Management Discussion

Baillie Gifford International Equity Fund

1) Market Conditions and Review of performance during 2010

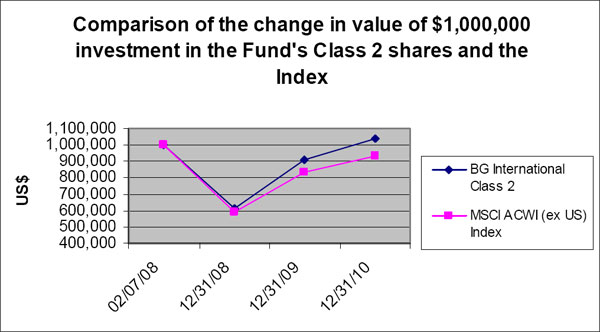

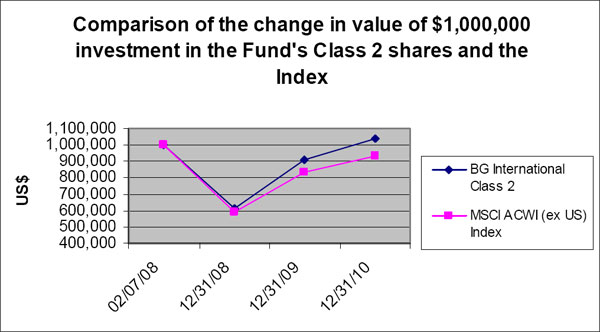

During 2010, The International Equity Fund Class 2 returned 14.65%, ahead of its benchmark, the MSCI ACWI ex US index which rose 11.60%. Corporate profitability strengthened over the year as cost cutting initiatives begun during the credit crisis combined with increasing demand from the less indebted regions. In aggregate, balance sheets remain strong, and plenty of cash remains either to be invested, or distributed to shareholders. In the emerging markets, continuing strong growth, inflows from abroad, and fears of inflation led to further tightening of policy. On the other hand, and in the clearest possible sign of the wide policy divergence which is opening up, the Federal Reserve did just the opposite, announcing a further $600 billion of quantitative easing. Throughout 2010, commentary on Europe was almost universally bleak. For Greece and Ireland, it was the year when the gap between their past spending and the cost of funding became unbridgeable without outside help, leaving them with no choice but to agree to bailouts, and the market remains nervous about the ‘European periphery’.

Stock selection was the main driver of the Fund’s relative performance during 2010. The top stock contributors came from a range of countries and sectors. They include Atlas Copco (Swedish engineer), Baidu (Chinese search engine), Massmart (South African retailer), Antofogasta (UK listed miner with assets in Chile), Seadrill (Norwegian deepwater driller) and Hong Kong Exchanges & Clearing. The main detractor from the year’s relative performance was the Brazilian oil company, Petrobras. Some of the weakness in its share price can be attributed to the size of the company’s capital-raising over the summer, although the shares also suffered earlier in the year from the general concerns over deep water drilling, following the BP disaster in the Gulf of Mexico. We believe these are short term distractions from the long term growth potential of a business with access to significant future reserves on reasonable terms. Alstom (French manufacturer of power generation equipment) also detracted from relative performance, and we have sold this company as we believe it now faces increasing competition in its growing emerging markets.

As bottom-up stock pickers, any changes to regional, country or sector weightings are as a result of individual stock decisions. Over 2010, we sold America Movil (Latin American mobile franchise which we believe is maturing), Industrial and Commercial bank of China (on concerns over asset quality) and Shinsegae (Korean retailer which we believe now has limited growth prospects). Towards the end of the year, we sold Garanti Bankasi (Turkish Bank) as we fear the Central Bank risks stoking excessive growth and inflation by relaxing monetary policy. We reduced BHP Billiton on capital allocation concerns, however as we believe the outlook for diversified miners remains robust we invested the proceeds in Rio Tinto, which has similar assets and traded on a similar valuation. In Europe, we purchased Ryanair (Irish listed short haul airline) where its competition advantage is strengthening as flag carriers retreat, and Inditex, the Spanish fashion retailer, which has an exciting global growth opportunity. Within the oil and gas sector, we purchased a new holding in Tullow Oil (UK listed oil and gas company with interests in Uganda and Ghana) and Inpex (Japanese oil and gas company). The latter was funded by the sale of Woodside Petroleum (Australian oil company) on valuation grounds.

2) Review of performance during the fourth quarter of 2010

The International Equity Fund Class 2 returned 7.79% over the final quarter of 2010, ahead of the benchmark which rose 7.3%. In the portfolio, the main contributors to performance were Atlas Copco (Swedish manufacturer of compressor and mining equipment) and Antofagasta (UK-listed copper miner), followed by TSMC (Taiwanese semiconductor

Page 1

Management Discussion

Baillie Gifford International Equity Fund

manufacturer) and Naspers (South African media group). The detractors from performance were companies which have had a strong run and where some profit taking was probably at play. OGX, the Brazilian oil company, underperformed in a quarter that saw a degree of unease about the direction of policy in Brazil following the presidential election. Baidu, widely referred to as the Chinese Google, gave up some of the huge gains it made throughout 2010 and Garanti Bankasi, the Turkish bank, also underperformed as the Central Bank took the unusual step of cutting rates, despite recent strong growth.

3) Investment Strategies used to manage the Fund

Baillie Gifford is a growth manager with a bottom up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above that of the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met.

The ACWI Alpha Portfolio Construction Group is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction for existing holdings. We will continue to monitor the long term prospects for the Fund’s holdings and make changes where appropriate.

4) Outlook

We have had a bias towards optimism for some time. We still do. There are three reasons behind it:

| |

• | Our confidence about global growth, which is being powered by the developing world. This is not a cyclical phenomenon; it will continue for years to come. |

• | The overhang of debt in the developed world means that monetary policy will remain loose for a long time. This is a good thing for businesses and real assets such as shares. |

• | Most investors refuse to recognise how favourable the investment background has become. The formation of any sort of optimistic consensus is continually being disrupted by ‘crises’ such as the Irish one. This is restraining valuations and provides a favourable background to financial investment. All the best times to invest have been suffused with gloom. |

Underlying all this is a healthy supply of good companies in which to invest, with new markets and new technologies becoming available. What could go wrong? Plenty, of course, but what are the most likely pitfalls? The first leg of our argument, the fundamental one, is the strongest one. Global growth does now look strong and sustainable. So what could go wrong with the other two legs? Easy money could lead to inflation. Indeed, inflation is a traditional escape route from debt. There is some evidence of it in the commodity markets. The prices of a wide range of raw materials and foodstuffs from copper and lumber to sugar, corn and oats have been very strong in recent months. This has contributed to price rises generally in most places, depending on how inflation is measured: food prices are more influential in China than in the US, for example; but there is no sign of inflation becoming entrenched. Consumers do not expect it; wages do not reflect it, and credit growth is still anaemic (except in China, where strenuous efforts are being made to slow it down). On balance, it looks as though deflationary forces have peaked, and that the pricing power of

Page 2

Management Discussion

Baillie Gifford International Equity Fund

commodity producers is increasing, but prices generally are not rising very much. Interest rates will probably stay low over the immediate future in the developed world and continue to rise in the emerging markets. The relative performance of developed stock markets may improve in the short term, as a result, but in the longer run the money will go to where the growth is. It is hard to dispute the claim that for the indebted developed countries the end game will involve higher inflation eventually – history, as chronicled by Rogoff and others, is fairly clear on this point – but we are not there yet. In the meantime, we are encouraged by the strong progress of most of the companies in The International Equity Fund.

| | | | | | | | |

| | | | | | | | |

Performance for the period ended 12/31/10 (Average Annual Total Return) |

| | | | | | | | |

| | One Year | | Since Inception

(February 7, 2008) | | |

| | | | | | | | |

|

The International Equity Fund | | | | | | | | |

Class 2 | | 14.65% | | | 1.42 | % | |

| | | | | | | |

MSCI ACWI (ex US) Index | | 11.60% | | | -2.35 | % | |

| | | | | | | |

Past performance is not a guarantee of future results. Returns for the International Equity Fund are before taxes and are net of all expenses, advisory fees and commission charges and include the reinvestment of the Fund’s dividends and distributions.

The MSCI ACWI (ex US) Index is a market capitalization index designed to measure equity performance in global world markets. The index is unmanaged, is not available for investment, and does not reflect sales charges, fees, commissions, taxes or other expenses of investing. The Fund’s holdings may differ from the index.

Page 3

Management Discussion

Baillie Gifford EAFE Fund

|

1) Market Conditions and Review of performance during 2010 |

|

We find it hard to recall a year in which the daily preoccupations of the market have seemed quite so divorced from either investment outcomes or global economic development. Some dissonance is usual but seldom has market and media commentary appeared so consistently out of context with unfolding events. Some countries are not in good shape: the indebted developed world has required significant debt restructuring, the implementation of strict austerity measures and a 750 billion euro bail out fund was created. However, a recovery has in fact been underway in the less indebted Northern ‘industrial’ European countries that are benefiting from the loose monetary policy required by their neighbours. In particular Germany, the industrial backbone of Europe, enjoyed its strongest growth rates since reunification and its future growth prospects are underpinned by export competitiveness, wage growth and consumer confidence. |

|

Corporate profitability strengthened over the year as cost cutting initiatives begun during the crisis combined with increasing demand of the less indebted regions. In aggregate balance sheets remain extremely strong and an unprecedented amount of cash remains to be either invested or distributed to shareholders. |

|

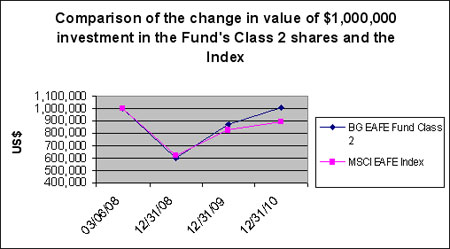

For the year ended December 31, 2010, The EAFE Fund Class 2 generated a return of 16.60%, outperforming its benchmark, the MSCI EAFE Index, which returned 8.21% for the year. The portfolio’s optimistic positioning was beneficial over the course of 2010, with both developed and emerging market holdings contributing to positive absolute and relative performance. |

|

Swedish industrial equipment companies, Atlas Copco and Sandvik, were amongst the largest contributors to performance for 2010. Similarly, Australian holdings responsible for providing the raw materials for this spate of building benefited the fund, including mining behemoth BHP and Fortescue Metals. Consumers in booming countries such as China and Singapore have been spending their wealth. European luxury goods companies have been prime beneficiaries, with France’s PPR (Gucci brand) and the Swiss Richemont (Cartier) both performing well through the year. |

|

However, it has been an uncomfortable year for European banks. The Fund’s holding in Spain’s Banco Santander has been impacted by negative sentiment. Petrobras was also a detractor from the year’s performance. Some of the weakness in its share price can be attributed to market unease at the size of the company’s capital raising over the summer, although the shares also suffered earlier in the year from concerns over deep water drilling. We believe these are short term distractions from the long term growth potential of a business with access to large future reserves on reasonable terms. |

|

2) Review of performance during the fourth quarter of 2010 |

|

The fund slightly underperformed a buoyant market during the quarter. Positive contributions to returns came from substantial holdings in industrial cyclical companies such as Atlas Copco, SMC and Fortescue Metals. The resurgence in global growth following the financial crisis has been positive to these companies over the past quarter and over the longer term. Markets have reacted strongly to the struggling economic condition of some European countries. In particular, this has negatively impacted European financial stocks and fund holdings were not immune. Banks such as Banco Santander and Standard Chartered detracted from returns. The Turkish bank Garanti Bankasi also suffered over the quarter as the market worried about the potential overheating of the Turkish economy and the government’s unorthodox policy response. We remain positive on the long term prospect of these banks due to their sensible attitude to capital allocation and their exposure to developing markets. |

Page 4

Management Discussion

Baillie Gifford EAFE Fund

|

3) Investment Strategies used to manage the Fund |

|

Baillie Gifford is a growth manager with a bottom up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met. |

|

The EAFE Alpha Portfolio Construction Group is responsible for the overall strategy and stock selection process. They meet regularly to discuss both buy and sell ideas and the level of conviction in their continuing holdings. |

|

As we move on into a new decade, our focus remains exactly the same; to identify exciting growth businesses in a position to grow their earnings and cash flow over the long term. |

|

4) Outlook |

|

We have had a bias towards optimism for some time. We still do. There are three reasons behind it: |

| | |

| • | Our confidence about global growth, which is being powered by the developing world. This is not a cyclical phenomenon; it will continue for years to come. |

| • | The overhang of debt in the developed world means that monetary policy will remain loose for a long time. This is a good thing for businesses and real assets such as shares. |

| • | Most investors refuse to recognise how favourable the investment background has become. Formation of any sort of optimistic consensus is continually being disrupted by ‘crises’ such as the Irish one. This is restraining valuations and provides a favourable background to financial investment. All the best times to invest have been suffused with gloom. |

Page 5

Management Discussion

Baillie Gifford EAFE Fund

| | | | | | | |

Performance for the period ended 12/31/10 (Average Annual Total Return) |

| | | | | | | |

| | One Year | | Since Inception

(March 6, 2008) | |

| | | | | | | | |

| | | | | | | |

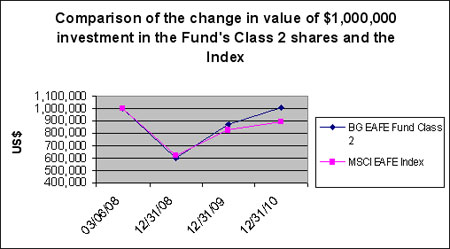

The EAFE Fund Class 2 | | 16.60 | % | | 0.22 | % | |

| | | | | | | |

MSCI EAFE Index | | 8.21 | % | | -3.94 | % | |

Past performance is not a guarantee of future results. Returns for the EAFE Fund are before taxes and are net of all expenses, advisory fees and commission charges and include the reinvestment of the Fund’s dividends and distributions.

The MSCI EAFE Index is a market capitalization index designed to measure equity performance in global world markets. The index is unmanaged, is not available for investment, and does not reflect sales charges, fees, commissions, taxes or other expenses of investing. The Fund’s holdings may differ from the index.

Page 6

Management Discussion

Baillie Gifford EAFE Choice Fund

|

1) Market Conditions and Review of performance during 2010 |

|

Despite the gloomy tone of much commentary, often centered on the small but troubled periphery of Europe, and the lingering structural debt issues facing America and some other western countries, 2010 proved to be a year of robust growth in the global economy. This was led by large emerging markets but also helped by what appears to be a recent resurgence in Germany and, after a summer lull, improving sentiment in America too. Over the latter part of the year stock markets in developed countries generally reacted positively to the improving tone of economic data and the apparent determination of policy makers to force their economies onto a firmer footing, although part of these gains in international markets will have been mitigated by the strengthening dollar. Some emerging markets have also been more lackluster. Perhaps this reflects the recent evidence of a wide policy divergence opening up between major economies. In response to strong growth, massive inflows from abroad, and some fears about inflation, we have witnessed some tightening of policy in larger emerging economies. The Chinese authorities, for instance, raised capital reserve requirements six times during the year for the largest banks while Brazil and others have introduced policy measures to curtail strong capital inflows. In contrast, the Federal Reserve did just the opposite, authorizing a further $600bn in quantitative easing, whilst in countries such as the UK interest rates seem set to remain at exceptionally low levels despite some surprisingly ‘sticky’ inflation indicators. |

|

The Fund’s portfolio benefited from the prosperous global economy. Although we have a relatively low direct exposure to buoyant commodity prices, several of the holdings in the industrial sector and the service industries to the oil and mining companies thrived in the favorable operating conditions. Atlas Copco, which manufactures compressors for industrial applications, was a prominent beneficiary of the high and rapidly rising levels of capital spending across the industry. Other investments such as Weir Group, which makes a range of pumps and valves for the oil industry, also performed well. Beyond the narrow area of commodities, holdings such as Schindler and Kone, which supply escalators and elevators, also delivered good returns on the back of strong demand in developing economies. In most cases we believe that these share price moves are justified by operational performance which surpassed even our starting expectations. |

|

A low exposure to many of the larger troubled European financials also helped. Whilst not completely without sin, we had very low exposure to the large integrated European banks or insurance conglomerates, where concerns over sovereign debt exposures around the European periphery weighed on equity values. Fortunately, most of those European banks that we did own, such as the Swedish retail bank Svenska Handelsbanken or the Danish Jyske Bank, were rewarded for their more conservative lending and more stable funding positions. Elsewhere in the portfolio, the other main bank holdings, such as Bank of China (Hong Kong) and the Asian focused Standard Chartered, also benefited from their better growth prospects and superior asset quality, and each made a helpful contribution. |

Page 7

Management Discussion

Baillie Gifford EAFE Choice Fund

|

A third favorable theme was some fortunate stock selection within the energy sector. We had no exposure to BP and the disaster in the Gulf of Mexico earlier in the year. More importantly though, we held a collection of some of the smaller service companies, such as Wood Group and AMEC which provide engineering and other services to the large oil companies, and their share prices responded well to the large and growing levels of capital spending from major customers. |

|

We construct the portfolio on a ‘bottom up’ stock by stock basis, so there was more to 2010 than the admittedly strong themes of commodities, China, and other emerging markets. Encouragingly, investment performance in 2010 was spread over a number of other names, too. For instance, ASOS, the UK based internet apparel retailer, enjoyed a terrific year of progress in what looks to be a very exciting retail category, whilst Nestlé, the international consumer brand business, added to its long history of compounding steady, long term, profitable growth. |

|

2) Review of performance during the fourth quarter of 2010 |

|

The Fund outperformed its benchmark, with European stocks held in the portfolio performing very strongly. Industrial stocks performed particularly well over the quarter, with Atlas Copco (Swedish engineering company), Geberit (Swiss manufacturer of advanced plumbing and plastics equipment) as well as SMC Corp (Japanese manufacturer of pneumatics equipment) among the top contributors to the fund’s performance. Other top contributors included ASOS (UK online fashion retailer) and the Health Care stocks, Cochlear (Australian ear implant manufacturer) and Mettler Toledo (Swiss manufacturer of precision weighing and measuring equipment). Overall, Developed Asian holdings, such as Aristocrat Leisure (Australian gaming machine manufacturer) and Esprit Holdings (Hong Kong based producer of clothing/footwear and accessories), detracted from performance, as did the portfolio’s underweight position in Materials. |

|

3) Investment Strategies used to manage the Fund |

|

Baillie Gifford is a growth manager with a bottom up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met. |

|

The International Focus Portfolio Construction Group (PCG) is responsible for the overall strategy and stock selection process used to select investments for the fund. This process shares the long-term, bottom up approach to investing that is applied across the firm whilst attempting to develop a comparatively more diversified portfolio. The PCG meets regularly to discuss both buy and sell ideas and the level of conviction in existing holdings. |

|

As we move on into a new decade, our focus remains exactly the same; to identify exciting growth businesses in a position to grow their earnings and cash flow over the long term. |

Page 8

Management Discussion

Baillie Gifford EAFE Choice Fund

|

4) Outlook |

The gyrations of world stock markets over the last three years perhaps highlight the futility of indulging in short term predictions. We are nevertheless still optimistic, based on the evidence we see in the real global economy. The much improved health and confidence of most international companies underpins our conviction that we will see another year of robust global growth powered by the developing world. Conditions are clearly more fragile in some debt laden parts of the developed world, although improvement is tangible and, in any case, a period of very loose monetary policy seems likely to continue until the recovery appears stronger. There are considerable uncertainties and risks regarding the future inflationary impacts of such a massive and largely untested policy response, but such a large dose of monetary stimulus is usually good for real assets such as equities. Finally, valuations still do not appear excessive, especially when considered in the context of current and future levels of profits and cash flows rather than the unusually depressed levels of markets a couple of years ago. |

|

It is still unclear how the smaller parts of the eurozone periphery will drag themselves out of their current mess whilst coexisting with a thriving Germany and without the assistance of some more explicit, yet politically controversial, fiscal transfer. The portfolio continues to have very low exposure to the economically sensitive areas of that eurozone periphery. In part, this reflects some concern that it may prove to be a long hard slog for those relatively tiny countries. Mainly though, it is simply because we still feel confident in identifying a range of exciting growth investments in other more promising and interesting areas of international markets, and we are encouraged by the operational progress of most companies in the portfolio. |

Page 9

Management Discussion

Baillie Gifford EAFE Choice Fund

| | | | |

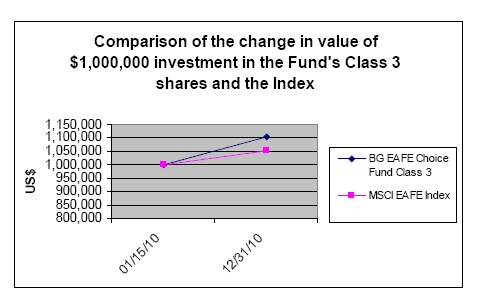

Performance for the period ended 12/31/10 (Average Annual Total Return) |

| | | |

| | Since Inception

(January 15, 2010) | |

| | | | |

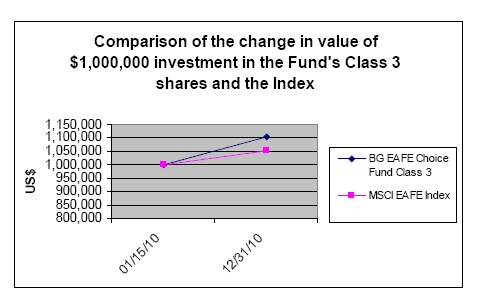

The EAFE Choice | | | | |

Fund Class 3 | | 10.40 | % | |

| | | | |

MSCI EAFE Index | | 5.14 | % | |

Past performance is not a guarantee of future results. Returns for the EAFE Choice Fund are before taxes and are net of all expenses, advisory fees and commission charges and include the reinvestment of the Fund’s dividends and distributions.

The MSCI EAFE Index is a market capitalization index designed to measure equity performance in global world markets. The index is unmanaged, is not available for investment, and does not reflect sales charges, fees, commissions, taxes or other expenses of investing. The Fund’s holdings may differ from the index.

Page 10

Management Discussion

Baillie Gifford Emerging Markets Fund

|

1) Market Conditions and Review of performance during 2010 |

|

2010 was a year of polarised performance in the Emerging Market universe. Leading the charge were some of the smaller, more peripheral stock markets. Thailand was the star performer, with Peru, Chile and Indonesia following closely behind. In marked contrast, China and Brazil were amongst the worst performing markets, beaten only by the Czech Republic and Hungary which both delivered negative returns. |

|

The smaller emerging market indices have been huge beneficiaries of continuing strong economic growth and massive capital inflows from abroad. Whilst this has also been true of China and Brazil, in China, the market remains fixated with the severity of any cooling measures as the government wrestles with containing the burgeoning money supply. In Brazil, the huge equity issuance by Petrobras hampered the market but flows were still strong enough to push the government to raise the tax on foreign bondholders to 6%. The broad policy actions so far appear reasonable, but we must acknowledge that the risk of a policy error is increasing. |

|

Throughout 2010 loose policy in developed markets, made possible by wide output gaps and spare capacity, has been fuelling potential asset price bubbles in the emerging market universe. Inflation expectations in Asia especially have been increasing as a result, and with real yields negative, wages and rents are rising too. Food inflation has regularly reared its ugly head due to a variety of causes from droughts in Russia to snow storms in China and the ensuing hoarding of stores in the hope of further price rises. |

|

Perhaps unsurprisingly, strong growth and an uncertain outlook have seen the dispersion of stock valuations widen significantly during the course of 2010. As such, the team remains focused on picking those companies that will benefit from the pockets of superior growth, wherever they may be. |

|

For the year ended December 31, 2010, The Emerging Markets Fund Class III generated a return of 19.73%, outperforming its benchmark, the MSCI Emerging Markets Index, which returned 19.20% for the year. Stock selection in Indonesia and Brazil was the main contributor to the outperformance. The Indonesian index delivered strong returns on the back of foreign investor flows, healthy GDP growth and the perception that infrastructure improvements are on track, aided by increased investment from the Chinese. Relative performance was helped by the overweight positions in Astra International (conglomerate), Bumi Resources (coal miner) and the two banks, Mandiri and Rakyat. In Brazil, an underweight position in Petrobras and a holding in E&P company OGX added value for the Fund. |

|

The Chinese market performed relatively poorly amidst monetary policy concerns. However, relative performance was boosted by the holding in Baidu; this Chinese internet search engine extended its dominance in the market over Google and online advertising spend in China is still at a very nascent stage. Conversely, the overweight positions in BYD (battery |

Page 11

Management Discussion

Baillie Gifford Emerging Markets Fund

|

and auto producer), China Longyuan Power (wind farm operator) and Evergrande Real Estate (high end property developer) all detracted from relative performance. |

|

Throughout the year there has been a slight shift in the shape of the portfolio. Though it maintains its bias towards the more pro-cyclical sectors such as Consumer Discretionary, the scale of these overweights has decreased. This is most true of the Financials sector which is now an underweight position, having been the fund’s top sector overweight twelve months ago. A number of our bank positions have been trimmed following sharp rebounds in their share prices from the lows of March 2009. Conversely the fund’s exposure to the Materials sector has been increased with the purchase of a variety of companies from the South African platinum producer Impala Platinum to Russian gold miner Petropavlovsk. |

|

2) Review of performance during the fourth quarter of 2010 |

|

The Emerging Markets Fund Class III returned 6.50% during the quarter, slightly underperforming the MSCI Emerging Markets Index which rose 7.4%. Stock selection in some of the frontier countries was helpful and there was notable strength in the Materials sector, with some of the Information Technology holdings also enjoying a good quarter. However, this was more than offset by stock selection in the Energy and Financials sectors. Turkey was noticeably weak over the quarter, suffering negative absolute returns versus a buoyant index. |

|

Stock selection in the Materials sector was the top contributor to performance over the period. A diverse range of holdings from the Mozambique mineral sands miner Kenmare Resources, to the Russian steel company Evraz, and South African gold miner Gold Fields, to cement company Cemex, performed strongly. |

|

However, this was more than offset by the lacklustre performance of some of the fund’s energy holdings. Cairn Energy, the UK listed oil E&P company, released drilling results in Greenland that disappointed the market but we remain optimistic regarding the longer term drilling programme; the same was true of the market’s reaction to Desire Petroleum’s drilling off the Falklands Islands. |

|

In stark contrast to the previous quarter the fund’s holdings in the two Turkish banks, Garanti and Isbank, were unhelpful. The country is facing a worsening macroeconomic backdrop with a rising oil price driving the current account deficit wider which has prompted the central bank to lower interest rates, partly to stop further Lira appreciation, but to hike reserve requirements. Given these macro risks and the strong performance of the banks in recent months, we have been trimming the holdings. |

Page 12

Management Discussion

Baillie Gifford Emerging Markets Fund

|

3) Investment Strategies used to manage the Fund |

|

Baillie Gifford is a growth manager with a bottom up approach to stock picking. We aim to invest in companies that will generate sustainable earnings growth above the market over the long term. In determining the potential of a company, we analyse the industry background, competitive advantage, management attitudes and financial strength, and finally we consider valuation. We meet the management of the companies within our investment universe and revisit the investment case for the portfolio’s holdings on a regular basis to ensure that our expectations are being met. |

|

The Emerging Markets investment team is responsible for the overall strategy and stock selection process, led by the most senior investment managers. The team meets regularly to discuss both buy and sell ideas and the level of conviction in the Fund’s continuing holdings. |

|

4) Outlook |

|

We remain excited about the long-term outlook for the stocks that make up the core of the portfolio. Where we struggle is anticipating where the voting machines will head in the short-term. Much of the sell-side discussion on Emerging Markets has focused recently on parallels with the early 90s, when U.S. Federal Reserve rates were slashed in the wake of the savings and loans crisis, and easy money in search of higher growth and yields sent emerging markets asset prices temporarily parabolic. Nearly 20 years later, there are many who argue that the recipe for another liquidity-fuelled emerging bubble has been concocted from similar macro ingredients: a dual-speed global economy; profound monetary stimulus in developed markets; and an understandable reluctance on the part of emerging policy makers to completely destroy their export industries. But the parallels are imprecise. This time, policymakers in emerging markets have made it quite clear that they are not going to allow themselves to be overwhelmed by the destabilising influence of cross-border flows. |

|

Capital controls have been put in place in a number of countries as a means of allowing currency appreciation to occur at an orderly pace. And while significant interest rate hikes have yet to take place across emerging markets, active use of credit controls suggest that monetary policy is probably rather more proactive than a cursory glance at real rates might suggest. As one would expect in such a diverse region, the challenge differs from country to country. On balance, the broad policy response so far appears a sensible step in the long-term aim of allowing growth to adjust towards a more sustainable level. However, easy money in search of the ‘emerging bubble redux’ may be sorely disappointed. |

|

In this sense, we remain open to the possibility that positive surprises in the near-term may be more likely to come from developed markets rather than our own. The apparent dichotomy of ebullient sentiment in emerging markets, and profound misery on the global outlook, can be seen as the broader context for recent additions to our North Asian tech holdings, or the purchase of stocks like Cemex; at the margin, these have tended to be funded by reductions to some of the strongest-performing domestically-focused stocks. However, exposure to domestic emerging growth remains the dominant theme in the portfolio. We will remain fully-invested, resolutely committed to seeking out long-term winners. |

Page 13

Management Discussion

Baillie Gifford Emerging Markets Fund

| | | | | | | | | | |

Performance for the period ended 12/31/10 (Average Annual Total Return) |

| | | | | | | | | | |

| | One Year | | Five Year | | Since Inception

(April 4, 2003) | |

| | | | | | | | | | |

| | | | | | | | | | |

The Emerging Markets | | | | | | | | | | |

Fund Class III | | 19.73 | % | | 15.95 | % | | 25.60 | % | |

| | | | | | | | | | |

MSCI Emerging Markets Index | | 19.20 | % | | 15.88 | % | | 22.61 | % | |

Past performance is not a guarantee of future results. Returns for the Emerging Markets Fund are before taxes and are net of all expenses, advisory fees and commission charges and include the reinvestment of the Fund’s dividends and distributions.

The MSCI Emerging Markets Index is a market capitalization index designed to measure equity performance in global world markets. The index is unmanaged, is not available for investment, and does not reflect sales charges, fees, commissions, taxes or other expenses of investing. The Fund’s holdings may differ from the index.

Page 14

Fund Expenses (unaudited)

As a shareholder of the Baillie Gifford International Equity Fund, the Baillie Gifford EAFE Fund, the Baillie Gifford EAFE Choice Fund and/or the Baillie Gifford Emerging Markets Fund (together, the “Funds”), you incur two types of costs: (1) transaction costs, which may include purchase premiums and redemption fees and (2) ongoing costs, including management fees, shareholder service fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in the other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2010 to December 31, 2010.

Actual Expenses

The first line of each table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide the account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as purchase premiums and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Page 15

Fund Expenses (unaudited) (continued)

| | | | | | | | | |

| | | Beginning

Account

Value

7/01/10 | | Ending

Account

Value

12/31/10 | | Annualized

Expense Ratio

Based on Period

7/01/10 to

12/31/10 | | Expenses Paid

During Period

7/01/10 to

12/31/10 |

| | | | | | | | | |

Baillie Gifford International Equity Fund - Class 1 | | | | | | | | |

| Actual | | $1,000.00 | | $1,276.97 | | 0.86% | | $4.95 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.86 | | 0.86% | | $4.39 |

| | | | | | | | | |

Baillie Gifford International Equity Fund - Class 2 | | | | | | | | |

| Actual | | $1,000.00 | | $1,278.12 | | 0.69% | | $3.93 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.75 | | 0.69% | | $3.49 |

| | | | | | | | | |

Baillie Gifford International Equity Fund - Class 3 (a) | | | | | | | | |

| Actual | | $1,000.00 | | $1,201.86 | | 0.61% | | $2.23 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.13 | | 0.61% | | $3.11 |

| | | | | | | | | |

Baillie Gifford International Equity Fund - Class 4 (b) | | | | | | | | |

| Actual | | $1,000.00 | | $1,163.84 | | 0.58% | | $2.62 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.26 | | 0.58% | | $2.98 |

| | | | | | | | | |

Baillie Gifford EAFE Fund - Class 1 | | | | | | | | |

| Actual | | $1,000.00 | | $1,271.69 | | 0.79% | | $4.53 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.22 | | 0.79% | | $4.03 |

| | | | | | | | | |

Baillie Gifford EAFE Fund - Class 2 | | | | | | | | |

| Actual | | $1,000.00 | | $1,273.14 | | 0.62% | | $3.57 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.07 | | 0.62% | | $3.17 |

| | | | | | | | | |

Baillie Gifford EAFE Fund - Class 3 | | | | | | | | |

| Actual | | $1,000.00 | | $1,274.88 | | 0.55% | | $3.16 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.43 | | 0.55% | | $2.81 |

| | | | | | | | | |

Baillie Gifford EAFE Fund - Class 4 | | | | | | | | |

| Actual | | $1,000.00 | | $1,274.52 | | 0.52% | | $2.98 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,022.58 | | 0.52% | | $2.65 |

| | | | | | | | | |

Baillie Gifford EAFE Choice Fund - Class 2 | | | | | | | | |

| Actual | | $1,000.00 | | $1,273.19 | | 0.73% | | $4.16 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.54 | | 0.73% | | $3.70 |

| | | | | | | | | |

Baillie Gifford EAFE Choice Fund - Class 3 | | | | | | | | |

| Actual | | $1,000.00 | | $1,274.19 | | 0.66% | | $3.76 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.90 | | 0.66% | | $3.34 |

| | | | | | | | | |

Baillie Gifford Emerging Markets Fund - Class III | | | | | | | | |

| Actual | | $1,000.00 | | $1,272.92 | | 0.80% | | $4.57 |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.18 | | 0.80% | | $4.06 |

(a) Commencement of investment operations is September 1, 2010.

(b) Commencement of investment operations is July 30, 2010.

Page 16

Fund Expenses (unaudited) (concluded)

Expenses are calculated using the annualized expense ratio for the Funds, which represents the ongoing expenses as a percentage of net assets for the six-months ended 12/31/10. Expenses are calculated by multiplying the annualized expense ratio by the average account value for the period; then multiplying the result by the number of days in the most recent fiscal half-year; and then dividing that result by the number of days in the calendar year. Expense ratios for the most recent fiscal half-year may differ from expense ratios based on the one-year data in the financial highlights.

Page 17

| |

INDUSTRY DIVERSIFICATION TABLE | |

December 31, 2010 (unaudited) | Baillie Gifford International Equity Fund |

| |

| | | | | | | | |

| | Value | | % of Total

Net Assets | |

| | | | |

| | | | | | | | |

Airlines | | $ | 6,059,997 | | | | 0.9 | % |

Apparel | | | 14,227,033 | | | | 2.1 | |

Auto Manufacturers | | | 4,481,733 | | | | 0.7 | |

Banks | | | 48,972,011 | | | | 7.1 | |

Beverages, Food & Tobacco | | | 41,726,762 | | | | 6.0 | |

Biotechnology | | | 9,221,435 | | | | 1.3 | |

Commercial Services | | | 30,248,019 | | | | 4.4 | |

Construction & Building Materials | | | 11,516,597 | | | | 1.7 | |

Distribution/Wholesale | | | 13,876,775 | | | | 2.0 | |

Diversified Financial Services | | | 41,898,919 | | | | 6.0 | |

Diversified Industrials | | | 12,803,358 | | | | 1.8 | |

Electronic & Electrical Equipment | | | 36,316,689 | | | | 5.2 | |

Engineering & Machinery | | | 39,915,010 | | | | 5.8 | |

Food Producers & Processors | | | 27,661,251 | | | | 4.0 | |

Healthcare - Products | | | 18,739,568 | | | | 2.7 | |

Insurance | | | 13,529,490 | | | | 2.0 | |

Internet | | | 23,035,028 | | | | 3.3 | |

Investment Companies | | | 4,942,988 | | | | 0.7 | |

Media & Photography | | | 15,110,821 | | | | 2.2 | |

Mining & Metals | | | 78,020,285 | | | | 11.2 | |

Office/Business Equipment | | | 9,892,952 | | | | 1.4 | |

Oil & Gas | | | 72,583,060 | | | | 10.4 | |

Pharmaceuticals | | | 20,395,902 | | | | 2.9 | |

Real Estate | | | 9,339,355 | | | | 1.3 | |

Retailers - General | | | 24,484,366 | | | | 3.5 | |

Semiconductors | | | 23,723,484 | | | | 3.4 | |

Software | | | 5,780,344 | | | | 0.8 | |

Telecommunication Services | | | 5,909,340 | | | | 0.9 | |

Toys/Games/Hobbies | | | 3,678,592 | | | | 0.5 | |

Transportation | | | 21,082,470 | | | | 3.0 | |

| | | | | | | | |

| | | | | | | | |

Total Value of Investments | | | 689,173,634 | | | | 99.2 | |

Other assets less liabilities | | | 5,588,180 | | | | 0.8 | |

| | | | | | | | |

Net Assets | | $ | 694,761,814 | | | | 100.0 | % |

| | | | | | | | |

Page 18

| |

PORTFOLIO OF INVESTMENTS | |

December 31, 2010 | Baillie Gifford International Equity Fund |

| |

| | | | | | | |

| | Shares | | Value | |

| | | | | | |

| | | | | | | |

COMMON STOCKS - 95.8% | | | | | | | |

ARGENTINA - 0.8% | | | | | | | |

MercadoLibre, Inc. (a) | | | 84,200 | | $ | 5,611,930 | |

| | | | | | | |

| | | | | | | |

AUSTRALIA - 3.6% | | | | | | | |

Brambles Ltd. | | | 1,528,876 | | | 11,136,470 | |

Cochlear Ltd. | | | 79,666 | | | 6,558,059 | |

Woolworths Ltd. | | | 257,414 | | | 7,108,441 | |

| | | | | | | |

| | | | | | 24,802,970 | |

| | | | | | | |

BELGIUM - 0.8% | | | | | | | |

Groupe Bruxelles Lambert SA | | | 67,685 | | | 5,694,917 | |

| | | | | | | |

| | | | | | | |

BERMUDA - 1.7% | | | | | | | |

Seadrill Ltd. | | | 347,173 | | | 11,843,183 | |

| | | | | | | |

| | | | | | | |

BRAZIL - 4.7% | | | | | | | |

All America Latina Logistica | | | 530,260 | | | 4,791,506 | |

BM&F BOVESPA SA | | | 954,100 | | | 7,546,586 | |

OGX Petroleo e Gas Participacoes SA (a) | | | 648,400 | | | 7,812,048 | |

Petroleo Brasileiro SA ADR | | | 331,800 | | | 12,555,312 | |

| | | | | | | |

| | | | | | 32,705,452 | |

| | | | | | | |

CANADA - 5.1% | | | | | | | |

Cenovus Energy, Inc. | | | 127,557 | | | 4,269,433 | |

Eldorado Gold Corp. | | | 443,458 | | | 8,251,004 | |

EnCana Corp. | | | 122,143 | | | 3,573,509 | |

Fairfax Financial Holdings Ltd. | | | 23,867 | | | 9,817,323 | |

IAMGOLD Corp. | | | 262,182 | | | 4,680,409 | |

Ritchie Bros. Auctioneers, Inc. | | | 204,010 | | | 4,702,655 | |

| | | | | | | |

| | | | | | 35,294,333 | |

| | | | | | | |

CHINA - 8.1% | | | | | | | |

Baidu, Inc. ADR (a) | | | 97,650 | | | 9,426,154 | |

Cheung Kong (Holdings) Ltd. | | | 606,000 | | | 9,339,355 | |

China Shenhua Energy Co., Ltd., Class H | | | 1,738,500 | | | 7,285,945 | |

Hang Seng Bank Ltd. | | | 467,500 | | | 7,681,181 | |

Hong Kong Exchanges & Clearing Ltd. | | | 573,400 | | | 13,000,510 | |

Kunlun Energy Co., Ltd. | | | 3,998,000 | | | 6,201,830 | |

Pacific Basin Shipping Ltd. | | | 4,848,000 | | | 3,221,133 | |

| | | | | | | |

| | | | | | 56,156,108 | |

| | | | | | | |

DENMARK - 3.2% | | | | | | | |

A P Moller - Maersk AS, B Shares | | | 713 | | | 6,455,249 | |

DSV AS | | | 298,399 | | | 6,614,582 | |

Novozymes AS, B Shares | | | 66,088 | | | 9,221,435 | |

| | | | | | | |

| | | | | | 22,291,266 | |

| | | | | | | |

FINLAND - 2.3% | | | | | | | |

Kone Oyj, B Shares | | | 200,460 | | | 11,134,037 | |

Sampo Oyj, A Shares | | | 188,674 | | | 5,045,070 | |

| | | | | | | |

| | | | | | 16,179,107 | |

| | | | | | | |

FRANCE - 1.8% | | | | | | | |

CFAO | | | 132,575 | | | 5,774,679 | |

Essilor International SA | | | 110,811 | | | 7,139,660 | |

| | | | | | | |

| | | | | | 12,914,339 | |

| | | | | | | |

The accompanying notes are an integral part of the financial statements.

Page 19

| |

PORTFOLIO OF INVESTMENTS (continued) | |

December 31, 2010 | Baillie Gifford International Equity Fund |

| |

| | | | | | | |

| | Shares | | Value | |

| | | | | | |

| | | | | | | |

GERMANY - 2.9% | | | | | | | |

Aixtron SE | | | 164,668 | | $ | 6,136,469 | |

Celesio AG | | | 165,823 | | | 4,132,394 | |

Deutsche Boerse AG | | | 146,442 | | | 10,117,836 | |

| | | | | | | |

| | | | | | 20,386,699 | |

| | | | | | | |

INDIA - 1.5% | | | | | | | |

Infrastructure Development Finance Co., Ltd. | | | 1,210,891 | | | 4,942,988 | |

Jindal Steel & Power Ltd. | | | 252,160 | | | 4,013,410 | |

Reliance Capital Ltd. | | | 94,807 | | | 1,416,664 | |

| | | | | | | |

| | | | | | 10,373,062 | |

| | | | | | | |

IRELAND - 2.5% | | | | | | | |

CRH Plc. | | | 283,872 | | | 5,888,351 | |

James Hardie Industries SE CDI (a) | | | 811,666 | | | 5,628,246 | |

Ryanair Holdings Plc. ADR | | | 197,009 | | | 6,059,997 | |

| | | | | | | |

| | | | | | 17,576,594 | |

| | | | | | | |

ISRAEL - 0.8% | | | | | | | |

Teva Pharmaceutical Industries Ltd. ADR | | | 103,500 | | | 5,395,455 | |

| | | | | | | |

| | | | | | | |

JAPAN - 9.6% | | | | | | | |

Canon, Inc. | | | 192,600 | | | 9,892,952 | |

Chugai Pharmaceutical Co., Ltd. | | | 224,300 | | | 4,107,045 | |

Fast Retailing Co., Ltd. | | | 46,300 | | | 7,344,174 | |

INPEX Corp. | | | 982 | | | 5,734,282 | |

Japan Tobacco, Inc. | | | 1,883 | | | 6,953,111 | |

Mitsui & Co., Ltd. | | | 388,500 | | | 6,392,345 | |

Nintendo Co., Ltd. | | | 12,600 | | | 3,678,592 | |

Olympus Corp. | | | 222,400 | | | 6,696,495 | |

Rakuten, Inc. (a) | | | 9,556 | | | 7,996,944 | |

SMC Corp. | | | 44,700 | | | 7,627,891 | |

| | | | | | | |

| | | | | | 66,423,831 | |

| | | | | | | |

NETHERLANDS - 1.7% | | | | | | | |

ASML Holding NV | | | 101,841 | | | 3,905,825 | |

Heineken Holding NV | | | 178,329 | | | 7,755,432 | |

| | | | | | | |

| | | | | | 11,661,257 | |

| | | | | | | |

PORTUGAL - 0.5% | | | | | | | |

Galp Energia, SGPS, SA, B Shares | | | 182,934 | | | 3,508,306 | |

| | | | | | | |

| | | | | | | |

RUSSIA - 2.0% | | | | | | | |

Mobile TeleSystems ADR | | | 283,150 | | | 5,909,341 | |

X5 Retail Group NV GDR Reg S (a) | | | 176,950 | | | 8,196,150 | |

| | | | | | | |

| | | | | | 14,105,491 | |

| | | | | | | |

SINGAPORE - 2.7% | | | | | | | |

DBS Group Holdings Ltd. | | | 731,000 | | | 8,159,100 | |

United Overseas Bank Ltd. | | | 755,000 | | | 10,714,182 | |

| | | | | | | |

| | | | | | 18,873,282 | |

| | | | | | | |

SOUTH AFRICA - 3.7% | | | | | | | |

Massmart Holdings Ltd. | | | 472,034 | | | 10,513,537 | |

Naspers Ltd., N Shares | | | 256,301 | | | 15,110,821 | |

| | | | | | | |

| | | | | | 25,624,358 | |

| | | | | | | |

SOUTH KOREA - 2.6% | | | | | | | |

Hyundai Mobis (a) | | | 17,900 | | | 4,481,733 | |

Samsung Electronics Co., Ltd. | | | 16,092 | | | 13,439,012 | |

| | | | | | | |

| | | | | | 17,920,745 | |

| | | | | | | |

The accompanying notes are an integral part of the financial statements.

Page 20

| |

PORTFOLIO OF INVESTMENTS (continued) | |

December 31, 2010 | Baillie Gifford International Equity Fund |

| |

| | | | | | | |

| | Shares | | Value | |

| | | | | | |

| | | | | | | |

SPAIN - 1.5% | | | | | | | |

Banco Santander SA | | | 329,238 | | $ | 3,508,303 | |

Industria de Diseno Textil SA | | | 91,951 | | | 6,882,858 | |

| | | | | | | |

| | | | | | 10,391,161 | |

| | | | | | | |

SWEDEN - 4.8% | | | | | | | |

Atlas Copco AB, B Shares | | | 934,435 | | | 21,153,082 | |

Svenska Handelsbanken AB, A Shares | | | 385,158 | | | 12,311,777 | |

| | | | | | | |

| | | | | | 33,464,859 | |

| | | | | | | |

SWITZERLAND - 4.1% | | | | | | | |

Nestle SA | | | 366,171 | | | 21,451,642 | |

Roche Holding AG | | | 46,121 | | | 6,761,008 | |

| | | | | | | |

| | | | | | 28,212,650 | |

| | | | | | | |

TAIWAN - 4.0% | | | | | | | |

Hon Hai Precision Industry Co., Ltd. GDR Reg S | | | 827,764 | | | 6,622,112 | |

MediaTek, Inc. | | | 514,371 | | | 7,362,277 | |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | | 1,091,004 | | | 13,681,190 | |

| | | | | | | |

| | | | | | 27,665,579 | |

| | | | | | | |

TURKEY - 2.0% | | | | | | | |

Anadolu Efes Biracilik ve Malt Sanayii AS | | | 504,430 | | | 7,618,787 | |

BIM Birlesik Magazalar AS | | | 183,025 | | | 6,209,609 | |

| | | | | | | |

| | | | | | 13,828,396 | |

| | | | | | | |

UNITED KINGDOM - 16.8% | | | | | | | |

Amlin Plc. | | | 1,329,000 | | | 8,484,420 | |

Antofagasta Plc. | | | 451,463 | | | 11,423,374 | |

BG Group Plc. | | | 373,760 | | | 7,581,799 | |

BHP Billiton Plc. | | | 240,707 | | | 9,684,046 | |

British American Tobacco Plc. | | | 296,305 | | | 11,397,658 | |

Capita Group Plc. | | | 563,670 | | | 6,130,199 | |

Experian Plc. | | | 664,679 | | | 8,278,695 | |

Premier Farnell Plc. | | | 491,120 | | | 2,196,793 | |

Rio Tinto Plc. | | | 223,200 | | | 15,909,997 | |

Sage Group Plc. (The) | | | 1,353,251 | | | 5,780,344 | |

Smith & Nephew Plc. | | | 477,500 | | | 5,041,849 | |

Tesco Plc. | | | 1,206,719 | | | 8,001,774 | |

Tullow Oil Plc. | | | 481,244 | | | 9,503,358 | |

Wolseley Plc. (a) | | | 233,800 | | | 7,484,430 | |

| | | | | | | |

| | | | | | 116,898,736 | |

| | | | | | | |

Total Common Stocks | | | | | | | |

(cost $544,815,348) | | | | | | 665,804,066 | |

| | | | | | | |

| | | | | | | |

PREFERRED STOCKS - 3.4% | | | | | | | |

BRAZIL - 3.4% | | | | | | | |

Itau Unibanco Holding SA ADR | | | 274,780 | | | 6,597,468 | |

Vale SA ADR | | | 555,000 | | | 16,772,100 | |

| | | | | | | |

| | | | | | | |

Total Preferred Stocks | | | | | | | |

(cost $17,404,070) | | | | | | 23,369,568 | |

| | | | | | | |

| | | | | | | |

TOTAL INVESTMENTS - 99.2% | | | | | | | |

(cost $562,219,418) | | | | | | 689,173,634 | |

Other assets less liabilities - 0.8% | | | | | | 5,588,180 | |

| | | | | | | |

NET ASSETS - 100.0% | | | | | $ | 694,761,814 | |

| | | | | | | |

The accompanying notes are an integral part of the financial statements.

Page 21

| |

PORTFOLIO OF INVESTMENTS (concluded) | |

December 31, 2010 | Baillie Gifford International Equity Fund |

| |

(a) Non-income producing security.

CDI - Chess Depository Interest.

GDR - Global Depositary Receipt.

ADR - American Depositary Receipt.

Reg S - is a safe harbor that defines when an offering of securities will be deemed to come to rest abroad and therefore is not subject to the registration obligations imposed under Section 5 of the 1933 Act. The regulation includes two safe harbor provisions: an issuer safe harbor and a resale safe harbor. In each case, the regulation demands that offers and sales of the securities be made outside the United States and that no offering participant (which includes the issuer, the banks assisting with the offer and their respective affiliates) engage in “directed” selling efforts. In the case of issuers for whose securities there is substantial U.S. market interest, the regulation also requires that no offers and sales be made to U.S. persons (including U.S. persons physically located outside the United States).

The accompanying notes are an integral part of the financial statements.

Page 22

| |

STATEMENT OF ASSETS AND LIABILITIES | |

December 31, 2010 | Baillie Gifford International Equity Fund |

| | |

| | | | |

ASSETS | | | | |

Investments, at value (cost $562,219,418) | | $ | 689,173,634 | |

Cash | | | 1,106,095 | |

Foreign cash, at value (cost $6,084,080) | | | 6,194,310 | |

Dividends receivable | | | 346,686 | |

Tax reclaims receivable | | | 158,032 | |

Capital shares sold receivable | | | 37,850 | |

| | | | |

| | | | |

Total Assets | | | 697,016,607 | |

| | | | |

| | | | |

LIABILITIES | | | | |

Payable for investments purchased | | | 949,962 | |

Management fee payable | | | 499,023 | |

Servicing fee payable | | | 452,023 | |

Distributions payable | | | 201,706 | |

Accrued expenses | | | 152,079 | |

| | | | |

| | | | |

Total Liabilities | | | 2,254,793 | |

| | | | |

| | | | |

NET ASSETS | | $ | 694,761,814 | |

| | | | |

| | | | |

| | | | |

COMPOSITION OF NET ASSETS | | | | |

Paid-in capital | | $ | 573,419,814 | |

Distributions in excess of net investment income | | | (3,215,796 | ) |

Accumulated net realized loss on investments and foreign currency transactions | | | (2,516,601 | ) |

Net unrealized appreciation in value of investments and foreign currencies | | | 127,074,397 | |

| | | | |

| | $ | 694,761,814 | |

| | | | |

| | | | |

NET ASSET VALUE, PER SHARE | | | | |

| | | | |

Class 1 ($72,365,556 / 7,257,461 shares outstanding), | | | | |

unlimited authorized, no par value | | $ | 9.97 | |

| | | | |

Maximum Purchase Price Per Share (Note D) | | $ | 9.99 | |

| | | | |

Minimum Redemption Price Per Share (Note D) | | $ | 9.96 | |

| | | | |

| | | | |

Class 2 ($447,232,444 / 44,961,120 shares outstanding), | | | | |

unlimited authorized, no par value | | $ | 9.95 | |

| | | | |

Maximum Purchase Price Per Share (Note D) | | $ | 9.97 | |

| | | | |

Minimum Redemption Price Per Share (Note D) | | $ | 9.94 | |

| | | | |

| | | | |

Class 3 ($154,209,203 / 15,329,438 shares outstanding), | | | | |

unlimited authorized, no par value | | $ | 10.06 | |

| | | | |

Maximum Purchase Price Per Share (Note D) | | $ | 10.08 | |

| | | | |

Minimum Redemption Price Per Share (Note D) | | $ | 10.04 | |

| | | | |

| | | | |

Class 4 ($20,954,611 / 2,038,935 shares outstanding), | | | | |

unlimited authorized, no par value | | $ | 10.28 | |

| | | | |

Maximum Purchase Price Per Share (Note D) | | $ | 10.30 | |

| | | | |

Minimum Redemption Price Per Share (Note D) | | $ | 10.26 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

Page 23

| |

STATEMENT OF OPERATIONS | |

For the Year Ended December 31, 2010 | Baillie Gifford International Equity Fund |

| | |

| | | | |

INVESTMENT INCOME | | | | |

Dividends (net of foreign withholding taxes of $678,459) | | $ | 8,818,190 | |

Interest | | | 3,596 | |

| | | | |

Total Investment Income | | | 8,821,786 | |

| | | | |

| | | | |

EXPENSES | | | | |

Management fee (Note B) | | | 1,304,343 | |

Shareholder Servicing fees - Class 1 Shares (Note B) | | | 299,807 | |

Shareholder Servicing fees - Class 2 Shares (Note B) | | | 836,382 | |

Shareholder Servicing fees - Class 3 Shares (Note B) | | | 96,479 | |

Shareholder Servicing fees - Class 4 Shares (Note B) | | | 13,637 | |

Fund Accounting | | | 258,995 | |

Custody | | | 85,782 | |

Legal | | | 45,042 | |

Transfer Agency | | | 24,203 | |

Professional fees | | | 23,166 | |

Trustees’ fees | | | 16,210 | |

Insurance | | | 13,733 | |

Miscellaneous | | | 14,390 | |

| | | | |

Total Expenses | | | 3,032,169 | |

| | | | |

| | | | |

Net Investment Income | | | 5,789,617 | |

| | | | |

| | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS | | | | |

Net realized gain (loss) from: | | | | |

Investments | | | 9,188,527 | |

Foreign currency transactions | | | (373,813 | ) |

| | | | |

| | | 8,814,714 | |

| | | | |

| | | | |

Net change in unrealized appreciation on: | | | | |

Investments | | | 70,472,047 | |

Translation of assets and liabilities in foreign currencies | | | 161,065 | |

| | | | |

| | | 70,633,112 | |

| | | | |

| | | | |

Net realized and unrealized gain on investments and foreign currency transactions | | | 79,447,826 | |

| | | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 85,237,443 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

Page 24

| |

STATEMENTS OF CHANGES IN NET ASSETS | Baillie Gifford International Equity Fund |

| | |

| | | | | | | | |

| | For the

Year Ended

December 31, 2010 | | | For the

Year Ended

December 31, 2009 | |

| | | | | | |

INCREASE IN NET ASSETS FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 5,789,617 | | | $ | 3,055,724 | |

Net realized gain (loss) from investments and foreign currency transactions | | | 8,814,714 | | | | (1,399,037 | ) |

Net change in unrealized appreciation on investments and translation of assets and liabilities in foreign currencies | | | 70,633,112 | | | | 72,412,809 | |

| | | | | | | | |

Net increase in net assets from operations | | | 85,237,443 | | | | 74,069,496 | |

| | | | | | | | |

| | | | | | | | |

DIVIDENDS TO SHAREHOLDERS FROM: | | | | | | | | |

Net investment income: | | | | | | | | |

Class 1 | | | (1,213,165 | ) | | | (635,724 | ) |

Class 2 | | | (7,775,994 | ) | | | (2,951,387 | ) |

Class 3 | | | (2,843,440 | ) | | | - | |

Class 4 | | | (383,650 | ) | | | - | |

| | | | | | | | |

| | | | | | | | |

Total Dividends | | | (12,216,249 | ) | | | (3,587,111 | ) |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

TRANSACTIONS IN SHARES OF BENEFICIAL INTEREST | | | | | | | | |

Net proceeds from shares subscribed: | | | | | | | | |

Class 1 | | | 58,565,548 | | | | 118,875,750 | |

Class 2 | | | 197,769,223 | | | | 158,653,946 | |

Class 3 | | | 128,255,931 | | | | - | |

Class 4 | | | 18,009,486 | | | | - | |

Purchase premiums: | | | | | | | | |

Class 1 | | | 90,426 | | | | 110,922 | |

Class 2 | | | 346,429 | | | | 76,723 | |

Class 3 | | | 98,509 | | | | - | |

Class 4 | | | 13,573 | | | | - | |

Redemption fees: | | | | | | | | |

Class 1 | | | 4,011 | | | | 1,726 | |

Class 2 | | | 16,205 | | | | 2,030 | |

Class 3 | | | 2,837 | | | | - | |

Class 4 | | | 983 | | | | - | |

Dividends reinvested: | | | | | | | | |

Class 1 | | | 980,900 | | | | 635,723 | |

Class 2 | | | 7,775,994 | | | | 2,951,387 | |

Class 3 | | | 2,843,440 | | | | - | |

Class 4 | | | 383,650 | | | | - | |

Cost of shares redeemed: | | | | | | | | |

Class 1 | | | (61,133,453 | ) | | | (160,156,199 | ) |

Class 2 | | | (11,517,276 | ) | | | (26,242,512 | ) |

| | | | | | | | |

|

Increase in Net Assets from Transactions in Shares of Beneficial Interest | | | 342,506,416 | | | | 94,909,496 | |

| | | | | | | | |

| | | | | | | | |

Total Increase in Net Assets | | | 415,527,610 | | | | 165,391,881 | |

| | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 279,234,204 | | | | 113,842,323 | |

| | | | | | | | |

End of year (including distributions in excess of net investment income of $3,215,796 and $1,673,895, respectively) | | $ | 694,761,814 | | | $ | 279,234,204 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

Page 25

| |

| |

FINANCIAL HIGHLIGHTS | Baillie Gifford International Equity Fund |

| | |

| |

Selected data for a Class 1 Share outstanding throughout each period: | |

| | | | | | | |

| | For the

Year Ended

December 31, 2010 | | For the

Year Ended

December 31, 2009 | | For the Period

July 1, 2008(a)

through

December 31, 2008 | |

| | | | | | | |

Net asset value, beginning of period | | $8.86 | | $6.07 | | $10.52 | |

| | | | | | | |

| | | | | | | |

From Investment Operations | | | | | | | |

Net investment income(b) | | 0.12 | | 0.16 | | 0.03 | |

Net realized and unrealized gain (loss) on investments and foreign currency transactions | | 1.15 | | 2.70 | | (4.42) | |

| | | | | | | |

Net increase (decrease) in net asset value from investment operations | | 1.27 | | 2.86 | | (4.39) | |

| | | | | | | |

| | | | | | | |

Dividends to Shareholders | | | | | | | |

Dividends from net investment income | | (0.17) | | (0.08) | | (0.08) | |

| | | | | | | |

| | | | | | | |

Proceeds from Purchase Premiums and Redemption Fees | | 0.01 | | 0.01 | | 0.02 | |

| | | | | | | |

| | | | | | | |

Net asset value, end of period | | $9.97 | | $8.86 | | $6.07 | |

| | | | | | | |

| | | | | | | |

Total Return | | | | | | | |

Total investment return based on net asset value(c) | | 14.44% | | 47.24% | | (41.51)% | |

| | | | | | | |

Ratios/Supplemental Data | | | | | | | |

Net assets, end of period (000’s omitted) | | $72,366 | | $64,512 | | $63,086 | |

Ratio of net expenses to average net assets, after waiver | | 0.86% | | 0.93%(d) | | 0.90% *(d) | |

Ratio of net expenses to average net assets, before waiver | | 0.86% | | 0.94%(d) | | 1.05% *(d) | |

Ratio of net investment income to average net assets | | 1.36% | | 2.17% | | 1.14%* | |

Portfolio turnover rate | | 24% | | 17% | | 71% | |

| |

* | Annualized. |

(a) | Commencement of investment operations. |

(b) | Calculated based upon average shares outstanding during the period. |

(c) | Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption on the last day of the period. Total return is not annualized for periods less than one year. |

(d) | Baillie Gifford Overseas Limited had contractually agreed to waive its fees and/or bear other expenses through March 31, 2009 to the extent that such Fund’s total annual operating expenses (excluding interest, taxes and extraordinary expenses) exceeded 0.90% for Class 1 Shares. |

The accompanying notes are an integral part of the financial statements.

Page 26

| |

| |

FINANCIAL HIGHLIGHTS | Baillie Gifford International Equity Fund |

| | |

| |

Selected data for a Class 2 Share outstanding throughout each period: | |

| | | | | | | |

| | For the

Year Ended

December 31, 2010 | | For the

Year Ended

December 31, 2009 | | For the Period

February 7, 2008(a)

through

December 31, 2008 | |

| | | | | | | |

Net asset value, beginning of period | | $8.84 | | $6.07 | | $10.00 | |

| | | | | | | |

| | | | | | | |

From Investment Operations | | | | | | | |

Net investment income(b) | | 0.13 | | 0.09 | | 0.16 | |

Net realized and unrealized gain (loss) on investments and foreign currency transactions | | 1.15 | | 2.80 | | (4.03) | |

| | | | | | | |

Net increase (decrease) in net asset value from investment operations | | 1.28 | | 2.89 | | (3.87) | |

| | | | | | | |

| | | | | | | |

Dividends to Shareholders | | | | | | | |

Dividends from net investment income | | (0.18) | | (0.13) | | (0.08) | |

| | | | | | | |

| | | | | | | |

Proceeds from Purchase Premiums and Redemption Fees | | 0.01 | | 0.01 | | 0.02 | |

| | | | | | | |

| | | | | | | |

Net asset value, end of period | | $9.95 | | $8.84 | | $6.07 | |

| | | | | | | |

| | | | | | | |

Total Return | | | | | | | |

Total investment return based on net asset value(c) | | 14.65% | | 47.76% | | (38.51)% | |

| | | | | | | |

Ratios/Supplemental Data | | | | | | | |

Net assets, end of period (000’s omitted) | | $447,232 | | $214,722 | | $50,756 | |

Ratio of net expenses to average net assets, after waiver | | 0.68% | | 0.70%(d) | | 0.72% *(d) | |

Ratio of net expenses to average net assets, before waiver | | 0.68% | | 0.70%(d) | | 0.94%*(d) | |

Ratio of net investment income to average net assets | | 1.43% | | 1.12% | | 1.84% * | |

Portfolio turnover rate | | 24% | | 17% | | 71% | |

| |

* | Annualized. |

(a) | Commencement of investment operations. |

(b) | Calculated based upon average shares outstanding during the period. |

(c) | Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption on the last day of the period. Total return is not annualized for periods less than one year. |

(d) | Baillie Gifford Overseas Limited had contractually agreed to waive its fees and/or bear other expenses through March 31, 2009 to the extent that such Fund’s total annual operating expenses (excluding interest, taxes and extraordinary expenses) exceeded 0.72% for Class 2 Shares. |

The accompanying notes are an integral part of the financial statements.

Page 27

| |

FINANCIAL HIGHLIGHTS | Baillie Gifford International Equity Fund |

Selected data for a Class 3 Share outstanding throughout the period:

| | |

| | For the Period

September 1, 2010(a)

through

December 31, 2010 |

Net asset value, beginning of period | | $ 8.53 |

| | |

From Investment Operations | | |

Net investment income(b) | | 0.02 |

Net realized and unrealized gain on investments and foreign currency transactions | | 1.69 |

Net increase in net asset value from investment operations | | 1.71 |

| | |

Dividends to Shareholders | | |

Dividends from net investment income | | (0.19) |

| | |

Proceeds from Purchase Premiums and Redemption Fees | | 0.01 |

| | |

Net asset value, end of period | | $10.06 |

| | |

Total Return | | |

Total investment return based on net asset value(c) | | 20.19% |

| | |

Ratios/Supplemental Data | | |

Net assets, end of period (000’s omitted) | | $154,209 |

Ratio of net expenses to average net assets | | 0.61%* |

Ratio of net investment income to average net assets | | 0.76%* |

Portfolio turnover rate | | 24% |

| |

* | Annualized. |

(a) | Commencement of investment operations. |

(b) | Calculated based upon average shares outstanding during the period. |

(c) | Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption on the last day of the period. Total return is not annualized for periods less than one year. |

The accompanying notes are an integral part of the financial statements.

Page 28

| |

FINANCIAL HIGHLIGHTS | Baillie Gifford International Equity Fund |

Selected data for a Class 4 Share outstanding throughout the period:

| | |

| | For the Period

July 30, 2010(a)

through

December 31, 2010 |

Net asset value, beginning of period | | $9.00 |

| | |

From Investment Operations | | |

Net investment income(b) | | 0.04 |

Net realized and unrealized gain on investments and foreign currency transactions | | 1.42 |

Net increase in net asset value from investment operations | | 1.46 |

| | |

Dividends to Shareholders | | |

Dividends from net investment income | | (0.19) |

| | |

Proceeds from Purchase Premiums and Redemption Fees | | 0.01 |

| | |

Net asset value, end of period | | $10.28 |

| | |

Total Return | | |

Total investment return based on net asset value(c) | | 16.38% |

| | |

Ratios/Supplemental Data | | |

Net assets, end of period (000’s omitted) | | $20,955 |

Ratio of net expenses to average net assets | | 0.58%* |

Ratio of net investment income to average net assets | | 0.97%* |

Portfolio turnover rate | | 24% |

| |

* | Annualized. |

(a) | Commencement of investment operations. |

(b) | Calculated based upon average shares outstanding during the period. |

(c) | Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption on the last day of the period. Total return is not annualized for periods less than one year. |

The accompanying notes are an integral part of the financial statements.

Page 29

| |

INDUSTRY DIVERSIFICATION TABLE | |

December 31, 2010 (unaudited) | Baillie Gifford EAFE Fund |

| | | | | | | | |

| | Value | | | % of Total

Net Assets | |

| | | | | | | | |

Aerospace/Defense | | $ | 43,475,367 | | | | 2.8 | % |

Apparel | | | 55,662,281 | | | | 3.6 | |

Auto Manufacturers | | | 8,814,631 | | | | 0.5 | |

Banks | | | 188,681,719 | | | | 12.1 | |

Beverages, Food & Tobacco | | | 109,431,655 | | | | 7.0 | |

Biotechnology | | | 21,125,913 | | | | 1.3 | |

Chemicals | | | 25,494,730 | | | | 1.6 | |

Commercial Services | | | 29,187,564 | | | | 1.9 | |

Construction & Building Materials | | | 42,312,771 | | | | 2.7 | |

Cosmetics/Personal Care | | | 35,395,315 | | | | 2.3 | |

Distribution/Wholesale | | | 10,861,395 | | | | 0.7 | |

Diversified Financial Services | | | 56,679,205 | | | | 3.6 | |

Diversified Industrials | | | 40,010,290 | | | | 2.6 | |

Electronic & Electrical Equipment | | | 48,682,060 | | | | 3.1 | |

Energy - Alternate Sources | | | 20,428,729 | | | | 1.3 | |

Engineering & Machinery | | | 128,275,580 | | | | 8.2 | |

Healthcare - Products | | | 24,623,196 | | | | 1.6 | |

Insurance | | | 25,731,423 | | | | 1.6 | |

Internet | | | 112,428,135 | | | | 7.2 | |

Investment Companies | | | 683,796 | | | | 0.0 | |

Mining & Metals | | | 80,197,756 | | | | 5.1 | |

Motorcycles | | | 14,978,205 | | | | 1.0 | |

Office/Business Equipment | | | 24,752,927 | | | | 1.6 | |

Oil & Gas | | | 107,913,920 | | | | 6.9 | |

Pharmaceuticals | | | 42,221,887 | | | | 2.7 | |

Retailers - General | | | 113,782,118 | | | | 7.3 | |

Semiconductors | | | 25,935,573 | | | | 1.7 | |

Software | | | 46,683,726 | | | | 3.0 | |

Toys/Games/Hobbies | | | 35,530,525 | | | | 2.3 | |

Travel & Leisure | | | 12,355,649 | | | | 0.8 | |

| | | | | | | | |

Total Value of Investments | | | 1,532,338,041 | | | | 98.1 | |

Other assets less liabilities | | | 30,315,790 | | | | 1.9 | |

Net Assets | | $ | 1,562,653,831 | | | | 100.0 | % |

Page 30

| |

PORTFOLIO OF INVESTMENTS | |

December 31, 2010 | Baillie Gifford EAFE Fund |

| | | | | | | |

| | Shares | | Value | |

| | | | | | | |

COMMON STOCKS - 94.1% | | | | | | | |

AUSTRALIA - 6.1% | | | | | | | |

Brambles Ltd. | | | 4,007,030 | | $ | 29,187,565 | |

Fortescue Metals Group Ltd. (a) | | | 2,234,646 | | | 14,979,625 | |

Woodside Petroleum Ltd. | | | 631,708 | | | 27,517,544 | |

Woolworths Ltd. | | | 831,720 | | | 22,967,799 | |

| | | | | | 94,652,533 | |

BRAZIL - 2.2% | | | | | | | |

B2W Companhia Global do Varejo | | | 428,500 | | | 8,131,175 | |

BM&F BOVESPA SA | | | 1,506,500 | | | 11,915,871 | |

OGX Petroleo e Gas Participacoes SA (a) | | | 1,242,100 | | | 14,965,060 | |

| | | | | | 35,012,106 | |

CHINA - 8.8% | | | | | | | |

Baidu, Inc. ADR (a) | | | 505,700 | | | 48,815,221 | |

China Merchants Bank Co., Ltd., Class H | | | 5,522,000 | | | 13,929,481 | |

CNOOC Ltd. | | | 6,109,000 | | | 14,541,420 | |

Hong Kong Exchanges & Clearing Ltd. | | | 915,200 | | | 20,750,030 | |

Li & Fung Ltd. | | | 1,872,000 | | | 10,861,395 | |

Ports Design Ltd. | | | 1,078,000 | | | 2,974,426 | |

Tencent Holdings Ltd. | | | 1,175,000 | | | 25,508,596 | |

| | | | | | 137,380,569 | |

DENMARK - 3.2% | | | | | | | |

Novo Nordisk AS, B Shares | | | 203,697 | | | 22,949,426 | |

Novozymes AS, B Shares | | | 99,518 | | | 13,886,012 | |

Vestas Wind Systems AS (a) | | | 433,940 | | | 13,743,006 | |

| | | | | | 50,578,444 | |

FRANCE - 5.8% | | | | | | | |

Essilor International SA | | | 382,164 | | | 24,623,196 | |

L’Oreal SA | | | 236,246 | | | 26,268,610 | |

PPR | | | 247,726 | | | 39,440,895 | |

| | | | | | 90,332,701 | |

GERMANY - 5.6% | | | | | | | |

Adidas AG | | | 385,561 | | | 25,080,417 | |

Aixtron SE | | | 229,300 | | | 8,545,026 | |

HeidelbergCement AG | | | 204,842 | | | 12,856,487 | |

Q-Cells SE (a) | | | 288,421 | | | 964,890 | |

SAP AG | | | 417,870 | | | 21,312,483 | |

SMA Solar Technology AG | | | 61,880 | | | 5,720,833 | |