Exhibit 99.3

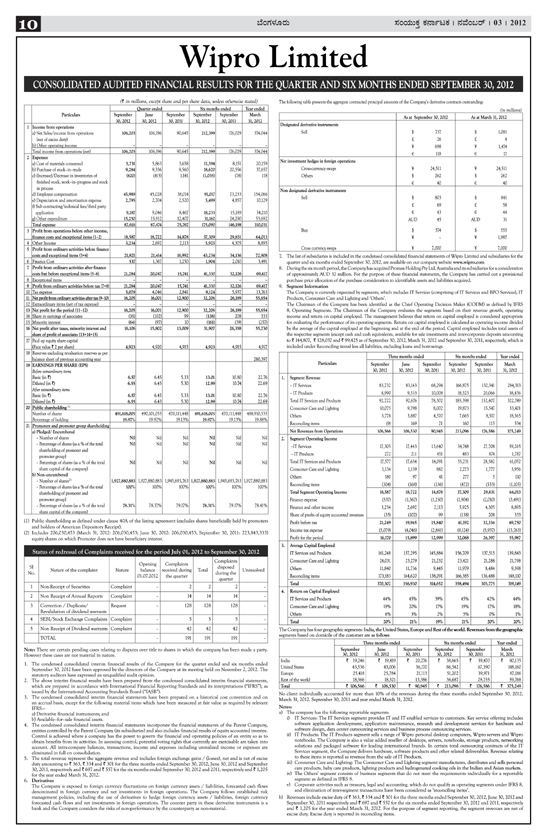

sSorteted: riooi»g g?rar&3g I tfsSowo* I 03 I 2012 —8 Wipro Limited (? in millions, except share and per share data, unless otherwise stated) Quarter ended Six months ended Year ended Particulars September June September September September March 30.2012 30,2012 30.2011 30,2012 30.2011 31,2012 1 Income from operations a) Net Sales/income from operations 106,203 106,196 90,645 212,399 176,029 374,044 (net of excise duty) b) Other operatitiH income - - - - - - Total income from operations (net) 106.203 106,196 90,645 212,399 176,029 374.044 2 Expenses Cost of materials consumed 5,731 5,863 3,658 11,594 8,151 20,159 Purchase of stock-in-trade 9,284 9,336 9,560 18,620 20,556 37,657 (lncrease)/f>crease in inventories of (620) (415) 1,141 (1,035) (78) 118 finished stock, work-in-progress and stock in process Employee compensation 45,989 45,028 38,014 91,017 73,233 154,066 Depreciation and amortisation expense 2,795 2,704 2,520 5,499 4,857 10,129 Sub contracting/technical fees/third party application 9,187 9,046 8,467 18,233 15,189 34,210 e) Other expenditure 15.250 15.912 12,407 31,162 24,290 53.692 Total expense 87.616 87.474 75.767 175,090 146,198 310.031 3 Profit from operations before other income, finance costs and exceptional items (1-2) 18,587 18.722 14.878 37,309 29.831 _641013 Other Income 3.234 2.692 Z.I 13 5.925 4.305 6.895 Profit from ordinary activities before finance costs and exceptional items (3+4) 21.821 21.414 16.992 43.234 34,136 72,908 Finance Cost 537 1,367 1,250 1.904 2.010 3.491 Profit from ordinary activities after finance costs but before exceptional items (5-6) 21,284 20,047 15,741 41,330 32.126 69.417 Exceptional items ^ - - - - - Profit from ordinary activities before tax (7*8) 21,284 20,047 15,741 41,330 32.126 69.417 Tax expense 5.079 4,046 2.84) 9.124 5,937 13.763 Netprontfomordinaryacrmriesaftertax(9-lQ) 16,205 16,001 12,900 32,206 26,189 55,654 Extraordinary items (net of tax expense) - - - - - - Net profit for the period (11-12) 16.205 16,001 12.900 32.206 26,189 55.654 Share in earnings of associates (351 (102) 99 (OS) 208 333 Minority interest (64) {97j 10 (161) (39) (257) 16 Net profit after taxes, minority interest and 16,106 15,802 13,009 31,907 26,358 55,730 share of profit of associates (13+14+15) 17 Paid up equity share capital (Face value? 2 per share) 4,923 4.920 4,915 4,923 4,915 4,917 18 Reserves excluding revaluation reserves as per balance sheet of previous accounting year 280,397 19 EARNINGS PER SHARE (EPS) Before extraordinary itemi Basic (in T) 6.57 6.45 5.33 13.01 10.80 22.76 Diluted (in ?) 6.55 6,43 5.30 12.99 10.74 22,69 After ejtTBOrdinarj items Basic (in ?) 6.57 6,45 5.33 13.01 10,80 22.76 Diluted (in ?) 6.55 6.43 5.30 12.99 10.74 22.69 20 Public shareholding”’ Number of shares 491,618,005 490,101,055 470,111,448 491,618,005 470,111,448 488,910,535 Percentage of holding 19.97% 19.92% 19.13% 19.97% 19.13% 19.88% 21 Promoters and promoter group shareholdinjj a) Pledged/ Encumbered Number of shares Nit Nil Nil Nil Nil Nil Percentage of shares (as a % of the total Nil Nil Nil Nil Nil Nil shareholding of promoter and promoter group) - Percentage of shares (as a % of the total Nil Nil Nil Nil Nil Nil share capital of the company) b) Non-encumbered -Number of shares121 1,927,880,883 1,927,880,883 1,945,693,763 1,927,880,883 1,945,693,763 1,927,880,883 - Percentage of shares (as a % of the total 100% 100% 100% 100% 100% 100% shareholding of promoter and promoter group) -Petcentageofshates(asa%ofthetotal 78.31% 78.37% 79.17% 78.31% 79.17% 78,41% slim- turutiil ot tliL’ iiimrNiny) Public shareholding as defined under clause 40A of the listing agreement (excludes shares beneficially held by promoters and holders of American Depository Receipt). Includes 206,030,453 (March 31, 2012: 206,030,453; June 30, 2012: 206,030,453; September 30, 2011: 223,843,333) equity shares on which Promoter does not have beneficiary interest. -. ,, , . Complaints „. L/pening Complaints .. , Nature of the complaint Nature balance received during Total Unresolved No. _, „_,,,.. , during the 01.07.2012 the quarter 2 quarter Non-Receipt of Securities Complaint 22 2 Non Receipt of Annual Reports Complaint 14 14 14 Correction / Duplicate/ Request 128 128 128 Revalidation of dividend warrants SEBI/Stock Exchange Complaints Complaint 55 5 Non Receipt of Dividend warrants Complaint 42 42 42 TOTAL - 191 191 191 Notei There are certain pending cases relating to disputes over title to shares in which the company has been made a party. However these cases are not material in nature. The condensed consolidated interim financial results of the Company for the quarter ended and six months ended September 30, 2012 have been approved by the directors of the Company at its meeting held on November 2, 2012. The statutory auditors have expressed an unqualified audit opinion. The above interim financial results have been prepared from the condensed consolidated interim financial statements, which are prepared in accordance with International Financial Reporting Standards and its interpretations (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). The condensed consolidated interim financial statements have been prepared on a historical cost convention and on an accrual basis, except for the following material items which have been measured at fair value as required by relevant IFRS:- Derivative financial instruments; and Available-for-sale financial assets. The condensed consolidated interim financial statements incorporate the financial statements of the Parent Company, entities controlled by the Parent Company (its subsidiaries) and also includes financial results of equity accounted investee. Control is achieved where a company has the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities. In assessing control, potential voting rights that currently are exercisable are taken into account. All intra-company balances, transactions, income and expenses including unrealized income or expenses are eliminated in full on consolidation, The total revenue represent the aggregate revenue and includes foreign exchange gains / (losses), net and is net of excise duty amounting to ? 363, ? 334 and ? 301 for the three months ended September 30, 2012, June .30, 2012 and September 30, 2011, respectively and ? 697 and ? 557 for the six months ended September 30, 2012 and 2011, respectively and ? 1,205 for the year ended March 31, 2012. Derivatives The Company is exposed to foreign currency fluctuations on foreign currency assets / liabilities, forecasted cash flows denominated in foreign currency and net investments in foreign operations. The Company follows established risk management policies, including the use of derivatives to hedge foreign currency assets / liabilities, foreign currency forecasted cash flows and net investments in foreign operations. The counter party in these derivative instruments is a bank and the Company considers the risks of non-performance by the counterparty as non-material. The following table presents the aggregate contracted principal amounts of the Company’s derivative contracts outstanding: (in millions) As at September 30, 2012 As atMarch 31, Z01Z Designated derivative instruments Sell $ 737 $ 1,081 26 4 ¥ 698 ¥ 1,474 e us c 17 Net investment hedges in foreign operations Cross-currency swaps ¥ 24,511 V 24,511 Others $ 262 $ 262 £ 40 € 40 Non designated derivative instruments Sell $ 803 $ 841 £ 69 £58 €43 € 44 ALJD 45 AUD 31 Buy $ 574 $ 555 ¥ ¥ 1,997 Cross currency swaps | ¥ 7,000 | ¥ 7,000 The list of subsidiaries is included in the condensed consolidated financial statements of Wipro Limited and subsidiaries for the quarter and six months ended September 30, 2012, are available on our company website www.wipro.com During the six month period, the Company has acquired Promax Holding Pry Ltd, Australia and its subsidiaries fora consideration of approximately AUD 32 million. For the purpose of these financial statements, the Company has carried out a provisional purchase price allocation of the purchase consideration to identifiable assets and liabilities acquired. Segment Information The Company is currently organized by segments, which includes IT Services (comprising of IT Services and BPO Services), IT Products, Consumer Care and Lighting and ‘Others’. The Chairman of the Company has been identified as the Chief Operating Decision Maker (CODM) as defined by 1FRS 8, Operating Segments. The Chairman of the Company evaluates the segments based on their revenue growth, operating income and return on capital employed. The management believes that return on capital employed is considered appropriate for evaluating the performance of its operating segments. Return on capital employed is calculated as operating income divided by the average of the capital employed at the beginning and at the end of the period. Capital employed includes total assets of the respective segments (except cash and cash equivalents, available for sale investments and intercorporate deposits amounting to ? 144,807, ? 128,037 and ? 99,425 as of September 30, 2012, March 31, 2012 and September 30, 2011, respectively, which is included under Reconciling items) less all liabilities, excluding loans and borrowings. Three months ended Six months ended Year ended Particulars September June September September September March 30,2012 30,2012 30,2011 30,2012 30,2011 31,2012 [. Segment Revenue -ITServices 83,732 83,143 63,294 166,875 132,341 284,313 - IT Products 8,990 9,533 iO,OQ8 18,523 20,066 38,436 Total IT Services and Products 92,722 92,676 78,302 185,398 152,407 322,749 Consumer Care and Lighting 10.075 9,798 8,002 19,873 15,547 33,401 Others 3.778 3,887 4,570 7,665 8,517 18,565 Reconciling items (9) 169 71 160 115 534_ Net Revenues from Operations 106,566 !06,530 90,945 213,096 176,566 375,249 2. Segment Operating Income -ITServices 17,305 17,443 13,640 34,748 27,708 59,265 -ITPtoducts 272 211 451 483 874 1,787 Total IT Services and Products 17.577 17,654 14,091 35,231 28,582 61,052 Consumei Care and Lighting 1,134 1,139 882 2,273 1,777 3,956 Others 180 97 41 277 5 110 Reconciling items (304) (168) (136) (472) (533) (1,105) Total Segment Operating Income 18,587 18,722 14,878 37,309 29,831 64,013 Finance expense (537) (1,367) (1,250) (1,904) (2,010) (3,491) Finance and other income 3,234 2,692 2,113 5,925 4,305 8,895 Share of ptofts of equity accounted investees (35) (102) 99 (138) 208 333 Profit before tax 21,249 19,945 15,840 41,192 32,334 69,750 Income tax expense (5,079) (4,046) (2.841) (9,124) (5,937) (13,763) Profit for the period 16,170 15,899 12,999 32,068 26,397 55,987 3. Average Capital Employed IT Services and Products 161,248 157,295 145,884 156,709 137,515 139,843 Consumer Care and Lighting 24.0.31 23,279 21,232 23,421 21,288 21,798 Others 11,840 11,736 9,445 11,979 8,484 9,398 Reconciling items 173,183 164.620 138,091 166,385 136,488 148,110 Total 370,302 356,930 314,652 358,494 303,775 319,149 4. Return on Capital Employed IT Services and Products 44% 45% 39% 45% 42% 44% Consumer Care and Lighting 19% 20% 17% 19% 17% 18% Others 6% 3% 2% 5% 0% 1%_ Total 20% 21% 19% 21% 20% 20% The Company has four geographic segments: India, the United States, Europe and Rest of the world. Revenues from the geographic segments based on domicile of the customer are as follows Three months ended Six months ended Year ended September June September September September March 30.2012 30, 2012 30,2011 30. 2012 30, 2011 31. 2012 India ? 19,246 ? 19,419 ? 20,276 ? 38,665 ? 39,470 ? 80,135 United States 43,536 43,006 36,170 86,542 67,390 148,160 Europe 25,418 25,784 21,113 51,202 39,971 87,186 Rest of the world 18,366 18,321 13,386 36.687 29.755 59,768 Total I ? 106,5661 ~ ? 106,5301 ? 90,9451 ? 213,0% | ~ 176,5861 ? 375,249 No client individually accounted for more than 10% of the revenues during the three months ended September 30, 2012, March 31, 2012, September 30, 2011 and year ended March 31, 2012. Notes! a) The company has the following reportable segments: i) IT Services: The IT Services segment provides IT and IT enabled services to customers. Key service offering includes software application development, application maintenance, research and development services for hardware and software design, data center outsourcing services and business process outsourcing services. ii) IT Products: The IT Products segment sells a range of Wipro personal desktop computers, Wipro servers and Wipro notebooks. The Company is also a value added teseller of desktops, servers, notebooks, storage products, networking solutions and packaged software for leading international brands. In certain total outsourcing contracts of the IT Services segment, the Company delivers hardware, software products and other related deliverables. Revenue relating to these items is reported as revenue from the sale of IT Products. iii) Consumer Care and Lighting: The Consumer Care and Lighting segment manufactures, distributes and sells personal care products, baby care products, lighting products and hydrogenated cooking oils in the Indian and Asian markets. iv) The Others* segment consists of business segments that do not meet the tequirements individually for a reportable segment as defined in IFRS 8, v) Corporate activities such as treasury, legal and accounting, which do not qualify as operating segments under IFRS 8, and elimination of inter-segment transactions have been considered as ‘reconciling items’. b) Revenues include excise duty of? 363,? 334 and? 301 for the three months ended September 30,2011, June 30, 2012 and September 30, 2011 respectively and ? 697 and ? 557 for the six months ended September 30, 2012 and 2011, respectively and f 1,205 for the year ended March 31, 2012. For the purpose of segment reporting, the segment revenues are net of excise duty. Excise duty is reported in reconciling items.

For the purpose of segment reporting, the Company has included the impact of ‘foreign exchange gains / (losses)’, net in revenues (which are reported as a part of operating profit in the statement of income). For evaluating performance of the individual business segments, stock compensation expense is allocated on the basis of straight line amortiiation. The incremental impact of accelerated amortization of stock compensation expense over stock compensation expense allocated to the individual business segments is reported in reconciling items. For evaluating the performance of the individual business segments, amortization of intangibles acquired through business combinations ate reported in reconciling items. 0 For evaluating the performance of the individual business segments, loss on disposal of subsidiaries are reported in reconciling items. g) The Company generally offers multi-year payment terms in certain total outsourcing contracts. These payment terms ptimarily relate to IT hardware, software and certain transformation services in outsourcing contracts, Corpotate treasury provides internal financing to the business units offering multi-year payments terms. Accordingly, such receivables are reflected in capital employed in reconciling items. As of September 30, 2012, June 30, 2012 and September 30, 2011, capital employed in reconciling items includes ? 13,862, ? 13,101 and ? 14,511, respectively, of such receivables on extended collection terms. The finance income on deferred consideration earned under these contracts is included in the revenue of the respective segment and is eliminated under reconciling items. h) Operating income of segments is after recognition of stock compensation expense arising from the grant of options: Three months ended Six months ended ended September June 30, September September September March 30.2012 2012 30.2011 30.2012 30.2011 31.2012 IT Services ? 184 ? 69 ? 161 ? 253 ? 467 ? 871 IT Products 11 5 14 16 36 62 Consumer Care and Lighting 21 25 18 45 45 89 Others II 5 7 17 15 26 Reconciling items (122) [57] 54 (179) (112) (99) | Total | ? 105 I ? 47 i ? 254 I ? 152 I ? 451 | ? 949~| Management believes that it is currently not practicable to provide disclosure of geographical location wise assets, since the meaningful segregation of the available- information is onerous. 10. Stand-alone information (Audited) Three months ended Six months ended Year ended Particulars September June 30, September September September March 31, 30,2012 2012 30,2011 30,2012 30,2011 2012 Income ftom Operations f 90,820 ? 89,326 ? 78,638 ? 180,145 ? 151,581 ? 320,536 Profit before tax 21,962 15,355 13,001 37,316 27,980 59,186 1 Profit after rax 17.193 I 11.580 I 10.506 I 28,772 I 22.699 I 46.851 I The Company has granted Nil, Nil and Nil options under RSU Options Plan during the three months ended September 30, 2012, June 30, 2012 and September 30, 2011, respectively and Nil options 30,000 options under RSU Plan during the six months ended September 30, 2012 and 2011, respectively and 40,000 options under RSU Plan during the year ended March 31 2012. On November 1, 2012, the Board of Directors’ of the Company has approved a scheme of demerger effective April 1, 2012 (‘Scheme’} to demerge the consumer care and lighting, infrastructure engineering businesses and other non IT businessof the Company (collectively, the “Diversified Business”). The Scheme envisages the transfer of the Diversified Business to a “Resulting Company” whose equity shares are not listed in any stock exchange in India or abroad. The Resulting Company, at the option of the shareholder, issues either its equity or redeemable preference shares in consideration of the demerger to each shareholder of the Company on a proportionate basis. The Scheme also provides an option for the public shareholders to exchange equity shares of the Resulting Company for the listed shares in the Company held by the promoter group. The Scheme will become effective only after the approvals of authorities inter-alia stock exchanges, shareholders and creditors of die Company arc received and followed by the sanction of the Honorable High Court. Consolidated statement of assets and liabilities (1FRS) As of As of Particulars September March 30, 2012 31,2012 I. EQUITY AND LIABILITIES 1. Shareholder’s funds Share capita I 4,923 4,917 Reserves and surplus 305.317 280.397 310.240 285,314 Minority Interest 1,032 849 Non- current liabilities Long-term borrowings 564 22,510 Deferred tax liabilities 382 353 Other long term liabilities 4,103 3,826 Long-term provisions 4,856 5,464 9,905 32,153 4. Current liabilities Short term borrowings 60,031 36,448 Trade payables and accrued expense 49,107 47,258 Othercurrentliabilities 27,47 9 25,626 Short term provisions 12,513 8,353 149,130 117,685 TOTAL EQUITY AND LIABILTIES 470,307 436,001 II ASSETS 1. Non-current assets Fixed assets Tangible assets 53,027 53,529 Intangible assets 4,693 4,229 Capital work-in-progress (including capital advances) 6,362 5,459 Goodwill 71,798 67,937 Non-current investments 3,161 3,232 Deferred tax assets 2,853 2,597 Long-term loans and advances 10,618 10,287 Other non-current assets 10,456 15,243 162,968 162,513 2. Current assets Current investments 66,822 41,961 Inventories 12,096 10,662 Trade receivables 83,588 80,328 Cash and bank balances 66,574 77,666 Short-term loans and advances 7,374 5,635 Other current assets 70,885 57,236 307,339 273,468 [~ I TOTAL ASSETS 470,307 [ 436,001 | W1PRO Applying Thought By Order of the Board, WIPRO LIMITED for Wipro Ltd. Regd. Office: DoddakannelH, Place: Bangalore Aztm H Premji Sarjapur Road, Bangalore - 560 035. Date: November 2, 2012 Chairman www.wipro.com tjoo&s &rar&3g i sJsSozoo* I 3 i 2012 ^ ^ dort&od: “-’’’ £uH Brv^^^3S-”’ “ * “’^**«„ ‘”-; . =-’ ..- ‘ . I . .. .... ^ecusds 3&3pri 33^ aed^ sbaeioa $,& s^ra^rt soOSos draertjSto/i s&s^rofici $,& ?£ra£ort 3oOctf»s3 sio^sad aedc^ abtisftsi^ 3J8.& aSo^zburooi 3boe| ste>Qri&. tart 3d& aecb-3j07)d AcSe oifc<!«e3 e) o o h ^»|<sb ssosi, g^ aeQo&S ^stores 5ro?j?3 zoSoto^c^ srjOrassk ^c&ysos^stegirorbacS, ^sexradi, 5!. 2: <goa3 stead 2007-08 60 aoQ3 e2£xira draea sirancjdD. sbsSradisSxradi^d a^5±®^cji3 Bj&3prt«b sfrfe ^d^pj^ a,a,^o&3c33^ “ SjSefcssS^cf ^SeSriSsptoSasSraFtssBft 3rtrfrt«i otesj 5±u3e3oi>(3 e>s3Qo£<9 33^ aedS^ es^geaS: racdbr Mrao^rf, &3eSdd£> &i; ^ tfo^oa ?^&rt 20<s>3 stecfcsS 3®^ DedoJ ^o^dras SfcBriea S3S2FSOU £0&; olffieS&icSak S35±J3raOrt ^ 1, ,^| tftitti® 5±J3Di ^JBO^rfO rt»e*. ^octo ** ede ^^ sedcBcao*. ^^^5 sect aSsart stodcBrtrid” fcttB^ cfclsSBB^ stescj aarerfO sb* sedcfc, 3§J8d ^™^°°^°^ 53-^ o^Q “ WO^BM* 03*^3 i&rt SBfe^ Ibd^rt 8-Odi ™f^*rt* Deog ^0* 5^3 d£l 3pl»ertrt*eeSe*ziBfe5J>& d^ri risratfH tortosn*. “°™n^’^°^(f^ aed^sfcedSsS sfc/ao* 3§J8<5 BSrtddg^oA 19 ^dFrt«od sb* De* JdcctorfTOifr^abg aeO 4^raM ^ *£etf3 Q3 BteefcSS ertsfc* 35j8«aeacfcg ^^a^^H aeoaodertsadssBsSSoiSx zbd^rt«rt8^adei330jw Ksaeu:)^ ^s gdoi05SO ^^ ^^ aortMbert**»*rakS . 3^0^* J^Sf^ ^^S’ v-i-^-e-j _*___vrM-f-<-<-> So -° 2Jn 2323F 5333SI _, _, , _. ,_. «.Bto,tfW s±B333^d£S> sS-asaWab* 83e««db abttttf H*An^-(^«. sisteaodb* a>d* 53ert 33?Se aspBcaosbsScfc ,lHKfN-«r«nnrt «*,*«’ «*S^5$sia* SwpOdi QSS 1,600 ara. iua»r j-^j _»._*. _^ *\«h-<-\ -^o^fis aodsiaoiBte*BSiSe*odsO * ^s^ottS^ s^ aedS>4 ^o* *««d& Bbdrtdato aa£ aosadsteKfcstoi e$-si$S$ «ad>5S d^d -s.H-ir vo-t-f,. _; _,_.-$. | «riSoaddi.lra?3rtra &£oeari ^^roobt Dec&s3 3edS> 3o?ioa sisteraobs ^^ ^ ae^ ^^ ,.,_, * _, :L _,° _,_._, s i -vort-h% _,At^-{Ma-?^->^ _; &J ^_,_» j .1 =,^* Btobri$sbci;fcstoa?kb;4rt oirae&?3 ^rasSr&saSd Sed?» 2oSn^S e>3 S,e33pg jjo^ ^e£)draaJ2rb^&. r1 ^ ,, .. , ^.—Ji,^ ,,d^«s|_5._, , -° S3?j^3ioao3dae*s3 ^o^rt 353^,533^. ‘gcj- S)^33p3Sp», as?sa^s^)TOS gdood es^-si^d ^ ° -hni.i* i-rfrrtMfl ^nrtftn-i^ ° j ^^’’j jj 530JDF|5toOC330jD^. OOd ^D^S?S 3j,rfe2Jd d,^0rt 531QU5 2SU0320 533330032 ^S33^ri«rt D^ ?Sd^Oi53gfS jijj _,_, J j .^ ® ^-i^^-^^j , , s , SSOQciBbd?JSp3SSd.iJ ?5^lQU533rii3c3. 3&DS2?0333nn. a^^S^SdOSB^S). ^ -tmt-nai-t. ^23^,^0,^0333^0^ ^d. 2oOC3i 3#k33d<£) 33.&1 O3DL>e33cScO: 5.5^^3 ^ 533&oS>i3F3 s “ s ^ _> j _t JLJj IT_j ?55dd a^OJDO S353^ri30 DedD ^O^dra SS33^O3AC3i, tf538FM< DedD ^d^D3^ K^0rt ^frt *^^rtf ** SifflESFrtflOdTaedS Se^rfS i&rt U^rt ^ tddoa artsisS «raoBBftrt)3&. ^^^o ^dEBBafcS’aoaaed^ aerfoBrtsid astsed abd^ ^deBS ^^3^ ^jed ^^^^ ^ ^ ^fs^ ^ek^o^oi * e9*>orttb ________________^ ^nppv*mmminiR^ 1 tro£j^^es^* 5tooa?5a?5ri^(g^o^o^cd L mm. «wm »*W Mvm mvw> «»/ «i^ «M) =*.«*, B^aedSSiOrt^EBB Sffl^ffl^ E30^?3 ?^C3i, *rt uoitifl^rf rssx; EtoriCfi: =bruoa sfajosi *c=q *^roctj=d tsai^* ittHMxi 5^63^ 2,4 c^O,^?/,a,(SflO- zSdoijfl 33 & DtdO ajofcxB^BritS. BrtWwIiw*^, tto.7s/T.ttoOojrtn<rw.*te!rjt«!EiULi,cB. ,=,.,,_,,x^-^._;__s _,^w. mm & £, ^rt^-wMi.^^Jg,-^^^^^*^^^^^ ‘ Se^^^j^F^raacsi, ^draoJDS aSeexrado aieaiaj ^efrtosi Oimotf, T^nto m=,7^ gtf_: ^ ^1.6 c20,c2S/,S Sbd^ 3J.d!& ^3cSdO gC3 stoo^: 9-11-2012 itijaU:lfl-00rtolJotosio* aedbsaj6i.a«5e55BO aod&aaFOocSB§acSd& Stf : Ebtn iJjs;tf:iiociuo-aafds’dbou’ woo1 s.eto^ rfo. CioUc*’ .,,. a, ,_? * w j p>^ l.tt.^uii^a.^.o.^^.^^^.fc-^^.d.^^-s^o^ sp’wIsodi^d^ort^OcS 2orad23eexradD5&d^o-to BtanchHame I LOAN No. sjds&o^sooirae^^aeS^ ^q^ SrtjBoadid s3o^|cd glrtfld) PROOMM94tPRDO(H»261,PRDD(lOMf9,PR«OI>OOi14, DfditfO&J^5333^05 S^d) D3&iS 553SdOOi53f>d Kinmzu.pRMNrai.pRommi.pRmiNa, __-,.4=j^^rt- ^^^^^ PR (0001139, PR DOIOUH, PR COW2S20. PR 000025J7. O3^3033cOS ^SD” 55^ OT^ 3JO^id| PR MOOI633i 3tl/3dS)o333dOiSd. c330Q0333Sc3 SJCJd & StKiS’IpfSt^cl PR00000197,PR00001674,PRM001S97,PROO«HI»49, SoOCfc^ 25rt~800dj3 +, ^^ v« -i r PR 0000078S, PR 00000(4!, PR 00000670, PR 00005932, 2oODD 5,K A SOU OQ 530i)F^ ?J00333^ PR 00001698, PR 00002081, PR 00002173, PR 00002119, 23dDriQ 5333C3O3f\c3. ^F^fl S333S &i?5d &g& PR 10002462, PR 00000863, PR 00000982, PR 000016H, J0vir!p-,* ° or-!^ A-!* 1 * 7^ PR (000213S, PR 00001321, PR 00001432, PR 00001607, ^dtS^OdS QcS^S S,23 rt«^23efe. PR 00102707, PR 0.0001717, PR OM01S36,PR OOOJ3JOS, PR00002465,PR00002624,PR00002H6.PR00002)45, o J - _J .»_»_> _4.J_ -JJ.j- _J PROOOO!943rPR0000341),PROOOOMi2rPR00003S)!, U«J3DO tOC^ &02 SU2O7j&Ou SSOO&N afdtK!;isirid “ PR 00001179. PR 00002S17. j 4 & ^ ‘A erf ^yofc. iBSV. PR 05003442, PR 000034S5, PR 00000504, PR 00050S7S, 355,^, 5$. 2: ^53FO S3D3b e)^C33D^ SJ^S) S)J35SF 53de2iDri^S PR 00001G92, PR 00000650, PR 00003449, PR 000(3456, J „ , „_,.,_, PR 00001130, PR 00001138, PR 00001220, PR 00001391, S33 »0n S33£l cSrotS^F 2012o S33S03DG ?3ao DsSeOOD &O3X^ PR00001644,PR00001)65,PROM01S05, S33&F^3JOeSOJD^233^£)233rto<9SiddOKSOrt OT^erSFD3n Sf. !i3S»i#aMi PR 00000319, PR 00000321, PR 00003041, PR 00000506, , * , ,J ^ „ PR 00001653, PR 00001751, PR 00001656, PR 00001505, 80 S3rlf3 ftSdd^O^ ^tfeeSO^ 3J^d a^FDOijdi 2012-13 fSf PR00001S90.PR 00002)64, PR 00003536, PR 00003187, ^^ ggLradD ror§ jgjj -jj sfed^ad ^XU^ftSSFOdiSBd. PR00003513,PR00003S6), J 4 & i ‘Si jjjjjj-j ~~PRODMJ«j”” e>^FD3d S)C33gaFri^ *^020dsSdD e3.&.c2S/. 53d FcS^ OSEi»(i?Wo PR00003JJ2 PR00003S80 ^raOQdESeSD. ^30^^ (3C33®FrisSD 33o§ o337)0rt c333^Cd NOTE : 1) Those who irn interested in Releasing or renewing your above loan may 53«5e23?S aJS/SBOJiFdcS^ ^rfe 5 dj3^ron *j03j«F*) ^i0200Q^d do to on or beforer 06-11-2013 try clearing their duo at the concerned branches 330^ 33^eOTdOOd d,?e^0^d e3.&.c2(^ 53C^F S3D3b 2] Bidders are Requested to Produce Identity Card I Pan Card No. t TIN No. o e)^ _t (Incase Registered Dealers) (3| The Intending bidder snail Deposit > Sum of Us, I.OO.OOW- Q^eoft ^Odx^j e>o33iy S3rlra 2toe^ S335S^^d dSe^oiraoan 35 EMD before participating in the Auction. sraSTOOfcFd S^^^ S^dcSoiJcS^ OTSi Dc3eF2i^dD, 3idS DAaNte:L”E11-2012 AUTHORIZEDAUCT1CTIEER I ^*&*™*.™*^*®to*™te**S. (doolaififlfctfnanaf ^^_ .*b*w -^f^^^^. ^?*^^B in the court of the additional ---””H*” -.-.-- r ! ITOM f”^ \5r^ CITY CIVIL AND SESSIONS JUDGE &j.$ S^)e©^^^| C’ ==*£ -~\ V^^ffi^ I H? ! Execution ca«nJC73S206i2 TJ> “ ^^^^J- *a_JP\ \ C^S^yjf**’) - -I n O.S. N01149/2009 ^^ ~ “ V^— _i^ !>L^1 LI I Between: Sri Ramaswamy. H .*^KT^E«Effi22^^^r ^tar^P^tSyR’i^TSSl |TATA”^rae£l3*>C-^ GayathriNagar, Bangalore -560021 ‘-’ oA,DQ,«uil4MM)4 Ks^fipPril TOYOTA^”3SoiraTVS And DecreeHolder dMt^ritmui ttavtfc MteShl VIDEOCONAB»rtf3td^di533 Sri toicha”dra Judgement Debtor TO«^d, a^^ tm^cri, ^sg^^l 7th/SSLC/PUC/JOC/ITr not,ce to judgement debtor: rtairfLo;^, BiTOdrtolnri ^rsBStrf rg^^l^t^n J f^ BlPLOMA (alitrades) asSOtoOfltJ Sri Ravichandra R MS^uS iasitijiJwiStsoae tacrt^^m.o.Sa^^a^d, hiqiag- SOpO/- 16000/- i°”d°K,N4oKvReanrsSappa Naik’ «* ^fflTPTTftfc *iftow*4.rt4w*rt»%wiw HMMliMMKiMM M:HH ^dmg at M| 2nd noor, ^^^^^^tj^f^ r$g& Tlsii^rigrt aiBassd *tnaii*>i Kushal apartments, 9th cross road, i-: Vrf-: 1 H^t ^t*^ Jtilttiil^SttHiBSBiSBSiiiB I IT’TT^ITriTWT^TT^TTl CholanayakanahalliWllagc, |^fe’£!dlK^’5’ag!i’£^1 lEMm^^wllll f FtaTS ‘.Tl’rd! 1 R.T.Nagar Post, Bangalore:560032 | HENNUR WAIN ROAD Ri.29.Sai Decree holder in the O.S.1149J2009 T\ &Jnii &Jt ffu”?’] I * t^)e qirffclSe electronic cirri phase Rs.27.2U SMsionl^eM’’^^^™”* \f\* flnfflRfffiffilll ‘®C’ ^J£3eO O±JO^ WHITEFIELO Rs.26.1BL (ccH-16), Bangalore hJ instituted the &LlJertLJ^BliUillta^JW >^,->’’ fcc^riuA(,titi{rid^-rij OppMNYArHA TECH PARK Rs.43.00l above execution petition against the ii*ESlJiaB=}*o’Wi33-j<[»olsrtmt«;, ^™r j^w« »wtu ««5«tw timmriD ««r«D fc 11 71 I Judgement Debtor for execution of the rf *« tebMMft d,5M udQ| «us *j»*,!StJEM«i B^ StsRJbrt S*HAKM NAGdR b.31.71L decr866 passed on 10 oa 2011: e for jW^aoS^S,*!* 5B*!tKrti8* *,5*j, iai^rt*, J»Wf»d, tWttrijtrt, W39f TUWKltR ROAD fo.25.75L execution and resgistration of the sale SL?^25{.S£t*ISf5«l2^^a tp^ 5atdfl,jfMaffltetof|1B[MS,t SAR/APURItOAD Ri.21.77L deedin respectofthesuitschedule IXtitlf, BMCUBA «ncnrKb4ED-mw> j’^^^.j jt^jj _.j. .-,*.. property i.e.property bearing present ««1»»CS>.JaSsJ^c^dJ^dj. =» l^Slr^ ^^ I iwn nwwPBC: Muncipal no.9, old no.547 (also called m iaaa /BWfta jib din* AMMM mi i innnnmnmr , L .V = ,J as 8th Cross), IstCross, Kempaiah bSaA?^?’ “^H BfllTil9D08270fi25l *««»lRaSffW B,ocMarJ:ardno,9,Pa,aPce |ii-li .Ji.agSMrtauiitofr JointVenture Sujroundlno Banoatore. guttahalli, Venkataramanapuram, Qj^^^^JtOO% ffiZlf’CT”! _^^^^^^^^^^_^^^^^^^^^^_ Call - 90030 11532 Bruhath Bangalore Mahanagara Palike liWclH’ll irtlLHLl^cUf ‘WlllV&l ^^^^^^^m ^^ ITTc^ P^^BT^T^VSCT^F^P limits measuring 30 feet East to west PfVlJifejil !g jJaiinM’Bftaggi jl^ffll^fc /R) M? ff-rlr.r n’.TT’rT.tjT and 50 feet north to south. ^n^^U^F VS^ i inn* tTft-faaiiu] Therefore, you the Judgement I . Debtor are hereby warned to appear in ^^K r^ffagg 6T Institute Of Management t-jyFJSt»M^t^ts=t«TS^Sd person or through pleader duly %^fr*B»’fc* - ^^^^^^j^^^^^^^^^j instructed before the XVII Addl. City _> _^ 9 StudiES and Research *r ^,^:^f & t^.. *& ^w. Ci¥il s Sessions Judge City Civi| S^SjO . ,,,i Bio-llS/l. torf rtJj insifeiF*!. Court(CCH-16), Bangalore city at JrTZ!T^ <SI No-17Z’ ^cri^- 561) U5I. f«c BsrtocfcS. 11.00amon5thdayofDecember2012, ^’*Jte- »^^^ Total Fee for TWO Years ™ 2l-US~2<im 3=d 23-U5-2ULIW failing which the execution petition rra3rfd),eiadj ‘ BrfeabC flaa-^us. raasd sarBdtfs will be heard and determined exparte. j__kjj is 1.5 Lakhs including fees ^ ~a«- ^^^ etfcfWifc. *.t.a. hi^ given under my hand and i --’-’-. ..-MtaDrrCT C««iiirLi»l=e 20(l)rft SJsffic! -j^tiort aSnsi £Sutisi( THE SEAL OF THE COURT THIS THE Ifais syJsto ucsrtssi, ^i^Q^ Pald to PGCET- Fee ‘”eludes j^, W-i 1-2012 00a -jert, 10 n«Jrt 20TH day of october 2012 ^a^cttt$aa«cHd!^tt>caKi uniform, induction, training *™.-^ ^^ ^^^ by order of the court bSSSfcfi-flL^B1 -* and placement. S^™«) iwt. *^ om-. assistant’registrar, pjana, =js^ j^nota „* ^i ^swjsa,- S6U uoi. ^asi aKnta city civil court, bangalore (MiaiSrt ajtSSS^ Sd^ «Mlto!rtO>’ Uj*WjKjMtmfly*SIjjPI:BJ; sSsasEJ*. siijS ^aan-frun Advocate for Decree Holder; dursf =i^ioi: ^4ii^=d rtJR mj||>mgmy|ggg | nciaaieaSi loaiiri. | C.Chennaraya Reddy, C.Shankar Reddy, EQUIPS:. £^^$ _ v^^^m^m^^^f—^^mmm^^r^^r^^^^^^-^^^^^^^M Advocates, No.16,6th Main Road,