SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Under Rule 14a-12 |

Iowa Telecommunications Services, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 15, 2006

To Our Shareholders:

The 2006 annual meeting of shareholders of Iowa Telecommunications Services, Inc. (“Iowa Telecom”) will be held at the Sodexho DMACC Conference Center, 600 North 2nd Avenue West, Newton, Iowa 50208 on Thursday, June 15, 2006 at 10:00 AM central time. At the meeting, shareholders will act on the following matters:

| | 1. | Election of three directors to serve as Class II directors whose terms will expire in 2009, one director to serve as a Class III director whose term will expire in 2007, and one director to serve as a Class I director whose term will expire in 2008 (Proposal No. 1); |

| | 2. | Approval of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, hereinafter referred to as independent auditors, for the year ending December 31, 2006 (Proposal No. 2); and |

| | 3. | Any other matters that properly come before the meeting. |

Only shareholders of record at the close of business on April 25, 2006 are entitled to vote at the meeting or at any postponement or adjournment of the meeting.

We hope that as many shareholders as possible will personally attend the meeting. Whether or not you plan to attend the meeting, please complete the enclosed proxy card and sign, date and return it promptly so that your shares will be represented. Sending in your proxy will not prevent you from voting in person at the meeting.

|

By Order of the Board of Directors, |

|

|

Donald G. Henry |

Vice President, General Counsel and Secretary |

April 25, 2006

TABLE OF CONTENTS

i

ii

Iowa Telecommunications Services, Inc. 115 S. Second Avenue West Newton, Iowa 50208

PROXY STATEMENT

This proxy statement contains information related to the annual meeting of shareholders of Iowa Telecommunications Services, Inc. (“Iowa Telecom” or the “Company”) to be held on Thursday, June 15, 2006, beginning at 10:00 AM central time, at Sodexho DMACC Conference Center, 600 North 2nd Avenue West, Newton, Iowa 50208, and at any postponement or adjournment of the meeting. The approximate date of mailing for this proxy statement and proxy card as well as a copy of Iowa Telecom’s 2006 Annual Report is April 28, 2006.

ABOUT THE MEETING

What is the purpose of the annual meeting?

At Iowa Telecom’s annual meeting, shareholders will act upon the matters outlined in the accompanying notice of meeting, including:

| | • | | the election of three directors to serve as Class II directors whose terms will expire in 2009, one director to serve as a Class III director whose term will expire in 2007, and one director to serve as a Class I director whose term will expire in 2008; and |

| | • | | the approval and ratification of the appointment of Deloitte & Touche LLP as our independent auditors. |

In addition, management will report on our performance during 2005 and respond to questions from shareholders.

Who is entitled to vote?

Only shareholders of record at the close of business on the record date, April 25, 2006, are entitled to receive notice of the annual meeting and to vote the shares of common stock that they held on that date at the meeting, or any postponement or adjournment of the meeting. Each outstanding share entitles its holder to cast one vote on each matter to be voted upon.

Who can attend the meeting?

All shareholders as of the record date, or their duly appointed proxies, may attend the meeting. Cameras, recording devices and other electronic devices will not be permitted at the meeting. If you hold your shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum, permitting the meeting to conduct its business. As of April 25, 2006, the record date, 31,409,856 shares of Iowa Telecom’s common stock were outstanding. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of the number of shares considered present at the meeting.

How do I vote?

If you complete and properly sign the accompanying proxy card and return it to us, it will be voted as you direct. If you are a registered shareholder as of the record date and attend the meeting, you may deliver your completed proxy card in person. If you are a “street name” shareholder, you should refer to the information

forwarded by your bank, broker or other holder of record to see the procedures for voting your shares. If you are a “street name” shareholder and you wish to vote in person at the meeting, you will need to obtain a proxy from the institution that holds your shares and present it to the inspector of elections with your ballot when you vote at the annual meeting.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with Iowa Telecom’s Secretary either a notice of revocation or a duly executed proxy bearing a later date. If you are a “street name” shareholder you may vote in person at the annual meeting if you obtain a proxy as described in the answer to the previous question. The powers of the proxy holders with regard to your shares will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

Can I vote by telephone or electronically?

No. We have not instituted any mechanism for telephone or electronic voting. “Street name” shareholders, however, may be able to vote electronically through their bank, broker or other holder of record. If so, instructions regarding electronic voting will be provided by the broker as part of the package which includes this proxy statement.

What are the board’s recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the board of directors. The board’s recommendation is set forth together with the description of each proposal in this proxy statement. In summary, the board recommends a vote:

| | • | | for the election of the nominated slate of directors (see page 5 of this proxy statement); and |

| | • | | for the approval and ratification of the appointment of Deloitte & Touche LLP as Iowa Telecom’s independent auditors (see page 22 of this proxy statement). |

Pursuant to the provisions of Rule 14a-4(c) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the board of directors or, if no recommendation is given, in their own discretion.

What vote is required to approve each item?

Election of directors. The affirmative vote of a plurality of the votes cast at the meeting at which a quorum is present is required for the election of directors. A properly executed proxy card marked “WITHHOLD AUTHORITY” or “FOR ALL EXCEPT” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

Other proposals. For each other proposal, the affirmative vote of the holders of a majority of the shares actually voting on the proposal will be required for approval. A properly executed proxy card marked “ABSTAIN” with respect to any such matter will not be voted on such matter and will not affect the outcome of any matter, although it will be counted for purposes of determining whether there is a quorum.

Broker non-votes. Where brokers are prohibited from exercising discretionary authority for beneficial owners who have not provided voting instructions (commonly referred to as “broker non-votes”), such broker non-votes will be treated as shares that are present for purposes of determining the presence of a quorum. Broker non-votes will not affect the outcome of any matter.

2

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table and footnotes set forth the beneficial ownership of Iowa Telecom common stock held by (i) each person or group of persons known to Iowa Telecom to beneficially own more than five percent (5%) of the outstanding shares of our common stock, (ii) each Iowa Telecom director, (iii) each executive officer of Iowa Telecom named in the Summary Compensation Table on page 16 of this proxy statement, and (iv) Iowa Telecom’s executive officers and directors as a group. The amounts and percentages of common stock beneficially owned are reported on the basis of regulations of the Securities and Exchange Commission (“SEC”) governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. The information in the following table and footnotes is taken from or is based upon filings made by such persons with the SEC, or upon information provided by such persons. All information is as of April 25, 2006 unless otherwise noted.

| | | | | |

Name and address of beneficial owner or identity of group(1)

| | Aggregate

number of

shares

beneficially

owned(2)

| | Percent of

shares

outstanding(3)

| |

Pine Island Capital Corporation | | | | | |

Iowa Network Services, Inc.(4) | | 3,104,607 | | 9.88 | % |

FMR Corp(5) | | 2,903,000 | | 9.24 | % |

NFJ Investment Group L.P.(6) | | 1,877,000 | | 5.98 | % |

Norman C. Frost | | 6,000 | | * | |

Brian G. Hart | | 3,000 | | * | |

Kevin R. Hranicka(7) | | — | | — | |

Craig A. Lang | | — | | — | |

Kendrik E. Packer | | 1,456 | | * | |

Alan L. Wells | | 632,116 | | 1.98 | % |

Craig A. Knock | | 76,332 | | * | |

Brian T. Naaden | | 68,232 | | * | |

David M. Anderson | | 36,676 | | * | |

Michael A. Struck | | 30,589 | | * | |

All executive officers and directors as a group (15 persons) | | 1,101,342 | | 3.41 | % |

| * | Represents less than 1% of Iowa Telecom’s outstanding common stock. |

| (1) | Unless otherwise indicated below, the persons in the above table have sole voting and investment power with respect to all shares set forth opposite their names. The address of all executive officers and directors is c/o Iowa Telecommunications Services, Inc., 115 S. Second Avenue West, Newton, Iowa 50208. |

| (2) | Includes the following numbers of shares subject to options to purchase common stock of Iowa Telecom which are currently exercisable or exercisable within 60 days of April 25, 2006 and shares of unvested restricted stock: |

| | | | |

Name

| | Options

| | Restricted

Shares

|

Alan L. Wells | | 532,116 | | 100,000 |

Craig A. Knock | | 46,232 | | 30,000 |

Brian T. Naaden | | 48,232 | | 20,000 |

David M. Anderson | | 26,676 | | 10,000 |

Michael A. Struck | | 20,589 | | 10,000 |

| (3) | The applicable percentage of shares outstanding for each beneficial owner is calculated by dividing (i) the number of shares deemed to be beneficially owned by such person as of April 25, 2006 by (ii) the sum of (A) the number of shares of common stock outstanding as of April 25, 2006 plus (B) the number of shares |

3

| | issuable upon exercise of options held by such shareholder which were exercisable as of April 25, 2006 or which will become exercisable within 60 days after April 25, 2006. |

| (4) | Pine Island Capital Corporation, a wholly-owned subsidiary of Iowa Network Services, Inc., is the record owner of these shares. Pine Island Capital Corporation and Iowa Network Services, Inc. share voting and investment power with regard to these shares. Iowa Network Services, Inc.’s address is 4201 Corporate Drive, West Des Moines, Iowa 50266. Pine Island Capital Corporation’s address is 2265-B Renaissance Drive, Suite 9, Las Vegas, Nevada 89119. The information set forth in the table pertaining to Pine Island Capital Corporation and Iowa Network Services, Inc. and in this footnote is as reported on a statement on Schedule 13G/A filed on February 14, 2006, except that the number of shares beneficially owned is as reported on Form 4 filed March 6, 2006. |

| (5) | FMR Corp. discloses that it has sole power to vote or direct the vote with respect to 190,409 shares and sole power to dispose or to direct the disposition of 2,903,000 shares. FMR Corp.’s address is 82 Devonshire Street, Boston, Massachusetts 02109. The information set forth in the table pertaining to FMR Corp. and in this footnote is as reported on a statement on Schedule 13G/A filed on February 14, 2006. |

| (6) | NFJ Investment Group L.P.’s address is 2100 Ross Avenue, Suite 1840, Dallas, Texas 75201. The information set for in the table pertaining to NFJ Investment Group L.P. and in this footnote is as reported on a statement on Schedule 13G/A filed on February 14, 2006. |

| (7) | Mr. Hranicka is also a director of Iowa Network Services, Inc. |

Section 16(a) beneficial ownership reporting compliance

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership with the SEC. To Iowa Telecom’s knowledge, based solely upon a review of filings with the SEC and written representations that no other reports were required, we believe that all of our executive officers, directors and 10% shareholders complied during 2005 with the reporting requirements of Section 16(a) of the Exchange Act, except that Craig A. Lang disposed of 679 shares of Iowa Telecom common stock for no consideration on December 29, 2005 but did not report the change in ownership until February 14, 2006 when he caused to be filed an annual statement of changes in beneficial ownership of securities on Form 5.

4

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Our restated articles of incorporation provide that our board of directors is divided into three classes of directors, designated Class I, Class II and Class III, as nearly equal in size as is practicable, serving staggered three-year terms. One class of directors is elected each year to hold office for a three-year term and until successors of such directors are duly elected and qualified. The class that will stand for election in 2006 is Class II.

In addition, Iowa law requires that a director elected to fill a vacancy on the board of directors stand for election at the next shareholders’ meeting at which directors are elected. Four of our directors, Kendrik E. Packer, Norman C. Frost, Craig A. Lang and Brian G. Hart, were elected to fill vacancies after the 2005 annual meeting of shareholders. Iowa law requires that each stand for election at the 2006 Annual Meeting.

The Nominating and Governance Committee has recommended, and the board also recommends, that the shareholders elect the nominees designated below to serve as directors. More specifically, it is recommended that Kevin R. Hranicka, Kendrik E. Packer and Norman C. Frost be elected at this year’s Annual Meeting to serve as Class II directors whose terms will expire at the 2009 annual meeting of shareholders or when their successors are duly elected and qualified, that Craig A. Lang be elected at this year’s Annual Meeting to serve as a Class III director whose term will expire at the 2007 annual meeting of shareholders or when his successor is duly elected and qualified, and that Brian G. Hart be elected at this year’s Annual Meeting to serve as a Class I director whose term will expire at the 2008 annual meeting of shareholders or when his successor is duly elected and qualified.

The nominees for election to the office of director, and certain information with respect to their backgrounds and the background of the non-nominee director, are set forth below. It is the intention of the persons named in the accompanying proxy card, unless otherwise instructed, to vote to elect the nominees named herein as directors. Each of the nominees named herein presently serves as a director of the Company. In the event any of the nominees named herein is unable to serve as a director, discretionary authority is reserved to the board to vote for a substitute. The board has no reason to believe that any of the nominees named herein will be unable to serve if elected.

Nominees standing for election to the board

| | | | |

Name

| | Age

| | Current Position With Company

|

Norman C. Frost | | 51 | | Class II Director |

Brian G. Hart | | 50 | | Class I Director |

Kevin R. Hranicka | | 53 | | Class II Director |

Craig A. Lang | | 54 | | Class III Director |

Kendrik E. Packer | | 44 | | Class II Director |

Non-nominees continuing to serve in the office of director

| | | | |

Name

| | Age

| | Current Position With Company

|

Alan L. Wells | | 46 | | President, Chief Executive Officer, Class I Director and Chairman |

It is expected there will be one Class III vacancy on the board as of the date of the annual meeting of shareholders.

Business experience of nominees to the board

Kevin R. Hranicka.Mr. Hranicka has served on the board of directors of Iowa Telecom since February 2003 and is also a director of Iowa Network Services, Inc. He has over 30 years of telecommunications industry experience and is the General Manager of the Van Buren Telephone Company (Van Buren) in Keosauqua, Iowa. Prior to joining Van Buren, Mr. Hranicka served as Plant Manager for Northern Arkansas Telephone Company and held various managerial and supervisory positions with GTE Midwest Incorporated and Continental Telephone. Mr. Hranicka serves on the board of directors of the National Telecommunications Cooperative Association and on various committees associated with the Rural Iowa Independent Telephone Association and the Iowa Telecommunications Association.

Kendrik E. Packer.Mr. Packer has served on the board of directors of Iowa Telecom since August 2005. He is a Managing Partner with Financial Advisory Partners, Inc., which he founded in 1997, where he consults with clients on merger and acquisition transactions and private financings. Prior to forming Financial Advisory

5

Partners, Mr. Packer held several positions in corporate finance since 1984, including senior vice president with Everen Securities, Kemper Securities and R.G. Dickinson & Company.

Norman C. Frost. Mr. Frost has served on the board of directors of Iowa Telecom since March 2006. He currently is a private investor. He was a Managing Director of Legg Mason Wood Walker, Inc. and head of the firm’s Technology sector in the Investment Banking Department from 1998 to 2005. Mr. Frost worked as an investment banker for over 25 years, focusing primarily on the telecommunications industry, where he executed a wide range of assignments for his clients including international and domestic merger and acquisition advisories, valuations, public and private equity and debt offerings, and project financings. Mr. Frost began his investment-banking career at The First Boston Corporation, spent several years as a Managing Director in the Communications Group at Bear, Stearns & Co. Inc. and prior to joining Legg Mason, was a Managing Director in the Telecommunications Group at Smith Barney, Inc. Mr. Frost also serves on The Maryland Zoological Society Board of Trustees, Tissue Banks International Board of Trustees, and as an Anthem Capital II, L.P. Advisory Board Member.

Craig A. Lang. Mr. Lang has served on the board of directors of Iowa Telecom since August 2005 and serves as our lead director. He has been the president of the Iowa Farm Bureau Federation (IFBF) since 2001 and has been affiliated with the IFBF board since 1992 when he was elected as a district representative. In addition, he also serves as chairman of the board of FBL Financial Group, Inc. (NYSE: FBL) and as president of Farm Bureau Life Insurance Company. Mr. Lang also serves on the Iowa Department of Economic Development board and the American Farm Bureau Federation board of directors, representing the Midwest Region, and is director of Farm Bureau Bank. For six years, he served as a director on the GROWMARK board and three years as a director on the Cattlemen’s Beef Board. He is also past chairman of the Iowa Values Fund Board.

Brian G. Hart. Mr. Hart has served on the board of directors of Iowa Telecom since November 2005. He currently is President of Hart Financial, LLC, a registered investment advisor providing financial planning and investment advisory services. Mr. Hart previously served as Vice President and Chief Financial Officer of Pioneer Hi-Bred International, Inc. and has held various other accounting, finance and auditing positions, including Partner at McGladrey & Pullen. Mr. Hart is a certified public accountant and a registered investment advisor. Mr. Hart also serves on the Des Moines University Board of Trustees, on the Executive Committee of the Board of the Civic Center of Greater Des Moines and on the Luther College Board Investment Committee. Previously, he served on many community boards and organizations.

Business experience of continuing director

Alan L. Wells. Mr. Wells is President and Chief Executive Officer of Iowa Telecom, and Chairman of our board of directors. He joined us in 1999 as President and Chief Operating Officer, and was appointed to the role of President and Chief Executive Officer in 2002. Prior to joining Iowa Telecom, Mr. Wells was Senior Vice President and Chief Financial Officer at MidAmerican Energy Holdings Company (MidAmerican), a Des Moines, Iowa-based electric and gas utility holding company, from 1997 until 1999. During the same period, Mr. Wells also served as President of MidAmerican’s non-regulated businesses. Mr. Wells held various executive and management positions with MidAmerican, its subsidiaries, and Iowa-Illinois Gas and Electric, one of its predecessors, from 1993 through 1999. Prior to that, Mr. Wells was with Deloitte Consulting (previously Deloitte & Touche Consulting) and previously held various positions with the Public Utility Commission of Texas and Illinois Power Company. Mr. Wells is a certified public accountant, and serves on the board of directors of the United States Telecommunications Association, the Newton Development Corporation, and Progress Industries.

Board recommendation and shareholder vote required

The board of directors recommends a vote FOR the election of each of the nominees named above (Proposal No. 1 on the proxy card). The affirmative vote of a plurality of the votes cast at the meeting at which a quorum is present is required for the election of directors.

6

CORPORATE GOVERNANCE AND BOARD COMMITTEES

Are a majority of the directors independent?

The board of directors has determined that Messrs. Hranicka, Packer, Frost, Lang and Hart are independent directors in accordance with Section 303A of the New York Stock Exchange (“NYSE”) corporate governance listing standards because none of them are believed to have any direct or indirect material relationships that, in the opinion of the board, would interfere with the exercise of independent judgment in carrying out their responsibilities as a director. In addition, the board has adopted Corporate Governance Guidelines which conform to or are more exacting than the NYSE listing standards and has determined that Messrs. Hranicka, Packer, Frost, Lang and Hart are independent under these guidelines. A copy of our Corporate Governance Guidelines may be found on our website atwww.iowatelecom.com. Mr. Wells is not considered independent under the NYSE listing standards because he currently serves as an executive officer of Iowa Telecom.

How are directors compensated?

We pay our non-employee directors an annual retainer of $25,000. Each non-employee director may elect to receive up to half of the annual retainer in shares of our common stock. Board members also are paid $1,000 for each board meeting attended in person, $500 for each board committee meeting attended in person and $500 for each board or board committee meeting attended by means of a telephone conference call. In addition, the Chairman of the Audit Committee receives an additional annual retainer of $5,000. We promptly reimburse all non-employee directors for reasonable expenses incurred to attend board or board committee meetings. Under our director compensation policy, a director who also serves as an executive officer receives compensation solely for acting in such capacity as an executive officer. The compensation levels for our executive officers are currently determined by our Compensation Committee. See “Summary Compensation Table” on page 16.

How often did the board meet during 2005?

The board met nine times during 2005. Each director attended at least 75% of the total number of meetings of the board and committees on which he served. In 2005, the non-employee directors of the board met three times in executive session.

How many directors attended the 2005 annual meeting of shareholders?

Each director is expected to make a reasonable effort to attend all board and board committee meetings. Iowa Telecom does not require directors to attend the annual meeting of shareholders. The 2005 annual meeting was attended by two directors.

What committees has the board established?

The board of directors has standing Audit, Nominating and Governance, and Compensation committees. The membership of the standing committees is as follows:

| | | | | | |

Name

| | Audit Committee

| | Nominating and Governance

Committee

| | Compensation Committee

|

Kevin R. Hranicka | | * | | * | | |

Kendrik E. Packer | | * | | * | | |

Norman C. Frost | | * | | | | * |

Craig A. Lang | | | | * | | * |

Brian G. Hart | | * | | | | * |

Alan L. Wells | | | | | | |

7

Audit Committee. The Audit Committee consists of Messrs. Hart, Hranicka, Packer and Frost, with Mr. Hart serving as Chair. The board has determined that all members of the Audit Committee are independent, as defined in Section 303A of the NYSE corporate governance listing standards and Section 10A(m)(3) of the Exchange Act. Each of the members is able to read and understand financial statements, including a balance sheet, income statement and statement of cash flow, and is financially literate as determined by Iowa Telecom’s board in its business judgment. The board has determined that in addition to being independent, each of Messrs. Hart, Packer and Frost is an “audit committee financial expert” as such term is defined under the applicable SEC rules. The Audit Committee met seven times in 2005. The board has adopted an Audit Committee Charter, which may be found on our website atwww.iowatelecom.com. The charter describes the primary functions of the Audit Committee, which are to assist the board of directors in its oversight of:

| | • | | the financial reporting process and internal control system; |

| | • | | the independent registered public accounting firm’s qualifications and independence; |

| | • | | compliance with legal, ethical and regulatory matters; and |

| | • | | the performance of our internal audit function and our independent registered public accounting firm. |

Our Audit Committee is also responsible for the following:

| | • | | conducting an annual performance evaluation of the Audit Committee; |

| | • | | compensating, retaining and overseeing the work of our independent registered public accounting firm; and |

| | • | | establishing procedures for (a) receipt and treatment of complaints on accounting and other related matters and (b) submission of confidential employee concerns regarding questionable accounting or auditing matters. |

The Audit Committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties.

The “Report of the Audit Committee of the Board of Directors” is presented on page 12 of this proxy statement.

Nominating and Governance Committee.The Nominating and Governance Committee consists of Messrs. Packer, Hranicka and Lang, with Mr. Packer serving as Chair. The board has determined that all members of the Nominating and Governance Committee are independent, as defined in Section 303A of the NYSE corporate governance listing standards. The Nominating and Governance Committee met five times in 2005. The purpose of the Nominating and Governance Committee is to:

| | • | | establish criteria for board and committee membership and recommend to our board of directors proposed nominees for election to the board of directors and for membership on committees of the board of directors; |

| | • | | make recommendations regarding proposals submitted by our shareholders; |

| | • | | make recommendations to our board of directors regarding corporate governance matters and practices; and |

| | • | | oversee the evaluation of our board of directors and management. |

The board has adopted a Nominating and Governance Committee Charter, a copy of which may be found on our website atwww.iowatelecom.com. The Nominating and Governance Committee will consider candidates for board membership that shareholders recommend. Shareholders may recommend candidates for consideration by the Nominating and Governance Committee by mailing a written notice to the Nominating and Governance Committee in care of the Secretary of Iowa Telecom. Such recommendations for the 2007 annual meeting of shareholders must be received by Iowa Telecom no later than December 30, 2006. The written notice must include the following information regarding each person whom the shareholder proposes to nominate for election

8

or reelection as a director: the name, age, business address and, if known, the residential address of such person; the principal occupation or employment of such person; the class, series and number of shares of the corporation which are owned beneficially and of record by such person; all other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to the Exchange Act and the rules and regulations promulgated thereunder; and such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected. In addition, the written notice must include the following information regarding the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination is made: the name and address of such shareholder, as they appear on the corporation’s books, and of such beneficial owner; the class, series and number of shares of the corporation which are owned beneficially and of record by such shareholder and such beneficial owner; a representation that such shareholder is a shareholder of record and intends to appear in person or by proxy at the meeting; and any other information relating to such shareholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to the Exchange Act and the rules and regulations promulgated thereunder.

The charter of the Nominating and Governance Committee sets forth the criteria for identifying and recommending new candidates to serve as directors. In considering potential candidates for the board, the Nominating and Governance Committee will give consideration to director candidates recommended by shareholders and the Nominating and Governance Committee’s own candidates, provided that the shareholder recommendations are made in accordance with the procedures described above. Candidates will be interviewed by the Nominating and Governance Committee to evaluate the following, among other qualifications it may deem appropriate:

| | • | | experience as a board member of another publicly-traded corporation, experience in industries or with technologies relevant to Iowa Telecom, accounting or financial reporting experience, or such other professional experience which the Nominating and Governance Committee determines qualifies an individual for board service; |

| | • | | candidates’ business judgment and even temperament, high ethical standards, a healthy view of the relative responsibilities of a board member and management, independent thinking, articulate communication and intelligence; and |

| | • | | any other factors, as the Nominating and Governance Committee deems appropriate, including judgment, skill, diversity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other board members, and the extent to which the candidate would be a desirable addition to the board and any committees of the board. |

Current directors standing for reelection are not required to participate in an interview process. All of the directors named on the proxy card are standing for reelection.

Compensation Committee. The Compensation Committee consists of Messrs. Lang, Hart and Frost, with Mr. Lang serving as Chair. The board has determined that all members of the Compensation Committee are independent, as defined in Section 303A of the NYSE corporate governance listing standards.

The Compensation Committee is charged with:

| | • | | reviewing and approving goals and objectives relating to the compensation of our Chief Executive Officer and, based upon a performance evaluation, determining and approving the compensation of the Chief Executive Officer; |

| | • | | reviewing and approving the evaluation process and compensation structure for our executive officers; and |

| | • | | producing reports on executive compensation to be included in our public filings with the SEC. |

9

The Compensation Committee met four times in 2005. The board has adopted a Compensation Committee Charter, a copy of which may be found on our website atwww.iowatelecom.com.

The “Report of the Compensation Committee of the Board of Directors” is presented on page 19 of this proxy statement.

Executive Sessions

Executive sessions or meetings of outside (non-management) directors without management present were held three times in 2005. Mr. Craig A. Lang, our lead director, serves as the presiding director of the executive sessions. The outside directors reviewed the report of the independent auditor, the criteria upon which the performance of the Chief Executive Officer and other senior managers was evaluated, the performance of the Chief Executive Officer against such criteria, the compensation of the Chief Executive Officer and other senior managers, and any other relevant matters. Meetings were also held from time to time with the Chief Executive Officer for a general discussion of relevant subjects.

Communications with Directors

The board has implemented a process by which our shareholders may send written communications to the board’s attention. Any shareholder desiring to communicate with our board, or one or more of our directors, may send a letter addressed to the Iowa Telecom Board of Directors c/o Donald G. Henry, Vice President, General Counsel and Secretary, Iowa Telecommunications Services, Inc., 115 S. Second Avenue West, P.O. Box 1046, Newton, Iowa 50208-1046. The Secretary has been instructed by the board to promptly forward all communications so received to the full board or the individual board member(s) specifically addressed in the communication.

Communications will be distributed to the board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, our board of directors has requested that certain items that are unrelated to the duties and responsibilities of the board should be excluded, such as:

| | • | | junk mail and mass mailings; |

| | • | | resumés and other forms of job inquiries; |

| | • | | business solicitations or advertisements. |

In addition, material deemed by the Secretary to be unduly hostile, threatening, illegal or similarly unsuitable will be excluded.

Code of Business Conduct and Ethics

The board has adopted a Code of Business Conduct and Ethics (the “Code”), a copy of which may be found on our website atwww.iowatelecom.com. Under the Code, we insist on honest and ethical conduct by all of our directors, officers, employees and other representatives, including the following:

| | • | | Our directors, officers and employees are required to deal honestly and fairly with our customers, collaborators, competitors and other third parties; |

| | • | | Our directors, officers and employees should not be involved in any activity that creates or gives the appearance of a conflict of interest between their personal interests and the interests of Iowa Telecom; and |

10

| | • | | Our directors, officers and employees should not disclose any confidential information of Iowa Telecom or its suppliers, customers or other business partners. |

We also are committed to providing our shareholders and investors with full, fair, accurate and understandable disclosure in the reports that we file with the SEC. We will comply with all laws and governmental regulations that are applicable to our activities, and expect all of our directors, officers and employees to do the same.

Our board of directors and Audit Committee have established the standards in the Code and oversee compliance with the Code. The board has also created the position of Ethics Officer to assist in the administration of the Code and adherence to the Code. Donald G. Henry has been appointed as the Ethics Officer, and as Ethics Officer he reports directly to the board. Directors, officers and employees must report any known or suspected violations of the Code to the Ethics Officer or the Chairman of the Audit Committee or our board of directors. If it is determined that the Code has been violated, Iowa Telecom will take necessary corrective action reasonably calculated to address and correct the alleged violation.

11

REPORT OF THE AUDIT

COMMITTEE OF THE BOARD OF DIRECTORS

The Board of Directors and the Audit Committee believe that the composition of the Audit Committee meets the requirements of the rules and regulations of the Securities and Exchange Commission, New York Stock Exchange (the “NYSE”) and the Sarbanes-Oxley Act of 2002, including the requirement that all committee members be “independent” as defined in Section 303A of the NYSE listing standards. The Audit Committee operates under a written charter adopted by the board of directors in October 2004, a copy of which was appended to the Company’s proxy statement filed in 2005.

Management is responsible for the Company’s internal controls and the financial reporting process. The Company’s independent registered public accounting firm, Deloitte & Touche LLP, is responsible for conducting an audit of the financial statements in accordance with the standards of the Public Company Accounting Oversight Board (the “PCAOB”). Deloitte & Touche LLP is also responsible for conducting an audit, in accordance with the standards of the PCAOB, of the effectiveness of the Company’s internal control over financial reporting based on the criteria established inInternal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. The Audit Committee assists the Board of Directors with fulfilling its oversight responsibility regarding the quality and integrity of the Company’s accounting, auditing and financial reporting practices. In performing its oversight responsibilities regarding the audit process, the Audit Committee has reviewed and discussed the Company’s consolidated financial statements with management and with Deloitte & Touche LLP, the Company’s independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles generally accepted in the United States. The Audit Committee also discussed with the Company’s independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61, Communications with Audit Committees, as amended.

The Company’s independent registered public accounting firm also provided and discussed with the Audit Committee the written disclosure required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Audit Committee also reviewed and discussed with the Company’s independent registered public accounting firm the accounting firm’s independence. Based on these discussions and input from management, the Audit Committee found that the non-audit services provided by the Company’s independent registered public accounting firm during the year ended December 31, 2005 were compatible with maintaining the independent accountants’ independence.

During 2005, management completed the documentation, testing and evaluation of the Company’s system of internal control over financial reporting in response to the requirements set forth in Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. The Audit Committee met periodically, both independently and with management, to review and discuss the Company’s progress on complying with Section 404, including the PCAOB’s Auditing Standard No. 2 regarding the audit of the internal control over financial reporting. The Audit Committee also met periodically with the Company’s independent registered public accounting firm to discuss the Company’s internal controls and the status of its Section 404 compliance efforts. At the conclusion of the process, management provided the Audit Committee with a report on the effectiveness of the Company’s internal control over financial reporting. The Audit Committee continues to oversee the Company’s efforts related to its internal controls.

Based upon the Audit Committee’s discussion with management and the Company’s independent registered public accounting firm and the Audit Committee’s review of the representation of management and on the report of the Company’s independent registered public accounting firm to the Audit Committee, the Audit Committee recommended to the Company’s Board of Directors that the Company’s audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 filed with the Securities and Exchange Commission on March 10, 2005.

|

| MEMBERS OF THE AUDIT COMMITTEE |

|

Norman C. Frost |

Brian G. Hart |

Kevin R. Hranicka |

Kendrik E. Packer |

12

PRINCIPAL INDEPENDENT ACCOUNTANT FEES AND SERVICES

Pre-approval Policy

In accordance with the requirements of the Sarbanes-Oxley Act of 2002 and the Audit Committee Charter, all audit and audit-related work and all non-audit work performed by the independent accountants, Deloitte & Touche LLP, must be submitted to the Audit Committee for specific approval in advance by the Audit Committee, including the proposed fees for such work. The Audit Committee has not delegated any of its responsibilities under the Sarbanes-Oxley Act to management.

Audit Fees

The aggregate fees billed for professional services rendered by Deloitte & Touche LLP for the audit of our consolidated financial statements for fiscal 2005 and 2004 were $490,000 and $1,171,000, respectively. Audit fees for 2005 also include the audit of the effectiveness of the Company’s internal control over financial reporting in accordance with the PCAOB. Audit fees for fiscal 2004 also included fees billed for professional services rendered with respect to engagements, consents, comfort letters and assistance with the review of our filings with the SEC in connection with our initial public offering.

Audit-related Fees

The aggregate fees billed for audit-related services rendered by Deloitte & Touche LLP during fiscal 2005 and 2004, which consisted principally of audits and related services of the employee benefit plans were $29,000 and $24,000, respectively.

Tax Fees

The aggregate fees billed for professional services rendered by Deloitte & Touche LLP during fiscal 2005 and 2004 for tax compliance, tax advice and tax planning in connection with our tax returns were $24,000 and $17,000, respectively.

All Other Fees

None.

13

BUSINESS EXPERIENCE OF EXECUTIVE OFFICERS

The following is a description of the background of the executive officers of Iowa Telecom who are not directors:

David M. (Mike) Anderson.Mr. Anderson is our Vice President—External Affairs and Marketing. Mr. Anderson is responsible for all of our state and federal regulatory and legislative activities. He is also responsible for our marketing organization, which includes development and implementation of product and marketing plans that support our statewide core businesses. His responsibilities also include the operation of our wholesale services group, which manages and services our business relationships with competitive local carriers and wireless carriers. In addition, he is responsible for the activities of our corporate communications group. Prior to joining Iowa Telecom in 2000 in conjunction with the GTE Midwest Incorporated acquisition, Mr. Anderson spent 21 years with GTE Midwest Incorporated in various management positions involving regulatory and legislative policy development and implementation. From 1989 to 2000, Mr. Anderson was Director of External Affairs for GTE Midwest Incorporated’s Midwest operations group. In that position he managed GTE Midwest Incorporated’s regulatory and legislative activities in Iowa, Missouri, Nebraska and Minnesota. He is a past President and past Director of the Iowa Telecommunications Association. He has also served on the board of directors of the Nebraska, Minnesota and Missouri Telephone Associations. He is currently a member of United States Telecommunications Association’s Telecom Policy Committee.

Charles J. Bruggemann.Mr. Bruggemann is our Vice President—Operations. Mr. Bruggemann is responsible for our field force operations, including our central office, service provisioning, dispatch and repair activities. He is also responsible for external contract labor associated with outside plant activities, and for buildings, fleet and supply operations. Prior to joining Iowa Telecom in 2000 in conjunction with the GTE Midwest Incorporated acquisition, Mr. Bruggemann held several positions with GTE Midwest Incorporated. From 1997 to 2000, he was General Manager, Customer Operations for the Midwest Division and had overall responsibility for service operations in the states of Iowa, Nebraska and Minnesota. Prior to that assignment, Mr. Bruggemann held various technical and managerial positions with GTE Midwest Incorporated. Mr. Bruggemann has over 34 years of telecommunications operations experience. Mr. Bruggemann currently serves as president of Iowa One Call, a non-profit organization.

Donald G. Henry.Mr. Henry is our Vice President, General Counsel and Secretary. From 1999 until he joined Iowa Telecom in 2003, Mr. Henry represented the Office of Consumer Advocate in administrative proceedings before the Iowa Utilities Board relating to telecommunications law and policy and in various judicial proceedings. Between 1992 and 1999, Mr. Henry served as administrative law judge for the Utilities Division of the Iowa Department of Commerce, on behalf of the Iowa Utilities Board. Prior to that time, Mr. Henry was in private law practice. Mr. Henry received his law degree from the University of Michigan and holds a masters degree in economics from the University of Iowa.

Lon M. Hopkey.Mr. Hopkey is our Vice President—Corporate Development. Mr. Hopkey is responsible for our competitive local exchange carrier operations and for growth initiatives including strategic acquisitions and divestitures. Prior to joining Iowa Telecom in 1999, Mr. Hopkey held several positions with MidAmerican Energy Company. From 1996 to 1999, Mr. Hopkey was Manager Corporate Development for MidAmerican, with responsibilities for completing purchase and sale transactions for various non-regulated entities and for evaluating business combinations for MidAmerican. From 1997 to 1999, Mr. Hopkey was responsible for running several nonregulated entities of MidAmerican. From 1990 through 1996, Mr. Hopkey held various corporate finance positions with MidAmerican and its predecessor companies. Mr. Hopkey has a Masters of Business Administration degree and a Bachelor of Science degree in Biomedical Engineering from the University of Iowa.

Dennis R. Kilburg.Mr. Kilburg is our Vice President—Engineering. Mr. Kilburg is responsible for all network planning, all capital expenditures related to network infrastructure and all network technical support. Prior to joining Iowa Telecom in 1999, Mr. Kilburg was the Director of Advanced Network Products at Iowa Network Services, Inc. From 1994 until 1998, Mr. Kilburg managed Hickory Tech Corporation’s

14

telecommunications operations within Iowa. Prior to joining Hickory Tech, Mr. Kilburg worked in various management roles for GTE Midwest Incorporated and Contel Corporation from 1985 until 1994, and with the Preston Telephone Co. from 1971 until 1985. Mr. Kilburg has over 35 years of experience in telecommunications operations and engineering.

Craig A. Knock.Mr. Knock is our Vice President, Chief Financial Officer and Treasurer. From 1998 until he joined us in January 2000, he served as the Vice President and Chief Financial Officer for Racom Corporation, a wireless telecommunications company in Iowa. From 1993 until 1998, he was the Vice President and Chief Financial Officer and Treasurer for Atlantic Tele-Network, Inc., a publicly-held telecommunications company headquartered in the U.S. Virgin Islands. He also served as the Controller for Atlantic Tele-Network from 1992 until 1993. Prior to joining Atlantic Tele-Network, Mr. Knock worked as an audit manager with Deloitte & Touche. Mr. Knock is a certified public accountant and has a Bachelor of Business Administration degree in Accounting from the University of Iowa.

Timothy D. Lockhart.Mr. Lockhart is our Vice President—Customer Services and Human Resources. Mr. Lockhart is responsible for all customer service accountabilities for our residential, business and competitive markets. Additionally, he is accountable for all human resource functions within the company. Prior to joining Iowa Telecom in 2000, Mr. Lockhart held human resource positions with the Menasha Corporation from 1993 through 1999. From 1988 to 1992, Mr. Lockhart served in various human resource and operational roles with the Weyerhaeuser Corporation. Mr. Lockhart has a Bachelor of Science degree in Communications from Toccoa Falls College and a Masters of Arts degree in Organizational Development and Business from Arizona State University.

Brian T. Naaden.Mr. Naaden is our Vice President and Chief Information Officer. Mr. Naaden is responsible for our information systems and for our Internet service and our data subsidiary. Prior to joining Iowa Telecom in 2000, Mr. Naaden served as Vice President of Technical Services for McLeodUSA, a communications provider based in Cedar Rapids, Iowa, from 1996 to 2000. From 1984 to 1996, Mr. Naaden held various directorial and managerial positions with MCI, TelecomUSA and Teleconnect. Mr. Naaden has over 22 years of experience in the telecommunications industry.

Michael A. Struck.Mr. Struck is our Vice President—Sales. Prior to joining Iowa Telecom in 2001, Mr. Struck held various positions with MCI WorldCom. From 1998 to 2001, Mr. Struck was responsible for National Account voice and data sales in nine midwestern states. From 1991 through 1997, Mr. Struck held various MCI sales and service management roles in Iowa, Nebraska and South Dakota. From 1983 through 1990, Mr. Struck held various positions within the sales, marketing and engineering departments at Telecom USA and one of its predecessors, Teleconnect Company. Mr. Struck began his career with Northwestern Bell as an Account Executive in 1980. Mr. Struck has a Bachelor of Science degree with a major in Marketing from the University of Iowa.

15

SUMMARY COMPENSATION TABLE

As of December 31, 2005, Iowa Telecom had ten executive officers including its Chief Executive Officer. The following table provides a summary of compensation for each of the years ended December 31, 2005, 2004 and 2003 with respect to the person serving as Iowa Telecom’s Chief Executive Officer during the year ended December 31, 2005 and each of Iowa Telecom’s other four most highly compensated executive officers during the year ended December 31, 2005 who were serving in that capacity as of December 31, 2005 and whose annual salary and bonus during the year ended December 31, 2005 exceeded $100,000 (collectively the “Named Executive Officers”).

| | | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long Term Compensation

| | |

| | | | | | | | | | | Awards

| | Payouts

| | |

Name

| | Year

| | Salary(1)

| | Bonus

| | Other Annual

Compensation

| | Restricted

Stock Awards

($)(2)

| | Securities

Underlying

Options (#)

| | LTIP

Payouts

($)

| | All Other

Compensation(3)

|

Alan L. Wells | | 2005 | | $ | 339,231 | | $ | 400,000 | | — | | $ | 1,867,000 | | — | | — | | $ | 64,279 |

Chairman, President and Chief | | 2004 | | $ | 278,462 | | $ | 175,000 | | — | | | — | | — | | — | | $ | 53,370 |

Executive Officer | | 2003 | | $ | 280,385 | | $ | 148,500 | | — | | | — | | — | | — | | $ | 48,548 |

Craig A. Knock | | 2005 | | $ | 189,846 | | $ | 100,000 | | — | | $ | 559,800 | | — | | — | | $ | 15,750 |

Vice-President, Chief Financial | | 2004 | | $ | 133,385 | | $ | 100,000 | | — | | | — | | — | | — | | $ | 13,904 |

Officer and Treasurer | | 2003 | | $ | 135,000 | | $ | 52,000 | | — | | | — | | — | | — | | $ | 13,200 |

Brian T. Naaden | | 2005 | | $ | 154,615 | | $ | 80,000 | | — | | $ | 373,200 | | — | | — | | $ | 15,750 |

Vice-President and Chief | | 2004 | | $ | 124,231 | | $ | 60,000 | | — | | | — | | — | | — | | $ | 4,411 |

Information Officer | | 2003 | | $ | 124,615 | | $ | 22,800 | | — | | | — | | — | | — | | $ | 5,688 |

David M. Anderson | | 2005 | | $ | 139,308 | | $ | 63,000 | | — | | $ | 186,600 | | — | | — | | $ | 6,258 |

Vice-President—External Affairs | | 2004 | | $ | 134,423 | | $ | 48,780 | | — | | | — | | — | | — | | $ | — |

and Marketing | | 2003 | | $ | 133,442 | | $ | 48,830 | | — | | | — | | — | | — | | $ | — |

Michael A. Struck | | 2005 | | $ | 157,000 | | $ | 37,000 | | — | | $ | 186,600 | | — | | — | | $ | 14,400 |

Vice President—Sales | | 2004 | | $ | 156,538 | | $ | 35,000 | | — | | | — | | — | | — | | $ | 15,375 |

| | | 2003 | | $ | 159,923 | | $ | 50,000 | | — | | | — | | — | | — | | $ | 6,000 |

| (1) | Includes amounts deferred under the Iowa Telecommunications Services, Inc. Deferred Compensation Plan. |

| (2) | Represents restricted stock awards valued at the closing market price of unrestricted shares of our common stock on the date of grant. The value of the restricted shares of our common stock held by each of the named executive officers as of December 31, 2005 was as follows: |

| | | | | |

Named Officer

| | Restricted

Shares Held

| | Value as of

December 31, 2005

|

Alan L. Wells | | 100,000 | | $ | 1,549,000 |

Craig A. Knock | | 30,000 | | $ | 464,700 |

Brian T. Naaden | | 20,000 | | $ | 309,800 |

David M. Anderson | | 10,000 | | $ | 154,900 |

Michael A. Struck | | 10,000 | | $ | 154,900 |

All of the restricted shares in the table above, except the restricted shares of Mr. Wells, were granted on August 2, 2005 pursuant to the Company’s 2005 Stock Incentive Plan. Under the terms of a restricted stock agreement, each award vests at a rate of 25% per year commencing on the second anniversary of the date of grant, subject to certain forfeiture provisions. With respect to Mr. Wells, 100,000 shares of restricted stock were granted on August 3, 2005. Pursuant to the Company’s 2005 Stock Incentive Plan and under the terms of a restricted stock agreement these shares will vest at the rate of 25% per year commencing April 1, 2007, subject to certain forfeiture provisions. Holders of our restricted shares are entitled to receive dividends and other distributions, if any, as and when declared by the board of directors.

16

| (3) | Includes the Company’s (i) contribution under the Iowa Telecommunications Services, Inc. Deferred Compensation Plan; (ii) matching contribution to the 401(k) plan; and (iii) discretionary contribution to the 401(k) plan, in each case for and on behalf of the named officers as follows: |

| | | | | | | | | | | | | | |

Name

| | Year

| | Deferred

Compensation

Plan

| | Matching

Contribution to 401(k) Plan

| | Discretionary contribution to

401(k) Plan

| | Total All

Other

Compensation

|

Alan L. Wells | | 2005 | | $ | 48,529 | | $ | 9,450 | | $ | 6,300 | | $ | 64,279 |

Chairman, President and Chief | | 2004 | | $ | 37,995 | | $ | 9,225 | | $ | 6,150 | | $ | 53,370 |

Executive Officer | | 2003 | | $ | 33,548 | | $ | 9,000 | | $ | 6,000 | | $ | 48,548 |

Craig A. Knock | | 2005 | | $ | — | | $ | 9,450 | | $ | 6,300 | | $ | 15,750 |

Vice-President, Chief Financial | | 2004 | | $ | — | | $ | 8,342 | | $ | 5,562 | | $ | 13,904 |

Officer and Treasurer | | 2003 | | $ | — | | $ | 7,920 | | $ | 5,280 | | $ | 13,200 |

Brian T. Naaden | | 2005 | | $ | — | | $ | 9,450 | | $ | 6,300 | | $ | 15,750 |

Vice-President and Chief | | 2004 | | $ | — | | $ | — | | $ | 4,411 | | $ | 4,411 |

Information Officer | | 2003 | | $ | — | | $ | — | | $ | 5,688 | | $ | 5,688 |

David M. Anderson | | 2005 | | $ | — | | $ | 4,158 | | $ | 2,100 | | $ | 6,258 |

Vice-President—External Affairs | | 2004 | | $ | — | | $ | — | | $ | — | | $ | — |

and Marketing | | 2003 | | $ | — | | $ | — | | $ | — | | $ | — |

Michael A. Struck | | 2005 | | $ | — | | $ | 8,640 | | $ | 5,760 | | $ | 14,400 |

Vice President—Sales | | 2004 | | $ | — | | $ | 9,225 | | $ | 6,150 | | $ | 15,375 |

| | | 2003 | | $ | — | | $ | — | | $ | 6,000 | | $ | 6,000 |

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table sets forth the information with respect to the Named Executive Officers concerning the exercise of options during 2005 and unexercised options held as of December 31, 2005.

Aggregate Option Exercise in Last Fiscal Year and Fiscal Year-End Option Values

| | | | | | | | | | | | | | | |

Name

| | Shares

Acquired

on

Exercise

(#)

| | Value

Realized

($)

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year-End

| | Value of Unexercised In-the-Money Options at Fiscal Year-End(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Alan L. Wells | | 25,000 | | $ | 255,116 | | 582,116 | | — | | $ | 5,385,737 | | $ | — |

Craig A. Knock | | 8,000 | | $ | 82,558 | | 68,232 | | — | | $ | 635,990 | | $ | — |

Brian T. Naaden | | 18,000 | | $ | 205,512 | | 58,232 | | — | | $ | 542,780 | | $ | — |

David M. Anderson | | — | | $ | — | | 26,676 | | — | | $ | 248,647 | | $ | — |

Michael A. Struck | | 59,400 | | $ | 686,841 | | 20,589 | | — | | $ | 191,910 | | $ | — |

| (1) | The amount represents the difference between the exercise price as of December 31, 2005 and a market value of $15.49 as determined by the last sale price as quoted by the NYSE on December 30, 2005. |

Iowa Telecommunications Services, Inc. 2002 Stock Incentive Plan

We adopted the Iowa Telecommunications Services, Inc. Stock Incentive Plan, on April 26, 2002. Options were granted under the plan to officers and certain key employees.

As of December 31, 2005 there were a total of 995,507 options outstanding under the 2002 Stock Incentive Plan, all of which were vested.

No further options will be granted under the 2002 Stock Incentive Plan.

17

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information concerning compensation plans previously approved by security holders and not previously approved by security holders as of December 31, 2005.

| | | | | | | |

Plan Category

| | Number of Securities to

be Issued upon Exercise

of Outstanding Options

Column A

| | Weighted-Average

Exercise Price of

Outstanding

Options

Column B(1)

| | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

(Excluding Securities

Reflected in Column A) Column C(2)

|

Equity compensation plans approved by

security holders | | 995,507 | | $ | 6.29 | | 256,144 |

Equity compensation plans not approved

by security holders | | — | | | — | | — |

| | |

| |

|

| |

|

Total | | 995,507 | | $ | 6.29 | | 256,144 |

| | |

| |

|

| |

|

| (1) | Pursuant to the terms of our 2002 Stock Incentive Plan, the exercise price of outstanding options is adjusted to reflect the payment of cash dividends in respect to Common Stock. |

| (2) | The number of securities noted represents the remaining shares available for future issuance under the Company’s 2005 Stock Incentive Plan. Although the 2002 Stock Incentive Plan permits the issuance of options to purchase 32,354 additional shares, the board has determined that no further options will be granted under the 2002 Plan. |

PENSION PLAN

Mr. Anderson participates in the Iowa Telecom Pension Plan (the “Pension Plan”) together with certain other employees who were employed by GTE Midwest Incorporated at the time of the acquisition in June 2000. In general, a participant’s benefit under the Pension Plan is the greater benefit resulting from the application of two alternative formulas, which are based on “average annual compensation”, and years of service. Pension benefits for Mr. Anderson, as well as other salaried employees who are covered under the Pension Plan, were frozen effective June 30, 2005. Mr. Anderson’s normal retirement benefit at age 65, paid in the form of a single life annuity, is $4,827 per month or $57,924 annually.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The compensation levels of our executive officers are currently determined by our board of directors upon the recommendation of the Compensation Committee and our Chief Executive Officer. None of the directors who served on the Compensation Committee during the year ended December 31, 2005 has ever been an officer or employee of Iowa Telecom or any of its subsidiaries. During the year ended December 31, 2005, no executive officer of Iowa Telecom served on the Compensation Committee or board of directors of any other entity which had any executive officer who also served on the Compensation Committee or board of Iowa Telecom. No executive officer of Iowa Telecom currently serves on the Compensation Committee.

18

REPORT OF THE COMPENSATION COMMITTEE

OF THE BOARD OF DIRECTORS

The Compensation Committee of the board of directors determines the total compensation, including base salaries and incentive compensation, paid or awarded to our executive officers. The Compensation Committee also administers our incentive and equity-based compensation plans. The board of directors has determined that all members of the Compensation Committee are independent. The Compensation Committee charter is available on our website at www.iowatelecom.com.

The Compensation Committee believes Iowa Telecom must retain, adequately compensate and financially motivate talented and dedicated managers capable of leading Iowa Telecom. The Compensation Committee’s goal is to use Iowa Telecom resources wisely by attracting and retaining effective and efficient managers. The Compensation Committee also reviews trends in executive compensation and the compensation practices of comparable companies, with a goal of remaining reasonably competitive with those companies, and seeks the advice of compensation consultants as it deems appropriate.

Compensation for our executive officers has three components: annual base salaries, short-term incentives in the form of cash bonuses, and long-term incentives awarded pursuant to our stock incentive plan. The incentive plans reward executives when financial and operational objectives established and monitored by the Compensation Committee are attained.

In determining the total compensation of each executive officer for 2005, the Compensation Committee considered the responsibilities assigned for the current year , compensation paid by comparable companies to their officers with similar responsibilities, and performance. Consideration of performance included review and assessment of the extent to which individual and company-wide goals were attained. The short-term cash bonuses paid to executive officers were related to both the individual’s performance and the company’s attainment of previously determined target levels of an adjusted measure of company-wide earnings before interest, taxes, depreciation and amortization (“EBITDA”).

In 2005 the Compensation Committee recommended, and the board of directors and shareholders approved, adoption of the Iowa Telecommunications Services, Inc. 2005 Stock Incentive Plan (the “2005 Stock Incentive Plan”). The purpose of the 2005 Stock Incentive Plan is to promote the interests of the Company and our shareholders by aiding us in attracting and retaining those who will make substantial contributions to the Company’s financial performance for the benefit of our shareholders. In 2005 the total compensation of each executive officer included an award of restricted stock. Each award vests at a rate of 25% per year beginning in 2007 and is subject to certain forfeiture provisions as set forth in a restricted stock agreement.

President and Chief Executive Officer Alan L. Wells receives an annual base salary of $350,000 and is entitled to an annual cash bonus based on achievement of performance criteria and other usual benefits pursuant to an employment agreement entered into by the Company and Mr. Wells in August 2005. The 2005 agreement superseded and replaced a previous employment agreement by which Mr. Wells was paid an annual base salary of $280,000 plus annual bonus and other usual benefits. The cash bonus paid to Mr. Wells for 2005 was $400,000, and during 2005 Mr. Wells was awarded 100,000 shares of restricted stock which vests at a rate and subject to certain forfeiture provisions similar to those applicable to other executive officers. The total compensation paid Mr. Wells for 2005 was based on the Compensation Committee’s assessment of the responsibilities assigned to Mr. Wells, the total compensation paid chief executive officers by comparable companies, the board’s desire to retain Mr. Wells’ services in future years, and the Company’s performance. For purposes of determining Mr. Wells’ 2005 cash bonus, half of the Compensation Committee’s assessment of performance was based on the Company’s attainment of target levels of adjusted EBITDA and half was based on an assessment of the Company’s performance in relation to other strategic objectives.

|

MEMBERS OF THE COMPENSATION COMMITTEE |

|

Norman C. Frost |

Brian G. Hart Craig A. Lang |

19

EMPLOYMENT AGREEMENT

The Company has entered into an employment agreement with Alan L. Wells, our President and Chief Executive Officer. The employment agreement expires on December 31, 2010, and is subject to automatic extensions for successive terms of one year unless either party delivers at least 120 days’ notice of non-renewal. Under his employment agreement, Mr. Wells receives a base salary of at least $350,000, which may be increased following annual review by our board of directors. Mr. Wells also receives an annual bonus equal to a percentage of his base salary, ranging from zero to 200% of base salary if certain “maximum” goals are met or exceeded. Goals used to assess Mr. Wells’ performance are established by the Compensation Committee in its sole discretion not later than the end of each first fiscal quarter, except that one-half of Mr. Wells’ potential bonus is based on the Company’s “Adjusted EBITDA.” Bonus amounts in excess of 100% of Mr. Wells’ base salary may, in the Compensation Committee’s sole discretion, be paid in the form of restricted stock issued under our 2005 Equity Incentive Plan, valued at fair market value and vesting over three years, subject to accelerated vesting if Mr. Wells’ employment is terminated by the Company without “cause,” by Mr. Wells for “good reason,” due to Mr. Wells’ death or disability, or due to expiration of the term of the agreement without renewal.

The employment agreement also provides various fringe benefits, including vacation, use of a motor vehicle, participation in the Company’s 401(k) plan, and certain minimum amounts to be credited to Mr. Wells’ account under the Company’s Deferred Compensation Plan. Pursuant to the agreement, Mr. Wells also received a one-time grant of 100,00 shares of restricted stock under our 2005 Equity Incentive Plan, vesting over five-years, subject to accelerated vesting if, in connection with a “change of control” of the Company, Mr. Wells’ employment is terminated by the Company without “cause” or by Mr. Wells for “good reason.”

If we terminate Mr. Wells’ employment without “cause”, or if Mr. Wells terminates his employment for “good reason”, then (1) Mr. Wells will receive a pro-rated bonus for the year in which such termination occurs based on the Company’s actual results for such year but pro rated based on the number of days employed during the year, and (2) Mr. Wells will continue to receive his base salary, “target” bonus, and health insurance for 24 months. The agreement also restricts Mr. Wells from competing with the Company for up to 24 months after termination of his employment.

We do not have employment agreements or change of control agreements with any other members of our management team.

20

SHAREHOLDER RETURN PERFORMANCE

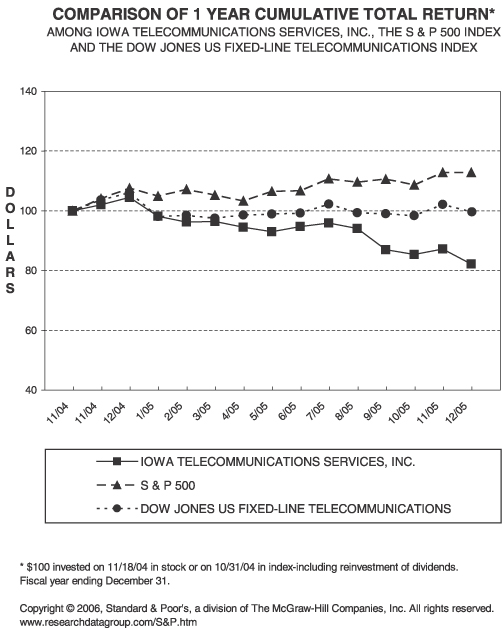

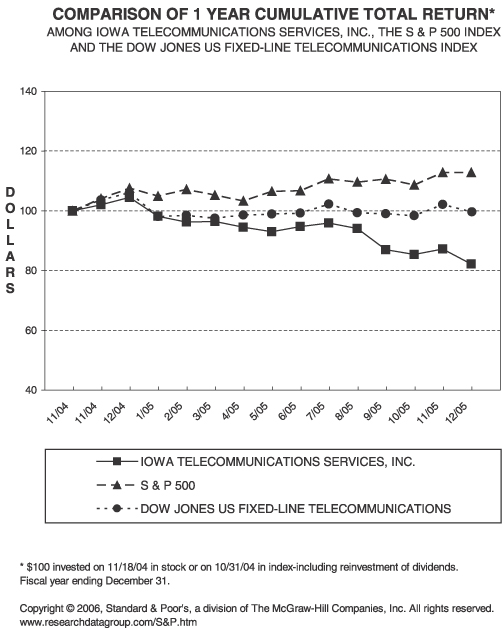

Set forth below is a line graph comparing the change in the cumulative total return on our company’s common stock with the cumulative total return of the S&P 500 and the Dow Jones US Fixed Line Telecommunications Index for the period from November 18, 2004 (the first day of trading of our common stock on the NYSE) to December 31, 2005, assuming the investment of $100 on November 18, 2004 and the reinvestment of dividends.

The common stock price performance shown on the graph only reflects the change in our company’s common stock price relative to the noted indices and is not necessarily indicative of future price performance.

| | | | | | | | | |

| | | 11/18/2004

| | 12/31/2004

| | 12/31/2005

|

Iowa Telecommunications Services, Inc. | | $ | 100.00 | | $ | 104.54 | | $ | 82.16 |

S&P 500 | | $ | 100.00 | | $ | 107.59 | | $ | 112.87 |

Dow Jones US Fixed Line Telecommunications Index | | $ | 100.00 | | $ | 105.94 | | $ | 99.70 |

21

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Telecommunications Service Arrangements with Iowa Network Services

We currently have several agreements with Iowa Network Services (“INS”), the beneficial owner of approximately 9.88% of the shares of our common stock outstanding. We sell network and special access services to INS. In 2005 we recognized $2.1 million related to these services. We also purchase certain services including switch monitoring and telecommunication circuits from INS and resell certain products obtained from INS. In 2005 we recognized expenses of $12.1 million related to these products and services.

PROPOSAL NO. 2—APPROVAL OF AUDITORS

The Audit Committee of the board of directors approved the retention of Deloitte & Touche LLP as Iowa Telecom’s independent auditors for the year ending December 31, 2006, subject to shareholder approval. Deloitte & Touche LLP has served as Iowa Telecom’s independent auditors since December 31, 2000. Representatives of Deloitte & Touche LLP will be available to answer questions and make statements at the annual meeting.

Board recommendation and shareholder vote required

The Audit Committee of the board of directors recommends a vote FOR the approval and ratification of the appointment of Deloitte & Touche LLP as Iowa Telecom’s independent auditors for the year ending December 31, 2006 (Proposal No. 2 on the proxy card). The affirmative vote of the holders of a majority of the shares actually voting on the proposal will be required for approval.

If the appointment is not ratified, the Audit Committee will select other independent auditors. If the appointment is ratified, the Audit Committee reserves the right to appoint other independent auditors.

ANNUAL REPORT TO SHAREHOLDERS

Iowa Telecom’s 2005 Annual Report to Shareholders accompanies this proxy statement. It includes a copy of our Annual Report on Form 10-K for the year ended December 31, 2005, which includes a list of exhibits thereto. Iowa Telecom will furnish to shareholders a copy of any such exhibit(s) upon written request and advance payment of reasonable fees related to furnishing such exhibit(s). Requests for copies of such exhibit(s) should be directed to our Secretary at Iowa Telecommunications Services, Inc., 115 S. Second Avenue West, P.O. Box 1046, Newton, Iowa 50208-1046.

SHAREHOLDERS’ PROPOSALS

In order for a shareholder to have a proposal included in the proxy statement for the 2007 annual meeting of shareholders, the proposal must comply with the procedures identified by Rule 14a-8 under the Exchange Act and be received in writing by Iowa Telecom’s Secretary no later than December 30, 2006. A proposal satisfying such requirements will be considered at the 2007 annual meeting of shareholders.

The following information must be provided regarding each proposal: a brief description of the business desired to be brought before the meeting; the reasons for conducting such business at the meeting; and a statement of any material interest in such business of such shareholder and the beneficial owner, if any, on whose behalf the proposal is made. In addition, the following information must be provided regarding the shareholder giving the notice and the beneficial owner, if any, on whose behalf the proposal is made: the name and address of such shareholder, as they appear on the corporation’s books, and of such beneficial owner; the class, series and number of shares of the corporation which are owned beneficially and of record by such shareholder and such beneficial owner; a representation that such shareholder is a shareholder of record and intends to appear in person or by proxy at the meeting to bring the business proposed in the notice before the meeting; and any other information relating to such shareholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to the Exchange Act and the rules and regulations promulgated thereunder.

22

GENERAL