UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| | | | | | | | |

| Filed by a Party other than the Registrant | | ☐ |

Check the appropriate box:

| | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| | |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☒ | | Definitive Proxy Statement |

| | |

| ☐ | | Definitive Additional Materials |

| | |

| ☐ | | Soliciting Material Pursuant §240.14a-12 |

INTEGER HOLDINGS CORPORATION

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| ☒ | | No fee required. |

| | |

| ☐ | | Fee paid previously with preliminary materials. |

| | |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Proxy Statement for

2023 Annual Meeting

of Stockholders

April 10, 2023

Dear Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders of Integer Holdings Corporation, which will be held on Wednesday, May 24, 2023 at 12:30 p.m., Eastern Time, at The Hotel Roanoke & Conference Center, 110 Shenandoah Avenue NE, Roanoke, VA 24016.

Details of the business to be conducted at the Annual Meeting are given in the enclosed Notice of Annual Meeting and Proxy Statement. Included with the Proxy Statement is a copy of the company’s 2022 Annual Report. We encourage you to read this document. It includes information on the company’s operations, markets and products, as well as the company’s audited consolidated financial statements.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted. We are using the “Notice and Access” (Notice of Internet Availability) method of providing proxy materials to you via the Internet. We believe that this process should provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. We have mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice and Access Letter”) containing instructions on how to access our Proxy Statement and Annual Report and vote electronically on the Internet or by telephone. The Notice and Access Letter also contains instructions on how to receive a paper copy of the proxy materials.

We look forward to seeing you at the Annual Meeting.

Sincerely,

| | | | | | | | |

| /s/ Pamela G. Bailey | |

| Pamela G. Bailey | |

| Chair of the Board | |

| | |

| | |

| | |

| /s/ Joseph W. Dziedzic | |

| Joseph W. Dziedzic | |

| President and Chief Executive Officer | |

| | |

INTEGER HOLDINGS CORPORATION

5830 GRANITE PARKWAY, SUITE 1150

PLANO, TEXAS 75024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

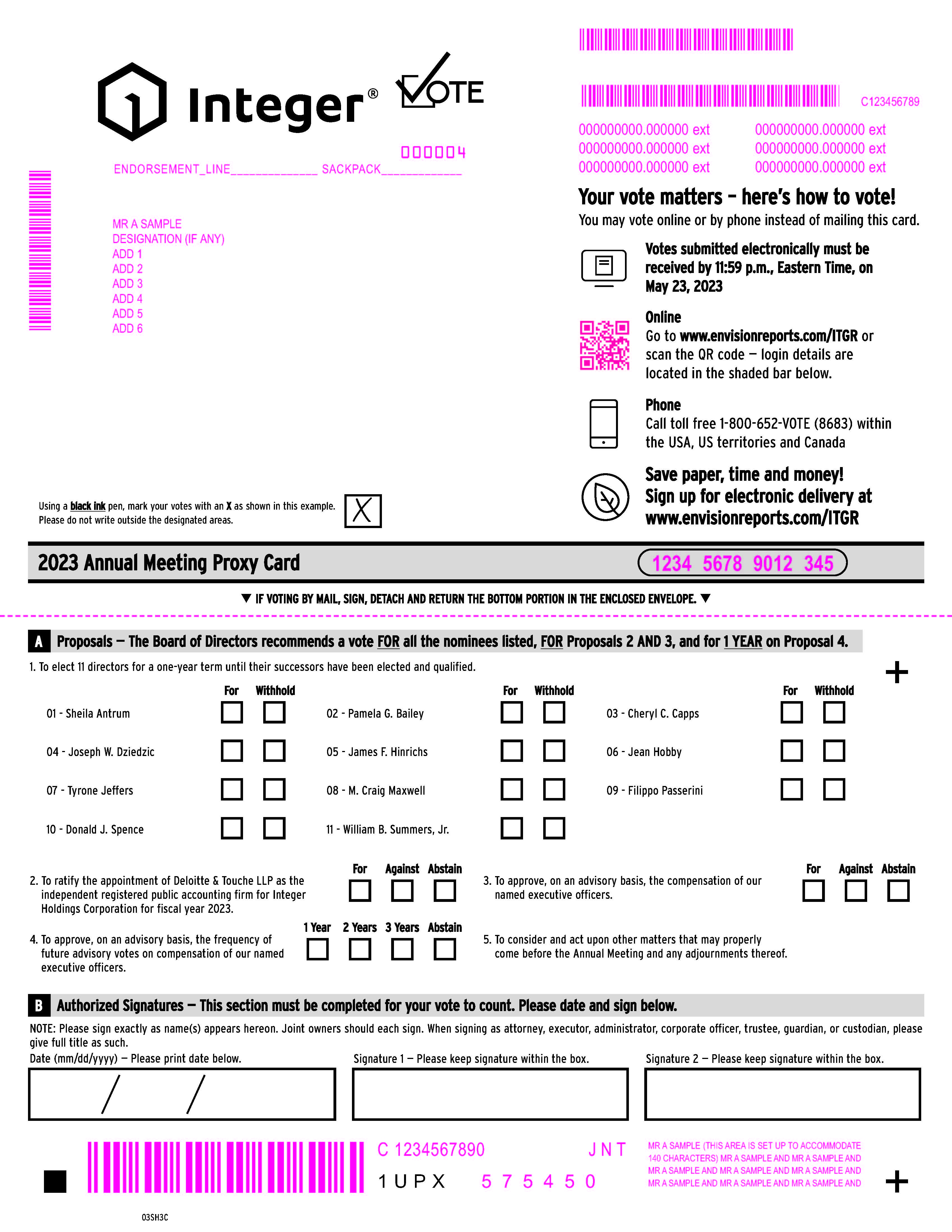

The 2023 Annual Meeting of Stockholders of Integer Holdings Corporation will be held at The Hotel Roanoke & Conference Center, 110 Shenandoah Avenue NE, Roanoke, VA 24016 on Wednesday, May 24, 2023 at 12:30 p.m., Eastern Time, for the following purposes:

1.To elect 11 directors for a one-year term until their successors have been elected and qualified;

2.To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm for Integer Holdings Corporation for fiscal year 2023;

3.To approve, on an advisory basis, the compensation of our named executive officers;

4.To approve, on an advisory basis, the frequency of future advisory votes on compensation of our named executive officers; and

5.To consider and act upon other matters that may properly come before the Annual Meeting and any adjournments thereof.

Stockholders of record at the close of business on March 27, 2023 are entitled to vote at the Annual Meeting.

By Order of the Board of Directors,

| | | | | | | | |

| /s/ McAlister C. Marshall, II | |

| McAlister C. Marshall, II | |

| Senior Vice President,

General Counsel and Corporate Secretary | |

Plano, Texas

April 10, 2023

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THE ANNUAL MEETING. IF YOU RECEIVED A NOTICE AND ACCESS LETTER, YOU CAN VOTE YOUR SHARES BY PROXY VIA INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS FOUND IN THE NOTICE AND ACCESS LETTER. IF YOU RECEIVED PRINTED COPIES OF THE PROXY MATERIALS BY MAIL, YOU CAN VOTE YOUR SHARES BY PROXY VIA INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS FOUND ON THE PROXY CARD OR BY MARKING, SIGNING, DATING AND PROMPTLY RETURNING THE ENCLOSED PROXY CARD IN THE POSTAGE-PAID ENVELOPE FURNISHED FOR THAT PURPOSE. ANY PROXY MAY BE REVOKED IN THE MANNER DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT AT ANY TIME PRIOR TO ITS USE AT THE 2023 ANNUAL MEETING OF STOCKHOLDERS. ANY STOCKHOLDER PRESENT AT THE MEETING MAY WITHDRAW HIS OR HER PROXY AND VOTE PERSONALLY ON ANY MATTER PROPERLY BROUGHT BEFORE THE MEETING.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 24, 2023

INTEGER HOLDINGS CORPORATION’S 2023 PROXY STATEMENT AND 2022 ANNUAL REPORT

ARE AVAILABLE AT www.envisionreports.com/ITGR

TABLE OF CONTENTS

INTEGER HOLDINGS CORPORATION

PROXY STATEMENT

2023 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT SUMMARY

To assist you in reviewing the proxy statement for the 2023 Annual Meeting of Stockholders (the “Annual Meeting”), we call your attention to the following summary information, which highlights certain information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. References in this proxy statement to the “Company,” "Integer," “we,” or “our” refer to Integer Holdings Corporation and references to the "Board" refer to the Company's Board of Directors. The Notice and Access Letter is first being mailed, and this proxy statement and the accompanying form of proxy are first being made available, to Company’s stockholders beginning on or about April 10, 2023. Web links throughout this proxy statement are inactive textual references provided for convenience only, and the content on the referenced websites is not incorporated herein by reference and does not constitute a part of this proxy statement.

Information regarding our Annual Meeting

| | | | | |

| Date and Time | Wednesday, May 24, 2023 at 12:30 p.m., Eastern Time |

Place |

The Hotel Roanoke & Conference Center 110 Shenandoah Avenue NE, Roanoke, VA 24016 |

| Record Date | March 27, 2023 |

Voting |

Stockholders as of the Record Date are entitled to vote their shares of common stock, $0.001 par value per share, at the Annual Meeting. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at the Annual Meeting. |

Matters to be Voted on at our Annual Meeting

| | | | | |

Proposal 1 - Election of 11 directors for a term of one year and until their successors have been elected and qualified. For more information, see page 7 of this proxy statement. |

The Board

recommends a

vote “FOR”

each director

nominee |

Proposal 2 - Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2023. For more information, see page 15 of this proxy statement. |

The Board

recommends a

vote “FOR”

Proposal 2 |

Proposal 3 - Non-binding advisory vote on the compensation of the Company’s named executive officers. For more information, see page 16 of this proxy statement. |

The Board

recommends a

vote “FOR”

Proposal 3 |

Proposal 4 - Non-binding advisory vote on the frequency of future advisory votes on executive compensation. For more information, see page 16 of this proxy statement. |

The Board

recommends a

vote “FOR”

Proposal 4 |

| |

Performance Highlights for Fiscal Year 2022

Integer is one of the largest medical device outsource manufacturers in the world, serving the cardiac, vascular, cardiac rhythm management, neuromodulation and portable medical markets. We provide innovative, high-quality medical technologies that enhance the lives of patients worldwide. We also develop batteries for high-end niche applications in the energy, military and environmental markets. Our common stock trades on the New York Stock Exchange ("NYSE") under the symbol “ITGR.”

Our company is on a Journey to Excellence with a clear strategy to win in the markets we serve and achieve excellence in all that we do. All our actions are anchored to this strategy. We measure progress through three financial goals: (i) to grow sales 200 basis points faster than the markets we serve, (ii) to deliver profit growth at twice the rate of sales growth, and (iii) to achieve debt leverage of 2.5 - 3.5 times adjusted EBITDA.

We achieved two of these financial goals – debt leverage ratio and profit growth – within two years of launching our strategy in 2018. Though our momentum shifted with the macro-environmental challenges of the last few years, we remained focused on delivering for our customers, ensuring the safety of our associates, executing our strategy, and meeting our financial goals.

Our strong cash flow has enabled us to keep our debt leverage ratio within range while investing in research, development and manufacturing capabilities and capacity that support our customers’ efforts to address significant unmet patient needs.

•The nearly complete Oscor integration expands our ability to design develop and manufacture a comprehensive portfolio of highly specialized access products and implantable devices, while adding low-cost manufacturing capacity in the Dominican Republic.

•The more recent acquisition of Aran Biomedical provides development and manufacturing services related to proprietary medical textiles, high precision biomaterial coverings and coatings for the structural heart, vascular and urology markets.

•We are making great progress constructing a new, state-of-the-art development and manufacturing center in Galway, Ireland, to better serve structural heart and neurovascular customers in this important medical device hub.

In addition to adding end-to-end capabilities, platform technologies and capacity to accelerate our growth in the faster growing end markets, we have taken strategic actions to improve profitability and drive excellence across our operations.

•We are making Manufacturing Excellence a competitive advantage through deployment of the Integer Production System, an enterprise-wide structure of standardized systems and processes to deliver world-class operational performance, quality and efficiency across all of our global sites.

•Committed to creating a more inclusive, values-based culture where individual ideas, perspectives and differences are valued, we launched three new Employee Resource Groups and held more than 150 diversity and inclusion-focused engagement activities in 2022, all driven by associates and supported by executive leadership.

•We are working with customers to transition out of unfavorable markets within our Portable Medical product line and moving the more profitable, higher growth heart failure and cochlear application products to our Cardiac Rhythm Management & Neuromodulation product line.

By closely managing expenses and focusing our investments to create clear differentiation in faster growing end-markets, we are making progress on our operational and financial objectives and delivering tangible improvements for our shareholders.

Highlights from our 2022 financial results confirm our strategy is positioning Integer to win in the markets we serve:

•Increased sales by 13% to $1.376 billion, primarily from the Oscor acquisition and continued product demand recovery from the impacts of the COVID-19 pandemic.

•Generated $116 million of cash flow from operating activities compared to $157 million for 2021.

•Adjusted operating income increased 3% to $192 million.

Our scalability, global presence, unmatched design and development capabilities, innovative technologies and world-class manufacturing uniquely position us to serve our customers through all phases of their product lifecycles. Our customers are rewarding us with more development programs that support their product roadmaps, and we are uniquely equipped to help bring these lifesaving and life-enhancing products to market faster.

As we continue on our Journey to Excellence, we see the potential for significant growth ahead for our associates, our customers, our shareholders and the communities in which we live and work, all while achieving our vision to enhance the lives of patients worldwide by being our customers’ partner of choice for innovative technologies.

We delivered strong year-over-year financial results in 2022 despite a challenging labor and supply chain environment and expect our year-over-year sales and profit growth to increase throughout 2023 as we execute our strategy and complete the integration of Oscor and Aran.

For further details on our fiscal year 2022 consolidated financial results, please see our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the Securities and Exchange Commission (“SEC”) on February 21, 2023. For more information on how our fiscal year 2022 business performance affected our named executive officers’ compensation, please see our Compensation Discussion and Analysis beginning on page 17 of this proxy statement. Executive Compensation Highlights

The Company’s compensation program is designed to provide a competitive compensation package that will attract, retain and motivate our executives to drive the Company’s success through high performance and innovation, to link our executives’ compensation to short- and long-term performance of the Company and to align our executives’ compensation with the interests of our stockholders. To do this, we:

•Provide our named executive officers ("NEOs") with a fixed level of cash compensation in the form of base salary that is consistent with their skill level, experience, knowledge, length of service with the Company and the level of responsibility and complexity of their position, and is generally targeted near the competitive market median of our peer group for base salary for the position;

•Provide an annual short-term incentive program cash incentive award with the objective of providing a competitive level of performance-based annual compensation at the target achievement level, with the opportunity for significantly higher incentive compensation if stretch performance is achieved, and with metrics that focus on key measures of success that the executive team is able to impact over an annual timeframe; and

•Provide a long-term incentive plan ("LTI") award that is the largest component of our NEOs' total compensation and is designed to align management’s performance incentives with the interests of our stockholders by linking executive pay to stockholder value creation as the award consists of a combination of performance stock units (“PSUs”) that use revenue growth (one-third of the award) and relative total stockholder return versus our peer group as the performance metric (one-third of the award), and time-based restricted stock units ("RSUs") that vest ratably over a three-year period (one-third of the award).

During 2022, the Compensation and Organization Committee (the “Compensation Committee”) continued its stockholder supported philosophies to ensure alignment to market-based best practices and policies.

The Compensation Committee took the following actions regarding our incentive programs, for 2022:

•Reintroduced revenue growth PSUs using a modified approach based on annual performance in each of the three years in the performance cycle. This design better protects against significant events, beyond management’s control, resulting in the forfeiture of the entire award, while still requiring three-year compound annual growth achieve a target level to earn a payout above 100%.

•Due to the uncertainty of the lingering impact of the pandemic, continued a wider than typical threshold and maximum achievement level in our short-term incentive program, as first introduced for 2021, making maximum payout more difficult to achieve while reducing the threshold achievement level for a minimum payout.

•Approved short-term incentive payouts based on achievement against targets established early in 2022, and did not use discretion to adjust payout.

•In connection with the successful implementation of the restructuring of our Power Solutions business, provided a special recognition award to the leader of that business.

•Granted special stock-based incentive awards to our Chief Executive Officer (“CEO”) and two other NEOs, in support of both long-term retention efforts and as an incentive to drive long-term shareholder growth.

Below are some highlights of our compensation program:

| | | | | | | | | | | | | | |

| WHAT WE DO | | WHAT WE DON’T DO |

| ü | Align our executive pay with performance, resulting in a substantial portion of executive pay being at-risk and tied to objective performance goals | | û | Multi-year guarantees for salary increases, non-performance based bonuses or equity compensation |

| ü | Long-term incentive award grants that are predominantly performance-based and measured over multi-year periods, and short-term incentive plan awards that are also based on rigorous performance objectives | | û | A high percentage of fixed compensation |

| ü | Hold an annual “say on pay” advisory vote | | û | Tax gross-ups for change-in control benefits |

| ü | Set multiple challenging performance objectives for our executives | | û | Permit short sales, hedging, or pledging of stock ownership positions by directors, executive officers or associates |

| ü | Stock ownership guidelines for all executive officers and non-employee directors | | û | Excessive perquisites |

| ü | Caps on director equity awards and fees | | û | Repricing of stock options |

| ü | Independent compensation consultant engaged by the Compensation Committee | | û | Single trigger equity acceleration on change in control where the acquiror agrees to assume the award |

| ü | Compensation Committee carefully considers annual equity usage and potential dilution in its compensation decisions | | û | Maintain evergreen provisions in long-term incentive plans |

| ü | Annual review and approval of our compensation strategy | | | |

| ü | Compensation Committee reviews an annual risk assessment of our compensation program | | | |

| ü | Require a double trigger for acceleration of severance payments or benefits upon a change in control | | | |

| ü | Clawback policy that permits recoupment of cash and equity awards under specified circumstances | | | |

Last year’s “say-on-pay” vote received the support of approximately 97% of votes cast by our stockholders (excluding abstentions and broker non-votes). Based on the voting results, we believe our overall executive compensation program is aligned with the interests of our stockholders.

Corporate Governance Highlights

We believe that good corporate governance promotes the long-term interests of our stockholders, strengthens Board and management accountability, and leads to better business performance. We are committed to maintaining strong corporate governance practices and will continually evaluate these practices going forward. More information about our corporate governance can be found beginning on page 43 of this proxy statement. The following table summarizes certain highlights of our governance policies and practices:

| | | | | | | | | | | | | | |

| ü | Unclassified board with annual election of all directors | | ü | Engage in stockholder outreach |

| ü | 10 out of 11 director nominees are independent | | ü | Code of conduct applies to all directors, officers, associates and consultants |

| ü | Audit Committee, Corporate Governance and Nominating Committee and Compensation Committee composed entirely of independent directors | | ü | Annual say-on-pay vote |

| ü | Non-executive, independent chair of the board | | ü | Stock ownership guidelines for all executive officers and non-employee directors |

| ü | Independent directors meet regularly without management present | | ü | Strategic and risk oversight by full Board and committees |

| ü | No supermajority voting provisions | | ü | Stockholders have right to act by written consent |

| ü | Director attendance at >75% of meetings in 2022 | | ü | No stockholder rights plan (i.e., no “poison pill”) |

| ü | 100% Board attendance at 2022 annual meeting | | ü | Anti-hedging and pledging policy |

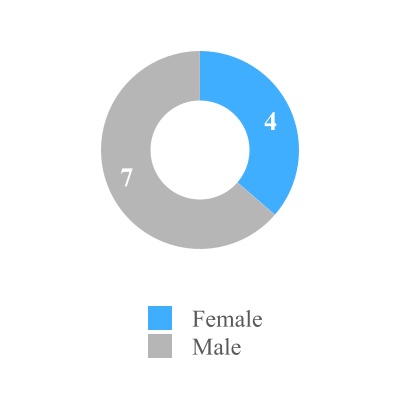

| ü | Diverse Board in terms of gender, ethnicity and specific skills and qualifications | | ü | CEO evaluation process |

| ü | Director resignation policy if any director receives a greater number of “withhold” votes than “for” votes | | ü | Annual Board and committee evaluations |

| ü | Balance of new and experienced directors | | ü | Annual review of committee charters |

| ü | Board oversight of strategy on corporate social responsibility and sustainability, entity risk management and cybersecurity | | ü | All committee charters address Company’s commitment to diversity and inclusion |

As described in greater detail under “Environmental, Social and Governance Matters” beginning on page 50 of this proxy statement, we understand the importance of environmental, social and governance (“ESG”) matters and their impact on our stakeholders and the communities in which we live and work. Through our ESG programs, we are committed to conducting business in a socially and environmentally responsible manner and aligning our ESG goals, programs and initiatives with our corporate strategy.

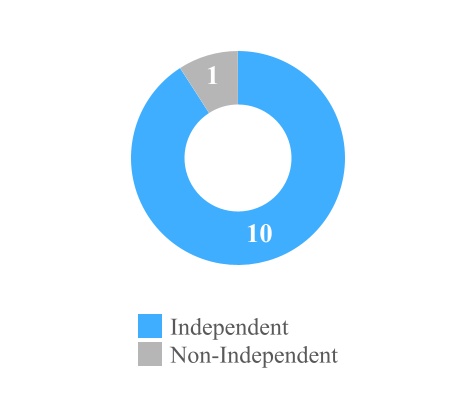

Our Director Nominees

You are being asked to vote on the director nominees listed below. The chart below summarizes some of the key characteristics of the members of our Board. Detailed information about each director nominee’s background can be found beginning on page 7 of this proxy statement. The Board determined that each of the director nominees, other than Mr. Dziedzic, is independent under the NYSE’s Corporate Governance Listing Standards. The information below regarding the director nominees to be elected at the Annual Meeting is as of April 10, 2023. Consistent with the Board’s commitment to good corporate governance and Board refreshment to ensure a balanced mix of tenure in its membership, five of the ten independent director nominees listed below have joined the Board since the beginning of 2016.

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Primary Occupation | Current Committee Membership | Independent |

| Sheila Antrum | 64 | 2021 | Senior Vice President and Chief Operating Officer at UCSF Health | | Audit Compensation & Organization Technology Strategy | ü |

| Pamela G. Bailey | 74 | 2002 | Retired President and Chief Executive Officer, The Grocery Manufacturers Association | | Board Chair Corporate Governance & Nominating | ü |

| Cheryl C. Capps | 61 | 2021 | Senior Vice President and Chief Supply Chain Officer of Corning Inc. | | Audit Compensation & Organization Technology Strategy | ü |

| Joseph W. Dziedzic | 54 | 2013 | President and Chief Executive Officer, Integer Holdings Corporation | | | |

| James F. Hinrichs | 55 | 2018 | Founding Partner, Atmas Health

Retired Chief Financial Officer of Alere, Inc. and CareFusion Corporation |

| Compensation & Organization (Chair) Audit Corporate Governance & Nominating | ü |

| Jean Hobby | 62 | 2015 | Retired Partner, PricewaterhouseCoopers, LLP | | Audit (Chair) Compensation & Organization Corporate Governance & Nominating | ü |

| Tyrone Jeffers | 49 | 2021 | Vice President, Global Manufacturing and Supply Chain of SPX FLOW, Inc. |

| Compensation & Organization Corporate Governance & Nominating Technology Strategy | ü |

| M. Craig Maxwell | 64 | 2015 | Retired Vice President and Chief Technology and Innovation Officer for Parker Hannifin Corporation | | Technology Strategy (Chair) Audit Corporate Governance & Nominating | ü |

| Filippo Passerini | 65 | 2015 | Retired Group President and Chief Information Officer, Procter & Gamble Company |

| Audit Corporate Governance & Nominating Technology Strategy

| ü |

| Donald J. Spence | 69 | 2016 | Retired President and Chief Executive Officer, Ebb Therapeutics | | Audit Compensation & Organization Technology Strategy | ü |

| William B. Summers, Jr. | 72 | 2001 | Retired Chairman and Chief Executive Officer, McDonald Investments Inc. |

| Corporate Governance & Nominating (Chair) Compensation & Organization Technology Strategy | ü |

COMPANY PROPOSALS

PROPOSAL 1 – Election of Directors

Shares represented by properly executed proxies will be voted, unless authority is withheld, for the election as directors of the Company of the following 11 persons nominated by the Board, to hold office until the 2024 Annual Meeting of Stockholders and until their successors have been elected and qualified. Each of the other nominees listed below was elected at the 2022 Annual Meeting of Stockholders.

If any nominee for any reason should become unavailable for election or if an additional vacancy should occur before the election (which is not expected), the shares of common stock, $0.001 par value per share (“common stock”), voted for such nominee and represented by the proxies will be voted for such other person, if any, as the Corporate Governance and Nominating Committee shall designate as a nominee. Information regarding the nominees standing for election as directors is set forth below:

Nominees for Director

| | | | | | | | | | | | | | |

| Sheila Antrum |

| | | | |

| | Ms. Antrum is Senior Vice President and Chief Operating Officer at UCSF Health, the health system and umbrella brand for the clinical enterprise of the University of California San Francisco. She has been with UCSF Health since 2007 and is responsible for ensuring that patient care service operations across the health system align with UCSF Health’s vision and strategic objectives. Ms. Antrum also oversees strategic implementation of finances, quality and safety across the adult inpatient UCSF Health enterprise. As Chief Operating Officer, nursing, clinical services, facilities, supply chain, major construction projects, pharmaceutical, women’s services and perioperative services report to her. Ms. Antrum also serves as President of Adult Services at UCSF Health and has served in that capacity since 2015. From 2007 to 2015 and again from 2019 to 2020, Ms. Antrum served as Chief Nursing and Patient Care Services Officer for UCSF Medical Center and UCSF Benioff Children’s Hospital San Francisco. She was Chief of Ambulatory Operations at University of California San Diego Medical Center from 2003 to 2007, and held various operations, administrative and clinical roles at hospitals in California, Connecticut, Maryland and Pennsylvania. Ms. Antrum is also a director of FIGS, Inc., and a member of its Audit Committee and its Nominating and Corporate Governance Committee. Ms. Antrum's more than 40 years of experience delivering medical operations and oversight of clinical services across multiple facilities supports her service as a member of the Board. |

Age: 64 | |

Director Since: 2021 | |

| Integer Committee(s): | |

•Audit | |

•Compensation and Organization | |

•Technology Strategy | |

| | | | | | | | | | | | | | |

| Pamela G. Bailey |

| | | | |

| | Ms. Bailey served as President and Chief Executive Officer of The Grocery Manufacturers Association (“GMA”), a Washington, D.C. based trade association, from January 2009 until she retired in August 2018. From April 2005 until January 2009, she was President and Chief Executive Officer of the Personal Care Products Council. Ms. Bailey served as President and Chief Executive Officer of the Advanced Medical Technology Association (“AdvaMed”), the world’s largest association representing the medical technology industry, from June 1999 to April 2005. From 1970 to 1999, she served in the White House, the Department of Health and Human Services and other public and private organizations with responsibilities for health care public policy. Ms. Bailey serves as a director of Timilon Corporation and formerly served as a director of American Stores, Inc., Albertsons, Inc., and MedCath Corporation. From 2010 to 2014, Ms. Bailey was appointed by President Obama to serve on the Advisory Committee for Trade Policy and Negotiations, the principal trade advisory committee for the Office of the U.S. Trade Representative. Ms. Bailey’s 40 years of health care public policy experience in both public and private sectors, including service in the White House, the Department of Health and Human Services, and as President and Chief Executive Officer of AdvaMed, gives her a unique perspective on a variety of health care policy and regulatory issues. With over 25 years of chief executive officer experience at GMA, the Personal Care Products Council, AdvaMed, and other Washington-based health care trade associations, Ms. Bailey brings to the Board demonstrated management ability at senior levels. This experience, together with her experience gained as a director of American Stores, Albertsons and MedCath, supports her continued service as a member of the Board. |

Age: 74 | |

Director Since: 2002 | |

| Integer Committee(s): | |

•Corporate Governance and Nominating | |

| |

| | | | | | | | | | | | | | |

| Cheryl C. Capps |

| | | | |

| | Ms. Capps serves as Senior Vice President and Chief Supply Chain Officer of Corning Inc., a leading innovator in materials science. Ms. Capps has been with Corning Inc. since 2011 and is responsible for developing capabilities within the global supply management function and across the corporation, in order to transform supply chain into a competitive advantage. Prior to joining Corning in 2011, Ms. Capps was Senior Vice President, Global Manufacturing and Supply Chain, for ConvaTec, the medical device division of Bristol-Myers Squibb. She had responsibility for global manufacturing, supply chain (sourcing, planning, logistics, distribution, customer service operations), and engineering (packaging, facilities, plant). Ms. Capps joined Bristol-Myers Squibb in 1997 at Zimmer, Inc. as Vice President of Sourcing and Packaging Engineering before moving to the pharmaceutical division where she held numerous leadership roles in sourcing and supply chain. Ms. Capps’ more than 35 years of diverse leadership experience in manufacturing, supply chain, research and development, quality, strategy, business management and ESG matters, supports her service as a member of the Board. |

Age: 61 | |

Director Since: 2021 | |

| Integer Committee(s): | |

•Audit | |

•Compensation and Organization | |

•Technology Strategy | |

| | | | | | | | | | | | | | |

| Joseph W. Dziedzic |

| | | | |

| | Mr. Dziedzic has served as President and Chief Executive Officer of the Company since March 2017. Prior to being appointed as the President and Chief Executive Officer of the Company, Mr. Dziedzic served as Chair of the Audit Committee and a member of the Compensation and Organization Committee. From 2009 to 2016, Mr. Dziedzic was the Executive Vice President and Chief Financial Officer of The Brink’s Company, a global leader in security-related services for banks, retailers and a variety of other commercial and governmental customers. Prior to joining The Brink’s Company in 2009, he had a 20-year career with General Electric, including leadership roles in six different businesses, including General Electric Medical Systems. Mr. Dziedzic has 30 years of experience in global operations and financial matters. The depth and breadth of Mr. Dziedzic’s global operating and financial experience and his role as the Company’s President and Chief Executive Officer support his continued service as a member of the Board. |

Age: 54 | |

Director Since: 2013 | |

| | | | | | | | | | | | | | |

| James F. Hinrichs |

| | | | |

| | Mr. Hinrichs is a Founding Partner of Atmas Health, which seeks to acquire healthcare assets in cooperation with Carlyle (NASDAQ: CG). He served as Chief Financial Officer of Cibus Ltd., a gene-editing company focused on applications in agriculture from May 2018 until July 2019. From April 2015 until its sale to Abbott Labs in October 2017, he served as Executive Vice President and Chief Financial Officer of Alere, Inc. From December 2010 through March 2015, Mr. Hinrichs served as Chief Financial Officer of CareFusion Corporation prior to its sale to Becton Dickinson. He previously served as CareFusion’s Senior Vice President, Global Customer Support, and as its Senior Vice President, Controller. Prior to joining CareFusion upon its spin-off from Cardinal Health, Inc., Mr. Hinrichs worked for five years at Cardinal Health in various positions including Executive Vice President and Corporate Controller of Cardinal Health and as Executive Vice President and Chief Financial Officer of its Healthcare Supply Chain Services segment. He joined Cardinal Health following more than a decade of finance and marketing roles at Merck & Co. Mr. Hinrichs is a director of Orthofix Medical Inc. and serves as Chair of its Audit and Finance Committee and a member of its Nominating & Governance Committee. Mr. Hinrichs is also a director of Acutus Medical, Inc. and serves as Chair of its Audit Committee and as a member of its Compensation Committee. He also serves as a director of Outset Medical, Inc. and as the chair of its Audit Committee. In addition, Mr. Hinrichs serves as a director of Signifier Medical, a privately-held company. Mr. Hinrichs has over 25 years of experience in financial and accounting matters at companies in the medical device and pharmaceutical industries. The depth and breadth of his financial experience support his continued service as a member of the Board. |

Age: 55 | |

Director Since: 2018 | |

| Integer Committee(s): | |

•Audit | |

•Compensation and Organization (Chair) | |

•Corporate Governance and Nominating | |

| | | | | | | | | | | | | | |

| Jean Hobby |

| | | | |

| | Ms. Hobby served as a global strategy partner at PricewaterhouseCoopers, LLP from 2013 until she retired in June 2015 following a 33-year career at that firm. Prior to 2013, Ms. Hobby served as PricewaterhouseCoopers’ Technology, Media and Telecom Sector Leader from 2008 to 2013, and as its Chief Financial Officer from 2005 to 2008. She joined PricewaterhouseCoopers in 1983 and became a partner in 1994. Ms. Hobby is also a director of Texas Instruments Incorporated and serves on its Audit Committee, and a director of Hewlett Packard Enterprise Company and serves on its Audit Committee. She is a former director of CA, Inc. The depth and breadth of Ms. Hobby’s nearly 35 years of experience in global operations and financial and accounting matters support her continued service as a member of the Board. |

Age: 62 | |

Director Since: 2015 | |

| Integer Committee(s): | |

•Audit (Chair) | |

•Compensation and Organization | |

•Corporate Governance and Nominating | |

| | | | | | | | | | | | | | |

| Tyrone Jeffers |

| | | | |

| | Mr. Jeffers serves as Vice President, Global Manufacturing and Supply Chain of SPX FLOW, Inc., a Charlotte, N.C. based company that innovates with customers to help feed and enhance the world by designing, delivering and servicing high value process solutions at the heart of growing and sustaining diverse communities. He has been with SPX Flow since April 2018 and is responsible for the company’s global manufacturing sites, leading an enterprise-wide team in improving operational effectiveness, increasing productivity, delivering on customer commitments and enhancing safety. From 2016 to 2018, Mr. Jeffers served as the Vice President of Infrastructure and Supply Chain Integration for the Baker Hughes and GE merger, responsible for driving cost efficiency and rationalization to deliver over $1 billion in cost synergies. From 1996 until 2016, Mr. Jeffers was with GE, beginning as a manufacturing training program member and spending more than 22 years running factories and supply chains within GE Industrial and GE Oil & Gas. His career includes two years of living in Shanghai, China. One of his career highlights was serving as a global operating leader for GE’s African American Forum. Mr. Jeffers serves as the Chairman of the Engineering Advisory Board at North Carolina Agricultural & Technical State University’s College of Engineering where he partners the university with industry to drive innovation and growth. His more than 25 years of manufacturing and supply chain experience, together with his experience helping organizations navigate cultural change, supports his service as a member of the Board. |

Age: 49 | |

Director Since: 2021 | |

| Integer Committee(s): | |

•Compensation and Organization | |

•Corporate Governance and Nominating | |

•Technology Strategy | |

10 | 2023 PROXY STATEMENT

| | | | | | | | | | | | | | |

| M. Craig Maxwell |

| | | | |

| | Mr. Maxwell was the Vice President and Chief Technology and Innovation Officer for Parker Hannifin Corporation, a Fortune 250 company located in Cleveland, Ohio that is one of the global leaders in motion and control technologies and systems, providing precision-engineered solutions for a variety of mobile, industrial, medical and aerospace markets. Mr. Maxwell was with Parker Hannifin from 1996 until his retirement in 2020, and his responsibilities included leading the company in new and emerging markets and implementing Parker Hannifin’s new product development process. Additionally, Mr. Maxwell was responsible for Parker Hannifin’s technology incubator designed to facilitate cross group opportunities that leveraged the company’s portfolio of products and technology to develop emerging opportunities. As Vice President and Chief Technology and Innovation Officer for Parker Hannifin, Mr. Maxwell led that company’s innovation research that commercializes new technologies. Through this service, he gained management experience at senior levels as well as manufacturing experience. These attributes provide the Company valuable insight into developing new technologies to support future growth and support Mr. Maxwell’s continued service on the Board. |

Age: 64 | |

Director Since: 2015 | |

| Integer Committee(s): | |

•Audit | |

•Corporate Governance and Nominating | |

•Technology Strategy (Chair) | |

| | | | | | | | | | | | | | |

| Filippo Passerini |

| | | | |

| | Mr. Passerini served as Procter & Gamble’s Group President, Global Business Services and Chief Information Officer, positions he held from 2004 and 2005, respectively, until his retirement following a 33-year career in business and digital technology. He joined Procter & Gamble in 1981 and held executive positions in Italy, Turkey, United Kingdom, Greece, Latin America and the United States. In these roles, he led Procter & Gamble’s global operations and oversaw technology and business services operations in over 70 countries. Mr. Passerini also led the integration of Procter & Gamble’s IT and Business Services groups. Mr. Passerini is a director of United Rentals, Inc. and serves as a member of its Strategy Committee and its Audit Committee. Mr. Passerini is a former director of ABM Industries Incorporated. Mr. Passerini brings to the Company over three decades of global experience in digital technology, general management and operations roles. He is globally recognized as a digital technology and shared services thought leader, known for creating new, progressive business models and driving innovation. Mr. Passerini’s extensive background and experience supports his continued service as a member of the Board. |

Age: 65 | |

Director Since: 2015 | |

| Integer Committee(s): | |

•Audit | |

•Corporate Governance and Nominating | |

•Technology Strategy | |

2023 PROXY STATEMENT | 11

| | | | | | | | | | | | | | |

| Donald J. Spence |

| | | | |

| | Donald J. Spence retired in August 2019 as President and Chief Executive Officer of Ebb Therapeutics, a company in the business of developing and marketing medical products for the treatment of insomnia, a position he held since March 2017. He had been Chairman and Chief Executive Officer of Lake Region Medical from 2010 until its acquisition by the Company in October of 2015. From 2005 to 2008, Mr. Spence served as President of the Sleep and Home Respiratory Group for Philips Respironics, and from 2008 to 2010 as Chief Executive Officer of Philips Home Healthcare Solutions. Prior to that, he spent eight years with GKN Sinter Metals, as Senior Vice President for Global Sales and Marketing from 1998 to 2001 and as President from 2001 to 2005. Prior to 1998, Mr. Spence served in a number of roles at BOC Group, plc over a 15-year career, including President, Ohmeda Medical Systems from 1997 to 1998. Mr. Spence is a director of Vapotherm, Inc. and serves as the chair of its Compensation Committee and as a member of its Nomination and Governance Committee. Mr. Spence also serves as a director of Eargo, Inc. as board chair and as a member of its Audit Committee. In addition, Mr. Spence serves as a director of Linguaflex, Inc., a privately-held medtech company. Having served in the role of Chairman and Chief Executive Officer of Lake Region Medical and in senior management roles with other companies, Mr. Spence has significant management experience and business understanding of a medical technology and device company. Mr. Spence’s background and expertise in the medical device industry support his continued service as a member of the Board. |

Age: 69 | |

Director Since: 2016 | |

| Integer Committee(s): | |

•Audit | |

•Compensation and Organization | |

•Technology Strategy | |

| | | | | | | | | | | | | | |

| William B. Summers, Jr. |

| | | | |

| | Mr. Summers retired in June 2006 as Chairman of McDonald Investments Inc., a position he had held since 1998. He also held the additional positions of President from 1989 through 1998 and Chief Executive Officer from 1994 through 1998 of that investment company. Mr. Summers serves on the board of directors of RPM International, Inc. and is a member of its Compensation Committee. He also serves on the advisory boards of Molded Fiberglass Companies and Citymark Capital, is a Life Trustee and past board chair of The Rock and Roll Hall of Fame and Museum, on the board and past board chair of Baldwin-Wallace University, and a board member of the United States Army War College Foundation. Mr. Summers previously served as chair of the board of the National Association of Securities Dealers, as chair of the board of the NASDAQ Stock Market, and as a director of the NYSE. He is a former director of Developers Diversified Realty, Inc., McDonald Investments Inc., Cleveland Indians Baseball Company, and Penton Media Inc. Through his positions with McDonald Investments, Mr. Summers gained leadership experience and extensive knowledge of complex financial and operational issues. In addition, through his service with the NASDAQ Stock Market and NYSE and on the boards of other public companies, Mr. Summers has gained valuable experience dealing with the capital markets, accounting principles and financial reporting rules and regulations, evaluating financial results and generally overseeing the financial reporting process of large public corporations. This experience supports Mr. Summers’ continued service as a member of the Board. |

Age: 72 | |

Director Since: 2001 | |

| Integer Committee(s): | |

•Compensation and Organization | |

•Corporate Governance and Nominating (Chair) | |

•Technology Strategy | |

12 | 2023 PROXY STATEMENT

The table below shows some of the relevant qualification, experience and demographics of our director nominees identified by the Corporate Governance and Nominating Committee.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Antrum | Bailey | Capps | Dziedzic | Hinrichs | Hobby | Jeffers | Maxwell | Passerini | Spence | Summers |

| Qualifications and Experience |

| Health Care Industry Knowledge | ● | ● | ● | ● | ● | | | ● | ● | ● | |

| Executive Leadership | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Finance and Accounting | | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Strategic Planning | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Technology, Innovation and Product Development Leadership | ● | | ● | ● | | ● | | ● | ● | ● | |

| International/Global Business | | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Public Company Governance | | ● | | ● | ● | ● | | ● | ● | ● | ● |

| Manufacturing and Operations | ● | | ● | ● | | | ● | ● | ● | ● | |

| Risk Management | ● | ● | ● | ● | ● | ● | | ● | ● | ● | ● |

| Government/Regulatory Policy | ● | ● | | | | ● | | ● | | | ● |

| Information Technologies | | | | | ● | | | ● | ● | |

|

| Human Capital Management | ● | ● | | ● | ● | | ● | ● | ● | ● | ● |

| Health, Safety and Environment | ● | ● | ● | | | | ● | ● | ● | ● | |

| Regulatory and Compliance | | ● | ● | ● | | | | ● | ● | | |

| | | | | | | | | | | |

|

| Additional Qualifications and Information |

Audit Committee Financial Expert | | | | | ● | ● | | | | | |

# of Other Public Company

Boards (Current│Past) | 1│0 | 0│3 | 0│0 | 0│0 | 3│0 | 2│1 | 0│0 | 0│0 | 1│1 | 2│0 | 1│3 |

2023 PROXY STATEMENT | 13

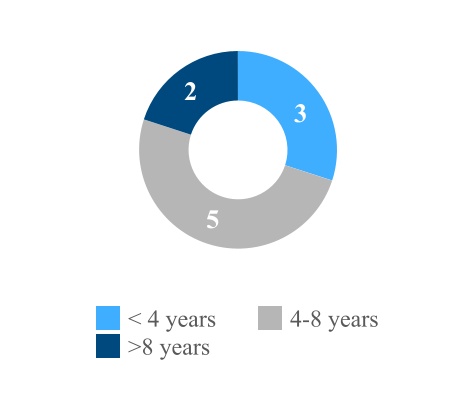

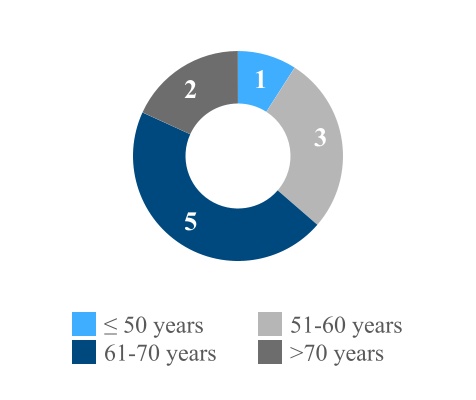

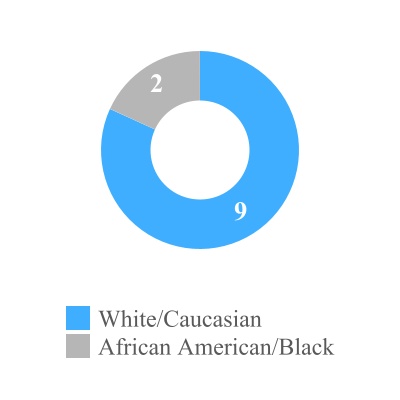

Board Diversity and Composition

In the process of identifying nominees to serve as members of the Board, the Corporate Governance and Nominating Committee strives to ensure that an appropriate balance of specialization, skills, gender and ethnic diversity and independence is reflected in the composition and structure of the Board. All of our directors are committed to the Company’s long-term success and creating value for stockholders. The information provided in the charts below is with respect to the director nominees to be elected at the Annual Meeting.

| | | | | | | | |

| Independent Director Tenure (Average 8.5 years) | Director Age | Independence |

| | | | | |

| Gender Diversity* | Racial Diversity* |

* Diversity characteristics based on information self-identified by each director nominee to the Company.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR

14 | 2023 PROXY STATEMENT

PROPOSAL 2 – Ratification of the Appointment of Independent Registered Public Accounting Firm

Deloitte & Touche LLP (“Deloitte & Touche”) has been appointed by the Audit Committee as the Company’s independent registered public accounting firm for fiscal year 2023. Deloitte & Touche has served as the Company’s auditor since 1985. Although stockholder approval is not required, the Company has determined that it is desirable to request that the stockholders ratify the appointment of Deloitte & Touche as the Company’s independent registered public accounting firm for fiscal year 2023. In the event the stockholders fail to ratify the appointment, the Audit Committee will reconsider this appointment and make such a determination as it believes to be in the Company’s best interests. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s best interests. Representatives of Deloitte & Touche are expected to be present at the Annual Meeting. The representatives may, if they wish, make a statement and, it is expected, will be available to respond to appropriate questions.

The following table sets forth the aggregate fees billed by Deloitte & Touche for services provided to the Company during fiscal years 2022 and 2021:

| | | | | | | | | | | | | | | | | | | | |

| | 2022 | | 2021 |

| Audit Fees(1) | $ | 2,215,243 | | | $ | 2,120,000 | |

| Audit-Related Fees(2) | | 366,500 | | | | 41,000 | |

| Total Audit and Audit-Related Fees | | 2,581,743 | | | | 2,161,000 | |

| Tax Fees(3) | | 170,000 | | | | 12,270 | |

| | | | | | |

| Total Fees | $ | 2,751,743 | | | $ | 2,173,270 | |

(1)Audit fees include amounts billed by Deloitte & Touche for services rendered for the audit of the Company’s annual consolidated financial statements, the review of the Company’s quarterly condensed consolidated financial statements, and statutory and subsidiary audits.

(2)Audit-related fees billed by Deloitte & Touche for the audit of the Integer Holdings Corporation 401(k) Retirement Plan (the “Company 401(k) Plan”). In 2022, the audit-related fees also included fees related to the issuance of a comfort letters and due diligence services on potential acquisitions.

(3)Represents fees billed by Deloitte & Touche for tax compliance, planning and consulting services.

Audit Committee Pre-Approval Policy on Audit and Non-Audit Services. As described in the Audit Committee charter, the Audit Committee must review and pre-approve both audit and non-audit services to be provided by the Company’s independent registered public accounting firm (other than with respect to de minimis exceptions permitted by SEC rules). This duty may be delegated to one or more designated members of the Audit Committee with any such pre-approval reported to the Audit Committee at its next regularly scheduled meeting. None of the services described above were performed by Deloitte & Touche under the de minimis exception rule.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2023

2023 PROXY STATEMENT | 15

PROPOSAL 3 – Advisory Vote on Compensation of the Named Executive Officers

As required pursuant to Section 14A of the Exchange Act of 1934, as amended (the “Exchange Act”), the Company seeks your advisory vote on a resolution to approve the compensation of our NEOs as disclosed in this proxy statement. Our NEOs are the Chief Executive Officer, the Chief Financial Officer, and the next three highest paid executive officers. Although your vote is advisory and will not be binding on the Board or the Company, the Board reviews the voting results and takes these results into consideration when making future decisions regarding executive compensation. The next advisory vote on the compensation of our NEOs will be held at the 2024 Annual Meeting of Stockholders.

The Company’s executive compensation programs have played an important role in our ability to drive financial results and attract and retain a highly experienced, successful management team. We believe that our executive compensation programs are structured to support the Company’s business objectives. We closely monitor the compensation programs and pay levels of executives from companies of similar size and complexity to ensure that our compensation programs are within the norm of a range of market practices. As discussed below under “Compensation Discussion and Analysis,” the Company’s compensation for its named executive officers includes the following elements:

•Long-term equity compensation with performance-based vesting. The most significant elements of the NEOs’ equity compensation opportunity for 2022 were performance-based awards under the LTI Program for which vesting depends on the Company’s (i) annual sales growth over a three-year period ending in 2024 and (ii) total stockholder return relative to its peer group over a three-year period ending in 2025.

•Total cash compensation tied to performance. A significant portion of the cash compensation opportunity for the NEOs is based on the Company’s performance. As such, the cash compensation for the NEOs has fluctuated from year to year, reflecting the Company’s financial results.

The text of the resolution in respect of Proposal 3 is as follows:

“Resolved, that the stockholders approve, on a non-binding basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement.”

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

PROPOSAL 4 – Advisory Vote on the Frequency of Future Advisory Votes on Compensation of the Named Executive Officers

In accordance with the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and the related rules of the SEC, the Company seeks your advisory vote on the frequency of holding future stockholder advisory votes on the compensation of our Named Executive Officers. Currently, an advisory vote on the compensation of our Named Executive Officers is provided to the Company’s stockholders every year. In particular, we are asking whether future advisory votes should occur every one, two or three years.

The stockholder advisory vote on the compensation of our Named Executive Officers is very important to the Company. We believe an annual stockholder vote enhances stockholder communication by providing a clear, simple means for the Company to obtain information on investor sentiment about our executive compensation programs. The Company believes that an advisory vote every year will be the most effective timeframe for the Company to respond to stockholders' feedback and provide the Company with an opportunity to engage with stockholders to understand and respond to voting results.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR A FREQUENCY

OF “ONE YEAR,” ON AN ADVISORY BASIS, FOR FUTURE ADVISORY STOCKHOLDER VOTES

TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

16 | 2023 PROXY STATEMENT

COMPENSATION DISCUSSION AND ANALYSIS

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

Introduction. This Compensation Discussion and Analysis ("CD&A") describes the compensation of our Chief Executive Officer (“CEO”) and together with our other Named Executive Officers ("NEOs") during 2022. Our NEOs for 2022 were:

•Joseph W. Dziedzic, President and Chief Executive Officer

•Jason K. Garland, Executive Vice President and Chief Financial Officer

•Jennifer M. Bolt, Executive Vice President, Global Operations and ESG

•Carter Houghton, President, Electrochem and Power Solutions

•Payman Khales, President, Cardio & Vascular

2022 Performance. In 2022, we delivered 13% revenue growth, including 6% organic revenue growth, to $1.376 billion despite the persistent challenges of the current labor and supply chain environments. Customer demand remains strong, and our two recent acquisitions contributed to our growth in adjusted operating income of 3% from 2021 to $192 million. We continued to execute both our product line and operational strategies to position us to deliver on our financial objectives of above market growth, profit growth twice as fast as sales and maintaining our debt leverage between 2.5 and 3.5 times EBITDA. While we did not fully meet our internal goal under the incentive plan measure of adjusted operating income (as described below), we expect to achieve our strategic financial objectives in 2023.

During 2022, the Company completed the implementation of its Power Solutions product line strategy to exit approximately $40 million of product sales over the next approximately three to four years and to consolidate the remaining approximately $30 million of product sales into another product line within the Company. In connection with the completion of this business strategy, the Company restructured its leadership team by eliminating the position of President, Electrochem and Power Solutions, held my Mr. Houghton. During the execution of this strategy, Mr. Houghton’s continued service has been headlined by exemplary performance of the business unit, significantly exceeding the Company’s expectations and by contributing to the Company’s results in 2022. Mr. Houghton’s separation arrangement is described below under the heading “Separation Arrangement for Mr. Houghton.”

Performance under the 2022 Short-Term Incentive and Long-Term Incentive Programs. Our 2022 Short- and Long-Term Incentive (“STI” and “LTI”, respectively) programs are market-competitive, performance-based incentive programs, designed to focus our NEOs on key measures of success that the executive team can impact over multiple time frames, and to align and balance decision making with the interests of stockholders for long-term and sustained growth. As measured under our 2022 STI program, the target level for Short-Term Incentive plan Adjusted Operating Income (“STI AOI”), was set at $214.0 million, which was 14.5% above the 2021 actual STI AOI. For compensation purposes, STI AOI excludes from AOI the impact of acquisitions that occurred during the period. Our 2022 STI AOI was $187.3 million, which is 87.5% of the target performance goal, resulting in an STI AOI “payout factor” of 58.33%. Bonus payouts for our NEOs were based on STI AOI, as well as functional and product performance categories. Final payouts to our NEOs ranged from 47% to 59% of target.

The 2022 LTI program for our NEOs was comprised of equity-based awards that vest over three-years, including time-based restricted stock units (“RSUs”) and two separate awards of performance stock units (“PSUs”) that vest based on (i) our year-over-year organic revenue, also referred to as organic sales, growth and (ii) our relative total stockholder return (“rTSR”) as compared to our peer group. The PSUs granted under the 2021 and 2022 LTI programs have three-year performance periods, and, as a result, vesting of these awards remains subject to future performance. The PSU awards granted in 2020 were based on rTSR and revenue and had performance periods that ended in 2022. Final rTSR for the 2020 PSUs was at the 50th percentile, resulting in a payout for rTSR awards at 91.67%. The impact of COVID-19 on the Company’s revenue during the measurement period resulted in the three-year performance finishing below threshold on the revenue metric, and as a result, there was no payout for the 2020 revenue-based PSUs. Due to the COVID-19 impact, there was no payout for the organic revenue-based PSUs that would have paid out in 2021, 2022 and 2023. These PSU awards are further described below under the heading “Long-Term Incentive Programs.”

During 2022, the Compensation Committee made special stock-based incentive awards described below under the heading “Long-Term Incentive Plan” to Messrs. Dziedzic, Garland and Khales, in support of both long-term retention efforts and as an incentive to drive long-term shareholder growth. The award for Mr. Dziedzic is performance-based, with vesting contingent on specific stock price growth (along with a minimum service period), and the awards for both Mr. Garland and Mr. Khales are time-based RSUs that require continued employment with Integer.

2023 PROXY STATEMENT | 17

COMPENSATION DISCUSSION AND ANALYSIS

Components of the 2022 Executive Compensation Program. The principal components of our executive compensation program for 2022 are summarized below.

| | | | | | | | | | | |

| Compensation Element | Objective | Vehicles | Key Metrics |

| Base Salary | To provide market competitive pay to attract and retain executives. | Fixed cash | |

| Short-Term Incentive | To motivate and reward achievement of short-term financial and strategic objectives. | Variable cash | STI AOI, Quality measured as Product Lot Acceptance Rate ("Quality PLA Rate"), On-Time Delivery and Inventory Days on Hand; Functional Performance |

| Long-Term Incentive | To motivate and reward achievement of long-term performance consistent with stockholder interests and enhance retention of executives. | PSUs and RSUs | For PSUs, organic revenue growth and rTSR versus peers |

| | | |

| | | |

Corporate Governance Best Practices. Below is a summary of best practices that the Compensation Committee has implemented with respect to the compensation of our NEOs. We believe these practices support our compensation philosophy and are in the best interests of the Company and our stockholders.

| | | | | | | | | | | | | | |

| WHAT WE DO | | WHAT WE DON’T DO |

| ü | Align NEOs to our pay-for-performance philosophy | | û | Provide automatic, annual increases in executive salaries |

| ü | Substantial portion of NEO pay is performance-based | | û | Provide tax gross-ups for change-in control benefits |

| ü | Use independent performance metrics in LTI | | û | Stock-option award repricing |

| ü | Consider equity usage and stockholder dilution | | û | Single trigger equity acceleration on change in control |

| ü | Double trigger severance agreements | | | where the acquiror agrees to assume the award |

| ü | Maintain a Clawback / Recoupment Policy | | û | Permit hedging and pledging of Company stock |

| ü | Stock ownership guidelines for executives and directors | | û | Reload exercised stock option grants |

| ü | Engage in stockholder outreach | | û | Maintain evergreen provisions in long-term incentive plans |

| ü | Annual assessment of compensation risks | | û | Excessive perquisites |

| ü | Hold an annual say-on-pay advisory vote | | û | Grant stock options with an exercise price less than fair |

| ü | Independent Compensation Committee consultant | | | value at grant |

| ü | Cap value of shares vesting under rTSR PSUs and cap annual cash incentive | | | |

| ü | Annually review our compensation strategy | | | |

| ü | CEO compensation approved by independent Board members | | | |

Say-on-Pay. At our 2022 Annual Meeting of Stockholders, our stockholders had the opportunity to vote on an advisory basis on the compensation paid to our NEOs. The result of this advisory “say-on-pay” vote was overwhelmingly supportive, with 96.6% of votes cast (excluding abstentions and broker non-votes) voting in favor of our compensation program for our NEOs. Based on the voting results, we believe our overall executive compensation program is aligned with the interests of our stockholders. The Compensation Committee will consider the results of this year’s say‑on‑pay proposal, as well as feedback from our stockholders, when making future executive compensation decisions.

18 | 2023 PROXY STATEMENT

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Philosophy

Our compensation philosophy is to provide a competitive compensation package that will attract, retain and motivate our executives to drive the Company’s success through high performance and innovation, to link our executives’ compensation to short- and long-term performance of the Company and to align our executives’ compensation with the interests of our stockholders. The compensation programs for our NEOs are designed to be consistent with our compensation philosophy.

We have designed our executive compensation programs to include:

•Base salary

•Annual performance-based incentives under our STI program

•Long-term equity incentives, including RSUs and PSUs

•Limited executive perquisites

•Health and welfare benefits

•Retirement savings plans

•Change-in-control agreements and severance benefits

Total target compensation opportunities are set within the competitive ranges provided by our peers (as discussed below under “Competitive Market Review”) and industry surveys for comparable positions. However, due to the performance-based nature of our program, our executives can realize more, or less, than these target amounts commensurate with the Company’s performance against pre-established short- and long-term goals, individual performance, and additional Committee considerations. The Compensation Committee believes that this design allows the Company to attract and retain executives who have developed the appropriate skill set to execute our strategic plans as we work towards attaining both our short- and long-term strategic objectives, while properly incentivizing and aligning our executive officers to our stockholders. The executive compensation program for our NEOs allows the Compensation Committee to respond to the evolving business environment, address individual performance and consider internal and external pay equity.

Compensation Committee Practices and Procedures

The Compensation Committee has direct oversight responsibility for the Company’s compensation practices with appropriate approval and general oversight from the Board. This responsibility includes the determination of compensation levels and awards provided to the Company’s executive leadership team who report to the CEO, which includes all NEOs other than the CEO. The independent members of the Board maintain responsibility for determining the compensation levels and awards provided to the CEO after the Compensation Committee evaluates and reports to the Board on the CEO’s performance in light of annual compensation-related goals and objectives. The Compensation Committee directly engages an independent compensation consulting firm to review the Company’s executive compensation programs and provide guidance on compensation matters and recommendations made by management. During 2022, the Committee performed a request for proposal process, and decided to retain the incumbent consultant, Frederic W. Cook & Co., Inc. (“FW Cook”), after a thorough review of each participating consulting firm’s capability, experience and proposed fees. In 2022, FW Cook advised the Compensation Committee on the Company’s executive compensation programs and representatives of FW Cook were present for all meetings held by the Compensation Committee, except during select instances when the Compensation Committee met in executive session.

In accordance with SEC and NYSE rules regarding the independence of compensation consultants, the Compensation Committee annually considers (i) the other services the independent compensation consulting firm provides to the Company, (ii) the amount of fees paid to the independent compensation consulting firm by the Company, (iii) the independent compensation consulting firm’s policies and procedures designed to prevent conflicts of interest, (iv) any business or personal relationship the independent compensation consulting firm may have with any member of the Compensation Committee, (v) any stock of the Company owned by the independent compensation consulting firm, and (vi) any business or personal relationships the independent compensation consulting firm has with any of the NEOs. Following the annual review, the Compensation Committee concluded for purposes of 2022 that FW Cook’s work for the Compensation Committee did not raise a conflict of interest.

In 2022, the Compensation Committee evaluated a comprehensive compensation comparison report and the analysis by FW Cook. For CEO compensation, the Compensation Committee reported its conclusions to the independent members of the Board, who then approved base salary, target bonus percentage and LTI awards for Mr. Dziedzic, our President and CEO, incorporating an evaluation of his performance. The performance reviews for Mr. Dziedzic used as part of the compensation determination were based on his individual performance as well as on the Company’s performance during the prior year. Similarly, in February 2023, the independent members of the Board reviewed and approved Mr. Dziedzic’s STI award payout for 2022. For the other NEOs, the Compensation Committee gave consideration to the input and recommendations from Mr. Dziedzic regarding performance, base salary adjustments and annual STI and LTI programs and award amounts for each NEO.

2023 PROXY STATEMENT | 19

COMPENSATION DISCUSSION AND ANALYSIS

Competitive Market Review

The Compensation Committee compares Company performance and compensation programs against a peer group of companies. Prior to setting compensation for 2022, the Compensation Committee reviewed the make-up of the peer group. Cantel Medical Corp. and Wright Medical Group N.V. were removed from the peer group as they were acquired. The Committee determined that ICU Medical, Natus Medical and Orthofix Medical would be added to the peer group based on size/financial profile and business fit, for compensation decisions impacting 2022. In selecting the peer group, the Compensation Committee applied the following screening criteria and rationale:

•Public company - ensures availability of market data

•Headquartered in the United States - ensures labor market overlap

•Medical equipment and supplies industry focus - considers impact of industry practices on compensation amount and design

•Revenue proximity - revenue is a proxy for business complexity and is correlated to compensation

•Market cap - secondary size characteristic and one of the constraints on the aggregate equity award value

The companies included in the peer group for the evaluation of 2022 executive compensation are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Avanos Medical, Inc. | | Integra LifeSciences Holdings Corporation | | Orthofix Medical Inc. | |

| Benchmark Electronics, Inc. | | ICU Medical, Inc. | | Plexus Corp. | |

| Bruker Corporation | | Masimo Corporation | | STERIS plc | |

| CONMED Corporation | | Merit Medical Systems, Inc. | | Teleflex Incorporated | |

| Haemonetics Corporation | | Natus Medical Incorporated | | Varex Imaging Corporation | |

| Hill-Rom * | | NuVasive, Inc. | | West Pharmaceutical Services, Inc. | |

| | | | | | |

| | |

* Hill-Rom was acquired in December 2021, and was no longer part of the compensation peer group, however their available information was included in benchmarking used for 2022 compensation decisions by the Compensation Committee.

During 2022, the Compensation Committee reviewed the make-up of the peer group in light of recent corporate transactions among the collective group, and determined that: (i) Hill-Rom Holdings, Inc. and Natus Medical, Inc. should be removed as they had been acquired; (ii) STERIS plc and West Pharmaceutical Services, Inc. should be removed as their market capitalizations are significantly in excess of the Company’s market capitalization; and (iii) Envista Holdings Corporation, Globus Medical, Inc., Methode Electronics, Inc., Nordson Corporation and OSI Systems, Inc. would be added to the peer group based on size/financial profile and business fit, for compensation decisions impacting 2023.

20 | 2023 PROXY STATEMENT

COMPENSATION DISCUSSION AND ANALYSIS

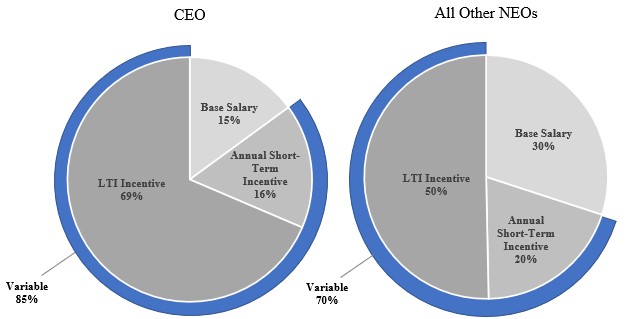

Executive Compensation Pay Mix

The overall mix of base salary, STI awards and LTI awards as a percent of total target direct compensation for our CEO and the average for our other NEOs as a group are illustrated below. The value of the STI is based on target performance. The value of the LTI is based on the grant date fair value of the regular annual long-term incentive award value, excluding any special awards made in 2022. In 2022, special recognition and retention awards were made to Messrs. Dziedzic, Garland and Khales. These awards are described below in the section titled “Long-Term Incentive Plan.” All other compensation has been excluded in determining these percentages.

Our pay-for-performance philosophy is reflected in the pie charts below, which depict the composition of our CEO’s and other NEOs’ target total direct 2022 compensation, and the portions that are subject to Company performance. For our CEO, 85% of target direct compensation is subject to performance (70% for our other NEOs as a group), including financial goals and stock price:

CEO and Other NEOs’ Target Pay Mix(1)

(1) The amounts shown for All Other NEOs represent their average target pay mix, and LTI Incentives for both CEO and Other NEOs exclude the grant date fair value of any special long-term incentive awards.

Base Salary

We provide our NEOs with a fixed level of cash compensation in the form of base salary to provide market competitive pay to attract and retain executives. Base salary is consistent with each NEO’s skill level, experience, knowledge, length of service with our Company and the level of responsibility and complexity of their position. The Compensation Committee does not use a specific formula when setting base salary for our NEOs, but our general practice is to target the competitive market median of our peer group for base salary. In addition to the factors listed above, actual individual base salaries may differ from the competitive market median of our peer group with consideration for various other factors including specific responsibilities, relative depth of experience, prior individual performance and expected future contributions, internal pay equity considerations within our Company and the degree of difficulty in replacing the individual.

The base salaries of our NEOs are reviewed by the Compensation Committee on an annual basis, as well as at the time of promotion or significant changes in responsibility.

Effective in March 2022, our NEOs received base pay increases ranging from 4% to 20%. The pay increases varied in order to align base salaries with the desired competitive market position and the Compensation Committee’s assessment of individual performance.

The annualized base salary for 2022 and 2021 for each of our NEOs was as follows:

| | | | | | | | | | | | | | | | | | | | | | |

| NEO | | 2022 | | 2021 | | Increase | | |

| Joseph W. Dziedzic | | $ | 1,200,000 | | | $ | 1,000,000 | | | 20.0 | % | | |

| Jason K. Garland | | 550,000 | | | 509,000 | | | 8.1 | | | |

| Jennifer M. Bolt | | 450,000 | | | 410,000 | | | 9.8 | | | |

| Carter Houghton | | 385,000 | | | 367,000 | | | 4.9 | | | |

| Payman Khales | | 450,000 | | | 421,000 | | | 6.9 | | | |

2023 PROXY STATEMENT | 21

COMPENSATION DISCUSSION AND ANALYSIS

Short-Term Performance-Based Incentives

The objective of our annual STI program is to provide a competitive level of performance-based annual compensation at the target achievement level, with the opportunity for incentive compensation above target if stretch performance is achieved. Achievement at the 100% target level is deemed to be a “realistic” but challenging goal, and any amount greater than the target is considered a “stretch” goal. Accordingly, performance achievement at target would result in 100% payout of the target STI bonus amount, whereas better performance would result in a higher than target payout, up to 200%, and lower performance would result in a lower than target payout, and no payout if performance fails to reach at least a threshold level. The Compensation Committee established the 2021 STI plan in recognition of the potential for lingering effects of the pandemic on the Company. The Compensation Committee established a wider-than-typical range of achievement to payout ratios and a flatter curve for payout, making the maximum payout more difficult to achieve while reducing the threshold achievement level and corresponding payout percentage. For the 2022 STI goal setting process, the Compensation Committee, in recognition of the ongoing impact of the global pandemic and its uncertainty on predictable results, continued to maintain the same payout curve set for the 2021 year. The Compensation Committee plans to revisit this approach in future periods to determine the most appropriate threshold and maximum achievement levels for the STI plan. The threshold and maximum payouts under the 2022 STI plan can be summarized as follows:

| | | | | | | | | | | | | | | | |

2022 Performance % of Target | | Payout

% of Target | | |

| 75% | * | | 25% | | |

| 85% | | 50% | | |

| 100% | | 100% | | |

| 120% | | 200% | | |

* No payout for performance below the threshold level of 75% performance.

The STI program focuses on key measures of success that the executive team is able to impact over an annual timeframe. The metrics provide a balanced view of executive performance on the following dimensions:

•Company-wide financial results (STI AOI);

•Financial results of the product category for Product Category Presidents (“Product Category Performance”), with Product Category Performance composed of measures of product category operating profit (40% weight), Quality PLA Rate (30% weight), inventory days-on-hand (15% weight) and on-time delivery measured in terms of delivery-to-promise and delivery-to-lead-time (10% and 5% weight, respectively); and

•Function performance rating (“Function Performance Rating”) for leaders of key functions, which focuses on the function’s performance in delivering against the leader’s objectives and contributions in advancing the Company’s strategy and delivering on strategic imperatives.