Filed Pursuant to Rule 424(b)(5)

Registration No. 333-236116

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 28, 2020

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus Dated January 28, 2020)

$450,000,000

PolyOne Corporation

Common Shares

We are offering $450,000,000 of our common shares, par value $0.01 per share.

Our common shares are listed on the New York Stock Exchange under the symbol “POL.” The last reported sale price of our common shares on the New York Stock Exchange on January 27, 2020 was $33.88 per share.

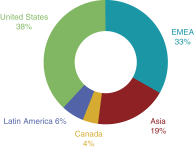

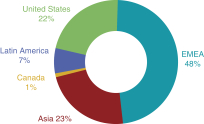

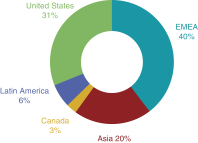

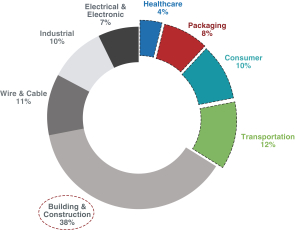

On December 19, 2019, we entered into (1) a definitive share purchase agreement (the “Agreement”) with Clariant AG, a corporation organized and existing under the laws of Switzerland (“Clariant”), and (2) through one of our wholly owned subsidiaries, a definitive business transfer agreement (the “BTA”), with Clariant Chemicals (India) Limited, a public limited company incorporated in India and an indirect majority-owned subsidiary of Clariant (“Clariant India” and, together with Clariant, the “Sellers”). Pursuant to the Agreement, we have agreed to acquire Clariant’s global masterbatch business outside of India (the “Clariant Masterbatch Business”), and pursuant to the BTA, we have agreed to purchase Clariant India’s masterbatch business (the “Clariant India Masterbatch Business”), for a net purchase price of $1.45 billion in cash, subject to customary working capital and net debt adjustments. We refer to the Clariant Masterbatch Business and the Clariant India Masterbatch Business collectively as the “Business.”

We intend to use the net proceeds from this offering to finance a portion of the consideration for our pending acquisitions of the Clariant Masterbatch Business (the “Clariant Masterbatch Acquisition”) and the Clariant India Masterbatch Business (the “Clariant India Masterbatch Acquisition”), including the payment of related fees and expenses as described under the heading “Use of Proceeds.” We refer to the Clariant Masterbatch Acquisition and the Clariant India Masterbatch Acquisition each individually as an “Acquisition” and together, as the “Acquisitions.” The closing of this offering is expected to occur prior to, and is not conditioned upon, the consummation of either of the Acquisitions. In the case that either of the Acquisitions is not consummated for any reason, and the other Acquisition is consummated, we intend to use the net proceeds from this offering to finance, in part, the Acquisition that is consummated, and any remaining proceeds for general corporate purposes. In the case that neither Acquisition is consummated, we intend to use the net proceeds from this offering for general corporate purposes, including potentialbolt-on acquisitions.

Investing in our common shares involves risks that are described or referred to in the “Risk Factors” section beginning on pageS-21 of this prospectus supplement.

| | | | | | | | |

| | | Per

Share | | | Total | |

Public offering price | | $ | | | | $ | | |

Underwriting discount | | $ | | | | $ | | |

Proceeds, before expenses, to us | | $ | | | | $ | | |

We have granted an option to the underwriters, exercisable for 30 days after the date of this prospectus supplement, to purchase up to $67,500,000 of additional shares at the public offering price, less the underwriting discount.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common shares to purchasers on or about , 2020.

Joint Book-Running Managers

| | | | |

| Morgan Stanley | | | | Citigroup |

| Wells Fargo Securities |

The date of this prospectus supplement is , 2020.