UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to § 240.14a-12 |

MILLENNIUM CELL INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant): not applicable

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: not applicable |

| | |

| (2) | Aggregate number of securities to which transaction applies: not applicable |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): not applicable |

| | |

| (4) | Proposed maximum aggregate value of transaction: not applicable |

| | |

| (5) | Total fee paid: not applicable |

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount Previously Paid: not applicable |

| | |

| (2) | Form, Schedule or Registration Statement No.: not applicable |

| | |

| (3) | Filing Party: not applicable |

| | |

| (4) | Date Filed: not applicable |

MILLENNIUM CELL INC.

ONE INDUSTRIAL WAY WEST

EATONTOWN, NEW JERSEY 07724

(732) 542-4000

To Our Stockholders:

On behalf of the Board of Directors (the “Board of Directors”) of Millennium Cell Inc. (the “Company”), it is my pleasure to invite you to the 2006 annual meeting of stockholders (the “Annual Meeting”). The Annual Meeting will be held on Tuesday, May 2, 2006 at 9:00 a.m., local time, at the Sheraton Eatontown Hotel at Six Industrial Way East, Eatontown, New Jersey 07724.

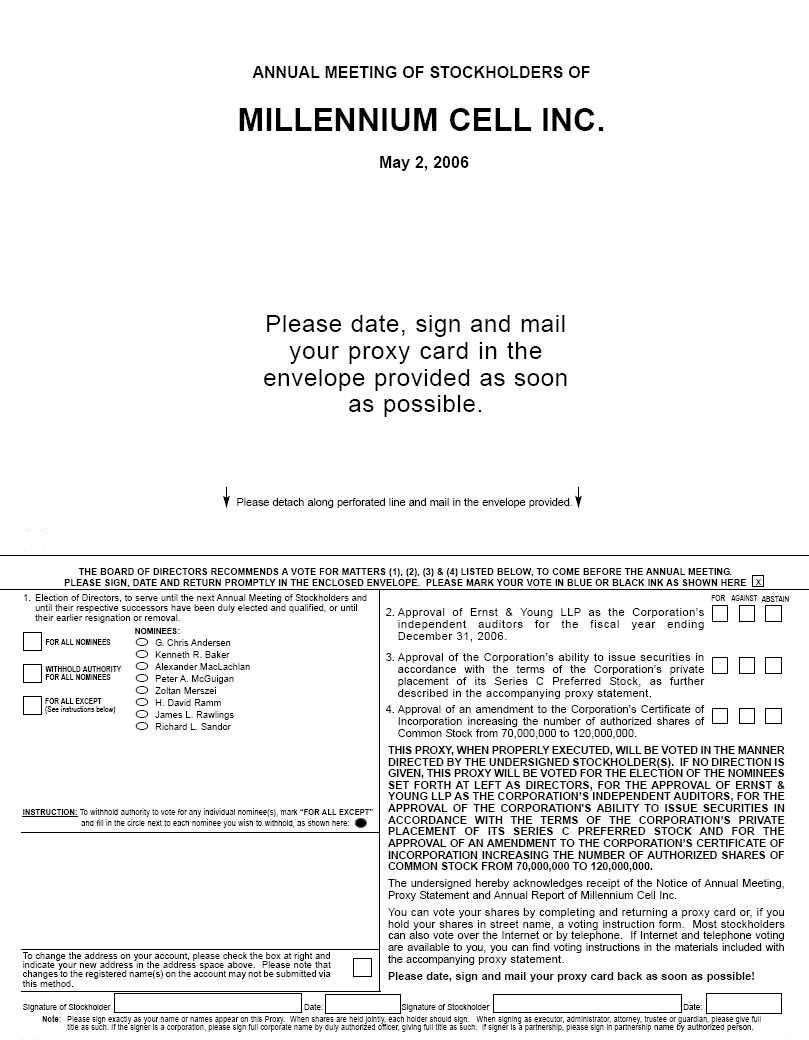

The Annual Meeting has been called for the following purposes: (1) to elect eight directors to serve on the Board of Directors, each for a one-year term; (2) to ratify the Board of Directors’ appointment of Ernst & Young LLP as the Company’s independent public accountants for the 2006 fiscal year; (3) to approve the Company’s ability to issue securities in accordance with the terms of its private placement of Series C Convertible Preferred Stock, as described in the accompanying Proxy Statement; (4) to approve an amendment to the Company’s Certificate of Incorporation increasing the number of authorized shares of the Company’s Common Stock from 70,000,000 to 120,000,000; and (5) to transact such other business as may properly come before the Annual Meeting or any adjournment thereof, all as more fully described in the accompanying Proxy Statement.

The Board of Directors has approved the matters being submitted by the Company for stockholder approval at the Annual Meeting and recommends that stockholders vote “FOR” such proposals. It is important that your votes be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please vote your shares electronically on the Internet or by telephone, or complete, sign and date the enclosed proxy card and promptly return it in the prepaid envelope.

| | G. Chris Andersen |

| | Chairman, Board of Directors |

MILLENNIUM CELL INC.

ONE INDUSTRIAL WAY WEST

EATONTOWN, NEW JERSEY 07724

(732) 542-4000

_____________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 2, 2006

______________________

NOTICE IS HEREBY GIVEN that the 2006 annual meeting of stockholders (the “Annual Meeting”) of Millennium Cell Inc., a Delaware corporation (the “Company”), will be held on Tuesday, May 2, 2006, at 9:00 a.m., local time, at the Sheraton Eatontown Hotel at Six Industrial Way East, Eatontown, New Jersey 07724, for the purpose of considering and voting upon the following matters:

| 1. | to elect eight directors to serve on the Board of Directors, each for a one-year term and until their respective successors are elected; |

| | |

| 2. | to ratify the Board of Directors’ appointment of Ernst & Young LLP as the Company’s independent public accountants for the 2006 fiscal year; |

| | |

| 3. | to approve the Company’s ability to issue securities in accordance with the terms of its private placement of Series C Convertible Preferred Stock, as described in the accompanying Proxy Statement; |

| | |

| 4. | to approve an amendment to the Company’s Certificate of Incorporation increasing the number of authorized shares of the Company’s Common Stock from 70,000,000 to 120,000,000; and |

| | |

| 5. | to transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice. Pursuant to the Company’s Bylaws, the Board of Directors has fixed March 7, 2006, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at all adjournments thereof. Only stockholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. A list of all stockholders entitled to vote at the Annual Meeting will be open for examination by any stockholder for any purpose germane to the Annual Meeting during ordinary business hours for a period of 10 days before the Annual Meeting at the offices of the Company located at One Industrial Way West, Eatontown, New Jersey 07724.

| | By Order of the Board of Directors |

| | |

| | Sincerely, |

| | |

| |  |

| | John D. Giolli |

| | Chief Financial Officer and Secretary |

Eatontown, New Jersey

March 29, 2006

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED POSTAGE PREPAID ENVELOPE. IF YOU SIGN AND RETURN YOUR PROXY CARD WITHOUT SPECIFYING A CHOICE, YOUR SHARES WILL BE VOTED IN ACCORDANCE WITH THE RECOMMENDATIONS OF THE BOARD OF DIRECTORS. YOU MAY, IF YOU WISH, REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE TIME IT IS VOTED BY FILING WITH THE SECRETARY OF THE COMPANY A WRITTEN REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE OR BY ATTENDING THE ANNUAL MEETING AND VOTING IN PERSON.

MILLENNIUM CELL INC.

ONE INDUSTRIAL WAY WEST

EATONTOWN, NEW JERSEY 07724

(732) 542-4000

___________________

PROXY STATEMENT

2006 ANNUAL MEETING OF STOCKHOLDERS

MAY 2, 2006

__________________

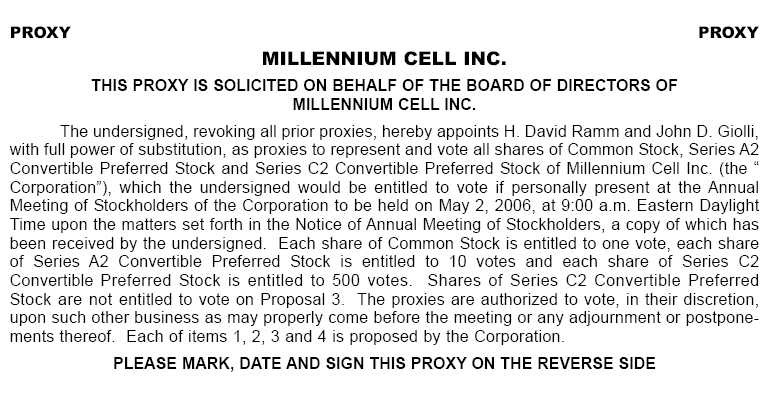

SOLICITATION, VOTING AND REVOCABILITY OF PROXIES

This Proxy Statement and the accompanying proxy card are furnished to stockholders of Millennium Cell Inc., a Delaware corporation (the “Company”), in connection with the solicitation by the Company’s Board of Directors (the “Board of Directors” or the “Board”) of proxies to be used at the 2006 annual meeting of stockholders (the “Annual Meeting”), to be held on Tuesday, May 2, 2006, at 9:00 a.m., local time, at the Sheraton Eatontown Hotel at Six Industrial Way East, Eatontown, New Jersey 07724, and at any adjournments thereof. This Proxy Statement, Notice of Annual Meeting of Stockholders, the proxy card and the Company’s Annual Report to Stockholders were first mailed to stockholders on or about March 29, 2006.

ABOUT THE MEETING

WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

At the Annual Meeting, stockholders will act upon the matters outlined in the accompanying notice of meeting, including the election of directors, the ratification of the appointment of the Company’s independent accountants, the Company’s issuance of securities in accordance with the terms of its private placement of Series C Convertible Preferred Stock, as described in this Proxy Statement, and an amendment to the Company’s Certificate of Incorporation increasing the number of the Company’s authorized shares of common stock, par value $0.001 per share (“Common Stock”) from 70,000,000 to 120,000,000. In addition, management will report on the performance of the Company during the 2005 fiscal year and respond to appropriate questions from stockholders.

WHO IS ENTITLED TO VOTE?

Only holders of record of the Company’s outstanding Common Stock, Series A2 Convertible Preferred Stock, par value $0.001 per share (“Series A2 Preferred Stock”), Series B Convertible Preferred Stock, par value $0.001 per share (“Series B Preferred Stock”), and Series C2 Convertible Preferred Stock, par value $0.001 per share (“Series C2 Preferred Stock”), in each case as of the close of business on March 7, 2006 (the “Record Date”), are entitled to receive notice of the Annual Meeting and to vote at the Annual Meeting or any postponement or adjournment of that meeting. Holders of outstanding shares of Common Stock as of the close of business on the Record Date will be entitled to cast one vote for each share of Common Stock held. Holders of outstanding shares of Series A2 Preferred Stock, Series B Preferred Stock and Series C2 Preferred Stock, in each case as of the close of business on the Record Date, are entitled to vote such shares on an “as converted basis,” which will result in each holder of Series A2 Preferred Stock being entitled to cast 10 votes per share of Series A2 Preferred Stock, each holder of Series B Preferred Stock being entitled to cast 10 votes per share of Series B Preferred Stock, and each holder of Series C2 Preferred Stock being entitled to cast 500 votes per share of Series C2 Preferred Stock. Pursuant to IM-4350-2 of the NASDAQ Marketplace Rules, holders of shares of Series C2 Preferred Stock are not entitled to vote such shares on the proposal to approve the Company’s issuance of securities in accordance with the terms of its private placement of Series C Preferred Stock. Stockholders’ votes will be tabulated by persons appointed by the Board to act as inspectors of election for the Annual Meeting.

Please note that if you hold your shares in “street name” (that is, through a broker or other nominee), you will need to obtain a proxy from your broker or nominee to personally vote at the Annual Meeting.

Note also that in June 2005, the Company completed an exchange offer whereby all outstanding shares of the Company’s Series A Preferred Stock were exchanged for shares of Series A2 Preferred Stock and all outstanding shares of the Company’s Series C Preferred Stock were exchanged for shares of Series C2 Preferred Stock. The terms of the Series A2 Preferred Stock are identical to the terms of the Series A Preferred Stock except that the number of votes to which each holder of shares of Series A2 Preferred Stock is entitled will not be subject to any adjustment based on price-based anti-dilution protections. The terms of the Series C2 Preferred Stock are identical to the terms of the Series C Preferred Stock, except that the number of votes to which each holder of shares of Series C2 Preferred Stock is entitled will not be subject to any adjustment based on price-based anti-dilution protections. References in this Proxy Statement to shares of Series A Preferred Stock and Series C Preferred Stock are references to shares that have since been exchanged for a like number of shares of Series A2 Preferred Stock and Series C2 Preferred Stock, respectively.

As of the Record Date, there were 47,550,936 shares of Common Stock outstanding, 155,724 shares of Series A2 Preferred Stock outstanding, no shares of Series B Preferred Stock outstanding and 5,376 shares of Series C2 Preferred Stock outstanding.

WHAT CONSTITUTES A QUORUM?

The presence at the Annual Meeting, in person or by proxy, of holders of a majority of the outstanding shares of Common Stock, Series A2 Preferred Stock (on an as-converted basis) and Series C2 Preferred Stock (on an as-converted basis), together as a single class, as of the Record Date, will constitute a quorum permitting the conduct of business at the Annual Meeting. As of the Record Date, an aggregate of 47,550,936 shares of Common Stock, 1,557,240 shares Series A2 Preferred Stock (on an as-converted basis) and 2,688,000 shares of Series C2 Preferred Stock (on an as-converted basis) were outstanding. Thus, the presence of holders representing at least 25,898,089 of such shares will be required to establish a quorum. Votes for and against, proxies received but marked as abstentions, and broker non-votes will each be included in the calculation of the number of shares considered to be present at the Annual Meeting for purposes of determining the presence of a quorum. A “broker non-vote” occurs when a broker or other nominee indicates on the proxy card that it does not have discretionary authority to vote on, and has not received instructions with respect to, a particular matter.

HOW DO I VOTE?

If you complete and properly sign the accompanying proxy card and return it to the Company, it will be voted as directed on such proxy card. If your shares are held in “street name,” you may be able to vote by telephone or electronically through the Internet by following the voting instructions in the materials accompanying this Proxy Statement. The deadline for voting by telephone or electronically is 11:59 p.m. Eastern Daylight Time on April 28, 2006.

If you are a registered stockholder and attend the Annual Meeting, you may deliver your completed proxy card in person. “Street name” stockholders who wish to vote at the Annual Meeting will need to obtain a proxy from the institution that holds their shares.

CAN I CHANGE MY VOTE AFTER I RETURN MY PROXY CARD?

Yes. Even after you have submitted your proxy, you may revoke your proxy or change your vote at any time before the proxy is exercised by filing with the Secretary of the Company either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request, although attendance at the Annual Meeting will not by itself revoke a previously granted proxy.

HOW ARE SHARES HELD IN THE COMPANY’S 401(K) PLAN VOTED?

Shares held in the Company’s 401(k) Plan are voted by the Plan’s Trustee.

WHAT ARE THE BOARD’S RECOMMENDATIONS?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board’s recommendation is set forth below, together with the description of each item in this Proxy Statement. The Board recommends a vote:

| · | for Proposal 1, election of the nominated slate of eight directors (see page 6); |

| | |

| · | for Proposal 2, ratification of the appointment of Ernst & Young LLP as the Company’s independent accountants for the 2006 fiscal year (see page 23); |

| | |

| · | for Proposal 3, approval of the Company’s issuance of securities in accordance with the terms of the private placement of the Series C Preferred Stock, as described in this Proxy Statement (see page 30); and |

| | |

| · | for Proposal 4, approval of an amendment to the Company’s Certificate of Incorporation increasing the number of authorized shares of the Company’s Common Stock from 70,000,000 to 120,000,000 (see page 45). |

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

WHAT VOTE IS REQUIRED TO APPROVE EACH ITEM?

ELECTION OF DIRECTORS. The affirmative vote of a plurality of the votes cast at the Annual Meeting is required for the election of directors. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Abstentions and broker non-votes will have no legal effect on the election of directors but will be counted for purposes of determining whether there is a quorum. The Company’s Certificate of Incorporation, as amended, does not provide for cumulative voting in the election of directors.

RATIFICATION OF INDEPENDENT ACCOUNTANTS, APPROVAL OF THE COMPANY’S ISSUANCE OF SECURITIES IN ACCORDANCE WITH THE TERMS OF ITS PRIVATE PLACEMENT OF SERIES C PREFERRED STOCK, AND OTHER ITEMS. For (i) the ratification of the Company’s independent accountants, (ii) the approval of the Company’s issuance of securities in accordance with the terms of its private placement of Series C Preferred Stock, as described in this Proxy Statement, and (iii) the approval of any other matter that properly comes before the Annual Meeting, the affirmative vote of holders of a majority of the outstanding shares of the Company’s voting stock represented in person or by proxy at the Annual Meeting and entitled to vote on such matters will be required. Abstentions and broker non-votes will not be counted in determining the number of shares necessary for approval of these matters. Accordingly, abstentions and broker non-votes will have the same legal effect as votes against each of these proposals. Pursuant to IM-4350-2 of the NASDAQ Marketplace Rules, holders of shares of Series C2 Preferred Stock are not entitled to vote such shares on the matter described in clause (ii) above.

AMENDMENT TO CERTIFICATE OF INCORPORATION. For the amendment to the Company’s Certificate of Incorporation increasing the number of authorized shares of the Company’s Common Stock from 70,000,000 to 120,000,000, the affirmative vote of holders of a majority of the outstanding shares of the Company’s voting stock entitled to vote on such matter will be required for approval, including outstanding shares of Series A2 Preferred Stock and Series C2 Preferred Stock on an as-converted basis. Abstentions and broker non-votes will be counted in tabulations of the votes cast on this proposal and, accordingly, both will have the same effect as votes against this proposal.

VOTING AGREEMENT. In order to induce the investors to purchase the Series C Preferred Stock, certain officers and directors of the Company, in their respective capacities as stockholders, entered into a Voting Agreement with the Company whereby each such stockholder agreed to vote all of its respective shares in favor of Proposal 3 and Proposal 4 (See “Voting Agreement” on page 41). As of the Record Date, such stockholders held shares representing approximately 9.5% of the Company’s outstanding voting power with respect to Proposal 3 and approximately 8.7% of the Company’s outstanding voting power with respect to Proposal 4.

WHY ARE WE SEEKING STOCKHOLDER APPROVAL FOR PROPOSAL 3?

In a Securities Purchase Agreement dated April 20, 2005 between the Company and certain institutional investors, the Company sold to such investors 10,000 shares of Series C Preferred Stock and warrants (“Warrants”) to purchase a number of shares of Common Stock equal to 25% of the shares of Common Stock underlying the Series C Preferred Stock purchased by each investor. Under the Securities Purchase Agreement, the Company agreed, among other things, to solicit from each Company stockholder entitled to vote at the Annual Meeting, the approval of Proposal 3 and Proposal 4, in each case in accordance with applicable law and the rules and regulations of the applicable trading market.

As the Common Stock is listed on The NASDAQ Capital Market, the Company is subject to the Marketplace Rules of the NASDAQ. Marketplace Rule 4350(i)(D) requires the Company to obtain stockholder approval prior to certain issuances or potential issuances of Common Stock or securities convertible into or exchangeable for Common Stock at a price less than the greater of market or book value of such securities (on an as-converted basis) if such issuance or potential issuance equals 20% or more of the Common Stock or voting power of the Company outstanding before the transaction. Depending on the circumstances, the aggregate number of shares of Common Stock issuable to holders of the Series C2 Preferred Stock and Warrants may equal or exceed 20% of the Company’s outstanding Common Stock or voting power prior to the issuance of the Series C Preferred Stock and the Warrants.

Accordingly, the Company is seeking stockholder approval of Proposal 3 to comply with its obligations under the Securities Purchase Agreement and the NASDAQ Marketplace Rules.

WHO WILL BEAR THE COSTS OF SOLICITING PROXIES FOR THE ANNUAL MEETING?

The cost of soliciting proxies for the Annual Meeting will be borne by the Company. The Company has retained The Proxy Advisory Group, LLC to assist in the solicitation of votes for a fee of approximately $7,500. Following the mailing of proxy solicitation materials, proxies may be solicited personally or by telephone, by officers and employees of the Company who will not receive any additional compensation for their services. Proxies and proxy materials will also be distributed at the expense of the Company by brokers, nominees, custodians and other similar parties.

If the enclosed form of proxy is properly executed and returned to the Company in a timely manner to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with instructions marked thereon. Executed but unmarked proxies will be voted “FOR” Proposal 1 -- to elect the Board of Directors’ eight nominees for Director, “FOR” Proposal 2 -- to ratify the Board of Directors’ appointment of Ernst & Young LLP as the Company’s independent public accountants for the 2006 fiscal year, “FOR” Proposal 3 -- to ratify the Company’s ability to issue securities in accordance with the terms of its Series C Preferred Stock and related Warrants, and “FOR” Proposal 4 -- to approve an amendment to the Company’s Certificate of Incorporation increasing the number of the Company’s authorized shares of Common Stock from 70,000,000 to 120,000,000. If any other matters properly come before the Annual Meeting, the persons named in the accompanying proxy will vote the shares represented by such proxies on such matters in accordance with their best judgment.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE

“FOR” THE APPROVAL OF THE PROPOSALS SET FORTH IN THIS PROXY STATEMENT.

ELECTION OF DIRECTORS

(PROPOSAL 1)

The Company’s Bylaws provide that the Board of Directors shall consist of not fewer than one director nor more than 11 directors and that the number of directors, within such limits, shall be voted upon by the stockholders at each Annual Meeting. The Board of Directors currently consists of nine directors, each serving a one-year term. John R. Wallace, a current director, has declined to stand for re-election at the Annual Meeting. The Board has begun the process of seeking a qualified candidate to fill the vacancy on the Board, but to date, a nominee to fill the vacancy on the Board has not been selected. Therefore, the Board of Directors has nominated the following eight candidates for election as director at the Annual Meeting: G. Chris Andersen, Kenneth R. Baker, Alexander MacLachlan, Peter A. McGuigan, Zoltan Merszei, H. David Ramm, James L. Rawlings and Richard L. Sandor. Proxies may not be voted for more than eight directors at the Annual Meeting.

Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election as directors of Messrs. Andersen, Baker, MacLachlan, McGuigan, Merszei, Ramm, Rawlings and Sandor. The Board of Directors believes that such nominees will stand for election and will serve if elected as directors. However, if any person nominated by the Board of Directors fails to stand for election or is unable to accept election, the proxies will be voted for the election of such other person or persons as the persons named in the accompanying proxy shall determine in accordance with their best judgment. Pursuant to the Company’s Bylaws, directors are elected by plurality vote. The Company’s Certificate of Incorporation, as amended, does not provide for cumulative voting in the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF ITS NOMINEES FOR DIRECTORS.

INFORMATION AS TO DIRECTOR NOMINEES AND EXECUTIVE OFFICERS

NAME | AGE | POSITION |

DIRECTORS | | |

G. Chris Andersen | 67 | Chairman of the Board of Directors |

Kenneth R. Baker | 59 | Director |

Alexander MacLachlan | 73 | Director |

Peter A. McGuigan | 46 | Director |

Zoltan Merszei | 83 | Director |

H. David Ramm | 54 | Director and Chief Executive Officer |

James L. Rawlings | 61 | Director |

Richard L. Sandor | 64 | Director |

EXECUTIVE OFFICERS

| Adam P. Briggs | 45 | President |

| John V. Battaglini | 41 | Vice President, Sales, Marketing and Product Management |

| John D. Giolli | 34 | Chief Financial Officer and Corporate Secretary |

| Rex E. Luzader | 57 | Vice President, Government Relations |

| George C. Zalepa | 50 | Vice President, Administration |

Directors are elected to serve for one year or until their successors are elected and qualified or until their earlier resignation or removal. All directors are elected annually at the annual meeting of stockholders and all executive officers serve at the pleasure of the Board.

DIRECTORS STANDING FOR ELECTION

G. CHRIS ANDERSEN has served as the Chairman of the Company’s Board of Directors since April 2000. Mr. Andersen is a partner of G.C. Andersen Partners, LLC, a merchant-banking firm. From 1990 to 1995, Mr. Andersen was Vice Chairman of PaineWebber Incorporated. Previously, Mr. Andersen was a managing director for 15 years at Drexel Burnham Lambert, Incorporated, and a member of its Board of Directors. He is currently a director of TEREX Corporation, a manufacturer of mining, lifting and construction equipment. He is also a Director and member of the Executive Committee of Junior Achievement of New York, Inc.

KENNETH R. BAKER has served on the Company’s Board of Directors since July 2000. Mr. Baker has served as president, chief executive officer and a member of the board of trustees of Altarum (formerly the Environmental Research Institute of Michigan) since November 1999. From 1969 to 1999, Mr. Baker served in various executive positions with General Motors Corporation, including vice president and general manager of the GM Distributed Energy Business Unit, vice president and general manager of GM Research and Development and program manager of GM Electric Vehicles. Following his retirement in February 1999, Mr. Baker served as vice chairman and chief operating officer of Energy Conversion Devices, Inc. Mr. Baker also serves on the Board of Directors of AeroVironment, Inc., the Center for Automotive Research and the National Coalition for Advanced Manufacturing (NACFAM); the Michigan Council for Labor & Economic Growth, the National Advisory Board of the University of Michigan College of Engineering and the Advisory Board of the Automotive Research Center of the University of Michigan.

ALEXANDER MACLACHLAN, PH.D. has served on the Company’s Board of Directors since May 2000. He was recently a member of the National Research Council’s Board on Radioactive Waste Management and co-author of “The Hydrogen Economy: Opportunities, Costs, Barriers and R&D Needs”. Prior to his retirement in March 1996, Dr. MacLachlan was the Deputy Under Secretary for R&D Management at the U.S. Department of Energy and held various other positions in the Department of Energy. Prior to his employment at the Department of Energy, Dr. MacLachlan was employed by DuPont for 36 years, where he was senior vice president for research and development and chief technical officer from 1986 to 1993, and a member of DuPont’s operating group from 1990 to 1993. He is currently President of the University of Delaware Research Foundation. Dr. MacLachlan is a graduate of Tufts University with a B.S. in Chemistry (1954) and the Massachusetts Institute of Technology with a Ph.D. in Physical Organic Chemistry (1957). He is a member of Phi Beta Kappa and was elected to the National Academy of Engineering in 1992.

PETER A. MCGUIGAN has served on the Company’s Board of Directors since March 2004. Mr. McGuigan has served as managing shareholder of McGuigan Tombs & Company, CPA since founding the firm in March 1990. Mr. McGuigan has served on various AICPA and NJSCPA sponsored tax and accounting committees since obtaining his CPA certification in May 1984. From 1982 through 1990, Mr. McGuigan held both audit and tax supervisory positions for both international and medium-sized public accounting firms.

ZOLTAN MERSZEI has served on the Company’s Board of Directors since May 2000. Mr. Merszei served as the President and CEO of The Dow Chemical Company and retired as its Chairman in March 1980. During his thirty-year career with Dow, he pioneered and helped build the Company’s worldwide business. After retiring from Dow, Mr. Merszei joined Occidental Petroleum Corporation as Vice Chairman of the Board and later held various executive positions including President of Occidental Chemical and President of Occidental Petroleum until 1988. He has served on the Board of Directors of companies in the U.S. and abroad, among them The Budd Corporation, British Telecom (US), Dole Food International, Thyssen Industrial Corporation (Germany), Flexivan Corporation and Burlington Industries. Mr. Merszei is also active on numerous philanthropy Boards, notably the Marron Foundation.

H. DAVID RAMM has served on the Company’s Board of Directors since June 2000 and as its CEO since March, 2004. Mr. Ramm is a principal of DKRW Energy, L.L.C., a Houston, Texas based energy project development firm that is active in wind energy, LNG regasification and pipeline development and coal-to-liquids technology. He was formerly the president, chief executive officer and a director of Integrated Electrical Services, the largest electrical contracting firm in the U.S. From 1997 to March 2000 he worked at Enron, first as managing director of Enron Renewable Energy and then as president of Enron Wind Corporation (which is now GE Wind Energy). Prior to his employment at Enron, Mr. Ramm worked for 14 years at United Technologies Corporation, where he held several senior management positions, including vice president, marketing and sales at Otis Elevator and chairman and chief executive officer of International Fuel Cells Corporation.

JAMES L. RAWLINGS has served on the Company’s Board of Directors since April 2000. Mr. Rawlings is currently a partner of G.C. Andersen Partners, LLC. Prior to joining a predecessor of G.C. Andersen Partners, LLC, he was a Managing Director, principal and member of the Board of Schooner Asset Management Co. LLC, where he was responsible for new product development and investment oversight. Before joining Schooner, he was a Managing Director of Robert Fleming & Co., based in New York, where he was responsible for the London-based firm’s investment banking activities throughout the Americas. Before joining Fleming in 1993, he was an Executive Director of Southern Equities Corporation, an Australian-based industrial holding company, with responsibility for the executive level management and reorganization of the group’s U.S. activities. He was with Drexel Burnham Lambert, Incorporated, from 1979 to 1988, where, as a Managing Director in the Corporate Finance Department, he was responsible for initiating and developing relationships with international companies in most parts of the world. Mr. Rawlings was with Bank of America from 1967 to 1979 where he was responsible for Bank of America’s U.S. merchant banking and project finance activities. Mr. Rawlings is also a director of City Brewing Company, LLC. He holds a B.S. in Economics from Indiana University and an MBA from the University of Michigan.

RICHARD L. SANDOR, PH.D. has served on the Company’s Board of Directors since April 2003. Dr. Sandor is currently chairman and chief executive officer of Chicago Climate Exchange, Inc., a self-regulatory exchange that administers a voluntary greenhouse gas reduction and trading program for North America. Prior to the establishment of the Chicago Climate Exchange, Dr. Sandor was a senior markets executive with several financial institutions including Kidder Peabody, Banque Indosuez and Drexel Burnham Lambert, Incorporated. For more than three years, he was Vice President and Chief Economist at the Chicago Board of Trade. From 1997 to 1998, Dr. Sandor served as Second Vice Chairman - Strategy for the Chicago Board of Trade. Dr. Sandor is currently a director of the Intercontinental Exchange, an electronic marketplace for commodity and derivative products. He is a director of American Electric Power, a Columbus-based public utility that provides electric power, telecommunication, energy efficiency and financial services. In addition, Dr. Sandor is a research professor at the Kellogg Graduate School of Management at Northwestern University and previously held faculty positions with the School of Business Administration at the University of California, Berkeley and Stanford University.

EXECUTIVE OFFICERS

ADAM P. BRIGGS has served as the Company’s President since April 2005 and, prior to that, as Senior Vice President from December 2004 until April 2005. Mr. Briggs has responsibility for the Company’s Sales, Marketing, Product Development, Research, Finance and Administration. From June 2004 to December 2004 he held the position of Vice President of Product Development of the Company. From August 2003 to June 2004 he served the Company as Vice President of Product Management. From December 2001 to August 2003 he held the position of Vice President of Business Development for Distributed Generation. From February 2001 to December 2001, Mr. Briggs served as the Company’s Vice President of Business Development and Portable Power. Mr. Briggs was employed at The Gillette Company and Duracell Inc., from 1984 to 2001, where he was most recently Vice President -- Strategic OEM (Original Equipment Manufacturer) Sales and Consulting Group in the Global Business Management Group. Prior positions include Director of Global Strategic Account Management; Program Director -- Alkaline; Director of OEM Sales and Marketing -- Asia; Leader, Design Win Management Team -- Far East and OEM Marketing Director -- Far East. Mr. Briggs received his B.A. in physics from Bowdoin College.

REX E. LUZADER has served as the Company’s Vice President of Government Relations since February 2004. He has an office in Washington, D.C. and is primarily responsible for interfacing directly with federal and state legislators and key members of the Department of Energy and Department of Defense to promote funding of the Company’s initiatives. From December 2001 through January 2004, he had responsibility for business development for Transportation and Hydrogen Fuel Infrastructure. Prior to joining the Company, Mr. Luzader was the Vice President of Original Equipment Sales and Engineering and Corporate Strategy for Exide Corporation from 1998 to 1999. Mr. Luzader held a number of Vice Presidential positions at Exide Corporation including sales to the original equipment transportation industry, product engineering, process and equipment engineering, research and development and quality assurance. Mr. Luzader has served on the SAE Fuel Cell Standards Committee since 2001 and participated in the DOE Hydrogen road mapping efforts. He served as co-organizer of the SAE TopTech titled Facets of Implementing a Hydrogen Economy held in February of 2004. He serves on the Kettering University Fuel Cell Advisory Board, the US Fuel Cell Council Government Affairs working group and the National Hydrogen Association Legislative Affairs Council. He received his B.S. in Mechanical Engineering from Kettering University.

JOHN D. GIOLLI, C.P.A. has served as the Company’s Chief Financial Officer and Corporate Secretary since April 2005 and, from March 2004 until April 2005, he served as the Company’s Vice President, Finance and Acting Chief Financial Officer. From January 2001 to March 2004, he held the position of Corporate Controller and Principal Accounting Officer. Prior to joining Millennium Cell, Mr. Giolli held financial management positions with public companies in the technology and retail sectors. Mr. Giolli began his career in public accounting with Price Waterhouse LLP. He received his B.S. in Accounting from the State University of New York College at Oswego and is a Certified Public Accountant.

GEORGE ZALEPA has served as the Company’s Vice President, Administration since June 2004. Prior to such date, Mr. Zalepa was a consultant to the Company and acted as the Company’s Director of Human Resources. In his current role, Mr. Zalepa leads the Human Resources, IT and Administration programs at the Company. He has over 15 years of industry experience in Human Resources and has particular expertise in Human Resource Information Systems. Prior to joining the Company, Mr. Zalepa was a Human Resource Manager at Air Products and Chemicals, Inc. He received his MBA in engineering management from Fairleigh Dickinson University and his B.A. in chemistry and biology from East Stroudsburg University.

JOHN V. BATTAGLINI has served as the Company’s Vice President of Sales, Marketing and Product Management since January 2005. Mr. Battaglini has over 17 years of international marketing and sales experience in small and large high technology firms. Prior to joining the Company, Mr. Battaglini was the Marketing Director for Clare (an IXYS company), a designer and manufacturer of high voltage integrated circuits and discrete products for the telecommunications, power, industrial, medical and consumer markets. While at Clare, he was the leader for a start-up product line that he guided from start-up phase to annual revenues of $10 million. He began his career with Lucent Technologies in the semiconductor division where he progressed through a number of positions of increasing responsibility from product engineering, program management to strategic marketing. He received his MBA from Villanova University, an MSEE from Clemson University and a BSEE from Drexel University.

THE BOARD AND ITS COMMITTEES

The Board held four meetings in 2005 in addition to acting by unanimous written consent one time. Each director, except Mr. Merszei and Dr. Sandor, attended 100% of all meetings of the Board and committees of the Board to which he was assigned. Mr. Merszei attended more than 75% of all meetings of the Board. Dr. Sandor attended more than 50% of all meetings of the Board. Members of the Company’s Board of Directors are invited but not required to attend the Annual Meeting of Stockholders. The 2005 Annual Meeting of Stockholders was attended by the following directors: Andersen, Baker, MacLachlan, McGuigan, Ramm, Rawlings and Wallace.

INDEPENDENT DIRECTORS

The Board has determined that the following individuals are independent directors within the meaning of the regulations of the Securities and Exchange Commission (the “SEC”) and the listing standards of the NASDAQ Stock Market: Messrs. Andersen, Baker, MacLachlan, McGuigan, Merszei, Rawlings, Sandor and Wallace. The independent directors will meet regularly in executive session and outside the presence of the Company’s management throughout the 2006 fiscal year in compliance with the listing standards of the NASDAQ Stock Market.

DIRECTOR NOMINATIONS

Due to the relatively small size of the Company, the Board of Directors has determined that it is not necessary or appropriate at this time to establish a separate Nominating Committee. The Board has adopted a requirement that all director nominees be nominated by a majority vote of the independent directors prior to consideration by the full Board. All of the nominees recommended for election to the Board of Directors at the Annual Meeting are directors standing for re-election.

The Board of Directors believes that it is necessary that the majority of the Board of Directors must be comprised of independent directors as mandated by the listing standards of the NASDAQ Stock Market and that it is desirable to have at least one financial expert on the Board of Directors. When considering potential director candidates, the Board also considers the candidate’s character, judgment, age, skills, including financial literacy, and experience in the context of the needs of the Company and the Board of Directors. In 2005, the Company did not pay any fees to any third party to assist in identifying or evaluating potential director nominees.

The Board of Directors will consider director candidates recommended by the Company’s stockholders in a similar manner as those recommended by members of management or other directors. The name of any recommended candidate for director, together with a brief biographical sketch, a document indicating the candidate’s willingness to serve, if elected, and evidence of the nominating person’s ownership of Company stock should be sent to the attention of the Secretary of the Company. To date, the Company has not received any recommended nominees from any non-management stockholder or group of stockholders that beneficially owns 5% or more of the Company’s voting stock.

STOCKHOLDER COMMUNICATION WITH THE BOARD OF DIRECTORS

Stockholders may communicate with the Board of Directors by contacting the Chief Executive Officer by phone at (732) 542-4000 or in writing at the Company’s headquarters. Any such communication must contain (i) a representation that the stockholder is a holder of record of stock of the Company, (ii) the name and address, as they appear on the Company’s books, of the stockholder sending such communication and (iii) the number of shares of Company stock that are beneficially owned by such stockholder. The Secretary of the Company will relay the question or message to the specific director identified by the stockholder or, if no specific director is requested, to a director selected by the Secretary of the Company, unless such communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Secretary of the Company has the authority to discard the communication or to take appropriate legal action regarding such communication.

DIRECTOR COMPENSATION

Employee directors receive no additional compensation for serving as a director of the Company. Non-employee directors receive annual compensation for serving in such capacities as follows: Chairman of the Board - $40,000; all other Board members - $12,000. Each non-employee director that serves as a Chairman of any Committee of the Board receives an additional $3,000 annual compensation. In addition, each non-employee director receives $1,000 for each Board and Committee meeting attended by such director. In lieu of cash payments, non-employee directors were granted a combination of restricted stock and cash for all fees earned during fiscal year 2005.

BOARD COMMITTEES & MEETINGS

The Board has three standing committees -- an Executive Committee, an Audit Committee and a Compensation Committee.

Executive Committee

The Board has established an Executive Committee consisting of G. Chris Andersen, James L. Rawlings and H. David Ramm. The principal functions of the Executive Committee include exercising the powers of the Board during intervals between Board meetings and acting as an advisory body to the Board by reviewing various matters prior to their submission to the Board. The Executive Committee held four meetings in 2005.

Audit Committee

The Board has established an Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 consisting of Kenneth R. Baker, Peter A. McGuigan and John R. Wallace, all of whom are independent directors within the meaning of the applicable SEC regulations and the listing standards of the NASDAQ Stock Market. Mr. Baker is the Chairman of the Audit Committee. The Board has determined that Peter A. McGuigan is qualified as an “audit committee financial expert” within the meaning of SEC regulations and that he has accounting and related financial management experience within the meaning of the listing standards of the NASDAQ Stock Market. The Audit Committee held seven meetings in 2005.

As disclosed above, Mr. Wallace has declined to stand for re-election and his term as a director and as a member of the Audit Committee will expire as of the Annual Meeting. Accordingly, the Board has determined to appoint James L. Rawlings to succeed Mr. Wallace as a member of the Audit Committee effective as of the Annual Meeting. The Board has determined that Mr. Rawlings satisfies the applicable SEC and NASDAQ Stock Market qualifications and requirements relating to audit committee membership.

The Audit Committee is responsible for reviewing and inquiring into matters affecting financial reporting, the system of internal accounting, financial controls and procedures and audit procedures and audit plans. In addition, the Audit Committee generally oversees the Company’s internal compliance program. In accordance with applicable law, the Audit Committee is responsible for establishing procedures for the receipt, retention and treatment regarding accounting, internal accounting controls or audit matters, including the confidential, anonymous submission by Company employees, received through established procedures, of concerns regarding questionable accounting or auditing matters. Furthermore, the Audit Committee approves the quarterly financial statements and also recommends to the Board of Directors, for approval, the annual financial statements, the annual report and certain other documents required by regulatory authorities. The Audit Committee is further responsible to pre-approve all audit and non-audit services performed by the Company’s independent auditors.

In response to the audit committee requirements adopted by the SEC and the NASDAQ Stock Market in 2003, the Board of Directors has adopted an Amended and Restated Audit Committee Charter that specifies the responsibilities of the Audit Committee. The Amended and Restated Audit Committee Charter is attached to the Definitive Proxy Statement filed by the Company with the SEC on March 18, 2004.

Audit Committee Report

During the fiscal year ended December 31, 2005, the Audit Committee reviewed and discussed the audited financial statements with management and the Company’s independent accountants, Ernst & Young LLP. The Audit Committee discussed with the independent accountants the matters required to be discussed by the Statement of Auditing Standards No. 61 “Communication with Audit Committees” and reviewed the results of the independent accountants’ examination of the financial statements.

The Audit Committee also reviewed the written disclosures and the letter from the independent accountants required by Independence Standards Board, Standard No. 1 “Independence Discussions with Audit Committees”, discussed with the accountants the accountants’ independence, including a review of audit and non-audit fees, and satisfied itself as to the accountants’ independence.

Based on the above reviews and discussions, the Audit Committee recommends to the Board of Directors that the financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2005, for filing with the SEC.

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings made by the Company under those statutes, in whole or in part, this report shall not be deemed to be incorporated by reference into any such filings, nor will this report be incorporated by reference into any future filings made by the Company under those statutes.

| | Kenneth R. Baker, Chairman of the Audit Committee |

| | John Wallace |

| | Peter A. McGuigan |

Compensation Committee

The Company’s Board of Directors has established a Compensation Committee consisting of Alexander MacLachlan, Zoltan Merszei and James L. Rawlings, all of whom are independent directors within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market. Mr. Rawlings is the Chairman of the Compensation Committee. The Compensation Committee reviews and acts on matters relating to compensation levels and benefit plans for the Company’s executive officers and key employees, including salary, restricted stock and stock options. The Compensation Committee is also responsible for granting stock options, restricted stock and other awards to be made under the Company’s Amended and Restated 2000 Stock Option Plan. The Compensation Committee held three meetings in 2005.

Compensation Committee Report

The Board appointed the Compensation Committee in June 2000. Since that time, decisions on compensation of the Company’s executive officers have been made by the Compensation Committee. No member of the Compensation Committee is an employee of the Company and each member is “independent” within the meaning of SEC regulations and the listing standards of the NASDAQ Stock Market.

The Compensation Committee reviews and approves base salary, annual management incentive compensation and long-term incentive awards for all corporate officers and certain other key executives, with the objective of attracting and retaining individuals of the necessary quality and stature to operate the Company’s business. The Compensation Committee considers individual contributions, performance against strategic goals and direction, and industry-wide pay practices in determining the levels of base compensation for key executives. In addition, the Compensation Committee recommends recipients of the “Chairman’s Award,” which is a recognition program for leaders of projects, programs, initiatives and policies made to advance the success of the Company. The Chairman’s Award program, adopted by the Board in December 2005 upon the recommendation of the Compensation Committee, is not tied to a specific award cycle, but is expected to occur (if at all) on an annual basis upon significant events resulting from contributions that advance the success of the Company.

Long-term incentive awards are granted to corporate officers and certain other key employees under the Company’s Amended and Restated 2000 Stock Option Plan. The awards take the form of stock options or restricted stock that are tied directly to the market value of the Company’s Common Stock.

The Compensation Committee believes that the Amended and Restated 2000 Stock Option Plan aligns the interests of management with the stockholders and focuses the attention of management on the long-term success of the Company. A significant portion of the executives’ compensation is at risk, based on the financial performance of the Company and the value of the Company’s Common Stock in the marketplace.

In August 2005, the Compensation Committee approved an Employment Agreement and Restricted Stock Award Agreement with H. David Ramm, the Company’s Chief Executive Officer, and a related agreement between the Company and DKRW, a limited liability Company of which Mr. Ramm is a member. Under the Employment Agreement, Mr. Ramm agreed to serve as the Company’s Chief Executive Officer through December 31, 2005 in exchange for a restricted stock award of 50,000 shares of Common Stock, all of which vested on December 31, 2005. In addition, the Company agreed to pay DKRW $12,500 per month in exchange for DKRW’s waiver of certain provisions in its limited liability company agreement which otherwise would have restricted Mr. Ramm’s ability to serve as the Company’s Chief Executive Officer. See also “H. David Ramm and DKRW Agreements” on page 18.

Section 162(m) of the Internal Revenue Code limits to $1 million in a taxable year the deduction publicly held companies may claim for compensation paid to any executive officer, unless such compensation is performance-based and meets certain requirements. None of the Company’s executive officers’ compensation exceeds the limit set by Code Section 162(m).

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings made by the Company under those statutes, in whole or in part, this report shall not be deemed to be incorporated by reference into any such filings, nor will this report be incorporated by reference into any future filings made by the Company under those statutes.

| | James L. Rawlings, Chairman of the Compensation Committee |

| | Alexander MacLachlan |

| | Zoltan Merszei |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Company’s Compensation Committee consists of Alexander MacLachlan, Zoltan Merszei, and James L. Rawlings. The Company formed this Committee in June 2000. During 1999, Mr. Rawlings served as the Company’s acting Chief Executive Officer.

CODE OF CONDUCT

The Company has adopted a Code of Conduct that applies to all officers, directors, employees and consultants. The Code of Conduct is intended to comply with SEC regulations and the listing standards of the NASDAQ Stock Market. The Company’s Code of Conduct is posted on its Internet website under the “Investor Relations” page. The Company’s Internet website address is www.millenniumcell.com.

EXECUTIVE COMPENSATION

The following table sets forth all compensation awarded to, earned by or paid to the Company’s Chief Executive Officer and the Company’s four other most highly compensated executive officers whose annual salary and bonus exceeded $100,000 for 2005 (the “named executive officers”) during the fiscal years ended December 31, 2003, 2004 and 2005 for services rendered in all capacities to the Company during those fiscal years.

SUMMARY COMPENSATION TABLE

| | | Annual Compensation | Long-Term Compensation | |

| | | | | Awards | Payouts | |

| | | | | | Securities | | |

| | | | | | Under- | | |

| | | | | Restricted | lying | | |

| | | | Other Annual | Stock | Options/ | LTIP | All Other |

Name and | Fiscal | Salary | Bonus | Compensation | Award(s) | SARs | Payouts | Compensation |

Principal Position | Year | ($) | ($) | ($) | ($) | (#) | ($) | ($)(8) |

| | | | | | | | | |

H. David Ramm (1) | 2005 | | | — | 65,500 | | | | 197,500 | (2) |

Chief Executive Officer | 2004 | | | — | 129,000 | | | | 160,833 | (2) |

| | 2003 | | | | 20,800 | (3) | | | 7,000 | (3) |

| | | | | | | | | |

| Adam P. Briggs, | 2005 | 220,000 | | — | 106,600 | (4) | | | 12,600 | |

President | 2004 | 228,976 | | | 128,000 | (5) | | | 13,000 | |

| | 2003 | 203,478 | | | 58,650 | (6) | 75,000 | | 12,000 | |

| | | | | | | | | |

| Rex E. Luzader, | 2005 | 218,629 | | — | 82,000 | (4) | | | 83,067 | |

Vice President - | 2004 | 227,418 | | | 70,400 | (5) | | | 30,701 | |

Government Relations | 2003 | 232,327 | | | 52,572 | (6) | 50,000 | | 12,000 | |

| | | | | | | | | |

| John D. Giolli, | 2005 | 165,000 | | — | 98,400 | (4) | — | | 12,600 | |

Chief Financial Officer and | 2004 | 145,957 | | | 96,000 | (5) | 50,000 | | 9,365 | |

Corporate Secretary | 2003 | 110,158 | | | 24,395 | (6) | 14,500 | | 6,610 | |

| | | | | | | | | |

John V. Battaglini(7) | 2005 | 165,000 | | — | 73,800 | (4) | 50,000 | — | 67,596 | |

Vice President Sales, Marketing | | | | | | | | |

And Product Development | | | | | | | | |

| (1) | Mr. Ramm was appointed Chief Executive Officer on April 25, 2005. |

| | |

| (2) | This figure represents payments made to DKRW Energy L.L.C. in connection with Mr. Ramm’s services to the Company. |

| | |

| (3) | Issuance of shares of restricted stock and other compensation are related to Mr. Ramm’s service as a Director on the Board of Directors of the Company. |

| | |

| (4) | The Compensation Committee designated a pool of restricted stock to grant to employees in December 2005 and granted such restricted stock to specific employees in February 2006. The value set forth above is based on the closing price of the Common Stock on February 28, 2006, which was $1.64. The restricted stock vests in 20% tranches based on specific stock prices or after five years if the stock targets are not met. The restricted stock is entitled to dividends. However, the Company has never paid dividends on its Common Stock and does not expect to pay any dividends in the foreseeable future. |

| (5) | The Compensation Committee designated a pool of restricted stock to grant to employees in December 2004 and granted such restricted stock to specific employees in February 2005. The value set forth above is based on the closing price of the Common Stock on December 31, 2004, which was $1.28. The restricted stock vests in 20% tranches based on specific stock prices or after five years if the stock targets are not met. The restricted stock is entitled to dividends. However, the Company has never paid dividends on its Common Stock and does not expect to pay any dividends in the foreseeable future. |

| | |

| (6) | This figure represents the issuance of restricted stock pursuant to an exchange offer in August 2003 whereby eligible stock options were exchanged, at the option of the holder, for shares of restricted stock at an exchange rate based on the calculated market value of the stock options using a Black-Scholes model. The restricted stock vests in two tranches: 50% of such restricted stock vested on August 22, 2004 and the remaining 50% vested on August 22, 2005. The value set forth above is based on the closing price of the stock on the date of grant, August 20, 2003, which was $1.70. The restricted stock is entitled to dividends, however, the Company has never paid dividends on its Common Stock and does not expect to pay any dividends in the foreseeable future. |

| | |

| (7) | Mr. Battaglini was hired on January 3, 2005. |

| | |

| (8) | Amounts indicated are the Company contributions to the Company’s 401(k) plan and other executive benefits such as estate planning, tax preparation, and financial advisors. Amounts indicated for Mssrs. Luzader and Battaglini also include reimbursed relocation expenses. |

OPTION GRANTS IN 2005

The following table provides information with respect to stock options granted to the named executive officers during fiscal 2005.

| | | | | | | | | | | Potential Realizable | |

| | | | | | | | | | | Value At Assumed | |

| | | | | Annual Rates Of | |

| | | | | | | | | | | Stock Price Appreciation | |

| | | Individual Grants | | For Option Term | |

Name | | Number Of Shares Underlying Options/SARS Granted | | % of Total Options Granted To Employees In Fiscal Year | | Exercise Price Per Share | | Expiration Date | | 5% | | 10% | |

| John Battaglini | | | 50,000 | | | 86% | | | $1.25 | | | 1/2/2015 | | | $5,090 | | | $8,105 | |

FISCAL YEAR-END 2005 OPTION VALUES

The following table provides information with respect to the Company’s named executive officers concerning unexercised options held by them at the end of fiscal year 2005. There were no stock options exercised by any named executive officers during 2005.

Name of Executive Officer | Number of Shares Acquired on Exercise | Value Realized ($) | Number of Securities Underlying Unexercised Options at Fiscal Year End; (Exercisable/Unexercisable) | Value of Unexercised In-the-Money Options at Fiscal Year End ($); Exercisable/ Unexercisable) |

| H. David Ramm | 0 | 0 | 75,000/0 | $0 |

| Adam P. Briggs | 0 | 0 | 75,000/75,000 | $0 |

| Rex E. Luzader | 0 | 0 | 50,000/50,000 | $0 |

| John D. Giolli | 0 | 0 | 31,148/47,823 | $0 |

| John V. Battaglini | 0 | 0 | 0/50,000 | $0 |

EQUITY COMPENSATION PLAN INFORMATION

Plan Category | Number of securities to be issued upon exercise of outstanding options | Weighted average exercise price of outstanding options | Number of securities remaining available for future issuance |

| | (a) | (b) | (c) |

Equity compensation plans approved by security holders(1) | 5,092,649 | $2.94 | 3,407,351 |

| Equity compensation plans not approved by security holders | 0 | 0 | 0 |

| TOTAL | 5,092,649 | $2.94 | 3,407,351 |

(1) This plan is the Company’s Amended and Restated 2000 Stock Option Plan and includes restricted stock awards. The restricted stock grants were not included in the calculation of the weighted average exercise price.

EMPLOYMENT AGREEMENTS & CHANGE-IN-CONTROL AGREEMENTS

H. David Ramm and DKRW Agreements

On August 12, 2005, the Company entered into an Employment Agreement and a Restricted Stock Grant Agreement with Mr. H. David Ramm and an Agreement with DKRW Energy L.L.C. (“DKRW”), a limited liability company of which Mr. Ramm is a member, in connection with Mr. Ramm’s serving as Chief Executive Officer of the Company.

Under the Employment Agreement, which replaced the prior Employment Agreement between the Company and Mr. Ramm dated July 14, 2004, the Company agreed to continue to employ Mr. Ramm as Chief Executive Officer subject to either party’s right to terminate the agreement at any time for any reason. Since December 31, 2005, the Employment Agreement has automatically renewed on a monthly basis and will continue to renew on a monthly basis until either party delivers 30 days’ prior written notice of non-renewal. As full consideration of his services under the Employment Agreement, the Company granted to Mr. Ramm 50,000 shares of restricted stock (all of which vested on December 31, 2005) in accordance with the Restricted Stock Agreement. The Employment Agreement contains customary non-solicitation, confidentiality and work-for-hire covenants.

As a member of DKRW, Mr. Ramm is restricted from acting as an employee of an energy-related business without the consent of DKRW’s board of managers. Under the agreement between the Company and DKRW, the Company agreed to pay to DKRW $12,500 per month for its waiver of this restriction to permit Mr. Ramm to continue to serve as the Company’s Chief Executive Officer. This agreement replaced a prior agreement between DKRW and the Company dated July 14, 2004.

Adam P. Briggs

Pursuant to a Change-In-Control Agreement dated July 28, 2004 between the Company and Mr. Briggs, if Mr. Briggs’ employment is terminated within two years following a change of control (i) by the Company without cause or (ii) by Mr. Briggs for good reason, Mr. Briggs will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Briggs is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

Rex E. Luzader

On July 28, 2004, the Company entered into a Change-In-Control Agreement with Mr. Luzader, the Company’s Vice President of Government and Military Sales. In the event Mr. Luzader’s employment is terminated within two years following a change of control (i) by the Company without cause or (ii) by Mr. Luzader for good reason, he will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Luzader is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

John D. Giolli

Pursuant to a Change-In-Control Agreement dated July 28, 2004 between the Company and Mr. Giolli, if Mr. Giolli’s employment is terminated within two years following a change of control (i) by the Company without cause or (ii) by Mr. Giolli for good reason, Mr. Giolli will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Giolli is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

John V. Battaglini

On January 3, 2005, the Company entered into a Change-In-Control Agreement with Mr. Battaglini, the Company’s Vice President of Sales, Marketing and Product Management. In the event Mr. Battaglini’s employment is terminated within two years following a change of control (i) by the Company without cause or (ii) by Mr. Battaglini for good reason, he will be entitled to receive 200% of the sum of his base salary at that time and the average of his annual bonuses paid in the three calendar years prior to the year in which termination occurs. In addition, Mr. Battaglini is entitled to continuing coverage of life, disability, accident and health insurance which covers any senior executive of the Company generally for two years from the date of termination or until similar coverage is provided by a new employer, whichever occurs earlier.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Option Grant

On January 4, 2005 the Company granted John Battaglini, its Vice President of Sales, Marketing and Product Management, options to purchase 50,000 shares of Common Stock at an exercise price of $1.25 per share. The options vest in three equal annual installments commencing on January 4, 2006.

Joint Development Agreement with The Dow Chemical Company

On April 25, 2005, the Company entered in a Joint Development Agreement with The Dow Chemical Company (“Dow”), whereby the Company and Dow agreed to jointly develop portable energy solutions using certain processes developed by the Company to produce hydrogen gas for use by fuel cells. The Joint Development Agreement has a three year term, may be terminated by either party upon certain circumstances described in the Joint Development Agreement and may be terminated by Dow for any reason upon 30 days’ notice to the Company. Under the Joint Development Agreement, there is a series of four milestones designed to culminate in a commercially available product. Upon the successful completion of each milestone, Dow will have a right to increase its equity ownership in the Company as summarized below and as set forth in a Stock Purchase Agreement between the Company and Dow dated February 27, 2005.

Upon execution of the Joint Development Agreement on April 25, 2005, the Company issued to Dow 155,724 shares of Series A Preferred Stock (subsequently exchanged for a like number of shares of Series A2 Preferred Stock in an exchange offer conducted by the Company). Upon the successful completion of each of the four milestones, Dow has the right to purchase a number of shares of Series B Preferred Stock equal to the number of shares of Common Stock that could be purchased for $1,250,000 (based upon a purchase price equal to the volume weighted average price for the 30-trading day period prior to the date of issuance). In addition, if Dow purchases shares of Series B Preferred Stock, the Company will grant Dow warrants to purchase a number of shares of Common Stock that equals 25% of the number of shares of Common Stock issuable upon conversion of such shares of Series B Preferred Stock. If Dow purchases shares of Series B Preferred Stock in such instances, the Company will issue to Dow additional shares of Series A2 Preferred Stock on the terms set forth in the Stock Purchase Agreement.

In connection with the transactions described above, the Company and Dow also entered into an Investor Rights Agreement, a Registration Rights Agreement, a Standstill Agreement, a Cross Licensing and Intellectual Property Agreement and a Patent Assignment Agreement and License. All of the foregoing agreements are described in the Company’s Current Reports on Form 8-K filed with the SEC on each of February 28, 2005 and April 26, 2005 (second filing). The entire text of these agreements are attached as exhibits to such Current Reports on Form 8-K.

Securities Purchase Agreement

On April 20, 2005 the Company sold shares of Series C Preferred Stock and Warrants to each of Portside Growth and Opportunity Fund, Provident Premier Master Fund Ltd., Iroquois Master Fund, Ltd., Langley Partners, L.P., JGB Capital L.P., Smithfield Fiduciary LLC and Tailwind Fund, Ltd. pursuant to a Securities Purchase Agreement. The terms of this transaction are described under Proposal 3.

Voting Agreement

In order to induce the investors to purchase the Series C Preferred Stock, on April 25, 2005, certain officers and directors of the Company, in their respective capacities as stockholders, entered into a Voting Agreement with the Company whereby each such stockholder agreed to vote all of its respective shares in favor of Proposal 3 and Proposal 4 (See “Voting Agreement” on page 41).

Employment Agreement with H. David Ramm and Agreement with DKRW

On August 12, 2005, the Company entered into an Employment Agreement and a Restricted Stock Grant Agreement with Mr. H. David Ramm and an Agreement with DKRW in connection with Mr. Ramm’s serving as Chief Executive Officer of the Company.

Under the Employment Agreement, which replaced the prior Employment Agreement between the Company and Mr. Ramm dated July 14, 2004, the Company agreed to continue to employ Mr. Ramm as Chief Executive Officer subject to either party’s right to terminate the agreement at any time for any reason. Since December 31, 2005, the Employment Agreement has automatically renewed on a monthly basis and will continue to renew on a monthly basis until either party delivers 30 days’ prior written notice of non-renewal. As full consideration of his services under the Employment Agreement, the Company granted to Mr. Ramm 50,000 shares of restricted stock (all of which vested on December 31, 2005) in accordance with the Restricted Stock Agreement. The Employment Agreement contains customary non-solicitation, confidentiality and work-for-hire covenants.

As a member of DKRW, Mr. Ramm is restricted from acting as an employee of an energy-related business without the consent of DKRW’s board of managers. Under the agreement between the Company and DKRW, the Company agreed to pay to DKRW $12,500 per month for its waiver of the restriction to permit Mr. Ramm to continue to serve as the Company’s Chief Executive Officer. This agreement replaced a prior agreement between DKRW and the Company dated July 14, 2004.

Chairman’s Award

In December 2005, Zoltan Merzsei, a member of the Board, was awarded options to purchase 100,000 shares of Common Stock at an exercise price of $1.48 per share. These options will vest ratably over three years. The options were awarded by the Board of Directors upon recommendation of the Compensation Committee in recognition of Mr. Merzsei’s contributions towards the negotiation of the joint development arrangement with Dow (see “Joint Development Agreement with The Dow Chemical Company,” page 20). Mr. Merzsei is a former member of the Board of Directors of Dow and has a family member who is currently employed by Dow.

Issuance to G.C. Andersen Partners, LLC

As consideration for financial advisory services rendered to the Company in connection with the Company’s joint development program with Dow, in March 2005, G.C. Andersen Partners, LLC received a fee equal to $62,500 in the form of 52,477 shares of Common Stock. Two members of the Company’s Board of Directors are principals of G.C. Andersen Partners, LLC: G. Chris Andersen, the Chairman of the Board, and James L. Rawlings, the Chairman of the Compensation Committee.

COMPARATIVE STOCK PRICES

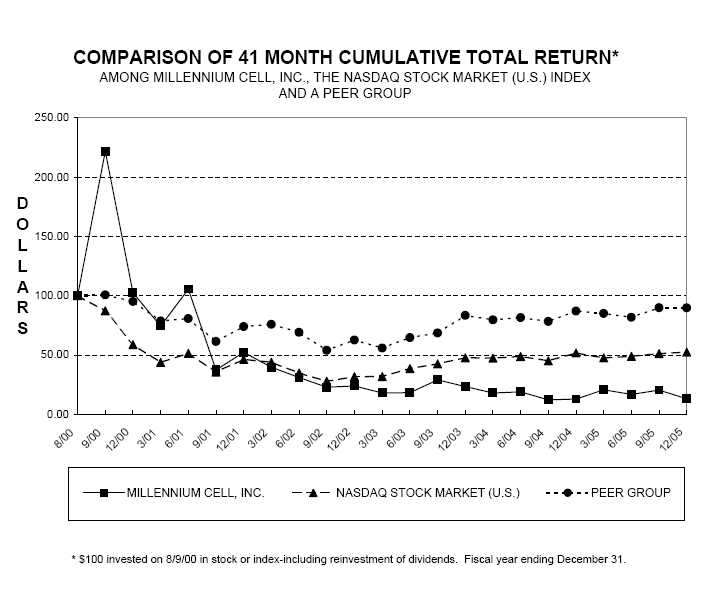

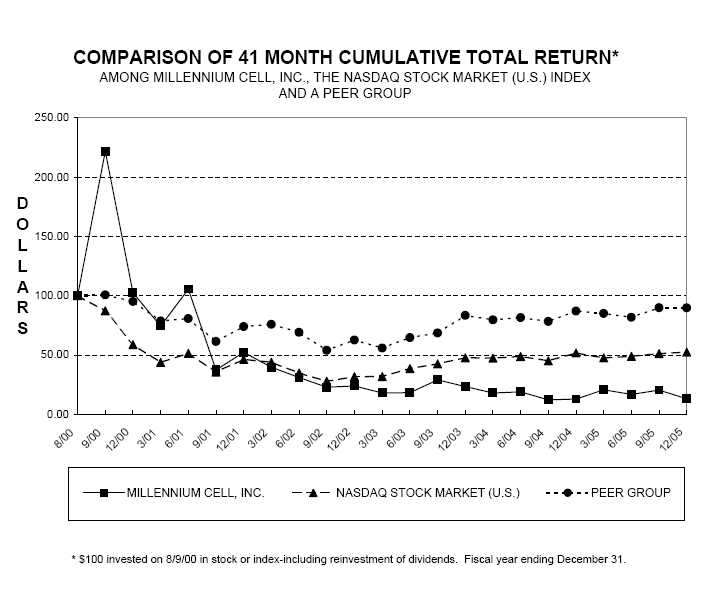

The following chart sets forth comparative information regarding the Company’s cumulative stockholder return on the Common Stock since December 31, 2000. Total stockholder return is measured by dividing share price change for a period by the share price at the beginning of the measurement period. The Company’s cumulative stockholder return based on an investment of $100 at December 31, 2000, and its closing price of $1.31 on December 30, 2005 is compared to the cumulative total return of the NASDAQ Capital Market (formerly the NASDAQ SmallCap Market) and the industry index based on the Company’s SIC code, 3690 -- “Miscellaneous Electrical Machinery, Equipment and Supplies” during that same period assuming dividend reinvestment.

RATIFICATION OF THE APPOINTMENT OF THE

COMPANY’S INDEPENDENT PUBLIC ACCOUNTANTS

(PROPOSAL 2)

Effective March 7, 2000, the Company engaged the accounting firm of Ernst & Young LLP as the Company’s principal independent accountants. The Board of Directors approved the recommendation of the Audit Committee for the appointment of Ernst & Young LLP to audit the financial statements of the Company for the fiscal year ending December 31, 2006. If the stockholders do not ratify the appointment of Ernst & Young LLP, the Audit Committee may reconsider its selection.

Ernst & Young LLP performed various audit and other services for the Company during fiscal year 2005. Such services included an audit of annual financial statements, interim reviews of quarterly financial statements, review and consultation connected with certain filings with the SEC, financial accounting and reporting matters, and meetings with the Audit Committee of the Board of Directors.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions.

FEES PAID TO THE COMPANY’S AUDITORS

Set forth below is certain information concerning fees billed to the Company by Ernst & Young LLP in respect of services provided in fiscal years 2005 and 2004. The Audit Committee has determined that the provision of the provided services is compatible with maintaining the independence of Ernst & Young LLP.

| | | FY 2005 | | FY 2004 | |

| Audit Fees | | $ | 382,000 | | $ | 288,000 | |

| Audit Related Fees | | $ | 1,500 | | $ | 0 | |

| Tax Fees | | $ | 0 | | $ | 0 | |

| All Other Fees | | $ | 8,000 | | $ | 0 | |

Audit Fees. Annual audit fees relate to services rendered in connection with the audit of the annual financial statements included in the Company’s Form 10-K filing, the quarterly reviews of financial statements included in the Company’s Form 10-Q filings and registration statement consent procedures.

Audit Related Fees. The audit-related fees for fiscal 2005 were for fees related to a subscription to Ernst & Young’s online accounting and auditing research tool.

Other Fees. The other fees for fiscal 2005 were for services rendered to the Company by Ernst & Young LLP for an executive compensation study.

There were no tax fees for professional services rendered by Ernst & Young LLP for fiscal years 2005 or 2004, respectively.

PRE-APPROVAL POLICIES

The Audit Committee pre-approves all audit and non-audit services provided by the Company’s independent auditors prior to the engagement of the independent auditors with respect to such services.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION

AND APPROVAL OF THE APPOINTMENT OF ERNST & YOUNG LLP AS

INDEPENDENT ACCOUNTANTS FOR THE COMPANY FOR FISCAL YEAR 2006.

SECURITY OWNERSHIP OF

PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The table below lists the beneficial ownership of the Company’s Common Stock, Series A2 Preferred Stock and Series C2 Preferred Stock by (i) each director of the Company, (ii) each named executive officer, (iii) all of the Company’s directors and executive officers as a group, and (iv) each stockholder known to the Company to be the beneficial owner of more than 5% of the outstanding shares of any class of the Company’s voting securities.

The Common Stock, Series A2 Preferred Stock and Series C2 Preferred Stock are the only classes of the Company’s voting securities outstanding. Holders of Common Stock, Series A2 Preferred Stock (on an as-converted basis) and Series C2 Preferred Stock (on an as-converted basis) vote together as a single class on all matters submitted to a vote of the Company’s stockholders, except that the Series A2 Preferred Stock and the Series C2 Preferred Stock are each entitled to vote as a separate class on matters that are required by applicable law or by the terms of the Series A2 Preferred Stock or Series C2 Preferred Stock to be submitted to a separate class vote. Pursuant to NASDAQ Marketplace Rule IM-4350-2, holders of shares of Series C2 Preferred Stock are not entitled to vote such shares on Proposal 3.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and investment power with respect to such securities. Except as noted below, to the Company’s knowledge the persons named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them. The beneficial ownership percentages are based on 47,550,936 shares of Common Stock outstanding, 155,724 shares of Series A2 Preferred Stock outstanding and 5,376 shares of Series C2 Preferred Stock outstanding, in each case as of March 7, 2006.