About Quotient Technology Inc.

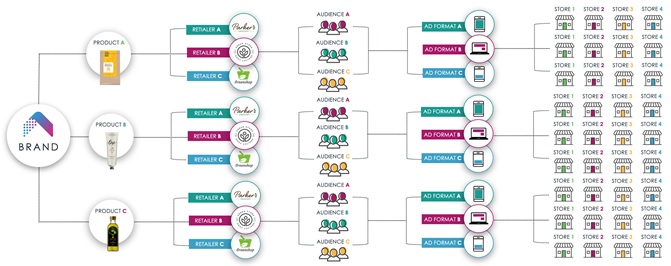

Quotient Technology (NYSE: QUOT) is the leading digital media and promotions technology company for advertisers, retailers and consumers. Quotient’s omnichannel platform is powered by exclusive consumer spending data, location intelligence and purchase intent data to reach millions of shoppers daily and deliver measurable, incremental sales.

Quotient partners with leading advertisers, publishers and retailers, including Clorox, Procter & Gamble, General Mills, Unilever, CVS, Dollar General, Peapod Digital Labs, a company of Ahold Delhaize USA, Amazon and Microsoft. Quotient is headquartered in Salt Lake City, Utah, and has offices across the US, as well as in Bangalore, Paris, London and Tel Aviv. For more information visit www.quotient.com.

Quotient and the Quotient logo are trademarks or registered trademarks of Quotient Technology Inc. and its subsidiaries in the United States and other countries. Other marks are the property of their respective owners.

Forward Looking Statements

This stockholder letter includes forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to management, including our current expectations with respect to revenues, non-GAAP operating expenses, Adjusted EBITDA, and operating cash flow for the second quarter of 2022, revenue, non-GAAP gross margin, Adjusted EBITDA for the full fiscal year 2022, and weighted average diluted shares outstanding for fiscal year 2022; our belief that, based upon restructuring of a majority of our commercial terms and operations, we will experience improvement in non-GAAP gross margins in future quarters; our belief that strong growth from higher margin national promotions will drive positive mix; our intent to expand our partnership network and drive greater adoption of our retail media platform in order to drive operating leverage and scale, and our belief that these factors, along with the majority of our shopper media and shopper promotion campaigns being recognized net of third-party media and distribution fees and the impact of continued cost management, will result in growth in gross profits and expansion of gross margins quarter-over-quarter as we move through the year; we believe the changes we have made to our business over the past two years provide a strong foundation from which to grow profitably; our belief that we are successfully executing on our new strategy, including signing up exciting new network partners and making positive changes to our existing partner relationships to extend the reach and availability of our promotions, as well as building a self-serve retail media platform designed to be scalable, transparent and a meaningful value-add to our clients and retailers by reducing many of their pain points; our expectation that recently signed network partnerships, combined with expected growth in high margin national promotions revenues, and continued adoption of our retail media platform will lead to increased scale and operating leverage as the year progresses; our expectation that we will deliver full year adjusted EBITDA of $35 - $45 million, despite losing one of our large retail partners, due to our expectation of benefiting from operating leverage and cost management measures that we are implementing; difficulty in predicting the future mix of our