SCHEDULE 14A INFORMATION

(Rule 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to sec.240.14a-11(c) or sec.240.14a-12 |

DESIGN WITHIN REACH, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

DESIGN WITHIN REACH, INC.

225 Bush Street, 20th Floor

San Francisco, California 94104

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS AND PROXY STATEMENT

To the Stockholders of Design Within Reach, Inc.:

Notice is hereby given that the Annual Meeting of the Stockholders of Design Within Reach, Inc. will be held on June 7, 2005 at 4:00 p.m. at the Company’s corporate offices at 225 Bush Street, 20th Floor, San Francisco, California 94104, for the following purposes:

| 1. | To elect two directors for a three-year term to expire at the 2008 Annual Meeting of Stockholders. Our present Board of Directors has nominated and recommends for election as director the following persons: |

John Hansen

Hilary Billings

| 2. | To ratify the selection of Grant Thornton LLP as our independent auditors for the fiscal year ending December 31, 2005. |

| 3. | To transact such other business as may be properly brought before our Annual Meeting or any adjournment thereof. |

Our Board of Directors has fixed the close of business on April 26, 2005 as the record date for the determination of stockholders entitled to notice of and to vote at our Annual Meeting and at any adjournment or postponement thereof.

Accompanying this Notice is a Proxy.Whether or not you expect to be at our Annual Meeting, please complete, sign and date the enclosed Proxy and return it promptly. If you plan to attend our Annual Meeting and wish to vote your shares personally, you may do so at any time before the Proxy is voted.

All stockholders are cordially invited to attend the meeting.

| By Order of the Board of Directors, |

|

Wayne Badovinus President and Chief Executive Officer |

San Francisco, California

April 29, 2005

DESIGN WITHIN REACH, INC.

225 Bush Street, 20th Floor

San Francisco, California 94104

PROXY STATEMENT

The Board of Directors of Design Within Reach, Inc., a Delaware corporation, is soliciting the enclosed Proxy for use at our Annual Meeting of Stockholders to be held on June 7, 2005 at 4:00p.m. at the Company’s corporate offices at 225 Bush Street, 20th Floor, San Francisco, California 94104, and at any adjournments or postponements thereof. This Proxy Statement will be first sent to stockholders on or about May 7, 2005.

All stockholders who find it convenient to do so are cordially invited to attend the meeting in person. In any event, please complete, sign, date and return the Proxy in the enclosed envelope.

A proxy may be revoked by written notice to the Secretary of our company at any time prior to the voting of the proxy, or by executing a later proxy or by attending the meeting and voting in person. Unrevoked proxies will be voted in accordance with the instructions indicated in the proxies, or if there are no such instructions, such proxies will be voted (1) for the election of our Board of Directors’ nominees for director and (2) for ratification of the selection of Grant Thornton LLP as our independent auditors. Shares represented by proxies that reflect abstentions or include “broker non-votes” will be treated as present and entitled to vote for purposes of determining the presence of a quorum. Abstentions and “broker non-votes” do not constitute a vote “for” or “against” any matter and thus will be disregarded in the calculation of “votes cast.”

Stockholders of record at the close of business on April 26, 2005 (the “Record Date”) will be entitled to vote at the meeting or vote by proxy using the enclosed proxy card. As of that date, 13,751,411 shares of our common stock, par value $0.001 per share, were outstanding. Each share of our common stock is entitled to one vote. A majority of the outstanding shares of our common stock entitled to vote, represented in person or by proxy at our Annual Meeting, constitutes a quorum. A plurality of the votes of the shares present in person or represented by proxy at our Annual Meeting and entitled to vote on the election of directors is required to elect directors, and a majority of the shares present in person or represented by proxy and entitled to vote thereon is required for the ratification of the selection of Grant Thornton LLP as our independent auditors for the fiscal year ending December 31, 2005.

The cost of preparing, assembling and mailing the Notice of Annual Meeting, Proxy Statement and Proxy will be borne by us. In addition to soliciting proxies by mail, our officers, directors and other regular employees, without additional compensation, may solicit proxies personally or by other appropriate means. It is anticipated that banks, brokers, fiduciaries, other custodians and nominees will forward proxy soliciting materials to their principals, and that we will reimburse such persons’ out-of-pocket expenses.

1

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of eight members. Our Amended and Restated Certificate of Incorporation provides for the classification of our Board of Directors into three classes, as nearly equal in number as possible, with staggered terms of office and provides that upon the expiration of the term of office for a class of directors, nominees for such class shall be elected for a term of three years or until their successors are duly elected and qualified. At this meeting, two nominees for director are to be elected as Class I directors. The nominees are John Hansen and Hilary Billings, who are each members of our present Board of Directors. The Class II and Class III directors have one year and two years, respectively, remaining on their terms of office.

A plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors is required to elect directors. If no contrary indication is made, Proxies in the accompanying form are to be voted for our Board of Directors’ nominees or, in the event any of such nominees is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who shall be designated by our Board of Directors to fill such vacancy.

Information Regarding Directors

The information set forth below as to the nominees for director has been furnished to us by the nominees:

Nominees for Election to the Board of Directors

For a Three-Year Term Expiring at the

2008 Annual Meeting of Stockholders

Name | Age | Present Position with the Company | ||

John Hansen | 45 | Chairman | ||

Hilary Billings | 41 | Director | ||

John Hansen. Mr. Hansen has served as the chairman of our board of directors since November 2003 and as a member of our board of directors since November 1998. Since March 1998, Mr. Hansen has served as president of JH Partners, LLC, a private equity firm formerly known as Jesse.Hansen&Co. Mr. Hansen is currently a member of the boards of directors of Sagus International, Inc., a manufacturer and supplier of educational furnishings; NapaStyle, Inc., a multi-channel retailer of food and lifestyle products; MD Beauty, Inc., a retailer of cosmetic and skin care products; and Six Degrees Records, Ltd., an independent music label, each of which is privately held. Mr. Hansen holds an A.B. from Harvard College, an M.B.A. from Harvard Business School and a J.D. from University of California, Berkeley.

Hilary Billings. Ms. Billings has served as a member of our board of directors since November 2003. Since April 2003, Ms. Billings has served as brand strategist of RedEnvelope, Inc., an Internet retailer of upscale gifts. From February 2000 to April 2003, Ms. Billings served as chief marketing officer and chairman of the board of RedEnvelope, Inc. From June 1999 to February 2000, Ms. Billings served as chief executive officer of RedEnvelope, Inc. From May 1999 to June 1999, Ms. Billings served as chief merchandising officer of RedEnvelope, Inc. From July 1997 to May 1999, Ms. Billings served as senior vice president of brand design for Starwood Hotels & Resorts Worldwide, Inc., a hotel and leisure company. Ms. Billings is currently a member of the boards of directors of Peet’s Coffee and Tea, Inc., a publicly held coffee and tea retailer, and Hanna Andersson, Inc., a privately held multi-channel specialty apparel company. Ms. Billings holds a B.A. from Brown University.

2

Members of the Board of Directors Continuing in Office

Term Expiring at the

2006 Annual Meeting of Stockholders

Name | Age | Present Position with the Company | ||

Robert Forbes, Jr. | 53 | Founder and Director | ||

Edward Freidrichs | 60 | Director | ||

Terry Lee | 55 | Director | ||

Robert Forbes, Jr. Mr. Forbes is our founder and has served as a member of our board of directors since November 1998. From July 1999 to May 2000, Mr. Forbes served as our chief executive officer. From November 1995 to January 1998, Mr. Forbes served as Vice President Business Development of Smith Hawken Ltd., a retailer of outdoor furniture, gardening tools, work wear, plants and accessories. Mr. Forbes is currently a member of the board of directors of the San Francisco Jazz Festival, a non-profit organization, and the International Design Conference at Aspen, a non-profit organization. Mr. Forbes holds a B.A. in Aesthetic Studies from the University of California Santa Cruz, an M.F.A. in Design from the State University of New York and an M.B.A. from Stanford University.

Edward Friedrichs. Mr. Friedrichs has served as a member of our board of directors since July 2000. From October 2000 to September 2003, Mr. Friedrichs served as president and chief executive officer of Gensler…Architecture, Design & Planning Worldwide, a global architectural, design and strategic consulting firm. From October 1995 to October 2000, Mr. Friedrichs served as president of Gensler…Architecture, Design & Planning Worldwide. Mr. Friedrichs is currently a member of the board of overseers of the University of Pennsylvania School of Design and a member of the executive boards of the San Francisco Council and the Boy Scouts of America, a non-profit organization. Mr. Friedrichs holds a B.A. from Stanford University and an M.A. in Architecture from the University of Pennsylvania.

Terry Lee. Mr. Lee has served as a member of our board of directors since November 2003. Mr. Lee is currently co-chairman of Bell Sports Corp., a private company that sells bicycle helmets and accessories, a position he has held since April 2001; executive chairman of Bay Travelgear, Inc., a private company that sells Arctic Zone coolers and lunch kits, luggage and sport bags, a position he has held since August 2001; and chief executive officer of Bell Automotive Products, Inc., a private company that sells automotive accessories, a position he has held since February 2000. From January 2001 to May 2001, Mr. Lee served as chief executive officer of Bell Sports Corp. From August 2000 to January 2001, Mr. Lee served as a member of the board of directors of Bell Sports Corp. From August 1998 to August 2000, Mr. Lee served as chairman of the board of directors of Bell Sports Corp. Mr. Lee is also currently a member of the board of directors of Tailwind Sports Marketing, Inc., a company that owns the U.S. Postal Pro Bicycle Team, The Boys and Girls Club of Metropolitan Phoenix, a non profit organization, and USA Cycling, the national governing body for the sport of bicycling. Mr. Lee attended The University of Utah and Weber State College on a non-matriculated basis.

3

Term Expiring at the

2007 Annual Meeting of Stockholders

Name | Age | Present Position with the Company | ||

Wayne Badovinus | 61 | President, Chief Executive Officer, and Director | ||

William McDonagh | 48 | Director | ||

Lawrence Wilkinson | 55 | Director | ||

Wayne Badovinus. Mr. Badovinus has served as our president and chief executive officer since May 2000 and as a member of our board of directors since November 1998, and has served as our acting chief financial officer since February 2005. Mr. Badovinus has also served as a senior operating partner for JH Partners, LLC, a San Francisco-based private equity firm since April 2004. From September 1998 to May 2000, Mr. Badovinus served on the faculty of Green Mountain College. Mr. Badovinus is currently a member of the board of directors of NapaStyle, Inc., a multi-channel retailer of food and lifestyle products. Mr. Badovinus holds a B.A. from the University of Washington.

William McDonagh. Mr. McDonagh has served as a member of our board of directors since March 2004. Mr. McDonagh is currently a partner of WaldenVC, a venture capital firm, since September 2000, and has been a management consultant since January 1999. From April 1994 to March 1998, Mr. McDonagh served as president and chief operating officer of Broderbund Software, Inc., a company that develops and markets computer software. Mr. McDonagh is currently a member of the board of directors of Carlston Family Foundation, a charitable organization supporting education and teachers in California. Mr. McDonagh holds a B.B.A. in accounting from the University of Notre Dame and an M.B.A. from Golden Gate University.

Lawrence Wilkinson. Mr. Wilkinson has served as a member of our board of directors since May 2000. Mr. Wilkinson is currently the chairman of Heminge & Condell, a provider of corporate strategic counsel and venture design services, a position he has held since November 1997, and co-founder of and counsel to Global Business Network, a strategic consulting organization, a position he has held since November 1987. Mr. Wilkinson co-founded Oxygen Media, Inc. in June 1998, and served as its vice-chairman until January 2002. Mr. Wilkinson serves on the boards of Oxygen Media, Inc. and Ealing Studios, Ltd. He is a director of Public Radio International, a non-profit organization, and a member of the Board of Visitors of Davidson College. Mr. Wilkinson holds a B.A. from Davidson College, an M.B.A. from Harvard Business School and a B.Phil. from Oxford University.

Board Meetings

Our Board of Directors held three regularly scheduled meetings and six special telephonic meetings during 2004. No director who served as a director during the past year attended fewer than 75% of the aggregate of the total number of meetings of our Board of Directors and the total number of meetings of committees of our Board of Directors on which he or she served.

Committees of the Board

Compensation Committee. The compensation committee is comprised of Edward Friedrichs, who serves as its chairman, and Hilary Billings, each of whom is an independent director for the purposes of the federal securities laws and the Nasdaq Rules. The compensation committee held no meetings during 2004 and held one meeting in 2005 prior to distribution of this Proxy Statement. The functions of this committee include reviewing and recommending to the Board of Directors the compensation and benefits of all of our executive officers, administering our stock option plans and establishing and reviewing general policies relating to compensation and benefits of our employees.

Audit Committee. The audit committee is comprised of William McDonagh, who serves as its chairman, Terry Lee and Lawrence Wilkinson. Each of these directors is “independent” as defined under and required by

4

the federal securities laws, including Rule 10A-3(b)(i) under the Securities Exchange Act of 1934 and the Nasdaq Rules. In addition, our board of directors has determined that William McDonagh qualifies as an “audit committee financial expert” under the federal securities laws. The audit committee held four meetings, including telephonic meetings, during 2004. The audit committee is governed by a written charter approved by our Board of Directors, a copy of which is included as Annex A to this proxy statement. The functions of this committee include reviewing and monitoring our financial statements and internal accounting procedures, recommending the selection of independent auditors by our Board of Directors, evaluating the scope of the annual audit, reviewing audit results, consulting with management and our independent auditor prior to presentation of financial statements to stockholders and, as appropriate, initiating inquiries into aspects of our internal accounting controls and financial affairs. Both our independent auditors and internal financial personnel regularly meet privately with the audit committee and have unrestricted access to this committee.

Nominating and Corporate Governance Committee. The nominating and corporate governance committee is comprised of Lawrence Wilkinson, who serves as its chairman, Edward Friedrichs and Hilary Billings, each of whom is an independent director for the purposes of the federal securities laws and the Nasdaq Rules. The nominating and corporate governance committee held no meetings during 2004 and held one meeting in 2005 prior to the distribution of this Proxy Statement. The functions of this committee include identifying prospective board candidates, recommending nominees for election to our Board of Directors, developing and recommending board member selection criteria, considering committee member qualification, recommending corporate governance principles to the Board of Directors, and providing oversight in the evaluation of the Board of Directors and each committee.

Director Nomination Process

Director Qualifications

In evaluating director nominees, the nominating and corporate governance committee considers, among others, the following factors:

| • | the appropriate size of our Board of Directors; |

| • | personal and professional integrity, ethics and values; |

| • | experience in corporate management, such as serving as an officer or former officer of a publicly held company; |

| • | experience in our industry; |

| • | experience as a board member of another publicly held company; and |

| • | other relevant experience. |

The nominating and corporate governance committee’s goal is to assemble a Board of Directors that brings to our company a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the nominating and corporate governance committee also considers candidates with appropriate non-business backgrounds.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the nominating and corporate governance committee may also consider such other facts as it may deem are in the best interests of our company and our stockholders. The nominating and corporate governance committee does, however, believe it appropriate for at least one member of our Board of Directors to meet the criteria for an “audit committee financial expert” as defined by Securities and Exchange Commission rules, and that a majority of the members of our Board of Directors meet the definition of “independent director” under the Nasdaq Stock Market qualification standards. The nominating and corporate governance committee also believes it appropriate for certain key members of our management to participate as members of our Board of Directors.

5

Identification and Evaluation of Nominees for Directors

The nominating and corporate governance committee identifies nominees for director by first evaluating the current members of our Board of Directors willing to continue in service. Current members with qualifications and skills that are consistent with the nominating and corporate governance committee’s criteria for Board of Directors service and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our Board of Directors with that of obtaining a new perspective. If any member of our Board of Directors does not wish to continue in service or if our Board of Directors decides not to re-nominate a member for re-election, the nominating and corporate governance committee identifies the desired skills and experience of a new nominee in light of the criteria above. The nominating and corporate governance committee generally polls our Board of Directors and members of management for their recommendations. The nominating and corporate governance committee may also review the composition and qualification of the Boards of Directors of our competitors, and may seek input from industry experts or analysts. The nominating and corporate governance committee reviews the qualifications, experience and background of the candidates. Final candidates are interviewed by our independent directors and executive management. In making its determinations, the nominating and corporate governance committee evaluates each individual in the context of our Board of Directors as a whole, with the objective of assembling a group that can best perpetuate the success of our company and represent stockholder interests through the exercise of sound judgment. After review and deliberation of all feedback and data, the nominating and corporate governance committee makes its recommendation to our Board of Directors. Historically, the nominating and corporate governance committee has not relied on third-party search firms to identify Board of Directors candidates. The nominating and corporate governance committee may in the future choose to do so in those situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate.

The nominating and corporate governance committee evaluates nominees recommended by stockholders in the same manner as it evaluates other nominees. We have not received director candidate recommendations from our stockholders and do not have a formal policy regarding consideration of such recommendations. However, any recommendations received from stockholders will be evaluated in the same manner that potential nominees suggested by board members, management or other parties are evaluated. Stockholders wishing to suggest a candidate for director should write to our company’s corporate secretary. In order to be considered, the recommendation for a candidate must include the following written information: (i) the stockholders’ name and contact information; (ii) a statement that the writer is a stockholder and is proposing a candidate for consideration by the nominating and corporate governance committee; (iii) the name of and contact information for the candidate and a statement that the candidate is willing to be considered and serve as a director, if nominated and elected; (iv) a statement of the candidate’s business and educational experience; (v) information regarding each of the factors listed above, other than that regarding Board of Directors size and composition, sufficient to enable the nominating and corporate governance committee to evaluate the candidate; (vi) a statement of the value that the candidate would add to our Board of Directors; (vii) a statement detailing any relationship between the candidate and any customer, supplier or competitor of our company; (viii) detailed information about any relationship or understanding between the proposing stockholder and candidate; and (ix) a list of three character references, including complete contact information for such references. In order to give the committee sufficient time to evaluate a recommended candidate, the recommendation should be received by our corporate secretary at our principal executive offices not later than 120th calendar day before the one year anniversary of the date our proxy statement was mailed to stockholders in connection with the previous year’s annual meeting of stockholders.

Communications with our Board of Directors

Our stockholders may send correspondence to our Board of Directors c/o Corporate Secretary at Design Within Reach, Inc., 225 Bush Street, 20th Floor, San Francisco, California 94104. Our corporate secretary will review all correspondence addressed to our Board of Directors, or any individual director, for any inappropriate correspondence and correspondence more suitably directed to management. Our corporate secretary will forward appropriate stockholder communications to our Board of Directors prior to the next regularly scheduled meeting

6

of our Board of Directors following the receipt of the communication. Our corporate secretary will summarize all correspondence not forwarded to our Board of Directors and make the correspondence available to our Board of Directors for its review at our Board of Director’s request.

Code of Ethics

Our company has established a Code of Ethics that applies to our officers, directors and employees. The Code of Ethics contains general guidelines for conducting the business of our company consistent with the highest standards of business ethics, and is intended to qualify as a “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act of 2002 and Item 406 of Regulation S-K.

Corporate Governance Documents

Our company’s corporate governance documents, including the Audit Committee Charter, Compensation Committee Charter, Nominating and Corporate Governance Committee Charter and Code of Ethics, are available, free of charge, on our website atwww.dwr.com. Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this Proxy Statement. We will also provide copies of these documents, free of charge, to any stockholder upon written request to Secretary, Design Within Reach, Inc., 225 Bush Street, 20th Floor, San Francisco, California 94104.

Report of the Audit Committee

The audit committee oversees our financial reporting process on behalf of our Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in our Annual Report with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The audit committee reviewed with Grant Thornton LLP, who are responsible for expressing an opinion on the conformity of these audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards. In addition, the audit committee has discussed with Grant Thornton LLP their independence from management and our company, has received from Grant Thornton LLP the written disclosures and the letter required by Independence Standards Board Standard No. 1, and has considered the compatibility of non-audit services with the auditors’ independence.

The audit committee discussed with Grant Thornton LLP the overall scope of their audit. The audit committee met with Grant Thornton LLP, with and without management present, to discuss the results of their examination, their evaluation of our internal controls and the overall quality of our financial reporting.

In reliance on the reviews and discussions referred to above, the audit committee has recommended to our Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended January 1, 2005 for filing with the Securities and Exchange Commission. The audit committee and our Board of Directors also have recommended, subject to stockholder approval, the ratification of the selection of Grant Thornton LLP as our independent auditors for 2005.

This report of the audit committee shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

William McDonagh, Chairman

Terry Lee

Lawrence Wilkinson

7

Compensation of Directors

During fiscal year 2003, we did not compensate our non-employee directors for their service on our board of directors. In January 2004, we granted each of our independent directors, Ms. Billings, Mr. Friedrichs, Mr. Lee and Mr. Wilkinson, an option to purchase 30,000 shares of our common stock under our 1999 Stock Plan. Such option grants have an exercise price of $4.50 and will vest in three equal annual installments commencing on the first anniversary of the date of grant. In March 2004, we granted Mr. McDonagh, upon joining our board of directors, an option to purchase 30,000 shares of our common stock under our 1999 Stock Plan. Such option grant has an exercise price of $7.00 and will vest in three equal installments commencing on the first anniversary of the date of the grant. We did not otherwise compensate our non-employee directors during fiscal year 2004.

In February 2005, we granted John Hansen, our Chairman of the Board of Directors, two stock options to purchase an aggregate of 75,000 shares of our common stock pursuant to our 2004 Equity Incentive Award Plan. Both options have an exercise price of $14.68 and have ten-year terms. One option to purchase 30,000 shares of common stock was immediately vested as to one-third of the shares covered by the option, with the balance to vest in equal installments on the first and second anniversaries of the grant date. The other option covers 45,000 shares of common stock and will vest in three equal annual installments commencing on the first anniversary of the grant date.

We will compensate new non-employee directors for their service on our board of directors with an initial grant of an option to purchase 30,000 shares of our common stock under our 2004 Equity Incentive Award Plan, which will vest in three equal annual installments commencing on the first anniversary of the date of grant. We intend to compensate non-employee directors for their service on our board of directors with an annual grant of an option to purchase 10,000 shares of our common stock under our 2004 Equity Incentive Award Plan, which will vest in full on the first anniversary of the date of grant. Options granted to non-employee directors will have an exercise price equal to the fair market value of our common stock on the date of grant. We also reimburse our non-employee directors for their reasonable expenses incurred in attending board meetings. Directors who are also employees of our company do not receive any additional compensation for board service.

Director Attendance at Annual Meetings

Although our company does not have a formal policy regarding attendance by members of our Board of Directors at our Annual Meeting, we encourage all of our directors to attend. We were incorporated in California in November 1998, and we reincorporated in Delaware in March 2004. We did not hold an annual meeting in 2004.

Our Board of Directors unanimously recommends a vote “FOR” each nominee listed above.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of April 14, 2005 regarding the beneficial ownership of our common stock by (a) each person known to our Board of Directors to own beneficially 5% or more of our common stock, (b) each director of our company, (c) the named executive officers (as defined below), and (d) all of our directors and executive officers as a group. Information with respect to beneficial ownership has been furnished by each director, officer or 5% or more stockholder, as the case may be. The address for all executive officers and directors is c/o Design Within Reach, Inc., 225 Bush Street, 20th Floor, San Francisco, California 94104.

Percentage of beneficial ownership is calculated based upon 13,742,293 shares of common stock which were outstanding as of April 14, 2005. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and includes shares of our common stock issuable pursuant to the exercise of stock options, warrants or other securities that are immediately exercisable or convertible or exercisable or convertible within 60 days of April 14, 2005. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them.

Name and Address of Beneficial Owner | Number of Shares Beneficially Owned (1) | Percentage of Shares Beneficially Owned | |||

5% Stockholders: | |||||

Stephen F. Mandel, Jr. and affiliates (2) | 1,068,258 | 7.8 | % | ||

Credit Suisse Asset Management, LLC (3) | 868,300 | 6.3 | |||

Granite Capital, L.P. and affiliates (4) | 759,197 | 5.5 | |||

Directors and Named Executive Officers: | |||||

Wayne Badovinus | 489,216 | 3.5 | |||

Robert Forbes, Jr. | 1,093,800 | 8.0 | |||

Vincent Barriero | 80,172 | * | |||

John Ball (5) | 72,185 | * | |||

Ray Brunner | 69,227 | * | |||

David Barnard (6) | 100,000 | * | |||

John Hansen (7) | 522,941 | 3.8 | |||

Hilary Billings | 35,000 | * | |||

Edward Friedrichs (8) | 53,985 | * | |||

Terry Lee | 48,571 | * | |||

William McDonagh | 30,000 | * | |||

Lawrence Wilkinson | 55,000 | * | |||

All executive officers and directors as a group (15 persons) (9) | 2,908,488 | 19.6 | |||

| * | Represents beneficial ownership of less than 1% of our outstanding common stock. |

| (1) | The following table indicates the number of shares subject to options exercisable within sixty (60) days of April 14, 2005, held by individuals listed in the table above: |

Name of Beneficial Owner | Shares Subject to Options Exercisable | |

Directors and Named Executive Officers: | ||

Wayne Badovinus | 300,000 | |

Robert Forbes, Jr. | — | |

Vincent Barriero | 30,172 | |

John Ball | 72,185 |

9

Name of Beneficial Owner | Shares Subject to Options Exercisable | |

Ray Brunner | 69,227 | |

David Barnard | — | |

John Hansen | 75,000 | |

Hilary Billings | 35,000 | |

Edward Friedrichs | 45,000 | |

Terry Lee | 30,000 | |

William McDonagh | 30,000 | |

Lawrence Wilkinson | 45,000 | |

All executive officers and directors as a group (15 persons. Does not include shares subject to options held by John Ball and David Barnard, who are no longer our executive officers.) | 1,089,275 |

| (2) | Stephen F. Mandel, Jr. and affiliates’ address is Two Greenwich Plaza, Greenwich, Connecticut 06830. Information is based on a Schedule 13G filed with the SEC by Stephen F. Mandel, Jr. and affiliates on March 17, 2005. Stephen F. Mandel, Jr. has shared investment and voting power with respect to all such shares, Lone Spruce, L.P. has shared investment and voting power with respect to 38,457 such shares, Lone Balsam, L.P. has shared investment and voting power with respect to 84,393 such shares, Lone Sequoia, L.P. has shared investment and voting power with respect to 70,505 such shares, Lone Pine Associates LLC has shared investment and voting power with respect to 193,355 such shares, and Lone Pine Capital LLC has shared investment and voting power with respect to 874,903 such shares. |

| (3) | Credit Suisse Asset Management, LLC’s address is 466 Lexington Avenue, New York, NY 10017. Information is based on a Schedule 13G/A filed with the SEC by Credit Suisse Asset Management, LLC on February 17, 2005. Credit Suisse Asset Management, LLC has sole investment and voting power with respect to all such shares. |

| (4) | Granite Capital, L.P. and affiliates’ address is 126 East 56th Street, 25th Floor, New York, New York 10022. Information is based on a Schedule 13G filed with the SEC by Granite Capital, L.P. and affiliates on April 11, 2005. Granite Capital, L.P. has shared investment and voting power with respect to 327,700 such shares, Granite Capital II, L.P. has shared investment and voting power with respect to 22,500 such shares, Granite Capital Opportunity Fund L.P. has shared investment and voting power with respect to 62,039 such shares, Granite Capital Opportunity Fund II, L.P. has shared investment and voting power with respect to 95,791 such shares, Granum Value Fund has shared investment and voting power with respect to 122,323 such shares, Granite Capital, L.L.C. has shared investment and voting power with respect to 514,030 such shares, Granum Capital Management, L.L.C. has shared investment and voting power with respect to 122,323 such shares, Granite Capital Management L.P. has shared investment and voting power with respect to 122,844 such shares, Laurence Zuriff has shared investment and voting power with respect to 280,674 such shares, Lewis M. Eisenberg has shared investment and voting power with respect to all such shares, and Walter F. Harrison, III has shared investment and voting power with respect to all such shares. |

| (5) | Mr. Ball became one of our Regional Sales Directors in August 2004 and is no longer one of our executive officers. |

| (6) | Mr. Barnard resigned from his position with us on February 18, 2005. |

| (7) | Includes (i) 325,593 shares held by Siberia Investment Company, LLC and (ii) 122,348 shares held by Monte Savello, L.P. Mr. Hansen is the President of JH Partners LLC, the Manager of the General Partner (Hansen GP LLC) of Monte Savello, LP and the Manager of Siberia Investment Company, LLC. Mr. Hansen disclaims beneficial ownership of the shares held by Monte Savello, LP and Siberia Investment Company, LLC, except to the extent of his pecuniary interest in such shares, if any. |

| (8) | Includes 28,985 shares held by Edward C. Friedrichs & Patricia A. Friedrichs Revocable Trust dated 8/23/03. Edward Friedrichs is a trustee and beneficiary under this trust. |

| (9) | Includes 1,089,275 shares subject to options exercisable within 60 days of April 14, 2005 held by our executive officers and directors. Does not include shares and shares subject to options held by John Ball and David Barnard, who are no longer our executive officers. |

10

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Our Executive Officers

The following table sets forth information as to persons who serve as our executive officers as of April 14, 2005.

Name | Age | Position | ||

Wayne Badovinus | 61 | President, Chief Executive Officer, acting Chief Financial Officer and Director | ||

Robert Forbes, Jr. | 53 | Founder and Director | ||

Vincent Barriero | 56 | Chief Information Officer | ||

Ray Brunner | 57 | Vice President—Real Estate and Construction | ||

Wanda Gierhart | 40 | Chief Marketing Officer | ||

Carmela Krantz | 42 | Vice President—Human Resources | ||

Tara Poseley | 39 | Vice President—Merchandising | ||

Laura Sites-Reynolds | 44 | Vice President—Inventory Management | ||

Elizabeth Rivera | 45 | Vice President—Studios | ||

Benjamin Dixon | 26 | Controller and Secretary | ||

For information on Messrs. Badovinus and Forbes, see “Proposal 1—Election of Directors.”

Vincent Barriero. Mr. Barriero has served as our chief information officer since July 2000. From May 1999 to May 2000, Mr. Barriero served as chief information officer of Tavolo, Inc., an Internet retailer of cooking and gourmet food items. From August 1997 through April 1999, Mr. Barriero served as vice president of information systems of Kendall-Jackson Wine Estates Ltd., a producer of premium wines. Mr. Barriero holds a B.A. from St. Mary’s College and an M.B.A. from Pepperdine University.

Ray Brunner. Mr. Brunner has served as our vice president of real estate and construction since November 2004 and prior to that served as our vice president of studios since April 2002. From June 1993 to April 2002, Mr. Brunner served as president of RGB & Associates, a strategic consulting company. Mr. Brunner holds a B.A. in business administration from Western Connecticut State University.

Wanda Gierhart. Ms. Gierhart has served as our chief marketing officer since April 2004. Before joining us, from December 1995 to March 2004, Ms. Gierhart served at a number of companies in roles of increasing responsibility from director of direct marketing, director of marketing, vice president of brand and creative group to, most recently, executive vice president of brand and creative group for The Limited, Inc., a specialty retailer of women’s apparel. Ms. Gierhart holds a B.S. in business administration—finance from the University of Nebraska-Lincoln.

Carmela Krantz. Ms. Krantz has served as our vice president of human resources since April 2002. From September 2000 through January 2002, Ms. Krantz served as vice president of human resources/administration for Reactivity, Inc., a software start-up company. From April 2000 through August 2000, Ms. Krantz served as vice president of human resources for Linuxcare, Inc., a company that provides system management products. From April 1998 through April 2000, Ms. Krantz served as vice president of human resources/corporate administration for Sydran Services, a restaurant franchisee. Ms. Krantz holds a B.A. in speech communication and a B.S. in political science from the University of Nevada at Reno.

Tara Poseley. Ms. Poseley has served as our vice president of merchandising since August 2004. From December 1989 to July 2004, Ms. Poseley served in various merchandising, product development, planning,

11

production, distribution and strategy positions for The Gap, Inc. and most recently was senior vice president of merchandising for GapKids and babyGap. Ms. Poseley holds a B.S. in retailing from the University of Wisconsin-Madison.

Laura Sites-Reynolds. Ms. Sites-Reynolds has served as our vice president of inventory management since May 2000. From February 2000 to May 2000, Ms. Sites-Reynolds served as a consultant to, and from September 1998 to February 2000, as vice president of planning of, HomeChef Inc., a cooking school and retailer of kitchen supplies and equipment. Ms. Sites-Reynolds holds a B.S. in marketing from San Jose State University.

Elizabeth Rivera. Ms. Rivera has served as our Vice President of Studios since November 2004. From August 1999 until November 2004, Ms. Rivera served as the Vice President of Stores for Pottery Barn Kids (a division of Williams-Sonoma, Inc.) where she was responsible for opening and operating 83 stores, including staffing, merchandising and financial planning for the stores. Ms. Rivera holds a B.A. from the University of San Francisco.

Benjamin Dixon. Mr. Dixon has served as our controller since April 2000. Mr. Dixon has also served as our principal accounting officer and secretary since March 2005. From January 1998 to March 2000, Mr. Dixon served as senior accountant for Grant Thornton, LLP, an independent registered accounting firm. Mr. Dixon holds a B.S. in Accounting from Golden Gate University and is an M.B.A. candidate at the University of California, Haas School of Business. Mr. Dixon has informed us that he intends to resign from his position with us in May 2005.

12

Executive Compensation

The following table shows compensation earned during the fiscal years ended January 1, 2005 and December 27, 2003 by our Chief Executive Officer and our four most highly compensated executive officers for 2004, other than the Chief Executive Officer. We refer to these executives as the named executive officers in this Proxy Statement. The information in the table includes salaries, bonuses, stock options granted and other miscellaneous compensation.

Summary Compensation Table

Fiscal | Annual Compensation | Long-Term Compensation | All Other | |||||||||||

Securities Underlying Options (#) | ||||||||||||||

Name and Principal Position | Salary | Bonus | ||||||||||||

Wayne Badovinus President and Chief Executive Officer | 2004 2003 | $ $ | 400,000 346,500 | $ $ | — 70,500 | 50,000 — | | — — | | |||||

Robert Forbes, Jr. Founder | 2004 2003 | $ $ | 250,000 204,000 | $ $ | — 47,000 | — — | | — — | | |||||

Vincent Barriero Chief Information Officer | 2004 2003 | $ $ | 217,000 205,000 | $ $ | 32,000 38,890 | 15,000 2,500 | | — — | | |||||

John Ball Former Vice President—Merchandising (1) | 2004 2003 | $ $ | 215,000 200,000 | $ $ | — 32,000 | 15,000 7,000 | | — — | | |||||

Ray Brunner Vice President—Real Estate and Construction | 2004 2003 | $ $ | 205,000 190,000 | $ $ | 30,000 35,720 | 15,000 2,000 | $ | — 8,400 | (2) | |||||

David Barnard Former Chief Financial Officer (3) | 2004 2003 | $ $ | 182,000 165,095 | $ $ | — 31,960 | 15,000 — | | — — | | |||||

| (1) | Mr. Ball became one of our regional sales directors in August 2004 and is no longer one of our executive officers. |

| (2) | Consists of temporary housing payments associated with Mr. Brunner’s relocation to Northern California upon joining us. |

| (3) | Mr. Barnard resigned from his position with us on February 18, 2005. |

Option Grants in Fiscal Year 2004

The following table sets forth information regarding grants of stock options to each of the named executive officers during the fiscal year ended January 1, 2005. During the fiscal year ended January 1, 2005, we granted stock options to purchase 633,250 shares of common stock to employees. All options were granted at the fair market value of our common stock, as determined by our board of directors, on the date of grant.

| Individual Grants | |||||||||||||||||||

Number of Shares of Common Stock Options | Percentage of Granted to Fiscal Year | Exercise or Base Price Per Share | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price | |||||||||||||||

| 0% | 5% | 10% | |||||||||||||||||

Wayne Badovinus | 50,000 | 7.90 | % | $ | 7.00 | 3/3/2014 | $ | 200,000 | $ | 545,892 | $ | 1,076,588 | |||||||

Robert Forbes, Jr. | — | — | — | — | — | — | — | ||||||||||||

Vincent Barriero | 15,000 | 2.37 | % | $ | 7.00 | 3/3/2014 | $ | 60,000 | $ | 163,768 | $ | 322,968 | |||||||

John Ball | 15,000 | 2.37 | % | $ | 7.00 | 3/3/2014 | $ | 60,000 | $ | 163,768 | $ | 322,968 | |||||||

Ray Brunner | 15,000 | 2.37 | % | $ | 7.00 | 3/3/2014 | $ | 60,000 | $ | 163,768 | $ | 322,968 | |||||||

David Barnard | 15,000 | 2.37 | % | $ | 7.00 | 3/3/2014 | $ | 60,000 | $ | 163,768 | $ | 322,968 | |||||||

| (1) | Options are exercisable immediately upon the date of grant and vest in equal monthly installments over four years from the date of grant. Options may be exercised prior to the time such options are vested. All unvested shares are subject to repurchase by us at the exercise price paid for such shares. |

13

| (2) | Potential realizable values are calculated based on $11.00, the fair market value of the underlying shares of our common stock on the date of grant, less the per share exercise price. Potential realizable values are net of exercise price, but before taxes associated with exercise. Amounts representing hypothetical gains are those that could be achieved if options are exercised at the end of the option term. The assumed 0%, 5% and 10% rates of stock price appreciation are provided in accordance with rules of the SEC and do not represent our estimate or projection of the future stock price. |

Aggregated Option Exercises in Fiscal Year 2004 and Option Values at January 1, 2005

The following table sets forth the number of shares of common stock subject to exercisable and unexercisable stock options held as of January 1, 2005 by each of the named executive officers. The value realized and the value of unexercised in-the-money options at January 1, 2005 is calculated based on $14.55, the fair market value of the underlying shares of our common stock on December 31, 2004 (the last trading day of fiscal year 2004), less the per share exercise price multiplied by the number of shares issued upon exercise of the options.

| Shares Acquired on Exercise | Value Realized | Number of Securities Underlying Fiscal Year-End (1) | Value of Unexercised In-the-Money Options at | |||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

Wayne Badovinus | — | — | 550,000 | (2) | — | $ | 7,457,500 | — | ||||||

Robert Forbes, Jr. | — | — | — | — | — | — | ||||||||

John Ball | — | — | 122,000 | (3) | — | $ | 1,590,850 | — | ||||||

Vincent Barriero | — | — | 85,500 | (4) | — | $ | 1,091,350 | — | ||||||

Ray Brunner | — | — | 117,000 | (5) | — | $ | 1,531,850 | — | ||||||

David Barnard | — | — | 210,000 | (6) | — | $ | 2,882,500 | — | ||||||

| (1) | The options set forth in the table are exercisable immediately upon the date of grant and vest in equal monthly installments over four years from the date of grant. These options may be exercised prior to the time such options are vested. All unvested shares are subject to repurchase by us at the exercise price paid for such shares. |

| (2) | Includes 107,292 shares underlying options that were subject to repurchase by us as of January 1, 2005. |

| (3) | Includes 28,771 shares underlying options that were subject to repurchase by us as of January 1, 2005. |

| (4) | Includes 19,646 shares underlying options that were subject to repurchase by us as of January 1, 2005. |

| (5) | Includes 57,104 shares underlying options that were subject to repurchase by us as of January 1, 2005. |

| (6) | Includes 30,521 shares underlying options that were subject to repurchase by us as of January 1, 2005. |

Equity Compensation Plan Information

The following table sets forth information regarding all of our equity compensation plans as of January 1, 2005.

Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (excluding securities reflected in column (a)) | |||||

| (a) | (b) | (c) | ||||||

Equity compensation plans approved by security holders | 2,377,544 | $ | 3.70 | 971,359 | (1) | |||

Equity compensation plans not approved by security holders | — | — | — | |||||

Total | 2,377,544 | $ | 3.70 | 971,359 | (1) | |||

| (1) | Includes 400,000 shares of our common stock available for issuance under our Employee Stock Purchase Plan. |

14

Offer of Employment Letters

We are a party to an offer of employment letter dated February 22, 2000 with Wayne Badovinus. The letter provides that upon a change of control of us, if Mr. Badovinus is terminated or if he is not offered a new position with the acquiring company that is substantially similar to his current position as our Chief Executive Officer, fifty percent of his unvested stock options shall become immediately vested and exercisable and Mr. Badovinus would be paid twelve months base salary either as a lump sum or as salary continuance. The letter also provides that if we terminate the employment of Mr. Badovinus for any reason other than for cause, fifty percent of his unvested stock options shall become immediately vested and exercisable and Mr. Badovinus would be paid twelve months base salary either in a lump sum or as salary continuance.

We are a party to an offer of employment letter dated June 1, 2004 with Tara Poseley. The agreement provides that upon a change of control of us, if Ms. Poseley is terminated or if she is not offered a new position with the acquiring company that is substantially similar to her current position as Vice President of Merchandising, all of her unvested options shall become immediately vested and exercisable and Ms. Poseley would be paid six months base salary as a salary continuance. The letter also provides that if we terminate the employment of Ms. Poseley for any reason other than for cause, she would be paid six months base salary as a salary continuance.

Employee Benefit Plans

1999 Stock Plan

In January 1999, we adopted our 1999 Stock Plan, which was approved by our stockholders in January 1999. The plan allows us to issue incentive and nonstatutory stock options and make restricted stock awards. Our employees, outside directors and consultants are eligible to receive awards under the plan, but only employees may receive incentive stock options. We reserved a total of 3,100,000 shares of our common stock for issuance under the plan. As of April 14, 2005, there were 240,821 shares of our common stock available for issuance under the plan. The plan is administered by our board of directors, or a committee of our board appointed by the board to administer the plan. The board of directors or the committee administering the plan selects the participants who will receive awards and determines the terms and conditions of such awards. Our incentive and nonstatutory stock options and our restricted stock are generally subject to special forfeiture conditions, rights of repurchase, rights of first refusal and other transfer restrictions as the board of directors may determine.

In the event of certain corporate transactions, such as a merger or consolidation, the plan provides for: (1) the continuation of the outstanding options by us if we are the surviving corporation; (2) the assumption of the 1999 Stock Plan and the outstanding options by the surviving corporation or its parent; (3) the substitution by the surviving corporation or its parent of options with substantially the same terms; or (4) the cancellation of the outstanding options without payment of any consideration. In the event of a change in control, the plan provides that: (a) each outstanding award will vest if the repurchase right is not assigned to the entity that employs the optionee immediately after the change in control or its parent or subsidiary; and (b) each outstanding option will become exercisable in full if such options do not remain outstanding, are not assumed by the surviving corporation or its parent and the surviving corporation or its parent does not substitute options with substantially the same terms for such options. A change in control means: (i) the consummation of our merger or consolidation with or into another entity or any other corporate reorganization, if persons who were not our stockholders immediately prior to such merger, consolidation or other reorganization own immediately after such merger, consolidation or other reorganization 50% or more of the voting power of the outstanding securities of each of (A) the continuing or surviving entity and (B) any direct or indirect parent corporation of such continuing or surviving entity; or (ii) the sale, transfer or other disposition of all or substantially all of our assets.

2004 Equity Incentive Award Plan

In March 2004, our board of directors adopted our 2004 Equity Incentive Award Plan and it was approved by our stockholders in April 2004. The plan allows us to issue awards of incentive or nonqualified stock options,

15

restricted stock or stock appreciation rights. Our employees, consultants and directors are eligible to receive awards under the plan, but only employees may receive incentive stock options. We initially reserved a total of 500,000 shares of our common stock for issuance under the plan. The reserve automatically increases on each December 31 during the term of the plan by an amount equal to the lesser of (1) 200,000 shares or (2) a lesser amount determined by the board of directors. As of April 14, 2005, there were 215,500 shares of common stock available for issuance under the plan. The plan is administered by our board of directors, or a committee of our board appointed by the board to administer the plan. The board of directors or the committee administering the plan selects the participants who will receive awards and determines the terms and conditions of such awards. Restricted stock is generally subject to forfeiture upon termination of the employee or consultant’s relationship with us for any reason, with exceptions for certain terminations for cause.

In the event of certain corporate transactions, such as a merger or consolidation or sale of all or substantially all of the assets of our company, the plan provides that each outstanding award may, and in some cases will, be assumed or replaced with a comparable award by our successor company or its parent. If the successor company or its parent does not assume or replace the awards, outstanding options will become 100% vested and exercisable immediately before the corporate transaction. To the extent that options accelerate due to a corporate transaction, the restrictions on restricted stock awards will also lapse. In the event of such a corporate transaction or a change in capitalization, the board of directors or the committee administering the plan also has the discretion to make adjustments, where appropriate, with respect to the number and types of shares that may be issued under the plan, the terms and conditions of outstanding awards and the grant or exercise price per share for outstanding awards in order to prevent dilution or enlargement of the benefits or potential benefits we intend to provide under the plan.

Employee Stock Purchase Plan

In March 2004, our board of directors adopted our Employee Stock Purchase Plan and it was approved by our stockholders in April 2004. The plan is designed to allow our eligible employees to purchase shares of common stock, at semi-annual intervals, with their accumulated payroll deductions.

We initially reserved a total of 300,000 shares of our common stock for issuance under the plan. The reserve automatically increases on each December 31 during the term of the plan by an amount equal to the lesser of (1) 100,000 shares or (2) a lesser amount determined by the board of directors.

The plan generally will have a series of successive 12-month offering periods. The first offering period commenced on July 6, 2004 and will end on May 1, 2005.

Individuals whose customary employment is for more than 20 hours per week and who have been continuously employed by us for at least six months may join an offering period on the first day of the offering period or the beginning of any semi-annual purchase period within that period. Individuals who become eligible employees after the start of an offering period may join the plan at the beginning of any subsequent semi-annual purchase period.

Participants may contribute up to 15% of their cash earnings through payroll deductions, and the accumulated deductions will be applied to the purchase shares on each semi-annual purchase date. The purchase price per share will be equal to 85.0% of the fair market value per share on the participant’s entry date into the offering period or, if lower, 85.0% of the fair market value per share on the semi-annual purchase date.

If the fair market value per share of our common stock on any purchase date is less than the fair market value per share on the start date of the 12-month offering period, then that offering period will automatically terminate, and a new 12-month offering period will begin on the next business day. All participants in the terminated offering will be transferred to the new offering period.

16

In the event of a proposed sale of all or substantially all of our assets, or our merger with or into another company, the outstanding rights under the plan will be assumed or an equivalent right substituted by the successor company or its parent. If the successor company or its parent refuses to assume the outstanding rights or substitute an equivalent right, then all outstanding purchase rights will automatically be exercised prior to the effective date of the transaction. The purchase price will be equal to 85.0% of the market value per share on the participant’s entry date into the offering period in which an acquisition occurs or, if lower, 85.0% of the fair market value per share on the date the purchase rights are exercised.

The plan will terminate no later than the tenth anniversary of the plan’s initial adoption by the board of directors.

401(k) Plan

Effective in 2000, we adopted the Design Within Reach 401(k) plan covering our employees. The 401(k) plan is intended to qualify under Section 401(k) of the Internal Revenue Code of 1986, as amended, so that the contributions to the 401(k) plan by employees, and the investment earning thereon, are not taxable to employees until withdrawn from the 401(k) plan, and so that contributions by us, if any, will be deductible by us for federal income tax purposes when made. Under the 401(k) plan, employees may elect to reduce their current compensation by up to the statutorily prescribed annual limit and to have the amount of such reduction contributed to the 401(k) plan. The 401(k) plan permits, but does not require additional matching contributions to the 401(k) plan by us on behalf of all participants in the 401(k) plan. During fiscal year 2004, we made no contributions to the 401(k) plan.

Compensation Committee Interlocks and Insider Participation

Edward Freidrichs and Hilary Billings serve on the compensation committee of our Board of Directors. No interlocking relationship exists between any member of the compensation committee and any member of any other company’s board of directors or compensation committee.

17

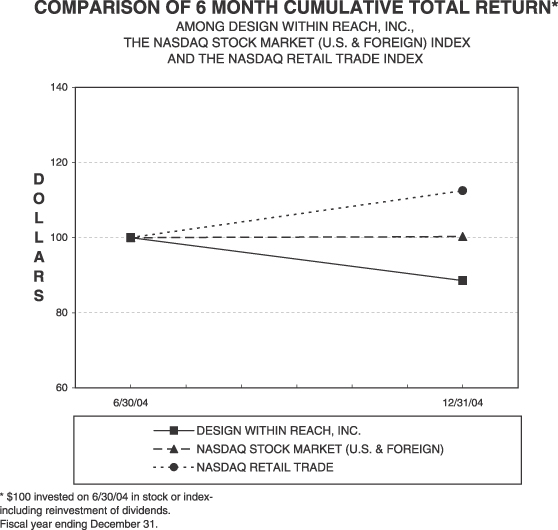

PERFORMANCE GRAPH

The following graph illustrates a comparison of the total cumulative stockholder return on our common stock since June 30, 2004 to two indices: the Nasdaq Composite Index, U.S. Companies, and the Nasdaq Retail Trade Index. The graph assumes an initial investment of $100 on June 30, 2004. The comparisons in the graph are required by the Securities and Exchange Commission and are not intended to forecast or be indicative of possible future performance of our common stock.

Comparison of Cumulative Total Return on Investment

Since June 30, 2004

| 6/30/2004 | 1/1/2005 | |||||

Design Within Reach, Inc. | $ | 100.00 | $ | 88.56 | ||

NASDAQ Retail Trade Index | 100.00 | 112.51 | ||||

NASDAQ Composite Index | 100.00 | 100.31 | ||||

18

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The compensation committee is composed of two directors of our Board of Directors, each of whom is a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act and an “outside director” within the meaning of Section 162(m) of the Code. The compensation committee receives and approves each of the elements of the executive compensation program of our company and continually assesses the effectiveness and competitiveness of the program. In addition, the compensation committee administers the stock option program and other key provisions of the executive compensation program and reviews with our Board of Directors all aspects of the compensation structure for our company’s executives. Set forth below in full is the Report of the Compensation Committee regarding compensation paid by us to our executive officers during 2004.

Compensation Philosophy

Our executive compensation program is based upon a pay-for-performance philosophy. The executive compensation program is designed to provide value to the executive based on the extent of individual performance, our performance versus budgeted earnings targets and other financial measures, our longer-term financial performance and total return to stockholders. Under this program design, only when expectations are exceeded can incentive payments exceed targeted levels.

Elements of the Executive Compensation Program

Base Salary. As a general matter, the base salary for each executive is initially established through negotiation at the time the officer is hired, taking into account such officer’s qualifications, experience, prior salary and competitive salary information. Year-to-year adjustments to each executive officer’s base salary is determined by an assessment of her or his sustained performance against her or his individual job responsibilities including, where appropriate, the impact of such performance on our company’s business results, current salary in relation to the salary range designated for the job, experience and potential for advancement.

Annual Incentive Bonuses. Payments under our annual performance incentive bonus plan are based on achieving personal and corporate goals. Key performance criteria for evaluating executive officers include business and financial objectives, and people and organizational goals, as well as other relevant factors as determined by us with input from the company’s senior management. These criteria change from year to year. Use of corporate goals establishes a direct link between the executive’s pay and our financial success. The annual incentive bonus opportunity for executives, including the President and Chief Executive Officer, is generally targeted at 40% of his or her salary.

Long-Term Incentives. Our long-term incentives will be primarily in the form of stock option awards. The objective of these awards is to advance our longer-term interests and those of our stockholders and to complement incentives tied to annual performance. These awards will provide rewards to executives based upon the creation of incremental stockholder value.

Stock options will only produce value to executives if the price of our stock appreciates, thereby directly linking the interests of executives with those of stockholders. The number of stock options granted will be based on the grade level of an executive’s position, the executive’s performance in the prior year and the executive’s potential for continued sustained contributions to our success. The executive’s right to the stock options will generally vest over a four-year period and each option will be exercisable over a ten-year period following its grant unless the executive’s employment terminates prior to such date.

CEO Compensation

Wayne Badovinus’ base salary was established pursuant to his offer of employment letter. The compensation committee believes that the total compensation of our President and Chief Executive Officer is

19

largely based upon the same policies and criteria used for other executive officers at comparable companies. Each year the compensation committee reviews the Chief Executive Officer’s compensation arrangement, the individual performance for the calendar year under review, as well as our company’s performance. In determining Mr. Badovinus’ bonus for 2004, the compensation committee considered his contributions to our company, particularly in connection with our initial public offering, and his role in implementing strategic and financial initiatives designed to augment our development and growth efforts. For the fiscal year ended January 1, 2005, the compensation committee approved a bonus for Mr. Badovinus of $60,000, however, due to the success of the company’s initial public offering, Mr. Badovinus elected not to accept such bonus.

The compensation committee approved an increase in Mr. Badovinus’ base salary for fiscal year 2005 to $420,000, from $400,000 in fiscal year 2004. Additionally, in March 2005, Mr. Badovinus was granted an option to purchase 100,000 shares of our common stock pursuant to our 2004 Equity Incentive Award Plan. The option has an exercise price of $16.30 and a ten-year term and will vest in three equal annual installments commencing on the first anniversary of the grant date.

The compensation committee believes Mr. Badovinus’ compensation, including salary and bonus, is at a level competitive with chief executive officer salaries within the retail industry.

Section 162(m) Compliance

Section 162(m) of the Code generally limits the tax deductions a public corporation may take for compensation paid to its Named Executive Officers to $1 million per executive per year. Performance based compensation tied to the attainment of specific goals is excluded from the limitation. Our stockholders have previously approved the 1999 stock plan and the 2004 equity incentive plan, qualifying stock options under these plans as performance-based compensation exempt from the Section 162(m) limits. Other awards under these plans also may qualify as performance-based compensation in the discretion of the compensation committee. In addition, the compensation committee intends to evaluate our executive compensation policies and benefit plans during the coming year to determine whether additional actions to maintain the tax deductibility of executive compensation are in the best interest of our stockholders.

Conclusion

Through the programs described above, a significant portion of our compensation program and realization of its benefits is contingent on both our company and individual performance.

The foregoing report has been furnished by the compensation committee.

Edward Freidrichs, Chairman

Hilary Billings

20

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Common Stock

In October 1998, we engaged JH Partners, LLC, formerly known as Jesse.Hansen&Co., a San Francisco-based private equity investment firm affiliated with John Hansen, the Chairman of our board of directors, to act as our financial advisor. The financial and strategic advisory services we received from JH Partners, LLC consisted primarily of business plan development and strategic consulting, budget planning, assistance with fundraising, arrangement of bank debt, and recruitment of our chief executive officer. In connection with this engagement, and as partial consideration for such financial advisory services, we issued to JH Partners, LLC, a warrant to purchase 700,000 shares of our common stock at an exercise price of $1.50 per share. In 1998, JH Partners, LLC sold this warrant to JH Capital Partners, L.P., an entity affiliated with JH Partners, LLC and Mr. Hansen. This warrant was exercised in full immediately prior to the closing of our initial public offering in July 2004.

In November 1998, we sold 2,600,000 shares of our common stock at a price of $0.0001 per share to Robert Forbes, Jr., our founder and member of our Board of Directors.

From November 1998 to April 14, 2005, we granted options to purchase an aggregate of 1,847,500 shares of our common stock to our current directors and executive officers, with exercise prices ranging from $0.25 to $16.50 per share. In October 2002, Wayne Badovinus, our President, Chief Executive Officer and a member of our Board of Directors, exercised options for 200,000 shares of our common stock at an exercise price of $0.25 per share, and in March 2005, Mr. Badovinus exercised options for an additional 250,000 shares of our common stock at an exercise price of $0.25 per share. In October 2002, David Barnard, our former Secretary and Chief Financial Officer, exercised options for 50,000 shares of our common stock at an exercise price of $0.25 per share, in September 2003, Mr. Barnard exercised options for an additional 50,000 shares of our common stock at an exercise price of $0.25 per share, and in March 2005, Mr. Barnard exercised options for an additional 185,000 shares of our common stock at an exercise price of $0.25 per share. In July 2001, Vincent Barriero, our Chief Information Officer, exercised options for 25,000 shares of our common stock at an exercise price of $0.60 per share, in August 2002, Mr. Barriero exercised options for an additional 25,000 shares of our common stock at an exercise price of $0.60 per share, and in March 2005, Mr. Barriero exercised options for an additional 55,328 shares of our common stock at an exercise price of $0.60 per share. In March 2005, Ray Brunner, our Vice President—Real Estate and Construction, exercised options for 47,773 shares of our common stock at an exercise price of $0.60 per share. In March 2005, Carmela Krantz, our Vice President—Human Resources, exercised options for 25,316 shares of our common stock at an exercise price of $0.60 per share. In March 2005, Laura Sites-Reynolds, our Vice President—Inventory Management, exercised options for 29,808 shares of our common stock at an exercise price of $0.60 per share.

Preferred Stock

In April 1999, we issued and sold to investors an aggregate of 1,500,000 shares of our Series A preferred stock at a price of $1.00 per share for aggregate consideration of $1.5 million, which included 850,000 shares sold to JH Capital Partners, L.P., 50,000 shares sold to Mr. Badovinus and 25,000 shares sold to Mr. Forbes. In July 1999, we issued and sold to investors an aggregate of 500,000 shares of our Series A preferred stock at a price of $1.00 per share for aggregate consideration of $500,000, which included 240,000 shares sold to JH Capital Partners, L.P. The Series A preferred stock issued in these transactions ranked on a parity with our Series B preferred stock and was senior to our common stock, was entitled to receive non-cumulative dividends when and as declared by our board of directors at a rate of $0.08 per share per annum, voted equally with our common stock and Series B preferred stock and not as a separate class (except as otherwise provided in our certificate of incorporation or as required by law) and was convertible into shares of our common stock at a rate of one to one. The Series A preferred stock converted automatically into shares of our common stock upon the closing of our initial public offering in July 2004.

21

In December 1999, we obtained bridge loans from some of our investors, including a bridge loan from Mr. Barnard in the principal amount of $50,000 and bridge loans from JH Capital Partners, L.P. in an aggregate principal amount of $1,505,000. These bridge loans accrued interest at the rate of 8.0% per annum, were convertible into shares of, and became due and payable upon the issuance in June 2000 of, our Series B preferred stock. These bridge loans were repaid by us in full or converted into shares of Series B preferred stock in June 2000. In connection with these bridge loans, we issued warrants to purchase an aggregate of 261,172 shares of our Series B preferred stock at an exercise price of $2.55 per share. Of these warrants, warrants to purchase 5,882 and 177,057 shares of our Series B preferred stock were issued to Mr. Barnard and JH Capital Partners, L.P., respectively. These warrants were exercised in full immediately prior to the closing of our initial public offering in July 2004.

In June 2000, we issued and sold to investors an aggregate of 1,952,154 shares of our Series B preferred stock at a price of $2.55 per share for aggregate consideration of $5.0 million, which included 1,056,863 shares sold to Jesse.Hansen Co-Investment Vehicle, L.P., 609,917 shares sold to JH Capital Partners, L.P. and 39,216 shares sold to Mr. Badovinus. The Series B preferred stock ranked on a parity with our Series A preferred stock and was senior to our common stock, was entitled to receive non-cumulative dividends when and as declared by our board of directors at a rate of $0.204 per share per annum, voted equally with our common stock and Series A preferred stock and not as a separate class (except as otherwise provided in our certificate of incorporation or as required by law) and was convertible into shares of our common stock at a rate of one to one. The Series B preferred stock converted automatically into shares of our common stock upon the closing of our initial public offering in July 2004.