This report and the financial statements contained herein are submitted for the general information of the shareholders of the Hillman Value Fund (“Fund”). The Fund’s shares are not deposits or obligations of, or guaranteed by, any depository institution. The Fund’s shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested. Neither the Fund nor the Fund’s distributor is a bank.

The Hillman Value Fund is distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 100 E. Six Forks Road, Suite 200, Raleigh, NC, 27609. There is no affiliation between the Hillman Value Fund, including its principals, and Capital Investment Group, Inc.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports, as permitted by regulations adopted by the Securities and Exchange Commission. Instead, the reports will be made available on the Fund’s website at https://www.nottinghamco.com/fundpages/Hillman, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by clicking Enroll at https://www.nottinghamco.com/fundpages/Hillman.

You may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 800-773-3863 to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

Letter to Shareholders (Unaudited)

Dear Hillman Value Fund Shareholder,

We are pleased to provide the annual report for the Hillman Value Fund for the fiscal year ended September 30, 2020.

We have enclosed the attached performance summary to remind our shareholders of Hillman Capital Management’s approach and to share some perspective on current economic conditions.

On behalf of the team at Hillman Capital Management, I thank you for your ongoing confidence. It is our hope that we may continue to serve you throughout the years to come.

Sincerely,

Mark A. Hillman

CEO and Chief Investment Officer

Hillman Capital Management, Inc.

Performance Summary

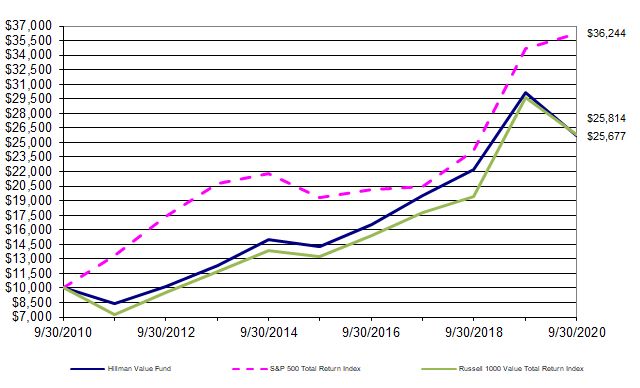

For the year ended September 30, 2020, the Hillman Value Fund returned -4.10% versus a return of -5.02% for the Russell 1000 Value Total Return Index and 15.15% for the S&P 500 Total Return Index. We believe that strict adherence to a fundamentally sound valuation discipline, coupled with investment in high quality enterprises, helped to support performance in a volatile market.

With demand severely restricted by voluntary and mandated pandemic related measures, the Energy and Real Estate sectors were a drag on portfolio performance. Financials suffered as well, likely because of the perceived prospect for continued low interest rates and potential credit losses. These losses were partially mitigated by our strong results in the Consumer Discretionary, Information Technology, Health Care, Industrials, and Communication Services sectors. The income generated from option writing nominally benefitted performance.

The second half of this fiscal year was dominated by the societal dislocation and economic havoc wreaked by COVID-19. With the population shifting to work from home and eat at home mode, a bifurcation has been occurring, which has benefitted shares of companies that investors believe may benefit from the pandemic. Owing in part to this trend, Facebook, Amazon, Apple, Google, and Microsoft now make up almost one quarter of the value of the S&P 500 Index. Perhaps this leaves those who use index investing as a tool for portfolio diversification in a bit of a quandary. In the quarter ended June 30, 2020, these five stocks led that quarter’s market advance, on average growing by over 34%. While this represents a bit of good fortune for index investors, hoping for continued favorable luck could be a questionable long-term strategy.

Our equity strategies are driven by our core belief that competitively advantaged companies will outperform their peers through economic cycles and market cycles. Our goal is to invest in great enterprises at attractive prices. We will continue to invest according to this precept for the long-term interest of our clients. We feel that the Fund is well positioned with investments in companies with sustainable competitive advantages, at prices that we believe to be reasonable.

Disclosure:

Past performance is not indicative of future results. An investment in the Fund is subject to investment risks, including the possible loss of some or all of the principal amount invested. There can be no assurance that the Fund will be successful in meeting its investment objective. Investment in the Fund is subject to the following risks: value risk, cybersecurity risk, investment advisor risk, market risk, risks from writing options, sector focus risk, and small-cap and mid-cap companies risk. More information about these risks and other risks can be found in the Fund’s prospectus. The S&P 500 Total Return Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. It is not possible to invest in this index. The Russell 1000 Value Total Return Index is an index of approximately 1,000 of the largest companies in the U.S. equity market and is a widely recognized, unmanaged index of large-cap equities. It is not possible to invest in this index.

Statements in this Annual Report reflect projections or expectations of future financial or economic performance of the Fund and of the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include general economic conditions such as inflation, recession and interest rates.

Underwriter and Distributor: Capital Investment Group, Inc.

100 E. Six Forks Road

Suite 200

Raleigh, NC 27609

Phone (800) 773-3863

There is no affiliation between Capital Investment Group, Inc. and Hillman Capital Management, Inc.

HCM-20-162

Hillman Value Fund

|

|

Notes to Financial Statements

|

|

As of September 30, 2020

|

1. Organization and Significant Accounting Policies

The Hillman Value Fund (the “Fund”) is a series of the Hillman Capital Management Investment Trust (the “Trust”), which was organized on July 14, 2000 as a Delaware Business Statutory Trust and is registered under the Investment Company Act of 1940, (the “1940 Act”), as amended, as an open-ended management investment company.

The Fund commenced operations on December 29, 2000. The investment objective of the Fund is to seek to provide long-term total return from a combination of income and capital gains.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946 “Financial Services – Investment Companies,” and Financial Accounting Standards Update (“ASU”) 2013-08.

Investment Valuation

The Fund’s investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the mean of the most recent bid and ask prices. Securities and assets for which representative market quotations are not readily available (e.g., (i) a portfolio security is so thinly traded that there have been no transactions for that security over an extended period of time; (ii) the exchange on which the portfolio is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the Fund’s NAV calculation) or which cannot be accurately valued using the Fund’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Board of Trustees (the “Trustees”). A portfolio security’s “fair value” price may differ from the price next available for that portfolio security using the Fund’s normal pricing procedures. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value.

Option Valuation

Options are valued at the mean of the last quoted bid and ask prices as of the valuation time. If there is an ask price but no bid price on the valuation date, the option shall be priced at the mean of zero and the ask price at the valuation time. Options will be valued on the basis of prices provided by pricing services when such prices are reasonably believed to reflect the market value of such options and may include the use of composite or NBBO pricing information provided by the pricing services. An option may be fair valued when (i) the option does not trade on the valuation date and a reliable last quoted bid and ask price at the valuation time are not readily available or (ii) the Fund’s investment advisor or Fund management does not believe the prices provided by the pricing services reflect the market value of such option.

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

a. | Level 1: quoted prices in active markets for identical securities |

b. | Level 2: other significant observable inputs (including quoted prices for similar securities and identical securities in inactive markets, interest rates, credit risk, etc.) |

c. | Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments) |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Hillman Value Fund

|

|

Notes to Financial Statements

|

|

As of September 30, 2020

|

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of September 30, 2020 for the Fund’s investments:

| | | |

| Investments in Securities (a) | | Total | | Level 1 | | Level 2 | | Level 3 |

Assets Common Stocks* | $ | 90,865,569 | $ | 90,865,569 | $ | - | $ | - |

Real Estate Investment Trust | | 2,781,240 | | 2,781,240 | | - | | - |

Limited Partnerships | | 5,433,890 | | 5,433,890 | | - | | - |

Short-Term Investment | | 5,186,257 | | 5,186,257 | | - | | - |

| Total Assets | $ | 104,266,956 | $ | 104,266,956 | $ | - | $ | - |

| | | | | | | | | |

Liabilities Call Options Written | $ | 185,500 | $ | - | $ | 185,500 | $ | - |

Put Options Written | | 15,084 | | - | | 15,084 | | - |

| Total Liabilities | $ | 200,584 | $ | - | $ | 200,584 | $ | - |

| | | | | | | | | |

(a) The Fund did not hold any Level 3 securities during the year.

*For a detailed breakout by sector, please refer to the Schedule of Investments.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion and amortization of discounts and premiums using the effective interest method. Gains and losses are determined on the identified cost basis, which is the same basis used for Federal income tax purposes.

Expenses

The Fund bears expenses incurred specifically on its behalf and Trust level expenses.

Distributions

The Fund may declare and distribute dividends from net investment income (if any) annually. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are recorded on ex-date.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

Hillman Value Fund

|

|

Notes to Financial Statements

|

|

As of September 30, 2020

|

Option Writing

When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains (losses) from options written. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain or loss (depending on if the premium is less than the amount paid for the closing purchase transaction). If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund, as the writer of an option, bears the market risk of an unfavorable change in the price of the security underlying the written option. Written options are non-income producing securities.

Derivative Financial Instruments

The Fund may invest in derivative financial instruments (derivatives) in order to manage risk or gain exposure to various other investments or markets. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and the potential for market movements which may expose the Fund to gains or losses in excess of the amounts shown on the Statement of Assets and Liabilities.

Derivatives are marked to market daily based upon quotations from market makers or the Fund’s independent pricing services and the Fund’s net benefit or obligation under the contract, as measured by the fair market value of the contract, is included in Investments in securities, at value on the Statement of Assets and Liabilities for options purchased and the Options Written, at value on the Statement of Assets and Liabilities for options written. Net realized gains and losses and net change in unrealized appreciation and depreciation on these contracts for the year are included in the Realized and Unrealized Gain on Investments on the Statement of Operations for options purchased and Realized and Unrealized Gain on Options Written on the Statement of Operations for options written.

The derivative instruments outstanding as of September 30, 2020 are disclosed below and the amounts of realized and changes in unrealized gains and losses on derivative instruments during the year as disclosed below serve as indicators of the volume of derivative activity for the Fund.

The following table sets forth the effect of the derivative instruments on the Statement of Assets and Liabilities as of September 30, 2020:

Derivative Type | | | Market Value | Notional Value |

| | | | | |

| Equity Contracts – written options | Liabilities-Options written, at value | | $200,584 | $4,962,104 |

The following table sets forth the effect of the derivative instruments on the Statement of Operations for the fiscal year ended September 30, 2020:

| Derivative Type | Location | Gains/Losses |

| | | |

| Equity Contracts – written options | Net realized gain from options written | $ 1,759,394 |

| | | |

| Equity Contracts – written options | Net change in unrealized depreciation on options written | $ (50,326) |

| | | |

Hillman Value Fund

|

|

Notes to Financial Statements

|

|

As of September 30, 2020

|

The following table presents the Fund’s liabilities available for offset under a master netting arrangement of collateral pledged as of September 30, 2020:

Gross Amounts of Assets Presented in the Statement of Assets & Liabilities

|

| | Gross Amounts of Recognized Liabilities | Financial Instruments Pledged* | Cash Collateral Pledged | Net Amount of Liability |

Description of Liability: | | | | |

Options Written | $200,584 | $200,584 | $ - | $ - |

Total | $200,584 | $200,584 | $ - | $ - |

| | | | | |

*The actual financial instruments pledged may be in excess of the amounts shown in the table. The table only reflects collateral amounts up to the amount of the financial instrument disclosed on the Statement of Assets and Liabilities.

2. Transactions with Affiliates

Advisor

Effective January 31, 2020, the Fund pays a monthly fee to Hillman Capital Management, Inc. (the “Advisor”) calculated at the annual rate of 0.85% of the Fund’s average daily net assets. Prior to January 31, 2020, the Fund paid a management fee calculated at the annual rate of 1.00% of the Fund’s average daily net assets.

The Advisor has entered into an Expense Limitation Agreement with the Trust, pursuant to which the Advisor has agreed to waive or limit its fees and to assume other expenses so that the total annual operating expenses of the Fund (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions, (iii) acquired fund fees and expenses; (iv) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold short); (vi) taxes; and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor)) is limited to 0.95% of the average daily net assets of the Fund. The Expense Limitation Agreement runs through January 31, 2021 and may be terminated by the Board at any time. The Advisor cannot recoup from the Fund any amounts paid by the Advisor under the Expense Limitation Agreement. Prior to January 31, 2020, the percentage of the average daily net assets were limited as set forth in the table below.

| Average Daily Net Assets of the Fund | Expense Cap |

| Up to $53 million | 1.50% |

| $53 million to $60 million | 1.25% |

| $60 million to $75 million | 1.18% |

| $75 million to $100 million | 1.08% |

| Over $100 million | 0.98% |

For the fiscal year ended September 30, 2020, $795,548 in advisory fees were incurred, of which $281,348 in advisory fees were waived by the Advisor.

Administrator

The Fund pays a monthly fee to The Nottingham Company (the “Administrator”) based upon the average daily net assets of the Fund and calculated at the annual rates as shown in the schedule below subject to a minimum of $2,000 per month. The Administrator also receives a fee to procure and pay the Fund’s custodian, as additional compensation for fund accounting and recordkeeping services, and additional compensation for certain costs involved with the daily valuation of securities and as reimbursement for out-of-pocket expenses. The Administrator also receives a miscellaneous compensation fee for peer group, comparative analysis, and compliance support totaling $350 per month. As of September 30, 2020, the Administrator received $4,224 in miscellaneous expenses.

Hillman Value Fund

|

|

Notes to Financial Statements

|

|

As of September 30, 2020

|

A breakdown of the fees is provided in the following table:

| Administration Fees* | Custody Fees* | Fund Accounting Fees (minimum monthly) | Fund Accounting Fees (asset- based fee) | Blue Sky Administration Fees (annual) |

Average Net Assets | Annual Rate | Average Net Assets | Annual Rate |

| First $250 million | 0.100% | First $200 million | 0.020% | $2,250 | 0.01% | $150 per state |

| Next $250 million | 0.080% | Over $200 million | 0.009% | | | |

| Next $250 million | 0.060% | | | | | |

| Next $250 million | 0.050% | *Minimum monthly fees of $2,000 and $417 for Administration and Custody, respectively. |

| Next $1 billion | 0.040% |

| Over $2 billion | 0.035% |

The Fund incurred $94,481 in administration fees, $27,923 in custody fees (received by the Administrator to pay the custodian), and $35,970 in fund accounting fees for the fiscal year ended September 30, 2020.

Compliance Services

For the fiscal period from October 1, 2019 through April 30, 2020, Cipperman Compliance Services, LLC provided services as the Trust’s Chief Compliance Officer. Cipperman Compliance Services, LLC was entitled to receive customary fees from the Fund for their services pursuant to the Compliance Services Agreement with the Fund.

Effective May 1, 2020, The Nottingham Company, Inc. replaced Cipperman Compliance Services, LLC as the Trust’s compliance services provider including services as the Trust’s Chief Compliance Officer.

Transfer Agent

Nottingham Shareholder Services, LLC (“Transfer Agent”) serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation from the Fund pursuant to the Transfer Agent’s fee arrangements with the Fund. The Fund incurred $30,467 in transfer agent fees during the fiscal year ended September 30, 2020.

Distributor

Capital Investment Group, Inc. (the “Distributor”) serves as the Fund’s principal underwriter and distributor. The Distributor receives $5,000 per year paid in monthly installments for services provided and expenses assumed. These are included on the Statement of Operations in the Shareholder Fulfillment Expenses.

3. Trustees and Officers

The Board of Trustees is responsible for the management and supervision of the Fund. The Trustees approve all significant agreements between the Trust, on behalf of the Fund, and those companies that furnish services to the Fund; review performance of the Advisor and the Fund; and oversee activities of the Fund. Officers of the Trust and Trustees who are interested persons of the Trust or the Advisor will receive no salary or fees from the Trust. Trustees who are not “interested persons” of the Trust or the Advisor within the meaning of the 1940 Act (the “Independent Trustees”) an annual retainer of $5,000, plus a meeting fee of $500 for each quarterly meeting. In addition, each Independent Trustee receives a meeting fee of $500 for each special meeting attended in-person and $250 for each special meeting attended via telephone. Prior to January 1, 2020, each Independent Trustee received an annual retainer of $4,000, plus $250 per series of the Trust per meeting attended in person and $100 per series of the Trust per meeting attended by telephone. The Trust will reimburse each Trustee and officer of the Trust for his or her travel and other expenses relating to attendance of Board meetings. Additional fees may also be incurred during the year as special meetings are necessary in addition to the regularly scheduled meetings of the Board of Trustees.

Certain officers of the Trust may also be officers of the Administrator.

Hillman Value Fund

|

|

Notes to Financial Statements

|

|

As of September 30, 2020

|

4. Purchases and Sales of Investment Securities

For the fiscal year ended September 30, 2020, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

Purchases of Securities | | Proceeds from Sales of Securities |

| $71,044,618 | | $24,670,876 |

There were no long-term purchases or sales of U.S Government Obligations during the fiscal year ended September 30, 2020.

5. Federal Income Tax

Distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. Permanent differences do not have an effect on the net asset values of the Fund. There were no such reclassifications during the fiscal year ended September 30, 2020.

Management reviewed the Fund’s tax positions taken or to be taken on Federal income tax returns for the open tax years September 30, 2018 through September 30, 2020 and determined that the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Distributions during the fiscal years ended were characterized for tax purposes as follows:

| | September 30, 2020 | September 30, 2019 |

Ordinary Income | $1,505,998 | $236,135 |

Long-Term Capital Gains | 1,520,000 | - |

Total Distributions | $3,025,998 | $236,135 |

Reclassifications relate primarily to differing book/tax treatment of non-deductible expenses from partnerships.

For the fiscal year ended September 30, 2020, the following reclassifications were necessary:

Paid-in-Capital | $ (168) |

Distributable Earnings | 168 |

At September 30, 2020, the tax-basis cost of investments and components of distributable earnings were as follows:

Cost of Investments | | $ 111,565,857 |

| | | |

Gross Unrealized Appreciation | | 6,995,988 |

Gross Unrealized Depreciation | | (14,495,473) |

Net Unrealized Depreciation | | (7,499,485) |

| | | |

Undistributed Net Investment Income | | 4,792,525 |

Accumulated Capital Gains | | 5,036,673 |

Distributable Earnings | | $ 2,329,713 |

| | | |

| | | | | | |

Hillman Value Fund

|

|

Notes to Financial Statements

|

|

As of September 30, 2020

|

6. Commitments and Contingencies

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects the risk of loss to be remote.

7. Subsequent Events

Management is currently evaluating the impact of the COVID-19 virus on the financial services industry and has concluded that while it is reasonably possible that the virus could have a negative effect on the fair value of the Fund’s investments and results of operations, the specific impact is not readily determinable as of the date of these financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

In accordance with GAAP, management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. Management has concluded there are no additional matters, other than those noted above, requiring recognition or disclosure.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Hillman Capital Management Investment Trust

and the Shareholders of Hillman Value Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Hillman Value Fund, a series of shares of beneficial interest in Hillman Capital Management Investment Trust (the “Fund”), including the schedule of investments, as of September 30, 2020, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2020, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2020 by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Hillman Capital Management Investment Trust since 2004.

Philadelphia, Pennsylvania

November 23, 2020

Hillman Value Fund

|

|

Additional Information

(Unaudited)

|

|

As of September 30, 2020

|

1. Proxy Voting Policies and Voting Record

A copy of the Advisor’s Disclosure Policy is included as Appendix B to the Fund’s Statement of Additional Information and is available, (1) without charge, upon request, by calling 800-773-3863 and (2) on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (1) without charge, upon request, by calling the Fund at the number above and (2) on the SEC’s website at http://www.sec.gov.

2. Quarterly Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s website at http://www.sec.gov. You may obtain copies without charge, upon request, by calling the Fund at 800-773-3863.

3. Tax Information

We are required to advise you within 60 days of the Fund’s fiscal year-end regarding the Federal tax status of certain distributions received by shareholders during each fiscal year. The following information is provided for the Fund’s fiscal year ended September 30, 2020.

During the fiscal year, income distributions totaling $1,505,998 were paid from the Fund, and $1,520,000 were paid in long-term capital gain distributions.

Dividend and distributions received by retirement plans such as IRAs, Keogh-type plans, and 403(b) plans need not be reported as taxable income. However, many retirement plans may need this information for their annual information meeting.

4. Schedule of Shareholder Expenses

As a shareholder of the Fund, you incur other Fund expenses, including Advisory fees. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2020 through September 30, 2020.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Hillman Value Fund

|

|

Additional Information

(Unaudited)

|

|

As of September 30, 2020

|

| | Beginning Account Value April 1, 2020 | Ending Account Value September 30, 2020 |

Expenses Paid During Period* |

Actual Hypothetical (5% annual return before expenses) | | | |

| $1,000.00 | $1,181.80 | $5.45 |

| $1,000.00 | $1,020.00 | $5.05 |

*Expenses are equal to the average account value over the period multiplied by the Fund’s annualized expense ratio of 1.00%, multiplied by 183/366 (to reflect the one-half year period).

5. Approval of Investment Advisory Agreement

In connection with the regular Board meeting held on December 18, 2019, the Board, including a majority of the Independent Trustees, discussed the approval of a management agreement between the Trust and the Advisor, with respect to the Fund (the "Investment Advisory Agreement").

The Trustees were assisted by legal counsel throughout the review process. The Trustees relied upon the advice of legal counsel and their own business judgment in determining the material factors to be considered in evaluating the Investment Advisory Agreement and the weight to be given to each factor considered. The conclusions reached by the Trustees were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching his conclusions with respect to the approval of the Investment Advisory Agreement. In connection with their deliberations regarding approval of the Investment Advisory Agreement, the Trustees reviewed materials prepared by the Advisor.

In deciding on whether to approve the renewal of the Investment Advisory Agreement, the Trustees considered numerous factors, including:

(i) Nature, Extent, and Quality of Services. The Trustees considered the responsibilities of the Advisor under the Investment Advisory Agreement. The Trustees reviewed the services being provided by the Advisor to the Fund including, without limitation, the quality of its investment advisory services since the Fund’s inception (including research and recommendations with respect to portfolio securities); its procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives, policies and limitations; its coordination of services for the Fund among the Fund’s service providers; and its efforts to promote the Fund, grow the Fund’s assets, and assist in the distribution of Fund shares. The Trustees evaluated: the Advisor’s staffing, personnel, and methods of operating; the education and experience of the Advisor’s personnel; the Advisor’s compliance program; and the financial condition of the Advisor.

After reviewing the foregoing information and further information in the memorandum from the Advisor (e.g., descriptions of the Advisor’s business, compliance program, and the Form ADV), the Board concluded that the nature, extent, and quality of the services provided by the Advisor were satisfactory and adequate for the Fund.

(ii) Performance. The Trustees compared the performance of the Fund with the performance of its benchmark index, comparable funds with similar strategies managed by other investment advisers, and applicable peer group data (e.g., Lipper peer group average). The Trustees noted the Fund’s strong performance having outperformed its peer group and category for all periods shown. The Trustees also considered the consistency of the Advisor’s management of the Fund with its investment objective, policies and limitations. After reviewing the investment performance of the Fund, the Advisor’s experience managing the Fund, the Advisor’s historical investment performance, and other factors, the Board concluded that the investment performance of the Fund and the Advisor was satisfactory.

(iii) Fees and Expenses. The Trustees first noted the management fee for the Fund under the Investment Advisory Agreement. The Trustees then compared the advisory fee and expense ratio of the Fund to other comparable funds. The Trustees noted that the management fee and expense ratio were higher than the peer group and category averages. It was noted this is mostly due to the relatively small size of the Fund and its peers achieving economies of scale. The Trustees considered the Advisor’s unique research and investment process in evaluating the reasonableness of its management fee.

Hillman Value Fund

|

|

Additional Information

(Unaudited)

|

|

As of September 30, 2020

|

Following this comparison, and upon further consideration and discussion of the foregoing, the Board concluded that the fees to be paid to the Advisor by the Fund were not unreasonable in relation to the nature and quality of the services provided by the Advisor and that they reflected charges that were within a range of what could have been negotiated at arm’s length.

(iv) Profitability. The Board reviewed the Advisor’s profitability analysis in connection with its management of the Fund over the past twelve months. The Board noted that the Advisor did not earn a profit from its management of the Fund during the period. The Board considered the quality of the Advisor’s service to the Fund, and after further discussion, concluded that the Advisor’s level of profitability was not excessive.

(v) Economies of Scale. In this regard, the Trustees reviewed the Fund’s operational history and noted that the size of the Fund had not provided an opportunity to realize economies of scale. The Trustees then reviewed the Fund’s fee arrangements for breakpoints or other provisions that would allow the Fund’s shareholders to benefit from economies of scale in the future as the Fund grows. The Trustees determined that the maximum management fee would stay the same regardless of the Fund’s asset levels. The Trustees noted that the Fund was a relatively small size and economies of scale were unlikely to be achievable in the near future. It was pointed out that breakpoints in the advisory fee could be reconsidered in the future as the Fund grows.

Conclusion. Having reviewed and discussed in depth such information from the Advisor as the Trustees believed to be reasonably necessary to evaluate the terms of the Investment Advisory Agreement and as assisted by the advice of legal counsel, the Trustees concluded that renewal of the Investment Advisory Agreement was in the best interest of the shareholders of the Fund.

6. Information about Trustees and Officers

The business and affairs of the Fund and the Trust are managed under the direction of the Trustees. Information concerning the Trustees and officers of the Trust and Fund is set forth below. Generally, each Trustee and officer serves an indefinite term or until certain circumstances such as their resignation, death, or otherwise as specified in the Trust’s organizational documents. Any Trustee may be removed at a meeting of shareholders by a vote meeting the requirements of the Trust’s organizational documents. The Statement of Additional Information of the Fund includes additional information about the Trustees and officers and is available, without charge, upon request by calling the Fund toll-free at 800-773-3863. The address of each Trustee and officer, unless otherwise indicated below, is 116 South Franklin Street, Rocky Mount, North Carolina 27804. The Independent Trustees received aggregate compensation of $7,248 during the fiscal year ended September 30, 2020 from the Fund for services to the Fund and Trust. The Interested Trustee and officers did not receive compensation from the Fund for their services to the Fund and Trust.

Hillman Value Fund

|

|

Additional Information

(Unaudited)

|

|

As of September 30, 2020

|

Name and

Date of Birth | Position

held with

Funds or Trust | Length of Time Served | Principal Occupation

During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships

Held by Trustee

During Past 5 Years |

| Independent Trustees |

James H. Speed, Jr.

(06/1953) | Independent Trustee, Chairman | Since 3/2009 | Previously President and CEO of NC Mutual Insurance Company (insurance company) from 2003 to 2015. | 1 | Independent Trustee of the Brown Capital Management Mutual Funds for all its series from 2011 to present, Starboard Investment Trust for all its series from 2009 to present, Centaur Mutual Funds Trust for all its series from 2013 to present, Chesapeake Investment Trust for all its series from 2016 to present, Leeward Investment Trust for all its series from 2018 to present, and WST Investment Trust for all its series from 2013 to present (all registered investment companies). Member of Board of Directors of Communities in Schools of N.C. from 2001 to present. Member of Board of Directors of Investors Title Company from 2010 to present. Member of Board of Directors of AAA Carolinas from 2011 to present. Previously, member of Board of Directors of M&F Bancorp Mechanics & Farmers Bank from 2009 to 2019. Previously, member of Board of Visitors of North Carolina Central University School of Business from 1990 to 2016. Previously, Board of Directors of NC Mutual Life Insurance Company from 2004 to 2016. Previously, President and CEO of North Carolina Mutual Life Insurance Company from 2003 to 2015. |

Theo H. Pitt, Jr.

(04/1936) | Independent Trustee | Since 5/2013 | Senior Partner, Community Financial Institutions Consulting (financial consulting) since 1999. | 1 | Independent Trustee of World Funds Trust for all its series from 2013 to present, Chesapeake Investment Trust for all its series from 2002 to present, Leeward Investment Trust for all its series from 2011 to present, and Starboard Investment Trust for all its series from 2010 to present (all registered investment companies). Senior Partner of Community Financial Institutions Consulting from 1997 to present. Previously, Partner at Pikar Properties from 2001 to 2017. |

| Interested Trustee* |

Mark A. Hillman (03/1962) | Trustee and President (Principal Executive Officer) | Since 12/2000 | CEO, Hillman Capital Management, Inc. (investment advisor to the Fund). | 1 | None. |

* Basis of Interestedness. Mr. Hillman is an Interested Trustee because he is an officer of Hillman Capital Management, Inc., the investment advisor to the Fund. |

Hillman Value Fund

|

|

Additional Information

(Unaudited)

|

|

As of September 30, 2020

|

Name and

Date of Birth | Position held with

Funds or Trust | Length of

Time Served | Principal Occupation

During Past 5 Years |

| Officers |

C. Frank Watson III

(09/1970)

| Treasurer (Principal Financial Officer) | Since 10/2011 | President, Fairview Investment Services, LLC since 2005; Chief Compliance Officer of Hillman Capital Management, Inc. since 2006. |

Ashley H. Lanham

(03/1984) | Assistant Secretary and Assistant Treasurer | Since 05/2014 and Since 06/2016, respectively | Director of Fund Administration. The Nottingham Company since 2008. |

Tracie A. Coop

(12/1976) | Secretary | Since 12/2019 | General Counsel, The Nottingham Company since 2019. Formerly, Vice President and Managing Counsel, State Street Bank and Trust Company from 2015 to 2019. Formerly, General Counsel for Santander Asset Management USA, LLC from 2013 to 2015. |

Matthew Baskir

(07/1979) | Chief Compliance Officer | Since 05/20 | Compliance Director, The Nottingham Company, Inc., since 2020. Formerly, Consultant at National Regulatory Services from 2019 to 2020. Formerly, Counsel at Financial Industry Regulatory Authority (FINRA), Member Supervision from 2016-2019. Formerly Counsel at FINRA, Market Regulation Enforcement from 2014 – 2016. |