UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

Quotient Technology Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | | | | | | | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | | | | | | | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PROXY STATEMENT

FOR 2021 ANNUAL MEETING OF STOCKHOLDERS

QUOTIENT TECHNOLOGY INC.

400 LOGUE AVENUE

MOUNTAIN VIEW, CA 94043

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 10:00 a.m. Pacific Daylight Time on Thursday, June 3, 2021

TO THE STOCKHOLDERS OF QUOTIENT TECHNOLOGY INC.:

The Annual Meeting of Stockholders (“Annual Meeting”) of Quotient Technology Inc., a Delaware corporation (“Quotient” or the “Company”), will be held on Thursday, June 3, 2021, at 10:00 a.m. PDT, for the following purposes as more fully described in the accompanying proxy statement:

1.To elect our Board of Directors’ two nominees for Class I directors named herein to serve until the 2024 annual meeting of stockholders and until their successors are duly elected and qualified, subject to earlier resignation or removal;

2.To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement in accordance with Securities and Exchange Commission (“SEC”) rules;

3.To ratify the selection by the Audit Committee of our Board of Directors of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021; and

4.To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

This year's Annual Meeting will be held as a virtual-only meeting due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our employees, directors and stockholders. While you will not be able to attend the Annual Meeting physically, the Annual Meeting has been designed to provide stockholders with the same opportunities to participate in the virtual meeting as they would have had at an in-person meeting. Stockholders of record as of the record date will be able to attend and participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/QUOT2021. To join the meeting, you will need your 16-digit control number as provided in your proxy materials. For further information regarding the virtual meeting, please see the "Questions and Answers" section of the proxy statement.

Only stockholders of record of our common stock at the close of business on April 13, 2021 (the “Record Date”) will be entitled to receive a notice of, and to vote at the Annual Meeting and any adjournments thereof. Further information regarding voting rights and the matters to be voted upon is presented in our proxy statement.

In accordance with SEC rules, we sent a Notice of Internet Availability of Proxy Materials on or about April 22, 2021 and provided access to our proxy materials over the internet on or before that date, to the holders of record of our common stock as of the close of business on the Record Date.

If you have any further questions about voting or attending the Annual Meeting, please contact our proxy solicitor, D.F. King & Co., Inc. Stockholders may call toll-free at (800) 549-6746, and banks and brokers may call collect at (212) 269-5550. D.F. King may be reached by email at Quot@dfking.com. If you have any general questions regarding the Annual Meeting, please visit our website at www.quotient.com or contact our investor relations department at (650) 605-4600 (option 7). Our Annual Report on Form 10-K for the year ended December 31, 2020 and our 2021 Proxy Statement are available at https://materials.proxyvote.com/749119103.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to submit your vote via the internet, telephone or mail.

We appreciate your continued support of Quotient and look forward to receiving your proxy.

By order of the Board of Directors,

Connie Chen

General Counsel and Secretary

Mountain View, California

April 22, 2021

We are closely monitoring developments related to the COVID-19 pandemic. It could become necessary to change the date, time and/or means of holding the Annual Meeting of Stockholder. If such a change is made, we will announce the change in advance, and details on how to participate will be issued by press release, posted on our website and filed as additional proxy materials.

As used in this proxy statement, the terms “Quotient,” the “Company,” “we,” “us,” and “our” mean Quotient Technology Inc. and its subsidiaries unless the context indicates otherwise.

PROXY STATEMENT

FOR 2021 ANNUAL MEETING OF STOCKHOLDERS

to be held on Thursday, June 3, 2021 at 10:00 a.m. PDT

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting of stockholders to be held at 10:00 a.m. PDT on Thursday, June 3, 2021, and any postponements or adjournments thereof, which we refer to as the Annual Meeting. The Annual Meeting will be held as a virtual-only meeting by visiting www.virtualshareholdermeeting.com/QUOT2021 and entering your 16-digit control number as provided in your proxy materials. This proxy statement and the accompanying form of proxy are first being mailed to stockholders on or about April 22, 2021. Our annual report for the year ended December 31, 2020 is enclosed with this proxy statement. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

PROXY SUMMARY

Business Performance

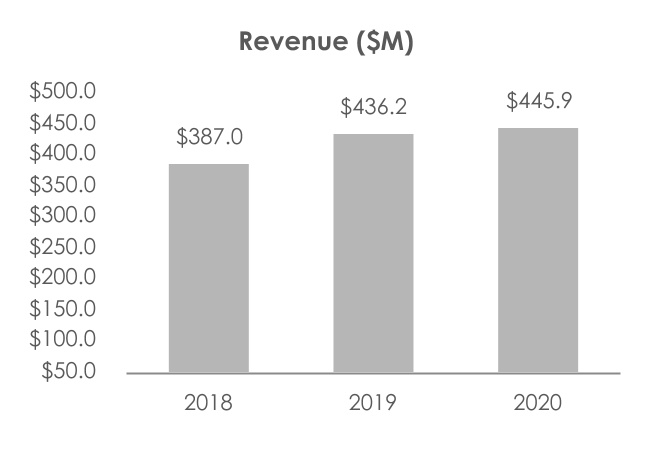

2020 was a year of progress for Quotient. Although the global pandemic caused many challenges, we stayed the course and focused on delivering value through our solutions for consumer-packaged goods (CPGs) manufacturers, our retail partners and consumers. We published our first ever Corporate Social Responsibility (CSR) report outlining our commitment to sustainability and how we are making meaningful efforts in the areas of diversity and inclusion, protecting and contributing to our society and making a positive impact on our environment.

Highlights

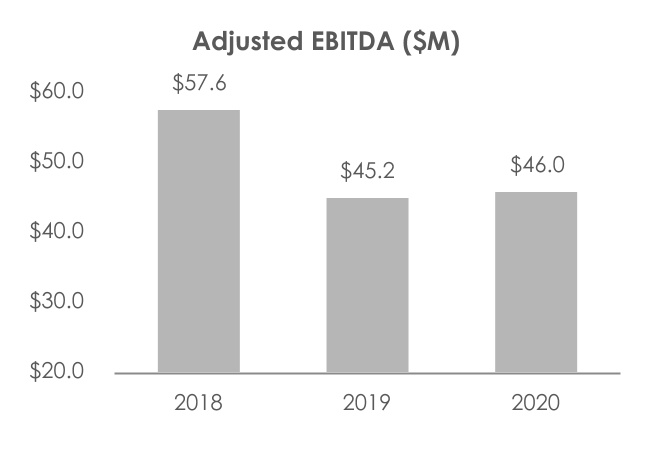

•We ended 2020 strong as CPGs rebounded from earlier impacts of the pandemic in the first half of the year. Q4 revenue was up 20% over Q4 2019 and up 18% over Q3 2020. We ended 2020 with annual revenues of $445.9 million or 2% growth over the prior year.

•In response to the COVID-19 pandemic we executed a plan in Q2 that sustained our business and employment levels during the market downturn. As a result, we experienced no material disruptions to normal operations.

•We added invaluable best-in-class talent to strengthen our organization and guide our future.

•We experienced 3% growth in new CPG customers and 11% growth in brand expansion, as well as more demand and higher spend commitments from our existing customers due to the effectiveness of our platform and solutions.

•We grew our retailer relationships with four new partnerships added to our network, including Shipt, 7-Eleven, Rite Aid and Hy-Vee.

•We improved our forecasting ability and accuracy with collaborative processes and procedures for go-to-market, bookings and pipeline building — a crucial component for insight into our future outlook.

•We rolled out our first long-term financial outlook in November 2020, reflecting 15% to 20% projected revenue growth CAGR along with margin expansion over the next three years.

Compensation

Say-On-Pay

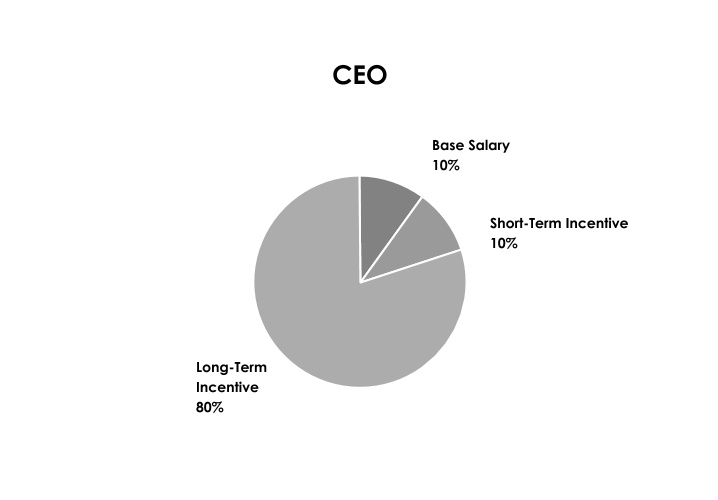

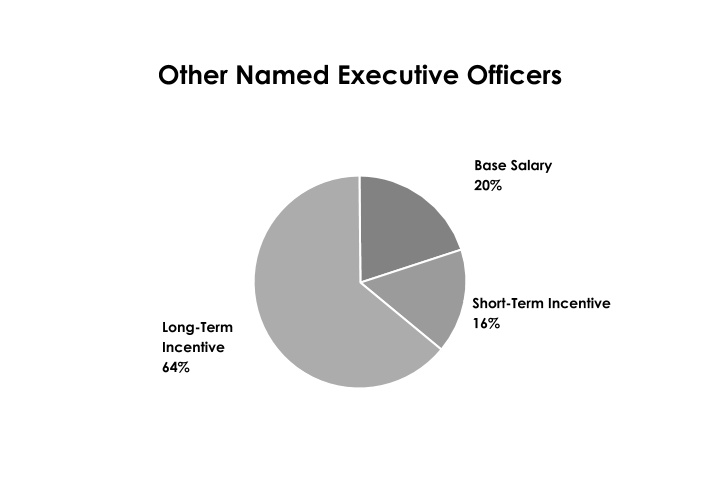

At the Annual Meeting of Stockholders on June 3, 2020, 53% of votes were cast in favor of the advisory Proposal on Executive Compensation, commonly known as “Say-On-Pay”. In response, we engaged directly with our stockholders to solicit feedback and input. These conversations were very beneficial and resulted in several significant changes to our executive compensation programs which included increasing the portion of our long-term equity compensation that is at-risk and performance-based. These changes were directly in response to this stockholder feedback and were implemented for our 2021 compensation plan. For more information please see “Executive Compensation - Compensation Overview - 2020 Advisory Vote on Executive Compensation.”

Compensation Changes in Response to Stockholder Feedback:

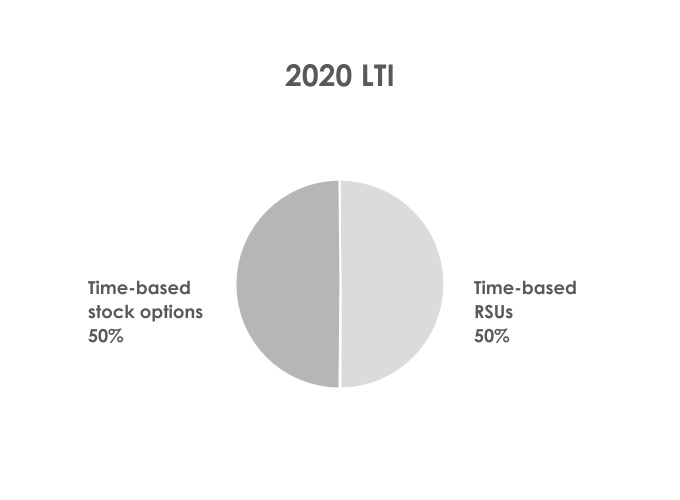

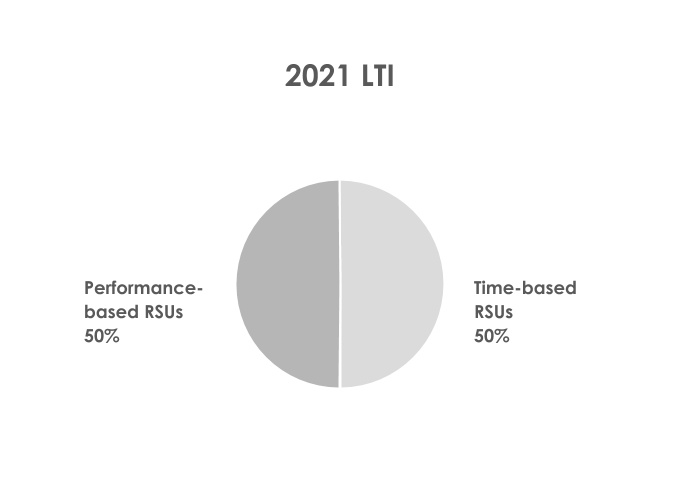

•Effective 2021, 50% of long-term equity awards to NEOs will be subject to the achievement of 3-year quantitative performance hurdles. Gross margin dollars and a stock price modifier were selected as the performance metrics to align with our three-year financial plan.

•We re-aligned the composition of our compensation peer group to better reflect our current profile which resulted in the removal of a number of companies, and the addition of others.

2020 Compensation Highlights

While our business performance ended the year in a much stronger position than we expected, it was impacted significantly by the market contraction and challenges such as supply chain disruptions caused by the COVID-19 pandemic in the first half of 2020. The performance targets under our Annual Incentive Plan that govern annual incentive awards were established in February pre-pandemic and were not adjusted during the year. Our full year performance did not meet achievement threshold targets required for our CEO, Mr. Boal, to earn his annual incentive payout in 2020.

For named executive officers other than Mr. Boal, our full year performance met the threshold targets necessary for those participants to earn payouts, but following a recommendation from the leadership team, the Compensation Committee reduced such formulaic payouts from 60% to 25% to align with the payout approved for non-executive Annual Incentive Plan participants. The payout approved for the non-executive participants followed a decision made by the leadership team in Q2, with support of the Compensation Committee and the Board, to suspend the normal operation of the Annual Incentive Plan in response to the market contraction caused by the COVID-19 pandemic. This decision enabled the Company to avoid employee layoffs and other adverse employment actions while delivering sustainable financial performance.

QUESTIONS AND ANSWERS

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

What matters am I voting on?

You will be voting on:

| | |

•a proposal for the election of our Board’s two nominees for Class I directors named herein to hold office until the 2024 annual meeting of stockholders and until their successors are elected and qualified, subject to earlier resignation or removal; |

•a proposal to approve on an advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement in accordance with SEC rules; |

•a proposal to ratify the selection by the Audit Committee of our Board of Ernst & Young LLP, as our independent registered public accounting firm for the year ending December 31, 2021; and |

•any other business that may properly come before the Annual Meeting. |

How does the Board recommend I vote on these proposals?

The Board recommends a vote:

•FOR the election of Steve Horowitz and Christy Wyatt, as Class I directors to hold office until the 2024 Annual Meeting of Stockholders and until their successors are elected and qualified, subject to earlier resignation or removal;

•FOR the compensation of our named executive officers described in this proxy statement; and

•FOR the ratification of the selection by the Audit Committee of our Board of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021.

Who is entitled to vote?

Holders of our common stock as of the close of business on April 13, 2021 (the “Record Date”), may vote at the Annual Meeting. As of the Record Date, we had 93,359,430 shares of common stock outstanding. In deciding all matters at the Annual Meeting, each holder of common stock of Quotient will be entitled to one vote for each share of common stock held as of the close of business on the Record Date. We do not have cumulative voting rights for the election of directors.

Registered Stockholders. If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares, and the proxy materials were provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote during the Annual Meeting.

Street Name Stockholders. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name and the proxy materials were forwarded to you by your broker or nominee who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares. Beneficial owners are also invited to attend and vote during the Annual Meeting. If you request a printed copy of the proxy materials by mail, your broker or nominee will provide a voting instruction card for you to use. Throughout this proxy, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name holders.”

How do I vote if I am a stockholder of record?

| | |

•vote by internet— visit www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. EDT on June 2, 2021 (have your proxy card in hand when you visit the website); |

•vote by telephone—call toll-free at 1-800-690-6903 (have your proxy card in hand when you call); |

•vote by mail—simply complete, sign and date the enclosed proxy card and return it before the Annual Meeting in the postage-paid envelope provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717; or |

•vote during the Annual Meeting—visit www.virtualshareholdermeeting.com/QUOT2021. |

How do I vote if I am a street name holder?

Street name holders may submit their voting instructions by internet or telephone using the information provided by their respective brokers or other nominees and may complete and mail voting instruction forms to their respective brokers or nominees. Street name holders can also vote during the Annual Meeting by visiting www.virtualshareholdermeeting.com/QUOT2021.

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

| | |

•entering a new vote by internet or by telephone (until 11:59 p.m. EDT on June 2, 2021); |

•returning a later-dated proxy card so that it is received prior to the Annual Meeting; |

•notifying the Secretary of Quotient, in writing, at 400 Logue Avenue, Mountain View, CA 94043; or |

•voting during the Annual Meeting— visit www.virtualshareholdermeeting.com/QUOT2021. |

Street name holders may change their voting instructions by submitting new instructions by internet or by telephone or by returning a later-dated voting instruction form to their respective brokers or nominees. Street name holders can also change their vote by voting during the Annual meeting by visiting www.virtualshareholdermeeting.com/QUOT2021.

What do I need to do to attend the virtual-only Annual Meeting?

You can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/QUOT2021, where you will be able to listen live, submit questions, and vote online. To enter the Annual Meeting, you will need your 16-digit control number as provided in your proxy materials if you are a stockholder of record, or included with your voting information provided by your respective brokers or nominees if you are a street name holder.

The Annual Meeting will begin promptly at 10:00 a.m. PDT. We encourage you to access the meeting in advance to ensure you are logged in when the meeting starts. Online registration will begin at 9:45 a.m. PDT, and you should allow ample time for the registration procedures.

What if I have technical difficulties before or during the meeting?

If you are having difficulties accessing the Annual Meeting during registration or meeting time, please call the technical support number that will be posted on the Annual Meeting registration page.

How Can I Submit Questions at the Annual Meeting?

Stockholders can submit questions during the meeting by visiting www.virtualshareholdermeeting.com/QUOT2021 and entering your 16-digit control number. Once logged in, click the "Q&A" button, type your question, and click "Submit".

After the business portion of the Annual Meeting concludes and the meeting is adjourned, we will hold a Q&A session during which we intend to answer all questions submitted during the meeting that are pertinent to the Company and the items being brought before the stockholder vote at the Annual Meeting, as time permits and in accordance with our rules of procedure for the Annual Meeting. Any remaining questions submitted during the Annual Meeting can be addressed by contacting our IR Department at IR@quotient.com.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board. Steven Boal and Connie Chen have been designated as proxies by our Board. When proxy votes are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board as described above. If any matters not described in the Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, the proxy holders can vote your shares at the adjourned meeting date as well, unless you have properly revoked your proxy instructions, as described above.

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting for the meeting to be properly held under our Amended and Restated Bylaws (our “Bylaws”) and Delaware state law. The presence, in person or by proxy, of a majority of the voting power of the shares of stock entitled to vote at the meeting will constitute a quorum at the meeting. A proxy submitted by a stockholder may indicate that the shares represented by the proxy are not being voted (“stockholder withholding”) with respect to a particular matter. In addition, a broker may not be permitted to vote on shares held in street name on a particular matter in the absence of instructions from the beneficial owner of the stock (“broker non-vote”). The shares subject to a proxy which are not being voted on a particular matter because of either stockholder withholding or broker non-votes will count for purposes of determining the presence of a quorum. Abstentions are counted in the determination of a quorum.

How many votes are needed for approval of each matter?

•Proposal No. 1: The election of directors requires a plurality of the votes cast by the holders of shares present in person or represented by proxy at the meeting and entitled to vote thereon, to be approved. “Plurality” means that the nominees who receive the largest number of votes cast “FOR” are elected as directors. Only votes “FOR” will affect the outcome, and any shares not voted “FOR” a particular nominee (including as a result of stockholder withholding or a broker non-vote) will not be counted in such nominee’s favor.

•Proposal No. 2: The advisory approval of the compensation of our named executive officers must receive the affirmative vote of a majority of the votes cast by the holders of shares present in person or represented by proxy at the meeting and entitled to vote thereon to be approved. Abstentions are considered votes present and entitled to vote on this proposal, and thus have the same effect as a vote “AGAINST” the proposal.

•Proposal No. 3: The ratification of the appointment of Ernst & Young LLP must receive the affirmative vote of a majority of the votes cast by the holders of shares present in person or represented by proxy at the meeting and entitled to vote thereon to be approved. Abstentions are considered votes present and entitled to vote on this proposal, and thus have the same effect as a vote “AGAINST” the proposal.

How are proxies solicited for the Annual Meeting?

The Board is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by Quotient. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending these proxy materials to you if a broker or other nominee holds your shares. In addition to solicitation by mail, some of our directors, officers and employees may solicit proxies in person or by telephone for no additional compensation. We have retained D.F. King & Co., Inc., to assist in the solicitation of proxies under customary terms and anticipate that this will cost us approximately $8,500 plus certain out-of-pocket expenses.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker may have discretion to vote your shares in its discretion. Under the rules of the NYSE, brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to all matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. In this regard, the proposal to ratify the selection of Ernst & Young LLP (Proposal No. 3) is considered to be a “routine” matter under NYSE rules, meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on this proposal. Your broker will not have discretion to vote on (i) the election of directors (Proposal No. 1) and (ii) advisory approval of the compensation of our named executive officers (Proposal No. 2), which are considered “non-routine” matters under NYSE rules.

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, Quotient has elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) with instructions on how to access the proxy materials online or request a printed copy of the materials.

Stockholders may follow the instructions in the Notice of Internet Availability to elect to receive future proxy materials in print by mail or electronically by email. We encourage stockholders to take advantage of the availability of the proxy materials online to help reduce the environmental impact of our annual meetings, and reduce Quotient’s printing and mailing costs.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

Quotient has adopted a procedure called “householding.” Under this procedure, Quotient may deliver a single copy of the Notice of Internet Availability and, if you requested printed versions by mail, this Proxy Statement and the Annual Report to multiple stockholders who share the same address, unless Quotient has received contrary instructions from one or more stockholders. This procedure reduces the environmental impact of our annual meetings and reduces Quotient’s printing and mailing costs. Stockholders who participate in householding will continue to receive separate proxy cards. Upon written or oral request, Quotient will deliver promptly a separate copy of the Notice of Internet Availability and, if you requested printed versions by mail, this Proxy Statement and the Annual Report to any stockholder that elects not to participate in householding.

To receive, free of charge, a separate copy of the Notice of Internet Availability and, if you requested printed versions by mail, this Proxy Statement or the Annual Report, or separate copies of any future notice, proxy statement, or annual report, you may write or call Quotient at the following email address, physical address, or phone number:

IR@quotient.com

Quotient Technology Inc.

Attention: Investor Relations

400 Logue Avenue

Mountain View, California 94043

(650) 605-4600 (option 7)

If you are receiving more than one copy of the proxy materials at a single address and would like to participate in householding, please contact Quotient at the email address, physical address, or phone number above. Stockholders who hold shares in “street name” may contact their brokerage firm, bank, broker-dealer, or other similar organization to request information about householding.

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Quotient or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

Who will pay for the cost of this proxy solicitation?

We will bear the cost of this proxy solicitation. In addition to solicitation by mail, some of our directors, officers and employees may solicit proxies in person or by telephone for no additional compensation. We will also ask stockholders of record who are brokerage firms, custodians and fiduciaries to forward proxy materials to the beneficial owners of such shares and upon request we will reimburse such stockholders of record for the customary costs of forwarding the proxy materials. We have retained D.F. King & Co., Inc. to assist in the solicitation of proxies under customary terms and anticipate that this will cost us approximately $8,500 plus certain out-of-pocket expenses.

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to our Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 2022 Annual Meeting of Stockholders, our Secretary must receive the written proposal at our principal executive offices not later than December 23, 2021. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended, regarding the inclusion of stockholder proposals in Company-sponsored proxy materials. Stockholder proposals should be addressed to:

Quotient Technology Inc.

Attention: Investor Relations

400 Logue Avenue

Mountain View, California 94043

Our Bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our Bylaws provide that the only business that may be conducted at an annual meeting is business that is (i) specified in our proxy materials with respect to such meeting, (ii) otherwise properly brought before the annual meeting by or at the direction of our Board, or (iii) otherwise properly brought before the annual meeting by a stockholder of record entitled to vote at the annual meeting who has delivered timely written notice to our Secretary, which notice must contain the information specified in our Bylaws. To be timely for our 2022 Annual Meeting of Stockholders, our Secretary must receive the written notice at our principal executive offices:

•no earlier than February 3, 2022; and

•no later than the close of business on March 5, 2022.

In the event that we hold our 2022 Annual Meeting of Stockholders more than 30 days before or more than 30 days after the one-year anniversary of the Annual Meeting, then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before such annual meeting and no later than the close of business on the later of the following two dates:

•the 90th day prior to such annual meeting; or

•the 10th day following the day on which public announcement of the date of such annual meeting is first made.

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting does not appear to present his, her or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

Nomination of Director Candidates

You may propose director candidates for consideration by our Nominating and Corporate Governance Committee. Any such recommendations should include the nominee’s name and qualifications for membership on our Board and should be directed to our Secretary at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Board and Corporate Governance—Stockholder Recommendations for Nominations to the Board.”

In addition, our Bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our Bylaws. In addition, the stockholder must give timely notice to our Secretary in accordance with our Bylaws, which, in general, require that the notice be received by our Secretary within the time period described above under “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.

Availability of Bylaws

You may contact our Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board has the authority to establish the authorized number of directors from time to time by resolution. Our Board currently consists of eight members. Our Amended and Restated Certificate of Incorporation (our “Restated Certificate”) and our Bylaws provide for a classified Board consisting of three classes of directors, with directors serving staggered three-year terms.

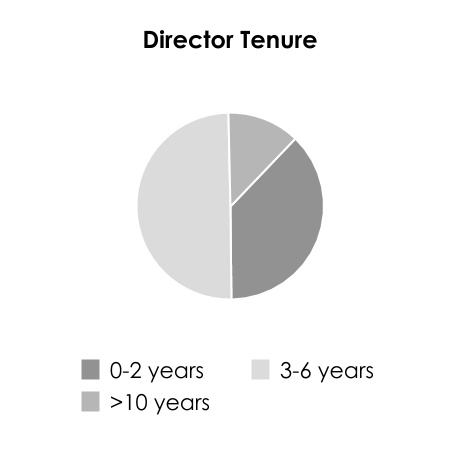

Directors in a particular class will be elected for a three-year term at the annual meeting of stockholders in the year in which their terms expire. As a result, only one class of directors will be elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year term. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. The initial class of each director is set forth in the table below.

The nominees and the directors who are serving for terms that end following the Annual Meeting, and their ages, occupations and length of board service as of April 22, 2021, are provided in the table below. Additional biographical descriptions of each nominee and director are set forth in the text below the table. These descriptions include the primary individual experience, qualifications, qualities and skills of our nominees and directors that led to the conclusion that each person should serve as a member of our Board.

| | | | | | | | | | | | | | | | | | | | | | | |

| Nominees | Independent? | Class | Age | Position | Director

Since | Current

Term

Expires | Expiration of

Term For

Which

Nominated |

| Steve Horowitz | √ | I | 53 | Director | 2015 | 2021 | 2024 |

| Christy Wyatt | √ | I | 49 | Director | 2018 | 2021 | 2024 |

| Continuing Directors | | | | | | | |

| Steven Boal | | II | 55 | Chairman of Board and CEO | 1998 | 2022 | — |

| Robert McDonald | √ | II | 67 | Director | 2018 | 2022 | — |

| Michelle McKenna | √ | II | 55 | Director | 2017 | 2022 | — |

| Andrew Gessow | √ | III | 63 | Director | 2013 | 2023 | — |

| David Oppenheimer | √ | III | 64 | Director | 2017 | 2023 | — |

| Lorraine Hariton | √ | III | 66 | Director | 2021 | 2023 | — |

Nominees for Director

Steve Horowitz has served on our Board since June 2015. Mr. Horowitz is currently a partner at Alpha Edison, a venture capital firm. Mr. Horowitz served as Vice President of Technology at Snap Inc. (“Snap”), a public camera company, from September 2017 until March 2019 and previously as Vice President of Hardware with Snap from January 2015 until September 2017. Before joining Snap, Mr. Horowitz served as Senior Vice President of Software Engineering at Motorola Mobility, LLC, a public mobile communications company, formerly a Google company, from December 2012 through January 2015. From January 2009 through November 2012, Mr. Horowitz served as our Chief Technology Officer. Prior to that he worked at Google, Microsoft and Apple. Mr. Horowitz holds a B.A. degree from the University of Michigan, Ann Arbor. We have determined that Mr. Horowitz is qualified to serve as a member of our Board because of his significant industry experience and company experience.

Christy Wyatt has served on our Board since July 2018. Ms. Wyatt currently serves as the President and Chief Executive Officer at Absolute Software Corporation, a Canadian public company that specializes in endpoint security and data risk management solutions, which she joined in November 2018. Ms. Wyatt served as President and Chief Executive Officer at Dtex Systems, Inc. (“Dtex”), a private company, from August 2016 until November 2018. Prior to joining Dtex, Ms. Wyatt served as Chairman, President and Chief Executive Officer of Good Corporation from January 2013 until October 2015. Prior to Good, Ms. Wyatt has held leadership positions across both consumer and enterprise at Citigroup, Motorola Mobility, Apple Inc., Palm, Inc. and Sun Microsystems, Inc. Ms. Wyatt currently serves on the board of directors of Absolute Software Corporation since December 2018, and Silicon Labs since January 2019, a public company and leading provider of silicon, software, and solutions. Ms. Wyatt served on the board of directors of Dtex from November 2018 to May 2019. Ms. Wyatt graduated from the College of Geographic Sciences. We have determined that Ms. Wyatt is qualified to serve as a member of our Board because of her industry experience and experience in managing and evaluating companies as an executive officer and as a board member. For more information please see “Corporate Governance and Directors - Director Commitments.”

Continuing Directors

Steven Boal founded Quotient in 1998. Mr. Boal has served as our Chief Executive Officer and Chairman of our Board since August 2019 and has been a member of the Board since 1998. Mr. Boal was our Executive Chairman from September 2017 to August 2019, our CEO from 1998 until September 2017, our Chairman from February 2017 until September 2017, and our President from 1998 until September 2015. Prior to founding Quotient, Mr. Boal served as Vice President of Business Development for Integral Development Corporation, a privately held financial software company. Mr. Boal holds a B.A. from the State University of New York at Albany. We have determined that Mr. Boal’s perspective, operational and historical expertise gained from his experience as our founder, Chief Executive Officer, former President and one of our largest stockholders, make him a critical member of our Board.

Andrew Gessow has served on our Board since May 2013. Mr. Gessow currently serves as a managing partner at DivCore Equity Partners, a real estate investment firm and as senior advisor at Divco West Real Estate Services (“Divco”). From May 2007 through December 2011, Mr. Gessow was the West Coast Partner and Managing Director of One Equity Partners LLC, the private equity platform of J.P. Morgan Chase & Co. Mr. Gessow has served on the board of directors of Waterfall Security Solutions, an Israeli private industrial cybersecurity company, since January 2020. Previously, Mr. Gessow served as a member of the board of directors of Mandiant Corporation and the TV Guide Network. Mr. Gessow holds a B.B.A. in Business Administration from Emory University and an M.B.A. from Harvard University. We have determined that Mr. Gessow is qualified to serve as a member of our Board because of his experience in both managing and evaluating companies as an executive officer, board member and investor.

Lorraine Hariton has served on our Board since January 2021. Ms. Hariton currently serves as the President and Chief Executive Officer of Catalyst, a global nonprofit that provides leadership to the world’s most powerful CEOs and companies to help build workplaces that work for women. Prior to joining Catalyst, Ms. Hariton worked independently as a consultant from 2014 until August 2018. Previously, Ms. Hariton spent 25 years in various senior-level positions in Silicon Valley including CEO of two venture-backed start-ups, before being appointed by President Obama as Special Representative for Commercial and Business Affairs at the US Department of State in 2009. More recently, she served as SVP for Global Partnerships for the New York Academy of Sciences where she was instrumental in establishing the Global STEM Alliance. From March 2014 to February 2016, Ms. Hariton served on the board of directors of Wave Systems Corporation, a publicly traded data security company, where she was chair of the nominating and governance committee. She also served on the California Board of Accountancy; the Entrepreneurs Foundation, and the Stanford Clayman Institute for Gender Research, amongst others. Ms. Hariton earned an MBA from Harvard University, and BS from Stanford University. We have determined that Ms. Hariton is qualified to serve as a member of our Board because of her experience in the technology industry, public company experience and diversity and inclusion expertise.

Robert McDonald has served on our Board since November 2018. Mr. McDonald currently serves on boards of various companies and organizations, private and public, non-profit and for-profit. Mr. McDonald served as the U.S. Secretary of Veterans Affairs from July 2014 until January 2017. Mr. McDonald was Chairman, and Chief Executive Officer of Procter & Gamble Company from January 2010 until June 2013. Mr. McDonald joined Procter & Gamble in 1980 and served in various positions for that company. He was named Procter & Gamble’s Vice Chairman, Global Operations in 2004; Chief Operating Officer in 2007; President and Chief Executive Officer in 2009; and Chairman of the Board in 2010. From 2005 to July 2014 Mr. McDonald served on the board of directors of Xerox Corporation, a provider of document management solutions, and from January 2014 to July 2014, Mr. McDonald served on the board of directors of United States Steel Corporation, an integrated steel producer, both public companies. Mr. McDonald graduated from the United States Military Academy at West Point in 1975. He earned his M.B.A. from the University of Utah in 1978. We have determined that Mr. McDonald is qualified to serve as a member of our Board because of his deep industry experience, public company experience, executive leadership expertise and extensive knowledge of operational matters.

Michelle McKenna has served on our Board since October 2017. Ms. McKenna is currently the Senior Vice President and Chief Information Officer of the National Football League (the “NFL”), which she joined in September 2012. Prior to joining the NFL, Ms. McKenna served as Senior Vice President and Chief Information Officer at Constellation Energy Group, Inc., an energy company. Ms. McKenna has served on the board of directors of RingCentral, Inc., a public global enterprise cloud communications and collaboration company, since March 2015 and Alticor, a private parent company of Amway, one of the world’s leading direct selling companies, since February 2020. Ms. McKenna served on the board of directors of Insperity, a human resources and business solutions company, from April 2015 until August 2017 and comScore, Inc., a global information and analytics company, from October 2017 until March 2019, both public companies. Ms. McKenna holds a B.S. in Accounting from Auburn University and a M.B.A. from Rollins College. Ms. McKenna was formerly licensed as a certified public accountant in the State of Georgia. We have determined that Ms. McKenna is qualified to serve as a member of our Board because of her experience serving on the board of directors of public companies and expertise in financial accounting and risk management.

David Oppenheimer has served on our Board since July 2017. Mr. Oppenheimer is currently a President of Oppenheimer Advisors and General Partner of Verissimo Ventures. Mr. Oppenheimer served as the Chief Financial Officer at Udemy, Inc., a global marketplace for learning and teaching online, from August 2018 through January 2019. Previously Mr. Oppenheimer was Chief Financial Officer at Planet Labs Inc., a space and analytics company from October 2015 through August 2018. From April 2013 through February 2015, Mr. Oppenheimer served as Chief Financial Officer at Ebates Inc. (acquired by Rakuten, Inc.), an e-commerce company. Mr. Oppenheimer currently serves on the board of directors of Lumus Ltd, an Israeli private augmented reality technology company, since April 2020. Additionally, Mr. Oppenheimer served on the board of directors and audit committee of HotChalk, Inc., a Delaware private education software company, from May 2015 until December 2020, and The Olympic Club, a private company, from January 2018 until December 2020. Mr. Oppenheimer holds a B.S. in Mechanical Engineering from the State University of New York at Buffalo and a M.B.A. from the University of California, Berkeley. We have determined that Mr. Oppenheimer is qualified to serve as a member of our Board because of his experience serving on audit committees and expertise in financial accounting at technology companies.

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES

NAMED ABOVE.

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

At the 2019 Annual Meeting, our stockholders indicated their preference that we solicit a non-binding advisory vote on the compensation of our named executive officers, commonly referred to as a “say-on-pay” vote,” every year. The Board has adopted a policy that is consistent with that preference. In accordance with that policy, this year, we are again asking our stockholders to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules.

This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. The compensation of our named executive officers subject to the vote is disclosed in the Compensation Discussion and Analysis, the compensation tables, and the related narrative disclosure contained in this proxy statement. As discussed in those disclosures, we believe that our compensation policies and decisions are focused on pay-for-performance principles and are strongly aligned with our stockholders’ interests so that we can attract and retain talented and experienced executives to lead the Company successfully in a competitive environment.

The overall objective of our executive compensation programs is to pay our executive officers competitively and equitably in a way that aligns our business and financial goals, and ties back to overall Company and individual performance. The primary objectives of our executive compensation programs are:

| | | | | |

| Pay-for-Performance | A significant portion of pay for executive officers is at-risk and performance-based with metrics that align total compensation with the Company’s sustainable growth strategy and values, annual financial objectives and performance of our stock price. At-risk compensation includes short-term cash incentives, performance-based equity awards and long-term incentives in the form of equity awards. |

| Alignment with Stockholders | Our compensation programs align executive officers’ interests with those of our stockholders, by providing equity-based forms of compensation and tying pay to Company and stock performance. We maintain stock ownership guidelines for all executive officers, and we remain committed to a culture of shared success through long-term equity awards. In response to stockholder feedback, we moved a portion of the 2021 equity grant to performance-based RSUs to align with stockholder interest. |

| Competitive Appeal | Our compensation programs’ goals are to attract, reward, and retain talented and highly qualified executive officers whose abilities and alignment to our values are critical to our success. We use market-based pay information to align each executive officer’s compensation to their position, responsibilities, and impact. |

| Drive Future Growth | We use our compensation programs to invest in and reward talent with the greatest potential to drive the long-term growth of our Company, while holding employees accountable to the Company’s strategy and values. |

We set the compensation of our executive officers, including the named executive officers, by considering factors such as their ability to create sustainable long-term stockholder value in a cost-effective manner, prevailing market conditions, and compensation levels and practices of our peers. Our executive compensation philosophy is to align executive compensation decisions with our desired business direction, strategy, and performance.

Accordingly, the Board is asking the stockholders to indicate their support for the compensation of our named executive officers as described in this proxy statement by casting a non-binding advisory vote “FOR” the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”

Because the vote is advisory, it is not binding on the Board or the Company. Nevertheless, the views expressed by the stockholders, whether through this vote or otherwise, are important to management and the Board and, accordingly, the Board and the Compensation Committee intend to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

Advisory approval of this proposal requires the vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote on the matter at the annual meeting.

THE BOARD RECOMMENDS A VOTE “FOR” THE COMPENSATION

OF OUR NAMED EXECUTIVE OFFICERS

AS DISCLOSED IN THIS PROXY STATEMENT.

PROPOSAL NO. 3

RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board (the “Audit Committee”) has appointed the firm of Ernst & Young LLP (“Ernst & Young”) as our independent registered public accounting firm to audit our financial statements for the year ending December 31, 2021. During our previous fiscal year ended December 31, 2020 (“Fiscal 2020”), Ernst & Young served as our independent registered public accounting firm.

At the Annual Meeting, the stockholders are being asked to ratify the appointment of Ernst & Young as our independent registered public accounting firm for the year ending December 31, 2021. Our Audit Committee is submitting the selection of Ernst & Young to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Representatives of Ernst & Young will be present at the Annual Meeting and they will have an opportunity to make statements and will be available to respond to appropriate questions from stockholders. If this proposal does not receive the affirmative approval of a majority of the votes cast on the proposal, the Audit Committee would reconsider the appointment.

Notwithstanding its selection and even if our stockholders ratify the selection, our Audit Committee, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of the Company and its stockholders.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees billed or to be billed by Ernst & Young for professional services rendered with respect to the years ended December 31, 2020 and 2019. All of these services rendered were preapproved by the Audit Committee.

| | | | | | | | |

| 2020 ($) | 2019 ($) |

Audit Fees(1) | 2,204,830 | | 2,432,491 | |

| Audit-Related Fees | — | | 297,400(2) |

Tax Fees(3) | — | | 70,200 | |

| TOTAL | 2,204,830 | | 2,800,091 | |

(1)“Audit fees” consist of fees for professional services provided in connection with the audit of our annual consolidated financial statements, the review of our quarterly consolidated financial statements, and audit services that are normally provided by our independent registered public accounting firm in connection with regulatory filings. The audit fees also include fees for professional services incurred with rendering an opinion under Section 404 of the Sarbanes-Oxley Act of 2002.

(2)“Audit-related fees” include fees for professional services related to due-diligence services for the acquisition of Ubimo Ltd.

(3)“Tax fees” include fees for professional services related to tax advice. Tax advice fees encompass permissible services mainly related to technical tax advice related to federal, state and international tax compliance, acquisitions and international tax planning.

Auditor Independence

Under its charter, the Audit Committee pre-approves all services rendered by our independent registered public accounting firm, Ernst & Young. The Audit Committee has determined that the rendering of non-audit services by Ernst & Young was compatible with maintaining their independence.

Pre-Approval Policies and Procedures.

Consistent with requirements of the SEC and the Public Company Accounting Oversight Board (the “PCAOB”) regarding auditor independence, our Audit Committee is responsible for the appointment, compensation and oversight of the work of our independent registered public accounting firm. In recognition of this responsibility, our Audit Committee (or a member of the Audit Committee delegated by the Audit Committee) pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services.

THE BOARD RECOMMENDS A VOTE “FOR” THE RATIFICATION

OF THE SELECTION OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

CORPORATE GOVERNANCE AND DIRECTORS

Our Corporate Governance Guidelines, together with the Board’s committee charters, provide the framework for the corporate governance of the Company. Following is a summary of our Corporate Governance Guidelines. Our Corporate Governance Guidelines, as well as the charters of each of our Board committees, are available on our website at www.quotient.com, on the Governance page under the Investors section.

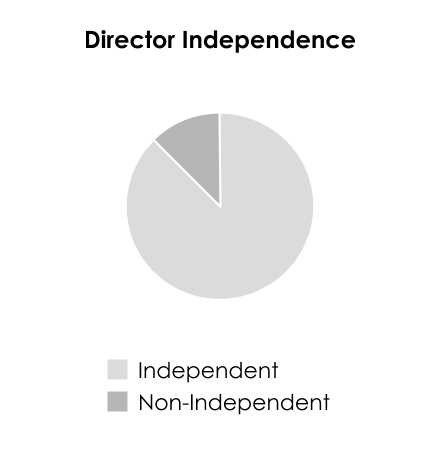

Board Composition

Our business and affairs are managed under the direction of our Board. Our Board currently consists of eight members, seven of whom qualify as “independent” under the listing standards of the New York Stock Exchange (the “NYSE”). The authorized number of directors may be changed only by resolution of our Board. The classification of our Board into three classes with staggered three-year terms may have the effect of delaying or preventing changes in control of our Company or management.

Committees of the Board

Our Board has established an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Members serve on these committees until their resignation or until otherwise determined by our Board. The following table provides membership information for 2020 for each of our Board committees:

| | | | | | | | | | | |

| Name | Audit

Committee | Compensation

Committee | Nominating and

Corporate Governance

Committee |

| | | |

| Andrew Gessow | | | |

| | | |

Lorraine Hariton(1) | | | |

| | | |

| Steve Horowitz | | | |

| | | |

| Robert McDonald | | | |

| | | |

Michelle McKenna | | | |

| | | |

David Oppenheimer  | | | |

| | | |

| Christy Wyatt | | | |

| | | | | | | | |

= Chairperson = Chairperson | |  = Member = Member  = Financial Expert = Financial Expert |

(1)Ms. Hariton was appointed to serve on the Board and the Nominating and Corporate Governance Committee effective January 25, 2021.

Effective upon and subject to the election of our Class I directors at the Annual Meeting, the composition of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee is expected to remain the same as it is currently comprised.

Audit Committee

Our Audit Committee currently consists of Mr. Oppenheimer and Mses. McKenna and Wyatt, with Mr. Oppenheimer serving as our Audit Committee chairperson. Our Board has determined that all of the members of the Audit Committee possess the level of financial literacy and sophistication required under the listing standards of the NYSE, and that Mr. Oppenheimer, and Ms. McKenna are audit committee financial experts as defined by SEC rules. Our Board has also determined that Messr. Oppenheimer and Mses. McKenna and Wyatt satisfy the independence requirements of Audit Committee members under the applicable rules and regulations of the SEC and the listing standards of the NYSE. Our Audit Committee met seven times and did not act by written consent during 2020.

Our Audit Committee is responsible for, among other things:

| | |

•appointing, compensating, retaining and overseeing our independent registered public accounting firm; |

•approving the audit and non-audit services to be performed by our independent registered public accounting firm; |

•reviewing, with our independent registered public accounting firm, all critical accounting policies and procedures; |

•oversees the performance of our internal audit function; |

•reviewing with management the adequacy and effectiveness of our internal control structure and procedures for financial reports; |

•reviewing and discussing with management and our independent registered public accounting firm our annual audited financial statements and any certification, report, opinion or review rendered by our independent registered public accounting firm; |

•reviewing and investigating conduct alleged to be in violation of our Code of Business Conduct and Ethics, if requested by the Board; |

•reviewing and approving related party transactions; |

•reviewing and discussing with management procedures and any related policies with respect to risk assessment and risk management; |

•reviewing and discussing with management cybersecurity and other information technology risks, including steps management have taken to mitigate such risks; |

•preparing the Audit Committee report required in our annual proxy statement; and |

•reviewing and evaluating, at least annually, its own performance and the adequacy of the Audit Committee charter. |

The Audit Committee operates under a written charter that was adopted by our Board and satisfies the applicable standards of the SEC and the NYSE. A copy of the Audit Committee charter is posted under the “Governance” portion of the “Investors” section on our website at http://investors.quotient.com/investors/governance/governance-documents/default.aspx.

Compensation Committee

Our Compensation Committee currently consists of Messrs. Gessow and Oppenheimer and Ms. Wyatt, with Mr. Gessow serving as our Compensation Committee chairperson. Each member of our Compensation Committee satisfies the independence requirements under the applicable rules and regulations of the SEC and the listing standards of the NYSE. In addition, each member of our Compensation Committee qualifies as a “non-employee director” as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. Our Compensation Committee met five times and acted by written consent two times during 2020.

Our Compensation Committee is responsible for, among other things:

| | |

•reviewing and approving corporate goals and objectives relevant to compensation of our Chief Executive Officer and other executive officers; |

•identifying peer group of companies to be used for comparison purposes in connection with any review of executive officer compensation; |

•reviewing and approving the following compensation for our Chief Executive Officer and our other executive officers: salaries, bonuses, incentive compensation, equity awards, benefits and perquisites; |

•recommending the establishment and terms of our incentive compensation plans and equity compensation plans, and administering such plans; |

•recommending compensation program(s) for non-employee directors; |

•retaining a compensation consultant to assist it in the performance of its duties, after taking into consideration all factors relevant to the adviser’s independence from management, including those specified by the NYSE; |

•preparing disclosures regarding executive compensation and any related reports required by the rules of the SEC, including a Compensation Discussion & Analysis section for inclusion in our annual proxy statement; |

•approving grants of options and other equity awards to all executive officers, non-employee directors and all other eligible individuals; and |

•reviewing and evaluating, at least annually, its own performance and the adequacy of the committee charter. |

In carrying out these responsibilities, the Compensation Committee reviews all components of executive compensation for consistency with our compensation philosophy and with the interests of our stockholders.

In 2020, our Compensation Committee retained an independent compensation consultant, Radford, a part of Aon plc. (“Radford”), to assist our Compensation Committee. The Compensation Committee assessed the independence of Radford pursuant to SEC and NYSE rules and concluded that no conflict of interest exists that would prevent Radford from independently advising the Compensation Committee.

The Compensation Committee has delegated in accordance with applicable law, rules and regulations, and our Restated Certificate and Bylaws, authority to an equity awards committee comprised of certain executive officers of our Company to make certain types of equity awards to any employee who is not an executive on our senior leadership team or non-employee director under our Company’s 2013 Equity Incentive Plan pursuant to the terms of such plan and the equity award guidelines approved by our Compensation Committee.

The Compensation Committee operates under a written charter that was adopted by our Board and satisfies the applicable standards of the SEC and the NYSE. A copy of the Compensation Committee charter is posted under the “Governance” portion of the “Investors” section on our website at http://investors.quotient.com/investors/governance/governance-documents/default.aspx.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee currently consists of Messrs. Horowitz and McDonald and Mses. McKenna and Hariton, with Mr. McDonald serving as our Nominating and Corporate Governance Committee chairperson. Ms. Hariton joined the Nominating and Corporate Governance Committee on January 25, 2021. Each member of our Nominating and Corporate Governance Committee satisfies the independence requirements under applicable rules and regulations of the SEC and the listing standards of the NYSE. Our Nominating and Corporate Governance Committee met three times and did not act by written consent during 2020.

Our Nominating and Corporate Governance Committee is responsible for, among other things:

| | |

•assisting our Board in identifying qualified director nominees and recommending nominees for each annual meeting of stockholders; |

•overseeing the Board’s committee structure and operations; |

•reviewing and recommending plans of succession for the offices of chief executive officer and other executive officers; |

•developing, recommending and reviewing corporate governance principles and a code of conduct applicable to us; |

•reviewing and discussing with management disclosure of Company’s corporate governance practices for inclusion in the Company’s proxy statement or annual report on Form 10-K, as applicable; |

•assisting our Board in its evaluation of the performance of our Board and each committee thereof; |

•overseeing corporate governance risks, including risks associated with director independence; |

•overseeing environmental and social risks; and |

•reviewing and evaluating, at least annually, its own performance and the adequacy of the committee charter. |

The Nominating and Corporate Governance Committee operates under a written charter that was adopted by our Board and satisfies the applicable standards of the SEC and the NYSE. A copy of the Nominating and Corporate Governance Committee charter is posted under the “Governance” portion of the “Investors” section on our website at http://investors.quotient.com/investors/governance/governance-documents/default.aspx.

Board Leadership Structure

The Board has a Lead Independent Director and believes this role addresses the need for independent leadership and an organizational structure for the independent directors. The Lead Independent Director coordinates the activities of the other independent directors, presides over meetings of the Board at which the Chairman of the Board is not present and at each executive session, serves as liaison between the Chairman of the Board and the independent directors, and is available for consultation and direct communication if requested by major stockholders. Andrew Gessow was appointed as our Lead Independent Director effective August 5, 2019.

The Board believes that the Company's Chief Executive Officer is best suited to serve as Chairman because he is the director most familiar with the Company's business and industry, and most capable of effectively identifying strategic priorities and leading any discussion about the Company's business. The Board and management have different perspectives and roles in strategy development. The Company's independent directors bring experience, oversight and expertise from outside the Company and from industry, while the Chief Executive Officer brings company-specific experience and expertise. The Board believes that the combined role of Chairman and Chief Executive Officer promotes strategy development and execution, and facilitates information flow between management and the Board, which are essential to effective governance.

Director Independence

Our Board has undertaken a review of the independence of each director. Based on information provided by each director concerning his or her background, employment and affiliations, our Board has determined that each of Messrs. Gessow, Horowitz, McDonald, and Oppenheimer and Mses. McKenna, Wyatt, and Hariton does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing standards of the NYSE.

In considering the independence of the directors, the Board considered the Company's 10-year lease agreement with DW Cal 301 Howard, LLC, a joint venture in which DivcoWest Real Estate Services, LLC is a minority member; and Mr. Gessow's role as Senior Advisor at Divco and as a managing partner at DivCore Equity Partners which is affiliated with Divco. The terms of the lease were negotiated at arms-length and were consistent with market comparisons. Mr. Gessow was not involved in negotiating the lease, making any decisions regarding the lease, or approving the lease. In addition, Divco's share of the total lease payment of $16.3 million was less than 1% of the consolidated gross revenues of each of the Company and Divco in 2020, when we entered into the lease. This level is significantly below the maximum amount permitted under the NYSE listing standards for director independence (i.e., 2% of consolidated gross revenues). Accordingly, the Board determined that Mr. Gessow is independent.

Risk Oversight

One of the key functions of our Board is to provide informed oversight of our risk management process. Our Board administers its oversight function directly as a whole, as well as through various standing committees of our board that address risks inherent in their respective areas of oversight, which they regularly report back to the full Board. While management is responsible for the day-to-day management of the material risks we face, our Board believes that evaluating the executive team’s management of the various risks confronting the Company is one of its most important areas of oversight.

The Board has designated the Audit Committee with primary responsibility for overseeing enterprise risk management. In accordance with this responsibility, the Audit Committee monitors the Company’s significant business risks, including financial, financial reporting, operational, privacy, cybersecurity, business continuity and legal and regulatory compliance. The Audit Committee reviews the steps management has taken to monitor and mitigate these risks. With respect to cybersecurity, the Audit Committee reviews reports from our Chief Information Security Officer and others including an independent expert that assessed the Company’s cybersecurity policies and programs. These reports include updates on risk management and technical developments.

While the Audit Committee has primary responsibility for overseeing enterprise risk management and reports regularly to the Board, the other Board committees also consider risks within their area of responsibility and apprise the Board of significant risks and management’s response to those risks. For example, the Nominating and Corporate Governance Committee monitors legal and regulatory compliance risks as they relate to Quotient’s corporate governance structure and processes, oversees our succession planning, and has oversight over environmental and social risks. The Nominating and Corporate Governance Committee also oversees annual performance evaluations of the Board and of each committee. The Compensation Committee reviews risks related to compensation matters. While the Board and its committees oversee risk management strategy, management is responsible for implementing and supervising day-to-day risk management processes and reporting to the Board and its committees.

In establishing and reviewing our executive compensation program, the Compensation Committee considers whether the program encourages unnecessary or excessive risk-taking and has concluded that it does not. The program includes several components. Base salaries are fixed in amount and thus do not encourage risk-taking. By tying our Annual Incentive Plan to specific corporate financial performance measures, requiring a minimum performance level to receive any payout, and applying a cap on annual cash incentive awards, we mitigate against risk-taking behavior. For the same reason, we grant long term incentives, in the form of options and RSUs, subject to service requirements that reward performance in the form of financial goals and/or stock appreciation. We also maintain stock ownership guidelines for our executive officers. Collectively, these policies help to mitigate against risk-taking.

In 2020, we formed a cross-functional global response team, as well as local response teams in each region where we have offices, to monitor the impact of the COVID-19 pandemic on our business operations and the health and safety of our employees. The teams met regularly to review and discuss pandemic developments, and to implement measures to manage related risks. Our enterprise risk management plan, and updates to the Audit Committee, included mitigation strategies for COVID-19 risks impacting our business. The Board and Audit Committee were actively engaged in overseeing these risk management strategies and initiatives, receiving updates from the management team and providing input and oversight as we executed our strategy.

Prohibition on Short Sales, Hedging Transactions and Margin Accounts and Pledges

We prohibit (i) all short sales and “selling short against the box” of our stock, (ii) all transactions in derivatives of our stock, this extends to any hedging or similar transaction designed to decrease the risks associated with holding our stock, (iii) pledging of our stock as collateral for loans and (iv) holding our stock in margin accounts, for all our personnel, including non-employee directors, officers, employees, independent contractors and consultants.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics (the “Code of Business Conduct and Ethics”), which outlines the principles of legal and ethical business conduct under which we do business. The code is applicable to all of our non-employee directors, officers and employees. We intend to disclose any amendments to our code of business conduct and ethics, or waivers of its requirements, on our website or in filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) to the extent required by applicable rules and exchange requirements. The Code of Business Conduct and Ethics is available under the “Governance” portion of the “Investors” section on our website at http://investors.quotient.com/investors/governance/governance-documents/default.aspx.

Director Stock Ownership Guidelines

In 2016, our Board adopted stock ownership guidelines for our non-employee directors. Under the guidelines, non-employee directors are expected to own shares of Quotient common stock, the lesser of a value equal to three times their annual cash retainer or 7,500 shares, for serving as a director. Shares may be owned directly by the individual, owned jointly with or separately by the individual’s spouse, or held in trust for the benefit of the individual, the individual’s spouse or children. Each non-employee director is required to satisfy the stock ownership guidelines by October 24, 2021, or within five years after first becoming subject to the guidelines. As of December 31, 2021, Messrs. Gessow, Horowitz, McDonald and Oppenheimer and Mses. McKenna and Wyatt have already satisfied the stock ownership guidelines and we believe Ms. Hariton is on track to meet the objective within the required time frame.

Meetings of the Board

Our Board met six times and acted by written consent two times during 2020. No director attended fewer than 75% of the total number of meetings of the Board and of any Board committees of which he or she was a member during 2020.

Director Commitments

Our Board believes that all members of the board should have sufficient time and attention to devote to board duties and to otherwise fulfill the responsibilities required of directors. Each Board member is expected to ensure that other existing and planned future commitments do not materially interfere with their service as a director. Our Corporate Governance Guidelines also includes limits on board memberships. Directors who serve as CEOs or equivalent positions should not serve on more than two boards of public companies, in addition to our Board, and other directors should not serve on more than four other public company boards in addition to our Board.

While our Nominating and Corporate Governance Committee and Board recognize that certain institutional investors and proxy advisory firms may deem Ms. Wyatt “overboarded” based on the number of public company boards on which she serves, they believe Ms. Wyatt has demonstrated the ability to dedicate sufficient time to, and to focus on, her duties as a director of the Company, including her role as a member of our audit and compensation committee. In fiscal 2020, Ms. Wyatt has attended all board and applicable committee meetings at all companies where she serves as a board member. Ms. Wyatt's attendance record demonstrates her commitment to our board, participating in 100% of board meetings and 100% of the audit and compensation committee meetings since her appointment in July 2018. Ms. Wyatt's other public company boards have offices located in San Jose, enabling her to travel and regularly attend our board and committee meetings. Ms. Wyatt is consistently prepared and has exemplary participation at meetings, contributes significantly to discussions and decision-making, and is highly engaged with management and other members of our board of directors.

Attendance at Annual Stockholder Meetings by the Board

It is our policy that directors are invited and encouraged to attend our annual meetings of stockholders. Directors Boal, Gessow, McDonald, Oppenheimer, and Horowitz attended Quotient’s virtual-only 2020 Annual Meeting of Stockholders.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee consisted of Messrs. Gessow and Oppenheimer and Ms. Wyatt. None of the current members of the Compensation Committee is currently or has been at any time one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

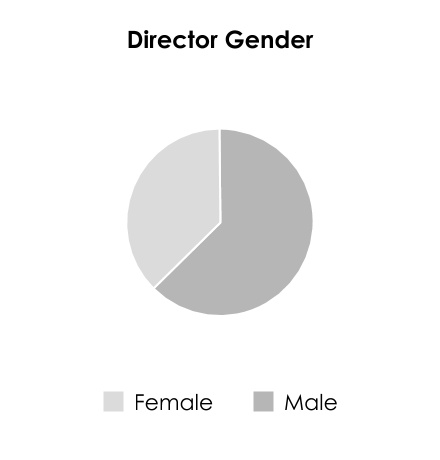

Considerations in Evaluating Director Nominees

The Nominating and Corporate Governance Committee is responsible for identifying, evaluating and recommending candidates to the Board for Board membership. A variety of methods are used to identify and evaluate director nominees, with the goal of maintaining and further developing a diverse, experienced and highly qualified Board. The Nominating and Corporate Governance Committee does consider the diversity of its directors and nominees in terms of knowledge, experience, background, skills, expertise and other demographic factors. Candidates may come to our attention through current members of our Board, professional search firms, stockholders or other persons.

The Nominating and Corporate Governance Committee will recommend to the Board for selection all nominees to be proposed by the Board for election by the stockholders, including approval or recommendation of a slate of director nominees to be proposed by the Board for election at each annual meeting of stockholders, and will recommend all director nominees to be appointed by the Board to fill interim director vacancies.

Director Qualifications