UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10045

CALVERT IMPACT FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Twelve months ended September 30, 2013

Item 1. Report to Stockholders.

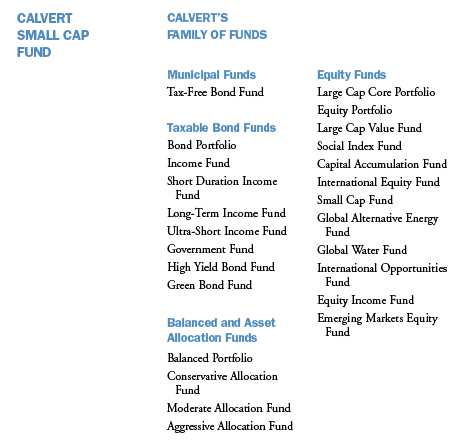

[Calvert Small Cap Fund Annual Report to Shareholders]

and

[Calvert Global Alternative Energy Fund and Calvert Global Water Fund Annual Report to Shareholders]

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

Barbara Krumsiek

President and CEO of Calvert Investments, Inc.

Dear Calvert Shareholder,

For the 12 months ended September 30, 2013, the global equity markets generally had a strong year, while bonds saw more mixed results. Large-cap stocks, as represented by the Russell 1000 Index, posted a healthy 20.9% return, while the smaller-cap Russell 2000 Index led with a 30.1% gain. This occurred despite political turmoil and market concerns worldwide about a forced shutdown of the U.S. government and the upcoming debt ceiling deadline.

Despite these advances, it was a challenging year for the financial markets overall. At various times, issues at home and abroad led to marked volatility in the performance of both stocks and bonds. Emerging-market performance was notably low, as fears of slowing growth in China and the Eurozone, along with continuing struggles in the Eurozone periphery, stalled regional investment. As a result, the formerly high-flying MSCI Emerging Markets Index gained only 1.3% for the period. The Barclays U.S. Credit Index, a barometer for the overall U.S. bond market, returned -1.9%.

Early in the Fall, Fed Chairman Ben Bernanke’s retirement was big news. The nomination of Vice Chair Janet Yellen as his replacement means the Fed will likely stay the course with current monetary policy. Yet, this is a historic moment for the United States, as Yellen, following Senate approval, will be the first woman to lead this critical agency.

Calvert Co-Founder Honored

I’m proud to congratulate Calvert co-founder Wayne Silby, who received the prestigious Joseph Wharton Award for Social Impact from The Alumni Club of New York, honoring his lifetime of achievement in impact investing and social entrepreneurship. Besides founding Calvert with John Guffey, Wayne is a co-founder of the Social Venture Network, Co-Chairman of the board of the Calvert Foundation, Chairman of Syntao Ltd., a CSR consultancy in Beijing, and active in other ventures in social impact and entrepreneurship.

Calvert Releases New Report on Diversity

In March, we published the latest edition of Examining the Cracks in the Glass Ceiling, which measures diversity practices of the companies that constitute the S&P 100 Index. As you know, Calvert believes companies with a diverse workforce are poised for greater success in today’s increasingly global marketplace and will enjoy greater long-term value—a view supported by a growing body of research from McKinsey, Credit Suisse, and others.

Companies in the report were rated on 10 indicators: EEO policy, internal diversity initiatives, external diversity initiatives, scope of diversity initiatives, family-friendly benefits, demographic disclosure of employees (EEO-1), highest-paid executives, board diversity,

4 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

director selection criteria, and overall corporate commitment. The highest-rated companies were Citigroup, Merck, The Coca-Cola Company, and J.P. Morgan Chase, all scoring at least 95 points or more out of 100. We hold these companies in a number of our Calvert portfolios.

While some progress has been achieved in corporate diversity practices since our last assessment in 2010, the S&P 100 companies are largely failing to translate progressive practices into increased promotion rates for women and minority employees. For example, women are now hired as often as men. However, more than half of the S&P 100 companies lack diversity among their highest-paid senior executive positions. And women still only represent 19% of board members among these large-cap companies. Much remains to be done, which is why we continue to work with a number of international, multi-stakeholder groups on these issues, as well as conduct advocacy work with individual companies.

Stay Informed in the Months Ahead

Maintaining a well-diversified mix of U.S. and international stocks, bonds, and cash—appropriate for your goals and risk tolerance—is one of the best ways to mitigate the effects of an uneven recovery in the economy and markets. Of course, we recommend consulting your financial advisor if you have questions or concerns about your investments.

We also invite you to visit our website, www.calvert.com, for fund information, portfolio updates, and commentary from Calvert professionals. As always, we thank you for investing with Calvert.

The following companies represented the following percentages of Fund net assets: Citigroup 2.27% of Calvert Large Cap Value, 1.32% of Calvert Social Index; Merck 2.26% of Calvert Equity Income, 2.01% of Calvert Large Cap Value, and 1.25% of Calvert Social Index; Coca-Cola 1.29% of Calvert Social Index, 3.20% of Calvert Large Cap Core and 3.29% Calvert Equity Portfolio; J.P. Morgan Chase 2.54% of Calvert Equity Income, 1.74% of Calvert Social Index and 0.34% of Calvert Balanced Portfolio. Holdings are subject to change.

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 5

As always, Calvert continues to work hard to ensure you have a say in the responsible management of environmental, social, and governance (ESG) factors for the companies in which we invest. Below are highlights of our accomplishments during the reporting period.

Shareholder Advocacy

Over the past year, Calvert engaged with 139 companies via emails, letters, phone calls, and in-person meetings. We also filed 22 shareholder proposals during the 2013 proxy season, which led to agreements with 14 companies on the issues of board diversity and sustainability reporting, among others. We also presented at four annual meetings where the proposals came to a vote and received shareholder support that exceeded 40% at two companies.

One proposal was for diversified energy services company Cleco, which has significant assets in thermoelectricity, to report on its sustainability risks and opportunities, including an analysis of material water-related risks. The other at Pioneer Natural Resources focused on reporting the environmental and social challenges and opportunities associated with hydraulic fracturing.

Company Engagement

Research and an intensive dialogue across a range of corporate responsibility and sustainability issues led to McDonald’s and Walt Disney meeting our Signature® criteria1 for the first time. McDonald’s is improving its supply chain labor policies and practices, diversifying its menu options, and disclosing their nutritional content—although it continues to face challenges in both areas. Walt Disney now meets the criteria for workplace safety, while continuing to meet our criteria on supply chain labor and human rights practices.

We undertook more engagement with Coca-Cola and PepsiCo on labor and human rights, water, and sustainability issues. In fact, PepsiCo management credited our recommendations with influencing their decision to strengthen their human rights policy framework.

Climate Change And Energy

Calvert, the World Wildlife Fund (WWF) and Ceres published, “Power Forward: Why the World’s Largest Companies are Investing in Renewable Energy.” The report found that more than half of the largest U.S. corporations and more than two-thirds of the largest companies across the globe have set greenhouse gas (GHG) emissions reduction commitments and/or renewable energy commitments.

Calvert joined with other Investor Network on Climate Risk (INCR) members to speak at congressional staff briefings about recommendations for corporations in the report and draft an investor letter to Congress supporting the production tax credit (PTC) for wind

6 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

energy, which was due to expire at the end of 2012. The report, briefings and investor letter helped spur extension of the PTC to support the growth of renewable energy.

350.Org Divestment Campaign On Fossil Fuels

Calvert watched closely the 350.org campaign urging college and university endowments, as well as other institutional investors, to divest from companies producing fossil fuels. In December, Calvert posted a statement on our website expressing support for the campaign’s broad objectives while making the case for a complementary strategy of active ownership and engagement. The statement pointed to specific fossil fuel companies such as Denbury Resources and Suncor Energy that Calvert has successfully engaged on climate change, alternative energy, and revenue transparency.

Burma

After the lifting of U.S. sanctions prohibiting new investment in Burma by American companies, the Calvert Social Funds Board approved revisions to Calvert’s long-standing policy language in September. Instead of urging U.S. companies to “cease operations” in Burma, the new language instead calls for Calvert to advocate for “responsible investment.”

Garment Industry Safety

Following the Rana Plaza tragedy earlier this year, where more than 1,100 Bangladesh garment factory workers were killed, Calvert assessed the state of significant country-level sourcing disclosure by retail companies, which is essential to assessing sourcing risks more effectively. After learning that only a handful of companies disclose this necessary data, we contacted 26 retail company CEOs requesting disclosure of sourcing information for those countries representing 5% or more of global order volume.

Human Rights Report

In March, Calvert, Interfaith Center on Corporate Responsibility and the Institute for Human Rights and Business launched “Investing the Rights Way: A Guide for Business and Human Rights” in both New York and London. The guide outlines how investors can apply the UN Guiding Principles on Business and Human Rights as a due diligence and risk assessment framework to assess companies in their portfolios.

Conflict Minerals

Calvert continued to be a leader among investors on “conflict minerals” through a multi-stakeholder group supporting disclosure requirements enacted as Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The disclosure would certify that certain minerals used in cell phones and other consumer electronic components (tin, titanium, tantalum and gold) are not illegally mined to fuel the continuing bloody conflict in the Democratic Republic of Congo (DRC).

After the SEC approved and released the final rule to implement the reporting requirements of Section 1502 in August 2012, the U.S. Chamber of Commerce filed a lawsuit against the Securities and Exchange Commission (SEC) to stop implementation. Calvert led the multi-stakeholder group’s effort to forge a common statement urging implementation of the law as outlined by the rule, regardless of the lawsuit. On July 23, the court upheld the “conflict minerals rule” in favor of the SEC and the statute requiring adoption of the rule—a major victory for Calvert and its allies.

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 7

Extractives Revenue Transparency

Widely credited for its leadership role among investors in supporting extractive revenue transparency as an imperative for investors interested in full disclosure of material information related to oil, gas and mining in certain countries, Calvert has remained actively engaged in the SEC rule-making process. The U.S. Chamber of Commerce and the American Petroleum Institute filed a lawsuit challenging the pro-disclosure rules, Calvert submitted a sworn statement about the problems investors would face if the rules were delayed or revoked. We also sent letters to the SEC emphasizing the materiality of disclosures required by the rules and contributed research to Oxfam America’s January 2013 brief.

On July 2, the court “vacated” the SEC’s rule, declaring it inoperative until the SEC addresses certain key issues (the necessity for exemptions for certain countries and public reporting of the disclosures). Calvert subsequently drafted a letter to SEC Chairman Mary Jo White that acknowledged the value of the Commission’s rules to implement Section 1504 and urged her respond to the API vs. SEC decision by reinstating rules consistent with those issued in August 2012, which were endorsed by investors representing more than $5.6 trillion in assets under management.

1. Calvert’s Signature® criteria examine corporate performance across seven broad areas of concern: Governance and Ethics, Environment, Workplace, Product Safety and Impact, International Operations and Human Rights, Indigenous Peoples’ Rights, and Community Relations. For a company to be eligible for inclusion in a Calvert Signature portfolio, it must meet the criteria in all seven categories.

The following companies represented the following percentages of net assets: Cleco 0.02% of Calvert Social Index; Pioneer Natural Resources 0.23% of Calvert Social Index and 1.39% of Calvert Balanced Portfolio; McDonald’s 0.86% of Calvert Social Index and 2.35% of Calvert Equity Portfolio, Walt Disney 0.96% of Calvert Social Index and 2.25% of Calvert Equity Portfolio; Coca-Cola 1.29% of Calvert Social Index, 3.20% of Calvert Large Cap Core and 3.29% Calvert Equity Portfolio; PepsiCo 1.10% of Calvert Social Index, 1.20% of Calvert Equity Portfolio and 0.54% of Calvert Balanced Portfolio; Denbury Resources 0.06% of Calvert Social Index and 2.86% of Calvert Large Cap Core; and Suncor Energy 0.71%% of Calvert International Equity Portfolio. Holdings are subject to change.

8 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

Investment Performance

Calvert Small Cap Fund’s Class A Shares (at NAV) returned 32.42% for the 12-month period ended September 30, 2013, outperforming the Russell 2000 Index, which returned 30.06%. The outperformance is largely attributable to effective stock selection.

Investment Climate

Equities faced a brief pullback in late 2012, but recovered and posted strong gains throughout most of 2013. The third round of quantitative easing (QE), unleashed in mid-2012, provided an impetus for equity investors to look past numerous macro head-winds from fiscal cliff debates, sequester, slow growth in China and the Eurozone, and weak corporate earnings. The macro-economic picture in the U.S. continued to show improvement in the key economic sectors—housing and employment. For the year, the S&P 500, Russell 1000, Russell 2000, MSCI EAFE, and MSCI Emerging Markets Indices returned 19.34%, 20.91%, 30.06%, 24.92%, and 1.33%, respectively.

Value stocks outperformed growth stocks by 3.03%, as measured by the Russell 1000 Value and Russell 1000 Growth Indices for the 12-month period. Within the Russell 1000 Index, Consumer Discretionary, Industrials, and Health Care were the top-performing sectors, while Telecoms, Utilities, and Materials lagged.

Corporate Earnings Are Weaker

Corporate earnings reports in late 2012 and throughout the first half of 2013 were largely weak on both the top- and bottom-line figures, with the sequester negatively impacting corporate results in the first half of 2013.

Sounding a cautious note, several bellwether companies that reported late in the summer of 2013, including names like Walmart and Cisco, issued reduced earnings forecasts citing everything from consumer weakness to fears of rising interest rates. We continue to believe that, going forward, the U.S. economic recovery can be sustained and able to support earnings growth for U.S. companies.

Improving Macro-Economic Picture in the U.S., But Continued Softness Abroad

Throughout the year, U.S. macro indicators continued to improve, albeit slowly. The unemployment rate ticked down to just above 7% and initial jobless claims hit post-financial crisis lows in the third quarter of 2013. New job growth remains sluggish. However, consumers continue to remain upbeat and willing to spend on bigger-ticket

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 9

| | |

| CALVERT |

| SMALL CAP FUND |

| SEPTEMBER 30, 2013 |

| |

| | % OF TOTAL | |

| ECONOMIC SECTORS | INVESTMENTS | |

| Consumer Discretionary | 12.0 | % |

| Consumer Staples | 5.0 | % |

| Energy | 5.0 | % |

| Financials | 17.8 | % |

| Health Care | 11.2 | % |

| Industrials | 12.6 | % |

| Information Technology | 12.5 | % |

| Materials | 4.5 | % |

| Short-Term Investments | 16.6 | % |

| Telecommunication Services | 1.2 | % |

| Utilities | 1.6 | % |

| Total | 100 | % |

| CALVERT |

| SMALL CAP FUND |

| SEPTEMBER 30, 2013 |

| |

| INVESTMENT PERFORMANCE | | | |

| (TOTAL RETURN AT NAV*) | | | |

| | 6 MONTHS | | 12 MONTHS | |

| | ENDED | | ENDED | |

| | 9/30/13 | | 9/30/13 | |

| Class A | 15.34 | % | 32.42 | % |

| Class B | 14.50 | % | 30.40 | % |

| Class C | 14.96 | % | 31.35 | % |

| Class I | 15.87 | % | 33.43 | % |

| |

| Russell 2000 | | | | |

| Index | 13.61 | % | 30.06 | % |

| |

| Lipper Small | | | | |

| Cap Core | | | | |

| Funds Average | 11.92 | % | 28.77 | % |

| TEN LARGEST | % OF NET | |

| STOCK HOLDINGS | ASSETS | |

| Sanmina Corp. | 3.8 | % |

| Platinum Underwriters | | |

| Holdings Ltd. | 2.8 | % |

| Deluxe Corp. | 2.8 | % |

| Grand Canyon Education, Inc. | 2.7 | % |

| Worthington Industries, Inc. | 2.6 | % |

| Barnes Group, Inc. | 2.6 | % |

| Texas Roadhouse, Inc. | 2.5 | % |

| Belden, Inc. | 2.4 | % |

| Brown Shoe Co., Inc. | 2.4 | % |

| Molina Healthcare, Inc. | 2.4 | % |

| Total | 27.0 | % |

* Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charges.

items, as reflected in improving vehicle and home sales. Sales of previously owned homes hit a three-year high in May of 2013 and housing prices continued to trend upward, despite the looming threat of rising interest rates.

Abroad, developed markets kept pace with the U.S., but emerging markets were rattled by developments in China and the Eurozone periphery. A transition of power in China went smoothly, but new leadership promised to curb excesses in the economy, triggering fears of an economic slowdown. The pullback reached its climax with a 14% sell-off in the Shanghai composite in June that rattled markets around the globe. Elsewhere in Asia, Japan launched an unprecedented QE program in late 2012, triggering a massive rally in Japanese equi-

ties and a large sell-off in the yen. With similar (but smaller) policy measures in Europe, investors began to focus on the theme of coordinated global QE as a stabilizing force for the global economy in the near term, despite potentially negative effects in the longer term.

10 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

In Europe, economic turmoil in the so called “PIIGS” (Portugal, Italy, Ireland, Greece and Spain) continued to simmer in the background. While Italy nearly saw its government collapse, unemployment in Spain reached almost 50% among youth—reminding investors that the region, while improving, remains fragile.

Federal Reserve: QE Taper and Transition Talk

During the summer, investor consensus largely settled around the view that the Federal Reserve (Fed) would begin tapering its QE program in September of 2013 by reducing both its Treasury and mortgage-backed security purchases. This view took hold despite weakness in both employment and inflation, the two areas highlighted by Fed Chairman Ben Bernanke as needing improvement before tapering would begin. Nevertheless, the “surprise” decision not to taper in September caught market participants off guard, sending equities up and sparking a retreat in bond yields.

As markets digested the lack of a QE taper – and largely gave back the equity gains won on the news – focus also returned to the transition of the Fed Chairman role. With Larry Summers removing himself from consideration, consensus coalesced around eventual nominee Vice Chair Janet Yellen, a selection largely signaling favor for continuing current monetary policy with little change.

With Political Stalemate in Washington, It’s Déjà Vu All Over Again…

The debt ceiling drama of 2011 reared its head again in late September 2013. The government shutdown and debt ceiling impasse in Washington fueled uncertainty and created a negative feedback loop in the U.S. economy. Although U.S. labor conditions improved materially since the asset purchase program began, recent reductions in public-sector employment were felt in the July and August employment reports.

The U.S. Congress failed to approve a budget to fund the government past September 30, which culminated in the shutdown of the federal government. Equity markets appeared largely unconcerned with the event in September despite the looming U.S. debt ceiling debate. Congress was not able to raise the debt ceiling until hours before the October 17 deadline identified by the Treasury Department.

Although the markets welcomed the resolution, the turmoil took its toll. Estimates of fiscal drag from the shutdown were in the billions, while credit-rating firm Fitch put the nation’s credit rating on negative outlook as a result of the political stalemate and inability to take timely action on raising the debt ceiling.

Portfolio Strategy

U.S. small-cap stocks posted impressive returns with the Russell 2000 Index returning 30.06% for the period. Calvert Small Cap Fund, which returned 32.42%, outperformed its benchmark by 2.36% due to effective stock selection. Stock selection was notably strong across several sectors with the largest impacts from our picks in Financials, Energy, Materials and Industrials.

Our stock selection in Financials produced significant contributions to the Fund’s relative outperformance. Top performers included commercial banker SVB Financial Group and loan servicing company Nelnet, which were up 43% and 70%, respectively.1 Additionally, Platinum Underwriters Holdings, Ltd., a company that offers reinsurance

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 11

and risk management to other insurance companies, gained 47% as the company beat analysts’ earnings estimates throughout the period. We also added value in the sector by avoiding the interest-rate sensitive real estate investment trusts (REITs).

In Energy, New Orleans-based EPL Oil and Gas rose over 77%. EPL increased its revenue by 85% and its earnings per share by 176% year-over-year as of June 30, 2013. Energy services companies Exterran Holdings and Helix Energy Solutions Group contributed to the outperformance as well, returning 59% and 39%, respectively.

Worthington Industries, a metal processing company within the Materials sector, gained 62%. As falling steel prices prompted international competitors to reduce their exports to the U.S., Worthington was able to increase its market share.

In Industrials, cable and networking products manufacturer Belden was up over 72% as its sales growth and margins improved after a lackluster 2012. Two other picks in Industrials that made positive contributions were office furniture manufacturer Steelcase and SkyWest airline, which returned 65% and 58%, respectively.

| CALVERT |

| SMALL CAP FUND |

| SEPTEMBER 30, 2013 |

| |

| AVERAGE ANNUAL TOTAL RETURNS | |

| |

| CLASS A SHARES | (WITH MAX. LOAD) | |

| One year | 26.10 | % |

| Five year | 9.40 | % |

| Since inception (10/1/2004) | 5.60 | % |

| |

| CLASS B SHARES | (WITH MAX. LOAD) | |

| One year | 25.40 | % |

| Since inception (11/29/2010) | 13.30 | % |

| |

| CLASS C SHARES | (WITH MAX. LOAD) | |

| One year | 30.35 | % |

| Five year | 9.48 | % |

| Since inception (4/1/2005) | 4.99 | % |

| |

| CLASS I SHARES | | |

| One year | 33.43 | % |

| Five year | 11.33 | % |

| Since inception (4/29/2005) | 7.71 | % |

Across other sectors, the Fund benefited from our selection of Health Care companies Molina Healthcare and USANA Health Sciences, which returned 51% and 81%, respectively. In the Consumer Discretionary sector, restaurant chain Texas Roadhouse gained 57% and Grand Canyon Education, which provides post-secondary education services, rose 67% after beating analysts’ earnings estimates.

The Fund’s greatest single contribution came from Sanmina Corporation, which designs, engineers and manufactures electronic components. Sanmina’s gross margins increased by 7% year-over-year and the company had strong order increases in the second quarter of 2013. Unfortunately, these positive contributions were partially offset by other stock selections in the Information Technology sector. The largest detractor was Diebold, an IT security systems firm that returned -8%. Diebold’s guidance for 2013 earnings has remained low with expectations of flat revenue growth. Additionally, IT services company Unisys, and Lender Processing, a provider of IT services to the real estate industry, each returned 15%--significantly lagging other small-cap technology stocks.

12 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

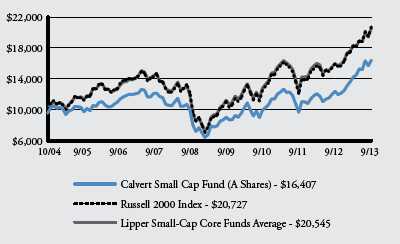

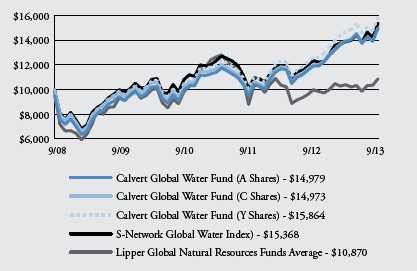

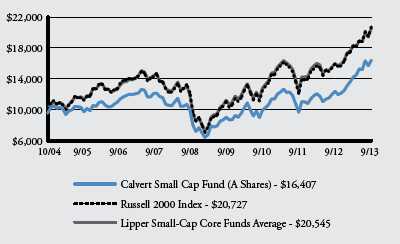

GROWTH OF $10,000

The graph below shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods or since inception (for funds without 10-year records). The results shown are for Class A shares and reflect the deduction of the maximum front-end Class A sales charge of 4.75%, or deferred sales charge, as applicable and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

* The month-end date of 10/31/04 is used for comparison purposes only: actual fund inception is 10/1/04.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. All performance data reflects fee waivers and/or expense limitations, if any are in effect; in their absence performance would be lower. See Note B in Notes to Financial Statements. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.78%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 13

Company Highlight

Throughout late 2012 and much of 2013, we were increasingly concerned that a key value driver for Portland General entailed higher risk than realized by the market. Portland General, a regulated utility in the Pacific Northwest, began to invest in a 215-mile energy transmission line planned to run through the Confederated Tribes of the Warm Springs reservation. According to our integrated analysis, the market underestimated the ESG risks, particularly in terms of potential delays, cost overruns and even cancellation. Power transmission assets tend to trade at higher valuations than those of traditional regulated utilities. Using our integrated financial analysis, we valued the additional risk.

Our concerns were supported early in 2012, when management restructured the project to end the transmission line just before the reservation’s border. Management cited financial advantages, but gave no hard information about how the restructured plan was better. In June, management cancelled the entire project. In August, it announced the financial impact—a $52 million charge to earnings and lower financial projections.

With the transmission project now behind it, the company’s present strategy is more focused within management’s core operational expertise. While we have long regarded the company to be well managed, this event reduced the premium we assigned that attribute. We believe Portland General is less likely to take advantage of other non-core opportunities in the future and have reduced our position.

Outlook

As we have stated in the past, despite negative short-term investor sentiment, the long-term drivers of economic recovery continue to gain strength. Investors continue to look beyond the headlines and focus on the improving macro-economic climate in the U.S. and, to some degree, overseas.

The path to recovery will not necessarily be smooth, however. The Fed is largely expected to taper QE as early as December and interest rates are expected to continue climbing. In such a scenario, higher dividend stocks remain especially vulnerable. While growth stocks made an impressive recovery in the third quarter, value names may recover when the reality of Fed tapering and interest rate uptick returns to focus.

However, longer-term factors, such as historically low housing inventories and continued household formation, will provide support for improving economic growth. Likewise, manufacturing is pulling out of its seasonal slump and the broader trend of consumer balance sheet repair is well underway.

As confidence sets in at both the consumer and corporate level, we continue to expect consumers to increase spending and companies to eventually expand capital expenditures and increase inventories. The sharp rise in interest rates that many feared would continue to 3% and beyond has tempered. While consumers and companies alike must prepare for a rising-rate environment, over the medium- and longer-terms, a gradual shift up in borrowing costs may be a sign of an improving economy and not necessarily a near-term threat to growth.

Calvert Investment Management, Inc.

October 2013

14 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

1. Returns reflect the period the stock was in the portfolio.

As of September 30, 2013, the following companies represented the following percentages of Fund net assets: Walmart 0.00%; Cisco 0.00%; SVB Financial Group 2.25%, Nelnet 1.95%, EPL Oil and Gas 0.89%, Worthington 2.61%, Diebold 1.39%, Platinum Underwriters 2.81%, Exterran 0.00%, Helix Energy Solutions, 2.26%, Belden. 2.42%, Steelcase, 2.08%, Skywest 2.31%, Molina Healthcare 2.39%, USANA Health Services 1.44%, Grand Canyon Education 2.71%, Texas Roadhouse 2.51%, Sanmina 3.79%, Unisys 2.11%, Portland General Electric 1.72%, and Lender Processing 2.00%. Holdings are subject to change.

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 15

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2013 to September 30, 2013).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

16 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

| | BEGINNING | ENDING ACCOUNT | EXPENSES PAID |

| | ACCOUNT VALUE | VALUE | DURING PERIOD* |

| | 4/1/13 | 9/30/13 | 4/1/13 - 9/30/13 |

| CLASS A | | | |

| Actual | $1,000.00 | $1,153.45 | $8.95 |

| Hypothetical | $1,000.00 | $1,016.75 | $8.39 |

| (5% return per year before expenses) | | | |

| |

| CLASS B | | | |

| Actual | $1,000.00 | $1,145.05 | $17.15 |

| Hypothetical | $1,000.00 | $1,009.07 | $16.07 |

| (5% return per year before expenses) | | | |

| |

| CLASS C | | | |

| Actual | $1,000.00 | $1,149.57 | $13.13 |

| Hypothetical | $1,000.00 | $1,012.85 | $12.29 |

| (5% return per year before expenses) | | | |

| |

| CLASS I | | | |

| Actual | $1,000.00 | $1,158.66 | $4.98 |

| Hypothetical | $1,000.00 | $1,020.46 | $4.66 |

| (5% return per year before expenses) | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.66%, 3.19%, 2.44%, and 0.92% for Class A, Class B, Class C, and Class I, respectively, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 17

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors of Calvert Impact Fund, Inc. and Shareholders of Calvert Small Cap Fund: We have audited the accompanying statement of net assets of the Calvert Small Cap Fund (the “Fund”), a series of Calvert Impact Fund, Inc., as of September 30, 2013, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2013, by correspondence with the custodian and brokers or by performing other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Calvert Small Cap Fund as of September 30, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

18 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

| | | |

| STATEMENT OF NET ASSETS |

| SEPTEMBER 30, 2013 |

| |

| EQUITY SECURITIES - 91.2% | SHARES | | VALUE |

| Aerospace & Defense - 1.2% | | | |

| Ducommun, Inc.* | 57,779 | $ | 1,657,102 |

| Sparton Corp.* | 24,296 | | 619,548 |

| | | | 2,276,650 |

| |

| Airlines - 2.3% | | | |

| Skywest, Inc. | 302,886 | | 4,397,905 |

| |

| Biotechnology - 4.1% | | | |

| Acorda Therapeutics, Inc.* | 126,691 | | 4,342,967 |

| PDL BioPharma, Inc | 439,428 | | 3,502,241 |

| | | | 7,845,208 |

| |

| Chemicals - 1.5% | | | |

| Minerals Technologies, Inc. | 58,333 | | 2,879,900 |

| |

| Commercial Banks - 8.6% | | | |

| Columbia Banking System, Inc. | 87,832 | | 2,169,450 |

| East West Bancorp, Inc | 84,245 | | 2,691,628 |

| PrivateBancorp, Inc. | 125,643 | | 2,688,760 |

| SVB Financial Group* | 49,506 | | 4,275,833 |

| Umpqua Holdings Corp | 275,995 | | 4,476,639 |

| | | | 16,302,310 |

| |

| Commercial Services & Supplies - 4.9% | | | |

| Deluxe Corp | 127,604 | | 5,315,983 |

| Steelcase, Inc. | 238,259 | | 3,959,864 |

| | | | 9,275,847 |

| |

| Computers & Peripherals - 1.4% | | | |

| Diebold, Inc. | 89,612 | | 2,631,008 |

| |

| Consumer Finance - 1.9% | | | |

| Nelnet, Inc. | 96,259 | | 3,701,159 |

| |

| Diversified Consumer Services - 2.7% | | | |

| Grand Canyon Education, Inc.* | 128,122 | | 5,160,754 |

| |

| Diversified Telecommunication Services - 0.8% | | | |

| Atlantic Tele-Network, Inc. | 27,810 | | 1,449,735 |

| PCCW Ltd. (ADR) | 25,173 | | 111,768 |

| | | | 1,561,503 |

| |

| Electric Utilities - 1.7% | | | |

| Portland General Electric Co | 115,984 | | 3,274,228 |

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 19

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Electronic Equipment & Instruments - 9.0% | | | |

| Arrow Electronics, Inc.* | 40,113 | $ | 1,946,684 |

| Belden, Inc | 71,932 | | 4,607,244 |

| PC Connection, Inc. | 14,826 | | 223,724 |

| Plexus Corp.* | 86,424 | | 3,214,973 |

| Sanmina Corp.* | 412,626 | | 7,216,829 |

| | | | 17,209,454 |

| |

| Energy Equipment & Services - 3.0% | | | |

| Dresser-Rand Group, Inc.* | 22,487 | | 1,403,189 |

| Helix Energy Solutions Group, Inc.* | 170,086 | | 4,315,082 |

| | | | 5,718,271 |

| |

| Food & Staples Retailing - 1.8% | | | |

| Harris Teeter Supermarkets, Inc | 70,634 | | 3,474,486 |

| |

| Food Products - 1.7% | | | |

| Darling International, Inc.* | 157,222 | | 3,326,818 |

| |

| Health Care Equipment & Supplies - 2.0% | | | |

| Mindray Medical International Ltd. (ADR) | 98,359 | | 3,825,182 |

| |

| Health Care Providers & Services - 4.0% | | | |

| Magellan Health Services, Inc.* | 51,278 | | 3,074,629 |

| Molina Healthcare, Inc.* | 128,159 | | 4,562,460 |

| | | | 7,637,089 |

| |

| Hotels, Restaurants & Leisure - 2.5% | | | |

| Texas Roadhouse, Inc. | 181,717 | | 4,775,523 |

| |

| Insurance - 6.9% | | | |

| FBL Financial Group, Inc | 44,438 | | 1,995,266 |

| Platinum Underwriters Holdings Ltd. | 89,635 | | 5,353,899 |

| ProAssurance Corp | 66,516 | | 2,997,211 |

| Symetra Financial Corp | 91,846 | | 1,636,696 |

| The Navigators Group, Inc.* | 21,161 | | 1,222,471 |

| | | | 13,205,543 |

| |

| Internet Software & Services - 1.0% | | | |

| AOL, Inc.* | 52,677 | | 1,821,571 |

| |

| IT Services - 4.9% | | | |

| CSG Systems International, Inc. | 59,183 | | 1,482,534 |

| Lender Processing Services, Inc | 114,111 | | 3,796,473 |

| Unisys Corp.* | 159,112 | | 4,008,031 |

| | | | 9,287,038 |

| |

| Machinery - 3.0% | | | |

| Barnes Group, Inc. | 140,976 | | 4,922,882 |

| LB Foster Co | 7,168 | | 327,864 |

| Standex International Corp. | 8,003 | | 475,378 |

| | | | 5,726,124 |

20 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

| | | | |

| EQUITY SECURITIES - CONT’D | | SHARES | | VALUE |

| Media - 2.5% | | | | |

| Madison Square Garden Co.* | | 71,082 | $ | 4,127,732 |

| McClatchy Co.* | | 224,923 | | 674,769 |

| | | | | 4,802,501 |

| |

| Metals & Mining - 2.6% | | | | |

| Worthington Industries, Inc. | | 143,845 | | 4,952,583 |

| |

| Oil, Gas & Consumable Fuels - 2.5% | | | | |

| EPL Oil & Gas, Inc.* | | 45,382 | | 1,684,126 |

| Ship Finance International Ltd | | 200,162 | | 3,056,474 |

| | | | | 4,740,600 |

| |

| Paper & Forest Products - 0.8% | | | | |

| PH Glatfelter Co | | 57,150 | | 1,547,050 |

| |

| Personal Products - 1.9% | | | | |

| Revlon, Inc.* | | 34,091 | | 946,707 |

| USANA Health Sciences, Inc.* | | 31,540 | | 2,737,357 |

| | | | | 3,684,064 |

| |

| Pharmaceuticals - 2.2% | | | | |

| Viropharma, Inc.* | | 104,236 | | 4,096,475 |

| |

| Specialty Retail - 5.5% | | | | |

| ANN, Inc.* | | 123,906 | | 4,487,875 |

| Barnes & Noble, Inc.* | | 105,884 | | 1,370,139 |

| Brown Shoe Co., Inc. | | 195,753 | | 4,594,323 |

| | | | | 10,452,337 |

| |

| Thrifts & Mortgage Finance - 1.8% | | | | |

| Northwest Bancshares, Inc. | | 252,094 | | 3,332,683 |

| |

| Wireless Telecommunication Services - 0.5% | | | | |

| Shenandoah Telecommunications Co. | | 39,972 | | 963,325 |

| |

| Total Equity Securities (Cost $130,850,869) | | | | 173,885,189 |

| |

| |

| | | PRINCIPAL | | |

| HIGH SOCIAL IMPACT INVESTMENTS - 0.4% | | AMOUNT | | |

| Calvert Social Investment Foundation Notes, 0.50%, 7/1/14 (b)(i)(r) | $ | 651,905 | | 636,716 |

| |

| Total High Social Impact Investments (Cost $651,905) | | | | 636,716 |

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 21

| | | | | |

| | | PRINCIPAL | | | |

| TIME DEPOSIT - 18.2% | | AMOUNT | | VALUE | |

| State Street Bank Time Deposit, 0.083%, 10/1/13 | $ | 34,672,080 | $ | 34,672,080 | |

| |

| Total Time Deposit (Cost $34,672,080) | | | | 34,672,080 | |

| |

| TOTAL INVESTMENTS (Cost $166,174,854) - 109.8% | | | | 209,193,985 | |

| Other assets and liabilities, net - (9.8%) | | | | (18,600,172 | ) |

| NET ASSETS - 100% | | | $ | 190,593,813 | |

| |

| |

| NET ASSETS CONSIST OF: | | | | | |

| Paid-in capital applicable to the following shares of common stock, | | | | | |

| with 250,000,000 of $0.01 par value shares authorized: | | | | | |

| Class A: 5,263,778 shares outstanding | | | $ | 94,568,688 | |

| Class B: 52,800 shares outstanding | | | | 370,792 | |

| Class C: 597,383 shares outstanding | | | | 10,403,395 | |

| Class I: 1,807,431 shares outstanding | | | | 38,101,783 | |

| Undistributed net investment income (loss) | | | | (401,637 | ) |

| Accumulated net realized gain (loss) | | | | 4,531,661 | |

| Net unrealized appreciation (depreciation) | | | | 43,019,131 | |

| |

| NETASSETS | | | $ | 190,593,813 | |

| |

| |

| NET ASSET VALUE PER SHARE | | | | | |

| Class A (based on net assets of $129,406,899) | | | $ | 24.58 | |

| Class B (based on net assets of $1,263,132) | | | $ | 23.92 | |

| Class C (based on net assets of $13,725,657) | | | $ | 22.98 | |

| Class I (based on net assets of $46,198,125) | | | $ | 25.56 | |

| RESTRICTED SECURITIES | ACQUISITION

DATES | COST |

| Calvert Social Investment Foundation Notes, 0.50%, 7/1/14 | 7/1/10 | $651,905 |

(b) This security was valued under the direction of the Board of Directors. See Note A.

(i) Restricted securities represent 0.4% of net assets for the Small Cap Fund.

(r) The coupon rate shown on floating or adjustable rate securities represents the rate at period end.

* Non-income producing security.

Abbreviations:

ADR: American Depositary Receipts

See notes to financial statements.

22 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

| | | |

| STATEMENT OF OPERATIONS |

| YEAR ENDED SEPTEMBER 30, 2013 |

| |

| NET INVESTMENT INCOME | | | |

| Investment Income: | | | |

| Interest income | $ | 11,517 | |

| Dividend income | | 2,441,819 | |

| Total investment income | | 2,453,336 | |

| |

| Expenses: | | | |

| Investment advisory fee | | 1,055,605 | |

| Transfer agency fees and expenses | | 402,101 | |

| Administrative fees | | 329,981 | |

| Distribution Plan expenses: | | | |

| Class A | | 267,724 | |

| Class B | | 13,256 | |

| Class C | | 110,381 | |

| Directors’ fees and expenses | | 15,514 | |

| Custodian fees | | 25,889 | |

| Registration fees | | 49,907 | |

| Reports to shareholders | | 72,689 | |

| Professional fees | | 28,171 | |

| Accounting fees | | 22,638 | |

| Miscellaneous | | 25,933 | |

| Total expenses | | 2,419,789 | |

| Reimbursement from Advisor: | | | |

| Class B | | (6,016 | ) |

| Class I | | (19,317 | ) |

| Fees paid indirectly | | (247 | ) |

| Net expenses | | 2,394,209 | |

| |

| |

| NET INVESTMENT INCOME | | 59,127 | |

| |

| |

| REALIZED AND UNREALIZED | | | |

| GAIN (LOSS) ON INVESTMENTS | | | |

| Net realized gain (loss) | | 21,131,949 | |

| Change in unrealized appreciation (depreciation) | | 21,290,978 | |

| |

| NET REALIZED AND UNREALIZED | | | |

| GAIN (LOSS) ON IVESTMENTS | | 42,422,927 | |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | |

| RESULTING FROM OPERATIONS | $ | 42,482,054 | |

See notes to financial statements.

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 23

| | | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | | YEAR

ENDED | | | YEAR

ENDED | |

| | | SEPTEMBER

30, | | | SEPTEMBER

30, | |

| INCREASE (DECREASE) IN NET ASSETS | | 2013 | | | 2012 | |

| Operations: | | | | | | |

| Net investment income | $ | 59,127 | | $ | 1,450,692 | |

| Net realized gain (loss) | | 21,131,949 | | | 2,290,129 | |

| Change in unrealized appreciation (depreciation) | | 21,290,978 | | | 26,719,904 | |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | |

| RESULTING FROM OPERATIONS | | 42,482,054 | | | 30,460,725 | |

| |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A shares | | (1,239,153 | ) | | (231,181 | ) |

| Class C shares | | (21,918 | ) | | — | |

| Class I shares | | (484,645 | ) | | (317,661 | ) |

| Net realized gain: | | | | | | |

| Class A shares | | (2,586,265 | ) | | — | |

| Class B shares | | (38,354 | ) | | — | |

| Class C shares | | (288,508 | ) | | — | |

| Class I shares | | (707,515 | ) | | — | |

| Total distributions | | (5,366,358 | ) | | (548,842 | ) |

| |

| Capital share transactions: | | | | | | |

| Shares sold: | | | | | | |

| Class A shares | | 24,588,981 | | | 10,573,719 | |

| Class B shares | | 13,124 | | | 27,875 | |

| Class C shares | | 2,375,780 | | | 756,259 | |

| Class I shares | | 18,224,871 | | | 6,361,024 | |

| Reinvestment of distributions: | | | | | | |

| Class A shares | | 3,585,262 | | | 212,545 | |

| Class B shares | | 36,506 | | | — | |

| Class C shares | | 261,891 | | | — | |

| Class I shares | | 1,105,442 | | | 317,661 | |

| Redemption fees: | | | | | | |

| Class A shares | | 376 | | | 92 | |

| Shares redeemed: | | | | | | |

| Class A shares | | (20,298,567 | ) | | (18,929,423 | ) |

| Class B shares | | (542,521 | ) | | (1,235,717 | ) |

| Class C shares | | (1,506,475 | ) | | (1,696,666 | ) |

| Class I shares | | (7,040,078 | ) | | (3,695,176 | ) |

| Total capital share transactions | | 20,804,592 | | | (7,307,807 | ) |

| |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | 57,920,288 | | | 22,604,076 | |

| |

| |

| NET ASSETS | | | | | | |

| Beginning of year | | 132,673,525 | | | 110,069,449 | |

| End of year (including distributions in excess of net | | | | | | |

| investment income and undistributed net investment income | | | | | | |

| of $401,637 and $1,021,399, respectively) | $ | 190,593,813 | | $ | 132,673,525 | |

See notes to financial statements.

24 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

| | | | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | YEAR

ENDED | | YEAR

ENDED | |

| | SEPTEMBER

30, | | SEPTEMBER

30, | |

| CAPITAL SHARE ACTIVITY | 2013 | | 2012 | |

| Shares sold: | | | | |

| Class A shares | 1,106,630 | | 591,192 | |

| Class B shares | 604 | | 1,584 | |

| Class C shares | 110,481 | | 44,571 | |

| Class I shares | 770,556 | | 350,694 | |

| Reinvestment of distributions: | | | | |

| Class A shares | 193,984 | | 12,517 | |

| Class B shares | 2,027 | | — | |

| Class C shares | 15,188 | | — | |

| Class I shares | 57,733 | | 18,162 | |

| Shares redeemed: | | | | |

| Class A shares | (952,854 | ) | (1,057,872 | ) |

| Class B shares | (26,539 | ) | (70,728 | ) |

| Class C shares | (76,223 | ) | (101,484 | ) |

| Class I shares | (323,345 | ) | (198,820 | ) |

| Total capital share activity | 878,242 | | (410,184 | ) |

See notes to financial statements.

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 25

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: Calvert Small Cap Fund (the “Fund”), a series of Calvert Impact Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. Calvert Impact Fund, Inc. is comprised of three separate series. The operations of each series are accounted for separately. The Fund offers four classes of shares - Classes A, B, C, and I. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class B shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge at the time of redemption, depending on how long investors have owned the shares. Class B shares are no longer offered for purchase, except through reinvestment of dividends and/or distributions and through certain exchanges. Class C shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment is waived for retirement plans that trade through omnibus accounts and may be waived for certain other institutional accounts where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Each Class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class-specific expenses, (b) exchange privileges, and (c) class-specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors (“the Board”) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

The Board has adopted Valuation Procedures (the “Procedures”) to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. The Board has delegated the day-to-day responsibility for determining the fair value of assets of the Fund to Calvert Investment Management, Inc. (the “Advisor” or “Calvert”) and has provided these Procedures to govern Calvert in its valuation duties.

Calvert has chartered an internal Valuation Committee to oversee the implementation of these Procedures and to assist it in carrying out the valuation responsibilities that the Board has delegated.

The Valuation Committee meets on a regular basis to review illiquid securities and other investments which may not have readily available market prices. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

The Valuation Committee utilizes various methods to measure the fair value of the Fund’s investments. Generally Accepted Accounting Principles (GAAP) establishes a dis-

26 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

closure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. There were no such transfers during the period. Valuation techniques used to value the Fund’s investments by major category are as follows: Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or using the last available price and are categorized as Level 2 in the hierarchy. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term securities of sufficient credit quality with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Advisor, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would materially affect the value of the security, the security will be fair valued as determined in good faith by the Valuation Committee.

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 27

The Valuation Committee considers a number of factors, including significant unobservable valuation inputs when arriving at fair value. It considers all significant facts that are reasonably available and relevant to the determination of fair value.

The Valuation Committee primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. When more appropriate, the fund may employ an income-based or cost approach. An income-based valuation approach discounts anticipated future cash flows of the investment to calculate a present amount (discounted). The measurement is based on the value indicated by current market expectations about those future amounts. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. A cost based approach is based on the amount that currently would be required to replace the service capacity of an asset (current replacement cost). From the seller’s perspective, the price that would be received for the asset is determined based on the cost to a buyer to acquire or construct a substitute asset of comparable utility, adjusted for obsolescence.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis and reviews of any related market activity.

At September 30, 2013, securities valued at $636,716, or 0.4% of net assets, were fair valued in good faith under the direction of the Board.

The following is a summary of the inputs used to value the Fund’s net assets as of September 30, 2013:

| | | VALUATION INPUTS | |

| INVESTMENTS IN SECURITIES | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTAL |

| Equity securities* | $173,885,189 | — | — | $173,885,189 |

| Other debt obligations | — | $35,308,796 | — | 35,308,796 |

| TOTAL | $173,885,189 | $35,308,796 | — | $209,193,985 |

* For further breakdown of equity securities by industry, please refer to the Statement of Net Assets.

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Fund’s Statement of Net Assets.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and

28 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

may include proceeds from litigation. Dividend income is recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a specific class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Redemption Fees: The Fund charges a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase (within seven days for Class I shares). The redemption fee is accounted for as an addition to paid-in capital and is intended to discourage market-timers by ensuring that short-term trading costs are borne by the investors making the transactions and not the shareholders already in the Fund.

Expense Offset Arrangement: The Fund had an arrangement with the custodian bank whereby the custodian’s fees may have been paid indirectly by credits earned on the Fund’s cash on deposit with the bank. These credits were used to reduce the Fund’s expenses. This arrangement was suspended on January 1, 2013, until further notice, due to low interest rates. Such a deposit arrangement was an alternative to overnight investments.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund’s tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements. A Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

NOTE B — RELATED PARTY TRANSACTIONS

Calvert Investment Management, Inc. (the “Advisor”) is wholly-owned by Calvert Investments, Inc., which is indirectly wholly-owned by Ameritas Mutual Holding

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 29

Company. The Advisor provides investment advisory services and pays the salaries and fees of officers and Directors of the Fund who are employees of the Advisor or its affiliates. For its services, the Advisor receives an annual fee, payable monthly, of .70% of the average daily net assets. Under the terms of the agreement, $113,629 was payable at year end. In addition, $14,244 was payable at year end for operating expenses paid by the Advisor during September 2013.

The Advisor has contractually agreed to limit net annual fund operating expenses through January 31, 2014. The contractual expense cap is 1.69%, 3.19%, 2.69%, and .92% for Class A, B, C, and I, respectively. For the purpose of these expense limits, operating expenses do not include interest expense, brokerage commissions, taxes, or extraordinary expenses. This expense limitation does not limit acquired fund fees and expenses, if any. To the extent that any expense offset credits were earned, the Advisor’s obligation under the contractual limitation may have been reduced and the Advisor may have benefited from the expense offset arrangement.

Calvert Investment Administrative Services, Inc., an affiliate of the Advisor, provides administrative services to the Fund for an annual fee, payable monthly, of .25% for Classes A, B, and C shares and .10% for Class I shares based on the average daily net assets. Under the terms of the agreement, $34,751 was payable at year end.

Calvert Investment Distributors, Inc. (“CID”), an affiliate of the Advisor, is the distributor and principal underwriter for the Fund. Pursuant to Rule 12b-1 under the Investment Company Act of 1940, the Fund has adopted a Distribution Plan that permits the Fund to pay certain expenses associated with the distribution and servicing of its shares. The expenses paid may not exceed .35%, 1.00%, and 1.00% annually of average daily net assets of Class A, B, and C shares, respectively. The amount actually paid by the Fund is an annualized fee, payable monthly, of .25%, 1.00%, and 1.00% of average daily net assets of Class A, B, and C, respectively. Class I shares do not have Distribution Plan expenses. Under the terms of the agreement, $40,427 was payable at year end.

CID received $29,900 as its portion of the commissions charged on sales of Class A shares for the year ended September 30, 2013.

Calvert Investment Services, Inc. (“CIS”), an affiliate of the Advisor, acts as shareholder servicing agent for the Fund. For its services, CIS received a fee of $76,940 for the year ended September 30, 2013. Under the terms of the agreement, $5,735 was payable at year end. Boston Financial Data Services, Inc. is the transfer and dividend disbursing agent.

The Fund invests in Community Investment Notes issued by the Calvert Social Investment Foundation (the “CSI Foundation”). The CSI Foundation is a 501(c)(3) non-profit organization that receives in-kind support from Calvert and its subsidiaries. The Fund has received an exemptive order from the Securities and Exchange Commission permitting the Fund to make investments in these notes under certain conditions.

Each Director of the Fund who is not an employee of the Advisor or its affiliates receives an annual retainer of $48,000 plus a meeting fee of up to $3,000 for each Board meeting attended. Additional fees of up to $5,000 annually may be paid to the Board chair and Committee chairs ($10,000 for the Special Equities Committee chair) and $2,500 annually may be paid to Committee members, plus a Committee meeting fee of $500 for each Committee meeting attended. Directors’ fees are allocated to each of the funds served.

30 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

NOTE C — INVESTMENT ACTIVITY AND TAX INFORMATION

During the year, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $124,357,356 and $117,829,271, respectively.

The Fund intends to elect to defer ordinary losses of $401,637 incurred from January 1, 2013 through September 30, 2013 and treat them as arising in the fiscal year ending September 30, 2014.

The tax character of dividends and distributions paid during the years ended September 30, 2013 and September 30, 2012 was as follows:

| DISTRIBUTIONS PAID FROM: | 2013 | 2012 |

| Ordinary income | $1,745,716 | $548,842 |

| Long-term capital gain | 3,620,642 | — |

| Total | $5,366,358 | $548,842 |

As of September 30, 2013, the tax basis components of distributable earnings/(accumulated losses) and the federal tax cost were as follows:

| Unrealized appreciation | $43,660,471 | |

| Unrealized (depreciation) | (691,001 | ) |

| Net unrealized appreciation/(depreciation) | $42,969,470 | |

| |

| Undistributed long-term capital gain | $4,581,322 | |

| |

| Federal income tax cost of investments | $166,224,515 | |

The differences between the components of distributable earnings on a tax basis and the amounts reflected in the statement of net assets are primarily due to temporary book-tax differences that will reverse in a subsequent period. These book-tax differences are due to wash sales and deferral of post-December ordinary losses.

Reclassifications, as shown in the table below, have been made to the Fund’s components of net assets to reflect income and gains available for distribution (or available capital loss carryovers, as applicable) under income tax law and regulations. These reclassifications are due to permanent book-tax differences and have no impact on net assets. The primary permanent differences causing such reclassifications are due to passive foreign investment companies and recharacterization of distributions.

| Undistributed net investment income | $263,553 | |

| Accumulated net realized gain (loss) | (263,553 | ) |

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 31

NOTE D — LINE OF CREDIT

A financing agreement is in place with the Calvert Funds and State Street Corporation (“SSC”). Under the agreement, SSC provides an unsecured line of credit facility, in the aggregate amount of $50 million ($25 million committed and $25 million uncommitted), accessible by the Funds for temporary or emergency purposes only. Borrowings under the committed facility bear interest at the higher of the London Interbank Offered Rate (LIBOR) or the overnight Federal Funds Rate plus 1.25% per annum. A commitment fee of .11% per annum is incurred on the unused portion of the committed facility, which is allocated to all participating funds. The Fund had no loans outstanding pursuant to this line of credit at September 30, 2013. For the year ended September 30, 2013, borrowings by the Fund under the agreement were as follows:

| AVERAGE DAILY BALANCE | WEIGHTED AVERAGE INTEREST RATE | MAXIMUM AMOUNT BORROWED | MONTH OF MAXIMUM AMOUNT BORROWED |

| $16,967 | 1.45% | $2,356,583 | March 2013 |

NOTE E — SUBSEQUENT EVENTS

The Fund began offering Class Y shares on October 18, 2013.

In preparing the financial statements as of September 30, 2013, no other subsequent events or transactions occurred that would have required recognition or disclosure in these financial statements.

32 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

| | | | | | | | | |

| FINANCIAL HIGHLIGHTS |

| |

| | | | | | YEARS ENDED | | | | |

| | | SEPTEMBER

30, | | | SEPTEMBER

30, | | | SEPTEMBER

30, | |

| CLASS A SHARES | | 2013 | (z) | | 2012 | (z) | | 2011 | (z) |

| Net asset value, beginning | $ | 19.36 | | $ | 15.15 | | $ | 15.55 | |

| Income from investment operations: | | | | | | | | | |

| Net investment income (loss) | | (.01 | ) | | .20 | | | .02 | |

| Net realized and unrealized gain (loss) | | 6.02 | | | 4.05 | | | (.42 | ) |

| Total from investment operations | | 6.01 | | | 4.25 | | | (.40 | ) |

| Distributions from: | | | | | | | | | |

| Net investment income | | (.25 | ) | | (.04 | ) | | — | |

| Net realized gain | | (.54 | ) | | — | | | — | |

| Total distributions | | (.79 | ) | | (.04 | ) | | — | |

| Total increase (decrease) in net asset value | | 5.22 | | | 4.21 | | | (.40 | ) |

| Net asset value, ending | $ | 24.58 | | $ | 19.36 | | $ | 15.15 | |

| |

| Total return* | | 32.42 | % | | 28.12 | % | | (2.56 | %) |

| Ratios to average net assets:A | | | | | | | | | |

| Net investment income (loss) | | (.05 | %) | | 1.13 | % | | .13 | % |

| Total expenses | | 1.67 | % | | 1.78 | % | | 1.81 | % |

| Expenses before offsets | | 1.67 | % | | 1.69 | % | | 1.69 | % |

| Net expenses | | 1.67 | % | | 1.69 | % | | 1.69 | % |

| Portfolio turnover | | 82 | % | | 3 | % | | 9 | % |

| Net assets, ending (in thousands) | $ | 129,407 | | $ | 95,189 | | $ | 81,374 | |

| |

| | | | | | YEARS ENDED | |

| | | | | | SEPTEMBER

30, | | | SEPTEMBER

30, | |

| CLASS A SHARES | | | | | 2010 | | | 2009 | |

| Net asset value, beginning | | | | $ | 14.14 | | $ | 15.61 | |

| Income from investment operations: | | | | | | | | | |

| Net investment income (loss) | | | | | (.06 | ) | | (.02 | ) |

| Net realized and unrealized gain (loss) | | | | | 1.47 | | | (1.45 | ) |

| Total from investment operations | | | | | 1.41 | | | (1.47 | ) |

| Total increase (decrease) in net asset value | | | | | 1.41 | | | (1.47 | ) |

| Net asset value, ending | | | | $ | 15.55 | | $ | 14.14 | |

| |

| Total return* | | | | | 9.97 | % | | (9.42 | %) |

| Ratios to average net assets:A | | | | | | | | | |

| Net investment income (loss) | | | | | (.35 | %) | | (.18 | %) |

| Total expenses | | | | | 1.94 | % | | 2.09 | % |

| Expenses before offsets | | | | | 1.69 | % | | 1.70 | % |

| Net expenses | | | | | 1.69 | % | | 1.69 | % |

| Portfolio turnover | | | | | 174 | % | | 61 | % |

| Net assets, ending (in thousands) | | | | $ | 34,763 | | $ | 34,051 | |

See notes to financial highlights.

www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT 33

| | | | | | |

| FINANCIAL HIGHLIGHTS |

| |

| | | | PERIODS ENDED | | | |

| | SEPTEMBER

30, | | SEPTEMBER

30, | | SEPTEMBER

30, | |

| CLASS B SHARES | 2013 | (z) | 2012 | (z) | 2011 | (z)# |

| Net asset value, beginning | $18.89 | | $14.97 | | $16.81 | |

| Income from investment operations: | | | | | | |

| Net investment income (loss) | (.32 | ) | (0.05 | ) | (.21 | ) |

| Net realized and unrealized gain (loss) | 5.89 | | 3.97 | | (1.63 | ) |

| Total from investment operations | 5.57 | | 3.92 | | (1.84 | ) |

| Distributions from: | | | | | | |

| Net realized gain | (.54 | ) | — | | — | |

| Total distributions | (.54 | ) | — | | — | |

| Total increase (decrease) in net asset value | 5.03 | | 3.92 | | (1.84 | ) |

| Net asset value, ending | $23.92 | | $18.89 | | $14.97 | |

| |

| Total return* | 30.40 | % | 26.19 | % | (10.95 | %) |

| Ratios to average net assets:A | | | | | | |

| Net investment income (loss) | (1.53 | %) | (.31 | %) | (1.38 | %) (a) |

| Total expenses | 3.64 | % | 3.50 | % | 3.46 | % (a) |

| Expenses before offsets | 3.19 | % | 3.19 | % | 3.19 | % (a) |

| Net expenses | 3.19 | % | 3.19 | % | 3.19 | % (a) |

| Portfolio turnover | 82 | % | 3 | % | 9 | %** |

| Net assets, ending (in thousands) | $1,263 | | $1,449 | | $2,183 | |

See notes to financial highlights.

34 www.calvert.com CALVERT SMALL CAP FUND ANNUAL REPORT

| | | | | | | | | |

| FINANCIAL HIGHLIGHTS |

| |

| | | | | | YEARS ENDED | | | | |

| | | SEPTEMBER

30, | | | SEPTEMBER

30, | | | SEPTEMBER

30, | |

| CLASS C SHARES | | 2013 | (z) | | 2012 | (z) | | 2011 | (z) |

| Net asset value, beginning | $ | 18.08 | | $ | 14.25 | | $ | 14.77 | |

| Income from investment operations: | | | | | | | | | |

| Net investment income (loss) | | (.17 | ) | | .03 | | | (.15 | ) |

| Net realized and unrealized gain (loss) | | 5.65 | | | 3.80 | | | (.37 | ) |

| Total investment operations | | 5.48 | | | 3.83 | | | (.52 | ) |

| Distributions from: | | | | | | | | | |

| Net investment income | | (.04 | ) | | — | | | — | |

| Net realized gain | | (.54 | ) | | — | | | — | |

| Total distributions | | (.58 | ) | | — | | | — | |