UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Exact Sciences Corporation | | |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a—6(i)(1) and 0—11

5505 Endeavor Lane

Madison, Wisconsin 53719

April 25, 2024

To our shareholders,

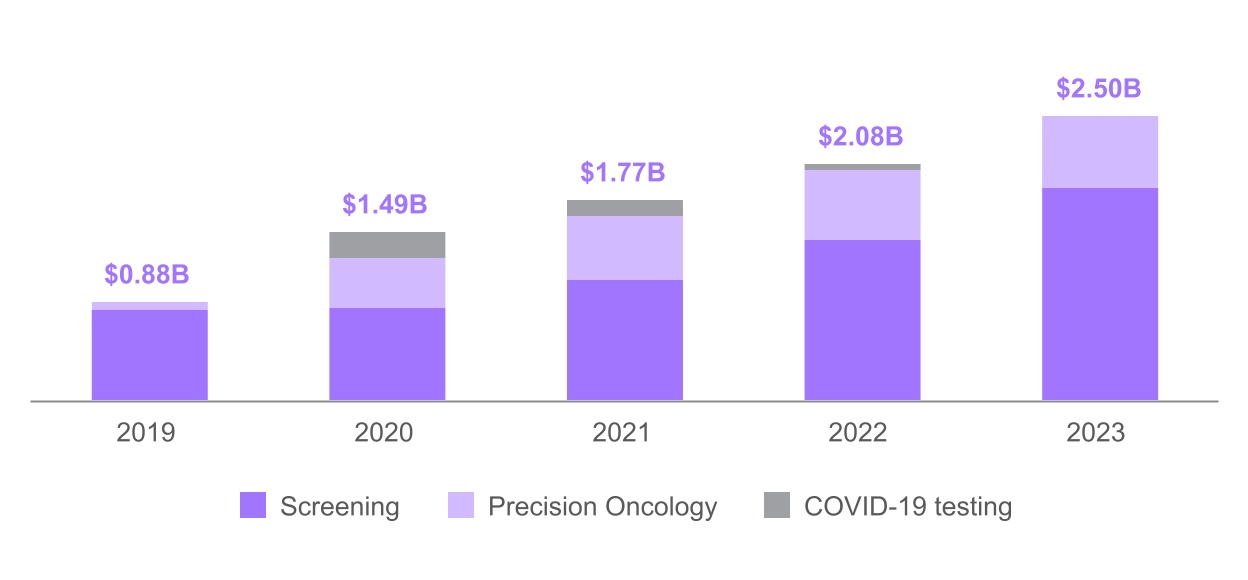

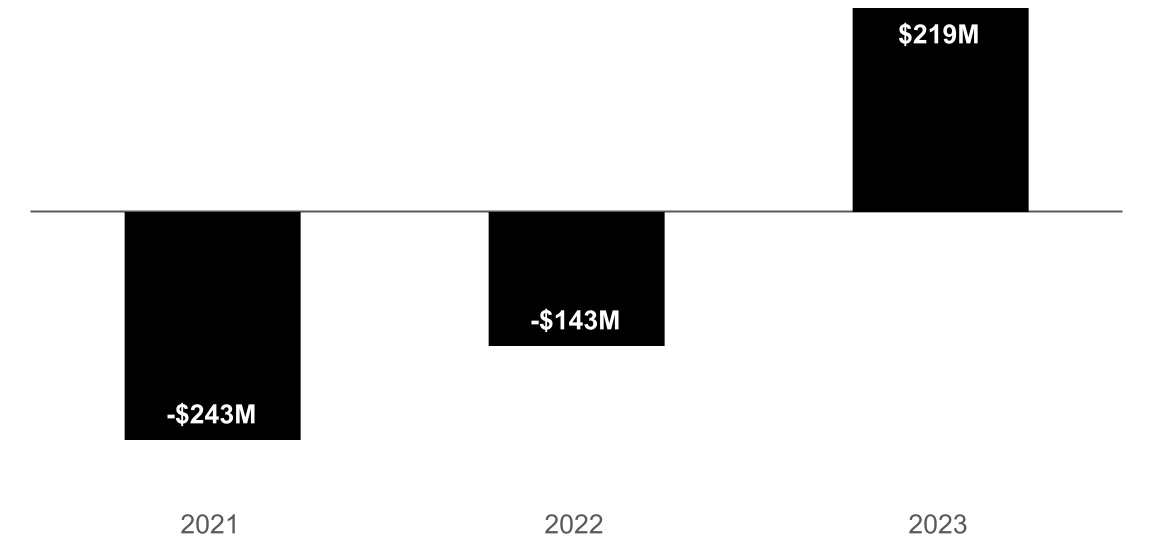

Teams across Exact Sciences continue to advance our mission to help eradicate cancer by preventing it, detecting it earlier, and guiding personalized treatment. We made tremendous progress last year during what proved to be another transformative year for the company. We tested a record 4.1M patients for cancer and rare diseases. We also significantly improved profitability, achieving $219M in adjusted EBITDA, while growing core revenue 24% to $2.5B in revenue. These results have accelerated Exact Sciences past escape velocity, and we are primed to magnify our impact in the global fight against cancer.

We ask ourselves three essential questions to inform our long-term strategy about the expansion of our offerings: Is it something that fuels our passion of defeating cancer? Can we be the best in the world at it? Does it drive our economic engine of growing our breadth of customers and profits per customer? We create patient and shareholder value when we can answer all three questions affirmatively.

Today, the best brands in cancer diagnostics—Cologuard® and Oncotype DX®—are fueling our success. Our competitively differentiated scientific, laboratory, commercial, and customer engagement platform supports those tests and gives us runway to grow rapidly and profitably for years to come. We look to extend our leadership position by bringing to life a suite of complementary cancer screening and precision oncology tests that reduce the suffering caused by cancer.

Your vote is important. On behalf of the Board, management, and our team, thank you for investing in Exact Sciences. Together, we have celebrated wins and embraced opportunities for growth. With your continued support, I am more confident than ever that we will reach new heights and continue to advance our mission.

Sincerely,

Kevin Conroy

Chairman, President, and Chief Executive Officer

5505 Endeavor Lane

Madison, Wisconsin 53719

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 13, 2024

To the Shareholders of Exact Sciences Corporation:

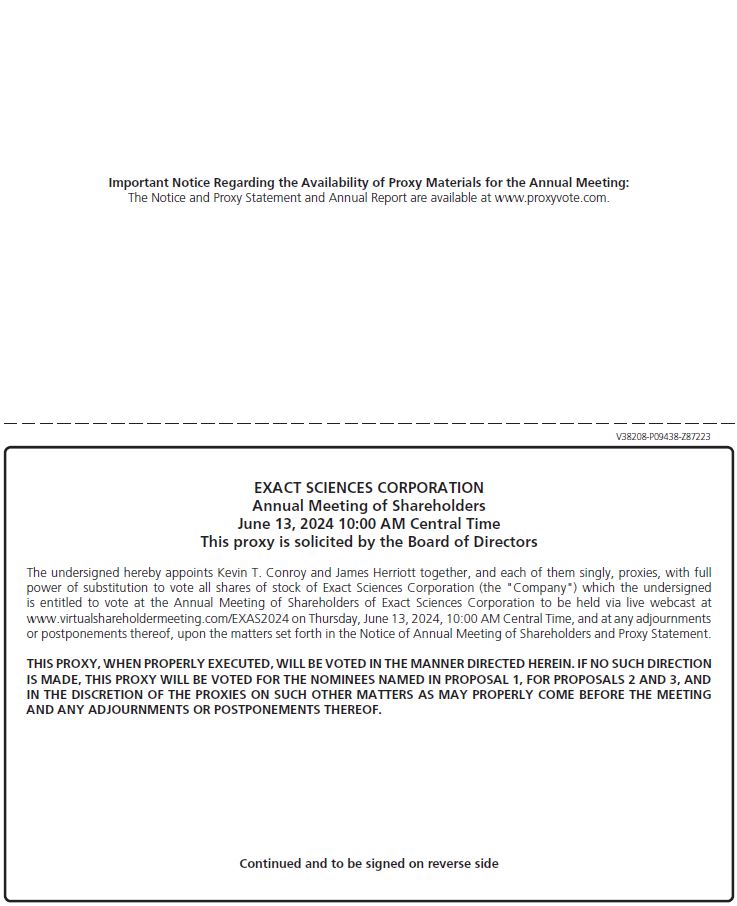

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting (the “Annual Meeting”) of Shareholders of Exact Sciences Corporation, a Delaware corporation (the “Company”, “Exact Sciences”, “we”, “our”, or “us”), will be held on Thursday, June 13, 2024, at 10:00 a.m., Central Time. The Annual Meeting will be a virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/EXAS2024. For instructions on how to attend and vote your shares at the Annual Meeting, see the information in the accompanying Proxy Statement in the section titled “Questions and Answers” beginning on page 89.

The Annual Meeting is being held for the following purposes:

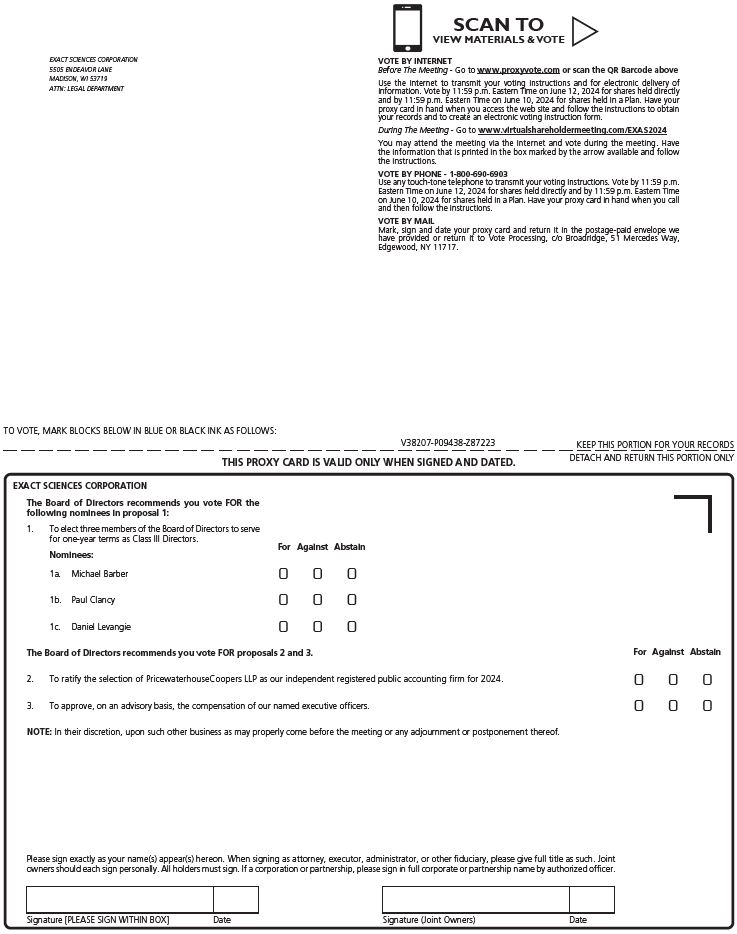

1.To elect the three nominees to our Board of Directors nominated by our Board of Directors to serve for a one-year term.

2.To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024.

3.To hold an advisory vote on executive compensation.

4.To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

We are pleased to utilize the Securities and Exchange Commission (“SEC”) rules that allow issuers to furnish proxy materials to their shareholders on the Internet. We believe these rules allow us to provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting. On or about April 25, 2024, we will mail to our shareholders of record as of April 15, 2024 (other than those who previously requested electronic or paper delivery on an ongoing basis) a Notice of Meeting and Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and our 2023 Annual Report, which includes our Annual Report on Form 10-K for the year ended December 31, 2023.

By Order of our Board of Directors,

James Herriott

Senior Vice President, General Counsel,

and Secretary

Madison, Wisconsin

April 25, 2024

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about April 25, 2024.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting:

This Proxy Statement and our 2023 Annual Report are available free of charge at www.proxyvote.com.

TABLE OF CONTENTS

| | | | | |

| 2024 Proxy Statement Summary | |

| PROPOSAL 1—Election of Directors | |

| Information Concerning Directors and Nominees for Directors | |

| Information Concerning Executive Officers | |

| Corporate Governance Principles, Board Matters, and Non-Employee Director Compensation | |

| PROPOSAL 2—Ratification of Appointment of Independent Registered Public Accounting Firm | |

| Independent Registered Public Accounting Firm | |

| Report of the Audit and Finance Committee | |

| PROPOSAL 3—Advisory Vote on Executive Compensation | |

| Compensation and Other Information Concerning Named Executive Officers | |

| CEO Pay Ratio | |

| Pay versus Performance | |

| Securities Ownership of Certain Beneficial Owners and Management | |

| Section 16(a) Reports | |

| Other Business | |

| Questions and Answers | |

| APPENDIX A | |

| | | | | | | | |

| | |

| i | Exact Sciences 2024 Proxy Statement | |

2024 PROXY STATEMENT SUMMARY

This summary highlights the proposals to be acted upon, nominees for election as directors, as well as selected environmental, social, and governance information described in more detail in this Proxy Statement.

Annual Meeting of Shareholders | | | | | | | | |

| | |

| Date and Time: | | June 13, 2024, at 10:00 a.m., Central Time |

| Location: | | www.virtualshareholdermeeting.com/EXAS2024 |

| | |

The record date for the Annual Meeting is April 15, 2024. Only shareholders of record as of the close of business on this date are entitled to vote at the Annual Meeting. Shareholders will need the 16-digit control number included on the Notice of Internet Availability of Proxy Materials on the proxy card, or on the instructions that accompanied their proxy materials. Voting Matters

At or before the Annual Meeting, we ask that you vote on the following items: | | | | | | | | |

| Proposal | Recommendation

of the Board |

| 1. | Election of Directors | FOR EACH NOMINEE |

| 2. | Ratification of Appointment of Independent Registered Public Accounting Firm | FOR |

| 3. | Non-Binding, Advisory Approval of Fiscal 2023 Compensation to Named Executive Officers | FOR |

How to Vote

Our Board of Directors is requesting you to allow your common stock to be represented at the Annual Meeting by the proxies named on the proxy card.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Vote in Advance of the Meeting | | | | | Vote Online During the Meeting | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | Vote your shares at www.proxyvote.com. Have your Notice of Internet Availability or proxy card for the 16-digit control number needed to vote. | | | | | | See page 91 - How can I attend and vote at the Annual Meeting? for details on voting your shares during the Annual Meeting through www.virtualshareholdermeeting.com/EXAS2024 | | |

| | | | | | | | | | | | | |

| | | | Call toll-free number 1-800-690-6903 | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | Sign, date, and return the enclosed proxy card or voting instruction form. | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

In connection with this request, on or about April 25, 2024, we expect to send to our shareholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our Proxy Statement and our 2023 Annual Report, which includes our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”), and how to vote through the Internet or by telephone.

Shareholders of record may vote their shares prior to the Annual Meeting via the Internet, by telephone, or by mail. Beneficial owners of shares held in “street name” may vote by following the voting instructions provided to them by their bank or broker.

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 1 |

| | | | | | | | |

| 2024 PROXY STATEMENT SUMMARY | | |

Nominees for Election as Directors and Continuing Directors

Our Board of Directors recommends a vote FOR the election of each of the following nominees for director for a one-year term: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Director Class | Primary Occupation | | Committee Membership |

| AFC | CGNC | HCC | ITPC |

| Nominees for Election as Directors | | | | | | |

| Michael Barber* | 63 | — | Class III | Former Chief Diversity Officer of General Electric Company and former President and CEO of GE Molecular Imaging and Computed Tomography | | | | | |

| Paul Clancy* | 62 | 2021 | Class III | Former Executive Vice President and Chief Financial Officer of Alexion Pharmaceuticals, Inc. | | | | | |

| Daniel Levangie* | 73 | 2010 | Class III | Former Chief Executive Officer and President of Cytyc Health Corporation; Currently Co-founder and Manager of ATON Partners and Chairman, President and Chief Executive Officer of CereVasc | | | | | |

| Continuing Directors | | | | | | | | | |

| Kevin Conroy | 58 | 2009 | Class I | President, Chief Executive Officer, and Chairman of the Board of Directors of Exact Sciences Corporation | | | | | |

| Shacey Petrovic* | 50 | 2020 | Class I | Former President and Chief Executive Officer of Insulet Corporation | | | | | |

| Katherine Zanotti* | 69 | 2009 | Class I | Former Chief Executive Officer of Arbonne International | | | | | |

| D. Scott Coward | 59 | 2022 | Class II | Former Chief Legal Officer, Secretary, General Counsel, and Chief Administrative Officer of Exact Sciences Corporation | | | | | |

| James Doyle*† | 78 | 2014 | Class II | Former Governor of Wisconsin; Currently Of Counsel at Foley & Lardner LLP and Partner of Doyle & Boyce Strategies | | | | | |

| Kathleen Sebelius* | 75 | 2019 | Class II | Former Secretary of the Department of Health and Human Services and former Governor of Kansas; Currently Chief Executive Officer of Sebelius Resources LLC | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Independent | | Chair | | Member | † | Lead Independent Director | |

AFC = Audit and Finance Committee; HCC = Human Capital Committee; CGNC = Corporate Governance and Nominating Committee; ITPC = Innovation, Technology & Pipeline Committee |

Pierre Jacquet and Timothy Scannell are not standing for re-election at the Annual Meeting and Freda Lewis-Hall, whose term expires in 2026, intends to retire immediately following the Annual Meeting for personal reasons. Mr. Jacquet currently chairs the Innovation, Technology & Pipeline Committee. Dr. Lewis-Hall is currently a member of the Human Capital Committee and the Innovation, Technology & Pipeline Committee. Mr. Scannell is currently a member of the Audit and Finance Committee.

We expect that immediately following the Annual Meeting, Michael Barber will serve as chair of the Innovation, Technology & Pipeline Committee and as a member of the Audit and Finance Committee.

| | | | | | | | |

| | |

| 2 | Exact Sciences 2024 Proxy Statement | |

| | | | | | | | |

| | 2024 PROXY STATEMENT SUMMARY |

Diverse Skill Sets and Experiences Among Our Continuing Directors and Director Candidates

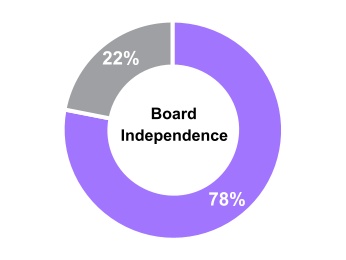

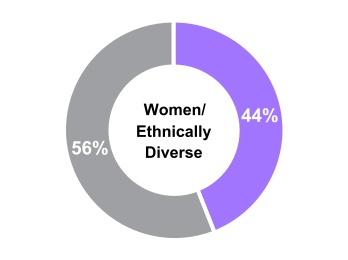

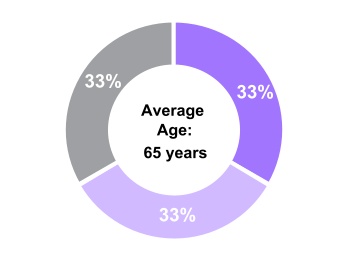

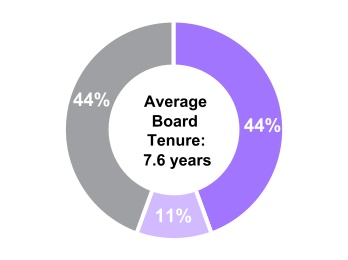

Our Board strives to maintain a highly independent, balanced, and diverse group of directors that collectively possesses the expertise to ensure effective oversight of management. The following reflects the characteristics of our continuing directors and director nominees.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| n | Independent | | n | Women/Ethnically Diverse | | n | ≤ 60 years | | n | < 5 years | |

| n | Non-Independent | | n | Men/White | | n | 61-69 years | | n | 5-10 years | |

| | | | | | | n | ≥ 70 years | | n | > 10 years | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Qualifications and Experience | Barber | Conroy | Clancy | Coward | Doyle | Levangie | Petrovic | Sebelius | Zanotti |

| Diagnostics/Medical Device and Technology | l | l | | l | l | l | l | | l |

| Pipeline Development/Commercialization | l | l | l | l | | l | l | l | l |

| Global Business Perspective | l | l | l | l | | l | l | l | l |

| Corporate Governance and Sustainability | l | l | | l | | | l | l | l |

| Medical Practice and Public Health | | | | | | | | l | |

| Executive Leadership | l | l | l | l | l | l | l | l | l |

| Finance, Corporate Strategy, and M&A | l | l | l | l | | l | l | | l |

| Talent Management | l | l | l | l | l | l | l | | l |

| Science, Research, and Development | l | l | | l | | l | l | | l |

| Government, Regulatory, and Compliance | l | l | | l | l | l | l | l | l |

| Risk Management | l | | l | l | l | | l | | l |

| Cybersecurity Oversight | l | | l | | l | | l | | l |

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 3 |

| | | | | | | | |

| 2024 PROXY STATEMENT SUMMARY | | |

Governance Highlights

| | | | | | | | | | | | | | |

| Strong Governance Practices |

| | | | |

Regular executive sessions of non-management directors Clawback provisions above and beyond the requirements set forth in the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) Firm limits on board service at other public companies | | Caps on performance-based cash and equity incentive compensation for our executive officers Annual review and approval of executive compensation program Significant portion of executive compensation is variable and at risk based on performance | | Robust stock ownership guidelines for non-employee directors and executive officers Anti-hedging, anti-short sale, and anti-pledging policies Limited perquisites No post-termination pension-type benefits or perquisites for our executive officers that are not generally available to our employees |

| Independent Oversight | | Continuous Improvement | | Shareholder Rights |

| | | | |

Seven of nine directors are independent Audit and finance, human capital, and corporate governance and nominating committees comprised entirely of independent directors Lead Independent Director exercises decisive, energetic, and independent leadership Diverse Board based on gender, ethnicity, experience, education, and talents | | Annual Board and committee self-evaluations Annual Board evaluation of CEO Risk oversight by Board and committees Robust director nominee selection process Annual shareholder engagement efforts with director participation Onboarding and continuing education opportunities for directors | | Majority voting standard for directors in uncontested elections Proxy Access by-law provisions Annual “say-on-pay” advisory vote Board declassification in process after Board-sponsored and shareholder-approved proposal |

| | | | | | | | |

| | |

| 4 | Exact Sciences 2024 Proxy Statement | |

| | | | | | | | |

| | 2024 PROXY STATEMENT SUMMARY |

Executive Compensation Highlights

| | | | | | | | | | | | | | |

| Pay-for-Performance |

| | | | |

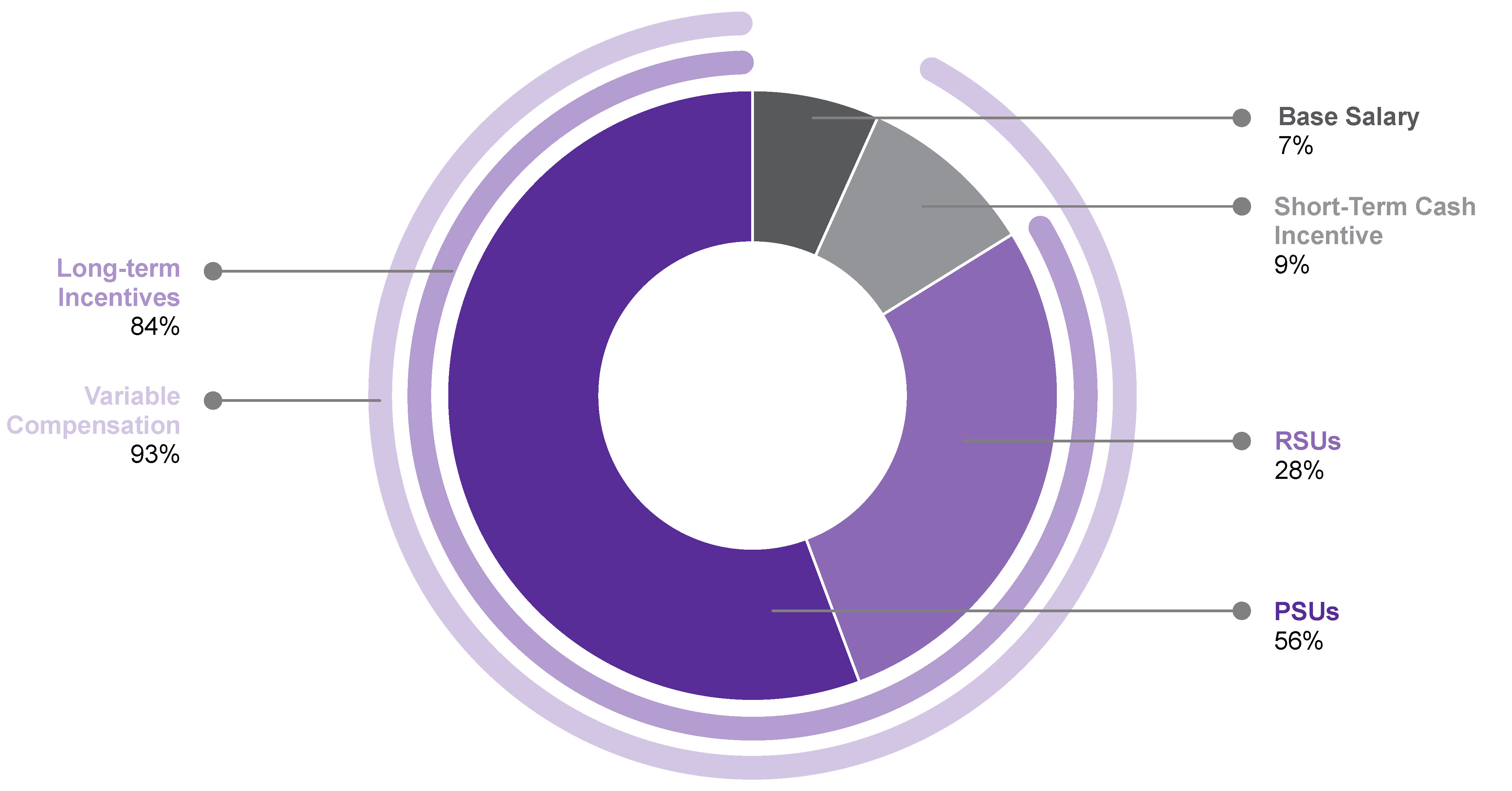

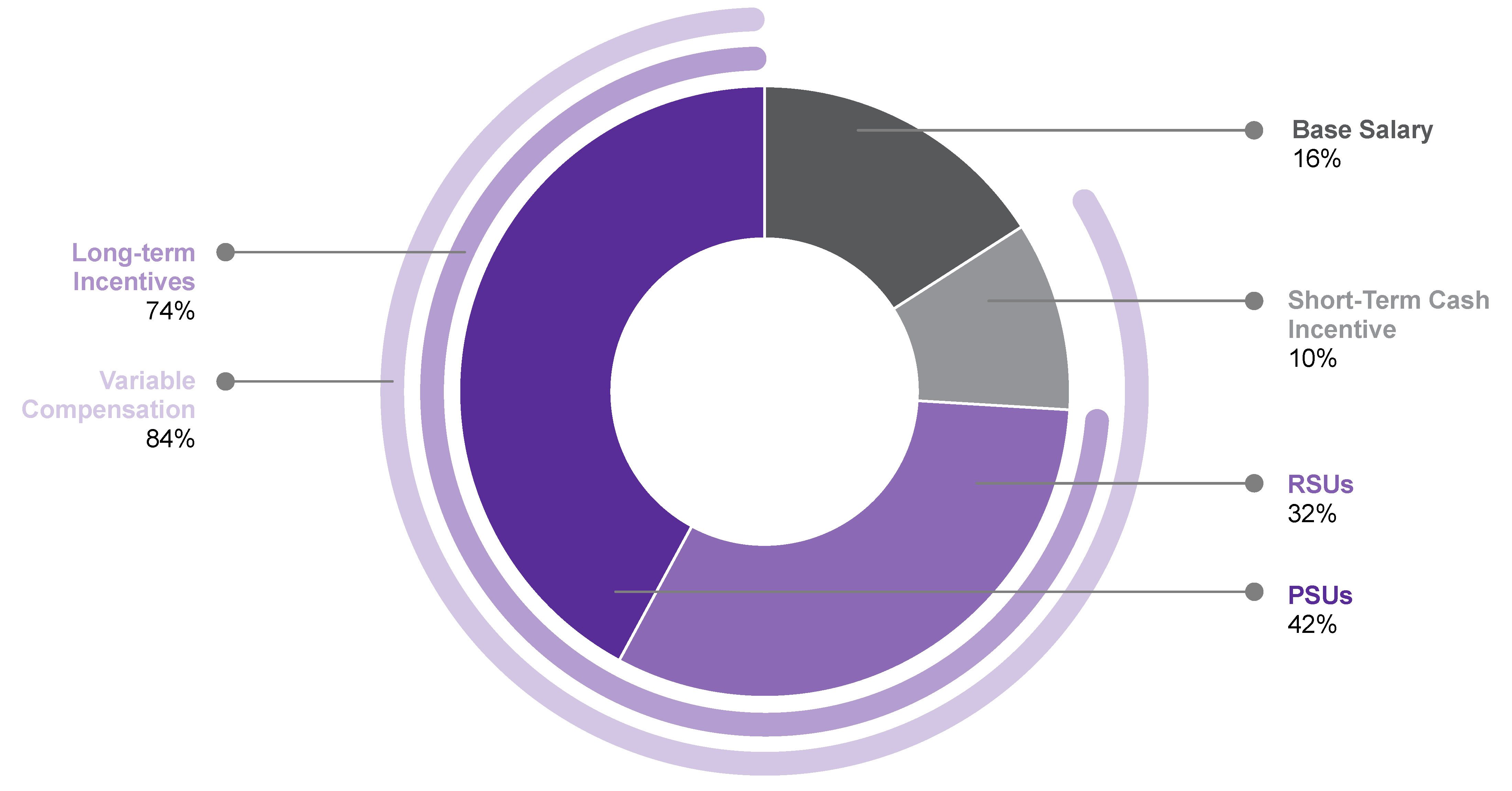

Our executive compensation program supports long-term value creation. Approximately 93% of our CEO target compensation and approximately 84% of the target compensation for our other NEOs is variable and at risk, tied to our stock price performance, or subject to achievement of pre-set rigorous performance targets. | | Our NEO compensation program reflects our focus on long-term shareholder value creation, including the following: Ratio of target performance stock units (“PSUs”) for CEO long-term incentives (“LTI”) at 60%; average ratio of target PSUs for other non-CEO NEO LTI at 50% (up from 33%); Use of a relative total shareholder return (“rTSR” or “relative TSR”) modifier for the PSUs granted in 2023, which may increase or decrease the earned payout by up to 50% to reinforce alignment with shareholders; and A clawback policy that goes beyond the requirements set forth in the Dodd-Frank Act by allowing recoupment of incentive compensation in the event of misconduct that did not result in a financial restatement. | | Our 2023 annual incentive plan paid out at 133% of target in alignment with our strong financial results. These payouts reflected strong financial performance and high customer satisfaction, determined by Customer Satisfaction Score (“CSAT”). |

Environmental, Social, and Governance (ESG)

The work we do every day is aimed at eliminating the suffering cancer causes to create a more enduring, cancer-free world for future generations. The success of Exact Sciences would reduce the economic and social burden of cancer care around the world. Exact Sciences publicly discloses information about our key sustainability programs and policies in our ESG report. In our ESG report, we mapped and linked our disclosures on a range of ESG topics to metrics outlined by voluntary disclosure frameworks such as the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD). Our ESG report is available at www.investor.exactsciences.com/investor-relations/corporate-governance. The information contained in our ESG report and on our website does not constitute a part of this proxy statement and is not incorporated by reference herein.

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 5 |

| | | | | | | | |

| 2024 PROXY STATEMENT SUMMARY | | |

Oversight of ESG by our Board of Directors and Committees

Our Board of Directors and its Committees provide oversight and regularly receives updates on policies and risks associated with ESG, including covering topics such as cyber security at least quarterly. Topics such as the following were reviewed by our Board and its Committees in the past year:

| | | | | | | | | | | | | | |

| | | | |

Executive compensation Culture, talent, and human capital, including diversity, equity, and inclusion (“DEI”) Environmental and social affairs | | Legal and regulatory compliance Clinical research standards Shareholder feedback Risk management | | Information and cyber security Product quality and safety Product development |

ESG Highlights

We are committed to reducing the economic and social burdens associated with cancer care. To us, success includes reaching financial goals and creating positive change in the world around us. We embed sustainability and responsible practices into the actions we take to advance our mission.

In 2023, Exact Sciences partnered with a leading professional services firm to determine which non-financial issues are most material to key stakeholders. The assessment was conducted in accordance with globally recognized frameworks and standards, including SASB and TCFD, to ensure its completeness and alignment with best practices in sustainability reporting. The assessment showed that the issues that can have a significant impact on our business and are of greater importance to our stakeholders include: manufacturing safety & compliance, customer health & safety, talent attraction, engagement & retention, and compliance & anti-corruption. We are committed to reporting on these topics and continually enhancing our disclosures within our ESG report.

| | | | | | | | |

| | |

| 6 | Exact Sciences 2024 Proxy Statement | |

| | | | | | | | |

| | 2024 PROXY STATEMENT SUMMARY |

Highlights from our 2022 ESG report include:

| | | | | | | | | | | | | | |

| Environmental | | Social | | Governance |

| A more sustainable planet | | Best team dedicated to fighting cancer | | Robust ESG Oversight |

Disclosed Scope 1, Scope 2, and Scope 3 emissions aligned with Greenhouse Gas Protocol, as well as total water usage, and total waste Implemented new energy efficiency improvement project which reduced our annual electricity usage by 126,000 kWh and provided $18,000 per year in energy cost savings. Recycled over 94% of plastic waste associated with our Cologuard sample collection and testing processes, equating to 2.5 million pounds of plastic waste diverted from landfill in 2022. | | Employees reported that: •Exact Sciences is a great place to work (80%) •They are made to feel welcome when joining the company (95%) •They are treated fairly regardless of their sexual orientation (95%) •They are able to take time off when necessary (90%) •They are proud to work here (89%) Advanced DEI and health equity: •Launched campaigns to improve access to cancer screenings among diverse populations •54% workforce gender diversity •Expanded employee DEI training •Broadened talent pipeline and increased access to employment opportunities for diverse populations | | Board of Directors provides oversight of ESG and sustainability is embedded in the activities of the following board committees, which comprise of all of our board committees: •Human Capital •Corporate Governance and Nominating •Audit and Finance •Innovation, Technology & Pipeline Continued integration of ESG goals into incentive plans: •Maintained established diversity metric •Maintained mentorship metric |

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 7 |

PROPOSAL 1—ELECTION OF DIRECTORS | | |

|

| WHAT YOU ARE VOTING ON: |

| Shareholders are being asked to elect three Class III directors to our Board of Directors each to hold office until the 2025 annual meeting and until his or her respective successor is elected and qualified, or until his or her earlier death, resignation, or removal. |

We are seeking the election of three members to our Board of Directors. Our Board of Directors currently consists of 11 members and is currently divided into three classes. Upon the recommendation of the Corporate Governance and Nominating Committee, our Board of Directors has nominated and recommended Michael Barber, Paul Clancy, and Daniel Levangie for election to our Board of Directors for a one-year term as our Class III directors. Pierre Jacquet and Timothy Scannell are not standing for re-election at the Annual Meeting and Freda Lewis-Hall, whose term expires in 2026, intends to retire immediately following the Annual Meeting for personal reasons. Immediately following the conclusion of the Annual Meeting, the size of the Board of Directors will be reduced to nine members.

At our 2023 annual meeting of shareholders, our shareholders approved an amendment to the Company’s Certificate of Incorporation providing for the elimination of the classified board structure over a three-year period (the “Declassification Amendment”). Beginning with the Class III directors standing for election at the Annual Meeting, directors will be elected for a one-year term, subject to such director’s prior death, resignation, or removal. The approval of the Declassification Amendment by the shareholders did not shorten the terms for any previously elected directors. This means that directors who were elected prior to the Annual Meeting will continue to hold office until the end of the terms for which they were elected and until their successors are duly elected and qualified. Accordingly, directors elected at the 2022 and 2023 annual meetings will continue their terms until the 2025 and 2026 annual meetings, respectively. Going forward, all directors will be elected for one-year terms, and by the 2026 annual meeting, all directors will be elected on an annual basis. Accordingly, each nominee for director at the Annual Meeting, if elected, will serve for a one-year term, expiring at our 2025 annual meeting.

Shares represented by all proxies received by our Board of Directors and not marked with voting direction for any individual nominee will be voted FOR the election of each nominee. Our Board of Directors knows of no reason why any nominee would be unable or unwilling to serve, but if such should be the case, proxies may be voted for the election of some other person nominated by our Board of Directors.

Our By-laws provide that, in an election of directors where the number of nominees does not exceed the number of directors to be elected, each director must receive the majority of the votes cast with respect to that director. This means that the number of shares voted “for” a director must exceed the number of shares voted “against” that director. Our Board of Directors believes this majority vote standard appropriately gives shareholders a greater voice in the election of directors than the traditional plurality voting standard.

If an incumbent director does not receive a majority vote, our Corporate Governance Guidelines further provide that such director must tender his or her written resignation as a director to the Chairman of our Board of Directors for consideration by the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee will consider such tendered resignation and, within 45 days following the date of the shareholders’ meeting at which the election occurred, recommend to our Board of Directors action to be taken with respect to the tendered resignation, including whether to accept the tendered resignation. Our Board of Directors will, no later than 75 days following the date of the shareholders’ meeting at which the election occurred, take formal action upon such recommendation and promptly disclose its decision, together with an explanation of the process by which the decision was made and, if applicable, our Board of Directors’ reason or reasons for rejecting the tendered resignation, by filing a Form 8-K with the SEC.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE NOMINEES | | | |

| | | | | | |

| | | | | | |

| | | | | | | | |

| | |

| 8 | Exact Sciences 2024 Proxy Statement | |

INFORMATION CONCERNING CONTINUING DIRECTORS AND NOMINEES FOR DIRECTOR

Evaluation of Director Candidates

Director candidates are considered based upon a variety of criteria, including:

•demonstrated business and professional skills and experiences relevant to our business and strategic direction;

•concern for long-term shareholder interests;

•personal integrity; and

•sound business judgment.

Our Board of Directors seeks members from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise that, in concert, offer us and our shareholders diversity of opinion and insight in the areas most important to us and our corporate mission. In addition, nominees for director are selected to have complementary, rather than overlapping, skill sets. When filling positions for Board membership, including through retained searches by third party search firms, we are committed to actively seeking qualified candidates with a broad range of experience, viewpoints, professions, skills, geographic representations, and backgrounds as well as diversity of race, ethnicity, gender, age, and culture. All director candidates must have time available to devote to the activities of our Board of Directors. Our Corporate Governance and Nominating Committee also considers the independence of director candidates, including the appearance of any conflict in serving as a director.

Below is background information for each current director and nominee for director, as well as information regarding additional experience, qualifications, attributes or skills that led our Board of Directors to conclude that such director or nominee should serve on our Board of Directors.

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 9 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

Nominees for Director

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Barber contributes over 40 years of experience serving in a series of executive roles with increasing scope of responsibilities in operations, human capital, engineering, and product management at General Electric Company (NYSE: GE). He is a well-respected innovator, inventor, and healthcare industry leader, with a proven global track record of launching transformational technologies and successfully delivering advanced products to market in the diagnostic imaging and point of care technology fields. KEY SKILLS AND EXPERTISE Global Business Perspective; Pipeline Development/Commercialization: Mr. Barber contributes significant global operational insights from his experience at pharmaceutical and other healthcare companies, where he has led product development for advanced healthcare technologies, positioning him with a unique understanding of product impact on a wide variety of healthcare focused stakeholders. While serving as CEO of GE’s Molecular Imaging and Computed Tomography business, he oversaw the launch of a revolutionary CT portfolio, game-changing, deep learning-based image reconstruction and patient positioning technology, as well as the world’s first digital PET scanner, transforming GE’s position in the cancer, oncology, and cardiac care markets globally. Talent Management; Corporate Governance and Sustainability: Acquired in his most recent role as Chief Diversity Officer for GE, where he was responsible for leading the approximately 179,000 employee company’s inclusion and diversity strategy to drive sustainable change with an added focus on enhancing employee engagement, leadership accountability, building an inclusive culture and reinvigorating inclusion and diversity learning and mentoring. He also brings valuable insight from his experience overseeing human capital management efforts, including a deep understanding of human resources, labor relations and sustainability matters. Executive Leadership: Obtained from Mr. Barber’s numerous executive leadership positions throughout his career at GE. While serving as CEO of GE’s Molecular Imaging and Computed Tomography business, he was responsible for driving growth and innovation to meet customer and business needs for multiple product lines. His executive responsibilities have also included oversight of complex operational execution of healthcare company manufacturing processes. CAREER HIGHLIGHTS General Electric (NYSE: GE) – multinational provider of energy solutions, jet engines and healthcare technologies •Chief Diversity Officer (2020-2022) •President and Chief Executive Officer, GE Molecular Imaging and Computed Tomography (2016-2020) •Chief Engineer, GE Healthcare and Chief Operating Officer, GE Healthcare Systems (2013-2015) •Vice President and General Manager, Molecular Imaging, GE Healthcare (2011-2012) •Vice President, Healthymagination Strategy (2009-2011) •Vice President of Technology, GE Healthcare (2007-2008) •Vice President of Engineering, Diagnostic Imaging (2005-2006) •Several additional roles (1982-2005) EDUCATION •B.S., Engineering, Milwaukee School of Engineering •Honorary Doctorate, Engineering, Milwaukee School of Engineering

| |

| | Michael Barber | | | |

| | (NOMINEE) | | | |

| | AGE: 63 INDEPENDENT DIRECTOR (CLASS III) SINCE: N/A | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Catalent, Inc. (NYSE: CTLT) (since 2021)

| | | |

| | | | | | | | |

| | |

| 10 | Exact Sciences 2024 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Clancy contributes over 30 years of experience in financial management and strategic business planning, as well as extensive financial leadership in the biopharmaceutical and biotechnology industries. His broad experience in strategic planning, financial management, capital allocation, mergers and acquisitions, business development and investor relations allow him to contribute insights to the Board’s oversight of value-creation initiatives. KEY SKILLS AND EXPERTISE Finance, Corporate Strategy and M&A: Acquired from his extensive financial and executive leadership experience at large, public companies with complex operations, including his former roles as the Chief Financial Officer of Alexion Pharmaceuticals, Inc. (Nasdaq: ALXN) and Biogen Inc. (Nasdaq: BIIB). During his tenure at Biogen, he oversaw the company’s rapid growth and shareholder value creation that ranked at the top decile of S&P 500 companies, driven by its expanded product lines and pipeline through organic growth opportunities and M&A. Mr. Clancy was recognized in the top three biotech CFOs in the Institutional Investor annual survey in all years from 2011-2020. Risk Management: As a board director at three other public life sciences companies, Mr. Clancy brings a deep understanding of the evolving risks associated with the industry. Additionally, he brings significant risk management expertise to the Board from his over 30-year career in financial management. His responsibilities have included leading the treasury, tax, investor relations and business planning groups of several multinational large companies. Diagnostics/Medical Device and Technology: Obtained through his service at executive level positions at large biopharmaceutical and biotechnology companies, where he was responsible for aligning the company’s financial management with strategic business planning. CAREER HIGHLIGHTS Alexion Pharmaceuticals, Inc. (Nasdaq: ALXN) – biopharmaceutical company •Executive Vice President and Senior Adviser (2019-2020) •Executive Vice President and Chief Financial Officer (2017-2019) Biogen, Inc. (Nasdaq: BIIB) – biotechnology company •Executive Vice President, Finance and Chief Financial Officer (2007-2017) •Senior Vice President, Finance (2006-2007) •Various other leadership roles, including Vice President, U.S. Marketing and Vice President of Portfolio Management (2001-2006) PepsiCo, Inc. (Nasdaq: PEP) – multinational food, snack and beverage company •Vice President and General Manager, Great West business unit (1997-2000) •Various other leadership positions (1987-1996) EDUCATION •B.S., Finance, Babson College •M.B.A., Columbia University | |

| | Paul Clancy | | | |

| | | | | |

| | AGE: 62 INDEPENDENT DIRECTOR (CLASS III) SINCE: 2021 COMMITTEES Audit and Finance (Chair) Corporate Governance and Nominating | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Xilio Therapeutics (Nasdaq: XLO) (since 2020) Incyte Corporation (Nasdaq: INCY) (since 2015)

Agios Pharmaceuticals (Nasdaq: AGIO) (2013-2023) | | | |

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 11 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Levangie contributes his extensive expertise in all stages of product pipeline development acquired through his executive leadership roles overseeing commercialization, sales and marketing, operations and talent management throughout different product’s life cycles. He has a proven track record of successfully operating and leading companies in in the in vitro diagnostics and medical devices fields, with extensive product development and commercialization expertise. KEY SKILLS AND EXPERTISE Pipeline Development/Commercialization; Talent Management: Developed extensive expertise through his over a 40-year career in the in vitro diagnostics and medical device industry, successfully overseeing complex diagnostic testing processes at the early stage of the pipeline development. Diagnostics/Medical Device and Technology: Acquired a deep knowledge of the healthcare industry, particularly in diagnostics and screening, from his experience overseeing a number of impactful, innovative diagnostic products in the oncology and diabetes markets while serving in senior executive roles with oversight responsibilities for driving growth initiatives and product integrations with other pharmaceutical products. Executive Leadership: Obtained significant executive leadership from numerous roles leading medical device and in vitro diagnostics companies, including as Chief Executive Officer of CereVasc, Dune Medical Devices and Keystone Dental, further enhanced by public company board experience. CAREER HIGHLIGHTS CereVasc, LLC – early-stage medical device company •Chairman, Founder, President and Chief Executive Officer (since 2018) ATON Partners – private management advisory and investment firm focused on healthcare companies and technologies •Founder and Managing Partner (2013-2018) Insulet Corporation (Nasdaq: PODD) – innovative medical device company •President, Insulet Drug Delivery (2013-2017) Dune Medical Devices, Inc. – medical device company focused on specialized diagnostic and therapeutic applications •Chief Executive Officer (2011-2013) Constitution Medical Investors, Inc (acquired by Roche in 2013) – private investment and product development firm •Co-Founder and Managing Partner (2008-2013) Keystone Dental – dental implant and manufacturing company •Chief Executive Officer (2009-2011) Cytyc Corporation (acquired by Hologic, Inc. in 2007) – in vitro diagnostics and medical device company focused on women’s health •Executive Vice President and Chief Operating Officer (2002-2007) •Various other leadership positions (1992-2007]) Abbott Laboratories (Nasdaq: ABT) – a diversified healthcare company •Various sales, marketing and management positions (1975-1992) EDUCATION •B.S., Pharmacy, Northeastern University

| |

| | Daniel Levangie | | | |

| | | | | |

| | AGE: 73 INDEPENDENT DIRECTOR (CLASS III) SINCE: 2010 COMMITTEES Audit and Finance Human Capital | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Renalytix, plc (Nasdaq: RNLX) (since 2021) Insulet Corporation (Nasdaq: PODD) (2011-2016) Hologic, Inc. (Nasdaq: HOLX) (2007-2009)

| | | |

| | | | | | | | |

| | |

| 12 | Exact Sciences 2024 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

Other Members of Our Board of Directors

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Coward contributes to the board decades of legal experience working with large corporations and emerging growth healthcare companies, where he has gained extensive legal and healthcare industry expertise. His previous role leading our legal department uniquely positions him with critical knowledge to advise on complex nuances that may impact our strategy and rapidly evolving business. KEY SKILLS AND EXPERTISE Diagnostics/Medical Device and Technology; Executive Leadership: Obtained significant operational and executive leadership experience from his multiple roles overseeing and advising the legal teams at a number of large public and early-stage growth companies. His strategic counsel included issues related to real estate, corporate affairs, governmental affairs, clinical and regulatory matters. Corporate Governance and Sustainability; Finance, Corporate Strategy, and M&A: Contributes a deep understanding of our business, gained during his time as our Chief Legal Officer, General Counsel, and Chief Administrative Officer, including experience analyzing and navigating legal, regulatory, compliance, corporate governance and sustainability issues, particularly as they affect the company’s corporate strategy and M&A. Pipeline Development/Commercialization, Global Business Perspective: Acquired expertise navigating the global, public company regulatory and legal landscape in the healthcare industry from his long career advising life sciences companies, including as a Managing Partner of the Raleigh, North Carolina office of K&L Gates LLP and as Associate General Counsel of GE Medical Systems. His pharmaceutical and biotechnology company counsel has spanned multiple pipeline development stages in areas including R&D, complex licensing, healthcare data and intellectual property. CAREER HIGHLIGHTS College of Charleston – public university •Adjunct professor of business law (since 2023) Exact Sciences (Nasdaq: EXAS) •Chief Legal Officer (January - December 2022) •Executive Vice President, Chief Administrative Officer (2018-2021) •Executive Vice President, General Counsel (2015-2022) K&L Gates LLP – global law firm •Managing Partner of Raleigh, NC office (2004-2014) Blue Rhino Corporation – leading supplier of consumer propane-related products •General Counsel (2003-2004) GE Medical Systems – a business of General Electric Company (NYSE: GE), medical electronic equipment manufacturer •Associate General Counsel (2002-2003) Smith Anderson Blount Dorsett Mitchell & Jernigan LLP – business and litigation law firm •Partner (1991-2002) EDUCATION •B.S., Business Administration, University of North Carolina at Chapel Hill •J.D., Columbia Law School | |

| | D. Scott Coward | | | |

| | | | | |

| | AGE: 59 NON-INDEPENDENT DIRECTOR (CLASS II) SINCE: 2022 COMMITTEES Innovation, Technology and Pipeline | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 13 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Doyle contributes extensive leadership experience from his career serving in various government leadership roles, including his two terms serving as the 44th Governor of the state of Wisconsin. He is a seasoned and skilled lawyer with expertise guiding both private and public companies as they operate through complex legal challenges and highly regulated industries. KEY SKILLS AND EXPERTISE Government, Regulatory, and Compliance: Mr. Doyle contributes significant government, regulatory and compliance experience from his decades serving in various elected official positions, including as Governor of Wisconsin, where he worked closely with policy makers and gained insights into policy and regulatory issues impacting the healthcare industry. He has experience working closely with the White House, high-ranking Administration officials and other governors, has led multiple coordinated multi-state legislative efforts and has argued three cases before the U.S. Supreme Court. Medical Practice and Public Health; Risk Management: Acquired throughout his career providing strategic legal counsel in the healthcare industry, including his oversight work of a major Medicare program and initiatives to expand healthcare coverage for state residents and advising clients on compliance with the evolving legal and regulatory frameworks governing the healthcare industry. He contributes to the Board strong analytical skills to evaluate the legal and regulatory risks affecting our business and strategy. Executive Leadership; Talent Management: Obtained proven executive leadership, managerial and talent management skills from his time serving as an elected state official and law firm partner. CAREER HIGHLIGHTS Foley and Lardner LLP – international law firm •Of Counsel (since 2011) Doyle & Boyce Strategies – national foundations consultant •Partner (since 2011) State of Wisconsin, U.S. •44th State Governor (2003-2011) •Attorney General (1991-2003) •District Attorney, Dane County (1977-1982) EDUCATION •B.A.,University of Wisconsin-Madison •J.D., Harvard Law School | |

| | James Doyle | | | |

| | | | | |

| | AGE: 78 INDEPENDENT DIRECTOR (CLASS II) SINCE: 2014 COMMITTEES Human Capital Corporate Governance and Nominating | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | |

| | |

| 14 | Exact Sciences 2024 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Ms. Sebelius is one of America’s leading experts on national and global health issues, human services and executive leadership and contributes decades of public and private company health policy insights to the Board. She brings a proven track record of delivering strategic advice to companies, investors and non-profit organizations, and is a distinguished government official with robust knowledge of the healthcare industry. KEY SKILLS AND EXPERTISE Medical Practice and Public Health: Obtained medical practice and public health experience from time spent overseeing federal and state health medical programs and agencies while serving as the U.S. Secretary of Health and Human Services, including her critical contributions to the approval and implementation of the Affordable Care Act. Executive Leadership; Talent Management: Brings extensive leadership track record in the healthcare reimbursement industry and talent development experience in the public sector, including serving as the former Governor of Kansas. During her time as the U.S. Secretary of Health and Human Services, she was responsible for managing 11 operating agencies, 90,000 employees across 50 countries and a $1.0 trillion budget. Government, Regulatory, and Compliance: Through her service in a number of elected public official leadership positions has developed a significant understanding of government policy and familiarity with healthcare and government processes, which allows Ms. Sebelius to contribute invaluable insights into relevant regulatory processes and policies that may impact our company as it relates to our compliance, growth strategy and evolving risks. CAREER HIGHLIGHTS Sebelius Resources LLC – strategic consultant firm •Chief Executive Officer (since 2014) President Barack Obama’s Cabinet •U.S. Secretary of Health and Human Services (2009-2014) State of Kansas •Governor (2003-2009) •Insurance Commissioner (two terms, 1995-2003) •Kansas Legislature (four terms, 1987-1995) Kansas Trial Lawyers Association – non-profit bar organization for lawyers in Kansas •Executive Director and Chief Lobbyist (1977-1986) EDUCATION •B.A., Trinity Washington University •M.P.A., University of Kansas | |

| | Kathleen Sebelius | | | |

| | | | | |

| | AGE: 75 INDEPENDENT DIRECTOR (CLASS II) SINCE: 2019 COMMITTEES Corporate Governance and Nominating Innovation, Technology and Pipeline | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Humacyte, Inc. (Nasdaq: HUMA) (since 2015) Myovant Sciences Ltd (NYSE: MYOV) (2016-2021) Demira, Inc. (Nasdaq: DERM) (2015-2020) | | | |

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 15 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Mr. Conroy has served as our Chief Executive Officer since 2009, and as Chairman of our Board of Directors since 2014. He has been responsible for transforming the organization into one of the world’s premier cancer diagnostics companies and contributes his extensive business knowledge, legal and executive leadership experience and strategic counsel to the Board. His familiarity with the biotechnology industry follows an over 20-year career in the healthcare and health technology space. KEY SKILLS AND EXPERTISE Executive Leadership; Finance, Corporate Strategy, and M&A: Obtained from his tenure as Chief Executive Officer of two major public diagnostics companies, Exact Sciences (Nasdaq: EXAS) and Third Wave Technologies (Nasdaq: TWTI). As our Chief Executive Officer, he has created shareholder value through innovative new technologies and key acquisitions, including Genomic Health and Thrive Earlier Detection, and positioned the Company as a global leader in cancer screening and diagnostics. Diagnostics/Medical Device and Technology; Science, Research, and Development: Acquired significant experience overseeing the development, regulatory approval, and commercialization of diagnostic tests and building a high performing team culture within our Company. While Chief Executive Officer of Exact Sciences, he spearheaded collaborative research efforts to identify highly discriminant cancer biomarkers, leading to the development of Cologuard®, a proprietary multi-marker test for the early detection of colorectal cancer. Pipeline Development/Commercialization; Global Business Perspective: In his current role as Chief Executive Officer, he has led the Company through the regulatory approval and commercialization of Cologuard® - the first cancer diagnostic test to receive simultaneous FDA approval and national Medicare coverage. Separately, while serving as Chief Executive Officer of Third Wave Technologies, he was responsible for the successful development oversight of Cervista, a cervical cancer screening test. His insight and global perspective into the development, regulatory approval and commercialization processes of diagnostic tests provides valuable insight to the Board in shaping our business strategy. CAREER HIGHLIGHTS Exact Sciences (Nasdaq: EXAS) •President, Chairman and Chief Executive Officer (since 2009, Chairman since 2014) Third Wave Technologies, (Nasdaq: TWTI) (acquired by Hologic, Inc. in 2008) – molecular diagnostics business •President and Chief Executive Officer (2005-2008) •General Counsel (2004-2005) GE Healthcare – healthcare technology arm of General Electric (NYSE: GE) •Intellectual Property Counsel (2002-2004) EDUCATION •B.S., Electrical Engineering, Michigan State University •J.D., University of Michigan | |

| | Kevin Conroy | | | |

| | | | | |

| | AGE: 58 NON-INDEPENDENT DIRECTOR (CLASS I) SINCE: 2009 COMMITTEES None | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Align Technology, Inc. (Nasdaq: ALGN) (since 2023) Adaptive Biotechnologies Corporation (Nasdaq: ADPT) (2019-2023) Epizyme, Inc. (Nasdaq: EPZM) (2017-2022) CM Life Sciences II Inc. (Nasdaq: CMIIU) (2021) SomaLogic, Inc. (Nasdaq: SLGC) (2021) Arya Sciences Acquisition Corp. (Nasdaq: ARYA) (2018-2020) | | | |

| | | | | | | | |

| | |

| 16 | Exact Sciences 2024 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Ms. Petrovic contributes decades of experience as an executive in the medical device industry, where she is well-known as a visionary and inspiring leader who has dedicated her career to improving care for patients, while bringing tremendous value to the clinical community. She contributes extensive industry leadership experience and first-hand oversight of the successful launch of impact-focused technologies and medical devices, which have positively impacted business growth. KEY SKILLS AND EXPERTISE Executive Leadership; Pipeline Development/Commercialization: During Ms. Petrovic’s tenure as Chief Executive Officer of Insulet Corporation (Nasdaq: PODD), she spearheaded a period of strong financial growth as the company shifted to pharmacy and launched its flagship innovation, the Omnipod 5. She also contributes deep sales and marketing experience to the Board from her previous role as Chief Executive Officer at Clinical Innovations and several leadership positions at Hologic (Nasdaq: HOLX). Diagnostics/Medical Device and Technology; Government, Regulatory, and Compliance: Obtained from her career of developing deep relationships within the healthcare industry, particularly within diagnostics and screening, which has been critical in her oversight of the full commercialization lifespan of medical device products, including the critical regulatory approval stage. Talent Management; Finance, Corporate Strategy, and M&A: Acquired valuable talent acquisition and management experience from her numerous leadership positions of increasing responsibility at both Insulet Corporation and Hologic. While serving as Chief Executive Officer of Insulet Corporation, her responsibilities included active ultimate oversight of the finance and corporate strategy functions, which resulted in the company’s growth from $2 billion to over $20 billion in market capitalization. CAREER HIGHLIGHTS Insulet Corporation, (Nasdaq: PODD) – innovative medical device company •Board Member and Advisor (2018-2024) •President and Chief Executive Officer (2019-2022) •President and Chief Operating Officer (2016-2018) •President, Insulet Diabetes Products (2016) •Chief Commercial Officer (2015-2016) Clinical Innovations, LLC – developer and manufacturer of medical devices and diagnostics for women’s health •President and Chief Executive Officer (2013-2015) Hologic, Inc, (Nasdaq: HOLX) – medical technology company •Vice President and General Manager, GYN Surgical Products (2012-2013) •Vice President, Global Surgical Marketing (2010-2012) •Business Director (2008-2010) Cytyc Corporation (acquired by Hologic, Inc. in 2007) – biotechnology company focused on women’s health •Various leadership roles, including in sales (2000-2007) EDUCATION •B.S., Biology, University of Wisconsin-Milwaukee | |

| | Shacey Petrovic | | | |

| | | | | |

| | AGE: 50 INDEPENDENT DIRECTOR (CLASS I) SINCE: 2020 COMMITTEES Corporate Governance and Nominating (Chair) | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Ambu A/S (Nasdaq Nordic: AMBU B) (since 2022) Insulet Corporation (Nasdaq: PODD) (2018-2024) | | | |

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 17 |

| | | | | | | | |

| INFORMATION CONCERNING DIRECTORS AND NOMINEES FOR DIRECTOR |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | DIRECTOR QUALIFICATIONS Ms. Zanotti contributes over four decades of health and personal care industry expertise, including executive and senior leadership experience. She contributes an impressive track record of successfully executing on international omni-channel growth initiatives, with valuable insights on go-to-market and customer engagement strategies that have reached millions of global customers. KEY SKILLS AND EXPERTISE Executive Leadership; Finance, Corporate Strategy, and M&A: Obtained from her various executive and senior level leadership experiences, including multiple public company board directorships. In her most recent role as Chief Executive Officer of Arbonne International, she was responsible for successfully fortifying the company’s financial standing and reputation as a premium international skin care and wellness enterprise. She has also overseen three public company sale transactions to strategic acquirers throughout her career. Pipeline Development/Commercialization: Acquired over four-decade career in health and personal care industry where she led global commercialization of multiple consumer products at Procter & Gamble (NYSE: PG), McDonald's Corporation (NYSE: MCD), and Arbonne International; led global pipeline development of pharmaceutical products for P&G, and then commercialized in North American market. All leadership positions led to significant business growth and profitability. Talent Management; Corporate Governance and Sustainability: Developed from her time serving on six public company boards, where she has contributed her expertise in compensation and talent acquisition and development. Her former directorships include companies focused on creating cleaner, more efficient and safer consumer and medical technology products that have helped transform the health and wellness industry. CAREER HIGHLIGHTS Arbonne International (acquired by Groupe Rocher in 2018) – botanically based skin care, cosmetic and nutrition company •Chief Executive Officer (2009-2018) McDonald’s Corporation, (NYSE: MCD) – global fast-food chain •Senior Vice President, Marketing (2002-2006) Procter & Gamble, (NYSE: PG) – manufacturer and marketer of consumer goods •Vice President and General Manager, North American Pharmaceutical and Corporate Women’s Health (1997-2002) •Various other leadership roles (1979-1997) EDUCATION •B.A., Economics/Studio Fine Arts, Georgetown University •M.B.A., Finance and Marketing, Xavier University

| |

| | Katherine Zanotti | | | |

| | | | | |

| | AGE: 69 INDEPENDENT DIRECTOR (CLASS I) SINCE: 2009 COMMITTEES Human Capital (Chair) | | | |

| | | | | |

| | | | | |

| | OTHER PUBLIC COMPANY BOARD DIRECTORSHIPS Diversey Holdings, Ltd. (Nasdaq: DSEQ) (2022-2023) Cutera, Inc. (Nasdaq: CUTR) (2019-2022) Hill-Rom Holdings, Inc. (NYSE: HRC) (2009-2013) Mentor Corporation (NYSE: MNT) (2007-2009) Alberto Culver Company (NYSE: ACV) (2006-2009) Third Wave Technologies, Inc. (Nasdaq: TWTI) (2006-2008) | | | |

| | | | | | | | |

| | |

| 18 | Exact Sciences 2024 Proxy Statement | |

INFORMATION CONCERNING EXECUTIVE OFFICERS

Below is background information relating to our executive officers. Kevin Conroy is discussed above under “Information Concerning Directors and Nominees for Director”.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Brian Baranick | | | | | |

| | | | | | | |

| | | | | | Brian Baranick, age 46, has served as General Manager, Precision Oncology since July 2022, and served as Senior Vice President, Strategy and Business Development from February 2021 to July 2022, and Vice President, Corporate Strategy from August 2020 to February 2021. Prior to joining Exact Sciences, Mr. Baranick was with L.E.K. Consulting, LLC, where Mr. Baranick was a Partner and Managing Director focused on growing the diagnostics and life science tools segment of L.E.K.’s healthcare vertical from 2007 to July 2020. Mr. Baranick holds a Ph.D. in Molecular Biology from the University of California Los Angeles. | |

| | Position: Executive Vice President and General Manager, Precision Oncology | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Aaron Bloomer | | | | | |

| | | | | | | |

| | | | | | Aaron Bloomer, age 38, has served as Executive Vice President, Finance since April 15, 2024, and will succeed Jeffrey Elliott as our Chief Financial Officer following a 30-day transition period. Prior to joining Exact Sciences, Mr. Bloomer previously served as the Vice President, Corporate Financial Planning, Reporting, and Analytics for Baxter International Inc. (NYSE: BAX), where he led Baxter International’s global financial planning and reporting function. Prior to joining Baxter International in August 2021, Mr. Bloomer held a series of increasingly senior roles with 3M Company (NYSE: MMM) from June 2008 to August 2021, including Senior Vice President, Corporate Financial Planning, Reporting and Analytics of 3M, Vice President and CFO of 3M’s Greater China area, Global Director and Division CFO for 3M’s Display Materials Division, and Global Senior Finance Manager and Division CFO of 3M’s Consumer Health Care Division. Mr. Bloomer earned a bachelor’s degree in business administration from the University of Wisconsin-Eau Claire and an M.B.A. from the University of Minnesota. | |

| | Position: Executive Vice President, Finance | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Sarah Condella | | | | | |

| | | | | | | |

| | | | | | Sarah Condella, age 43, has served as our Executive Vice President, Human Resources since January 2021, and previously served in increasing roles of responsibility, including as Senior Vice President, Human Resources; Vice President; Senior Director; and Director, since joining Exact Sciences in 2012. Prior to joining Exact Sciences, Ms. Condella served as a Human Resources Manager at GE Healthcare and as a Manager and Project Director at the University of Wisconsin Survey Center. Ms. Condella currently serves on the board of the Madison Children’s Museum. Ms. Condella earned a bachelor’s degree and an M.B.A. from the University of Wisconsin-Madison. | |

| | Position: Executive Vice President, Human Resources | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 19 |

| | | | | | | | |

| INFORMATION CONCERNING EXECUTIVE OFFICERS |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Everett Cunningham | | | |

| | | | | | | |

| | | | | | Everett Cunningham, age 57, has served as our Chief Commercial Officer since 2021. Prior to joining Exact Sciences, Mr. Cunningham served as President & Chief Executive Officer of GE Healthcare’s U.S. & Canada region from July 2019 to October 2021. Before joining GE, Mr. Cunningham served as the Senior Vice President, Commercial at Quest Diagnostics, where he was responsible for global sales, marketing, and commercial operations from October 2012 to July 2019. Mr. Cunningham also served in numerous senior leadership roles at Pfizer, including Regional President, Established Products for Asia Pacific, Senior Director of Worldwide Learning and Development, Senior Director of Business Operations, Vice President Sales for U.S. Pharmaceuticals, and Vice President of Global Corporate Human Resources. Mr. Cunningham earned a bachelor’s degree in economics from Northwestern University. | |

| | Position: Executive Vice President and Chief Commercial Officer | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Jeffrey Elliott | | | | | |

| | | | | | | |

| | | | | | Jeffrey Elliott, age 46, has served as our Chief Financial Officer since November 2016. Prior to his appointment as Chief Financial Officer, Mr. Elliott served as the Company’s Vice President, Business Development and Strategy, from June 2016 to November 2016. Prior to joining the Company, from 2007 to 2016, Mr. Elliott was with Robert W. Baird & Co., where from June 2012 to June 2016, he was a senior research analyst covering diagnostics and life science tools companies. Earlier in his career, Mr. Elliott worked in a supply chain role for Walgreens and as a consultant at Cap Gemini Ernst & Young. Mr. Elliott earned a bachelor’s degree in business administration from the University of Illinois at Urbana-Champaign and an M.B.A. from the University of Chicago Booth School of Business. Mr. Elliott is a CFA charterholder. | |

| | Position: Executive Vice President, Chief Financial Officer | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | James Herriott | | | | | |

| | | | | | | |

| | | | | | James Herriott, age 44, has served as our Senior Vice President, General Counsel since January 2022 and as our Secretary since December 2022. Mr. Herriott previously served as our Deputy General Counsel from February 2020 until January 2022 and Senior Counsel from August 2018 to February 2020. Mr. Herriott joined us from the global law firm K&L Gates LLP, where he practiced corporate and securities law. Prior to his tenure at K&L Gates, Mr. Herriott practiced corporate and securities law at Paul Hastings LLP. Mr. Herriott earned a bachelor’s degree in economics from Duke University and a Juris Doctorate from Vanderbilt University Law School. | |

| | Position: Senior Vice President, General Counsel | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | |

| | |

| 20 | Exact Sciences 2024 Proxy Statement | |

| | | | | | | | |

| INFORMATION CONCERNING EXECUTIVE OFFICERS |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Jacob Orville | | | | | |

| | | | | | | |

| | | | | | Jacob Orville, age 50, has served as our General Manager, Screening since July 2022, as General Manager, Pipeline from November 2019 to July 2022, and as Senior Vice President, Pipeline from February 2019 to November 2019. Mr. Orville previously served as General Manager, Cardiometabolic & Endocrinology Franchise at Quest Diagnostics, Inc. from November 2017 to February 2018. Mr. Orville co-founded Cleveland HeartLab, Inc. in December 2008 and served as its Chief Executive Officer from December 2008 to November 2017, when it was acquired by Quest Diagnostics. Earlier in his career, Mr. Orville served in leadership and operational roles at NextGen Sciences, Inc. and Third Wave Technologies, Inc. Mr. Orville earned a bachelor’s degree from University of Massachusetts-Amherst and an M.B.A. from the University of Wisconsin-Madison. | |

| | Position: Executive Vice President and General Manager, Screening | | | |

| | | | | | |

| | | | | | | |

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 21 |

CORPORATE GOVERNANCE PRINCIPLES, BOARD MATTERS, AND NON-EMPLOYEE DIRECTOR COMPENSATION

Board Independence

Our Board of Directors has determined that Michael Barber, Paul Clancy, James Doyle, Pierre Jacquet, Daniel Levangie, Freda Lewis-Hall, Shacey Petrovic, Timothy Scannell, Kathleen Sebelius, and Katherine Zanotti are each independent within the meaning of the director independence standards of The Nasdaq Stock Market (“Nasdaq”). Furthermore, our Board of Directors has determined that all of the members of our Audit and Finance Committee, Human Capital Committee, and Corporate Governance and Nominating Committee are independent within the meaning of the director independence standards of Nasdaq and the rules of the SEC applicable to each such committee.

Our Board of Directors has determined that Kevin Conroy and D. Scott Coward are not independent within the meaning of director independence standards of Nasdaq.

Executive Sessions of Independent Directors

Executive sessions of our independent directors are generally scheduled following each regularly scheduled meeting of our Board of Directors. Executive sessions are led by James Doyle, our Lead Independent Director, who actively solicits other independent directors for agenda items in advance of such meetings. The independent directors utilize the executive sessions to discuss, among other items, corporate strategy and planning, including succession planning for our executive officers.

Board Qualifications

Our Corporate Governance and Nominating Committee is responsible for identifying the desired qualifications, skills, and characteristics of our Board of Directors, considering the needs of the business and the current composition of our Board.

Director candidates are considered based upon a variety of criteria, including demonstrated business and professional skills and experiences relevant to our business and strategic direction, concern for long-term shareholder interests, personal integrity, and sound business judgment. Our Board of Directors seeks members from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise that, in concert, offer us and our shareholders diversity of opinion and insight in the areas most important to us and our corporate mission. In addition, nominees for director are selected to have complementary, rather than overlapping, skill sets. When filling positions for Board membership, including through retained searches by third party search firms, we are committed to actively seeking qualified candidates with a broad range of experience, viewpoints, professions, skills, geographic representations, and backgrounds as well as diversity of race, ethnicity, gender, age, and culture. All director candidates must have time available to devote to the activities of our Board of Directors. Our Corporate Governance and Nominating Committee also considers the independence of director candidates, including the appearance of any conflict in serving as a director.

Director candidates who do not meet all of these criteria may still be considered for nomination to our Board of Directors if our Corporate Governance and Nominating Committee believes that the candidate will make an exceptional contribution to us and our shareholders.

Board Leadership Structure

Currently, Mr. Conroy serves as both the Chairman of our Board of Directors (the “Chairman”) and the Chief Executive Officer (“CEO”) of the Company and Mr. Doyle serves as the Company’s Lead Independent Director. Our By-laws permit the positions of CEO and Chairman to be held by the same person, and our Board of Directors believes that it is in the best interests of the Company to retain flexibility in determining whether to separate or combine the roles of Chairman and CEO based on our circumstances. While our Board of Directors does not have a formal policy regarding the separation of the roles of Chairman and CEO, our Board of Directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure to provide independent oversight of senior management, a highly engaged Board of Directors, and the right balance between (i) effective independent oversight of the Company’s business, (ii) our Board of Directors’ activities, and (iii) consistent corporate leadership. On at least

| | | | | | | | |

| | |

| 22 | Exact Sciences 2024 Proxy Statement | |

| | | | | | | | |

| CORPORATE GOVERNANCE PRINCIPLES, BOARD MATTERS AND NON-EMPLOYEE DIRECTOR COMPENSATION |

an annual basis, our Corporate Governance and Nominating Committee reviews our corporate leadership structure. As part of its most recent such assessment, the Corporate Governance and Nominating Committee gave thorough consideration to a number of factors, including, but not limited to, the pros and cons of alternative leadership structures given the Company’s current operating and governance environment, investor feedback, and the dynamics of our Board of Directors.

Based upon these considerations and the recommendation of the Corporate Governance and Nominating Committee, our Board of Directors determined to maintain our Board of Directors’ current leadership structure with Mr. Conroy serving as both the Chairman of our Board of Directors and the CEO of the Company. Our Board of Directors based this determination on (1) Mr. Conroy’s extensive experience in and knowledge of the Company, the molecular diagnostics industry, and the regulatory environment; (2) the highly effective bridge Mr. Conroy’s service provides between our Board of Directors and the Company’s management; (3) Mr. Conroy’s continued leadership and vision necessary to lead our Board of Directors and the Company through its challenging industry and macroeconomic environments; (4) Mr. Conroy’s investor-focused perspective; and (5) the effective independent leadership provided on our Board of Directors by our Lead Independent Director, other independent directors, and our standing committees, which are comprised almost entirely of independent directors.

Pursuant to our Corporate Governance Guidelines, at any time that the Company does not have an independent chairman of our Board of Directors, our Board of Directors appoints an independent director to serve as Lead Independent Director. The Lead Independent Director is elected to serve a one-year term commencing upon the adjournment of the annual meeting of shareholders until the adjournment of the following year’s annual meeting of shareholders, subject to such individual’s earlier death, resignation, or removal or replacement by the Board. Our Corporate Governance Guidelines empower our Lead Independent Director with well-defined duties that are further summarized below. In addition, our Board of Directors—which currently is comprised of 82% independent directors—exercises a strong, independent oversight function which enhances the accountability of the senior management team to our Board of Directors and provides for robust and impartial leadership and a unified voice that is accountable to our shareholders. This oversight function is enhanced by the fact that our Audit and Finance, Human Capital, and Corporate Governance and Nominating Committees are comprised entirely of independent directors. Further, our Board of Directors meetings include regular executive sessions of the independent directors and an annual evaluation of our CEO’s performance against pre-determined goals. Our Board of Directors can and will change its leadership structure if our Board of Directors determines that doing so is in the best interest of our Company and shareholders.

| | |

| Lead Independent Director Duties |

|

•Counsel the CEO on issues of interest and/or concern to the independent directors •Coordinate, develop the agenda for, and chair executive sessions of the Board's independent directors •Act as principal liaison between the independent directors and the CEO on sensitive issues •Lead the annual CEO review process and meet with the CEO to discuss such evaluation •Review recommendations for retention of consultants who report directly to our Board of Directors •Provide our Board of Directors’ Chair with input as to the preparation of the agenda for Board of Directors meetings •Advise our Board of Directors’ Chair as to the quantity, quality, and timeliness of the flow of information from management to the independent directors |

Corporate Governance Guidelines

Our Board of Directors has approved, upon the recommendation of the Corporate Governance and Nominating Committee, a set of Corporate Governance Guidelines under which our Board of Directors and its committees operate. Our Corporate Governance Guidelines assist our Board of Directors and its committees in the exercise of their responsibilities and establish a common set of expectations and guidelines in order to provide a strong and robust governance framework for the Company. Among other topics, our Corporate Governance Guidelines address the following matters:

| | | | | | | | |

| | |

| Exact Sciences 2024 Proxy Statement | 23 |

| | | | | | | | |

| CORPORATE GOVERNANCE PRINCIPLES, BOARD MATTERS AND NON-EMPLOYEE DIRECTOR COMPENSATION |

•Board evaluation: Our Board of Directors annually conducts a confidential performance evaluation to determine whether it and its committees are functioning effectively. As part of this evaluation, each director completes a written self-assessment questionnaire with a variety of questions designed to gather suggestions for improving the effectiveness of the Board of Directors and its committees and to solicit feedback on a range of issues, including Board composition, Board dynamics, the Board’s relationship with senior management, Board agendas and meetings, Board processes, and Board committees.

•Limitation on other board service: Carrying out the duties and fulfilling the responsibilities as a member of our Board of Directors requires a significant commitment of an individual’s time and attention. Accordingly, the Company’s Corporate Governance Guidelines provide (1) no director who serves as the chief executive officer of, or occupies an equivalent position at, any public company (including the Company) should serve on the boards of directors of more than two public companies (including the Company), (2) no other director should serve on the boards of directors of more than four public companies (including the Company), and (3) no member of the Audit and Finance Committee should serve simultaneously on the audit committees of more than three public companies (including the Company), in each case unless the Board determines that such service would not impair the ability of such director to effectively serve on the Board or the Audit and Finance Committee, as applicable. Directors must notify the Chair of the Corporate Governance and Nominating Committee in connection with accepting a seat on the board of directors of another business corporation so that the potential for conflicts or other factors compromising the director’s ability to perform his or her duties may be fully assessed.

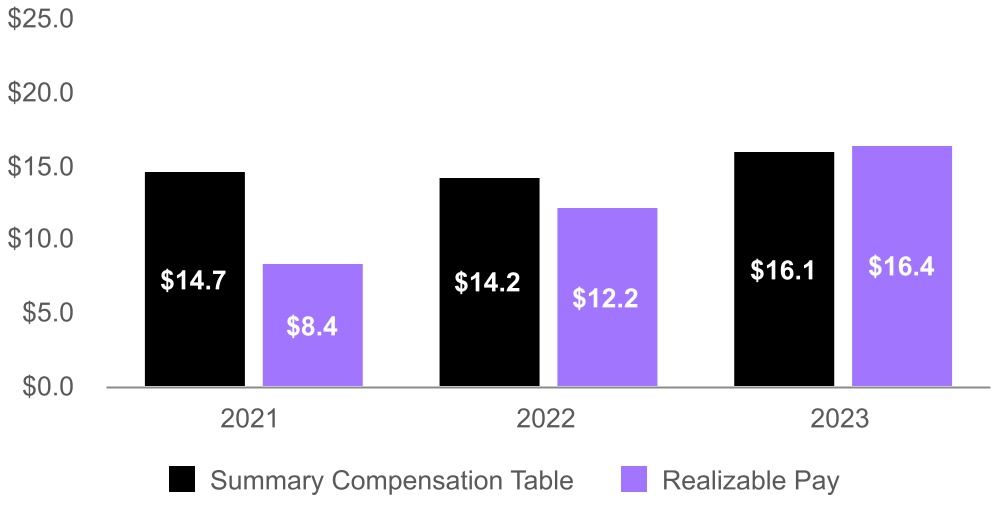

•Board and committee meeting attendance: Each member of the Board is expected to make reasonable efforts to attend regularly scheduled meetings of the Board and to participate in telephone conference meetings or other special meetings of the Board. Attendance and participation at meetings are important components of the directors’ duties and, as such, attendance rates are taken into account by the Corporate Governance and Nominating Committee in connection with assessments of director candidates for re-nomination as directors.