UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| |

| | Filed by the Registrant ý |

| | Filed by a Party other than the Registrant o |

| |

| | Check the appropriate box: |

| |

| | o Preliminary Proxy Statement |

| | o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | ý Definitive Proxy Statement |

| | o Definitive Additional Materials |

| | o Soliciting Material Pursuant to §240.14a-12 |

Bank Mutual Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

| | ý No fee required. |

| | o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| | 1) Title of each class of securities to which transaction applies: |

| |

| | 2) Aggregate number of securities to which transaction applies: |

| |

| | 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | 4) Proposed maximum aggregate value of transaction: |

| |

| | o Fee paid previously with preliminary materials. |

| |

| | o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| | 1) Amount Previously Paid: |

| |

| | 2) Form, Schedule or Registration Statement No.: |

| |

| SEC 1913 (02-02) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

BANK MUTUAL CORPORATION

4949 West Brown Deer Road

Milwaukee, Wisconsin 53223

(414) 354-1500

March 10, 2014

Dear Fellow Shareholder,

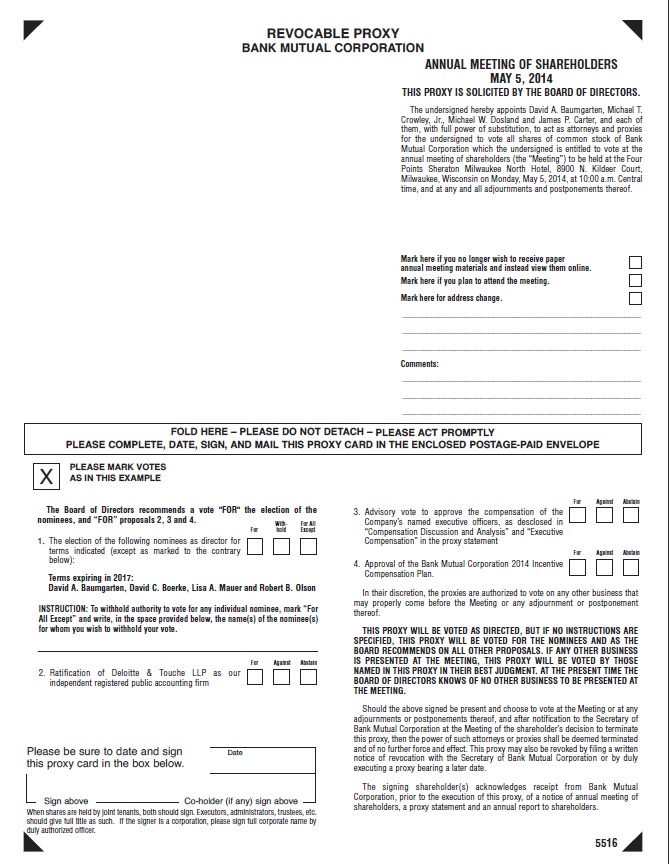

We invite you to attend the Bank Mutual Corporation 2014 Annual Meeting of Shareholders, which will be held at the Four Points Sheraton Milwaukee North Hotel, 8900 N. Kildeer Court, Milwaukee, Wisconsin, at 10:00 a.m., Central Time, on Monday, May 5, 2014.

Bank Mutual Corporation’s Notice of Annual Meeting of Shareholders and Proxy Statement, which are enclosed, describe the business to be conducted at the Annual Meeting. If you plan to attend the Annual Meeting, please check the box on the proxy form so that we can plan for the appropriate number of people.

Also enclosed is a copy of Bank Mutual Corporation’s Summary Annual Report, and attached to this Proxy Statement is the Annual Report on Form 10-K for the year ended December 31, 2013.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you tomark, sign, date and return your proxy form in the enclosed postage-paid envelope as soon as possible to make sure that you are represented. Signing the proxy will not prevent you from voting in person at the Annual Meeting, but will ensure that your shares will be represented if you are unable to attend.

| Sincerely, | |

| | |

| BANK MUTUAL CORPORATION | |

| | |

| | |

| | |

| |

| David A. Baumgarten | |

| President and Chief Executive Officer | |

BANK MUTUAL CORPORATION

______________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 5, 2014

____________________________

To the Shareholders of Bank Mutual Corporation:

The 2014 annual meeting of shareholders of Bank Mutual Corporation will be held on Monday, May 5, 2014, at 10:00 a.m., Central Time, at the Four Points Sheraton Milwaukee North Hotel, 8900 N. Kildeer Court, Milwaukee, Wisconsin, for the following purposes:

| (1) | Electing four directors to serve for terms expiring in 2017; |

| (2) | Ratifying the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2014; |

| (3) | Holding an advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in “Compensation Discussion and Analysis” and “Executive Compensation” herein; |

| (4) | Approving Bank Mutual Corporation’s 2014 Incentive Compensation Plan; and |

| (5) | Transacting such other business as may properly come before the annual meeting or any adjournment thereof. |

The board of directors recommends that shareholders vote FOR each of the board’s director nominees, FOR the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm, FOR advisory approval of the compensation of the Company’s named executive officers, and FOR approval of the 2014 Incentive Compensation Plan.

The board of directors has fixed the close of business on March 3, 2014, as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and any adjournment thereof. Only shareholders of record at the close of business on that date will be entitled to vote at the annual meeting.

We call your attention to the proxy statement accompanying this notice for a more complete statement regarding the matters to be acted upon at the annual meeting. Please read it carefully.

If you have questions or comments, please direct them to Bank Mutual Corporation, 4949 West Brown Deer Road, Milwaukee, Wisconsin 53223, Attention: Corporate Secretary. Please also contact the corporate secretary if you would like directions to the annual meeting. If you prefer, you may also e-mail questions, comments or requests for directions to james.carter@bankmutual.com.

| | By Order of the Board of Directors | |

| | | |

| | | |

| |  | |

| | James P. Carter | |

| | Vice President and Secretary | |

Milwaukee, Wisconsin

March 10, 2014

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May5, 2014: The Company’s Proxy Statement, Annual Report on Form 10-K for the year ended December 31, 2013, and Summary Annual Report are available at: http://www.bankmutualcorp.com under the link “Annual Meeting Materials.”

To view this material, your browser must support the PDF file format. If your browser does not support PDF viewing, download and installation instructions are available at the above link.

YOUR VOTE IS IMPORTANT

Your vote is important regardless of the number of shares you own. Whether or not you expect to attend the annual meeting, please indicate your voting directions, sign, date and promptly return the accompanying proxy, which is solicited by the Bank Mutual Corporation board of directors, using the enclosed self-addressed envelope, which requires no postage if mailed in the United States. If for any reason you should desire to revoke your proxy, you may do so at any time before it is voted at the annual meeting.

PROXY STATEMENT

BANK MUTUAL CORPORATION

4949 West Brown Deer Road

Milwaukee, Wisconsin 53223

(414) 354-1500

______________________

SOLICITATION AND VOTING

This proxy statement and accompanying proxy are furnished to the shareholders of Bank Mutual Corporation (“Bank Mutual Corporation” or the “Company”) in connection with the solicitation of proxies by Bank Mutual Corporation’s board of directors for use at the annual meeting of Bank Mutual Corporation shareholders on Monday, May 5, 2014, and at any adjournment of that meeting. The 2013 summary annual report to shareholders, which accompanies this proxy statement, and the 2013 annual report on Form 10-K, attached hereto, contain financial statements and other information concerning the Company. The Company is mailing the proxy materials to shareholders beginning on or about March 10, 2014.

Record Date and Meeting Information. The board of directors has fixed the close of business on March 3, 2014, as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and any adjournment thereof. Only holders of record of Company common stock, the only class of voting stock of Bank Mutual Corporation outstanding, on the record date are entitled to notice of and to vote at the annual meeting. Each share of common stock is entitled to one vote. At the record date, there were 46,551,284 shares of common stock validly issued and outstanding.

The board of directors of Bank Mutual Corporation knows of no matters to be acted upon at the annual meeting other than as set forth in the notice attached to this proxy statement. If any other matters properly come before the annual meeting, or any adjournment thereof, it is the intention of the persons named in the proxy to vote such proxies in accordance with their best judgment on such matters.

Voting Your Shares. Any shareholder entitled to vote at the annual meeting may vote either in person or by a properly executed proxy. Shares represented by properly executed proxies received by Bank Mutual Corporation will be voted at the annual meeting, or any adjournment thereof, in accordance with the terms of such proxies, unless revoked. If you own your shares directly and no voting instructions are given on a properly executed proxy, the shares will be voted by the persons named to vote the proxy FOR the election of the designated director nominees, FOR ratification of the selection of Deloitte & Touche LLP as the independent registered public accounting firm, FOR advisory approval of the compensation of the Company’s named executive officers, and FOR approval of the Company’s 2014 Incentive Compensation Plan.

Brokers do not have discretion to cast votes in the election of directors with respect to any shares held in street name for which they have not received voting directions from the beneficial owners. Therefore, if you hold your shares in street name, you must vote your proxy if you wish your shares to be voted in the election of directors, or on the advisory vote regarding executive compensation.

A shareholder may revoke a proxy at any time prior to the time it is voted by filing a written notice of revocation with the corporate secretary of the Company, by delivering a properly executed proxy bearing a later date or by voting in person at the annual meeting. Attendance at the annual meeting will not in itself constitute revocation of a proxy.

Shares in Dividend Reinvestment or Employee Plans. If a shareholder participates in the Company’s Dividend Reinvestment and Stock Purchase Plan (the “DRP”), the proxy also will serve as voting instructions for the participant’s shares held in the DRP. Participants’ shares will be voted by the administrator of the DRP in accordance with those voting instructions. If a participant does not return a proxy, the DRP administrator will not vote that participant’s shares held in the DRP.

Any shareholder who owns shares through an investment in the Company Common Stock Fund of the Bank Mutual Corporation 401(k) Plan (the “401(k) Plan”), including shares transferred into the 401(k) Plan from the former Employee Stock Owenrship Plan ("ESOP"), will receive a separate blue proxy card, marked “401k,” to instruct the 401(k) Plan’s administrator how to vote those shares. The administrator will vote shares in those participants’ 401(k) Plan accounts in accordance with the voting instructions on the proxies. If a 401(k) Plan participant does not return a proxy, the administrator will vote that participant’s shares in the 401(k) Plan in the same proportion as the voting of all shares in the 401(k) Plan for which voting instructions have been received.

Quorum and Required Vote. A majority of the votes entitled to be cast by the shares entitled to vote, represented in person or by proxy, will constitute a quorum of shareholders at the annual meeting. Shares for which authority is withheld to vote for director nominees, abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares as to a matter with respect to which the brokers or nominees do not have discretionary power to vote) will be considered present for purposes of establishing a quorum. The inspectors of election appointed by the board of directors will count the votes and ballots at the annual meeting.

Assuming a quorum is present, a plurality of the votes cast at the annual meeting by the holders of shares of common stock entitled to vote is required for the election of directors. In other words, the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors in a class to be chosen at the annual meeting. With respect to the election of directors, any shares not voted, whether by withheld authority, broker non-vote or otherwise, will have no effect on the election of directors except to the extent that the failure to vote for an individual results in another individual receiving a comparatively larger number of votes.

Assuming that a quorum is present, the selection of Deloitte & Touche LLP will be deemed to have been ratified if more shares are voted in favor of ratification than are voted against ratification. Accordingly, any shares not voted on this matter, whether by abstention or otherwise, will have no effect on this matter.

Assuming a quorum is present, the advisory vote approving the compensation of the Company’s named executive officers will be deemed to have been approved if more shares are voted in favor of approval than are voted against approval. Accordingly, any shares not voted on this matter, whether by abstention or otherwise, will have no effect on this matter.

Assuming a quorum is present, the Bank Mutual Corporation 2014 Incentive Compensation Plan will be deemed to have been approved if more shares are voted in favor of approval than are voted against approval. Accordingly, any shares not voted on this matter, whether by abstention or otherwise, will have no effect on this matter.

Expenses and Solicitation. Expenses in connection with the solicitation of proxies will be paid by the Company. Proxies will be solicited principally by mail, but may also be solicited by the directors, officers and other employees of the Company in person or by telephone, facsimile or other means of communication. Those directors, officers and employees will receive no compensation therefor in addition to their regular compensation, but may be reimbursed for their related out-of-pocket expenses. Brokers, dealers, banks, or their nominees, who hold common stock on behalf of another will be asked to send proxy materials and related documents to the beneficial owners of such stock, and the Company will reimburse those persons for their reasonable expenses.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The table below sets forth information regarding the beneficial ownership of Company common stock as of the March 3, 2014, record date by each director and nominee for director, by each executive officer named in the Summary Compensation Table below and by all directors and executive officers of the Company as a group. The table also includes information as to the only known 5% or greater shareholders of the Company.

| | | | Number of Shares and | | | | | |

| | | | Nature of Beneficial | | | | Percent | |

| Name of Beneficial Owner | | | Ownership (1)(2) | | | | of Class | |

| | | | | | | | | |

| P. Terry Anderegg | | | 290,018 | | | | * | |

| David A. Baumgarten | | | 217,338 | | | | * | |

| David C. Boerke | | | 44,600 | | | | * | |

| Richard A. Brown | | | 51,500 | | | | * | |

| Thomas H. Buestrin | | | 194,572 | | | | * | |

| Michael T. Crowley, Jr. (3) | | | 2,667,634 | | | | 5.7 | % |

| Michael W. Dosland | | | 173,824 | | | | * | |

| Mark C. Herr | | | 141,796 | | | | * | |

| Gregory A. Larson | | | 118,230 | | | | * | |

| Thomas J. Lopina, Sr. | | | 224,927 | | | | * | |

| Christopher L. Mayne | | | 78,800 | | | | * | |

| William J. Mielke | | | 370,829 | | | | * | |

| Robert B. Olson | | | 326,823 | | | | * | |

| J. Gus Swoboda | | | 224,538 | | | | * | |

| | | | | | | | | |

| All directors and executive officers | | | | | | | | |

| as a group (19 persons) (4) | | | 5,228,183 | | | | 11.2 | % |

| | | | | | | | | |

| Lisa A. Mauer | | | 100 | | | | * | |

| | | | | | | | | |

| BlackRock, Inc. (5) | | | 4,393,681 | | | | 9.4 | % |

__________________

| * | Less than 1.0%. Percentages are based on shares outstanding on the record date. |

| (1) | Unless otherwise noted, the specified persons have sole voting and dispositive power as to the shares. Includes the following shares that are either unvested restricted stock or were allocated to individuals’ ESOP accounts and now have been transferred into the 401(k) plan, for which individuals have sole voting power but may have more limited dispositive power over such shares: Mr. Anderegg – 36,435; Mr. Crowley Jr. – 24,480; Mr. Dosland – 582; and all directors and executive officers as a group –79,232. Includes the following shares that are allocated to individuals’ accounts under the Benefits Restoration Plan related to the 401(k) Plan for which individuals have sole dispositive power but no voting power over such shares: Mr. Anderegg – 3,447; Mr. Crowley Jr. – 32,599; and all directors and executive officers as a group – 36,046. Includes the following shares for which beneficial ownership is shared: Mr. Buestrin – 32,029; Mr. Crowley Jr. – 131,458; Mr. Dosland – 6,800; Mr. Herr – 39,213; Mr. Lopina –77,343; Mr. Mielke – 56,826; Mr. Olson – 229,623; and all directors and executive officers as a group – 694,669. See also notes (4) and (5) below. |

| (2) | Includes the following shares subject to options exercisable at or within 60 days of the record date: Mr. Anderegg – 119,400; Mr. Baumgarten – 80,800; Messrs. Boerke and Brown – 33,200 each; Messrs. Buestrin, Herr, Mielke, Olson and Swoboda – 97,200 each; Mr. Lopina – 88,200; Mr. Crowley Jr. – 719,400; Mr. Dosland – 69,400; Mr. Larson – 40,400; Mr. Mayne – 40,400; and all directors and executive officers as a group – 1,748,000. As of December 31, 2013, Mr. Lopina had pledged86,034 shares. |

| (3) | The information for Mr. Crowley Jr. is based in part on an amendment to Schedule 13G dated February 11, 2014, filed by him along with other information available to the Company. Mr. Crowley Jr.’s business address is c/o Bank Mutual Corporation, 4949 West Brown Deer Road, Milwaukee, WI 53223. |

| (4) | Because the 401(k) Plan permits participants to vote shares and make investment decisions, except for certain takeover offers, shares held in the 401(k) Plan are included only if held in the accounts of named persons, even though certain of the officers are trustees or administrators of one of the plans. With respect to shares allocated to individuals’ accounts under the Benefits Restoration Plan, the individuals whose accounts hold such shares have sole dispositive power but no voting power over such shares; such shares are included in the individuals’ ownership in the table. |

| (5) | BlackRock, Inc. (“BlackRock”) filed an amendment to Schedule 13G dated January 28, 2014, reporting sole voting power as to 4,271,549 shares of common stock and sole dispositive power as to 4,393,681 shares of common stock. BlackRock filed the report as a parent holding company; the report identifies the following subsidiaries as subsidiaries which hold or acquired the securities reported; BlackRock Advisors, LLC, BlackRock Investment Management, LLC, BlackRock Asset Management Ireland Limited, BlackRock Fund Advisors, BlackRock Institutional Trust Company, N.A. and BlackRock Japan Co. Ltd. The address of BlackRock is 40 East 52nd Street, New York, NY 10022. |

The above beneficial ownership information is based on data furnished by the specified persons and is determined in accordance with Rule 13d-3 under the Securities Exchange Act, as required for purposes of this proxy statement. It is not necessarily to be construed as an admission of beneficial ownership for other purposes.

ELECTION OF DIRECTORS

The bylaws provide that the number of directors of Bank Mutual Corporation shall be between seven and thirteen, as determined by the board of directors. At each annual meeting, the term of office of one class of directors expires and a class of directors is elected to serve for a term of three years or until their successors are elected and qualified. Under the bylaws, the board may appoint a new director to fill a vacancy that occurs between annual meetings, including a vacancy that would result from a later determination to increase the size of the board.

The board has ten directors. This year’s board nominees for election for terms expiring at the annual meeting are David A. Baumgarten, David C. Boerke, Lisa A. Mauer and Robert B. Olson.

One of the nominees, Lisa A. Mauer, is not currently a director of the Company or the Bank, and is standing for election for the first time. It is the Company’s policy that the board of directors should reflect a broad variety of experience and talents. When the Nominating and Governance Committee makes nominations for election to the board, it reviews the Company’s director selection criteria and seeks to choose individuals who bring a variety of expertise to the board within these criteria. For further information regarding the reasons Ms. Mauer was selected as a nominee, and criteria used to evaluate board membership generally, see "Director Attributes" and “Board Meetings and Committees–Nominating and Governance Committee,” respectively, below.

The term of Thomas J. Lopina, Sr. expires at the 2014 annual meeting. Mr. Lopina has decided to retire from the board upon the expiration of his term, and is therefore not standing for re-election. Mr. Lopina has served as a director of the Company and its affiliates since 2000, and previously as a director of First Northern Savings Bank, which the Company acquired in 2000, since 1979. We appreciate his many years of service to the Company; the board of directors would like to thank Mr. Lopina for his dedicated service.

Shares represented by proxies will be voted FOR the election of each of the nominees unless otherwise specified by the executing shareholder. If any nominee declines or is unable to act as a director, which the Company does not foresee, the board may name a replacement, in which case the shares represented by proxies will be voted FOR the substitute nominee.

Information regarding the nominees and the directors whose terms continue is set forth in the following table. For additional information regarding the specific attributes possessed by each of the current directors and nominees, which together with their specific business and personal experience listed in the following table, provide the bases for their nomination, see “Director Attributes” below.

The board of directors unanimously recommends that shareholders vote FOR the election of the director nominees listed in the following table.

Name and Age | | Principal Occupation and Business Experience (1) | | | Director Since (2) | |

| | | | | | | |

| | | Nominees for terms expiring in 2017 | | | | |

| | | | | | | |

| David A. Baumgarten, 63 (3) | | President of the Company and the Bank since 2010, and Chief Executive Officer of the Company and the Bank since 2013; previously Executive Vice President – Regional Banking of Associated Banc-Corp | | | 2010 | |

| | | | | | | |

David C. Boerke,

68 (4) (5) | | Principal and commercial real estate advisor, The Boerke Company, Inc., a member of the Cushman Wakefield Alliance, a commercial real estate company; president, Boerke Advocates, Inc., commercial real estate company; principal private equity investor, Antietam, LLC

| | | 2007 | |

| | | | | | | |

| Lisa A. Mauer, 56 | | Senior Vice President, Regional Development of BlackHawk Industrial (industrial products distributor) since 2011; previously, owner, president and CEO of Tool Service Corporation and affiliated entities | | | -- | |

| | | | | | | |

Robert B. Olson,

76 (5)(6) | | Retired as self-employed consultant in 2005; prior to 2000, an executive with Little Rapids Corporation, specialty paper producer

| | | 2000 | |

| | | | | | | |

| | | Continuing Directors - Terms expire in 2015 | | | | |

| | | | | | | |

Thomas H. Buestrin,

77 (4) (6) (7) (8) | | President of Buestrin, Allen & Associates Ltd., real estate investment, management and development | | | 1995 | |

| | | | | | | |

Michael T. Crowley, Jr.,

71 (3) (8) | | Chairman of the Company and the Bank; retired as Chief Executive Officer of the Company and the Bank in 2013. | | | 1970 | |

| | | | | | | |

William J. Mielke,

66 (5) (6) (7)(8) | | President and CEO of Ruekert & Mielke Inc., engineering consulting company

| | | 1988 | |

| | | Continuing Directors – Terms expire in 2016 | | | | |

| | | | | | | |

Richard A. Brown,

65 (6) | | Owner, Richard A. Brown, CPA, a firm providing CFO consulting services, since 2007; retired in 2006 as an audit partner, KPMG LLP, an international accounting firm; private equity investor and board member, Fortress Partners Capital Management, LTD | | | 2007 | |

| | | | | | | |

| Mark C. Herr, 61 (6) | | Senior Partner, Plunkett Raysich Architects LLP | | | 2001 | |

| | | | | | | |

J. Gus Swoboda,

78 (7) (8) | | Retired; prior thereto, Senior Vice President, Human and Corporate Development, Wisconsin Public Service Corporation, electric and gas utility | | | 2000 | |

______________________________________________________________________________________

| (1) | Unless otherwise noted, all directors have been employed in their respective principal occupations listed for at least the past five years. |

| (2) | Indicates the date when director was first elected to the board of the Company or Bank Mutual (the “Bank”) (the Bank is a subsidiary of the Company), as the case may be. Messrs. Brown and Boerke each became a director of the Company in 2008. Messrs. Olson and Swoboda became directors of the Company in 2000 when the Company acquired First Northern Savings Bank (“First Northern”); they became directors of First Northern in 1997 (Mr. Olson) and 1987 (Mr. Swoboda). Ms. Mauer is first standing for election at the 2014 Annual Meeting. |

| (3) | Mr. Crowley Jr. was Chief Executive Officer of the Bank and Company until his retirement on July 1, 2013, at which time Mr. Baumgarten assumed those positions. Mr. Crowley Jr. remains Chairman of the Company and Bank. |

| (4) | Messrs. Boerke and Buestrin are first cousins. |

| (5) | Member of the Compensation Committee, of which Mr. Mielke is Chairman. |

| (6) | Member of the Audit Committee, of which Mr. Brown is Chairman. |

| (7) | Member of the Nominating and Governance Committee, of which Mr. Mielke is Chairman. |

| (8) | Member of the Executive Committee, of which Mr. Crowley Jr. is Chairman. |

Director Attributes

When making its decisions regarding who to nominate, or re-nominate, for the board, the Nominating and Governance Committee of the board of directors considers an individual’s particular background and prior service with the Company, as summarized above, along with the general factors discussed in “Selection Criteria for Directors” and “Board Meetings and Committees–Nominating and Governance Committee” below.

As further discussed below, the board believes that, particularly in the context of a regulated industry, the Company generally benefits from retaining existing, long-term directors in office because of the knowledge of the industry and the Company that they can gain over the course of time. Thus, the Nominating and Governance Committee generally nominates incumbent directors for re-election to the board as long as those directors have performed, and are expected to continue to perform, in a satisfactorily manner and the board maintains an acceptable overall balance of skills and experience. On the basis of their prior professional experience, their years of experience on the Company’s board and their strong contributions as long-time directors, the Nominating and Governance Committee nominated Messrs. Baumgarten, Boerke and Olson for re-election at the 2014 annual meeting, and nominated Messrs. Crowley Jr., Buestrin, Mielke, Brown, Herr, and Swoboda for re-election at the prior two annual meetings, and that is also why the Nominating and Governance Committee has concluded, as of the date of the filing of this proxy statement, that each individual is qualified to serve on the board.

In addition, Mr. Crowley Jr. was re-nominated to the board in 2012 in part due to the practice of having the Company’s chief executive officer serve on the board. Similarly, Mr. Baumgarten is being re-nominated in part because he succeeded Mr. Crowley Jr. as Chief Executive Officer in 2013. Mr. Brown was initially nominated, and was nominated for re-election at the 2013 annual meeting, due to his extensive financial industry and accounting background, including over 36 years of public company auditing experience, focusing on the financial institutions industry, with KPMG LLP and his qualification as an “audit committee financial expert.”

Ms. Mauer is being nominated for election as a new director at the 2014 annual meeting due to her considerable business experience. Ms. Mauer was initially suggested for consideration by Mr. Buestrin, one of the independent directors. The Nominating Committee chose to nominate Ms. Mauer because, in addition to her primary employment and extensive business experience, she has significant board experience for both businesses and not-for-profit organizations. Ms Mauer has also served on the State of Wisconsin Economic Development Corporation Board since 2011.

Selection Criteria for Directors

The selection criteria for membership on Bank Mutual Corporation’s board of directors, which were confirmed by the board in connection with the formation of the Nominating and Governance Committee and have been periodically reviewed thereafter, include: strength of character and judgment; honesty and integrity; a diversity of skill, education and experience with businesses and other organizations; interplay of the candidates’ experience with the experience of other board members; and the extent to which the candidate would be a desirable addition to the board or its committees. Nominees must have a background that demonstrates an understanding of business and

financial affairs, and should have a proven record of competence and accomplishments through leadership in industry, education, the professions or government. The Nominating and Governance Committee Charter identifies the following core areas that should be represented on the board: accounting and finance; business judgment; management; crisis response; industry knowledge; leadership; and strategic vision. A first-time nominee should be highly respected and active in his or her profession. A nominee must be a Company shareholder, and the willingness to hold a significant position in Company stock will be considered. A nominee must be capable and able to work well with other directors and management and be able to spend the time needed to function effectively as a director. To help assure that the director has the necessary time to effectively function as a director, the Nominating and Governance Committee Charter prohibits a director from serving on more than three boards of publicly-held companies in addition to the Company. The nominee must have a genuine interest in representing the interests of the Company and the shareholders overall, not any particular interest group. The nominee should not have conflicts of interest that would interfere with that person’s duty of loyalty.

When considering directors for re-nomination, in addition to the above criteria, the Nominating and Governance Committee also heavily weights the existing director’s record of service on the board by assessing and reviewing such director’s contributions to the board and the Company. Assuming satisfactory performance, an existing director will generally be re-nominated absent specific need by the Company to change the mix of directors. Significant job or employment changes are also considered in determining whether to re-nominate an existing director. Further, the Nominating and Governance Committee Charter provides that if a director experiences a change in employment (other than a promotion or retirement), he or she must submit a resignation letter to the board; the board will decide to accept the resignation or not based on its determination of whether the change will adversely affect the board or the Company. The Company has not paid any third party fee to assist in the process of identifying or evaluating director nominees.

While the board does not have a separate formal diversity policy, it is the Company’s and the board’s policy to identify qualified potential candidates without regard to any candidate’s race, color, disability, gender, national origin, religion or creed, and the Company seeks to ensure the fair representation of shareholder interests on the board through the criteria set forth above. The board believes that the use of the Nominating and Governance Committee’s general criteria, along with non-discriminatory policies, will best result in a board that shows diversity in many respects. The board believes that it currently maintains that diversity.

Board Meetings and Committees

The Bank Mutual Corporation board of directors met five times during 2013. Messrs. Boerke, Brown, Buestrin, Herr, Lopina, Mielke, Olson and Swoboda are considered “independent” under The Nasdaq Stock Market rules; all members of the Audit, Compensation and Nominating and Governance Committees are “independent.” If elected, Ms. Mauer would also be considered “independent” under such standards. As part of the board meetings, independent directors regularly met without management or non-independent directors present. Mr. Mielke informally chairs those executive sessions. Each director attended at least 75% of the total of the number of meetings of the board and the number of meetings of all committees of the board on which such director served during the year.

When making its determinations regarding director independence, the board of directors considers The Nasdaq Stock Market rules and also reviews other transactions and relationships involving the Company, which are described, or of the types described, in “Certain Transactions and Relationships with the Company.” The board has not considered ordinary course of business banking transactions with the Bank, such as a banking relationship with a trust for Mr. Buestrin’s daughter, to be an impediment to independence, so long as the transactions meet the standards described in “Certain Transactions and Relationships with the Company.”

Board Leadership Structure. Historically, the Company has combined the positions of Chairman and Chief Executive Officer because it believed that, based on the highly-regulated nature of the financial institutions industry and the increased frequency of interactions with the regulators in recent periods, it was important that the Chairman be very familiar with the industry and the Company’s operations.

As of July 1, 2013, Mr. Crowley Jr. retired as Chief Executive Officer of the Company and the Bank; however, as previously announced, he remains part of the board of directors as non-executive Chairman. Since Mr. Crowley Jr. has remained as a director, the board determined that he should remain as non-executive chairman because he will continue to use the skills and knowledge he obtained as Chief Executive Officer for the Company’s benefit. Having a current or former executive officer such as Mr. Crowley Jr. serve as chairman allows him to use his substantial experience and information gained from those roles to effectively lead the Company and keep the non-management board members apprised of recent developments regarding the day-to-day operations of the Company and the industry.

From time to time, the Company re-evaluates whether to combine or separate the Chairman and Chief Executive Officer positions. One occasion for doing so was Mr. Crowley Jr.’s decision to retire as Chief Executive Officer. Given Mr. Crowley Jr.’s long history of leadership within the Company and experience in the financial institutions industry, the Company believed that it was appropriate for Mr. Crowley Jr. to continue to serve as Chairman and, therefore, separated the Chairman and Chief Executive Officer positions following Mr. Crowley Jr.’s retirement. Although Mr. Crowley Jr. is not an “independent” Chairman under Nasdaq and federal securities rules (by virtue of his prior employment with the Company), the board currently believes that having a non-independent Chairman is appropriately counter-balanced by the fact that all but one of the other directors are independent and that the independent directors meet in executive session at each board meeting. While the board has not formally appointed an independent lead director, Mr. Mielke has traditionally served as the independent directors’ designee for relaying information from the independent directors of the board to management and effectively has undertaken many of the same responsibilities that an independent lead director would have.

Audit Committee. The Audit Committee is responsible for, among other things, assisting the board in: fulfilling its fiduciary responsibilities as to the Company’s accounting policies, reporting practices and controls and the sufficiency of auditing relating thereto; assuring the independence and qualifications of the outside auditors, the integrity of management and the adequacy of disclosures to shareholders; evaluating the performance of the Company’s independent registered public accounting firm; and reviewing related party transactions and potential conflict of interest situations.

The Audit Committee met four times in 2013. On behalf of the Audit Committee, Mr. Brown, its chair, also regularly consulted with the independent registered public accounting firm about the Company’s periodic public financial disclosures, and participated in eight calls relating to SEC-filed documents and financial disclosures. See also “Report of the Audit Committee” and “Independent Registered Public Accounting Firm” for other information pertaining to the Audit Committee.

The current members of the Audit Committee are Messrs. Brown (Chairman), Buestrin, Mielke and Olson. The board believes that all of the members of the Audit Committee have sufficient experience, knowledge and other personal qualities to be “financially literate” and be active, effective and contributing members of the Audit Committee. In addition, the board has determined that Mr. Brown meets the SEC’s definition of “audit committee financial expert.” The board’s determination was based on Mr. Brown’s 36 years of employment and public company auditing experience with KPMG LLP, an international public accounting firm. The board has also determined that Messrs. Buestrin, Mielke and Olson are “financially sophisticated” within The Nasdaq Stock Market rules. Mr. Buestrin was for seven years a member of the board of directors of the Federal Home Loan Bank of Chicago, and served for several years on its audit committee and, at its request, on the boards of several savings institutions. Both Messrs. Buestrin and Mielke have served as executive officers of their companies, and in those positions have regularly had responsibility for their companies’ financial affairs as well as financial matters for projects undertaken by their companies. Mr. Olson has served as an executive officer of a manufacturing company, and for many years was the chief operating officer of one of its divisions. As such, Mr. Olson had primary responsibility for financial performance and reporting of that division.

Compensation Committee.The current members of the Compensation Committee are Messrs. Mielke (Chairman), Boerke, Lopina and Olson. The Compensation Committee held nine regular meetings during 2013. The Compensation Committee reviews, and either establishes or recommends to the board: compensation policies and plans; salaries, bonuses and benefits for all officers; salary and benefit levels for employees; determinations with respect to stock options and restricted stock awards; and other personnel policies and procedures. In addition, the Compensation Committee met informally numerous additional times with respect to changes in the Company’s

401(k) and pension plans. See also “Compensation Discussion and Analysis”for other information pertaining to the Compensation Committee, including information about the Compensation Committee’s policies and procedures. Upon expiration of his term as a director at the 2014 annual meeting, Mr. Lopina will also resign from his service on the Compensation Committee.

Compensation Committee Interlocks and Insider Participation. None of the members of the Compensation Committee served as an officer or employee of the Company, the Bank or a Bank subsidiary, nor did any of them have any other reportable interlock. For a description of the Company’s policies with respect to loans to and other banking transactions with officers, directors and employees, see “Certain Transactions and Relationships with the Company.”

Nominating and Governance Committee. The current members of the Nominating and Governance Committee are Messrs. Mielke (Chairman), Buestrin, Herr and Swoboda. The Nominating and Governance Committee held one meeting in 2013. The Nominating and Governance Committee considers nominees for director positions and also evaluates and oversees other corporate governance and related issues. The Nominating and Governance Committee will identify nominees based upon suggestions by outside directors, management members and/or shareholders and evaluate them in accordance with its established criteria. See “Director Attributes” and “Selection Criteria for Directors” above.

The Nominating and Governance Committee will consider proposed nominees whose names are submitted to it by shareholders, and it would evaluate proposed nominees from shareholders the same regardless of who has made the proposal. If a shareholder wishes to suggest a name for the Nominating and Governance Committee to consider for a director position, the name of that nominee and related personal information should be forwarded to the Nominating and Governance Committee, in care of the corporate secretary, at least five months before the next annual meeting to assure time for meaningful consideration by the Nominating and Governance Committee or should be submitted to the corporate secretary in accordance with the procedures set forth in the Company’s bylaws. The Nominating and Governance Committee believes that such this process for considering shareholder nominations is adequate given the lack of suggestions received from shareholders in the past. The Nominating and Governance Committee reviews periodically whether additional policies should be adopted. See also “Shareholder Proposals and Notices” for bylaw requirements for nominations. The Company has not received any proposed nominees who have been suggested by eligible 5%-or-greater security holders contemplated by relevant SEC disclosure requirements, or rejected any such nominees.

Executive Committee. The current members of the Executive Committee are Messrs. Crowley Jr. (Chairman), Buestrin, Mielke and Swoboda. The Executive Committee did not meet in 2013. The Executive Committee may act on most matters on behalf of the entire board when action is necessary or appropriateon short notice between board meetings.

Committee Charters. The board of directors has adopted charters for the Audit, Compensation and Nominating and Governance Committees. The Company will continue to respond to and comply with SEC and The Nasdaq Stock Market proposals relating to board committees as they are finalized, adopted and become effective. The Company posts copies of the charters for its Audit, Compensation and Nominating and Governance Committees (including director selection criteria) and other corporate governance documents on its website, at www.bankmutualcorp.com, under the link “Corporate Governance.” If any of those documents are changed, or related documents adopted, those changes and new documents will be posted on the Company’s corporate website at the internet address above.

Other Board and Corporate Governance Matters

Communications between Shareholders and the Board. Any shareholder communication that is sent to the board in care of the chief executive officer, the corporate secretary or another corporate officer is forwarded to the board, unless the communication relates specifically to a customer inquiry or complaint for which shareholder status is not relevant. The chief executive officer and the corporate secretary have been given the authority to conduct that screening process and make that determination. The procedure has been unanimously approved by the board, and was specifically approved by its independent members. Unless and until any other more specific procedures are

developed and posted on the Company’s website, any communications to the board of directors should be sent to it in care of the chief executive officer or the corporate secretary.

Director Attendance at Annual Shareholders’ Meeting. Bank Mutual Corporation expects all of its directors to attend the annual meeting of shareholders. A board meeting is also held immediately after the annual shareholders’ meeting to facilitate directors’ attendance at both. All directors attended the 2013 annual meeting of shareholders.

Code of Ethics and Code of Conduct. As a long-standing part of the Company’s and the Bank’s corporate governance practices, the Bank has had for many years a code of ethics and a code of conduct. Bank Mutual Corporation has built on these codes to reflect current circumstances and SEC and Nasdaq definitions for such codes, and currently has a vision statement, a code of ethics and a code of conduct for itself, the Bank and other subsidiaries. Among other things, the code of ethics and code of conduct include provisions regarding honest and ethical conduct, conflicts of interest, full and fair disclosure, compliance with law, and reporting of and sanctions for violations. The codes apply to all directors, officers and employees of Bank Mutual Corporation and subsidiaries. The Company has posted copies of its vision statement, code of ethics and code of conduct on its corporate website, at www.bankmutualcorp.com, under the link “Corporate Governance.” If further matters are documented, or if those documents (including the code of ethics and the code of conduct) are changed, waivers from the code of ethics or the code of conduct are granted, or new procedures are adopted, those new documents, changes and/or waivers will be posted on the corporate website at the internet address above.

Board Role in Risk Oversight. The board believes that long-term, sustainable value creation and preservation is attainable through the prudent assumption and management of both risks and potential rewards, and the Company’s board as a whole takes a leading role in overseeing the Company’s overall risk tolerances. Eight of the ten members currently serving on the Company’s board also comprise the Bank’s board and, therefore, are aware of and can report to the entire Company board regarding the Bank’s risk-related policies, and help implement oversight by the Company’s board. The financial institutions industry is highly-regulated; the board of the Bank maintains and considers compliance with various extensive formal policies that are reviewed and approved annually to ensure that the Bank and its policies comply with those regulations. The policies include, among other matters, those related to interest rate risk, business continuity risk, lending and underwriting, regulatory compliance, environmental risks, insider trading, codes of ethics and conduct, internal controls, information security and information technology risk management.

In addition, the Compensation Committee of the Company’s board of directors also considers risk when making compensation determinations so as not to encourage excessive risk-taking. See “Risk Management and Compensation” below.

DIRECTORs’ COMPENSATION

Meeting Fees

The Company. In 2013, Bank Mutual Corporation’s directors who are not officers received a $14,000 annual retainer for serving as a member of the board of directors. Each director also received a fee of $1,600 per board meeting attended, the Chairman of the Audit Committee received $1,000 for each Audit Committee meeting and each other non-officer director received $600 for each meeting attended of a committee of which the director is a member. For purposes of determining fees, meetings include conference calls in which committee chairs and/or other representatives participate to review Company disclosures and filings. For 2014, the annual retainer for serving as a member of the board of directors has been increased to $16,000; board and committee meeting fees remain the same for 2014. Some directors of the Company also serve as a director of the Bank; compensation for service on the Bank’s board of directors is described below. As a consequence of his retirement as an officer and an employee of the Company as of June 30, 2013, Mr. Crowley Jr. became eligible to receive this compensation as a director after that date.

The Bank. The Bank does not pay a retainer fee to its directors. In 2013, each director received a $1,400 fee for each board meeting attended and each non-officer director received a $1,500 fee for attending an executive committee meeting. For 2014, the board meeting fee was increased to $1,600 for each board meeting attended; the

non-officer director fee for attending an executive committee meeting remains $1,500 for each such meeting attended.

Messrs. Baumgarten, Boerke, Brown, Buestrin, Crowley Jr., Herr, Mielke and Olson were directors of the Bank in 2013. Messrs. Baumgarten, Boerke, Buestrin, Crowley Jr. and Olson were members of the Bank’s executive committee in 2013. Each individual who served as a director of the Bank or as a member of its executive committee in 2013 is expected to continue as such in 2014.

Stock Incentive Plans

Bank Mutual Corporation directors were previously eligible to participate in the Company’s 2004 Stock Incentive Plan (“2004 Stock Plan”). The options and restricted stock grants vest 20% per year, becoming fully vested after five years, subject to accelerated vesting in the event of a change in control of the Company, death or disability. Other than grants to Messrs. Boerke and Brown in 2008 when they joined the Company’s board, no options or awards of restricted stock were granted to non-employee directors under either plan from 2005 through 2010. However, to recognize the additional responsibilities placed on directors as a consequence of recent legislation, the more stringent regulatory climate and the challenges in the weak economy, the Compensation Committee began to grant options annually in January, 2011. Consistent with this practice, the Compensation Committee granted options to purchase 11,000 shares to each non-officer director on January 22, 2013. Such options were granted at $4.82 per share, the average of the high and low trading prices on that date, and vest over a five-year period. Similarly, the Compensation Committee granted options to purchase 7,500 shares to each non-officer director on January 21, 2014, excluding Mr. Crowley, who was granted options to purchase 10,000 shares in recognition of his role as Chairman. Such options were granted at $7.17 per share, the average of the opening and closing trading prices on that date, and vest over a five-year period. The Compensation Committee also granted 8,000 shares of restricted stock to Mr. Crowley Jr. in recognition of his role as Chairman.

The 2004 Stock Plan expired in February, 2014, and no more awards can be granted under it. Therefore, after careful consideration, the Committee has prepared a new equity incentive plan and is now seeking shareholder approval of the plan. See “Approval of the Bank Mutual Corporation 2014 Incentive Compensation Plan” herein for the details of a proposed successor plan in which the directors may participate.

Deferred Plans for Directors

The Company maintains a deferred retirement plan for its non-officer directors (other than Messrs. Lopina, Olson and Swoboda who are covered by the First Northern plan described below). Effective January 1, 2014, Non-officer directors who have provided at least five years of service will be paid $1,333 per month for 10 years (or, if less, the number of years of service on the board) after their retirement from the Bank board or age 65, whichever is later (this amount was $1,167 per month through December 31, 2013). As of December 31, 2013, all of the existing eligible non-officer directors’ benefits have vested. In the event a director dies prior to completion of these payments, payments will go to the director’s heirs. The Company has funded these arrangements through “rabbi trust” arrangements and, based on actuarial analyses, believes these obligations are adequately funded. The plan may be amended by the Company’s board of directors, although a plan amendment generally may not impair the rights of persons who are receiving benefits under the plan.

A similar deferred retirement plan of First Northern established prior to its acquisition by the Company in 2000 terminated upon First Northern’s merger into the Bank in 2003. Messrs. Lopina, Olson and Swoboda have vested benefits under that plan, but do not accrue further benefits. That plan provides for monthly payments of $1,000 for 180 months after the end of First Northern board service or until the director’s death, if earlier. Payments under that plan to Messrs. Lopina, Olson and Swoboda began in 2003 as a consequence of the merger of First Northern into the Bank and are continuing.

Other

See “Executive Compensation” for compensation paid to, and other compensatory agreements with, Messrs. Crowley Jr. and Baumgarten during 2013 as executive officers and employees of Bank Mutual Corporation and the Bank. See also “Certain Transactions and Relationships with the Company” for information on amounts paid to Michael T. Crowley Sr., a former director and the father of Mr. Crowley Jr.

Directors’ Compensation Table

Set forth below is a summary of the compensation paid to each person who served as non-officer director in fiscal 2013:

Directors’ Compensation Table

2013

| Name | | Fees Earned or Paid in Cash ($) (1) | | | Stock Awards ($) | | | Option Awards ($) (2) | | | All Other Compensation ($) (3) | | | Total ($) | |

| Mr. Boerke | | | 77,200 | | | | 0 | | | | 14,355 | | | | 14,000 | | | | 105,555 | |

| Mr. Brown | | | 47,600 | | | | 0 | | | | 14,355 | | | | 14,000 | | | | 75,955 | |

| Mr. Buestrin | | | 74,800 | | | | 0 | | | | 14,355 | | | | 0 | | | | 89,155 | |

| Mr. Crowley Jr. | | | 36,600 | | | | 0 | | | | 0 | | | | 0 | | | | 36,600 | |

| Mr. Herr | | | 39,400 | | | | 0 | | | | 14,355 | | | | 0 | | | | 53,755 | |

| Mr. Lopina | | | 27,400 | | | | 0 | | | | 14,355 | | | | 12,000 | | | | 53,755 | |

| Mr. Mielke | | | 47,500 | | | | 0 | | | | 14,355 | | | | 0 | | | | 61,855 | |

| Mr. Olson | | | 76,700 | | | | 0 | | | | 14,355 | | | | 12,000 | | | | 103,055 | |

| Mr. Swoboda | | | 22,600 | | | | 0 | | | | 14,355 | | | | 12,000 | | | | 48,955 | |

| (1) | Includes annual retainer, meeting, committee and chairmanship fees for services on the board of the Company and, when applicable, the Bank. For director fees paid to Mr. Crowley Jr. prior to his retirement and to Mr. Baumgarten, see the “Summary Compensation Table” below. |

| (2) | As discussed above, on January 22, 2013, each non-officer director received options to purchase 11,000 shares of Company common stock. Such options were granted at $4.82 per share, the average of high and low trading prices on that date, and vest over a five-year period. The amounts shown reflect the grant date fair value computed in accordance with ASC 718 for grants and awards under the 2004 Stock Plan. ASC 718 requires the Company to recognize compensation expense for stock options and other stock-related awards granted to employees and directors based on the estimated fair value under ASC 718 of the equity instrument at the time of grant. The assumptions used to determine the valuation of the awards are discussed in Note 11 to the consolidated financial statements. See the following table for information regarding all outstanding awards to non-officer directors. |

The ultimate value of the options will depend on the future market price of Company common stock, which the Company cannot forecast. The actual value, if any, that an optionee would realize upon exercise of an option depends on the market value of Company common stock as compared to the exercise price when the option is exercised.

| (3) | Represents, in the case of Messrs. Lopina, Olson and Swoboda, payments under the First Northern directors’ deferred retirement plan. In the case of Messrs. Boerke and Brown, it represents benefits accrued during the fiscal year under the Company’s deferred retirement plan for directors, based on one additional year of service. The deferred compensation payments for the non-officer directors have fully vested as of December 31, 2013. No further benefits are being accrued nor do any earnings accrue thereon. |

* * *

Each non-officer director who served as a director in 2013 had the following equity awards outstanding as of the end of fiscal 2013. For information regarding options and restricted stock held by Mr. Baumgarten, see the “Outstanding Equity Awards at Fiscal Year-End” table below.

| | Option Awards | | | Stock Awards | |

| Name | | Number of Securities Underlying Unexercised Options (#) (1) (2) | | | Number of Shares of Stock That Have Not Vested (#) (2) | |

| Mr. Boerke | | | 57,000 | | | | 0 | |

| Mr. Brown | | | 57,000 | | | | 0 | |

| Mr. Buestrin | | | 121,000 | | | | 0 | |

| Mr. Crowley Jr. | | | 747,000 | | | | 0 | |

| Mr. Herr | | | 121,000 | | | | 0 | |

| Mr. Lopina | | | 112,000 | | | | 0 | |

| Mr. Mielke | | | 121,000 | | | | 0 | |

| Mr. Olson | | | 121,000 | | | | 0 | |

| Mr. Swoboda | | | 121,000 | | | | 0 | |

| (1) | The options generally expire upon on the earlier of (i) 10 years from the date of grant or (ii) termination of service as a director, except that directors and executive officers have: (x) one year after death or termination due to disability to exercise options, whether or not exercisable at the time of such death or termination, or (y) one year upon a termination other than for cause to exercise options that were exercisable at the time of such termination. |

| (2) | Options vest 20% per year in each of the five years after the grant date, or earlier in the event of a change in control of the Company, death or disability. The following option shares had vested as of December 31, 2013: Messrs. Brown and Boerke – 25,000 each; Messrs. Buestrin, Herr, Mielke, Olson and Swoboda – 89,000 each; and Mr. Lopina – 80,000. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the federal securities laws, the Company’s directors, executive officers and any person holding more than 10% of Company common stock are required to report their initial ownership of the common stock and any change in that ownership to the Securities and Exchange Commission (“SEC”). Specific due dates for these reports have been established and the Company is required to disclose in this proxy statement any failure to file such reports by these dates during the last year.

The Company believes that all of these filing requirements, except one, were satisfied on a timely basis for the year ended December 31, 2013. In making these disclosures, the Company has relied solely on written representations of its directors and executive officers and copies of the reports that they have filed with the SEC. Based on information in his Form 4 filed February 5, 2014, Mr. Mielke filed on an untimely basis with respect to one sale of shares of the Company’s common stock by a trust for the benefit of Mr. Mielke’s mother-in-law, for which Mr. Mielke’s wife served as trustee.

EXECUTIVE OFFICERS

The following table lists the executive officers of the Company and the Bank as of March 3, 2014.

| Name and Age | | Offices and Positions with the Company and the Bank (1) | | | Executive Officer Since | |

| | | | | | | |

| David A. Baumgarten, 63 | | Chief Executive Officer of the Company and the Bank since 2013 and President of each since 2010; previously, Executive Vice President – Regional Banking of Associated Banc-Corp | | | 2010 | |

| Michael W. Dosland, 54 | | Senior Vice President and Chief Financial Officer of the Company and the Bank since 2008; former President and Chief Executive Officer of Vantus Bank and First Federal Bankshares from 2006 to August 2008; Lieutenant Colonel and Infantry Battalion Commander, United States Army, Iraq Theater of Operations prior thereto (2) | | | 2008 | |

| P. Terry Anderegg, 63 | | Senior Vice President – Retail Banking of the Bank | | | 1993 (3) | |

| James P. Carter, 56 | | Vice President and Secretary of the Company since 2009; Vice President Corporate Counsel of the Bank since 1991 | | | 2009 | |

| Gregory A. Larson, 59 | | Senior Vice President – Director of Commercial Banking of the Bank since 2010; previously, Senior Vice President/Group Manager – Commercial Banking of Associated Bank, N.A. | | | 2011 | |

| Patrick W. Lawton, 51 | | Senior Vice President—Investment Real Estate of the Bank since 2013; formerly Senior Vice President—Real Estate of BMO Harris Bank (M&I). | | | 2014 | |

| Christopher L. Mayne, 49 | | Senior Vice President – Chief Credit Officer of the Bank since 2011; previously, Senior Vice President – Senior Credit Officer for Middle Market Lending of Associated Bank, N.A. | | | 2011 | |

| Daniel J. Mekemson, 69 | | Senior Vice President—Residential Lending of the Bank since 2013; previously President of Mekemson Consulting Services. | | | 2014 | |

| Terri M. Pfarr, 53 | | Senior Vice President—Human Resources of the Bank since 2014, and its Vice President—Human Resources since 2013; formerly Director of Human Resources for ACC Holding, Inc. | | | 2014 | |

| Richard L. Schroeder, 56 | | Vice President – Controller and Principal Accounting Officer of the Company since 2009, Vice President – Controller of the Bank since 2008; formerly Vice President – Finance of Guaranty Bank from 1995 to 2008 | | | 2009 | |

| (1) | Excluding directorships and excluding positions with Bank subsidiaries. Those positions do not constitute a substantial part of the officers’ duties. Includes other positions held in the past five years, if the individuals have not held their current positions for that entire period. |

| (2) | In September 2009, Vantus Bank was closed by the Office of Thrift Supervision, and the Federal Deposit Insurance Corporation (“FDIC”) was appointed as Vantus’ receiver. Those events occurred more than one year after Mr. Dosland left his positions with Vantus Bank. In May 2013, the FDIC brought suit against the directors and executive officers of Vantus Bank, including Mr. Dosland, alleging negligence and breaches of duty in connection with certain actions taken while at Vantus Bank; Mr. Dosland and the other defendants are vigorously defending against these allegations, which remain unproven. |

| (3) | This position has been considered to be an executive officer position of the Company since 2003. |

COMPENSATION DISCUSSION AND ANALYSIS

Summary.The board’s Compensation Committee (for purposes of this Compensation Discussion and Analysis, the “Compensation Committee” or the “Committee”) makes decisions relating to Company compensation consistent with an intent to use compensation to attract and retain talented and highly-experienced personnel and to provide incentives for such personnel to maximize corporate performance. The major elements of compensation that the Committee uses to achieve these goals are driven by competitive market pressures and include:

| · | fixed salaries, which are intended to provide the Company’s executive officers with a predictable stream of income for their living expenses, in an amount commensurate with their duties and responsibilities and which is competitive with peer companies; |

| · | possible annual cash incentive bonuses, which tie potential additional cash compensation to specified objective Company financial goals and specific individual performance goals; |

| · | stock-based compensation, which is intended to further align the interests of executive officers and shareholders and incent executive officers by providing economic rewards tied to increases in shareholder value; and |

| · | longer-term compensation, including retirement benefits and protections in the event of a change in control, which are intended to retain executives and reward long-term service to the Company and provide a degree of security to executive officers to assist their focus on corporate goals. |

In addressing these elements, the Company is aware that there is a high degree of competition for the services of talented employees, particularly those with significant experience in the financial institutions industry. The Committee particularly focuses on obtaining and retaining the services of highly-experienced personnel, especially those with a long-term commitment to the Company.

Committee Composition. The Bank Mutual Corporation board of directors has established a Compensation Committee to determine salaries of executive officers and make other compensation and benefit plan decisions. The Committee made compensation determinations for 2013, and expects to continue in that role going forward, including for 2014. All members of the Committee are independent directors.

Compensation Philosophy. In determining compensation, the Committee has recognized that the Company must provide its executive officers and key employees a market-competitive compensation package in order to attract and retain talented and highly-experienced personnel. The Committee has sought to offer compensation which it believes is in line with compensation paid by other similarly situated institutions, including banks, savings banks and savings associations, so as to be neither unduly generous nor lagging behind other institutions. In making its decisions, the Committee has also noted that, as a mutual institution, the Bank previously could not provide stock-based incentive compensation, as could publicly-held institutions, and noted the effect on prior compensation. In particular, and in part because of the years as a mutual institution, the Committee has sought to especially recognize and reward service to the Company over an extended period of time; the Committee believes that the Company greatly benefits from such continuity of experience.

The Committee has the ultimate authority within the Company to make fundamental decisions as to the types of compensation plans offered by the Company to its executive officers, as well as to determine compensation levels under those plans. From time to time, the Committee uses outside consultants or advisors to assist it in analyzing the Company’s compensation programs and determining appropriate levels of compensation and benefits. The Committee has full discretion as to whether to use compensation consultants or other third party services, as well as the identity and compensation of such persons or entities.

In making its determinations (including for fiscal 2013 and 2014), the Committee has utilized compensation summaries involving comparably-sized Midwestern financial institutions. While the Committee reviews these studies and uses them as a resource, it does not formally or numerically benchmark Company

compensation as compared to other companies or aim for any particular compensation level compared to those other companies. In 2012, these studies were prepared for the Committee by RP Financial, LC. (“RP Financial”), which also advises the Company and its management on certain other financial matters. Since the analyses by RP Financial have generally involved objective criteria and summarization, the Committee believes that RP Financial is sufficiently independent to make an appropriate review and that its relationship with RP Financial has not given rise to any conflict of interest, even though the Company utilizes RP Financial’s services for other purposes. RP Financial does not make recommendations to the Committee or management or otherwise act as a “compensation consultant.”

From time to time, the Company may also use other third-party compiled compensation information to assist in making compensation decisions. For example, in 2012, the Committee utilized the services of Milliman Inc. (“Milliman”), a provider of actuary services to the Company, to perform calculations to help with analyzing various potential changes to the Company’s pension plan. Prior to engaging Milliman to perform these calculations, the Committee considered the relevant factors set forth in the final SEC and proposed Nasdaq rules and determined that Milliman is sufficiently independent to appropriately advise the Committee on such matters and that its relationship with Milliman does not give rise to any conflict of interest. In addition, Fidelity Workplace Service, LLC, was a consultant to the Company and the board as a whole with respect to changes in the pension and 401(k).

As a federally-regulated savings bank holding company, the Company is subject to various laws and regulations that govern the compensatory plans, programs, agreements and arrangements established by the Company and the Bank. The Committee therefore establishes compensation in a manner intended to conform with those laws and regulations. In addition, compensation decisions, like all others, must be made with the safety and soundness of the regulated institutions in mind. See also “Risk Management and Compensation” below.

The Committee also considers the results of advisory “say-on-pay” shareholder votes when making compensation decisions. The Company holds such votes annually, and the Company’s shareholders have voted to approve the compensation of the Company’s executive officers at each previous annual meeting for which there was such an advisory vote.

In addition, upon request, other personnel of the Company (including from time to time executive officers) compile and summarize additional information and prepare tally sheets for the Committee. For 2013, Messrs. Crowley Jr. and Dosland provided these services. In addition, Messrs. Crowley Jr. and Baumgarten participated in discussions of, and made recommendations regarding, other executive officers’ compensation for 2013, but not in discussions of their own. Mr. Baumgarten similarly participated for other executive officers’ compensation for 2014.

Elements of Compensation. The Company, with the review of the Committee, offers various types of compensation for its executive officers and, in most cases, other employees in order to achieve and balance various corporate goals and remain competitive with other financial institutions. The Company’s corporate compensation goals include attracting and retaining highly-qualified employees, motivating those employees to achieve improved corporate results without encouraging unnecessary risk taking, and connecting employees’ interests with shareholders’ interests in order to induce long-term commitment to the Company through the provision of financial security in retirement and, in the case of executive officers, in the event of a change in control of the Company.

Salary. The Company provides a significant portion of compensation through a fixed salary. The Committee believes that providing competitive base salary levels is important in attracting and retaining talent, as salary levels are often the initial point of consideration in a compensation package. The Committee also believes salary is important to provide officers with a steady and predictable source of income for them and for their families’ basic living needs. Salaries are intended to be commensurate with their duties and responsibilities and market competitiveness.

Cash Bonus/Incentives. The Committee considers it important to offer financial incentives to achieve corporate performance goals that are measured by specific financial metrics. Therefore, the Company provides annual cash incentives through its Management Incentive Compensation Plan (the “Management Incentive Plan”). Under the Management Incentive Plan, the Committee establishes Company financial performance criteria upon which cash incentives depend. The Committee believes it is important to align performance criteria with specific incentives to promote achievement of corporate financial goals. These goals are particularly targeted to the

Company’s goalsand results, and do not depend upon stock market performance, which can be heavily influenced by factors outside of the Company’s control and its own financial performance. The Committee believes that this creates further incentive for employees to achieve corporate goals and aims to establish goals that are reasonably achievable but do not encourage unnecessary risk taking.

Individual goals are also set for the executive officers (other than the President and CEO, whose bonus solely depends on corporate performance) and employees, and a portion of their bonuses depend upon the achievement of these goals. The Committee believes that it is important to particularize some portion of the bonuses for these individuals to incent personal performance. However, in the case of executive officers, to recognize the importance of the Company-wide goals, these plan bonuses may be earned only if the Company also meets its corporate financial performance thresholds.

In addition, the Committee may from time to time award discretionary bonuses based on various factors and achievements, including for example, the successful completion of a specific project, achievement of meaningful business development or increased profitability, responding to adverse economic conditions, promotion to a new position or increased responsibilities and case-by-case increases driven by competitive pressures and market conditions.

Stock-Based Plans. Historically, the Company and the Committee have provided incentives that link executive officers’ compensation to the returns experienced by Company shareholders. To accomplish that, the Committee has maintained a stock incentive plan (and, in prior years, utilized an employee stock ownership plan) to provide awards of Company common stock. Restricted stock grants issued under an equity incentive plan are intended to provide an additional equity stake in the Company with the goal of helping grantees further identify with other shareholders of the Company. The Company has previously granted stock options and made management recognition awards of shares of restricted stock under its 2004 Stock Incentive Plan (“2004 Stock Plan”). Both options and restricted stock have vested over five-year periods, in order to incent long-term employment with the Company and to comply with regulations in place when the 2004 Stock Plan was adopted; these regulatory limitations would not apply to the 2014 Incentive Plan (defined below), which is drafted to permit the Committee greater flexibility to respond to the Company’s needs and establish conditions when the awards are made.

The 2004 Stock Plan expired in February, 2014, but the Committee believes these incentives are important and wishes to continue them. Therefore, the Company has prepared, and is seeking shareholder approval of, a 2014 Incentive Compensation Plan (“2014 Incentive Plan”), discussed below. Stock options, which are awarded at the average market value (average of the high and low trading prices) on the date of grant, are intended to reward option holders in the event of increases in market price of that stock over time.

The 2004 Stock Plan, and a similar predecessor plan, were established in connection with the Company’s conversion from a mutual institution to a fully shareholder-owned institution. The Company’s and the Bank’s primary regulator at the time of the conversion had regulations that significantly controlled the types and provisions of plans that could be adopted shortly after conversion. Because the 2004 Stock Plan and its predecessor plan were adopted during those periods, they were limited by those regulations. In light of these regulations and in recognition of the fact that periods of conversion from a mutual form of organization create insecurity for management and other employees, the Committee did not believe it was appropriate to impose further limitations upon the stock plans. Therefore, for example, the Company chose to implement plans that provide for time vesting (rather than performance vesting) for the awards. In addition, through 2010, the Company historically made relatively large option grants only after the two conversion transactions and in connection with new hires, rather than making annual grants, because it believed that this practice would recognize the past service of key employees, best recognize long-term service to the Company and attract key employees to join, and incent them to remain with, the Company.

As a result of its regular reviews and other relevant factors, in January 2011, the Committee began the practice of annually granting certain officers and key employees options or restricted stock. The Committee also considers and makes additional grants in connection with new hiring and significant promotions.