SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registranto

| Check the appropriate box: |

| | |

| x | Preliminary Proxy Statement |

| o | Confidential, for Use of the |

| | Commission Only (as permitted |

| | by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to § 240.14a-12 |

| | |

MILLENNIUM CELL INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant):not applicable

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies:not applicable |

| | (2) | Aggregate number of securities to which transaction applies:not applicable |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):not applicable |

| | (4) | Proposed maximum aggregate value of transaction:not applicable |

| | (5) | Total fee paid:not applicable |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: not applicable |

| | (2) | Form, Schedule or Registration Statement No.:not applicable |

| | (3) | Filing Party:not applicable |

| | (4) | Date Filed:not applicable |

MILLENNIUM CELL INC.

ONE INDUSTRIAL WAY WEST

EATONTOWN, NEW JERSEY 07724

(732) 542-4000

March 21, 2005

To Our Stockholders:

On behalf of the Board of Directors (the “Board of Directors”) of Millennium Cell Inc. (the “Company”), it is my pleasure to invite you to the 2005 annual meeting of stockholders (the “Annual Meeting”). The Annual Meeting will be held on Thursday, April 21, 2005 at 9:30 a.m., local time, at New York Hilton, Midtown Suite, 1335 Avenue of Americas, New York, NY 10019.

The Annual Meeting has been called for the following purposes: (1) to elect nine directors to serve on the Board of Directors, each for a one-year term; (2) to ratify the Board of Director’s appointment of Ernst & Young LLP as the Company’s independent public accountants for the 2005 fiscal year; (3) to approve the issuance of securities of the Company to the extent that such issuance is, on an as converted, as exercised basis, equal to 20% or more of the outstanding Common Stock or voting power of the Company to the Dow Chemical Company in connection with a proposed joint development program between the Company and Dow; and (4) to transact such other business as may properly come before the Annual Meeting or any adjournment thereof, all as more fully described in the accompanying proxy statement.

The Board of Directors has approved the matters being submitted by the Company for stockholder approval at the Annual Meeting and recommends that stockholders vote “FOR” such proposals. It is important that your votes be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please complete, sign and date the enclosed proxy card and promptly return it in the prepaid envelope.

| | Sincerely, |

| | |

| | G. Chris Andersen, |

| | Chairman, Board of Directors |

MILLENNIUM CELL INC.

ONE INDUSTRIAL WAY WEST

EATONTOWN, NEW JERSEY 07724

(732) 542-4000

_____________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 21, 2005

______________________

NOTICE IS HEREBY GIVEN that the 2005 annual meeting of stockholders (the “Annual Meeting”) of Millennium Cell Inc., a Delaware corporation (the “Company”), will be held on Thursday, April 21, 2005, at 9:30 a.m., local time, at New York Hilton, Midtown Suite, 1335 Avenue of Americas, New York, NY 10019, for the purpose of considering and voting upon the following matters:

| | 1. | to elect nine directors to serve on the Board of Directors, each for a one-year term and until their respective successors are elected; |

| | 2. | to ratify the Board of Director’s appointment of Ernst & Young LLP as the Company’s independent public accountants for the 2005 fiscal year; |

| | 3. | to approve the issuance of securities of the Company to the Dow Chemical Company in connection with the proposed joint development program between the Company and Dow to the extent that such issuance, on an as converted, as exercised basis, is equal to 20% or more of the outstanding Common Stock or voting power of the Company; and |

| | 4. | to transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice. Pursuant to the Company’s bylaws, the Board of Directors has fixed February 25, 2005, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at all adjournments thereof. Only stockholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. A list of all stockholders entitled to vote at the Annual Meeting will be open for examination by any stockholder for any purpose germane to the Annual Meeting during ordinary business hours for a period of 10 days before the Annual Meeting at the offices of the Company located at One Industrial Way West, Eatontown, New Jersey 07724.

| | By Order of the Board of Directors |

| | |

| | Sincerely, |

| | |

| | G. Chris Andersen, |

| | Chairman, Board of Directors |

| | Eatontown, New Jersey |

| | March 21, 2005 |

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED POSTAGE PREPAID ENVELOPE. IF YOU SIGN AND RETURN YOUR PROXY CARD WITHOUT SPECIFYING A CHOICE, YOUR SHARES WILL BE VOTED IN ACCORDANCE WITH THE RECOMMENDATIONS OF THE BOARD OF DIRECTORS. YOU MAY, IF YOU WISH, REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE TIME IT IS VOTED BY FILING WITH THE SECRETARY OF THE COMPANY A WRITTEN REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE OR BY ATTENDING THE ANNUAL MEETING AND VOTING IN PERSON.

MILLENNIUM CELL INC.

ONE INDUSTRIAL WAY WEST

EATONTOWN, NEW JERSEY 07724

(732) 542-4000

___________________

PROXY STATEMENT

2005 ANNUAL MEETING OF STOCKHOLDERS

APRIL 21, 2005

__________________

SOLICITATION, VOTING AND REVOCABILITY OF PROXIES

This Proxy Statement and the accompanying proxy card are furnished to stockholders of Millennium Cell Inc., a Delaware corporation (the “Company”), in connection with the solicitation by the Company’s Board of Directors (the “Board of Directors” or the “Board”) of proxies to be used at the 2005 annual meeting of stockholders (the “Annual Meeting”), to be held on Thursday, April 21, 2005, at 9:30 a.m., local time, at New York Hilton, Midtown Suite, 1335 Avenue of Americas, New York, NY 10019, and at any adjournments thereof.

ABOUT THE MEETING

WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

At the Annual Meeting, stockholders will act upon the matters outlined in the accompanying notice of meeting, including the election of directors, the ratification of the appointment of the Company’s independent accountants and an issuance of securities of the Company to be described in this Proxy Statement. In addition, management will report on the performance of the Company during the 2004 fiscal year and respond to appropriate questions from stockholders.

WHO IS ENTITLED TO VOTE?

Only stockholders of record at the close of business on the record date, February 25, 2005 (the “Record Date”), are entitled to receive notice of the Annual Meeting and to vote with respect to their shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), that they held on the Record Date at the Annual Meeting or any postponement or adjournment of that meeting. Each outstanding share entitles its holder to cast one vote on each matter to be voted upon. Stockholders’ votes will be tabulated by persons appointed by the Board to act as inspectors of election for the Annual Meeting.

Please note that if you hold your shares in “street name” (that is, through a broker or other nominee), you will need to obtain a proxy from your broker or nominee to personally vote at the Annual Meeting.

WHAT CONSTITUTES A QUORUM?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding on the Record Date will constitute a quorum, permitting the meeting to conduct its business. As of the Record Date, 39,240,060 shares of Common Stock were outstanding. Thus, the presence of the holders of Common Stock representing at least 19,620,031 shares will be required to establish a quorum. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the Annual Meeting for purposes of determining the presence of a quorum. A “broker non-vote” occurs when a broker or other nominee indicates on the proxy card that it does not have discretionary authority to vote on a particular matter.

HOW DO I VOTE?

If you complete and properly sign the accompanying proxy card and return it to the Company, it will be voted as directed on such proxy card. If your shares are held in “street name,” you may vote by telephone or electronically through the Internet by following the voting instructions on the form of proxy you receive. The deadline for voting by telephone or electronically is 11:59 p.m. eastern standard time on April 20, 2005.

If you are a registered stockholder and attend the Annual Meeting, you may deliver your completed proxy card in person. “Street name” stockholders who wish to vote at the Annual Meeting will need to obtain a proxy from the institution that holds their shares.

CAN I CHANGE MY VOTE AFTER I RETURN MY PROXY CARD?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with the secretary of the Company either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request, although attendance at the Annual Meeting will not by itself revoke a previously granted proxy.

HOW ARE SHARES HELD IN THE COMPANY’S 401(K) PLAN VOTED?

Shares held in the Company’s 401(k) Plan are voted by the Plan’s Trustee.

WHAT ARE THE BOARD’S RECOMMENDATIONS?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board’s recommendation is set forth below, together with the description of each item in this Proxy Statement. The Board recommends a vote:

| · | for election of the nominated slate of nine directors (see page 5); |

| · | for ratification of the appointment of Ernst & Young LLP as the Company’s independent accountants for the 2005 fiscal year (see page 21); and. |

| · | for the issuance of securities of the Company to the Dow Chemical Company (“Dow”) in connection with the proposed joint development program between the Company and Dow to the extent that such issuance, on an as converted, as exercised basis, is equal to 20% or more of the Company’s outstanding common stock, par value $0.001 per share (the “Common Stock”), or voting power (see page 25). |

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

WHAT VOTE IS REQUIRED TO APPROVE EACH ITEM?

ELECTION OF DIRECTORS. The affirmative vote of a plurality of the votes cast at the Annual Meeting is required for the election of directors. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Abstentions and broker non-votes will have no legal effect on the election of directors but will be counted for purposes of determining whether there is a quorum. The Company’s Certificate of Incorporation, as amended, does not provide for cumulative voting in the election of directors.

OTHER ITEMS. For the ratification of the Company’s independent accountants, the issuance of a number of securities of the Company to the Dow Chemical Company in connection with the proposed joint development program between the Company and Dow, to the extent that such issuance is equal to, or in excess of, 20% of the outstanding Common Stock or voting power of the Company and any other item that properly comes before the Annual Meeting to be voted upon at the Annual Meeting, the affirmative vote of the holders of a majority of the outstanding shares of the Company’s voting stock represented in person or by proxy at the Annual Meeting and entitled to vote on the item will be required for approval. Abstentions will not be voted for any such matter. Accordingly, abstentions will have the same legal effect as a negative vote. Broker non-votes will not be counted in determining the number of shares necessary for approval.

WHY ARE WE SEEKING STOCKHOLDER APPROVAL FOR PROPOSAL 3?

On February 27, 2005, the Company entered into a stock purchase agreement (the “Stock Purchase Agreement”), in connection with a proposed joint development program with Dow. Pursuant to the terms and conditions of the Stock Purchase Agreement and a joint development agreement to be entered into between the Company and Dow upon and subject to stockholder approval of the issuance of securities as set forth above, the Company expects to issue to Dow certain shares of the Company’s Series A Preferred Stock (the “Series A Preferred”), the Company’s Series B Preferred Stock (the “Series B Preferred”) and warrants to purchase Common Stock (the “Warrants”). The conditions and related information for such issuances are described in detail in Proposal Three on page 25. Depending on the Company’s achievement of certain performance milestones and subject to Dow’s election to purchase shares of Series B Preferred upon the achievement of such milestones, the aggregate amount of shares to be issued to Dow, on an as converted, as exercised basis, may be equal to or exceed, 20% of the outstanding Common Stock or voting power of the Company as of February 27, 2005.

As the Common Stock is listed on the National Association of Securities Dealers, Inc. (“NASD”), Automated Quotation System (“Nasdaq”), the Company is subject to the Marketplace Rules of the NASD. Marketplace Rule 4350(i)(D) requires the Company to obtain stockholder approval prior to certain issuances of Common Stock or securities convertible into or exchangeable for Common Stock at a price equal to less than the greater of market or book value of such securities (on an as converted basis) if such issuance equals 20% or more of the Common Stock or voting power of the Company outstanding before the transaction. As of the date hereof, the number of shares of Series A Preferred and Series B Preferred, and the Warrants, issuable to Dow in connection with the Stock Purchase Agreement is indeterminable. However, the Company may issue a number of shares of Common Stock to Dow, on an as converted, as exercised basis, that meets or exceeds 20% of the outstanding voting stock of the Company as of February 27, 2005.

Marketplace Rule 4350(i)(C) requires the Company to obtain stockholder approval prior to certain issuances with respect to Common Stock or securities convertible into Common Stock which will result in a change of control of the Company. Generally, available NASD interpretations provide that 20% ownership of the shares of an issuer is deemed to be control of such issuer. The Stock Purchase Agreement prohibits Dow from acquiring pursuant to such agreement more than 19.9% of the shares of the Company at any time. However, situations may exist in the future in which an issuance under the Stock Purchase Agreement will cause Dow to own 20% or more of the outstanding capital stock of the Company.

The stockholders should note that the change of control under the NASD interpretations apply only with respect to the Marketplace Rules of the NASD. Notwithstanding such Rules, the Company does not deem the contemplated transactions to be an actual change in control. Further, the transaction does not meet the definition of change in control in any contract, agreement or other understanding to which the Company is a party. Lastly, the Company does not believe that Dow will not be deemed a control person of the Company under the rules and regulations promulgated by the Securities and Exchange Commission under the Securities Act of 1933 (the “1933 Act”) and the Securities Exchange Act of 1934. Therefore, although the joint development program and the other agreements related thereto do not require stockholder approval under Delaware law, the Company’s certificate of incorporation or the Company’s bylaws, the Company is required to obtain stockholder approval prior to issuing any shares that will meet or exceed the 20% threshold.

WHO WILL BEAR THE COSTS OF SOLICITING PROXIES FOR THE ANNUAL MEETING?

The cost of soliciting proxies for the Annual Meeting will be borne by the Company. In addition to the use of the mails, proxies may be solicited personally or by telephone, by officers and employees of the Company who will not receive any additional compensation for their services. Proxies and proxy material will also be distributed at the expense of the Company by brokers, nominees, custodians and other similar parties.

If the enclosed form of proxy is properly executed and returned to the Company in time to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with instructions marked thereon. Executed but unmarked proxies will be voted “FOR” Proposal 1 -- to elect the Board of Directors’ nine nominees for Director, “FOR” Proposal 2 -- to ratify the Board of Directors’ appointment of Ernst & Young LLP as the Company’s independent public accountants for the 2005 fiscal year and “FOR” Proposal 3 -- to approve the issuance of a number of securities of the Company to Dow in connection with the proposed joint development program, to the extent that such issuance is equal to, or in excess of, 20% of the outstanding Common Stock or voting power of the Company. If any other matters properly come before the Annual Meeting, the persons named in the accompanying proxy will vote the shares represented by such proxies on such matters in accordance with their best judgment.

This Proxy Statement, Notice of Annual Meeting of Stockholders, the proxy card and the Company’s Annual Report to Stockholders were first mailed to stockholders on or about March 21, 2005.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE PROPOSALS SET FORTH IN THIS PROXY STATEMENT.

ELECTION OF DIRECTORS

(PROPOSAL 1)

The Company’s bylaws provide that the Board of Directors shall consist of not fewer than one director nor more than 11 directors and that the number of directors, within such limits, shall be voted upon by the stockholders at each Annual Meeting. The Board of Directors currently consists of 9 directors, each serving a one-year term. The Board of Directors has nominated for director each of G. Chris Andersen, Kenneth R. Baker, Alexander MacLachlan, Peter A. McGuigan, Zoltan Merszei, H. David Ramm, James L. Rawlings, Richard L. Sandor and John R. Wallace to be elected at the Annual Meeting.

Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election as directors of Messrs. Andersen, Baker, MacLachlan, McGuigan, Merszei, Ramm, Rawlings, Sandor and Wallace. The Board of Directors believes that such nominees will stand for election and will serve if elected as directors. However, if any person nominated by the Board of Directors fails to stand for election or is unable to accept election, the proxies will be voted for the election of such other person or persons as the persons named in the accompanying proxy shall determine in accordance with their best judgment. Pursuant to the Company’s bylaws, directors are elected by plurality vote. The Company’s Certificate of Incorporation, as amended, does not provide for cumulative voting in the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF ITS NOMINEES FOR DIRECTORS.

INFORMATION AS TO DIRECTORS AND EXECUTIVE OFFICERS

| NAME | AGE | POSITION |

| DIRECTORS | | |

| | | |

G. Chris Andersen | 66 | Chairman of the Board of Directors |

Kenneth R. Baker | 57 | Director |

Alexander MacLachlan | 72 | Director |

Peter A. McGuigan | 45 | Director |

Zoltan Merszei | 82 | Director |

H. David Ramm | 53 | Director, Interim Chief Executive Officer and President |

James L. Rawlings | 60 | Director |

Richard L. Sandor | 63 | Director |

John R. Wallace | 56 | Director |

| | | |

| EXECUTIVE OFFICERS | | |

| | | |

| Adam P. Briggs | 44 | Senior Vice President |

| John V. Battaglini | 40 | Vice President, Sales, Marketing and Product Management |

| John D. Giolli | 33 | Vice President, Finance and Acting Chief Financial Officer |

| Rex E. Luzader | 56 | Vice President, Government Relations |

| George C. Zalepa | 49 | Vice President, Administration |

| | | |

Directors are elected to serve for one year or until their successors are elected and qualified or until their earlier resignation or removal. All directors are elected annually at the annual meeting of stockholders.

DIRECTORS STANDING FOR ELECTION

G. CHRIS ANDERSEN has served as the Chairman of the Company’s Board of Directors since April 2000. Mr. Andersen is a partner of G.C. Andersen Partners, LLC, a merchant-banking firm, and Andersen & Co. LLC. From 1990 to 1995, Mr. Andersen was Vice President of PaineWebber Incorporated. Previously, Mr. Andersen was a managing director for 15 years at Drexel Burnham Lambert, Incorporated, and a member of its Board of Directors. He is currently a director of TEREX Corporation, a manufacturer of mining, lifting and construction equipment. He is also a Director and member of the Executive Committee of Junior Achievement of New York, Inc.

KENNETH R. BAKER has served on the Company’s Board of Directors since July 2000. Mr. Baker has served as president, chief executive officer and a member of the board of trustees of Altarum (formerly the Environmental Research Institute of Michigan) since November 1999. From 1969 to 1999, Mr. Baker served in various executive positions with General Motors Corporation, including vice president and general manager of the GM Distributed Energy Business Unit, vice president and general manager of GM Research and Development and program manager of GM Electric Vehicles. Following his retirement in February 1999, Mr. Baker served as vice chairman and chief operating officer of Energy Conversion Devices, Inc. Mr. Baker also serves on the Board of Directors of AeroVironment, Inc., the Center for Automotive Research and the National Coalition for Advanced Manufacturing (NACFAM); the Michigan Technology Tri-Corridor Steering Committee, the National Advisory Board of the University of Michigan College of Engineering, the Board of Governors of the Cranbrook Institute of Science, and the Advisory Board of the Automotive Research Center of the University of Michigan.

ALEXANDER MACLACHLAN, PH.D. has served on the Company’s Board of Directors since May 2000. He was recently a member of the National Research Council’s Board on Radioactive Waste Management and co-author of “The Hydrogen Economy: Opportunities, Costs, Barriers and R&D Needs”. Prior to his retirement in March 1996, Dr. MacLachlan was the Deputy Under Secretary for R&D Management at the U.S. Department of Energy and held various other positions in the Department of Energy. Prior to his employment at the Department of Energy, Dr. MacLachlan was employed by DuPont for 36 years, where he was senior vice president for research and development and chief technical officer from 1986 to 1993, and a member of DuPont’s operating group from 1990 to 1993. He is currently president of the University of Delaware Research Foundation. Dr. MacLachlan is a graduate of Tufts University with a B.S. in Chemistry (1954) and the Massachusetts Institute of Technology with a Ph.D. in Physical Organic Chemistry (1957). He is a member of Phi Beta Kappa and was elected to the National Academy of Engineering in 1992.

PETER A. MCGUIGAN has served on the Company’s Board of Directors since March 2004. Mr. McGuigan has served as managing partner of McGuigan Tombs & Company, P.C. since such firm’s founding in March 1990. Mr. McGuigan has served on various AICPA and NJSCPA sponsored tax and accounting committees since obtaining his CPA certification in May 1984 From 1982 through 1990, Mr. McGuigan held both audit and tax supervisory positions for both international and medium sized public accounting firms.

ZOLTAN MERSZEI has served on the Company’s Board of Directors since May 2000. Mr. Merszei retired as the president, chairman and chief executive officer of The Dow Chemical Company in March 1980. From August 1974 to March 1980, he served as president and chief executive officer of Dow Chemical Europe. From May 1980 to May 1988, Mr. Merszei served in various executive positions with Occidental Petroleum Corporation, including chairman and chief executive officer of Occidental Chemical, chairman of Occidental Research and president and chief executive officer, and subsequently, vice chairman of the Board of Directors of Occidental Petroleum. Mr. Merszei currently serves as a director of Thyssenkrupp Budd Company and Dole Food Company Inc.

H. DAVID RAMM has served on the Company’s Board of Directors since June 2000 and as its Interim President and Chief Executive Officer since March 2004. Mr. Ramm is a principal of DKRW Energy, L.L.C., a renewable energy consulting and project development firm. He was formerly president, chief executive officer and a director of Integrated Electrical Services. From 1997 to March 2000, he was employed by Enron, first as managing director of Enron Renewable Energy, and then as president of Enron Wind Corp. Prior to his employment at Enron, Mr. Ramm worked for 14 years at United Technologies Corporation, where he held several senior management positions, including chairman and chief executive officer of International Fuel Cells Corporation.

JAMES L. RAWLINGS has served on the Company’s Board of Directors since April 2000. Mr. Rawlingsis currently a partner of Andersen & Co., LLC. Prior to joining a predecessor of Andersen & Co., LLC, he was a Managing Director, principal and member of the Board of Schooner Asset Management Co. LLC, where he was responsible for new product development and investment oversight. Before joining Schooner, he was a Managing Director of Robert Fleming & Co., based in New York, where he was responsible for the London-based firm’s investment banking activities throughout the Americas. Before joining Fleming in 1993, he was an Executive Director of Southern Equities Corporation, an Australian-based industrial holding company, with responsibility for the executive level management and reorganization of the group’s U.S. activities. He was with Drexel Burnham Lambert, Incorporated, from 1979 to 1988, where, as a Managing Director in the Corporate Finance Department, he was responsible for initiating and developing relationships with international companies in most parts of the world. Mr. Rawlings was with Bank of America from 1967 to 1979 where he was responsible for Bank of America’s U.S. merchant banking and project finance activities. Mr. Rawlings is also a director of City Brewing Company, LLC. He holds a B.S. in Economics from Indiana University and an MBA from the University of Michigan.

RICHARD L. SANDOR, PH.D. has served on the Company’s Board of Directors since April 2003. Dr. Sandor is currently chairman and chief executive officer of Chicago Climate Exchange, Inc., a self-regulatory exchange that administers a voluntary greenhouse gas reduction and trading program for North America. Prior to the establishment of the Chicago Climate Exchange, Dr. Sandor was a senior markets executive with several financial institutions including Kidder Peabody, Banque Indosuez and Drexel Burnham Lambert, Incorporated. For more than three years, he was Vice President and Chief Economist at the Chicago Board of Trade. From 1997 to 1998, Dr. Sandor served as Second Vice Chairman - Strategy for the Chicago Board of Trade. Dr. Sandor is currently a director of NASDAQ LIFFE Markets and of the Intercontinental Exchange, an electronic marketplace for commodity and derivative products. He is a director of American Electric Power, a Columbus-based public utility that provides electric power, telecommunication, energy efficiency and financial services. He is also a director of the Zurich-based Sustainable Performance Group, an investment and risk management company. In addition, Dr. Sandor is a research professor at the Kellogg Graduate School of Management at Northwestern University and previously held faculty positions with the School of Business Administration at the University of California, Berkeley and Stanford University.

JOHN R. WALLACE has served on the Company’s Board of Directors since April 2003. Mr. Wallace recently retired as executive director of TH!NK Group at Ford Motor Company and, since August 2002, has served as a consultant in the areas of fuel cell and hybrid electric vehicle strategy. Mr. Wallace was active in Ford Motor Company’s alternative fuel vehicle program since 1990, serving first as Director, Technology Development Programs, then as Director, Electronic Vehicle Programs, Director, Alternative Fuel Vehicles, and finally Director, Environmental Vehicles. From 1988 to 1990, Mr. Wallace served as a Director of Ford’s Electronic Systems Research Laboratory, Research Staff. Prior to joining Ford Research Staff, he was president of Ford Microelectronics, Inc. Mr. Wallace currently serves on the Board of Directors of Enova Systems, Inc., Xantrex and the Electric Drive Transportation Association, and is interim CEO of Avestor, LLC.

EXECUTIVE OFFICERS

ADAM P. BRIGGS has served as the Company’s Senior Vice President since December 2004. In this role he has responsibility for the Company’s Sales, Marketing, Product Development, Research, Finance and Administration. From June 2004 to December 2004 he held the position of Vice President of Product Development. From August 2003 to June 2004 he served the Company as Vice President of Product Management. From December 2001 to August 2003 he held the position of Vice President of Business Development for Distributed Generation. From February 2001 to December 2001, Mr. Briggs served as the Company’s Vice President of Business Development and Portable Power. Mr. Briggs was employed at The Gillette Company and Duracell Inc., from 1984 to 2001, where he was most recently Vice President -- Strategic OEM (Original Equipment Manufacturer) Sales and Consulting Group in the Global Business Management Group. Prior positions include Director of Global Strategic Account Management; Program Director -- Alkaline; Director of OEM Sales and Marketing -- Asia; Leader, Design Win Management Team -- Far East and OEM Marketing Director -- Far East. Mr. Briggs received his B.A. in physics from Bowdoin College.

REX E. LUZADER has served as the Company’s Vice President of Government Relations since February 2004. From December 2001 through January 2004, he had various responsibilities for Business Development within the Company. Mr. Luzader served as the Company’s Vice President of Business Development for Transportation and Hydrogen Fuel Infrastructure between November 2001 and December 2003. Prior to joining the Company, Mr. Luzader was the Vice President of Original Equipment Sales and Engineering and Corporate Strategy for Exide Corporation from 1998 to 1999. From 1988 to 1998, Mr. Luzader also held a number of Vice Presidential positions at Exide Corporation including sales to the transportation industry, product engineering, process and equipment engineering, research and development and quality control. Mr. Luzader received his B.S. in Mechanical Engineering from Kettering University. Mr. Luzader has served on The SAE Fuel Cell Standards Committee since 2001 and participated in the DOE Hydrogen Road Mapping efforts. He serves on the Kettering University Fuel Cell Advisory Board, the US Fuel Cell Council Government Affairs working group and the National Hydrogen Association Legislative Affairs Council. Mr. Luzader was co-organizer of the SAE TopTech titled Facets of Implementing a Hydrogen Economy held in February of 2004.

JOHN D. GIOLLI, C.P.A.has served as the Company's Vice President, Finance and Acting Chief Financial Officer since March 2004. From January 2001 to March 2004, he held the position of Corporate Controller and Principal Accounting Officer. Prior to joining the Company, Mr. Giolli held financial management positions with public companies in the technology and retail sectors. Mr. Giolli began his career in public accounting with Price Waterhouse LLP. He received his BS in Accounting from the State University of New York College at Oswego and is a Certified Public Accountant.

GEORGE ZALEPA has served as the Company’s Vice President, Administration since June 1, 2004. Prior to such date, Mr. Zalepa was a consultant to the Company and acted as the Company’s Director of Human Resources. In his current role, Mr. Zalepa leads the Human Resources, IT and Administration programs at the Company. He has over 15 years of industry experience in Human Resources and has particular expertise in Human Resource Information Systems. Prior to joining the Company, Mr. Zalepa was a Human Resource Manager at Air Products and Chemicals, Inc. He received his MBA in engineering management from Fairleigh Dickinson University and his BA in chemistry and biology from East Stroudsburg University.

JOHN V. BATTAGLINIhas served as the Company’s Vice President of Sales, Marketing and Product Management since January, 2005.Mr. Battaglinihas over 16 years of international marketing and sales experience in small and large high technology firms. Prior to joiningthe Company, Mr. Battaglini was the Marketing Director for Clare (an IXYS company), a designer and manufacturer of high voltage integrated circuits and discrete products for the telecommunications, power, industrial, medical and consumer markets. While at Clare, he was the leader for a start-up product line that he guided from start-up phase to annual revenues of $10 million. He began his career with Lucent Technologies in the semiconductor division where he progressed through a number of positions of increasing responsibility from product engineering, program management to strategic marketing.He received his MBA from Villanova University, an MSEE from Clemson University and a BSEE from Drexel University.

THE BOARD AND ITS COMMITTEES

The Board held six meetings in 2004 in addition to acting by unanimous written consent 6 times. Each director, except Dr. Sandor, attended 100% of all meetings of the Board and committees of the Board to which he was assigned. Dr. Sandor attended more than 75% of all meetings of the Board. Members of the Company’s Board of Directors are invited but not required to attend the Annual Meeting of Stockholders. The 2004 Annual Meeting of Stockholders was attended by the following directors: Andersen, MacLachlan, Merszei, McGuigan, Ramm, Rawlings and Wallace.

INDEPENDENT DIRECTORS

The Board has determined that the following individuals are independent directors within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market: Messers. Baker, MacLachlan, McGuigan, Merszei, Rawlings, Sandor and Wallace. The independent directors will meet regularly in executive session and outside the presence of our management throughout the 2005 fiscal year in compliance with the listing standards of the NASDAQ Stock Market.

DIRECTOR NOMINATIONS

Due to the relatively small size of the Company, the Board of Directors has determined that it is not necessary or appropriate at this time to establish a separate Nominating Committee. The Board has adopted a requirement that all director nominees be nominated by a majority vote of the independent directors prior to consideration by the full Board. All of the nominees recommended for election to the Board of Directors at the Annual Meeting are directors standing for re-election.

The Board of Directors believes that it is necessary that the majority of the Board of Directors must be comprised of independent directors as mandated by the listing standards of the NASDAQ Stock Market and that it is desirable to have at least one financial expert on the Board of Directors. When considering potential director candidates, the Board also considers the candidate’s character, judgment, age, skills, including financial literacy, and experience in the context of the needs of the Company and the Board of Directors. In 2004, the Company did not pay any fees to any third party to assist in identifying or evaluating potential nominees.

The Board of Directors will consider director candidates recommended by the Company’s stockholders in a similar manner as those recommended by members of management or other directors. The name of any recommended candidate for director, together with a brief biographical sketch, a document indicating the candidate’s willingness to serve, if elected, and evidence of the nominating person’s ownership of Company stock should be sent to the attention of the Secretary of the Company. To date, the Company has not received any recommended nominees from any non-management stockholder or group of stockholders that beneficially owns 5% of the Company’s voting stock.

STOCKHOLDER COMMUNICATION WITH THE BOARD OF DIRECTORS

Stockholders may communicate with the Board of Directors by contacting the Chief Executive Officer by phone at (732) 542-4000 or in writing at the Company’s headquarters. Any such communication must contain (i) a representation that the stockholder is a holder of record of stock of the Company, (ii) the name and address, as they appear on the Company’s books, of the stockholder sending such communication and (iii) the number of shares of Company stock that are beneficially owned by such stockholder. The Secretary of the Company will relay the question or message to the specific director identified by the stockholder or, if no specific director is requested, to a director selected by the Secretary of the Company, unless such communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Secretary of the Company has the authority to discard the communication or to take appropriate legal action regarding such communication.

DIRECTOR COMPENSATION

Employee directors receive no additional compensation for serving as a director of the Company. Non-management directors receive compensation for serving in the following capacities: Chairman of the Board -- $40,000, Committee Chairman -- $3,000. Independent directors who do not serve in a chairman capacity receive $12,000. In addition, each non-management director receives $1,000 for each Board and Committee meeting attended. In lieu of cash payments, non-management directors were granted a combination of restricted stock and cash for all fees earned during fiscal year 2004.

BOARD COMMITTEES & MEETINGS

The Board has three standing committees -- an Executive Committee, an Audit Committee and a Compensation Committee.

Executive Committee

The Board has established an Executive Committee consisting of G. Chris Andersen, James L. Rawlings and H. David Ramm. The principal functions of the Executive Committee include exercising the powers of the Board during intervals between Board meetings and acting as an advisory body to the Board by reviewing various matters prior to their submission to the Board. The Executive Committee held four meetings in 2004.

Audit Committee

The Board has established an Audit Committee consisting of Kenneth R. Baker, Peter A. McGuigan and John R. Wallace, all of whom are independent directors within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market. Mr. Baker is the Chairman of the Audit Committee. Peter A. McGuigan is qualified as an “audit committee financial expert” within the meaning of SEC regulations and the Board has determined that he has accounting and related financial management experience within the meaning of the listing standards of the NASDAQ Stock Market. The Audit Committee held seven meetings in 2004.

The Audit Committee is responsible for reviewing and inquiring into matters affecting financial reporting, the system of internal accounting, financial controls and procedures and audit procedures and audit plans. In addition, the Audit Committee generally oversees the Company’s internal compliance program. In accordance with applicable law, the Audit Committee is responsible for establishing procedures for the receipt, retention and treatment regarding accounting, internal accounting controls or audit matters, including the confidential, anonymous submission by Company employees, received through established procedures, of concerns regarding questionable accounting or auditing matters. Furthermore, the Audit Committee approves the quarterly financial statements and also recommends to the Board of Directors, for approval, the annual financial statements, the annual report and certain other documents required by regulatory authorities. The Audit Committee is further responsible to pre-approve all audit and non-audit services performed by the Company’s independent auditors.

In response to the audit committee requirements adopted by the SEC and the NASDAQ Stock Market in 2003, the Board of Directors has adopted an Amended and Restated Audit Committee Charter that specifies the responsibilities of the Audit Committee. The Amended and Restated Audit Committee Charter is attached hereto as Appendix A.

Audit Committee Report

During the fiscal year ended December 31, 2004, the Audit Committee reviewed and discussed the audited financial statements with management and the Company’s independent accountants, Ernst & Young LLP. The Audit Committee discussed with the independent accountants the matters required to be discussed by the Statement of Auditing Standards No. 61 “Communication with Audit Committees” and reviewed the results of the independent accountants’ examination of the financial statements.

The Audit Committee also reviewed the written disclosures and the letter from the independent accountants required by Independence Standards Board, Standard No. 1 “Independence Discussions with Audit Committees”, discussed with the accountants the accountants’ independence, including a review of audit and non-audit fees, and satisfied itself as to the accountants’ independence.

Based on the above reviews and discussions, the Audit Committee recommends to the Board of Directors that the financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2004, for filing with the SEC.

The Board of Directors has determined that the members of the Audit Committee are independent within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market.

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings made by the Company under those statutes, in whole or in part, this report shall not be deemed to be incorporated by reference into any such filings, nor will this report be incorporated by reference into any future filings made by the Company under those statutes.

| | Kenneth R. Baker |

| | Chairman of the Audit Committee |

| | John Wallace |

| | Peter A. McGuigan |

Compensation Committee

The Company’s Board of Directors has established a Compensation Committee consisting of Alexander MacLachlan, Zoltan Merszei and James L. Rawlings, all of whom are independent directors within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market. Mr. Rawlings is the Chairman of the Compensation Committee. The Compensation Committee reviews and acts on matters relating to compensation levels and benefit plans for the Company’s executive officers and key employees, including salary, restricted stock and stock options. The Compensation Committee is also responsible for granting stock options and other awards to be made under the Company’s stock option plan. The Compensation Committee held four meetings in 2004.

Compensation Committee Report

The Board appointed the Compensation Committee in June 2000. Since that time, decisions on compensation of the Company’s executive officers have been made by the Compensation Committee. No member of the Compensation Committee is an employee of the Company and each member is “independent” within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market.

The Compensation Committee reviews and approves base salary, annual management incentive compensation and long-term incentive awards for all corporate officers and certain other key executives, with the objective of attracting and retaining individuals of the necessary quality and stature to operate the business. The Compensation Committee considers individual contributions, performance against strategic goals and direction, and industry-wide pay practices in determining the levels of base compensation for key executives.

Long-term incentive awards are granted to corporate officers and certain other key employees under the Company’s Amended and Restated 2000 Stock Option Plan. The awards take the form of stock options or restricted stock that are tied directly to the market value of the Company’s Common Stock.

The Compensation Committee believes that the Amended and Restated 2000 Stock Option Plan aligns the interests of management with the stockholders and focuses the attention of management on the long-term success of the Company. A significant portion of the executives’ compensation is at risk, based on the financial performance of the Company and the value of the Company’s Common Stock in the marketplace.

Section 162(m) of the Internal Revenue Code limits to $1 million in a taxable year the deduction publicly held companies may claim for compensation paid to executive officers, unless such compensation is performance-based and meets certain requirements. None of the Company’s executive officers’ compensation exceeds the limit set by Code Section 162(m).

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings made by the Company under those statutes, in whole or in part, this report shall not be deemed to be incorporated by reference into any such filings, nor will this report be incorporated by reference into any future filings made by the Company under those statutes.

| | James L. Rawlings |

| | Chairman of the Compensation Committee |

| | Alexander MacLachlan |

| | Zoltan Merszei |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Company’s Compensation Committee consists of Alexander MacLachlan, Zoltan Merszei, and James L. Rawlings. The Company formed this Committee in June 2000. During 1999, Mr. Rawlings served as the Company’s acting Chief Executive Officer.

CODE OF CONDUCT

The Company has adopted a Code of Conduct that applies to all officers, directors, employees and consultants. The Code of Conduct is intended to comply with SEC regulations and the listing standards of the NASDAQ Stock Market. The Company’s Code of Conduct is posted on its Internet website under the “Investor Relations” page. The Company’s Internet website address iswww.millenniumcell.com.

EXECUTIVE COMPENSATION

The following table sets forth all compensation awarded to, earned by or paid to the Company’s Chief Executive Officer and the Company’s four other most highly compensated executive officers whose annual salary and bonus exceeded $100,000 in the fiscal years ended December 31, 2002, 2003 and 2004 for services rendered in all capacities to the Company during those fiscal years (“named executive officers”).

SUMMARY COMPENSATION TABLE

Name and Principal Position* | Fiscal Year | Annual Compensation | Long-Term Compensation | All Other Compensation ($)(8) |

Salary ($) | Bonus ($) | Other Annual Compensation ($) | Awards | Payouts |

Restricted Stock Award(s) ($) | Securities Under-lying Options/ SAR (1) (#) | LTIP Payouts ($) |

| H. David Ramm (1), | 2004 | — | 0 | | 129,000 | — | — | 160,833 (2) |

Interim President and CEO | 2003 | — | — | — | 20,800 (3) | — | — | 7,000 (3) |

| | 2002 | — | — | — | 17,551 (3) | — | — | 8,000 (3) |

| | | | | | | | | |

| Stephen S. Tang (4), | 2004 | 74,001 | 0 | — | — | — | — | 321,277 (5) |

former Chief Executive Officer | 2003 | 344,226 | 0 | — | — | 125,000 | — | 12,000 |

and acting Chief Financial Officer | 2002 | 319,856 | 0 | — | — | 125,000 | — | 11,000 |

| | | | | | | | | |

| Adam P. Briggs, | 2004 | 228,976 | 0 | — | 128,000 (6) | — | — | 13,000 |

Senior Vice President | 2003 | 203,478 | 0 | — | 58,650 (7) | 75,000 | — | 12,000 |

| | 2002 | 187,620 | 0 | — | — | 75,000 | — | 11,000 |

| | | | | | | | | |

| Rex E. Luzader, | 2004 | 227,418 | 0 | — | 70,400 (6) | — | — | 30,701 |

Vice President - | 2003 | 232,327 | 0 | — | 52,572 (7) | 50,000 | — | 12,000 |

Government Relations | 2002 | 211,070 | 0 | — | — | 50,000 | — | 11,000 |

| | | | | | | | | |

| John D. Giolli, | 2004 | 145,957 | 0 | — | 96,000 (6) | 50,000 | — | 9,365 |

Vice President, Finance and | 2003 | 110,158 | 0 | — | 24,395 (7) | 14,500 | — | 6,610 |

Acting Chief Financial Officer | 2002 | 96,374 | 0 | — | — | 14,471 | — | 5,653 |

| | | | | | | | | |

| George C. Zalepa, (9) | 2004 | 151,242 | 0 | — | 96,000 (6) | 50,000 | — | 4,900 |

Vice President, Administration | 2003 | 143,400 | 0 | — | 24,038 (7) | 15,500 | — | 0 |

| | 2002 | 126,413 | 0 | — | — | 18,000 | — | 0 |

| (1) | Mr. Ramm was appointed Interim President and Chief Executive Officer on July 14, 2004. |

| (2) | This figure represents payments made to DKRW Energy L.L.C. in connection with Mr. Ramm’s services to the Company. |

| (3) | Issuance of restricted shares and other compensation are related to Mr. Ramm’s service as a Director on the Board of Directors of the Company. |

| (4) | Dr. Tang left the Company on March 19, 2004. |

| (5) | This figure represents payments made to Dr. Tang as outlined in his separation agreement. |

| (6) | The Compensation Committee designated a pool of restricted stock to grant to employees in December 2004 and granted such restricted stock to specific employees in February 2005. The value set forth above is based on the closing price of the common stock on December 31, 2004, which was $1.28. The restricted stock vests in 20% tranches based on specific stock prices or after five years if the stock targets are not meet. The restricted stock is entitled to dividends. However, the Company has never paid dividends on its common stock and does not expect to pay any dividends in the foreseeable future. |

| (7) | This figure represents the issuance of restricted stock pursuant to an exchange offer in August 2003 whereby eligible stock options were exchanged, at the option of the holder, for shares of restricted stock at an exchange rate based on the calculated market value of the stock options using a Black-Scholes model. The restricted stock vests in two tranches: 50% of such restricted stock vested on August 22, 2004 and the remaining 50% vests on August 22, 2005, or on such date that the common stock price closes at or above $5.10, whichever occurs first. The value set forth above is based on the closing price of the stock on the date of grant, August 20, 2003, which was $1.70. The restricted stock is entitled to dividends, however, the Company has never paid dividends on its common stock and does not expect to pay any dividends in the foreseeable future. |

| (8) | Amounts indicated are the Company contributions to the Company’s 401(k) plan and other executive benefits such as estate planning, tax preparation, and financial advisors. |

| (9) | Mr. Zalepa was converted from an independent contractor to an employee on June 1, 2004. Accordingly, information presented for fiscal years 2002 and 2003, and for the period beginning on January 1, 2004, and ending on May 31, 2004, relating to Mr. Zalepa represents his compensation as an independent contractor. The information presented with respect to June 1, 2004 through the end of fiscal year 2004 relate to Mr. Zalepa’s compensation as an officer and employee of the Company. |

OPTION GRANTS IN 2004

The following table provides information with respect to stock options granted to the named executive officers during fiscal year 2004.

Name | Individual Grants | Potential Realizable |

Value At Assumed |

Annual Rates Of |

Number Of Shares Underlying Options/SARS Granted | % Of Total Options Granted To Employees In Fiscal Year | Exercise Price Per Share | Expiration Date | Stock Price Appreciation |

For Option Term |

5% | 10% |

| Stephen S. Tang (1) | 125,000 | 28% | $2.40 | 3/19/2005 | $24,433 | $38,906 |

| H. David Ramm | 0 | 0% | | | $0 | $0 |

| Adam P. Briggs | 75,000 | 17% | $2.40 | 2/24/2014 | $14,660 | $23,344 |

| Rex E. Luzader | 50,000 | 11% | $2.40 | 2/24/2014 | $9,773 | $15,562 |

| John D. Giolli | 14,500 | 3% | $2.40 | 2/24/2014 | $2,834 | $4,513 |

| | 50,000 | 11% | $2.00 | 3/19/2014 | $8,144 | $12,969 |

| George C. Zalepa | 14,500 | 3% | $2.40 | 2/24/2014 | $2,834 | $4,513 |

| | 50,000 | 11% | $2.25 | 6/1/2014 | $8,144 | $12,969 |

| | | | | | | |

| (1) | Dr. Tang left the Company on March 19, 2004. |

FISCAL YEAR-END 2004 OPTION VALUES

The following table provides information with respect to the Company’s named executive officers concerning unexercised options held by them at the end of fiscal year 2004. Dr. Tang was the only named executive officer of the Company to have exercised options in 2004. The total number of options exercised were 129,712.

Name of Executive Officer | Number of Shares Acquired on Exercise | Value Realized ($) | Number of Securities Underlying Unexercised Options at Fiscal Year End; (Exercisable/Unexercisable) | Value of Unexercised In-the-Money Options at Fiscal Year End ($); (Exercisable/ Unexercisable) |

| Stephen S. Tang (1) | 129,712 | $44,055 | 1,276,352/0 | $0 |

| H. David Ramm | 0 | 0 | 75,000/0 | $0 |

| Adam P. Briggs | 0 | 0 | 25,000/125,000 | $0 |

| Rex E. Luzader | 0 | 0 | 16,667/83,333 | $0 |

| John D. Giolli | 0 | 0 | 4,824/74,147 | $0 |

| George C. Zalepa | 0 | 0 | 6,000/76,500 | $0 |

(1) Dr. Tang left the Company on March 19, 2004.

EQUITY COMPENSATION PLAN INFORMATION

Plan Category | Number of securities to be issued upon exercise of outstanding options | Weighted average exercise price of outstanding options | Number of securities remaining available for future issuance |

| | (a) | (b) | (c) |

Equity compensation plans approved by security holders(1) | 4,017,191 | $3.79 | 4,401,384 |

Equity compensation plans not approved by security holders | — | — | — |

TOTAL | 4,017,191 | $1.60 | 4,401,384 |

(1) This plan is the Company’s Amended and Restated 2000 Stock Option Plan and includes restricted stock awards issued as part of the Tender Exchange Offer to employees of the Company in August 2003.

EMPLOYMENT AGREEMENTS & CHANGE-IN-CONTROL AGREEMENTS

H. David Ramm and DKRW Agreements

On July 14, 2004, the Company entered into an Employment Agreement and a Restricted Stock Grant Agreement with Mr. H. David Ramm, the Interim President and Chief Executive Officer, and an Agreement with DKRW Energy L.L.C. (“DKRW”), a limited liability company of which Mr. Ramm is a member. The Company made a one-time grant to Mr. Ramm of 100,000 shares of restricted stock in accordance with the Restricted Stock Agreement. Under an agreement between the Company and DKRW, the Company agreed to pay a monthly retainer of $25,000 to DKRW in connection with Mr. Ramm’s serving as the Company’s Interim President and Chief Executive Officer. In September 2004, the initial term of Mr. Ramm’s employment agreement had expired and the agreement was automatically renewed.

Adam P. Briggs

On January 1, 2003, the Company entered into a Change-In-Control Agreement with Mr. Briggs, the Company’s Vice President of Product Management. In the event Mr. Briggs’ employment is terminated within two years following a change of control by the Company without cause or by Mr. Briggs for good reason, he will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Briggs is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

Rex E. Luzader

On January 1, 2003, the Company entered into a Change-In-Control Agreement with Mr. Luzader, the Company’s Vice President of Government and Military Sales. In the event Mr. Luzader’s employment is terminated within two years following a change of control by the Company without cause or by Mr. Luzader for good reason, he will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Luzader is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

John D. Giolli

On July 28, 2004, the Company entered into a Change-In-Control Agreement with Mr. Giolli, the Company’s Vice President of Finance and Acting Chief Financial Officer. In the event Mr. Giolli’s employment is terminated within two years following a change of control by the Company without cause or by Mr. Giolli for good reason, he will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Giolli is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

George C. Zalepa

On July 28, 2004, the Company entered into a Change-In-Control Agreement with Mr. Zalepa, the Company’s Vice President of Administration. In the event Mr. Zalepa’s employment is terminated within two years following a change of control by the Company without cause or by Mr. Zalepa for good reason, he will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Zalepa is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

John V. Battaglini

On January 3, 2005, the Company entered into a Change-In-Control Agreement with Mr. Battaglini, the Company’s Vice President of Sales, Marketing and Product Management. In the event Mr. Battaglini’s employment is terminated within two years following a change of control by the Company without cause or by Mr. Battaglini for good reason, he will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Battaglini is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In October, 2004, the Board of Directors approved a financial advisory services agreement with Andersen & Co., LLC (“Andersen”), pursuant to which Andersen is to act as the Company’s Senior Financial Advisor. As Senior Financial Advisor, Andersen is required to support the Company’s efforts to raise capital through transactions that contemplate issuances of debt, equity and/or convertible securities by Millennium to strategic entities and financial investors. In consideration therefore, the Company paid Andersen a non-refundable retainer in the amount of $62,500 in cash. Further, upon the execution and delivery of definitive agreements with respect to a strategic transaction, Andersen shall be entitled to a fee equal to $62,500 payable in shares of restricted Common Stock. The later fee became payable upon the execution of the Stock Purchase Agreement dated as of February 27, 2005, between the Company and Dow as described in Proposal 3 of this proxy statement. The value of the Common Stock will be calculated based upon the average closing sales price of the Common Stock during the ten (10) consecutive trading days immediately preceding the date of issuance. Andersen shall also be entitled to reimbursement of all reasonable and necessary out-of-pocket expenses incurred in rendering such services;provided, that the Company shall not be required to reimburse Andersen for any such expenses once the aggregate of the reimbursed expenses exceeds $5,000, without the prior written approval of the Company. Two members of the Company’s Board of Directors are principals of Andersen: G. Chris Andersen, the Chairman of the Board, and James L. Rawlings, the Chairman of the Compensation Committee.

On July 14, 2004, the Company entered into an Employment Agreement and a Restricted Stock Grant Agreement with Mr. H. David Ramm, the Company’s Interim President and Chief Executive Officer, and an agreement with DKRW. The Company made a one-time grant to Mr. Ramm of 100,000 shares of restricted stock in accordance with the Restricted Stock Agreement. Under an agreement between the Company and DKRW, the Company agreed to pay a monthly retainer of $25,000 to DKRW in connection with Mr. Ramm’s serving as the Company’s Interim President and Chief Executive Officer. In September 2004, the initial term of Mr. Ramm’s employment agreement had expired and the agreement was automatically renewed.

On July 14, 2004, the Company’s Board of Directors approved a financial advisory services agreement with Andersen for services provided in connection with the Company’s private placement transaction which closed on February 17, 2004. For these services, Andersen received consideration of $200,000, which was paid for by the issuance of 111,421 shares of Common Stock in August 2004 and which was recorded as debt issue costs in the accompanying balance sheet. The number of shares to be issued was calculated using an average closing price of the Company’s common stock for the 10 days preceding the approval by the Board.

COMPARATIVE STOCK PRICES

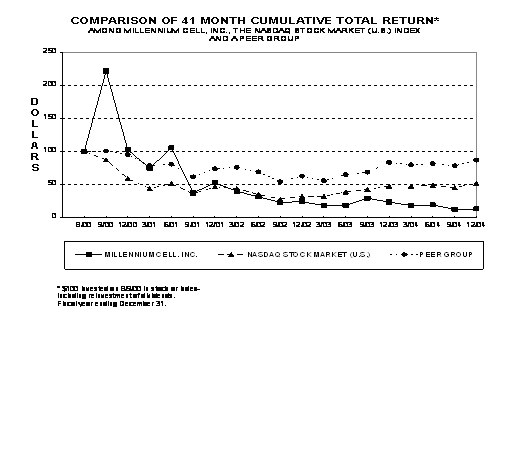

The following chart sets forth comparative information regarding the Company’s cumulative stockholder return on its common stock since its initial public offering in August 2000. Total stockholder return is measured by dividing share price change for a period by the share price at the beginning of the measurement period. The Company’s cumulative stockholder return based on an investment of $100 at August 9, 2000, when the common stock was first traded on the Nasdaq National Market, and its closing price of $1.28 on December 31, 2004 is compared to the cumulative total return of the Nasdaq National Market and the industry index based on the Company’s SIC code, 3690 -- “Miscellaneous Electrical Machinery, Equipment and Supplies” during that same period assuming dividend reinvestment.

RATIFICATION OF THE APPOINTMENT OF THE

COMPANY’S INDEPENDENT PUBLIC ACCOUNTANTS

(PROPOSAL 2)

Effective March 7, 2000, the Company engaged the accounting firm of Ernst & Young LLP as the Company’s principal independent accountants. The Board of Directors approved the recommendation of the Audit Committee for the appointment of Ernst & Young LLP to audit the financial statements of the Company for the fiscal year ending December 31, 2005. If the stockholders do not ratify the appointment of Ernst & Young LLP, the Audit Committee may reconsider its selection.

Ernst & Young LLP performed various audit and other services for the Company during fiscal year 2004. Such services included an audit of annual financial statements, interim reviews of quarterly financial statements, review and consultation connected with certain filings with the SEC, financial accounting and reporting matters, and meetings with the Audit Committee of the Board of Directors.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions.

FEES PAID TO THE COMPANY’S AUDITORS

Set forth below is certain information concerning fees billed to the Company by Ernst & Young LLP in respect of services provided in fiscal years 2004 and 2003. The Audit Committee has determined that the provision of the provided services is compatible with maintaining the independence of Ernst & Young LLP.

| | FY 2004 | FY 2003 |

| Audit Fees | $288,000 | $252,000 |

| Audit Related Fees | $0 | $0 |

| Tax Fees | $0 | $0 |

| All Other Fees | $0 | $0 |

Audit Fees. Annual audit fees relate to services rendered in connection with the audit of the annual financial statements included in the Company’s Form 10-K filing, the quarterly reviews of financial statements included in the Company’s Form 10-Q filings and registration statement consent procedures.

There were no audit related fees, tax fees or other fees for professional services rendered by Ernst & Young LLP for fiscal years 2004 or 2003, respectively.

PRE-APPROVAL POLICIES

The Audit Committee pre-approves all audit and non-audit service provided by the Company’s independent auditors prior to the engagement of the independent auditors with respect to such services.

The stockholders are being asked to ratify the Board’s appointment of Ernst & Young LLP. The affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting is required for the ratification and approval of the appointment of independent accountants. All shares of Common Stock represented by valid proxies received pursuant to this solicitation, and not revoked before they are exercised, will be voted in the manner specified. If you execute and return a proxy without instruction, your shares will be voted for ratification of the appointment of Ernst & Young LLP as independent accountants for the Company for fiscal year 2005.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION

AND APPROVAL OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT ACCOUNTANTS FOR THE COMPANY FOR FISCAL YEAR 2005.

COMMON STOCK OWNERSHIP OF

PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table lists the beneficial ownership of the Common Stock of each director of the Company, the named executive officers, each stockholder known to the Company to be the beneficial owner of more than 5% of the Common Stock and directors and executive officers as a group.

The Common Stock is the only class of voting securities outstanding. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and investment power with respect to such securities. The persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. The percentage of beneficial ownership is based on 39,240,060 shares of Common Stock outstanding as of February 25, 2005. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock subject to options held by that person that are currently exercisable or will become exercisable within 60 days following February 25, 2005 are deemed outstanding. However, these shares are not deemed outstanding for the purpose of computing the percentage ownership of any other person or entity.

| | NUMBER OF SHARES | PERCENTAGE OF SHARES OUTSTANDING |

DIRECTORS AND EXECUTIVE OFFICERS: | | |

| G. Chris Andersen | 3,906,656 (1) | 9.96 % |

| Kenneth R. Baker | 114,021 (2) | * |

| Adam P. Briggs | 166,038 (3) | * |

| John D. Giolli | 83,896 (4 ) | * |

| Rex E. Luzader | 123,561 (5) | * |

| Alexander MacLachlan | 108,089 (2) | * |

| Peter A. McGuigan | 87,115 (2) | * |

| Zoltan Merszei | 108,167 (2) | * |

| H. David Ramm | 206,540 (2) | * |

| James L. Rawlings | 570,988 (6) | 1.5 % |

| Richard L. Sandor | 92,109 (2) | * |

| Stephen S. Tang | 1,279,352 (7 ) | 3.3 % |

| John R. Wallace | 102,478 (2) | * |

| George C. Zalepa | 88,670 (8) | * |

| All directors and executive officers as | | |

| a group (14 persons) | 7,037,680 (9) | 17.9 % |

| | | |

FIVE PERCENT STOCKHOLDERS | | |

| | | |

| Mainfield Enterprises, Inc. | 3,420,928 (10) | 8.1% |

___________

*Less than 1%

The address for all officers and directors is c/o Millennium Cell Inc., One Industrial Way West, Eatontown, New Jersey 07724.

| (1) | Based on Form 4 filed on December 15, 2004. |

| (2) | Includes options to acquire 75,000 shares exercisable within 60 days. |

| (3) | Includes options to acquire 50,000 shares exercisable within 60 days. Does not include options to acquire 100,000 shares not exercisable within 60 days. |

| (4) | Includes options to acquire 26,324 shares exercisable within 60 days. Does not include options to acquire 52,647 shares not exercisable within 60 days. |

| (5) | Includes options to acquire 33,334 shares exercisable within 60 days. Does not include options to acquire 66,666 shares not exercisable within 60 days. |

| (6) | Based on Form 4 filed December 15, 2004. |

| (7) | Dr. Tang left the company on March 19, 2004 at which time all unvested stock options previously awarded vested immediately and unconditionally. |

| (8) | Includes options to acquire 10,833 shares exercisable within 60 days. Does not include options to acquire 71,667 shares not exercisable within 60 days. |

| (9) | Includes options to acquire 1,921,843 shares exercisable within 60 days. Does not include options to acquire 290,980 shares not exercisable within 60 days. |

| (10) | Includes issued and outstanding shares of Common Stock and shares of Common Stock issuable upon conversion of convertible debentures, issued to the holder on February 17, 2004, and September 28, 2004, and assumes conversion of a $1.4 million debenture currently outstanding at an initial conversion price of $3.30 per share and a $4 million debenture currently outstanding at an initial conversion price of $1.55 per share. The terms of the debentures preclude the holder from converting the debentures if and to the extent that such conversions would result in the holder and its affiliates beneficially owning in excess of 9.999% of the outstanding shares of Common Stock following such conversions. Address is c/o Sage Capital Corp., 660 Madison Avenue, 18th Floor, New York, NY 10021. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s executive officers and directors, and persons who beneficially own more than 10% of a registered class of the Company’s equity securities to file reports of initial ownership and reports of changes in ownership with the SEC and furnish the Company with copies of such reports. Based solely on a review of the copies of reports furnished to the Company by its executive officers, directors and persons who beneficially own more than 10% of the Company’s equity securities and written representations from the Company’s executive officers and directors, the Company believes that, during the preceding year, all filing requirements applicable to the Company’s executive officers, directors and 10% beneficial owners under Section 16(a) were satisfied.

APPROVAL OF THE ISSUANCE OF SECURITIES OF THE COMPANY TO THE COMPANY’S STRATEGIC PARTNER IN CONNECTION WITH A PROPOSED JOINT DEVELOPMENT ARRANGEMENT TO THE EXTENT THAT, UPON CONVERSION OR EXERCISE THEREOF, SUCH ISSUANCE IS EQUAL TO, OR IN EXCESS OF, TWENTY PERCENT OR MORE OF THE OUTSTANDING VOTING STOCK OF THE COMPANY.

(Proposal 3)

Background

On February 27, 2005, the Company entered into a stock purchase agreement (the “Stock Purchase Agreement”) with Dow. The Stock Purchase Agreement represents the first step of a proposed joint development program between the Company and Dow. The purpose of the joint development program is to jointly develop portable energy solutions through the production of hydrogen gas for use by fuel cells using certain processes currently being developed by the Company.

In connection with the joint development program, the Company and Dow intend to enter into the following agreements, drafts of each of which are attached to the Stock Purchase Agreement as exhibits: a joint development agreement; a cross licensing and intellectual property agreement; a patent assignment agreement and license; an investor rights agreement; a registration rights agreement; a warrant; and a standstill agreement (collectively, the “Definitive Agreements”). Stockholder approval of the issuance of securities of the Company to Dow in the proposed joint development program to the extent that such issuance, on an as converted, as exercised basis, is equal to 20% or more of the outstanding voting stock of the Company as of February 27, 2005, is a condition precedent to closing of the transactions contemplated by the Definitive Agreements.

Stock Purchase Agreement

The Stock Purchase Agreement sets forth the compensation to which Dow is entitled in connection with the successful achievement by the Company of each Milestone. Such compensation is summarized as follows:

The first closing under the Stock Purchase Agreement is anticipated to occur after shareholder approval of the issuance of securities to Dow under the circumstances described above, although this closing (as well as subsequent closings) are subject to the successful completion of Milestone 0, which is the execution of all the Definitive Agreements. At the first closing, Dow shall be entitled to a grant of a number of shares of the Company’s Series A Preferred Stock equal to 3% of the Company’s outstanding capital stock on a fully diluted basis on the date of issuance.

Upon the successful completion of each of Milestones 1 through 4, Dow has the right to purchase a number of the Company’s Series B Preferred Stock (“Series B Preferred”) which is convertible into number of shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), that is equal to $1,250,000 divided by the Volume Weighted Average Price (“VWAP”) of the Common Stock for the 30 trading day period preceding the date of purchase. In addition, upon each such purchase by Dow of shares of Series B Preferred, the Company shall grant to Dow warrants (“Warrants”) to purchase a number of shares of Common Stock of the Company equal to 25% of the number of shares of Common Stock issuable upon the conversion of the shares of Series B Preferred so purchased;provided,however, that Dow is not required to purchase any Series B Preferred and the closing of any purchase of shares of Series B Preferred is subject to approval of the Definitive Agreements by the Company’s stockholders to the extent required by the National Association of Securities Dealers, Inc., internal approval by Dow and other customary closing conditions. The terms and conditions of the Warrants are described below under the caption “Warrants”.