UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b)

OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2011

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 0-30858

VALCENT PRODUCTS INC.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

Alberta, Canada

(Jurisdiction of incorporation or organization)

120 Columbia Street, Vancouver, British Columbia V6A 3Z8

(Address of principal executive offices)

John N. Hamilton

120 Columbia Street, Vancouver, B.C. Canada V6A 3Z8

Phone: (604) 638-4906

Fax: (604) 608-9543

(Name, Telephone, Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | | Name of each exchange |

| | | on which registered |

| | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Stock, no par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

83,218,571 common shares, without par value, issued and outstanding at March 31, 2011, and 84,254,834 common shares, without par value, issued and outstanding as of September 28, 2011.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated filer o | Accelerated filer o | Non Accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | o | International Financial Reporting Standards as issued | o | Other | x |

| | | by the International Accounting Standards Board | | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 x Item 18 o

If this is an annual report, indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

TABLE OF CONTENTS

| | | | | |

| | | | | Page Number |

| PART I | | | | |

| | | | | |

| ITEM 1 | | Identity of Directors, Senior Management and Advisors | | 5 |

| | | | | |

| ITEM 2 | | Offer Statistics and Expected Timetable | | 5 |

| | | | | |

| ITEM 3 | | Key Information | | 5 |

| | | | | |

| ITEM 4 | | Information on the Company | | 14 |

| | | | | |

| ITEM 5 | | Operating and Financial Review and Prospects | | 26 |

| | | | | |

| ITEM 6 | | Directors, Senior Management and Employees | | 43 |

| | | | | |

| ITEM 7 | | Major Shareholders and Related Party Transactions | | 46 |

| | | | | |

| ITEM 8 | | Financial Information | | 49 |

| | | | | |

| ITEM 9 | | The Offer and Listing | | 49 |

| | | | | |

| ITEM 10 | | Additional Information | | 50 |

| | | | | |

| ITEM 11 | | Quantitative and Qualitative Disclosures About Market Risk | | 59 |

| | | | | |

| ITEM 12 | | Description of Securities Other than Equity Securities | | 59 |

| | | | | |

| | | | | |

| PART II | | | | 60 |

| | | | | |

| ITEM 13 | | Defaults, Dividends, Arrearages and Delinquencies | | 60 |

| | | | | |

| ITEM 14 | | Material Modifications to the Rights of Security Holders and Use of Proceeds | | 60 |

| | | | | |

| ITEM 15 T | | Control and Procedures | | 60 |

| | | | | |

| ITEM 16 | | [Reserved] | | |

| | | | | |

| ITEM 16A | | Audit Committee Financial Expert | | 62 |

| | | | | |

| ITEM 16B | | Code of Ethics | | 62 |

| | | | | |

| ITEM 16C | | Principal Accountant Fees and Services | | 63 |

| | | | | |

| ITEM 16D | | Exemptions from the Listing Standards for Audit Committee | | 63 |

| | | | | |

| ITEM 16E | | Purchase of Equity Securities by the Issuer and Affiliated Purchasers | | 63 |

| | | | | |

| ITEM 16F | | Change in registrant’s certifying accountant | | 63 |

| | | | | |

| ITEM 16G | | Corporate governance | | 63 |

| | | | | |

| | | | | |

| PART III | | | | F-1 |

| | | | | |

| ITEM 17 | | Financial Statements | | F-1 |

| | | | | |

| ITEM 19 | | Exhibits | | 64 |

PART I

CAUTIONARY NOTICE REGARDING FORWARD LOOKING STATEMENTS

Certain written and oral statements made by our Company and subsidiaries of our Company may constitute “forward-looking statements” as defined under the Private Securities Litigation Reform Act of 1995. This includes statements made in this report, in other filings with the Securities and Exchange Commission (“SEC’), in press releases, and in certain other oral and written presentations. Generally, the words “anticipates”, “believes”, “expects”, “plans”, “may”, “will”, “should”, “seeks”, “estimates”, “projects”, “predicts”, “potential”, “continues”, “intends”, and other similar words identify forward-looking statements. All statements that address operating results, events or developments that we expect or anticipate will occur in the future, including statements related to sales, earnings per share results, and statements expressing general expectations about future operating results, are forward-looking statements and are based upon the Company’s current expectations and various assumptions. The Company believes there is a reasonable basis for its expectations and assumptions, but there can be no assurance that the Company will realize its expectations or that the Company’s assumptions will prove correct. Forward-looking statements are subject to risks that could cause them to differ materially from actual results. Accordingly, the Company cautions readers not to place undue reliance on forward-looking statements. We believe that these risks include but are not limited to the risks described in this report under Part I, Item 3, Subsection D entitled “Risk Factors” and Part I, Item 5, entitled “Operating and Financial Review and Prospects” and that are otherwise described from time to time in our SEC reports filed after this report. These statements appear in a number of places in this Form 20-F and include all statements that are not statements of historical fact regarding the intent, belief or current expectations of us, our directors or our officers, with respect to, among other things: (i) our liquidity and capital resources, (ii) our financing opportunities and plans, (iii) our ability to attract customers to generate revenues, (iv) competition in our business segment, (v) market and other trends affecting our future financial condition or results of operations, (vi) our growth strategy and operating strategy, and (vii) the declaration and/or payment of dividends.

This Form 20-F and in particular the “Outlook” section, contains forward-looking statements including, but not limited to, the ability to implement corporate strategies, the state of domestic capital markets, the ability to obtain financing, operating risks, changes in general economic conditions, and other factors are based on current expectations and various estimates, factors and assumptions and involve known and unknown risks, uncertainties and other factors.

It is important to note that:

| Unless otherwise indicated, forward-looking statements in this Form 20-F describe the Company’s expectations as of March 31, 2011. |

| Readers are cautioned not to place undue reliance on these statements as the Company’s actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements if known or unknown risks, uncertainties or other factors affect the Company’s business, or if the Company’s estimates or assumptions prove inaccurate. Therefore, the Company cannot provide any assurance that forward-looking statements will materialize. |

| The Company assumes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or any other reason, except as required by law. |

For a brief description of material factors that could cause the Company’s actual results to differ materially from the forward-looking statements in this Form 20-F, please see “RISK FACTORS”.

The risks and uncertainties that could affect future events or the Company's future financial performance are more fully described in the Company's annual reports (on Form 20-F filed in the U.S. and Canada) and the other recent filings in the U.S. and Canada. These filings are available at www.sec.gov in the U.S. and www.sedar.com in Canada.

Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. The factors that might cause such differences include, among others, those set forth in this annual report, and we undertake no obligation to update any of the forward-looking statements in this annual report on Form 20-F after the date of this report.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

ITEM 3. KEY INFORMATION

SELECTED FINANCIAL DATA

We are at present a life sciences development stage company focused primarily on:

| | (i) | the development and commercialization of our “High Density Vertical Growth System” (“VertiCrop™” or “HDVG System”) designed to produce vegetables, herbs and other plant crops, |

Due to economic circumstances and to make our Company more conducive to investment the shareholders of the Company approved a special resolution to reorganize the capital structure of the Company by a share consolidation of its common shares on the basis of one new share for each eighteen old shares. This share consolidation became effective July 16, 2009. Also effective July 16, 2009 our trading symbol changed to “VCTZF” and our CUSIP number changed to 918881202. Our website is located at www.valcent.net

Unless otherwise noted, all references to the number of common shares are stated on a post-consolidation basis.

As at September 28, 2011, 84,254,834 common shares were issued and outstanding, the Company had 23,857,410 warrants outstanding and 8,724,195 share options outstanding. In addition,, the Company had a commitment to issue 7,989,686 common shares. (see ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS, Liquidity and Capital Resources).

All amounts are stated in United States dollars unless otherwise noted.

The following selected financial data has been derived from our audited financial statements and related notes for the preceding two years and has been prepared and presented in accordance with Canadian generally accepted accounting principles. The selected financial data for March 2009, 2008, 2007 has been derived from our audited financial statements and translated by management to United States dollars using the current rate method. and has been prepared and presented in accordance with Canadian generally accepted accounting principles. For comparative purposes this selected financial data for the years ended March 31, 2007, 2008, 2009, 2010 and 2011 is presented as though it were prepared under United States generally accepted accounting principles. Our audited financial statements for the year ended March 31, 2011 have been prepared in accordance with Canadian generally accepted accounting principles, which, except as noted in Note 19, conform in all material respects with those of the United States and with the requirements of the United States Securities and Exchange Commission.

ITEM 3. KEY INFORMATION - continued

SELECTED FINANCIAL DATA - continued

| Valcent Products Inc. Selected Financial Data (Expressed in US Dollars) | |

| | | | March 31 | |

| | | | 2011 | | | | 2010 | | | | 2009 | | | | 2008 | | | | 2007 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net operating revenues | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from operations per CDN GAAP | | $ | 6,181,103 | | | $ | 4,610,264 | | | $ | 12,574,679 | | | $ | 11,676,998 | | | $ | 7,181,571 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss per CDN GAAP | | $ | 6,454,452 | | | $ | 6,287,047 | | | $ | 15,536,062 | | | $ | 12,341,157 | | | $ | 7,152,834 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss per US GAAP | | $ | 8,607,278 | | | $ | 12,489,601 | | | $ | 13,055,344 | | | $ | 12,904,736 | | | $ | 8,568,694 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss per share, CDN GAAP | | $ | 0.11 | | | $ | 0.15 | | | $ | 5.58 | | | $ | 6.25 | | | $ | 6.68 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss per share, U.S.GAAP | | $ | 0.15 | | | $ | 0.29 | | | $ | 4.69 | | | $ | 6.53 | | | $ | 8.01 | |

| | | | | | | | | | | | | | | | | | | | | |

| Common shares issued | | | 83,218,571 | | | | 52,175,329 | | | | 3,008,977 | | | | 2,459,636 | | | | 1,703,670 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average shares outstanding per CDN GAAP | | | 57,331,417 | | | | 42,354,279 | | | | 2,782,284 | | | | 1,974,763 | | | | 1,070,066 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average shares outstanding per U.S. GAAP | | | 57,331,417 | | | | 42,354,279 | | | | 2,782,284 | | | | 1,974,763 | | | | 1,070,066 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Assets per CDN GAAP | | $ | 1,001,036 | | | $ | 1,261,497 | | | $ | 1,882,276 | | | $ | 4,501,820 | | | $ | 3,583,664 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Assets per U.S. GAAP | | $ | 1,001,036 | | | $ | 1,261,497 | | | $ | 1,908,329 | | | $ | 4,594,251 | | | $ | 3,782,897 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets (liabilities) per CDN GAAP | | $ | (1,465,413) | | | $ | (2,836,450 | ) | | $ | (825,290 | ) | | $ | (3,918,858 | ) | | $ | (21,088 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets (liabilities) per U.S. GAAP | | $ | (2,393,475) | | | $ | (3,650,497 | ) | | $ | 764,906 | | | $ | (3,089,574 | ) | | $ | (576,074 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Exchange Rates (CDN to 1 USD) For the five most recent years ended March 31, calculated on the average of 12 month end closing days | |

| | | |

| March 31, 2011 | | $ | 0.9850 | |

| March 31, 2010 | | $ | 0.9219 | |

| March 31, 2009 | | $ | 0.8969 | |

| March 31, 2008 | | $ | 0.9708 | |

| March 31, 2007 | | $ | 0.8789 | |

Exchange Rates (CDN to 1 USD) for eight most recent months | | Period High | | | Period Low | |

| | | | | | | |

| September 28, 2011 | | $ | 1.0223 | | | $ | 09692 | |

| August 2011 | | $ | 1.0484 | | | $ | 1.0067 | |

| July 2011 | | $ | 1.0590 | | | $ | 1.0310 | |

| June 2011 | | $ | 1.0309 | | | $ | 1.0111 | |

| May 2011 | | $ | 1.0576 | | | $ | 1.0221 | |

| April 2011 | | $ | 1.0534 | | | $ | 1.0301 | |

| March 2011 | | $ | 1.0307 | | | $ | 1.0106 | |

| February 2011 | | $ | 1.0226 | | | $ | 0.9991 | |

| January 2011 | | $ | 1.0128 | | | $ | 0.9983 | |

Exchange Rate (CDN to 1 USD) September 28, 2011: $0.9777

ITEM 3. KEY INFORMATION - continued

CAPITALIZATION AND INDEBTEDNESS

Not Applicable.

REASONS FOR THE OFFER AND USE OF PROCEEDS

Not Applicable.

RISK FACTORS

Our business entails a significant degree of risk, and an investment in our securities should be considered highly speculative. An investment in our securities should only be undertaken by persons who can afford the loss of their entire investment. The following is a general description of material risks, which may adversely affect our business, our financial condition, including liquidity and profitability, and our results of operations, ultimately affecting the value of an investment in shares of our common stock.

General Business Risks

We are a development stage company and based on our historical operating losses and negative cash flows from operating activities there is substantial doubt as to our ability to continue as a going concern.

We have a history of operating losses and negative cash flows from operating activities, resulting in our continued dependence on external financing arrangements. In the event that we are unable to achieve or sustain profitability or are otherwise unable to secure additional external financing, we may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern. Any such inability to continue as a going concern may result in our security holders losing their entire investment. Our financial statements, which have been prepared in accordance with Canadian GAAP, contemplate that we will continue as a going concern and do not contain any adjustments that might result if we were unable to continue as a going concern. Changes in our operating plans, our existing and anticipated working capital needs, the acceleration or modification of our expansion plans, lower than anticipated revenues, increased expenses, potential acquisitions or other events will all affect our ability to continue as a going concern.

From inception, we have historically generated minimal revenues while sustaining substantial operating losses and we anticipate incurring continued operating losses and negative cash flows in the foreseeable future resulting in uncertainty of future profitability and limitation on our operations.

From inception, we have generated minimal revenues and experienced negative cash flows from operating losses. We anticipate continuing to incur such operating losses and negative cash flows in the foreseeable future, and to accumulate increasing deficits as we increase our expenditures for (i) technology, (ii) infrastructure, (iii) research and development, (iv) sales and marketing, (v) interest charges and expenses related to previous equity and debt financings, and (v) general business enhancements. Any increases in our operating expenses will require us to achieve significant revenue before we can attain profitability. In the event that we are unable to achieve profitability or raise sufficient funding to cover our losses, we may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern.

We have historically had working capital shortages, even following significant financing transactions.

We have had working capital shortages in the past and, although we raised significant capital through debt and equity offerings, we have generated significant losses, which have impacted working capital. As of March 31, 2011, our balance sheet reflects a working capital deficit of $2,035,992. This condition has continued since the date of those financial statements, and we expect that these conditions will continue for the foreseeable future unless we are able to raise a substantial amount of additional financing. In view of the matters described herein, our ability to continue to pursue our plan of operations as described herein is dependent upon our ability to raise the capital necessary to meet our financial requirements on a continuing basis.

ITEM 3. KEY INFORMATION - continued

RISK FACTORS - continued

Our accumulated deficit and level of debt make it more difficult to borrow funds.

As of the year ended March 31, 2011, and as a result of historical operating losses from prior operations, we had a deficit from prior operations of $2,265,325, and a deficit of $53,083,400 from losses accumulated during our development stage resulting in a total accumulated deficit of $55,348,725. Lenders generally regard an accumulated deficit as a negative factor in assessing creditworthiness, and for this reason, the extent of our accumulated deficit, coupled with our historical operating losses will negatively impact our ability to borrow funds if and when required. Any inability to borrow funds, or a reduction in favorability of terms upon which we are able to borrow funds, including the amount available to us, the applicable interest rate and the collateralization required, may affect our ability to meet our obligations as they come due, and adversely affect our business, financial condition, and results of operations, raising substantial doubts as to our ability to continue as a going concern.

In addition, the Company also has aggregate debt of $2,466,449 as at March 31, 2011 and total assets of only $1,001,036 making it unreasonable to obtain debt due to the imbalance of debt over assets

Our debt arrangements include the provision of a secured interest in our assets and may make it more difficult to borrow funds, or default of debt provisions may impact our assets and ability to operate; certain unsecured debt instruments are due upon demand and may cause financial liquidity difficulties for the Company.

On July 14, 2011 the company entered into a Secured Bridge Loan with a third party in the amount of $700,000 giving them a first secured charge on the Company’s El Paso property thus increasing the costs of borrowing to any new lenders and making debt instruments less desirable to potential lenders. Proceeds on sale of the El Paso property must first be applied to the Secured Bridge Loan limiting the ability of the Company to use such funds in its operations.

In addition, the Company has interest bearing promissory notes that are due upon demand in the aggregate of $558,212. A demand by the debt holder(s) of such debt securities could cause financial hardship, litigation, and other negative influence on the financial condition of the Company that could cause disruption to our operations.

Our having recently undergone a significant restructuring coupled with our limited experience as a publicly traded company with substantial operations in several different industries, may increase our expenses and place significant demands on our management.

From inception we have undergone several changes in business direction and consequently have previously had only limited operations. Due to economic circumstances and to make our Company more conducive to investment the shareholders of the Company approved a special resolution to reorganize the capital structure of the Company by a share consolidation of its common shares on the basis of one new share for each eighteen old shares. This share consolidation became effective July 16, 2009. Our most recent change in business direction and this significant restructuring may make it difficult to respond to our regulatory and reporting obligations, and could increase our general, administrative, legal and auditing costs and place substantial time demands on our management. We anticipate that, due to the increased complexity of our corporate structure and increased reporting and governance obligations, and our simultaneous past pursuit of various product lines in different industries, our regulatory and reporting obligations will require further expenditures to train additional personnel and retain appropriate legal and accounting professional services. In the event that these expenditures precede, or are not subsequently followed by revenues, or that we are unable to raise sufficient funding to cover any increase in our expenses, we may not be able to meet our obligations as they come due, and our business, financial condition, and results of operations may be negatively affected, raising substantial doubts as to our ability to continue as a going concern.

We identified material weaknesses in our disclosure controls and procedures and our internal control over financial reporting.

Section 404 of the Sarbanes-Oxley Act of 2002 requires management to assess our internal control over financial reporting (“ICFR”) pursuant to a defined framework. In making that assessment, management identified a material weakness in our disclosure controls as a result of several material weaknesses identified in our ICFR as described in Item 15T below. There are inherent limitations in the effectiveness of any system of internal control, and accordingly, even effective ICFR can provide only reasonable assurance with respect to financial statement preparation and may not prevent or detect misstatements. Material weaknesses make it more likely that a material misstatement of annual or interim financial statements will not be prevented or detected. In addition, effective ICFR at any point in time may become ineffective in future periods because of changes in conditions or deterioration in the degree of compliance with our established policies and procedures.

ITEM 3. KEY INFORMATION - continued

RISK FACTORS - continued

Lack of insurance coverage on fixed assets located in the United States

The Company cut back its operations in its US based research facilities last year to a bare minimum. As a result of lack of financing, insurance has lapsed on many of our key fixed assets. During the year ended March 31, 2011, the Company decided to sell its property and remaining equipment in El Paso, Texas. In October 2010, the Company stopped amortizing these assets and classified these assets as assets held for sale. As at March 31, 2011, assets held for sale totalled $433,254. (Land $245,485 and Building $ 187,769)

Also during the year ended March 31, 2011, the Company determined that certain equipment used for development of some of its products had no continuing value to the Company and therefore wrote off the amount of $250,748, being the carrying value of those assets to the consolidated statement of operations. (2010 - $nil)

Disruptions in the Global Financial and Capital Markets May Impact Our Ability to Obtain Financing.

The global financial and capital markets have been experiencing extreme volatility and disruption, including the failures of financial services companies and the related liquidity crisis. Although we expect to meet our near term liquidity needs with our working capital on hand and near term financing instruments, we will continue to need further funding to achieve our business objectives. In the past, the issuance of debt and equity securities has been the major source of capital and liquidity for us. The extraordinary conditions in the global financial and capital markets have currently limited the availability of this funding. If the disruptions in the global financial and capital markets continue, debt or equity financing may not be available to us on acceptable terms, if at all. If we are unable to fund future operations by way of financing, including public or private offerings of equity or debt securities, our business, financial condition and results of operations will be adversely impacted.

Risks Associated With Our Businesses And Industries

We face serious competition in our business segments from new market entrants as well as a number of established companies with greater resources and existing customer bases.

The markets for our potential products rapidly evolve and are intensely competitive as new products are regularly introduced. Competition in our market segments is based primarily upon:

| | • | brand name recognition; |

| | | |

| | • | Availability of financial resources; |

| | | |

| | • | the quality and efficiency of products; |

| | | |

| | • | reviews received for products from independent reviewers who publish in magazines, websites, newspapers and other industry publications; |

| | | |

| | • | Availability of access to markets; |

| | | |

| | • | the price of each product; and |

| | | |

| | • | the number of products then available. |

We face competition from other industrial manufacturers, all of whom could generally sell through the same combination of channels as we intend to.

To remain competitive in the market for our products and potential products, we rely heavily upon what we believe to be our superior potential product quality, marketing and sales abilities, proprietary technology, product development capabilities and our management’s experience. However, we may not be able to effectively compete in these intensely competitive markets, as some of our competitors have longer operating histories, larger customer bases and greater financial, marketing, service, support, technical and other resources, affording them the ability to undertake more extensive marketing campaigns and adopt more aggressive pricing policies, than we can. Moreover, we believe that competition from new entrants will increase as the market for each of our potential products expands. If our potential product lines are not successful, our business, financial condition and results of operations will be negatively affected.

ITEM 3. KEY INFORMATION - continued

RISK FACTORS - continued

Our intellectual property may not be adequately protected from unauthorized use by others, which could increase our litigation costs and adversely affect our sales.

Our intellectual property assets/rights which ate in the patents pending not provide meaningful protection from unauthorized use by others, which could result in an increase in competing products and a reduction in our own sales. Moreover, if we must pursue litigation in the future to enforce or otherwise protect our intellectual property rights, or to determine the validity and scope of the proprietary rights of others, we may not prevail and will likely have to make substantial expenditures and divert valuable resources in any case. We may not have adequate remedies if our proprietary content is appropriated or if our intellectual property does not adequately protect unauthorized use by others.

Subsequent to March 31, 2011, the Company and the Company’s legal counsel performed a comprehensive review of the Company’s improved VertiCrop™ intellectual property and an Purchase Agreement the contain intellectual property relating to the vertical plant growing technology. The Company concluded that they were not using the intellectual property that was contemplated in the Purchase Agreement and thus terminated the Purchase Agreement on May 17, 2011.

If our potential products infringe upon proprietary rights of others, lawsuits may be brought requiring us to pay large legal expenses and judgments and redesign or discontinue selling one or more of our potential products.

We are not aware of any circumstances under which our potential products infringe upon any valid existing proprietary rights of third parties. Infringement claims, however, could arise at any time, whether or not meritorious, and could result in costly litigation or require us to enter into royalty or licensing agreements. If we are found to have infringed the proprietary rights of others, we could be required to pay damages, redesign our potential products or discontinue their sale. Any of these outcomes, individually or collectively, would negatively affect our business, financial condition and results of operations.

If we are unable to successfully break into new markets, implement our growth strategy or manage our business as it does grow, our future operating results could suffer.

As a development stage company, we face several challenges in entering each of the industrial markets and consumer retail markets for our respective potential products, particularly consumers’ lack of awareness of our Company and our potential product lines, competing for market share with established consumer retail product manufacturers and difficulties in competing for, hiring and retaining representative personnel in each of our respective potential markets. In addition, we face several challenges common to any new market entrant, including problems typically associated with unfamiliarity of local market conditions and market demographics. Each new market we enter may also have different competitive conditions, consumer tastes and discretionary spending patterns, which may require us to adjust our growth strategy or modify the way in which we manage our business. To the extent that we are unable to break into or meet the challenges associated with establishing ourselves in a new market, our future operating results could suffer and our financial condition and business may be negatively affected.

ITEM 3. KEY INFORMATION - continued

RISK FACTORS - continued

Changes in consumer and industrial preferences or discretionary spending may negatively affect our future operating results.

Within the industrial/retail businesses and industries in which we intend to operate, revenues are largely generated by industrial and retail consumer preferences and discretionary spending. Our success as a potential manufacturer and retailer of consumer and industrial products will depend, in part, on the popularity of each of our potential product offerings. Any shift in consumer sentiment away from our potential product or industrial product lines could have a negative effect on our ability to achieve future profitability. Our success also depends on a number of factors affecting levels of consumer discretionary income and spending, including, the following, among other, social and economic conditions:

| | • | general business conditions; |

| | • | interest rates; |

| | • | inflation; |

| | • | consumer debt levels; |

| | • | the availability of consumer credit; |

| | • | taxation; |

| | • | fuel prices and electrical power rates; |

| | • | unemployment trends; |

| | • | natural disasters; |

| | • | terrorist attacks and acts of war; and |

| | • | other matters that influences consumer confidence and spending. |

Consumer and end user purchases of discretionary items, including our potential products and product lines, could decline during periods in which discretionary income is lower or actual or perceived unfavorable economic conditions exist. Should this occur, and if we are unable to introduce new products and product lines that consumers find appealing, our business, financial condition and results of operations will be negatively affected.

We may be subject to adverse publicity or claims by consumers arising out of use of our potential product lines.

We may be subject to complaints from or litigation by consumers, whether or not meritorious, relating to quality, health, efficiency, efficacy, or operational aspects of our potential consumer and industrial product lines including environmental impacts. Such claims could arise at any time and, should they arise, we may not be successful in defending them. Any litigation, regardless of the outcome, would entail significant costs and use of management time, which could impair our ability to generate revenue and profit. For these reasons or, should we be found liable with regard to a claim arising out of any of our potential product lines, our business, financial condition, and results of operations would be negatively affected.

We face substantial competition in attracting and retaining qualified senior management and key personnel and may be unable to develop and grow our business if we cannot attract and retain senior management and key personnel as necessary, or if we were to lose our existing senior management and key personnel.

As a development stage company, our success, to a large extent, depends upon our ability to attract, hire and retain highly qualified and knowledgeable senior management and key personnel who possess the skills and experience necessary to satisfy our business and client service needs. Our ability to attract and retain such senior management and key personnel will depend on numerous factors, including our ability to offer salaries, benefits and professional growth opportunities that are comparable with and competitive to those offered by more established consumer retail product manufacturers and industrial product manufacturers. We may be required to invest significant time and resources in attracting and retaining, as necessary, additional senior management and key personnel, and many of the companies with which we will compete for any such individuals have greater financial and other resources which afford them the ability to undertake more extensive and aggressive hiring campaigns than we can. Furthermore, an important component to the overall compensation offered to our senior management and key personnel will be equity. If our stock prices do not appreciate over time, it may be difficult for us to attract and retain senior management and key personnel. Moreover, should we lose any member of our senior management or key personnel, we may be unable to prevent the unauthorized disclosure or use of our trade secrets, including our technical knowledge, practices, procedures or client lists by such individuals. The normal running of our operations may be interrupted, and our financial condition and results of operations negatively affected as a result of any inability on our part to attract or retain the services of qualified and experienced senior management and key personnel. If any member of our existing senior management or key personnel left and a suitable replacement was not found, or should any of our former senior management or key personnel disclose our trade secrets, the normal running of our operation may be negatively interrupted.

There is no certainty that our key projects will be operationally successful or profitable.

We are highly dependent upon the success of our high density vertical plant growing systems commercialization. The risks associated with the replication of laboratory results or prototype tests in the larger scale demonstration projects and commercialization projects are critical to the Company. If the expected results cannot be replicated on a commercial scale, the expected revenue from these ventures will not be realized and the investment in our pilot projects is unlikely to be recovered. This would have a very material adverse effect on the Company’s financial results.

ITEM 3. KEY INFORMATION - continued

RISK FACTORS - continued

There is no certainty that our key projects will be operationally successful or profitable.

We are highly dependent upon the success of our VertiCrop™ plant growing system – our core business. Although we are optimistic that there is a large amount of interest for these technologies, if that demand does not materialize to the extent that we project or we are not successful in promoting and distributing our technology, this will have a material adverse effect on the Company’s financial results.

Risks Associated With An Investment In Our Common Stock

Unless an active trading market develops for our securities, you may not be able to sell your shares.

Although, we are a reporting company and our common shares are listed on the OTC QB under the symbol “VCTZF”, currently, there is only a limited trading market for our common stock and a more active trading market may never develop or, if it does develop, may not be maintained. Failure to develop or maintain an active trading market will have a generally negative effect on the price of our common stock, and you may be unable to sell your common stock or any attempted sale of such common stock may have the effect of lowering the market price and therefore your investment could be a partial or complete loss.

Under certain circumstances, some of our outstanding common stock purchase warrants may be exercised without our receiving any cash.

As at March 31, 2011, we have outstanding warrants to purchase some of our common stock exercisable on a “net cashless” basis, which means they can be exercised, without payment of the stated exercise price, solely in exchange for cancellation of some number of common shares into which the warrants are exercisable. The number of shares for which any such warrant would be cancelled under a net cashless exercise would be the number of shares having a then current market value equal to the aggregate exercise price of the warrant, in whole or in part, based on its stated exercise price. In effect, a net cashless exercise of any such warrants would mean that, even though we would receive no cash, we would have to issue additional shares, thereby diluting, potentially significantly, our reportable earnings per share. Although the circumstances under which the net cashless exercise provision may be elected by the holders of our warrants may be limited, any such exercise could have a negative effect, directly or indirectly, on the trading market price of our common stock.

Since our common stock is thinly traded it is more susceptible to extreme rises or declines in price, and you may not be able to sell your shares at or above the price paid.

Since our common stock is thinly traded its trading price is likely to be highly volatile and could be subject to extreme fluctuations in response to various factors, many of which are beyond our control, including:

| | • | the trading volume of our shares; |

| | • | the number of securities analysts, market-makers and brokers following our common stock; |

| | • | changes in, or failure to achieve, financial estimates by securities analysts; |

| | • | new products introduced or announced by us or our competitors; |

| | • | announcements of technological innovations by us or our competitors; |

| | • | actual or anticipated variations in quarterly operating results; |

| | • | conditions or trends in our business industries; |

| | • | announcements by us of significant acquisitions, strategic partnerships, joint ventures or capital commitments; |

| | • | additions or departures of key personnel; |

| | • | sales of our common stock; and |

| | • | general stock market price and volume fluctuations of publicly-traded, and particularly microcap, companies. |

You may have difficulty reselling shares of our common stock, either at or above the price you paid, or even at fair market value. The stock markets often experience significant price and volume changes that are not related to the operating performance of individual companies, and because our common stock is thinly traded it is particularly susceptible to such changes. These broad market changes may cause the market price of our common stock to decline regardless of how well we perform as a company. In addition, securities class action litigation has often been initiated following periods of volatility in the market price of a company’s securities. A securities class action suit against us could result in substantial legal fees, potential liabilities and the diversion of management’s attention and resources from our business. Moreover, and as noted below, our shares are currently traded on the OTC Bulletin Board and, further, are subject to the penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to manipulation by market-makers, short-sellers and option traders.

ITEM 3. KEY INFORMATION - continued

RISK FACTORS - continued

Our common stock is subject to the “penny stock” regulations, which are likely to make it more difficult to sell.

Our common stock is considered a “penny stock,” which generally is a stock trading under US$5.00 and not registered on a national securities exchange. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. These rules generally have the result of reducing trading in such stocks, restricting the pool of potential investors for such stocks, and making it more difficult for investors to sell their shares once acquired. Prior to a transaction in a penny stock, a broker-dealer is required to:

| | • | deliver to a prospective investor a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market; |

| | • | provide the prospective investor with current bid and ask quotations for the penny stock; |

| | • | explain to the prospective investor the compensation of the broker-dealer and its salesperson in the transaction; |

| | • | provide investors monthly account statements showing the market value of each penny stock held in their account; and |

| | • | make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. |

These requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that is subject to the penny stock rules. Since our common stock is subject to the penny stock rules, investors in our common stock may find it more difficult to sell their shares.

We are a Canadian Company, and must ensure compliance with Canadian as well as American securities laws. As a result, there may be securities regulations in the jurisdiction where our shareholders are resident that must be met, and such regulations may impact the ability of our shareholders to trade our securities.

As a foreign private issuer, we are exempt from certain informational requirements of the Exchange Act to which domestic United States issuers are subject.

As a foreign private issuer we are not required to comply with all of the informational requirements of the Exchange Act. As a result, there may be less information concerning our Company publicly available than if we were a domestic United States issuer. In addition, our officers, directors and principal shareholders are exempt from the reporting and short profit provisions of Section 16 of the Exchange Act and the rules promulgated thereunder. Therefore, our shareholders may not know on a timely basis when our officers, directors and principal shareholders purchase or sell shares of our common stock. See “ITEM 10. ADDITIONAL INFORMATION”.

As we are a Canadian company with much of our assets and key personnel located outside of the United States, you may have difficulty in acquiring United States jurisdiction or enforcing a United States judgment against us, our key personnel or our assets.

We are a Canadian company organized under the Business Corporations Act (Alberta). Many of our assets and certain of our key personnel, including our directors and officers, reside outside of the United States. As a result, it may be difficult or impossible for you to effect service of process within the United States upon us or any of our key personnel, or to enforce against us or any of our key personnel judgments obtained in United States’ courts, including judgments relating to United States federal securities laws. In addition, Canadian courts may not permit you to bring an original action in Canada or recognize or enforce judgments of United States’ courts obtained against us predicated upon the civil liability provisions of the federal securities laws of the United States or of any state thereof. Accordingly, you may have more difficulty in protecting your interests in the face of actions taken by our management, members of our board of directors or our controlling shareholders than you would otherwise as shareholder in a United States public company.

We do not intend to pay any common stock dividends in the foreseeable future.

We have never declared or paid a dividend on our common stock and, because we have very limited resources and a substantial accumulated deficit, we do not anticipate declaring or paying any dividends on our common stock in the foreseeable future. Rather, we intend to retain earnings, if any, for the continued operation and expansion of our business. It is unlikely, therefore, that the holders of our common stock will have an opportunity to profit from anything other than potential appreciation in the value of our common shares held by them. If you require dividend income, you should not rely on an investment in our common stock. See “Dividend Policy”.

Future issuances of our common stock from equity financing, exercise of existing and future warrants and options, and convertible and future debt settlements, and equity issuances for services may depress our stock price and dilute your interest. Our stock trades at less than $0.10 per share leading to high levels of dilution from equity issuances.

ITEM 3. KEY INFORMATION - continued

RISK FACTORS - continued

As at September 28, 2011, we have outstanding warrants to purchase up to approximately 28,857,410 shares of our common stock and options issued to purchase up to approximately 8,724,195 shares of our common stock. In addition, the Company had a commitment to issue 7,989,686 common shares.

We may issue additional shares of our common stock in future financings or grant stock options to our employees, officers, directors and consultants under our stock option plan. We may issue common shares for services rendered. Any such issuances could have the effect of depressing the market price of our common stock and, in any case, would dilute the percentage ownership interests in our Company by our shareholders. In addition, we could issue serial preferred stock having rights, preferences and privileges senior to those of our common stock, including the right to receive dividends and/or preferences upon liquidation, dissolution or winding-up in excess of, or prior to, the rights of the holders of our common stock. This could depress the value of our common stock and could reduce or eliminate amounts that would otherwise have been available to pay dividends on our common stock (which are unlikely in any case) or to make distributions on liquidation.

Additionally, if possible under terms that we believe to be appropriate given our financial condition and other circumstances, we will likely seek to raise additional financing during our fiscal year ending March 31, 2012. We may also issue additional shares, options, and warrants to obtain necessary services.

Some of the issuances we have made in the past, and are likely to make in the future, have been issued at prices below market and at prices below our historical market prices. Consequently, our shareholders have suffered dilution in the value of their shares and can expect that we will be issuing additional securities on similar terms. Further dilution can be expected to occur when our outstanding options and warrants are exercised or debentures are converted at prices below the market.

Future releases from voluntary lock up arrangements of our common stock may depress our stock price

An aggregate of $2,345,498 of debt was settled on March 31, 2011 in exchange for 15,636,656 units. Each unit consists of one common share and one half warrants. One whole warrant is exercisable into one common share at $0.25. The common shares are subject to a 12 month lock up agreement from the date of issue which was March 31, 2011. The lock-up agreement covers 90% of the issued units whereby 30% will be released in six months, another 30% will be released in nine months and the balance will be released in 12 months from the issued date. Releases from lock up will increase supply of shares tradable and may depress the market price of our common shares trading in the market. ITEM 4. INFORMATION ON THE COMPANY.

ITEM 4. INFORMATION ON THE COMPANY

Corporate History

Prior Business Operations - We were incorporated in accordance with the provisions of the Business Corporations Act (Alberta) on January 19, 1996, as 681673 Alberta Ltd., later changed to Ironclad Systems Inc. Beginning in 1996, following the completion of a public offering, the Company’s common shares began trading as a junior capital pool company on the Alberta Stock Exchange (later becoming part of the Canadian Venture Exchange, which was thereafter acquired and renamed the TSX Venture Exchange).

Valcent Products Inc. - On March 24, 2004, we changed the Company’s name to Valcent Products Inc. to reflect a newly adopted business plan. On May 3, 2005 we delisted the Company’s common stock from the TSX Venture Exchange, maintaining only the Company’s OTC Bulletin Board listing; the Company’s symbol changed to “VCTPF”. Effective May 3, 2005, and in order to render the Company’s capital structure more amenable to contemplated financing, we effected a consolidation of the Company’s common shares on a one-for-three-basis (1:3).

In order to facilitate the business plan, the Company formed a wholly-owned Nevada corporation, Valcent USA, Inc. to conduct operations in the United States in October 2005. In turn, Valcent USA, Inc. organized Valcent Management, LLC, a wholly-owned limited liability corporation under the laws of Nevada, to serve as general partner to Valcent Manufacturing Ltd.; a limited partnership also formed by Valcent USA, Inc., under the laws of Texas, wherein Valcent USA, Inc. serves as limited partner to Valcent Manufacturing Ltd.

Also during the fiscal year ended March 31, 2007, Valcent Products EU Limited (“Valcent EU”) was incorporated by Valcent Products Inc. in the domicile of England to conduct operations in Europe. Valcent Products EU Limited has developed and commercialized the Company’s VertiCrop™ vertical growing technology.

On May 5, 2008, Vertigro Algae Technologies LLC, a Texas limited liability corporation, was formed as a 50% owned subsidiary of each of Valcent, USA Inc. and Global Green Solutions Inc. to develop algae related technologies. To concentrate on its core vertical plant growing technologies, during July, 2010, Valcent Products Inc. and its subsidiary Valcent USA and Global Green Solutions Inc., Inc. agreed to the wind-up and dissolution of Vertigro Algae Technologies LLC, through which they had jointly pursued development of algae related research and development projects.

ITEM 4. INFORMATION ON THE COMPANY - continued

Effective April 1, 2009, the Company executed a purchase agreement to acquire all ownership rights and intellectual property relating to certain vertical plant growing technology and Tomorrow Garden® kit technology (the “Technologies”) from Glen Kertz, Pagic, and West Peak and which provides the Company with all rights and knowhow to the Technologies (the “Purchase Agreement”). Pursuant to this agreement, original master license agreements between the Company and Pagic were terminated and this agreement replaced all financial obligations the Company had with Pagic related to the original master license agreements, including annual payments, royalty burden, and all other associated licensing costs. During the last quarter of the fiscal year ended March 31, 2010, the Company and Pagic entered into negotiations to resolve certain disputes regarding the Purchase Agreement. On March 8, 2010, an addendum to the Purchase Agreement (“Addendum”) was entered into by parties. On May 17, 2011 the company advised Pagic, based upon a comprehensive review of the intellectual property rights that were the subject of this agreement, that it was no longer relying upon these rights and terminated the agreement.

The shareholders of the Company approved a special resolution on June 22, 2009 to reorganize the capital structure of the Company through a consolidation of its common shares on the basis of one new share for each eighteen (1:18) old shares. This share consolidation became effective July 16, 2009. Also effective July 16, 2009, Valcent’s trading symbol changed to “VCTZF” and Valcent’s CUSIP number changed to 918881202. Unless otherwise noted, all references to the number of common shares and or prices(s) per share are stated on a post-consolidation basis.

Current Corporate Focus - We are at present a life sciences targeted, development stage company focused primarily on the development and commercialization of the Company’s “High Density Vertical Growth System” (“VertiCrop™”) designed to produce vegetables, herbs and other plant crops in climatically controlled, chemical free environments in both greenhouse and warehouse structures.

From inception, we have generated minimal cost recoveries, experienced negative cash flows from operating activities, and the Company’s history of losses has resulted in the Company’s continued dependence on external financing. Any inability to achieve or sustain profitability or otherwise secure additional external financing, will negatively impact the Company’s financial condition and raises substantial doubts as to the Company’s ability to continue as a going concern.

The Company and its management are working towards commercialization of its core technology with emphasis on reaching break even business operations as soon as feasible.

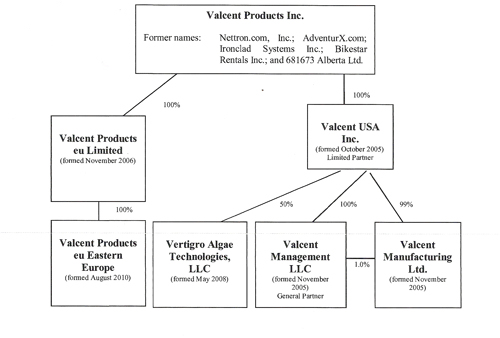

Organizational Structure

The following organizational chart sets forth the Company’s current corporate structure and reflects subsidiary interests relating to the Company’s various entities as at March 31, 2011.

Valcent Products, Inc. formed a wholly-owned Nevada corporation, Valcent USA, Inc. to conduct a range of business development initiatives in the United States in October 2005. In turn, Valcent USA, Inc. formed Valcent Management, LLC, as a wholly-owned limited liability corporation under the laws of Nevada to serve as the general partner to Valcent Manufacturing Ltd. A limited partnership was also formed by Valcent USA, Inc. under the laws of Texas, wherein Valcent USA, Inc. serves as limited partner to Valcent Manufacturing Ltd.

Valcent Products EU Limited was incorporated in the domicile of England in November 2006 as a wholly owned subsidiary of Valcent Products Inc. to develop and sell vertical plant growing systems in Europe. During August 2010 Valcent Products EU Limited incorporated a wholly-owned subsidiary Valcent (EU) Eastern Europe in Poland.

Vertigro Algae Technologies, LLC, a Texas Limited Liability Corporation was formed in May 2008 as a 50% owned subsidiary to each of Valcent, USA Inc. and Global Green Solutions Inc. to develop algae related technologies. During July, 2010, Valcent Products Inc. and its subsidiary Valcent USA and Global Green Solutions Inc., Inc. agreed to the wind-up and dissolution of Vertigro Algae Technologies LLC, through which they had jointly pursued development of algae related research and development projects.

ITEM 4. INFORMATION ON THE COMPANY - continued

Business Overview

The Com The Company any is in the business of developing, selling and delivering world-leading vertical farming solutions primarily through its high density vertical growing systems named VertiCrop™. |

| The Company has been developing and proving a growing technology that can be described as transformative. The profitability of the Company’s VertiCrop™ system is enabled by high contribution margins, and by existing market price premiums commanded by year round, locally grown, pesticide, herbicide free produce. The VertiCrop™ system’s small footprint and high yield enable market expansion into previously under addressed urban and near urban marketplaces. |

VertiCrop™ is a patent pending technology comprised of a suspended tray on a moving conveyor. VertiCrop™ provides maximum exposure to light (either natural or artificial), along with precisely measured nutrients for the plants. Designed to grow in a closed loop and controlled environment, VertiCrop™ eliminates the need for harmful herbicides and pesticides, while maximizing food taste and nutrition. Developed over several years by the Company, VertiCrop™ grows higher quality produce much more efficiently and with greater food value, when compared to commercial field agricultural.

| | • | Specially designed trays suspended from overhead track. |

| | • | Closed loop conveyor passing through feeding stations which provide water and nutrients. |

| | • | Supplementary lighting to enhance growth and provide for year round production. |

| | • | Even airflow over the plants and equal exposure to light. |

| | • | Water and nutrient run-off from the feeding station is captured and recycled. |

| | • | Conducive to optimum workflow – the crop comes to the crop worker. |

| | • | Can operate in closed and greenhouse application. |

Vertigro Algae Technologies LLC (“Vertigro Algae”) - Beginning on October 2, 2006, we granted certain rights to Global Green relating to a joint venture of the Company’s high density vertical bio-reactor technology named “Vertigro”, an algae biomass technology initiative. On May 5, 2008, the joint venture arrangement pertaining to the development of the algae biomass technology initiative was terminated and Vertigro Algae executed a separate Technology License Agreement (“Technology License”) together with Pagic, and West Peak. The Technology License licenses certain algae biomass technology and intellectual property to Vertigro Algae for purposes of commercialization and exploitation for all industrial, commercial, and retail applications worldwide “Algae Biomass Technology”. Vertigro Algae assessed its continued involvement in the Technology License; the Technology License was terminated in the quarter ended March 31, 2010.

Discontinued Product Development Lines and Settlement of Licensed Technologies - Of the Initial Products under license as defined above, the Company ceased development of Dust Wolf and Nova Skin Care Systems during the year ended March 31, 2009 due to economic conditions, project viability assessment, and increased corporate focus on life sciences plant growth technologies. During the year ended March 31, 2010, the Company, decided to discontinue development of its Tomorrow Garden® retail plant sales project to concentrate on the commercialization and roll out of its VertiCrop™.

VertiCrop™ Technology Purchase Agreement - Effective April 1, 2009, the Company terminated the original License Agreement dated July 29, 2005 and executed a new purchase agreement (the “Purchase Agreement”) to acquire all ownership rights and intellectual property relating to its VertiCrop™ vertical plant growing technology and Tomorrow Garden Kit technology (the “Technologies”) from a former director and officer of the Company, Pagic and West Peak.

Pursuant to the Purchase Agreement, the Company agreed to pay a total of $2,000,000 and issue 3% of its common shares on conclusion of the purchase agreement. The $2,000,000 is payable on a cumulative basis as to $65,000 on signing (paid) plus the greater of 3% of the gross monthly product sales less returns from exploitation of the Technologies or $12,000 per month until $2,000,000 has been paid. The ownership of the Technologies will remain in escrow until fully paid or if the Company defaults in making payments. The issuance of the 3% of its common shares is payable upon release of the Technologies from escrow to the Company. The Company may at any time elect to pay out the remaining balance due. Should the Company default under this agreement the Technologies will revert back to Glen Kertz and Pagic.

On March 8, 2010, an addendum to the Purchase Agreement (“Addendum”) was entered into by parties thereto whereby:

| | a) the purchase price of technology to be acquired was amended to an aggregate of $3,150,000 (previously $2,000,000) of which certain equipment was permitted to be used by Pagic as an incentive to enter into the Purchase Agreement (“Addendum”). |

| | b) $100,000 was paid to Pagic by the Company at the date of the Addendum; |

| | c) calculated minimum IP payments increased to $18,000 per month from $12,000 per month effective August 1, 2010; and |

| | d) the term to complete the technology purchased was reduced from July 1, 2019 to July 12, 2014. |

During the year ended March 31, 2011, $192,000 was paid or accrued to Pagic under the terms of the Purchase Agreement and its Addendum.

Subsequent to March 31, 2011, the Company and the Company’s legal counsel performed a comprehensive review of the Purchase Agreement and the Company’s improved VertiCrop™ technology and concluded that it is not using the intellectual property relating to the vertical plant growing technology as was contemplated in the Purchase Agreement and thus terminated the Purchase Agreement on May 17, 2011.

ITEM 4. INFORMATION ON THE COMPANY - continued

PLAN OF OPERATIONS

From inception we have generated minimal cost recoveries from the Company’s business operations and have traditionally met the Company’s ongoing obligations by raising capital through external sources of financing, such as private placement, convertible notes, demand and promissory notes, and director and shareholder advances.

At present, we do not believe that Valcent’s current financial resources are sufficient to meet the Company’s working capital needs in the near term or over the next twelve months and, accordingly, we will need to secure additional external financing to continue the Company’s operations. We anticipate raising additional capital though further private equity or debt financings and shareholder loans. If we are unable to secure such additional external financing, we may not be able to meet the Company’s obligations as they come due or to fully implement the Company’s intended plan of operations, as set forth below, raising substantial doubts as to the Company’s ability to continue as a going concern.

On December 16, 2010 Stephen Kenneth Fane, FCA, accepted the position of Chief Executive Officer and a Director of the Company and Chris Ng accepted the position of Chief Operating Officer and a Director of the Company.

New management has shifted the Company’s focus from being a research and development Company to marketing and commercializing the Company’s VertiCropTM System.

The company has established sales and marketing materials, established sales and marketing support, and has been providing quotes for specific, targeted customers.

The AlphaCrop™ system has been discontinued as there is not a clear market for this product.

The company is in the process of downsizing the Valcent EU Ltd. subsidiary and has changed its focus to an R&D function. In addition the company intends to develop and implement an R&D capability in Canada and the US.

Potential Markets – High Density Vertical Growth System for Vegetables: Vertical growing systems have been proposed as possible solutions for increasing urban food supplies while decreasing the ecological impact of farming, and as a result, we expect the technology to compete with traditional growing techniques Vertical growing, hydroponics and greenhouse production have yet to be combined into an integrated commercial production system, but, such a system would have major potential for the realization of environmentally sustainable urban food

ITEM 4. INFORMATION ON THE COMPANY - continued

PLAN OF OPERATIONS - continued

VertiCrop™ Technology – Concept and Advantages: The VertiCrop™ technology provides a solution to rapidly increasing food costs caused by transportation/fuel due to the cost of oil and transport fuels. Under traditional farming practice, a reduction in availability and nutritional values results in the food people consume. The VertiCrop™ is designed to grow vegetables and other plants close to urban centers much more efficiently and with greater food value than in agricultural field conditions that require transportation of product to distant consumption markets.

As the world population increases, agricultural land and water resources rapidly diminish. Alternative and innovative solutions have to be found to feed people and reduce the consumption of water, land, energy, and food miles.

VertiCrop™ is an innovative and exciting vertical growing system which:

| | · | Produces up to 20 times the normal production volume for field crops |

| | · | Requires approximately 5% of the normal water requirements for field crops |

| | · | Can be built on non arable lands and close to major city markets |

| | · | Can work in a variety of environments: urban, suburban, countryside, etc. |

| | · | Minimizes or eliminates the need for herbicides and insecticides |

| | · | Will have very significant operating and capital cost savings over field agriculture |

| | · | Will drastically reduce transportation costs to market, resulting in further savings, higher quality and fresher foods on delivery and less transportation pollution |

| | · | Is modular and easily scalable from small to very large food production situations |

The VertiCrop™ grows plants in closely spaced shelves vertically arranged on panels that are moving on an overhead conveyor system. The system is designed to provide maximum sunlight and precisely correct nutrients to each plant. Ultraviolet light and filter systems may exclude the need for herbicides and pesticides. Sophisticated control systems gain optimum growth performance through the correct distribution of nutrients, the accurate balancing of PH and the delivery of the correct amount of heat, light and water.

System Advantages

| | · | reduced global transport costs and associated carbon emissions |

| | · | food and fuel safety, security and sovereignty |

| | · | local food is better for public health |

| | · | building local economies |

| | · | control of externalities and true costs |

In a rapidly urbanizing world where the majority of people now live in cities, localization requires that food and fuel be produced in an urban context. Urban agriculture presents a number of technological challenges. The main challenge is a lack of growing space.

Vertical growing is a new idea currently emerging in the sustainability discourse which offers great promise for increasing urban production. Vertical growing systems have been proposed as possible solutions for increasing urban food supplies while decreasing the ecological impact of farming. The primary advantage of vertical growing is the high density production it allows using a much reduced physical footprint and fewer resources relative to conventional agriculture. Vertical growing systems can be applied in combination with existing hydroponics, and greenhouse technologies which already address many aspects of the sustainable urban production challenge (i.e., soil-free, organic production, closed loop systems that maximize water and nutrient efficiencies, etc.). Vertical growing, hydroponics and greenhouse production have yet to be combined into an integrated commercial production system, but, such a system would have major potential for the realization of environmentally sustainable urban food and fuel production.

Reduced Global Transport and Associated Carbon Emissions : It is widely recognized that the transportation of food over long distances – compared to locally sourced foods – causes excessive energy use, air pollution and is a contributor to climate change.

4. INFORMATION ON THE COMPANY - continued

PLAN OF OPERATIONS - continued

Today, food products typically travel great distances between source and market. The energy used for food transport often far outweighs the human energy gained by the food. The associated need for long-haul refrigeration and packaging further increases the energy costs of food transport. Long-distance and cross-continental food trade is clearly on the rise with the tonnage of food shipped between nations having grown many times over in the last fifty years. Choosing local over global products has powerful potential to reduce energy consumption.

Food and Fuel Safety, Security and Sovereignty: We believe that the further that food is shipped from its growing source, the more vulnerable our food and energy systems become. There are many factors that can interrupt global production and distribution systems including political instability, changes in government, fluctuations in international markets, oil shortages and depletion, war and conflict, acts of terrorism, and natural disasters such as floods, earthquakes, drought, or hurricanes. Localization of food and fuel production has important potential for daily security and emergency preparedness as every community should be able to supply at least a fraction of the food and fuel required by its residents.

Food that is transferred across borders does not necessarily meet the traditional safety standards of consumer countries. Since local food is produced under tractable conditions, in adherence with local food safety standards, greater levels of food safety are ensured.

About 25,000 people die every day of hunger or hunger related causes according to the United Nations. In Africa, for example, it is agriculture itself that is in crisis; caused by years of wars, coups and civil strife, increases in population, and natural problems such as drought. Sub Saharan African soil quality is classified as degraded in about 72% of arable land and 31% of pasture land.

The High Density Vertical Growing System grows leafy lettuce, micro greens (small leafed plants of a wide variety), spinach, herbs, mints, beets, strawberries, wheatgrass, alfalfa and other grains. The HDVG System has the capability of, on average, growing up to 10-20 times the amount of vegetables per acre than conventional field production while using only 5% of the water. Field lettuce loses half its nutritional value within 24 hours and delivery to distant customers can take up to a week. Innovations inherent to the HDVG System will make it possible to deliver vegetables which are still alive to the consumer.

The Company believes that one-eighth acre replicable turnkey modules can be scaled up to meet output and crop diversity requirements. The system can be sited anywhere, in urban, suburban or even desert environments, wherever vegetables are needed. A primary advantage of vertical growing is the high density production it allows using a much reduced physical footprint and fewer resources relative to conventional agriculture. Initial production performance for the HDVG System is based on growing leafy lettuce.

Commercial Deployment of the VertiCrop™ System – Paignton Zoo, Devon, UK: The Company via its UK subsidiary has in the summer months of 2009 deployed its first commercial test installation of its VertiCrop™ technology at the Paignton Zoo Environmental Park located in Devon, UK. The Paignton Zoo is one of the largest zoos in the UK. The Zoo is part of South West Environmental Parks Ltd which is owned by the Whitley Wildlife Conservation Trust. It is a combined zoo and botanic garden that welcomes over half a million visitors a year. The VertiCrop™ System installed at Paignton Zoo is meant to grow more plants in less room using less water and less energy. It will help to reduce food miles and bring down the Zoo’s annual costs for animal feed, which is currently in excess of £200,000 a year. The zoo will grow a whole range of herbs such as parsley and oregano, as well as leaf vegetables like lettuce and spinach, plus a range of fruits such as cherry tomato and strawberry. Reptiles, birds and most of the mammal collection - including primates and big cats -- will benefit from the production of year-round fresh food. The system which was a joint arrangement between Valcent Products EU Limited and the Paignton Zoo Environmental Park became operational on August 5, 2009, and will supply necessary data to the Company of semi-commercial crop yields, and other data for further commercialization of the VertiCrop™ System.

ITEM 4. INFORMATION ON THE COMPANY - continued

PLAN OF OPERATIONS - continued

Manufacturing, Fulfillment and Suppliers: Manufacture to date for VertiCrop™ has been carried out in the UK. The Company is currently sourcing alternative manufactures and suppliers in North America and offshore. As of the date of this annual report, we have no long-term written agreements and no intentions of entering into any such agreements with any suppliers or manufacturers, and we are not substantially dependent, nor do we anticipate becoming substantially dependent, upon any one or more suppliers, as we believe that there are many such suppliers available with the capabilities that we will require.

Restructuring Initiatives