SUMMARY

The following summary information is qualified in its entirety by the information contained elsewhere in this prospectus supplement and the accompanying prospectus, including the documents we have incorporated by reference. Because this is a summary, it does not contain all the information that may be important to you. We urge you to read this entire prospectus supplement and the accompanying prospectus, including the documents incorporated by reference, carefully, including the “Risk Factors” section and our consolidated financial statements and the related notes.

PolyOne Corporation

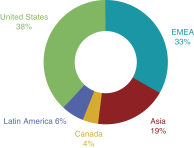

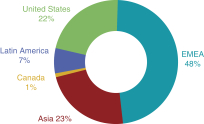

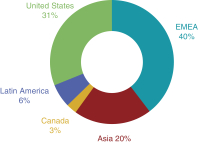

We are a premier provider of specialized polymer materials and polymer services and solutions. Our products include specialty engineered materials, advanced composites, color and additive systems and polymer distribution. We are also a highly specialized developer and manufacturer of performance enhancing additives, liquid colorants, and fluoropolymer and silicone colorants. Headquartered in Avon Lake, Ohio, we have employees at sales, manufacturing and distribution facilities across North America, South America, Europe and Asia.

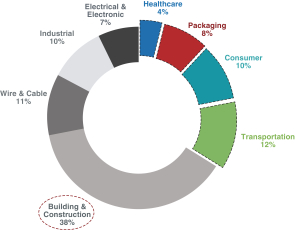

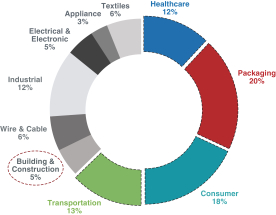

Using our formulation expertise and operational capabilities, we create an essential link between large chemical producers (our raw material suppliers) and designers, assemblers and processors of plastics (our customers). We believe that our role in the value chain continues to become more vital as our customers increasingly need reliable suppliers with a global reach and increasingly effective material-based solutions to improve their products’ appeal, performance, differentiation, profitability and competitive advantage. Our goal is to provide customers with specialized and sustainable materials and solutions through our global footprint, broad market knowledge, technical expertise, product breadth, manufacturing operations, a fully integrated information technology network and raw material procurement leverage. Our end markets include healthcare, transportation, packaging, consumer, building and construction, industrial, wire and cable, electrical and electronics and appliance.

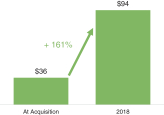

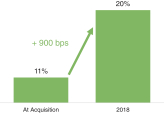

The Acquisitions

On December 19, 2019, we entered into (1) the Agreement with Clariant and (2) through one of our wholly owned subsidiaries, the BTA with Clariant India. Pursuant to the Agreement and the BTA, we have agreed to acquire the Business for a net purchase price of $1.45 billion in cash, subject to customary working capital and net debt adjustments. Based on management’s estimates, the purchase price is approximately 11.1x adjusted EBITDA (excluding synergies) and approximately 7.6x adjusted EBITDA (including synergies). Each of the Agreement and the BTA contain certain customary termination rights, and with respect to the Agreement only, the requirement that PolyOne pay a termination fee in the event the Agreement is terminated under certain conditions.

Each of the Agreement and the BTA contain customary representations, warranties, covenants and agreements, including, among others, that each party will use reasonable best efforts to complete the respective transaction. The closing of each Acquisition is expected to occur inmid-2020, subject to the receipt of regulatory approvals, the satisfaction or waiver of customary closing conditions and, in the case of the Clariant India Masterbatch Acquisition, shareholder approval of Clariant India. On January 27, 2020, we received early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

We intend to use the net proceeds from this offering to finance, in part, the Acquisitions, including the payment of related fees and expenses as described under the heading “Use of Proceeds.” The closing of this