(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If "Yes" is marked, indicate below the file number assigned to registrant in connection with Rule 12g3-2(b): 82-__________. )

| THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION |

If you are in any doubt as to any aspect of this circular, you should consult a stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser.

If you have sold or transferred all your shares of China Petroleum & Chemical Corporation, you should at once hand this circular together with the accompanying form of proxy to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale was effected for transmission to the purchaser or the transferee.

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular.

This circular is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for the securities.

(a joint stock limited company incorporated in the People’s Republic of China with limited liability)

(Stock Code: 00386)

(1) PROPOSED ISSUANCE OF A SHARES;

(2) CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED

ISSUANCE OF A SHARES UNDER GENERAL MANDATE;

(3) PROPOSED ELECTION OF DIRECTOR;

(4) PROPOSED REDUCTION OF THE REGISTERED CAPITAL AND AMENDMENTS TO THE ARTICLES OF ASSOCIATION;

(5) PROPOSED GRANT TO THE BOARD A MANDATE TO BUY BACK

DOMESTIC SHARES AND/OR OVERSEAS-LISTED FOREIGN SHARES

OF SINOPEC CORP.; AND

(6) NOTICE OF ANNUAL GENERAL MEETING FOR 2022 AND FIRST H SHAREHOLDERS CLASS MEETING FOR 2023

Independent Financial Adviser to the Independent Board Committee and Independent Shareholders

A letter from the Board is set out on pages 6 to 29 of this circular. A letter from the Independent Board Committee is set out on pages 30 to 31 of this circular. A letter from the Independent Financial Adviser is set out on pages 32 to 59 of this circular.

The AGM will be held at Beijing Chaoyang U-Town Crowne Plaza, No. 3 Sanfeng North Area, Chaoyang District, Beijing, PRC on Tuesday, 30 May 2023 at 9:00 a.m. and the H Shareholders Class Meeting will be held at the same venue immediately following the conclusion of the AGM and the A Shareholders Class Meeting. The Notice of Annual General Meeting for 2022 and First H Shareholders Class Meeting for 2023 is set out in this circular. Whether or not you are able to attend the AGM and/or H Shareholders Class Meeting, you are requested to complete and return the enclosed proxy forms in accordance with the instructions printed thereon as soon as possible and in any event not less than 24 hours before the time designated for convening the AGM (i.e. before 9:00 a.m. on 29 May 2023, Hong Kong time). Completion and return of the proxy forms shall not preclude you from attending and voting in person at the AGM and/or the H Shareholders Class Meeting should you so wish.

13 April 2023

Page

| DEFINITIONS | 1 |

| | |

| LETTER FROM THE BOARD | 6 |

| | |

| LETTER FROM THE INDEPENDENT BOARD COMMITTEE | 30 |

| | |

| LETTER FROM THE INDEPENDENT FINANCIAL ADVISER | 32 |

| | |

| APPENDIX I – DEMONSTRATION AND ANALYSIS REPORT ON THE PLAN OF THE PROPOSED ISSUANCE OF A SHARES | 60 |

| | |

| APPENDIX II – FEASIBILITY REPORT ON THE USE OF PROCEEDS RAISED FROM THE PROPOSED ISSUANCE OF A SHARES | 68 |

| | |

| APPENDIX III – DILUTION OF CURRENT RETURNS BY THE PROPOSED ISSUANCE OF A SHARES, REMEDIAL MEASURES AND THE COMMITMENTS OF RELATED ENTITIES | 84 |

| | |

APPENDIX IV – DIVIDEND DISTRIBUTION AND RETURN PLAN FOR SHAREHOLDERS FOR THE NEXT THREE YEARS (2023-2025). | 92 |

| | |

| APPENDIX V – EXPLANATORY STATEMENT | 95 |

| | |

| APPENDIX VI – GENERAL INFORMATION | 100 |

| | |

NOTICE OF ANNUAL GENERAL MEETING FOR 2022 AND FIRST H SHAREHOLDERS CLASS MEETING FOR 2023 | 104 |

In this circular, unless the context otherwise requires, the following expressions have the following meanings:

| “2021 General Mandate” | the approval granted by the Shareholders by way of special resolution passed at the 2021 annual general meeting of the Company held on 18 May 2022, which authorised the Board to allot, issue and deal with a maximum of 19,111,554,209 A Shares and 5,102,687,720 H Shares, respectively, representing not more than 20% of the number of each of the A Shares and H Shares in issue as at the date of passing such resolution; |

| “A Share Buy-back Mandate” | the general mandate to the Board to buy back A Shares not exceeding 10% of the number of A Shares in issue as at the date of passing the relevant proposed resolution(s) approving the A Share Buy-back Mandate at the AGM, the A Shareholders Class Meeting and the H Shareholders Class Meeting, details of which are set out in the Notice of Annual General Meeting for 2022 and First H Shareholders Class Meeting for 2023; |

| “A Share(s)” | the domestic share(s) issued by the Company to domestic investors denominated in RMB and which are listed on the Shanghai Stock Exchange; |

| “A Shareholder(s)” | holder(s) of A Share(s); |

| “A Shareholders Class Meeting” | the first class meeting of the A Shareholders for 2023 to be held at Beijing Chaoyang U-Town Crowne Plaza, No. 3 Sanfeng North Area, Chaoyang District, Beijing, PRC on Tuesday, 30 May 2023 immediately following the conclusion of the AGM; |

| “AGM” | the annual general meeting of the Company for 2022 to be held at Beijing Chaoyang U-Town Crowne Plaza, No. 3 Sanfeng North Area, Chaoyang District, Beijing, PRC on Tuesday, 30 May 2023 at 9:00 a.m.; |

| “Articles of Association” | the articles of association of the Company as amended from time to time; |

| “associate(s)” | has the meaning ascribed thereto under the Hong Kong Listing Rules; |

| “Board” | the board of directors of the Company; |

| “Buy-back Mandate” | the general mandate to the Board to buy back A Shares and/or H Shares not exceeding 10% of the number of A Shares and/or H Shares in issue as at the date of passing the relevant proposed resolution(s) approving the Buyback Mandate at the AGM, the A Shareholders Class Meeting and the H Shareholders Class Meeting, details of which are set out in the Notice of Annual General Meeting for 2022 and First H Shareholders Class Meeting for 2023; |

| “China” or “PRC” | the People’s Republic of China and, for the purpose of this circular, excludes Hong Kong, the Macau Special Administrative Region and Taiwan; |

| “China Petrochemical Corporation” | China Petrochemical Corporation, a state-owned enterprise established under the laws of the PRC and the controlling shareholder of the Company; |

| “Class Meeting(s)” | collectively, A Shareholders Class Meeting and H Shareholders Class Meeting; |

| “Company” or “Sinopec Corp.” | China Petroleum & Chemical Corporation, a joint stock limited company incorporated in the PRC with limited liability; |

| “connected person(s)” | has the meaning ascribed thereto under the Hong Kong Listing Rules; |

| “controlling shareholder” | has the meaning ascribed thereto under the Hong Kong Listing Rules; |

| “CSRC” | China Securities Regulatory Commission; |

| “Director(s)” | the directors of the Company; |

| “EVA” | ethylene vinyl acetate; |

| “Group” | the Company and its subsidiaries; |

| “H Share Buy-back Mandate” | the general mandate to the Board to buy back H Shares not exceeding 10% of the number of H Shares in issue as at the date of passing the relevant proposed resolution(s) approving the H Share Buy-back Mandate at the AGM, the A Shareholders Class Meeting and the H Shareholders Class Meeting, details of which are set out in the Notice of Annual General Meeting for 2022 and First H Shareholders Class Meeting for 2023; |

| “H Share(s)” | the overseas-listed foreign share(s) in the Company’s share capital, with a nominal value of RMB1.00 each, which are listed on the Hong Kong Stock Exchange; |

| “H Shareholder(s)” | holder(s) of H Share(s); |

| “H Shareholders Class Meeting” | the first class meeting of the H Shareholders for 2023 to be held immediately following the conclusion of the AGM and the A Shareholders Class Meeting of the Company at Beijing Chaoyang U-Town Crowne Plaza, No. 3 Sanfeng North Area, Chaoyang District, Beijing, PRC on Tuesday, 30 May 2023; |

| “HK$” | Hong Kong Dollars, the lawful currency of Hong Kong; |

| “Hong Kong” | the Hong Kong Special Administrative Region of the PRC; |

| “Hong Kong Listing Rules” | the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited; |

| “Hong Kong Stock Exchange” | The Stock Exchange of Hong Kong Limited; |

| “Independent Board Committee” | the independent board committee of the Company formed to advise the Independent Shareholders in relation to the connected transaction in respect of the Proposed Issuance of A Shares; |

| “Independent Financial Adviser” | Somerley Capital Limited, a corporation licensed to carry out Type 1 (dealing in securities) and Type 6 (advising on corporate finance) regulated activities under the SFO and is the independent financial adviser to the Independent Board Committee and the Independent Shareholders in relation to the connected transaction in respect of the Proposed Issuance of A Shares; |

| “Independent Shareholders” | The Shareholders, other than China Petrochemical Corporation and its associates; |

| “Issue Price” or “Subscription Price” | the subscription price for new A Shares to be issued under the Subscription Agreement; |

| “Latest Practicable Date” | 3 April 2023, being the latest practicable date prior to the printing of this circular for ascertaining certain information contained herein; |

| “LNG” | liquefied natural gas; |

| “Mandatory Provisions” | the Mandatory Provisions for Companies Listing Overseas set forth in Zheng Wei Fa (1994) No. 21 issued on 27 August 1994 by the State Council Securities Policy Committee and the State Commission for Restructuring the Economic System; |

| “Other Matters” | the matters to be approved at the AGM other than the Proposed Issuance of A Shares, i.e. (i) the Proposed Election; (ii) the reduction of the registered capital and the Proposed Amendments; and (iii) the Buy-back Mandate; |

| “POE” | polyolefin elastomer; |

| “Pricing Benchmark Date” | 27 March 2023, the pricing benchmark date of the Proposed Issuance of A Shares, being the date of the announcement regarding the Board resolutions approving the Proposed Issuance of A Shares published on the website of the Shanghai Stock Exchange; |

| “Proposed Amendments” | the proposed amendments to the Articles of Association; |

| “Proposed Election” | the proposed election of Mr. Lv Lianggong as an executive Director; |

| “Proposed Issuance of A Shares” | the proposed issuance of 2,238,805,970 A Shares by the Company to China Petrochemical Corporation pursuant to the Subscription Agreement under the 2021 General Mandate; |

| “RMB” | Renminbi, the lawful currency of the PRC; |

| “SFO” | Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) as amended from time to time; |

| “Shanghai Listing Rules” | Rules Governing the Listing of Stocks on the Shanghai Stock Exchange; |

| “Share(s)” | the ordinary shares of RMB1.00 each in the share capital of the Company, including the A Shares and H Shares; |

| “Shareholder(s)” | the holder(s) of Shares; |

| “Subscription Agreement” | the subscription agreement entered into between the Company and China Petrochemical Corporation on 24 March 2023, pursuant to which the Company agreed to allot and issue, and China Petrochemical Corporation agreed to subscribe for, 2,238,805,970 new A Shares at the Subscription Price; |

| “Supervisor(s)” | the supervisor(s) of the Company; |

| “Takeovers Code” | The Hong Kong Codes on Takeovers and Mergers and Share Buy-backs; |

(a joint stock limited company incorporated in the People’s Republic of China with limited liability)

(Stock Code: 00386)

Executive Directors: Yu Baocai Li Yonglin Liu Hongbin

Non-executive Directors: Ma Yongsheng Zhao Dong

Independent Non-Executive Directors: Cai Hongbin Ng, Kar Ling Johnny Shi Dan Bi Mingjian | Registered address: 22 Chaoyangmen North Street Chaoyang District Beijing 100728 The People’s Republic of China |

13 April 2023

To the Shareholders

(1) PROPOSED ISSUANCE OF A SHARES;

(2) CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE;

(3) PROPOSED ELECTION OF DIRECTOR;

(4) PROPOSED REDUCTION OF THE REGISTERED CAPITAL AND AMENDMENTS TO THE ARTICLES OF ASSOCIATION;

(5) PROPOSED GRANT TO THE BOARD A MANDATE TO BUY BACK DOMESTIC SHARES AND/OR OVERSEAS-LISTED FOREIGN SHARES OF SINOPEC CORP.; AND

(6) NOTICE OF ANNUAL GENERAL MEETING FOR 2022 AND FIRST H SHAREHOLDERS CLASS MEETING FOR 2023

References are made to (i) the announcement of the Company dated 24 March 2023 in relation to the Proposed Issuance of A Shares and the connected transaction in respect of the Proposed Issuance of A Shares under general mandate; (ii) the announcement of the Company dated 24 March 2023 in relation to the Proposed Election; and (iii) the announcement of the Company dated 24 March 2023 in relation to Proposed Amendments.

The purpose of this circular is to provide you with further information regarding, among other things, (i) details of the Proposed Issuance of A Shares and the connected transaction in respect of the Proposed Issuance of A Shares under general mandate; (ii) details of Other Matters to be approved at the AGM and/or the H Shareholders Class Meeting; (iii) a letter from the Independent Board Committee in relation to the connected transaction in respect of the Proposed Issuance of A Shares; and (iv) a letter of advice from the Independent Financial Adviser in relation to the connected transaction in respect of the Proposed Issuance of A Shares; so as to enable you to make an informed decision on whether to vote for or against the proposed resolutions at the AGM and the H Shareholders Class Meeting.

| II. | PROPOSED ISSUANCE OF A SHARES |

| 1. | Resolution regarding the satisfaction of the conditions of the issuance of A shares to target subscribers by the Company |

In accordance with the requirements of relevant laws, regulations and normative documents including the Company Law of the People’s Republic of China, the Securities Law of the People’s Republic of China and the Administrative Measures for the Registration of the Issuance of Securities by Listed Companies, the Company complies with the conditions of issuance of A shares to target subscribers after detailed verification of the actual situation of the Company.

| 2. | Resolution regarding the Plan of the Proposed Issuance of A Shares |

Details of the Plan of the Proposed Issuance of A Shares are as follows:

| (1) | Type and par value of shares to be issued |

The shares to be issued under the Proposed Issuance of A Shares are domestically listed domestic shares (A Shares), with par value of RMB1.00 each.

| (2) | Manner and timing of issuance |

The Proposed Issuance of A Shares shall be conducted by way of issuing A Shares to target subscribers. The Company will conduct the Proposed Issuance of A Shares at an appropriate time within the validity period of the consent for registration from the CSRC.

| (3) | Subscriber and manner of subscription |

The subscriber of the Proposed Issuance of A Shares is China Petrochemical Corporation, which will make a one-off subscription for all the A Shares to be issued under the Proposed Issuance of A Shares in cash.

| (4) | Pricing Benchmark Date, Issue Price and pricing principles |

Please refer to the section headed “III. CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE – 1. Subscription Agreement – Pricing Benchmark Date, Subscription Price and pricing principles” in this letter for further details.

| (5) | Number of shares to be issued |

Please refer to the section headed “III. CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE – 1. Subscription Agreement – Number of new A Shares to be issued” in this letter for further details.

Please refer to the section headed “III. CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE – 1. Subscription Agreement – Lock-up period” in this letter for further details.

| (7) | Amount and use of proceeds |

Please refer to the section headed “III. CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE – 6. Use of Proceeds” in this letter for further details.

Upon expiration of the lock-up period, the A Shares to be issued under the Proposed Issuance of A Shares will be listed and traded on the main board of the Shanghai Stock Exchange.

| (9) | Arrangement of accumulated undistributed profits |

The accumulated undistributed profits of the Company prior to the Proposed Issuance of A Shares shall be shared by all Shareholders, pro-rata to their respective shareholding in the Company, upon completion of the Proposed Issuance of A Shares.

The resolutions in relation to the Proposed Issuance of A Shares shall remain valid for twelve (12) months from the date on which these resolutions are considered and approved at the AGM.

| 3. | Resolution regarding the Proposal of the Proposed Issuance of A Shares |

Please refer to the details of Resolutions No. 2, 4, 6 to 9 as set out under this section, which form the major content of the Proposal of the Proposed Issuance of A Shares.

| 4. | Resolution regarding the Demonstration and Analysis Report on the Plan of the Proposed Issuance of A Shares |

In accordance with the requirements of relevant laws, regulations and normative documents including the Company Law of the People’s Republic of China, the Securities Law of the People’s Republic of China and the Administrative Measures for the Registration of the Issuance of Securities by Listed Companies, the Company has prepared the Demonstration and Analysis Report on the Plan of the Proposed Issuance of A Shares.

Please refer to Appendix I to this circular for further details of the Demonstration and Analysis Report on the Plan of the Proposed Issuance of A Shares. In the event of any discrepancy between the English translation and the Chinese version of the document, the Chinese version shall prevail.

| 5. | Resolution regarding the connected transaction involved in the Proposed Issuance of A Shares |

Please refer to the section headed “III. CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE” in this letter for further details.

| 6. | Resolution regarding the conditional Subscription Agreement entered into between the Company and China Petrochemical Corporation |

Please refer to the section headed “III. CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE – 1. Subscription Agreement” in this letter for further details.

| 7. | Resolution regarding the Feasibility Report on the Use of Proceeds Raised from the Proposed Issuance of A Shares |

Please refer to Appendix II to this circular for further details of the Feasibility Report on the Use of Proceeds Raised from the Proposed Issuance of A Shares. In the event of any discrepancy between the English translation and the Chinese version of the document, the Chinese version shall prevail.

| 8. | Resolution regarding the dilution of current returns by the Proposed Issuance of A Shares, remedial measures and the commitments of related entities |

In accordance with the requirements of relevant laws, regulations and normative documents including the Opinions of the General Office of the State Council on Further Strengthening the Work of Protection of the Legitimate Rights and Interests of Minority Investors in the Capital Markets (Guo Ban Fa [2013] No. 110) (《國務院辦公廳關於進一步加強資本市場中小投資者合法權益保護工作的意見》(國辦發[2013]110號)), Certain Opinions of the State Council on Further Promoting the Sound Development of Capital Markets (Guo Fa [2014] No. 17) (《國務院關於進一步促進資本市場健康發展的若干意見》(國發[2014]17號)) and the Guidelines on Matters concerning the Dilution of Current Returns of the Initial Offering, Refinancing and Major Asset Restructuring (CSRC Notice [2015] No. 31) (《關於首發及再融資、重大資產重組攤薄即期回報有關事項的指導意見》(證監會公告[2015]31號)), in order to protect the rights to information and safeguard interests of minority investors, the Company analysed the impact of the dilution of current returns by the Proposed Issuance of A Shares on the main financial indicators of the Company, and formulated the measures to be taken to prevent the relevant risks, and the controlling shareholder, de facto controllers, the Directors and senior management of the Company issued the relevant commitments of measures to replenish the diluted current returns.

Please refer to Appendix III to this circular for further details of the dilution of current returns by the Proposed Issuance of A Shares, remedial measures and the commitments of related entities. In the event of any discrepancy between the English translation and the Chinese version of the document, the Chinese version shall prevail.

| 9. | Resolution regarding the Dividend Distribution and Return Plan for Shareholders for the Next Three Years (2023-2025) |

In accordance with the relevant requirements of the Notice regarding Further Implementation of Cash Dividend Distribution by Listed Companies (Zheng Jian Fa [2012] No. 37) (《關於進一步落實上市公司現金分紅有關事項的通知》(證監發[2012]37號)), the No.3 Guidelines for the Supervision on Listed Companies – Cash Dividend Distribution of Listed Companies (2022 Revision) (CSRC Announcement [2022] No. 3) (《上市公司監管指引第3號 –上市公司現金分紅(2022年修訂)》(證監會公告[2022]3號)) issued by the CSRC and the Articles of Association, in order to further implement the dividend distribution policy, regulate the Company’s cash dividend, enhance the transparency of decision-making process for cash dividend and safeguard the legitimate rights and interests of investors, the Company formulated the Dividend Distribution and Return Plan for Shareholders for the Next Three Years (2023-2025).

Please refer to Appendix IV to this circular for further details of the Dividend Distribution and Return Plan for Shareholders for the Next Three Years (2023-2025). In the event of any discrepancy between the English translation and the Chinese version of the document, the Chinese version shall prevail.

| 10. | Resolution regarding the authorisation to the Board at the AGM with full power to deal with specific matters relating to the Proposed Issuance of A Shares |

In order to ensure the flexibility and smooth implementation of the relevant matters relating to the Proposed Issuance of A Shares, and pursuant to the relevant provisions of the laws, regulations, normative documents and the Articles of Association, the Board proposed to seek approval at the AGM to authorise the Board (or the persons authorised by the Board) with all the powers necessary to proceed with the specific matters relating to the Proposed Issuance of A Shares, including but not limited to:

| (1) | in accordance with laws, regulations and other normative documents, relevant regulations and opinions of regulatory bodies, within the scope of the Plan of the Proposed Issuance of A Shares considered and approved at the AGM, and taking into account the market environment and the Company’s specific conditions, to formulate the specific plan for the Proposed Issuance of A Shares, including but not limited to the manner of issuance, the issue price, the number of shares to be issued, the timing of issuance and the commencement and end dates of issuance; |

| (2) | subject to compliance with the then laws, regulations and other normative documents, if the laws, regulations and other normative documents and relevant regulatory bodies have new regulations on the issuance of new shares by listed companies and if market conditions change, save for matters involving relevant laws, regulations, other normative documents and the Articles of Association which are subject to re-approval at a general meeting and are not allowed to be authorised, to make adjustments to the Plan of the Proposed Issuance of A Shares and continue to process the Proposed Issuance of A Shares in accordance with the relevant regulations and the requirements of the regulatory bodies (including the review feedback on the application for the Proposed Issuance of A Shares) and market conditions; |

| (3) | to draft, revise, execute and submit to relevant government authorities, regulatory bodies and stock exchanges and securities registration and clearing institutions (including but not limited to the CSRC, the Shanghai Stock Exchange, the Hong Kong Stock Exchange and the Shanghai Branch of China Securities Depository and Clearing Corporation Limited) all the application, report or documents related to the Proposed Issuance of A Shares, and execute all the contracts, agreements and documents related to the Proposed Issuance of A Shares, as well as processing the procedures of approval, registration, filing, consent, registration, share lock-up and listing, and handling information disclosure matters related to the Proposed Issuance of A Shares in accordance with regulatory requirements; |

| (4) | to set up a special account for proceeds raised under the Proposed Issuance of A Shares and handle matters related to the set up of such account, including but not limited to confirming and executing relevant agreements and documents required for the set up of such account and handling relevant capital verification procedures, etc.; |

| (5) | within the scope of the use of proceeds considered and approved at the AGM and according to the actual needs of the investment projects, to make appropriate adjustment to the sequential order and amount in the use of the proceeds. Before the proceeds raised from the Proposed Issuance of A Shares are in place, to finance the investment projects with self-raised funds in advance according to the actual implementation progress of the investment projects to be financed with the proceeds from the Proposed Issuance of A Shares, which shall be replaced with the proceeds raised from the Proposed Issuance of A Shares in accordance with the procedures stipulated in the relevant regulations after the same are in place; |

| (6) | subject to compliance with laws, regulations and other normative documents, to decide and process all other matters relating to the Proposed Issuance of A Shares; and |

| (7) | this authorisation shall be effective for a period of twelve (12) months from the date of approval of this resolution at the AGM. |

Subject to the authorisation at the AGM, the Board agrees to continue to authorise the Chairman and/or the relevant persons authorised by the Chairman to specifically handle all the above-mentioned matters related to the Proposed Issuance of A Shares.

| 11. | Resolution regarding the authorisation to the Board at the AGM to amend the Articles of Association in accordance with the situation of the Proposed Issuance of A Shares |

Upon completion of the Proposed Issuance of A Shares, articles in relation to the registered capital, the total number of shares and the share capital structure as set out in the Articles of Association will be changed and the Articles of Association have to be amended accordingly. Therefore, the Board proposed to seek approval at the AGM to authorise the Board (or the persons authorised by the Board) to amend the corresponding articles in the Articles of Association in accordance with the actual situation after completion of the Proposed Issuance of A shares, and to register the relevant amendments with the market supervision and administration authorities and other relevant authorities.

Subject to the authorisation at the AGM, the Board agrees to continue to authorise the Chairman and/or the relevant persons authorised by the Chairman to specifically handle all the above-mentioned matters.

| III. | CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE |

On 24 March 2023, the Company and China Petrochemical Corporation entered into the Subscription Agreement, pursuant to which, the Company shall issue and China Petrochemical Corporation shall subscribe in cash for 2,238,805,970 new A Shares.

The major terms of the Subscription Agreement are as follows:

Date

24 March 2023

Parties

| (1) | The Company, as the issuer |

| (2) | China Petrochemical Corporation, as the subscriber |

Number of new A Shares to be issued

The Company shall issue under the 2021 General Mandate and China Petrochemical Corporation shall subscribe for 2,238,805,970 new A Shares, representing approximately 2.34% (not more than 20%) of the total number of A Shares in issue as at the date of the 2021 annual general meeting of the Company on which the 2021 General Mandate was approved and approximately 1.87% of the total number of Shares in issue as at the Latest Practicable Date. Pursuant to the regulatory requirements of the CSRC, the maximum number of new A Shares to be issued under the Proposed Issuance of A Shares shall be no more than 30% of the total number of Shares in issue immediately before completion of the Proposed Issuance of A Shares. The total gross proceeds to be raised from the Proposed Issuance of A Shares shall be no more than RMB12 billion (inclusive). Where there are any ex-rights or ex-dividend events such as distribution of dividend, bonus issue and capitalisation of capital reserve during the period from the Pricing Benchmark Date to the date of issuance of the A Shares pursuant to the Subscription Agreement that result in changes in the Issue Price, the number of A Shares to be issued under the Proposed Issuance of A Shares shall be adjusted accordingly, which shall be calculated by dividing the total gross proceeds to be raised (i.e. RMB12 billion) by the adjusted Issue Price. The final number of A Shares to be issued under the Proposed Issuance of A Shares shall be subject to the number of shares finally consented to be registered by the CSRC.

Par value of new A Shares to be issued

The aggregate par value of the new A Shares to be issued under the Proposed Issuance of A Shares will be RMB2,238,805,970.

Pricing Benchmark Date, Subscription Price and pricing principles

According to the Administrative Measures for the Registration of the Issuance of Securities by Listed Companies, the issue price of issuance of A shares to target subscribers should not be lower than 80% of the average trading price of the A Shares as quoted on the Shanghai Stock Exchange in the 20 trading days preceding the Pricing Benchmark Date (the “Pricing Criteria”).

The Pricing Benchmark Date of the Proposed Issuance of A Shares is the date of the announcement regarding the Board resolutions approving the Proposed Issuance of A Shares published on the website of the Shanghai Stock Exchange, i.e. 27 March 2023. The Subscription Price shall be RMB5.36 per A Share, being the average trading price of the A Shares as quoted on the Shanghai Stock Exchange in the 20 trading days preceding the Pricing Benchmark Date (which is calculated by dividing the total trading amount of A Shares traded in the 20 trading days preceding the Pricing Benchmark Date by the total trading volume of A Shares for the same period, and rounded up to the nearest two decimal places). The Subscription Price is more favourable than the minimum requirement under the Pricing Criteria.

For illustrative purposes only, the Subscription Price represents:

| (a) | a discount of approximately 3.60% to the closing price of RMB5.560 per A Share as quoted on the Shanghai Stock Exchange on the Latest Practicable Date; |

| (b) | a discount of approximately 2.90% to the average closing price of RMB5.520 per A Share as quoted on the Shanghai Stock Exchange for the five trading days immediately prior to the Latest Practicable Date; |

| (c) | a discount of approximately 3.75% to the average closing price of RMB5.569 per A Share as quoted on the Shanghai Stock Exchange for the ten trading days immediately prior to the date of the Latest Practicable Date. |

Where there are any ex-rights or ex-dividend events such as distribution of dividend, bonus issue and capitalisation of capital reserve during the period from the Pricing Benchmark Date to the date of issuance of the A Shares pursuant to the Subscription Agreement, the Subscription Price shall be adjusted accordingly. The adjustment methods are set out as follows:

| (1) | In the event of distribution of dividend, the adjustment formula will be: |

P1 = P0 – D

| (2) | In the event of bonus issue or capitalisation of capital reserve, the adjustment formula will be: |

P1 = P0/(1 + N)

| (3) | In the event that the events in (1) and (2) above were performed simultaneously, the adjustment formula will be: |

P1 = (P0 – D)/(1 + N)

where,

P1 represents the adjusted issue price;

P0 represents the issue price before adjustment;

D represents dividend per Share; and

N represents the number of Shares resulting from capitalisation of capital reserve to be issued for each Share or the number of bonus shares per Share.

In addition, pursuant to Rule 13.36(5) of the Hong Kong Listing Rules, the Subscription Price shall not represent a discount of 20% or more to the higher of (i) the closing price of the H Shares on the date of the Subscription Agreement (i.e. 24 March 2023), and (ii) the average closing price of the H Shares in the five trading days immediately prior to the date of the Subscription Agreement.

For illustrative purposes only and based on the central parity rate announced by the People’s Bank of China on the date of the Subscription Agreement (HK$1=RMB0.87107), the A Share Subscription Price represents:

| (a) | a premium of approximately 31.21% over the closing price of HK$4.690 per H Share (equivalent to approximately RMB4.085 per H Share) as quoted on the Stock Exchange on the date of the Subscription Agreement; and |

| (b) | a premium of approximately 28.91% over the average closing price of HK$4.774 per H Share (equivalent to approximately RMB4.158 per H Share) as quoted on the Stock Exchange for the five trading days immediately prior to the date of the Subscription Agreement. |

Despite any subsequent corporate events which may lead to an adjustment in the Subscription Price, the Company will take all actions in its power to monitor and control these corporate events so as to ensure that (i) the final Subscription Price is higher than HK$3.8192, being a discount of 20% of the higher of the above-mentioned benchmark prices; and (ii) the number of new A Shares to be issued will not exceed the maximum number of A Shares to be issued under the 2021 General Mandate (being 19,111,554,209 A Shares) and 30% of the total number of Shares in issue immediately before completion of the Proposed Issuance of A Shares. If any corporate event may cause the Proposed Issuance of A Shares to fail to meet the above-mentioned requirements, the Company will re-comply with the Hong Kong Listing Rules where necessary.

After satisfaction of all the conditions precedent stipulated in the Subscription Agreement, China Petrochemical Corporation shall subscribe for the A Shares issued by the Company in accordance with the Subscription Agreement and make payment for such subscription in cash in one lump sum into the designated bank account on or before the designated payment date stipulated in the payment notice of the subscription.

Lock-up period

The new A Shares to be subscribed by China Petrochemical Corporation shall not be transferred within thirty-six (36) months from the completion date of the Proposed Issuance of A Shares.

If the CSRC and/or the Shanghai Stock Exchange have different views on the above lock-up period arrangement, China Petrochemical Corporation agrees to revise and implement the above lock-up arrangement in accordance with the opinions of the CSRC and/or the Shanghai Stock Exchange.

Conditions precedent

The Subscription Agreement shall take effect after being executed by the legal or authorised representatives, as well as the satisfaction of the following conditions:

| (1) | the Subscription Agreement and the Proposed Issuance of A Shares having been approved by the Board and at the AGM; |

| (2) | the Proposed Issuance of A Shares having been approved by the relevant state-owned assets supervision bodies; and |

| (3) | the Proposed Issuance of A Shares having been considered and approved by the Shanghai Stock Exchange and consented for registration by the CSRC. |

In the event that any of the above-mentioned conditions is not satisfied, the Subscription Agreement shall terminate automatically.

As at the Latest Practicable Date, save for condition (1) above has been partly satisfied in that the Board has approved the Subscription Agreement and the Proposed Issuance of A Shares and condition (2) above has been satisfied, the remaining conditions have not been satisfied.

Liability for breach of contract

The breach of obligations, undertakings, representations and warranties under the Subscription Agreement by any party thereto shall constitute a breach of the Subscription Agreement. If the Subscription Agreement fails to be performed in full, in part or in a timely manner due to the breach of the defaulting party, the defaulting party shall be liable for the losses caused to the non-defaulting party as a result.

After the Subscription Agreement becomes effective, if China Petrochemical Corporation fails to pay the total Subscription Price in a timely manner and in full in accordance with the Subscription Agreement due to China Petrochemical Corporation’s fault, China Petrochemical Corporation shall pay to the Company damages at 1% of the amount due and unpaid. If the damages are insufficient to cover the losses suffered by the Company as a result, China Petrochemical Corporation shall also compensate the Company for the actual losses sustained or incurred by the Company.

If the registration procedures for the new A Shares held by China Petrochemical Corporation cannot be completed due to the Company’s fault, the Company shall compensate China Petrochemical Corporation for the actual losses incurred by China Petrochemical Corporation as a result.

Any party who fails to perform in full or in part its obligations under the Subscription Agreement due to force majeure shall not be liable for breach, but such party shall take all necessary practicable remedial measures to reduce the losses caused, otherwise it shall be liable for breach for the enlarged part of the other party’s losses.

| 2. | Ranking of new A Shares to be issued under the Proposed Issuance of A Shares and lock-up period |

The new A Shares to be issued pursuant to the Proposed Issuance of A Shares shall rank, upon issue, pari passu in all respects with the A Shares in issue at the time of issue and allotment of such new A Shares, except that the new A Shares to be issued to China Petrochemical Corporation are subject to a lock-up period of thirty-six (36) months.

| 3. | Application for listing |

Upon expiration of the lock-up period, the A Shares to be issued under the Proposed Issuance of A Shares will be listed and traded on the main board of the Shanghai Stock Exchange.

| 4. | Effect of the Proposed Issuance of A Shares on the shareholding structure of the Company |

The following table illustrates the shareholding structure of the Company as at the Latest Practicable Date and immediately after the completion of the Proposed Issuance of A Shares (assuming that a total of 2,238,805,970 A Shares will be issued under the Proposed Issuance of A Shares and there will be no other change in the number of issued Shares in the Company until the completion of the Proposed Issuance of A Shares):

| | As at the Latest Practicable Date | Immediately after the completion of the Proposed Issuance of A Shares |

| Name of Shareholders | Number of Shares | As a percentage of the total issued Shares | Number of Shares | As a percentage of the total issued Shares |

| | | | | |

| A Shares | | | | |

| China Petrochemical Corporation | 80,572,167,393 | 67.20% | 82,810,973,363 | 67.80% |

| Public A Shareholders | 14,543,303,653 | 12.13% | 14,543,303,653 | 11.91% |

| Total issued A Shares | 95,115,471,046 | 79.33% | 97,354,277,016 | 79.71 |

| | | | | % |

| H Shares | | | | |

Sinopec Century Bright Capital Investment Ltd.(Note 1) | 767,916,000 | 0.64% | 767,916,000 | 0.63% |

| Public H Shareholders | 24,013,020,600 | 20.03% | 24,013,020,600 | 19.66% |

| | | | | |

| Total issued H Shares | 24,780,936,600 | 20.67% | 24,780,936,600 | 20.29% |

| | | | | |

| Total issued Shares | 119,896,407,646 | 100% | 122,135,213,616 | 100% |

Note:

| 1. | Sinopec Century Bright Capital Investment Ltd. is a wholly-owned subsidiary of China Petrochemical Corporation. |

Upon completion of the Proposed Issuance of A Shares, the total shareholding percentage of China Petrochemical Corporation and its associate Sinopec Century Bright Capital Investment Ltd. in the Company will increase from approximately 67.84% to approximately 68.43%. China Petrochemical Corporation will remain as the controlling shareholder of the Company. The Proposed Issuance of A Shares will not result in any change in the control over the Company.

Upon completion of the Proposed Issuance of A Shares, pursuant to the information of the Company available in public and to the knowledge of the Directors, the Directors believe that the Company will continue to comply with the requirement of minimum public float under Rule 8.08(1)(a) of the Hong Kong Listing Rules.

| 5. | Equity fund raising activities in the past 12 months |

The Company has not conducted any fund raising activities involving issue of equity securities in the past 12 months preceding the Latest Practicable Date.

Assuming the maximum number of new A Shares will be issued at the Subscription Price under the Proposed Issuance of A Shares, the Company will be able to raise gross proceeds of not more than RMB12 billion (inclusive) from the Proposed Issuance of A Shares.

The proceeds raised from the Proposed Issuance of A Shares after deducting the relevant issuance expenses are intended to be used in the following projects:

| No. | Investment field | Project name | Total investment amount (RMB million) | Proposed amount of proceeds to be invested (RMB million) |

| | | | | |

| 1. | Clean energy | First Stage of Phase III of Tianjin LNG Project | 5,561.69 | 4,500 |

| 2. | Yanshan Branch Hydrogen Purification Facilities Improvement Project | 207.06 | 200 |

| 3. | High value added material | Maoming Branch Oil Refining Transformation and Upgrading and Ethylene Quality Revamping Project | 33,057.46 | 4,800 |

| 4. | Maoming Branch 50,000 tpa Polyolefin Elastomer (POE) Industrial Test Unit Project | 1,090.76 | 900 |

| 5. | Zhongke (Guangdong) Refinery & Petrochemical Company Limited No.2 EVA Project | 2,158.32 | 1,600 |

| | | | | |

| | | Total | 42,075.29 | 12,000 |

Notes:

| 1. | The total investment amount of the above-mentioned projects has been rounded off. |

| 2. | For the “Maoming Branch Oil Refining Transformation and Upgrading and Ethylene Quality Revamping Project”, the proceeds will mainly be invested towards fields in relation to high value-added materials, such as production facilities for thermoplastic polymeric new material. |

If the actual proceeds after deducting the issuance expenses are less than the amount of proceeds intended to be used for the above-mentioned projects, the shortfall shall be covered with the Company’s self-raised funds. The Company may make appropriate adjustments to the sequential order and amount of proceeds to be invested in the above-mentioned projects based on the practical needs of the projects. Before the proceeds raised from the Proposed Issuance of A Shares are in place, the Company will finance the projects with its self-raised funds in advance according to the actual implementation progress of the projects to be financed with the proceeds, which shall be replaced with the proceeds raised from the Proposed Issuance of A Shares in accordance with the procedures stipulated in the relevant regulations after the same are in place.

| 7. | Reasons for and benefits of the Proposed Issuance of A Shares |

The Proposed Issuance of A Shares will be fully subscribed at the average trading price of the A Shares as quoted on the Shanghai Stock Exchange in the 20 trading days preceding the Pricing Benchmark Date by China Petrochemical Corporation, the controlling shareholder of the Company, thus allowing higher issuance efficiency and certainty, which reflects China Petrochemical Corporation’s determination to support the high-quality transformation development of the Company and its confidence in the Company’s long-term sustainable development.

The proceeds from the Proposed Issuance of A Shares will be used for business development in relation to clean energy and high value-added materials. The implementation of the projects to be funded by the proceeds from the Proposed Issuance of A Shares (i) would be conducive to enhancing the Company’s capacity to supply natural gas and highly purified hydrogen for fuel cells and promoting the adjustment of the Company’s energy mix; (ii) would lay a good foundation for the Company to extend and upgrade its business to the fields of high value-added materials such as POE and EVA, which would help to improve quality and efficiency of its chemical business; and (iii) would strengthen the Company’s core competitiveness. At the same time, the proceeds from the Proposed Issuance of A Shares, when available, will be conducive to optimising the capital structure and enhancing the risk resistance capability of the Company.

The Directors (including the independent non-executive Directors) consider that, the terms of the Subscription Agreement are fair and reasonable, on normal commercial terms, and in the interests of the Company and the Shareholders as a whole.

| 8. | Hong Kong Listing Rules implications |

China Petrochemical Corporation is a connected person of the Company by virtue of being the controlling shareholder of the Company. Therefore, the entering into of the Subscription Agreement and the transactions contemplated thereunder constitutes a connected transaction of the Company under Chapter 14A of the Hong Kong Listing Rules and are subject to the reporting, announcement and independent Shareholders’ approval requirements under the Hong Kong Listing Rules.

The new A Shares to be issued pursuant to the Proposed Issuance of A Shares will be allotted and issued under the 2021 General Mandate. Under the 2021 General Mandate, the Board is authorised to allot, issue and deal with a maximum of 19,111,554,209 A Shares and 5,102,687,720 H Shares, respectively, representing not more than 20% of the number of each of the A Shares and H Shares in issue as at the date of passing such resolution. As at the Latest Practicable Date, the Company has not issued any Shares pursuant to the 2021 General

Mandate. Pursuant to Rule 19A.38 and note (1) to Rule 13.36(2) of the Hong Kong Listing Rules, the issue of new A Shares under the 2021 General Mandate to China Petrochemical Corporation, a connected person of the Company, is subject to Independent Shareholders’ approval at a general meeting. In addition, pursuant to the Articles of Association and relevant laws and regulations in the PRC, the Proposed Issuance of A Shares is subject to Shareholders’ approval.

The Company

The Company is a joint stock limited company established in the PRC, and is principally engaged in the exploration and production, pipeline transportation and sales of petroleum and natural gas; the production, sale, storage and transportation of refinery products, petrochemical products, coal chemical products, synthetic fiber and other chemical products; the import and export, including import and export agency business, of petroleum, natural gas, petroleum products, petrochemicals and chemical products, and other commodities and technologies; and research, development and application of technologies and information.

China Petrochemical Corporation

China Petrochemical Corporation is a limited liability company established under the laws of the PRC, and is a state-authorised investment organisation and a state-owned enterprise. Its principal businesses include exploration, production, storage and transportation (including pipeline transportation), sales and comprehensive utilisation of oil and natural gas; oil refining; wholesale and retail of oil products; production, sales, storage, transportation of petrochemical, natural gas chemical, coal chemical and other chemical products; industrial investment and investment management; production, sales, storage, transportation of energy products such as new energy and geothermal energy; exploration, consultation, design and installation of petroleum and petrochemical engineering; repairing and maintenance of

petroleum and petrochemical equipment; development, manufacture and sales of mechanical and electrical equipment; manufacture and sales of electricity, steam, water supplies and industrial gas; technology, electronic commerce and information, research and development, application and consultation services of alternative energy products; self-operating and acting as agent for import and export of relevant products and technology; project contracting procurement tendering, labour export; international storage and logistics business etc.

| IV. | PROPOSED ELECTION OF DIRECTOR |

The Board proposed to the Shareholders to elect Mr. Lv Lianggong (“Mr. Lv”) as an executive Director of the eighth session of the Board by way of ordinary resolution at the AGM.

The biographical details of Mr. Lv are set out below:

Lv Lianggong, aged 57, is Senior Vice President of Sinopec Corp. Mr. Lv is a professor level senior engineer with a master’s degree. In December 2001, he was appointed as Deputy Manager of Sinopec Jinan Company; in August 2008, he was appointed as Manager and Deputy Secretary of the CPC Committee of Sinopec Jinan Company; in December 2008, he was appointed as General Manager and Deputy Secretary of the CPC Committee of Sinopec Jinan Company; in December 2016, he was appointed as General Manager and Deputy Secretary of the CPC Committee of Anqing Petrochemical General Plant of China Petrochemical Corporation and General Manager of Sinopec Anqing Company; in July 2017, he was appointed to serve a temporary position as a member of the Standing Committee of the CPC Anqing Municipal Committee; in September 2018, he was appointed as the General Manager and Deputy Secretary of the CPC Committee of Sinopec Zhenhai Refining & Chemical Company; in December 2019, he was appointed as Representative and Secretary of the CPC Committee of Sinopec Zhenhai Refining & Chemical Company; in December 2020, he was appointed as Deputy Chief Economist, Director General of Organization Department of Leading Party Member Group of China Petrochemical Corporation and President of Human Resource Department of Sinopec Corp.; in June 2021, he was appointed as Director General of the Office of the Organizational Structure Establishment Committee of Leading Party Member Group of China Petrochemical Corporation; in August 2022, he was appointed as a Member of the Leading Party Member Group and Deputy General Manager of China Petrochemical Corporation. In May 2022, he was elected as Supervisor of Sinopec Corp.; in October 2022, he was appointed as Senior Vice President of Sinopec Corp.

Once the Proposed Election is approved at the AGM, Mr. Lv will enter into a service contract with Sinopec Corp. as an executive Director of the Company. Pursuant to provisions in the service contract, the term of Mr. Lv shall commence from the date on which the Proposed Election is approved at the AGM to the date when the term of the eighth session of the Board expires. His remunerations will consist of annual base salary, annual performance-based salary and incentive during the tenure. The Company will disclose in its annual report the remunerations obtained by Mr. Lv during the relevant reporting period.

Other than disclosed above and as of the Latest Practicable Date, Mr. Lv did not hold any directorships in any other listed public companies in Hong Kong or overseas in the last three years and did not have any relationship with any other Directors, Supervisors, senior management, substantial Shareholders or controlling Shareholder of the Company. As at the Latest Practicable Date, Mr. Lv does not have any interest in the Shares of Sinopec Corp. within the meaning of Part XV of the SFO. He has not received any regulatory sanction imposed by the CSRC, or any other government authorities or stock exchanges.

Save as disclosed herein, there are no other matters in relation to the Proposed Election which shall be disclosed to the Shareholders and the Hong Kong Stock Exchange or matters which would require disclosure under Rule 13.51(2)(h) to 13.51(2)(v) of the Hong Kong Listing Rules.

| V. | PROPOSED REDUCTION OF THE REGISTERED CAPITAL AND AMENDMENTS TO THE ARTICLES OF ASSOCIATION |

In order to safeguard the Company’s value and Shareholders’ interests, the Company repurchased its A Shares and H Shares since 21 September 2022. As of the Latest Practicable Date, the Company has cancelled all the repurchased A Shares and H Shares, and the total number of issued Shares of the Company has been changed from 121,071,209,646 Shares to 119,896,407,646 Shares. The Board proposes to reduce the registered capital of the Company accordingly and make the following amendments to the Articles of Association in accordance with the above share repurchase, specifically:

| No. of Article | Original Article | Amended Article |

| Article 21 | The existing structure of the Company’s share capital is as follows: the total number of issued ordinary shares of the Company is 121,071,209,646 shares, among which, 95,557,771,046 shares representing 78.93% of the total number of issued ordinary shares of the Company are held by the holders of domestic-listed domestic-invested A shares; and 25,513,438,600 shares representing 21.07% are held by the holder of foreign-listed foreign-invested H shares. | The existing structure of the Company’s share capital is as follows: the total number of issued ordinary shares of the Company is 119,896,407,646 shares, among which, 95,115,471,046 shares representing 79.33% of the total number of issued ordinary shares of the Company are held by the holders of A shares; and 24,780,936,600 shares representing 20.67% are held by the holders of H shares. |

| Article 24 | The registered capital of the Company is RMB121,071,209,646. | The registered capital of the Company is RMB119,896,407,646. |

On 24 March 2023, the Company convened the 15th meeting of the eighth session of the Board, and considered and approved the resolution in relation to the reduction of the registered capital and the Proposed Amendments. The secretary to the Board was authorized to represent Sinopec Corp. in handling the relevant formalities for application, approval, disclosure, registration and filing requirements for amendments to the Articles of Association (including textual amendments in accordance with the requirements of the relevant regulatory authorities). The reduction of the registered capital of the Company and Proposed Amendments are subject to the approval at the AGM.

The Directors are of the view that the Proposed Amendments are in the interest of the Company and its Shareholders as a whole. Advice has been obtained from independent legal advisers that the amended Articles of Association comply with the laws of the PRC and the Hong Kong Listing Rules requirements.

| VI. | PROPOSED GRANT TO THE BOARD A MANDATE TO BUY BACK DOMESTIC SHARES AND/OR OVERSEAS-LISTED FOREIGN SHARES OF THE COMPANY |

| 1. | A Share Buy-back Mandate |

The PRC Company Law (to which the Company is subject) provides that a joint stock limited company incorporated in the PRC may not buy back its shares unless such buy-back is effected for the purpose of: (a) reducing its registered share capital; (b) in connection with a merger between itself and another entity that holds its shares; (c) granting shares as reward to the staff of the company; (d) the buy-back is made at the request of its shareholders who disagrees with shareholders’ resolutions in connection with a merger or division; (e) utilizing the shares for conversion of corporate bonds which are convertible into shares issued by the Company; or (f) where it is necessary for safeguarding the value of the Company and the interests of its shareholders. The Mandatory Provisions, which the Company has incorporated in its Articles of Association, provides that subject to obtaining the approval of the relevant regulatory authorities and compliance with its Articles of Association, share buy-backs may be effected by a joint stock limited company listed outside the PRC for the purpose of reducing its share capital or in connection with a merger between itself and another entity that holds its shares or in circumstances permitted by law or administrative regulations.

PRC laws and regulations and the Shanghai Listing Rules permit shareholders of a PRC joint stock limited company to grant a general mandate to the directors to buy back the A shares of such company that are listed on the Shanghai Stock Exchange. Such mandate is required to be given by way of a special resolution passed by shareholders in general meeting and special resolutions passed by holders of domestic shares and overseas listed foreign shares in separate class meetings.

| 2. | H Share Buy-back Mandate |

The PRC Company Law (to which the Company is subject) provides that a joint stock limited company incorporated in the PRC may not buy back its shares unless such buy-back is effected for the purpose of: (a) reducing its registered share capital; (b) in connection with a merger between itself and another entity that holds its shares; (c) granting shares as reward to the staff of the company; (d) the buy-back is made at the request of its shareholders who disagrees with shareholders’ resolutions in connection with a merger or division; (e) utilizing the shares for conversion of corporate bonds which are convertible into shares issued by the Company; or (f) where it is necessary for safeguarding the value of the Company and the interests of its shareholders. The Mandatory Provisions, which the Company has incorporated in its Articles of Association, provides that subject to obtaining the approval of the relevant regulatory authorities and compliance with its Articles of Association, share buy-backs may be effected by a joint stock limited company listed outside the PRC for the purpose of reducing its share capital or in connection with a merger between itself and another entity that holds its shares or in circumstances permitted by law or administrative regulations.

PRC laws and regulations and the Hong Kong Listing Rules permit shareholders of a PRC joint stock limited company to grant a general mandate to the directors to buy back H shares of such company that are listed on the Hong Kong Stock Exchange. Such mandate is required to be given by way of a special resolution passed by shareholders in general meeting and special resolutions passed by holders of domestic shares and overseas listed foreign shares in separate class meetings.

Pursuant to the relevant regulatory requirements, it is proposed to the Shareholders at the AGM, the A Shareholders Class Meeting and the H Shareholders Class Meeting to grant the Buy-back Mandate:

| (1) | The Board (or the Director authorised by the Board) be and is hereby authorised to buy back A Shares not exceeding 10% of the number of A Shares of the Company in issue, calculated on the basis of the total share capital at the time when this resolution is considered and approved by the AGM and the Class Meetings, in accordance with market conditions and the needs of the Company, in order to maintain the value of the Company and the interests of Shareholders, or to use the Shares for purposes including, but not limited to, employee stock ownership plan or equity incentive, conversion of corporate bonds issued by the Company that are convertible into shares, etc. |

| (2) | The Board (or the Director authorised by the Board) be and is hereby authorised to buy back H Shares not exceeding 10% of the number of H Shares of the Company in issue, calculated on the basis of the total share capital at the time when this proposal is considered and approved by the AGM and the Class Meetings, in accordance with market conditions and the needs of the Company. |

| (3) | The Board (or the Director authorised by the Board) be and is hereby authorised to, among other things: |

| a. | formulate and implement specific buy-back plans including but not limited to the type of shares to be bought back, the buy-back price, and the number of shares to be bought back and to determine the timing and period of buy-back; b. notify the creditors and publish announcements in accordance with the provisions of the Company Law of the PRC and other relevant laws, regulations and regulatory documents and the Articles of Association of the Company (if applicable); |

| c. | open a foreign stock account and complete the corresponding registration procedure of the change in foreign exchange; |

| d. | fulfil the relevant approval or filing procedures in accordance with the requirements of the regulatory authorities and the place of listing of the Company (if applicable); |

|

e. | complete the procedure for the transfer or cancellation of the shares bought back according to the actual buy-back, to amend the Articles of Association with respect to, including but not limited to, the total share capital and shareholding structure, and to perform the relevant domestic and foreign registration and filing procedures related to buy-back according to the statutory requirements in the PRC and foreign regions; and |

| f. | sign and execute other documents and complete other matters related to the buy-back of shares. |

| (4) | The above general mandate shall not exceed the relevant period (“Relevant Period”), which shall start from the date of approval of this resolution by way of special resolution at the AGM and the Class Meetings until whichever is the earlier of: |

| a. | the conclusion of the next annual general meeting of the Company; or |

| b. | the date on which the authority conferred by this proposal is revoked or varied by a special resolution at an annual general meeting and/or a class meeting of A Shares and/or a class meeting of H Shares. |

If the Board decides to buy back A Shares during the Relevant Period, such buy-back may need to be pursued or implemented after the end of the Relevant Period.

| (5) | Subject to the authorisation of the AGM and the Class Meetings, the Board continues to authorise the Chairman and/or a Director designated by the Chairman to specifically handle the aforesaid buy-back. |

An explanatory statement giving certain information regarding the Buy-back Mandate is set out in Appendix V to this circular.

| VII. | RECOMMENDATION OF THE BOARD |

In relation to the resolutions regarding the Proposed Issuance of A Share, among the ten Directors, six connected Directors, Mr. Ma Yongsheng, Mr. Zhao Dong, Mr. Yu Baocai, Mr. Ling Yiqun, Mr. Li Yonglin and Mr. Liu Hongbin were required to abstain and had abstained from voting in the Board meeting held on 24 March 2023 in respect of Resolutions No. 2 to No. 6 and Resolution No. 10 as set out in the section headed “II. PROPOSED ISSUANCE OF A SHARES”. All remaining four Directors, i.e. all the independent non-executive Directors who were entitled to vote, unanimously approved all the resolutions at the Board meeting. The format and procedure for passing the resolutions were in compliance with the Company Law of the PRC and the Articles of Association.

Your attention is drawn to the letter from the Independent Board Committee as set out on pages 30 to 31 of this circular which contains its recommendation to the Independent Shareholders as to voting in respect of the Proposed Issuance of A Shares, the Subscription Agreement and the transactions contemplated thereunder at the AGM and to the letter from the Independent Financial Adviser as set out on pages 32 to 59 of this circular which contains its advice to the Independent Board Committee and the Independent Shareholders in relation to the Proposed Issuance of A Shares, the Subscription Agreement and the transactions contemplated thereunder therein.

Your attention is also drawn to the additional information set out in the Appendices to this circular.

In relation to the resolutions regarding Other Matters, the Board is of the view that the resolutions as set out in the Notice of AGM and the Notice of H Shareholders Class Meeting are in the interests of the Company and the Shareholders as a whole. Accordingly, the Board recommends the Shareholders to vote in favour of the resolutions in relation to Other Matters to be proposed at the AGM and the H Shareholders Class Meeting.

| VIII. | AGM AND H SHAREHOLDERS CLASS MEETING |

The AGM will be held at Beijing Chaoyang U-Town Crowne Plaza, No. 3 Sanfeng North Area, Chaoyang District, Beijing, PRC on Tuesday, 30 May 2023 at 9:00 a.m. and the H Shareholders Class Meeting will be held at the same venue immediately following the conclusion of the AGM and the A Shareholders Class Meeting. The Notice of Annual General Meeting for 2022 and First H Shareholders Class Meeting for 2023 is set out in this circular. The proxy forms and the reply slip of the AGM and the H Shareholders Class Meeting will be despatched to the H Shareholders with this circular.

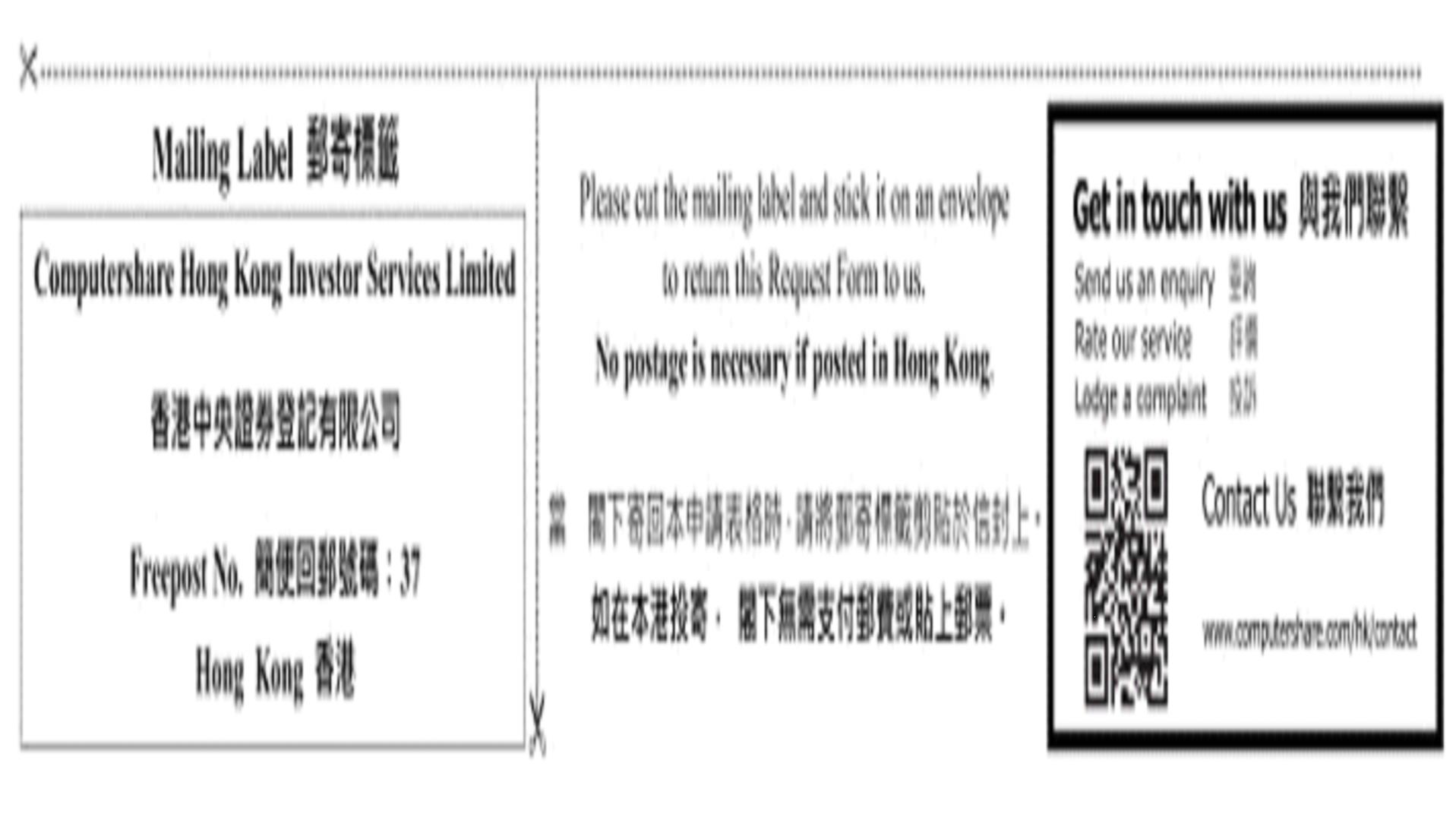

If you intend to appoint a proxy to attend the AGM and/or the H Shareholders Class Meeting, you are required to complete and return the enclosed proxy forms in accordance with the instructions printed thereon as soon as possible. For H Shareholders, the proxy forms should be returned to the Company’s H Share Registrar, Hong Kong Registrar Limited (the address is 17M Floor, Hopewell Centre, 183 Queen’s Road East, Wanchai, Hong Kong) in person or by post as soon as possible but in any event not less than 24 hours before the time stipulated for convening the AGM (i.e. before 9 a.m. on 29 May 2023, Hong Kong time). Completion and return of the proxy forms will not preclude you from attending and voting in person at the AGM and/or the H Shareholders Class Meeting should you so wish.

If you intend to attend the AGM and/or the H Shareholders Class Meeting in person or by proxy, you are required to complete and return the reply slip to the Board Secretariat of Sinopec Corp. by personal delivery, post or facsimile during hours between 9:00 a.m. and 11:30 a.m., 2:00 p.m. and 4:30 p.m. on every business day on or before Wednesday, 10 May 2023. Failure to complete or return the reply slip will not preclude eligible Shareholders from attending the AGM and/or the H Shareholders Class Meeting should they so wish.

Shareholders (or their proxies) shall vote by poll.

As at the Latest Practicable Date, China Petrochemical Corporation, the controlling shareholder of the Company (holding 80,572,167,393 Shares, representing approximately 67.20% of the total issued share capital of the Company), and its associate, Sinopec Century Bright Capital Investment Ltd. (a wholly-owned subsidiary of China Petrochemical Corporation, through HKSCC Nominees Limited, holding 767,916,000 Shares, representing approximately 0.64% of the total issued share capital of the Company), will abstain from voting at the AGM in respect of Resolutions No. 13 to 17 and Resolution No. 21 as set out in the Notice of AGM (corresponding to Resolutions No. 2 to No. 6 and Resolution No. 10 as set out in the section headed “II. PROPOSED ISSUANCE OF A SHARES”).

| IX. | CLOSURE OF REGISTER OF HOLDERS OF H SHARES |

The register of holders of H Shares will be closed from Friday, 28 April 2023 to Tuesday, 30 May 2023, both days inclusive, during which period no transfer of H Shares will be effected. In order to qualify for attending the AGM and/or the H Shareholders Class Meeting, all transfer documents of H Shares accompanied by the relevant share certificates must be lodged with the Hong Kong Registrars Limited at Shops 1712-1716, 17th Floor, Hopewell Centre, 183 Queen’s Road East, Wanchai, Hong Kong by no later than 4:30 p.m. on Thursday, 27 April 2023.

| | By order of the Board |

| | China Petroleum & Chemical Corporation |

| | Vice President and Secretary to the Board of Directors |

| | Huang Wensheng |

| LETTER FROM THE INDEPENDENT BOARD COMMITTEE |

(a joint stock limited company incorporated in the People’s Republic of China with limited liability)

(Stock Code: 00386)

13 April 2023

To the Independent Shareholders

Dear Sir or Madam,

CONNECTED TRANSACTION IN RESPECT OF THE

PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE

We refer to a circular (the “Circular”) of the Company dated 13 April 2023 of which this letter forms part. Unless otherwise defined, terms used herein shall have the same meaning as those defined in the Circular.

We have been appointed by the Board as the Independent Board Committee to advise you on whether, in our opinion, (i) the terms of the Subscription Agreement are fair and reasonable, (ii) the Subscription Agreement and the transactions contemplated thereunder are on normal commercial terms or better and in the ordinary and usual course of business of the Group; and (iii) the Subscription Agreement and the transactions contemplated thereunder are in the interests of the Company and the Shareholders as a whole. Somerley Capital Limited has been appointed as the Independent Financial Adviser to advise us and the Independent Shareholders in this regard.

We wish to draw your attention to (i) the letter from the Board as set out on pages 6 to 29 of the Circular and Appendices I to IV which contains the details of the Subscription Agreement and the transactions contemplated; and (ii) the letter from the Independent Financial Adviser as set out on pages 32 to 59 of the Circular which contains its advice and recommendation in respect of the Subscription Agreement and the transactions contemplated thereunder, as well as the principal factors and reasons for its advice and recommendation.

| LETTER FROM THE INDEPENDENT BOARD COMMITTEE |

Having considered the terms of the Subscription Agreement and the transactions contemplated thereunder and taking into account the advice and recommendation of the Independent Financial Adviser, we are of the view that (i) the terms of the Subscription Agreement are fair and reasonable; (ii) the Subscription Agreement and the transactions contemplated thereunder are, although not conducted in the ordinary and usual course of business of the Group, on normal commercial terms; and (iii) the Subscription Agreement and the transactions contemplated thereunder are in the interests of the Company and the Shareholders as a whole. Accordingly, we recommend the Independent Shareholders to vote in favour of the relevant resolutions regarding the Subscription Agreement and the transactions contemplated thereunder at the AGM.

Yours faithfully,

For and on behalf of the Independent Board Committee

China Petroleum & Chemical Corporation

Cai Hongbin Ng, Kar Ling Johnny Shi Dan Bi Mingjian

Independent Non-executive Directors

| LETTER FROM THE INDEPENDENT FINANCIAL ADVISOR |

The following is the text of a letter of advice from Somerley Capital Limited prepared for the purpose of inclusion in this circular, setting out its advice to the Independent Board Committee and the Independent Shareholders in respect of the Subscription Agreement and the transactions contemplated thereunder.

| SOMERLEY CAPITAL LIMITED 20th Floor China Building 29 Queen’s Road Central Hong Kong |

13 April 2023

| To: | The Independent Shareholders and the Independent Board Committee |

Dear Sirs,

CONNECTED TRANSACTION

IN RESPECT OF THE

PROPOSED ISSUANCE OF A SHARES UNDER GENERAL MANDATE

INTRODUCTION

We refer to our appointment to advise the Independent Board Committee and the Independent Shareholders in connection with the Subscription Agreement and the transactions contemplated thereunder. Details of the aforesaid transactions are set out in the letter from the Board contained in the circular of the Company (the “Circular”) to its Shareholders dated 13 April 2023, of which this letter forms part. Unless otherwise defined, terms used in this letter shall have the same meanings as those defined in the Circular.

On 24 March 2023, the Company and China Petrochemical Corporation (the “Subscriber”) entered into the Subscription Agreement, pursuant to which the Subscriber has agreed to subscribe in cash for 2,238,805,970 new A Shares (the “Proposed Issuance of A Shares”).

As at the Latest Practicable Date, China Petrochemical Corporation is a connected person of the Company by virtue of being the controlling shareholder of the Company. Therefore, the entering into of the Subscription Agreement and the transactions contemplated thereunder constitutes a connected transaction of the Company under Chapter 14A of the Hong Kong Listing Rules and are subject to the reporting, announcement and Independent Shareholders’ approval requirements under the Hong Kong Listing Rules.

| LETTER FROM THE INDEPENDENT FINANCIAL ADVISOR |

The Independent Board Committee comprising all the independent non-executive Directors, namely Mr. Cai Hongbin, Mr. Ng, Kar Ling Johnny, Ms. Shi Dan, and Mr. Bi Mingjian, has been established to make a recommendation to the Independent Shareholders in relation to the Subscription Agreement and the transactions contemplated thereunder. Somerley Capital Limited has been appointed as the independent financial adviser to advise the Independent Board Committee and the Independent Shareholders in the same regard.

We are not associated or connected with the Company, the Subscriber or their respective core connected persons or associates. In the two years prior to this appointment, we did not have other engagement with the Company or its associates except for having been the independent financial adviser to the Company to provide our independent advice in relation to the renewal of continuing connected transactions and discloseable transactions as contained in the circular dated 3 September 2021 and our appointment as the independent financial adviser to Sinopec Kantons Holdings Limited (934.HK) to provide our independent advice in relation to the renewal of non-exempt continuing connected transactions as contained in the circular dated 15 November 2022. We do not consider our past engagements as independent financial adviser give rise to any conflict for Somerley Capital Limited to act as the Independent Financial Adviser for the transactions contemplated under the Subscription Agreement. Apart from normal professional fees payable to us in connection with this appointment, no arrangement exists whereby we will receive any fees or benefits from the Company, the Subscriber or their respective core connected persons or associates.

In formulating our advice and recommendation, we have reviewed information on the Company, including but not limited to, the Subscription Agreement, annual reports of the Company for the year ended 31 December 2021 (“FY2021”) (the “2021 Annual Report”) and for the year ended 31 December 2022 (“FY2022”) (the “2022 Annual Report”) (together, as the “Reports”) and other information contained in the Circular.

In addition, we have relied on the information and facts supplied, and the opinions expressed, by the Directors and management of the Company (collectively, the “Management”) and the respective professional advisers of the Company, which we have assumed to be true, accurate and complete in all material aspects at the time they were made and will remain true, accurate and complete in all material aspects up to the date of the AGM. We have also sought and received confirmation from the Group that no material facts have been omitted from the information supplied by them and that their opinions expressed to us are not misleading in any material respect. We consider that the information we have received is sufficient for us to formulate our opinion and recommendation as set out in this letter and have no reason to believe that any material information has been omitted or withheld, nor to doubt the truth or accuracy of the information provided to us. We have, however, not conducted any independent investigation into the businesses and affairs of the Group or the Subscriber nor have we carried out any independent verification of the information supplied.

| LETTER FROM THE INDEPENDENT FINANCIAL ADVISOR |

PRINCIPAL FACTORS AND REASONS CONSIDERED

In formulating our opinion and recommendation regarding the Subscription Agreement, we have considered the following principal factors and reasons:

| 1. | Information on the Group |