UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-10157

Franklin Global Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650312-2000

Date of fiscal year end: 7/31

Date of reporting period: 7/31/19

| Item 1. | Reports to Stockholders. |

| | |

Franklin International Growth Fund | | Franklin International Small Cap Fund Formerly, Franklin International Small Cap Growth Fund |

Sign up for electronic delivery at franklintempleton.com/edelivery

Internet Delivery of Fund Reports Unless You Request Paper Copies:Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800)632-2301 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800)632-2301 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

FRANKLIN TEMPLETON

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

Dear Shareholder:

During the 12 months ended July 31, 2019, the global economy generally expanded amid positive economic data in certain regions, healthy corporate earnings, and the U.S. Federal Reserve’s (Fed’s) patient monetary policy stance. The European Central Bank left its benchmark interest rate unchanged and announced it would not raise rates in the next year due to risks including Brexit and global trade tensions. The Fed raised its target range for the federal funds rate by 0.25% at its September and December 2018 meetings, to 2.25%–2.50%. However, at its July 2019 meeting, the Fed lowered its target range to 2.00%–2.25%, citing muted inflation and the implications of global developments for the U.S. economy. Global markets were pressured by trade tensions between the U.S. and its trading partners and other geopolitical risks. In this environment, stocks in global developed markets excluding the U.S. and Canada ended the period with negative returns, as measured by the MSCI Europe, Australasia and Far East Index.

We are committed to ourlong-term perspective and disciplined investment approach as we conduct a rigorous, fundamental analysis of securities with a regular emphasis on investment risk management.

We believe active, professional investment management serves investors well. We also recognize the important role of financial advisors in today’s markets and encourage investors to continue to seek their advice. Amid changing markets and economic conditions, we are confident investors

with awell-diversified portfolio and a patient,long-term outlook should be well positioned for the years ahead.

Franklin Global Trust’s annual report includes more detail about prevailing conditions and discussions about investment decisions during the period. Please remember all securities markets fluctuate, as do mutual fund share prices.

We thank you for investing with Franklin Templeton, welcome your questions and comments, and look forward to serving your future investment needs.

Sincerely,

Edward Perks, CFA

President and Chief Executive Officer –

Investment Management

Franklin Global Trust

This letter reflects our analysis and opinions as of July 31, 2019, unless otherwise indicated. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

CFA® is a trademark owned by CFA Institute.

| | |

| | Not FDIC Insured | May Lose Value | No Bank Guarantee |

| | | | |

| | | |

| franklintempleton.com | | Not part of the annual report | | 1 |

Contents

|

| Visitfranklintempleton.comfor fund updates, to access your account, or to find helpful financial planning tools. |

| | | | |

| | | |

2 | | Annual Report | | franklintempleton.com |

ANNUAL REPORT

Economic and Market Overview

The U.S. economy grew during the 12 months ended July 31, 2019. After moderating for two consecutive quarters, the economy grew significantly faster in 2019’s first quarter. However, the economy moderated again in the second quarter, due to weakness in inventory investment, exports, business investment and housing investment. The unemployment rate decreased from 3.9% in July 2018 to 3.7% atperiod-end.1 The annual inflation rate, as measured by the Consumer Price Index, decreased from 2.9% in July 2018 to 1.9% atperiod-end.1

The U.S. Federal Reserve (Fed) raised its target range for the federal funds rate by 0.25% at its September and December 2018 meetings, to 2.25%–2.50%. However, at its July 2019 meeting, the Fed lowered the federal funds target rate for the first time since December 2008, to 2.00%–2.25%, citing muted inflation pressures and the potential effects of global trade tensions on economic growth. Furthermore, the Fed ended its balance sheet normalization program two months earlier than previously indicated. The broad U.S. stock market, as measured by the Standard & Poor’s® 500 Index, posted a +8.52% total return for the 12 months under review.2

The global economy expanded during the period, despite weakness in certain regions. Global developed and emerging market stocks were aided by upbeat economic data in some regions, encouraging corporate earnings reports and periods of optimism about a potential U.S.-China trade deal. The Fed’s patient approach to its monetary policy in early 2019, recent rate cut and indications it will act appropriately to sustain U.S. economic expansion and achieve its inflation objective aided market sentiment.

However, markets reflected concerns about the Fed’s interest-rate hikes and the European Central Bank’s (ECB’s) unwinding of its bond purchase program in 2018, political uncertainties in the U.S. and the European Union, and the impact of U.S. trade disputes with China and other trading partners on global growth and corporate earnings. In this environment, global developed and emerging market stocks, as measured by the MSCI All Country World Index, posted a +3.52% total return for the12-month period.2

In Europe, the U.K.’s quarterly gross domestic product (GDP) growth accelerated in 2018’s third quarter,

moderated in the fourth quarter and reaccelerated in 2019’s first quarter. However, GDP contracted in the second quarter compared with the first quarter, as Brexit uncertainties weighed on business sentiment. The Bank of England raised its key policy rate once during the period. The eurozone’s quarterly GDP growth moderated in 2018’s third quarter and accelerated in the next two quarters, before moderating again in 2019’s second quarter. The bloc’s annual inflation rate decreased during the period. The ECB concluded its bond purchase program at the end of 2018 and kept its benchmark interest rate unchanged. In June, the ECB mentioned it would leave interest rates unchanged through the first half of 2020 and provided details of its new stimulus. However, the ECB signaled in July the potential for a rate cut, while indicating support for additional stimulus to bolster economic expansion.

In Asia, Japan’s quarterly GDP growth contracted in 2018’s third quarter, accelerated in the next two quarters and moderated in 2019’s second quarter. The Bank of Japan (BOJ) left its benchmark interest rate unchanged and continued its stimulus measures during the period. In July, the BOJ expressed its openness to increase stimulus to sustain economic growth and achieve its inflation goal. China’s annual GDP growth rate moderated in 2018’s third and fourth quarters, held steady in 2019’s first quarter and moderated in the second quarter to its lowest level since 1992, amid trade tensions with the U.S. and weak global demand. The People’s Bank of China left its benchmark interest rate unchanged, but it took measures to improve financial liquidity to mitigate the effects of the U.S.-China trade dispute and support economic growth.

The foregoing information reflects our analysis and opinions as of July 31, 2019. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: U.S. Bureau of Labor Statistics.

2. Source: Morningstar.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 3 |

Franklin International Growth Fund

This annual report for Franklin International Growth Fund covers the fiscal year ended July 31, 2019.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital appreciation by investing predominantly in equity securities ofmid- and large-capitalization companies, generally those with market capitalizations greater than $2 billion, located outside of the U.S., including developing or emerging market countries. The Fund considers international companies to be those organized under the laws of a country outside of the U.S. or having a principal office in a country outside of the U.S., or whose securities are listed or traded principally on a recognized stock exchange orover-the-counter market outside of the U.S.

Performance Overview

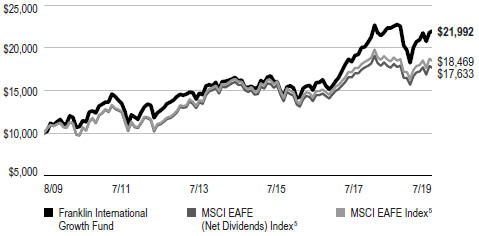

For the 12 months ended July 31, 2019, the Fund’s Class A shares posted a-2.62% cumulative total return. In comparison, the Fund’s benchmark, the MSCI Europe, Australasia and Far East (EAFE) (Net Dividends) Index, posted a-2.60% total return.1 Also for comparison, the Fund’s secondary benchmark, the MSCI EAFE Index, posted a-2.09% total return.1 Both indexes measure global developed stock market performance excluding the U.S. and Canada, taking into account the impact of foreign withholding taxes for the net index. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 8.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go tofranklintempleton.comor call(800)342-5236.

Investment Strategy

In choosing individual equity investments, we employ a disciplined,bottom-up approach to identify attractive investment opportunities that have higher expected revenue and earnings growth than their peers. We use a growth

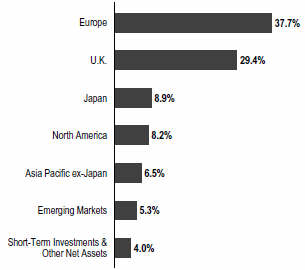

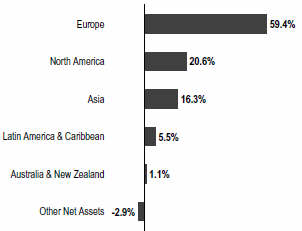

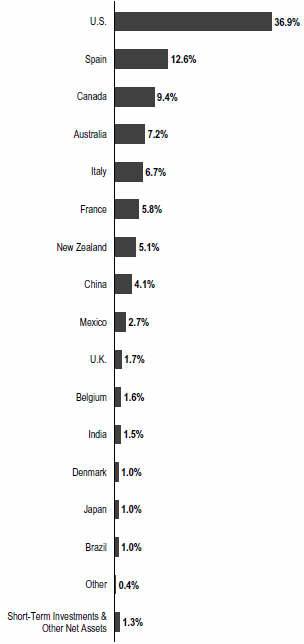

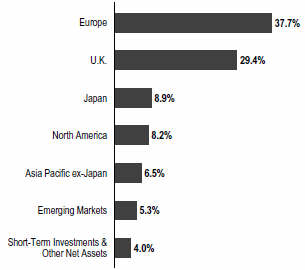

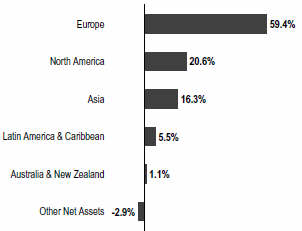

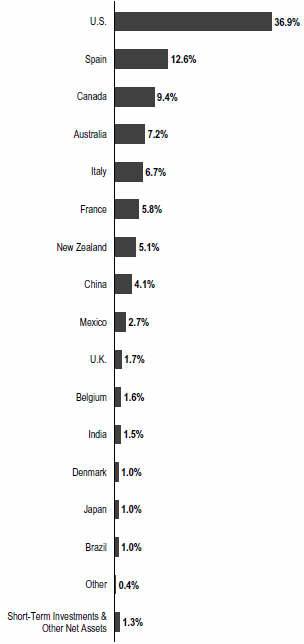

Geographic Composition

Based on Total Net Assets as of 7/31/19

investment style andin-depth, fundamental research to identify high-quality companies, across all industry groups, with sustainable business models that offer the most attractive combination of growth, quality and valuation. The investment manager’s process generally includes an assessment of the potential impacts of any material environmental, social and governance (ESG) factors on the long-term risk and return profile of a company.

Manager’s Discussion

During the12-month period under review, stock selection in the health care, communication services and materials sectors detracted from the Fund’s relative performance.2

In health care,off-benchmark positions in Ireland-based biopharmaceutical company Alkermes and U.S.-listed medical device maker LivaNova hurt relative performance. In April, LivaNova announced disappointing first quarter earnings due to short-term weakness in its neuromodulation business caused by competitive pressures and salesforce turnover. We believe the company’s strong market positions

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions (after the deduction of certain withholding taxes for the Net Dividends Index). It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. The health care sector comprises biotechnology, health care equipment and supplies, and pharmaceuticals in the SOI. The communication services sector comprises media in the SOI. The materials sector comprises chemicals in the SOI.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 25.

| | | | |

| | | |

4 | | Annual Report | | franklintempleton.com |

FRANKLIN INTERNATIONAL GROWTH FUND

in both cardiac surgery and neurostimulation products along with a robust product pipeline should support longer-term growth.

In communication services, Japan-based media and gaming company CyberAgent was a major relative detractor. Despite this, we remain optimistic and expect CyberAgent’s gaming and advertising businesses to continue to grow, which would allow the company to use those profits to invest in its media businesses to drive future growth.

Top 10 Countries

7/31/19

| | |

| | | % of Total

Net Assets |

U.K. | | 29.4% |

Germany | | 14.4% |

Japan | | 8.9% |

Netherlands | | 7.8% |

Australia | | 6.5% |

Denmark | | 5.5% |

Belgium | | 5.1% |

Canada | | 4.9% |

U.S. | | 3.3% |

Argentina | | 2.7% |

In materials, Belgium-based clean technology materials firm Umicore detracted from relative returns due to ongoing concerns about near-term weakness in sales, partly due to China’s ongoing reduction of electric vehicle subsidies. During the second quarter of 2019, the company acquired a cobalt refinery in Finland and secured a long-term supply agreement for the metal, which is used in electric car batteries. We believe Umicore should benefit from the ongoing global growth of electric car sales and continued demand for cleaner emissions technology over the longer term.

In other sectors, relative detractors included Zozo, a Japanese online apparel retailer, and Dollarama, a Canada-based discount retailer. Despite recent weakness, we expect Zozo to benefit as more Japanese consumers purchase clothing online. Other detractors included John Wood Group, a U.K.-based oilfield services firm, and Weir Group (not held atperiod-end), a U.K.- based engineering equipment company.

Top 10 Sectors/Industries

7/31/19

| | |

| | | % of Total

Net Assets |

Internet & Direct Marketing Retail | | 11.5% |

IT Services | | 10.5% |

Health Care Equipment & Supplies | | 9.2% |

Software | | 9.0% |

Chemicals | | 8.3% |

Media | | 6.2% |

Pharmaceuticals | | 5.1% |

Aerospace & Defense | | 4.8% |

Banks | | 4.6% |

Energy Equipment & Services | | 3.4% |

Turning to contributors, stock selection and an overweight in information technology (IT) and stock selection in industrials supported relative performance.3 Stock selection and an underweight in financials also helped relative results.4

Several IT stocks contributed to relative performance following strong sector-wide earnings reports in the first half of 2019. Shopify (not part of the index), a Canada-based provider of software for the retail industry, continued to grow as more merchants used its products and its international operations further expanded. The company also announced plans to offer logistic services to its customers. Other contributors included Dutch data center operator InterXion (not part of the index) and British business software firm The Sage Group.

In industrials, U.K.-based consumer credit information provider Experian boosted relative performance. Investor confidence increased after the company issued solid financial guidance for its upcoming fiscal year based on new product launches and growth in its consumer services business. MTU Aero Engines, a German aircraft engine manufacturer, benefited from solid demand for its new engines and the continued need for maintenance of older engines. Danish logistics firm DSV also bolstered relative results following the announcement of its acquisition of a Swiss rival in April 2019 and strong first-quarter volume growth across its business in the face of a challenging macroeconomic environment.

3. The IT sector comprises IT services, semiconductors and semiconductor equipment, and software in the SOI. The industrials sector comprises aerospace and defense, professional services, road and rail, and trading companies and distributors in the SOI.

4. The financials sector comprises banks and capital markets in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 5 |

FRANKLIN INTERNATIONAL GROWTH FUND

In the consumer discretionary sector, Latin American online marketplace operator MercadoLibre (not part of the index) contributed to relative performance. MercadoLibre reported robust revenue growth and improving margins in the past few quarters, with strength in both its payment services division and marketplace platform. U.K.-based online fashion brand boohoo Group (not part of the index) bolstered relative performance due to robust sales, as marketing efforts helped boost sales of its main brands.

Regionally, stock selection in Latin America and North America benefited relative results, while stock selection in Asia hurt performance.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended July 31, 2019, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities withnon-U.S. currency exposure.

Top 10 Holdings

7/31/19

| | |

Company Sector/Industry, Country | | % of Total

Net Assets |

Cochlear Ltd. Health Care Equipment & Supplies, Australia | | 3.5% |

John Wood Group PLC Energy Equipment & Services, U.K. | | 3.4% |

Infineon Technologies AG Semiconductors & Semiconductor Equipment, Germany | | 3.3% |

CyberAgent Inc. Media, Japan | | 3.3% |

Sophos Group PLC Software, U.K. | | 3.2% |

InterXion Holding NV IT Services, Netherlands | | 3.2% |

Shopify Inc., A IT Services, Canada | | 3.2% |

LivaNova PLC Health Care Equipment & Supplies, U.K. | | 3.2% |

Zozo Inc. Internet & Direct Marketing Retail, Japan | | 3.2% |

MTU Aero Engines AG Aerospace & Defense, Germany | | 3.1% |

Thank you for your continued participation in Franklin International Growth Fund. We look forward to serving your future investment needs.

| | |

| |

Donald G. Huber, CFA |

| | |

| |

John Remmert |

| | Portfolio Management Team |

| | | | |

| | | |

6 | | Annual Report | | franklintempleton.com |

FRANKLIN INTERNATIONAL GROWTH FUND

The foregoing information reflects our analysis, opinions and portfolio holdings as of July 31, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 7 |

FRANKLIN INTERNATIONAL GROWTH FUND

Performance Summary as of July 31, 2019

The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 7/31/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%.Class A:5.50% maximum initial sales charge;Advisor Class:no sales charges. For other share classes, visitfranklintempleton.com.

| | | | | | |

| Share Class | | Cumulative Total Return2 | | | | Average Annual Total Return3 |

A4 | | | | | | |

1-Year | | -2.62% | | | | -7.97% |

5-Year | | +34.60% | | | | +4.94% |

10-Year | | +114.53% | | | | +7.33% |

| | | |

Advisor | | | | | | |

1-Year | | -2.45% | | | | -2.45% |

5-Year | | +36.26% | | | | +6.38% |

10-Year | | +119.92% | | | | +8.20% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go tofranklintempleton.comor call(800)342-5236.

See page 10 for Performance Summary footnotes.

| | | | |

| | | |

8 | | Annual Report | | franklintempleton.com |

FRANKLIN INTERNATIONAL GROWTH FUND

PERFORMANCE SUMMARY

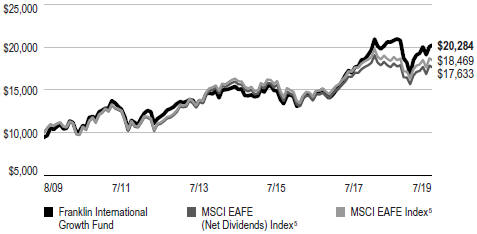

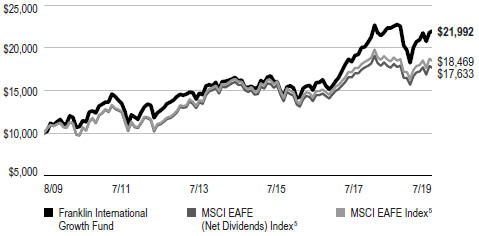

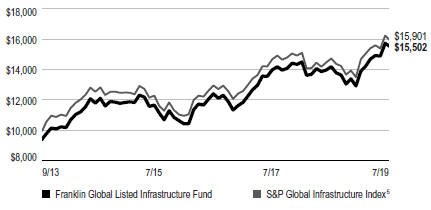

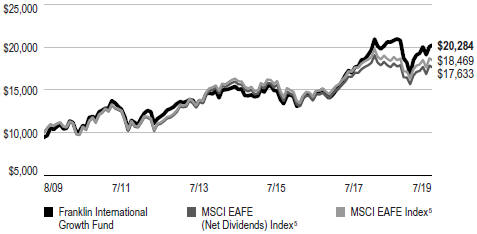

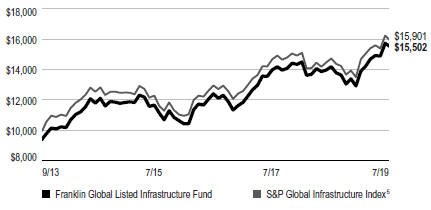

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Class A(8/1/09–7/31/19)

Advisor Class(8/1/09–7/31/19)

See page 10 for Performance Summary footnotes.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 9 |

FRANKLIN INTERNATIONAL GROWTH FUND

PERFORMANCE SUMMARY

Distributions(8/1/18–7/31/19)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share Class | | Net Investment

Income | | | | | | Short-Term

Capital Gain | | | | | | Long-Term

Capital Gain | | | | | | Total | |

| A | | | $0.0338 | | | | | | | | $0.0314 | | | | | | | | $0.1700 | | | | | | | | $0.2352 | |

| C | | | $ — | | | | | | | | $0.0314 | | | | | | | | $0.1700 | | | | | | | | $0.2014 | |

| R | | | $0.0283 | | | | | | | | $0.0314 | | | | | | | | $0.1700 | | | | | | | | $0.2297 | |

| R6 | | | $0.0542 | | | | | | | | $0.0314 | | | | | | | | $0.1700 | | | | | | | | $0.2556 | |

| Advisor | | | $0.0471 | | | | | | | | $0.0314 | | | | | | | | $0.1700 | | | | | | | | $0.2485 | |

Total Annual Operating Expenses6

| | | | | | |

| Share Class | | With Fee

Waiver | | | | Without Fee

Waiver |

| A | | 1.12% | | | | 1.26% |

| Advisor | | 0.87% | | | | 1.01% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 11/30/19. Fund investment results reflect the expense reduction and fee waiver, without these reductions, the result would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18 these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Source: Morningstar. The MSCI EAFE Index is a free float-adjusted, market capitalization weighted index designed to measure equity market performance in global developed markets excluding the U.S. and Canada. The Net Dividends Index reflects the deduction of withholding taxes on reinvested dividends.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

10 | | Annual Report | | franklintempleton.com |

FRANKLIN INTERNATIONAL GROWTH FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (ofcourse, your account value and expenses will differ from those in this illustration):Divide your account value by $1,000 (ifyour account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (ifActual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | | | | | Expenses | | | | | | Expenses | | | | Net |

| | | Beginning | | | | Ending | | Paid During | | | | Ending | | Paid During | | | | Annualized |

| Share | | Account | | | | Account | | Period | | | | Account | | Period | | | | Expense |

| Class | | Value 2/1/19 | | | | Value 7/31/19 | | 2/1/19–7/31/191, 2 | | | | Value 7/31/19 | | 2/1/19–7/31/191, 2 | | | | Ratio2 |

| | | | | | | | | | | | |

| A | | $1,000 | | | | $1,095.90 | | $5.61 | | | | $1,019.44 | | $5.41 | | | | 1.08% |

| C | | $1,000 | | | | $1,092.00 | | $9.49 | | | | $1,015.72 | | $9.15 | | | | 1.83% |

| R | | $1,000 | | | | $1,094.30 | | $6.80 | | | | $1,018.30 | | $6.56 | | | | 1.31% |

| R6 | | $1,000 | | | | $1,097.90 | | $3.49 | | | | $1,021.47 | | $3.36 | | | | 0.67% |

| Advisor | | $1,000 | | | | $1,096.50 | | $4.31 | | | | $1,020.68 | | $4.16 | | | | 0.83% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 11 |

Franklin International Small Cap Fund

Formerly, Franklin International Small Cap Growth Fund

This annual report for Franklin International Small Cap Fund covers the fiscal year ended July 31, 2019. Effective June 3, 2013, the Fund closed to new investors, with limited exceptions. As previously communicated, effective March 1, 2019, the Fund changed its name from Franklin International Small Cap Growth Fund to Franklin International Small Cap Fund.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital appreciation by investing at least 80% of its net assets in a diversified portfolio of marketable equity and equity-related securities of smaller international companies with market capitalizations not exceeding $5 billion (or the equivalent in local currencies), or the highest market capitalization of the MSCI Europe, Australasia and Far East (EAFE) Small Cap Index, whichever is greater, at the time of purchase. The Fund considers international companies to be those organized under the laws of a country outside of the U.S. or having a principal office in a country outside of the U.S., or whose securities are listed or traded principally on a recognized stock exchange orover-the-counter market outside of the U.S.

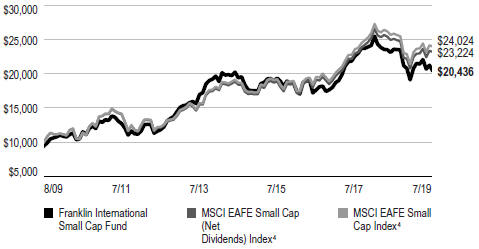

Performance Overview

For the 12 months ended July 31, 2019, the Fund’s Class A shares posted a-13.49% cumulative total return. In comparison, the Fund’s benchmark, the MSCI Europe, Australasia and Far East (EAFE) Small Cap (Net Dividends) Index, posted a-7.61% total return.1 Also for comparison, the Fund’s secondary benchmark, the MSCI EAFE Small Cap Index, posted a-7.24% total return.1 Both indexes track small cap equity performance in global developed markets excluding the U.S. and Canada, taking into account the impact of foreign withholding taxes for the net index. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 16.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

Geographic Composition

Based on Total Net Assets as of 7/31/19

figures shown. For most recentmonth-end performance, go tofranklintempleton.comor call(800)342-5236.

Investment Strategy

In choosing individual equity investments, we use a fundamental,bottom-up approach involvingin-depth analysis of individual equity securities. We employ a quantitative and qualitative approach to identify smaller international companies that we believe have the potential to generate attractive returns with lower downside risk. Such companies tend to have proprietary products and services, which can sustain a longer-term competitive advantage, and they tend to have a higher probability of maintaining a strong balance sheet and/or generating cash flow. After we identify a company, we conduct a thorough analysis to establish its earnings prospects and determine its value. Overall, we seek to invest in growth companies with attractive valuations. The investment manager’s process generally includes an assessment of the potential impacts of any material environmental, social and governance (ESG) factors on the long-term risk and return profile of a company.

We do not select investments for the Fund that are merely representative of the small cap asset class but instead aim to produce a portfolio of securities of exceptional companies operating in sectors that offer attractive growth potential.

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions (after the deduction of certain withholding taxes for the Net Dividends Index). It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 32.

| | | | |

| | | |

12 | | Annual Report | | franklintempleton.com |

FRANKLIN INTERNATIONAL SMALL CAP FUND

Although we seek to outperform the MSCI EAFE Small Cap (Net Dividends) Index, the Fund may take positions that are not represented in the index.

Manager’s Discussion

During the12-month review period, stock selection and an overweighted allocation in consumer staples as well as stock selection and underweighted allocation in real estate detracted from relative results.2 Stock selection and an overweighting in energy also curbed relative performance.3

In consumer staples, Ireland-based fresh produce provider Total Produce (not part of the index) detracted from relative performance due to a challenging market environment brought on by uncertainty surrounding international trade. However, its Dole business has been performing well as that brand recovers from recent food safety concerns. Over the longer term, we expect Total Produce to grow through increased demand for fresh fruits and vegetables as well as acquisitions. Denmark-based cigar maker Scandinavian Tobacco Group also detracted due to concerns about temporarily weaker sales in some markets.

Top 10 Countries

7/31/19

| | |

| | | % of Total |

| | | Net Assets |

U.K. | | 19.6% |

Canada | | 10.6% |

Spain | | 10.2% |

U.S. | | 10.0% |

France | | 8.7% |

Denmark | | 6.9% |

Sweden | | 6.4% |

Singapore | | 5.6% |

Chile | | 5.5% |

Hong Kong | | 4.7% |

In real estate, Spanish real estate investment trust (REIT) Lar Espana Real Estate Socimi was a relative detractor. We expect the REIT to benefit from the ongoing recovery in the Spanish commercial property market over time.

Top 10 Sectors/Industries

7/31/19

| | |

| | | % of Total |

| | | Net Assets |

Commercial Services & Supplies | | 13.7% |

Insurance | | 10.3% |

Marine | | 9.1% |

Energy Equipment & Services | | 7.2% |

Capital Markets | | 6.4% |

Media | | 5.5% |

Hotels, Restaurants & Leisure | | 4.9% |

Real Estate Management & Development | | 4.7% |

Machinery | | 4.6% |

Food Products | | 4.6% |

In the energy sector, Norway-based drilling services firm Borr Drilling was hurt by concerns about the capital spending environment in the broader oil and gas industry. However, we are beginning to see improving demand for self-elevating rigs as major oil companies look to replace depleted reserves. Borr Drilling also announced approval for a syndicated loan (a loan provided by a group of lenders) that could allow it to fully finance thebuild-out of several new rigs, as well as fund the activation costs for additional rigs. Anoff-benchmark position in U.K.-based oilfield services firm John Wood Group also hampered relative performance. The company was hurt by continued concerns about its efforts to reduce debt and the uncertain capital spending environment in the industry. We believe growth should return over the longer term, as we expect more large oil companies to boost their budgets to replace oil reserves.

In other sectors, Fairfax India (not part of the index), a Canada-based investment firm focused on India, curbed relative performance. Over the longer term, we expect the company’s investments, such as Bangalore Airport, to appreciate.

In contrast, stock selection in the financials, materials and consumer discretionary sectors bolstered relative performance.4

In financials,off-benchmark positions in Bermuda-based reinsurers Arch Capital Group and RenaissanceRe supported relative performance, helped by strong earnings

2. The consumer staples sector comprises food and staples retailing, food products and tobacco in the SOI. The real estate sector comprises equity real estate investment trusts and real estate management and development in the SOI.

3. The energy sector comprises energy equipment in the SOI.

4. The financials sector comprises capital markets and insurance in the SOI. The materials sector comprises metals and mining in the SOI. The consumer discretionary sector comprises distributors; hotels, restaurants and leisure; and internet and direct marketing retail in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 13 |

FRANKLIN INTERNATIONAL SMALL CAP FUND

results and optimism about rising premiums in the broader insurance industry. Arch Capital has also continued to see robust growth in its mortgage insurance business in recent quarters.

In the materials sector, Singapore-based mining and real estate company Straits Trading (not part of the index) supported relative performance. The company announced plans to buy back its shares and continues to shed its less profitable mining businesses to make investments in higher returning real estate assets. U.K.-based plastic packaging manufacturer RPC Group (not held atperiod-end) contributed after receiving a takeover offer from a U.S.-based rival, and Switzerland-based industrials firm Panalpina Welttransport (not held atperiod-end) contributed following a takeover offer from a Denmark-based rival.

Top 10 Holdings

7/31/19

| | |

| Company | | % of Total |

| Sector/Industry, Country | | Net Assets |

Fairfax India Holdings Corp. Capital Markets, Canada | | 6.4% |

Liberty Latin America Ltd. Media, Chile | | 5.5% |

Clarkson PLC Marine, U.K. | | 5.1% |

Elior Group SA Hotels, Restaurants & Leisure, France | | 4.9% |

John Wood Group PLC Energy Equipment & Services, U.K. | | 4.9% |

Hang Lung Group Ltd. Real Estate Management & Development, Hong Kong | | 4.7% |

Zardoya Otis SA Machinery, Spain | | 4.6% |

Biffa PLC Commercial Services & Supplies, U.K. | | 4.2% |

Fairfax Financial Holdings Ltd. Insurance, Canada | | 4.2% |

58.com Inc. Interactive Media & Services, China | | 4.1% |

Consumer discretionary stock Bandai Namco (not held atperiod-end), a Japan-based toy and game maker, bolstered relative performance. The company continues to see strong growth in the Japanese market and is looking to increase its presence in other parts of Asia, particularly China, to support future growth.

Regionally, stock selection in Europe and an underweighting in Australia and New Zealand hurt relative results, while

stock selection in Asia and North America bolstered relative performance.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended July 31, 2019, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities withnon-U.S. currency exposure.

Thank you for your continued participation in Franklin International Small Cap Fund. We look forward to serving your future investment needs.

| | | | |

| | | |

14 | | Annual Report | | franklintempleton.com |

FRANKLIN INTERNATIONAL SMALL CAP FUND

The foregoing information reflects our analysis, opinions and portfolio holdings as of July 31, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 15 |

FRANKLIN INTERNATIONAL SMALL CAP FUND

Performance Summary as of July 31, 2019

The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 7/31/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%.Class A:5.50% maximum initial sales charge;Advisor Class:no sales charges. For other share classes, visitfranklintempleton.com.

| | | | | | |

| Share Class | | Cumulative Total Return1 | | | | Average Annual Total Return2 |

A3 | | | | | | |

1-Year | | -13.49% | | | | -18.25% |

5-Year | | +5.28% | | | | -0.10% |

10-Year | | +116.25% | | | | +7.41% |

| | | |

Advisor | | | | | | |

1-Year | | -13.22% | | | | -13.22% |

5-Year | | +6.60% | | | | +1.29% |

10-Year | | +122.09% | | | | +8.31% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go tofranklintempleton.comor call(800)342-5236.

| | | | |

| | | |

16 | | Annual Report | | franklintempleton.com |

FRANKLIN INTERNATIONAL SMALL CAP FUND

PERFORMANCE SUMMARY

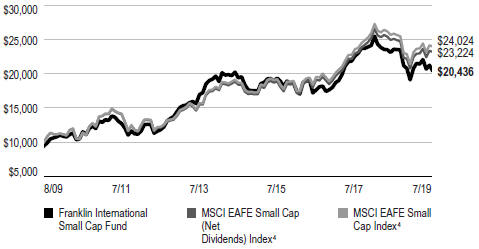

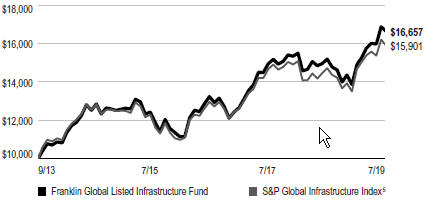

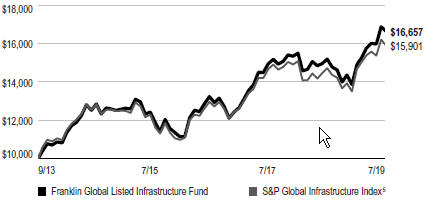

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Class A(8/1/09–7/31/19)

Advisor Class(8/1/09–7/31/19)

See page 18 for Performance Summary footnotes.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 17 |

FRANKLIN INTERNATIONAL SMALL CAP FUND

PERFORMANCE SUMMARY

Distributions(8/1/18–7/31/19)

| | | | | | | | | | | | | | | | | | | | |

| Share Class | | Net Investment

Income | | | | | | Short-Term

Capital Gain | | | | | | Total | |

| A | | | $0.2690 | | | | | | | | $0.2608 | | | | | | | | $0.5298 | |

| C | | | $0.1528 | | | | | | | | $0.2608 | | | | | | | | $0.4136 | |

| R | | | $0.2394 | | | | | | | | $0.2608 | | | | | | | | $0.5002 | |

| R6 | | | $0.3198 | | | | | | | | $0.2608 | | | | | | | | $0.5806 | |

| Advisor | | | $0.3023 | | | | | | | | $0.2608 | | | | | | | | $0.5631 | |

Total Annual Operating Expenses5

| | | | |

| Share Class | | | |

| A | | | 1.38 | % |

| Advisor | | | 1.13 | % |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. The Fund is intended for long-term investors who are comfortable with fluctuation in the value of their investment, especially over the short term. Smaller, relatively new and/or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Foreign investing involves additional risks such as currency and market volatility, as well as political and social instability. Investments in emerging markets involve heightened risks relating to the same factors. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Prior to 9/10/18 these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

4. Source: Morningstar. The MSCI EAFE Small Cap Index is a free float-adjusted, market capitalization-weighted index designed to measure the performance of small cap equity securities of global developed markets excluding the U.S. and Canada. The Net Dividends Index reflects the deduction of withholding taxes on reinvested dividends.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

18 | | Annual Report | | franklintempleton.com |

FRANKLIN INTERNATIONAL SMALL CAP FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (ofcourse, your account value and expenses will differ from those in this illustration):Divide your account value by $1,000 (ifyour account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (ifActual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual | | | | Hypothetical | | | | |

| | | | | | | (actual return after expenses) | | | | (5% annual return before expenses) | | | | |

| | | | | | | | | Expenses | | | | | | Expenses | | | | Net |

| | | Beginning | | | | Ending | | Paid During | | | | Ending | | Paid During | | | | Annualized |

| Share | | Account | | | | Account | | Period | | | | Account | | Period | | | | Expense |

| Class | | Value 2/1/19 | | | | Value 7/31/19 | | 2/1/19–7/31/191,2 | | | | Value 7/31/19 | | 2/1/19–7/31/191,2 | | | | Ratio2 |

| | | | | | | | | | | | |

| A | | $1,000 | | | | $983.30 | | $ 7.13 | | | | $1,017.60 | | $ 7.25 | | | | 1.45% |

| C | | $1,000 | | | | $980.10 | | $10.80 | | | | $1,013.88 | | $10.99 | | | | 2.20% |

| R | | $1,000 | | | | $982.10 | | $ 8.35 | | | | $1,016.36 | | $ 8.50 | | | | 1.70% |

| R6 | | $1,000 | | | | $985.70 | | $ 5.07 | | | | $1,019.69 | | $ 5.16 | | | | 1.03% |

| Advisor | | $1,000 | | | | $984.50 | | $ 5.90 | | | | $1,018.84 | | $ 6.01 | | | | 1.20% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements, for Class R6.

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 19 |

FRANKLIN GLOBAL TRUST

Financial Highlights

Franklin International Growth Fund

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Year Ended July 31, | | | | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $15.31 | | | | $13.18 | | | | $11.07 | | | | $11.16 | | | | $11.40 | |

| | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb | | | 0.04 | | | | 0.06 | | | | 0.05 | | | | 0.03 | | | | 0.06 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.50 | ) | | | 2.26 | | | | 2.12 | | | | (0.12 | ) | | | (0.20 | ) |

| | | | | |

Total from investment operations | | | (0.46 | ) | | | 2.32 | | | | 2.17 | | | | (0.09 | ) | | | (0.14 | ) |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.03 | ) | | | — | | | | (0.06 | ) | | | (— | )c | | | (0.03 | ) |

| | | | | |

Net realized gains | | | (0.20 | ) | | | (0.19 | ) | | | — | | | | — | | | | (0.07 | ) |

| | | | | |

Total distributions | | | (0.23 | ) | | | (0.19 | ) | | | (0.06 | ) | | | (— | )c | | | (0.10 | ) |

| | | | | |

Net asset value, end of year | | | $14.62 | | | | $15.31 | | | | $13.18 | | | | $11.07 | | | | $11.16 | |

| | | | | |

Total returnd | | | (2.62)% | | | | 17.73% | | | | 19.70% | | | | (0.80)% | | | | (1.13)% | |

| | | | | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 1.19% | | | | 1.27% | | | | 1.54% | | | | 1.65% | | | | 1.72% | |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 1.05% | e | | | 1.15% | e | | | 1.31% | e | | | 1.44% | e | | | 1.49% | |

| | | | | |

Net investment income | | | 0.32% | | | | 0.43% | | | | 0.37% | | | | 0.25% | | | | 0.61% | |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $289,944 | | | | $161,607 | | | | $185,680 | | | | $169,994 | | | | $182,825 | |

| | | | | |

Portfolio turnover rate | | | 18.11% | | | | 58.36% | | | | 28.66% | | | | 27.27% | | | | 47.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

20 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN GLOBAL TRUST

FINANCIAL HIGHLIGHTS

Franklin International Growth Fund(continued)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Year Ended July 31, | | | | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $14.74 | | | | $12.80 | | | | $10.77 | | | | $10.94 | | | | $11.22 | |

| | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)b | | | (0.06 | ) | | | (0.03 | ) | | | (0.04 | ) | | | (0.05 | ) | | | (0.01 | ) |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.48 | ) | | | 2.16 | | | | 2.07 | | | | (0.12 | ) | | | (0.20 | ) |

| | | | | |

Total from investment operations | | | (0.54 | ) | | | 2.13 | | | | 2.03 | | | | (0.17 | ) | | | (0.21 | ) |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net realized gains | | | (0.20 | ) | | | (0.19 | ) | | | — | | | | — | | | | (0.07 | ) |

| | | | | |

Net asset value, end of year | | | $14.00 | | | | $14.74 | | | | $12.80 | | | | $10.77 | | | | $10.94 | |

| | | | | |

Total returnc | | | (3.34)% | | | | 16.76% | | | | 18.85% | | | | (1.55)% | | | | (1.84)% | |

| | | | | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 1.94% | | | | 2.02% | | | | 2.29% | | | | 2.40% | | | | 2.42% | |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 1.80% | d | | | 1.90% | d | | | 2.06% | d | | | 2.19% | d | | | 2.19% | |

| | | | | |

Net investment income (loss) | | | (0.43)% | | | | (0.32)% | | | | (0.38)% | | | | (0.50)% | | | | (0.09)% | |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $27,397 | | | | $22,542 | | | | $8,702 | | | | $6,773 | | | | $7,179 | |

| | | | | |

Portfolio turnover rate | | | 18.11% | | | | 58.36% | | | | 28.66% | | | | 27.27% | | | | 47.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

dBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Annual Report | | 21 |

FRANKLIN GLOBAL TRUST

FINANCIAL HIGHLIGHTS

Franklin International Growth Fund(continued)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Year Ended July 31, | | | | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

Class R | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $15.21 | | | | $13.16 | | | | $11.02 | | | | $11.15 | | | | $11.38 | |

| | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)b | | | — | c | | | 0.04 | | | | 0.02 | | | | (— | )c | | | 0.04 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.48 | ) | | | 2.22 | | | | 2.13 | | | | (0.12 | ) | | | (0.19 | ) |

| | | | | |

Total from investment operations | | | (0.48 | ) | | | 2.26 | | | | 2.15 | | | | (0.12 | ) | | | (0.15 | ) |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.03 | ) | | | (0.02 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) |

| | | | | |

Net realized gains | | | (0.20 | ) | | | (0.19 | ) | | | — | | | | — | | | | (0.07 | ) |

| | | | | |

Total distributions | | | (0.23 | ) | | | (0.21 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.08 | ) |

| | | | | |

Net asset value, end of year | | | $14.50 | | | | $15.21 | | | | $13.16 | | | | $11.02 | | | | $11.15 | |

| | | | | |

Total return | | | (2.88)% | | | | 17.34% | | | | 19.54% | | | | (1.10)% | | | | (1.31)% | |

| | | | | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 1.43% | | | | 1.49% | | | | 1.76% | | | | 1.90% | | | | 1.92% | |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 1.29% | d | | | 1.37% | d | | | 1.53% | d | | | 1.69% | d | | | 1.69% | |

| | | | | |

Net investment income | | | 0.08% | | | | 0.21% | | | | 0.15% | | | | (—)% | e | | | 0.41% | |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $1,848 | | | | $1,086 | | | | $371 | | | | $295 | | | | $363 | |

| | | | | |

Portfolio turnover rate | | | 18.11% | | | | 58.36% | | | | 28.66% | | | | 27.27% | | | | 47.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dBenefit of expense reduction rounds to less than 0.01%.

eRounds to less than 0.01%.

| | | | |

| | | |

22 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN GLOBAL TRUST

FINANCIAL HIGHLIGHTS

Franklin International Growth Fund(continued)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Year Ended July 31, | | | | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $15.34 | | | | $13.25 | | | | $11.15 | | | | $11.25 | | | | $11.48 | |

| | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb | | | 0.08 | | | | 0.12 | | | | 0.08 | | | | 0.07 | | | | 0.15 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.48 | ) | | | 2.26 | | | | 2.15 | | | | (0.12 | ) | | | (0.23 | ) |

| | | | | |

Total from investment operations | | | (0.40 | ) | | | 2.38 | | | | 2.23 | | | | (0.05 | ) | | | (0.08 | ) |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.05 | ) | | | (0.10 | ) | | | (0.13 | ) | | | (0.05 | ) | | | (0.08 | ) |

| | | | | |

Net realized gains | | | (0.20 | ) | | | (0.19 | ) | | | — | | | | — | | | | (0.07 | ) |

| | | | | |

Total distributions | | | (0.25 | ) | | | (0.29 | ) | | | (0.13 | ) | | | (0.05 | ) | | | (0.15 | ) |

| | | | | |

Net asset value, end of year | | | $14.69 | | | | $15.34 | | | | $13.25 | | | | $11.15 | | | | $11.25 | |

| | | | | |

Total return | | | (2.26)% | | | | 18.15% | | | | 20.26% | | | | (0.39)% | | | | (0.62)% | |

| | | | | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 0.84% | | | | 0.85% | | | | 0.90% | | | | 1.01% | | | | 1.02% | |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 0.66% | c | | | 0.71% | c | | | 0.88% | c | | | 1.00% | c | | | 1.02% | d |

| | | | | |

Net investment income | | | 0.71% | | | | 0.87% | | | | 0.80% | | | | 0.69% | | | | 1.08% | |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $344,257 | | | | $83,292 | | | | $54,347 | | | | $122,862 | | | | $137,950 | |

| | | | | |

Portfolio turnover rate | | | 18.11% | | | | 58.36% | | | | 28.66% | | | | 27.27% | | | | 47.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cBenefit of expense reduction rounds to less than 0.01%.

dBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Annual Report | | 23 |

FRANKLIN GLOBAL TRUST

FINANCIAL HIGHLIGHTS

Franklin International Growth Fund(continued)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Year Ended July 31, | | | | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | |

Advisor Class | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $15.33 | | | | $13.24 | | | | $11.13 | | | | $11.24 | | | | $11.47 | |

| | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb | | | 0.09 | | | | 0.10 | | | | 0.08 | | | | 0.05 | | | | 0.10 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.51 | ) | | | 2.26 | | | | 2.13 | | | | (0.12 | ) | | | (0.20 | ) |

| | | | | |

Total from investment operations | | | (0.42 | ) | | | 2.36 | | | | 2.21 | | | | (0.07 | ) | | | (0.10 | ) |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.05 | ) | | | (0.08 | ) | | | (0.10 | ) | | | (0.04 | ) | | | (0.06 | ) |

| | | | | |

Net realized gains | | | (0.20 | ) | | | (0.19 | ) | | | — | | | | — | | | | (0.07 | ) |

| | | | | |

Total distributions | | | (0.25 | ) | | | (0.27 | ) | | | (0.10 | ) | | | (0.04 | ) | | | (0.13 | ) |

| | | | | |

Net asset value, end of year | | | $14.66 | | | | $15.33 | | | | $13.24 | | | | $11.13 | | | | $11.24 | |

| | | | | |

Total return | | | (2.45)% | | | | 17.98% | | | | 20.04% | | | | (0.62)% | | | | (0.76)% | |

| | | | | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 0.94% | | | | 1.02% | | | | 1.29% | | | | 1.40% | | | | 1.42% | |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 0.80% | c | | | 0.90% | c | | | 1.06% | c | | | 1.19% | c | | | 1.19% | |

| | | | | |

Net investment income | | | 0.57% | | | | 0.68% | | | | 0.62% | | | | 0.50% | | | | 0.91% | |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $863,973 | | | | $294,254 | | | | $147,926 | | | | $110,441 | | | | $126,130 | |

| | | | | |

Portfolio turnover rate | | | 18.11% | | | | 58.36% | | | | 28.66% | | | | 27.27% | | | | 47.52% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

24 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN GLOBAL TRUST

Statement of Investments, July 31, 2019

Franklin International Growth Fund

| | | | | | | | | | | | |

| | | Country | | | Shares | | | Value | |

| | | |

Common Stocks 96.0% | | | | | | | | | | | | |

| | | |

Aerospace & Defense 4.8% | | | | | | | | | | | | |

CAE Inc. | | | Canada | | | | 926,000 | | | $ | 24,971,654 | |

MTU Aero Engines AG | | | Germany | | | | 190,000 | | | | 47,618,225 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 72,589,879 | |

| | | | | | | | | | | | |

| | | |

Auto Components 2.9% | | | | | | | | | | | | |

Aptiv PLC | | | United States | | | | 500,000 | | | | 43,825,000 | |

| | | | | | | | | | | | |

| | | |

Banks 4.6% | | | | | | | | | | | | |

FinecoBank Banca Fineco SpA | | | Italy | | | | 3,656,000 | | | | 36,375,912 | |

a,bIrish Bank Resolution Corp. Ltd. | | | Ireland | | | | 11,500 | | | | — | |

KBC Groep NV | | | Belgium | | | | 532,000 | | | | 34,306,987 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 70,682,899 | |

| | | | | | | | | | | | |

| | | |

Biotechnology 3.4% | | | | | | | | | | | | |

aAlkermes PLC | | | United States | | | | 240,000 | | | | 5,558,400 | |

CSL Ltd. | | | Australia | | | | 292,000 | | | | 45,838,076 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 51,396,476 | |

| | | | | | | | | | | | |

| | | |

Capital Markets 2.7% | | | | | | | | | | | | |

Deutsche Boerse AG | | | Germany | | | | 298,000 | | | | 41,645,781 | |

| | | | | | | | | | | | |

| | | |

Chemicals 8.3% | | | | | | | | | | | | |

Koninklijke DSM NV | | | Netherlands | | | | 370,000 | | | | 46,180,882 | |

Symrise AG | | | Germany | | | | 402,000 | | | | 37,204,158 | |

Umicore SA | | | Belgium | | | | 1,380,000 | | | | 43,427,025 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 126,812,065 | |

| | | | | | | | | | | | |

| | | |

Diversified Consumer Services 2.6% | | | | | | | | | | | | |

aTAL Education Group, ADR | | | China | | | | 1,250,000 | | | | 40,250,000 | |

| | | | | | | | | | | | |

| | | |

Energy Equipment & Services 3.4% | | | | | | | | | | | | |

John Wood Group PLC | | | United Kingdom | | | | 8,150,000 | | | | 52,574,455 | |

| | | | | | | | | | | | |

| | | |

Health Care Equipment & Supplies 9.2% | | | | | | | | | | | | |

Cochlear Ltd. | | | Australia | | | | 355,000 | | | | 53,478,008 | |

GN Store Nord AS | | | Denmark | | | | 809,000 | | | | 38,490,132 | |

aLivaNova PLC | | | United Kingdom | | | | 629,000 | | | | 48,464,450 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 140,432,590 | |

| | | | | | | | | | | | |

| | | |

Internet & Direct Marketing Retail 11.5% | | | | | | | | | | | | |

aboohoo Group PLC | | | United Kingdom | | | | 16,200,000 | | | | 47,134,965 | |

aJust Eat PLC | | | United Kingdom | | | | 4,220,100 | | | | 39,035,367 | |

aMercadoLibre Inc. | | | Argentina | | | | 66,400 | | | | 41,262,288 | |

Zozo Inc. | | | Japan | | | | 2,550,000 | | | | 48,340,455 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 175,773,075 | |

| | | | | | | | | | | | |

IT Services 10.5% | | | | | | | | | | | | |

aAdyen NV | | | Netherlands | | | | 33,600 | | | | 25,541,560 | |

aInterXion Holding NV | | | Netherlands | | | | 651,000 | | | | 49,020,300 | |

Keywords Studios PLC | | | Ireland | | | | 1,870,000 | | | | 37,779,526 | |

aShopify Inc., A | | | Canada | | | | 153,000 | | | | 48,635,640 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 160,977,026 | |

| | | | | | | | | | | | |

| | | | |

| | | |

| franklintempleton.com | | Annual Report | | 25 |

FRANKLIN GLOBAL TRUST

STATEMENT OF INVESTMENTS

Franklin International Growth Fund(continued)

| | | | | | | | | | | | |

| | | Country | | | Shares | | | Value | |

| | | |

Common Stocks(continued) | | | | | | | | | | | | |

Media 6.2% | | | | | | | | | | | | |

Ascential PLC | | | United Kingdom | | | | 8,980,000 | | | $ | 43,441,043 | |

CyberAgent Inc. | | | Japan | | | | 1,245,000 | | | | 50,566,506 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 94,007,549 | |

| | | | | | | | | | | | |

| | | |

Pharmaceuticals 5.1% | | | | | | | | | | | | |

Hikma Pharmaceuticals PLC | | | United Kingdom | | | | 1,850,000 | | | | 41,364,731 | |

Santen Pharmaceutical Co. Ltd. | | | Japan | | | | 2,288,000 | | | | 37,024,287 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 78,389,018 | |

| | | | | | | | | | | | |

| | | |

Professional Services 2.8% | | | | | | | | | | | | |

Experian PLC | | | United Kingdom | | | | 1,400,000 | | | | 42,519,749 | |

| | | | | | | | | | | | |

| | | |

Road & Rail 3.0% | | | | | | | | | | | | |

DSV AS | | | Denmark | | | | 477,000 | | | | 45,586,754 | |

| | | | | | | | | | | | |

| | | |

Semiconductors & Semiconductor Equipment 3.3% | | | | | | | | | | | | |

Infineon Technologies AG | | | Germany | | | | 2,697,000 | | | | 50,791,601 | |

| | | | | | | | | | | | |

| | | |

Software 9.0% | | | | | | | | | | | | |

The Sage Group PLC | | | United Kingdom | | | | 5,000,000 | | | | 43,734,599 | |

SAP SE | | | Germany | | | | 352,000 | | | | 43,513,598 | |

Sophos Group PLC | | | United Kingdom | | | | 9,350,000 | | | | 49,410,986 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 136,659,183 | |

| | | | | | | | | | | | |

Trading Companies & Distributors 2.7% | | | | | | | | | | | | |

Ferguson PLC | | | United Kingdom | | | | 555,000 | | | | 41,560,261 | |

| | | | | | | | | | | | |

| | | |

Total Common Stocks (Cost $1,294,017,689) | | | | | | | | | | | 1,466,473,361 | |

| | | | | | | | | | | | |

| | | |

Short Term Investments (Cost $58,630,699) 3.8% | | | | | | | | | | | | |

| | | | | | | | | | | | |

Money Market Funds 3.8% | | | | | | | | | | | | |

c,dInstitutional Fiduciary Trust Money Market Portfolio, 2.00% | | | United States | | | | 58,630,699 | | | | 58,630,699 | |

| | | | | | | | | | | | |

| | | |

Total Investments (Cost $1,352,648,388) 99.8% | | | | | | | | | | | 1,525,104,060 | |

Other Assets, less Liabilities 0.2% | | | | | | | | | | | 2,315,497 | |

| | | | | | | | | | | | |

| | | |

Net Assets 100.0% | | | | | | | | | | $ | 1,527,419,557 | |

| | | | | | | | | | | | |

See Abbreviations on page 50.

aNon-income producing.

bFair valued using significant unobservable inputs. See Note 10 regarding fair value measurements.

cSee Note 3(f) regarding investments in affiliated management investment companies.

dThe rate shown is the annualizedseven-day effective yield at period end.

| | | | |

| | | |

26 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN GLOBAL TRUST

Financial Highlights

Franklin International Small Cap Fund

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Year Ended July 31, | | | | |