SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Under Rule 14a-12 |

Iowa Telecommunications Services, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 12, 2008

To Our Shareholders:

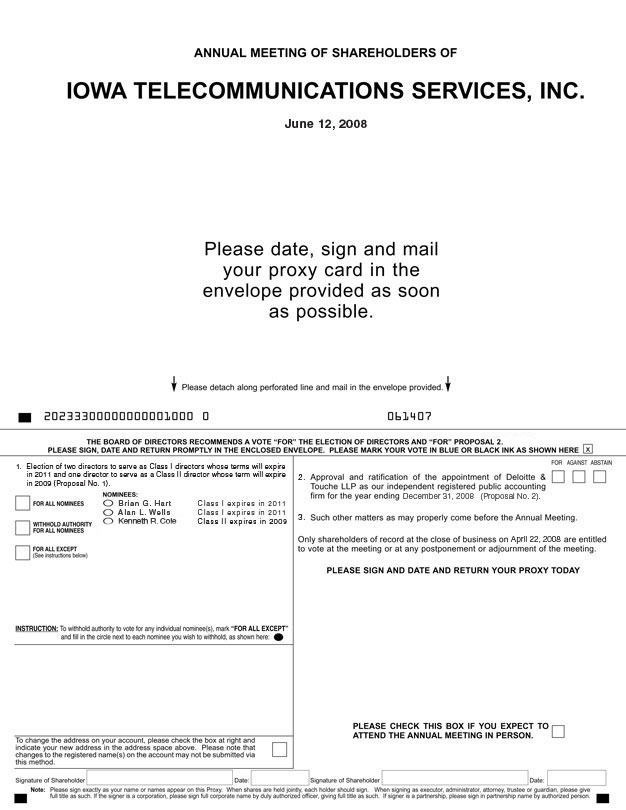

The 2008 annual meeting of shareholders of Iowa Telecommunications Services, Inc. (“Iowa Telecom”) will be held at the Sodexho DMACC Conference Center, 600 North 2nd Avenue West, Newton, Iowa 50208 on Thursday, June 12, 2008 at 10:00 AM central time. At the meeting, shareholders will act on the following matters:

| | 1. | Election of two directors to serve as Class I directors whose terms will expire in 2011 and one director to serve as a Class II director whose term will expire in 2009 (Proposal No. 1); |

| | 2. | Approval of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, hereinafter referred to as independent auditors, for the year ending December 31, 2008 (Proposal No. 2); and |

| | 3. | Any other matters that properly come before the meeting. |

Only shareholders of record at the close of business on April 22, 2008 are entitled to vote at the meeting or at any postponement or adjournment of the meeting.

We hope that as many shareholders as possible will personally attend the meeting. Whether or not you plan to attend the meeting, please complete the enclosed proxy card and sign, date and return it promptly so that your shares will be represented. Sending in your proxy will not prevent you from voting in person at the meeting.

|

By Order of the Board of Directors, |

|

|

Donald G. Henry |

Vice President, General Counsel and Secretary |

April 22, 2008

Important Notice Regarding the Availability of

Proxy Materials for the Annual Meeting of Shareholders to be held on June 12, 2008

This Notice of Annual Meeting of Shareholders is accompanied by and is a part of our proxy statement. Financial and other information concerning Iowa Telecom is contained in our 2007 Annual Report to Shareholders, which also accompanies this proxy statement. The 2007 Annual Report to Shareholders includes a copy of our Annual Report on Form 10-K for the year ended December 31, 2007. A proxy card is also enclosed.

This proxy statement and our 2007 Annual Report to Shareholders are available on our website at www.iowatelecom.com. You may obtain assistance with directions to attend the annual meeting and vote in person from our investor relations department by calling (641) 787-2089, by sending an e-mail request from our website atwww.iowatelecom.com or directly toInvestorRelations@iowatelecom.com, or by writing to Investor Relations at Iowa Telecommunications Services, Inc., 403 W. Fourth Street North, P.O. Box 1046, Newton, Iowa 50208-1046.

TABLE OF CONTENTS

i

ii

Iowa Telecommunications Services, Inc.,

403 W. Fourth Street North,

Newton, Iowa 50208

PROXY STATEMENT

This proxy statement contains information related to the annual meeting of shareholders of Iowa Telecommunications Services, Inc. (“Iowa Telecom” or the “Company”) to be held on Thursday, June 12, 2008, beginning at 10:00 AM central time, at Sodexho DMACC Conference Center, 600 North 2nd Avenue West, Newton, Iowa 50208, and at any postponement or adjournment of the meeting. The approximate date of mailing for this proxy statement and proxy card as well as a copy of Iowa Telecom’s 2007 Annual Report is April 28, 2008.

ABOUT THE MEETING

What is the purpose of the annual meeting?

At Iowa Telecom’s annual meeting, shareholders will act upon the matters outlined in the accompanying notice of meeting, including:

| | • | | the election of two directors to serve as Class I directors whose terms will expire in 2011 and one director to serve as a Class II director whose term will expire in 2009; and |

| | • | | the approval and ratification of the appointment of Deloitte & Touche LLP as our independent auditors. |

In addition, management will report on our performance during 2007 and respond to questions from shareholders.

Who is entitled to vote?

Only shareholders of record at the close of business on the record date, April 22, 2008, are entitled to receive notice of the annual meeting and to vote the shares of common stock that they held on that date at the meeting, or any postponement or adjournment of the meeting. Each outstanding share entitles its holder to cast one vote on each matter to be voted upon.

Who can attend the meeting?

All shareholders as of the record date, or their duly appointed proxies, may attend the meeting. Cameras, recording devices and other electronic devices will not be permitted at the meeting. If you hold your shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum, permitting the meeting to conduct its business. As of April 22, 2008, the record date, 31,990,606 shares of Iowa Telecom’s common stock were outstanding. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of the number of shares considered present at the meeting.

1

How do I vote?

The proxy card delivered to you with this proxy statement will be voted at the annual meeting as you direct on the card if you sign the card in the manner indicated on the card and return it to us in the envelope provided for that purpose. If you are a registered shareholder as of the record date and attend the meeting, you may deliver your completed proxy card in person. If you are a “street name” shareholder, you should refer to the information forwarded by your bank, broker or other holder of record to see the procedures for voting your shares. If you are a “street name” shareholder and you wish to vote in person at the meeting, you will need to obtain a proxy from the institution that holds your shares and present it to the inspector of elections with your ballot when you vote at the annual meeting.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with Iowa Telecom’s Secretary either a notice of revocation or a duly executed proxy bearing a later date. If you are a “street name” shareholder, you may vote in person at the annual meeting if you obtain a proxy as described in the answer to the previous question. The powers of the proxy holders with regard to your shares will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

Can I vote by telephone or electronically?

No. We have not instituted any mechanism for telephone or electronic voting. “Street name” shareholders, however, may be able to vote electronically through their bank, broker or other holder of record. If so, instructions regarding electronic voting will be provided by the broker as part of the package which includes this proxy statement.

What are the board’s recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the board of directors. The board’s recommendation is set forth together with the description of each proposal in this proxy statement. In summary, the board recommends a vote:

| | • | | for the election of the nominated slate of directors (see page 12 of this proxy statement); and |

| | • | | for the approval and ratification of the appointment of Deloitte & Touche LLP as Iowa Telecom’s independent auditors (see page 34 of this proxy statement). |

Pursuant to the provisions of Rule 14a-4(c) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the board of directors or, if no recommendation is given, in their own discretion.

What vote is required to approve each item?

Election of directors. The affirmative vote of a plurality of the votes cast at the meeting at which a quorum is present is required for the election of directors. A properly executed proxy card marked “WITHHOLD AUTHORITY” or “FOR ALL EXCEPT” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

Other proposals. For each other proposal, the affirmative vote of the holders of a majority of the shares actually voting on the proposal will be required for approval. A properly executed proxy card marked

2

“ABSTAIN” with respect to any such matter will not be voted on such matter and will not affect the outcome of any matter, although it will be counted for purposes of determining whether there is a quorum.

Broker non-votes. Where brokers are prohibited from exercising discretionary authority for beneficial owners who have not provided voting instructions (commonly referred to as “broker non-votes”), such broker non-votes will be treated as shares that are present for purposes of determining the presence of a quorum. Broker non-votes will not affect the outcome of any matter.

3

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table and footnotes set forth the beneficial ownership of Iowa Telecom common stock held by (i) each person or group of persons known to Iowa Telecom to beneficially own more than five percent (5%) of the outstanding shares of our common stock, (ii) each Iowa Telecom director, (iii) each executive officer of Iowa Telecom named in the Summary Compensation Table on page 24 of this proxy statement, and (iv) Iowa Telecom’s executive officers and directors as a group. The amounts and percentages of common stock beneficially owned are reported on the basis of regulations of the Securities and Exchange Commission (“SEC”) governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. The information in the following table and footnotes is taken from or is based upon filings made by such persons with the SEC, or upon information provided by such persons. All information is as of April 22, 2008 unless otherwise noted.

| | | | | |

Name and address of beneficial owner or identity of group(1)

| | Aggregate

number of

shares

beneficially

owned(2)

| | Percent of

shares

outstanding(3)

| |

Prudential Financial Inc.(4) | | 2,110,054 | | 6.60 | % |

Jennison Associates LLC(5) | | 2,033,254 | | 6.36 | % |

NFJ Investment Group L.P.(6) | | 1,743,000 | | 5.45 | % |

Barclays Global Investors, N.A.(7) | | 1,617,630 | | 5.06 | % |

Kenneth R. Cole | | 1,000 | | * | |

Norman C. Frost | | 7,000 | | * | |

Brian G. Hart | | 4,000 | | * | |

H. Lynn Horak | | 1,000 | | * | |

Craig A. Lang | | 1,000 | | * | |

Kendrik E. Packer | | 19,078 | | * | |

Alan L. Wells | | 538,532 | | 1.66 | % |

Craig A. Knock | | 127,683 | | * | |

Brian T. Naaden | | 67,610 | | * | |

Dennis R. Kilburg | | 84,527 | | * | |

Donald G. Henry | | 55,735 | | * | |

All executive officers and directors as a group (16 persons) | | 1,172,439 | | 3.59 | % |

| * | Represents less than 1% of Iowa Telecom’s outstanding common stock. |

| (1) | Unless otherwise indicated below, the persons in the above table have sole voting and investment power with respect to all shares set forth opposite their names. The address of all executive officers and directors is c/o Iowa Telecommunications Services, Inc., 403 W. Fourth Street North, Newton, Iowa 50208. |

| (2) | Includes the following numbers of shares subject to options to purchase common stock of Iowa Telecom which are currently exercisable or exercisable within 60 days of April 22, 2008 and shares of unvested restricted stock: |

| | | | |

Name

| | Unexercised

Options (#)

| | Restricted

Stock (#)

|

Alan L. Wells | | 407,116 | | 115,000 |

Craig A. Knock | | 46,232 | | 73,750 |

Brian T. Naaden | | 23,232 | | 41,000 |

Dennis R. Kilburg | | 55,232 | | 26,575 |

Donald G. Henry | | 15,195 | | 37,500 |

4

| (3) | The applicable percentage of shares outstanding for each beneficial owner is calculated by dividing (i) the number of shares deemed to be beneficially owned by such person as of April 22, 2008 by (ii) the sum of (A) the number of shares of common stock outstanding as of April 22, 2008 plus (B) the number of shares issuable upon exercise of options held by such shareholder which were exercisable as of April 22, 2008 or which will become exercisable within 60 days after April 22, 2008. |

| (4) | The address of Prudential Financial, Inc. (“Prudential”) is 751 Broad Street, Newark, New Jersey 07102. The information set forth in the table pertaining to Prudential and in this footnote is as reported on a statement on Schedule 13G filed on February 6, 2008. In its Schedule 13G, Prudential informed us that (a) through its beneficial ownership of the Prudential Insurance Company of America (“PICOA”), Prudential may be deemed to presently hold 4,400 shares of our common stock for the benefit of PICOA’s general account, and (b) Prudential may be deemed the beneficial owner of securities beneficially owned by certain entities listed in Item 7 of its Schedule 13G (including Jennison Associates, LLC, see footnote 5) and may have direct or indirect voting and/or investment discretion over 2,105,654 shares which are held for its own benefit or for the benefit of its clients by its separate accounts, externally managed accounts, registered investment companies, subsidiaries and/or other affiliates. |

| (5) | The address of Jennison Associates, LLC (“Jennison”) is 466 Lexington Avenue, New York, New York 10017. The information set forth in the table pertaining to Jennison and in this footnote is as reported on a statement on Schedule 13G/A filed on February 14, 2008. In its Schedule 13G/A, Jennison informed us that (a) Jennison provides investment advice to several investment companies, insurance separate accounts, and institutional clients (“Managed Portfolios”) and, as a result of its role as investment adviser of the Managed Portfolios, Jennison may be deemed to be the beneficial owner of the shares of Iowa Telecom’s common stock held by such Managed Portfolios, (b) Prudential indirectly owns 100% of equity interests of Jennison and therefore, may be deemed to have the power to exercise or to direct the exercise of such voting and/or dispositive power that Jennison may have with respect to our common stock held by the Managed Portfolios, and (c) since Jennison does not file jointly with Prudential, shares of our common stock reported on Jennison’s 13G may be included in the shares reported on the 13G filed by Prudential; see footnote 4. |

| (6) | NFJ Investment Group L.P.’s address is 2100 Ross Avenue, Suite 1840, Dallas, Texas 75201. The information set forth in the table pertaining to NFJ Investment Group L.P. and in this footnote is as reported on a statement on Schedule 13G/A filed on February 14, 2008. |

| (7) | The address of Barclays Global Investors, N.A. (“Barclays Investors”) and of Barclays Global Fund Advisors (“Barclays Advisors”) is 45 Fremont Street, San Francisco, CA 94105. The information set forth in the table pertaining to Barclays Investors and in this footnote is as reported on a statement on Schedule 13G jointly filed on February 5, 2008 by Barclays Investors, Barclays Advisors, Barclays Global Investors, LTD, Barclays Global Investors Japan Trust and Banking Company Limited, Barclays Global Investors Japan Limited, Barclays Global Investors Canada Limited, Barclays Global Investors Australia Limited and Barclays Global Investors (Deutschland) AG (collectively, the “Barclays Entities”). In their Schedule 13G, the Barclay Entities informed us that (a) they may be deemed the beneficial owners of shares of our common stock held by them in trust accounts for the economic benefit of the beneficiaries of those accounts, (b) Barclays Investors has sole voting power over 641,606 shares and sole dispositive power over 690,294 shares of our common stock and (c) Barclays Advisors has sole voting power and sole dispositive power over 927,336 shares of our common stock. |

Section 16(a) beneficial ownership reporting compliance

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership with the SEC. To Iowa Telecom’s knowledge, based solely upon a review of filings with the SEC and written representations that no other reports were required, we believe that all of our executive officers, directors and 10% shareholders complied during 2007 with the reporting requirements of Section 16(a) of the Exchange Act.

5

CORPORATE GOVERNANCE AND BOARD COMMITTEES

Are a majority of the directors independent?

The board of directors has determined that Messrs. Cole, Packer, Frost, Lang, Horak and Hart are independent directors in accordance with Section 303A of the New York Stock Exchange (“NYSE”) corporate governance listing standards because none of them are believed to have any direct or indirect material relationships that, in the opinion of the board, would interfere with the exercise of independent judgment in carrying out their responsibilities as a director. In addition, the board has adopted Corporate Governance Guidelines which conform to or are more exacting than the NYSE listing standards and has determined that Messrs. Cole, Packer, Frost, Lang, Horak and Hart are independent under these guidelines. A copy of our Corporate Governance Guidelines may be found on our website atwww.iowatelecom.com and is available in print to any shareholder who requests it. Mr. Wells is not considered independent under the NYSE listing standards because he currently serves as an executive officer of Iowa Telecom.

How are directors compensated?

In 2007, the Nominating and Governance Committee undertook a review of the compensation we pay to our non-employee directors. After completing its review, the committee recommended that our director compensation practices be modified, and in 2007 the board approved the committee’s recommendation. Beginning January 1, 2008, we pay our non-employee directors an annual retainer consisting of a $25,000 cash payment and 1,000 shares of our common stock. Each non-employee director may elect to receive up to one-half of the cash payment in shares of our common stock. Non-employee directors also are paid $1,000 for each board meeting attended in person, $500 for each board committee meeting attended in person and $500 for each board or board committee meeting attended by means of a telephone conference call. In addition, our lead director and the Chairman of the Audit Committee each receive an additional annual retainer of $10,000, and all other members of the Audit Committee receive an additional annual retainer of $5,000. We reimburse all non-employee directors for reasonable expenses incurred to attend board or board committee meetings. Under our director compensation policy, a director who also serves as an executive officer receives no additional compensation for serving as a director.

Director Compensation

The following table details compensation to our non-employee directors in 2007.

| | | | | | | | | | | | | | | | | | | | | |

Name

| | Fees

Earned

or

Paid in

Cash ($)(1)

| | Stock

Awards

($)(2)

| | Option

Awards ($)

| | Non-Equity

Incentive Plan

Compensation ($)

| | Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings ($)

| | All Other

Compensation ($)

| | Total

($)

|

Norman C. Frost | | $ | 32,500 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 32,500 |

Brian G. Hart | | | 38,000 | | | — | | | — | | | — | | | — | | | — | | | 38,000 |

H. Lynn Horak | | | 28,500 | | | — | | | — | | | — | | | — | | | — | | | 28,500 |

Kevin R. Hranicka(3) | | | 33,000 | | | — | | | — | | | — | | | — | | | — | | | 33,000 |

Craig A. Lang | | | 33,000 | | | — | | | — | | | — | | | — | | | — | | | 33,000 |

Kendrik E. Packer | | | 20,000 | | | 12,500 | | | — | | | — | | | — | | | — | | | 32,500 |

| (1) | Fees include the annual cash retainer, as well as meeting and other fees. In 2007, non-employee directors received an annual retainer of up to $25,000 in cash. Non-employee directors also were paid $1,000 for each board meeting attended in person, $500 for each board committee meeting attended in person and $500 for each board or board committee meeting attended by means of a telephone conference call. In addition, the Chairman of the Audit Committee received an additional annual retainer of $5,000. |

| (2) | Represents the value of 622 shares of our Common Stock that Mr. Packer received based on his voluntary election on February 12, 2007. The shares are fully vested. |

| (3) | Mr. Hranicka resigned from the board of directors effective November 29, 2007. |

6

How often did the board meet during 2007?

The board met ten times during 2007. Each director attended at least 75% of the total number of meetings of the board and committees on which he served. In 2007, the non-employee directors of the board met four times in executive session.

How many directors attended the 2007 annual meeting of shareholders?

Each director is expected to make a reasonable effort to attend all board meetings and all meetings of board committees of which such director is a member. Iowa Telecom does not require directors to attend the annual meeting of shareholders. The 2007 annual meeting was attended by three directors.

What committees has the board established?

The board of directors has standing Audit, Nominating and Governance, and Compensation committees. The membership of the standing committees is as follows:

| | | | | | |

Name

| | Audit

Committee

| | Nominating and

Governance

Committee

| | Compensation

Committee

|

Kendrik E. Packer | | * | | Chair* | | |

Norman C. Frost | | | | | | * |

Craig A. Lang | | | | * | | Chair* |

Brian G. Hart | | Chair* | | | | * |

H. Lynn Horak | | * | | | | |

Kenneth R. Cole | | | | | | |

Alan L. Wells | | | | | | |

Audit Committee. The Audit Committee consists of Messrs. Hart, Packer and Horak, with Mr. Hart serving as Chair. The board has determined that all members of the Audit Committee are independent, as defined in Section 303A of the NYSE corporate governance listing standards and Section 10A(m)(3) of the Exchange Act. Each of the members is able to read and understand financial statements, including a balance sheet, income statement and statement of cash flow, and is financially literate as determined by Iowa Telecom’s board in its business judgment. The board has determined that in addition to being independent, each of Messrs. Hart, Packer and Horak is an “audit committee financial expert” as such term is defined under the applicable SEC rules. The Audit Committee met four times in 2007. The board has adopted an Audit Committee Charter, which may be found on our website atwww.iowatelecom.com and is available in print to any shareholder who requests it. The charter describes the primary functions of the Audit Committee, which are to assist the board of directors in its oversight of:

| | • | | the financial reporting process and internal control system; |

| | • | | the independent registered public accounting firm’s qualifications and independence; |

| | • | | compliance with legal, ethical and regulatory matters; and |

| | • | | the performance of our internal audit function and our independent registered public accounting firm. |

Our Audit Committee is also responsible for the following:

| | • | | conducting an annual performance evaluation of the Audit Committee; |

| | • | | compensating, retaining and overseeing the work of our independent registered public accounting firm; and |

7

| | • | | establishing procedures for (a) receipt and treatment of complaints on accounting and other related matters and (b) submission of confidential employee concerns regarding questionable accounting or auditing matters. |

The Audit Committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties.

The “Report of the Audit Committee of the Board of Directors” is presented on page 33 of this proxy statement.

Nominating and Governance Committee.The Nominating and Governance Committee consists of Messrs. Packer and Lang, with Mr. Packer serving as Chair. The board has determined that all members of the Nominating and Governance Committee are independent, as defined in Section 303A of the NYSE corporate governance listing standards. The Nominating and Governance Committee met five times in 2007. The purpose of the Nominating and Governance Committee is to:

| | • | | establish criteria for board and committee membership and recommend to our board of directors proposed nominees for election to the board of directors and for membership on committees of the board of directors; |

| | • | | make recommendations regarding proposals submitted by our shareholders; |

| | • | | make recommendations to our board of directors regarding corporate governance matters and practices; and |

| | • | | oversee the evaluation of our board of directors and management. |

The board has adopted a Nominating and Governance Committee Charter, a copy of which may be found on our website atwww.iowatelecom.com and is available in print to any shareholder who requests it. The Nominating and Governance Committee will consider candidates for board membership that shareholders recommend. Shareholders may recommend candidates for consideration by the Nominating and Governance Committee by mailing a written notice to the Nominating and Governance Committee in care of the Secretary of Iowa Telecom. Such recommendations for the 2009 annual meeting of shareholders must be received by Iowa Telecom no later than December 31, 2008. The written notice must include the following information regarding each person whom the shareholder recommends for election or reelection as a director: the name, age, business address and, if known, the residential address of such person; the principal occupation or employment of such person; the class, series and number of Iowa Telecom shares which are owned beneficially and of record by such person; all other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to the Exchange Act and the rules and regulations promulgated thereunder; and such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected. In addition, the written notice must include the following information regarding the shareholder giving the notice and the beneficial owner, if any, on whose behalf the recommendation is made: the name and address of such shareholder, as they appear on the corporation’s books, and of such beneficial owner; the class, series and number of shares of the corporation which are owned beneficially and of record by such shareholder and such beneficial owner; a representation that such shareholder is a shareholder of record and intends to appear in person or by proxy at the meeting; and any other information relating to such shareholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to the Exchange Act and the rules and regulations promulgated thereunder.

The charter of the Nominating and Governance Committee sets forth the criteria for identifying and recommending new candidates to serve as directors. In considering potential candidates for the board, the Nominating and Governance Committee will give consideration to director candidates recommended by shareholders and the Nominating and Governance Committee’s own candidates, provided that the shareholder

8

recommendations are made in accordance with the procedures described above. Candidates will be interviewed by the Nominating and Governance Committee to evaluate the following:

| | • | | experience as a board member of other publicly-traded corporations, experience in industries or with technologies relevant to Iowa Telecom, accounting or financial reporting experience, or such other professional experience which the Nominating and Governance Committee determines qualifies an individual for board service; |

| | • | | the candidate’s business judgment and even temperament, high ethical standards, a healthy view of the relative responsibilities of a board member and management, independent thinking, articulate communication and intelligence; and |

| | • | | any other factors the Nominating and Governance Committee deems appropriate, including judgment, skill, diversity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other board members, and the extent to which the candidate would be a desirable addition to the board and any committees of the board. |

Current directors standing for reelection are not required to participate in an interview process. All of the directors named on the proxy card are standing for reelection.

Compensation Committee. The Compensation Committee consists of Messrs. Lang, Hart and Frost, with Mr. Lang serving as Chair. The board has determined that all members of the Compensation Committee are independent, as defined in Section 303A of the NYSE corporate governance listing standards.

The Compensation Committee is charged with:

| | • | | reviewing and approving goals and objectives relating to the compensation of our Chief Executive Officer and determining and approving the compensation of the Chief Executive Officer; |

| | • | | reviewing and approving the evaluation process and compensation structure for our executive officers; and |

| | • | | overseeing preparation of the discussion and analysis of executive compensation to be included in our public filings with the SEC. |

The Compensation Committee met eight times in 2007. The board has adopted a Compensation Committee Charter, a copy of which may be found on our website atwww.iowatelecom.com and is available in print to any shareholder who requests it.

The Compensation Committee Charter grants the Committee the power to retain and terminate compensation consultants and the sole authority to approve a consultant’s fees and other terms of engagement. Since October 2006, the Committee has retained Frederic W. Cook & Co. (“Cook”), a consulting firm specializing in executive compensation, as its independent advisor. Cook provides the Committee with information on industry pay practices and general advice on compensation design and levels. Cook had performed no prior services to the Company and does no other work with the Company or its management.

Generally, the only executive officer that attends the meetings of the Compensation Committee is Mr. Wells. Mr. Wells is not, however, a member of the committee. Mr. Wells assists with the administrative aspects of the Company’s relationship with its compensation consultant, and with the calculation and presentation to the Compensation Committee of current and proposed compensation for executive officers other than himself. Mr. Wells also occasionally relies on Mr. Knock, our Vice President, Chief Financial Officer and Treasurer, to calculate and review the Company’s Adjusted EBITDA and other business metrics, which are relevant performance measures under our annual incentive program. Decisions regarding Mr. Wells’ compensation are made by the Compensation Committee in executive session, excluding all members of management. Decisions regarding the compensation of Mr. Wells are communicated by the Compensation

9

Committee to Mr. Wells. Decisions regarding the compensation of other executive officers are communicated by the Committee through Mr. Wells to the other officers. Mr. Henry, Vice President, General Counsel and Corporate Secretary, is involved with respect to legal and Securities and Exchange Commission (SEC) issues relating to executive compensation, including reporting and disclosure issues.

The “Report of the Compensation Committee of the Board of Directors” is presented on page 23 of this proxy statement.

Executive Sessions

Executive sessions or meetings of outside (non-management) directors without management present were held four times in 2007. Mr. Craig A. Lang, our lead director, serves as the presiding director of the executive sessions. The outside directors reviewed the report of the independent auditor, the criteria upon which the performance of the Chief Executive Officer and other senior managers were evaluated, the performance of the Chief Executive Officer against such criteria, the compensation of the Chief Executive Officer and other senior managers, and any other relevant matters. Meetings were also held from time to time with the Chief Executive Officer for a general discussion of relevant subjects.

Communications with Directors

The board has implemented a process by which our shareholders or other interested parties may send written communications to the board’s attention. Any shareholder desiring to communicate with our board, our lead director, or one or more of our directors may send a letter addressed to the Iowa Telecom Board of Directors c/o Donald G. Henry, Vice President, General Counsel and Secretary, Iowa Telecommunications Services, Inc., 403 W. Fourth Street North, P.O. Box 1046, Newton, Iowa 50208-1046. The Secretary has been instructed by the board to promptly forward all communications so received to the full board or the individual board member(s) specifically addressed in the communication.

Communications will be distributed to the board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, our board of directors has requested that certain items that are unrelated to the duties and responsibilities of the board should be excluded, including spam, junk mail and mass mailings, consumer complaints and inquiries, resumes and other forms of job inquiries, surveys, and business solicitations or advertisements. In addition, material deemed by the Secretary to be unduly hostile, threatening, illegal or similarly unsuitable will be excluded.

Code of Business Conduct and Ethics

The board has adopted a Code of Business Conduct and Ethics (the “Code”), a copy of which may be found on our website atwww.iowatelecom.com and is available in print to any shareholder who requests it. Under the Code, we insist on honest and ethical conduct by all of our directors, officers, employees and other representatives, including the following:

| | • | | our directors, officers and employees are required to deal honestly and fairly with our customers, collaborators, competitors and other third parties; |

| | • | | our directors, officers and employees should not be involved in any activity that creates or gives the appearance of a conflict of interest between their personal interests and the interests of Iowa Telecom; and |

| | • | | our directors, officers and employees should not disclose any confidential information of Iowa Telecom or its suppliers, customers or other business partners. |

We also are committed to providing our shareholders and investors with full, fair, accurate and understandable disclosure in the reports that we file with the SEC. We will comply with all laws and

10

governmental regulations that are applicable to our activities, and expect all of our directors, officers and employees to do the same.

Our board of directors and Audit Committee have established the standards in the Code and oversee compliance with the Code. The board has also created the position of Ethics Officer to assist in the administration of the Code and adherence to the Code. Donald G. Henry has been appointed as the Ethics Officer, and as Ethics Officer he reports directly to the board. Directors, officers and employees must report any known or suspected violations of the Code to the Ethics Officer or the Chairman of the Audit Committee or our board of directors. If it is determined that the Code has been violated, Iowa Telecom will take necessary corrective action reasonably calculated to address and correct the alleged violation.

11

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Our restated articles of incorporation provide that our board of directors is divided into three classes of directors, designated Class I, Class II and Class III, as nearly equal in size as is practicable, serving staggered three-year terms. One class of directors is elected each year to hold office for a three-year term and until successors of such directors are duly elected and qualified. The class that will stand for election in 2008 is Class I.

In addition, Iowa law requires that a director elected to fill a vacancy on the board of directors stand for election at the next shareholders’ meeting at which directors are elected. One of our directors, Kenneth R. Cole, was elected to fill a vacancy after the 2007 annual meeting of shareholders. Iowa law requires that he stand for election at the 2008 Annual Meeting.

The Nominating and Governance Committee has recommended, and the board also recommends, that the shareholders elect the nominees designated below to serve as directors. More specifically, it is recommended that Brian G. Hart and Alan L. Wells be elected at this year’s Annual Meeting to serve as Class I directors whose terms will expire at the 2011 annual meeting of shareholders or when their successors are duly elected and qualified, and that Kenneth R. Cole be elected at this year’s Annual Meeting to serve as a Class II director whose term will expire at the 2009 annual meeting of shareholders or when his successor is duly elected and qualified.

The nominees for election to the office of director, and certain information with respect to their backgrounds and the background of the non-nominee directors, are set forth below. It is the intention of the persons named in the accompanying proxy card, unless otherwise instructed, to vote to elect the nominees named herein as directors. Each of the nominees named herein presently serves as a director of the Company. In the event any of the nominees named herein is unable to serve as a director, discretionary authority is reserved to the board to vote for a substitute. The board has no reason to believe that any of the nominees named herein will be unable to serve if elected.

Nominees standing for election to the board

| | | | |

Name

| | Age

| | Current Position With Company

|

Brian G. Hart | | 52 | | Class I Director |

Alan L. Wells | | 48 | | Class I Director, Chairman, President and Chief Executive Officer |

Kenneth R. Cole | | 60 | | Class II Director |

Non-nominees continuing to serve in the office of director

| | | | |

Name

| | Age

| | Current Position With Company

|

Norman C. Frost | | 53 | | Class II Director |

H. Lynn Horak | | 62 | | Class III Director |

Craig A. Lang | | 56 | | Class III Director |

Kendrik E. Packer | | 46 | | Class II Director |

Business experience of nominees to the board

Brian G. Hart.Mr. Hart has served on the board of directors of Iowa Telecom since November 2005. He currently is President of Hart Financial, LLC, a registered investment advisor providing financial planning and investment advisory services. Mr. Hart previously served as Vice President and Chief Financial Officer of Pioneer Hi-Bred International, Inc. and has held various other accounting, finance and auditing positions, including Partner at McGladrey & Pullen. Mr. Hart is a certified public accountant and a registered investment advisor. Mr. Hart also serves on the Des Moines University Board of Trustees, on the Executive Committee of

12

the Board of the Civic Center of Greater Des Moines, on the Luther College Board Investment Committee, and on the Greater Des Moines Community Foundation Investment Committee. Previously, he served on many community boards and organizations. Mr. Hart is also a director of two privately held businesses.

Alan L. Wells. Mr. Wells is President and Chief Executive Officer of Iowa Telecom, and Chairman of our board of directors. He joined us in 1999 as President and Chief Operating Officer, and was appointed to the role of President and Chief Executive Officer in 2002. Prior to joining Iowa Telecom, Mr. Wells was Senior Vice President and Chief Financial Officer at MidAmerican Energy Holdings Company (MidAmerican), a Des Moines, Iowa-based electric and gas utility holding company, from 1997 until 1999. During the same period, Mr. Wells also served as President of MidAmerican’s non-regulated businesses. Mr. Wells held various executive and management positions with MidAmerican, its subsidiaries, and Iowa-Illinois Gas and Electric, one of its predecessors, from 1993 through 1999. Prior to that, Mr. Wells was with Deloitte Consulting (previously Deloitte & Touche Consulting) and previously held various positions with the Public Utility Commission of Texas and Illinois Power Company. Mr. Wells is a certified public accountant, and serves on the board of directors of the United States Telecommunications Association, the Newton Development Corporation, and Progress Industries.

Kenneth R. Cole. Mr. Cole has served on the board of directors of Iowa Telecom since April 2008. He is a retired telecommunications executive, with 33 years of experience in the telecom industry. He held several senior positions within CenturyTel, a Fortune 500 telecommunications company, prior to helping establish Valor Telecommunications in 2000. As a founding member of Valor Telecommunications, he served as President and Chief Operating officer, as well as Chief Executive Officer and Vice Chairman of the Board. He has previously served on the Board of Directors and the Audit Committee for Occam Networks, Inc., a publicly traded telecom equipment manufacturer. Prior to his telecom experience, Mr. Cole served in the U.S. Navy and attended Northeast Louisiana University.

Business experience of continuing directors

Craig A. Lang.Mr. Lang has served on the board of directors of Iowa Telecom since August 2005 and serves as our lead director. He has been the president of the Iowa Farm Bureau Federation (IFBF) since 2001 and has been affiliated with the IFBF board since 1992 when he was elected as a district representative. In addition, he also serves as chairman of the board of FBL Financial Group, Inc. (NYSE: FFG) and as president of Farm Bureau Life Insurance Company. Mr. Lang also serves on the Board of Regents for the State of Iowa, the American Farm Bureau Federation board of directors, representing the Midwest Region, and is director of Farm Bureau Bank. For six years, he served as a director on the GROWMARK board and three years as a director on the Cattlemen’s Beef Board. He is also past chairman of the Iowa Values Fund Board and past vice chairman of the Iowa Economic Development Board.

Kendrik E. Packer.Mr. Packer has served on the board of directors of Iowa Telecom since August 2005. He is a Managing Partner with Financial Advisory Partners, Inc., which he founded in 1997, where he consults with clients on merger and acquisition transactions and private financings. Prior to forming Financial Advisory Partners, Mr. Packer held several positions in corporate finance since 1984, including senior vice president with Everen Securities, Kemper Securities and R.G. Dickinson & Company.

Norman C. Frost.Mr. Frost has served on the board of directors of Iowa Telecom since March 2006. He currently is a private investor. He was a Managing Director of Legg Mason Wood Walker, Inc. and head of that firm’s Technology sector in the Investment Banking Department from 1998 to 2005. Mr. Frost worked as an investment banker for over 25 years, focusing primarily on the telecommunications industry, where he executed a wide range of assignments for his clients including international and domestic merger and acquisition advisories, valuations, public and private equity and debt offerings, and project financings. Mr. Frost began his investment-banking career at The First Boston Corporation, spent several years as a Managing Director in the Communications Group at Bear, Stearns & Co. Inc. and prior to joining Legg Mason, was a Managing Director

13

in the Telecommunications Group at Smith Barney, Inc. Mr. Frost also serves on The Maryland Zoological Society Board of Trustees, Tissue Banks International Board of Trustees, and as an Anthem Capital II, L.P. Advisory Board Member.

H. Lynn Horak. Mr. Horak has served on the board of directors of Iowa Telecom since April 2007. He is a past regional chairman for Wells Fargo Regional Banking, and held many positions with Wells Fargo Bank since 1972, including executive vice president and chief financial officer from 1981 to 1986 and president and chief operating officer from 1986 to 2003. He serves or has served on the Drake University Board of Trustees and the United Way of Central Iowa Board. Mr. Horak is also active in his support of many civic organizations, including the March of Dimes, Children & Families of Iowa, the Juvenile Diabetes Foundation, and the United Negro College Fund. Mr. Horak was elected to the Iowa Business Hall of Fame and is a past recipient of the Drake University College of Business’ community leadership award. Mr. Horak is also a director of four privately held businesses.

Board recommendation and shareholder vote required

The board of directors recommends a vote FOR the election of each of the nominees named above (Proposal No. 1 on the proxy card). The affirmative vote of a plurality of the votes cast at the meeting at which a quorum is present is required for the election of directors.

14

BUSINESS EXPERIENCE OF EXECUTIVE OFFICERS

The following is a description of the background of the executive officers of Iowa Telecom who are not directors:

David M. (Mike) Anderson.Mr. Anderson is our Vice President—External Affairs and Marketing. Mr. Anderson is responsible for all of our state and federal regulatory and legislative activities. He is also responsible for our marketing organization, which includes development and implementation of product and marketing plans that support our statewide core businesses. His responsibilities also include the operation of our wholesale services group, which manages and services our business relationships with competitive local carriers and wireless carriers. In addition, he is responsible for the activities of our corporate communications group. Prior to joining Iowa Telecom in 2000 in conjunction with the GTE Midwest Incorporated acquisition, Mr. Anderson spent 21 years with GTE Midwest Incorporated in various management positions involving regulatory and legislative policy development and implementation. From 1989 to 2000, Mr. Anderson was Director of External Affairs for GTE Midwest Incorporated’s Midwest operations group. In that position he managed GTE Midwest Incorporated’s regulatory and legislative activities in Iowa, Missouri, Nebraska and Minnesota. He is a past President and past Director of the Iowa Telecommunications Association. He has also served on the board of directors of the Nebraska, Minnesota and Missouri Telephone Associations. He is currently a member of the Board of the Universal Service Administration Company (USAC).

Charles J. Bruggemann.Mr. Bruggemann is our Vice President—Operations. Mr. Bruggemann is responsible for our field force operations, including our central office, service provisioning, dispatch and repair activities. He is also responsible for external contract labor associated with outside plant activities, and for buildings, fleet and supply operations. Prior to joining Iowa Telecom in 2000 in conjunction with the GTE Midwest Incorporated acquisition, Mr. Bruggemann held several positions with GTE Midwest Incorporated. From 1997 to 2000, he was General Manager, Customer Operations for the Midwest Division and had overall responsibility for service operations in the states of Iowa, Nebraska and Minnesota. Prior to that assignment, Mr. Bruggemann held various technical and managerial positions with GTE Midwest Incorporated. Mr. Bruggemann has over 35 years of telecommunications operations experience. Mr. Bruggemann currently serves as president of Iowa One Call, a non-profit organization.

Donald G. Henry.Mr. Henry is our Vice President, General Counsel and Secretary. From 1999 until he joined Iowa Telecom in 2003, Mr. Henry represented the Office of Consumer Advocate in administrative proceedings before the Iowa Utilities Board relating to telecommunications law and policy and in various judicial proceedings. Between 1992 and 1999, Mr. Henry served as administrative law judge for the Utilities Division of the Iowa Department of Commerce, on behalf of the Iowa Utilities Board. Prior to that time, Mr. Henry was in private law practice. Mr. Henry received his law degree from the University of Michigan and holds a masters degree in economics from the University of Iowa.

Lon M. Hopkey.Mr. Hopkey is our Vice President—Corporate Development. Mr. Hopkey is responsible for our competitive local exchange carrier operations and for growth initiatives including strategic acquisitions and divestitures. Prior to joining Iowa Telecom in 1999, Mr. Hopkey held several positions with MidAmerican Energy Company. From 1996 to 1999, Mr. Hopkey was Manager Corporate Development for MidAmerican, with responsibilities for completing purchase and sale transactions for various non-regulated entities and for evaluating business combinations for MidAmerican. From 1997 to 1999, Mr. Hopkey was responsible for running several nonregulated entities of MidAmerican. From 1990 through 1996, Mr. Hopkey held various corporate finance positions with MidAmerican and its predecessor companies. Mr. Hopkey has a Masters of Business Administration degree and a Bachelor of Science degree in Biomedical Engineering from the University of Iowa.

Dennis R. Kilburg.Mr. Kilburg is our Vice President—Engineering. Mr. Kilburg is responsible for all network planning, all capital expenditures related to network infrastructure and all network technical support.

15

Prior to joining Iowa Telecom in 1999, Mr. Kilburg was the Director of Advanced Network Products at Iowa Network Services, Inc. From 1994 until 1998, Mr. Kilburg managed Hickory Tech Corporation’s telecommunications operations within Iowa. Prior to joining Hickory Tech, Mr. Kilburg worked in various management roles for GTE Midwest Incorporated and Contel Corporation from 1985 until 1994, and with the Preston Telephone Co. from 1971 until 1985. Mr. Kilburg has over 36 years of experience in telecommunications operations and engineering.

Craig A. Knock.Mr. Knock is our Vice President, Chief Financial Officer and Treasurer. From 1998 until he joined us in January 2000, he served as the Vice President and Chief Financial Officer for Racom Corporation, a wireless telecommunications company in Iowa. From 1993 until 1998, he was the Vice President and Chief Financial Officer and Treasurer for Atlantic Tele-Network, Inc., a publicly-held telecommunications company headquartered in the U.S. Virgin Islands. He also served as the Controller for Atlantic Tele-Network from 1992 until 1993. Prior to joining Atlantic Tele-Network, Mr. Knock worked as an audit manager with Deloitte & Touche. Mr. Knock is a certified public accountant and has a Bachelor of Business Administration degree in Accounting from the University of Iowa.

Timothy D. Lockhart.Mr. Lockhart is our Vice President—Customer Services and Human Resources. Mr. Lockhart is responsible for all customer service accountabilities for our residential, business and competitive markets. Additionally, he is accountable for all human resource functions within the company. Prior to joining Iowa Telecom in 2000, Mr. Lockhart held human resource positions with the Menasha Corporation from 1993 through 1999. From 1988 to 1992, Mr. Lockhart served in various human resource and operational roles with the Weyerhaeuser Corporation. Mr. Lockhart has a Bachelor of Science degree in Communications from Toccoa Falls College and a Masters of Arts degree in Organizational Development from Arizona State University.

Brian T. Naaden.Mr. Naaden is our Vice President and Chief Information Officer. Mr. Naaden is responsible for our information systems and for our Internet service and our data subsidiary. Prior to joining Iowa Telecom in 2000, Mr. Naaden served as Vice President of Technical Services for McLeodUSA, a communications provider based in Cedar Rapids, Iowa, from 1996 to 2000. From 1984 to 1996, Mr. Naaden held various directorial and managerial positions with MCI, TelecomUSA and Teleconnect. Mr. Naaden has over 23 years of experience in the telecommunications industry.

Michael A. Struck.Mr. Struck is our Vice President—Sales. Prior to joining Iowa Telecom in 2001, Mr. Struck held various positions with MCI WorldCom. From 1998 to 2001, Mr. Struck was responsible for National Account voice and data sales in nine Midwestern states. From 1991 through 1997, Mr. Struck held various MCI sales and service management roles in Iowa, Nebraska and South Dakota. From 1983 through 1990, Mr. Struck held various positions within the sales, marketing and engineering departments at Telecom USA and one of its predecessors, Teleconnect Company. Mr. Struck began his career with Northwestern Bell as an Account Executive in 1980. Mr. Struck has a Bachelor of Science degree with a major in Marketing from the University of Iowa.

16

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Objectives and Practices

It is our objective to motivate and retain talented and dedicated executive officers capable of leading the Company to the successful attainment of its goals and objectives. The Company’s executive compensation programs play an important role in the motivation and retention of management. These compensation programs are administered by the Compensation Committee, which determines the total compensation paid to our principal executive officer and to each of our other executive officers. The Compensation Committee strives to administer each compensation program in a manner that will provide the Company with effective leadership while also making efficient use of the Company’s resources.

The Company’s compensation programs are intended to motivate our executive officers to meet or exceed our expectations of their performance, align their goals and interests with those of our shareholders, retain their talents and services for our benefit in future periods, and attract potential executive officers possessing comparable characteristics should it become necessary or desirable to replace a member of our executive team or supplement our executive capabilities.

Overview of Compensation Components

Compensation for our executive officers has three primary elements: annual base salaries, short-term incentives in the form of cash bonuses, and long-term incentives awarded pursuant to our stock incentive plan. An executive officer’s total compensation thus has both fixed and variable, or “at-risk,” elements. Base salary is the primary fixed element of total compensation. The Compensation Committee includes base salary as an element of total executive officer compensation given its prevalence in the marketplace and as a means of achieving balance between the fixed and “at-risk” elements of compensation.

The “at-risk” elements of an executive officer’s total compensation consist of short-term incentive compensation in the form of an annual cash bonus and long-term incentive compensation in the form of awards of restricted stock that vest over several years.

The payment of short-term incentive compensation is dependent upon the attainment of performance goals. The goals for each executive officer are established annually near the beginning of each fiscal year. While the number of goals established for each executive officer varies, at least one-half of the annual cash bonus payable to each executive officer depends on the Company’s attainment of target levels of an adjusted measure of company-wide earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”). The balance of the annual cash bonus payable to each executive officer depends on the attainment of other quantitative or qualitative goals.

All of an executive officer’s short-term incentive compensation is “at-risk” in that failure to attain either the company-wide or executive-specific goals for the period will reduce or eliminate the annual cash bonus paid to the executive for that period. The Compensation Committee chooses to include short-term incentive compensation as an element of total executive officer compensation because the committee believes performance-based short-term incentive compensation is an effective means of aligning the personal interests of our executive officers with the financial and other interests of our shareholders.

Long-term incentive compensation in the form of awards of restricted stock that vest over several years is paid only if an executive officer remains in the employ of the Company until the restrictions lapse. Its value to an executive officer depends on the value of the Company’s common stock at the time the restrictions lapse and on the amounts of dividends paid to shareholders. The Compensation Committee chooses to include long-term incentive compensation as an element of total executive officer compensation because the committee believes that restricted stock aligns the personal interests of our executive officers with the interests of our shareholders over the longer-term and promotes their retention.

17

Review Process

All three elements of an executive’s total compensation are reviewed annually. Our chief executive officer evaluates the performance of the other executive officers and the Compensation Committee directly evaluates the performance of the chief executive officer. The Compensation Committee determines the short-term incentive compensation for the previous period and all elements of future compensation for all executive officers, after considering the chief executive officer’s report and recommendations as to all other executive officers. The Compensation Committee also establishes the performance goals upon which short-term incentive compensation for all executive officers for the following year is dependent.

In determining the total compensation for each executive officer, the Compensation Committee considers numerous factors, including the responsibilities assigned for the period in question, total compensation paid by comparable companies to their officers with similar responsibilities, and performance. Consideration of performance includes review and assessment of the extent to which individual and company-wide goals were attained.

Market Benchmarking

Market pay levels are one of many factors considered in setting compensation levels for our executive officers. To provide a frame of reference, information on market pay levels is obtained from various sources including published compensation surveys and information filed with by Securities and Exchange Commission by publicly traded telecom and utility companies.

The Compensation Committee has retained the services of consulting firms with expertise in executive compensation matters to assist with benchmarking pay levels and with the execution of its duties generally. These consulting firms have provided the committee with information on industry pay practices and general advice on compensation design and levels.

In 2005, the Compensation Committee retained the services of Mercer Consulting to assist it in benchmarking the three primary compensation elements: annual base salaries, short-term incentives in the form of annual cash bonuses, and long-term incentives in the form of equity-based compensation. In determining total executive compensation for 2006, the committee considered the information from various published compensation surveys gathered with the assistance of the consultant along with its own collective knowledge of the industry in which the Company operates and the responsibilities assigned to the executive officers. Since late 2006, the Compensation Committee has engaged Frederic W. Cook & Co. to assist in similar benchmarking exercises. For 2007, this analysis included information from various published compensation surveys as well as information for a benchmark group of the following publicly traded telecom companies: Alaska Communications Systems, Centurytel, Cincinnati Bell, Citizens Communications, Commonwealth Telephone, Consolidated Communications, CT Communications, D & E Communications, Eschelon Telecom, Fairpoint Communications, North Pittsburgh Systems, Shenandoah Telecommunications, and Surewest Communications. The benchmark telecom company analysis included total compensation for the top five officers at each company (salary, annual bonuses, and long-term incentives), retirement benefit practices, and the usage of equity for compensation programs.

We do not have formal policies or practices regarding specific relationships between compensation for our executives and statistics on market pay levels. Market pay information is intended to provide a frame of reference to ensure that the compensation we provide to our executive officers is reasonable in comparison to the industry companies we consider comparable. Our goal is to ensure that compensation is sufficiently competitive to allow us to attract and retain capable executives. Market pay levels are only one factor considered by the Compensation Committee in evaluating the supply of and demand for executives, with the decision ultimately reflecting an evaluation of individual contribution and value to the Company.

18

Executive Compensation Analysis

This section discusses and analyzes the compensation actions that were taken for our named executive officers in 2007, as summarized in the compensation tables that follow.

Base Salary. Adjustments to base salary generally are considered at the Compensation Committee’s meeting in the first quarter of each year. Each year the committee considers an executive officer’s performance, the Company’s overall performance, and how the executive officer’s total compensation compares with that of similar executives at comparable companies. Based on a review of these factors, salaries for the named executive officers for 2007 were established as shown in the table below, along with the 2006 salaries for the same named executive officers.

| | | | | | |

Name

| | 2006 Base

Salary

| | 2007 Base

Salary

|

Alan L. Wells | | $ | 375,000 | | $ | 400,000 |

Craig A. Knock | | | 250,000 | | | 260,000 |

Brian T. Naaden | | | 200,000 | | | 206,000 |

Dennis R. Kilburg | | | 175,000 | | | 180,000 |

Donald G. Henry | | | 200,000 | | | 211,000 |

Short-Term Cash Incentive Payments. The Company maintains a cash bonus plan that is designed to reward achievement of annual, short-term Company performance levels, the consistent attainment of which the Company believes are critical to its long term success. Each of the named executive officers is eligible to participate in the bonus plan, which provides them with the opportunity to earn a cash bonus payment. The payment, if any, is measured as a percentage of the executive officer’s salary and is based on the achievement of certain criteria established by the Compensation Committee.

For 2007, the Compensation Committee established the bonus opportunities, as a percentage of 2007 salary levels, based on its assessment of the appropriate balance between base salary and short-term bonus in determining the total cash to be paid to each executive. In accordance with our contract with Mr. Wells, he is eligible to receive a potential bonus equal to 100% of his base salary if the target levels of the performance objectives are achieved, and up to 200% of his base salary if maximum levels are achieved. The bonus opportunities as a percentage of salary for the named executive officers are shown in the table below. The Compensation Committee had full discretion to increase or decrease the amount of any actual payout, including discretion to pay no bonus if certain threshold objectives were not met.

| | | | | | | | | |

| | | Bonus as a Percentage of Salary

| |

Name

| | Threshold

| | | Target

| | | Maximum

| |

Alan L. Wells | | 50 | % | | 100 | % | | 200 | % |

Craig A. Knock | | 15 | % | | 30 | % | | 45 | % |

Brian T. Naaden | | 12.5 | % | | 25 | % | | 37.5 | % |

Dennis R. Kilburg | | 12.5 | % | | 25 | % | | 37.5 | % |

Donald G. Henry | | 12.5 | % | | 25 | % | | 37.5 | % |

For 2007, the total bonus opportunity for the named executive officers was divided into a performance and discretionary portion, as summarized below, which the Compensation Committee believes effectively promotes the Company’s primary short-term goals:

| | • | | Performance based targets. The performance portion of the annual bonus for 2007 was tied to the Company’s Adjusted EBITDA with the target performance set at $125.8 million. The threshold and maximum performance goals were approximately 3% lower and 2% higher than the target level. Bonuses for performance between target and threshold and maximum are interpolated on a straight-line basis. The portion of the named executive officers’ total potential bonus tied to Adjusted EBITDA for 2007 was 60%. |

19

| | • | | Discretionary based targets. The remainder of the bonus opportunity for the named executive officers is subject to the sole discretion of the Compensation Committee. The portion of the named executive officers’ total potential bonus that was discretionary for 2007 was 40%. |

The total cash bonus the Compensation Committee awarded to each of the named executive officers for 2007 pursuant to the Company’s bonus plan is reflected in two places in the Summary Compensation Table:

| | (1) | The “Bonus” column which represents the discretionary portion of the short-term cash incentive plan; and |

| | (2) | The “Non-Equity Incentive Plan Compensation” column, which represents the performance portion of the short-term cash incentive plan. For 2007, the Company achieved the performance target of 190% of the relative target for Mr. Wells and 145% of the target for each of the other named executive officers, based on our actual Adjusted EBITDA of $134.3 million, as adjusted at the discretion of the Compensation Committee. |

The bonuses, all of which were paid in March 2008, are summarized below and the total is compared to each named executive officer’s respective 2007 year-end annual salary level.

| | | | | | | | | | | | | | | |

Name

| | Bonus

| | Non-Equity

Incentive Plan

Compensation

| | Total Cash

Bonus

| | 2007 Bonus Payout as a

Percentage of 2007 Salary

| |

| | | | | Actual

| | | Target

| |

Alan L. Wells | | $ | 144,960 | | $ | 455,040 | | $ | 600,000 | | 150.0 | % | | 100.0 | % |

Craig A. Knock | | | 33,790 | | | 67,766 | | | 101,556 | | 39.1 | % | | 30.0 | % |

Brian T. Naaden | | | 22,001 | | | 44,743 | | | 66,744 | | 32.4 | % | | 25.0 | % |

Dennis R. Kilburg | | | 23,184 | | | 39,096 | | | 62,280 | | 34.6 | % | | 25.0 | % |

Donald G. Henry | | | 23,142 | | | 45,829 | | | 68,971 | | 32.7 | % | | 25.0 | % |

Equity-Incentive Awards. The Company maintains an equity-compensation program for executive officers to provide long-term incentives, which aligns the interests of executives with stockholders, and provides a retention incentive. The Compensation Committee has implemented its equity compensation program as part of its goal to make a portion of total direct compensation “at risk.” The Compensation Committee also prefers equity incentives to cash as a method of providing long-term compensation incentives.

For 2007, all executive officer equity compensation awards have been issued as restricted stock under the Iowa Telecom 2005 Stock Incentive Plan. Under this Plan, Iowa Telecom has not issued any stock options or forms of equity compensation other than restricted stock to its executive officers or other employees. The Compensation Committee believes that restricted stock awards are a preferred mechanism of equity compensation compared to stock options or other devices that derive value from future stock price appreciation due to the high-dividend profile of Iowa Telecom.

The Iowa Telecom Board of Directors has delegated responsibility for administration of the 2005 Stock Incentive Plan, including the authority to approve awards, to the Compensation Committee. The Compensation Committee approved all equity-based compensation awards to named executive officers for 2007 at its meeting in May 2007. In determining the amount of long-term incentive awards to be made, the Compensation Committee considered each named executive officer’s position, scope of responsibility, base salary, performance, market compensation information for executives in similar positions in similar companies, prior awards, and the recommendation of the chief executive officer (except in regard to his own award). In determining the number of shares of restricted stock or performance-based restricted stock to award to any individual under the 2005 Stock Incentive Plan, the Compensation Committee divides the approved grant value for such individual by the closing stock price of Iowa Telecom common stock on the date that the Compensation Committee approves the award (rounded down to the nearest whole share).

20

During 2007, the Compensation Committee approved the following restricted stock awards to the named executive officers. All of the restricted shares were granted on May 9, 2007 pursuant to the Company’s 2005 Stock Incentive Plan. Under the terms of a restricted stock agreement, each award vests at a rate of 25% per year commencing on April 1, 2009, subject to certain forfeiture provisions.

| | |

Name

| | Restricted

Stock

Awards (#)

|

Alan L. Wells | | 25,000 |

Craig A. Knock | | 17,500 |

Brian T. Naaden | | 9,000 |

Dennis R. Kilburg | | 6,500 |

Donald G. Henry | | 9,000 |

During the vesting period, the named executive officers have the rights of a stockholder to vote the restricted stock. Additionally, holders of our restricted shares are entitled to receive dividends and other distributions, if any, as and when declared by the board of directors in an effort to reinforce the alignment of the interests of the holders of restricted stock with the interests of our other shareholders. These cash dividends are considered in the Compensation Committee’s assessment of total executive officer compensation.

The Company also maintains the 2002 Stock Incentive Plan, which allows for the issuance of incentive stock options or nonqualified stock options, although the board of directors has determined that no new options will be granted under the 2002 Incentive Plan. All awards under this Plan were made prior to the Company’s initial public offering in November 2004. Under the 2002 Incentive Plan, options have been granted for the purchase of 2,227,714 shares, of which 1,031,795 were redeemed for cash in 2004 in conjunction with the Company’s initial public offering, 518,340 have been exercised and 677,579 remain outstanding as of December 31, 2007. The term of each option did not exceed 10 years from the date of grant. Options granted to employees vested over 3 to 5 years from the date of the grant. All unvested options outstanding at the time of the closing of the initial public offering vested pursuant to the terms of the 2002 Incentive Plan. The exercise price for unexercised options is automatically decreased by the amount of dividends that would have been paid on the shares issuable upon exercise. These dividend equivalent rights are non-cash in nature and, as such, executives do not actually receive the dividend payments.

Retirement Plans. Iowa Telecom maintains a defined benefit pension for certain of its employees that were former GTE employees prior to the GTE Acquisition in 2000. For 2007, none of the named executive officers participated in the plan. Iowa Telecom also maintains a qualified 401(k) defined contribution plan (“Iowa Telecom Savings Plan “) for its executive officers and employees. In addition, the Company contributed 3% of salary to the plan, subject to applicable limits under Code section 401(a)(17), which limit was $225,000 for 2007.

Deferred Compensation Plan. The Company maintains an elective Deferred Compensation Plan for its executive officers that is unfunded and any benefit due to the participants is an unsecured general obligation of the Company. The earnings credited to the participant’s account are based on their individual election of one, or more, of the following investments (a) Standard and Poor’s 500 Stock Index (including dividends reinvested), (b) Lehman Brothers Aggregate Bond Index, and (c) a one-year U.S. Treasury Bill. The Company’s Deferred Compensation Plan provides for the following:

| | • | | The Company will credit the eligible participant’s deferred compensation account with the difference between 3% of the participant’s base salary and annual cash bonus compensation for that calendar year, and the amount of the Company’s contributions (other than matching contributions and elective deferrals) made to the participant’s account under the Iowa Telecom Savings Plan for that calendar year. |

| | • | | The Company also credits the eligible participant’s deferred compensation account with the matching contribution that the eligible participant would have received if the participant’s deferrals under the Company’s Deferred Compensation Plan had instead been made to the Iowa Telecom Savings Plan, |

21

| | without regard to the annual compensation limits then in effect under Code section 401(a)(17) or any other Code section or rule. |

| | • | | Additionally, in accordance with the Employment Agreement with Mr. Wells, the Company also credits Mr. Wells’ deferred compensation account in a dollar amount equal to five percent (5%) of the sum of Mr. Wells’ base salary and annual cash bonus. Such deferrals are credited to Mr. Wells’ deferred compensation account during the year in accordance with the Company’s payroll cycles, and vest immediately. In accordance with the Employment Agreement with Mr. Wells, the amount of the Company’s matching and discretionary contributions for Mr. Wells’ account under the Company’s defined contribution retirement plans and deferred compensation plans shall not exceed $100,000 per year. |

In the event of a Change of Control, as defined, the Company shall create and fund an irrevocable trust for the payment of the benefits.