Dear stockholders,

I hope you, and everyone around you, are managing to stay healthy and safe during these most unprecedented times. The current market dynamics bring many challenges for us all, and at the same time, they also provide opportunities to innovate as we emerge from the initial shock of COVID-19. The consumer-packaged goods (CPG) and retail industries have felt the effects of the pandemic in both positive and negative ways. Brands and retailers have moved quickly to address shifting attitudes about handling money and paper coupons, the sharp increase in online sales (eCommerce) and changes needed to campaign and marketing messages. The industry’s rapid changes are driving innovative ways to engage shoppers, invest more in digital, build loyalty and long-term brand equity and drive sales. At the same time, shoppers’ rapid adoption of online grocery sales has created new opportunities and tailwinds for growth as brands and retailers prioritize digital. Our teams are moving swiftly, building new products, signing new retailers to the platform and delivering superior customer experiences. As a leadership team, we are focused on the health and wellbeing of our global workforce; building a strong pipeline of future business; and focusing Quotient on long-term, sustainable growth.

Revenue in the second quarter was $83.5 million, within our guidance range of $80.0 million to $90.0 million. As expected, revenue in the second quarter was soft - primarily due to the impacts of COVID-19 as CPGs and retailers paused, delayed or cancelled marketing campaigns. Today, many of those campaigns have been rebooked into the third and fourth quarters of this year, as CPGs recognize the importance of re-engaging with their shoppers and look for high value, ROI-driven digital marketing.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 2

|

We delivered $4.4 million of Adjusted EBITDA, well above the top end of our range of $0.0 to $3.0 million, primarily due to our continued focus on cost controls, which lowered total operating expenses.

As anticipated, April and May were impacted the most from the effects of COVID-19 as retailers and brands focused on shoring up supply chains to address low inventory levels or out-of-stocks on store shelves. Retailers also had the added challenge of trying to help manage retail foot traffic. Safety became a top priority, as retailers and brands implemented rigorous processes in order to keep employees and customers safe. This led to campaigns being rescheduled, and in many cases, media messages had to be altered to better reflect the rapidly changing environment. As a result, overall promotion and media spend was largely paused across the CPG/retail industry in the second quarter.

Some retailers even suspended the acceptance of printed coupons. In the example below, the retailer suspended the availability of printed paper circulars in an effort to limit direct contact between shoppers and staff.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 3

|

In May, we saw bookings stabilize as campaigns started to be rescheduled for June and into the back half of 2020. Revenue for the month of June represented 45% of total revenue in the second quarter 2020 as compared to 39% of total revenue in the second quarter 2019. This reflects a favorable trend, with customers beginning to return to more normalized spending patterns. Early indications are that this positive trend will continue throughout the third quarter.

Looking forward to the back half of this year, bookings are already higher than historical trends at this point in the quarter, and we have a strong, growing pipeline of new CPG and retailer business. Now more than ever, maintaining brand awareness and market share remains a key focus for brands as they think about marketing investments and the importance of shifting dollars to digital, to be front and center where shoppers are spending their time.

“If you think about it, at the very beginning…everything just got cancelled. So that led us to making big shifts in marketing and investment,…to fully invest in the second half…We’re talking about being as much as $60 million, in shift from the first half into the second half, much of that advertising and promotion.”

– Steven A. Cahillane, Chairman, CEO & President, Kellogg Company

We are also seeing positive signs in other areas, particularly around the demand from retailer partners. In March and April when the effects of COVID-19 were first being felt, in many cases, retailers led the requests for campaigns to be paused or delayed while they worked to implement safety measures and dealt with constrained product availabilities. Similarly, retailers are now leading the way for campaigns to resume as they prioritize digital-first strategies and hold brands accountable for digital merchandising dollars to drive sales.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 4

|

Recently, some of our customers opted to pause advertising on certain social media platforms. We believe the revenue impact from this event in July was negligible as we worked with our customers to move their advertising spend to other platforms. This was possible due to our diverse suite of media products and wide range of network partnerships. We also continue to expand our social media partnerships to give our advertisers several alternative and effective options to choose from. Our social media partnerships include platforms like Pinterest, Facebook, Instagram, Twitter, SnapChat and YouTube, and we’ll continue to add to this roster.

The Power of Data

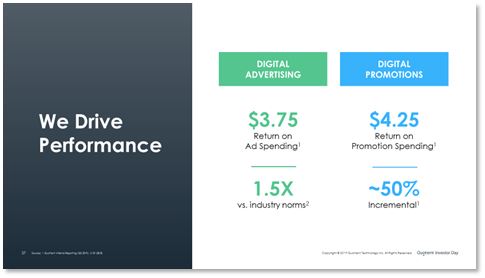

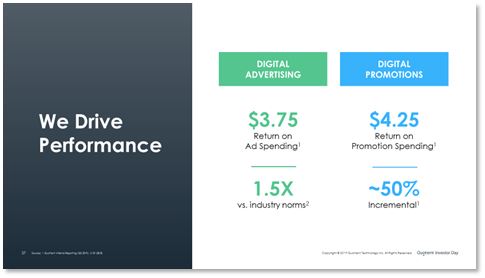

We have the ability to quickly adapt to current market dynamics and optimize campaigns to drive sales across multiple touchpoints. We continue to lead discussions with data, providing valuable insights to brands and partners that result in more dollars and campaigns across our platforms. Our audience targeting and measurement capabilities drive sales and demonstrate strong return on investment. Most importantly, the more our network scales, with more retailers and shoppers, the richer our data becomes.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 5

|

Sources: 1 Quotient Internal Reporting (Q3 2019); 2 IRI, Nielsen, 2018-2020 (2018)

“We also have become a bit more selective about the type of A&M (advertising and marketing) that we're doing. And some of the activities that had lower ROI, we're stopping them, and we're putting more money against the initiatives that had more return on investment.”

-Ramon Laguarta, Chairman and CEO, PepsiCo

As a true testament to our strong performance offerings, our recent “SNICKERS® World Wrestling Entertainment at Dollar General” campaign for Mars Wrigley earned both a 2020 Effie and a Silver Reggie award. This campaign seamlessly combined our social-influencer solution; a coupon offer; and strategic paid media buys featuring dynamic, effective creative including video and Quotient’s brand pages solution to drive outstanding performance results.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 6

|

This unique offer was available exclusively to Dollar General shoppers, resulting in brand growth that outpaced the category and the competition. Through weekly monitoring and optimizations, the campaign not only hit its objectives but also garnered significant additional bonus impressions.

New Retailers Added to Quotient Network

Adding new retailers to the Quotient network and expanding our offerings with existing retail partners are strategic growth drivers for us. We are very excited to announce two additional retailers and one significant retailer expansion to our growing network.

We recently signed Rite Aid, a national chain of drug stores with $22 billion in total annual sales and over 2,400 stores. In March, Rite Aid outlined a strategic plan that included revitalizing their retail and digital experiences. Quotient is partnering with Rite Aid to integrate Retailer iQ, Retail Performance Media (RPM) and our self-service sponsored product search platform to drive sales and shopper loyalty for the retailer and its CPG vendors. Rite Aid is focused on bringing a full omnichannel experience to shoppers and is exploring other ways to expand their offering through our partnership.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 7

|

Additionally, we signed HyVee, a chain of supermarkets and convenience stores in the Midwestern U.S., with more than $10 billion in total annual sales and more than 265 retail locations. In search of a strategic partnership, HyVee chose Quotient to integrate several initiatives around their digital-first strategy. Quotient brings a robust set of solutions to HyVee, including the reach and scale of our shopper network, advanced technological capabilities, actionable analytics, strong measurement capabilities and deep industry expertise. With Retailer iQ and RPM, HyVee will be delivering personalized and targeted digital promotions and media to their shoppers.

In June, we expanded our partnership with Ahold Delhaize USA and Peapod Digital Labs to power a self-service platform across their U.S. retail banners for sponsored product search advertising. The first online grocer in the U.S., Peapod’s grocery delivery technology and innovation is now being leveraged for the 86% of its customers that now have access to either delivery or click and collect options through Ahold Delhaize USA. With growth in their eCommerce channel, this gives brands a way to offer sponsored placements on their eCommerce websites and drive conversion at the point of purchase.

Rite Aid and Ahold Delhaize USA mark our third and fourth retail partners to join our sponsored search media network. For sponsored search media, Quotient offers a large national platform with shopper reach into $150 billion of sales across multiple classes of trade including grocery, drug, and dollar. This scale enables CPGs to shift search marketing dollars from places like Google to Quotient.

These retailer additions are the results of the work we have been doing over the past 12 months as we have put a sharp focus on growing our pipeline of new retailers, and this is only the beginning. In addition to the retailers mentioned above, we have several more in various stages of development. Some are in new verticals outside of our traditional grocery, drug, mass merchant, dollar, club and convenience channels, and we look forward to sharing more on these efforts in the coming months.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 8

|

New Offerings to Help Accelerate the Shift to Digital

Quotient provides an industry-leading platform that continues to deliver the best experiences for brands, retailers and shoppers. The investments we have made over the last year, since my return as CEO, have been focused around three primary themes: delivering the very best product experiences, sustainably growing our business and preparing to capture the rapidly accelerating shift from offline to digital.

Digital Out-Of-Home: In November 2019, we acquired Ubimo a demand-side-platform (DSP) that enhanced our media offering while also lowering a portion of our media cost of goods sold. Ubimo delivers an industry leading, programmatic digital out-of-home (DOOH) offering. The network of out-of-home screens includes billboards, transit shelters, malls, bars, in-store screens at point of sale, gyms and airports to name a few places.

By leveraging Quotient’s audience segments, our DOOH offering becomes part of a multi-channel campaign targeting shoppers in designated markets with targeted messaging. We can also retarget those shoppers on their mobile devices with a promotion or media campaign, amplifying the entire campaign through multi-channel touchpoints. Since the acquisition, we’ve enhanced our DOOH solution by adding video and audio messaging, dynamic messaging and scrolling. We’ve also integrated our performance measurement and analytics platform, tying DOOH campaigns directly to product sales. This is an exciting improvement, bringing the same performance transparency and insights to the DOOH space that have become the foundation of our promotion and media solutions.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 9

|

In late May and June, momentum in DOOH began to pick up as communities began to re-open. Using our data dashboards, brands and marketers can pinpoint the markets where movement is on the rise to deliver messages in an effective channel at the most opportune time.

DOOH represents a new and growing channel to the Quotient platform. It’s estimated that brands spent approximately $2.8 billion in the DOOH channel in 2019. This is an exciting new channel for us, and we are already seeing engagement by many brands and retailers including those in verticals outside of CPG and grocery.

Self-Service: Our product teams are focused on delivering the very best experiences for brands and retailers while also offering shoppers a wide set of options to engage with the Quotient network in the ways they most enjoy. With the growth in online grocery sales, our self-service ad platform continues to gain momentum. This self-service platform brings automation and easy adoption for CPGs looking to spend product search dollars directly on retailers’ properties, nearest to a shopper’s point of purchase. With our platform, brands and retailers can tie targeting and measurement together across channels that leverage a unified set of data. Sponsored product search lays the foundation for further innovation around self-service in an industry that has historically been more consultative. We continue to make investments in our promotions and media platforms to bring convenient and more margin attractive, self-service capabilities to market.

Digital Clearing: Our newly signed partnership with Mandlik & Rhodes disrupts the legacy clearing industry and brings transparency to brands and retailers. Digital coupons are inherently lower cost to process, which frees up more working dollars and increases the ROI of a brand’s overall marketing spend. Through this partnership, CPGs can spend less on clearing fees increasing their marketing ROI as the industry rapidly shifts from legacy offline print to digital coupons over the next 18 months.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 10

|

Second Half 2020 Growth Drivers

In addition to these new offerings and the expansion of our retailer network, the current market dynamics support and accelerate CPG and retailers’ shift to digital. Market growth drivers include higher shopper demand in the eCommerce channel, retailers demanding higher CPG investments in RPM and the shift from offline free-standing insert (FSI) promotions to digital that typically delivers higher ROI.

Growth in eCommerce channel: Online grocery is growing rapidly. It continues to be a source of incremental growth opportunities for Quotient as brands and retailers build digital strategies and collaboratively align marketing dollars to where their shoppers are. Brick Meets Click recently estimated that, in 2019, online sales accounted for 6.3% of total grocery spending in the U.S. or approximately $54.6 billion on an annualized basis. Setting aside interim spikes in online grocery sales due to the impact of COVID-19, Brick Meets Click projects sales in online grocery to grow to at least 8.2% of total sales by 2022.

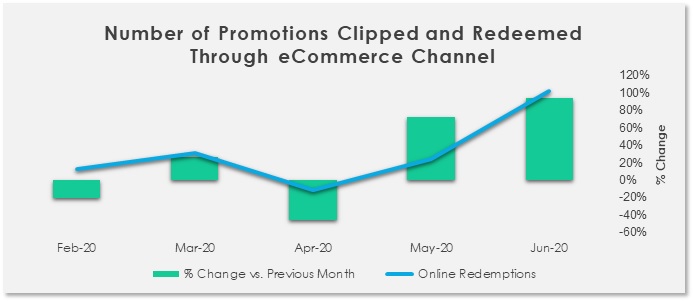

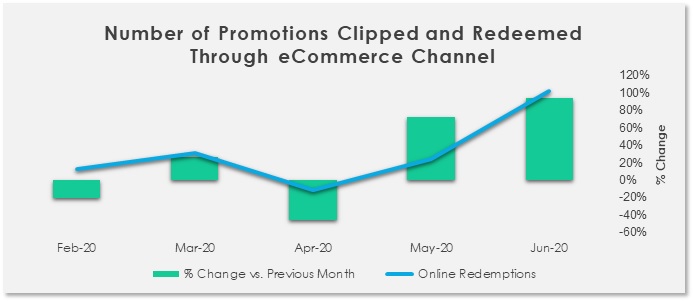

The sharp growth in online sales has provided incremental revenue opportunities across our platform. Quotient optimizes promotions and media delivery across channels, aligning to where shoppers spend most of their time. In Q2, the percentage of promotions clipped and then redeemed from our eCommerce channel increased 131% over Q1 of 2020. The chart below illustrates promotion trends on a month-over-month basis as strength in online grocery sales grew. Although this channel accounts for a small portion of our overall revenue, shopper demand is rising and budgets from brands and retailers are starting to increase. The lower growth rate for the month of April denotes the significant number of paused or delayed campaigns from the initial effects of the pandemic.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 11

|

“We have expanded our pool of loyal customers, broadened their engagement with us and retained their business. In Q1, we saw a 27% increase in the number of households that signed up for our loyalty program…the number of members in our program who redeemed digital deals and coupons was also up 32% year-on-year, with the average weekly spend being 2x that of customers that are not engaged in the digital deals and coupons.”

– Vivek Sankaran, President, CEO & Director, Albertsons Companies, Inc.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 12

|

Growth in eCommerce is creating opportunities in our media business as well. The number of brands who ran a sponsored search campaign increased 62% in the Q2 compared to Q1 2020. With Ahold Delhaize USA and Rite Aid expected to launch soon with our self-service sponsored product search offering, and our newly launched partnership with Shipt, we expect continued growth within eCommerce in both promotions and media.

Quotient Promotions:

The shift from offline paper coupons to digital continues to be a large growth driver as we begin to see more brands adopt strategies and roadmaps for exiting the FSIs. Several brands are now adding a corresponding digital coupon for every paper coupon included in the FSI. This provides a clear onramp for brands to shift their spend to digital from paper. In addition, retailers are starting to align on this strategy as well. One large retailer in the drugstore vertical has mandated that for every retailer-specific coupon a brand issues in print format, a corresponding digital coupon must be issued as well. We are already seeing an increase in bookings and a strong pipeline from these strategies for campaigns in the second half of the year. Over the course of 2020 and 2021, the offline FSIs are expected to lose over 20% of their coupon distribution from leading CPGs. As a result, the value of the FSI diminishes. As the market leader in digital promotions, we expect Quotient to benefit from this shift.

In addition to the overall shift from offline to digital, recessionary periods have historically experienced higher coupon distribution and usage. According to a survey from CPG industry expert Acosta, the pandemic has taken a financial toll on shoppers with 37% of those surveyed saying they are worse off now compared to pre-COVID. The report also noted that shoppers’ top priorities post-pandemic will be product availability and low prices. Digital coupons remain one of the most effective and efficient ways for CPGs to spend marketing dollars to drive sales.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 13

|

Retail Performance Media: Given the surge in eCommerce sales and shopper engagement, retailers are strengthening their digital-first strategies and prioritizing retail media. Quotient’s RPM drives sales and creates significant alternative revenue streams for retailers, enabling high-profit revenue to help fund important omnichannel investments that help retailers compete in today’s digital world. RPM gives retailers an advantage in the market with high-performing marketing solutions and a robust technology platform. In addition, our structured sales force helps retailers claim their share of national and shopper digital promotions and media dollars from CPGs.

To help drive these available dollars onto their digital platforms, some of our RPM partners have created programs for brands to commit marketing dollars measured as a percentage of gross sales. As a result, brands are now being held accountable for carefully planned annual investments on retailers’ digital platforms powered by Quotient. One retailer launched their program approximately a year ago. In response, top-tier brands in the carbonated soft drink, food and household product categories have committed to shift meaningful dollars onto our digital platform. We expect additional retailers to launch similar programs in the very near future. As many CPGs start to enter new annual fiscal cycles in the fall, we believe the timing for these programs is ideal and should act as a tailwind for us in the back half of 2020 and the full year 2021. Through RPM, retailers are able to demonstrate high ROI and incremental sales lift, which drives increased collaboration with brands and a sustainable business model for both retailers and CPGs.

As the industry continues to transform, we believe we are strategically well positioned for growth. With $250 billion dollars spent annually in marketing, and online grocery growing to over 8% of total grocery sales over the next few years, the shift to digital is underway. Importantly, retailers and brands are strategically aligned alongside growing consumer demand in digital channels. As upcoming fiscal budgets are being planned, brands and retailers are shifting their marketing dollars to digital. We also believe digital channels will benefit from the millions of dollars that CPGs had originally planned to spend on sponsored events, professional sports and the Olympics. With major events now postponed or cancelled, and sports seasons shortened, we expect that those marketing investments will be reconsidered and dollars redeployed. Our digital solutions, with their proven ability to drive sales, are well positioned to benefit from these changes.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 14

|

“We’re also increasing growth investment, primarily in digital advertising…We temporarily paused some investment in the second quarter and now plan to restore and further increase investment this year. We’re doing this to fuel market share momentum and to better position us for sustainable long-term success…”

– Michael Hsu, Chairman & CEO, Kimberly-Clark Corporation

In Summary

We believe we have a large and growing opportunity in front of us. Brands and retailers are prioritizing digital at a pace we have never seen before. New retailers signed to Quotient, and our strong pipeline for additional partners to come, demonstrate the importance retailers place on getting digital right. We are thrilled to partner with a long list of leading retailers across the grocery, drug, dollar, mass merchant, club and convenience store verticals. The industry is moving quickly, and our market-leading strength positions us well to deliver exceptional customer experiences and deep industry knowledge to brands and retailers.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 15

|

We expect to see significant growth in the second half of the year given CPGs’ plans to grow their investments in digital promotions and media. We continue to innovate with new products, boost our visibility in the market, manage costs appropriately, improve internal processes and invest in our culture. Driving sustainable growth is our number one focus. The hard work and dedication from this team have prepared us well for the rapid shift to digital that is currently underway. We thank each and every person at Quotient for their contribution in making us the market leader we are today. It’s an exciting time to be at Quotient.

Sincerely,

| |

Steven Boal

| Pamela Strayer

|

Chief Executive Officer

| Chief Financial Officer

|

Financial Review

Second Quarter 2020 Summary Results

●

| We delivered revenue of $83.5 million, down 20% over Q2 2019

|

| | |

●

| Adjusted EBITDA was $4.4 million, representing a 5.2% margin

|

| | |

●

| GAAP gross margin was 39.2%, compared to 38.8% in Q2 2019

|

| | |

●

| Non-GAAP gross margin was 47.2%, compared to 44.4% in Q2 2019

|

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 16

|

●

| GAAP operating expenses were 58.1% of revenue, compared to 40.5% of revenue in Q2 2019

|

| | |

●

| Non-GAAP operating expenses were flat compared to the prior year at $36.8 million and 44.1% of revenue, compared to 35.2% of revenue in Q2 2019

|

| | |

| ● | We recorded a GAAP net loss of $19.1 million, compared to a loss of $3.9 million in Q2 2019. The increase in GAAP net loss from prior year is due primarily to lower revenues resulting from COVID-19 as well as a $3.8 million charge for the increase in fair value of contingent consideration compared to a benefit of $3 million in the prior year. Net Loss Per Share in the quarter was $0.21, compared to $0.04 in Q2 2019

|

Revenue Details

We delivered $83.5 million of revenue in Q2 2020, down from $104.7 million in the prior year primarily due to the expected impact of COVID-19. Our revenue in the second quarter also included a negative impact as a result of a change we made in the delivery of media effective April 1, 2020 which resulted in a portion of our media revenue recognized on a net basis in Q2 2020 compared to gross basis in the prior year and the prior quarter. Had this business been recognized gross, our Q2 revenue would have been $8.6 million higher resulting in a year over year decrease in total revenues of 12%.

Revenue in April and May was the most impacted by COVID-19, with campaigns starting to return in June as we began to see bookings and the pipeline stabilize.

Media revenue was down 22% in the second quarter over last year, primarily due to the gross to net change mentioned above. Had this media revenue been recognized on a gross basis, total media revenue would have been down 4% from the prior year. The impact to media revenue in the second quarter from COVID-19 was primarily seen in our programmatic display and social-influencer solutions. Sponsored product search and DOOH are relatively new offerings, and although a much smaller portion of revenues, they showed significant growth in the second quarter over the last two consecutive quarters.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 17

|

Promotion revenue declined 19% over last year, primarily driven by the impact of COVID. Digital print declined 27% and digital paperless promotions, which are primarily retailer-specific, declined 19% over Q2 last year. This partially was offset by specialty retail which grew 15% year over year.On a trailing twelve-month basis, we saw overall growth of 2% year over year across our customer cohorts. Revenue from our Top 20 cohort grew 5% and revenue from our 21-40 cohort grew 3% year over year. Revenue from the longer tail of customers, the 40+ customer cohort, was down 5% year over year.

Gross Margin

Non-GAAP gross margin excludes stock-based compensation expense, amortization of acquired intangible assets and restructuring charges.

GAAP gross margins in the second quarter were 39.2%, up 40 basis points compared to the same quarter last year. As a percentage of revenue, Q2 2020 GAAP gross margin benefited as a result of a change we made in the delivery of media mentioned above. This benefit was partially offset by increased expense from amortization of intangible assets over the prior year, primarily from the acquition of Ubimo in November 2019.

Non-GAAP gross margin in Q2 2020 was 47.2%, up 280 basis points compared to 44.4% in Q2 last year. The increase is due primarily to the change in the delivery of a portion of our media revenue as mentioned above, partially offset by lower revenue in the quarter over fixed costs. With the expected increase in revenue across our business in the second half of the year, fixed costs in cost of revenues will scale and gross margins will increase on a consistent product mix.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 18

|

Operating Expenses

Non-GAAP operating expenses exclude stock-based compensation, the change in fair value of contingent consideration, amortization of acquired intangible assets, certain acquisition related costs and restructuring charges.

We continued to manage costs and invest where appropriate while driving greater efficiencies in the business.

GAAP operating expenses increased by $6.1 million over the prior year. This increase is primarily due to higher fair value of contingent consideration associated with the Ubimo acquisition. We booked an expense of $3.8 million compared to a benefit recorded in Q2 2019 of $3 million. On a quarter over quarter basis, operating expenses decreased by $2.7 million due to lower overall operating expenses, primarily attributable to variable compensation, lower FICA payroll taxes and one-time events held in the first quarter offset by an increase in fair value of contingent consideration.

Non-GAAP operating expenses were approximately flat compared to Q2 2019, while also absorbing approximately 42 employees from the Ubimo acquisition. As compared to Q1 2020, non-GAAP operating expenses were down $4.3 million, primarily due to variable compensation associated with lower revenue, a decrease in travel expenses and one-time events held in the first quarter, and FICA payroll taxes.

Adjusted EBITDA

Adjusted EBITDA excludes interest expense, income taxes, depreciation and amortization, the change in fair value of contingent consideration, stock-based compensation, restructuring charges, other income, net and certain acquisition related costs.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 19

|

We reported $4.4 million of Adjusted EBITDA in the second quarter 2020, above the top end of our range. This was primarily due to focused cost controls, which lowered total operating expenses.

Balance Sheet and Cash Flow

We generated $16.9 million of cash from operations in the second quarter, primarily driven by a strong accounts receivable balance and collections off strong revenue exiting Q4 2019 and first part of Q1 2020.

We continue to focus on maintaining a strong balance sheet. We ended Q2 with $211.9 million in cash and cash equivalents, up $15.1 million from the prior quarter.

Looking Forward

Market dynamics are accelerating the shift from offline to digital. Conversations with our customers and partners are positive, and bookings and pipeline momentum build our confidence heading into the second half of the year. We expect revenue in the second half of the year to be up by 36%+ over the first half, a significant return to spend from brands and retailers.

Achieving gross margin of 50%+ remains a priority. We have made solid improvements in gross margin, stemming from more efficient processes, streamlined operations and automation. However, the biggest variable in gross margin is product mix. Each of our product offerings have different gross margins. As a category, promotion revenue generally has higher gross margins than media revenue. Margins also vary within each category.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 20

|

While spending from brands and retailers is expected to return, the mix of products is harder to predict. Our customers can often provide insight into their spending plans for the year, but specific product selections are typically not known until much closer to when the order is committed.

We also continue to prioritize investments to meet the changing business environment while staying agile throughout the year to maintain our market-leading position. We anticipate non-GAAP operating expenses for the second half of the year to be approximately $42 million to $44 million per quarter.

We have a strong balance sheet and cash flow from operations in Q2. While we expect strong revenue growth in Q3, we are also forecasting significant operating cash outflows in Q3 as the lower Q2 revenue results in lower cash collections in the quarter. In Q4, cash flows from operations are expected to be breakeven to slightly positive – again, from higher Q3 revenue and higher Adjusted EBITDA margins.

Business Outlook

Our guidance today presents our reasonable estimates based on what we know currently and does not include any additional changes to market dynamics that may occur as a result of COVID-19. With increased visibility into the second half of the year, we feel confident in our ability to tighten the ranges.

For the third quarter of 2020, we expect revenue to be in the range of $120.0 million to $130.0 million. Predicting the mix of revenue between promotion and media remains difficult at this time.

For the third quarter of 2020, we expect Adjusted EBITDA to be in the range of $15.0 million to $20.0 million.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 21

|

For the full year 2020, we expect revenue to be in the range of $430.0 million to $455.0 million.

Adjusted EBITDA for the full year 2020 is expected to be in the range of $43.0 million to $53.0 million.

We expect weighted average diluted shares outstanding for 2020 to be approximately 92.0 million.

Quotient will be participating in the following events:

●

| Oppenheimer’s 23rd Annual Technology, Internet and Communications Virtual Conference, August 11-12, 2020

|

| | |

| ● | D.A Davidson’s 19th Annual Software and Internet Services Virtual Conference, September 9, 2020

|

| | |

| ● | Collier’s 2020 Virtual Institutional Investor Conference, September 10, 2020

|

Quotient will also host a virtual Investor Day on November 19, 2020. If you’d like to receive more information when it becomes available, please register here.

Quotient will host a conference call and live webcast today at 2:00pm PDT to discuss the second quarter 2020 financial results. To listen to a live audio webcast, please visit Quotient’s Investor Relations website at investors.quotient.com. A replay of the webcast will be available at the same website. You may also access the call and register with a live operator by dialing (866) 270-1533, or outside the U.S. (412) 317-0797, at least 15 minutes prior to the 2:00 p.m. PDT start time.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 22

|

About Quotient Technology Inc.

Quotient Technology (NYSE: QUOT) is the leading digital promotions, media and analytics company that delivers personalized digital coupons and ads informed by proprietary shopper and online engagement data to millions of shoppers daily. We use our proprietary Promotions, Media, Audience and Analytics Platforms and services to seamlessly target audiences; optimize performance; and deliver measurable, incremental sales for CPG and retail marketers. We serve hundreds of CPGs and retailers nationwide, including Clorox; Procter & Gamble; General Mills; Unilever; Albertsons Companies; CVS; Dollar General; and Peapod Digital Labs, a company of Ahold Delhaize USA. Quotient is headquartered in Mountain View, California and has offices in Bangalore, Cincinnati, New York, Paris, London and Tel Aviv. Visit www.quotient.com for more information.

Quotient and the Quotient logo are trademarks or registered trademarks of Quotient Technology Inc. and its subsidiaries in the United States and other countries. Other marks are the property of their respective owners.

Forward Looking Statements

This stockholder letter includes forward-looking statements that include projections for our third quarter and full year 2020; expectations about our ability to grow revenues, gross margin and Adjusted EBITDA; the impact of our shift to recognize certain media services on a net basis, our expectations for our solutions, partnerships, the Quotient Network and product launches; our ability to manage our business and liquidity during and after the COVID-19 pandemic; brands’ plans to reschedule paused or delayed campaigns later in the year; growth in Quotient Promotions, RPM and eCommerce; our ability to capture marketing dollars of CPGs on RPM as demanded by our retail partners or that was made available upon the cancellation or postponement of sponsored events including sporting events; retailers’ plans to prioritize RPM; increasing the number of retailers to our retailer network; benefits of a DOOH offering; our ability to power brands’ digital platforms; the importance of promotions to CPGs during recessionary periods; the effectiveness of our cost control measures; CPGs’ plans to reduce spending in offline free-standing inserts; the future demands and behaviors of consumers, retailers and CPGs, particularly in light of the continuing effects of the COVID-19 pandemic; the impacts of the ongoing COVID-19 pandemic, which may continue to significantly impact our business, plans, and results of operations, as well as the value of our common stock; the expected growth of, and investments in, our business generally and the expected ability to leverage investments and operating expenses.

Forward-looking statements are based on information available to and the good faith beliefs of our Management team as of the time of this call and are subject to known and unknown risks and uncertainties that could cause actual performances or results to differ materially.

Additional information about factors that could potentially impact our financial results can be found in today's press release and in the risk factors identified in our Quarterly Reports on Form 10-Q filed with the SEC on May 6, 2020. We disclaim any obligation to update information contained in these forward-looking statements, whether as a result of new information, future events or otherwise.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 23

|

| QUOTIENT TECHNOLOGY INC. |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (in thousands) |

|

|

| |

| June 30,

2020 |

| December 31,

2019 |

| (unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents | $ | 211,872 | |

| $ | 224,764 | |

| Accounts receivable, net | | 94,311 | |

| | 125,304 | |

| Prepaid expenses and other current assets | | 23,991 | |

| | 22,026 | |

| Total current assets | | 330,174 | |

| | 372,094 | |

| Property and equipment, net | | 15,340 | |

| | 13,704 | |

| Operating lease right-of-use-assets | | 16,851 | |

| | 7,211 | |

| Intangible assets, net | | 55,319 | |

| | 69,752 | |

| Goodwill | | 128,427 | |

| | 128,427 | |

| Other assets | | 1,098 | |

| | 750 | |

| Total assets | $ | 547,209 | |

| $ | 591,938 | |

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable | $ | 12,308 | |

| $ | 19,116 | |

| Accrued compensation and benefits | | 7,801 | |

| | 15,232 | |

| Other current liabilities | | 47,200 | |

| | 50,032 | |

| Deferred revenues | | 13,011 | |

| | 10,903 | |

| Contingent consideration related to acquisitions | | 3,207 | |

| | 27,000 | |

| Total current liabilities | | 83,527 | |

| | 122,283 | |

| Other non-current liabilities | | 17,572 | |

| | 7,119 | |

| Contingent consideration related to acquisitions | | 10,239 | |

| | 9,220 | |

| Convertible senior notes, net | | 171,589 | |

| | 166,157 | |

| Deferred tax liabilities | | 1,937 | |

| | 1,937 | |

| Total liabilities | | 284,864 | |

| | 306,716 | |

|

|

| |

| Stockholders’ equity: |

|

|

|

| Common stock | | 1 | |

| | 1 | |

| Additional paid-in capital | | 684,285 | |

| | 671,060 | |

| Accumulated other comprehensive loss | | (1,160 | ) |

| | (916 | ) |

| Accumulated deficit | | (420,781 | ) |

| | (384,923 | ) |

| Total stockholders’ equity | | 262,345 | |

| | 285,222 | |

| Total liabilities and stockholders’ equity | $ | 547,209 | |

| $ | 591,938 | |

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 24

|

| QUOTIENT TECHNOLOGY INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited, in thousands, except per share data) |

|

|

|

|

|

|

| |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| Revenues | $ | 83,455 | |

| $ | 104,691 | |

| $ | 182,242 | |

| $ | 202,798 | |

| Costs and expenses: |

|

|

|

|

|

|

|

| Cost of revenues (1) | | 50,731 | |

| | 64,106 | |

| | 111,842 | |

| | 120,929 | |

| Sales and marketing (1) | | 23,814 | |

| | 23,870 | |

| | 48,848 | |

| | 49,393 | |

| Research and development (1) | | 8,621 | |

| | 8,699 | |

| | 19,214 | |

| | 19,069 | |

| General and administrative (1) | | 12,268 | |

| | 12,835 | |

| | 27,358 | |

| | 26,458 | |

| Change in fair value of contingent consideration | | 3,766 | |

| | (3,009 | ) |

| | 4,226 | |

| | 53 | |

| Total costs and expenses | | 99,200 | |

| | 106,501 | |

| | 211,488 | |

| | 215,902 | |

| Loss from operations | | (15,745 | ) |

| | (1,810 | ) |

| | (29,246 | ) |

| | (13,104 | ) |

| Interest expense | | (3,610 | ) |

| | (3,470 | ) |

| | (7,184 | ) |

| | (6,909 | ) |

| Other income, net | | 187 | |

| | 1,508 | |

| | 767 | |

| | 3,039 | |

| Loss before income taxes | | (19,168 | ) |

| | (3,772 | ) |

| | (35,663 | ) |

| | (16,974 | ) |

| Provision for (benefit from) income taxes | | (35 | ) |

| | 134 | |

| | 195 | |

| | 160 | |

| Net loss | $ | (19,133 | ) |

| $ | (3,906 | ) |

| $ | (35,858 | ) |

| $ | (17,134 | ) |

|

|

|

|

|

|

| |

| Net loss per share, basic and diluted | $ | (0.21 | ) |

| $ | (0.04 | ) |

| $ | (0.40 | ) |

| $ | (0.18 | ) |

|

|

|

|

|

|

| |

| Weighted-average shares used to compute net loss per share, basic and diluted | | 90,112 | |

| | 92,558 | |

| | 89,875 | |

| | 93,406 | |

|

|

|

|

|

|

| |

| (1) The stock-based compensation expense included above was as follows: |

|

|

|

|

|

|

|

|

|

|

| |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| Cost of revenues | $ | 387 | |

| $ | 562 | |

| $ | 822 | |

| $ | 1,164 | |

| Sales and marketing | | 1,323 | |

| | 1,825 | |

| | 2,725 | |

| | 3,563 | |

| Research and development | | 839 | |

| | 1,073 | |

| | 1,720 | |

| | 2,439 | |

| General and administrative | | 4,457 | |

| | 4,576 | |

| | 9,265 | |

| | 8,918 | |

| Total stock-based compensation | $ | 7,006 | |

| $ | 8,036 | |

| $ | 14,532 | |

| $ | 16,084 | |

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 25

|

| QUOTIENT TECHNOLOGY INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Unaudited, in thousands) |

|

|

| |

| Six Months Ended

June 30, |

| 2020 | | 2019 |

|

|

| |

| Cash flows from operating activities: |

|

|

|

| Net loss | $ | (35,858 | ) |

| $ | (17,134 | ) |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

| Depreciation and amortization | | 17,843 | |

| | 15,632 | |

| Stock-based compensation | | 14,532 | |

| | 16,084 | |

| Amortization of debt discount and issuance cost | | 5,432 | |

| | 5,150 | |

| Allowance for credit losses | | 263 | |

| | 366 | |

| Deferred income taxes | | 195 | |

| | 160 | |

| Change in fair value of contingent consideration | | 4,226 | |

| | 53 | |

| Other non-cash expenses | | 1,442 | |

| | 1,219 | |

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable | | 30,730 | |

| | 3,368 | |

| Prepaid expenses and other current assets | | (2,470 | ) |

| | (2,779 | ) |

| Accounts payable and other current liabilities | | (7,551 | ) |

| | 3,349 | |

| Payments for contingent consideration and bonuses | | (15,418 | ) |

| | — | |

| Accrued compensation and benefits | | (7,478 | ) |

| | (3,249 | ) |

| Deferred revenues | | 2,108 | |

| | 1,616 | |

| Net cash provided by operating activities | | 7,996 | |

| | 23,835 | |

|

|

| |

| Cash flows from investing activities: |

|

|

|

| Purchases of property and equipment | | (4,689 | ) |

| | (4,729 | ) |

| Purchases of intangible assets | | — | |

| | (14,811 | ) |

| Proceeds from maturity of short-term investment | | — | |

| | 20,738 | |

| Net cash (used in) provided by investing activities | | (4,689 | ) |

| | 1,198 | |

|

|

| |

| Cash flows from financing activities: |

|

|

|

| Proceeds from issuances of common stock under stock plans | | 1,762 | |

| | 3,063 | |

| Payments for taxes related to net share settlement of equity awards | | (3,327 | ) |

| | (6,461 | ) |

| Repurchases and retirement of common stock under share repurchase program | | — | |

| | (69,879 | ) |

| Principal payments on promissory note and capital lease obligations | | (91 | ) |

| | (229 | ) |

| Payments for contingent consideration | | (14,582 | ) |

| | — | |

| Net cash used in financing activities | | (16,238 | ) |

| | (73,506 | ) |

| Effect of exchange rates on cash and cash equivalents | | 39 | |

| | 23 | |

| Net decrease in cash and cash equivalents | | (12,892 | ) |

| | (48,450 | ) |

| Cash and cash equivalents at beginning of period | | 224,764 | |

| | 302,028 | |

| Cash and cash equivalents at end of period | $ | 211,872 | |

| $ | 253,578 | |

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 26

|

| QUOTIENT TECHNOLOGY INC. |

| RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA |

| (Unaudited, in thousands) |

|

|

|

|

|

|

| |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| Net loss | $ | (19,133 | ) |

| $ | (3,906 | ) |

| $ | (35,858 | ) |

| $ | (17,134 | ) |

| Adjustments: |

|

|

|

|

|

|

|

| Stock-based compensation | | 7,006 | |

| | 8,036 | |

| | 14,532 | |

| | 16,084 | |

| Depreciation, amortization and other (1) | | 9,345 | |

| | 8,509 | |

| | 19,939 | |

| | 17,053 | |

| Change in fair value of contingent consideration | | 3,766 | |

| | (3,009 | ) |

| | 4,226 | |

| | 53 | |

| Interest expense | | 3,610 | |

| | 3,470 | |

| | 7,184 | |

| | 6,909 | |

| Other income, net | | (187 | ) |

| | (1,508 | ) |

| | (767 | ) |

| | (3,039 | ) |

| Provision for (benefit from) income taxes | | (35 | ) |

| | 134 | |

| | 195 | |

| | 160 | |

|

|

|

|

|

|

| |

| Total adjustments | $ | 23,505 | |

| $ | 15,632 | |

| $ | 45,309 | |

| $ | 37,220 | |

|

|

|

|

|

|

| |

| Adjusted EBITDA | $ | 4,372 | |

| $ | 11,726 | |

| $ | 9,451 | |

| $ | 20,086 | |

(1) For the three and six months ended June 30 2020, Other includes restructuring charges of zero and $1.5 million, respectively, and certain acquisition related costs of $0.4 million and $0.6 million, respectively. For the three and six months ended June 30, 2019, Other includes certain acquisition related costs of $0.6 million and $1.4 million, respectively.

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 27

|

| QUOTIENT TECHNOLOGY INC. |

| RECONCILIATION OF GROSS MARGIN TO NON-GAAP GROSS MARGIN |

| (Unaudited, in thousands) |

| | | | | | | | | | |

| | | Q2 FY 19 | | | Q1 FY 20 | | | Q2 FY 20 | |

| Revenues | | $ | 104,691 | | | $ | 98,787 | | | $ | 83,455 | |

| | | | | | | | | | | | | |

| Cost of revenues (GAAP) | | $ | 64,106 | | | $ | 61,111 | | | $ | 50,731 | |

| (less) Stock-based compensation | | | (562 | ) | | | (435 | ) | | | (387 | ) |

| (less) Amortization of acquired intangible assets | | | (5,377 | ) | | | (6,325 | ) | | | (6,278 | ) |

| (less) Restructuring charges | | | — | | | | (82 | ) | | | — | |

| Cost of revenues (Non-GAAP) | | $ | 58,167 | | | $ | 54,269 | | | $ | 44,066 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Gross margin (GAAP) | | $ | 40,585 | | | $ | 37,676 | | | $ | 32,724 | |

| Gross margin percentage (GAAP) | | | 38.8 | % | | | 38.1 | % | | | 39.2 | % |

| | | | | | | | | | | | | |

| Gross margin (Non-GAAP)* | | $ | 46,524 | | | $ | 44,518 | | | $ | 39,389 | |

| Gross margin percentage (Non-GAAP) | | | 44.4 | % | | | 45.1 | % | | | 47.2 | % |

| * Non-GAAP gross margin excludes stock-based compensation, amortization of acquired intangible assets and restructuring charges. |

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 28

|

| QUOTIENT TECHNOLOGY INC. |

| RECONCILIATION OF OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES |

| (Unaudited, in thousands) |

| | | | | | | | | | |

| | | Q2 FY 19 | | | Q1 FY 20 | | | Q2 FY 20 | |

| Revenues | | $ | 104,691 | | | $ | 98,787 | | | $ | 83,455 | |

| | | | | | | | | | | | | |

| Sales and marketing expenses | | | 23,870 | | | | 25,034 | | | | 23,814 | |

| (less) Stock-based compensation | | | (1,825 | ) | | | (1,402 | ) | | | (1,323 | ) |

| (less) Amortization of acquired intangible assets | | | (510 | ) | | | (916 | ) | | | (914 | ) |

| (less) Restructuring charges | | | — | | | | (526 | ) | | | — | |

| Non-GAAP Sales and marketing expenses | | $ | 21,535 | | | $ | 22,190 | | | $ | 21,577 | |

| Non-GAAP Sales and marketing percentage | | | 21 | % | | | 22 | % | | | 26 | % |

| | | | | | | | | | | | | |

| Research and development | | | 8,699 | | | | 10,593 | | | | 8,621 | |

| (less) Stock-based compensation | | | (1,073 | ) | | | (881 | ) | | | (839 | ) |

| (less) Restructuring charges | | | — | | | | (283 | ) | | | — | |

| Non-GAAP Research and development expenses | | $ | 7,626 | | | $ | 9,429 | | | $ | 7,782 | |

| Non-GAAP Research and development percentage | | | 7 | % | | | 10 | % | | | 9 | % |

| | | | | | | | | | | | | |

| General and administrative expenses | | | 12,835 | | | | 15,090 | | | | 12,268 | |

| (less) Stock-based compensation | | | (4,576 | ) | | | (4,808 | ) | | | (4,457 | ) |

| (less) Restructuring charges | | | — | | | | (591 | ) | | | — | |

| (less) Acquisiton related costs | | | (598 | ) | | | (226 | ) | | | (387 | ) |

| Non-GAAP General and administrative expenses | | $ | 7,661 | | | $ | 9,465 | | | $ | 7,424 | |

| Non-GAAP General and administrative percentage | | | 7 | % | | | 10 | % | | | 9 | % |

| | | | | | | | | | | | | |

| Non-GAAP Operating expenses* | | $ | 36,822 | | | $ | 41,084 | | | $ | 36,783 | |

| Non-GAAP Operating expense percentage | | | 35 | % | | | 42 | % | | | 44 | % |

| * Non-GAAP operating expenses excludes changes in fair value of contingent consideration, stock-based compensation, amortization of acquired intangible assets, restructuring charges, and acquisition related costs. |

| Q2 2020 FINANCIAL RESULTS AND BUSINESS UPDATES | 29

|