QuickLinks -- Click here to rapidly navigate through this document

EXHIBIT 99.3

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

AND MANAGEMENT PROXY CIRCULAR

Annual Meeting — February 17, 2005

TABLE OF CONTENTS

| |

| | Page

|

|---|

| A. | | VOTING INFORMATION | | |

| | | Solicitation of Proxies | | 3 |

| | | Appointment of Proxy holders and revocation of Proxies | | 3 |

| | | Voting shares and principal holders of voting shares | | 4 |

| B. | | BUSINESS OF THE ANNUAL MEETING | | |

| | | Election of Directors | | 5 |

| | | Appointment of Auditors | | 5 |

| | | Shareholder proposals | | 6 |

C. |

|

BOARD OF DIRECTORS |

|

|

| | | Biographies | | 6 |

| | | Board of Directors Meetings Held and Attendance Record | | 10 |

D. |

|

DIRECTOR AND EXECUTIVE COMPENSATION |

|

|

| | | Compensation of Directors | | 11 |

| | | Statement of Executive Compensation | | 11 |

| | | Performance Graph | | 13 |

| | | Employment Contracts | | 13 |

| | | Directors and Officers Liability Insurance | | 13 |

| | | Stock Option Plan | | 13 |

| | | Stock Participation Plan | | 16 |

E. |

|

OTHER INFORMATION |

|

|

| | | Board Mandate | | 17 |

| | | Board Committee Mandates | | 17 |

| | | Audit Committee | | 17 |

| | | Report of the Compensation Committee | | 18 |

| | | Report of the Corporate Governance and Nominating Committee | | 19 |

| | | Statement of Corporate Governance Practices | | 19 |

| | | Amendment to the Meeting Agenda | | 28 |

| | | Approval of the Directors | | 28 |

SCHEDULE A: Mandate of the Compensation Committee |

SCHEDULE B: Mandate and Principles of the Corporate Governance and Nominating Committee |

2

A. VOTING INFORMATION

SOLICITATION OF PROXIES

This Management Proxy Circular (the "Circular") is provided in connection with the solicitation by the management of Axcan Pharma Inc. ("Axcan" or the "Corporation") of proxies to be used at the Annual General Meeting of Shareholders of the Corporation to be held on Thursday, February 17, 2005 at the time, place and for the purposes stated in the foregoing Notice, and at any adjournment thereof (the "Meeting").

While proxies will be solicited primarily by mail, certain employees of Axcan may also solicit proxies in person or by telephone. Axcan may also retain the services of an outside proxy solicitation firm to aid in the solicitation of proxies. The cost of soliciting proxies will be borne by Axcan.

Except where otherwise indicated, dollar amounts herein refer to Canadian dollars.

APPOINTMENT OF PROXYHOLDERS AND REVOCATION OF PROXIES

A shareholder has the right to appoint a person to represent him/her at the Meeting other than the representatives designated in the enclosed form of proxy. Such right may be exercised by crossing out the names of the persons specified in the second paragraph in the proxy and by inserting in the space provided the name of the other person the shareholder wishes to appoint. Such other person need not be a shareholder.

The proxy should be signed and deposited with Computershare Trust Company of Canada by mail at:

Computershare Trust Company of Canada

Proxy Department, 9th Floor

100 University Avenue

Toronto, Ontario M5J 2Y1

or faxed to 1-866-249-7775, so as to arrive not later than 5:00 p.m. (Montreal time) on February 15, 2005, or if the Meeting is adjourned, not later than 5:00 p.m. (Montreal time) on the business day (excluding Saturdays and holidays) before the reconvening of the Meeting.

If the shareholder is an individual, please sign your name exactly as your shares are registered.

If the shareholder is a corporation, the form of proxy must be executed by a duly authorized officer or attorney of the shareholder and, if the corporation has a corporate seal, its corporate seal should be affixed.

If shares are registered in the name of an executor, administrator or trustee, please sign exactly as the shares are registered. If the shares are registered in the name of a deceased or other shareholder, the shareholder's name must be printed in the space provided, the proxy must be signed by the legal representative with his/her name printed below his/her signature, and evidence of authority to sign on behalf of the shareholder must be attached to the form of proxy.

In many cases, shares beneficially owned by a holder are registered in the name of a securities dealer or broker or other intermediary, or a clearing agency. Beneficial holders should, in particular, review the heading "Voting of Common Shares — Advice to Beneficial Holders of Securities" in this Circular and carefully follow the instructions of their intermediaries.

A proxy is revocable. The giving of a proxy will not affect the right of a shareholder to attend and vote in person at the Meeting. A shareholder, or his attorney authorized in writing, who executed a form of proxy may revoke it in any manner permitted by law, including the depositing of an instrument or revocation in writing at the Corporation's head office, located at 597, Laurier Blvd, Mont-Saint-Hilaire, Quebec, J3H 6C4, Canada, at any time up to and including the day preceding the Meeting, or any adjournment thereof.

3

VOTING OF COMMON SHARES — ADVICE TO BENEFICIAL HOLDERS OF SECURITIES

The information set forth in this section is of significant importance to many shareholders, as a substantial number of the shareholders hold common shares through brokers and their nominees and not in their own name. Shareholders who do not hold their common shares in their own name (referred to in this Proxy Circular as "Beneficial Shareholders") should note that only proxies deposited by shareholders whose names appear on the records of the Corporation as the registered holders of the common shares can be recognized and acted upon at the Meeting. If common shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those shares will not be registered under the name of the shareholder of the Corporation. Such shares will more likely be registered under the name of the shareholder's broker or an agent of that broker. Shares held by brokers or their nominees can only be voted (FOR or withheld from voting) upon the instructions of the Beneficial Shareholder. Without specific instructions, brokers and nominees are prohibited from voting shares for their clients.

Applicable regulatory policy requires intermediaries and brokers to seek voting instructions from Beneficial Shareholders in advance of shareholders' meetings. Every intermediary and broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their common shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the form of proxy provided to registered shareholders; however, its purpose is limited to instructing the registered shareholder how to vote on behalf of the Beneficial Shareholder. A Beneficial Shareholder receiving a proxy from an intermediary cannot use that proxy to vote shares directly at the Meeting, rather the proxy must be returned to the intermediary well in advance of the Meeting in order to have the shares voted.

EXERCISE OF DISCRETION BY PROXY HOLDERS

The persons whose names are printed on the accompanying form of proxy will, on a show of hands or any ballot that may be called for, vote, withhold from voting or vote against a motion or proposal in respect of the shares for which they are appointed proxy holder in accordance with the direction of the shareholder appointing them. If no choice is specified by the shareholder, then such shares will be voted "FOR" the election of Directors proposed by Management and "FOR" the reappointment of Raymond Chabot Grant Thornton as the Auditors of the Corporation.

VOTING SHARES AND PRINCIPAL HOLDERS OF VOTING SHARES

The common shares are the only securities of the share capital of the Corporation that carry voting rights. As at December 15, 2004, the Corporation had 45,564,849 common shares outstanding.

The holders of common shares of record as at January 11, 2005 (the "Record Date") will be entitled to one vote per common share held. A list of shareholders entitled to vote at the Meeting will be available for inspection by shareholders on and after January 20, 2005 during normal business hours at the offices of Computershare Trust Company of Canada, 1500 University Street, Suite 700, Montreal, Quebec H3A 3S8, and will also be available for inspection at the Meeting.

As at January 12, 2005, to the knowledge of the Corporation's management, there was no person who owned, directly or indirectly, or who exercised control or direction over more than 10% of the outstanding common shares of the Corporation.

4

B. BUSINESS OF THE ANNUAL MEETING

ELECTION OF DIRECTORS

The Articles of the Corporation stipulate that the Board of Directors shall consist of a minimum of three (3) Directors and a maximum of twelve (12) Directors. Except where the authority to vote in favour of the election of the nominees is withheld, the persons whose name is printed on the enclosed form of proxy intend to vote FOR the election of the nominees whose names are set forth in the following table. Each Director elected will hold office until the next annual meeting of shareholders or until that Director's successor is duly elected, unless his office is vacated earlier. In the event that prior to the Meeting, any vacancies occur in the slate of nominees, it is intended that the discretionary power granted by the form of proxy shall be used by the persons named therein to vote at their discretion for any other person or persons as Directors. Management is not aware that any of the nominees as Directors is unwilling or unable to serve as Director if elected.

Please refer to Section C. Board of Directors, page 6 for each nominee's biography.

| Dr. E. Rolland Dickson | | Colin R. Mallet | | |

| Léon F. Gosselin | | François Painchaud | | |

| Jacques Gauthier | | David W. Mims | | |

| Daniel Labrecque | | Dr. Claude Sauriol | | |

| Louis Lacasse | | Michael M. Tarnow | | |

APPOINTMENT OF AUDITORS

Raymond Chabot Grant Thornton, chartered accountants, have been the auditors of the Corporation since September 1995.

Audit Fees

Raymond Chabot Grant Thornton billed the Corporation and its subsidiaries U.S.$288,000 for professional services rendered for the audit of the Corporation's financial statements for fiscal year 2004 and U.S.$222,000 for the 2003 fiscal year.

Certification Related Fees

Fees billed by Raymond Chabot Grant Thornton for certification and related services were U.S.$39,000 for the 2004 fiscal year and U.S.$181,000 for the 2003 fiscal year. These services consisted principally of due diligence and consultation on acquisitions and other business transactions, internal control advisory services outside of the scope of the audit and the issuance of consents and comfort letters.

Tax Related Fees

Fees billed by Raymond Chabot Grant Thornton for tax compliance, advice and planning services were U.S.$157,000 for the 2004 fiscal year and U.S.$246,000 for the 2003 fiscal year. These services consisted principally of tax planning, assistance with preparation of various tax returns, tax services rendered in connection with acquisitions and tax advice on other related matters.

All Other Fees

Fees for other services billed by Raymond Chabot Grant Thornton were U.S.$34,000 for the 2004 fiscal year and U.S.$45,000 for the 2003 fiscal year. These services consisted principally of management consulting services which did not involve information systems design and implementation services

Except where the authority to vote in favour of the appointment of Raymond Chabot Grant Thornton is withheld, the persons whose names appear on the enclosed form of proxy intend to vote FOR the appointment of Raymond Chabot Grant Thornton, chartered accountants, as auditors of the Corporation and to authorize the Board of Directors to determine the auditors' remuneration. The auditors will hold office until the next annual meeting of shareholders or until their successors are appointed.

5

SHAREHOLDER PROPOSALS

Shareholders who wish to submit a proposal for consideration at the next annual meeting to be held in 2006 must do so by submitting them to the attention of the Secretary of the Corporation on or before October 14, 2005, in the manner and subject to the limitations prescribed by theCanada Business Corporation Act.

C. BOARD OF DIRECTORS

BIOGRAPHIES

The following table sets forth, for each individual nominated by management for election as a Director, his name, municipality of residence, position with the Corporation, the year in which he first became a Director, principal occupation and, to the knowledge of management, the number of common shares of the Corporation beneficially owned, directly or indirectly, or over which control or direction was exercised by each nominee as at December 13, 2004. Stock options refer to Corporation share purchase options held by each nominee:

Dr. E. Rolland Dickson

Director since 2004

Member of the Corporate Governance and Nominating Committee

Independent

Common Shareholdings:

2003: N/A

2004: 1,800

Stock Options: 27,500 |

|

Dr. E. Rolland Dickson, 70, of Mantorville, Minnesota, USA, as served on Axcan's Board of Directors since February 2004. He is Emeritus Mary Lowell Leary and has served in senior leadership positions at the Mayo Clinic, including as Section Head in the Division of Gastroenterology. Among other activities, Dr. Dickson has served on the Executive Committee of Mayo's Institutional Research Committee and was Chair of the Fiscal Committee. He also was Professor of Medicine at Mayo Medical School/Mayo Clinic and is Emeritus Medical Director of Development at the Mayo Foundation where he has served since 1993. In 1999, Dr. Dickson was appointed to the Board of Trustees of the Mayo Foundation.

Dr. Dickson currently serves on the Board of Directors of NeoRx Pharmaceutical Corporation and of Pathway Corporation and is a member of the Scientific Advisory Board of Baxter International. He is President of Mayo Clinic Stiftung in Frankfurt, Germany and Chairman of the Board of Directors of the A.J. and Sigismunda Charitable Foundation. |

|

Jacques Gauthier

Director since 1995

Chairman of the Compensation Committee

Independent

Common Shareholdings:

2003: 1,000

2004: 1,000

Stock Options: 54,000 |

|

Jacques Gauthier, 77, of Town Mount-Royal, Quebec, has served on the Board of Directors of Axcan Pharma Inc. since December 1995 and was a member of the Corporate Governance and Nominating Committee during Fiscal 2004. He has held various senior management positions, both in Canada and abroad, with Upjohn Laboratories Inc. and Upjohn International Inc., predecessor corporations to Pharmacia Corporation. In 1984, Mr. Gauthier joined Bio-Méga/Boehringer Ingelheim Research Inc. and served as President and General Manager until 1996.

Mr. Gauthier is currently an advisor to management of the Montreal Clinical Research Institute (IRCM) and serves on the Board of Directors of a variety of medical and pharmaceutical companies and associations. |

|

6

Léon F. Gosselin

Director since 1993

President, Chief Executive Officer and Chairman of the Board

Not Independent

Common Shareholdings:

2003: 2,826,000

2004: 2,750,000(1)

Stock Options: 209,183 | | Léon F. Gosselin, 59, of Mont-Saint-Hilaire, Quebec, has served as Chairman of the Board, President, and Chief Executive Officer of Axcan Pharma Inc. since 1993. He is the co-founder of Interfalk Canada Inc., the predecessor of Axcan Pharma Inc., and has held various positions within the pharmaceutical industry including Assistant General Manager at Nordic Laboratories Inc., which is now part of Aventis S.A. He has also acted as a consultant in the pharmaceutical industry. Mr. Gosselin holds a Bachelor's degree in Biochemistry and an M.B.A. from the University of Sherbrooke. |

|

Daniel Labrecque

Director since 2003

Member of the Corporate Governance and Nominating Committee

Independent

Common Shareholdings:

2003: N/A

2004: 1,000

Stock Options: 27,500 |

|

Daniel Labrecque, 48, of Montreal, Quebec, has served on the Board of Directors of Axcan Pharma Inc. since August 2003 and was named a member of the Corporate Governance and Nominating Committee in August of 2004. He began his career in 1977 as Auditor at Raymond, Chabot, Martin, Paré, then held various positions at the Royal Bank of Canada, the Mercantile Bank of Canada, the National Bank of Canada, Lévesque Beaubien Geoffrion, Schroder Canada and Lazard Canada. In April 2002, Mr. Labrecque joined Rothschild where he now acts as President and Chief Executive Officer of its Canadian operations.

Mr. Labrecque is also Chairman of the Canadian INSEAD Foundation and member of the International Council of INSEAD, as well as Director of the C.D. Howe Institute and Director of La Fondation de l'Ecole Nationale de Cirque. |

|

Louis P. Lacasse

Director since 1995

Chairman of the Audit Committee

Member of the Compensation Committee

Independent

Common Shareholdings:

2003: 1,000

2004: 1,000

Stock Options: 24,500 |

|

Louis P. Lacasse, 48, of Montreal, Quebec, has served on the Board of Directors of Axcan Pharma Inc. since December 1995. He is President of GeneChem Management Inc., an organization that manages biotechnology venture capital funds. Prior to joining GeneChem in April 1997, Mr. Lacasse was Vice-President of Healthcare and Biotechnology of SOFINOV, the venture capital subsidiary of Caisse de depot et placement du Québec. During his ten years with SOFINOV and the Caisse de dépôt et placement du Québec, Mr. Lacasse was involved in numerous investments in small and medium-sized businesses in high technology industries such as biotechnology, software and telecommunications. He was also responsible for setting up a network of regional venture capital funds throughout Quebec and for investments in funds both in Canada and the US. He has been a member of the Board of Directors of many private and public companies including BioChem Pharma Inc.

Mr. Lacasse is presently a Director of four publicly traded companies; Targeted Genetics, Methylgene, Warnex-Pharma and Chromos Molecular Systems, and of four privately held companies. |

|

7

Colin R. Mallet

Director since 1995

Chairman of the Corporate Governance and Nominating Committee

Member of the Compensation Committee

Independent

Common Shareholdings:

2003: 5,000

2004: 5,000

Stock Options: 55,000 |

|

Colin R. Mallet, 61, of Vancouver, British Columbia, has served on the Board of Directors of Axcan Pharma Inc. since December 1995 and was a member of the Audit Committee during fiscal 2004. He has worked in senior executive positions in the pharmaceutical industry in Europe, North America and southeast Asia. He was President and Chief Executive Officer of Sandoz Canada Inc. (now Novartis) for seven years and is a past Chair of the Canadian Association of Research-Based Pharmaceutical companies.

He is currently a Director of three other public pharmaceutical companies; AnorMED Inc., Methylgene Inc. and Migenix Inc., and is Chair of the Corporate Governance Committees of each of these companies. |

|

David W. Mims

Director since 2000

Executive Vice-President and

Chief Operating Officer

Not Independent

Common Shareholdings:

2003: 1,000

2004: 1,000

Stock Options: 215,300 |

|

David W. Mims, 42, of Birmingham, Alabama, USA, has served on the Board of Directors of Axcan Pharma Inc. since March 2000. He has served as senior accountant at a major accounting firm before joining Russ Pharmaceuticals, Inc. in 1987 as Accounting Services Manager. In 1991, Mr. Mims helped found Scandipharm, Inc. and served the Corporation as Vice President, Chief Operating Officer, and Chief Financial Officer. He resigned from Scandipharm, Inc. in March 1998 to join Cebert Pharmaceuticals, Inc. as Executive Vice President and Chief Operating Officer. Mr. Mims joined Axcan in 2000, shortly after the Corporation acquired Scandipharm, and presently serves as Executive Vice President and Chief Operating Officer.

He is a Director of the University of Alabama, Birmingham (UAB) Research Foundation and a member of the American Institute of Certified Public Accountants and the Alabama Society of Certified Public Accountants. |

|

François Painchaud(2)

Director since 1995

Secretary

Not Independent

Common Shareholdings:

2003: 1,700

2004: 1,700

Stock Options: 38,500 |

|

François Painchaud, 41, of St-Lambert, Quebec, has served on the Board of Directors of Axcan Pharma Inc. as Secretary and Director since December 1995. He is a partner in Léger Robic Richard, lawyers, patent and trademark agents, which specializes in business law and intellectual property, including patent law. Mr. Painchaud has oriented his practice towards the field of commercial law with particular emphasis on licensing of intellectual property and technology transfers.

Mr. Painchaud serves on the Board of several privately held companies and is also a Trustee and Vice-President of the Licensing Executive Society (USA and Canada), Inc. |

|

8

Dr. Claude Sauriol

Director since 1993

Member of the Audit Committee

Independent

Common Shareholdings:

2003: 1,102,030

2004: 1,100,530(3)

Stock Options: 53,500 |

|

Dr. Claude Sauriol, 63, of Laval, Quebec, has served on the Board of Directors of Axcan Pharma Inc. since 1993. He is a founder of Biopharm Laboratory Inc. where he was President and Chief Executive Officer for more than 25 years. He also served Axcan Pharma Inc. as Vice President of Research and Development where, for three years, he was responsible for regulatory affairs and clinical research.

He is currently a Director of Algorithme Pharma Inc. and is a member of the Audit and Compensation Committees of this company. |

|

Michael M. Tarnow

Director since 2000

Member of the Corporate Governance and Nominating Committee

Member of the Audit Committee

Independent

Common Shareholdings:

2003: 2,000

2004: 2,000

Stock Options: 52,800 |

|

Michael M. Tarnow, 60, of Boston, Massachusetts, USA, has served on the Board of Directors of Axcan Pharma Inc. since August 2000 and was a member of the Compensation Committee during fiscal 2004. He has held various positions with Merck & Co., Inc. including President and Chief Executive Officer of Merck Frosst Canada from 1990 to 1994. From 1995 to 2000, he was President and Chief Executive Officer of Creative BioMolecules, a biotechnology corporation.

Currently, he is Chairman of Entremed and MediGene Inc, two publicly traded companies, and serves on the Board of Directors of a number of private companies including Caprion Pharmaceuticals and Xenon Pharmaceuticals. |

|

- (1)

- Includes a total of 2,750,000 shares owned by Gestion Axcan Inc., a corporation that is owned by Mr. Léon F. Gosselin and his family.

- (2)

- François Painchaud's law firm has been paid U.S. $556,724 for legal services rendered to the Corporation during the fiscal year 2004

- (3)

- Includes a total of 1,098,530 common shares owned by Gestion Danilor Inc., a Corporation that is owned by Dr. Claude Sauriol and his family, and 2,000 common shares held by Dr. Claude Sauriol.

9

BOARD OF DIRECTORS MEETINGS HELD AND ATTENDANCE RECORD

Board and Committee meetings held during fiscal year ended September 30, 2004

| Board of Directors | | 10 |

| Audit Committee | | 4 |

| Compensation Committee | | 5 |

| Corporate Governance and Nominating Committee | | 3 |

ATTENDANCE RECORD FOR FISCAL YEAR ENDED SEPTEMBER 30, 2004

Director

| | Board Meetings Attended

| | Committee Meetings Attended

|

|---|

Léon F. Gosselin

Chairman of the Board | | (8 out of 10) | | N/A |

Dr. E. Rolland Dickson (1)

Member of the Corporate Governance and Nominating Committee |

|

(2 out of 10) |

|

N/A |

Jacques Gauthier

Chairman of the Compensation Committee

Member of the Corporate Governance and Nominating Committee |

|

(8 out of 10) |

|

(5 of 5)

(3 of 3) |

Daniel Labrecque (2)

Member of the Corporate Governance and Nominating Committee |

|

(8 out of 10) |

|

N/A |

Louis P. Lacasse

Chairman of the Audit Committee

Member of the Compensation Committee |

|

(10 out of 10) |

|

(4 of 4)

(5 of 5) |

Colin R. Mallet

Member of the Audit Committee

Chairman of the Corporate Governance and Nominating Committee |

|

(5 out of 10) |

|

(3 of 4)

(2 of 3) |

David W. Mims

Director |

|

(10 out of 10) |

|

N/A |

François Painchaud

Secretary |

|

(9 out of 10) |

|

N/A |

Dr. Claude Sauriol

Member of the Audit Committee |

|

(10 out of 10) |

|

(4 out of 4) |

Jean Sauriol (3)

Director |

|

(10 out of 10) |

|

N/A |

Michael M. Tarnow

Member of the Compensation Committee

Member of the Corporate Governance and Nominating Committee |

|

(10 out of 10) |

|

(4 out of 5)

(3 out of 3) |

- (1)

- Dr. Rolland E. Dickson joined Axcan's Board of Directors in February of 2004 and was named a member of the Corporate Governance and Nominating Committee in August of 2004. Mr. Daniel Labrecque was named a member of the Corporate Governance and Nominating in August of 2004.

- (2)

- Mr. Jean Sauriol will not seek renewal of his mandate as Director for the upcoming year. Committee

10

D. DIRECTOR AND EXECUTIVE COMPENSATION

COMPENSATION OF DIRECTORS

Only outside directors receive compensation for their duties as corporate directors and their attendance to the Board of Directors and Committee meetings (see summary table of compensation below). For the fiscal year ended September 30, 2004, the total amount of compensation paid to outside Directors was U.S. $207,746.

SUMMARY TABLE OF COMPENSATION FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2004

| Annual lump sum fee to outside directors (1)(2) | | $US 10,000 |

| Fee per Board of Directors meeting attendance | | $US 1,000 |

| Fee per Board of Directors meeting attendance by way of conference call | | $US 666 |

| Annual lump sum for each Board of Directors Committee Chair | | $US 2,500 |

| Fee per Board of Directors Committee meeting attendance | | $US 1,000 |

| Fee per Board of Directors Committee meeting attendance by way of conference call | | $US 666 |

- (1)

- Excludes Mr. Léon F. Gosselin, Chairman of the Board, and Mr. David W. Mims, corporate director, who are not compensated for their duties as directors and attendance to the Board of Directors meetings since they are not outside directors.

- (2)

- Board related fees totalling $US 29,932 where paid to Mr. François Painchaud during fiscal year 2004. Said fees are included in the total amount of compensation paid to outside directors for the fiscal year ended September 30, 2004.

In addition, directors are entitled to receive compensation under the Corporation's Stock Option Plan. In fiscal 2004, 80,000 options were granted to outside directors.

STATEMENT OF EXECUTIVE COMPENSATION

The Axcan Pharma Executive Compensation Program (the "Program") is designed to attract, motivate and retain talented individuals and the Program focuses on the long-term success of the Corporation. The Program is developed and administered in a manner that rewards superior operating performance while maximizing shareholder value. Rewards are linked to the accomplishment of specific business goals and outstanding individual performance.

The Program consists of the following three basic components:

- 1.

- Base salary that is internally equitable and externally competitive.

- 2.

- Annual compensation consisting of a cash bonus linked to the performance of both the Corporation and the individual executive officer.

- 3.

- Long-term incentives comprised of Corporation stock options.

Each compensation component has a different function, but all elements work in concert to maximize corporate and individual performance by establishing specific, aggressive operational and financial goals and by providing financial incentives to employees based on their level of achievement of these goals.

Specifically, the Program is designed to:

- •

- Motivate work performance and behavior that supports the corporate goals;

- •

- Motivate individual employees to achieve high-quality, consistent, and balanced business results over the long-term;

- •

- Reward individual employees based on their contributions to the overall success of Axcan Pharma;

- •

- Increase individual employees' understanding of the Corporation's major business goals and the way in which their individual roles and contributions strengthen and aid in the success of the Corporation; and

- •

- Provide very competitive compensation opportunities so the Corporation can attract, retain and motivate top performing employees.

As with other corporate programs within the Axcan organization, the design and administration of the Axcan Pharma Executive Compensation Program is guided and supported by the following six core values of the Corporation:Compassion, Service, Resourcefulness, Integrity, Commitment andFlexibility.

11

The table below details compensation information for the last three fiscal years for the Chief Executive Officer and the Chief Financial Officer of the Corporation and the three other most highly remunerated executive officers ("Named Executive Officers"), as measured by base salary and incentive bonuses during the most recently completed financial year. The table also includes similar information in respect of two executive officers who resigned during fiscal 2004 and would otherwise have been Named Executive Officers. The Corporation paid its Named Executive Officers an aggregate of $2,429,576 in salaries and bonuses during fiscal 2004.

SUMMARY COMPENSATION TABLE

Name and principal position

| | Year

| | Salary

(Cdn$)

| | Bonus

(Cdn$)

| | Other Annual Compensation

(Cdn$)

| | Long-Term Compensation Securites under

options (#)

| | All other Compensation

(Cdn$)

|

|---|

Léon F. Gosselin

President and

Chief Executive Officer | | 2004

2003

2002 | | 400,000

375,000

300,000 | | 150,000

175,000

188,623 | | —

—

— | | 12,500

12,500

12,500 | | —

—

— |

David W. Mims

Executive Vice President and

Chief Operating Officer |

|

2004

2003

2002 |

|

392,557

380,744

322,506 |

|

132,980

153,762

180,281 |

(1)

|

—

—

— |

|

7,500

7,500

112,500 |

|

—

—

— |

Dr. François Martin

Senior Vice President,

Scientific Affairs |

|

2004

2003

2002 |

|

235,200

210,221

182,700 |

|

65,000

66,241

59,648 |

|

—

—

— |

|

36,000

6,000 |

|

—

—

— |

Dr. Norbert Claveille

General Director

Axcan Pharma S.A. |

|

2004

2003

2002 |

|

305,254

293,593

239,858 |

|

100,431

74,835

68,307 |

(2)

|

—

—

— |

|

—

—

110,000 |

|

—

—

— |

Jean Vézina

Vice President, Finance and

Chief Financial Officer |

|

2004

2003

2002 |

|

175,200

160,200

150,200 |

|

40,000

43,099

44,580 |

|

—

—

— |

|

5,000

5,000

5,000 |

|

—

—

— |

John R. Booth

Senior Vice President

North American Commercial Operations |

|

2004

2003

2002 |

|

262,037

292,880

275,310 |

(1)(3)

|

—

95,296

99,347 |

|

—

—

— |

|

6,000

6,000

5,000 |

|

—

—

— |

Patrick L. McLean

Senior Vice President

European Commercial Operations |

|

2004

2003

2002 |

|

170,917

195,700

185,200 |

(4)

|

—

66,163

51,603 |

|

—

—

— |

|

6,000

6,000

5,000 |

|

—

—

— |

- (1)

- Amount paid in US$ but converted in Cdn$ for the purpose of this table, at the following rate: $US 1 = $Cdn 1.3298

- (2)

- Amount paid in Euros but converted in Cdn$ for the purpose of this table, at the following rate: Euro 1 = $Cdn 1.6127

- (3)

- Up to August 15, 2004

- (4)

- Up to May 31, 2004

12

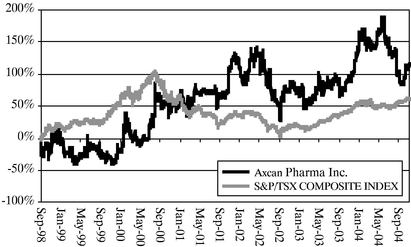

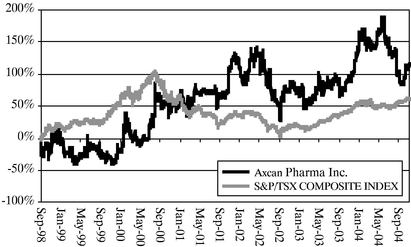

PERFORMANCE GRAPH

The following graph compares the cumulative total shareholder return for a CDN $100 investment in common shares of the Corporation made September 30, 1998 on the Toronto Stock Exchange and the cumulative total return of the TSX S&P Stock Index for the period ended September 30, 2004.

EMPLOYMENT CONTRACTS

Mr. Léon F. Gosselin's employment contract is for a term of five (5) years and will expire on September 30, 2008 and Mr. David W. Mims has also a five (5) year contract that will expire on September 30, 2008. Both contracts, which were negotiated by the Compensation Committee and ratified by the full Board in November 2003, contain usual termination provisions with a severance payment equal to two (2) times annual base salary.

DIRECTORS AND OFFICERS LIABILITY INSURANCE

The Corporation maintains liability insurance policies covering Directors and officers of the Corporation while acting in such capacity. Aggregate coverage for such matters is US $25,000,000 subject to a corporate deductible of US $500,000 per claim. The total premium paid by the Corporation in respect of this insurance coverage during the annual policy period from April 1, 2004 to April 1, 2005 is US $804,000.

STOCK OPTION PLAN — FISCAL YEAR 2004

The Corporation has adopted a stock option plan (the "Stock Option Plan") for the Directors, senior executives, full-time employees and consultants of the Corporation and its subsidiaries as designated from time to time by the Board of Directors of the Corporation or the Compensation Committee, pursuant to which options to purchase an aggregate of 4,500,000 common shares, which represent less than ten percent (10%) of all issued and outstanding common shares, may be granted.

The number of common shares covered by any stock option, the exercise price, expiry date and vesting period of such stock option and any other matter pertaining thereto are determined by the Board of Directors of the Corporation or the Compensation Committee at the time of its grant.

Options granted are non-assignable and no single person may be granted options covering more than 5% of the Corporation's issued and outstanding common shares. No option may be allotted for a period exceeding 10 years and the exercise price of each stock option is equal to the market value of the common shares on the date immediately preceding the grant of such stock option. The Stock Option Plan further provides that no more than 10% of the outstanding common shares may be reserved for issuance pursuant to stock options granted to insiders, or issued to insiders within a one-year period, and that no more than 5% of the outstanding common shares may be issued to any one insider and such insider's associates within a one-year period.

13

As of September 30, 2004, options for the purchase of a total of 2,600,556 common shares were outstanding under the Stock Option Plan as follows:

Optionee Group

| | Number of Optionees

| | Number of Optioned Shares

| | Exercise Price

($)

| | Market Value Date of Grant

| | Expiration Date

|

|---|

| Senior Executives | | 13 | | 12,500 | | 11.05 | | 11.05 | | August 20, 2007 |

| | | | | 13,000 | | 7.45 | | 7.45 | | May 24, 2009 |

| | | | | 304,372 | | 10.55 | | 10.55 | | February 23, 2010 |

| | | | | 2,000 | | 12.60 | | 12.60 | | August 9, 2010 |

| | | | | 65,000 | | 16.35 | | 16.35 | | October 3, 2010 |

| | | | | 15,000 | | 15.25 | | 15.25 | | November 8, 2010 |

| | | | | 78,679 | | 15.25 | | 15.25 | | December 18, 2010 |

| | | | | 215 | | 15.20 | | 15.20 | | February 21, 2011 |

| | | | | 14,000 | | 18.08 | | 18.08 | | May 9, 2011 |

| | | | | 22,000 | | 17.00 | | 17.00 | | July 17, 2011 |

| | | | | 160,000 | | 20.36 | | 20.36 | | December 6, 2011 |

| | | | | 52,600 | | 22.00 | | 20.36 | | December 18, 2011 |

| | | | | 105,000 | | 22.00 | | 22.00 | | May 6, 2012 |

| | | | | 57,200 | | 17.00 | | 17.00 | | November 11, 2012 |

| | | | | 35,000 | | 18.14 | | 18.14 | | February 19, 2013 |

| | | | | 175,500 | | 17.35 | | 17.35 | | November 10, 2013 |

| | | | | 60,000 | | 24.80 | | 24.80 | | February 4, 2014 |

| | | | | 50,000 | | 24.20 | | 24.20 | | May 4, 2014 |

| Outside Directors | | 9 | | 4,500 | | 7.45 | | 7.45 | | May 24, 2009 |

| | | | | 9,000 | | 10.55 | | 10.55 | | February 23, 2010 |

| | | | | 120,550 | | 15.25 | | 15.25 | | November 8, 2010 |

| | | | | 45,000 | | 15.20 | | 15.20 | | February 21, 2011 |

| | | | | 45,000 | | 19.04 | | 19.04 | | February 20, 2012 |

| | | | | 52,500 | | 18.14 | | 18.14 | | February 19, 2013 |

| | | | | 20,000 | | 18.74 | | 18.74 | | September 25, 2013 |

| | | | | 87,500 | | 26.48 | | 26.48 | | February 18, 2014 |

| Other Employees of the Company | | 230 | | 3,000 | | 11.25 | | 11.25 | | July 7, 2008 |

| | | | | 17,000 | | 6.00 | | 6.00 | | December 22, 2009 |

| | | | | 129,468 | | 10.55 | | 10.55 | | February 23, 2010 |

| | | | | 5,600 | | 10.00 | | 10.00 | | April 25, 2010 |

| | | | | 1,100 | | 12.60 | | 12.60 | | August 9, 2010 |

| | | | | 9,700 | | 15.25 | | 15.25 | | November 8, 2010 |

| | | | | 56,800 | | 15.25 | | 15.25 | | December 18, 2010 |

| | | | | 22,200 | | 15.20 | | 15.20 | | February 21, 2011 |

| | | | | 12,550 | | 18.08 | | 18.08 | | May 9, 2011 |

| | | | | 4,500 | | 17.00 | | 17.00 | | July 17, 2011 |

| | | | | 4,500 | | 18.00 | | 18.00 | | September 5, 2011 |

| | | | | 11,800 | | 16.45 | | 16.45 | | October 11, 2011 |

| | | | | 2,800 | | 20.36 | | 20.36 | | December 6, 2011 |

| | | | | 114,810 | | 22.00 | | 20.36 | | December 18, 2011 |

| | | | | 18,400 | | 19.15 | | 19.15 | | February 19, 2012 |

| | | | | 17,600 | | 22.00 | | 22.00 | | May 6, 2012 |

| | | | | 11,600 | | 19.96 | | 19.96 | | August 6, 2012 |

| | | | | 13,800 | | 17.80 | | 17.80 | | November 10, 2012 |

| | | | | 165,010 | | 17.00 | | 17.00 | | Decemder 10, 2012 |

| | | | | 33,500 | | 17.85 | | 17.85 | | February 18, 2013 |

| | | | | 8,000 | | 18.14 | | 18.14 | | February 19, 2013 |

| | | | | 50 | | 15.32 | | 15.32 | | April 14, 2013 |

| | | | | 8,500 | | 16.02 | | 16.02 | | May 11, 2013 |

| | | | | 14,800 | | 18.05 | | 18.05 | | August 5, 2013 |

| | | | | 25,500 | | 17.50 | | 17.50 | | November 9, 2013 |

| | | | | 196,352 | | 17.35 | | 17.50 | | November 10, 2013 |

| | | | | 25,500 | | 25.28 | | 25.28 | | February 3, 2014 |

| | | | | 26,500 | | 24.20 | | 24.20 | | May 4, 2014 |

| | | | | 3,000 | | 24.38 | | 24.38 | | May 5, 2014 |

| | | | | 30,500 | | 24.72 | | 24.72 | | August 4, 2014 |

14

The tables below set forth information regarding grants of share options under the Stock Option Plan to the Named Executive Officers and options exercised by them during the fiscal year ended September 30, 2004.

OPTION GRANTS TO NAMED EXECUTIVE OFFICERS DURING FISCAL YEAR 2004

Name

| | Optioned Shares

| | % of Total Options Granted to Employees in fiscal

Year

| | Exercise or Base Price

($/Share)

| | Market Value of Securities Underlying Options on the Date of

Grant ($/Share)

| | Expiration Date

|

|---|

| Léon F. Gosselin | | 12,500 | | 1.7% | | 17.35 | | 17.35 | | November 10, 2013 |

| David W. Mims | | 7,500 | | 1.0% | | 17.35 | | 17.35 | | November 10, 2013 |

| Dr. François Martin | | 6,000

30,000 | | 0.8%

4.1% | | 17.35

24.79 | | 17.35

24.79 | | November 10, 2013

February 4, 2014 |

| Dr. Norbert Claveille | | — | | — | | — | | — | | — |

| Jean Vézina | | 5,000 | | 0.7% | | 17.35 | | 17.35 | | November 10, 2013 |

These options vest over 5 years at 20% per year and expire after 10 years.

15

OPTIONS EXERCISED BY NAMED EXECUTIVE OFFICERS DURING FISCAL YEAR 2004 AND YEAR-END OPTION VALUES

| |

| |

| | Unexercised Options at Year-End

| | Value of Unexercised Options at Year-End(2)

|

|---|

Name

| | Shares Purchased on Exercise

| | Aggregate Value Realized(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Léon F. Gosselin | | — | | | — | | 10,000 | | — | | $ | 121,700 | | | — |

| | | — | | | — | | 111,600 | | 27,900 | | $ | 1,012,212 | | $ | 253,053 |

| | | — | | | — | | 13,309 | | 8,874 | | $ | 58,160 | | $ | 38,779 |

| | | — | | | — | | 5,000 | | 7,500 | | | — | | | — |

| | | — | | | — | | 2,500 | | 10,000 | | $ | 6,550 | | $ | 26,200 |

| | | — | | | — | | — | | 12,500 | | | — | | $ | 28,375 |

David W. Mims |

|

60,000 |

|

$ |

983,144 |

|

44,000 |

|

26,000 |

|

$ |

399,080 |

|

$ |

235,820 |

| | | — | | | — | | 10,680 | | 7,120 | | $ | 46,672 | | $ | 31,114 |

| | | — | | | — | | 3,000 | | 4,500 | | | — | | | — |

| | | — | | | — | | 42,000 | | 63,000 | | | — | | | — |

| | | — | | | — | | 1,500 | | 6,000 | | $ | 3,930 | | $ | 15,720 |

| | | — | | | — | | — | | 7,500 | | | — | | $ | 17,025 |

Dr. François Martin |

|

7,500 |

|

$ |

87,075 |

|

12,500 |

|

— |

|

$ |

107,125 |

|

|

— |

| | | 5,000 | | $ | 84,265 | | 3,000 | | — | | $ | 36,510 | | | — |

| | | — | | | — | | 24,442 | | 6,111 | | $ | 221,689 | | $ | 55,427 |

| | | — | | | — | | 8,010 | | 5,340 | | $ | 35,004 | | $ | 23,336 |

| | | — | | | — | | 2,000 | | 3,000 | | | — | | | — |

| | | — | | | — | | 1,200 | | 4,800 | | $ | 3,144 | | $ | 12,576 |

| | | — | | | — | | — | | 6,000 | | | — | | $ | 13,620 |

| | | — | | | — | | — | | 30,000 | | | — | | | — |

Dr. Norbert Claveille |

|

— |

|

|

— |

|

44,000 |

|

66,000 |

|

|

— |

|

|

— |

Jean Vézina |

|

18,400 |

|

$ |

336,845 |

|

— |

|

— |

|

|

— |

|

|

— |

| | | — | | | — | | 25,414 | | 6,353 | | $ | 230,501 | | $ | 57,625 |

| | | — | | | — | | 5,340 | | 3,560 | | $ | 23,336 | | $ | 15,557 |

| | | — | | | — | | 2,000 | | 3,000 | | | — | | | — |

| | | — | | | — | | 1,000 | | 4,000 | | $ | 2,620 | | $ | 10,480 |

| | | — | | | — | | — | | 5,000 | | | — | | $ | 11,350 |

- (1)

- Equals market value at exercise date over exercise price times the number of shares purchased.

- (2)

- Equals market value at year end over exercise price times the number of shares optioned.

STOCK PARTICIPATION PLAN

The Corporation has adopted an employee stock participation plan (the "Participation Plan"). The Participation Plan provides certain full-time employees of the Corporation with the opportunity to purchase common shares and thereby participate in the growth and development of the Corporation. The maximum number of common shares, which may be purchased pursuant to the Participation Plan is 185,000.

Pursuant to the Participation Plan, eligible employees are entitled to purchase annually a number of common shares, at a price equal to the market value as of the date immediately preceding the date of purchase, having an aggregate purchase price not exceeding 5% of their annual salary. The Corporation contributes an additional sum equal to 50% of the eligible employee's contribution to be used toward the purchase of additional common shares.

As of September 30, 2004, 101,554 common shares had been purchased pursuant to the Participation Plan.

16

E. OTHER INFORMATION

BOARD MANDATE

The Board of Directors assumes ultimate responsibility for the stewardship of the Corporation and carries out its mandate directly and through considering recommendations it receives from the three (3) Committees of the Board and from management.

Management is responsible for the day-to-day operations of the Corporation, and pursues Board approved strategic initiatives within the context of authorized business, capital plans and corporate policies. Management is expected to report to the Board on a regular basis on short-term results and long-term development activities.

The Board has adopted a written mandate, which details its specific responsibilities (which can be found at Schedule A of this Circular or at the Corporation's website www.axcan.com).

Operation of the Board

The Board is currently comprised of eleven (11) members. It is proposed that the shareholders elect ten (10) Directors at the Meeting. Each Director is elected annually by the shareholders and serves for a term that will end at the Corporation's next annual meeting. The Board believes that ten (10) Directors is an appropriate number to ensure the Board will be able to function effectively and independently of management.

All current Directors except Mr. Léon F. Gosselin, the Chairman of the Board, President & Chief Executive Officer of the Corporation, Mr. David W. Mims, the Corporation's Executive Vice President and Chief Operating Officer, and Mr. François Painchaud, the Corporation's Corporate Secretary, are "Independent" (as defined in the Corporation's Corporate Governance and Nominating Committee Mandate and Principles, which can be found at Schedule B of the Circular or at the Corporation's website www.axcan.com).

The Board has regularly scheduled quarterly meetings with special meetings to review matters when needed.

The Board of Directors met ten (10) times in fiscal 2004.

The Board, as part of its corporate governance review, with the assistance of the Corporate Governance and Nominating Committee, has engaged itself in a process that upon completion should result in the separation of the position of Chairman of the Board and the position of President and Chief Executive Officer of the Corporation.

BOARD COMMITTEE MANDATES

The Board of Directors has created three (3) Committees: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. These Committees allow Directors to share responsibility, to delegate powers, and to devote the necessary resources to a particular issue or area. Board Committees were created to achieve the objectives of the Board efficiently and utilize Board member's skills to the best advantage of the Corporation.

All Committees report and make recommendations to the Board on specific matters reviewed.

AUDIT COMMITTEE

The principal duties of the Audit Committee are to review annual and interim financial statements and all legally required public disclosure documents containing financial information prior to their approval by the Directors, review the planned scope of the examination of the annual consolidated financial statements by the auditors of the Corporation and review the adequacy of the systems of internal accounting and audit controls established by the Corporation. The Audit Committee is also responsible for overseeing reporting on internal control and management information systems. Commencing with the 2005 fiscal year, the Audit Committee, or in the absence of the full Committee, the Chairman of the Audit Committee is charged with pre-approving all engagements of the Corporation's auditors for audit-related and permitted non-audit services.

17

The current members of the Audit Committee are:

- •

- Louis P. Lacasse, Chairman

- •

- Dr. Claude Sauriol

- •

- Michael M. Tarnow.

The Audit Committee met four (4) times in fiscal 2004.

The three (3) Audit Committee members are Independent directors.

The Charter of the Audit Committee can be found at the Corporation's website www.axcan.com.

REPORT OF THE COMPENSATION COMMITTEE

The primary responsibility of the Compensation Committee is to evaluate the performance of the CEO and the other Named Executive Officers and to review their respective objectives and compensation. The Compensation Committee is also responsible for the compensation policies and benefits granted to employees of the Corporation and recommends Corporation guidelines including the establishment of categories of executives, pay scales, performance bonus guidelines, benefits and standardized grants of options for each category of executives.

The Compensation Committee determines the compensation of senior executive officers based on industry data and with the goal to attract, retain and motivate key executive officers to ensure the long-term success of the Corporation.

The compensation of senior executive officers is reviewed each year and includes the three (3) following components: base salary, annual bonus based on performance and grant of stock options.

The grant of stock options has been an important element in the development of the Corporation's compensation policy and the Corporation's Stock Option Plan has been adopted to attract and retain current employees by offering an incentive measure that permits participation in the Corporation's long-term development.

Based on the Corporation's achievements for the last fiscal year, the results regarding other corporate strategic objectives and Mr. Léon F. Gosselin's contribution to these results, the Compensation Committee has recommended, for the fiscal year ended September 30, 2004, the payment of a bonus calculated according to a formula determined in Mr. Léon F. Gosselin's Employment Agreement and an additional bonus, these bonuses aggregating $150,000 for such fiscal year. Bonuses for the other senior executives were established pursuant to the Corporation's existing Compensation Plan.

The current members of the Compensation Committee are:

- •

- Jacques Gauthier, Chairman

- •

- Louis P. Lacasse

- •

- Colin R. Mallet

The Compensation Committee held five (5) meetings during the fiscal year 2004.

The three (3) Compensation Committee members are Independent Directors.

The Compensation Committee Mandate can be found at the Corporation's websitewww.axcan.com

The Compensation Committee has approved the publication of this report and its inclusion in the Management Proxy Circular.

| |  | |  |

| |

| |

|

| Jacques Gauthier | | Louis P. Lacasse | | Colin R. Mallet |

18

REPORT OF THE CORPORATE GOVERNANCE AND NOMINATING COMMITTEE

The Board has always considered that the values and ethics of the Corporation and its employees are the cornerstone of the Corporation's operations. Transparency and high standards of corporate governance have been an essential part of those values, and the Corporate Governance and Nomination Committee is charged with maintaining these values.

The Committee is chaired by an independent director, and all of its members are also independent directors. The current members of the Corporate Governance and Nominating Committee are:

- •

- Colin R. Mallet, Chairman

- •

- Dr. E. Rolland Dickson

- •

- Daniel Labrecque

- •

- Michael M. Tarnow

The Corporate Governance and Nominating Committee met three (3) times in fiscal 2004.

The Corporate Governance and Nominating Committee Mandate and Principles can be found at the Corporation's websitewww.axcan.com

In carrying out its responsibilities, the Committee took the following actions in fiscal 2004:

- •

- Completed the annual Board Survey, to provide an assessment by Directors of the Board and Board Committee effectiveness;

- •

- Monitored national and international developments in the practice of corporate governance, making recommendations to the Board to improve the Corporation's corporate governance processes, based on these developments and the results of the annual Board effectiveness survey;

- •

- Reviewed the size and composition of the Board, to ensure an appropriate balance of expertise, resulting in the nomination of two new directors, and the re-alignment of the membership of the Board committees;

- •

- Reviewed the policy and performance of the Board and its committees, in relation to the TSX corporate governance recommendations, and prepared the Statement on the Corporation's corporate governance practices appearing below;

- •

- Ensured that the mandates of the Board and its committees, and the main governance policies (Ethics, Disclosure, etc.) are available to shareholders, through the Corporation Website www.axcan.com;

The Corporate Governance and Nomination Committee has approved the publication of this report and its inclusion in the Management Proxy Circular.

| |  | |  |

| |

| |

|

| C. Mallet | | J. Gauthier | | M. Tarnow |

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Toronto Stock Exchange (TSX), requires each listed Corporation such as Axcan to disclose its Corporate Governance practices each year in their annual report and/or management proxy circular. To comply with the TSX requirements, Axcan must describe its system of Corporate Governance and compare its practices against each of the 14 guidelines set out in Section 474 of the TSX Corporation Manual.

Also, major securities regulatory changes in the United States affecting Axcan have recently come into effect or have been proposed. Many such changes arise from the Sarbanes-Oxley Act of 2002, and subsequent rules and regulations issued by the U.S. Securities and Exchange Commission (SEC), as well as the NASDAQ new Corporate Governance Rules approved in November 2003.

Furthermore, on October 29, 2004, the Canadian Securities Administrators (CSA) released a new version of their rule on disclosure of Corporate Governance practices (CSA Proposals). The CSA Proposals relate to National Instrument 58-101 — Disclosure of Corporate Governance Practices (the Instrument) and a related National Policy 58-201, renamed asCorporate Governance Guidelines (the Guidelines). The CSA Proposals also affect Multilateral Instrument 52-110 — Audit Committees, aiming to make the definition of independence consistent between the proposed new Instrument and Multilateral Instrument 52-110, and also to match more closely definitions used by the SEC and the New-York Stock Exchange (NYSE).

19

The Corporate Governance and Nominating Committee has closely monitored the various changes and proposed changes in the regulatory environment and, where applicable, amended its governance practices to align them with these changes. The Committee believes that Axcan has adopted a proactive approach in meeting and exceeding "best practices" in this current environment of evolving Corporate Governance practices, requirements and guidelines.

Set out in the following table, are the details of Axcan's Corporate Governance practices in compliance with the TSX guidelines now in force. Where applicable, the table further sets out where the Corporation applies the recent CSA proposed changes. Also, the table outlines where the Corporation meets the requirements or guidelines of the Sarbanes-Oxley Act and the NASDAQ Corporate Governance Rules.

GUIDELINE

| | AXCAN'S PRACTICE

|

|---|

| 1. | | | | The Board of Directors should explicitly assume responsibility for stewardship of the Corporation, adopt a written mandate in which it assumes said responsibility, and as part of the overall stewardship responsibility, should assume responsibility for:

TSX Guidelines

CSA Proposals | | The Board of Directors of the Corporation assumes responsibility for the stewardship of the Corporation and the enhancement of shareholder value. The Board has formalized its position on Corporate Governance in a documented statement of Axcan Corporate Government Principles (which can be found at the Corporation's websitewww.axcan.com). All key responsibilities covered by the TSX Guidelines are addressed in these Principles.

The Board has also adopted a written mandate in which it has explicitly assumed responsibility for the stewardship of Axcan. The accountabilities and responsibilities of Directors are further defined in the Directors' position description, which is available at the Corporation's website www.axcan.com. |

|

|

a) |

|

adoption of strategic planning process and approving, on at least an annual basis, a strategic plan, which takes into account, among other things, the opportunities and risks for the business;

TSX Guidelines |

|

Board members and management participate in an annual strategic planning review process. Any revisions to the plan have to be approved by the Board. Implementation of the strategic plan is the responsibility of management. The Board systematically reviews opportunities by weighing them against the business risks and by ensuring that these risks are actively managed. The Board provides leadership but does not become involved in day-to-day matters. Management reports to the Board on a regular basis on the Corporation's progress in achieving these strategic objectives. |

|

|

b) |

|

the identification of the principal risks of the Corporation's business and ensuring the implementation of appropriate systems to manage these risks;

TSX Guidelines |

|

The Board believes that it understands the specific risks of Axcan's business. The Board has identified specific Board Committee responsibilities for key risks, and the Committees review these with management on a regular basis. Major strategic risks are reviewed by the Board as part of its annual review of the Corporation's strategic plan. Axcan also has in place an environmental risk review process that includes regular reporting to the Corporate Governance and Nominating Committee. |

|

|

c) |

|

succession planning, including appointing, training and monitoring senior management;

TSX Guidelines

CSA Proposals

Sarbanes-Oxley Act |

|

Appointments to senior management are subject to Board review. A system for management succession planning and development has been established, and plans for senior executives are reviewed annually by the Compensation Committee and the Board. The performance of the Chief Operating Officer (COO), as well as the Chief Executive Officer (CEO), is monitored by the Board through the Compensation Committee. The performance of other members of senior management is monitored by the CEO, but compensation recommendations are reviewed with the Compensation Committee. |

20

| |

| |

| |

|

|---|

| | | d) | | a Communications policy for the Corporation;

TSX Guidelines

CSA Proposals

Sarbanes-Oxley Act | | Axcan employs two Investor Relations professionals and complies fully with all regulatory requirements. It has systems in place to ensure effective communication with the public and its shareholders, as well as to ensure its compliance with regulatory reporting and disclosure obligations.

A formal communication policy (the "Disclosure Policy"), has been approved by the Board, to foster enhanced communication between the Board, the Corporation's security holders and its senior management. The Board reviews the contents of all major disclosure documents prepared by or on behalf of the Corporation, this includes, among others, the Annual Report, the Annual Information Form, and Management's Discussion and Analysis of quarterly results. Quarterly earnings conference calls are accessible on a live and recorded basis via telephone and Internet. The formal lines of communication between security holders and the Board are through the Chairman. Also, to further enhance communications with security holders, the Board has appointed a designated Independent director, Mr. Michael M. Tarnow, to receive security holders feedback and who can be contacted on request through the Corporation's Investor Relations contact (see Investor Relations atwww.axcan.com).

Also, Axcan has a policy addressing Insider Trading (Insider Trading Policy can be found at the Corporation's websitewww.axcan.com) that is required to be followed by members of the Board, employees, and insiders. Axcan periodically sets trading blackout periods for employees and Directors in advance of news releases, quarterly financial reports and in other circumstances, as deemed appropriate. |

21

| |

| |

| |

|

|---|

| | | e) | | the integrity of the Corporation's internal control and management information systems;

TSX Guidelines

CSA Proposals | | The Board has appointed an Audit Committee composed solely of Independent Directors, who are financially literate. The Committee has a written charter (See the Corporation's websitewww.axcan.com), and reviews compliance of financial reporting with accounting principles and appropriate internal controls. The Committee meets quarterly with management and the external auditors to review financial statements, internal controls and other matters. It also meets quarterly with the external auditors without the presence of management, and the auditors are fully aware that they are hired by, and their nomination in this Circular by the Board is subject to recommendation from the Audit Committee and that they are under the oversight of the Audit Committee and the Board. Axcan has also recently appointed an internal auditor.

The Audit Committee consists solely of Independent Directors. The current members of the Audit Committee are: Louis P. Lacasse (Chair), Michael M. Tarnow and Dr. Claude Sauriol. |

|

|

f) |

|

Adopting and publishing a written Code of Business Conduct and Ethics, applicable to Directors, officers and employees of the Corporation and for which compliance is monitored. Also, to the extent feasible, that the Board satisfies itself as to the integrity of the CEO and other senior officers, and that said individuals create a culture of integrity throughout the Corporation;

TSX Guidelines

CSA Proposals

Sarbanes-Oxley Act

NASDAQ Rules |

|

The Board has adopted and published a written Code of Business Conduct and Ethics (Seewww.axcan.com), which is discussed with all employees. It specifically includes guidelines with respect to conflicts of interest, protection and proper use of corporate assets and opportunity, confidentiality of corporate information, fair dealing with the Corporation's security holders, customers, suppliers, competitors and employees, compliance with laws, rules and regulations and reporting of any illegal or unethical behavior.

The Corporation has instituted a "Whistle Blowing" system, entirely confidential, which allows employees or third parties to report potential breaches of the Code. The Board is committed to maintaining compliance with the code. |

22

| |

| |

| |

|

|---|

| 2. | | | | The Board of Directors should be composed of a majority of independent Directors.

TSX Guidelines

CSA Proposals

Sarbanes-Oxley Act

NASDAQ Rules | | The standard of independence under the Corporation's Corporate Governance and Nominating Committee Mandate and Principles encompasses the standards contained in the TSX Guidelines, the CSA Proposals as well as under the Sarbanes-Oxley Act and NASDAQ Rules. Seven of the ten Board members nominated are "unrelated"(1) under the TSX guidelines and "independent"(2)(3)(4) as the term is defined in the CSA Proposals, the Sarbanes-Oxley Act and the NASDAQ rules. The Corporation has no significant shareholder with the ability to exercise the majority of votes for the election of Directors. All Board Committees are composed solely of independent Directors. The Corporate Governance and Nominating Committee reviews the status of each individual Director annually. For the fiscal year ended September 30, 2004: |

|

|

|

|

|

|

Léon F. Gosselin |

Related |

|

E. Rolland Dickson |

Independent |

| | | | | | | David W. Mims | Related | | Jacques Gauthier | Independent |

| | | | | | | François Painchaud | Related | | Daniel Labrecque | Independent |

| | | | | | | | | | Louis P. Lacasse | Independent |

| | | | | | | | | | Colin R. Mallet | Independent |

| | | | | | | | | | Dr. Claude Sauriol | Independent |

| | | | | | | | | | Michael M. Tarnow | Independent |

|

|

|

|

|

|

(1) |

|

As defined by the TSX, an "unrelated" Director is a Director who is independent of management and is free from any interest and any business or other relationship which could, or could reasonably be perceived to, materially interfere with the Director's ability to act with a view to the best interests of the Corporation, other than interests and relationships arising from shareholding. A related Director is a Director who is an unrelated Director. |

|

|

|

|

|

|

(2) |

|

As defined in the CSA proposal, an "independent" Director continues to be an individual that has no direct or indirect material relationship with the issuer. A material relationship being a relationship, which could be reasonably expected to interfere with the exercise of a member's independent judgement. The relationships, which are considered material, have expanded and are largely based on the requirements contained in the SEC and NYSE Corporate Governance Rules. Specifically, a Director will not be "independent" if as of March 30, 2004 he is; (i) an employee of the issuer or receives more than $75,000 per year in direct compensation other than for acting as a member of the Board; (ii) an employee of an internal or external auditor; (iii) an executive officer or its immediate family members serving on the Compensation Committee of another entity during that employment by that entity; (iv) receiving a consulting, advisory or other compensatory fee from an issuer or its subsidiaries, this applying also to his immediate family members and; (v) an affiliated entity of the issuer or any subsidiary entities. |

|

|

|

|

|

|

(3) |

|

As defined by SOX, to be determined "independent", a Director may not accept any consulting, advisory or other compensatory fee from the listed Corporation, or be an affiliated person of the listed Corporation or any subsidiary thereof, other than in such person's capacity as a member of the Board of Directors or Committees thereof. |

|

|

|

|

|

|

(4) |

|

As defined by the NASDAQ Rules, an "independent" Director is a person other than an officer or employee of the Corporation or its subsidiaries or any other individual having a relationship, which in the opinion of the Corporation's Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director. |

| |

| |

| |

|

|---|

| 3. | | | | The Board of Directors will assess and disclose on an annual basis:

TSX Guidelines | | |

|

|

a) |

|

whether the Board of Directors has a majority of independent Directors; and |

|

The Board has a majority of Independent Directors (see Guideline 2). |

23

|

|

b) |

|

the analysis of the application of the principles supporting this conclusion.

TSX Guidelines |

|

The Corporate Governance and Nominating Committee consists of three Independent Directors, who are responsible for reviewing and making recommendations on the size and composition of the Board of Directors and standing Committees of the Board of Directors, and for reviewing Corporate Governance matters (see Corporate Governance and Nominating Committee Mandate and Principles at the Corporation's websitewww.axcan.com).

This Committee, which currently consists of its Chairman, Mr. Colin R. Mallet, E. Rolland Dickson, Mr. Daniel Labrecque and Mr. Michael M. Tarnow, had three (3) meetings during fiscal 2004.

The Corporate Governance and Nominating Committee reviews questionnaires completed by current Directors to ascertain Board member independence. In proposing candidates to the Board of Directors, the business interests and relationships of the candidates are reviewed to ensure that such nominees would be able to act in the best interests of the Corporation. |

4. |

|

|

|

The Board of Directors should appoint a Nominating Committee of Directors, entirely composed of independent Directors, responsible for proposing new nominees to the Board and for assessing Directors.

TSX Guidelines

CSA Proposals

NASDAQ Rules |

|

The nominating function is the responsibility of the Corporate Governance and Nominating Committee, which consists entirely of Independent Directors. The current members are:

• Colin R. Mallet, Chairman

• Daniel Labrecque

• E. Rolland Dickson

• Michael M. Tarnow

The Corporate Governance and Nominating Committee has a written mandate that clearly establishes the Committee's purpose, responsibilities, member qualifications, member appointment and removal, structure and operations and manner of reporting to the Board (see Corporate Governance and Nominating Committee Mandate and Principles at the Corporation's websitewww.axcan.com).

It also has the right to engage an outside advisor, as do all Board Committees. In making its recommendations to the Board on Director nominees and the size of the Board, the Committee reviews the skills and competencies needed to complement those possessed by the current Board, and identifies candidates whose profiles match these needs. Axcan has no obligation or contract with any 3rd party, providing them with the right to nominate a Director. |

5. |

|

|

|

The Board of Directors should implement a process for assessing the effectiveness of the Board of Directors, its Committees and the contribution of each individual Directors.

TSX Guidelines

Sarbanes-Oxley Act |

|

The Board and each Committee have written mandates (available at the Corporation's websitewww.axcan.com). Also, clear positions descriptions have been developed for directors, the Chair of the Board and the Chair of each Committee (see Guideline 11). Each Director is expected to contribute to the Board deliberations, where they feel that they have appropriate competence and experience.

The Corporate Governance and Nominating Committee is mandated to ensure that the Board has the right balance of competence and skills, and that the contributions of Board members, Committees of the Board, and the Board as a whole are reviewed on an annual basis. A process has been established which involves questionnaires that are completed by individual Board members and representatives of management. |

24

|

|

|

|

|

|

The Chair of the Corporate Governance and Nominating Committee reviews the findings of the questionnaires and reports the aggregate results for the Board and Board Committees to the Board. Each Director completes a written self-assessment questionnaire bi-annually and discusses his/her contribution to the Board and its Committees with the Chair. Additionally, the Corporate Governance and Nominating Committee monitors the quality of the relationship between management and the Board, in order to recommend ways to improve that relationship. |

6. |

|

|

|

The Board should ensure that all new Directors receive a comprehensive orientation. All new Directors should fully understand the role of the Board and its Committees, as well as the contribution individual Directors are expected to make. All new Directors should also fully understand the nature and operation of the issuer's business. Also, the Board should provide continuing education opportunities for all Directors.

TSX Guidelines

CSA Proposals

NASDAQ Proposals

Sarbanes-Oxley Act |

|

A new Director receives a comprehensive orientation, including a Directors' Manual covering all Board member and Committee responsibilities. The commitment needed from Directors, particularly the commitment of time and energy, is made clear to Directors prior to their nomination. While the importance of a balance of experience on the Board is realized, critical attention is given in Director selection and orientation to ensuring that all Directors understand the pharmaceutical business. In addition, new members of the Board of Directors will receive training in the form of presentations and up-to-date documentation containing the basic information on the Corporation and its affairs.

Management makes presentations on various aspects of the Corporation's business to the Board of Directors, on a regular basis.

Directors are made aware of their responsibility to keep themselves up to date with best Director and Corporate Governance practices and are encouraged and funded to attend seminars which will increase their own, and the Board's effectiveness. Presentations on subjects relevant to the performance of their duties are, from time to time, made to the Board by experts selected by Management. |

7. |

|

|

|

Every Board of Directors should examine its size to determine the impact of the number upon effectiveness, and where appropriate, undertake a program to reduce the size to facilitate more effective decision-making.

TSX Guidelines |

|

The Corporate Governance and Nominating Committee and the Board of Directors as a whole annually monitor the size and composition of the Board of Directors. The current view is that ten (10) Board members', including seven Independent Directors, is an effective number for decision-making and Committee participation. |

8. |

|

|

|

The Board of Directors should review Director compensation and ensure such compensation realistically reflects the responsibilities and risk involved in being a Director.

TSX Guidelines |

|

The Compensation Committee reviews the amount and form of Director compensation periodically and submits its recommendations to the Board of Directors to ensure that such compensation realistically reflects the responsibilities and risks associated with the position of Director (see Compensation Committee Mandate at the Corporation's websitewww.axcan.com). |

25

9. |

|

|

|

Committees of the Board of Directors should be solely composed of independent Directors.

TSX Guidelines

CSA Proposals

NASAQ Rules

Sarbanes-Oxley Act |

|

All Committees of the Board are composed solely of Independent Directors. The Board has appointed three Committees:

• The Audit Committee

• The Corporate Governance and Nominating Committee

• The Compensation Committee |

10. |

|

|

|

The Board of Directors should assume responsibility for, or assign to a Committee of Directors, general responsibilities for developing the Corporation's approach to governance issues, including a set of Corporate Governance guidelines that are specifically applicable to the Issuer.

TSX Guidelines

CSA Proposals

NASDAQ Proposals

NASDAQ Rules |

|

Axcan is committed to maintaining the highest standards of corporate governance. The Corporate Governance and Nominating Committee was established in 1999, and has been given the mandate by the Board to ensure that Axcan maintains its high standards of corporate governance (Corporate Governance and Nominating Committee Mandate and Principles at the Corporation's websitewww.axcan.com).

The Committee consists solely of Independent Directors. The current members of the Corporate Governance and Nominating Committee are: its chairman, Colin R. Mallet, E. Rolland Dickson, Daniel Labrecque and Michael M. Tarnow.