united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-10123

The North Country Funds

(Exact name of Registrant as specified in charter)

80 Arkay Drive, Hauppauge, NY 11788

(Address of principal executive offices) (Zip code)

James Ash

c/o Gemini Fund Services, LLC., 80 Arkay Drive, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 11/30

Date of reporting period: 11/30/14

Item 1. Reports to Stockholders.

| | | The North Country Funds |

| | | |

| | | Equity Growth Fund |

| | | Intermediate Bond Fund |

| | | |

| | |  |

| | | |

| | | Annual Report |

| | | November 30, 2014 |

| | | |

| | | |

Investment Adviser North Country Investment Advisers, Inc. 250 Glen Street Glens Falls, NY 12801 Administrator and Fund Accountant Gemini Fund Services, LLC 80 Arkay Drive Hauppauge, NY 11788 Investor Information: (888) 350-2990 | | This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the North Country Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. |

The North Country Funds

ANNUAL REPORT

November 30, 2014

ECONOMIC SUMMARY

The U.S. economy grew 3.5% in the third quarter, and economic growth has exceeded 3.0% in four of the last five quarters. We expect the U.S. economy to expand by 3.0% in the fourth quarter and are forecasting GDP growth in 2015 to be between 3-3.25%.

Unemployment continues to improve. Nonfarm payrolls rose 214,000 in October, which marks the ninth consecutive month of increases of 200,000 or more. The unemployment rate dropped from 5.9% to 5.8%, and the participation rate improved slightly from 62.7% to 62.8%. While this is encouraging, the participation rate remains at historical lows and wage growth remains modest.

Consumer spending, business spending, housing and manufacturing have positively contributed to economic growth, and we expect that to be the case in 2015. We may see consumer spending surprise to the upside in the fourth quarter due to the reduction in gasoline and oil prices.

The Federal Reserve ended quantitative easing at its October meeting; however, short-term interest rates, in our opinion, should remain low, with the Federal Reserve keeping the Federal Funds rate between 0% and 0.25% through late 2015.

Global growth is slowing, especially within the Eurozone and Japan. We expect both regions to implement their own quantitative easing measures and expect economic growth out of the U.S. to exceed other developed economies in 2015.

The Equity Growth Fund

For the six months and one year ended November 30, 2014 the North Country Equity Growth Fund returned 8.23% and 12.93% while the S&P 5001 returned 8.58% and 16.86% respectively. On an annualized basis, the three, five, and ten year total returns for the North Country Equity Growth Fund were 18.35%, 13.13% and 6.34% versus the S&P 500 at 20.93%, 15.96% and 8.06% respectively.

An improving labor market, positive economic growth, accommodative monetary policies, strong corporate profit and reasonable valuations have resulted in positive returns for the S&P 500 in 2014.

| 1 | The S&P 500 is an unmanaged market capitalization-weighted index of common stocks. You cannot invest directly in an index. |

The Equity Fund began the fiscal year in December of 2013 with an over-weight, relative to the S&P 500 in the consumer discretionary, healthcare, financials and information technology sectors. We carried a marketweight in the energy and industrials sectors. The telecommunications, utility, materials and consumer staples sectors were at an underweight.

In January 2014 we elected to increase the industrial sector to an overweight from a market weight. Industrials were expected to benefit from an improving global economy and should continue to benefit from the recovery in housing as well as manufacturing. Valuations looked attractive relative to the S&P 500 and growth rates appeared reasonable for 2014.

In March 2014, the health care sector was reduced from an overweight to a marketweight. The health care sector had been the best performing sector year-to-date and over the past 12 months. Valuations appeared rich, the sector was trading at a premium to the S&P 500 and earnings growth was slowing. With the proceeds from healthcare, the consumer discretionary and industrials sectors overweight’s were increased. These two sectors had earnings that were expected to continue to grow and would continue to benefit from the improving U.S. economy.

In July 2014, the consumer discretionary sector was reduced from an overweight to marketweight due to high valuations and slowing estimated earnings growth. The sector was underperforming the S&P 500 and we felt that it would continue that underperformance for the remainder of the year. However, there were industries in the sector that we expected would continue their outperformance (retail, media) and elected to not reduce to an underweight.

In August 2014, we reduced the industrial sector from an overweight to a marketweight and increased the material sector from an underweight to a marketweight. Industrials were reduced due the sector’s exposure to Europe and Emerging Markets as both economies were experiencing slower economic growth. Materials were increased due to the sector’s exposure to residential and non-residential construction in the U.S. Valuations and dividend yields were attractive in the sector as well.

In September 2014, we reduced the financial sector to a marketweight from an overweight and increased the healthcare sector from a marketweight to an overweight. The financial sector had underperformed the S&P 500 through September and earnings were only expected to grow 4% in 2014. Valuations were no longer cheap by historical measures and dividend yields remained below average, although some firms were starting to reinstate or increase dividend payouts. We do expect that banks may eventually benefit from interest rates moving higher (expanding net interest rate margins) and as the U.S. economy continues to improve, so should bank’s earnings. The healthcare sector is expected to continue to benefit from an aging population, demand for products in emerging economies, and the Affordable Care Act.

Improving economic growth in the U.S, strong corporate profit growth, reasonable valuations and an accommodative Federal Reserve continue to support the case for equities in 2015. The Fund continues to favor a growth over value and continues to invest in companies and sectors of the economy that offer high growth rates at reasonable valuations.

The Intermediate Bond Fund

The North Country Intermediate Bond Fund returned 0.67% for the six month period ending November 30, 2014; while its benchmark, the Bank of America Merrill Lynch Corporate/Government “A” Rated or better 1-10 Year Index2, returned 1.17%. The North Country Intermediate Bond Fund had annualized total returns for the one year, three year, five year and ten year periods ending November 30, 2014 of 2.44%, 2.33%, 2.90% and 3.08% while the Bank of America Merrill Lynch Corporate/Government “A” Rated or better 1-10 Year Index returned 2.53%, 2.01%, 2.97% and 3.95% for the respective time periods.

The North Country Intermediate Bond Fund underperformed its benchmark for the six-month and one year periods ending November 30, 2014 as credit spreads widened in the last three months of the time period. The North Country Intermediate Bond Fund had sought to benefit from a low interest rate environment accompanied by expectations of modest economic growth and inflation, and attractive yields in corporate bonds relative to U.S. Treasuries.

For the three year period ending November 30, 2014 the North Country Intermediate Bond Fund outperformed its benchmark as we sought to benefit from opportunities for attractive yields in corporate bonds by maintaining an overweight in corporate bonds relative to our benchmark and an average maturity longer than that of our benchmark.

For the five year period ending November 30, 2014 the North Country Intermediate Bond Fund underperformed its benchmark as we sought to benefit from opportunities for attractive yields in corporate bonds by maintaining an overweight in corporate bonds relative to our benchmark while maintaining a neutral duration.

The relative investment performance for the ten-year period ending November 30, 2014 was impacted by the fund maintaining a shorter than benchmark duration during the period from September 2005 into the first quarter of 2007, when the yield curve was at first flat and then inverted. These occurrences negatively impacted the returns of short-term bonds, those maturing within two years, relative to longer term bonds, those maturing in ten years or beyond, and consequently our performance relative to our benchmark was negatively impacted. Additionally, an overweight in corporate bonds relative to our benchmark during the credit crisis, and a widening of credit spreads during that time frame, detracted from our relative performance.

| 2 | The Bank of America Merrill Lynch Government/Corporate Index is comprised of corporate and government issues with maturities ranging between 1-10 years rated A and above. |

| Equity Growth Fund: | | | |

| | | | |

| Annual Fund Operating Expenses*: | | (As a Percentage of Net Assets) | |

| Total Annual Operating Expenses: | | 1.03% | |

| | | | |

| Intermediate Bond Fund: | | | |

| | | | |

| Annual Fund Operating Expenses*: | | (As a Percentage of Net Assets) | |

| Total Annual Operating Expenses: | | 0.88% | |

Average Annual Total Returns as of September 30, 2014 (Latest Calendar Quarter)

| | | 1 Year | | 5 Years | | 10 Years | |

| | | | | | | | |

| North Country Equity Growth Fund | | 18.21% | | 13.09% | | 6.38% | |

| | | | | | | | |

| North Country Intermediate Bond Fund | | 2.02% | | 3.01% | | 2.93% | |

Average Annual Total Returns as of November 30, 2014 (Fiscal Year-End)

| | | 1 Year | | 5 Years | | 10 Years | |

| | | | | | | | |

| North Country Equity Growth Fund | | 12.93% | | 13.13% | | 6.34% | |

| | | | | | | | |

| North Country Intermediate Bond Fund | | 2.44% | | 2.90% | | 3.08% | |

Performance data quoted above is historical and is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month-end by calling 1-888-350-2990. Information provided is unaudited.

The views expressed are as November 30, 2014 and are those of the adviser, North Country Investment Advisers, Inc. The views are subject to change at any time in response to changing circumstances in the markets and are not intended to predict or guarantee the future performance of any individual security market sector or the markets generally, or the North Country Funds.

Not FDIC insured. Not obligations of or guaranteed by the bank. May involve investment risks, including possible loss of the principal invested.

5001-NLD-01/05/2015

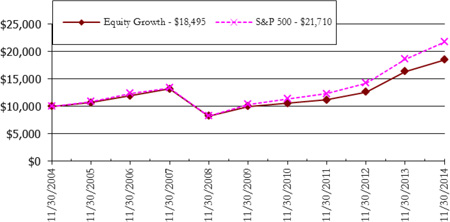

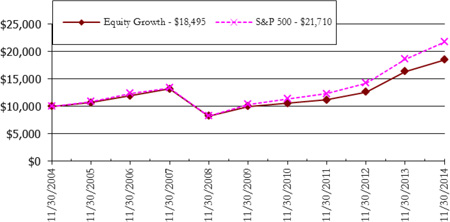

| North Country Equity Growth Fund |

| Growth of $10,000 Investment (Unaudited) |

This chart illustrates the comparison of a hypothetical investment of $10,000 in the North Country Equity Growth Fund (assuming reinvestment of all dividends and distributions) versus the Fund’s benchmark index.

Average Annual Total Returns as of November 30, 2014

| | | 1 Year | | 5 Years | | 10 Years | |

| North Country Equity Growth Fund | | 12.93% | | 13.13% | | 6.34% | |

The S&P 500 is a market capitalization-weighted index of 500 widely held common stocks. Lipper Large Cap Growth is a benchmark of large-company, growth oriented funds. Indexes and benchmarks are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index or benchmark, although they can invest in its underlying securities or funds.

Past performance is not indicative of future results. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions.

The returns do not reflect a reduction for taxes a shareholder would pay on the redemption of fund shares or fund distributions.

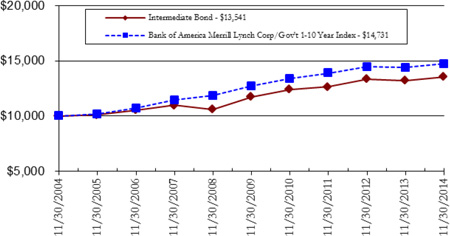

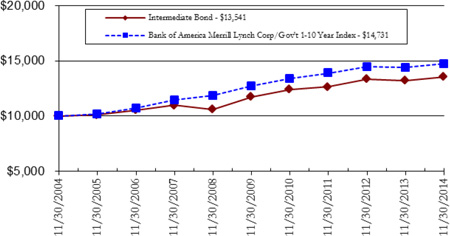

| North Country Intermediate Bond Fund |

| Growth of $10,000 Investment (Unaudited) |

This chart illustrates the comparison of a hypothetical investment of $10,000 in the North Country Intermediate Bond Fund (assuming reinvestment of all dividends and distributions) versus the Fund’s benchmark index.

Average Annual Total Returns as of November 30, 2014

| | | 1 Year | | 5 Years | | 10 Years | |

| North Country Intermediate Bond Fund | | 2.44% | | 2.90% | | 3.08% | |

The Bank of America Merrill Lynch Corporate/Government 1-10 year maturity “A” rated or better index is widely used as a broad measure of performance of bonds with maturities of less than 10 years. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Past performance is not indicative of future results. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions.

The returns do not reflect a reduction for taxes a shareholder would pay on the redemption of fund shares or fund distributions.

| North Country Equity Growth Fund |

| Portfolio Summary (Unaudited) |

November 30, 2014

| Industries | | % of Net Assets | | | Industries | | % of Net Assets | |

| Common Stock | | | 98.0 | % | | Cosmetics/Personal Care | | | 1.9 | % |

| Banks | | | 11.0 | % | | Miscellaneous Manufacturers | | | 1.9 | % |

| Internet | | | 10.1 | % | | Media | | | 1.7 | % |

| Pharmaceuticals | | | 7.3 | % | | Semiconductors | | | 1.7 | % |

| Oil & Gas Producers | | | 6.4 | % | | Airlines | | | 1.3 | % |

| Biotechnology | | | 6.3 | % | | Electric | | | 1.1 | % |

| Retail | | | 5.9 | % | | Machinery - Construction & Mining | | | 1.1 | % |

| Computers/Network Products | | | 5.3 | % | | Building Materials | | | 1.1 | % |

| Insurance | | | 4.4 | % | | Aerospace/Defense | | | 0.9 | % |

| Software | | | 4.3 | % | | Auto Parts & Equipment | | | 0.8 | % |

| Apparel | | | 3.7 | % | | Healthcare | | | 0.8 | % |

| Diversified Financial Services | | | 3.6 | % | | Telecommunications | | | 0.7 | % |

| Transportation | | | 3.2 | % | | Food | | | 0.5 | % |

| Electronics | | | 3.0 | % | | Gas | | | 0.4 | % |

| Beverages | | | 2.7 | % | | Iron/Steel | | | 0.3 | % |

| Chemicals | | | 2.4 | % | | Money Market Fund | | | 1.9 | % |

| Oil & Gas Services | | | 2.2 | % | | Other Assets Less Liabilites | | | 0.1 | % |

| | | | | | | Total Net Assets | | | 100.0 | % |

| Top Ten Holdings | | % of Net Assets | | | Top Ten Holdings | | % of Net Assets | |

| Apple, Inc. | | | 4.5 | % | | Bank of America Corp. | | | 2.0 | % |

| Amazon.Com, Inc. | | | 3.4 | % | | Facebook, Inc. - Class A | | | 2.0 | % |

| Visa, Inc. - Class A | | | 3.1 | % | | Amgen, Inc. | | | 1.9 | % |

| Under Armour, Inc. - Class A | | | 2.8 | % | | Google, Inc. - Class A | | | 1.9 | % |

| Salesforce.com, Inc. | | | 2.2 | % | | Berkshire Hathaway, Inc. | | | 1.8 | % |

| North Country Intermediate Bond Fund |

| Portfolio Summary (Unaudited) |

| November 30, 2014 |

| | | % of Net | | | | | % of Net | |

| Industries | | Assets | | | Industries | | Assets | |

| Corporate Bonds | | | 65.5 | % | | Transportation | | | 1.1 | % |

| Banks | | | 11.3 | % | | Iron/Steel | | | 0.9 | % |

| Telecommunications | | | 8.6 | % | | Computers | | | 0.9 | % |

| Retail | | | 6.4 | % | | Cosmetics/Personal Care | | | 0.8 | % |

| Diversified Financial Services | | | 5.9 | % | | Software | | | 0.8 | % |

| Chemicals | | | 4.0 | % | | Healthcare - Products | | | 0.8 | % |

| Aerospace/Defense | | | 3.2 | % | | Oil & Gas | | | 0.8 | % |

| Commercial Services | | | 2.9 | % | | Household Products/Wares | | | 0.7 | % |

| Electric | | | 2.8 | % | | Biotechnology | | | 0.4 | % |

| Pharmaceutical | | | 2.6 | % | | Media | | | 0.4 | % |

| Electric Components & Equipment | | | 2.5 | % | | U.S. Government Agency Obligations | | | 28.9 | % |

| Insurance | | | 2.5 | % | | Government Agencies | | | 28.9 | % |

| Food | | | 1.6 | % | | Money Market Fund | | | 5.0 | % |

| Beverages | | | 1.2 | % | | Other Assets Less Liabilites | | | 0.6 | % |

| Semiconductors | | | 1.2 | % | | Total Net Assets | | | 100.0 | % |

| Healthcare - Services | | | 1.2 | % | | | | | | |

| Top Ten Holdings | | % of Net Assets | |

| Federal Home Loan Bank, 1.75%, due 8/7/18 | | | 3.1 | % |

| Federal Home Loan Bank, 0.60%, due 2/8/17 | | | 3.0 | % |

| Federal Home Loan Mortgage Corp., 1.05%, due 10/30/18 | | | 3.0 | % |

| American Express Centurion, 5.95%, due 6/12/17 | | | 1.9 | % |

| Morgan Stanley, 5.625%, due 9/23/19 | | | 1.7 | % |

| AT&T, Inc., 5.60%, due 5/15/18 | | | 1.7 | % |

| Verizon Communications, Inc., 5.50%, due 2/15/18 | | | 1.7 | % |

| Lowe’s Cos., Inc., 4.625%, due 4/15/20 | | | 1.7 | % |

| Emerson Electric Co., 5.375%, due 10/15/17 | | | 1.7 | % |

| Federal Farm Credit Bank, 4.67%, due 2/27/18 | | | 1.7 | % |

| | THE NORTH COUNTRY FUNDS | |

| | EQUITY GROWTH FUND

SCHEDULE OF INVESTMENTS | |

| | November 30, 2014 | |

| | | | | | Fair | |

| Shares | | | | | Value | |

| COMMON STOCK - 98.0% | | | | |

| Aerospace/Defense - 0.9% | | | | |

| | 10,500 | | | United Technologies Corp. | | $ | 1,155,840 | |

| | | | | | | | | |

| Airlines - 1.3% | | | | |

| | 40,000 | | | Southwest Airlines Co. | | | 1,672,800 | |

| | | | | | | | | |

| Apparel - 3.7% | | | | |

| | 48,000 | | | Under Armour, Inc. * | | | 3,479,520 | |

| | 15,000 | | | VF Corp. | | | 1,127,550 | |

| | | | | | | | 4,607,070 | |

| Auto Parts & Equipment - 0.8% | | | | |

| | 25,000 | | | Gentherm, Inc. * | | | 942,250 | |

| | | | | | | | | |

| Banks - 11.0% | | | | |

| | 150,385 | | | Bank of America Corp. | | | 2,562,560 | |

| | 30,000 | | | Bank of New York Mellon Corp. | | | 1,200,900 | |

| | 42,500 | | | Citigroup, Inc. | | | 2,293,725 | |

| | 10,000 | | | Goldman Sachs Group, Inc. | | | 1,884,100 | |

| | 27,000 | | | JP Morgan Chase & Co. | | | 1,624,320 | |

| | 60,000 | | | Morgan Stanley | | | 2,110,800 | |

| | 22,300 | | | US Bancorp | | | 985,660 | |

| | 20,000 | | | Wells Fargo & Co. | | | 1,089,600 | |

| | | | | | | | 13,751,665 | |

| Beverages - 2.7% | | | | |

| | 20,000 | | | Coca-Cola Co. | | | 896,600 | |

| | 7,500 | | | Keurig Green Mountain, Inc. | | | 1,066,050 | |

| | 14,200 | | | PepsiCo, Inc. | | | 1,421,420 | |

| | | | | | | | 3,384,070 | |

| Biotechnology - 6.3% | | | | |

| | 15,000 | | | Amgen, Inc. | | | 2,479,650 | |

| | 5,000 | | | Biogen Idec, Inc.* | | | 1,538,450 | |

| | 19,000 | | | Celgene Corp. * | | | 2,160,110 | |

| | 17,500 | | | Gilead Sciences, Inc. * | | | 1,755,600 | |

| | | | | | | | 7,933,810 | |

| Building Materials - 1.1% | | | | |

| | 55,000 | | | Masco Corp. | | | 1,331,000 | |

| | | | | | | | | |

| Chemicals - 2.4% | | | | |

| | 10,000 | | | Dow Chemical Co. | | | 486,700 | |

| | 9,500 | | | EI du Pont de Nemours & Co. | | | 678,300 | |

| | 7,000 | | | International Flavors & Fragrances, Inc. | | | 708,190 | |

| | 5,000 | | | PPG Industries, Inc. | | | 1,094,100 | |

| | | | | | | | 2,967,290 | |

| | | | | | Fair | |

| Shares | | | | | Value | |

| Computers / Network Products - 5.3% | | | | |

| | 12,000 | | | Accenture PLC - Class A | | $ | 1,035,960 | |

| | 46,770 | | | Apple, Inc. | | | 5,562,356 | |

| | | | | | | | 6,598,316 | |

| Cosmetics/Personal Care - 1.9% | | | | |

| | 14,000 | | | Colgate-Palmolive Co. | | | 974,260 | |

| | 15,500 | | | Procter & Gamble Co. | | | 1,401,665 | |

| | | | | | | | 2,375,925 | |

| Diversified Financial Services - 3.6% | | | | |

| | 7,000 | | | American Express Co. | | | 646,940 | |

| | 15,000 | | | Visa, Inc. - Class A | | | 3,872,850 | |

| | | | | | | | 4,519,790 | |

| Electric - 1.1% | | | | |

| | 8,650 | | | Duke Energy Corp. | | | 699,785 | |

| | 6,965 | | | NextEra Energy, Inc. | | | 727,076 | |

| | | | | | | | 1,426,861 | |

| Electronics - 3.0% | | | | |

| | 105,000 | | | Corning, Inc. | | | 2,207,100 | |

| | 15,000 | | | Honeywell International, Inc. | | | 1,486,050 | |

| | | | | | | | 3,693,150 | |

| Food - 0.5% | | | | |

| | 10,500 | | | Kraft Foods Group, Inc. | | | 631,785 | |

| | | | | | | | | |

| Gas - 0.4% | | | | |

| | 5,000 | | | Sempra Energy | | | 558,650 | |

| | | | | | | | | |

| Healthcare - 0.8% | | | | |

| | 10,000 | | | UnitedHealth Group, Inc. | | | 986,300 | |

| | | | | | | | | |

| Insurance - 4.4% | | | | |

| | 30,000 | | | American International Group, Inc. | | | 1,644,000 | |

| | 15,500 | | | Berkshire Hathaway, Inc. * | | | 2,304,695 | |

| | 15,000 | | | Travelers Co., Inc. | | | 1,566,750 | |

| | | | | | | | 5,515,445 | |

| Internet - 10.1% | | | | |

| | 12,600 | | | Amazon.com, Inc. * | | | 4,266,864 | |

| | 32,500 | | | Facebook, Inc. - Class A* | | | 2,525,250 | |

| | 4,250 | | | Google, Inc. - Class A * | | | 2,333,590 | |

| | 4,250 | | | Google, Inc. - Class C * | | | 2,302,778 | |

| | 1,000 | | | Priceline Group, Inc. * | | | 1,160,190 | |

| | | | | | | | 12,588,672 | |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| | EQUITY GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) | |

| | November 30, 2014 | |

| | | | | | Fair | |

| Shares | | | | | Value | |

| Iron/Steel - 0.3% | | |

| | 10,000 | | | United States Steel Corp. | | $ | 333,500 | |

| | | | | | | | | |

| Machinery - Construction & Mining - 1.1% | | |

| | 14,000 | | | Caterpillar, Inc. | | | 1,408,400 | |

| | | | | | | | | |

| Media - 1.7% | | |

| | 10,000 | | | Comcast Corp. | | | 570,400 | |

| | 15,000 | | | Twenty-First Century Fox, Inc. | | | 552,000 | |

| | 10,345 | | | Walt Disney Co. | | | 957,016 | |

| | | | | | | | 2,079,416 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 1.9% | | |

| | 12,500 | | | Danaher Corp. | | | 1,044,500 | |

| | 50,000 | | | General Electric Co. | | | 1,324,500 | |

| | | | | | | | 2,369,000 | |

| Oil & Gas Producers - 6.4% | | |

| | 7,500 | | | Apache Corp. | | | 480,675 | |

| | 6,000 | | | Chevron Corp. | | | 653,220 | |

| | 14,750 | | | ConocoPhillips | | | 974,532 | |

| | 7,500 | | | EOG Resources, Inc. | | | 650,400 | |

| | 12,000 | | | Exxon Mobil Corp. | | | 1,086,480 | |

| | 13,900 | | | Helmerich & Payne, Inc. | | | 966,745 | |

| | 25,000 | | | Marathon Oil Corp. | | | 723,000 | |

| | 20,000 | | | Noble Energy, Inc. | | | 983,600 | |

| | 20,000 | | | Phillips 66 | | | 1,460,400 | |

| | | | | | | | 7,979,052 | |

| Oil & Gas Services - 2.2% | | |

| | 10,000 | | | Baker Hughes, Inc. | | | 570,000 | |

| | 14,500 | | | National Oilwell Varco, Inc. | | | 972,080 | |

| | 14,500 | | | Schlumberger, Ltd. | | | 1,246,275 | |

| | | | | | | | 2,788,355 | |

| Pharmaceuticals - 7.3% | | |

| | 5,000 | | | Actavis PLC * | | | 1,353,050 | |

| | 17,500 | | | AmerisourceBergen Corp. | | | 1,593,375 | |

| | 10,000 | | | Express Scripts Holding Co. * | | | 831,500 | |

| | 10,000 | | | Johnson & Johnson | | | 1,082,500 | |

| | 17,900 | | | Merck & Co, Inc. | | | 1,081,160 | |

| | 30,000 | | | Mylan, Inc. * | | | 1,758,300 | |

| | 47,000 | | | Pfizer, Inc. | | | 1,464,050 | |

| | | | | | | | 9,163,935 | |

| | | | | | Fair | |

| Shares | | | | | Value | |

| Retail - 5.9% | | | | |

| | 2,500 | | | Chipotle Mexican Grill, Inc. - Class A * | | $ | 1,659,050 | |

| | 13,000 | | | Costco Wholesale Corp. | | | 1,847,560 | |

| | 16,000 | | | CVS Health Corp. | | | 1,461,760 | |

| | 7,000 | | | Starbucks Corp. | | | 568,470 | |

| | 12,500 | | | Wal-Mart Stores, Inc. | | | 1,094,250 | |

| | 10,000 | | | Williams-Sonoma, Inc. | | | 745,600 | |

| | | | | | | | 7,376,690 | |

| | | | | | | | | |

| Semiconductors - 1.7% | | | | |

| | 20,000 | | | Intel Corp. | | | 745,000 | |

| | 18,250 | | | Qualcomm, Inc. | | | 1,330,425 | |

| | | | | | | | 2,075,425 | |

| Software - 4.3% | | | | |

| | 15,000 | | | Cerner Corp. * | | | 966,000 | |

| | 33,870 | | | Microsoft Corp. | | | 1,619,325 | |

| | 47,000 | | | Salesforce.com, Inc. * | | | 2,813,890 | |

| | | | | | | | 5,399,215 | |

| Telecommunications - 0.7% | | | | |

| | 16,540 | | | Verizon Communications, Inc. | | | 836,759 | |

| | | | | | | | | |

| Transportation - 3.2% | | | | |

| | 8,000 | | | FedEx Corp. | | | 1,425,440 | |

| | 16,000 | | | Union Pacific Corp. | | | 1,868,320 | |

| | 7,000 | | | United Parcel Service, Inc. - Class. B | | | 769,440 | |

| | | | | | | | 4,063,200 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | 122,513,636 | |

| (Cost - $76,297,444) | | | | |

| | | | | | | | | |

| MONEY MARKET FUND - 1.9% | | |

| | 2,421,059 | | | BlackRock Liquidity TempCash | | | | |

| | | | | Fund - Dollar Shares, 0.01% (a) | | | 2,421,059 | |

| TOTAL MONEY MARKET FUND | | | 2,421,059 | |

| (Cost - $2,421,059) | | | | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 99.9% | | | | |

| (Cost - $78,718,503)(b) | | $ | 124,934,695 | |

| Other assets less liabilities - 0.1% | | | 58,485 | |

| TOTAL NET ASSETS - 100.00% | | $ | 124,993,180 | |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| | EQUITY GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) | |

| | November 30, 2014 | |

PLC - Public Limited Company

| * | Non-income producing security. |

| (a) | Variable rate yield; the coupon rate shown represents the rate as of November 30, 2014. |

| (b) | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $78,747,604 and differs from market value by unrealized appreciation (depreciation) of securities as follows: |

| | Unrealized Appreciation: | | $ | 46,815,070 | |

| | Unrealized Depreciation: | | | (627,979 | ) |

| | Net Unrealized Appreciation | | $ | 46,187,091 | |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| | INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS | |

| | November 30, 2014 | |

| Principal | | | | | Fair | |

| Amount | | | | | Value | |

| CORPORATE BONDS - 65.5% | | | | |

| Aerospace / Defense - 3.2% | | | | |

| | | | | Boeing Co. | | | | |

| $ | 1,000,000 | | | 3.75%, due 11/20/16 | | $ | 1,059,021 | |

| | | | | Lockheed Martin Corp. | | | | |

| | 500,000 | | | 3.35%, due 9/15/21 | | | 522,805 | |

| | | | | Rockwell Collins, Inc. | | | | |

| | 500,000 | | | 5.25%, due 7/15/19 | | | 560,896 | |

| | | | | | | | 2,142,722 | |

| Banks - 11.3% | | | | |

| | | | | American Express Centurion | | | | |

| | 1,100,000 | | | 5.95%, due 6/12/17 | | | 1,228,116 | |

| | | | | Bank of America Corp. | | | | |

| | 500,000 | | | 2.65%, due 4/1/19 | | | 507,645 | |

| | | | | BB&T Corp. | | | | |

| | 500,000 | | | 5.25%, due 11/1/19 | | | 564,483 | |

| | | | | Goldman Sachs Group, Inc. | | | | |

| | 500,000 | | | 2.90%, due 7/19/18 | | | 514,662 | |

| | 800,000 | | | 5.375%, due 3/15/20 | | | 902,721 | |

| | | | | Morgan Stanley | | | | |

| | 1,000,000 | | | 5.75%, due 10/18/16 | | | 1,083,063 | |

| | 500,000 | | | 2.125%, due 4/25/18 | | | 502,715 | |

| | 500,000 | | | 2.50%, due 1/24/19 | | | 506,365 | |

| | 1,000,000 | | | 5.625%, due 9/23/19 | | | 1,140,734 | |

| | | | | Wells Fargo & Co. | | | | |

| | 500,000 | | | 3.45%, due 2/13/23 | | | 502,871 | |

| | | | | | | | 7,453,375 | |

| Beverages - 1.2% | | | | |

| | | | | Coca-Cola Co. | | | | |

| | 500,000 | | | 4.875%, due 3/15/19 | | | 564,273 | |

| | | | | Coca-Cola Enterprises, Inc. | | | | |

| | 250,000 | | | 3.50%, due 9/15/20 | | | 260,682 | |

| | | | | | | | 824,955 | |

| Biotechnology - 0.4% | | | | |

| | | | | Amgen, Inc. | | | | |

| | 250,000 | | | 3.45%, due 10/1/20 | | | 260,500 | |

| | | | | | | | | |

| Chemicals - 4.0% | | | | |

| | | | | Air Products & Chemicals, Inc. | | | | |

| | 500,000 | | | 3.00%, due 11/3/21 | | | 511,815 | |

| | | | | El du Pont de Nemours & Co. | | | | |

| | 500,000 | | | 3.625%, due 1/15/21 | | | 531,163 | |

| | | | | Monsanto Co. | | | | |

| | 1,000,000 | | | 5.125%, due 4/15/18 | | | 1,113,679 | |

| | | | | Praxair, Inc. | | | | |

| | 500,000 | | | 2.45%, due 2/15/22 | | | 489,330 | |

| | | | | | | | 2,645,987 | |

| | | | | | | | | |

| Principal | | | | | Fair | |

| Amount | | | | | Value | |

| | | | | |

| Commercial Services - 2.9% | | | | |

| | | | | MasterCard, Inc. | | | | |

| | 250,000 | | | 2.00%, due 4/1/19 | | $ | 251,638 | |

| | | | | Western Union Co. | | | | |

| | 1,000,000 | | | 5.93%, due 10/1/16 | | | 1,083,568 | |

| | 550,000 | | | 2.875%, due 12/10/17 | | | 564,076 | |

| | | | | | | | 1,899,282 | |

| Computers - 0.9% | | | | |

| | | | | International Business Machines Corp. | | | | |

| | 500,000 | | | 5.70%, due 9/14/17 | | | 561,378 | |

| | | | | | | | | |

| Cosmetics / Personal Care - 0.8% | | | | |

| | | | | Procter & Gamble Co. | | | | |

| | 500,000 | | | 4.70%, due 2/15/19 | | | 560,078 | |

| | | | | | | | | |

| Diversified Financial Services - 5.9% | | | | |

| | | | | American Express Co. | | | | |

| | 1,000,000 | | | 1.55%, due 5/22/18 | | | 993,242 | |

| | | | | Ameriprise Financial, Inc. | | | | |

| | 250,000 | | | 5.30%, due 3/15/20 | | | 286,211 | |

| | | | | Bear Stearns Company LLC | | | | |

| | 500,000 | | | 5.55%, due 1/22/17 | | | 544,177 | |

| | | | | Ford Motor Credit Co. LLC | | | | |

| | 500,000 | | | 2.375%, due 1/16/18 | | | 506,448 | |

| | | | | General Electric Capital Corp. | | | | |

| | 500,000 | | | 5.375%, due 10/20/16 | | | 542,233 | |

| | 500,000 | | | 2.3%, due 4/27/17 | | | 515,046 | |

| | 500,000 | | | 2.3%, due 1/14/19 | | | 511,335 | |

| | | | | | | | 3,898,692 | |

| Electric - 2.8% | | | | |

| | | | | American Electric Power Co., Inc. | | | | |

| | 250,000 | | | 1.65%, due 12/15/17 | | | 251,424 | |

| | | | | Duke Energy Corp. | | | | |

| | 1,000,000 | | | 3.55%, due 9/15/21 | | | 1,049,554 | |

| | | | | Duke Energy Florida, Inc. | | | | |

| | 250,000 | | | 3.10%, due 8/15/21 | | | 258,908 | |

| | | | | Exelon Generation Co. LLC | | | | |

| | 250,000 | | | 4.00%, due 10/1/20 | | | 263,589 | |

| | | | | | | | 1,823,475 | |

| Electrical Components & Equipment - 2.5% | | | | |

| | | | | Emerson Electric Co. | | | | |

| | 1,000,000 | | | 5.375%, due 10/15/17 | | | 1,115,870 | |

| | 500,000 | | | 4.875%, due 10/15/19 | | | 561,726 | |

| | | | | | | | 1,677,596 | |

| Food - 1.6% | | | | |

| | | | | Campbell Soup Co. | | | | |

| | 500,000 | | | 4.50%, due 2/15/19 | | | 543,229 | |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| | INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued) | |

| | November 30, 2014 | |

| Principal | | | | | Fair | |

| Amount | | | | | Value | |

| Food - 1.6% (Continued) | | | | |

| | | | | Kroger Co. | | | | |

| $ | 500,000 | | | 3.30%, due 1/15/21 | | $ | 512,756 | |

| | | | | | | | 1,055,985 | |

| Healthcare-Products-0.8% | | | | |

| | | | | Baxter International, Inc. | | | | |

| | 500,000 | | | 4.50%, due 8/15/19 | | | 551,620 | |

| | | | | | | | | |

| Healthcare-Services-1.2% | | | | |

| | | | | UnitedHealth Group, Inc. | | | | |

| | 500,000 | | | 1.625%, due 3/15/19 | | | 495,249 | |

| | 250,000 | | | 4.70%, due 2/15/21 | | | 282,205 | |

| | | | | | | | 777,454 | |

| Household Products/Wares - 0.7% | | | | |

| | | | | Kimberly Clark Corp. | | | | |

| | 500,000 | | | 2.40%, due 3/1/22 | | | 494,654 | |

| | | | | | | | | |

| Insurance - 2.5% | | | | |

| | | | | Aflac, Inc. | | | | |

| | 1,000,000 | | | 4.00%, due 2/15/22 | | | 1,063,704 | |

| | | | | Berkshire Hathaway Finance Corp. | | | | |

| | 500,000 | | | 5.40%, due 5/15/18 | | | 564,302 | |

| | | | | | | | 1,628,006 | |

| Iron / Steel - 0.9% | | | | |

| | | | | Nucor Corp. | | | | |

| | 500,000 | | | 5.85%, due 6/1/18 | | | 565,444 | |

| | | | | | | | | |

| Media - 0.4% | | | | |

| | | | | Walt Disney Co. | | | | |

| | 250,000 | | | 1.10%, due 12/1/17 | | | 249,433 | |

| | | | | | | | | |

| Oil & Gas - 0.8% | | | | |

| | | | | BP Capital Markets PLC | | | | |

| | 500,000 | | | 2.237%, due 5/10/19 | | | 503,803 | |

| | | | | | | | | |

| Pharmaceutical - 2.6% | | | | |

| | | | | Bristol-Myers Squibb Co. | | | | |

| | 500,000 | | | 1.75%, due 3/1/19 | | | 497,627 | |

| | | | | Eli Lilly & Co. | | | | |

| | 250,000 | | | 1.95%, due 3/15/19 | | | 251,366 | |

| | | | | Teva Pharmaceutical Finance Co. | | | | |

| | 1,000,000 | | | 2.95%, due 12/18/22 | | | 978,649 | |

| | | | | | | | 1,727,642 | |

| Principal | | | | | Fair | |

| Amount | | | | | Value | |

| Retail - 6.4% | | | | |

| | | | | Costco Wholesale Corp. | | | | |

| $ | 500,000 | | | 1.70%, due 12/15/19 | | $ | 493,050 | |

| | | | | Lowe’s Co., Inc. | | | | |

| | 1,000,000 | | | 4.625%, due 4/15/20 | | | 1,118,121 | |

| | | | | McDonald’s Corp. | | | | |

| | 500,000 | | | 2.625%, due 1/15/22 | | | 498,261 | |

| | | | | Staples, Inc. | | | | |

| | 500,000 | | | 2.75%, due 1/12/18 | | | 507,620 | |

| | 500,000 | | | 4.375%, due 1/12/23 | | | 509,207 | |

| | | | | Starbucks Corp. | | | | |

| | 500,000 | | | 6.25%, due 8/15/17 | | | 566,626 | |

| | | | | Walgreen Co. | | | | |

| | 500,000 | | | 1.80%, due 9/15/17 | | | 503,698 | |

| | | | | | | | 4,196,583 | |

| Semiconductors - 1.2% | | | | |

| | | | | Intel Corp. | | | | |

| | 750,000 | | | 3.30%, due 10/1/21 | | | 787,784 | |

| Software - 0.8% | | | | |

| | | | | Microsoft Corp. | | | | |

| | 500,000 | | | 4.20%, due 6/1/19 | | | 552,575 | |

| | | | | | | | | |

| Telecommunications - 8.6% | | | | |

| | | | | AT&T, Inc. | | | | |

| | 500,000 | | | 1.40%, due 12/1/17 | | | 497,927 | |

| | 1,000,000 | | | 5.60%, due 5/15/18 | | | 1,125,779 | |

| | 500,000 | | | 3.00%, due 2/15/22 | | | 498,421 | |

| | | | | Cisco Systems, Inc. | | | | |

| | 500,000 | | | 4.95%, due 2/15/19 | | | 560,482 | |

The accompanying notes are an integral part of these financial statements

| | THE NORTH COUNTRY FUNDS | |

| | INTERMEDIATE BOND FUND

SCHEDULE OF INVESTMENTS (Continued) | |

| | November 30, 2014 | |

| Principal | | | | | Fair | |

| Amount | | | | | Value | |

| Telecommunications - 8.6% (Continued) | | | | |

| | | | | Verizon Communications, Inc. | | | | |

| $ | 520,000 | | | 2.00%, due 11/1/16 | | $ | 530,037 | |

| | 1,000,000 | | | 5.50%, due 2/15/18 | | | 1,121,608 | |

| | 500,000 | | | 3.65%, due 9/14/18 | | | 531,075 | |

| | 500,000 | | | 4.60%, due 4/1/21 | | | 547,323 | |

| | | | | Vodafone Group PLC | | | | |

| | 250,000 | | | 4.375%, due 3/16/21 | | | 271,531 | |

| | | | | | | | 5,684,183 | |

| Transportation - 1.1% | | | | |

| | | | | Union Pacific Corp. | | | | |

| | 500,000 | | | 2.75%, due 4/15/23 | | | 497,497 | |

| | | | | United Parcel Service, Inc. | | | | |

| | 250,000 | | | 3.125%, due 1/15/21 | | | 261,574 | |

| | | | | | | | 759,071 | |

| TOTAL CORPORATE BONDS | | | | |

| (Cost - $41,679,426) | | | 43,282,277 | |

| | | | | | | | | |

| U.S. GOVERNMENT AGENCY OBLIGATIONS - 28.9% | | | | |

| Government Agencies - 28.9% | | | | |

| | | | | Federal Farm Credit Bank | | | | |

| | 1,000,000 | | | 1.10%, due 8/22/17 | | | 1,000,049 | |

| | 1,000,000 | | | 4.67%, due 2/27/18 | | | 1,115,550 | |

| | 500,000 | | | 1.62%, due 4/23/20 | | | 487,751 | |

| | | | | Federal Home Loan Bank | | | | |

| | 2,000,000 | | | 0.60%, due 2/8/17 | | | 1,997,322 | |

| | 500,000 | | | 1.22%, due 2/28/18 | | | 500,962 | |

| | 1,000,000 | | | 1.55%, due 7/27/18 | | | 1,011,174 | |

| | 2,000,000 | | | 1.75%, due 8/7/18 | | | 2,013,346 | |

| | 500,000 | | | 1.75%, due 12/14/18 | | | 506,784 | |

| | 250,000 | | | 2.00%, due 9/13/19 | | | 253,489 | |

| Principal | | | | | Fair | |

| Amount | | | | | Value | |

| Government Agencies - 28.9% (Continued) | | | | |

| $ | 1,000,000 | | | 1.37%, due 10/24/19 | | $ | 980,229 | |

| | 500,000 | | | 1.25%, due 12/13/19 | | | 492,753 | |

| | 1,000,000 | | | 1.78%, due 3/27/20 | | | 994,518 | |

| | 500,000 | | | 2.875%, due 9/11/20 | | | 526,083 | |

| | 1,000,000 | | | 3.125%, due 12/11/20 | | | 1,067,182 | |

| | 500,000 | | | 2.375%, due 9/10/21 | | | 506,117 | |

| | 500,000 | | | 3.00%, due 9/10/21 | | | 527,316 | |

| | | | | Federal Home Loan Mortgage Corp. | | | | |

| | 2,000,000 | | | 1.05%, due 10/30/18 | | | 1,974,932 | |

| | | | | Federal National Mortgage Association | | | | |

| | 1,000,000 | | | 1.00%, due 9/20/17 | | | 1,002,031 | |

| | 1,000,000 | | | 1.55%, due 9/26/19 | | | 984,532 | |

| | | | | Tennessee Valley Authority | | | | |

| | 1,000,000 | | | 4.50%, due 4/1/18 | | | 1,108,973 | |

| | | | | | | | 19,051,093 | |

| | | | | | | | | |

| TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | | | | |

| (Cost - $18,829,279) | | | 19,051,093 | |

| | | | | | | | | |

| Shares | | | | | | | |

| MONEY MARKET FUND - 5.0% | | | | |

| | | | | BlackRock Liquidity TempCash | | | | |

| | 3,307,539 | | | Fund - Dollar Shares, 0.01% (a) | | | 3,307,539 | |

| TOTAL MONEY MARKET FUND | | | | |

| (Cost - $3,307,539) | | | | |

| | | | | | | | | |

| TOTAL INVESTMENTS - 99.4% | | | | |

| (Cost - $63,816,244)(b) | | $ | 65,640,909 | |

| Other assets less liabilities - 0.6% | | | 391,813 | |

| TOTAL NET ASSETS - 100.0% | | $ | 66,032,722 | |

LLC - Limited Limited Company

PLC - Public Limited Company

| (a) | Variable rate yield; the coupon rate shown represents the rate as of November 30, 2014. |

| (b) | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $63,816,244 and differs from market value by unrealized appreciation (depreciation) of securities as follows: |

| | Unrealized Appreciation: | | $ | 1,940,548 | |

| | Unrealized Depreciation: | | | (115,883 | ) |

| | Net Unrealized Appreciation | | $ | 1,824,665 | |

The accompanying notes are an integral part of these financial statements

STATEMENTS OF ASSETS AND LIABILITIES

November 30, 2014

| | | Equity | | | Intermediate | |

| | | Growth Fund | | | Bond Fund | |

| ASSETS: | | | | | | | | |

| Investments in securities, at fair value (Cost $78,718,503 and $63,816,244, respectively) | | $ | 124,934,695 | | | $ | 65,640,909 | |

| Receivable for fund shares sold | | | 11,177 | | | | 586 | |

| Dividends and interest receivable | | | 186,422 | | | | 462,686 | |

| Prepaid expenses and other assets | | | 707 | | | | 1,475 | |

| Total Assets | | | 125,133,001 | | | | 66,105,656 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Accrued advisory fees | | | 76,529 | | | | 27,057 | |

| Payable for fund shares redeemed | | | 15,420 | | | | 2,041 | |

| Accrued administration and fund accounting fees | | | 14,017 | | | | 9,765 | |

| Accrued trustee fees | | | 4,876 | | | | 5,052 | |

| Accrued transfer agency fees | | | 3,248 | | | | 3,059 | |

| Other accrued expenses | | | 25,731 | | | | 25,960 | |

| Total Liabilities | | | 139,821 | | | | 72,934 | |

| Net Assets | | $ | 124,993,180 | | | $ | 66,032,722 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid in capital | | $ | 70,367,638 | | | $ | 65,867,538 | |

| Undistributed net investment income | | | 480,414 | | | | 53,629 | |

| Accumulated net realized gain (loss) from investment transactions | | | 7,928,936 | | | | (1,713,110 | ) |

| Net unrealized appreciation on investments | | | 46,216,192 | | | | 1,824,665 | |

| Net Assets | | $ | 124,993,180 | | | $ | 66,032,722 | |

| | | | | | | | | |

| Shares outstanding (unlimited number of shares authorized; no par value) | | | 7,710,588 | | | | 6,404,848 | |

| | | | | | | | | |

| Net asset value, offering and redemption price per share ($124,993,180/7,710,588 and $66,032,722/6,404,848, respectively) | | $ | 16.21 | | | $ | 10.31 | |

The accompanying notes are an integral part of these financial statements

STATEMENTS OF OPERATIONS

For the Year Ended November 30, 2014

| | | Equity | | | Intermediate | |

| | | Growth Fund | | | Bond Fund | |

| INVESTMENT INCOME: | | | | | | | | |

| Interest | | $ | 567 | | | $ | 1,697,272 | |

| Dividends (Less Foreign Tax Witheld $125) | | | 1,717,955 | | | | — | |

| Total investment income | | | 1,718,522 | | | | 1,697,272 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 893,117 | | | | 310,193 | |

| Administration and fund accounting fees | | | 166,821 | | | | 108,254 | |

| Transfer agency fees | | | 38,356 | | | | 28,545 | |

| Legal fees | | | 27,615 | | | | 27,615 | |

| Trustees’ fees | | | 18,869 | | | | 12,933 | |

| Audit fees | | | 15,900 | | | | 15,900 | |

| Printing expense | | | 15,819 | | | | 8,496 | |

| Chief Compliance Officer fees | | | 15,616 | | | | 8,014 | |

| Registration and filing fees | | | 14,013 | | | | 14,028 | |

| Custody fees | | | 9,150 | | | | 4,909 | |

| Insurance expense | | | 7,182 | | | | 5,054 | |

| Miscellaneous expenses | | | 1,902 | | | | 1,944 | |

| Total expenses | | | 1,224,360 | | | | 545,885 | |

| | | | | | | | | |

| Net investment income | | | 494,162 | | | | 1,151,387 | |

| | | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Net realized gain from investment transactions | | | 8,047,575 | | | | 425,525 | |

| Net change in unrealized appreciation (depreciation) of investments for the year | | | 6,130,685 | | | | (90,470 | ) |

| Net realized and unrealized gain on investments | | | 14,178,260 | | | | 335,055 | |

| Net increase in net assets resulting from operations | | $ | 14,672,422 | | | $ | 1,486,442 | |

The accompanying notes are an integral part of these financial statements

EQUITY GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | November 30, 2014 | | | November 30, 2013 | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 494,162 | | | $ | 891,728 | |

| Net realized gain from investment transactions | | | 8,047,575 | | | | 6,927,099 | |

| Net change in unrealized appreciation for the period | | | 6,130,685 | | | | 21,538,052 | |

| Net increase in net assets resulting from operations | | | 14,672,422 | | | | 29,356,879 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions from net investment income ($0.10 and $0.01 per share, respectively) | | | (801,887 | ) | | | (76,753 | ) |

| Distributions from net realized gains on investments ($0.31 and $0.00 per share, respectively) | | | (2,489,479 | ) | | | — | |

| Total distributions to shareholders | | | (3,291,366 | ) | | | (76,753 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 4) | | | (6,092,990 | ) | | | (12,933,328 | ) |

| | | | | | | | | |

| Net increase in net assets | | | 5,288,066 | | | | 16,346,798 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 119,705,114 | | | | 103,358,316 | |

| | | | | | | | | |

| End of year (including undistributed net investment income of $480,414 and $817,027, respectively) | | $ | 124,993,180 | | | $ | 119,705,114 | |

The accompanying notes are an integral part of these financial statements

INTERMEDIATE BOND FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | November 30, 2014 | | | November 30, 2013 | |

| | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS RESULTING | | | | | | | | |

| FROM OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 1,151,387 | | | $ | 1,326,026 | |

| Net realized gain from investment transactions | | | 425,525 | | | | 377,629 | |

| Net change in unrealized depreciation for the period | | | (90,470 | ) | | | (2,291,294 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 1,486,442 | | | | (587,639 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions from net investment income ($0.19 and $0.22 per share, respectively) | | | (1,135,617 | ) | | | (1,310,556 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 4) | | | 5,239,481 | | | | 448,182 | |

| | | | | | | | | |

| Net increase (decrease) in net assets | | | 5,590,306 | | | | (1,450,013 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 60,442,416 | | | | 61,892,429 | |

| | | | | | | | | |

| End of year (including undistributed net investment income of $53,629 and $37,817, respectively) | | $ | 66,032,722 | | | $ | 60,442,416 | |

The accompanying notes are an integral part of these financial statements

EQUITY GROWTH FUND

FINANCIAL HIGHLIGHTS

(For a fund share outstanding throughout each period)

| | | For the Year Ended November 30, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 14.77 | | | $ | 11.37 | | | $ | 10.17 | | | $ | 9.79 | | | $ | 9.37 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 0.06 | | | | 0.10 | | | | 0.11 | | | | 0.11 | | | | 0.08 | |

| Net realized and unrealized gains | | | | | | | | | | | | | | | | | | | | |

| on investments | | | 1.79 | | | | 3.31 | | | | 1.20 | | | | 0.47 | | | | 0.43 | |

| Total from investment operations | | | 1.85 | | | | 3.41 | | | | 1.31 | | | | 0.58 | | | | 0.51 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.10 | ) | | | (0.01 | ) | | | (0.11 | ) | | | (0.20 | ) | | | (0.09 | ) |

| Distribution from net realized gains | | | | | | | | | | | | | | | | | | | | |

| from security transactions | | | (0.31 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.41 | ) | | | (0.01 | ) | | | (0.11 | ) | | | (0.20 | ) | | | (0.09 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 16.21 | | | $ | 14.77 | | | $ | 11.37 | | | $ | 10.17 | | | $ | 9.79 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (2) | | | 12.93 | % | | | 30.00 | % | | | 12.91 | % | | | 5.94 | % | | | 5.50 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000’s) | | $ | 124,993 | | | $ | 119,705 | | | $ | 103,358 | | | $ | 85,684 | | | $ | 85,956 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 1.03 | % | | | 1.02 | % | | | 1.06 | % | | | 1.09 | % | | | 1.06 | % |

| Net investment income | | | 0.41 | % | | | 0.80 | % | | | 0.95 | % | | | 1.03 | % | | | 0.84 | % |

| Portfolio turnover rate | | | 29 | % | | | 41 | % | | | 55 | % | | | 63 | % | | | 69 | % |

| (1) | Net investment income per share is based on average shares outstanding during the period. |

| (2) | Total returns are historical and assume changes in share price and reinvestment of dividends and capital gain distributions, if any. Total return does not reflect the deductions of taxes that a shareholder would pay on distributions or on the redemption of shares. |

The accompanying notes are an integral part of these financial statements

INTERMEDIATE BOND FUND

FINANCIAL HIGHLIGHTS

(For a fund share outstanding throughout each period)

| | | For the Year Ended November 30, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.25 | | | $ | 10.57 | | | $ | 10.24 | | | $ | 10.31 | | | $ | 10.06 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (1) | | | 0.19 | | | | 0.23 | | | | 0.24 | | | | 0.26 | | | | 0.31 | |

| Net realized and unrealized gains (losses) on investments | | | 0.06 | | | | (0.33 | ) | | | 0.33 | | | | (0.07 | ) | | | 0.25 | |

| Total from investment operations | | | 0.25 | | | | (0.10 | ) | | | 0.57 | | | | 0.19 | | | | 0.56 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.19 | ) | | | (0.22 | ) | | | (0.24 | ) | | | (0.26 | ) | | | (0.31 | ) |

| Total distributions | | | (0.19 | ) | | | (0.22 | ) | | | (0.24 | ) | | | (0.26 | ) | | | (0.31 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 10.31 | | | $ | 10.25 | | | $ | 10.57 | | | $ | 10.24 | | | $ | 10.31 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (2) | | | 2.44 | % | | | (0.92 | )% | | | 5.57 | % | | | 1.90 | % | | | 5.65 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000’s) | | $ | 66,033 | | | $ | 60,442 | | | $ | 61,892 | | | $ | 59,797 | | | $ | 77,457 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 0.88 | % | | | 0.86 | % | | | 0.91 | % | | | 0.89 | % | | | 0.83 | % |

| Net investment income | | | 1.85 | % | | | 2.17 | % | | | 2.28 | % | | | 2.55 | % | | | 3.04 | % |

| Portfolio turnover rate | | | 25 | % | | | 29 | % | | | 24 | % | | | 32 | % | | | 55 | % |

| (1) | Net investment income per share is based on average shares outstanding during the period. |

| (2) | Total returns are historical and assume changes in share price and reinvestment of dividends and capital gain distributions, if any. Total return does not reflect the deductions of taxes that a shareholder would pay on distributions or on the redemption of shares. |

The accompanying notes are an integral part of these financial statements

NOTES TO FINANCIAL STATEMENTS

November 30, 2014

NOTE 1. ORGANIZATION

The North Country Funds (the “Trust”) was organized as a Massachusetts business trust on June 1, 2000, and registered under the Investment Company Act of 1940 as an open-end, diversified, management investment company on September 11, 2000. The Trust currently offers two series: the North Country Equity Growth Fund (the “Growth Fund”) and the North Country Intermediate Bond Fund (the “Bond Fund”, collectively the “Funds”). The Growth Fund’s principal investment objective is to provide investors with long-term capital appreciation while the Bond Fund seeks to provide investors with current income and total return with minimum fluctuations of principal value. Both Funds commenced operations on March 1, 2001.

The Bond Fund and the Growth Fund were initially organized on March 26, 1984 under New York law as Collective Investment Trusts sponsored by Glens Falls National Bank & Trust Company. Prior to their conversion to regulated investment companies (mutual funds) investor participation was limited to qualified employee benefit plans.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Trust in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with these generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the year. Actual results could differ from these estimates.

Security Valuation – Securities which are traded on a national securities exchange are valued at the last quoted sale price. NASDAQ traded securities are valued using the NASDAQ official closing price (NOCP). Investments for which no sales are reported are valued at the mean between the current bid and ask prices on the day of valuation. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy described below. When an equity security is valued by the independent pricing service using factors other than market quotations or the market is considered inactive, they will be categorized in level 2.

Fixed income securities such as corporate bonds, municipal bonds, and U.S. government and agency obligations, when valued using market quotations in an active market, are categorized as level 1 securities. However, fair value may be determined using an independent pricing service that considers market observable data such as reported sales of similar securities, broker quotes, yields, bids, offers, and other reference data. These securities would be categorized as level 2 securities. The fair value of mortgage-backed securities is estimated by an independent pricing service which uses models that consider interest rate movements, new issue information and other security pertinent data. Evaluations of tranches (non-volatile, volatile, or credit sensitive) are based on interpretations of accepted Wall Street modeling and pricing

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2014

conventions. Mortgage-backed securities are categorized in level 2 of the fair value hierarchy described below to the extent the inputs are observable and timely.

Any securities or other assets for which market quotations are not readily available, or securities for which the last bid price does not accurately reflect the current value, are valued at fair value as determined by the Trust’s Fair Value Committee (the “Committee”) in accordance with the Trust’s Portfolio Securities Valuation Procedures (the “Procedures”). Pursuant to the Procedures, the Committee will consider, among others, the following factors to determine a security’s fair value: (i) the nature and pricing history (if any) of the security; (ii) whether any dealer quotations for the security are available; and (iii) possible valuation methodologies that could be used to determine the fair value of the security. In the absence of readily available market quotations, or other observable inputs, securities valued at fair value pursuant to the Procedures would be categorized as level 3.

Money market funds are valued at their net asset value of $1.00 per share and are categorized as level 1. Securities with maturities of 60 days or less may be valued at amortized cost, which approximates fair value and would be categorized as level 2. The ability of issuers of debt securities held by the Funds to meet their obligations may be affected by economic or political developments in a specific country or region.

The Funds utilize various methods to measure the fair value of most of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Funds have the ability to access.

Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2014

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of inputs used as of November 30, 2014, in valuing the Funds’ assets carried at fair value.

| North Country Equity Growth Fund: | |

| | | | | | | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3* | | | Total | |

| Common Stock** | | $ | 122,513,636 | | | $ | — | | | $ | — | | | $ | 122,513,636 | |

| Money Market Fund | | | 2,421,059 | | | | — | | | | — | | | | 2,421,059 | |

| Total | | $ | 124,934,695 | | | $ | — | | | $ | — | | | $ | 124,934,695 | |

| | | | | | | | | | | | | | | | | |

| North Country Intermediate Bond Fund: | |

| | | | | | | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3* | | | Total | |

| Corporate Bonds** | | $ | — | | | $ | 43,282,277 | | | $ | — | | | $ | 43,282,277 | |

| U.S. Government Agency Obligations | | | — | | | | 19,051,093 | | | | — | | | | 19,051,093 | |

| Money Market Fund | | | 3,307,539 | | | | — | | | | — | | | | 3,307,539 | |

| Total | | $ | 3,307,539 | | | $ | 62,333,370 | | | $ | — | | | $ | 65,640,909 | |

| * | The Funds did not hold any Level 3 investments during the period. |

| ** | See Schedule of Investments for industry classifications. |

There were no transfers into and out of Level 1 and Level 2 during the period. It is the Funds’ policy to recognize transfers into and out of Level 1 and Level 2 at the end of the reporting period.

Federal Income Taxes – The Funds make no provision for federal income or excise tax. The Funds intend to qualify each year as regulated investment companies (“RICs”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of their taxable income. The Funds also intend to distribute sufficient net investment income and net capital gains, if any, so that they will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Funds could incur a tax expense.

Management reviewed the tax positions in open tax years 2011 through 2013 and those expected to be taken in the Funds’ fiscal 2014 year end tax returns, and determined that the Funds do not have a liability for unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statements of operations. During the year, the Funds did not incur any interest or penalties. The Funds identify their major tax jurisdictions as U.S. Federal and New York State.

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2014

Dividends and Distributions – The Bond Fund pays dividends from net investment income on a monthly basis. The Growth Fund will pay dividends from net investment income, if any, on an annual basis. Both Funds will declare and pay distributions from net realized capital gains, if any, annually. Income and capital gain distributions to shareholders are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Security Transactions – Securities transactions are recorded no later than the first business day after the trade date, except for reporting purposes when trade date is used. Realized gains and losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized over the life of the respective securities. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Expenses – Most expenses of the Trust can be directly attributed to a Fund. Expenses which are not readily identifiable to a specific Fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the Funds.

Indemnification – The Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, each Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. A Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Funds expect the risk of loss due to these warranties and indemnities to be remote.

NOTE 3. INVESTMENT ADVISORY FEE AND OTHER RELATED PARTY TRANSACTIONS

The Trust has entered into an investment advisory agreement (the “Advisory Agreement”) with North Country Investment Advisers, Inc. (the “Adviser”). Pursuant to the Advisory Agreement, the Adviser is responsible for formulating the Trust’s investment programs, making day-to-day investment decisions and engaging in portfolio transactions, subject to the authority of the Board of Trustees. Under the terms of the agreement, each Fund pays a fee, calculated daily and paid monthly, at an annual rate of 0.75% and 0.50% of the average daily net assets of the Growth Fund and Bond Fund, respectively. For the year ended November 30, 2014, the Adviser received advisory fees of $893,117 from the Growth Fund and $310,193 from the Bond Fund.

Pursuant to separate servicing agreements with Gemini Fund Services, LLC (“GFS”), the Funds pay GFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. GFS provides a Principal Executive Officer and a Principal Financial Officer to the Funds.

In addition, certain affiliates of GFS provide ancillary services to the Funds as follows:

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2014

Northern Lights Compliance Services, LLC (“NLCS”) – NLCS, an affiliate of GFS, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Funds.

Gemcom, LLC (“Gemcom”) – Gemcom, an affiliate of GFS, provides EDGAR conversion and filing services as well as print management services for the Funds on an ad-hoc basis. For the provision of these services, Gemcom receives customary fees from the Funds.

Certain officers and/or trustees of the Adviser and Administrator are also officers/trustees of the Trust.

NOTE 4. CAPITAL SHARE TRANSACTIONS

At November 30, 2014, there were an unlimited number of shares authorized with no par value. Paid in capital for the Growth Fund and Bond Fund amounted to $70,367,638 and $65,867,538, respectively.

Transactions in capital shares were as follows:

| Growth Fund: | | | | | | | | | | | | |

| | | For the year | | | For the year | |

| | | ended | | | ended | |

| | | November 30, 2014 | | | November 30, 2013 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | | | | | | | | | | |

| Shares sold | | | 950,374 | | | $ | 14,405,427 | | | | 577,713 | | | $ | 7,323,229 | |

| Shares issued for reinvestment of dividends | | | 39,374 | | | | 557,611 | | | | 1,092 | | | | 12,279 | |

| Shares redeemed | | | (1,383,433 | ) | | | (21,056,028 | ) | | | (1,561,261 | ) | | | (20,268,836 | ) |

| | | | | | | | | | | | | | | | | |

| Net decrease | | | (393,685 | ) | | $ | (6,092,990 | ) | | | (982,456 | ) | | $ | (12,933,328 | ) |

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2014

| Bond Fund: | | | | | | | | | | | | |

| | | For the year | | | For the year | |

| | | ended | | | ended | |

| | | November 30, 2014 | | | November 30, 2013 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | | | | | | | | | | |

| Shares sold | | | 1,618,457 | | | $ | 16,647,144 | | | | 855,736 | | | $ | 8,881,961 | |

| Shares issued for reinvestment of dividends | | | 9,765 | | | | 100,289 | | | | 12,328 | | | | 127,837 | |

| Shares redeemed | | | (1,119,556 | ) | | | (11,507,952 | ) | | | (825,288 | ) | | | (8,561,616 | ) |

| Net increase | | | 508,666 | | | $ | 5,239,481 | | | | 42,776 | | | $ | 448,182 | |

NOTE 5. INVESTMENTS

Investment transactions, excluding short-term securities, for the year ended November 30, 2014 were as follows:

| | | | | | Bond Fund | |

| | | | | | Excluding U.S. | | | U.S. | |

| | | | | | Government | | | Government | |

| | | Growth Fund | | | Securities | | | Securities | |

| Purchases | | $ | 34,657,240 | | | $ | 9,762,389 | | | $ | 8,329,348 | |

| Sales | | $ | 44,085,363 | | | $ | 11,198,980 | | | $ | 4,001,000 | |

At November 30, 2014, the aggregate cost for federal income tax purposes was $78,747,604 for the Growth Fund and $63,816,244 for the Bond Fund and differed from the fair value by net unrealized appreciation (depreciation) on investment securities as follows:

| | | Growth Fund | | | Bond Fund | |

| Aggregate gross unrealized appreciation for all investments for which there was an excess of value over cost | | $ | 46,815,070 | | | $ | 1,940,548 | |

| Aggregate gross unrealized depreciation for all investments for which there was an excess of cost over value | | | (627,979 | ) | | | (115,883 | ) |

| Net unrealized appreciation | | $ | 46,187,091 | | | $ | 1,824,665 | |

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2014

NOTE 6. TAX INFORMATION

The tax character of distributions paid during the fiscal year ended November 30, 2014 and fiscal year ended November 30, 2013 was as follows:

| | | For the year ended November 30, 2014: | | | | |

| | | Ordinary | | | Long-Term | | | | |

| Fund | | Income | | | Capital Gains | | | Total | |

| Growth Fund | | $ | 801,887 | | | $ | 2,489,479 | | | $ | 3,291,366 | |

| Bond Fund | | | 1,135,617 | | | | — | | | | 1,135,617 | |

| | | | | | | | | | | | | |

| | | For the year ended November 30, 2013: | | | | |

| | | Ordinary | | | Long-Term | | | | |

| Fund | | Income | | | Capital Gains | | | Total | |

| Growth Fund | | $ | 76,753 | | | $ | — | | | $ | 76,753 | |

| Bond Fund | | | 1,310,556 | | | | — | | | | 1,310,556 | |

On December 15, 2014, the Growth Fund paid an ordinary income dividend of $0.0531 per share, a short-term capital gain dividend of $0.0639, and a long-term capital gain dividend of $0.9828 per share to shareholders of record on December 12, 2014.

On December 15, 2014, the Bond Fund paid an ordinary income dividend of $0.0228 per share to shareholders of record on December 12, 2014.

As of November 30, 2014, the components of distributable earnings/ (deficit) on a tax basis were as follows:

| | | Undistributed | | | Undistributed | | | Post October Loss | | | Capital Loss | | | Unrealized | | | Total | |

| | | Ordinary | | | Long-Term | | | and | | | Carry | | | Appreciation/ | | | Accumulated | |

| Fund | | Income | | | Capital Gains | | | Late Year Loss | | | Forwards | | | (Depreciation) | | | Earnings | |

| Growth Fund | | $ | 969,675 | | | $ | 7,468,776 | | | $ | — | | | $ | — | | | $ | 46,187,091 | | | $ | 54,625,542 | |

| Bond Fund | | | 53,629 | | | | — | | | | — | | | | (1,713,110 | ) | | | 1,824,665 | | | | 165,184 | |

The difference between book basis and tax basis distributable earnings, if any, is primarily attributable to the tax deferral of losses on wash sales.

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2014

The Regulated Investment Company Modernization Act of 2010 (the “Act”), which was enacted on December 22, 2010, makes changes to several tax rules impacting the Funds. Although the Act provides several benefits, including unlimited carryover on future capital losses, there may be greater likelihood that all or a portion of the Funds’ pre-enactment capital loss carryovers may expire without being utilized due to the fact that post-enactment capital losses get utilized before pre-enactment capital loss carryovers. As of November 30, 2014, the Bond Fund had unused capital loss carry forwards of $1,713,110 available, for federal income tax purposes, to offset future capital gains. Such capital loss carry forwards expire on November 30, 2017.

Permanent book and tax differences, primarily attributable to the tax treatment of non-deductible expenses, and adjustments for real estate investment trusts and C-Corporation return of capital distributions, resulted in reclassification for the fiscal year ended November 30, 2014 as follows:

| | | Paid | | | Undistributed | | | Undistributed | |

| | | In | | | Ordinary | | | Long-Term | |

| Fund | | Capital | | | Income (Loss) | | | Gains (Loss) | |

| Growth Fund | | $ | — | | | $ | (28,888 | ) | | $ | 28,888 | |

| Bond Fund | | | (42 | ) | | | 42 | | | | — | |

NOTE 7. CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates presumption of control of the Fund, under Section 2(a) 9 of the Act. As of November 30, 2014, SEI Private Trust, an account holding shares for the benefit of others in nominee name, held approximately 88% of the voting securities of the Growth Fund and approximately 94% of the Bond Fund.

NOTE 8. SUBSEQUENT EVENTS

Subsequent events after the date of the Statements of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has concluded that there is no impact requiring additional adjustment or disclosure in the financial statements.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

The North Country Funds

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of The North Country Funds, comprising North Country Equity Growth Fund and North Country Intermediate Bond Fund (the “Funds”), as of November 30, 2014, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and Financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights arc free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2014, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the Funds constituting The North Country Funds as of November 30, 2014, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

January 28, 2015

COHEN FUND AUDIT SERVICES, LTD. | CLEVELAND | MILWAUKEE | 216.649.1700

| Registered with the Pubic Company Accounting Oversight Board. | cohenfund.com |

INFORMATION REGARDING

TRUSTEES AND OFFICERS (Unaudited)

The Trustees and officers of The North Country Funds (the “Trust”) are listed below, together with their principal occupations during the past five years. The term of office for trustees is for the duration of the Trust or until removal, resignation or retirement; officers are elected annually. Each individual listed below oversees both portfolios currently existing within the complex.

The following table provides information regarding each Trustee who is an “interested person” of the Trust, as defined in the Investment Company Act of 1940.

| Name, Address and Age | | Position &

Length of Time

Served with the

Trust | | Principal Occupations During Past

5 Years and Current Directorships |

John E. Arsenault*

c/o Gemini Fund Services, LLC

80 Arkay Drive, Suite 110

Hauppauge, NY 11788

Age: 67 | | Trustee since 2009 | | Retired (2013-Present); President, North Country Investment Advisers, Inc. (2012 - 2013; 2000-2011); Retired (2011- 2012); Executive Vice President & Head of the Trust and Investment Group, Glens Falls National Bank (1997-2009). |