Hillman Capital Management Investment Trust

116 South Franklin Street

Post Office Box 69

Rocky Mount, North Carolina 27802-0069

252-972-9922

January 25, 2010

VIA EDGAR

==========

Securities and Exchange Commission

Filing Desk

100 F Street, N.E.

Washington, DC 20549

| RE: | Hillman Capital Management Investment Trust (“Trust”) (File Nos. 333-44568 and 811-10085) on behalf of The Hillman Focused Advantage Fund and The Hillman Advantage Equity Fund (“Funds”), each a series of the Trust | |

Ladies and Gentlemen:

At the request of Ms. Patsy W. Mengiste of the Division of Investment Management of the Commission, this letter is being submitted to the Securities and Exchange Commission as correspondence. This letter is in response to oral comments received from Ms. Mengiste on January 7, 2010 in connection with the review of Post-Effective Amendment No. 12 to the Trust’s Registration Statement on Form N-1A filed electronically November 27, 2009. These comments address the prospectuses and statement of additional information for the Funds. Set forth below is a summary of Ms. Mengiste’s oral comments and the Trust’s responses thereto.

| 1. | Comment: On the cover pages of the prospectuses, remove the following sentence: “This prospectus includes information about the two Hillman Capital Management Funds – The Hillman Focused Advantage Fund and The Hillman Advantage Equity Fund (each a “Fund” and, collectively, the “Funds”).” |

Response: The sentence will be removed and the cover pages will appear similar in form to Exhibit A of this letter.

| 2. | Comment: In the summary section of the prospectuses under “Fees and Expenses of the Funds,” remove the footnote that appears beneath the fee table that reads as follows: “‘Other Expenses’ and ‘Total Annual Fund Operating Expenses’ reflect expenses of the Fund as of the fiscal year ended September 30, 2009. These expenses include expenses incurred indirectly as a result of investments in other funds (‘Acquired Fund Fees and Expenses’). For this period, the Acquired Fund Fees and Expenses were less than 0.01%.” |

Response: The footnote will be removed and the section of the prospectuses entitled “Fees and Expenses of the Funds” will appear similar in form to Exhibit B of this letter.

| 3. | Comment: Given that The Hillman Focused Advantage Fund may focus investments in one or more particular sectors of the economy, ensure that any policy to concentrate investments in a particular industry or group of industries is disclosed in the prospectuses under “Principal Investment Strategies.” |

Response: The second sentence in the last paragraph under the “Principal Investment Strategies” section will be modified to read as follows: “From time to time, the Fund may also focus the Fund’s assets in securities of one or more particular sectors of the economy and may at times invest more than 25% of the Fund’s net assets in a particular sector, such as the financial, healthcare, retail, or technology sectors.”

| 4. | Comment: In the summary section of the prospectuses under “Performance Information,” present the information that follows the risk/return bar chart in a tabular format. |

Response: The information that follows the risk/return bar chart will be presented in a tabular format and the section of the prospectuses entitled “Performance Information” will appear similar in form to Exhibit C of this letter.

| 5. | Comment: In the summary section of the prospectuses under “Purchase and Sales of Fund Shares,” change the reference to “additional investment” to “subsequent investment.” |

Response: The reference to “additional investment” will be revised to read “subsequent investment” and the section of the prospectuses entitled “Purchase and Sales of Fund Shares” will appear similar in form to Exhibit D of this letter.

| 6. | Comment: In light of the differences in the Fund’s investment objectives, enhance the disclosure in the prospectuses under “Principal Investment Strategies” to make clear the distinguishing characteristics of each Fund’s investment strategy. |

Response: In the section of the prospectuses under “Principal Investment Strategies,” the description of the quantitative measures used to select portfolio securities will be revised and an additional measure will be included for the Hillman Advantage Equity Fund in order to address the current income component of the Fund’s investment objective. The disclosure will appear similar in form to Exhibit E of this letter.

| 7. | Comment: In the summary section of the prospectuses under “Management,” remove the references to the Class A and Class C Shares. |

Response: The references to the Class A and Class C Shares will be removed and the section of the prospectuses entitled “Management” will appear similar in form to Exhibit F of this letter.

Notwithstanding the Staff’s comments, the Trust acknowledges that:

| 1. | Should the Commission or the Staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing; |

| 2. | The action of the Commission or the Staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the Trust from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and |

| 3. | The Trust may not assert this action as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions or comments, please contact the undersigned at (252) 972-9922, extension 249. Thank you for your consideration.

Sincerely,

Hillman Capital Management Investment Trust

/s/ A. Vason Hamrick

A. Vason Hamrick

Secretary and Assistant Treasurer

| cc: | Patsy Mengiste Division of Investment Management Securities and Exchange Commission |

Jeffrey T. Skinner

Kilpatrick Stockton LLP

1001 West Fourth Street

Winston-Salem, North Carolina 27101

Exhibit A

The Hillman Focused Advantage Fund – CUSIP Number 43162P108, NASDAQ Symbol HCMAX

The Hillman Advantage Equity Fund – CUSIP Number 43162P207, NASDAQ Symbol HCMTX

HILLMAN CAPITAL MANAGEMENT FUNDS

Each a series of the

Hillman Capital Management Investment Trust

NO LOAD SHARES

PROSPECTUS

January 28, 2010

The Hillman Focused Advantage Fund and The Hillman Advantage Equity Fund seek long-term capital appreciation. This prospectus relates to the No Load Shares offered by the Funds. The Funds also offer Class A Shares and Class C Shares in a separate prospectus.

Investment Advisor

Hillman Capital Management, Inc.

7501 Wisconsin Avenue, Suite 1100 E

Bethesda, Maryland 20814

www.hillmancapital.com

1-800-773-3863

The Securities and Exchange Commission has not approved or disapproved the securities being offered by this prospectus or determined whether this prospectus is accurate and complete. Any representation to the contrary is a criminal offense.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board, or any other agency and are subject to investment risks including possible loss of principal amount invested. Neither the Funds nor the Funds’ distributor is a bank. You should read the prospectus carefully before you invest or send money.

Exhibit B

Fees and Expenses of the Fund. These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load) Imposed On Purchases

(as a percentage of offering price)

Redemption Fee (as a % of amount redeemed) | None

None |

Annual Fund Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

Management Fees

Distribution and/or Service (12b-1) Fees Other Expenses Total Annual Fund Operating Expenses | 1.00% 0.25% [To Be Determined]% [To Be Determined]% |

Exhibit C

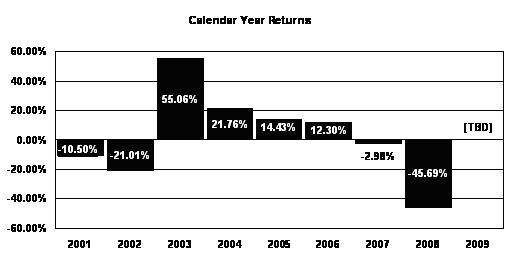

Performance Information. The bar chart and table shown below provide an indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns compare to those of a broad-based securities market index. The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

| Calendar Year Returns |

| Hillman Total Return Fund |

| 2001 | -10.50% |

| 2002 | -21.01% |

| 2003 | 55.06% |

| 2004 | 21.76% |

| 2005 | 14.43% |

| 2006 | 12.30% |

| 2007 | -2.98% |

| 2008 | -45.69% |

| 2009 | [TBD] |

Quarterly Returns During This Time Period |

Highest return for a quarter | 28.61% | Quarter ended June 30, 2003 |

Lowest return for a quarter | (25.33)% | Quarter ended December 31, 2008 |

Year-to-date return as of most recent quarter | 44.57% | Quarter ended December 31, 2009 |

Average Annual Total Returns Period Ended December 31, 2009 | Past 1 Year | Past 5 Years | Since Inception on 12/29/2000 |

No Load Shares Before taxes After taxes on distributions After taxes on distributions and sale of shares | ____% ____% ____% | ____% ____% ____% | ____% ____% ____% |

S&P 500 Total Return Index | ____% | ____% | ____% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown and are not applicable to investors who hold Fund shares through tax-deferred arrangements such as an individual retirement account (IRA) or 401(k) plan.

Exhibit D

Purchase and Sale of Fund Shares. You can purchase Fund shares directly from the Fund by mail or bank wire. The minimum initial investment is $100,000 and the minimum subsequent investment is $500 ($100 under an automatic investment plan), although the minimums may be waived or reduced in some cases. You can redeem Fund shares directly from the Fund by mail, facsimile, telephone, and bank wire.

Purchase and redemption orders by mail should be sent to the Hillman Capital Management Funds, No Load Shares c/o Nottingham Shareholder Services, Post Office Box 4365, Rocky Mount, North Carolina 27803-0365. Redemption orders by facsimile should be transmitted to 252-972-1908. Please call the Fund at 1-800-773-3863 to conduct telephone transactions or to receive wire instructions for bank wire orders. The Fund has also authorized certain broker-dealers to accept purchase and redemption orders on its behalf. Investors who wish to purchase or redeem Fund shares through a broker-dealer should contact the broker-dealer directly.

Exhibit E

Focused Advantage Fund – Principal Investment Strategies. In seeking to achieve its objective, the Fund invests primarily in common stocks of companies which Hillman Capital Management, Inc. (the “Advisor”) believes have qualitative and quantitative competitive advantages, as described below, and have temporarily fallen out of favor for reasons that are considered non-recurring or short-term; whose value is not currently well known; or whose value is not fully recognized by the public. As a matter of investment policy, the Fund will invest so that, under normal circumstances, at least 80% of the value of its total net assets is invested in publicly traded equity securities of various issuers, including common stock, preferred stock, and securities that may be converted into or are exercisable for common or preferred stock. This investment policy may be changed without shareholder approval upon 60-days’ prior notice to shareholders.

In selecting investments for the Fund, the Advisor first looks at qualitative measures of a company. Qualitative measures of a company include:

| · | dominance in a particular industry or niche market; |

| · | management style and adaptability; |

| · | strength of pricing and purchasing power; |

| · | barriers to industry competition; |

| · | strength of brand or franchise with commensurate brand loyalty; and |

| · | quality of products and services. |

If certain companies meet most or all of the qualitative measures, the Advisor then seeks to identify which of those companies possess certain positive quantitative measures and which of those companies the Advisor feels show superior prospects for growth. These companies may, in the view of the Advisor, exhibit positive changes such as a promising new product, new distribution strategy, new manufacturing technology, new management team, or new management philosophy. These companies may also be responsible for technological breakthroughs and/or unique solutions to market needs. The quantitative measures of a company include:

· price-to-book ratio;

· present value of discounted projected cash flows;

· balance sheet strength;

· price-to-sales ratio; and

· price-to-earnings ratio.

The Advisor allocates a target percentage of total portfolio value to each security it purchases. Under normal market conditions, the Advisor intends to be fully invested in equities with the portfolio comprised of approximately 20 stocks. From time to time, the Fund may also focus the Fund’s assets in securities of one or more particular sectors of the economy and may at times invest more than 25% of the Fund’s net assets in a particular sector, such as the financial, healthcare, retail, or technology sectors. The Advisor may sell a portfolio holding if the Advisor believes that the price of the security is overvalued or to rebalance the security to the Advisor’s targeted percentage of total portfolio value for that security.

Advantage Equity Fund – Principal Investment Strategies. In seeking to achieve its objective, the Fund invests primarily in common stocks of companies which Hillman Capital Management, Inc. (“Advisor”) believes have qualitative and quantitative competitive advantages, as described below, and have temporarily fallen out of favor for reasons that are considered non-recurring or short-term; whose value is not currently well known; or whose value is not fully recognized by the public. As a matter of investment policy, the Fund will invest so that, under normal circumstances, at least 80% of the value of its total net assets is invested in publicly traded equity securities of various issuers, including common stock,

preferred stock, and securities that may be converted into or are exercisable for common or preferred stock. This investment policy may be changed without shareholder approval upon 60-days’ prior notice to shareholders.

In selecting investments for the Fund, the Advisor first looks at qualitative measures of a company. Qualitative measures of a company include:

| · | dominance in a particular industry or niche market; |

| · | management style and adaptability; |

| · | strength of pricing and purchasing power; |

| · | barriers to industry competition; |

| · | strength of brand or franchise with commensurate brand loyalty; and |

| · | quality of products and services. |

If certain companies meet most or all of the qualitative measures, the Advisor then seeks to identify which of those companies possess certain positive quantitative measures and which of those companies the Advisor feels show superior prospects for growth. These companies may, in the view of the Advisor, exhibit positive changes such as a promising new product, new distribution strategy, new manufacturing technology, new management team, or new management philosophy. These companies may also be responsible for technological breakthroughs and/or unique solutions to market needs. The quantitative measures of a company include:

· price-to-book ratio;

· present value of discounted projected cash flows;

· balance sheet strength;

· price-to-sales ratio;

· price-to-earnings ratio; and

· sufficient cash flow to maintain current dividends.

The Advisor allocates a target percentage of total portfolio value to each security it purchases. Under normal market conditions, the Advisor intends to be fully invested in equities with the portfolio comprised of approximately 45 stocks. The Advisor may sell a portfolio holding if the Advisor believes that the price of the security is overvalued or to rebalance the security to the Advisor’s targeted percentage of total portfolio value for that security.

Exhibit F

Management. Hillman Capital Management, Inc. is the investment advisor for the Fund. Mark A. Hillman is the Fund’s portfolio manager and the founder and controlling shareholder of Hillman Capital Management, Inc. He has served as the portfolio manager since the Fund’s inception on December 29, 2000.