UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2009

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 0-30858

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

Alberta, Canada

(Jurisdiction of incorporation or organization)

789 West Pender Street, Suite 1010, Vancouver, British Columbia V6C 1H2

(Address of principal executive offices)

George Orr

789 West Pender Street, Suite 1010, Vancouver, B.C. Canada V6C 1H2

Phone: (800) 877-1626

Fax: (604) 606-7980

(Name, Telephone, Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | | Name of each exchange |

| | | on which registered |

| | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Stock, no par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

3,008,977 common shares, without par value, issued and outstanding at March 31, 2009, after having given effect to the one for eighteen share consolidation effected July 16, 2009, and 49,675,133 common shares, without par value, issued and outstanding as of September 30, 2009.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated filer o | Accelerated filer o | Non Accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | o | International Financial Reporting Standards as issued | o | Other | x |

| | | by the International Accounting Standards Board | | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 x Item 18 o

If this is an annual report, indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

TABLE OF CONTENTS

| | | | | |

| | | | | Page Number |

| PART I | | | | 4 |

| | | | | |

| ITEM 1 | | Identity of Directors, Senior Management and Advisors | | 4 |

| | | | | |

| ITEM 2 | | Offer Statistics and Expected Timetable | | 4 |

| | | | | |

| ITEM 3 | | Key Information | | 4 |

| | | | | |

| ITEM 4 | | Information on the Company | | 14 |

| | | | | |

| ITEM 5 | | Operating and Financial Review and Prospects | | 24 |

| | | | | |

| ITEM 6 | | Directors, Senior Management and Employees | | 37 |

| | | | | |

| ITEM 7 | | Major Shareholders and Related Party Transactions | | 41 |

| | | | | |

| ITEM 8 | | Financial Information | | 46 |

| | | | | |

| ITEM 9 | | The Offer and Listing | | 47 |

| | | | | |

| ITEM 10 | | Additional Information | | 48 |

| | | | | |

| ITEM 11 | | Quantitative and Qualitative Disclosures About Market Risk | | 57 |

| | | | | |

| ITEM 12 | | Description of Securities Other than Equity Securities | | 57 |

| | | | | |

| | | | | |

| PART II | | | | 57 |

| | | | | |

| ITEM 13 | | Defaults, Dividends, Arrearages and Delinquencies | | 57 |

| | | | | |

| ITEM 14 | | Material Modifications to the Rights of Security Holders and Use of Proceeds | | 57 |

| | | | | |

| ITEM 15 T | | Control and Procedures | | 57 |

| | | | | |

| ITEM 16 | | [Reserved] | | |

| | | | | |

| ITEM 16A | | Audit Committee Financial Expert | | 60 |

| | | | | |

| ITEM 16B | | Code of Ethics | | 60 |

| | | | | |

| ITEM 16C | | Principal Accountant Fees and Services | | 60 |

| | | | | |

| ITEM 16D | | Exemptions from the Listing Standards for Audit Committee | | 60 |

| | | | | |

| ITEM 16E | | Purchase of Equity Securities by the Issuer and Affiliated Purchasers | | 60 |

| | | | | |

| | | | | |

| PART III | | | | F-1 |

| | | | | |

| ITEM 17 | | Financial Statements | | F-1 |

| | | | | |

| ITEM 19 | | Exhibits | | 61 |

PART I

CAUTIONARY NOTICE REGARDING FORWARD LOOKING STATEMENTS

Certain written and oral statements made by our Company and subsidiaries of our Company may constitute “forward-looking statements” as defined under the Private Securities Litigation Reform Act of 1995. This includes statements made in this report, in other filings with the Securities and Exchange Commission (“SEC’), in press releases, and in certain other oral and written presentations. Generally, the words “anticipates”, “believes”, “expects”, “plans”, “may”, “will”, “should”, “seeks”, “estimates”, “projects”, “predicts”, “potential”, “continues”, “intends”, and other similar words identify forward-looking statements. All statements that address operating results, events or developments that we expect or anticipate will occur in the future, including statements related to sales, earnings per share results, and statements expressing general expectations about future operating results, are forward-looking statements and are based upon the Company’s current expectations and various assumptions. The Company believes there is a reasonable basis for its expectations and assumptions, but there can be no assurance that the Company will realize its expectations or that the Company’s assumptions will prove correct. Forward-looking statements are subject to risks that could cause them to differ materially from actual results. Accordingly, the Company cautions readers not to place undue reliance on forward-looking statements. We believe that these risks include but are not limited to the risks described in this report under Part I, Item 3, Subsection D entitled “Risk Factors” and Part I, Item 5, entitled “Operating and Financial Review and Prospects” and that are otherwise described from time to time in our SEC reports filed after this report. These statements appear in a number of places in this Form 20-F and include all statements that are not statements of historical fact regarding the intent, belief or current expectations of us, our directors or our officers, with respect to, among other things: (i) our liquidity and capital resources, (ii) our financing opportunities and plans, (iii) our ability to attract customers to generate revenues, (iv) competition in our business segment, (v) market and other trends affecting our future financial condition or results of operations, (vi) our growth strategy and operating strategy, and (vii) the declaration and/or payment of dividends.

Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. The factors that might cause such differences include, among others, those set forth in this annual report, and we undertake no obligation to update any of the forward-looking statements in this annual report on Form 20-F after the date of this report.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

ITEM 3. KEY INFORMATION

SELECTED FINANCIAL DATA

We are at present a life sciences development stage company focused primarily on:

| | (i) | the development and commercialization of our “High Density Vertical Growth System” (“VerticropTM” or “HDVG System”) designed to produce vegetables and other plant crops, |

| | (ii) | the development of a commercial algae growing technology via Vertigro Algae Technologies LLC (“Vertigro Algae”) with Global Green Solutions, Inc. (“Global Green”), and |

| | (iii) | the development and marketing of the Tomorrow GardenTM consumer retail product. |

ITEM 3. KEY INFORMATION - continued

SELECTED FINANCIAL DATA - continued

Due to economic circumstances and to make our Company more conducive to investment the shareholders of the Company approved a special resolution to reorganize the capital structure of the Company by a share consolidation of its common shares on the basis of one new share for each eighteen old shares. This share consolidation became effective July 16, 2009. Also effective July 16, 2009 our trading symbol changed to “VCTZF” and our CUSIP number changed to 918881202. Our website is located at www.valcent.net

Unless otherwise noted, all references to the number of common shares are stated on a post-consolidation basis.

As at September 30, 2009, 49,675,133 common shares were issued and outstanding, the Company had 6,813,795 warrants outstanding, and no options. In addition, the Company has certain secured promissory notes outstanding that may if not repaid on their due date of December 31, 2009 may then be converted at the election of the holders into common shares (see ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS, Liquidity and Capital Resources).

All amounts are stated in Canadian dollars unless otherwise noted.

The following selected financial data has been derived from our audited financial statements and related notes for the preceding five years and has been prepared and presented in accordance with Canadian generally accepted accounting principles. Effective March 24, 2004, we disposed of our interest in Nettron Media Group, formerly our wholly-owned subsidiary. The comparative financial results of Nettron Media Group for the year ended March 31, 2004 have been segregated and presented as deficit from prior operations and discontinued operations in our audited financial statements. For comparative purposes this selected financial data for the years ended March 31, 2005, 2006, 2007, 2008 and 2009 is also presented as though it were prepared under United States generally accepted accounting principles. Our audited financial statements for the year ended March 31, 2009 have been prepared in accordance with Canadian generally accepted accounting principles, which, except as noted in Notes 1 and 20, conform in all material respects with those of the United States and with the requirements of the United States Securities and Exchange Commission.

| | March 31, | | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| Selected Financial Data | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| (Expressed in Canadian Dollars) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net Operating Revenues per Canadian and U.S. GAAP | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from operations | | $ | 15,337,285 | | | $ | 12,028,222 | | | $ | 8,171,090 | | | $ | 3,442,933 | | | $ | 45,694 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from operations U.S. GAAP | | $ | 17,769,901 | | | $ | 12,563,451 | | | $ | 9,743,414 | | | $ | 2,844,879 | | | $ | 45,694 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from continued operations per Canadian GAAP | | $ | 15,337,285 | | | $ | 12,028,222 | | | $ | 8,171,090 | | | $ | 3,466,888 | | | $ | 45,694 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from discontinued operations per Canadian GAAP | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss per Canadian GAAP | | $ | 17,855,490 | | | $ | 12,712,358 | | | $ | 8,138,393 | | | $ | 3,466,888 | | | $ | 45,694 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from continued operations per U.S. GAAP | | $ | 18,000,141 | | | $ | 13,292,888 | | | $ | 9,749,339 | | | $ | 2,844,879 | | | $ | 45,694 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from discontinued operations per U.S. GAAP | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss per U.S. GAAP | | $ | 18,000,141 | | | $ | 13,292,888 | | | $ | 9,749,339 | | | $ | 2,844,879 | | | $ | 45,694 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss per share from continued operations, basic, Canadian GAAP | | $ | 6.43 | | | $ | 6.44 | | | $ | 7.60 | | | $ | 5.92 | | | $ | 0.13 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss per share from discontinued operations, Canadian GAAP | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

ITEM 3. KEY INFORMATION - continued

SELECTED FINANCIAL DATA - continued

| Loss per share after discontinued operations, Canadian GAAP | | $ | 6.43 | | | $ | 6.44 | | | $ | 7.60 | | | $ | 5.92 | | | $ | 0.13 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss per share from continued operations, U.S. GAAP | | $ | 6.47 | | | $ | 6.73 | | | $ | 9.11 | | | $ | 4.86 | | | $ | 0.13 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss per share from discontinued operations, U.S. GAAP | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss per share after discontinued operations, U.S.GAAP | | $ | 6.47 | | | $ | 6.73 | | | $ | 9.11 | | | $ | 4.86 | | | $ | 0.13 | |

| | | | | | | | | | | | | | | | | | | | | |

| Share capital per Canadian GAAP | | $ | 21,957,516 | | | $ | 16,691,282 | | | $ | 8,196,982 | | | $ | 4,099,870 | | | $ | 2,999,420 | |

| | | | | | | | | | | | | | | | | | | | | |

| Share capital per U.S. GAAP | | $ | 22,070,991 | | | $ | 16,866,115 | | | $ | 8,434,032 | | | $ | 4,391,371 | | | $ | 2,999,420 | |

| | | | | | | | | | | | | | | | | | | | | |

| Common shares issued | | | 3,008,977 | | | | 2,459,636 | | | | 1,703,670 | | | | 877,102 | | | | 357,521 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average shares outstanding per Canadian GAAP | | | 2,782,284 | | | | 1,974,763 | | | | 1,070,066 | | | | 586,002 | | | | 357,521 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average shares outstanding per U.S. GAAP | | | 2,782,284 | | | | 1,974,763 | | | | 1,070,066 | | | | 586,002 | | | | 357,521 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Assets per Canadian GAAP | | $ | 2,351,963 | | | $ | 4,605,914 | | | $ | 4,142,485 | | | $ | 1,392,801 | | | $ | 936 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Assets per U.S. GAAP | | $ | 2,351,963 | | | $ | 4,700,482 | | | $ | 4,372,786 | | | $ | 1,392,801 | | | $ | 936 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets (liabilities) per Canadian GAAP | | $ | (1,031,226 | ) | | $ | (4,009,472 | ) | | $ | (24,376 | ) | | $ | (441,099 | ) | | $ | (237,950 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets (liabilities) per U.S. GAAP | | $ | (1,031,226 | ) | | $ | (3,161,013 | ) | | $ | 665,904 | | | $ | (590,697 | ) | | $ | (237,950 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Convertible debentures (current and long term portions) per U.S. GAAP) | | $ | 11,228 | | | $ | 5,389,387 | | | $ | 2,282,483 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash Dividends Declared per common shares, Canadian and U.S. GAAP | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Exchange Rates (CND to 1 USD) Period Average | | $ | 0.8969 | | | $ | 0.9708 | | | $ | 0.8789 | | | $ | 0.8385 | | | $ | 0.7842 | |

Exchange Rates (CDN to 1 USD) For the five most recent years ended March 31, calculated on the average of 12 month end closing days | |

| | | |

| March 31, 2009 | | $ | 0.8969 | |

| March 31, 2008 | | $ | 0.9708 | |

| March 31, 2007 | | $ | 0.8789 | |

| March 31, 2006 | | $ | 0.8385 | |

| March 31, 2005 | | $ | 0.7842 | |

ITEM 3. KEY INFORMATION - continued

SELECTED FINANCIAL DATA - continued

Exchange Rates (CDN to 1 USD) for six most recent months | | Period High | | | Period Low | |

| | | | | | | |

| | | | | | | |

| August 2009 | | $ | 0.9402 | | | $ | 0.8987 | |

| July 2009 | | $ | 0.9300 | | | $ | 0.8527 | |

| June 2009 | | $ | 0.9269 | | | $ | 0.8590 | |

| May 2009 | | $ | 0.9177 | | | $ | 0.8296 | |

| April 2009 | | $ | 0.8344 | | | $ | 0.7861 | |

| March 2009 | | $ | 0.8202 | | | $ | 0.7653 | |

Exchange Rate (CDN to 1 USD) September 15, 2009: $0.9283

CAPITALIZATION AND INDEBTEDNESS

Not Applicable.

REASONS FOR THE OFFER AND USE OF PROCEEDS

Not Applicable.

RISK FACTORS

Our business entails a significant degree of risk, and an investment in our securities should be considered highly speculative. An investment in our securities should only be undertaken by persons who can afford the loss of their entire investment. The following is a general description of material risks, which may adversely affect our business, our financial condition, including liquidity and profitability, and our results of operations, ultimately affecting the value of an investment in shares of our common stock.

GENERAL BUSINESS RISKS

We are a development stage company and based on our historical operating losses and negative cash flows from operating activities there is uncertainty as to our ability to continue as a going concern.

We have a history of operating losses and negative cash flows from operating activities, resulting in our continued dependence on external financing arrangements. In the event that we are unable to achieve or sustain profitability or are otherwise unable to secure additional external financing, we may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern. Any such inability to continue as a going concern may result in our security holders losing their entire investment. Our financial statements, which have been prepared in accordance with Canadian GAAP, contemplate that we will continue as a going concern and do not contain any adjustments that might result if we were unable to continue as a going concern. Changes in our operating plans, our existing and anticipated working capital needs, the acceleration or modification of our expansion plans, lower than anticipated revenues, increased expenses, potential acquisitions or other events will all affect our ability to continue as a going concern.

From inception, we have historically generated minimal revenues while sustaining substantial operating losses and we anticipate incurring continued operating losses and negative cash flows in the foreseeable future resulting in uncertainty of future profitability and limitation on our operations.

From inception, we have generated minimal revenues and experienced negative cash flows from operating losses. We anticipate continuing to incur such operating losses and negative cash flows in the foreseeable future, and to accumulate increasing deficits as we increase our expenditures for (i) technology, (ii) infrastructure, (iii) research and development, (iv) sales and marketing, (v) interest charges and expenses related to previous equity and debt financings, and (v) general business enhancements. Any increases in our operating expenses will require us to achieve significant revenue before we can attain profitability. In the event that we are unable to achieve profitability or raise sufficient funding to cover our losses, we may not be able to meet our obligations as they come due, raising substantial doubts as to our ability to continue as a going concern.

ITEM 3. KEY INFORMATION - continued

GENERAL BUSINESS RISKS - continued

We have historically had working capital shortages, even following significant financing transactions.

We have had working capital shortages in the past and, although we raised significant capital through debt and equity offerings, we have generated significant losses, which have impacted working capital. As of March 31, 2009, our balance sheet reflects a working capital deficit of $2,101,443. This condition has continued since the date of those financial statements, and we expect that these conditions will continue for the foreseeable future unless we are able to raise a substantial amount of additional financing. In view of the matters described herein, our ability to continue to pursue our plan of operations as described herein is dependent upon our ability to raise the capital necessary to meet our financial requirements on a continuing basis.

Based on our expected negative cash flow from operations and investing activities, we anticipate that we will not be able to positively impact our working capital unless we are able to generate revenues. The holders of US$1,323,000 of the Company's promissory notes may have a security interest in substantially all of our assets which could make it difficult for us to raise additional capital through the issuance of debt securities. If these promissory notes are not repaid by the end of their term at December 31, 2009, these notes revert to convertible debt instruments previously executed in July, 2008, whereunder the US$1,323,000 will then be convertible into shares of our common stock at a substantial discount to the market price and be secured by substantially all of our assets.

Our accumulated deficit makes it more difficult to borrow funds.

As of the year ended March 31, 2009, and as a result of historical operating losses from prior operations, we had a deficit from prior operations of $3,237,370, and a deficit of $42,173,129 from losses accumulated during our development stage resulting in a total accumulated deficit of $45,410,499. Lenders generally regard an accumulated deficit as a negative factor in assessing creditworthiness, and for this reason, the extent of our accumulated deficit, coupled with our historical operating losses will negatively impact our ability to borrow funds if and when required. Any inability to borrow funds, or a reduction in favorability of terms upon which we are able to borrow funds, including the amount available to us, the applicable interest rate and the collateralization required, may affect our ability to meet our obligations as they come due, and adversely affect on our business, financial condition, and results of operations, raising substantial doubts as to our ability to continue as a going concern.

Our debt arrangements include the provision of a secured interest in our assets and may make it more difficult to borrow funds, or default of debt provisions may impact our assets and ability to operate; certain unsecured debt instruments are due upon demand and may cause financial liquidity difficulties for the Company.

During July 2008, the Company undertook a US$2.428 million financing through the issuance of convertible debt instruments that provide the holder a secured interest in the Company’s assets. Effective, March 27, 2009 the Company settled this debt through the issuance of shares and a promissory note in the amount of US$1.323 million, should the note not be settled by its December 31, 2009 due date then the promissory note will revert back to the secured convertible note which it replaced. Therefore, should the Company default on material terms of the debt instrument, the lenders may be able to realize on their secured interest in our assets which would have a negative affect on our ability to operate and conduct our business raising substantial doubts as to our ability to continue as a going concern.

In addition, the Company has interest bearing promissory notes that are due upon demand. A demand by the debt holder of such debt securities could cause financial hardship, litigation, and other negative influence on the financial condition of the Company that could cause disruption to our operations.

Our having recently undergone a change in business direction and significant restructuring coupled with our limited experience as a publicly traded company with substantial operations in several different industries, may increase our expenses and place significant demands on our management.

From inception we have undergone several changes in business direction and consequently have previously had only limited operations. Our most recent change in business direction and significant restructuring may make it difficult to respond to our regulatory and reporting obligations, and could increase our general, administrative, legal and auditing costs and place substantial time demands on our management. We anticipate that, due to the increased complexity of our corporate structure and increased reporting and governance obligations, and our simultaneous pursuit of various product lines in different industries, our regulatory and reporting obligations will require further expenditures to train additional personnel and retain appropriate legal and accounting professional services. In the event that these expenditures precede, or are not subsequently followed by revenues, or that we are unable to raise sufficient funding to cover any increase in our expenses, we may not be able to meet our obligations as they come due, and our business, financial condition, and results of operations may be negatively affected, raising substantial doubts as to our ability to continue as a going concern.

ITEM 3. KEY INFORMATION - continued

GENERAL BUSINESS RISKS - continued

We identified material weaknesses in our disclosure controls and procedures and our internal control over financial reporting.

Section 404 of the Sarbanes-Oxley Act of 2002 requires management to assess our internal control over financial reporting (“ICFR”) pursuant to a defined framework. In making that assessment, management identified a material weakness in our disclosure controls as a result of several material weaknesses identified in our ICFR as described in Item 15T below. There are inherent limitations in the effectiveness of any system of internal control, and accordingly, even effective ICFR can provide only reasonable assurance with respect to financial statement preparation and may not prevent or detect misstatements. Material weaknesses make it more likely that a material misstatement of annual or interim financial statements will not be prevented or detected. In addition, effective ICFR at any point in time may become ineffective in future periods because of changes in conditions or deterioration in the degree of compliance with our established policies and procedures.

Lack of insurance coverage on fixed assets located in the United States

The Company recently cut back its operations in its US based research facilities. As a result, insurance has lapsed and further insurance quotations are in the process of being obtained. As at March 31, 2009, the Company had a book value of fixed assets located in the United States in the aggregate of approximately US$703,000, of which approximately 35% represents land. As a result, and until such time as the Company obtains adequate and comprehensive insurance on its fixed assets located in the United States, a significant loss in excess of US$450,000 could result due to fire, theft, or other perils, and general third party liability costs due to accidents or other loss could greatly exceed this amount. The Company maintains a high security anti-intruder fence around the perimeter of its US research facility with 24 hour computer controlled perimeter intrusion alarm.

Disruptions in the Global Financial and Capital Markets May Impact Our Ability to Obtain Financing.

The global financial and capital markets have been experiencing extreme volatility and disruption, including the failures of financial services companies and the related liquidity crisis. Although we expect to meet our near term liquidity needs with our working capital on hand and near term financing instruments, we will continue to need further funding to achieve our business objectives. In the past, the issuance of debt and equity securities has been the major source of capital and liquidity for us. The extraordinary conditions in the global financial and capital markets have currently limited the availability of this funding. If the disruptions in the global financial and capital markets continue, debt or equity financing may not be available to us on acceptable terms, if at all. If we are unable to fund future operations by way of financing, including public or private offerings of equity or debt securities, our business, financial condition and results of operations will be adversely impacted.

RISKS ASSOCIATED WITH OUR BUSINESSES AND INDUSTRIES

We face serious competition in our business segments from new market entrants as well as a number of established companies with greater resources and existing customer bases.

The markets for our potential products rapidly evolve and are intensely competitive as new products are regularly introduced. Competition in our market segments is based primarily upon:

| | • | brand name recognition; |

| | | |

| | • | Availability of financial resources; |

| | | |

| | • | the quality and efficiency of products; |

| | | |

| | • | reviews received for products from independent reviewers who publish in magazines, websites, newspapers and other industry publications; |

| | | |

| | • | Availability of access to markets; |

| | | |

| | • | the price of each product; and |

| | | |

| | • | the number of products then available. |

We face competition from other industrial manufacturers, all of whom could generally sell through the same combination of channels as we intend to.

ITEM 3. KEY INFORMATION - continued

RISKS ASSOCIATED WITH OUR BUSINESSES AND INDUSTRIES - continued

To remain competitive in the market for our products and potential products, we rely heavily upon what we believe to be our superior potential product quality, marketing and sales abilities, proprietary technology, product development capabilities and our management’s experience. However, we may not be able to effectively compete in these intensely competitive markets, as some of our competitors have longer operating histories, larger customer bases and greater financial, marketing, service, support, technical and other resources, affording them the ability to undertake more extensive marketing campaigns and adopt more aggressive pricing policies, than we can. Moreover, we believe that competition from new entrants will increase as the market for each of our potential products expands. If our potential product lines are not successful, our business, financial condition and results of operations will be negatively affected.

Our intellectual property may not be adequately protected from unauthorized use by others, which could increase our litigation costs and adversely affect our sales.

Our intellectual property assets/rights are some of the most important assets that we possess in our ability to generate revenues and profits and we will rely very significantly on these intellectual property assets in being able to effectively compete in our markets. However, our intellectual property rights may not provide meaningful protection from unauthorized use by others, which could result in an increase in competing products and a reduction in our own sales. Moreover, if we must pursue litigation in the future to enforce or otherwise protect our intellectual property rights, or to determine the validity and scope of the proprietary rights of others, we may not prevail and will likely have to make substantial expenditures and divert valuable resources in any case. We may not have adequate remedies if our proprietary content is appropriated or if our intellectual property does not adequately protect unauthorized use by others.

If our potential products infringe upon proprietary rights of others, lawsuits may be brought requiring us to pay large legal expenses and judgments and redesign or discontinue selling one or more of our potential products.

We are not aware of any circumstances under which our potential products infringe upon any valid existing proprietary rights of third parties. Infringement claims, however, could arise at any time, whether or not meritorious, and could result in costly litigation or require us to enter into royalty or licensing agreements. If we are found to have infringed the proprietary rights of others, we could be required to pay damages, redesign our potential products or discontinue their sale. Any of these outcomes, individually or collectively, would negatively affect our business, financial condition and results of operations.

If we are unable to successfully break into new markets, implement our growth strategy or manage our business as it does grow, our future operating results could suffer.

As a development stage company, we face several challenges in entering each of the industrial markets and consumer retail markets for our respective potential products, particularly consumers’ lack of awareness of our Company and our potential product lines, competing for market share with established consumer retail product manufacturers and difficulties in competing for, hiring and retaining representative personnel in each of our respective potential markets. In addition, we face several challenges common to any new market entrant, including problems typically associated with unfamiliarity of local market conditions and market demographics. Each new market we enter may also have different competitive conditions, consumer tastes and discretionary spending patterns, which may require us to adjust our growth strategy or modify the way in which we manage our business. To the extent that we are unable to break into or meet the challenges associated with establishing ourselves in a new market, our future operating results could suffer and our financial condition and business may be negatively affected.

Changes in consumer and industrial preferences or discretionary spending may negatively affect our future operating results.

Within the industrial/retail businesses and industries in which we intend to operate, revenues are largely generated by industrial and retail consumer preferences and discretionary spending. Our success as a potential manufacturer and retailer of consumer and industrial products will depend, in part, on the popularity of each of our potential product offerings. Any shift in consumer sentiment away from our potential product or industrial product lines could have a negative affect on our ability to achieve future profitability. Our success also depends on a number of factors affecting levels of consumer discretionary income and spending, including, the following, among other, social and economic conditions:

| | • | general business conditions; |

| | • | interest rates; |

| | • | inflation; |

| | • | consumer debt levels; |

| | • | the availability of consumer credit; |

| | • | taxation; |

| | • | fuel prices and electrical power rates; |

| | • | unemployment trends; |

| | • | natural disasters; |

| | • | terrorist attacks and acts of war; and |

| | • | other matters that influences consumer confidence and spending. |

ITEM 3. KEY INFORMATION - continued

RISKS ASSOCIATED WITH OUR BUSINESSES AND INDUSTRIES - continued

Consumer and end user purchases of discretionary items, including our potential products and product lines, could decline during periods in which discretionary income is lower or actual or perceived unfavorable economic conditions exist. Should this occur, and if we are unable to introduce new products and product lines that consumers find appealing, our business, financial condition and results of operations will be negatively affected.

We may be subject to adverse publicity or claims by consumers arising out of use of our potential product lines.

We may be subject to complaints from or litigation by consumers, whether or not meritorious, relating to quality, health, efficiency, efficacy, or operational aspects of our potential consumer and industrial product lines including environmental impacts. Such claims could arise at any time and, should they arise, we may not be successful in defending them. Any litigation, regardless of the outcome, would entail significant costs and use of management time, which could impair our ability to generate revenue and profit. For these reasons or, should we be found liable with regard to a claim arising out of any of our potential product lines, our business, financial condition, and results of operations would be negatively affected.

We face substantial competition in attracting and retaining qualified senior management and key personnel and may be unable to develop and grow our business if we cannot attract and retain senior management and key personnel as necessary, or if we were to lose our existing senior management and key personnel.

As a development stage company, our success, to a large extent, depends upon our ability to attract, hire and retain highly qualified and knowledgeable senior management and key personnel who possess the skills and experience necessary to satisfy our business and client service needs. Our ability to attract and retain such senior management and key personnel will depend on numerous factors, including our ability to offer salaries, benefits and professional growth opportunities that are comparable with and competitive to those offered by more established consumer retail product manufacturers and industrial product manufacturers. We may be required to invest significant time and resources in attracting and retaining, as necessary, additional senior management and key personnel, and many of the companies with which we will compete for any such individuals have greater financial and other resources which afford them the ability to undertake more extensive and aggressive hiring campaigns than we can. Furthermore, an important component to the overall compensation offered to our senior management and key personnel will be equity. If our stock prices do not appreciate over time, it may be difficult for us to attract and retain senior management and key personnel. Moreover, should we lose any member of our senior management or key personnel, we may be unable to prevent the unauthorized disclosure or use of our trade secrets, including our technical knowledge, practices, procedures or client lists by such individuals. The normal running of our operations may be interrupted, and our financial condition and results of operations negatively affected as a result of any inability on our part to attract or retain the services of qualified and experienced senior management and key personnel. If any member of our existing senior management or key personnel left and a suitable replacement was not found, or should any of our former senior management or key personnel disclose our trade secrets, the normal running of our operation may be negatively interrupted.

There is no certainty that our key projects will be operationally successful or profitable.

We are highly dependent upon the success of both our algae technology project and its high density vertical growth system commercialization as well as our VerticropTM plant growing system and its commercialization. The risks associated with the replication of laboratory results or prototype tests in the larger scale demonstration projects and commercialization projects is critical to the Company. We believe that much research and development will be required regarding our algae technology joint venture project to create future anticipated products. If the expected results can not be replicated on a commercial scale, the expected revenue from these ventures will not be realized and the investment in these pilot projects is unlikely to be recovered. This would have a very material adverse effect on the Company’s financial results.

There is no certainty that our key projects will be operationally successful or profitable.

We are highly dependent upon the success of our algae technology project and our VerticropTM plant growing system. Although we are optimistic that there is a large amount of interest for these technologies, if that demand does not materialize to the extent that we project or we are not successful in promoting and distributing our technology, this will have a material adverse effect on the Company’s financial results.

RISKS ASSOCIATED WITH AN INVESTMENT IN OUR COMMON STOCK

Unless an active trading market develops for our securities, you may not be able to sell your shares.

Although, we are a reporting company and our common shares are listed on the OTC Bulletin Board (owned and operated by the Nasdaq Stock Market, Inc.) under the symbol “VCTZF”, currently, there is only a limited trading market for our common stock and a more active trading market may never develop or, if it does develop, may not be maintained. Failure to develop or maintain an active trading market will have a generally negative affect on the price of our common stock, and you may be unable to sell your common stock or any attempted sale of such common stock may have the affect of lowering the market price and therefore your investment could be a partial or complete loss.

ITEM 3. KEY INFORMATION - continued

RISKS ASSOCIATED WITH AN INVESTMENT IN OUR COMMON STOCK - continued

Under certain circumstances, some of our outstanding common stock purchase warrants may be exercised without our receiving any cash.

As at March 31, 2009, we have outstanding warrants to purchase up to approximately 1,149,516 shares of our common stock, most of which are exercisable on a “net cashless” basis, which means they can be exercised, without payment of the stated exercise price, solely in exchange for cancellation of some number of common shares into which the warrants are exercisable. The number of shares for which any such warrant would be cancelled under a net cashless exercise would be the number of shares having a then current market value equal to the aggregate exercise price of the warrant, in whole or in part, based on its stated exercise price. In effect, a net cashless exercise of any such warrants would mean that, even though we would receive no cash, we would have to issue additional shares, thereby diluting, potentially significantly, our reportable earnings per share. Although the circumstances under which the net cashless exercise provision may be elected by the holders of our warrants may be limited, any such exercise could have a negative affect, directly or indirectly, on the trading market price of our common stock.

Since our common stock is thinly traded it is more susceptible to extreme rises or declines in price, and you may not be able to sell your shares at or above the price paid.

Since our common stock is thinly traded its trading price is likely to be highly volatile and could be subject to extreme fluctuations in response to various factors, many of which are beyond our control, including:

| | • | the trading volume of our shares; |

| | • | the number of securities analysts, market-makers and brokers following our common stock; |

| | • | changes in, or failure to achieve, financial estimates by securities analysts; |

| | • | new products introduced or announced by us or our competitors; |

| | • | announcements of technological innovations by us or our competitors; |

| | • | actual or anticipated variations in quarterly operating results; |

| | • | conditions or trends in our business industries; |

| | • | announcements by us of significant acquisitions, strategic partnerships, joint ventures or capital commitments; |

| | • | additions or departures of key personnel; |

| | • | sales of our common stock; and |

| | • | general stock market price and volume fluctuations of publicly-traded, and particularly microcap, companies. |

You may have difficulty reselling shares of our common stock, either at or above the price you paid, or even at fair market value. The stock markets often experience significant price and volume changes that are not related to the operating performance of individual companies, and because our common stock is thinly traded it is particularly susceptible to such changes. These broad market changes may cause the market price of our common stock to decline regardless of how well we perform as a company. In addition, securities class action litigation has often been initiated following periods of volatility in the market price of a company’s securities. A securities class action suit against us could result in substantial legal fees, potential liabilities and the diversion of management’s attention and resources from our business. Moreover, and as noted below, our shares are currently traded on the OTC Bulletin Board and, further, are subject to the penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to manipulation by market-makers, short-sellers and option traders.

Our common stock is subject to the “penny stock” regulations, which are likely to make it more difficult to sell.

Our common stock is considered a “penny stock,” which generally is a stock trading under US$5.00 and not registered on a national securities exchange. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. These rules generally have the result of reducing trading in such stocks, restricting the pool of potential investors for such stocks, and making it more difficult for investors to sell their shares once acquired. Prior to a transaction in a penny stock, a broker-dealer is required to:

| | • | deliver to a prospective investor a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market; |

| | • | provide the prospective investor with current bid and ask quotations for the penny stock; |

| | • | explain to the prospective investor the compensation of the broker-dealer and its salesperson in the transaction; |

| | • | provide investors monthly account statements showing the market value of each penny stock held in their account; and |

| | • | make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. |

ITEM 3. KEY INFORMATION - continued

RISKS ASSOCIATED WITH AN INVESTMENT IN OUR COMMON STOCK - continued

These requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that is subject to the penny stock rules. Since our common stock is subject to the penny stock rules, investors in our common stock may find it more difficult to sell their shares.

We are a Canadian Company, and must ensure compliance with Canadian as well as American securities laws. As a result, there may be securities regulations in the jurisdiction where our shareholders are resident that must be met, and such regulations may impact the ability of our shareholders to trade our securities.

As a foreign private issuer, we are exempt from certain informational requirements of the Exchange Act to which domestic United States issuers are subject.

As a foreign private issuer we are not required to comply with all of the informational requirements of the Exchange Act. As a result, there may be less information concerning our Company publicly available than if we were a domestic United States issuer. In addition, our officers, directors and principal shareholders are exempt from the reporting and short profit provisions of Section 16 of the Exchange Act and the rules promulgated thereunder. Therefore, our shareholders may not know on a timely basis when our officers, directors and principal shareholders purchase or sell shares of our common stock. See “Additional Information”.

As we are a Canadian company with much of our assets and key personnel located outside of the United States, you may have difficulty in acquiring United States jurisdiction or enforcing a United States judgment against us, our key personnel or our assets.

We are a Canadian company organized under the Business Corporations Act (Alberta). Many of our assets and certain of our key personnel, including our directors and officers, reside outside of the United States. As a result, it may be difficult or impossible for you to effect service of process within the United States upon us or any of our key personnel, or to enforce against us or any of our key personnel judgments obtained in United States’ courts, including judgments relating to United States federal securities laws. In addition, Canadian courts may not permit you to bring an original action in Canada or recognize or enforce judgments of United States’ courts obtained against us predicated upon the civil liability provisions of the federal securities laws of the United States or of any state thereof. Accordingly, you may have more difficulty in protecting your interests in the face of actions taken by our management, members of our board of directors or our controlling shareholders than you would otherwise as shareholder in a United States public company.

We do not intend to pay any common stock dividends in the foreseeable future.

We have never declared or paid a dividend on our common stock and, because we have very limited resources and a substantial accumulated deficit, we do not anticipate declaring or paying any dividends on our common stock in the foreseeable future. Rather, we intend to retain earnings, if any, for the continued operation and expansion of our business. It is unlikely, therefore, that the holders of our common stock will have an opportunity to profit from anything other than potential appreciation in the value of our common shares held by them. If you require dividend income, you should not rely on an investment in our common stock. See “Dividend Policy”.

Future issuances of our common stock may depress our stock price and dilute your interest. We have US$1,323,000 in promissory notes outstanding that if not repaid by December 31, 2009, revert to convertible debt instruments convertible into common shares at a significant discount to the trading market.

There are existing promissory notes in the amount of US$1,323,000 as at March 31, 2009, that if unpaid at December 31, 2009, that may be converted into an unknown number of shares causing shareholder dilution. At current market prices at the date of this annual report, this may result in at least 2 million shares to be issued if the notes are fully converted. If the promissory notes revert to convertible notes, the convertible notes have provisions that are dilutive and impose significant restriction on our ability to issue additional securities as these notes have equity conversion privileges that allow a 30%+ conversion to the then trading market at the date of conversion allowing at any date an unknown amount of shares to be issued in exchange for the conversion of principal, and accrued interest. In addition, other provisions of some of these convertible securities limit or “cap” the exercise price at US$0.40 per share limiting the decrease in conversion equity to be issued in the event that our share price increases in the trading market. As a result, a significant risk relates to the shareholder dilution that may be experienced in consequence with securities issued and those that might be issued in the future.

As at March 31, 2009, we have outstanding warrants to purchase up to approximately 1,149,516 shares of our common stock.

We may issue additional shares of our common stock in future financings or grant stock options to our employees, officers, directors and consultants under our stock option plan. Any such issuances could have the affect of depressing the market price of our common stock and, in any case, would dilute the percentage ownership interests in our Company by our shareholders. In addition, we could issue serial preferred stock having rights, preferences and privileges senior to those of our common stock, including the right to receive dividends and/or preferences upon liquidation, dissolution or winding-up in excess of, or prior to, the rights of the holders of our common stock. This could depress the value of our common stock and could reduce or eliminate amounts that would otherwise have been available to pay dividends on our common stock (which are unlikely in any case) or to make distributions on liquidation.

ITEM 3. KEY INFORMATION - continued

RISKS ASSOCIATED WITH AN INVESTMENT IN OUR COMMON STOCK - continued

Additionally, if possible under terms that we believe to be appropriate given our financial condition and other circumstances, we will likely seek to raise additional financing during our fiscal year ending March 31, 2010. We may also issue additional shares, options, and warrants to obtain necessary services.

Some of the issuances we have made in the past, and are likely to make in the future, have been issued at prices below market and at prices below our historical market prices. Consequently, our shareholders have suffered dilution in the value of their shares and can expect that we will be issuing additional securities on similar terms. Further dilution can be expected to occur when our outstanding options and warrants are exercised or debentures are converted at prices below the market.

Future releases from voluntary lock up arrangements of our common stock may depress our stock price

An aggregate of US $10,806,780 of debt was settled on March 29, 2009 in exchange for 29,516,951 common shares issued on May 11, 2009. Included in these shares are 24,232,816 common shares which are subject to lock up restrictions with quarterly equal releases beginning on January 1, 2010, and a further 2,634,135 common shares are subject to lock up restrictions until January 1, 2010. Releases from lock up will increase supply of shares tradable and may depress the market price of our common shares trading in the market. See ITEM 4. INFORMATION ON THE COMPANY.

ITEM 4. INFORMATION ON THE COMPANY

Corporate History

We were incorporated in accordance with the provisions of the Business Corporations Act (Alberta) on January 19, 1996, as 681673 Alberta Ltd., later changed to Ironclad Systems Inc. Beginning in 1996, following the completion of a public offering, our common shares began trading as a junior capital pool company on the Alberta Stock Exchange (later becoming part of the Canadian Venture Exchange, which was thereafter acquired and renamed the TSX Venture Exchange).

On May 8, 1999, while still operating our bicycle rental and eco-tour businesses through Bikestar Rentals Inc., we incorporated Nettron Media Group Inc., a wholly-owned subsidiary under the laws of the State of Texas, as a marketing enterprise focusing on products and services that could be effectively marketed through internet as well as more traditional business channels. Nettron Media Group Inc.’s primary focus was Cupid’s Web, an interactive online dating and marketing service. We also changed our name from Bikestar Rentals Inc. to AdventurX.com, Inc., and later to Nettron.com, Inc.

In 2000, and in connection with Cupid’s Web, we signed an agreement in principle to acquire all of the outstanding capital stock of a group of companies operating a worldwide dating service franchise, as well as a collection of dating magazines and websites.

On January 1, 2001, in order to fully focus on our interactive dating and marketing services, we disposed of all of the outstanding capital stock of Arizona Outback Adventures LLC and Bikestar Rentals Inc.

On February 18, 2002, due to general weakness in the equity markets, we terminated the agreement in principle to acquire the dating service franchise and related businesses originally entered into in 2000. On March 24, 2004, we disposed of our interest in Nettron Media Group Inc. and began exploring business opportunities that might allow us to restart commercial operations.

By certificate of amendment dated April 15, 2005, we changed our name from Nettron.com, Inc. to Valcent Products Inc. to reflect a newly adopted business plan. On May 3, 2005 we delisted our common stock from the TSX Venture Exchange, maintaining only our OTC Bulletin Board listing and changing our symbol to “VCTPF”. Effective May 3, 2005, and in order to render our capital structure more amenable to contemplated financing, we effected a consolidation of our common shares on a one-for-three-basis.

On August 5, 2005, we completed a licensing agreement with Pagic LLP, formerly MK Enterprises LLC, (“Pagic”) for the exclusive worldwide marketing rights to certain potential products and a right of first offer on future potential products.

In order to facilitate the business plan, the Company formed a wholly-owned Nevada corporation, Valcent USA, Inc. to conduct operations in the United States in October 2005. In turn, Valcent USA, Inc. organized Valcent Management, LLC, a wholly-owned limited liability corporation under the laws of Nevada, to serve as the general partner in Valcent Manufacturing Ltd., a limited partnership also formed by Valcent USA, Inc., under the laws of Texas, wherein Valcent USA, Inc. serves as its limited partner.

Also during the year ended March 31, 2007, Valcent Products EU Limited (“Valcent EU”) was incorporated by Valcent Products Inc. in the domicile of England to conduct operations in Europe.

ITEM 4. INFORMATION ON THE COMPANY - continued

Corporate History - continued

On May 5, 2008, Valcent Vertigro Algae Technologies LLC, a Texas limited liability corporation, was formed as a 50% owned subsidiary to each of Valcent, USA Inc. and Global Green Solutions Inc. to develop algae related technologies.

The shareholders of the Company approved a special resolution on June 22, 2009 to reorganize the capital structure of the Company through a share consolidation of its common shares on the basis of one new share for each eighteen (1:18) old shares. This share consolidation became effective July 16, 2009. Also effective July 16, 2009 our trading symbol changed to “VCTZF” and our CUSIP number changed to 918881202. Unless otherwise noted, all references to the number of common shares and or prices(s) per share are stated on a post-consolidation basis.

We are, at present, a development stage company focused primarily on:

| | (i) | the development and commercialization of our “High Density Vertical Growth System” (“VerticropTM” or “HDVG System”) designed to produce vegetables and other plant crops, |

| | (ii) | the development of a commercial algae growing technology via Vertigro Algae with Global Green, and |

| | (iii) | the development and marketing of the Tomorrow GardenTM consumer retail product in our UK based subsidiary. |

From inception, we have generated minimal revenues and experienced negative cash flows from operating activities and our history of losses has resulted in our continued dependence on external financing. Any inability to achieve or sustain profitability or otherwise secure additional external financing, will negatively impact our financial condition and raises substantial doubts as to our ability to continue as a going concern.

Organizational Structure

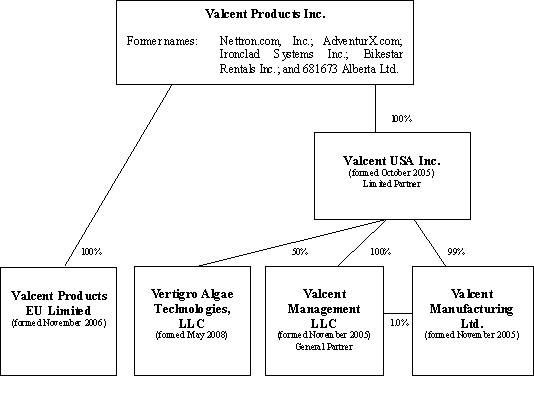

The following organizational chart sets forth our current corporate structure and reflects subsidiary interests relating to our various entities.

Valcent Products Inc., Alberta, Canada is the direct and or indirect parent corporation to the following:

Valcent USA Inc., Nevada, USA – 100%

Valcent Management LLC, Nevada, USA – 100%

Valcent Manufacturing Ltd., Texas, USA – 100%

Valcent Products EU Limited, UK – 100%

Vertigro Algae Technologies LLC, Texas, USA – 50%

ITEM 4. INFORMATION ON THE COMPANY - continued

Organizational Structure - continued

Valcent Products, Inc. formed a wholly-owned Nevada corporation, Valcent USA, Inc. to conduct operations in the United States in November 2006. In turn, Valcent USA, Inc. formed Valcent Management, LLC, as a wholly-owned limited liability corporation under the laws of Nevada, to serve as the general partner in Valcent Manufacturing Ltd., a limited partnership also formed by Valcent USA, Inc., under the laws of Texas, wherein Valcent USA, Inc. serves as its limited partner. Valcent Products EU Limited was incorporated by Valcent Products Inc. in the domicile of England to conduct future anticipated operations in Europe. Vertigro Algae Technologies, LLC, a Texas Limited Liability Corporation was formed as a 50% owned subsidiary to each of Valcent, USA Inc. and Global Green to develop algae related technologies.

Business Overview

Original Master License Agreements - On July 29, 2005, we entered into five related definitive agreements (the “Pagic Agreements”) with Pagic LP (formerly MK Enterprises LLC), an entity controlled by Malcolm Glen Kertz, our former Chief Executive Officer, and President, including:

| | (i) | a master license agreement for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to three unrelated and proprietary potential consumer retail products that had previously been developed (the “Pagic Master License”), certain of which are patent pending by Pagic, including the Nova Skin Care System, the Dust WolfTM, and the Tomorrow GardenTM Kit (collectively, and together with any improvements thereon, the “Initial Products”); |

| | (ii) | the Pagic Master License also included a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any ancillary products developed and sold for use by consumers in connection with the Initial Products (the “Initial Ancillaries”); |

| | (iii) | a product development agreement pursuant to which we were granted a right for an initial period of five years to acquire a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any new products developed by Pagic (any such products, collectively, the “Additional Products”, and, the agreement itself, the “Pagic Product Development Agreement”); |

| | (iv) | the Pagic Product Development Agreement also included a license for a term continuing so long as royalty payments continue to be made as required for the exclusive worldwide marketing and distribution rights to any ancillary products developed and sold for use by consumers in connection with the Additional Products (the “Additional Ancillaries”); and |

| | (v) | a related services agreement pursuant to which Pagic shall provide consulting support in connection with the Initial Products, the Initial Ancillaries, the Additional Products and the Additional Ancillaries (the “Pagic Consulting Agreement”), in exchange for the following: |

| | 1) | 1,111,112 shares of our common stock which have been issued; |

| | 2) | a one-time US$125,000 license fee (paid); |

| | 3) | reimbursement for US$125,000 in development costs associated with each of the Initial Products since March 17, 2005 (paid); |

| | 4) | consulting fees of US$156,000 per year, payable monthly in advance, which the Company has paid to date; and |

| | 5) | the greater of the following, payable annually beginning in the second license year (beginning April 1, 2007): |

(i) US$400,000 inclusive of all consulting fees, royalty and other fees; or

(ii) the aggregate of the following:

a minimum amount of US$37,500 per Initial Product during the second year of the Pagic Master License, and $50,000 US$ each year thereafter, continuing royalties payable quarterly at a rate of:

| | Ø | US$10.00 US per Nova Skin Care System unit sold; |

| | Ø | US$2.00 per Dust WolfTM unit sold; |

| | Ø | 4.5% of annual net sales of the Tomorrow GardenTM Kit; and |

| | Ø | 3% of annual net sales of Initial Ancillaries. |

| | 6) | a one-time $50,000 US license fee for each Additional Product licensed (except for one pre-identified product); and |

ITEM 4. INFORMATION ON THE COMPANY - continued

Business Overview - continued

| | 7) | subject to a minimum amount of US$50,000 per year commencing with the second year of each corresponding license, continuing royalties of 4.5% of annual net sales and 3% on annual net sales of any Additional Ancillaries. |

As described below these agreements were terminated effective April 1, 2009.

Joint Venture of Algae Related Business Operations - Beginning on October 2, 2006, we granted certain rights to Global Green relating to our joint venture of our high density vertical bio-reactor technology named “Vertigro”, an algae biomass technology initiative. Refer to “PLAN OF OPERATIONS, “High Density Vertical Bio-Reactor and Global Green Joint Venture”, and “Technology License Agreement” between Pagic LP, West Peak Ventures of Canada Ltd. (“West Peak”), and Valcent Products, Inc.

Algae Technology License - On May 5, 2008, the joint venture arrangement pertaining to the development of the algae biomass technology initiative was terminated and Vertigro Algae executed a separate Technology License Agreement (“Technology License”) together with Pagic, and West Peak. The Technology License licenses certain algae biomass technology and intellectual property to Vertigro Algae for purposes of commercialization and exploitation for all industrial, commercial, and retail applications worldwide “Algae Biomass Technology”.

Discontinued Product Development Lines and Settlement of Licensed Technologies - Of the Initial Products under license as defined above, the Company ceased development of Dust Wolf and Nova Skin Care Systems during the year ended March 31, 2009 due to economic conditions, and increased corporate focus on life sciences plant growth technologies. The Company has continued with Tomorrow Garden product development and commercialization though the VerticropTM Technology Purchase Agreement.

VerticropTM Technology Purchase Agreement - Effective April 1, 2009, the Company executed a purchase agreement to acquire all ownership rights and intellectual property relating to its VerticropTM vertical plant growing technology and Tomorrow Garden kit technology (the “Technologies”) from Glen Kertz, Pagic, and West Peak and which provides the Company with all rights and know how to the Technologies (the “Purchase Agreement”). Pursuant to this agreement original master license agreements between the Company and Pagic were terminated and this agreement replaced all financial obligations the Company had with Pagic related to the original master license agreements, including annual payments, royalty burden, and all other associated licensing costs. As noted above, all agreement related to the Algae Biomass Technology are with Vertigro Algae and as such survive the termination of all other agreements.

Pursuant to the Purchase Agreement, the Company agreed to pay a total of US$2,000,000 plus issue 3% of its common stock on conclusion of the purchase agreement. The US$2,000,000 is payable on a cumulative basis as to US$65,000 on signing (paid) plus the greater of 3% of the gross monthly product sales less returns from exploitation of the technologies or US$12,000 per month until US$2,000,000 has been paid. The ownership of the Technologies will remain in escrow until fully paid or if the Company defaults in making payments. The issuance of the 3% of its common stock is payable upon release of the Technologies from escrow to the Company. The Company may at any time elect to pay out the remaining balance due. Should the Company default under this agreement the Technologies will revert back to Glen Kertz and Pagic and the Company’s obligations under the Purchase Agreement will cease. The Company expenses amounts paid under the Purchase Agreement.

PLAN OF OPERATIONS

From inception we have generated minimal revenues from our business operations and have traditionally met our ongoing obligations by raising capital through external sources of financing, such as convertible notes, promissory notes and director and shareholder advances.

At present, we do not believe that our current financial resources are sufficient to meet our working capital needs in the near term or over the next twelve months and, accordingly, we will need to secure additional external financing to continue our operations. We anticipate raising additional capital though further private equity or debt financings and shareholder loans. If we are unable to secure such additional external financing, we may not be able to meet our obligations as they come due or to fully implement our intended plan of operations, as set forth below, raising substantial doubts as to our ability to continue as a going concern.

In addition, during the year ended March 31, 2009 we reduced staffing at our El Paso offices and research facility, transferring our primary development directives previously located in the United States to our UK offices.

Our plan of operations over the course of the next twelve months, subject to adequate financing, is to focus primarily on the continued development and marketing of our VerticropTM vertical plant growing systems, development and distribution of our lines of potential consumer retail Tomorrow Garden products, and the development of our high density vertical algae growth technology.

ITEM 4. INFORMATION ON THE COMPANY - continued

PLAN OF OPERATIONS - continued

Chris Bradford, our Managing Director, of Valcent EU, is responsible for UK business operations and the Company’s “Tomorrow GardenTM” retail plant sales initiative, as well as development of European based VerticropTM market development and sales rollout.

More specifically, our plan of operations with respect to each of our lines of potential retail and commercial products is provided as follows:

Vertigro Algae and the Algae High Density Vertical Bio-Reactor Technology

We are in the development stages of creating technology for a High Density Vertical Bio-Reactor (“Vertigro Project”). The objective of this technology is to produce algae related source products by utilizing the waste gas of carbon dioxide capable of growing micro-algae. Our High Density Vertical Bio-Reactor is configured in a manner intended to promote the rapid growth of various forms of micro-algae which is later processed to remove volatile oils suitable for the production of fuels, and/or other target products for commerce and industry. The design of our technology allows the reactors to be stacked on a smaller foot print of land than traditional growing methods require. We believe secondary potential markets for this technology include industrial, commercial and manufacturing businesses that produce carbon dioxide emissions. Technology development is ongoing and subject to adequate budgets for product development.

On May 5, 2008, the Company and Global Green concurrently organized Vertigro Algae and entered into an operating agreement (“Operating Agreement”). Pursuant to the Operating Agreement, Global Green and the Company each hold a 50% interest in Vertigro Algae and have committed to fund project development costs according to ownership allocation. Global Green will receive 70% of the net cash flow generated by Vertigro Algae until it has received US$3,000,000 in excess of its 50% interest in such cash flow and then thereafter it will be split equally.

Also on May 5, 2008, Vertigro Algae executed a Technology License Agreement (“Technology License”) together with Pagic and West Peak. The Technology License licenses certain algae biomass technology and intellectual property to Vertigro Algae for purposes of commercialization and exploitation for all industrial, commercial, and retail applications worldwide (“Algae Biomass Technology”). As consideration for the Technology License, the Company and Global Green agreed to issue 16,6667 common shares and 300,000 common shares respectively, to Pagic and also pay a one-time commercialization fee of US$50,000 upon the Algae Biomass Technology achieving commercial viability. The Technology License is subject to royalty of 4.5% of gross customer sales receipts for use of the Algae Biomass Technology and aggregate annual royalty minimum amounts of US$50,000 in 2009, US$100,000 in 2010 and US$250,000 in 2011 and each year thereafter in which the Technology License is effective. The Company issued the 16,667 common shares to Pagic on August 18, 2008 at a fair value of $190,746 which has been expensed to product development and has accrued and paid in full via equity debt settlement its share of the US$50,000 payment due on March 31, 2009.

As a result of economic conditions, the Company significantly reduced its staff at its El Paso research facility during the year ended March 31, 2009. The Company is currently negotiating for the continued development of the Company’s algae programs with certain universities.

Competition - High Density Vertical Bio-Reactor

The Company has many competitors attempting to create vegetable oils from algae utilizing a number of innovative technologies. For our algae based products, we depend on our scientific and engineering teams, and patent protection on those technologies and processes, product development capabilities, and our management’s experience to compete within the algae biofuels market segments. We may not be able to effectively compete in these intensely competitive markets. Moreover, some of our competitors have longer operating histories, greater financial resources, greater research and development support infrastructure, and technical and other resources. Furthermore, we believe that competition from new entrants will increase as the demand for green technologies and continues to increase worldwide. A partial list of competitors in the algae technology space follows:

| | · | Greenfuel Technologies Corporation |

| | · | Aquaflow Bionomic Corporation |

| | · | LiveFuels Inc. |

| | · | Green Star Products, Inc. |

| | · | Solazyme, Inc. |

| | · | Aurora BioFuels, Inc. |

| | · | Seambiotic Ltd. |

| | · | Royal Dutch Shell and HR Biopetroleum |

| | · | PetroSun Inc. |

| | · | International Energy, Inc. |

| | · | AlgoDyne |

| | · | Circle Biodiesel & Ethanol Corporation |

ITEM 4. INFORMATION ON THE COMPANY - continued

PLAN OF OPERATIONS - continued

VerticropTM Commercial Plant Growth Systems

Valcent Products Inc. has also introduced the “VerticropTM” HDVG System intended to grow a wide variety of crop products. The Company initially began experimenting with vegetable crops utilizing the growing system within its greenhouse production facilities in El Paso, Texas, however, during the year ended March 31, 2009 the Company’s development efforts shifted to Valcent EU where it has conducted detailed research and subsequently developed commercial scale growing systems.

HDVG System Technology – Concept and Advantages: The HDVG System technology provides a solution to rapidly increasing food costs caused by transportation/fuel due to the cost of oil. Together with higher cost comes a reduction in availability and nutritional values in the food people consume. The HDVG system is designed to grow vegetables and other plants much more efficiently and with greater food value than in agricultural field conditions.

As the world population increases, agricultural land and water resources rapidly diminish. Alternative and innovative solutions have to be found to feed people and reduce the consumption of water, land, energy, and food miles.

VerticropTM is an innovative and exciting vertical growing system which:

| | · | Produces up to 20 times the normal production volume for field crops |

| | · | Requires approximately 5% of the normal water requirements for field crops |

| | · | Can be built on non arable lands and close to major city markets |

| | · | Can work in a variety of environments: urban, suburban, countryside, etc. |

| | · | Minimizes or eliminates the need for herbicides and insecticides |