan awards that are also based on rigorous performance objectives | | û | A high percentage of fixed compensation |

| ü | Hold an annual “say on pay” advisory vote | | û | Tax gross-ups for change-of-control benefits |

| ü | Set multiple challenging performance objectives for our executives | | û | Permit short sales, hedging, or pledging of stock ownership positions by directors, executive officers or associates |

| ü | Stock ownership guidelines for all executives and non-employee directors | | û | Excessive perquisites |

| ü | Caps on director equity awards and fees | | û | Repricing of stock options without stockholder approval |

| ü | Independent compensation consultant engaged by the Compensation Committee | | û | Single-trigger equity acceleration on change-in control |

| ü | Compensation Committee carefully considers annual equity usage and potential dilution in its compensation decisions | | û | Maintain evergreen provisions in long-term incentive plans |

| ü | Annual review and approval of our compensation strategy | | | |

| ü | Compensation Committee conducts an annual risk assessment of our compensation program | | | |

| ü | Require a “double-trigger” for acceleration of severance payments or benefits upon a change of control | | | |

| ü | Clawback policy that permits recoupment of cash and equity awards under specified circumstances | | | |

Last year’s “say-on-pay” vote received the support of approximately 97% of votes cast by our stockholders (excluding abstentions and broker non-votes). Based on the voting results, we believe our overall executive compensation program is aligned with the interests of our stockholders.

Corporate Governance Highlights

We believe that good corporate governance promotes the long-term interests of our stockholders, strengthens Board and management accountability, and leads to better business performance. We are committed to maintaining strong corporate governance practices and will continually evaluate these practices going forward. More information about our corporate governance can be found beginning on page 43 of this proxy statement.

The following table summarizes certain highlights of our governance policies and practices:

| | | | | | | | | | | | | | |

| ü | Unclassified board with annual election of all directors | | ü | Code of conduct applies to all directors, officers, associates and consultants |

| ü | 11 out of 12 director nominees are independent | | ü | Annual say-on-pay vote |

| ü | Audit Committee, Corporate Governance and Nominating Committee and Compensation and Organization Committee composed entirely of independent directors | | ü | Stock ownership guidelines for executive officers and directors |

| ü | Non-executive, independent chairman of the board | | ü | Strategic and risk oversight by full board and committees |

| ü | Independent directors meet regularly without management present | | ü | Stockholders have right to act by written consent |

| ü | No supermajority voting provisions | | ü | No stockholder rights plan (i.e., no “poison pill”) |

| ü | Director attendance at >75% of meetings in 2020 | | ü | Anti-hedging and pledging policy |

| ü | Diverse Board in terms of gender, ethnicity and specific skills and qualifications | | ü | CEO evaluation process |

| ü | Director resignation policy if any director receives a greater number of “withhold” votes than “for” votes | | ü | Annual board and committee evaluations |

| ü | Balance of new and experienced directors | | ü | Annual review of committee charters |

| ü | Board oversight of strategy on corporate social responsibility and sustainability, entity risk management and cybersecurity | | ü | All committee charters address Company’s commitment to diversity and inclusion |

| ü | Engage in stockholder outreach | | | |

As described in greater detail under “Environmental, Social and Governance Matters” beginning on page 51 of this proxy statement, we understand the importance of environmental, social and governance (“ESG”) matters and their impact on our stakeholders and the communities in which we live and work. Through our ESG programs, we are committed to conducting business in a socially and environmentally responsible manner and aligning our ESG goals, programs and initiatives with our corporate strategy.

Our Director Nominees

You are being asked to vote on the director nominees listed below. The chart below summarizes some of the key characteristics of the members of our Board. Detailed information about each director nominee’s background can be found beginning on page 7 of this proxy statement. The Board determined that each of the director nominees, other than Mr. Dziedzic, is independent under the NYSE’s Corporate Governance Listing Standards. The information below regarding the director nominees to be elected at the Annual Meeting is as of April 5, 2021.

Consistent with the Board’s commitment to good corporate governance and Board refreshment to ensure a balanced mix of tenure in its membership, eight of the eleven independent director nominees listed below have joined the Board since the beginning of 2015.

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Primary Occupation | Current Committee Membership | Independent |

| Sheila Antrum | 62 | 2021 | Senior Vice President and Chief Operating Officer at UCSF Health | | Compensation & Organization Corporate Governance & Nominating | ü |

| Pamela G. Bailey | 72 | 2002 | Retired President and Chief Executive Officer, The Grocery Manufacturers Association |

| Corporate Governance & Nominating (Chair) Compensation & Organization | ü |

| Cheryl C. Capps | 59 | 2021 | Senior Vice President and Chief Supply Chain Officer of Corning Inc. |

| Corporate Governance & Nominating Technology | ü |

| Joseph W. Dziedzic | 52 | 2013 | President and Chief Executive Officer, Integer Holdings Corporation | | | |

| James F. Hinrichs | 53 | 2018 | Former Chief Financial Officer of Alere and CareFusion |

| Compensation & Organization (Chair) Audit | ü |

| Jean Hobby | 60 | 2015 | Retired Partner, PricewaterhouseCoopers, LLP | | Audit (Chair) Technology Strategy | ü |

| Tyrone Jeffers | 47 | 2021 | Vice President, Global Manufacturing and Supply Chain of SPX FLOW, Inc. | | Audit Technology Strategy | ü |

| M. Craig Maxwell | 62 | 2015 | Retired Vice President and Chief Technology and Innovation Officer for Parker Hannifin Corporation | | Technology Strategy (Chair) Audit | ü |

| Filippo Passerini | 63 | 2015 | Retired Group President and Chief Information Officer, Procter & Gamble Company |

| Corporate Governance & Nominating Technology Strategy

| ü |

| Bill R. Sanford | 77 | 2000 | Non-Executive Chairman of the Board; Founder and Chairman, Symark LLC |

| Corporate Governance & Nominating | ü |

| Donald J. Spence | 67 | 2016 | Retired President and Chief Executive Officer, Ebb Therapeutics | | Audit Compensation & Organization | ü |

| William B. Summers, Jr. | 70 | 2001 | Retired Chairman and Chief Executive Officer, McDonald Investments Inc. | | Compensation & Organization Corporate Governance & Nominating | ü |

COMPANY PROPOSALS

PROPOSAL 1 – Election of Directors

Shares represented by properly executed proxies will be voted, unless authority is withheld, for the election as directors of the Company of the following 12 persons nominated by the Board of Directors (the “Board”), to hold office until the 2022 Annual Meeting of Stockholders and until their successors have been elected and qualified. Mmes. Antrum and Capps and Mr. Jeffers were each appointed as a director as of February 1, 2021, upon the recommendation of the Corporate Governance and Nominating Committee. Each of the other nominees listed below was elected at the 2020 Annual Meeting of Stockholders.

If any nominee for any reason should become unavailable for election or if an additional vacancy should occur before the election (which is not expected), the shares of common stock, $0.001 par value per share (“common stock”), voted for such nominee and represented by the proxies will be voted for such other person, if any, as the Corporate Governance and Nominating Committee shall designate as a nominee. Information regarding the nominees standing for election as directors is set forth below:

Nominees for Director

| | | | | | | | | | | | | | |

| Sheila Antrum |

| | | | |

| | Ms. Antrum is Senior Vice President and Chief Operating Officer at UCSF Health, the health system and umbrella brand for the clinical enterprise of the University of California San Francisco. She has been with UCSF Health since 2007 and is responsible for ensuring that patient care service operations across the health system align with UCSF Health’s vision and strategic objectives. Ms. Antrum also oversees strategic implementation of finances, quality and safety across the adult inpatient UCSF Health enterprise. As Chief Operating Officer, nursing, clinical services, facilities, supply chain, major construction projects, pharmaceutical, women’s services and perioperative services report to her. Ms. Antrum also serves as President of Adult Services at UCSF Health and has served in that capacity since 2015. From 2007 to 2015 and again from 2019 to 2020, Ms. Antrum served as Chief Nursing and Patient Care Services Officer for UCSF Medical Center and UCSF Benioff Children’s Hospital San Francisco. She was Chief of Ambulatory Operations at University of California San Diego Medical Center from 2003 to 2007, and held various operations, administrative and clinical roles at hospitals in California, Connecticut, Maryland and Pennsylvania. Her more than 40 years of experience delivering medical operations and oversight of clinical services across multiple facilities supports her service as a member of the Board. |

Age: 62 | |

Director Since: 2021 | |

| Integer Committee(s): | |

•Compensation and Organization | |

•Corporate Governance and Nominating | |

| | | | | | | | | | | | | | |

| Pamela G. Bailey |

| | | | |

| | Ms. Bailey served as President and Chief Executive Officer of The Grocery Manufacturers Association (“GMA”), a Washington, D.C. based trade association, from January 2009 until she retired in August 2018. From April 2005 until January 2009, she was President and Chief Executive Officer of the Personal Care Products Council. Ms. Bailey served as President and Chief Executive Officer of the Advanced Medical Technology Association (“AdvaMed”), the world’s largest association representing the medical technology industry, from June 1999 to April 2005. From 1970 to 1999, she served in the White House, the Department of Health and Human Services and other public and private organizations with responsibilities for health care public policy. Ms. Bailey formerly served as a director of American Stores, Inc., Albertsons, Inc., and MedCath Corporation. From 2010 to 2014, Ms. Bailey was appointed by President Obama to serve on the Advisory Committee for Trade Policy and Negotiations, the principal trade advisory committee for the Office of the U.S. Trade Representative. Ms. Bailey’s 40 years of health care public policy experience in both public and private sectors, including service in the White House, the Department of Health and Human Services, and as President and Chief Executive Officer of AdvaMed, gives her a unique perspective on a variety of health care policy and regulatory issues. With over 25 years of chief executive officer experience at GMA, the Personal Care Products Council, AdvaMed, and other Washington-based health care trade associations, Ms. Bailey brings to the Board demonstrated management ability at senior levels. This experience, together with her experience gained as a director of American Stores, Albertsons and MedCath, supports her continued service as a member of the Board. |

Age: 72 | |

Director Since: 2002 | |

| Integer Committee(s): | |

•Compensation and Organization | |

•Corporate Governance and Nominating (Chair) | |

| | | | | | | | | | | | | | |

| Cheryl C. Capps |

| | | | |

| | Ms. Capps serves as Senior Vice President and Chief Supply Chain Officer of Corning Inc., a leading innovator in materials science. Ms. Capps has been with Corning Inc. since 2011 and is responsible for developing capabilities within the global supply management function and across the corporation, to transform supply chain into a competitive advantage. Prior to joining Corning in 2011, Ms. Capps was Senior Vice President, Global Manufacturing and Supply Chain, for ConvaTec, the medical device division of Bristol-Myers Squibb. She had responsibility for global manufacturing, supply chain (sourcing, planning, logistics, distribution, customer service operations), and engineering (packaging, facilities, plant). Ms. Capps joined Bristol-Myers Squibb in 1997 at Zimmer, Inc. as Vice President of Sourcing and Packaging Engineering before moving to the pharmaceutical division where she held numerous leadership roles in sourcing and supply chain. Ms. Capps’ more than 35 years of diverse leadership experience in manufacturing, supply chain, research and development, quality, strategy, business management and ESG matters, supports her service as a member of the Board. |

Age: 59 | |

Director Since: 2021 | |

| Integer Committee(s): | |

•Corporate Governance and Nominating | |

•Technology Strategy | |

| | | | | | | | | | | | | | |

| Joseph W. Dziedzic |

| | | | |

| | Mr. Dziedzic has served as President and Chief Executive Officer of the Company since March 2017. Prior to being appointed as the President and Chief Executive Officer of the Company, Mr. Dziedzic served as Chair of the Audit Committee and a member of the Compensation and Organization Committee. From 2009 to 2016, Mr. Dziedzic was the Executive Vice President and Chief Financial Officer of The Brink’s Company, a global leader in security-related services for banks, retailers and a variety of other commercial and governmental customers. Prior to joining The Brink’s Company in 2009, he had a 20-year career with General Electric, including leadership roles in six different businesses, including General Electric Medical Systems. Mr. Dziedzic has 30 years of experience in global operations and financial matters. The depth and breadth of Mr. Dziedzic’s global operating and financial experience and his role as the Company’s President and Chief Executive Officer support his continued service as a member of the Board. |

Age: 52 | |

Director Since: 2013 | |

| | | | | | | | | | | | | | |

| James F. Hinrichs |

| | | | |

| | Mr. Hinrichs served as Chief Financial Officer of Cibus Ltd., a gene-editing company focused on applications in agriculture from May 2018 until July 2019. From April 2015 until its sale to Abbott Labs in October 2017, he served as Executive Vice President and Chief Financial Officer of Alere, Inc. From December 2010 through March 2015, Mr. Hinrichs served as Chief Financial Officer of CareFusion Corporation prior to its sale to Becton Dickinson. He previously served as CareFusion’s Senior Vice President, Global Customer Support, and as its Senior Vice President, Controller. Prior to joining CareFusion upon its spin-off from Cardinal Health, Inc., Mr. Hinrichs worked for five years at Cardinal Health in various positions including Executive Vice President and Corporate Controller of Cardinal Health and as Executive Vice President and Chief Financial Officer of its Healthcare Supply Chain Services segment. He joined Cardinal Health following more than a decade of finance and marketing roles at Merck & Co. Mr. Hinrichs is a director of Orthofix Medical Inc. and serves as Chair of its Audit and Finance Committee and a member of its Nominating & Governance Committee. Mr. Hinrichs is also a director of Acutus Medical, Inc. and serves as its lead independent director, as Chair of its Audit Committee and as a member of its Compensation Committee. He also serves as a director of Outset Medical, Inc. and as the chair of its Audit Committee. In addition, Mr. Hinrichs serves as a director of Signifier Medical, a privately-held company. Mr. Hinrichs has over 25 years of experience in financial and accounting matters at companies in the medical device and pharmaceutical industries. The depth and breadth of his financial experience support his continued service as a member of the Board. |

Age: 53 | |

Director Since: 2018 | |

| Integer Committee(s): | |

•Audit | |

•Compensation and Organization (Chair) | |

| | | | | | | | | | | | | | |

| Jean Hobby |

| | | | |

| | Ms. Hobby served as a global strategy partner at PricewaterhouseCoopers, LLP from 2013 until she retired in June 2015 following a 33-year career at that firm. Prior to 2013, Ms. Hobby served as PricewaterhouseCoopers’ Technology, Media and Telecom Sector Leader from 2008 to 2013, and as its Chief Financial Officer from 2005 to 2008. She joined PricewaterhouseCoopers in 1983 and became a partner in 1994. Ms. Hobby is also a director of Texas Instruments Incorporated and serves on its Audit Committee, and a director of Hewlett Packard Enterprise Company and serves on its Audit Committee. She is a former director of CA, Inc. The depth and breadth of Ms. Hobby’s nearly 35 years of experience in global operations and financial and accounting matters support her continued service as a member of the Board. |

Age: 60 | |

Director Since: 2015 | |

| Integer Committee(s): | |

•Audit (Chair) | |

•Technology Strategy | |

| | | | | | | | | | | | | | |

| Tyrone Jeffers |

| | | | |

| | Mr. Jeffers serves as Vice President, Global Manufacturing and Supply Chain of SPX FLOW, Inc., a Charlotte, N.C. based company that innovates with customers to help feed and enhance the world by designing, delivering and servicing high value process solutions at the heart of growing and sustaining diverse communities. He has been with SPX Flow since April 2018 and is responsible for the company’s global manufacturing sites, leading an enterprise-wide team in improving operational effectiveness, increasing productivity, delivering on customer commitments and enhancing safety. From 2016 to 2018, Mr. Jeffers served as the Vice President of Infrastructure and Supply Chain Integration for the Baker Hughes and GE merger, responsible for driving cost efficiency and rationalization to deliver over $1 billion in cost synergies. From 1996 until 2016, Mr. Jeffers was with GE, beginning as a manufacturing training program member and spending more than 22 years running factories and supply chains within GE Industrial and GE Oil & Gas. His career includes two years of living in Shanghai, China. One of his career highlights was serving as a global operating leader for GE’s African American Forum. Mr. Jeffers serves as the Chairman of the Engineering Advisory Board at North Carolina Agricultural & Technical State University’s College of Engineering where he partners the university with industry to drive innovation and growth. His more than 25 years of manufacturing and supply chain experience, together with his experience helping organizations navigate cultural change, supports his service as a member of the Board. |

Age: 47 | |

Director Since: 2021 | |

| Integer Committee(s): | |

•Audit | |

•Technology Strategy | |

| | | | | | | | | | | | | | |

| M. Craig Maxwell |

| | | | |

| | Mr. Maxwell was the Vice President and Chief Technology and Innovation Officer for Parker Hannifin Corporation, a Fortune 250 company located in Cleveland, Ohio that is one of the global leaders in motion and control technologies and systems, providing precision-engineered solutions for a variety of mobile, industrial, medical and aerospace markets. Mr. Maxwell was with Parker Hannifin from 1996 until his retirement in 2020, and his responsibilities included leading the company in new and emerging markets and implementing Parker Hannifin’s new product development process. Additionally, Mr. Maxwell was responsible for Parker Hannifin’s technology incubator designed to facilitate cross group opportunities that leveraged the company’s portfolio of products and technology to develop emerging opportunities. As Vice President and Chief Technology and Innovation Officer for Parker Hannifin, Mr. Maxwell led that company’s innovation research that commercializes new technologies. Through this service, he gained management experience at senior levels as well as manufacturing experience. These attributes provide the Company valuable insight into developing new technologies to support future growth and support Mr. Maxwell’s continued service on the Board. |

Age: 62 | |

Director Since: 2015 | |

| Integer Committee(s): | |

•Audit | |

•Technology Strategy (Chair) | |

| | | | | | | | | | | | | | |

| Filippo Passerini |

| | | | |

| | Mr. Passerini served as Procter & Gamble’s Group President, Global Business Services and Chief Information Officer, positions he held from 2004 and 2005, respectively, until his retirement following a 33-year career in business and digital technology. He joined Procter & Gamble in 1981 and held executive positions in Italy, Turkey, United Kingdom, Greece, Latin America and the United States. In these roles, he led Procter & Gamble’s global operations and oversaw technology and business services operations in over 70 countries. Mr. Passerini also led the integration of Procter & Gamble’s IT and Business Services groups. Mr. Passerini is a director of United Rentals, Inc. and serves as Chair of its Strategy Committee and as a member of its Audit Committee. Mr. Passerini brings to the Company over three decades of global experience in digital technology, general management and operations roles. He is globally recognized as a digital technology and shared services thought leader, known for creating new, progressive business models and driving innovation. Mr. Passerini’s extensive background and experience supports his continued service as a member of the Board. |

Age: 63 | |

Director Since: 2015 | |

| Integer Committee(s): | |

•Corporate Governance and Nominating | |

•Technology Strategy | |

| | | | | | | | | | | | | | |

| Bill R. Sanford |

| | | | |

| | Mr. Sanford is Chairman of Symark LLC, a company he founded in 1979 that focuses on the development and commercialization of medical devices, bioscience inventions, nanotechnology, and advanced technology systems, products and services. He has broad experience as a board member and advisor of numerous public and private for-profit companies, not-for-profit organizations, investment limited partnerships and venture capital firms. Mr. Sanford is Executive Founder and retired Chairman, President and Chief Executive Officer of Steris Corporation, retired director of KeyCorp and KeyBank N.A., trustee of Cleveland Clinic, trustee emeritus of Case Western Reserve University, former director of AdvaMed, and a Fellow of the American Institute for Medical and Biological Engineering. Mr. Sanford has extensive public company, merger and acquisition, operations integration, marketing and sales, new venture, turnaround and market development experience. He has led public and private company financings, including initial and secondary public stock offerings, structured debt financings, public stock mergers, private equity and venture capital investments. Mr. Sanford’s background and expertise, including his substantial involvement in the medical device industry, support his continued service as a member of the Board. |

Age: 77 | |

Director Since: 2000 | |

| Integer Committee(s): | |

•Corporate Governance and Nominating | |

| | | | | | | | | | | | | | |

| Donald J. Spence |

| | | | |

| | Donald J. Spence retired in August 2019 as President and Chief Executive Officer of Ebb Therapeutics, a company in the business of developing and marketing medical products for the treatment of insomnia, a position he held since March 2017. He had been Chairman and Chief Executive Officer of Lake Region Medical from 2010 until its acquisition by the Company in October of 2015. From 2005 to 2008, Mr. Spence served as President of the Sleep and Home Respiratory Group for Philips Respironics, and from 2008 to 2010 as Chief Executive Officer of Philips Home Healthcare Solutions. Prior to that, he spent eight years with GKN Sinter Metals, as Senior Vice President for Global Sales and Marketing from 1998 to 2001 and as President from 2001 to 2005. Prior to 1998, Mr. Spence served in a number of roles at BOC Group, plc over a 15-year career, including President, Ohmeda Medical Systems from 1997 to 1998. Mr. Spence is a director of Vapotherm, Inc. and serves as the chair of its Compensation Committee and as a member of its Audit Committee. Mr. Spence also serves as a director of Linguaflex, Inc., which is a privately-held medtech company. Having served in the role of Chairman and Chief Executive Officer of Lake Region Medical and in senior management roles with other companies, Mr. Spence has significant management experience and business understanding of a medical technology and device company. Mr. Spence’s background and expertise in the medical device industry support his continued service as a member of the Board. |

Age: 67 | |

Director Since: 2016 | |

| Integer Committee(s): | |

•Audit | |

•Compensation and Organization | |

| | | | | | | | | | | | | | |

| William B. Summers, Jr. |

| | | | |

| | Mr. Summers retired in June 2006 as Chairman of McDonald Investments Inc., a position he had held since 1998. He also held the additional positions of President from 1989 through 1998 and Chief Executive Officer from 1994 through 1998 of that investment company. Mr. Summers serves on the board of directors of RPM International, Inc. and is a member of its Compensation Committee. He also serves on the advisory boards of Molded Fiberglass Companies and Citymark Capital, is a Life Trustee and past board chair of The Rock and Roll Hall of Fame and Museum, on the board and past board chair of Baldwin-Wallace University, and a board member of the United States Army War College Foundation. Mr. Summers previously served as chair of the board of the National Association of Securities Dealers, as chair of the board of the NASDAQ Stock Market, and as a director of the New York Stock Exchange (“NYSE”). He is a former director of Developers Diversified Realty, Inc., McDonald Investments Inc., Cleveland Indians Baseball Company, and Penton Media Inc. Through his positions with McDonald Investments, Mr. Summers gained leadership experience and extensive knowledge of complex financial and operational issues. In addition, through his service with the NASDAQ Stock Market and NYSE and on the boards of other public companies, Mr. Summers has gained valuable experience dealing with the capital markets, accounting principles and financial reporting rules and regulations, evaluating financial results and generally overseeing the financial reporting process of large public corporations. This experience supports Mr. Summers’ continued service as a member of the Board. |

Age: 70 | |

Director Since: 2001 | |

| Integer Committee(s): | |

•Compensation and Organization | |

•Corporate Governance and Nominating | |

The table below shows some of the relevant qualification, experience and demographics of our directors identified by the Corporate Governance and Nominating Committee.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Qualifications and Experience | |

| Health Care Industry Knowledge | ● | ● | ● | ● | ● |

| | ● | ● | ● | ● | | |

| Executive Leadership | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Finance and Accounting | | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Strategic Planning | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Technology, Innovation and Product Development Leadership | ● | | ● | ● | | ● | | ● | ● | ● | ● | | |

| International/Global Business | | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Public Company Governance | | ● | | ● | ● | ● | | ● | ● | ● | ● | ● | |

| Manufacturing and Operations | ● | | ● | ● | |

| ● | ● | ● | ● | ● | | |

| Risk Management | ● | ● | ● | ● | ● | ● | | ● | ● | ● | ● | ● | |

| Government/Regulatory Policy | ● | ● | | | | ● | | ● | | ● | | ● | |

| Information Technologies | | | | | ● | | | ● | ● | | |

| |

| Human Capital Management | ● | ● | | ● | ● | | ● | ● | ● | ● | ● | ● | |

| | | | | | | | | | | | | |

| |

| Additional Qualifications and Information | |

| Audit Committee Financial Expert | | | | | ● | ● | | | | | | | |

| # of Other Public Company Boards (Current│Past) | 0│0 | 0│3 | 0│0 | 0│0 | 3│0 | 2│1 | 0│0 | 0│0 | 1│1 | 0│3 | 1│0 | 1│2 | |

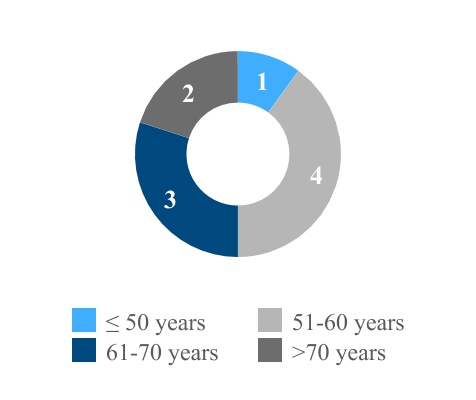

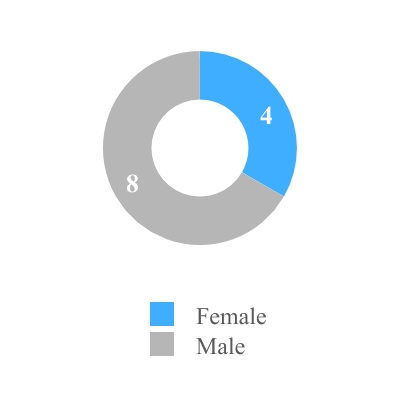

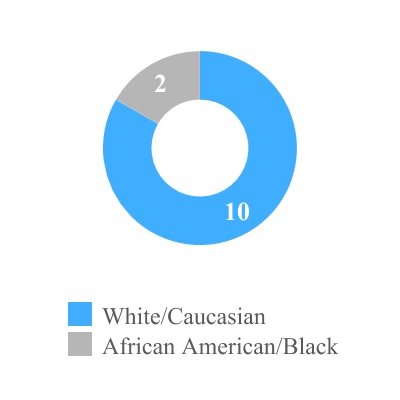

Board Diversity and Composition

In the process of identifying nominees to serve as members of the Board, the Corporate Governance and Nominating Committee strives to ensure that an appropriate balance of specialization, skills, diversity and independence is reflected in the composition and structure of the Board. Since the beginning of 2015, we have refreshed the Board with the addition of eight new independent directors. All of our directors are committed to the Company’s long-term success and creating value for stockholders.

| | | | | | | | |

| Independent Director Tenure (Average 7.8 years) | Director Age | Independence |

| | | | | |

| Gender Diversity* | Racial Diversity* |

* Diversity characteristics based on information self-identified by each director to the Company.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR

PROPOSAL 2 – Ratification of the Appointment of Independent Registered Public Accounting Firm

Deloitte & Touche LLP (“Deloitte & Touche”) has been appointed by the Audit Committee as the Company’s independent registered public accounting firm for fiscal year 2021. Deloitte & Touche has served as the Company’s auditor since 1985. Although stockholder approval is not required, the Company has determined that it is desirable to request that the stockholders ratify the appointment of Deloitte & Touche as the Company’s independent registered public accounting firm for fiscal year 2021. In the event the stockholders fail to ratify the appointment, the Audit Committee will reconsider this appointment and make such a determination as it believes to be in the Company’s best interests. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s best interests. Representatives of Deloitte & Touche are expected to be present at the Annual Meeting. The representatives may, if they wish, make a statement and, it is expected, will be available to respond to appropriate questions.

The following table sets forth the aggregate fees billed by Deloitte & Touche for services provided to the Company during fiscal years 2020 and 2019:

| | | | | | | | | | | | | | | | | | | | |

| | 2020 | | 2019 |

| Audit Fees(1) | $ | 1,913,960 | | | $ | 2,008,510 | |

| Audit-Related Fees(2) | | 38,796 | | | | 33,000 | |

| Total Audit and Audit-Related Fees | | 1,952,756 | | | | 2,041,510 | |

| Tax Fees(3) | | 15,500 | | | | 17,000 | |

| All Other Fees(4) | | — | | | | 35,000 | |

| Total Fees | $ | 1,968,256 | | | $ | 2,093,510 | |

(1)Audit fees include amounts billed by Deloitte & Touche for services rendered for the audit of the Company’s annual consolidated financial statements and for review of the Company’s quarterly condensed consolidated financial statements.

(2)Audit-related fees billed by Deloitte & Touche for the audit of the Integer Holdings Corporation 401(k) Retirement Plan (the “Company 401(k) Plan”).

(3)Represents fees billed by Deloitte & Touche for tax compliance, planning and consulting services.

(4)All other fees represent accounting advisory services provided in 2019 in connection with the Company’s adoption of new authoritative accounting guidance on leases.

Audit Committee Pre-Approval Policy on Audit and Non-Audit Services. As described in the Audit Committee charter, the Audit Committee must review and pre-approve both audit and non-audit services to be provided by the Company’s independent registered public accounting firm (other than with respect to de minimis exceptions permitted by SEC rules). This duty may be delegated to one or more designated members of the Audit Committee with any such pre-approval reported to the Audit Committee at its next regularly scheduled meeting. None of the services described above were performed by Deloitte & Touche under the de minimis exception rule.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2021

PROPOSAL 3 – Advisory Vote on Compensation of the Named Executive Officers

As required pursuant to Section 14A of the Exchange Act of 1934, as amended (the “Exchange Act”), the Company seeks your advisory vote on a resolution to approve the compensation of our named executive officers as disclosed in this proxy statement. Our named executive officers are the Chief Executive Officer, the Chief Financial Officer, and the next three highest paid executive officers. Although your vote is advisory and will not be binding on the Board or the Company, the Board reviews the voting results and takes these results into consideration when making future decisions regarding executive compensation. The next advisory vote on the compensation of our named executive officers will be held at the 2022 Annual Meeting of Stockholders.

The Company’s executive compensation programs have played an important role in our ability to drive financial results and attract and retain a highly experienced, successful management team. We believe that our executive compensation programs are structured to support the Company’s business objectives. We closely monitor the compensation programs and pay levels of executives from companies of similar size and complexity to ensure that our compensation programs are within the norm of a range of market practices. As discussed below under “Compensation Discussion and Analysis,” the Company’s compensation for its named executive officers includes the following elements:

•Long-term equity compensation with performance-based vesting. The most significant elements of the named executive officers’ equity compensation opportunity for 2020 were performance-based awards under the Long-Term Incentive Program for which vesting depends on the Company’s (i) annual sales growth and (ii) total stockholder return relative to its peer group over a three-year period ending in fiscal year 2022.

•Total cash compensation tied to performance. A significant portion of the cash compensation opportunity for the named executive officers is based on the Company’s performance. As such, the cash compensation for the named executive officers has fluctuated from year to year, reflecting the Company’s financial results.

The text of the resolution in respect of Proposal 3 is as follows:

“Resolved, that the stockholders approve, on a non-binding basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement.”

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

PROPOSAL 4 – Approval of Integer Holdings Corporation 2021 Omnibus Incentive Plan

On March 25, 2021, upon the recommendation of the Compensation and Organization Committee (the “Compensation Committee”), our Board adopted the Integer Holdings Corporation 2021 Omnibus Incentive Plan (the “Plan”), subject to approval by our stockholders. The Plan is intended to replace the Company’s existing equity compensation plan – the Greatbatch, Inc. 2016 Stock Incentive Plan (the “2016 Plan”) – which was approved by our stockholders at our 2016 annual meeting of stockholders.

In connection with the design and adoption of the Plan, our Board and Compensation Committee carefully considered our anticipated future equity needs, our historical equity compensation practices and the advice of the Compensation Committee’s independent compensation consultant. The aggregate number of shares being requested for authorization under the Plan is (i) 1,450,000 plus (ii) the total number of shares of our common stock reserved and available for issuance (but not otherwise granted) under the 2016 Plan plus (iii) any shares of our common stock that are subject to awards forfeited, cancelled, expired, terminated or otherwise lapsed or settled in cash, in whole or in part, without the delivery of shares under the 2016 Plan. Each of the Greatbatch, Inc. 2011 Stock Incentive Plan, the Greatbatch, Inc. 2009 Stock Incentive Plan and the Greatbatch, Inc. 2005 Stock Incentive Plan has expired, and no awards are available for issuance under these expired plans.

If the Plan is approved by our stockholders, the Plan will replace the 2016 Plan, and we will cease granting any new awards under the 2016 Plan. If the Plan is not approved by our stockholders, the 2016 Plan will remain in effect in its current form, and we will continue to be able to grant equity incentive awards under the 2016 Plan until its expiration on February 28, 2026. Following the expiration of the 2016 Plan, we will be unable to maintain our current equity grant practices and, therefore, we will be at a significant competitive disadvantage in attracting, retaining and motivating talented individuals who contribute to our success.

Considerations for the Approval the Plan

Corporate Governance Best Practices

The Plan incorporates certain corporate governance best practices to further align our equity compensation program with the interests of our stockholders. The following is a list of some of these best practices, which are intended to protect the interests of our stockholders:

| | | | | | | | |

| ü | Restricted dividends and dividend equivalents on awards. Dividends and dividend equivalents on restricted stock and restricted stock units are subject to the same vesting conditions as the underlying restricted stock or restricted stock unit and are paid only if and when the underlying award vests. Dividend equivalents on awards subject to a performance vesting condition are paid only if and when the underlying award vests. The Plan also prohibits the payment of dividend equivalents on shares subject to outstanding options or SAR awards. |

| | |

| ü | No repricings. Repricing of options and SAR awards is not permitted without stockholder approval, except for adjustments with respect to certain specified extraordinary corporate transactions. |

| | |

| ü | No “reload” options or stock appreciation rights. The Plan does not permit the use of reload options or stock appreciation rights, which provide that the exercise of a stock option or stock appreciation right can automatically trigger the grant of a new stock option or stock appreciation right. |

| | |

| ü | No “liberal” change in control definition. The change in control definition under the Plan is only triggered in those instances where an actual change in control occurs (see the definition set forth in Section 2(l) of the Plan). |

| | |

| ü | No evergreen provision. The Plan does not contain an “evergreen” feature pursuant to which the shares authorized for issuance under the plan can be increased automatically without stockholder approval. |

| | |

| ü | Clawback of awards. The Compensation Committee, or such other committee as designated by the Board, has the authority to subject awards granted under the Plan to any clawback or recoupment policies that the Company has in effect from time to time. All incentive awards, including awards under the Plan, will be subject to our Incentive Compensation Recoupment Policy, as described under “Compensation Discussion and Analysis – Other Features of Our Executive Compensation Program – Compensation Recoupment Policy.” |

| | |

| ü | Share ownership guidelines. Our executive officers (including all of our named executive officers) and directors are subject to share ownership guidelines to ensure that they face the same downside risk and upside potential as our stockholders. For additional details regarding our share ownership guidelines, see “Other Features of our Executive Compensation Program – Stock Ownership Guidelines.” |

| | |

| ü | No tax gross-ups. No participant is entitled under the Plan to any tax gross-up payments for any excise tax pursuant to Sections 280G or 4999 of the Code that may be incurred in connection with awards under the Plan. |

Modest Share Usage

When determining the number of shares authorized for issuance under the Plan, our Board and Compensation Committee carefully considered the potential dilution to our current stockholders as measured by our “burn rate,” “overhang” and projected future share usage needs for the Company to be able to make competitive grants to participants.

Specifically, our Board and the Compensation Committee considered a number of factors, including:

•Burn Rate: Our modest three-year average burn rate of 0.74% demonstrates our sound approach to the grant of equity incentive compensation and our commitment to aligning our equity compensation program with the interests of our stockholders.

•Historical Equity Award Grant Rate. Over the last three fiscal years, the Company has granted awards covering a total of 718,676 shares. The following table sets forth information regarding awards granted and the annualized grant rate for each of the last three fiscal years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year | | Stock Options Granted | | Full-Value Awards Granted | | Weighted Average Shares Outstanding | | Annualized Grant Rate(1) | | |

| 2020 | | — | | 210,390 | | 32,847,000 | | 0.64% | | |

| 2019 | | — | | 166,879 | | 32,627,000 | | 0.51% | | |

| 2018 | | — | | 341,407 | | 32,136,000 | | 1.06% | | |

(1)The annualized grant rate is calculated as of December 31 of each fiscal year by dividing the number of shares subject to awards granted in such fiscal year by the weighted average shares outstanding.

•Overhang: Our Board is committed to limiting stockholder dilution from our equity compensation program. Prior to shareholder approval of this Plan, our overhang is 3.5%. If the Plan is approved by our stockholders, our overhang would be 7.5%. We calculate “overhang” as the total of (a) shares underlying outstanding awards at target plus shares available for issuance for future awards, divided by (b) the total number of shares outstanding, including shares underlying outstanding awards and shares available for issuance under future awards.

Attract and Retain Talent

We grant equity incentive awards to a broad spectrum of our employees, not only executives and named executive officers. Approving the Plan will enable us to continue to recruit, retain and motivate top talent at many levels within the Company necessary to our success.

Summary of the Plan

The following is a summary of the principal features of the Plan. This summary does not purport to be complete and is subject to, and qualified in its entirety by, the Plan. A copy of the Plan has been filed with the SEC with this Proxy Statement as Appendix A.

Purpose

The purpose of the Plan is to motivate and reward those employees and other individuals who are expected to contribute significantly to our success to perform at the highest level and to further our best interests and those of our stockholders.

Eligibility

Our employees, consultants, advisors, other service providers and non-employee directors are eligible to receive awards under the Plan. All employees, non-employee directors, and consultants of the Company are eligible to receive awards under the Plan. However, approximately 180 employees and non-employee directors typically receive awards under the program annually. The basis of participation in the Plan is the Compensation Committee’s decision, in its sole discretion (except with respect to non-employee directors, for whom such awards are determined by our Corporate Governance and Nominating Committee), that an award to an eligible participant will further the Plan’s stated purpose (as described above). In exercising its discretion, the Compensation Committee will consider the recommendations of management and the purpose of the Plan. In a typical year, the Company expects to award long-term incentive and equity retention awards to executives and senior management as well as a select group of other high performing associates.

Authorized Shares

Subject to adjustment (as described below), the number of common shares that may be subject to awards granted under the Plan will equal 1,450,000 shares of common stock plus the number of common shares remaining available for grant under the 2016 Plan as of May 19, 2021, plus any shares of our common stock subject to outstanding awards that are forfeited, cancelled, expired, terminated or otherwise lapsed or settled in cash, in whole or in part, without the delivery of shares under the 2016 Plan. Any shares of our common stock granted between December 31, 2020 through the date of the approval of the Plan will be granted pursuant to the 2016 Plan; any such shares will reduce the number of shares available for issuance under the 2016 Plan and will not again become available for issuance under the Plan (except in the case of forfeited, cancelled, expired, terminated or otherwise lapsed awards or awards settled in cash).

If an award expires or is canceled or forfeited, or is otherwise settled without the issuance of shares, the shares covered by the award will again be available for issuance under the Plan. With respect to full value awards only (e.g., restricted stock, restricted stock units and other stock-based awards), shares surrendered or withheld in payment of taxes related to an award will become available again for issuance under the Plan, but for all other awards (e.g., options, stock appreciate rights), shares surrendered or withheld in payment of taxes related to an award will not become available again for issuance under the Plan. Shares tendered or withheld in payment of an exercise or purchase price will not again be available for issuance under the Plan. Shares underlying replacement awards (i.e., awards granted as replacements for awards granted by a company that we acquire or with which we combine) will not reduce the number of shares available for issuance under the plan.

Individual Limits

Subject to adjustment, the maximum number of shares that may be issued pursuant to incentive stock options is 1,450,000. A participant who is a non-employee director may not receive compensation for any calendar year in excess of $750,000 in the aggregate, including cash payments and awards granted under the Plan.

Administration

The Plan is administered by our Compensation Committee, unless another committee is designated by our Board. As set forth in the Corporate Governance and Nominating Committee’s charter, our Board has designated our Corporate Governance and Nominating Committee to administer awards granted to our non-employee directors. Under their respective charters, both the Compensation Committee and the Corporate Governance and Nominating Committee are required to be comprised of:

•independent directors, within the meaning of and to the extent required (unless controlled company status applies) by applicable rulings and interpretations of the applicable stock market or exchange on which our shares are quoted or traded; and

•non-employee directors within the meaning of Rule 16b-3 under the Exchange Act.

The applicable committee has authority under the Plan to:

•designate participants;

•determine the types of awards to grant, the number of shares to be covered by awards, the terms and conditions of awards, whether awards may be settled or exercised in cash, shares, other awards, other property or net settlement, the circumstances under which awards may be canceled, forfeited or suspended, and whether awards may be deferred automatically or at the election of the holder or the committee;

•amend the terms of any outstanding awards;

•correct any defect, supply any omission or reconcile any inconsistency in the Plan or any award agreement, in the manner and to the extent it shall deem desirable to carry the Plan into effect;

•interpret and administer the plan and any instrument or agreement relating to, or award made under, the Plan; and

•establish, amend, suspend or waive rules and regulations, appoint agents and make any other determination and take any other action that it deems necessary or desirable to administer the plan, in each case, as it deems appropriate for the proper administration of the plan and compliance with applicable requirements.

The committee may delegate the authority to grant awards under the Plan, to the extent permitted by applicable law, to (i) one or more officers of the Company (except that such delegation will not be applicable to any award for a person then covered by Section 16 of the Exchange Act) and (ii) one or more committees of the Board.

Types of Awards

The Plan provides for grants of stock options, SARs, restricted shares, RSUs, performance awards and other stock-based and cash-based awards.

Stock Options. A stock option is a contractual right to purchase shares at a future date at a specified exercise price. The per share exercise price of a stock option (other than a replacement award) will be determined by the committee and may not be less than the closing price of a share on the grant date. The committee will determine the date after which each stock option may be exercised and the expiration date of each option, provided that no option will be exercisable more than ten years after the grant date. Options that are intended to qualify as incentive stock options must meet the requirements of Section 422 of the Code.

SARs. SARs represent a contractual right to receive, in cash or shares, an amount equal to the appreciation of one share from the grant date. Any SAR will be granted subject to the same terms and conditions as apply to stock options.

Restricted Stock. Restricted stock is an award of shares that are subject to restrictions on transfer and a substantial risk of forfeiture.

RSUs. RSUs represent a contractual right to receive a share (or cash in an amount equal to the value of a share) at a future date, subject to specified vesting and other restrictions.

Performance Awards. Performance awards, which may be denominated in cash or shares, will be earned on the satisfaction of performance goals specified by the committee. The committee has authority to specify that any other award granted under the Plan will constitute a performance award by conditioning the exercisability or settlement of the award on the satisfaction of performance goals.

Other Stock-Based Awards. The committee is authorized to grant other stock-based awards, which may be denominated in shares or factors that may influence the value of our shares, including convertible or exchangeable debt securities, other rights convertible or exchangeable into shares, purchase rights for shares, dividend rights or dividend equivalent rights or awards with value and payment contingent on our performance or that of our business units or any other factors that the committee designates.

Other Cash-Based Awards. The committee is authorized to grant other cash-based awards (including cash awarded as a bonus or upon the attainment of specified performance criteria or otherwise as permitted under the Plan), either independently or as an element of or supplement to any other award under the Plan.

Adjustments

In the event the committee determines that, as a result of any dividend or other distribution, recapitalization, stock split, reverse stock split, reorganization, merger, amalgamation, consolidation, split-up, spin-off, combination, repurchase or exchange of shares or other securities, issuance of warrants or other rights to purchase our shares or other securities, issuance of our shares pursuant to the anti-dilution provisions of our securities, or other similar corporate transaction or event affecting our shares, or of changes in applicable laws, regulations or accounting principles, an adjustment is necessary to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan, the committee will adjust equitably any or all of: (i) the number and type of shares or other securities that thereafter may be made the subject of awards, including the aggregate limits under the plan; (ii) the number and type of shares or other securities subject to outstanding awards; (iii) the grant, purchase, exercise or hurdle price for any award or, if deemed appropriate, make provision for a cash payment to the holder of an outstanding award; and (iv) the terms and conditions of any outstanding awards, including the performance criteria of any performance awards.

Termination of Service and Change in Control

Generally, upon a participant’s termination of service, any unvested portion of an award will be forfeited without any consideration to be paid to the participant. In the event of a “change in control” (as defined in the Plan and described below), the committee may, in its sole discretion take any one or more of the following actions with respect to outstanding awards:

•continuation or assumption of the award by the successor or surviving corporation (or its parent);

•substitution or replacement of the award by the successor or surviving corporation (or its parent) with cash, securities, rights or other property to be paid or issued, as the case may be, by the successor or surviving corporation (or a parent or subsidiary thereof) with substantially the same terms and value as the award;

•acceleration of the vesting of the award and the lapse of any restrictions thereon, and in the case of options and SAR awards, acceleration of the right to exercise the award during a specified period (and the termination of such option or SAR award without payment of any consideration therefor to the extent the award is not timely exercised), in each case, either (i) immediately prior to or as of the date of the change in control, (ii) upon a participant’s involuntary termination of employment or service (including a termination of the participant’s employment by us without “cause” or by the participant for “good reason” and/or due to the participant’s death or “disability”, as such terms may be defined in the applicable award agreement and/or the participant’s employment agreement or offer letter, as the case may be) on or within a specified period following such change in control or (iii) upon the failure of the successor or surviving corporation (or its parent) to continue or assume the award;

•in the case of a performance award, determination of the level of attainment of any applicable performance conditions; and

•cancellation of the award in consideration of a payment equal to the value of the award (as determined in the discretion of the committee), with the form, amount and timing of such payment determined by the committee in its sole discretion (subject to the terms of the Plan), provided that the committee may, in its sole discretion, terminate without the payment of any consideration, any options or SAR awards for which the exercise or hurdle price is equal to or exceeds the per share value of the consideration to be paid in the change in control transaction.

Under the Plan, a “change in control” generally means, unless otherwise defined in the participant’s service agreement or award agreement, the occurrence of one or more of the following events:

•any person or entity is (or becomes, during any 12-month period) the beneficial owner of 50% or more of the total voting power of our stock;

•the replacement of more than 50% of our directors during any 12-month period;

•the consummation of our merger, amalgamation or consolidation with any other entity, or the issuance of voting securities in connection with our merger or consolidation with any other entity (unless (i) our voting securities outstanding immediately before such transaction continue to represent at least 50% of the voting power and total fair market value of the stock of the successor or surviving corporation (or its parent) or (ii) the merger or consolidation is effected to implement a recapitalization (or similar transaction) and no person or entity is or becomes the beneficial owner of 50% or more of either our then-outstanding shares or the combined voting power and total fair market value of our then-outstanding voting securities); or

•the sale or disposition of all or substantially all of our assets in which any person or entity acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such person or entity) assets from us that have a total gross fair market value equal to more than 50% of the total gross fair market value of all of our assets immediately prior to such acquisition(s).

Amendment and Termination

Our Board may amend, alter, suspend, discontinue or terminate the Plan, subject to approval of our stockholders if required by the rules of the stock exchange on which our shares are principally traded. The committee may amend, alter, suspend, discontinue or terminate any outstanding award. However, no such board or committee action that would materially adversely affect the rights of a holder of an outstanding award may be taken without the holder’s consent, except (i) to the extent that such action is taken to cause the Plan to comply with applicable law, stock market or exchange rules and regulations or accounting or tax rules and regulations or (ii) to impose any “clawback” or recoupment provisions on any awards in accordance with the terms of the Plan. In addition, the committee may amend the Plan in such manner as may be necessary or desirable to enable the plan to achieve its stated purposes in any jurisdiction in a tax-efficient manner and in compliance with local rules and regulations.

Prohibition on Repricing

Subject to the adjustment provision described above, the committee may not directly or indirectly, through cancellation or regrant or any other method (including through the repurchase of options or SAR awards (that are “out of the money”) for cash and/or other property), reduce, or have the effect of reducing, the exercise or hurdle price of any award established at the time of grant without approval of our stockholders.

Cancellation or “Clawback” of Awards

The committee may, to the extent permitted by applicable law and stock exchange rules or by any of our policies (including our incentive compensation recoupment policy), cancel or require reimbursement of any awards granted, shares issued or cash received upon the vesting, exercise or settlement of any awards granted under the Plan or the sale of shares underlying such awards.

Term