| 1

automotive components companies Johnson Controls7 and BorgWarner. Other major detractors included energy equipment and services company Weatherford International,5 financial services company Morgan Stanley, metals and mining concern Rio Tinto5, 7 and industrial conglomerate Siemens.5, 7

Thank you for your continued participation in Franklin Large Cap Equity Fund. We look forward to serving your future investment needs.

Portfolio Management Team

Franklin Large Cap Equity Fund

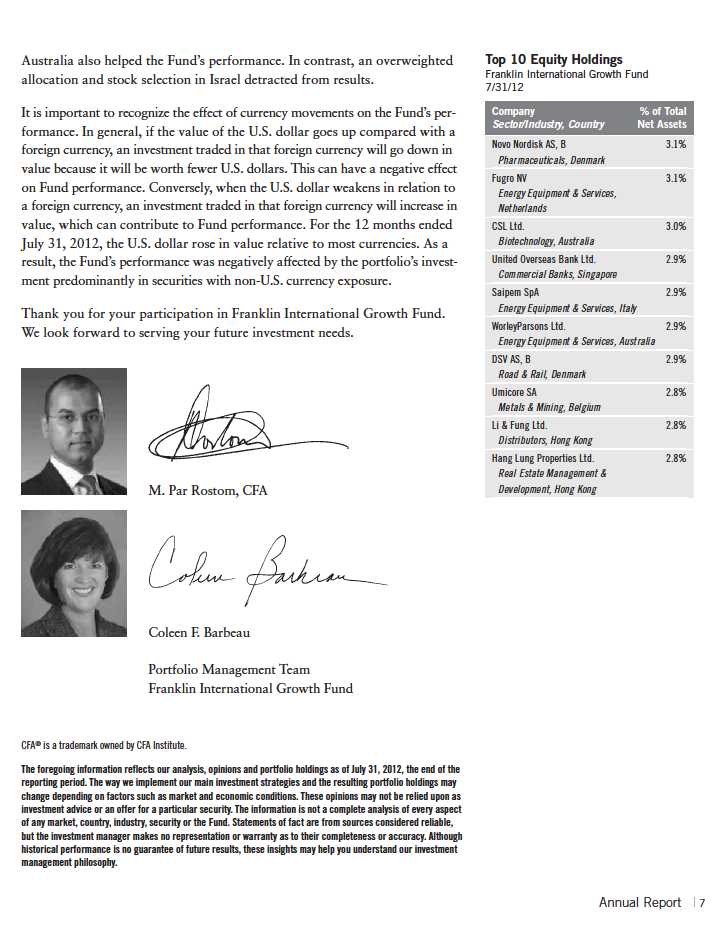

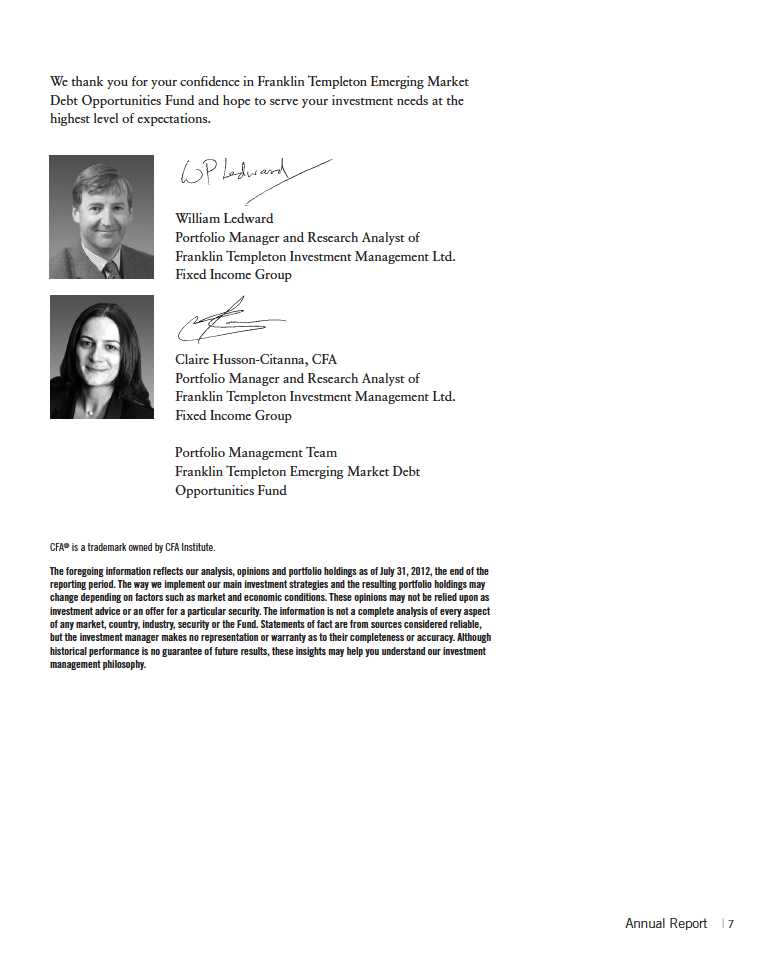

The foregoing information reflects our analysis, opinions and portfolio holdings as of July 31, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 | Annual Report

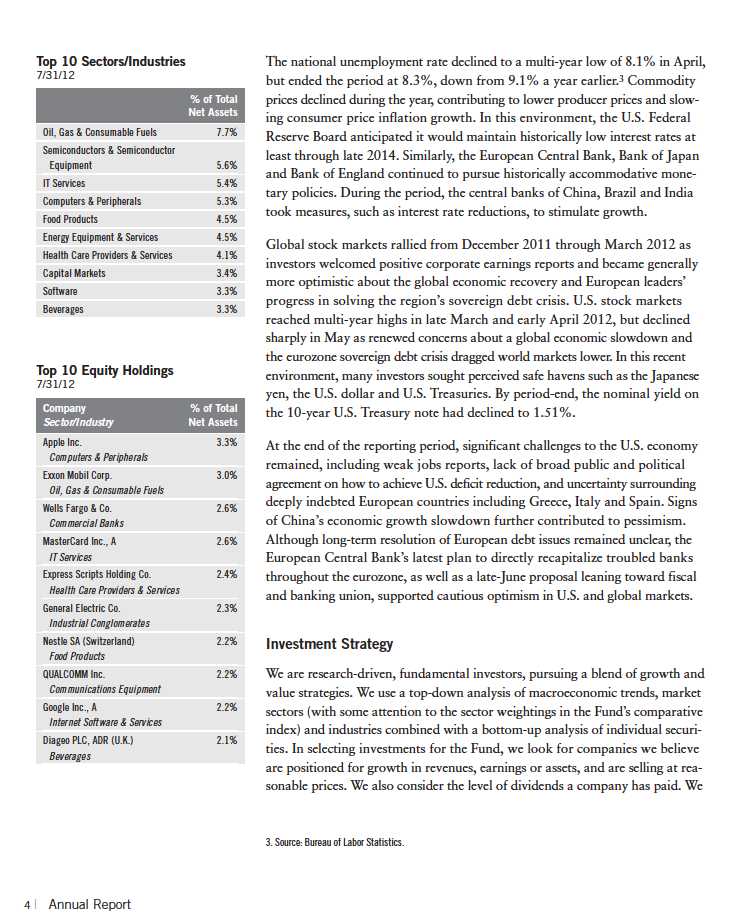

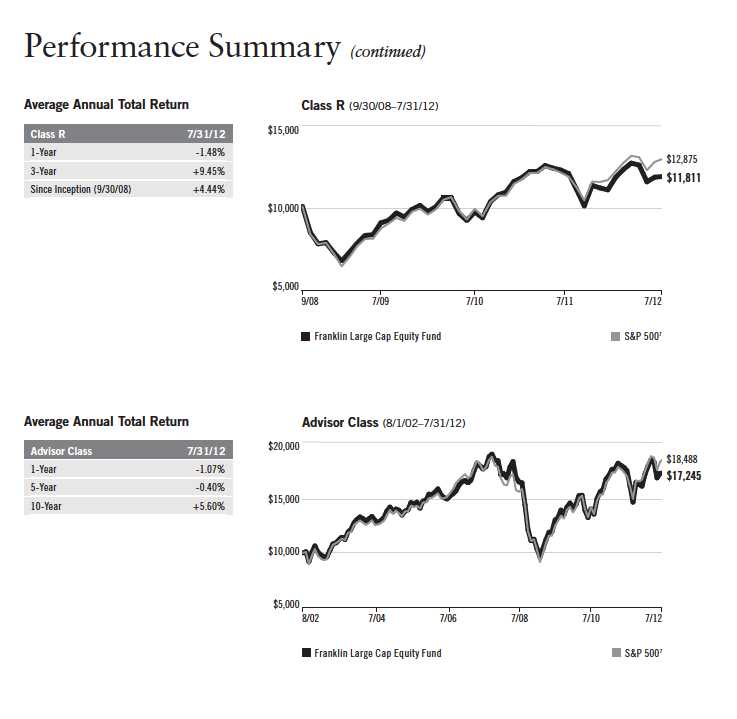

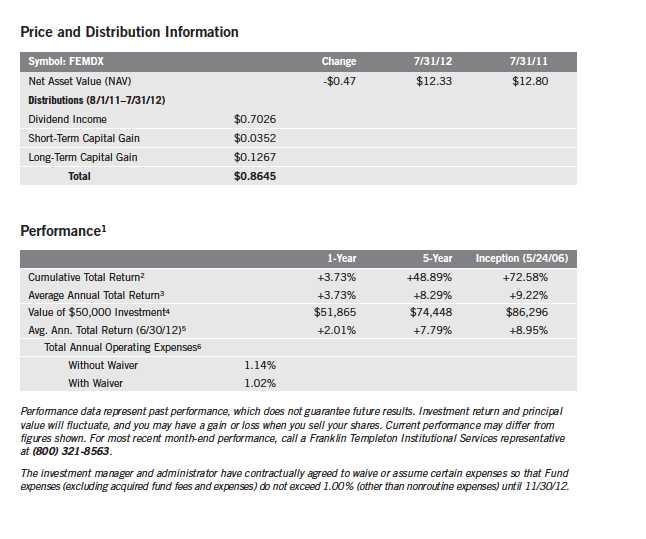

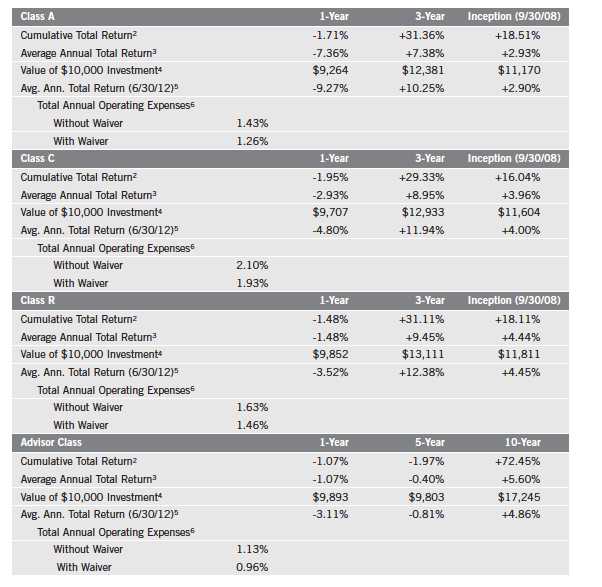

Performance Summary as of 7/31/12

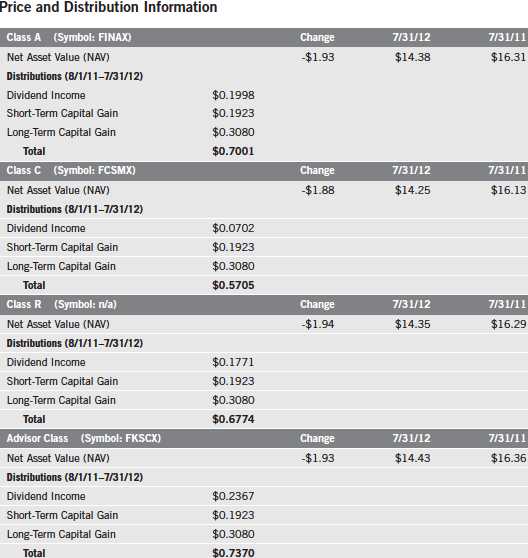

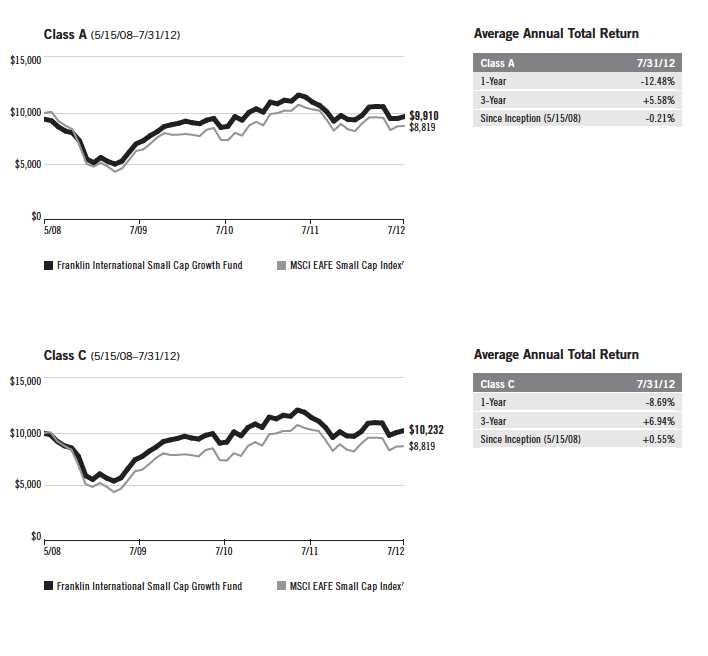

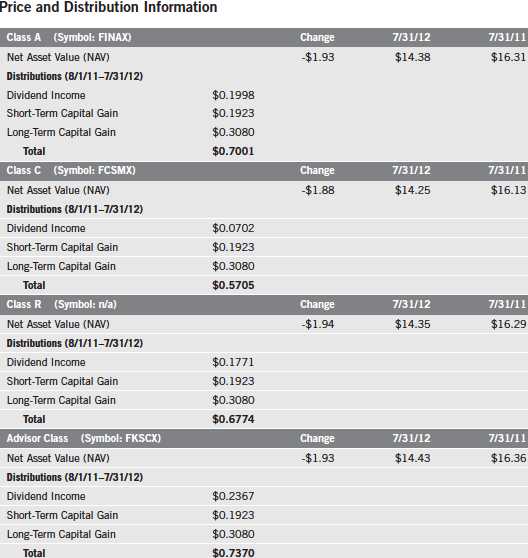

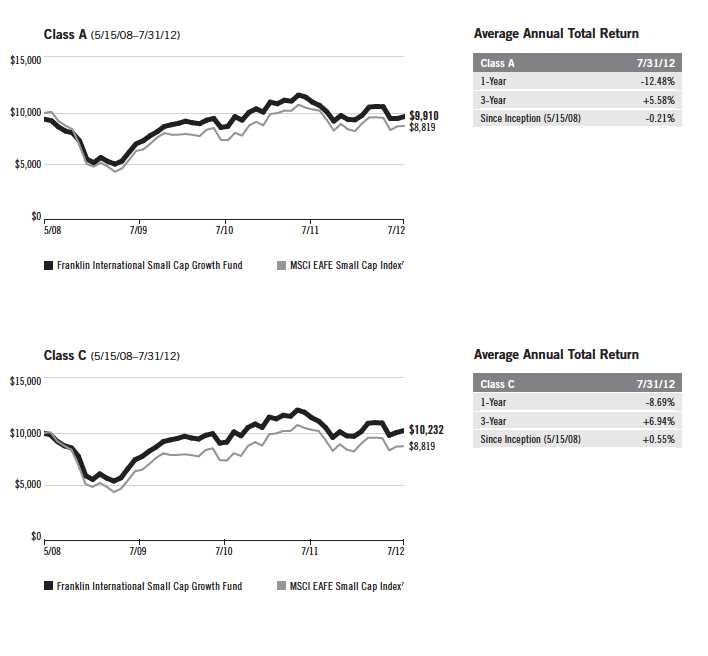

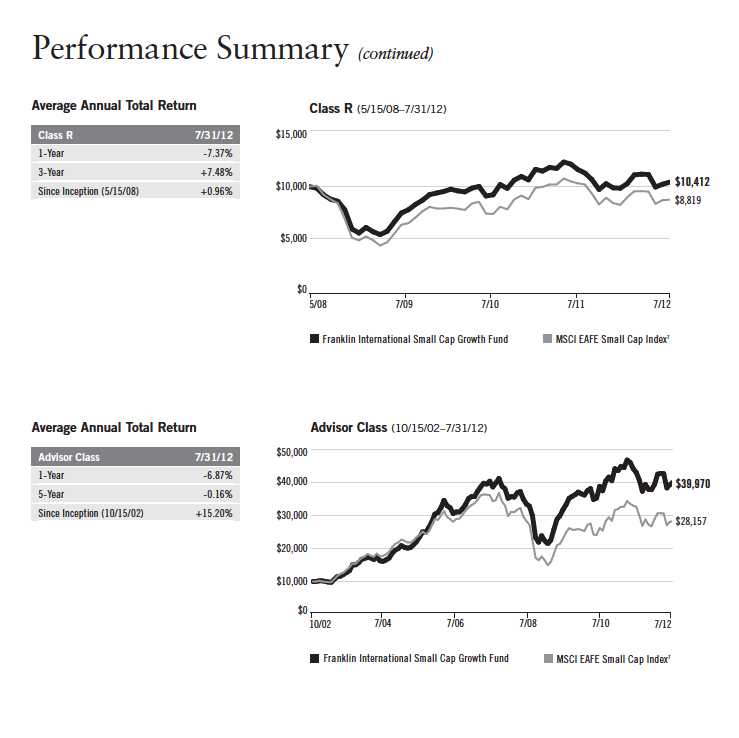

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Annual Report | 7

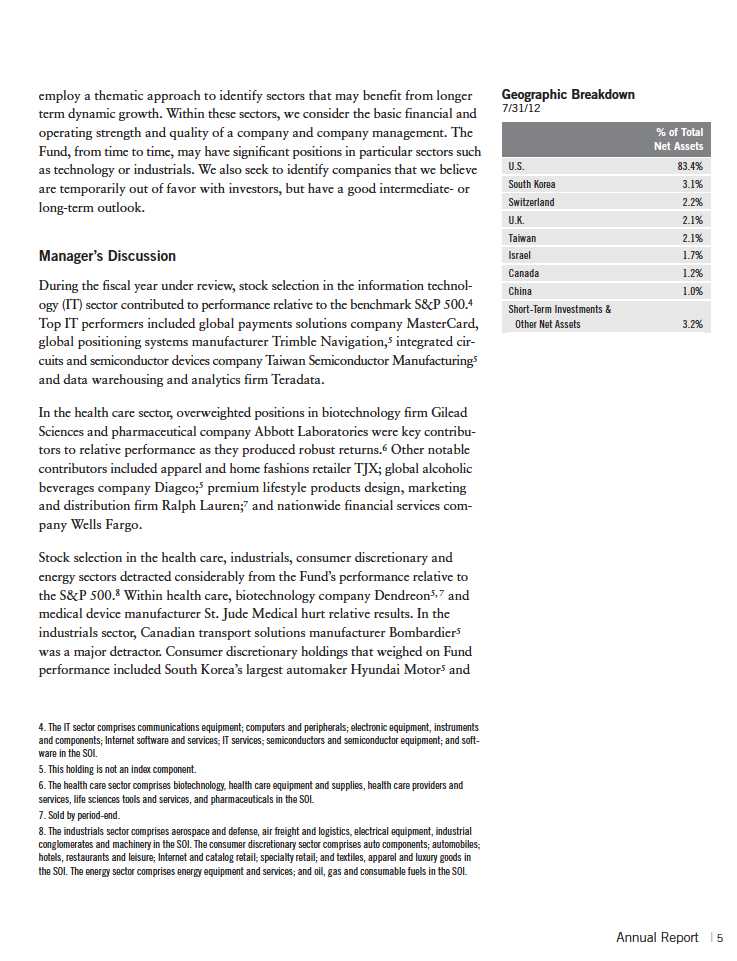

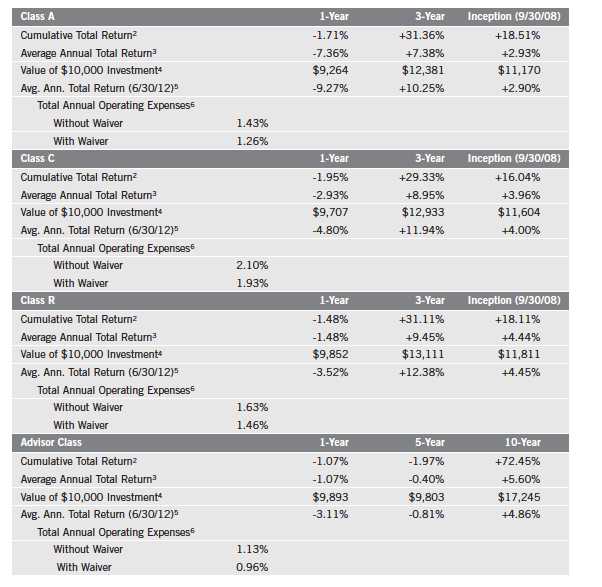

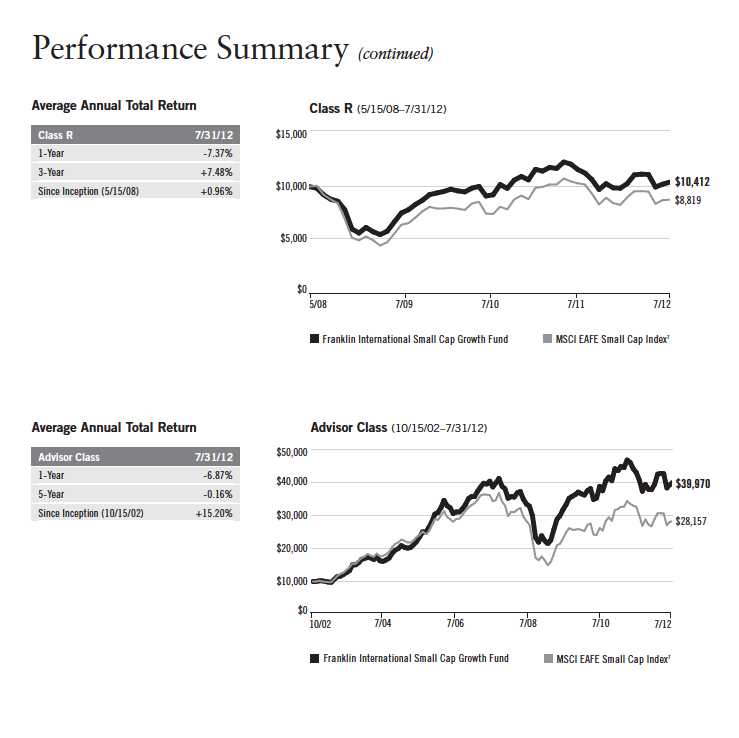

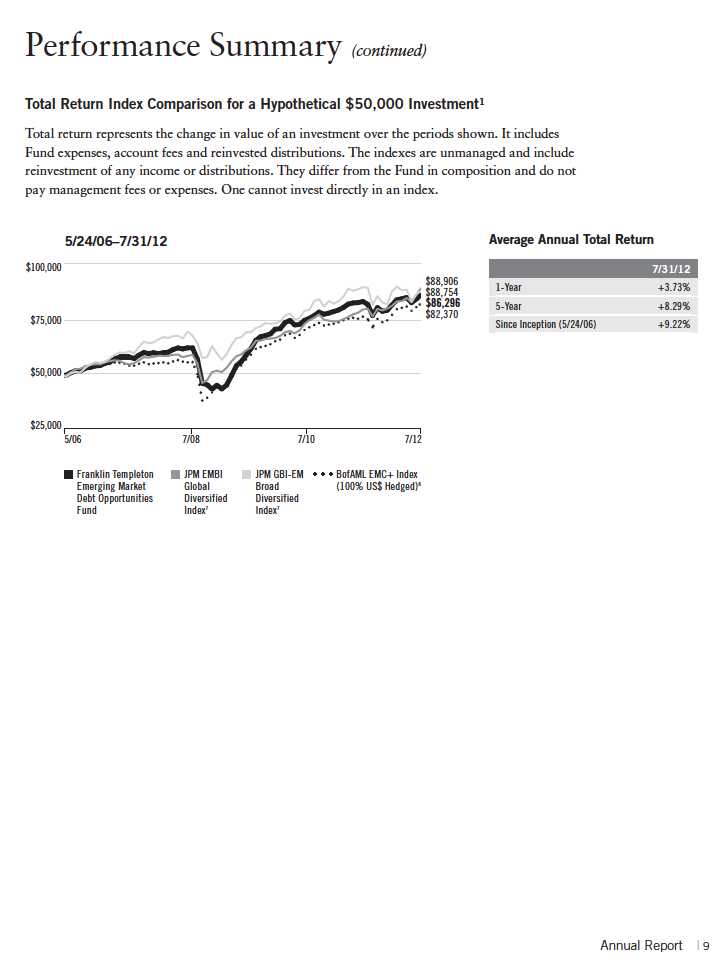

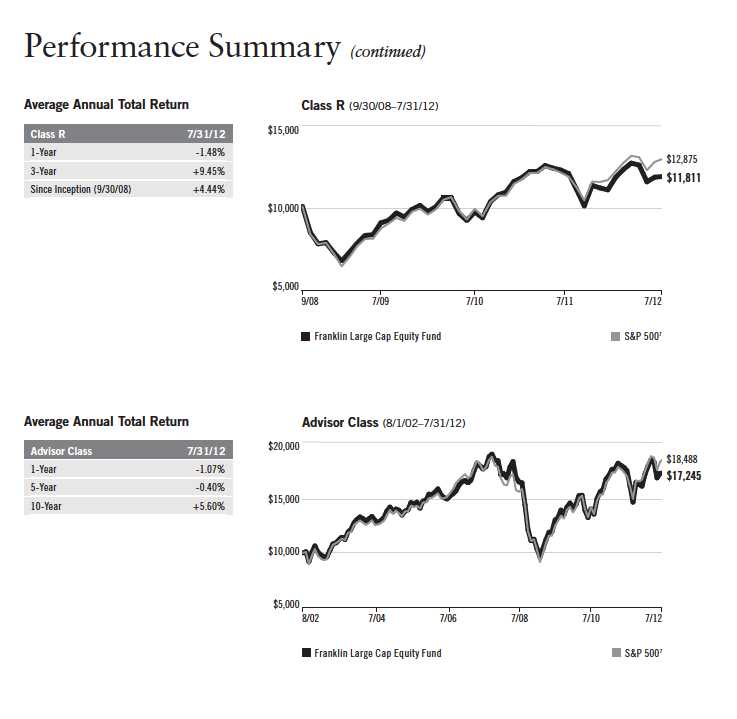

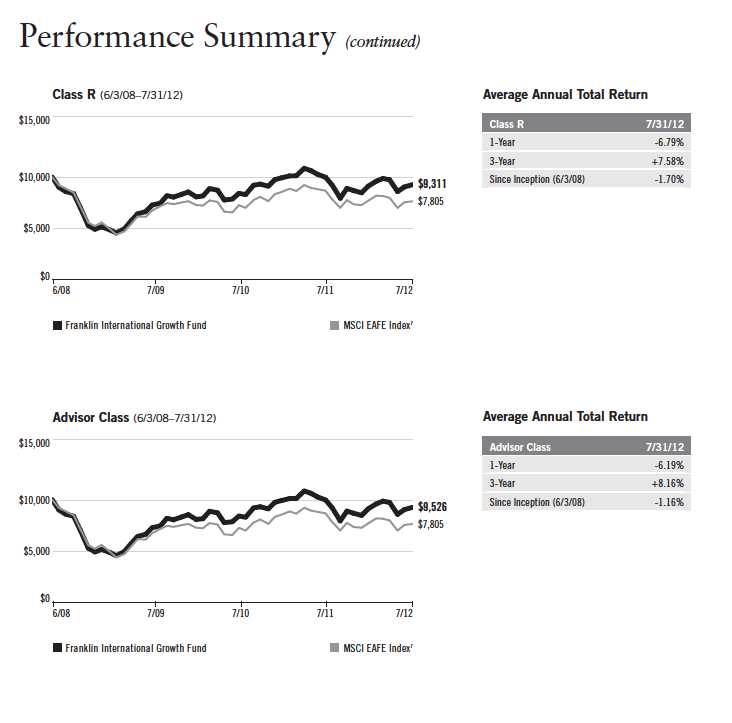

Performance Summary (continued)

Performance1

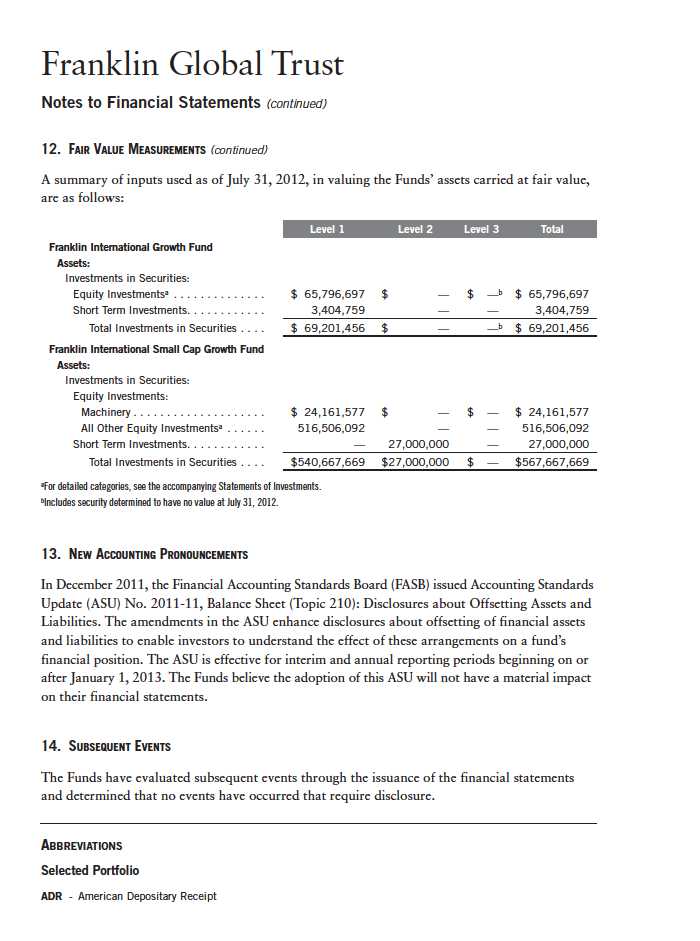

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include

maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in

first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or to assume certain expenses so that

common expenses (excluding Rule 12b-1 fees and acquired fund fees and expenses) for each class of the Fund do not

exceed 0.95% (other than certain nonroutine expenses) until 11/30/12.

8 | Annual Report

Performance Summary (continued)

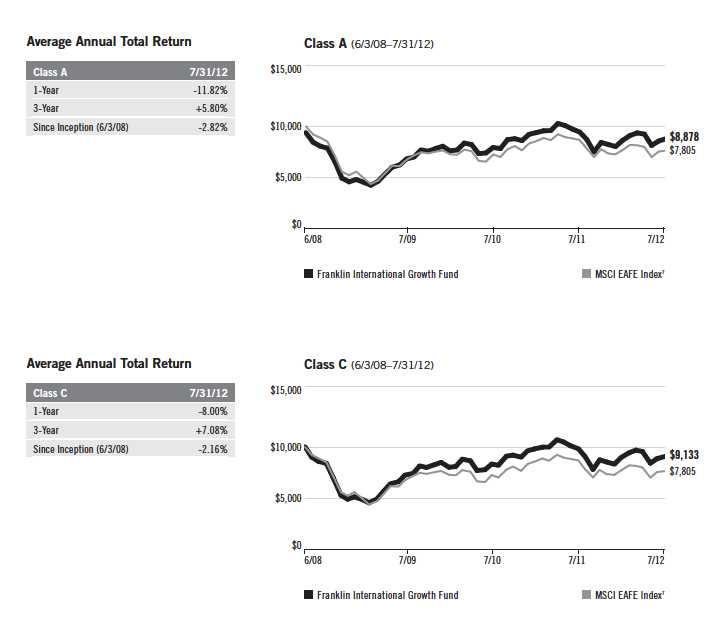

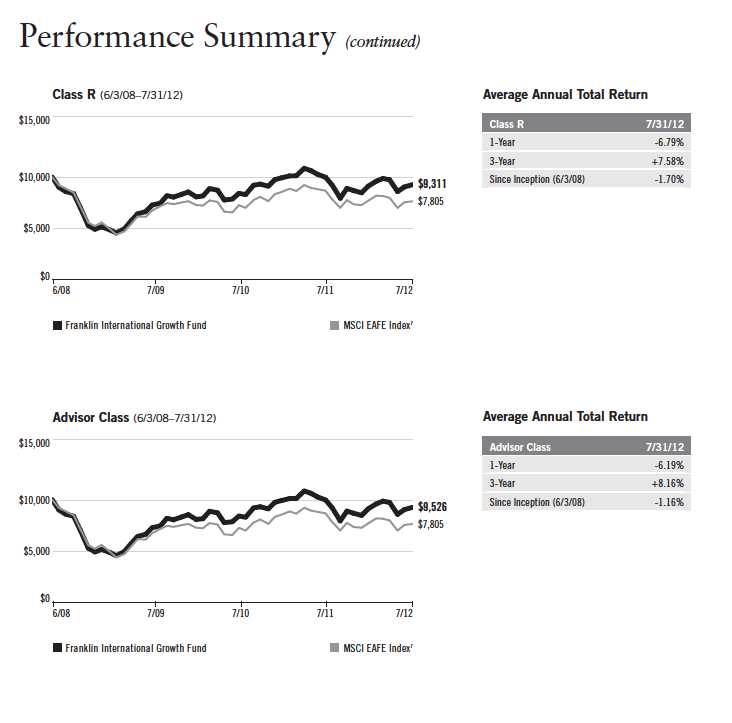

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Annual Report | 9

10 | Annual Report

Performance Summary (continued)

Endnotes

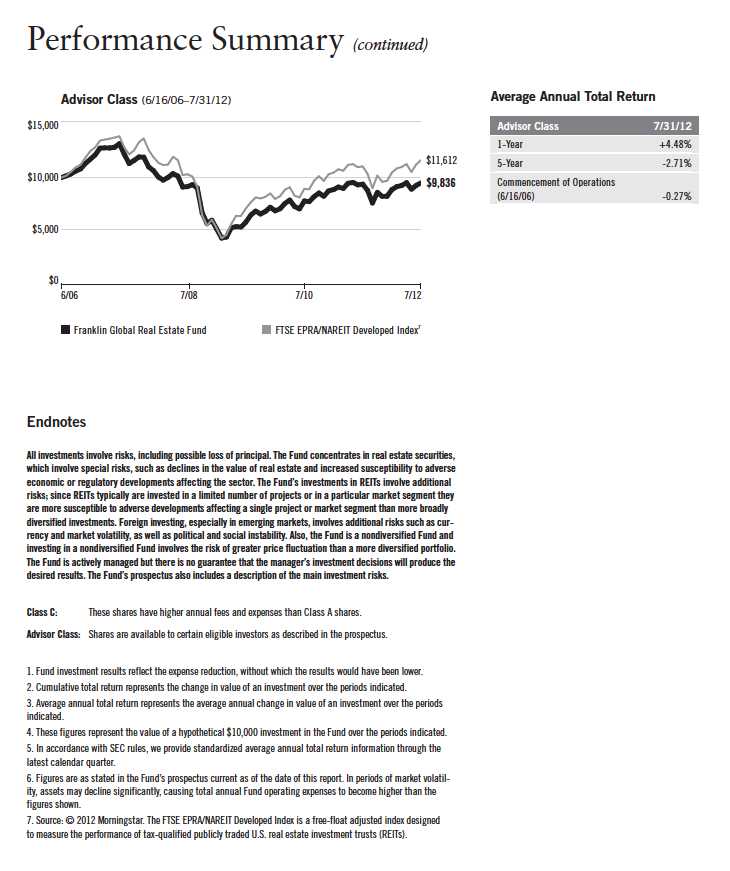

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The Fund’s investments in foreign company stocks involve special risks including currency fluctuations and political uncertainty. There are special risks involved with significant exposure to a particular sector, including increased susceptibility related to economic, business or other developments affecting that sector, which may result in increased volatility. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. Fund investment results reflect the expense reduction, without which the returns would have been lower. 2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. 4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

7. Source: © 2012 Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance.

Annual Report | 11

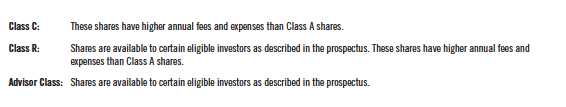

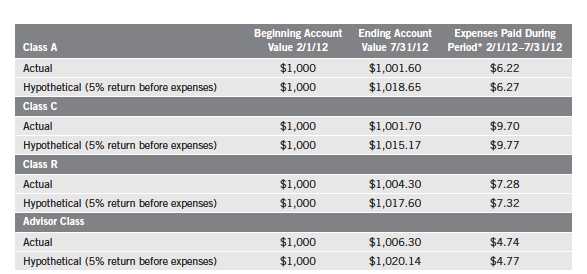

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases, if applicable; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if appli- cable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

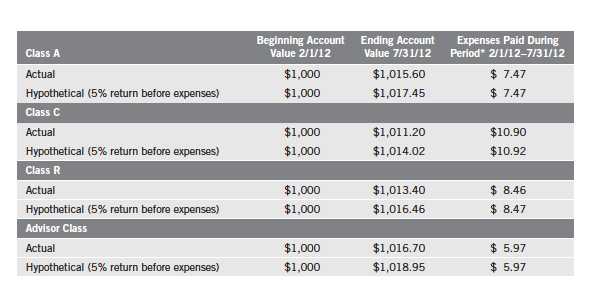

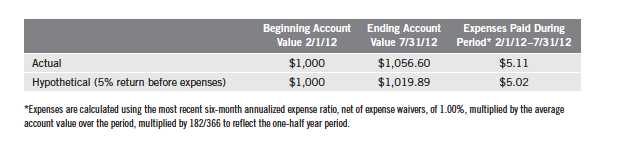

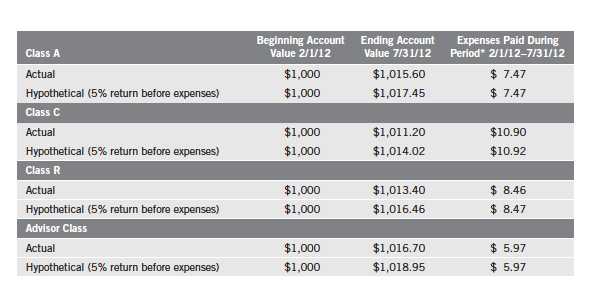

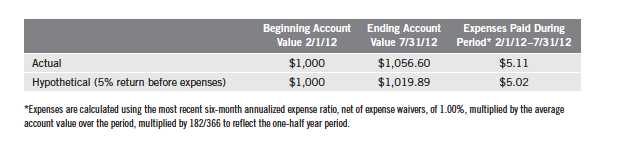

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

12 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.25%; C: 1.95%;

R: 1.46%; and Advisor: 0.95%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

Annual Report | 13

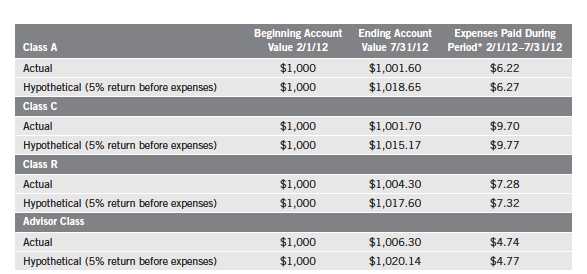

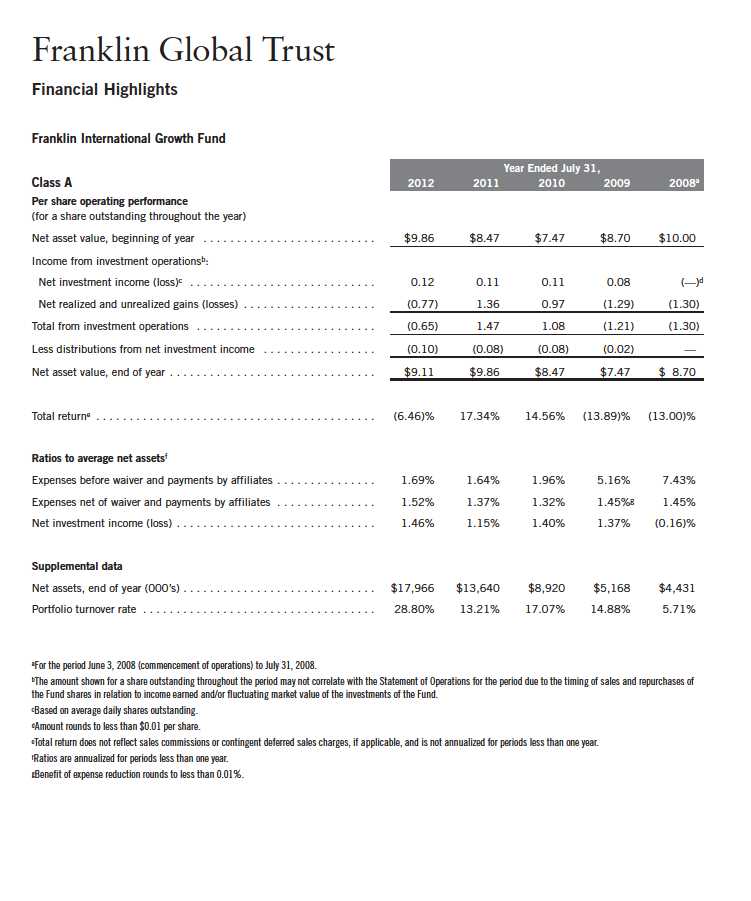

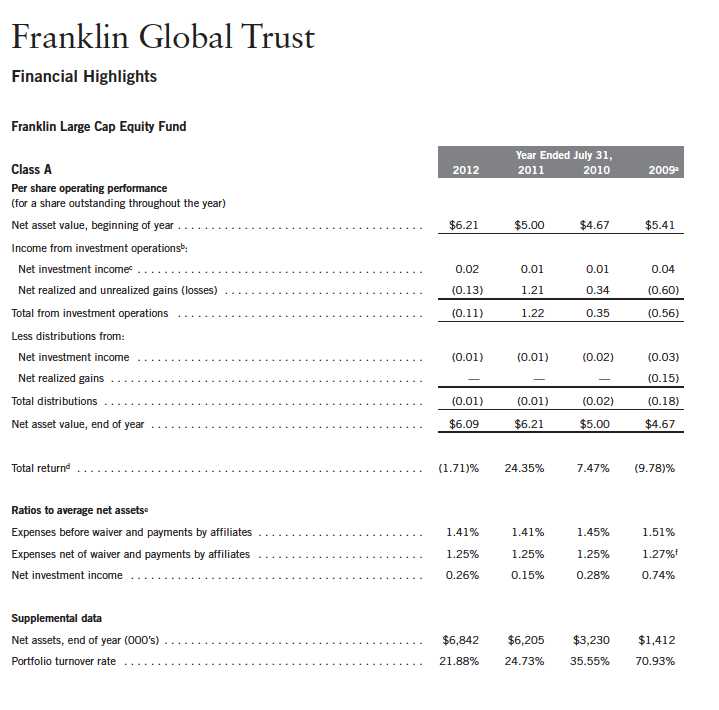

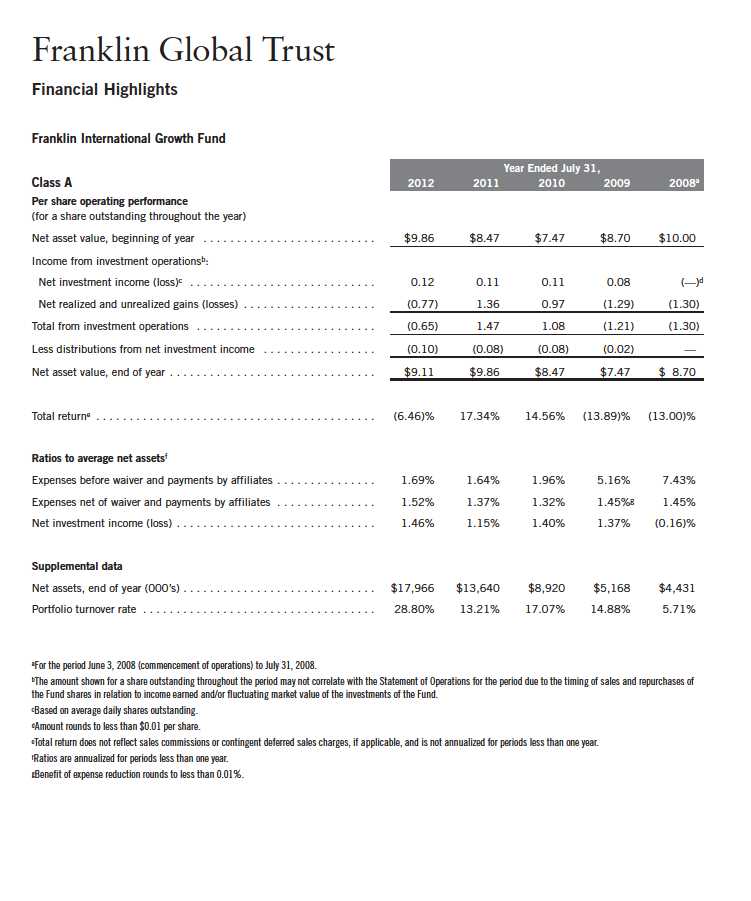

aFor the period September 30, 2008 (effective date) to July 31, 2009.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

14 | The accompanying notes are an integral part of these financial statements. | Annual Report

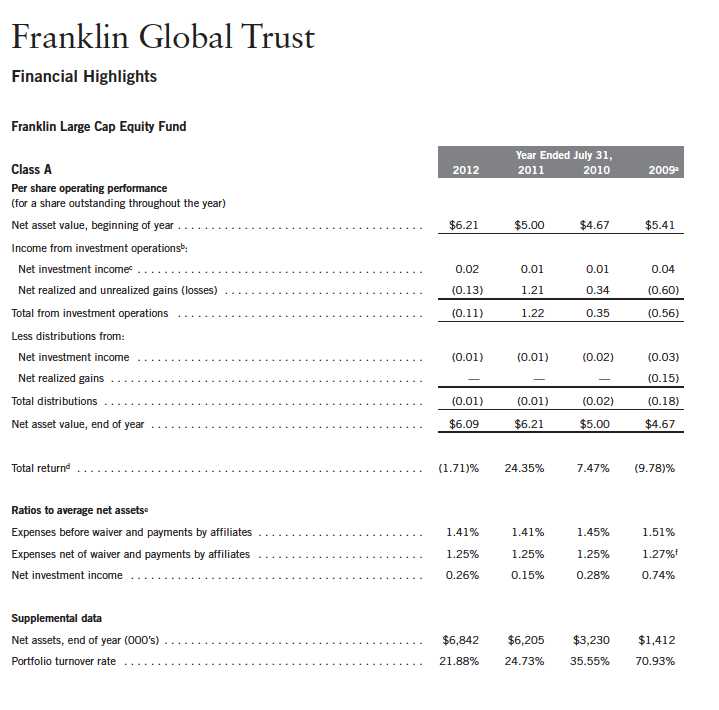

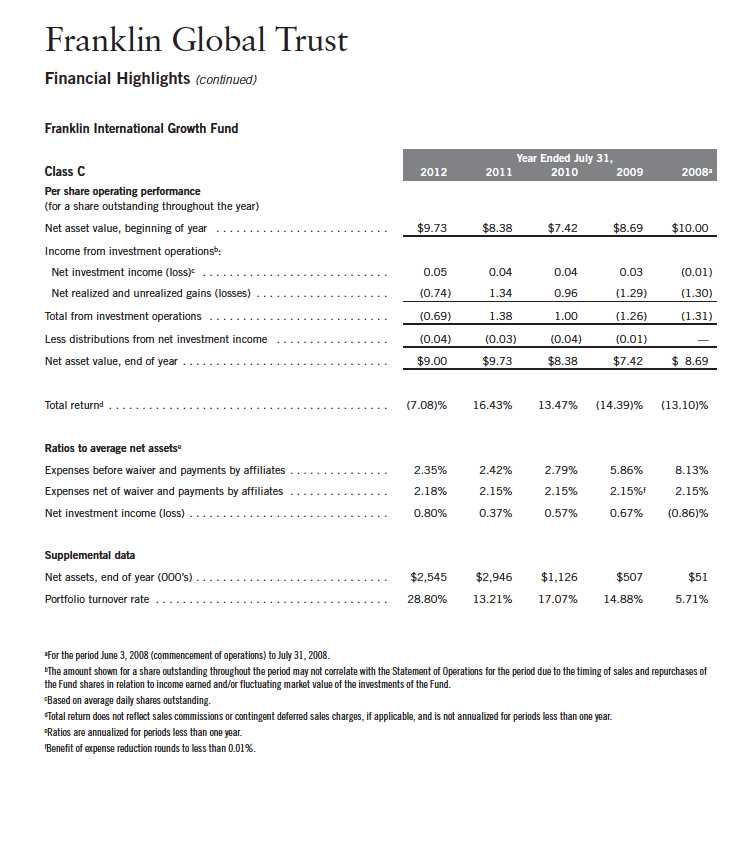

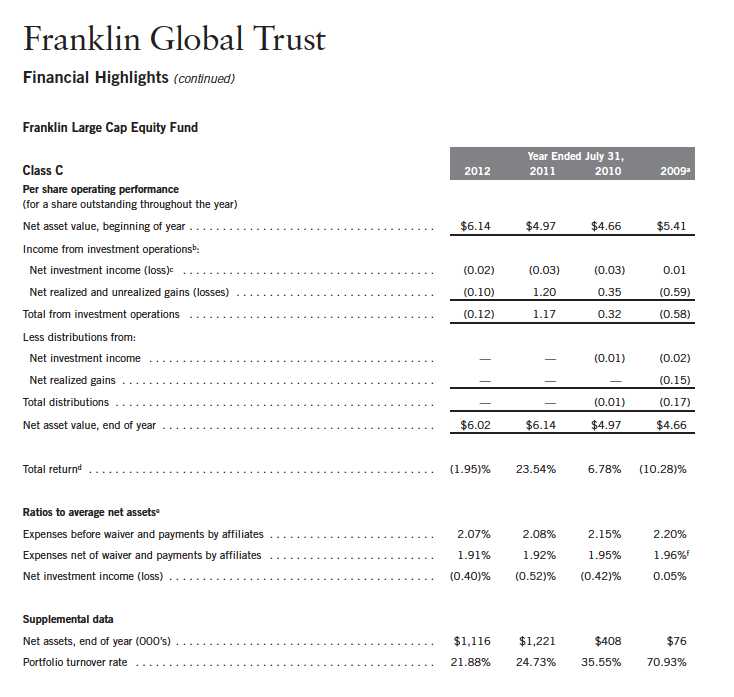

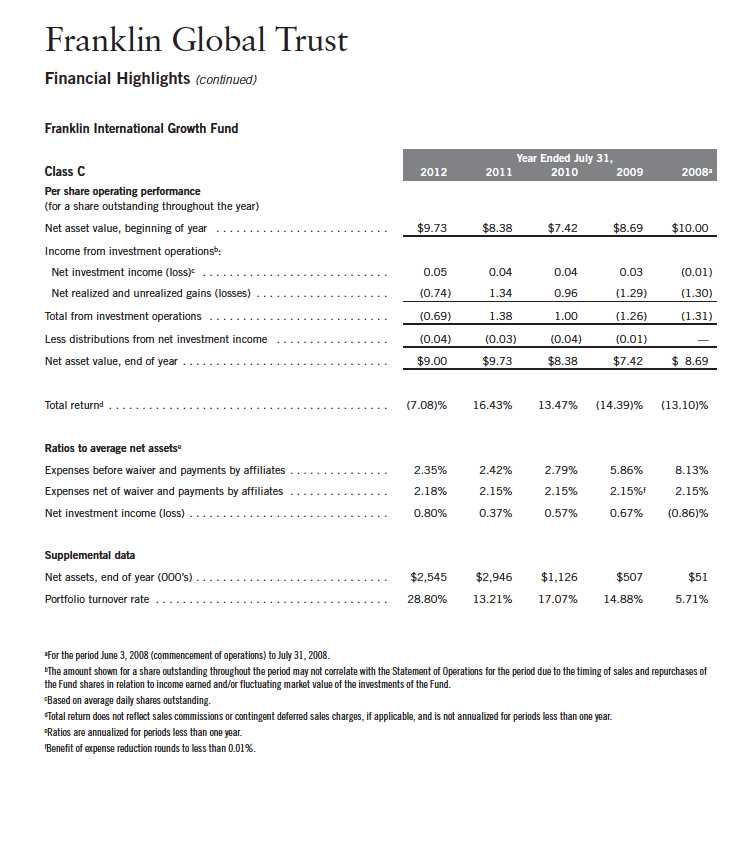

aFor the period September 30, 2008 (effective date) to July 31, 2009.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these financial statements. | 15

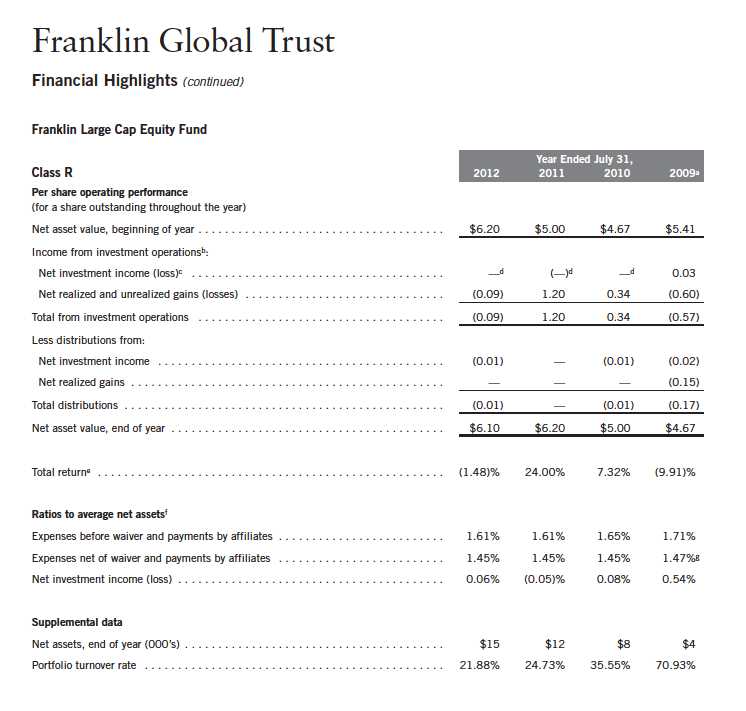

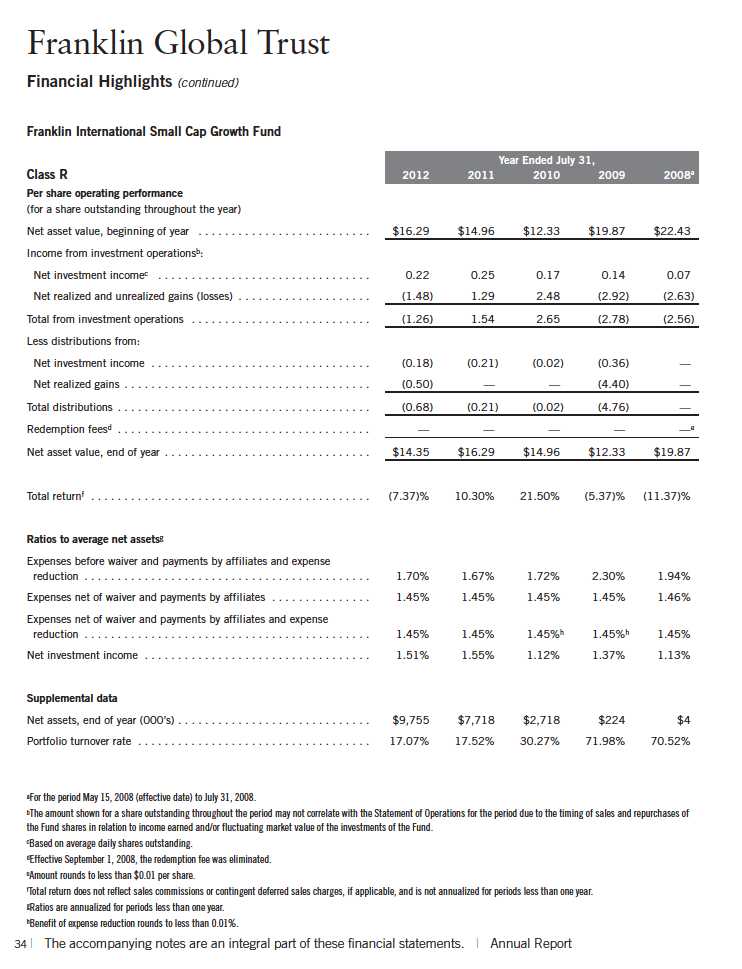

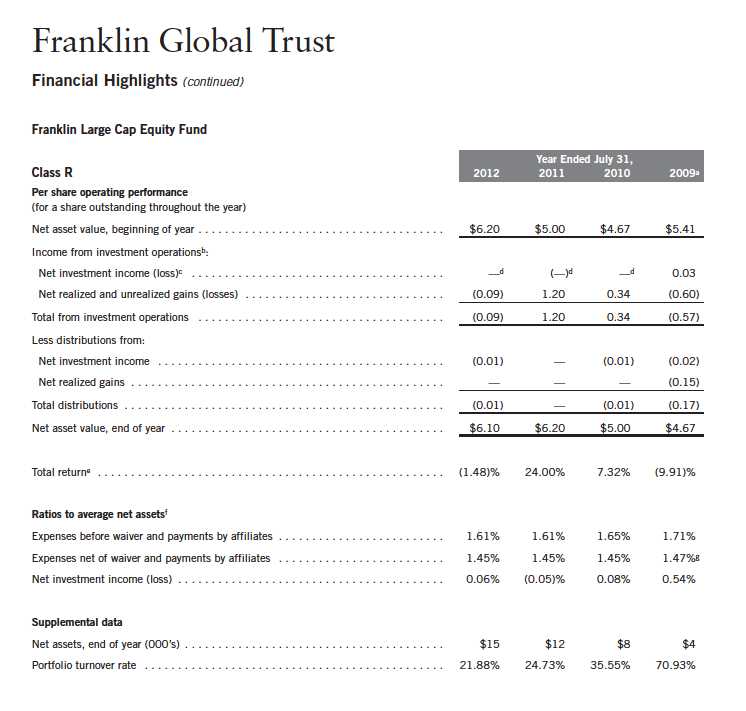

aFor the period September 30, 2008 (effective date) to July 31, 2009.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

16 | The accompanying notes are an integral part of these financial statements. | Annual Report

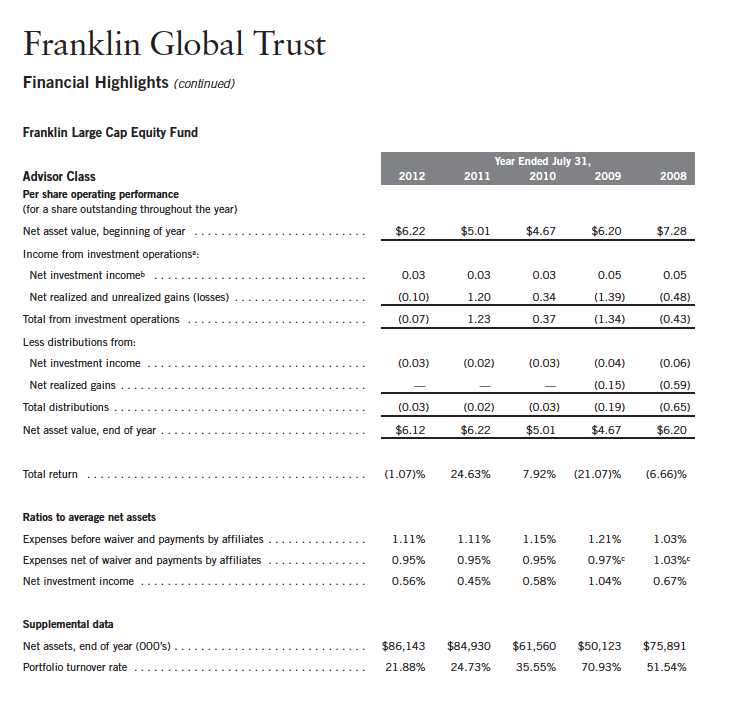

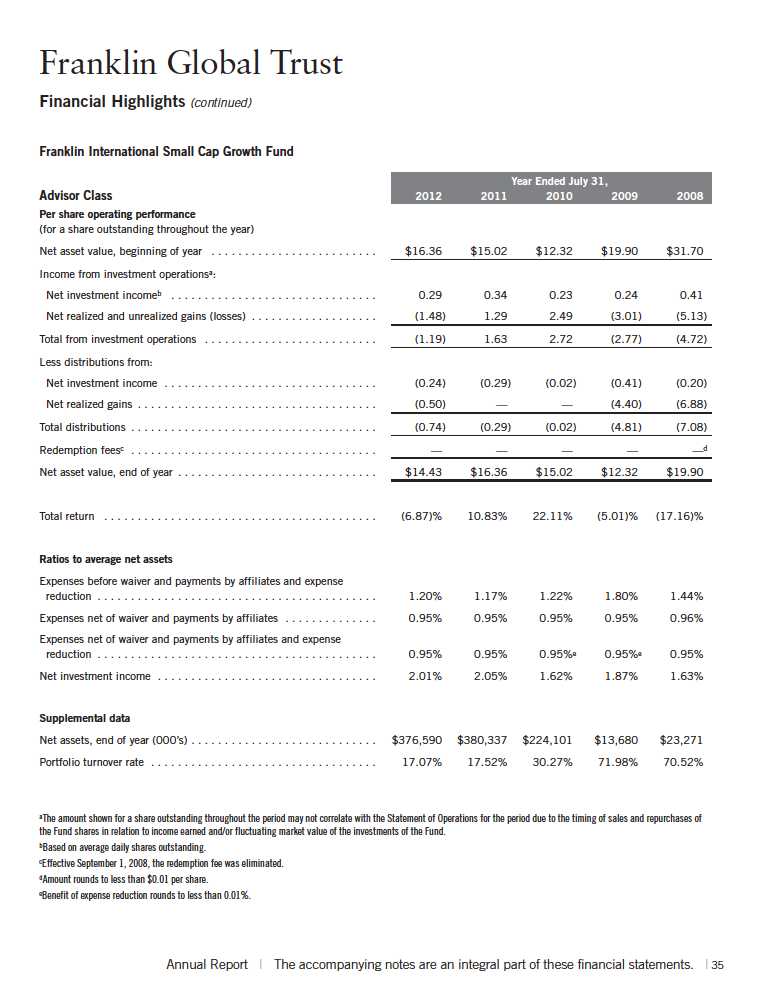

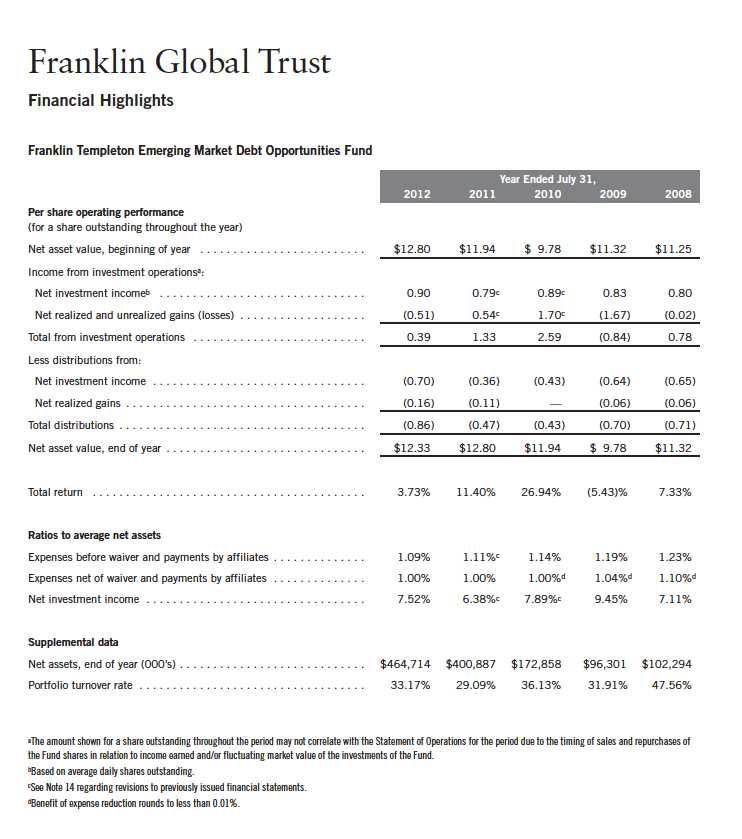

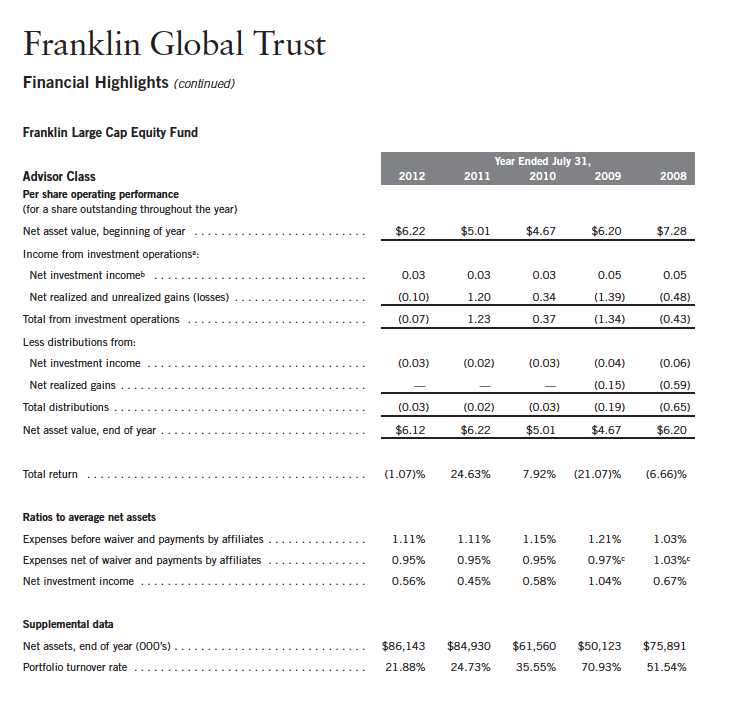

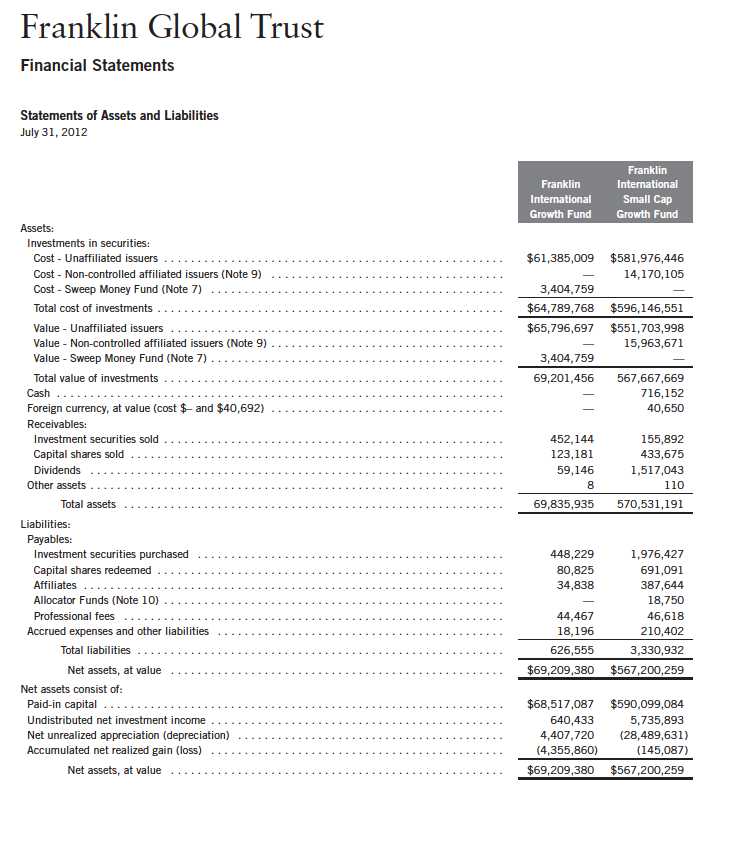

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these financial statements. | 17

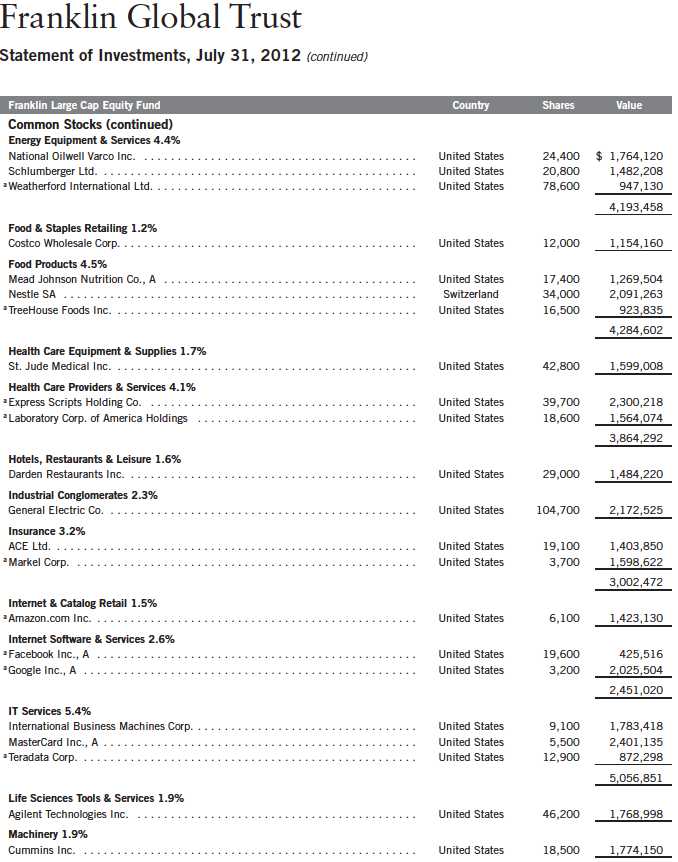

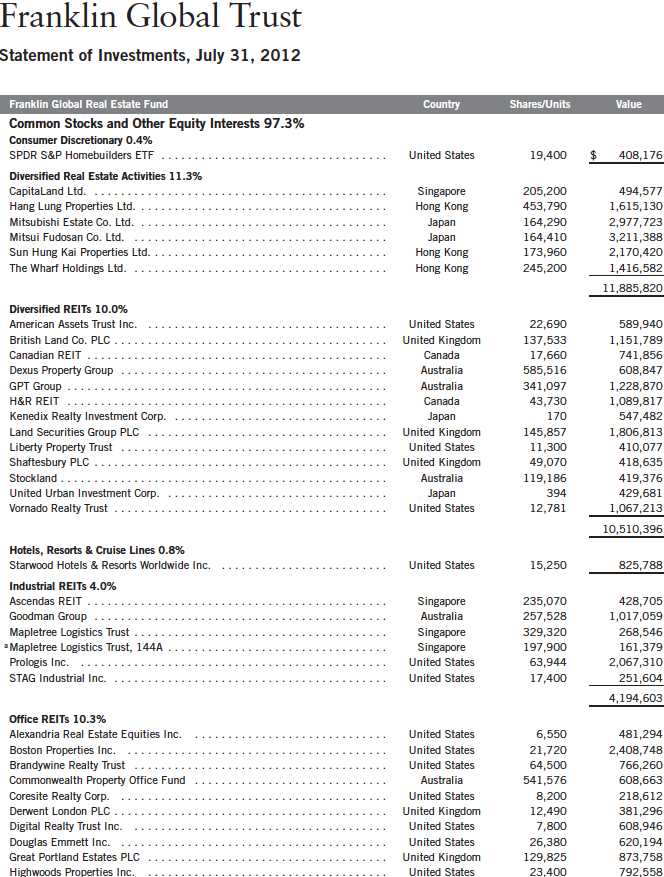

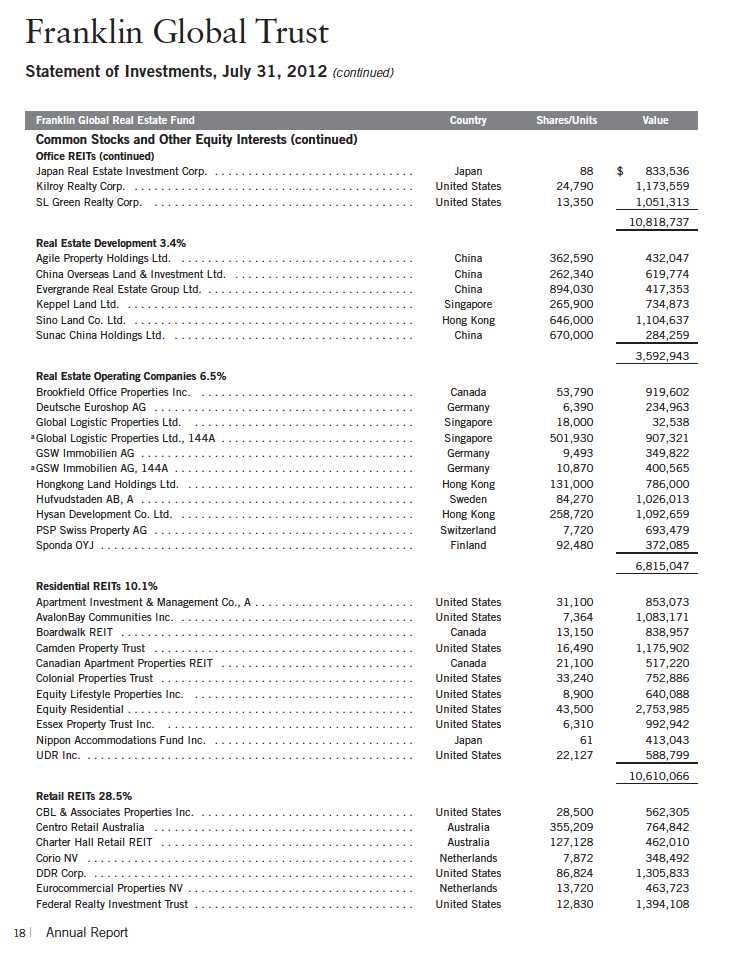

18 | Annual Report

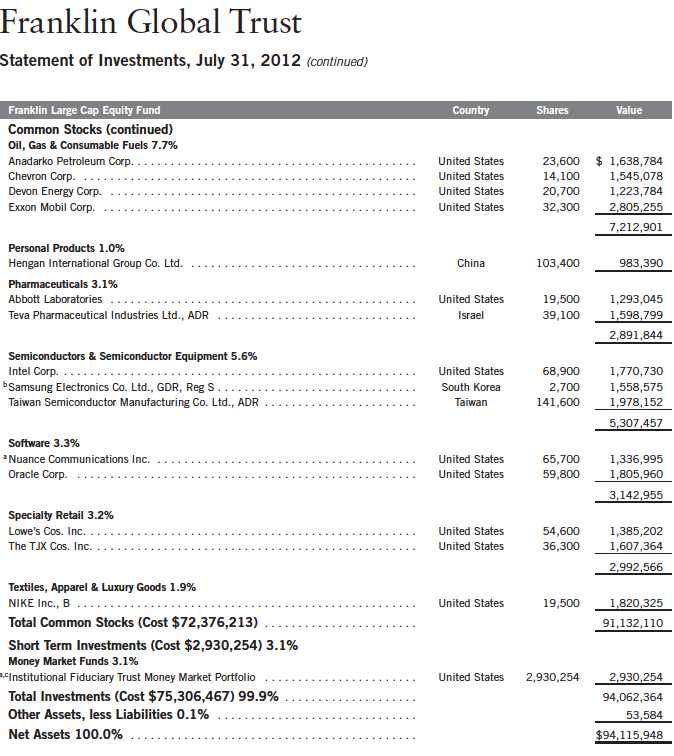

Annual Report | 19

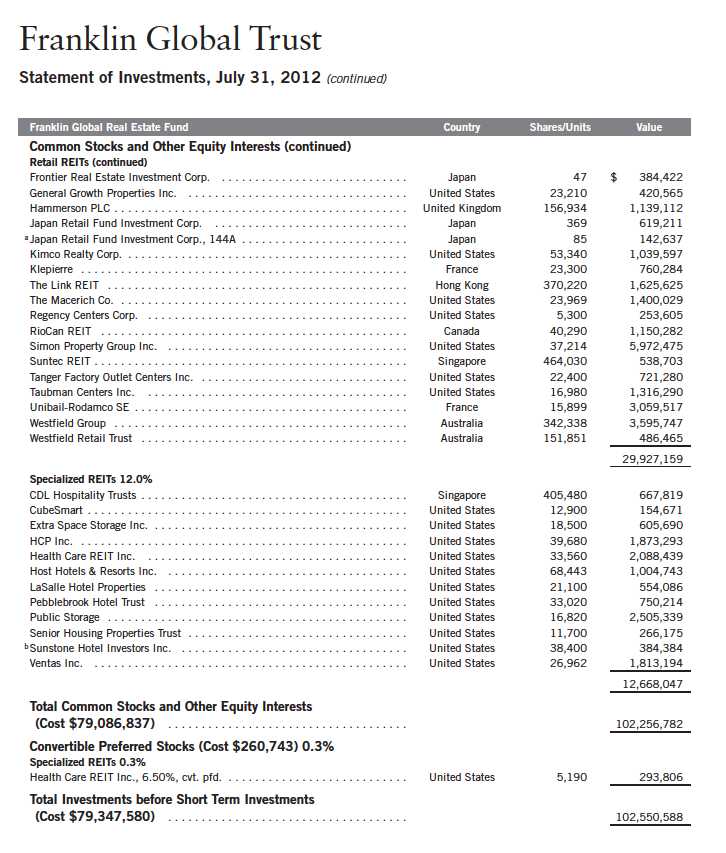

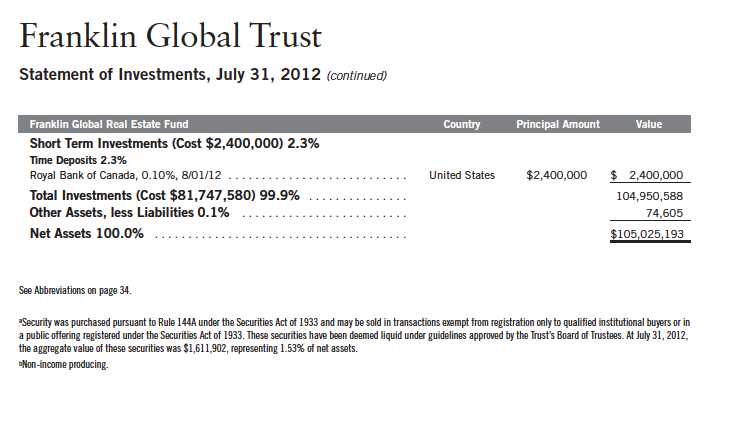

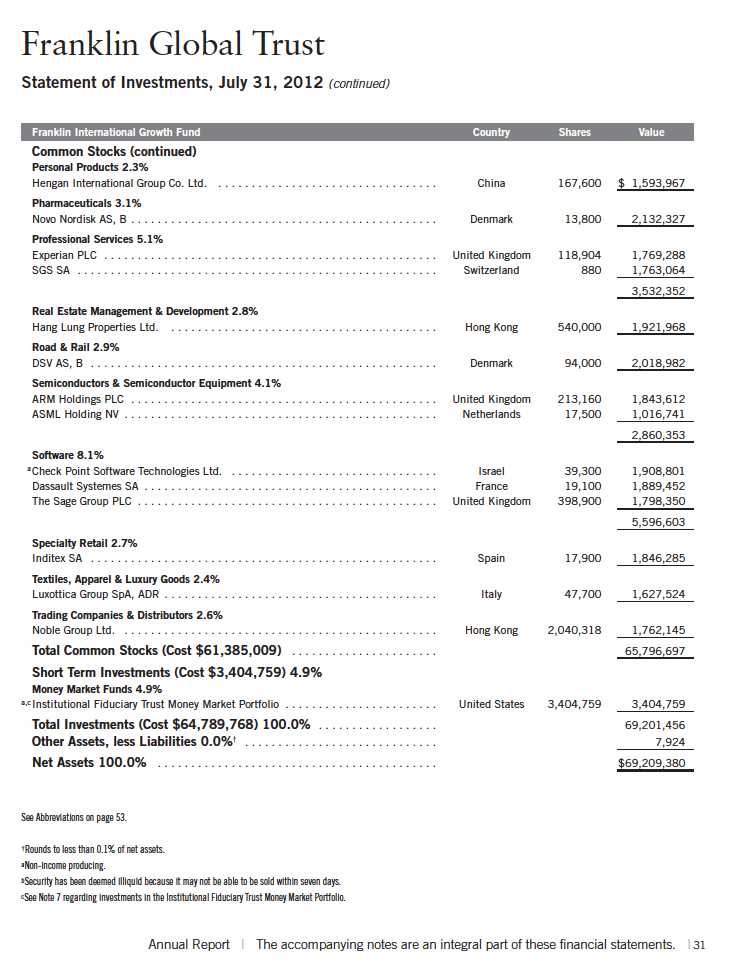

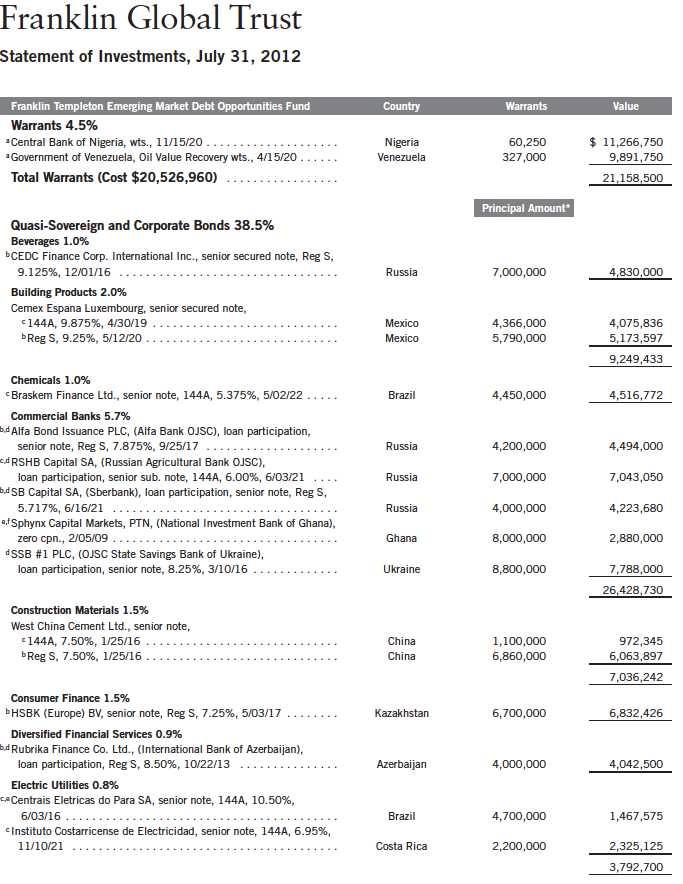

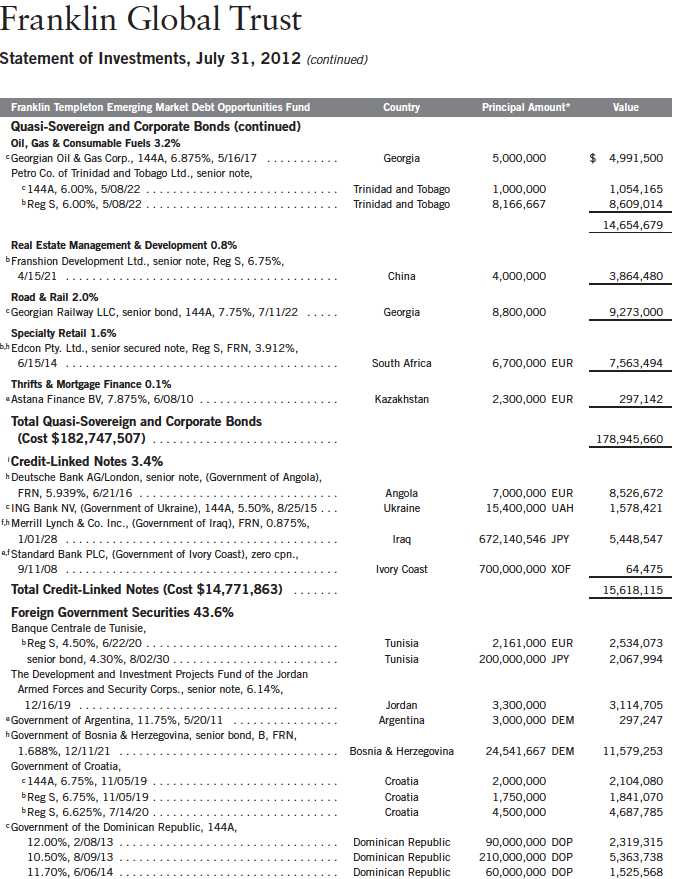

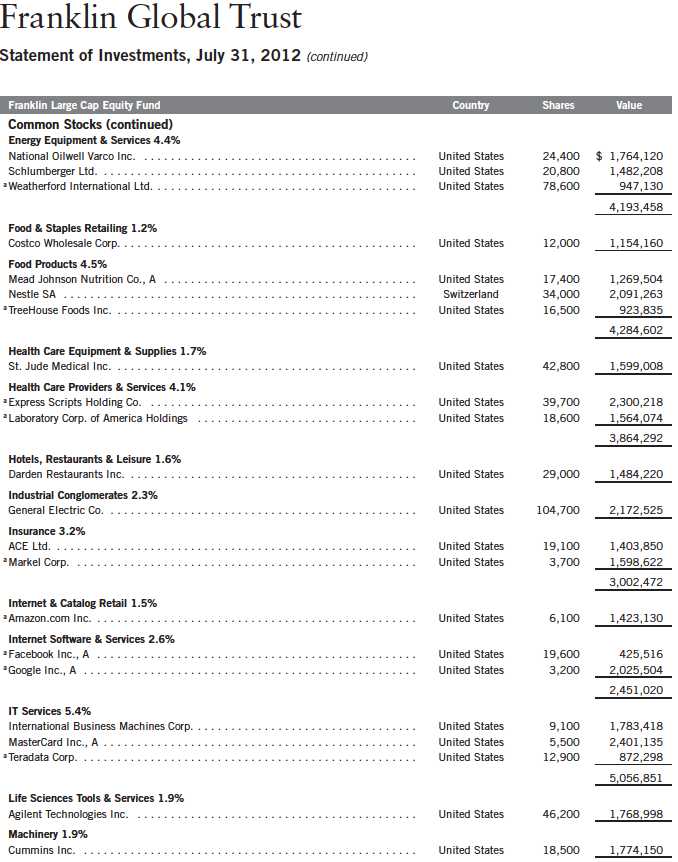

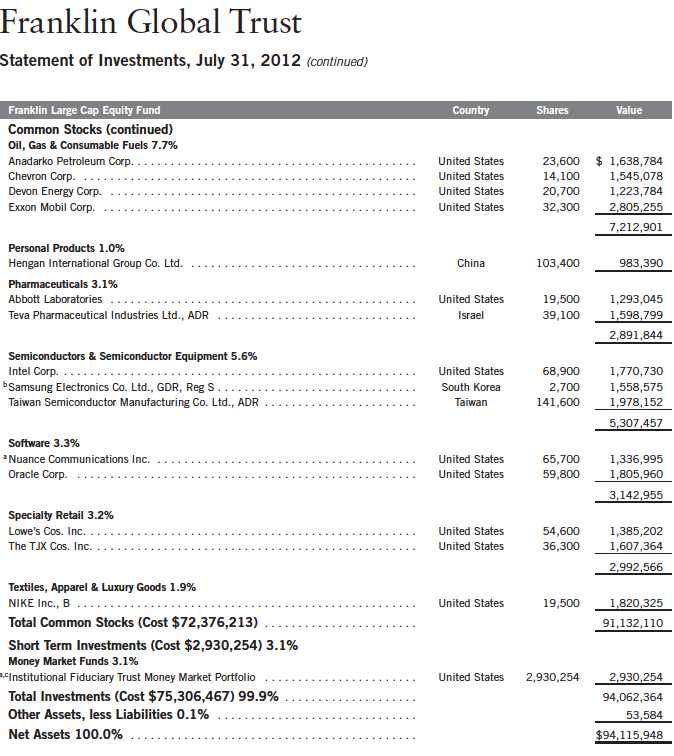

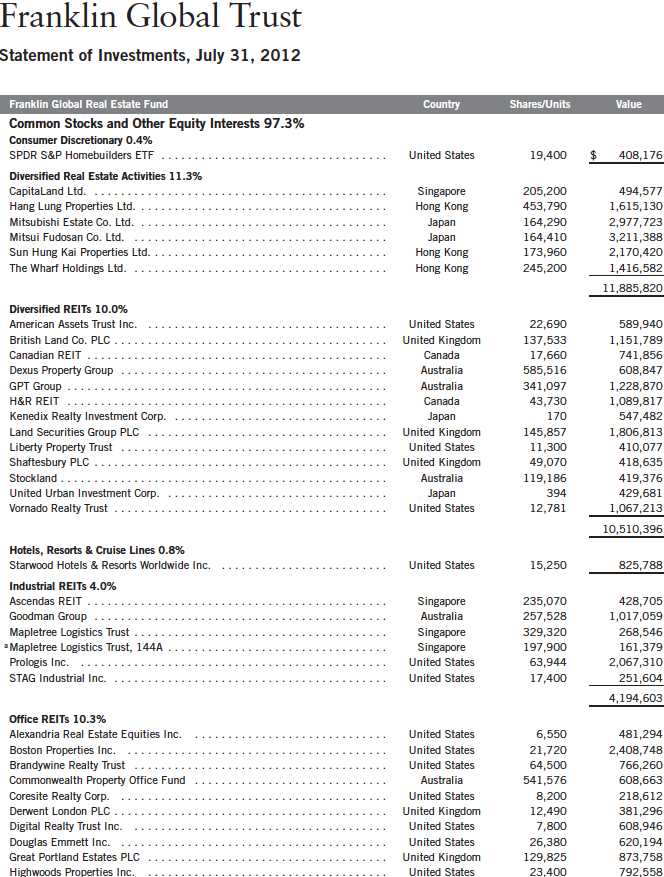

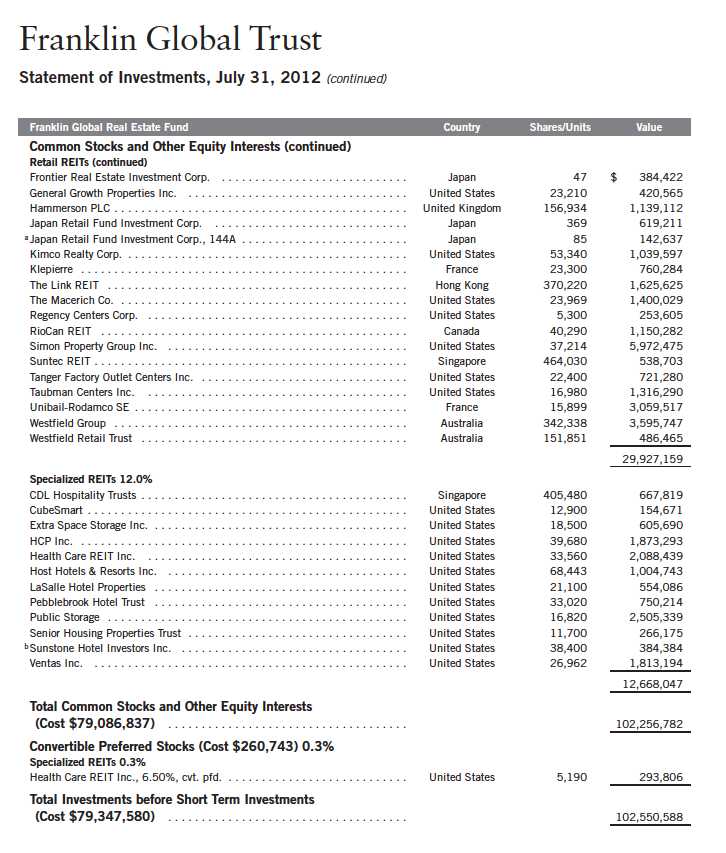

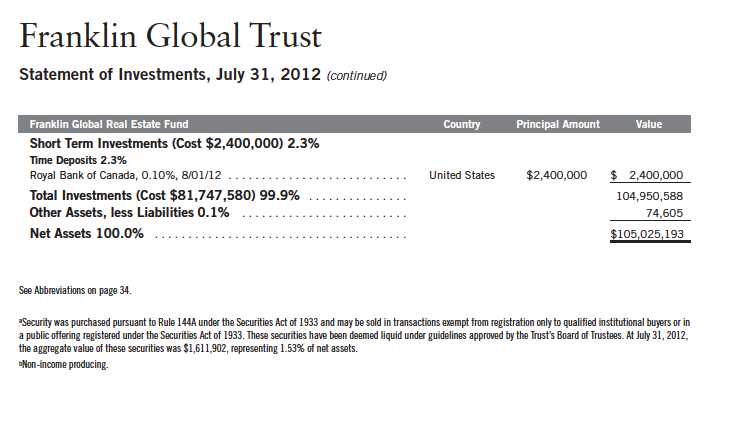

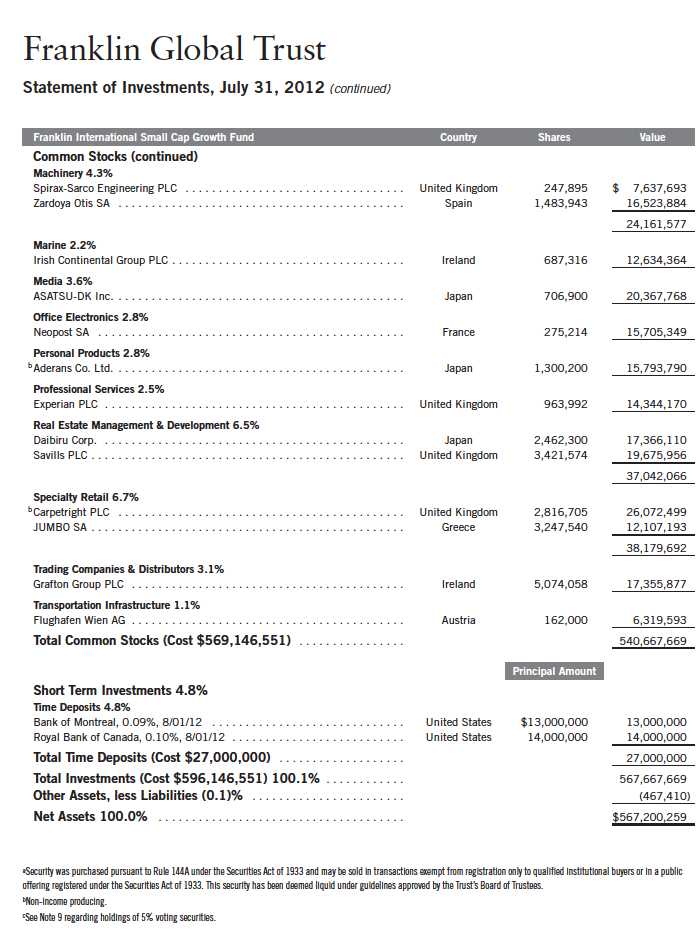

See Abbreviations on page 34.

aNon-income producing.

bSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States.

Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from

registration. These securities have been deemed liquid under guidelines approved by the Trust’s Board of Trustees. At July 31, 2012, the aggregate value of these securities was

$2,958,561, representing 3.14% of net assets.

cSee Note 7 regarding investments in the Institutional Fiduciary Trust Money Market Portfolio.

20 | The accompanying notes are an integral part of these financial statements. | Annual Report

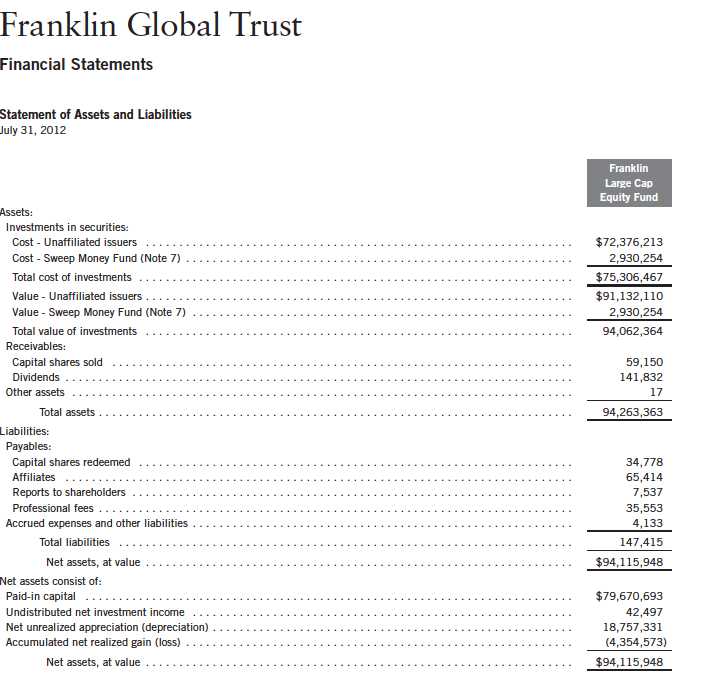

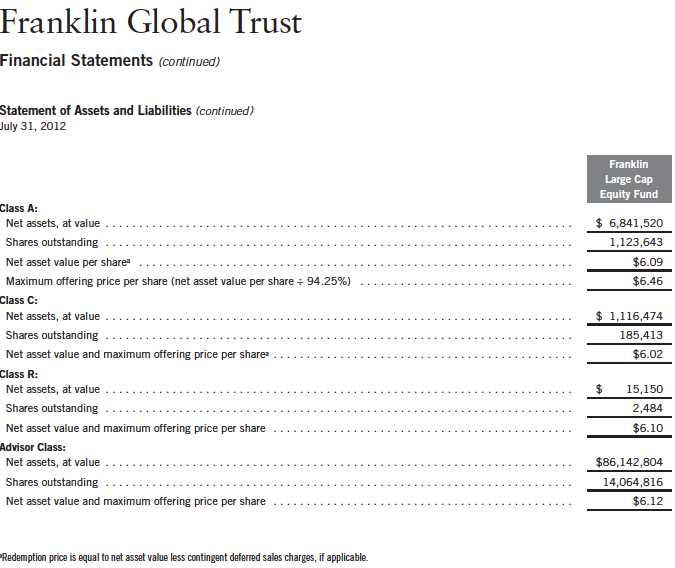

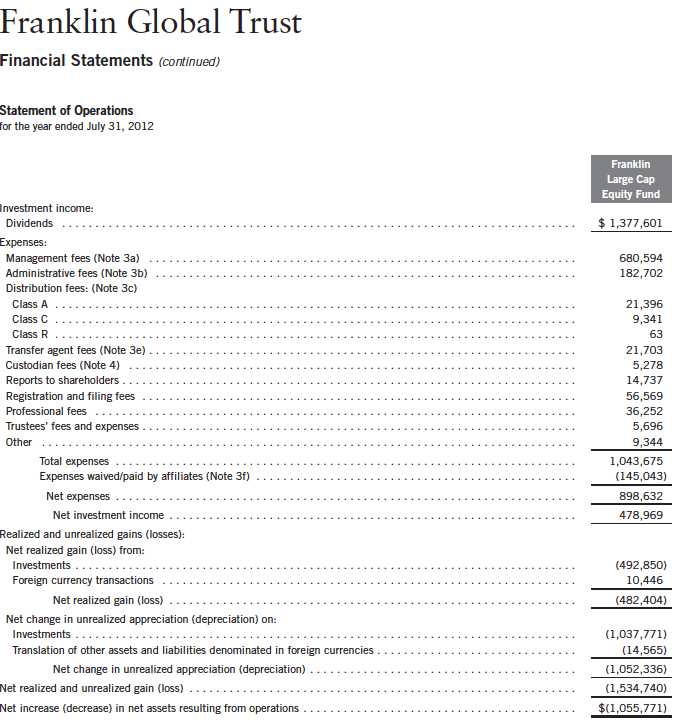

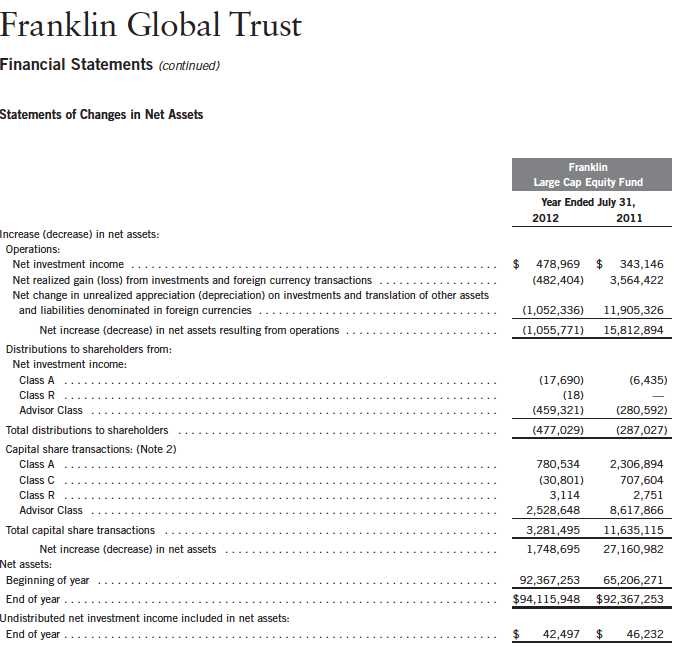

Annual Report | The accompanying notes are an integral part of these financial statements. | 21

22 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 23

24 | The accompanying notes are an integral part of these financial statements. | Annual Report

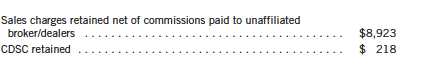

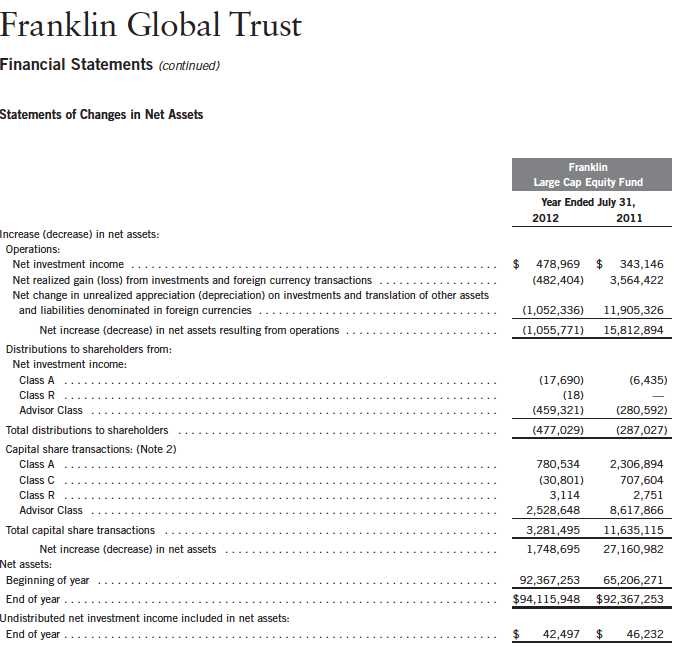

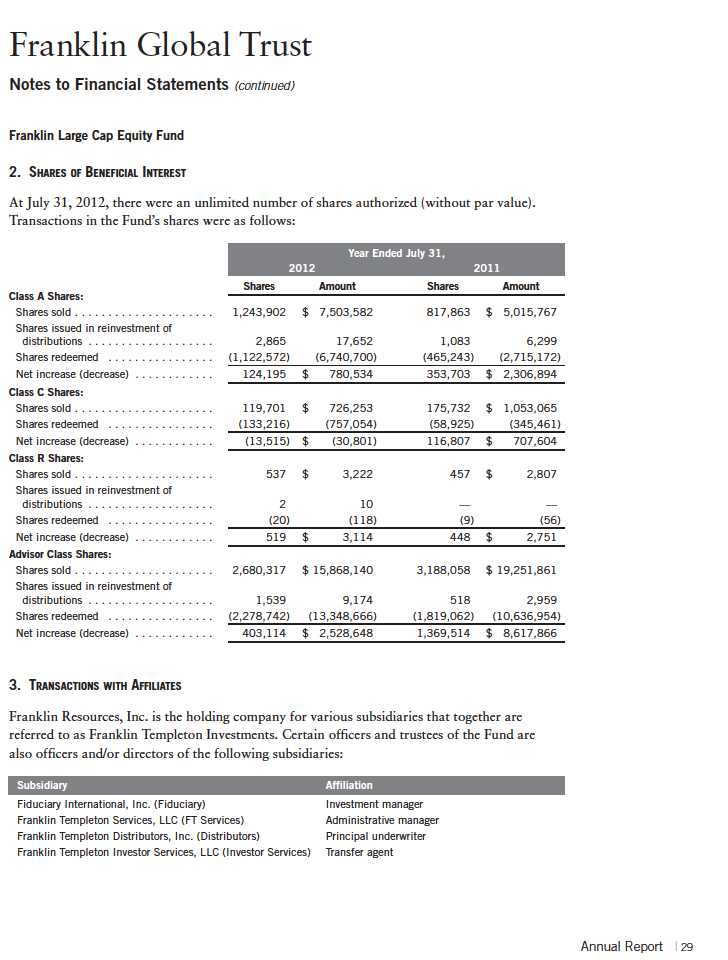

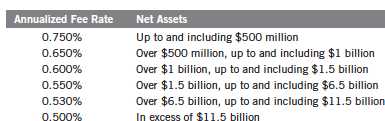

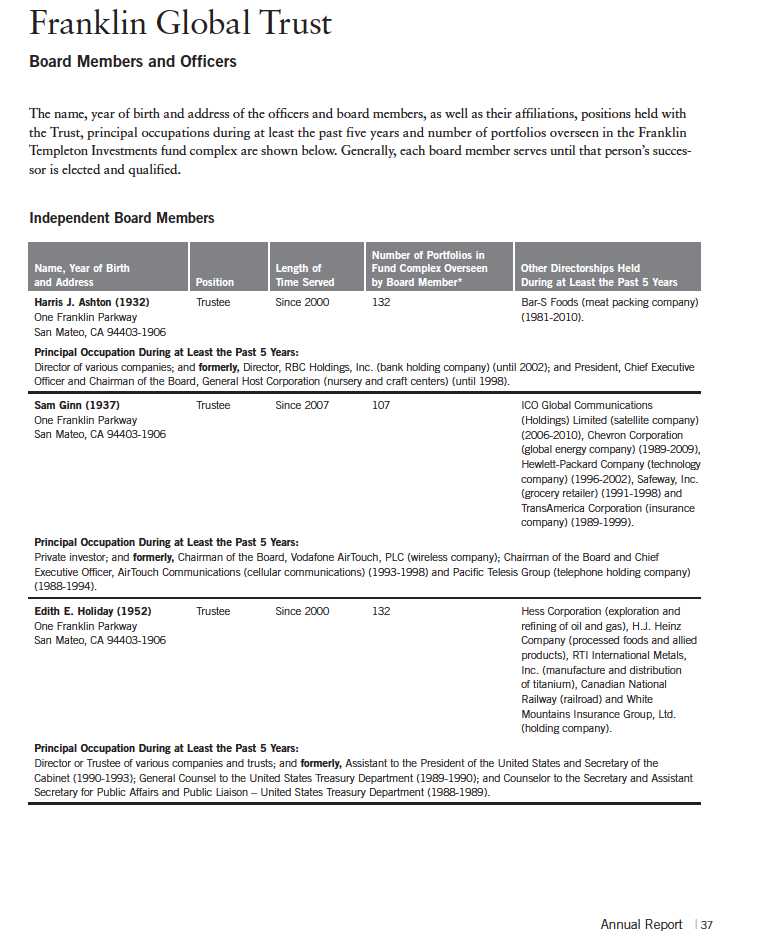

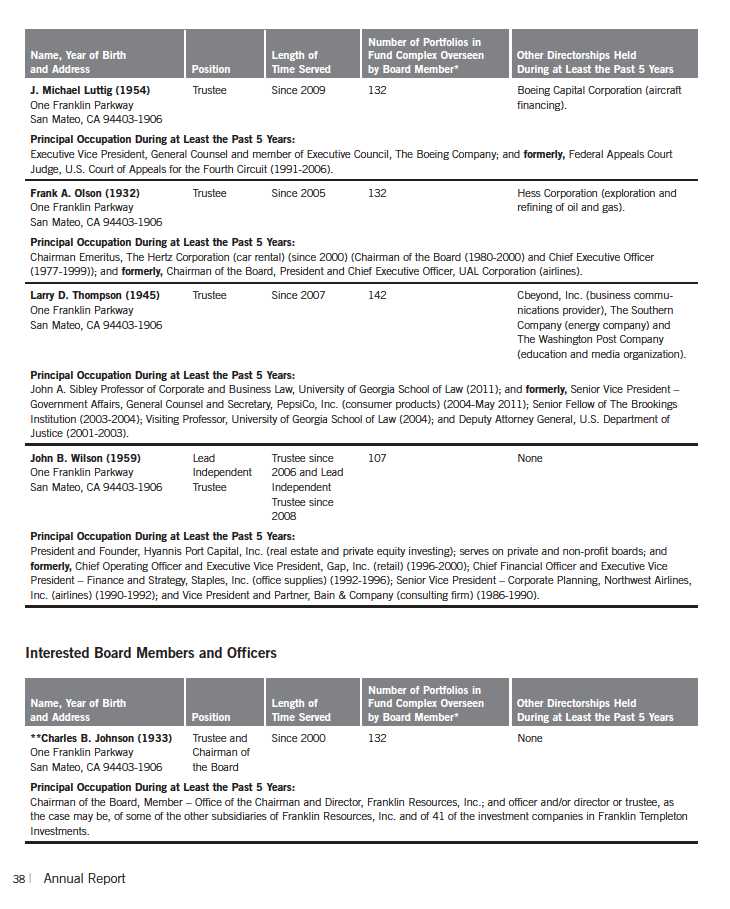

Franklin Global Trust

Notes to Financial Statements

Franklin Large Cap Equity Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

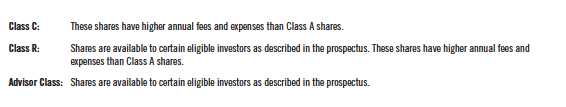

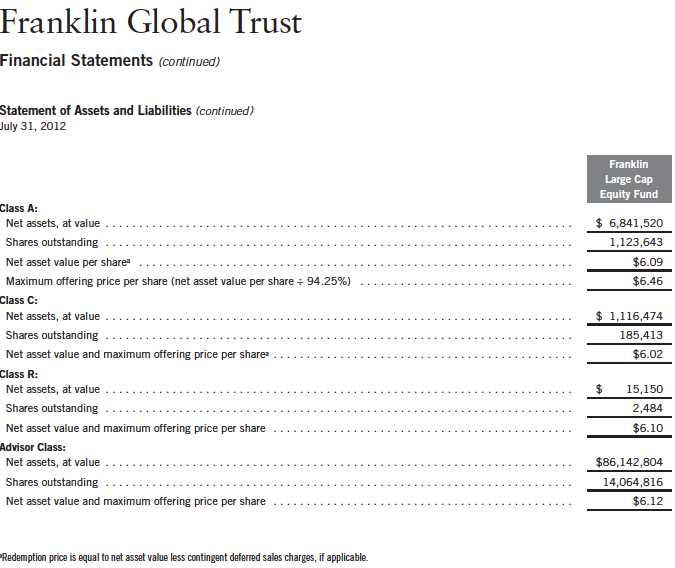

Franklin Global Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of five separate funds. The Franklin Large Cap Equity Fund (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. The Fund offers four classes of shares: Class A, Class C, Class R, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

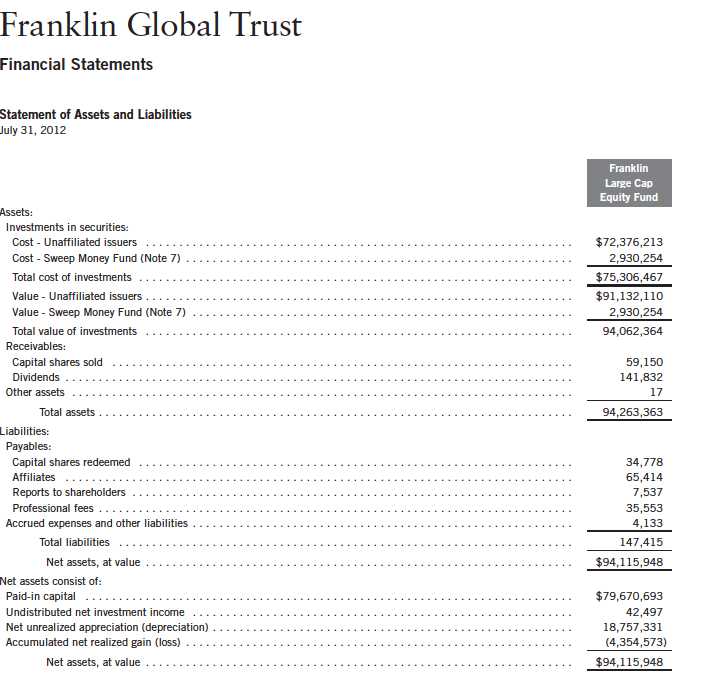

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust’s Board of Trustees (the Board), the Fund’s administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing net asset value.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment

Annual Report | 25

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Large Cap Equity Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

Trading in securities on foreign securities stock exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the VLOC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

26 | Annual Report

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Large Cap Equity Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Foreign Currency Translation (continued) |

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Income and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of July 31, 2012, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign

Annual Report | 27

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Large Cap Equity Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

e. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Fund, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

28 | Annual Report

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Large Cap Equity Fund

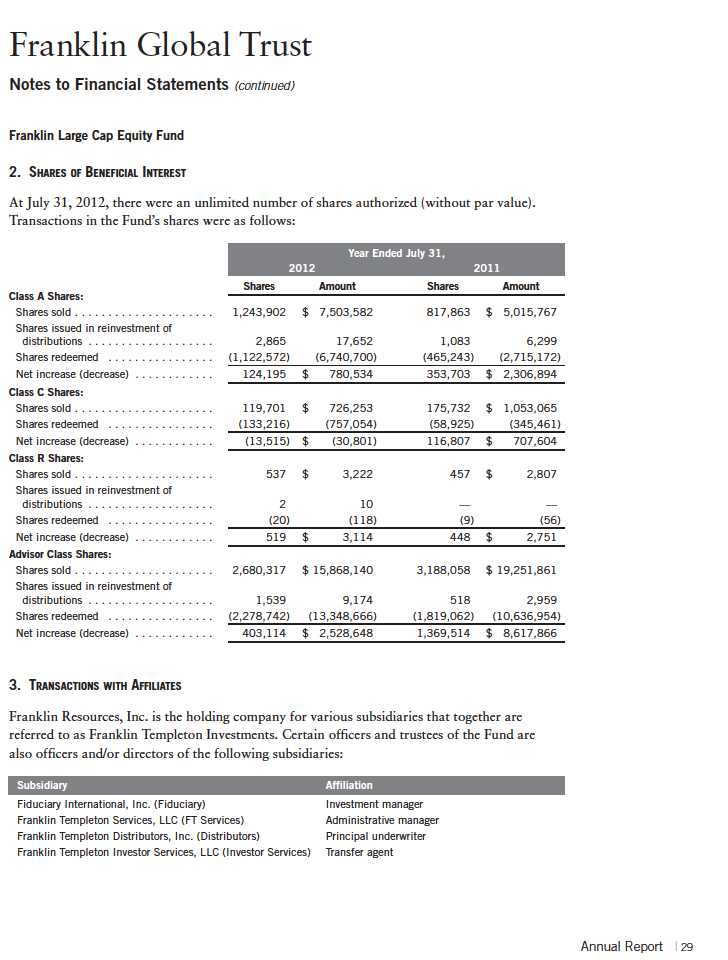

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| a. | Management Fees |

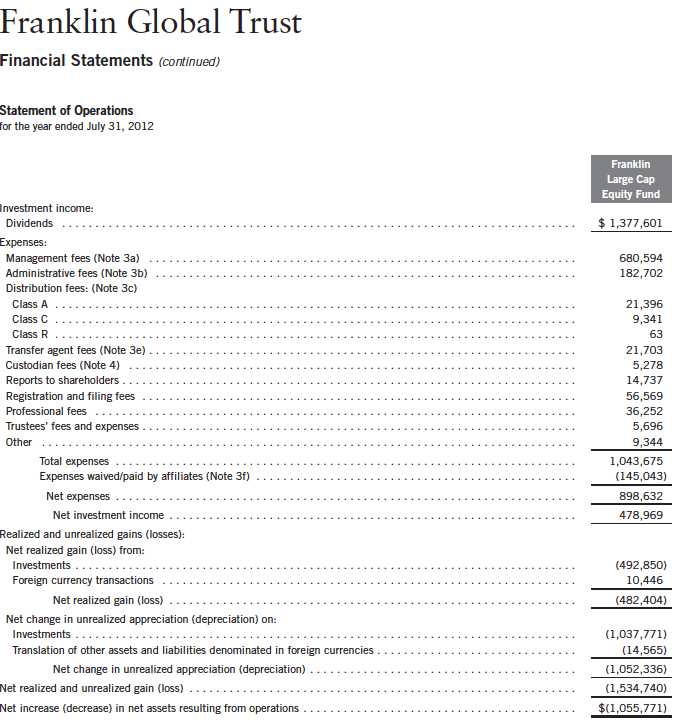

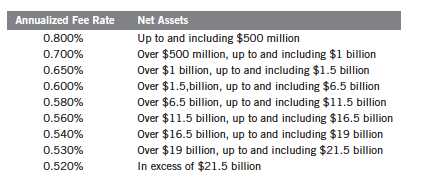

The Fund pays an investment management fee to Fiduciary based on the average daily net assets of the Fund as follows:

b. Administrative Fees

The Fund pays an administrative fee to FT Services of 0.20% per year of the average daily net assets of the Fund.

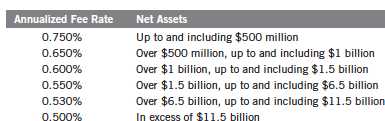

c. Distribution Fees

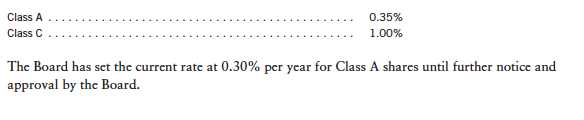

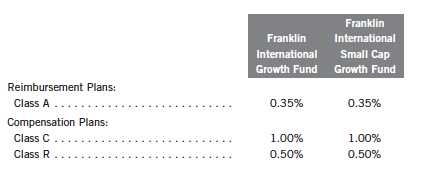

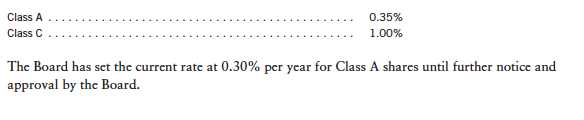

The Board has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

In addition, under the Fund’s Class B, C, and R compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate for each class.

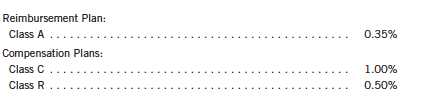

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

The Board has set the current rate at 0.30% per year for Class A shares until further notice and approval by the Board.

30 | Annual Report

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Large Cap Equity Fund

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

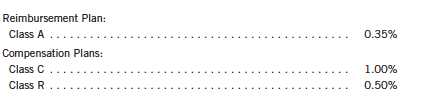

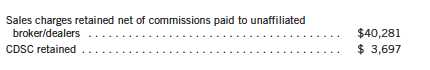

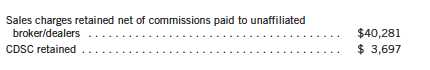

| d. | Sales Charges/Underwriting Agreements |

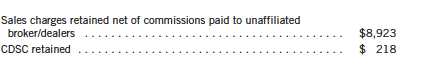

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

e. Transfer Agent Fees

For the year ended July 31, 2012, the Fund paid transfer agent fees of $21,703, of which $15,627 was retained by Investor Services.

f. Waiver and Expense Reimbursements

FT Services has contractually agreed in advance to waive or limit its fees and to assume as its own expense certain expenses otherwise payable by the Fund so that the common expenses (i.e. a combination of management fees, administrative fees, and other expenses, but excluding distribution fees, and acquired fund fees and expenses) for each class of the Fund do not exceed 0.95% (other than certain non-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) until November 30, 2012.

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended July 31, 2012, there were no credits earned.

5. INCOME TAXES

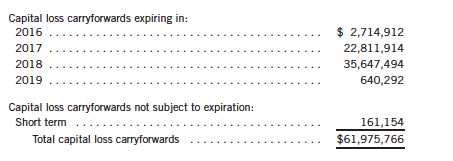

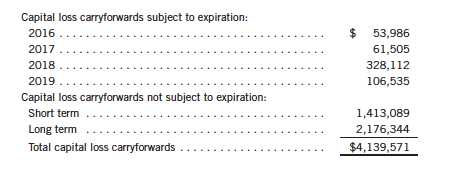

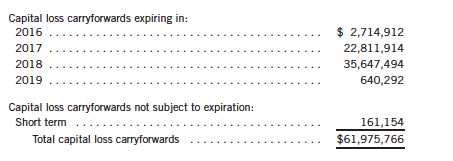

For tax purposes, capital losses may be carried over to offset future capital gains, if any. Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred by the Fund in taxable years beginning after December 22, 2010 are not subject to expiration and such losses retain their character as either short-term or long-term, rather than being considered short-term as under previous law. Post-enactment capital losses must be fully utilized prior to utilizing any losses incurred in pre-enactment tax years.

Annual Report | 31

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Large Cap Equity Fund

5. INCOME TAXES (continued)

At July 31, 2012, the Fund had capital loss carryforwards of $3,690,997 expiring in 2018. During the year ended July 31, 2012, the Fund utilized $170,462 of capital loss carryforwards.

For tax purposes, the Fund may elect to defer any portion of a post-October capital loss to the first day of the following fiscal year. At July 31, 2012, the Fund deferred post-October capital losses of $663,577.

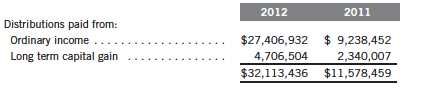

The tax character of distributions paid during the years ended July 31, 2012 and 2011, was as follows:

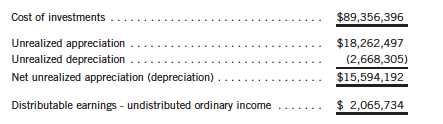

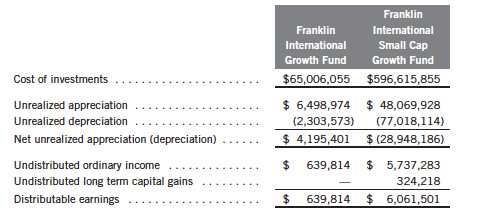

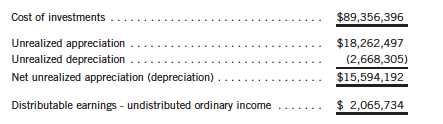

At July 31, 2012, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income for income tax purposes were as follows:

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatment of foreign currency transactions.

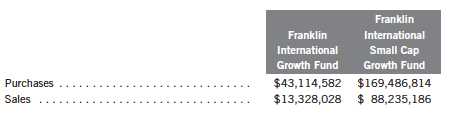

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the year ended July 31, 2012, aggregated $22,418,238 and $19,342,886, respectively.

7. INVESTMENTS IN INSTITUTIONAL FIDUCIARY TRUST MONEY MARKET PORTFOLIO

The Fund invests in the Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an open-end investment company managed by Franklin Advisers, Inc. (an affiliate of the investment manager). Management fees paid by the Fund are reduced on assets invested in the Sweep Money Fund, in an amount not to exceed the management and administrative fees paid by the Sweep Money Fund.

32 | Annual Report

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Large Cap Equity Fund

8. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $1.5 billion (Global Credit Facility) which matures on January 18, 2013. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.08% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the year ended July 31, 2012, the Fund did not use the Global Credit Facility.

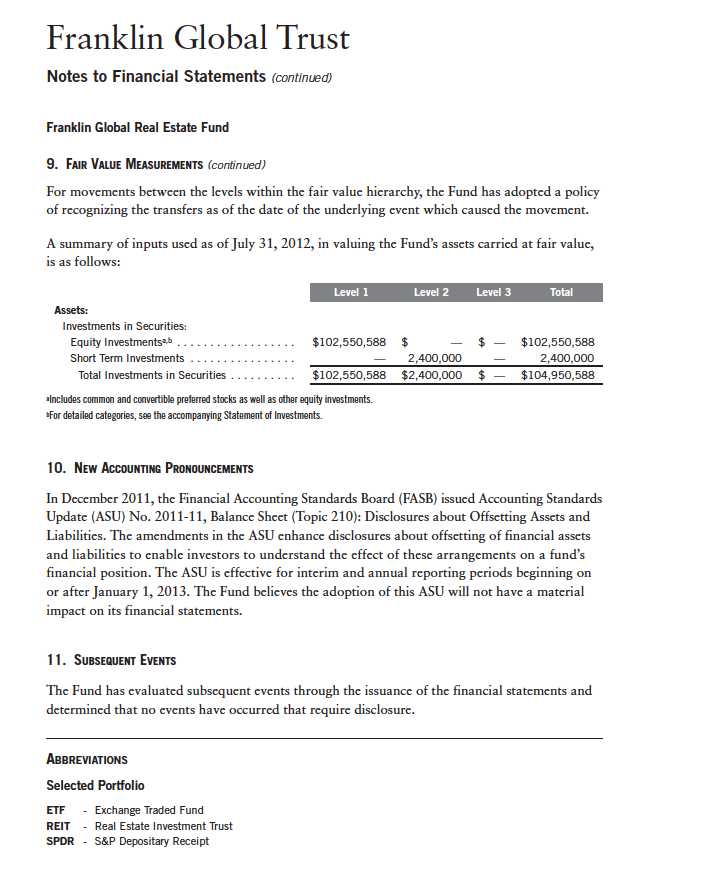

9. FAIR VALUE MEASUREMENTS

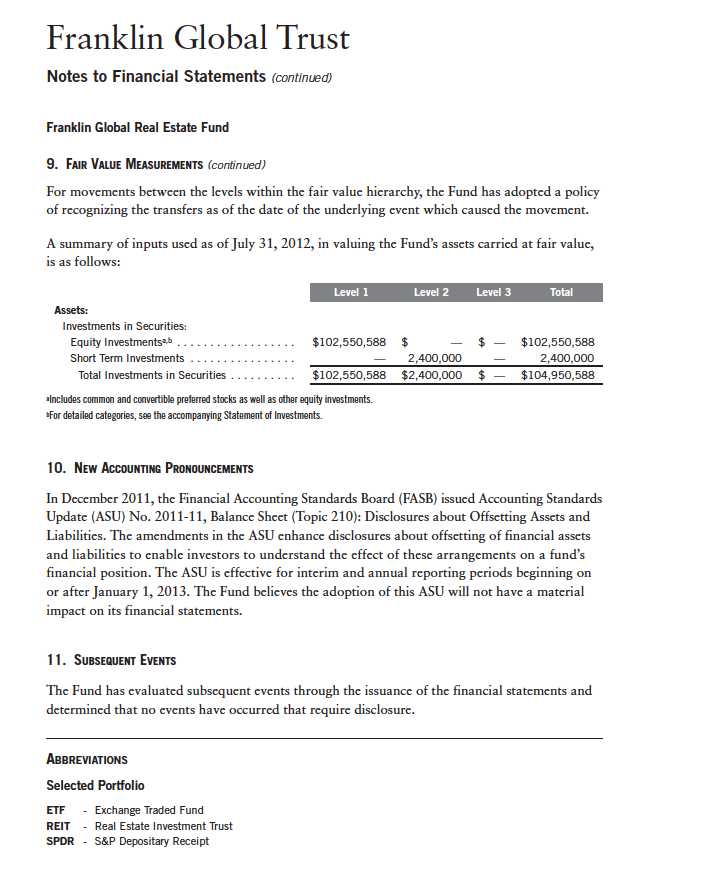

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s financial instruments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical financial instruments

- Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of financial instruments)

The inputs or methodology used for valuing financial instruments are not an indication of the risk associated with investing in those financial instruments.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At July 31, 2012, all of the Fund’s investments in financial instruments carried at fair value were valued using Level 1 inputs. For detailed categories, see the accompanying Statement of Investments.

Annual Report | 33

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Large Cap Equity Fund

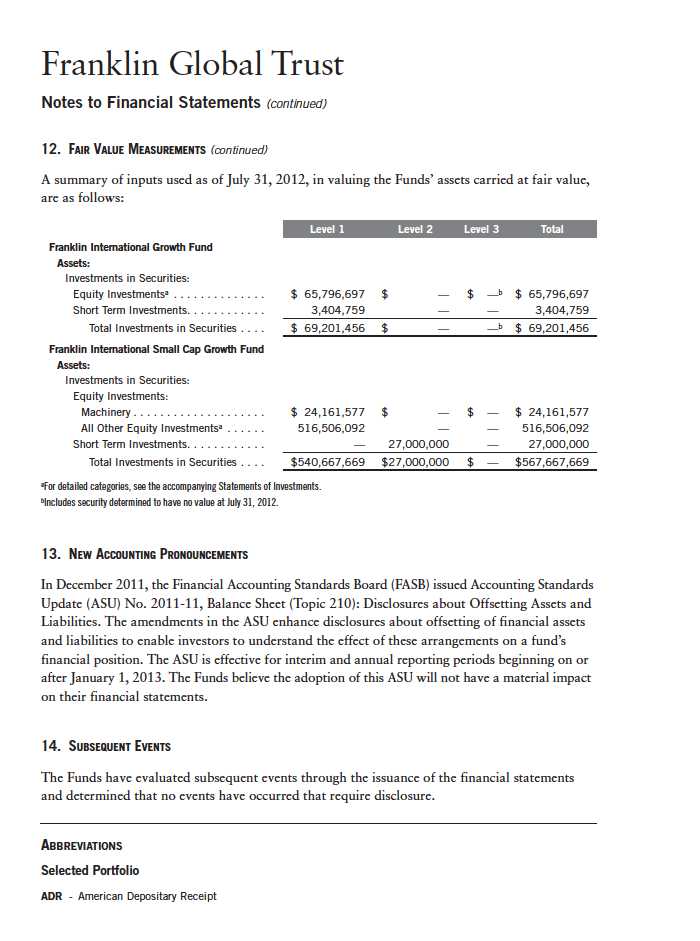

10. NEW ACCOUNTING PRONOUNCEMENTS

In December 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-11, Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities. The amendments in the ASU enhance disclosures about offsetting of financial assets and liabilities to enable investors to understand the effect of these arrangements on a fund’s financial position. The ASU is effective for interim and annual reporting periods beginning on or after January 1, 2013. The Fund believes the adoption of this ASU will not have a material impact on its financial statements.

11. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

ADR - American Depositary Receipt

GDR - Global Depositary Receipt

34 | Annual Report

Franklin Global Trust

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Franklin Large Cap Equity Fund

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Franklin Large Cap Equity Fund (the “Fund”) at July 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at July 31, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

September 17, 2012

Annual Report | 35

Franklin Global Trust

Tax Information (unaudited)

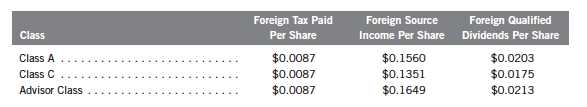

Franklin Large Cap Equity Fund

Under Section 854(b)(1)(A) of the Internal Revenue Code (Code), the Fund hereby reports 100% of the ordinary income dividends as income qualifying for the dividends received deduction for the fiscal year ended July 31, 2012.

Under Section 854(b)(1)(B) of the Code, the Fund hereby reports the maximum amount allowable but no less than $1,290,137 as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended July 31, 2012. Distributions, including qualified dividend income, paid during calendar year 2012 will be reported to shareholders on Form 1099-DIV by mid-February 2013. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their individual income tax returns.

36 | Annual Report

Franklin Global Trust

Shareholder Information

Franklin Large Cap Equity Fund

Board Review of Investment Management Agreement

At a meeting held February 28, 2012, the Board of Trustees (Board), including a majority of non-interested or independent Trustees, approved renewal of the investment management agreements for each of the separate funds within Franklin Global Trust (Fund(s)), including Franklin Large Cap Equity Fund. In reaching this decision, the Board took into account information furnished throughout the year at regular Board meetings, as well as information prepared specifically in connection with the annual renewal review process. Information furnished and discussed throughout the year included investment performance reports and related financial information for each Fund, as well as periodic reports on expenses, shareholder services, legal and compliance matters, pricing, brokerage commissions and execution and other services provided by the Investment Manager (Manager) and its affiliates. Information furnished specifically in connection with the renewal process included a report for each Fund prepared by Lipper, Inc. (Lipper), an independent organization, as well as additional material, including a Fund profitability analysis prepared by management. The Lipper report compared a Fund’s investment performance and expenses with those of other mutual funds deemed comparable to the Fund as selected by Lipper. The Fund profitability analysis discussed the profitability to Franklin Templeton Investments from its overall U.S. fund operations, as well as on an individual fund-by-fund basis. Additional material accompanying such profitability analysis included information on a fund-by-fund basis listing portfolio managers and other accounts they manage, as well as information on management fees charged by the Manager and its affiliates to U.S. mutual funds and other accounts, including management’s explanation of differences where relevant. Such material also included a memorandum prepared by management describing project initiatives and capital investments relating to the services provided to the Funds by the Franklin Templeton Investments organization, as well as a memorandum relating to economies of scale and an analysis concerning transfer agent fees charged by an affiliate of the Manager.

In considering such materials, the independent Trustees received assistance and advice from and met separately with independent counsel. While the investment management agreements for all Funds were considered at the same Board meeting, the Board dealt with each Fund separately. In approving continuance of the investment management agreement for each Fund, the Board, including a majority of independent Trustees, determined that the existing management fee structure was fair and reasonable and that continuance of the investment management agreement was in the best interests of each Fund and its shareholders. While attention was given to all information furnished, the following discusses some primary factors relevant to the Board’s decision.

NATURE, EXTENT AND QUALITY OF SERVICES. The Board was satisfied with the nature and quality of the overall services provided by the Manager and its affiliates to the Fund and its shareholders. In addition to investment performance and expenses discussed later, the Board’s opinion was based, in part, upon periodic reports furnished it showing that the investment policies and restrictions for the Fund were consistently complied with as well as other reports periodically

42 | Annual Report

Franklin Global Trust

Shareholder Information (continued)

Franklin Large Cap Equity Fund

Board Review of Investment Management Agreement (continued)

furnished the Board covering matters such as the compliance of portfolio managers and other management personnel with the code of ethics adopted throughout the Franklin Templeton fund complex, the adherence to fair value pricing procedures established by the Board, and the accuracy of net asset value calculations. The Board also noted the extent of benefits provided Fund shareholders from being part of the Franklin Templeton family of funds, including the right to exchange investments between the same class of funds without a sales charge, the ability to reinvest Fund dividends into other funds and the right to combine holdings in other funds to obtain a reduced sales charge. Favorable consideration was given to management’s continuous efforts and expenditures in establishing back-up systems and recovery procedures to function in the event of a natural disaster, it being noted that such systems and procedures had functioned smoothly during the Florida hurricanes and blackouts experienced in previous years. Among other factors taken into account by the Board were the Manager’s best execution trading policies, including a favorable report by an independent portfolio trading analytical firm, which also covered FOREX transactions. Consideration was also given to the experience of the Fund’s portfolio management team, the number of accounts managed and general method of compensation. In this latter respect, the Board noted that a primary factor in management’s determination of a portfolio manager’s bonus compensation was the relative investment performance of the funds he or she managed and that a portion of such bonus was required to be invested in a predesignated list of funds within such person’s fund management area so as to be aligned with the interests of shareholders. The Board also took into account the quality of transfer agent and shareholder services provided Fund shareholders by an affiliate of the Manager and the continuous enhancements to the Franklin Templeton website. Particular attention was given to management’s conservative approach and diligent risk management procedures, including continuous monitoring of counterparty credit risk and attention given to derivatives and other complex instruments including expanded collateralization requirements. The Board also took into account, among other things, management’s efforts in establishing a global credit facility for the benefit of the Fund and other accounts managed by Franklin Templeton Investments to provide a source of cash for temporary and emergency purposes or to meet unusual redemption requests as well as the strong financial position of the Manager’s parent company and its commitment to the mutual fund business as evidenced by its subsidization of money market funds.

INVESTMENT PERFORMANCE. The Board placed significant emphasis on the investment performance of the Fund in view of its importance to shareholders. While consideration was given to performance reports and discussions with portfolio managers at Board meetings throughout the year, particular attention in assessing performance was given to the Lipper reports furnished for the agreement renewal. The Lipper reports prepared for the Fund showed the investment performance of the largest share class of the Fund in comparison to a performance universe selected by Lipper. Comparative performance for the Fund was shown for the one-year period ended

Annual Report | 43

Franklin Global Trust

Shareholder Information (continued)

Franklin Large Cap Equity Fund

Board Review of Investment Management Agreement (continued)

December 31, 2011, and for additional periods ended that date depending on when the Fund commenced operations. The performance universe for the Fund consisted of the Fund and all retail and institutional large-cap core funds as selected by Lipper. The Lipper report showed the total return of the Fund’s Advisor Class shares for the one-year period to be in the second-lowest quintile of such performance universe, and on an annualized basis to be in the middle quintile of such universe for the previous three-, five- and 10-year periods. The Board discussed with management the reasons for the Fund’s underperformance in 2011, which largely resulted from stock selection in certain sectors, and the steps being taken to improve such performance. The Board was not satisfied with such performance but did not believe any change in portfolio management personnel was warranted, noting that the Fund’s total return as shown in the Lipper report was in either the highest performing quintile or second-highest performing quintile of its Lipper performance universe in three of the previous four years.

COMPARATIVE EXPENSES. Consideration was given to the management fee and total expense ratio of the dominant share class of the Fund with those of a comparative share class within a group of funds selected by Lipper as its appropriate Lipper expense group. Lipper expense data is based upon information taken from each fund’s most recent annual report, which reflects historical asset levels that may be quite different from those currently existing, particularly in a period of market volatility. While recognizing such inherent limitation and the fact that expense ratios generally increase as assets decline and decrease as assets grow, the Board believed the independent analysis conducted by Lipper to be an appropriate measure of comparative expenses. In reviewing comparative costs, Lipper provides information on the Fund’s management fee in comparison with the contractual investment management fee that would have been charged by other funds within its Lipper expense group assuming they were similar in size to the Fund, as well as the actual total expenses of the Fund in comparison with those of its Lipper expense group. The Lipper contractual investment management fee analysis includes the advisory and administrative fees directly charged to the Fund as being part of the management fee. The contractual investment management fee rate for the Fund was above the median of its Lipper expense group, but its actual total expense ratio was below the median of its Lipper expense group. The Board found the expenses of the Fund to be acceptable, noting they were subsidized by management.

MANAGEMENT PROFITABILITY. The Board also considered the level of profits realized by the Manager and its affiliates in connection with the operation of the Fund. In this respect, the Board reviewed the Fund profitability analysis that addresses the overall profitability of Franklin Templeton’s U.S. fund business, as well as its profits in providing management and other services to each of the individual funds during the 12-month period ended September 30, 2011, being the most recent fiscal year-end for Franklin Resources, Inc., the Manager’s parent. In reviewing the analysis, attention was given to the methodology followed in allocating costs to the Fund, it being

44 | Annual Report

Franklin Global Trust

Shareholder Information (continued)

Franklin Large Cap Equity Fund

Board Review of Investment Management Agreement (continued)

recognized that allocation methodologies are inherently subjective and various allocation methodologies may each be reasonable while producing different results. In this respect, the Board noted that, while being continuously refined and reflecting changes in the Manager’s own cost accounting, the allocation methodology was consistent with that followed in profitability report presentations for the Fund made in prior years and that the Fund’s independent registered public accounting firm had been engaged by the Manager to review the reasonableness of the allocation methodologies solely for use by the Fund’s Board in reference to the profitability analysis. In reviewing and discussing such analysis, management discussed with the Board its belief that costs incurred in establishing the infrastructure necessary for the type of mutual fund operations conducted by the Manager and its affiliates may not be fully reflected in the expenses allocated to the Fund in determining its profitability, as well as the fact that the level of profits, to a certain extent, reflected operational cost savings and efficiencies initiated by management. The Board also took into account management’s expenditures in improving shareholder services provided the Fund, as well as the need to implement systems and meet additional regulatory and compliance requirements resulting from statutes such as the Sarbanes-Oxley and Dodd-Frank Acts and recent SEC and other regulatory requirements. In addition, the Board considered a third-party study comparing the profitability of the Manager’s parent on an overall basis to other publicly held managers broken down to show profitability from management operations exclusive of distribution expenses, as well as profitability including distribution expenses. The Board also considered the extent to which the Manager and its affiliates might derive ancillary benefits from fund operations, including revenues generated from transfer agent services and potential benefits resulting from allocation of fund brokerage and the use of commission dollars to pay for research. Based upon its consideration of all these factors, and taking into account the fact that the expenses of the Fund were being subsidized through fee waivers, the Board determined that the level of profits realized by the Manager and its affiliates from providing services to the Fund was not excessive in view of the nature, quality and extent of services provided.

ECONOMIES OF SCALE. The Board also considered whether economies of scale are realized by the Manager as the Fund grows larger and the extent to which this is reflected in the level of management fees charged. While recognizing that any precise determination is inherently subjective, the Board noted that based upon the Fund profitability analysis, it appears that as some funds get larger, at some point economies of scale do result in the Manager realizing a larger profit margin on management services provided such a fund. The Board believed it unlikely that economies of scale existed in the management of the Fund, which had less than $100 million of assets at December 31, 2011.

Annual Report | 45

Franklin Global Trust

Shareholder Information (continued)

Franklin Large Cap Equity Fund

Proxy Voting Policies and Procedures

The Trust’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Trust uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Trust’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Trust’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Trust files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Householding of Reports and Prospectuses

You will receive the Fund’s financial reports every six months as well as an annual updated summary prospectus (prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the financial reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 632-2301. At any time you may view current prospectuses/summary prospectuses and financial reports on our website. If you choose, you may receive these documents through electronic delivery.

46 | Annual Report

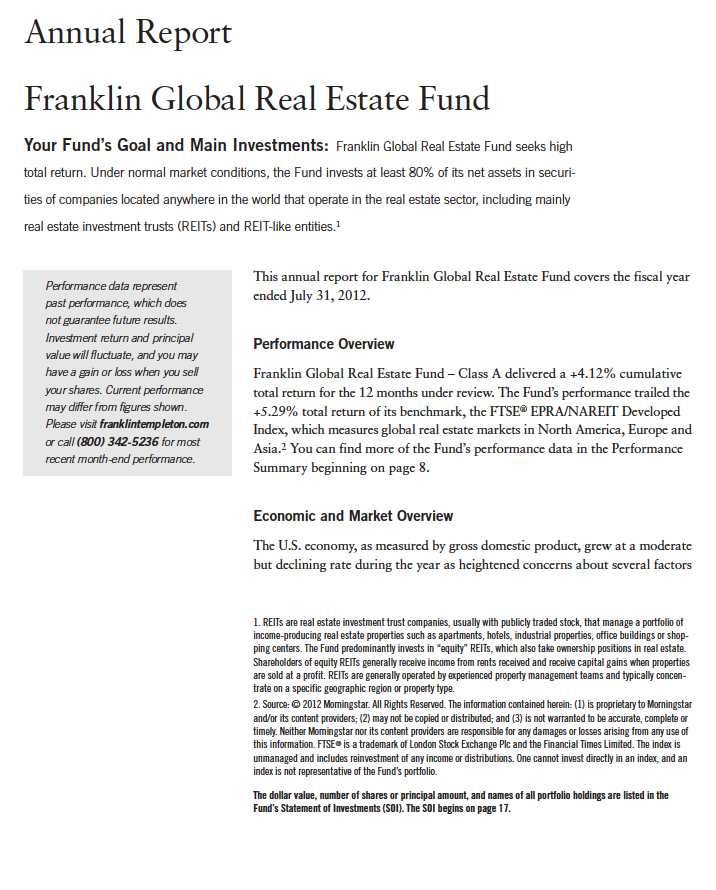

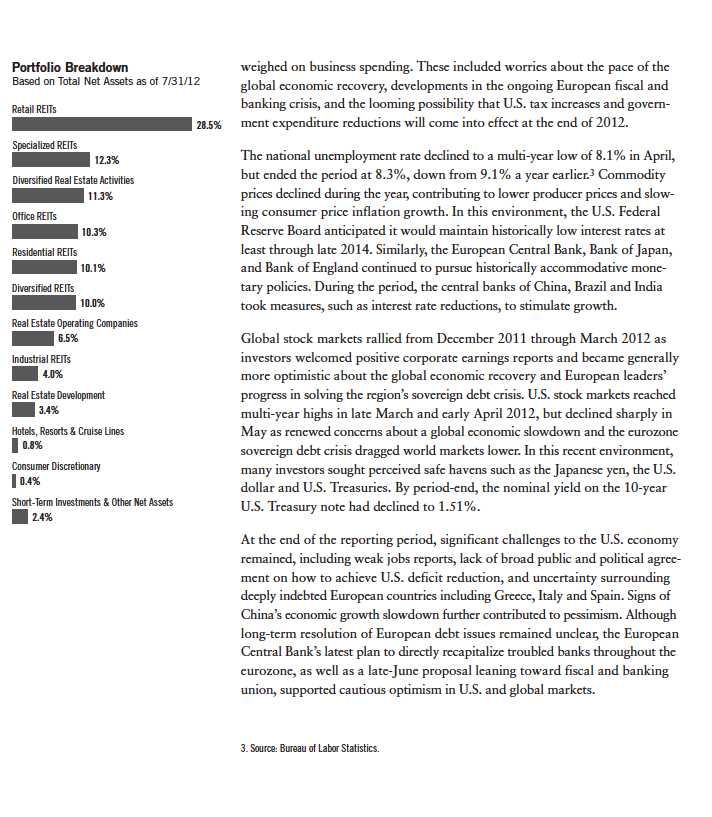

| 1

Annual Report | 3

4 | Annual Report

Annual Report | 5

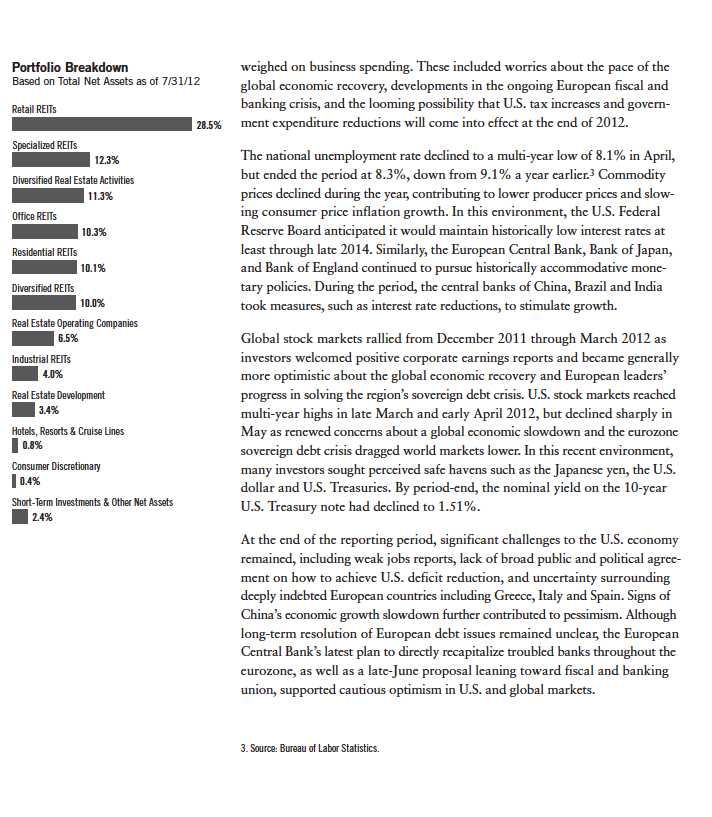

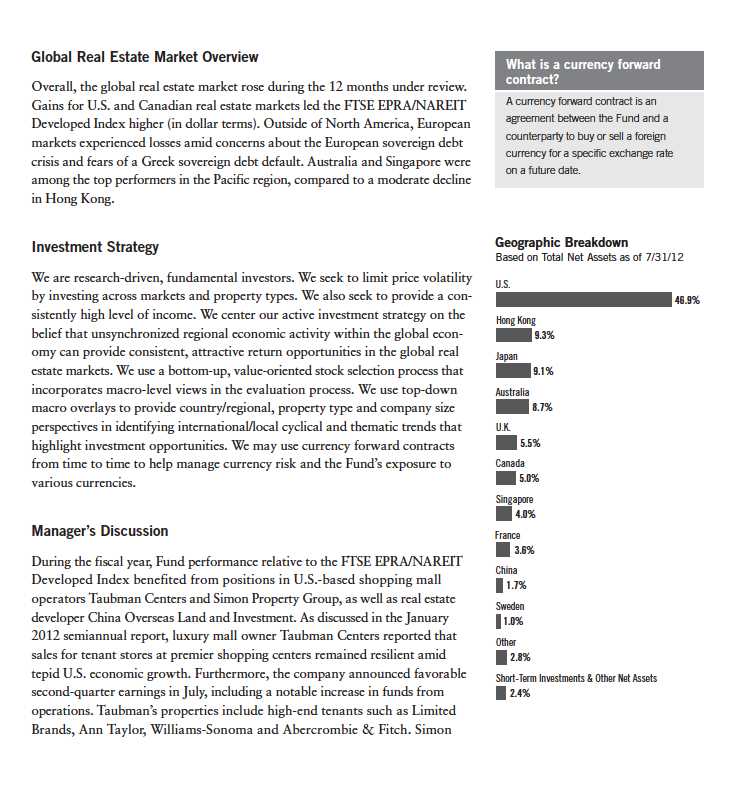

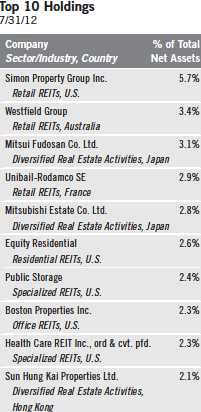

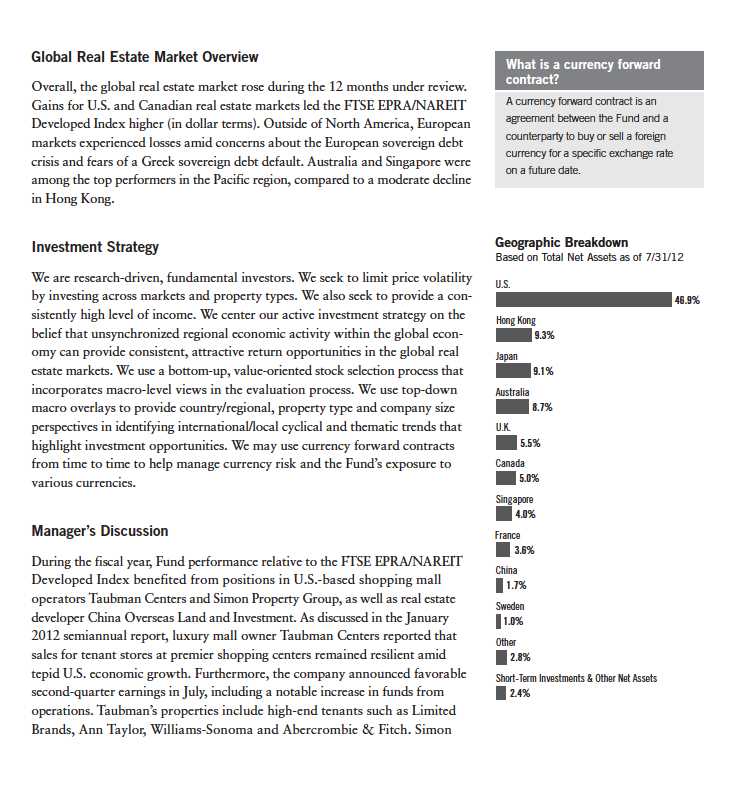

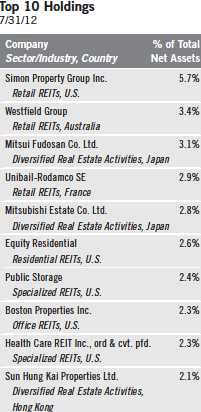

Property Group announced robust second-quarter earnings as occupancy rates and average rents continued to improve. Near period-end, Simon, the largest U.S. REIT and mall owner, raised its dividend payout and its earnings forecasts. The upscale mall operator also announced plans to develop centers in Brazil. Finally, shares of Hong Kong-based China Overseas Land and Investment climbed amid speculation that potential global stimulus from central banks could help boost China’s slowing economic growth and improve residential sales. The company’s property development and investment activities may benefit from new stimulus. China’s central bank cut its benchmark interest rate and lowered its one-year lending rate near the end of the reporting period, easing conditions and potentially providing a tailwind for China Overseas Land and Investment.

In contrast, shares of Evergrande Real Estate Group weighed on relative performance as the China-based developer reported contract sales dropped notably in late 2011 from the same period one year earlier. Share prices were also hampered when a U.S.-based online research organization called into question financial statements released by Evergrande, which owns the largest land bank in China. Commercial property investment firm Unibail-Rodamco is headquartered in Paris and focuses on shopping centers, convention centers and office properties. During the period, the firm announced profits declined from a year earlier primarily due to lower gains on sale from investment property dispositions and a corresponding reduction in recurring income. The company had previously paid a large special dividend as a result of these portfolio management activities. Investment holding company KWG Property Holding Limited4 warned it may have to cut pricing to stimulate demand for its residential, office, hotel and retail properties. Headquartered in Guangzhou, China, KWG Property has been negatively affected by the Chinese government’s curbs on home purchases and tightened credit to developers and buyers.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended July 31, 2012, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s substantial investment in securities with non-U.S. currency exposure.

4. No longer held at period-end.

6 | Annual Report

Thank you for your continued participation in Franklin Global Real Estate Fund. We look forward to serving your future investment needs.

Portfolio Management Team

Franklin Global Real Estate Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of July 31, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Annual Report | 7

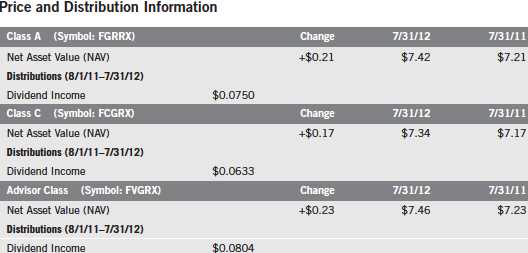

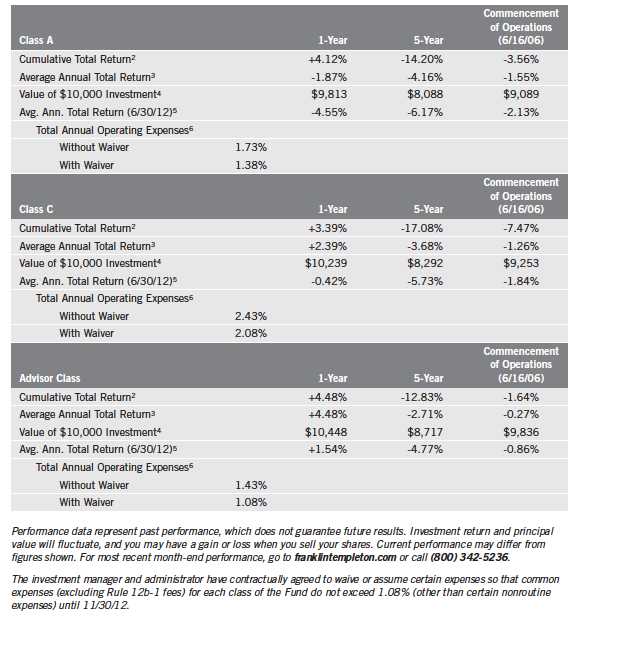

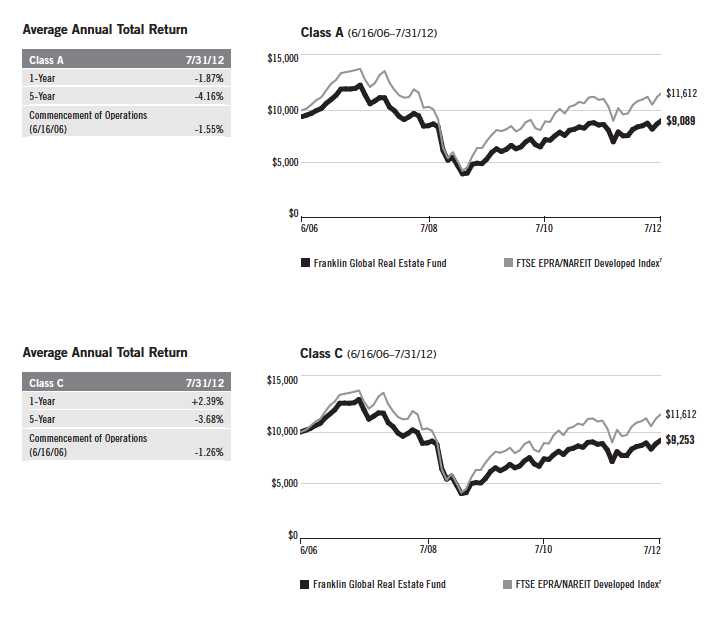

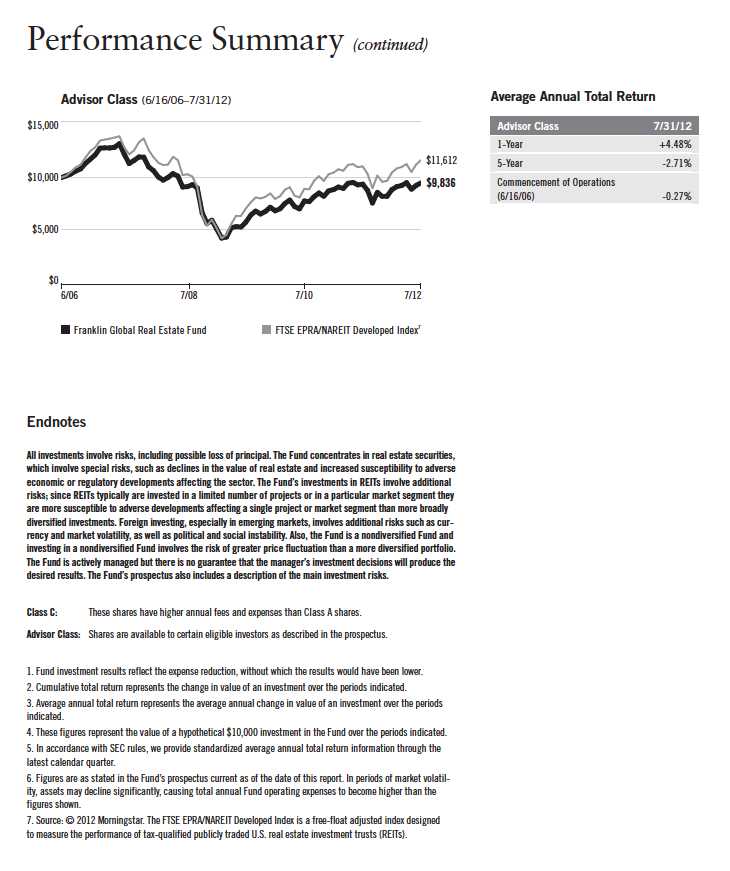

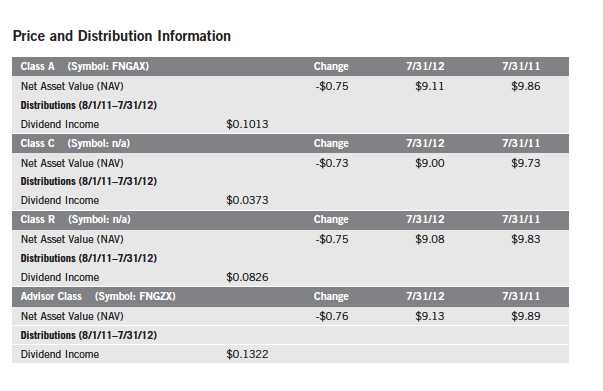

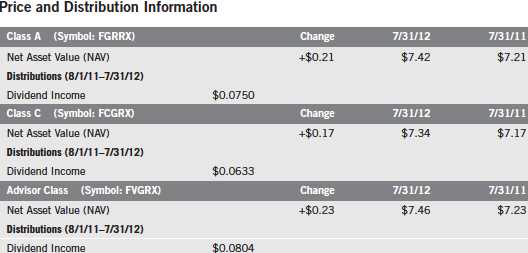

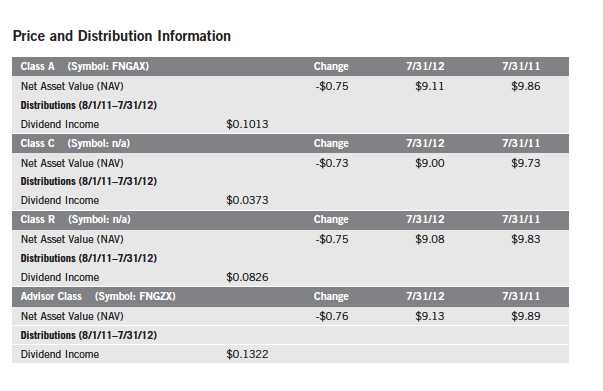

Performance Summary as of 7/31/12

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

8 | Annual Report

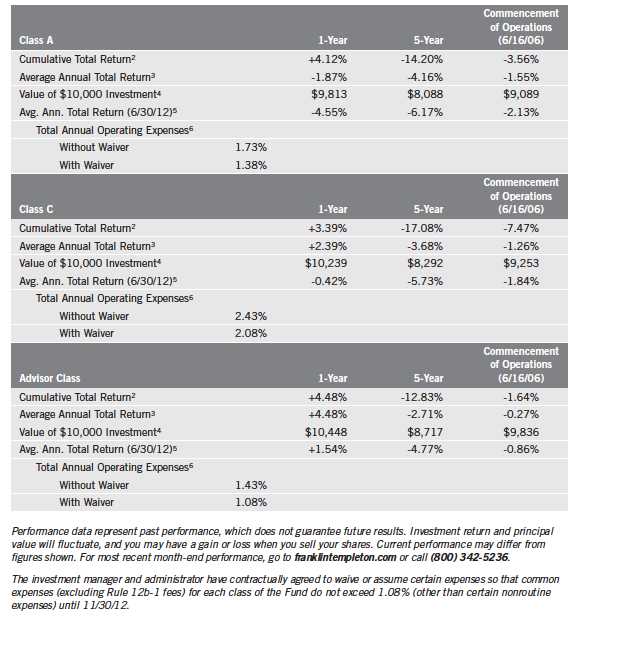

Performance Summary (continued)

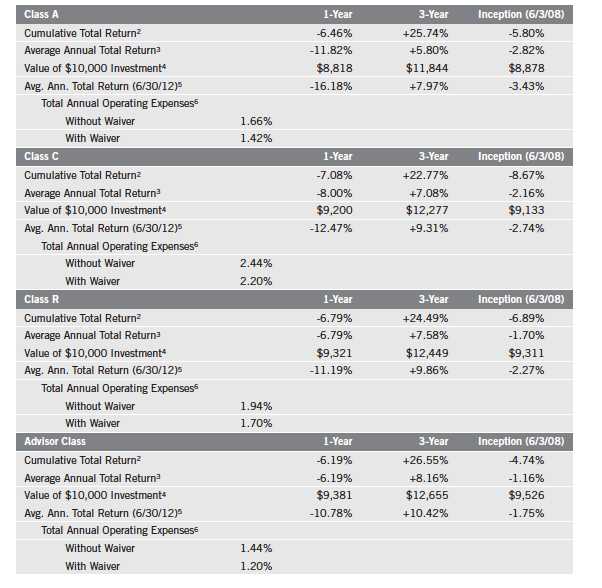

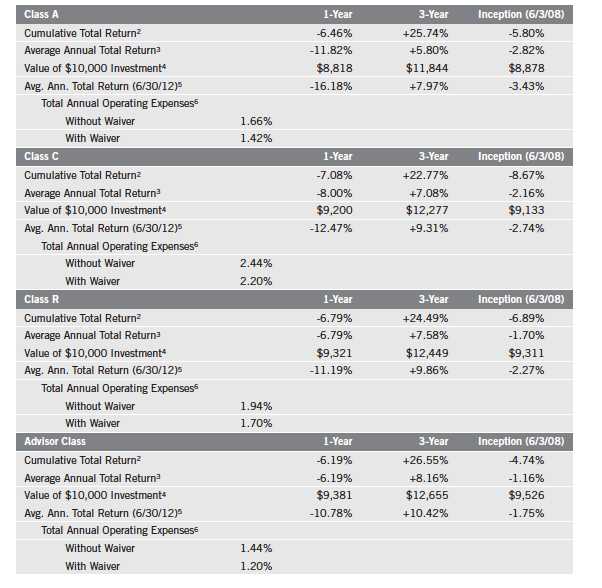

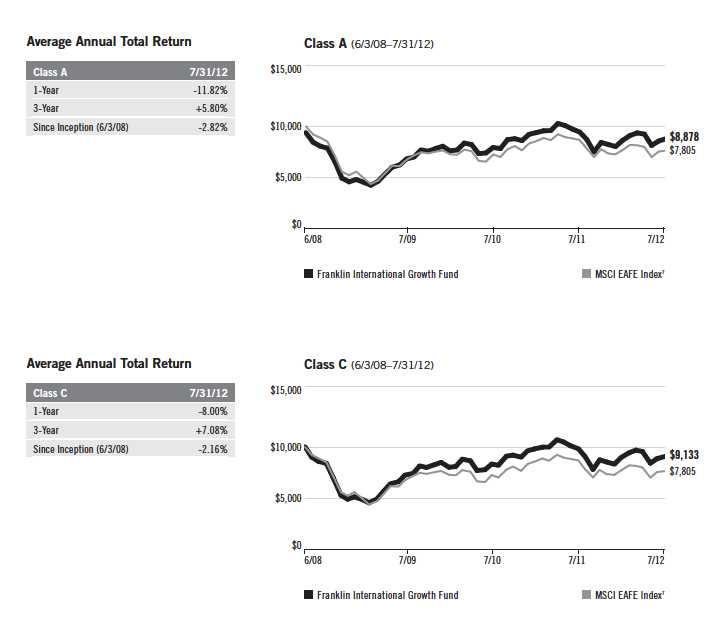

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

Annual Report | 9

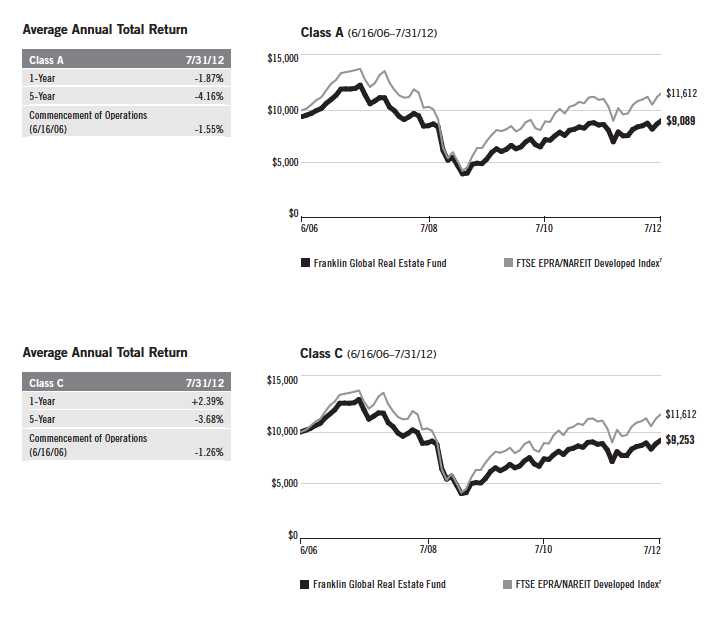

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

10 | Annual Report

Annual Report | 11

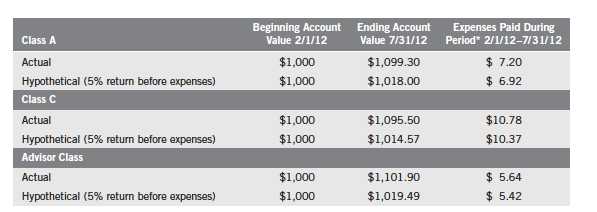

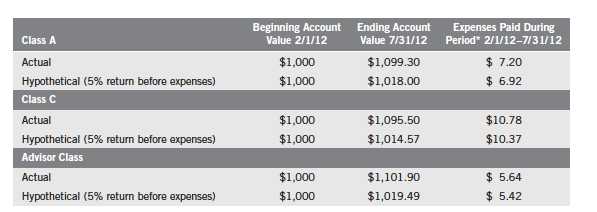

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,60 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

12 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.38%; C: 2.07%; and Advisor: 1.08%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

Annual Report | 13

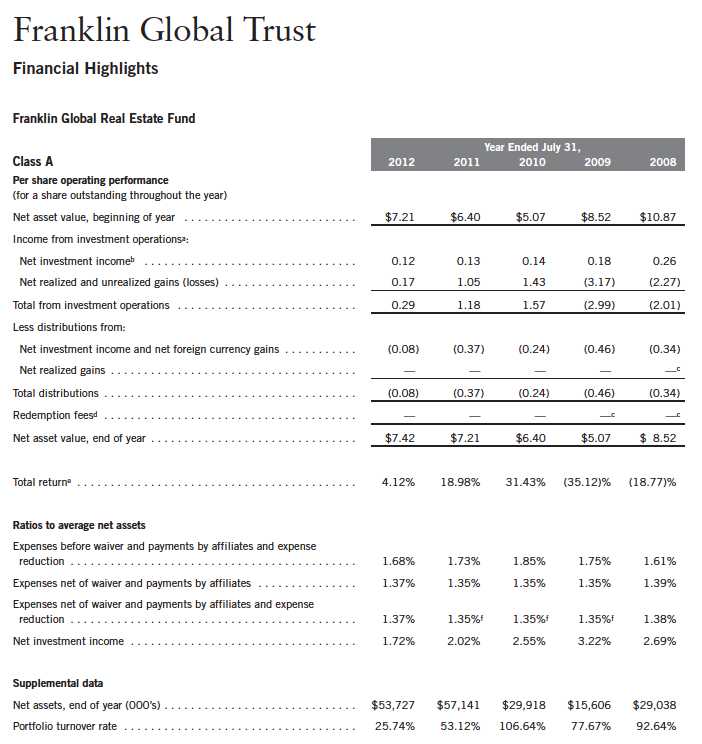

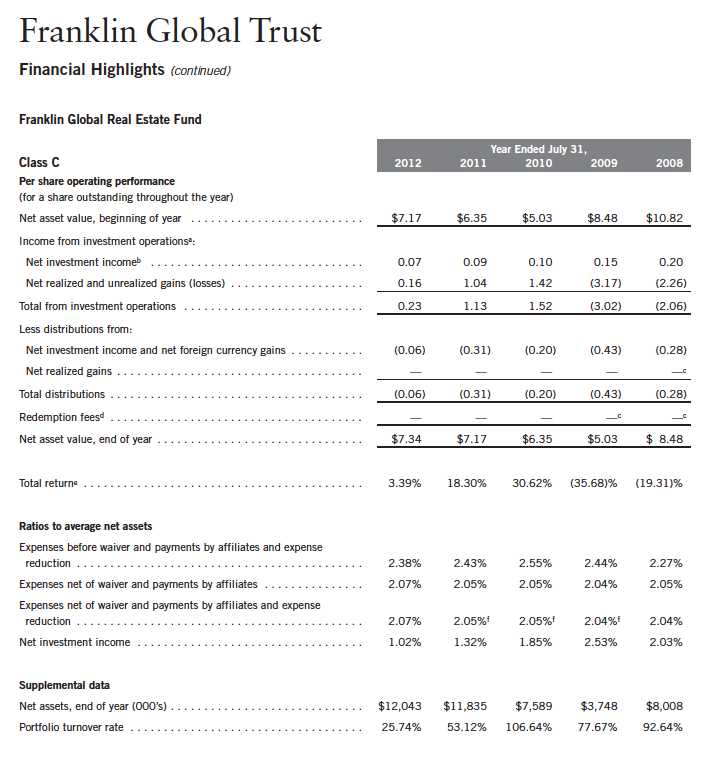

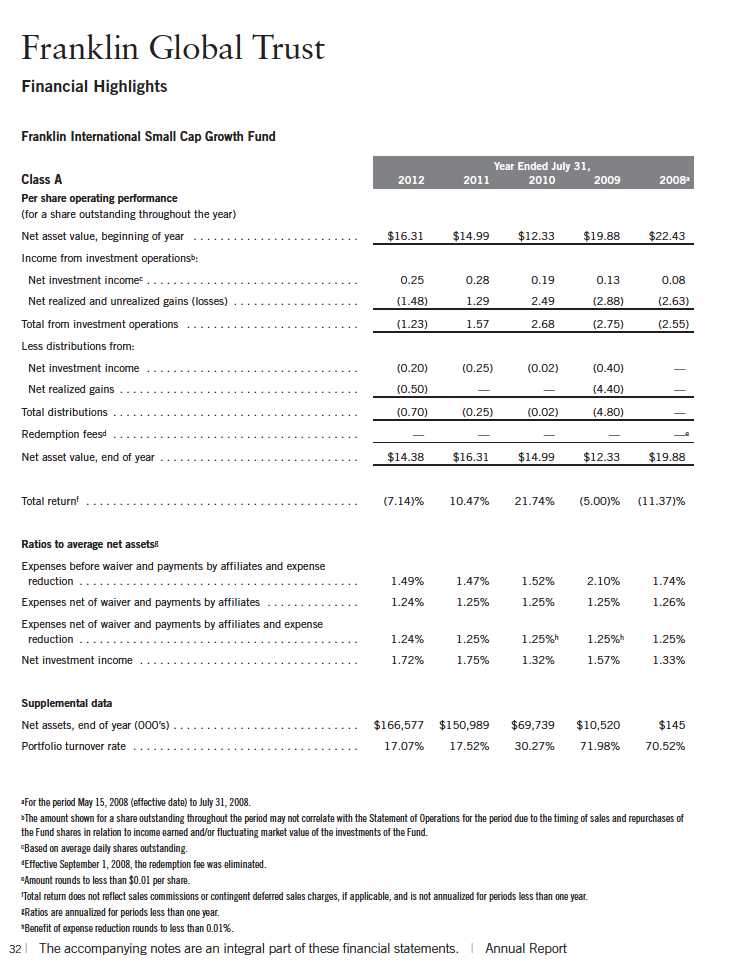

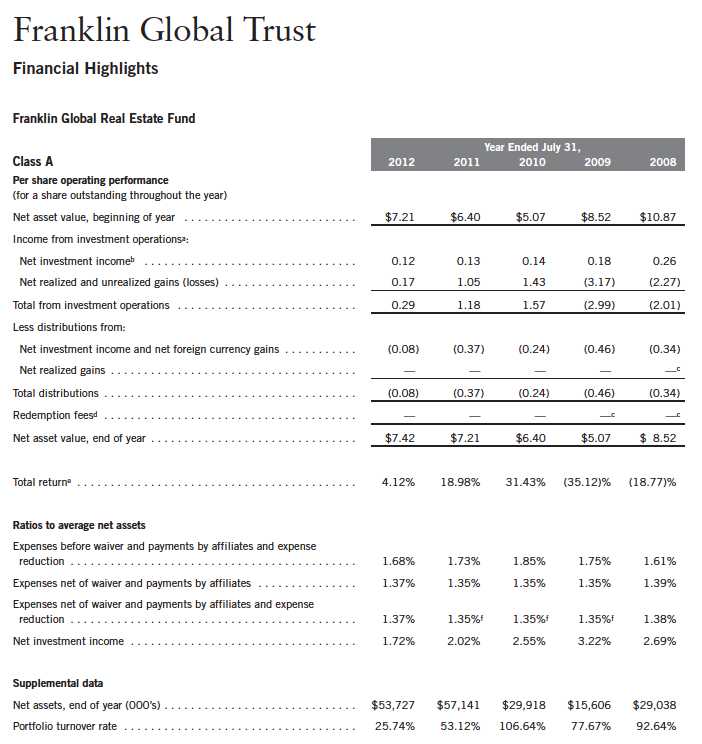

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

14 | The accompanying notes are an integral part of these financial statements. | Annual Report

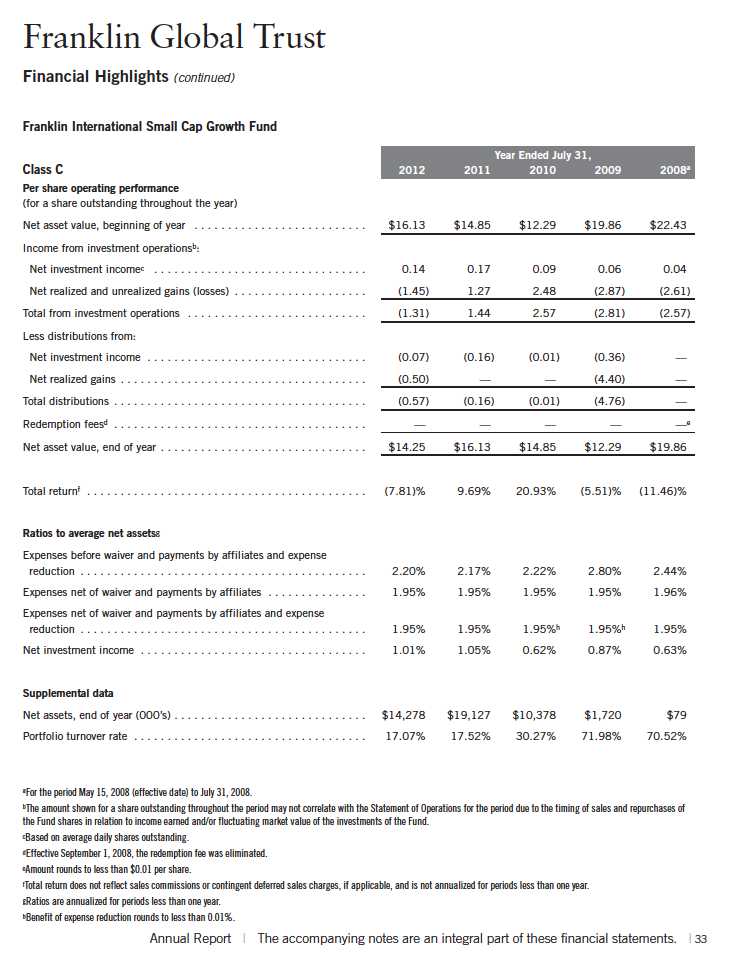

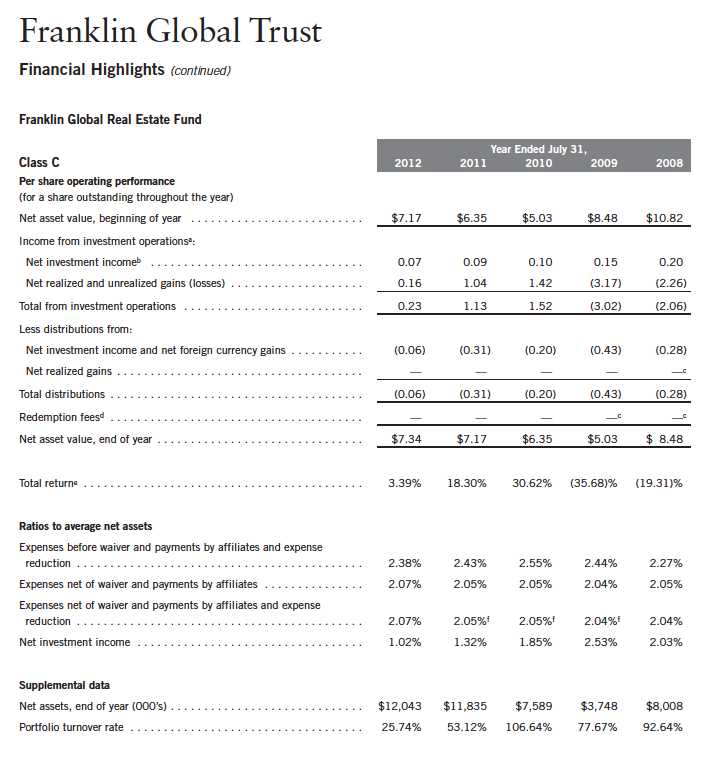

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these financial statements. | 15

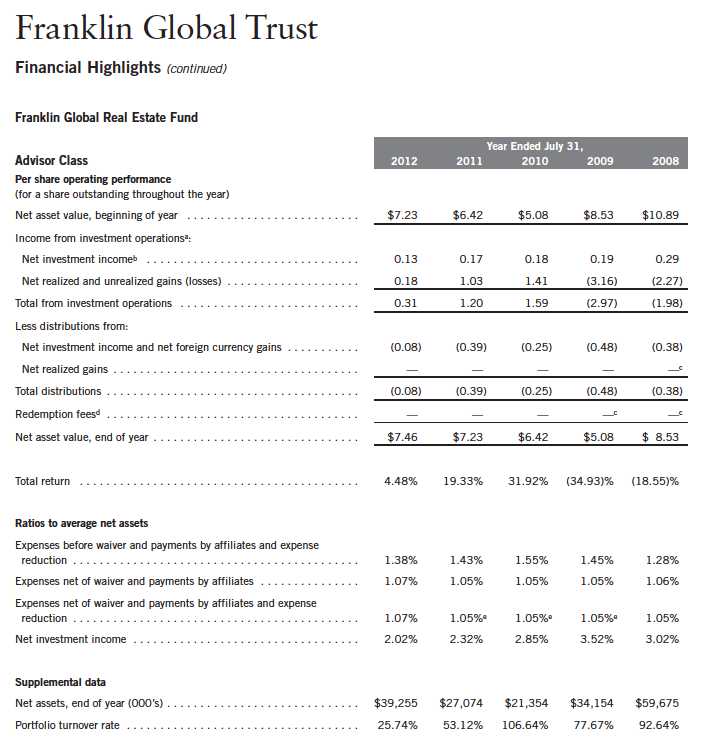

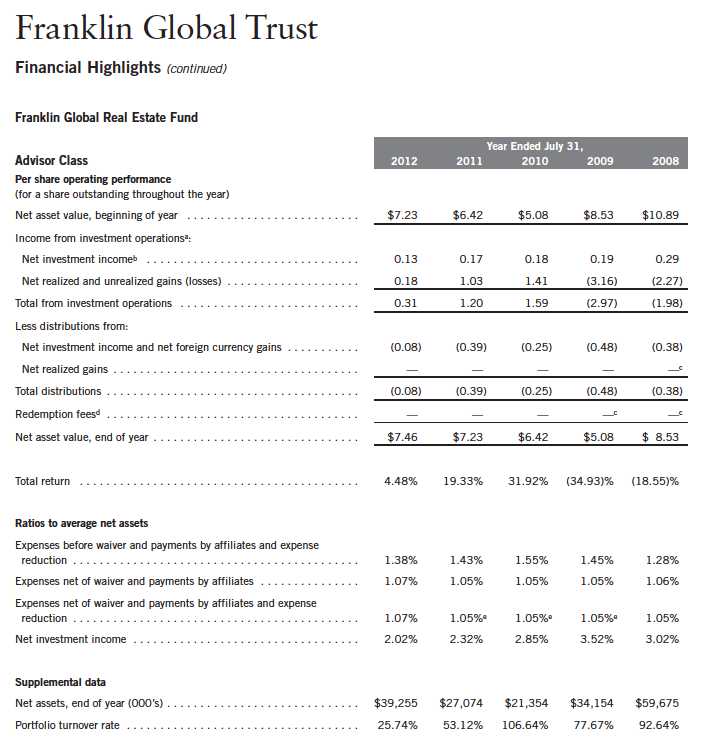

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eBenefit of expense reduction rounds to less than 0.01%.

16 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | 17

Annual Report | 19

20 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 21

22 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 23

24 | The accompanying notes are an integral part of these financial statements. | Annual Report

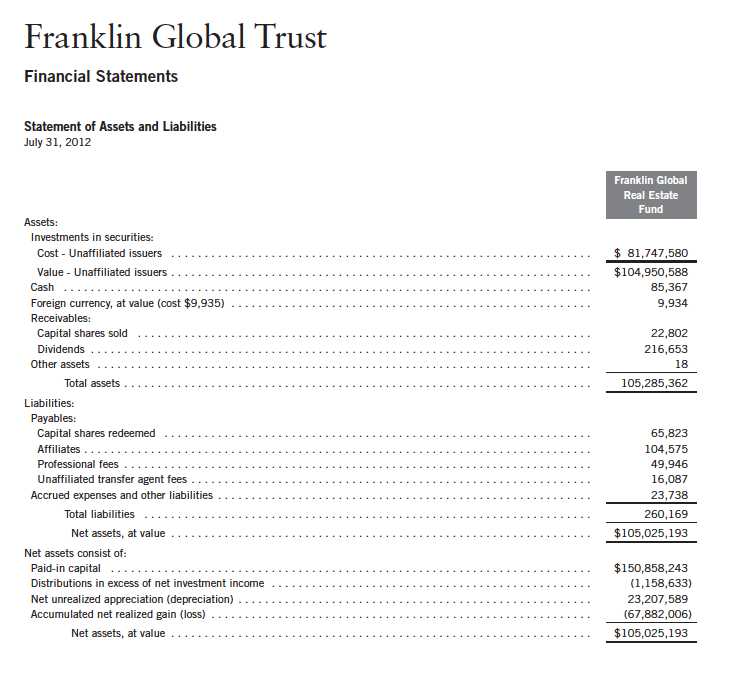

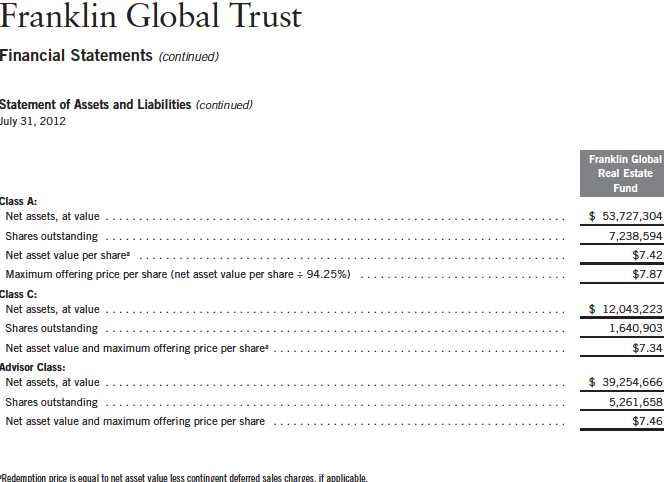

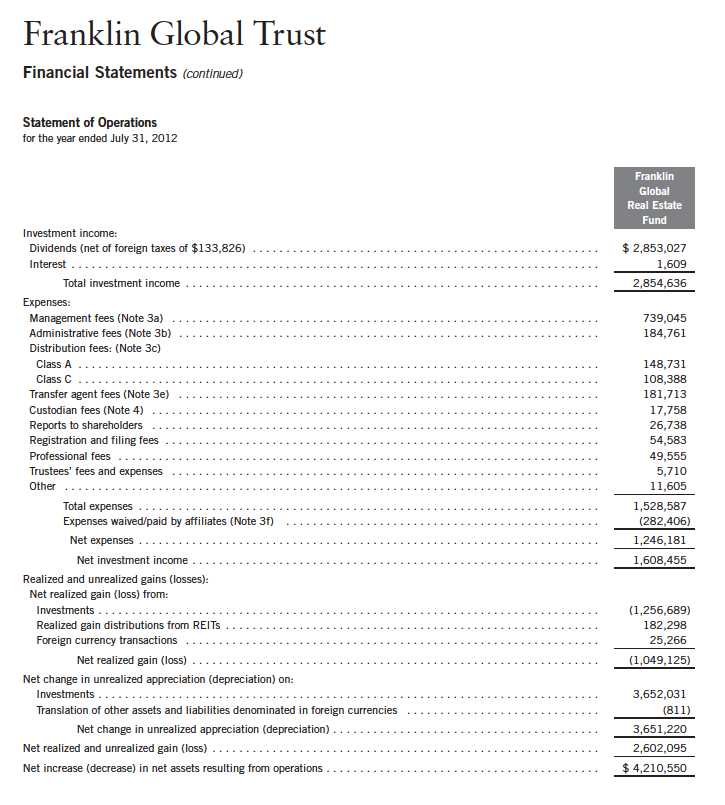

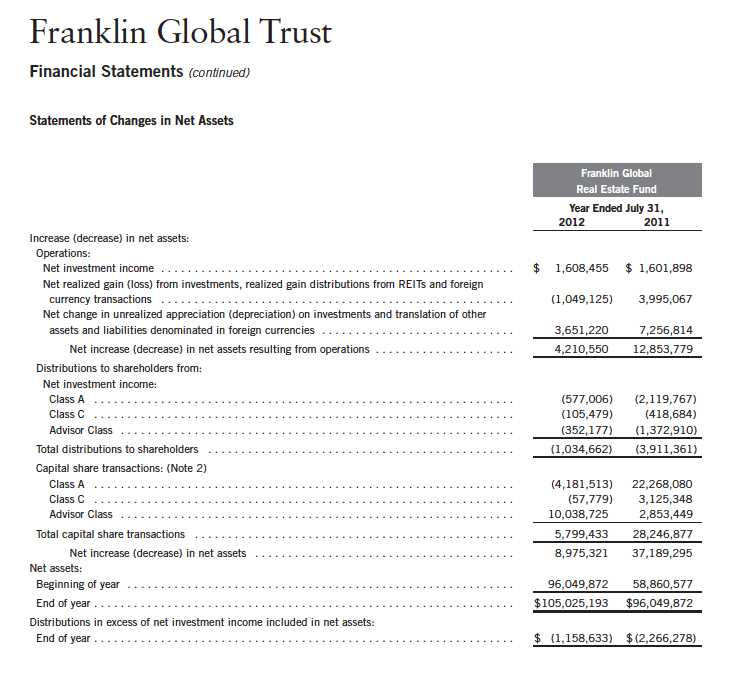

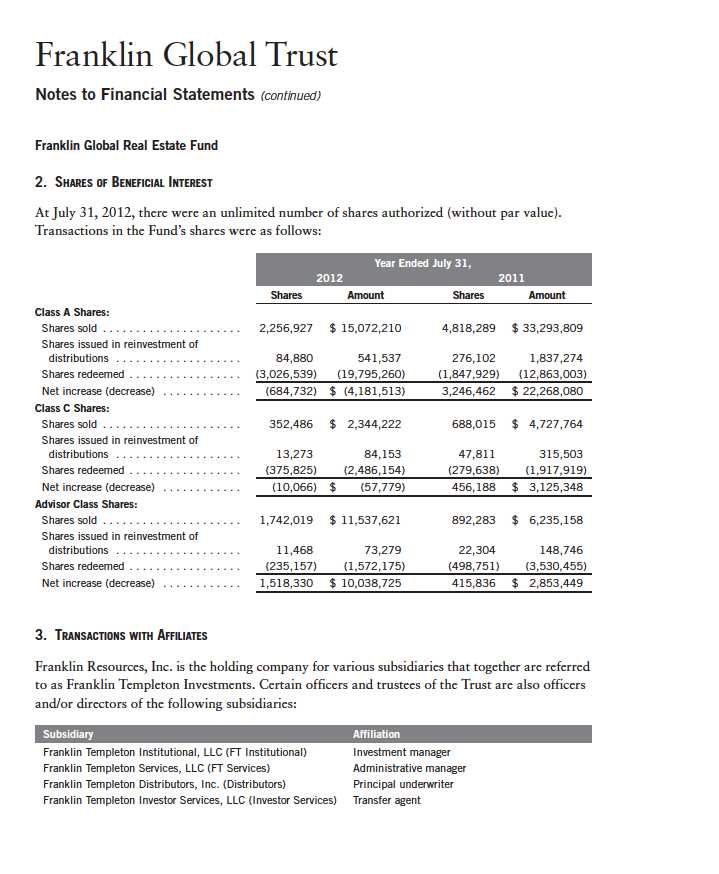

Franklin Global Trust

Notes to Financial Statements

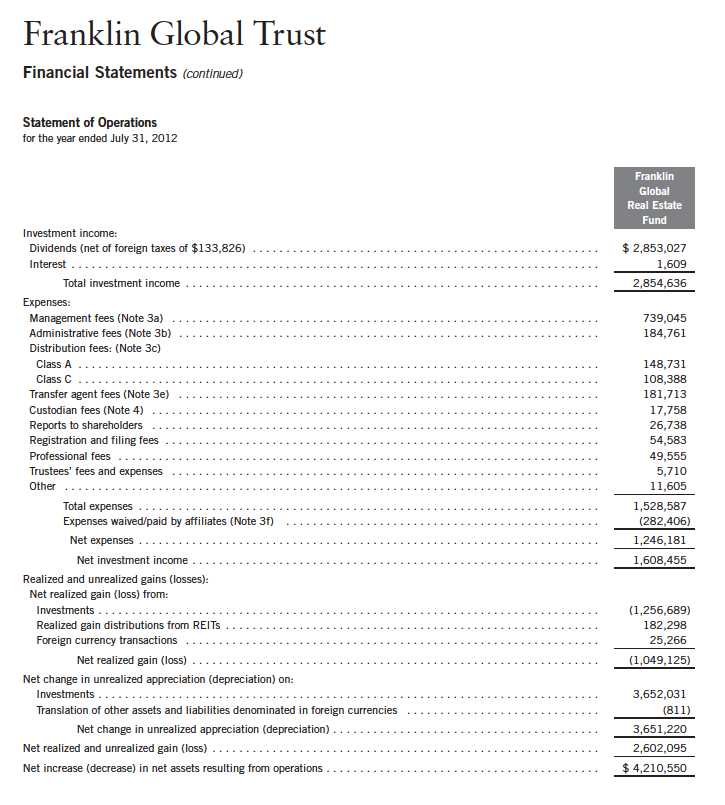

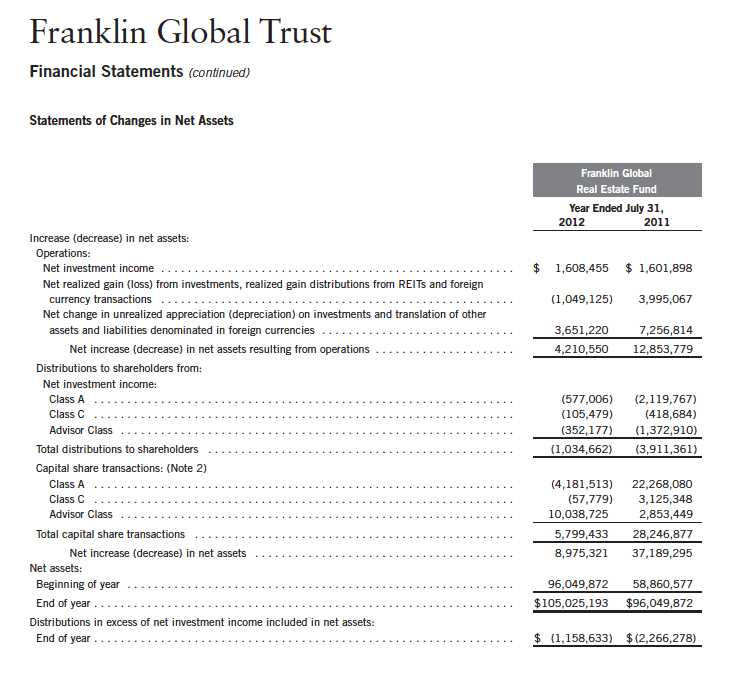

Franklin Global Real Estate Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

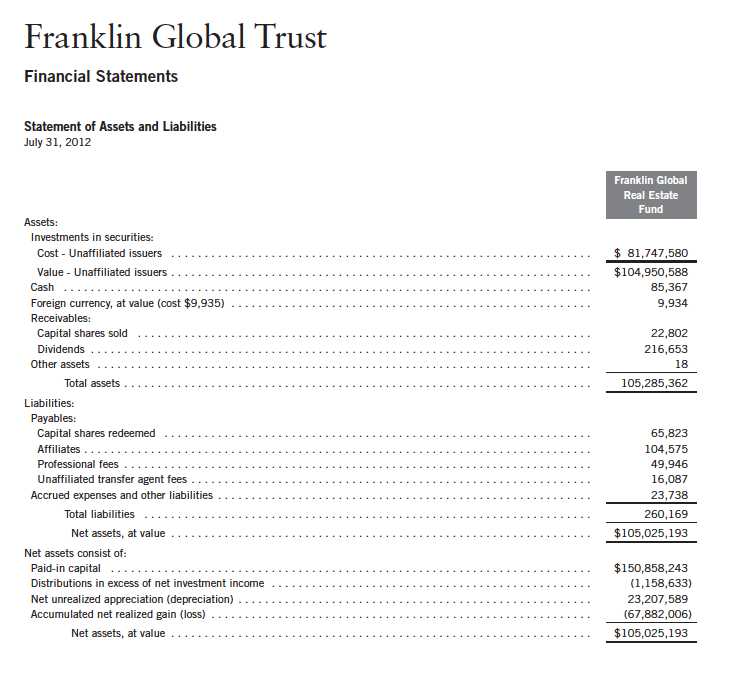

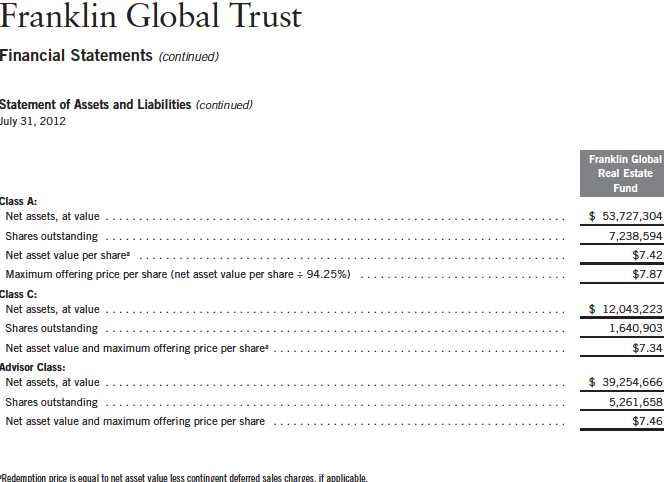

Franklin Global Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of five separate funds. The Franklin Global Real Estate Fund (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. The Fund offers three classes of shares: Class A, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust’s Board of Trustees (the Board), the Fund’s administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities and exchange traded funds listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Time deposits are valued at cost, which approximates market value.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be

Annual Report | 25

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Global Real Estate Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

Trading in securities on foreign securities stock exchanges and OTC markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the VLOC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

26 | Annual Report

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Global Real Estate Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Foreign Currency Translation (continued) |

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Income Taxes and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of July 31, 2012, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent

Annual Report | 27

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Global Real Estate Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

Distributions received by the Fund from certain securities may be a return of capital (ROC). Such distributions reduce the cost basis of the securities, and any distributions in excess of the cost basis are recognized as capital gains.

e. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Funds, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

28 | Annual Report

Annual Report | 29

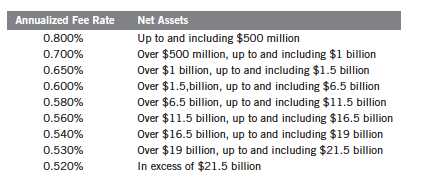

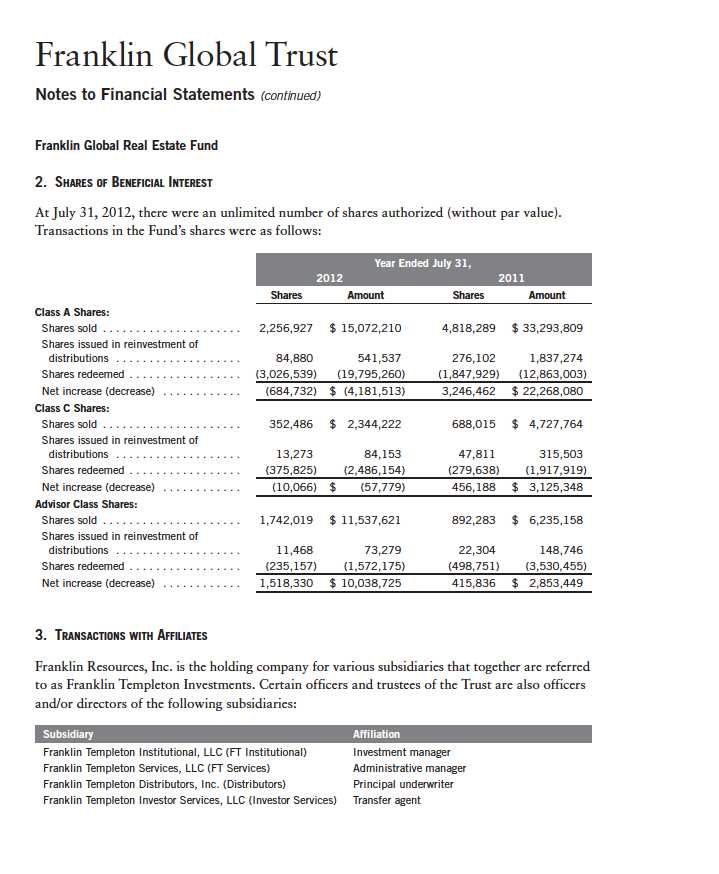

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Global Real Estate Fund

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| a. | Management Fees |

The Fund pays an investment management fee to FT Institutional based on the average daily net assets of the Fund as follows:

b. Administrative Fees

The Fund pays an administrative fee to FT Services of 0.20% per year of the average daily net assets of the Fund.

c. Distribution Fees

The Board has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

In addition, under the Fund’s Class C compensation distribution plan, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

30 | Annual Report

Franklin Global Trust

Notes to Financial Statements (continued)

Franklin Global Real Estate Fund

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| d. | Sales Charges/Underwriting Agreements |

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

e. Transfer Agent Fees

For the year ended July 31, 2012, the Fund paid transfer agent fees of $181,713, of which $98,812 was retained by Investor Services.

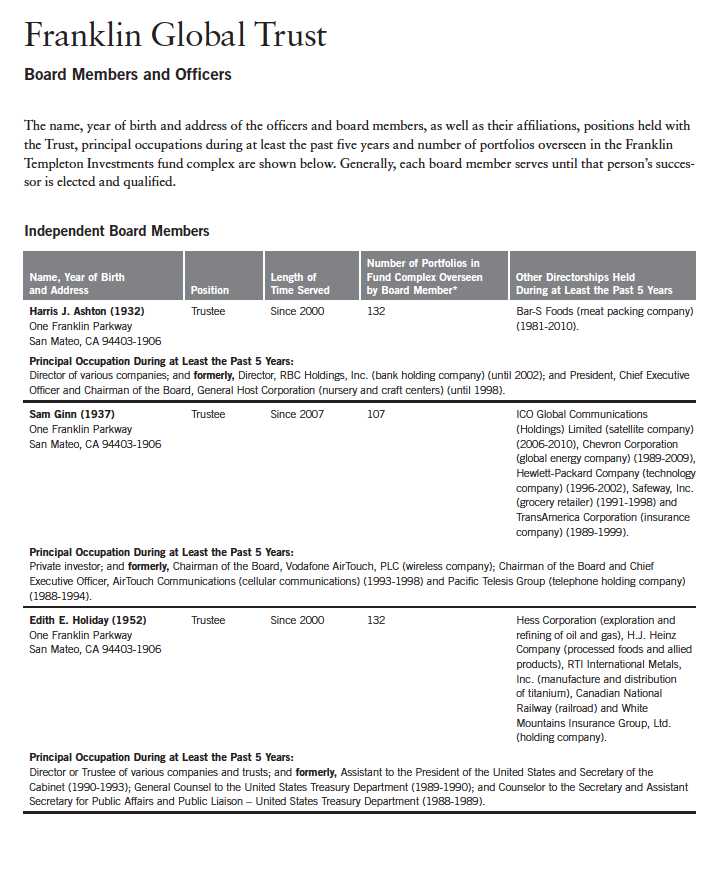

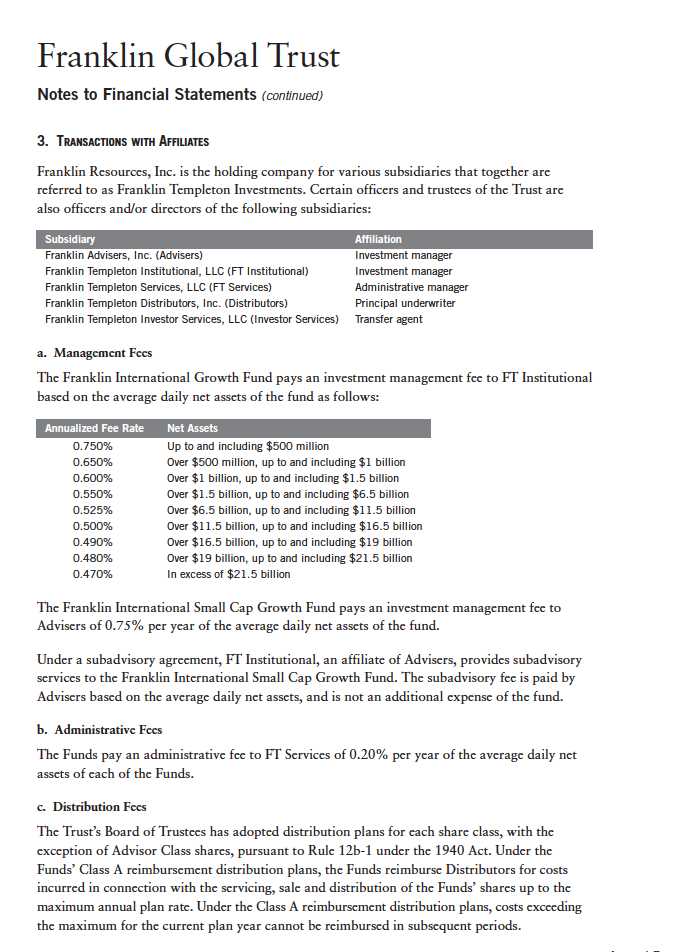

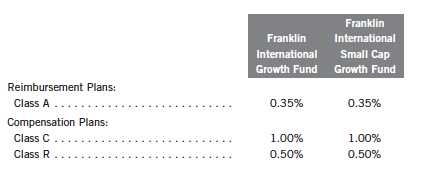

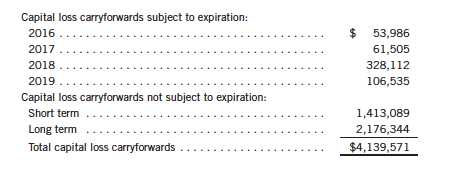

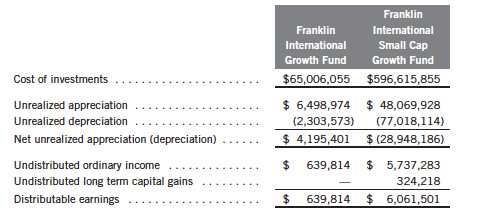

f. Waiver and Expense Reimbursements