Exhibit 99.2

©2016 Quotient Technology Inc. T he Quotient logo is a trademark of Quotient Technology Inc

©2016 Quotient Technology Inc. 2 Forward Looking Statements This presentation and the accompanying oral presentation contain “forward - looking” statements that are based on our management’s beliefs and assumptions and on information currently available to management, including our projections regarding future financial performance, our ability to grow our business, our plans for our future investments and expansion, the continued shifts in our industry, and our expectations with respect to consumers’ and CPG’s fu tur e demand and behavior, our expectations regarding the continued rollout, growth and performance of Retailer iQ platform, as well as the anticipated financial benefits therefrom, our expectation regarding the rollout of Brandcaster , our media offerings, and Quotient Insight and our ability to leverage these capabilities, the integration of Shopmium and t he benefits expected from the acquisition, our plans with respect to future stock repurchases, our digital print initiative and our efforts with respect to at tract additional retailers, and our expectations to successfully leverage our investment and operating expenses. Quotient operates in very competitive and rapidly changing environments, and new risks may emerge from time to time. It is not possible for Quotient’s management to predict all risks, nor can it assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements Quo tient may make. Forward - looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of the ti mes at, or by, which such performance or results will be achieved. Forward - looking statements are based on information available to Quotient’s management at the date of this rel ease and its management’s good faith belief as of such date with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward - looking statements. Important factors that could cause such differences include, but ar e not limited to, Quotient’s financial performance, including its revenues, margins, costs, expenditures, growth rates and operating expenses, and its ability to ge ner ate positive cash flow and become profitable; the amount and timing of digital promotions by CPGs, which are affected by budget cycles, economic conditions and other facto rs; the company’s ability to adapt to changing market conditions, including the Company’s ability to adapt to changes in consumer habits, including mobile device usage; sea son al variations in consumer behavior; the Company’s ability to retain and expand its business with existing CPGs and retailers; the company’s ability to negotiate fee arr angements with CPGs and retailers; the impact of mobile on the Company’s platform; the Company’s ability to maintain and expand the use by consumers of digital promotions on its platforms and add retailers to such platforms; the Company’s ability to attract and retain third - party advertising agencies, performance marketing networks and othe r intermediaries; the Company’s ability to acquire and integrate new companies; the Company’s ability to effectively manage its growth; the effects of increased competi tio n in the Company’s markets and its ability to compete effectively; the Company’s ability to effectively grow and train its sales team; the Company’s ability to obtain new CPG s and retailers and to do so efficiently; the Company’s ability to successfully integrate acquired companies into its business; the Company’s ability to maintain, protect and enhance its brand and intellectual property; costs associated with defending intellectual property infringement and other claims; the Company’s ability to successfully en ter new markets; the Company’s ability to develop and launch new services and features; and the Company’s ability to attract and retain qualified employees and key personnel. The se factors, together with those described in greater detail in the Company’s annual report on Form 10 - K filed with the SEC on March 19, 2015, the Company’s quarterly reports on Form 10 - Q filed on May 14, 2015, August 13, 2015 and November 12, 2015 and in the Company’s future quarterly reports on Form 10 - Q, annual reports on Form 10 - K a nd other filings made with the SEC, may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implie d b y our forward - looking statements. Quotient disclaims any obligation to update information contained in these forward - looking statements whether as a result of new informat ion, future events, or otherwise. In addition to the U.S. GAAP financials, this presentation includes certain non - GAAP financial measures. The non - GAAP measures have limitations as analytical tools and you should not consider them in isolation or as a substitute for an analysis of our results under U.S. GAAP. There are a number of limitatio ns related to the use of these non - GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non - GAAP financial measures different ly or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non - GAAP financial measures as tools for comparison. Quotient considers these non - GAAP financial measures to be important because they provide useful measures of the operating performance of the company, exclusiv e o f unusual events or factors that do not directly affect what we consider to be our core operating performance, and are used by the company's management for that purp ose . The use of non - GAAP measures is further discussed in the accompanying press release, which has been furnished to the SEC on Form 8 - K and posted on Quotient’s we bsite. The press release also defines our non - GAAP financial measure of Adjusted EBITDA. A reconciliation between GAAP and non - GAAP measures can also be found in the accompanying press release and in the Appendix hereto .

©2016 Quotient Technology Inc. Steven Boal CEO 3

©2016 Quotient Technology Inc. Jennifer Ceran CFO 4

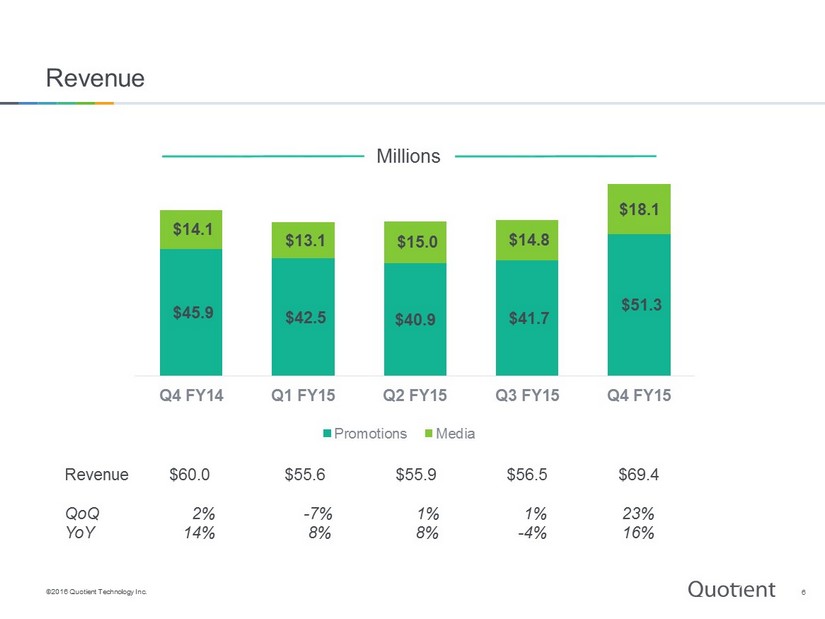

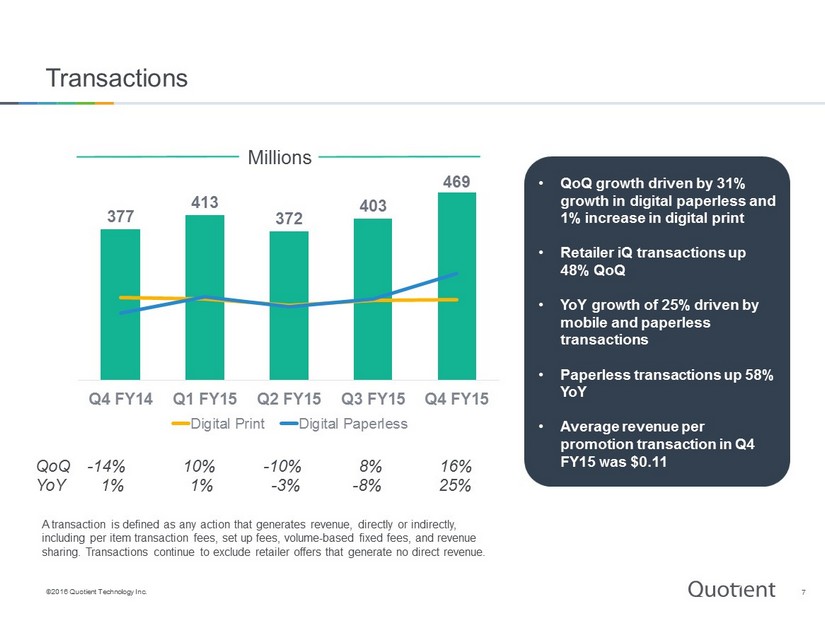

©2016 Quotient Technology Inc. 5 Q4 FY2015 Financial Summary • Revenue was $ 69.4 million • Up 23% sequentially and 16% YoY due to strong media performance, stable print volumes and acceleration in digital paperless, primarily Retailer iQ • Total transactions were 469 million • Up 16% sequentially and 25% YoY, driven by acceleration in digital paperless • Adjusted EBITDA was $7.5 million , reflecting strong revenue in the quarter, as well as continued investment for future growth • Ended 2015 with a cash balance of $160 million, which includes approximately $17 million to acquire Shopmium and $14 million used to repurchase stock • A uthorized a new $50 million buyback program to be available for use over the next 12 months

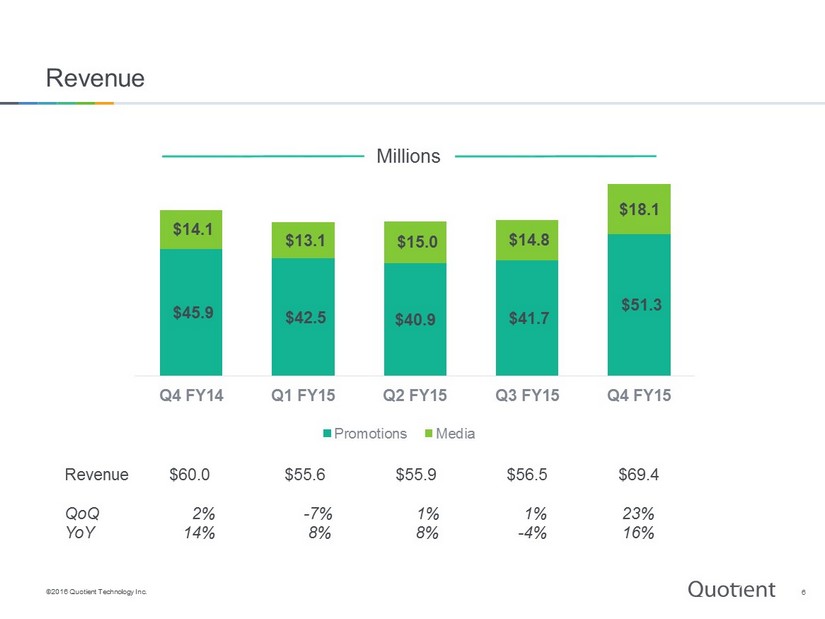

©2016 Quotient Technology Inc. 6 Revenue Revenue $60.0 $55.6 $55.9 $56.5 $ 69.4 QoQ 2% - 7% 1% 1% 23% YoY 14% 8% 8% - 4% 16% Millions $45.9 $42.5 $40.9 $41.7 $51.3 $14.1 $13.1 $15.0 $14.8 $18.1 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Promotions Media

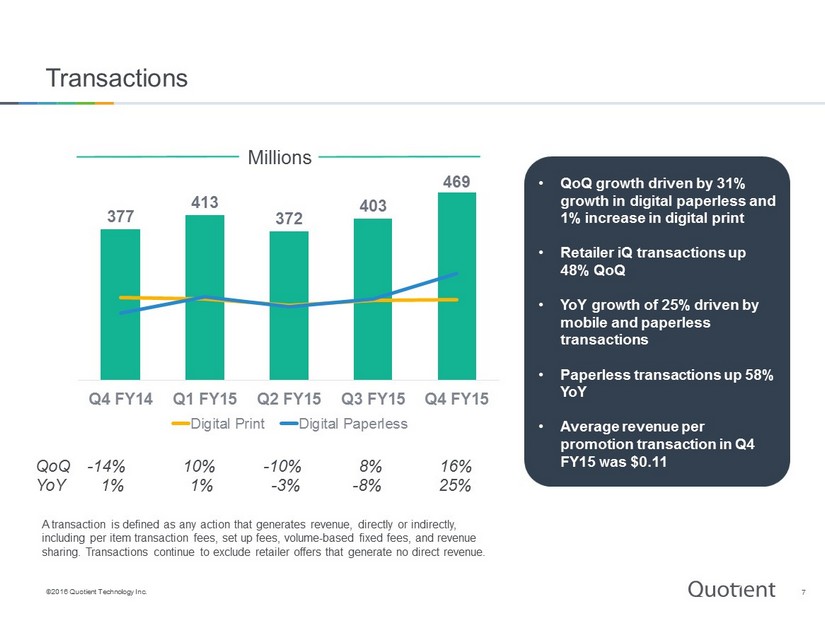

©2016 Quotient Technology Inc. 7 Transactions QoQ - 14% 10% - 10% 8% 16% YoY 1% 1% - 3% - 8% 25% • QoQ growth driven by 31% growth in digital paperless and 1% increase in digital print • Retailer iQ transactions up 48% QoQ • YoY growth of 25% driven by mobile and paperless transactions • Paperless transactions up 58% YoY • Average revenue per promotion transaction in Q4 FY15 was $ 0.11 A transaction is defined as any action that generates revenue, directly or indirectly, including per item transaction fees, set up fees, volume - based fixed fees, and revenue sharing. Transactions continue to exclude retailer offers that generate no direct revenue. Millions 377 413 372 403 469 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 Digital Print Digital Paperless

©2016 Quotient Technology Inc. 8 Retailer iQ Rollout By Retailer Banner Q3 FY15 Q4 FY15 As of Today Implemented Retailer iQ deployed at POS and live at retail stores 10 15 16 Marketing Retailer has begun marketing digital coupon program to build consumer adoption 7 7 7 • Retailers live on the platform now represent multiple classes of trade - grocery, drug, dollar and mass merchandise • Growth in Retailer iQ demonstrates compounded marketing efforts over time

©2016 Quotient Technology Inc. 9 Non - GAAP Gross Margin • Excludes $400K for SBC expense • The QoQ increase was driven by strong revenue growth in the quarter and expense leverage • The YoY decline was driven primarily by a higher proportion of distribution fees related to Retailer iQ 64.6% 61.5% 61.2% 60.4% 64.0% Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15

©2016 Quotient Technology Inc. 34% 35% 15% 14% 9% 11% Q4 FY14 Q4 FY15 Gen'l and Administrative Research & Development Sales & Marketing 10 Q4 Non - GAAP Operating Expenses YoY increase driven primarily by growth in headcount, one time transaction costs related to Shopmium and other expenses YoY increase driven by increased advertising expenses, and headcount related costs $41.5M $ 34.5M YoY decrease driven primarily from headcount growth in lower cost locations

©2016 Quotient Technology Inc. Adjusted EBITDA Margin 14% 7% 8% 4% 11% Millions • QoQ increase primarily driven by stronger revenue • YoY decrease primarily driven by higher marketing expenses, headcount growth and other operating costs • Headcount at FY15 year end was 618 FTEs vs. 552 at the end of FY14 $8.3 $4.0 $4.6 $2.2 $7.5 Q4 FY14 Q1 FY15 Q2 FY15 Q3 FY15 Q4 FY15 11

©2016 Quotient Technology Inc. Stock Buyback • Bought back 2.1 million shares for $14.3 million during the fourth quarter • Total shares purchased in FY2015 is 3.1 million for $23.5 million • As of February 10 th , we have repurchased a total of 4.3 million shares for a total of approximately $30.3 million • Authorized new $50 million buyback program, which replaces expiring program, to be available for additional purchases over the next 12 months 12

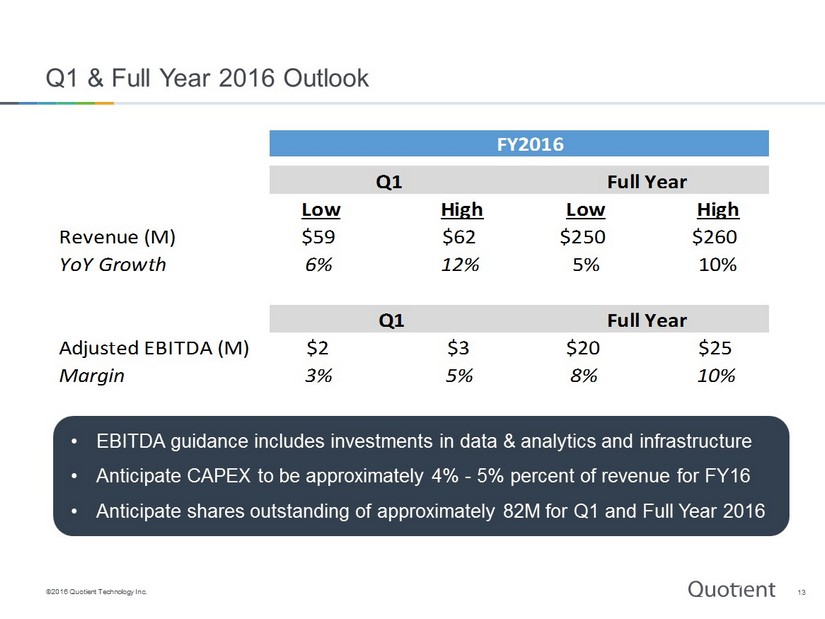

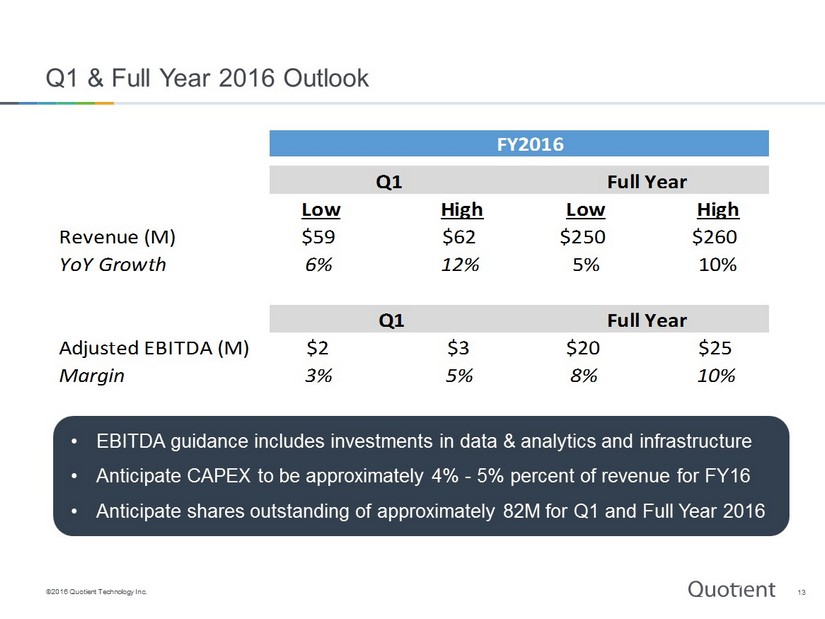

©2016 Quotient Technology Inc. 13 Q1 & Full Year 2016 Outlook • EBITDA guidance includes investments in data & analytics and infrastructure • Anticipate CAPEX to be approximately 4% - 5% percent of revenue for FY16 • A nticipate shares outstanding of approximately 82M for Q1 and F ull Y ear 2016 FY2016 Q1 Full Year Low High Low High Revenue (M) $59 $62 $250 $260 YoY Growth 6% 12% 5% 10% Q1 Full Year Adjusted EBITDA (M) $2 $3 $20 $25 Margin 3% 5% 8% 10%

©2016 Quotient Technology Inc. In Summary • Q4 record revenue and transaction results driven by momentum in digital paperless, as Retailer iQ ramps through ongoing marketing efforts, as well as strong performance in media • Expect continued roll out of Retailer iQ in first half 2016 to expand our network and accelerate mobile adoption • Continuing to invest in the platform around media, our cash - back application, Shopmium , and data and analytics to drive more targeted promotions and insights • Starting FY2016 with increasing confidence in our opportunity 14

©2016 Quotient Technology Inc. Q&A 15

©2016 Quotient Technology Inc. Appendix 16

©2016 Quotient Technology Inc. 17 Reconciliation of Non - GAAP Gross Margin Q4 FY 14 Q1 FY 15 Q2 FY 15 Q3 FY 15 Q4 FY 15 Revenues 60,001$ 55,562$ 55,867$ 56,467$ 69,413$ Cost of Revenues 21,722 21,867 22,122 22,778 25,436 (less) Stock based compensation (492) (449) (433) (419) (427) Non-GAAP Cost of revenues 21,230$ 21,418$ 21,689$ 22,359$ 25,009$ Non-GAAP Gross margin* 38,771$ 34,144$ 34,178$ 34,108$ 44,404$ Adjusted Gross Margin Percentage 64.6% 61.5% 61.2% 60.4% 64.0% * Non-GAAP gross margin excludes stock-based compensation. QUOTIENT TECHNOLOGY INC. RECONCILIATION OF GROSS MARGIN TO NON-GAAP GROSS MARGIN (Unaudited, in thousands)

©2016 Quotient Technology Inc. 18 Reconciliation of Non - GAAP Operating Expense Q4 FY 14 Q1 FY 15 Q2 FY 15 Q3 FY 15 Q4 FY 15 Revenues 60,001$ 55,562$ 55,867$ 56,467$ 69,413$ Sales and marketing expenses 22,686 21,084 21,834 23,403 26,133 (less) Stock based compensation (2,565) (2,941) (3,432) (2,723) (1,561) Non-GAAP Sales and marketing expenses 20,121$ 18,143$ 18,402$ 20,680$ 24,572$ Non-GAAP Sales and marketing percentage 34% 33% 33% 37% 35% Research and development 10,984 12,942 11,839 11,890 11,696 (less) Stock based compensation (2,119) (2,784) (2,266) (2,411) (2,220) Non-GAAP Research and development expenses 8,865$ 10,158$ 9,573$ 9,479$ 9,476$ Non-GAAP Sales and marketing percentage 15% 18% 17% 17% 14% General and administrative expenses 8,085 8,491 7,867 8,382 10,093 (less) Stock based compensation (2,607) (2,758) (2,376) (2,521) (2,625) Non-GAAP General and administrative expenses 5,478$ 5,733$ 5,491$ 5,861$ 7,468$ Non-GAAP General and administrative percentage 9% 10% 10% 10% 11% Non-GAAP Operating expenses* 34,464$ 34,034$ 33,466$ 36,020$ 41,516$ Non-GAAP Operating expense percentage 57% 61% 60% 64% 60% * Non-GAAP operating expenses excludes stock-based compensation and any change in fair value of contingent consideration. QUOTIENT TECHNOLOGY INC. RECONCILIATION OF OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES (Unaudited, in thousands)

©2016 Quotient Technology Inc. 19 Reconciliation of Net Loss to Adjusted EBITDA 2015 2014 2015 2014 Net loss (3,569)$ (1,723)$ (26,730)$ (23,444)$ Adjustments: Stock-based compensation 6,833 7,783 32,346 35,510 Depreciation and amortization 4,621 3,959 16,500 14,737 Change in fair value of contingent consideration (253) (2,935) 1,231 (5,741) Interest expense 2 79 290 922 Other (income) expense, net 48 (16) 22 72 Provision for (benefit from) income taxes (173) 1,119 (561) 1,926 Gain on sale of a right to use a web domain name - — (4,800) — Total adjustments 11,078$ 9,989$ 45,028$ 47,426$ Adjusted EBITDA 7,509$ 8,266$ 18,298$ 23,982$ Transactions (1) 469,010 376,512 1,657,039 1,608,082 Q4 FY 14 Q1 FY 15 Q2 FY 15 Q3 FY 15 Q4 FY 15 Net loss (1,723)$ (4,001)$ (9,342)$ (9,818)$ (3,569)$ Adjustments: Stock-based compensation 7,783 8,932 8,507 8,074 6,833 Depreciation and amortization 3,959 3,908 3,872 4,099 4,621 Change in fair value of contingent consideration (2,935) (354) 2,076 (238) (253) Interest expense 79 80 82 126 2 Other (income) expense, net (16) 61 (40) (47) 48 Provision for (benefit from) income taxes 1,119 192 (571) (9) (173) Gain on sale of a right to use a web domain name — (4,800) — — — Total adjustments 9,989$ 8,019$ 13,926$ 12,005$ 11,078$ Adjusted EBITDA 8,266$ 4,018$ 4,584$ 2,187$ 7,509$ Adjusted EBITDA Margin (2) 14% 7% 8% 4% 11% (2) Adjusted EBITDA margin is the ratio of Adjusted EBITDA and Revenues. QUOTIENT TECHNOLOGY INC. RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA AND TRANSACTION DATA (Unaudited, in thousands) (1) A transaction is any action that generates revenue, directly or indirectly, including per item transaction fees, revenue sharing fees, set up fees and volume-based fixed fees. Transactions exclude self-generated retailer offers where no revenue is received. Three Months Ended December 31, Year Ended December 31, QUOTIENT TECHNOLOGY INC. RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA AND TRANSACTION DATA (Unaudited, in thousands)