Directors are elected to serve for one year or until their successors are elected and qualified or until their earlier resignation or removal. All directors are elected annually at the annual meeting of stockholders.

Department of Energy. Prior to his employment at the Department of Energy, Dr. MacLachlan was employed by DuPont for 36 years, where he was senior vice president for research and development and chief technical officer from 1986 to 1993, and a member of DuPont's operating group from 1990 to 1993.

PETER A. MCGUIGAN has served on the Company's Board of Directors since March 2004. Mr. McGuigan has served as managing partner of McGuigan Tombs & Company, P.C. since the firm's founding in March 1990. Mr. McGuigan has served on various AICPA and NJSCPA sponsored tax and accounting committees since obtaining his CPA certification in May 1984. From 1982 through 1990, Mr. McGuigan held both audit and tax supervisory positions for both international and medium sized public accounting firms.

ZOLTAN MERSZEI has served on the Company's Board of Directors since May 2000. Mr. Merszei retired as the president, chairman and chief executive officer of The Dow Chemical Company in March 1980. From August 1974 to March 1980, he served as president and chief executive officer of Dow Chemical Europe. From May 1980 to May 1988, Mr. Merszei served in various executive positions with Occidental Petroleum Corporation, including chairman and chief executive officer of Occidental Chemical, chairman of Occidental Research and president and chief executive officer, and subsequently, vice chairman of the Board of Directors of Occidental Petroleum. Mr. Merszei currently serves as a director of ThyssenKrupp Budd Company, Dole Food Company Inc., Thyssen Industrie AG (Germany) and Thyssen Henschel America.

H. DAVID RAMM has served on the Company's Board of Directors since June 2000. Effective March 19, 2004, Mr. Ramm was named Chief Executive Officer and President of the Company until the Company selects a permanent successor to Dr. Tang. Mr. Ramm is a principal of DKR Development, L.L.C., a renewable energy consulting and project development firm. He was formerly president, chief executive officer and a director of Integrated Electrical Services. From 1997 to March 2000, he was employed by Enron, first as managing director of Enron Renewable Energy, and then as president of Enron Wind Corp. Prior to his employment at Enron, Mr. Ramm worked for 14 years at United Technologies Corporation, where he held several senior management positions, including chairman and chief executive officer of International Fuel Cells Corporation.

JAMES L. RAWLINGS has served on the Company's Board of Directors since April 2000. Mr. Rawlings is a member of Andersen & Company, LLC. Prior to joining Andersen & Company, LLC, he was a managing director, principal and member of the Board of Directors of Schooner Asset Management Co. LLC, an asset management firm. Before joining Schooner, he was a managing director of Robert Fleming & Co., a London-based investment bank, where he was responsible for investment banking activities in North and South America. He was a managing director in the corporate finance department with Drexel Burnham Lambert, Incorporated from 1979 to 1988.

RICHARD L. SANDOR, PH.D. has served on the Company's Board of Directors since April 2003. Dr. Sandor is currently Chairman and Chief Executive Officer of Chicago Climate Exchange, Inc., a self-regulatory exchange that administers a voluntary greenhouse gas reduction and trading program for North America. Prior to the establishment of Chicago Climate Exchange, Dr. Sandor was a senior markets executive with several financial institutions including Kidder Peabody, Banque Indosuez, and Drexel Burnham Lambert. For more than three years, he was Vice President and Chief Economist at the Chicago Board of Trade. From 1997 to 1998, Dr. Sandor served as Second Vice Chairman - Strategy for the Chicago Board of Trade. Dr. Sandor is currently a director of NASDAQ LIFFE Markets and of the IntercontinentalExchange, an electronic marketplace for commodity and deriviative products. He is a director of American Electric Power, a Columbus-based public utility that provides electric power, telecommunication, energy efficiency and financial services. He is also a director of the Zurich-based Sustainable Performance Group, an investment and risk management company. In addition, Dr. Sandor is a research professor at the Kellogg Graduate School of Management at Northwestern University and previously held faculty positions with the School of Business Administration at the University of California, Berkeley and Stanford University.

JOHN R. WALLACE has served on the Company's Board of Directors since April 2003. Mr. Wallace recently retired as executive director of TH!NK Group at Ford Motor Company and, since

5

August 2002, has served as a consultant in the areas of fuel cell and hybrid electric vehicle strategy. Mr. Wallace was active in Ford Motor Company's alternative fuel vehicle program since 1990, serving first as Director, Technology Development Programs, then as Director, Electronic Vehicle Programs, Director, Alternative Fuel Vehicles, and finally Director, Environmental Vehicles. From 1988 to 1990, Mr. Wallace served as a Director of Ford's Electronic Systems Research Laboratory, Research Staff. Prior to joining Ford Research Staff, he was president of Ford Microelectronics, Inc. Mr. Wallace currently serves on the Board of Directors of Enova Systems, Inc., Xantrex and the Electric Drive Transportation Association.

Executive Officers

ADAM P. BRIGGS currently serves as the Company's Vice President of Product Management. Prior to joining the Company in 2001, Mr. Briggs was employed at Duracell from 1984 to 2001, where he was the Vice President of Strategic OEM (Original Equipment Manufacturer) Sales and Consulting Group in the Global Business Management Group. Prior positions include Director of Global Strategic Account Management; Program Director — Alkaline; Director of OEM Sales and Marketing — Asia; Leader, Design Win Management Team — Far East and OEM Marketing Director — Far East. Mr. Briggs received his B.A. in physics from Bowdoin College.

REX E. LUZADER serves as the Company's Vice President of Government and Military Sales. Prior to joining the Company in 2000, Mr. Luzader was the Vice President of Original Equipment Sales and Engineering and Corporate Strategy for Exide Corporation from 1998 to 1999. From 1988 to 1998, Mr. Luzader also held a number of Vice Presidential positions at Exide Corporation including sales to the transportation industry, product engineering, process and equipment engineering, research and development and quality control. Mr. Luzader received his B.S. in mechanical engineering from Kettering University. From 1988 to 1999 he also served as a member of the Board of Directors of Great Valley Bank in Reading, Pennsylvania.

The Board and Its Committees

The Board held eight meetings in 2003 in addition to acting by unanimous written consent once. Each director, except Messrs. Sandor and Wallace, attended at least 75% of all meetings of the Board and committees of the Board to which he was assigned. Members of the Company's Board of Directors are invited but not required to attend the Annual Meeting of Stockholders. The 2003 Annual Meeting of Stockholders was attended by the following directors: Andersen, Baker, MacLachlan, Ramm, Rawlings, Tang and Wallace.

Independent Directors

The Board has determined that the following individuals are independent directors within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market: Messers. Baker, MacLachlan, McGuigan, Merszei, Rawlings, Sandor and Wallace. The independent directors will meet regularly in executive session and outside the presence of our management throughout the 2004 fiscal year in compliance with the listing standards of the NASDAQ Stock Market.

Director Nominations

Due to the relatively small size of the Company, the Board of Directors has determined that it is not necessary or appropriate at this time to establish a separate Nominating Committee. The Board has adopted a requirement that all director nominees be nominated by a majority vote of the independent directors prior to consideration by the full Board. All of the nominees recommended for election to the Board of Directors at the Annual Meeting are directors standing for re-election.

The Board of Directors believes that it is necessary that the majority of the Board of Directors must be comprised of independent directors as mandated by the listing standards of the NASDAQ Stock Market and desirable to have at least one financial expert on the Board of Directors. When considering potential director candidates, the Board also considers the candidate's character, judgment, age, skills, including financial literacy, and experience in the context of the needs of the Company and the Board of Directors. In 2003, we did not pay any fees to any third party to assist in identifying or evaluating potential nominees.

6

The Board of Directors will consider director candidates recommended by our stockholders in a similar manner as those recommended by members of management or other directors. The name of any recommended candidate for director, together with a brief biographical sketch, a document indicating the candidate's willingness to serve, if elected, and evidence of the nominating person's ownership of Company stock should be sent to the attention of the Secretary of the Company. To date, we have not received any recommended nominees from any non-management stockholder or group of stockholders that beneficially owns five percent of our voting stock.

Stockholder Communication with the Board of Directors

Stockholders may communicate with directors by contacting the Chief Executive Officer by phone at (732) 542-4000 or in writing at the Company's headquarters. Any such communication must contain (i) a representation that the stockholder is a holder of record of stock of the Company, (ii) the name and address, as they appear on the Company's books, of the stockholder sending such communication, and (iii) the number of shares of Company stock that are beneficially owned by such stockholder. The Secretary of the Company will relay the question or message to the specific director identified by the stockholder or, if no specific director is requested, to a director selected by the Secretary of the Company, unless such communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Secretary of the Company has the authority to discard the communication or to take appropriate legal action regarding such communication.

Director Compensation

Employee directors receive no additional compensation for serving as a director of the Company. Non-management directors receive compensation for serving in the following capacities: Chairman of the Board — $40,000, Committee Chairman — $30,000. Independent directors who do not serve in a chairman capacity receive $12,000. In addition, each non-management director receives $1,000 for each Board and Committee meeting attended. In lieu of cash payments, non-management directors were granted restricted stock for all fees earned in 2003.

Board Committees & Meetings

The Board has three standing committees — an Executive Committee, an Audit Committee and a Compensation Committee.

Executive Committee

The Board has established an Executive Committee consisting of G. Chris Andersen, James L. Rawlings and H. David Ramm. The principal functions of the Executive Committee include exercising the powers of the Board during intervals between Board meetings and acting as an advisory body to the Board by reviewing various matters prior to their submission to the Board. The Executive Committee held four meetings in 2003.

Audit Committee

The Board has established an Audit Committee consisting of Kenneth R. Baker, Peter A. McGuigan, Zoltan Merszei, and John R. Wallace, all of whom are independent directors within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market. Mr. Baker is the Chairman of the Audit Committee. Peter A. McGuigan is qualified as an "audit committee financial expert" within the meaning of SEC regulations and the Board has determined that he has accounting and related financial management experience within the meaning of the listing standards of the NASDAQ Stock Market. The Audit Committee held five meetings in 2003.

The Audit Committee is responsible for reviewing and inquiring into matters affecting financial reporting, the system of internal accounting, financial controls and procedures and audit procedures and audit plans. In addition, the audit committee generally oversees the Company's internal compliance program. In accordance with applicable law, the Audit Committee is responsible for

7

establishing procedures for the receipt, retention and treatment regarding accounting, internal accounting controls or audit matters, including the confidential, anonymous submission by Company employees, received through established procedures, of concerns regarding questionable accounting or auditing matters. Furthermore, the Audit Committee approves the quarterly financial statements and also recommends to the Board of Directors, for approval, the annual financial statements, the annual report and certain other documents required by regulatory authorities. The Audit Committee is further responsible to pre-approve all audit and non-audit services performed by the Company's independent auditors.

In response to the audit committee requirements adopted by the SEC and the NASDAQ Stock Market in 2003, the Board of Directors has adopted an Amended and Restated Audit Committee Charter that specifies the responsibilities of the Audit Committee. The Amended and Restated Audit Committee Charter is attached hereto as Appendix A.

Audit Committee Report

During the year ended December 31, 2003, the Audit Committee reviewed and discussed the audited financial statements with management and the Company's independent accountants, Ernst & Young LLP. The Audit Committee discussed with the independent accountants the matters required to be discussed by the Statement of Auditing Standards No. 61 "Communication with Audit Committees" and reviewed the results of the independent accountants' examination of the financial statements.

The Audit Committee also reviewed the written disclosures and the letter from the independent accountants required by Independence Standards Board, Standard No. 1 "Independence Discussions with Audit Committees", discussed with the accountants the accountants' independence, including a review of audit and non-audit fees, and satisfied itself as to the accountants' independence.

Based on the above reviews and discussions, the Audit Committee recommends to the Board of Directors that the financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2003 for filing with the SEC.

The Board of Directors has determined that the members of the Audit Committee are independent within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market.

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings made by the Company under those statutes, in whole or in part, this report shall not be deemed to be incorporated by reference into any such filings, nor will this report be incorporated by reference into any future filings made by the Company under those statutes.

| Kenneth R. Baker

Chairman of the Audit Committee

Kenneth R. Baker

Peter A. McGuigan

Zoltan Merszei |

Compensation Committee

The Company's Board has established a Compensation Committee consisting of Alexander MacLachlan and James L. Rawlings, all of whom are independent directors within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market. Mr. Rawlings is the Chairman of the Compensation Committee. The Compensation Committee reviews and acts on matters relating to compensation levels and benefit plans for the Company's executive officers and key employees, including salary and stock options. The Compensation Committee is also responsible for granting stock options and other awards to be made under the Company's stock option plan. The Compensation Committee held two meetings in 2003.

8

Compensation Committee Report

The Board appointed the Compensation Committee in June 2000. Since that time, decisions on compensation of the Company's executive officers have been made by the Compensation Committee. No member of the Compensation Committee is an employee of the Company and each member is "independent" within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market.

The Compensation Committee reviews and approves base salary, annual management incentive compensation and long-term incentive awards for all corporate officers and certain other key executives, with the objective of attracting and retaining individuals of the necessary quality and stature to operate the business. The Compensation Committee considers individual contributions, performance against strategic goals and direction, and industry-wide pay practices in determining the levels of base compensation for key executives.

Long-term incentive awards are granted to corporate officers and certain other key employees under the Company's Amended and Restated 2000 Stock Option Plan. The awards take the form of stock options that are tied directly to the market value of the Company's Common Stock.

The Compensation Committee believes that the Amended and Restated 2000 Stock Option Plan aligns the interests of management with the stockholders and focuses the attention of management on the long-term success of the Company. A significant portion of the executives' compensation is at risk, based on the financial performance of the Company and the value of the Company's Common Stock in the marketplace.

In August 2003, the Compensation Committee approved the exchange of 835,500 eligible stock options for 197,599 shares of restricted stock related to an exchange offer. This offer allowed eligible plan participants to exchange options for restricted stock at an exchange rate based on the calculated market value of the stock options using a Black-Scholes model.

Section 162(m) of the Internal Revenue Code limits to $1.0 million in a taxable year the deduction publicly held companies may claim for compensation paid to executive officers, unless such compensation is performance-based and meets certain requirements. None of the Company's executive officers' compensation exceeds the limit set by Code Section 162(m).

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings made by the Company under those statutes, in whole or in part, this report shall not be deemed to be incorporated by reference into any such filings, nor will this report be incorporated by reference into any future filings made by the Company under those statutes.

| James L. Rawlings

Chairman of the Compensation Committee

Alexander MacLachlan |

Compensation Committee Interlocks and Insider Participation

The Company's Compensation Committee consists of Alexander MacLachlan and James L. Rawlings. Mr. Ramm has resigned from the Compensation Committee in connection with his being selected to serve as the Company's Chief Executive Officer. The Company formed this Committee in June 2000. During 1999, Mr. Rawlings served as the Company's acting Chief Executive Officer.

Code of Conduct

The Company has adopted a Code of Conduct that applies to all officers, directors, employees and consultants. The Code of Conduct is intended to comply with SEC regulations and the listing standards of the NASDAQ Stock Market. The Company's Code of Conduct is posted on its Internet website under the "Investor Relations" page. The Company's Internet website address is www.millenniumcell.com.

9

Executive Compensation

The following table sets forth all compensation awarded to, earned by or paid to the Company's Chief Executive Officer and the Company's four other most highly compensated executive officers whose annual salary and bonus exceeded $100,000 in the fiscal years ended December 31, 2001, 2002 and 2003 for services rendered in all capacities to the Company during those fiscal years ("named executive officers"). The Company's named executive officers commenced employment with the Company during 2000, except Mr. Briggs who commenced employment in 2001 and Mr. Lefebvre who commenced employment in April, 2003. Accordingly, information presented for 2001 relating to Mr. Briggs and in 2003 relating to Mr. Lefebvre represents their compensation for a partial year.

Summary Compensation Table

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Annual Compensation |  | Long Term

Compensation Awards |  |

| Name And Principal Position |  | Fiscal

Year |  | Salary |  | Bonus |  | Restricted

Stock

Awards(1) |  | Stock

Options

# of shares |  | All Other

Compensation(3) |

| Stephen S. Tang * |  | | 2003 | |  | $ | 344,226 | |  | $ | 0 | |  | | 0 | |  | | 125,000 | (2) |  | $ | 12,000 | |

| President, Chief Executive Officer |  | | 2002 | |  | $ | 319,856 | |  | $ | 0 | |  | | | |  | | 125,000 | |  | $ | 11,000 | |

| & Acting Chief Financial Officer |  | | 2001 | |  | $ | 283,833 | |  | $ | 130,281 | |  | | | |  | | 143,564 | |  | $ | 10,500 | |

| |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  |

| Roland E. Lefebvre * |  | | 2003 | |  | $ | 213,148 | (4) |  | $ | 75,000 | |  | | 0 | |  | | 250,000 | |  | $ | 12,000 | |

| Former Chief Operating Officer |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  |

| |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  |

| Terry M. Copeland * |  | | 2003 | |  | $ | 220,632 | (5) |  | $ | 0 | |  | | 0 | |  | | 0 | |  | $ | 12,000 | |

| Former Vice President, Product |  | | 2002 | |  | $ | 242,078 | |  | $ | 0 | |  | | | |  | | 50,000 | |  | $ | 11,000 | |

| Development |  | | 2001 | |  | $ | 210,700 | |  | $ | 85,800 | |  | | | |  | | 172,500 | |  | $ | 10,500 | |

| |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Rex E. Luzader |  | | 2003 | |  | $ | 232,327 | |  | $ | 0 | |  | $ | 52,572 | |  | | 50,000 | (2) |  | $ | 12,000 | |

| Vice President of Government |  | | 2002 | |  | $ | 211,070 | |  | $ | 0 | |  | | | |  | | 50,000 | |  | $ | 11,000 | |

| and Military Sales |  | | 2001 | |  | $ | 202,367 | |  | $ | 82,800 | |  | | | |  | | 127,500 | |  | $ | 10,500 | |

| |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Adam P. Briggs |  | | 2003 | |  | $ | 203,478 | |  | $ | 0 | |  | $ | 58,650 | |  | | 75,000 | (2) |  | $ | 12,000 | |

| Vice President, Product |  | | 2002 | |  | $ | 187,620 | |  | $ | 0 | |  | | | |  | | 75,000 | |  | $ | 11,000 | |

| Management |  | | 2001 | |  | $ | 154,828 | |  | $ | 81,260 | |  | | | |  | | 150,000 | |  | $ | 8,750 | |

|

| *Dr. Tang has tendered his resignation effective as of March 19, 2004. Mr. Lefebvre left the Company on January 30, 2004. Mr. Copeland left the Company on August 30, 2003. |

| (1) | Issuance of restricted stock pursuant to an exchange offer in August 2003 whereby eligible stock options were exchanged, at the option of the holder, for shares of restricted stock at an exchange rate based on the calculated market value of the stock options using a Black-Scholes model. The restricted stock vests in two tranches: 50% vests on August 22, 2004, or if the common stock price closes at or above $4.25, whichever occurs first, and the remaining 50% vests on August 22, 2005, or if the common stock price closes at or above $5.10, whichever occurs first. No shares of restricted stock have vested to date. The value set forth above is based on the closing price of the stock on the date of grant, August 20, 2003, which was $1.70. The restricted stock is entitled to dividends, however, the Company has never paid dividends on its common stock and does not expect to pay any dividends in the foreseeable future. |

| (2) | The Compensation Committee designated a pool of options to grant to employees in December 2003 and granted such options to specific employees in February 2004. The options included in the amount relate to the February 2004 allocation. |

| (3) | Amounts indicated are the Company contributions to the Company's 401(k) plan. |

| (4) | Includes $28,287 in relocation assistance. |

| (5) | Includes $36,800 in severance payment. |

10

Option Grants in 2003

The following table provides information with respect to stock options granted to the named executive officers during fiscal year 2003.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Individual Grants |  | Potential Realizable

Value At Assumed

Annual Rates Of

Stock Price Appreciation

For Option Term |

| |  | Number Of

Shares

Underlying

Options

Granted(1) |  | % Of Total

Options

Granted To

Employees

In Fiscal Year |  | Exercise

Price Per

Share |  | Expiration

Date |  |  |

| |  | 5% |  | 10% |  |

| Stephen S. Tang |  | | 125,000 | |  | | 15 | % |  | $ | 2.40 | |  | | 2/24/2014 | |  | $ | 24,433 | |  | $ | 38,906 | |  |

| Roland E. Lefebvre |  | | 250,000 | |  | | 30 | % |  | $ | 2.08 | |  | | 4/22/2013 | |  | $ | 42,351 | |  | $ | 67,437 | |  |

| Terry M. Copeland |  | | 0 | |  | | 0 | |  | $ | 0.00 | |  | | | |  | $ | 0 | |  | $ | 0 | |  |

| Rex E. Luzader |  | | 50,000 | |  | | 6 | % |  | $ | 2.40 | |  | | 2/24/2014 | |  | $ | 9,773 | |  | $ | 15,562 | |  |

| Adam P. Briggs |  | | 75,000 | |  | | 9 | % |  | $ | 2.40 | |  | | 2/24/2014 | |  | $ | 14,660 | |  | $ | 23,344 | |

|

|  |

| (1) | Options indicated were earned in 2003 but actually granted in 2004, except for Mr. Roland Lefebvre which were granted on April 22, 2003. |

Fiscal Year-End 2003 Option Values

The following table provides information with respect to the Company's named executive officers concerning unexercised options held by them at the end of 2003. The table includes options which were earned by the named executive officers in 2003 but actually granted in 2004. There were no options exercised in 2003 by the Company's named executive officers.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Number of Securities

Underlying Unexercised

Options at

December 31, 2003 |  | Value of Unexercised In-The-

Money Options at

December 31, 2003 |

| Name |  | Exercisable |  | Unexercisable |  | Exercisable |  | Unexercisable |

| Stephen S. Tang (1) |  | | 1,114,397 | |  | | 291,667 | |  | $ | 0 | |  | $ | 0 | |

| Roland E. Lefebvre (2) |  | | 0 | |  | | 250,000 | |  | $ | 0 | |  | $ | 62,500 | |

| Terry M. Copeland(3) |  | | 149,170 | |  | | | |  | $ | 0 | |  | $ | 0 | |

| Rex E. Luzader |  | | 0 | |  | | 100,000 | |  | $ | 0 | |  | $ | 0 | |

| Adam P. Briggs |  | | 0 | |  | | 150,000 | |  | $ | 0 | |  | $ | 0 | |

|

| (1) | Dr. Tang has tendered his resignation effective as of March 19, 2004. |

| (2) | Mr. Lefebvre left the Company on January 30, 2004. |

| (3) | Mr. Copeland left the Company on August 30, 2003. |

Employment Agreements & Change-in-Control Agreements

Stephen S. Tang

In May 2000, the Company entered into an employment agreement with Stephen S. Tang. Dr. Tang's employment agreement contemplated that Dr. Tang shall serve as the Company's Chief Executive Officer and President and provided for a base salary of $250,000 per year and a guaranteed bonus of 50% of his base salary in 2001. Dr. Tang was paid a $135,000 signing bonus. Dr. Tang was granted 1,012,500 options at an exercise price of $2.90 per share, with a term of 10 years in 2000 and 125,000 options at an exercise price of $4.35 per share, with a term of 10 years in 2002 but relating to fiscal 2001. One third of these options vest at the end of each year of employment for the first three years. In addition, in lieu of a 2001 bonus, Dr. Tang was granted options to acquire 18,564 shares at an exercise price of $4.35 with a term of 10 years which are immediately exercisable. One third of these options vest at the end of each year of employment for the first three years.

11

The Company and Dr. Tang entered into an amended and restated employment agreement effective as of January 1, 2002. The amended and restated employment agreement provides for a base salary of $318,056 for 2002 with at least annual increases as determined by the Compensation Committee of the Board of Directors. Under the amended and restated employment agreement, annual bonuses are paid to Dr. Tang upon the attainment of performance goals, as determined by the Compensation Committee and approved by the Board of Directors. Dr. Tang is also eligible for a discretionary bonus in addition to, or in lieu of, the annual bonus, as determined by the Board of Directors, based on his overall performance or achievement of certain objectives, other than those comprised in any annual bonus for that year, as the Board deems important for the success of the Company. In lieu of a 2003 annual bonus, Dr. Tang was granted an additional 125,000 options at an exercise price of $2.40, with a term of 10 years. One third of these options vests at the end of each year of employment for the first three years. In the event that Dr. Tang's employment is terminated without cause, Dr. Tang will be entitled to receive a severance payment in the amount of 150% of his base salary at that time plus 150% of his average annual bonus for the one and one-half years prior to the year in which such termination occurs. In addition, Dr. Tang is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for three years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier. Furthermore, he will be entitled to immediate and unconditional vesting of any unvested stock options and stock grants previously awarded to him and will have the right to exercise any stock options held by him for one year following the termination date, provided that any unvested performance stock options or awards will not vest unless the applicable performance objectives have been met prior to the termination date. In the event Dr. Tang's employment is terminated within two years following a change of control by the Company without cause or by Dr. Tang for good reason, he will be entitled to receive 300% of the sum of his base salary at that time and the average of his annual bonuses for the three years prior to the year in which the termination occurs. In addition, Dr. Tang is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for three years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier. Furthermore, he will be entitled to immediate and unconditional vesting of any unvested stock options and stock grants previously awarded to him and will have the right to exercise any stock options held by him for one year following the termination date, provided that any unvested performance stock options or awards will not vest unless the applicable performance objectives have been met prior to the termination date.

Dr. Tang has tendered his resignation effective as of March 19, 2004. The Company expects to make certain paymentss to Dr. Tang consistent with the provisions of his amended employment agreement as set forth above.

Adam P. Briggs

On January 1, 2003, the Company entered into a Change-In-Control Agreement with Mr. Briggs, the Company's Vice President of Product Management. In the event Mr. Briggs' employment is terminated within two years following a change of control by the Company without cause or by Mr. Briggs for good reason, he will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Briggs is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

Rex E. Luzader

On January 1, 2003, the Company entered into a Change-In-Control Agreement with Mr. Luzader, the Company's Vice President of Government and Military Sales. In the event Mr. Luzader's employment is terminated within two years following a change of control by the Company without cause or by Mr. Luzader for good reason, he will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the

12

year in which termination occurs. In addition, Mr. Luzader is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

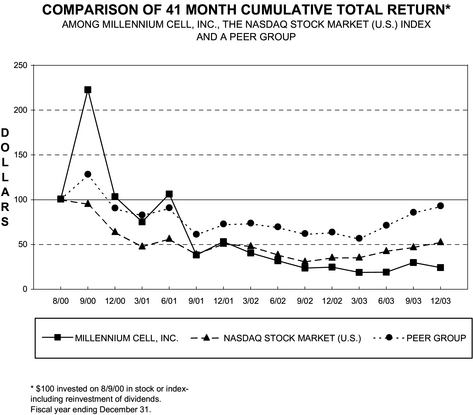

Comparative Stock Prices

The following chart sets forth comparative information regarding the Company's cumulative stockholder return on its common stock since its initial public offering in August 2000. Total stockholder return is measured by dividing share price change for a period by the share price at the beginning of the measurement period. The Company's cumulative stockholder return based on an investment of $100 at August 9, 2000, when the common stock was first traded on the Nasdaq National Market, and its closing price of $2.33 on December 31, 2003 is compared to the cumulative total return of the Nasdaq National Market and the industry index based on the Company's SIC code, 3690 — "Miscellaneous Electrical Machinery, Equipment and Supplies" during that same period assuming dividend reinvestment.

13

RATIFICATION OF THE APPOINTMENT OF THE

COMPANY'S INDEPENDENT PUBLIC ACCOUNTANTS

(PROPOSAL 2)

Effective March 7, 2000, the Company engaged the accounting firm of Ernst & Young LLP as the Company's principal independent accountants. The Board of Directors approved the recommendation of the Audit Committee for the appointment of Ernst & Young LLP to audit the financial statements of the Company for the fiscal year ending December 31, 2004. If the stockholders do not ratify the appointment of Ernst & Young LLP, the Audit Committee may reconsider its selection.

Ernst & Young LLP performed various audit and other services for the Company during fiscal year 2003. Such services included an audit of annual financial statements, interim reviews of quarterly financial statements, review and consultation connected with certain filings with the SEC, financial accounting and reporting matters, and meetings with the Audit Committee of the Board of Directors.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions.

Fees Paid to the Company's Auditors

Set forth below is certain information concerning fees billed to the Company by Ernst & Young LLP in respect of services provided in 2003 and 2002. The Audit Committee has determined that the provision of the provided services is compatible with maintaining the independence of Ernst & Young LLP.

|  |  |  |  |  |  |  |  |  |  |

| Fees |  | 2003 |  | 2002 |

| Audit Fees |  | $ | 252,000 | |  | $ | 221,000 | |

| Audit-Related Fees |  | | 0 | |  | | 0 | |

| Tax Fees |  | | 0 | |  | | 5,000 | |

| All Other Fees |  | | 0 | |  | | 9,500 | |

| TOTAL |  | $ | 252,000 | |  | $ | 235,500 | |

|

Audit Fees. Annual audit fees relate to services rendered in connection with the audit of the annual financial statements included in the Company's Form 10-K filing, the quarterly reviews of financial statements included in our Form 10-Q filings and registration statement consent procedures.

Audit Related Fees. There were no audit related fees for professional services rendered by Ernst & Young LLP for fiscal years 2003 or 2002, respectively.

Tax Fees. The 2002 fees primarily related to tax services including fees for tax compliance, tax advice and tax planning.

All Other Fees. The 2002 fees primarily related to market compensation analysis. No professional services were rendered or billed by Ernst & Young LLP for financial information systems design and implementation for the fiscal years 2003 and 2002.

Pre-Approval Policies

The Audit Committee pre-approves all audit and non-audit service provided by our independent auditors prior to the engagement of the independent auditors with respect to such services.

The stockholders are being asked to ratify the Board's appointment of Ernst & Young LLP. The affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting is required for the ratification and approval of the appointment of independent accountants. All shares of common stock represented by valid proxies received pursuant to this solicitation, and not revoked before they are exercised, will be voted in the manner specified. If you execute and return a proxy without instruction, your shares will be voted for ratification of the appointment of Ernst & Young LLP as independent accountants for the Company for fiscal year 2004.

14

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" RATIFICATION AND APPROVAL OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT ACCOUNTANTS FOR THE COMPANY FOR FISCAL YEAR 2004.

COMMON STOCK OWNERSHIP OF

PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table lists the beneficial ownership of the common stock of each director of the Company, the named executive officers, each stockholder known to the Company to be the beneficial owner of more than 5% of the Company's common stock, and directors and executive officers as a group:

Our common stock is the only class of voting securities outstanding. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and investment power with respect to the securities. The persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. The percentage of beneficial ownership is based on 35,374,906 shares of common stock outstanding as of February 27, 2004. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of our common stock subject to options held by that person that are currently exercisable or will become exercisable within 60 days following February 27, 2004 are deemed outstanding. However, these shares are not deemed outstanding for the purpose of computing the percentage ownership of any other person or entity.

|  |  |  |  |  |  |  |  |  |  |

| |  | Number of Shares |  | Percentage of Shares

Outstanding |

| Directors and Executive Officers: |  | | | |  | | | |

| G. Chris Andersen |  | | 3,850,640 | (1) |  | | 10.9 | % |

| Kenneth R. Baker |  | | 99,888 | (2) |  | * |

| Adam P. Briggs |  | | 60,050 | (3) |  | * |

| Rex E. Luzader |  | | 52,592 | (4) |  | * |

| Alexander MacLachlan |  | | 95,996 | (2) |  | * |

| Peter A. McGuigan |  | | 75,000 | (2) |  | * |

| Zoltan Merszei |  | | 96,786 | (2) |  | * |

| H. David Ramm |  | | 97,254 | (2) |  | * |

| James L. Rawlings |  | | 559,808 | (5) |  | | 1.6 | % |

| Richard L. Sandor |  | | 87,409 | (2) |  | * |

| Stephen S. Tang |  | | 1,158,064 | (6) |  | | 3.2 | % |

| John R. Wallace |  | | 88,017 | (2) |  | * |

| All directors and executive officers as |  | | | |  | | | |

| a group (12 persons) |  | | 6,321,504 | (7) |  | | 17.04 | % |

| |  | | | |  | | | |

| Five Percent Stockholders |  | | | |  | | | |

| GP Strategies Corporation |  | | 2,833,642 | (8) |  | | 8.0 | % |

| Lenz Family Partners, L.L.P. |  | | 2,269,760 | (9) |  | | 6.4 | % |

| Stephen D. Weinroth |  | | 3,068,078 | (10) |  | | 8.7 | % |

| Mainfield Enterprises, Inc. |  | | 1,958,362 | (11) |  | | 5.3 | % |

|

| The address for all officers and directors is c/o Millennium Cell Inc., One Industrial Way West, Eatontown, New Jersey 07724. |

| (1) | Based on Schedule 13G dated February 23, 2004. |

| (2) | Includes options to acquire 75,000 shares exercisable within 60 days. |

| (3) | Includes options to acquire 25,000 shares exercisable within 60 days. |

15

| (4) | Includes options to acquire 16,667 shares exercisable within 60 days. |

| (5) | Based on Form 4 filed December 11, 2003. |

| (6) | Dr. Tang has tendered his resignation effective as of March 19, 2004. Upon the effectiveness of Dr. Tang's resignation, 1,406,064 option shares held by Dr. Tang shall vest. All of the shares issuable pursuant to the exercise of Dr. Tang's options are exercisable for a one year period expiring on March 19, 2005. |

| (7) | Includes options to acquire 1,722,731 shares exercisable within 60 days. |

| (8) | Based on Form 4/A filed September 18, 2002. Address is 777 Westchester Avenue, 4th Floor, White Plains, New York 10604. |

| (9) | Based on 13G dated September 11, 2000. Address is P.O. Box 304979, Charlotte Amalie, U.S.V.I. 00803. |

| (10) | Based on Form 4/A filed July 15, 2003. Address is 590 Madison Avenue, 38th Floor, New York, NY 10022 |

| (11) | Includes shares of common stock and shares of the Company's common stock issuable upon conversion of a $6 million convertible debenture, both issued to the holder on February 17, 2004, and assumes conversion of the entire $6 million debenture currently outstanding at an initial conversion price of $3.30 per share. The terms of the debenture preclude the holder from converting its debenture if such conversion would result in the holder and its affiliates beneficially owning in excess of 9.999% of the outstanding shares of common stock following such conversion. Address is c/o Sage Capital Corp., 660 Madison Avenue, 18th Floor, New York, NY 10021 |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's executive officers and directors, and persons who beneficially own more than 10% of a registered class of the Company's equity securities to file reports of initial ownership and reports of changes in ownership with the SEC and furnish the Company with copies of such reports. Based solely on a review of the copies of reports furnished to the Company by its executive officers, directors and persons who beneficially own more than 10% of the Company's equity securities and written representations from the Company's executive officers and directors, the Company believes that, during the preceding year, all filing requirements applicable to the Company's executive officers, directors and 10% beneficial owners under Section 16(a) were satisfied except that a Form 3 filing for Mr. Sandor and a Form 4 filing for Mr. Weinroth each were inadvertently filed several days late.

Submission of Stockholder Proposals for 2005 Annual Meeting

Any proposal or proposals by a stockholder intended to be included in the Company's proxy statement and form of proxy relating to the 2005 annual meeting of stockholders must be received by the Company no later than November 18, 2004, pursuant to the proxy solicitation rules of the SEC. Nothing in this paragraph shall be deemed to require the Company to include in its proxy statement and proxy relating to the 2004 Annual Meeting of Stockholders any stockholder proposal that may be omitted from the Company's proxy materials pursuant to applicable regulations of the SEC in effect at the time such proposal is received.

16

Other Matters

The Board of Directors of the Company does not know of any other matters to be presented for a vote at the Annual Meeting. If, however, any other matter should properly come before the Annual Meeting or any adjournment thereof, the persons named in the accompanying proxy will vote such proxy in accordance with their best judgment.

By Order of the Board of Directors

Eatontown, New Jersey

March 18, 2004

A COPY OF THE ANNUAL REPORT TO STOCKHOLDERS FOR THE FISCAL YEAR ENDED DECEMBER 31, 2003 ACCOMPANIES THIS PROXY STATEMENT. THIS REPORT IS A COMBINED REPORT WITH THE COMPANY'S ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2003 FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. THE COMPANY WILL PROVIDE COPIES OF THE EXHIBITS TO THE FORM 10-K UPON PAYMENT OF A REASONABLE FEE, UPON RECEIPT OF A REQUEST ADDRESSED TO THE CHIEF EXECUTIVE OFFICER, MILLENNIUM CELL INC., ONE INDUSTRIAL WAY WEST, EATONTOWN, NEW JERSEY 07724.

17

MILLENNIUM CELL, INC.

AMENDED AND RESTATED AUDIT COMMITTEE CHARTER

This document represents the amended and restated charter of the Audit Committee of the Board of Directors of Millennium Cell, Inc., a Delaware corporation (the "Company"). It has been amended and restated to comply with the provisions of the Sarbanes-Oxley Act of 2002 and the revised NASDAQ listing and corporate governance standards. It was approved by the Audit Committee and Board of Directors on December 4, 2003.

Organization

This charter governs the operations of the audit committee ("committee"). The committee shall review and reassess the charter at least annually and obtain the approval of the board of directors if any changes are proposed to be made to the charter. Each member of the committee shall be independent pursuant to the independence standards under Section 10A(m) of the Securities Exchange Act of 1934, as amended, and NASDAQ's rules and regulations and sufficiently financially literate to understand financial statements (including a balance sheet, income statement and cash flow statement) to enable him or her to discharge the responsibilities of a committee member. One member of the committee shall have such experience to qualify as an "audit committee financial expert" as defined under the rules and regulations of the Securities and Exchange Commission and NASDAQ requirements.

Each member of the committee shall be subject to annual re-election and may be removed by the Board at any time. A Chairman of the committee shall be elected annually.

Meetings

The committee shall meet at least four times each year, or more frequently as it deems necessary to fulfill its responsibilities, and may form and delegate authority to subcommittees comprised of committee members. Meetings of the committee may be called by the Chairman of the committee, Chairman of the Board of Directors of the Company, or President and Chief Executive Officer of the Company, in accordance with the procedures in the Company's By-Laws. To foster open communication, (a) the committee shall meet quarterly with the independent auditors and management to review the Company's financial statements, and (b) the committee shall also meet annually, or more frequently as it deems appropriate, with management, including the chief financial officer and corporate controller, and independent auditors, in separate executive sessions to discuss any matters that any of these groups believes should be addressed. The committee shall report its activities to the Board at each Board meeting.

Purpose

The purpose of the committee shall be to assist the Board of Directors in fulfilling its oversight responsibility to the shareholders, potential shareholders, the investment community, and others relating to: the integrity of the Company's financial statements; the financial reporting process; the systems of internal accounting and financial controls; the performance of the Company's internal audit function and independent auditors; the independent auditors' qualifications and independence; and the Company's compliance with the Company's Code of Conduct, ethics policies and legal regulatory requirements. The committee shall also evaluate and approve or disapprove related party transactions involving officers and directors of the Company pursuant to NASDAQ rules. In so doing, it is the responsibility of the committee to maintain free and open communication between the committee, independent auditors, the internal auditors, and management of the Company.

In discharging its oversight role, the committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities, and personnel of the Company and the authority to engage independent counsel and other advisers as it determines necessary to carry out its duties.

Duties and Responsibilities

The primary responsibility of the committee is to oversee the Company's financial reporting process on behalf of the Board of Directors and report the results of their activities to the Board.

18

Management is responsible for the preparation, presentation, and integrity of the Company's financial statements and for the appropriateness of the accounting principles and reporting policies that are used by the Company. The independent auditors are responsible for auditing the Company's financial statements and for reviewing the Company's unaudited interim financial statements.

The committee, in carrying out its responsibilities, believes its policies and procedures should remain flexible, in order to best react to changing conditions and circumstances. The committee should take appropriate actions to set the overall corporate "tone" for quality financial reporting, sound business risk practices, and ethical behavior. The following shall be the principal duties and responsibilities of the committee. These are set forth as a guide with the understanding that the committee may supplement them as appropriate.

The committee shall be directly responsible for the appointment, retention, and termination of the independent auditors (subject, if applicable, to shareholder ratification), and the independent auditors must report directly to the committee. The committee also shall be directly responsible for the oversight of the work of the independent auditors, including resolution of disagreements between management and the auditor regarding financial reporting. The committee shall pre-approve all audit and non-audit services provided by the independent auditors and shall not engage the independent auditors to perform the specific non-audit services proscribed by law or regulation. The committee may delegate pre-approval authority to a member of the committee. The decisions of any committee member to whom pre-approval authority is delegated must be presented to the full committee at its next scheduled meeting. The committee shall have the responsibility to evaluate, approve or disapprove any related party transaction involving officers and directors of the Company pursuant to NASD Rule 4350(h).

At least annually, the committee shall obtain and review a report by the independent auditors describing:

|  |

| • | The independent auditor's internal quality control procedures. |

|  |

| • | Any material issues raised by the most recent internal quality control review, or peer review, of the independent auditor, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, representing one or more independent audits carried out by the independent auditor, and any steps taken to deal with any such issues. |

|  |

| • | All relationships between the independent auditor and the Company (to assess the auditor's independence). |

In addition, the committee shall set clear hiring policies for employees or former employees of the independent auditors that meet SEC and NASDAQ rules and regulations.

The committee shall discuss with the Company's management, finance department members, internal auditors and the independent auditors the overall scope and plans for their respective audits, including the adequacy of staffing and compensation. Also, the committee shall discuss with management, finance department members, the Company's internal auditors, and the independent auditors the adequacy and effectiveness of the accounting and financial controls, including the Company's policies and procedures to assess, monitor, and manage business risk, and legal and ethical compliance programs (e.g., Company's Code of Conduct).

The committee shall meet separately periodically with management, the internal auditors, and the independent auditors to discuss issues and concerns warranting committee attention. The committee shall provide sufficient opportunity for the Company's internal auditors and the independent auditors to meet privately with the members of the committee. The committee shall review with the Company's independent auditor any audit problems or difficulties and management's response.

The committee shall receive a report from the independent auditor, prior to the filing of its audit report with the SEC, on all critical accounting policies and practices of the Company, all material alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, including the ramifications of the use of such alternative treatments and disclosures and the treatment preferred by the independent auditor, and other material written communications between the independent auditor and management.

19

The committee shall review management's assertion on its assessment of the effectiveness of internal controls as of the end of the most recent fiscal year and the independent auditors' report on management's assertion.

The committee shall review and discuss earnings press releases, as well as financial information and earnings guidance, if any, provided to analysts and rating agencies (if applicable).

The committee shall review the interim financial statements and disclosures under Management's Discussion and Analysis of Financial Condition and Results of Operations with management and the independent auditors prior to the filing of each of the Company's Quarterly Reports on Form 10-Q. Also, the committee shall discuss the results of the quarterly review and any other matters required to be communicated to the committee by the independent auditors under generally accepted auditing standards.

The committee shall review with management and the independent auditors the financial statements and disclosures under Management's Discussion and Analysis of Financial Condition and Results of Operations to be included in the Company's Annual Report on Form 10-K (or the annual report to shareholders if distributed prior to the filing of Form 10-K), including their judgment about the quality, not just the acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. Also, the committee shall discuss the results of the annual audit and any other matters required to be communicated to the committee by the independent auditors under generally accepted auditing standards.

The committee shall establish procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by employees, officers and directors of the Company of concerns regarding questionable accounting or auditing matters. These procedures shall be consistent with the Company's Code of Conduct.

The committee shall receive corporate attorneys' reports of evidence of a material violation of securities laws or breaches of fiduciary duty.

The committee shall also prepare its report to be included in the Company's annual proxy statement, as required by SEC regulations.

The committee shall perform an evaluation of its performance at least annually to determine whether it is functioning effectively.

The committee shall report to the Board of Directors on a regular basis on the major events covered by the committee and make recommendations to the Board and management on these matters.

The committee shall undertake such other activities consistent with this charter, the Company's By-Laws, governing law and SEC and NASDAQ rules and regulations as the committee or Board deems necessary or appropriate.

20