OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2010

Estimated average burden hours per response: 18.9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10223

ING Senior Income Fund

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

The Corporation Trust Company, 1209 Orange

Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | February 28 |

| |

Date of reporting period: | August 31, 2007 |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Funds

Semi-Annual Report

August 31, 2007

ING Senior Income Fund

E-Delivery Sign-up – details inside

E-Delivery Sign-up – details inside

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds' investment objectives, risks, charges, expenses and other information. This information should be read carefully.

ING Senior Income Fund

SEMI-ANNUAL REPORT

August 31, 2007

Table of Contents

| Portfolio Managers' Report | | | 3 | | |

|

| Statement of Assets and Liabilities | | | 8 | | |

|

| Statement of Operations | | | 10 | | |

|

| Statements of Changes in Net Assets | | | 11 | | |

|

| Statement of Cash Flows | | | 12 | | |

|

| Financial Highlights | | | 13 | | |

|

| Notes to Financial Statements | | | 15 | | |

|

| Additional Information | | | 24 | | |

|

| Portfolio of Investments | | | 25 | | |

|

Go Paperless with E-Delivery!

Go Paperless with E-Delivery!

Sign up now for on-line prospectuses, fund reports, and proxy statements. In less than five minutes, you can help reduce paper mail and lower fund costs.

Just go to www.ingfunds.com, click on the E-Delivery icon from the home page, follow the directions and complete the quick 5 Steps to Enroll.

You will be notified by e-mail when these communications become available on the internet. Documents that are not available on the internet will continue to be sent by mail.

(THIS PAGE INTENTIONALLY LEFT BLANK)

ING Senior Income Fund

PORTFOLIO MANAGERS' REPORT

Dear Shareholders:

ING Senior Income Fund (the "Fund") is a continuously offered, diversified, closed-end management investment company that seeks to provide investors with a high level of monthly income. The Fund seeks to achieve this objective by investing in a professionally managed portfolio comprised primarily of senior loans.

PORTFOLIO CHARACTERISTICS

AS OF AUGUST 31, 2007 | |

| Net Assets | | $ | 1,998,773,510 | | |

| Total Assets | | $ | 2,489,989,304 | | |

| Assets Invested in Senior Loans | | $ | 2,415,645,072 | | |

| Senior Loans Represented | | | 675 | | |

| Average Amount Outstanding per Loan | | $ | 3,578,733 | | |

| Industries Represented | | | 38 | | |

| Average Loan Amount per Industry | | $ | 63,569,607 | | |

| Portfolio Turnover Rate | | | 41 | % | |

| Weighted Average Days to Interest Rate Reset | | | 42 | | |

| Average Loan Final Maturity | | | 66 months | | |

| Total Leverage as a Percentage of Total Assets | | | 16.9 | % | |

PERFORMANCE SUMMARY

During the six months ended August 31, 2007, the Fund's Class A and Q shares each distributed total dividends from income of $0.52, resulting in an average annualized distribution rate of 6.82%(1) and 6.85%(1), respectively. During the same period, the Fund's Class B and Class C shares each distributed total dividends from income of $0.49, resulting in an average annualized distribution rate of 6.33%(1) and 6.32%(1), respectively.

The Fund's total return for the six months ended August 31, 2007, for each of the share classes, excluding sales charges, was (1.71)% on Class A, (1.96)% on Class B, (1.96)% on Class C and (1.71)% on Class Q. The Fund's net returns were slightly less than the returns of the S&P/LSTA Leveraged Loan Index ("LLI"), which had a gross return of (1.35)%.

MARKET REVIEW

The global senior loan market experienced its most severe technical correction on record during the Fund's fiscal half-year, driven by a rapid drop in liquidity as credit market investors grappled with uncertainty created by the sub-prime mortgage implosion. We should emphasize that the Fund does not own, nor has it ever invested significantly in, residential or commercial mortgage-backed or asset-backed securities. The Fund's investment strategy continues to concentrate on traditional, secured floating rate senior loans to corporate issuers.

The overall tone and performance of the senior loan market has improved since the liquidity squeeze, enough to push the year-to-date total return of the S&P/LSTA Leveraged Loan index into positive territory. There were many factors at play in the improved sentiment, including a sense that the overhang of underwritten and unsold loans ultimately will be absorbed by the market,

(1) The distribution rate is calculated by annualizing dividends declared during the period and dividing the resulting annualized dividend by the Fund's average month-end net asset value (in the case of net asset value) or the average month-end New York Stock Exchange Composite closing price (in the case of Market). The distribution rate is based solely on the actual dividends and distributions, which are made at the discretion of management. The distribution rate may or may not include all investment income and ordinarily will not include capital gains or losses, if any.

3

ING Senior Income Fund

PORTFOLIO MANAGERS' REPORT (continued)

and a better tone in the high yield bond and equity markets due in part to the widely held assumption that the Federal Reserve Board ("Fed") would stand by to ensure the liquidity of U.S. capital markets.

Although loan prices were highly volatile due to these unprecedented technical developments, the fundamental credit condition of the loan market (as measured by trailing default rates) remained solid. While up fractionally as compared to the previous quarter, the S&P trailing 12-month default rate (by issuer) closed August at 0.42%, well below the historical average.

USE OF LEVERAGE

The Fund seeks to prudently utilize financial leverage in order to increase the yield to shareholders. As of August 31, 2007, the Fund had $420 million outstanding under a $750 million revolving credit facility. The use of leverage for investment purposes increases both investment opportunity and investment risk.

OUTLOOK

While uncertainty still looms over the capital markets, the Fed's resolve and less-frequent bad news have bolstered confidence. We believe the near-term direction of the loan market will be dictated by a few key developments: the direction of the credit markets overall (certainly, to be influenced by Fed decisions) and, within the senior loan market, the continued ability of banks to manage the supply of new loans coming to market. The latter is critical to maintaining a healthy supply/demand balance; so far, the supply has been amazingly well controlled. Longer term, the general health of the major global economies, and its effects on non-investment grade issuers, will play a central role in loan market performance.

TOP TEN SENIOR LOAN ISSUERS

AS OF AUGUST 31, 2007

AS A PERCENTAGE OF: | |

| | | TOTAL

ASSETS | | NET

ASSETS | |

| Charter Communications Operating, LLC | | | 2.6 | % | | | 3.3 | % | |

| Metro-Goldwyn-Mayer, Inc. | | | 1.9 | % | | | 2.4 | % | |

| Georgia Pacific Corporation | | | 1.8 | % | | | 2.3 | % | |

| Cequel Communications, LLC | | | 1.8 | % | | | 2.2 | % | |

| CHS/Community Health Systems, Inc. | | | 1.8 | % | | | 2.2 | % | |

| CSC Holdings, Inc. | | | 1.5 | % | | | 1.8 | % | |

| Idearc, Inc. | | | 1.4 | % | | | 1.7 | % | |

| HCA, Inc. | | | 1.3 | % | | | 1.6 | % | |

| ARAMARK Corporation | | | 1.2 | % | | | 1.5 | % | |

| Univision Communications, Inc. | | | 1.2 | % | | | 1.5 | % | |

TOP TEN INDUSTRY SECTORS

AS OF AUGUST 31, 2007

AS A PERCENTAGE OF: | |

| | | TOTAL

ASSETS | | NET

ASSETS | |

| North American Cable | | | 10.8 | % | | | 13.4 | % | |

| Healthcare, Education and Childcare | | | 10.1 | % | | | 12.6 | % | |

| Printing & Publishing | | | 6.5 | % | | | 8.1 | % | |

| Chemicals, Plastics & Rubber | | | 5.9 | % | | | 7.4 | % | |

| Oil & Gas | | | 4.9 | % | | | 6.1 | % | |

| Utilities | | | 4.7 | % | | | 5.9 | % | |

| Retail Stores | | | 4.7 | % | | | 5.9 | % | |

| Leisure, Amusement, Entertainment | | | 4.0 | % | | | 5.0 | % | |

| Data and Internet Services | | | 4.0 | % | | | 4.9 | % | |

| Containers, Packaging & Glass | | | 3.0 | % | | | 3.7 | % | |

4

ING Senior Income Fund

PORTFOLIO MANAGERS' REPORT (continued)

Our investment process remains squarely focused on seeking to provide attractive risk-adjusted returns over a full credit cycle through systematic, thorough credit underwriting, a high level of issuer and industry diversification and rigorous, ongoing monitoring. We continue to closely scrutinize both the underlying performance of our portfolio companies and the relevant economic data for signs of any meaningful shift in the strength of the global economy. Although headwinds are present, we are confident that growth will be strong enough to allow leveraged issuers to remain fundamentally sound from a credit perspective. Should that happen, we believe demand will remain strong as investors recognize the value proposition of loans trading at current levels.

| |  | |

|

Jeffrey A. Bakalar

Senior Vice President

Senior Portfolio Manager

ING Investment Management Co. | | Daniel A. Norman

Senior Vice President

Senior Portfolio Manager

ING Investment Management Co. | |

|

| |  | |

|

ING Senior Income Fund

October 12, 2007

5

ING Senior Income Fund

PORTFOLIO MANAGERS' REPORT (continued)

| | | Average Annual Total Net Returns for the

Periods Ended August 31, 2007 | |

| | | 1 Year | | 3 Years | | 5 Years | | April 2, 2001 | |

| Including Sales Charge: | |

| Class A(1) | | | (0.06 | )% | | | 2.55 | % | | | 4.42 | % | | | 5.10 | % | |

| Class B(2) | | | (0.85 | )% | | | 3.07 | % | | | 4.70 | % | | | 4.53 | % | |

| Class C(3) | | | 1.07 | % | | | 3.68 | % | | | 4.89 | % | | | 4.55 | % | |

| Class Q | | | 2.55 | % | | | 4.19 | % | | | 5.39 | % | | | 5.03 | % | |

| Excluding Sales Charge: | |

| Class A | | | 2.53 | % | | | 4.22 | % | | | 5.44 | % | | | 5.10 | % | |

| Class B | | | 2.03 | % | | | 3.66 | % | | | 4.87 | % | | | 4.53 | % | |

| Class C | | | 2.03 | % | | | 3.68 | % | | | 4.89 | % | | | 4.55 | % | |

| Class Q | | | 2.55 | % | | | 4.19 | % | | | 5.39 | % | | | 5.03 | % | |

| S&P/LSTA Leveraged Loan Index(4) | | | 2.66 | % | | | 4.60 | % | | | 5.70 | % | | | 4.83 | % | |

Total net returns reflect that ING Investments, LLC (the Fund's Investment Adviser) may have waived, reimbursed or recouped fees and expenses otherwise payable by the Fund.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund's future performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month-end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Return calculations for the period beginning April 2, 2001 through June 30, 2002, reflect no deduction of a front-end sales charge. Return calculations for the period beginning July 1, 2002 through October 10, 2004, reflect deduction of the maximum Class A sales charge of 4.75%. Return calculations with a starting date after October 11, 2004 are based on a 2.50% sales charge. There is no front-end sales charge if you purchase Class A common shares in an amount of $1 million or more. However, the shares will be subject to a 1.00% Early Withdrawal Charge ("EWC") if they are repurchased by the Fund within one year of purchase.

(2) Class B maximum EWC is 3% in the first year, declining to 1% in the fifth year and eliminated thereafter.

(3) Class C maximum EWC is 1% for the first year.

(4) Source: S&P/Loan Syndications and Trading Association. The LLI Index ("LLI") is an unmanaged total return index that captures accrued interest, repayments, and market value changes. It represents a broad cross section of leveraged loans syndicated in the United States, including dollar-denominated loans to overseas issuers. Standard & Poor's and the Loan Syndications and Trading Association ("LSTA") conceived the LLI to establish a performance benchmark for the syndicated leveraged loan industry. An investor cannot invest directly in an index. Since inception performance for the index is shown from March 31, 2001 for Class A, B, C and Class Q common shares.

6

ING Senior Income Fund

PORTFOLIO MANAGERS' REPORT (continued)

YIELDS AND DISTRIBUTIONS RATES

| | | 30-Day SEC Yields(1) | | Average Annualized Distribution Rates(2) | |

| | | Class A | | Class B | | Class C | | Class Q | | Class A | | Class B | | Class C | | Class Q | |

| August 31, 2007 | | | 6.64 | % | | | 6.31 | % | | | 6.31 | % | | | 6.78 | % | | | 6.82 | % | | | 6.33 | % | | | 6.32 | % | | | 6.85 | % | |

| February 28, 2007 | | | 6.46 | % | | | 6.08 | % | | | 6.08 | % | | | 6.59 | % | | | 6.57 | % | | | 6.09 | % | | | 6.08 | % | | | 6.60 | % | |

(1) Yield is calculated by dividing the Fund's net investment income per share for the most recent thirty days by the net asset value. Yield calculations do not include any commissions or sales charges, and are compounded for six months and annualized for a twelve-month period to derive the Fund's yield consistent with the Securities Exchange Commission standardized yield formula for open-end investment companies.

(2) Distribution Rates are calculated by annualizing dividends declared during the period (i.e., by dividing the monthly dividend amount by the number of days in the month and multiplying by the number of days in the fiscal year) and then dividing the resulting annualized dividend by the month-ending NAV.

Risk is inherent in all investing. The following are the principal risks associated with investing in the Fund. This is not, and is not intended to be, a description of all risks of investing in the Fund. A more detailed description of the risks of investing in the Fund is contained in the Fund's current prospectus.

Credit Risk: The Fund invests a substantial portion of its assets in below investment grade senior loans and other below investment grade assets. Below investment grade loans involve a greater risk that borrowers may not make timely payment of the interest and principal due on their loans. They also involve a greater risk that the value of such loans could decline significantly. If borrowers do not make timely payments of the interest due on their loans, the yield on the Fund's common shares will decrease. If borrowers do not make timely payment of the principal due on their loans, or if the value of such loans decreases, the value of the Fund's NAV will decrease.

Interest Rate Risk: Changes in short-term market interest rates will directly affect the yield on the Fund's common shares. If short-term market interest rates fall, the yield on the Fund will also fall. To the extent that the interest rate spreads on loans in the Fund experience a general decline, the yield on the Fund will fall and the value of the Fund's assets may decrease, which will cause the Fund's value to decrease. Conversely, when short-term market interest rates rise, because of the lag between changes in such short-term rates and the resetting of the floating rates on assets in the Fund's portfolio, the impact of rising rates will be delayed to the extent of such lag.

Leverage Risk: The Fund's use of leverage through borrowings or the issuance of preferred shares can adversely affect the yield on the Fund's Common Shares. To the extent that the Fund is unable to invest the proceeds from the use of leverage in assets which pay interest at a rate which exceeds the rate paid on the leverage, the yield on the Fund's Common Shares will decrease. In addition, in the event of a general market decline in the value of assets such as those in which the Fund invests, the effect of that decline will be magnified in the Fund because of the additional assets purchased with the proceeds of the leverage.

No Daily Redemptions: The Fund does not redeem its shares on a daily basis and there is no market for its shares. Shareholders can only redeem their shares once a month, and if redemption requests from all shareholders exceed 5% of the Fund's total assets in a particular month, the Fund may reduce such requests pro rata and redeem only an amount equal to 5% of its total assets.

7

ING Senior Income Fund

STATEMENT OF ASSETS AND LIABILITIES as of August 31, 2007 (Unaudited)

| ASSETS: | |

| Investments in securities at value (Cost $2,502,891,063) | | $ | 2,420,098,284 | | |

| Cash | | | 7,284,696 | | |

| Foreign currencies at value (Cost $6,733,899) | | | 6,814,391 | | |

| Receivables: | |

| Investment securities sold | | | 25,277,433 | | |

| Fund shares sold | | | 4,098,006 | | |

| Interest | | | 25,472,072 | | |

| Other | | | 53,529 | | |

| Unrealized appreciation on foreign currency contracts | | | 836,836 | | |

| Prepaid expenses | | | 53,542 | | |

| Prepaid arrangement fees on notes payable | | | 515 | | |

| Total assets | | | 2,489,989,304 | | |

| LIABILITIES: | |

| Payable for investment securities purchased | | | 61,550,824 | | |

| Notes payable | | | 420,000,000 | | |

| Accrued interest payable | | | 1,818,044 | | |

| Deferred arrangement fees on senior loans | | | 327,855 | | |

| Payable to affilates | | | 2,686,093 | | |

| Income distribution payable | | | 3,882,804 | | |

| Unrealized depreciation on foreign currency contracts | | | 564,707 | | |

| Accrued trustees fees | | | 65,566 | | |

| Other accrued expenses and liabilities | | | 319,901 | | |

| Total liabilities | | | 491,215,794 | | |

| NET ASSETS | | $ | 1,998,773,510 | | |

| NET ASSETS CONSIST OF: | |

| Paid-in capital | | $ | 2,085,062,531 | | |

| Distributions in excess of net investment income | | | (5,455,989 | ) | |

| Accumulated net realized gain on investments | | | 1,537,748 | | |

Net unrealized depreciation on investments

and foreign currency related transactions | | | (82,370,780 | ) | |

| NET ASSETS | | $ | 1,998,773,510 | | |

See Accompanying Notes to Financial Statements

8

ING Senior Income Fund

STATEMENT OF ASSETS AND LIABILITIES as of August 31, 2007 (Unaudited) (continued)

| Class A: | |

| Net assets | | $ | 926,909,601 | | |

| Shares authorized | | | unlimited | | |

| Par value | | $ | 0.01 | | |

| Shares outstanding | | | 62,672,238 | | |

| Net asset value and redemption price per share | | $ | 14.79 | | |

| Maximum offering price per share (2.50%)(1) | | $ | 15.17 | | |

| Class B: | |

| Net assets | | $ | 99,358,827 | | |

| Shares authorized | | | unlimited | | |

| Par value | | $ | 0.01 | | |

| Shares outstanding | | | 6,734,446 | | |

| Net asset value and redemption price per share(2) | | $ | 14.75 | | |

| Class C: | |

| Net assets | | $ | 866,888,011 | | |

| Shares authorized | | | unlimited | | |

| Par value | | $ | 0.01 | | |

| Shares outstanding | | | 58,680,853 | | |

| Net asset value and redemption price per share(2) | | $ | 14.77 | | |

| Class Q: | |

| Net assets | | $ | 105,617,071 | | |

| Shares authorized | | | unlimited | | |

| Par value | | $ | 0.01 | | |

| Shares outstanding | | | 7,179,661 | | |

| Net asset value and redemption price per share | | $ | 14.71 | | |

(1) Maximum offering price is computed ar 100/97.50 of net asset value. On purchases of $100,000 or more, the offering price is reduced.

(2) Redemption price per share may be reduced for any applicable contingent deferred sales charge.

See Accompanying Notes to Financial Statements

9

ING Senior Income Fund

STATEMENT OF OPERATIONS for the Six Months Ended August 31, 2007 (Unaudited)

| INVESTMENT INCOME: | |

| Interest | | $ | 94,143,217 | | |

| Arrangement fees earned | | | 326,117 | | |

| Other | | | 1,467,076 | | |

| Total investment income | | | 95,936,410 | | |

| EXPENSES: | |

| Investment management fees | | | 9,675,042 | | |

| Administration fees | | | 1,209,380 | | |

| Distribution and service fees: | |

| Class A | | | 1,244,644 | | |

| Class B | | | 541,851 | | |

| Class C | | | 3,483,364 | | |

| Class Q | | | 165,911 | | |

| Transfer agent fees: | |

| Class A | | | 156,792 | | |

| Class B | | | 17,052 | | |

| Class C | | | 146,253 | | |

| Class Q | | | 20,855 | | |

| Shareholder reporting expense | | | 147,200 | | |

| Interest expense | | | 7,791,409 | | |

| Custodian fees | | | 527,789 | | |

| Credit facility fees | | | 15,778 | | |

| Professional fees | | | 97,680 | | |

| Trustees' fees | | | 66,800 | | |

| Registration fees | | | 107,683 | | |

| Postage expense | | | 294,400 | | |

| Insurance expense | | | 14,122 | | |

| Miscellaneous expense | | | 46,717 | | |

| Total expenses | | | 25,770,722 | | |

| Less: | |

| Net waived and reimbursed fees | | | (135,463 | ) | |

| Net expenses | | | 25,635,259 | | |

| Net investment income | | | 70,301,151 | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND

FOREIGN CURRENCY RELATED TRANSACTIONS: | | | | | |

| Net realized gain (loss) on: | |

| Investments | | | 9,437,536 | | |

| Foreign currency related transactions | | | (3,804,479 | ) | |

| Net realized gain on investments and foreign currency related transactions | | | 5,633,057 | | |

| Net change in unrealized appreciation or depreciation on: | |

| Investments | | | (115,607,268 | ) | |

| Foreign currency related transactions | | | 1,002,424 | | |

Net change in unrealized appreciation or depreciation on investments and

foreign currency related transactions | | | (114,604,844 | ) | |

Net realized and unrealized gain (loss) on investments

and foreign currency related transactions | | | (108,971,787 | ) | |

| Net decrease in net assets resulting from operations | | $ | (38,670,636 | ) | |

See Accompanying Notes to Financial Statements

10

ING Senior Income Fund

STATEMENTS OF CHANGES IN NET ASSETS (Unaudited)

| | | Six Months Ended | | Year Ended | |

| | | August 31, | | February 28, | |

| | | 2007 | | 2007 | |

| INCREASE IN NET ASSETS FROM OPERATIONS: | |

| Net investment income | | $ | 70,301,151 | | | $ | 136,929,195 | | |

Net realized gain (loss) on investments and foreign

currency related transactions | | | 5,633,057 | | | | (1,310,799 | ) | |

Net change in unrealized appreciation or

depreciation on investments and foreign currency

related transactions | | | (114,604,844 | ) | | | 4,713,875 | | |

Net increase (decrease) in net assets resulting

from operations | | | (38,670,636 | ) | | | 140,332,271 | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | |

| From net investment income | |

| Class A | | | (33,670,227 | ) | | | (64,626,473 | ) | |

| Class B | | | (3,407,564 | ) | | | (7,057,368 | ) | |

| Class C | | | (29,140,780 | ) | | | (56,290,853 | ) | |

| Class Q | | | (4,512,818 | ) | | | (10,499,863 | ) | |

| Decrease in net assets from distributions to shareholders | | | (70,731,389 | ) | | | (138,474,557 | ) | |

| CAPITAL SHARE TRANSACTIONS: | |

| Net proceeds from sale of shares | | | 335,308,059 | | | | 915,801,787 | | |

| Dividends reinvested | | | 47,512,243 | | | | 91,655,109 | | |

| | | | 382,820,302 | | | | 1,007,456,896 | | |

| Cost of shares repurchased | | | (448,158,846 | ) | | | (982,810,449 | ) | |

Net increase (decrease) in net assets resulting from

capital share transactions | | | (65,338,544 | ) | | | 24,646,447 | | |

| Net increase (decrease) in net assets | | | (174,740,569 | ) | | | 26,504,161 | | |

| NET ASSETS: | |

| Beginning of period | | | 2,173,514,079 | | | | 2,147,009,918 | | |

| End of period | | $ | 1,998,773,510 | | | $ | 2,173,514,079 | | |

Distributions in excess of net investment income

at end of period | | $ | (5,455,989 | ) | | $ | (5,025,751 | ) | |

See Accompanying Notes to Financial Statements

11

ING Senior Income Fund

STATEMENT OF CASH FLOWS for the Six Months Ended August 31, 2007 (Unaudited)

INCREASE (DECREASE) IN CASH

Cash Flows From Operating Activities: | |

| Interest received | | $ | 87,691,703 | | |

| Arrangement fee received | | | 171,632 | | |

| Other income received | | | 1,467,076 | | |

| Interest paid | | | (7,328,480 | ) | |

| Other operating expenses paid | | | (17,777,625 | ) | |

| Purchases of securities | | | (1,124,297,811 | ) | |

| Proceeds from sale of securities | | | 982,048,947 | | |

| Net cash used in operating activities | | | (78,024,558 | ) | |

| Cash Flows From Financing Activities: | |

| Distributions paid to common shareholders | | | (22,731,702 | ) | |

| Proceeds from capital shares sold | | | 341,785,615 | | |

| Disbursements for capital shares repurchased | | | (448,158,846 | ) | |

| Net issuance of notes payable | | | 183,000,000 | | |

| Net cash flows provided by financing activities | | | 53,895,067 | | |

| Net decrease in cash | | | (24,129,491 | ) | |

| Cash at beginning of period | | | 31,414,187 | | |

| Cash at end of period | | $ | 7,284,696 | | |

Reconciliation of Net Decrease in Net Assets Resulting from

Operations to Net Cash Used in Operating Activities: | | | | | |

| Net decrease in net assets resulting from operations | | $ | (38,670,636 | ) | |

Adjustments to reconcile net decrease in net assets resulting

from operations to net cash used in operating activities: | | | | | |

| Change in unrealized appreciation or depreciation on investments | | | 115,607,268 | | |

| Change in unrealized appreciation on foreign currencies | | | (142,596 | ) | |

| Change in unrealized appreciation or depreciation on forward currency contracts | | | (859,828 | ) | |

| Net accretion/amortization of discounts on investments | | | (2,995,565 | ) | |

| Realized gain on sale of investments and foreign currency related transactions | | | (5,633,057 | ) | |

| Purchases of securities | | | (1,124,297,811 | ) | |

| Proceeds from sale of securities | | | 982,048,947 | | |

| Increase in other assets | | | (3,026 | ) | |

| Increase in interest receivable | | | (3,455,949 | ) | |

| Decrease in prepaid arrangement fees on notes payable | | | 15,778 | | |

| Decrease in prepaid expenses | | | 80,993 | | |

| Decrease in deferred arrangement fees on senior loans | | | (154,485 | ) | |

| Increase in accrued interest payable | | | 462,929 | | |

| Increase in payable to affiliate | | | 177,282 | | |

| Increase in accrued trustee fees | | | 22,055 | | |

| Decrease in accrued expenses | | | (226,857 | ) | |

| Total adjustments | | | (39,353,922 | ) | |

| Net cash used in operating activities | | $ | (78,024,558 | ) | |

| Non Cash Financing Activities | |

| Receivable for shares sold | | $ | 4,098,006 | | |

| Reinvestment of dividends | | $ | 47,512,243 | | |

See Accompanying Notes to Financial Statements

12

ING SENIOR INCOME FUND (UNAUDITED) FINANCIAL HIGHLIGHTS

Selected data for a share of beneficial interest outstanding for each period.

| | | Class A | |

| | | Six Months

Ended

August 31, | | Year Ended

February 28 or 29, | |

| | | 2007 | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per Share Operating Performance: | |

| Net asset value, beginning of period | | $ | 15.57 | | | | 15.56 | | | | 15.59 | | | | 15.47 | | | | 14.83 | | | | 14.92 | | |

| Income (loss) from investment operations: | |

| Net investment income | | $ | 0.52 | | | | 1.01 | | | | 0.78 | | | | 0.55 | | | | 0.61 | | | | 0.69 | | |

| Net realized and unrealized gain (loss) on investments | | $ | (0.78 | ) | | | 0.02 | | | | (0.03 | ) | | | 0.18 | | | | 0.69 | | | | (0.09 | ) | |

| Total income (loss) from investment operations | | $ | (0.26 | ) | | | 1.03 | | | | 0.75 | | | | 0.73 | | | | 1.30 | | | | 0.60 | | |

| Less distributions from: | |

| Net investment income | | $ | 0.52 | | | | 1.02 | | | | 0.78 | | | | 0.56 | | | | 0.64 | | | | 0.69 | | |

| Net realized gain on investments | | $ | — | | | | — | | | | — | | | | 0.05 | | | | 0.02 | | | | — | | |

| Total distributions | | $ | 0.52 | | | | 1.02 | | | | 0.78 | | | | 0.61 | | | | 0.66 | | | | 0.69 | | |

| Net asset value, end of period | | $ | 14.79 | | | | 15.57 | | | | 15.56 | | | | 15.59 | | | | 15.47 | | | | 14.83 | | |

| Total Investment Return(1) | | % | (1.71 | ) | | | 6.84 | | | | 4.96 | | | | 4.80 | | | | 8.93 | | | | 4.15 | | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (000's) | | $ | 926,910 | | | | 998,140 | | | | 918,621 | | | | 736,740 | | | | 172,975 | | | | 11,106 | | |

| Average borrowings (000's)(2) | | $ | 251,674 | | | | 404,137 | | | | 325,044 | | | | 34,767 | | | | 20,771 | | | | 17,655 | | |

| Asset coverage per $1,000 of debt | | $ | 5,759 | | | | 10,171 | | | | 6,519 | | | | 1,251 | | | | — | * | | | 689 | | |

| Ratios to average net assets after reimbursement/recoupment: | |

| Expenses (before interest and other fees related to revolving credit facility)(3)(4) | | % | 1.41 | | | | 1.50 | | | | 1.50 | | | | 1.34 | | | | 1.36 | | | | 1.42 | | |

| Expenses (with interest and other fees related to revolving credit facility)(3)(4) | | % | 2.13 | | | | 2.56 | | | | 2.20 | | | | 1.45 | | | | 1.43 | | | | 1.63 | | |

| Net investment income(3)(4) | | % | 6.74 | | | | 6.42 | | | | 4.98 | | | | 3.49 | | | | 3.84 | | | | 4.88 | | |

| Ratios to average net assets before reimbursement/recoupment: | |

| Expenses (before interest and other fees related to revolving credit facility)(3)(4) | | % | 1.41 | | | | 1.48 | | | | 1.48 | | | | 1.35 | | | | 1.46 | | | | 1.57 | | |

| Expenses (with interest and other fees related to revolving credit facility)(3)(4) | | % | 2.13 | | | | 2.54 | | | | 2.18 | | | | 1.46 | | | | 1.53 | | | | 1.78 | | |

| Net investment income(3)(4) | | % | 6.74 | | | | 6.44 | | | | 5.00 | | | | 3.48 | | | | 3.74 | | | | 4.73 | | |

| Portfolio turnover rate | | % | 41 | | | | 57 | | | | 82 | | | | 82 | | | | 72 | | | | 60 | | |

| Shares outstanding at end of period (000's) | | | 62,672 | | | | 64,122 | | | | 59,029 | | | | 47,252 | | | | 11,180 | | | | 749 | | |

| | | Class B | |

| | | Six Months

Ended

August 31, | | Year Ended

February 28 or 29, | |

| | | 2007 | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per Share Operating Performance: | |

| Net asset value, beginning of period | | $ | 15.53 | | | | 15.53 | | | | 15.57 | | | | 15.45 | | | | 14.82 | | | | 14.92 | | |

| Income (loss) from investment operations: | |

| Net investment income | | $ | 0.48 | | | | 0.92 | | | | 0.70 | | | | 0.47 | ** | | | 0.53 | | | | 0.62 | | |

| Net realized and unrealized gain (loss) on investments | | $ | (0.77 | ) | | | 0.02 | | | | (0.04 | ) | | | 0.18 | ** | | | 0.69 | | | | (0.10 | ) | |

| Total income (loss) from investment operations | | $ | (0.29 | ) | | | 0.94 | | | | 0.66 | | | | 0.65 | | | | 1.22 | | | | 0.52 | | |

| Less distributions from: | |

| Net investment income | | $ | 0.49 | | | | 0.94 | | | | 0.70 | | | | 0.48 | | | | 0.57 | | | | 0.62 | | |

| Net realized gain on investments | | $ | — | | | | — | | | | — | | | | 0.05 | | | | 0.02 | | | | — | | |

| Total distributions | | $ | 0.49 | | | | 0.94 | | | | 0.70 | | | | 0.53 | | | | 0.59 | | | | 0.62 | | |

| Net asset value, end of period | | $ | 14.75 | | | | 15.53 | | | | 15.53 | | | | 15.57 | | | | 15.45 | | | | 14.82 | | |

| Total Investment Return(1) | | % | (1.96 | ) | | | 6.26 | | | | 4.37 | | | | 4.28 | | | | 8.33 | | | | 3.57 | | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (000's) | | $ | 99,359 | | | | 111,749 | | | | 120,254 | | | | 125,200 | | | | 62,852 | | | | 17,648 | | |

| Average borrowings (000's)(2) | | $ | 251,674 | | | | 404,137 | | | | 325,044 | | | | 34,767 | | | | 20,771 | | | | 17,655 | | |

| Asset coverage per $1,000 of debt | | $ | 5,759 | | | | 10,171 | | | | 6,519 | | | | 1,251 | | | | — | * | | | 689 | | |

| Ratios to average net assets after reimbursement/recoupment: | |

| Expenses (before interest and other fees related to revolving credit facility)(3)(4) | | % | 1.91 | | | | 2.00 | | | | 1.99 | | | | 1.87 | | | | 1.87 | | | | 1.91 | | |

| Expenses (with interest and other fees related to revolving credit facility)(3)(4) | | % | 2.63 | | | | 3.06 | | | | 2.69 | | | | 1.94 | | | | 1.97 | | | | 2.09 | | |

| Net investment income(3)(4) | | % | 6.22 | | | | 5.91 | | | | 4.45 | | | | 2.93 | | | | 3.47 | | | | 4.12 | | |

| Ratios to average net assets before reimbursement/recoupment: | |

| Expenses (before interest and other fees related to revolving credit facility)(3)(4) | | % | 2.16 | | | | 2.23 | | | | 1.97 | | | | 2.13 | | | | 2.22 | | | | 2.31 | | |

| Expenses (with interest and other fees related to revolving credit facility)(3)(4) | | % | 2.88 | | | | 3.29 | | | | 2.67 | | | | 2.19 | | | | 2.31 | | | | 2.49 | | |

| Net investment income(3)(4) | | % | 5.97 | | | | 5.68 | | | | 4.47 | | | | 2.67 | | | | 3.13 | | | | 3.72 | | |

| Portfolio turnover rate | | % | 41 | | | | 57 | | | | 82 | | | | 82 | | | | 72 | | | | 60 | | |

| Shares outstanding at end of period (000's) | | | 6,734 | | | | 7,195 | | | | 7,742 | | | | 8,043 | | | | 4,068 | | | | 1,191 | | |

(1) Total investment returns do not include sales load.

(2) Based on the active days of borrowing.

(3) The Investment Adviser has agreed to limit expenses excluding interest, taxes, brokerage commissions, leverage expenses, other investment related costs and extraordinary expenses, subject to possible recoupment by the Investment Adviser within three years to the following:

Class A – 0.90% of Managed Assets plus 0.45% of average daily net assets

Class B – 0.90% of Managed Assets plus 1.20% of average daily net assets

Class C – 0.90% of Managed Assets plus 0.95% of average daily net assets

Class Q – 0.90% of Managed Assets plus 0.45% of average daily net assets

(4) Annualized for periods less than one year.

* There were no loans outstanding at period end.

** Per share numbers have been calculated using average number of shares outstanding throughout the period.

See Accompanying Notes to Financial Statements

13

ING SENIOR INCOME FUND (UNAUDITED) (CONTINUED) FINANCIAL HIGHLIGHTS

Selected data for a share of beneficial interest outstanding for each period.

| | | Class C | |

| | | Six Months

Ended

August 31, | | Year Ended

February 28 or 29, | |

| | | 2007 | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per Share Operating Performance: | |

| Net asset value, beginning of period | | $ | 15.55 | | | | 15.55 | | | | 15.58 | | | | 15.46 | | | | 14.82 | | | | 14.92 | | |

| Income (loss) from investment operations: | |

| Net investment income | | $ | 0.48 | | | | 0.93 | | | | 0.70 | | | | 0.47 | | | | 0.53 | | | | 0.62 | | |

| Net realized and unrealized gain (loss) on investments | | $ | (0.77 | ) | | | 0.01 | | | | (0.03 | ) | | | 0.18 | | | | 0.70 | | | | (0.10 | ) | |

| Total income (loss) from investment operations | | $ | (0.29 | ) | | | 0.94 | | | | 0.67 | | | | 0.65 | | | | 1.23 | | | | 0.52 | | |

| Less distributions from: | |

| Net investment income | | $ | 0.49 | | | | 0.94 | | | | 0.70 | | | | 0.48 | | | | 0.57 | | | | 0.62 | | |

| Net realized gain on investments | | $ | — | | | | — | | | | — | | | | 0.05 | | | | 0.02 | | | | — | | |

| Total distributions | | $ | 0.49 | | | | 0.94 | | | | 0.70 | | | | 0.53 | | | | 0.59 | | | | 0.62 | | |

| Net asset value, end of period | | $ | 14.77 | | | | 15.55 | | | | 15.55 | | | | 15.58 | | | | 15.46 | | | | 14.82 | | |

| Total Investment Return(1) | | % | (1.96 | ) | | | 6.25 | | | | 4.44 | | | | 4.28 | | | | 8.40 | | | | 3.57 | | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (000's) | | $ | 866,888 | | | | 927,950 | | | | 923,549 | | | | 830,584 | | | | 275,849 | | | | 32,647 | | |

| Average borrowings (000's)(2) | | $ | 251,674 | | | | 404,137 | | | | 325,044 | | | | 34,767 | | | | 20,771 | | | | 17,655 | | |

| Asset coverage per $1,000 of debt | | $ | 5,759 | | | | 10,171 | | | | 6,519 | | | | 1,251 | | | | — | * | | | 689 | | |

| Ratios to average net assets after reimbursement/recoupment: | |

| Expenses (before interest and other fees related to revolving credit facility)(3)(4) | | % | 1.91 | | | | 2.00 | | | | 1.99 | | | | 1.83 | | | | 1.86 | | | | 1.91 | | |

| Expenses (with interest and other fees related to revolving credit facility)(3)(4) | | % | 2.63 | | | | 3.06 | | | | 2.69 | | | | 1.94 | | | | 1.94 | | | | 2.09 | | |

| Net investment income(3)(4) | | % | 6.23 | | | | 5.92 | | | | 4.46 | | | | 2.88 | | | | 3.38 | | | | 4.19 | | |

| Ratios to average net assets before reimbursement/recoupment: | |

| Expenses (before interest and other fees related to revolving credit facility)(3)(4) | | % | 1.91 | | | | 1.98 | | | | 1.97 | | | | 1.83 | | | | 1.96 | | | | 2.06 | | |

| Expenses (with interest and other fees related to revolving credit facility)(3)(4) | | % | 2.63 | | | | 3.04 | | | | 2.67 | | | | 1.95 | | | | 2.04 | | | | 2.24 | | |

| Net investment income(3)(4) | | % | 6.23 | | | | 5.93 | | | | 4.48 | | | | 2.87 | | | | 3.28 | | | | 4.04 | | |

| Portfolio turnover rate | | % | 41 | | | | 57 | | | | 82 | | | | 82 | | | | 72 | | | | 60 | | |

| Shares outstanding at end of period (000's) | | | 58,681 | | | | 59,679 | | | | 59,402 | | | | 53,316 | | | | 17,841 | | | | 2,202 | | |

| | | Class Q | |

| | | Six Months

Ended

August 31, | | Year Ended

February 28 or 29, | |

| | | 2007 | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per Share Operating Performance: | |

| Net asset value, beginning of period | | $ | 15.49 | | | | 15.49 | | | | 15.52 | | | | 15.41 | | | | 14.79 | | | | 14.89 | | |

| Income (loss) from investment operations: | |

| Net investment income | | $ | 0.51 | | | | 0.99 | | | | 0.78 | | | | 0.52 | | | | 0.63 | | | | 0.69 | | |

| Net realized and unrealized gain (loss) on investments | | $ | (0.77 | ) | | | 0.03 | | | | (0.03 | ) | | | 0.20 | | | | 0.65 | | | | (0.10 | ) | |

| Total income (loss) from investment operations | | $ | (0.26 | ) | | | 1.02 | | | | 0.75 | | | | 0.72 | | | | 1.28 | | | | 0.59 | | |

| Less distributions from: | |

| Net investment income | | $ | 0.52 | | | | 1.02 | | | | 0.78 | | | | 0.56 | | | | 0.64 | | | | 0.69 | | |

| Net realized gain on investments | | $ | — | | | | — | | | | — | | | | 0.05 | | | | 0.02 | | | | — | | |

| Total distributions | | $ | 0.52 | | | | 1.02 | | | | 0.78 | | | | 0.61 | | | | 0.66 | | | | 0.69 | | |

| Net asset value, end of period | | $ | 14.71 | | | | 15.49 | | | | 15.49 | | | | 15.52 | | | | 15.41 | | | | 14.79 | | |

| Total Investment Return(1) | | % | (1.71 | ) | | | 6.81 | | | | 4.97 | | | | 4.75 | | | | 8.82 | | | | 4.09 | | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (000's) | | $ | 105,617 | | | | 135,675 | | | | 184,586 | | | | 183,017 | | | | 157,051 | | | | 215,341 | | |

| Average borrowings (000's)(2) | | $ | 251,674 | | | | 404,137 | | | | 325,044 | | | | 34,767 | | | | 20,771 | | | | 17,655 | | |

| Asset coverage per $1,000 of debt | | $ | 5,759 | | | | 10,171 | | | | 6,519 | | | | 1,251 | | | | — | * | | | 689 | | |

| Ratios to average net assets after reimbursement/recoupment: | |

| Expenses (before interest and other fees related to revolving credit facility)(3)(4) | | % | 1.41 | | | | 1.50 | | | | 1.49 | | | | 1.34 | �� | | | 1.40 | | | | 1.41 | | |

| Expenses (with interest and other fees related to revolving credit facility)(3)(4) | | % | 2.13 | | | | 2.56 | | | | 2.19 | | | | 1.45 | | | | 1.54 | | | | 1.59 | | |

| Net investment income(3)(4) | | % | 6.71 | | | | 6.39 | | | | 4.96 | | | | 3.39 | | | | 4.17 | | | | 4.69 | | |

| Ratios to average net assets before reimbursement/recoupment: | |

| Expenses (before interest and other fees related to revolving credit facility)(3)(4) | | % | 1.41 | | | | 1.48 | | | | 1.47 | | | | 1.34 | | | | 1.48 | | | | 1.56 | | |

| Expenses (with interest and other fees related to revolving credit facility)(3)(4) | | % | 2.13 | | | | 2.54 | | | | 2.17 | | | | 1.45 | | | | 1.62 | | | | 1.74 | | |

| Net investment income(3)(4) | | % | 6.71 | | | | 6.41 | | | | 4.98 | | | | 3.38 | | | | 4.09 | | | | 4.54 | | |

| Portfolio turnover rate | | % | 41 | | | | 57 | | | | 82 | | | | 82 | | | | 72 | | | | 60 | | |

| Shares outstanding at end of period (000's) | | | 7,180 | | | | 8,761 | | | | 11,918 | | | | 11,789 | | | | 10,188 | | | | 14,559 | | |

(1) Total investment returns do not include sales load.

(2) Based on the active days of borrowing.

(3) The Investment Adviser has agreed to limit expenses excluding interest, taxes, brokerage commissions, leverage expenses, other investment related costs and extraordinary expenses, subject to possible recoupment by the Investment Adviser within three years to the following:

Class A – 0.90% of Managed Assets plus 0.45% of average daily net assets

Class B – 0.90% of Managed Assets plus 1.20% of average daily net assets

Class C – 0.90% of Managed Assets plus 0.95% of average daily net assets

Class Q – 0.90% of Managed Assets plus 0.45% of average daily net assets

(4) Annualized for periods less than one year.

* There were no loans outstanding at period end.

See Accompanying Notes to Financial Statements

14

ING Senior Income Fund

NOTES TO FINANCIAL STATEMENTS as of August 31, 2007 (Unaudited)

NOTE 1 — ORGANIZATION

ING Senior Income Fund (the "Fund"), a Delaware statutory trust, is registered under the Investment Company Act of 1940 as amended, (the "1940 Act"), as a continuously-offered, diversified, closed-end, management investment company. The Fund invests at least 80% of its net assets plus the amount of any borrowings, for investment purposes, in U.S. dollar denominated, floating rate secured senior loans, which generally are not registered under the Securities Act of 1933 as amended (the "'33 Act"), and contain certain restrictions on resale and cannot be sold publicly. These loans bear interest (unless otherwise noted) at rates that float periodically at a margin above the London Inter-Bank Offered Rate ("LIBOR") and other short-term rates. During the period December 15, 2000 through March 30, 2001, the Fund issued 19,933,953 Class Q shares to an affiliate of the Fund's manager, ING Investments, LLC (the "Investment Manager") in exchange for $2 00,000,000. Effective April 2, 2001, the Fund commenced the offering of Class A, Class B, Class C and Class Q shares to the public.

The Fund currently has four classes of shares; A, B, C and Q. Class A shares are subject to a sales charge of up to 2.50%. Class A shares purchased in excess of $1,000,000 are not subject to a sales charge but are subject to an Early Withdrawal Charge ("EWC") of 1% within one year of purchase. Class A shares are issued upon conversion of Class B shares eight years after purchase or through an exchange of Class A shares of certain ING Funds. Class B shares are subject to an EWC of up to 3% over the five-year period after purchase and Class C shares are subject to an EWC of 1% during the first year after purchase.

To maintain a measure of liquidity, the Fund offers to repurchase between 5% and 25% of its outstanding common shares on a monthly basis. This is a fundamental policy that cannot be changed without shareholder approval. The Fund may not repurchase more than 25% in any calendar quarter. Other than these monthly repurchases, no market for the Fund's common shares is expected to exist. The separate classes of shares differ principally in their distribution fees and shareholder servicing fees. All shareholders bear the common expenses of the Fund and earn income and realized gains/losses from the portfolio pro rata on the average daily net assets of each class, without distinction between share classes. Differences in the per share dividend rates generally result from differences in separate class expenses, including distribution fees and shareholder servicing fees.

Effective January 31, 2005, Class B common shares of the Fund became closed to new investment, provided that: (1) Class B common shares of the Fund may be purchased through the reinvestment of dividends issued by the Fund; and (2) subject to the terms and conditions of relevant exchange privileges and as permitted under their respective prospectuses, Class B common shares of the Fund may be acquired through exchange of Class B shares of other funds in the ING mutual funds complex for the Fund's Class B common shares.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with U.S. generally accepted accounting principles.

A. Senior Loan and Other Security Valuation. Senior loans held by the Fund are normally valued at the average of the means of one or more bid and asked quotations obtained from a pricing service or other sources determined by the Board of Trustees to be independent and believed to be reliable. Loans for which reliable market value quotations are not readily available may be valued with reference to another loan or a group of loans for which quotations are more readily available and whose characteristics are comparable to the loan being valued. Under this approach, the comparable loan or loans serve as a proxy for changes in value of the loan being valued. The Fund has engaged an independent pricing service to provide quotations from dealers in loans and to calculate values under the proxy procedure described above.

15

ING Senior Income Fund

NOTES TO FINANCIAL STATEMENTS as of August 31, 2007 (Unaudited) (continued)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

It is expected that most of the loans held by the Fund will be valued with reference to quotations from the independent pricing service or with reference to the proxy procedure described above. As of August 31, 2007, 99.13% of total loans were valued based on these procedures.

Prices from a pricing service may not be available for all loans and the Investment Manager may believe that the price for a loan derived from market quotations or the proxy procedure described above is not reliable or accurate. Among other reasons, this may be the result of information about a particular loan or borrower known to the Investment Manager that the Investment Manager believes may not be known to the pricing service or reflected in a price quote. In this event, the loan is valued at fair value as determined in good faith under procedures established by the Fund's Board of Trustees and in accordance with the provisions of the 1940 Act. Under these procedures, fair value is determined by the Investment Manager and monitored by the Fund's Board of Trustees through its Valuation, Proxy and Brokerage Committee (formerly, Valuation and Proxy Committee).

In fair valuing a loan, consideration is given to several factors, which may include, among others, the following: (i) the characteristics of and fundamental analytical data relating to the loan, including the cost, size, current interest rate, period until the next interest rate reset, maturity and base lending rate of the loan, the terms and conditions of the loan and any related agreements, and the position of the loan in the borrower's debt structure; (ii) the nature, adequacy and value of the collateral, including the Fund's rights, remedies and interests with respect to the collateral; (iii) the creditworthiness of the borrower and the cash flow coverage of outstanding principal and interest, based on an evaluation of its financial condition, financial statements and information about the borrower's business, cash flows, capital structure and future prospects; (iv) information relating to the market for the loan, including price quotat ions for, and trading in, the loan and interests in similar loans and the market environment and investor attitudes towards the loan and interests in similar loans; (v) the reputation and financial condition of the agent for the loan and any intermediate participants in the loan; (vi) the borrower's management; and (vii) the general economic and market conditions affecting the fair value of the loan. Securities other than senior loans for which reliable market value quotations are not readily available and all other assets will be valued at their respective fair values as determined in good faith by, and under procedures established by, the Board of Trustees of the Fund. Investments in securities maturing in 60 days or less from the date of valuation are valued at amortized cost, which, when combined with accrued interest, approximates market value. To the extent the Fund invests in other registered companies, the Fund's NAV is calculated based on the current NAV of the registered investment company in which the Fund invests. The prospectuses for those investment companies explain the circumstances under which they will use fair value pricing and the effects of using fair value pricing.

B. Distributions to Shareholders. The Fund declares and goes ex-dividend daily and pays dividends monthly from net investment income. Distributions from capital gains, if any, are declared and paid annually. The Fund may make additional distributions to comply with the distribution requirements of the Internal Revenue Code. The character and amounts of income and gains to be distributed are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles for investment companies. The Fund records distributions to its shareholders on the ex-dividend date.

C. Security Transactions and Revenue Recognition. Revolver and delayed draw loans are booked on a settlement date basis. Security transactions and senior loans are accounted for on trade date (date the order to buy or sell is executed). Realized gains or losses are reported on the basis of identified cost of securities sold. Interest income is recorded on an accrual basis at the then-current loan rate. The accrual of interest on loans is partially or fully discontinued when, in the opinion of management, there is an indication that the borrower may be unable to meet payments as they become due. If determined to be uncollectible, unpaid accrued interest is also written off. Cash collections on non-accrual senior loans are generally applied as a reduction to the recorded investment of the loan. Loans are generally returned to accrual status only after all past due amounts have been received and the borrower has demonstrated sustained performance. Premium

16

ING Senior Income Fund

NOTES TO FINANCIAL STATEMENTS as of August 31, 2007 (Unaudited) (continued)

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

amortization and discount accretion are determined by the effective yield method over the shorter of four years or the actual term of the loan. Arrangement fees received on revolving credit facilities, which represent non-refundable fees or purchase discounts associated with the acquisition of loans, are deferred and recognized using the effective yield method over the shorter of four years or the actual term of the loan. No such fees are recognized on loans which have been placed on non-accrual status. Arrangement fees associated with all other loans, except revolving credit facilities, are treated as discounts and are accreted as described above. Dividend income is recorded on the ex-dividend date.

D. Federal Income Taxes. It is the Fund's policy to comply with subchapter M of the Internal Revenue Code and related excise tax provisions applicable to regulated investment companies and to distribute substantially all of its net investment income and net realized capital gains to its shareholders. Therefore, no federal income tax provision is required. No capital gain distributions shall be made until any capital loss carryforwards have been fully utilized or expire.

E. Use of Estimates. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

F. Forward Foreign Currency Contracts. The Fund may enter into forward foreign currency contracts primarily to hedge against foreign currency exchange rate risks on its non-U.S. dollar denominated investment securities. When entering into a currency forward contract, the Fund agrees to receive or deliver a fixed quantity of foreign currency for an agreed-upon price on an agreed future date. These contracts are valued daily and the Fund's net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the forward foreign exchange rates at the dates of entry into the contracts and the forward rates at the reporting date, is included in the Statement of Assets and Liabilities. Realized and unrealized gains and losses are included in the S tatement of Operations. These instruments involve market and/or credit risk in excess of the amount recognized in the Statement of Assets and Liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency and securities values and interest rates. Open forward foreign currency contracts are presented following the respective Portfolio of Investments.

NOTE 3 — INVESTMENTS

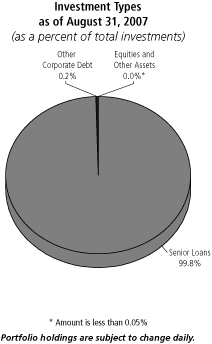

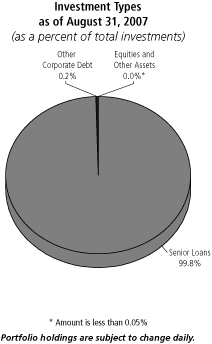

For the six months ended August 31, 2007, the cost of purchases and the proceeds from principal repayment and sales of investments, excluding short-term investments, totaled $1,138,245,379 and $1,001,433,852, respectively. At August 31, 2007, the Fund held senior loans valued at $2,415,645,072 representing 99.8% of its total investments. The market value of these assets is established as set forth in Note 2.

The senior loans acquired by the Fund typically take the form of a direct lending relationship with the borrower acquired through an assignment of another lender's interest in a loan. The lead lender in a typical corporate loan syndicate administers the loan and monitors collateral. In the event that the lead lender becomes insolvent, enters FDIC receivership or, if not FDIC insured, enters into bankruptcy, the Fund may incur certain costs and delays in realizing payment, or may suffer a loss of principal and/or interest.

Warrants and shares of common stock held in the portfolio were acquired in conjunction with loans held by the Fund. Certain of these shares and warrants are restricted and may not be publicly sold without registration under the '33 Act, or without an exemption under the 1933 Act. In some cases, these restrictions expire after a designated period of time after the issuance of the shares or warrants.

17

ING Senior Income Fund

NOTES TO FINANCIAL STATEMENTS as of August 31, 2007 (Unaudited) (continued)

NOTE 3 — INVESTMENTS (continued)

Dates of acquisition and cost or assigned basis of restricted securities are as follows:

| | | Date of

Acquisition | | Cost or

Assigned Basis | |

| Decision One Corporation (463,664 Common Shares) | | 06/03/05 | | $ | 295,535 | | |

| Neoplan USA Corporation (1,627 Common Shares) | | 08/31/04 | | | — | | |

| Neoplan USA Corporation (170 Series B Preferred Shares) | | 08/29/03 | | | — | | |

| Neoplan USA Corporation (102 Series C Preferred Shares) | | 08/29/03 | | | 40,207 | | |

| Neoplan USA Corporation (331 Series D Preferred Shares) | | 08/29/03 | | | 330,600 | | |

| Norwood Promotional Products, Inc. (80,087 Common Shares) | | 08/23/04 | | | 10,046 | | |

| Safelite Realty Corporation (30,003 Common Shares) | | 06/21/01 | | | — | | |

Total restricted securities excluding senior loans (market value

of $545,337 was 0.0% of net assets at August 31, 2007). | | | | $ | 676,388 | | |

NOTE 4 — MANAGEMENT AND ADMINISTRATION AGREEMENTS

The Fund has entered into an investment management agreement ("Management Agreement") with the Investment Adviser to provide advisory and management services. The Management Agreement compensates the Investment Adviser with a fee, computed daily and payable monthly, at an annual rate of 0.80% of the Fund's average daily gross asset value, minus the sum of the Fund's accrued and unpaid dividends on any outstanding preferred shares and accrued liabilities (other than liabilities for the principal amount of any borrowings incurred, commercial paper or notes issued by the Fund and the liquidation preference of any outstanding preferred shares) ("Managed Assets"). The Fund is sub-advised by ING Investment Management Co. ("ING IM"). Under the sub-advisory agreement, ING IM is responsible for managing the assets of the Fund in accordance with its investment objective and policies, subject to oversight by the Investment Adviser. Both ING IM and the Investment Adviser are indirect, wholly-owned subsidiaries of ING Groep N.V. ("ING Groep") and affiliates of each other.

The Fund has also entered into an Administration Agreement with ING Funds Services, LLC (the "Administrator"), an indirect, wholly-owned subsidiary of ING Groep N.V., to provide administrative services. The Administrator is compensated with a fee, computed daily and payable monthly, at an annual rate of 0.10% of the Fund's Managed Assets.

NOTE 5 — DISTRIBUTION AND SERVICE FEES

Each share class of the Fund has adopted a Plan pursuant to Rule 12b-1 under the 1940 Act (the "12b-1 Plans"), whereby ING Funds Distributor, LLC (the "Distributor") is compensated by the Fund for expenses incurred in the distribution of the Fund's shares ("Distribution Fees"). Pursuant to the 12b-1 Plans, the Distributor is entitled to a payment each month for actual expenses incurred in the distribution and promotion of the Fund's shares, including expenses incurred in printing prospectuses and reports used for sales purposes, expenses incurred in preparing and printing sales literature and other such distribution related expenses, including any distribution or Shareholder Servicing Fees ("Service Fees") paid to securities dealers who executed a distribution agreement with the Distributor. Under the 12b-1 plans, each class of shares of the Fund pays the Distributor a combined Distribution and/or Service Fee based on average daily net asset s at the following annual rates:

| Class A | | Class B | | Class C | | Class Q | |

| | 0.25 | % | | | 1.00 | % | | | 0.75 | % | | | 0.25 | % | |

During the six months ended August 31, 2007, the Distributor waived 0.25% of the Service Fee on Class B shares only.

18

ING Senior Income Fund

NOTES TO FINANCIAL STATEMENTS as of August 31, 2007 (Unaudited) (continued)

NOTE 6 — EXPENSE LIMITATIONS

The Investment Adviser has voluntarily agreed to limit expenses, excluding interest, taxes, brokerage commissions, leverage expenses, other investment-related costs and extraordinary expenses, to the following:

| Class A — 0.90% of Managed Assets plus 0.45% of average daily net assets | |

|

| Class B — 0.90% of Managed Assets plus 1.20% of average daily net assets | |

|

| Class C — 0.90% of Managed Assets plus 0.95% of average daily net assets | |

|

| Class Q — 0.90% of Managed Assets plus 0.45% of average daily net assets | |

|

NOTE 7 — COMMITMENTS

The Fund has entered into a revolving credit agreement, collateralized by assets of the Fund, to borrow up to $750 million maturing June 12, 2008. On September 10th, 2007, the amount of the credit agreement was increased to $840 million. Borrowing rates under this agreement are based on a commercial paper pass through rate plus 0.25% on the funded portion. A facility fee of 0.15% is charged on the entire facility. There was $420 million of borrowings outstanding at August 31, 2007 at a rate of 5.75%, excluding other fees related to the entire facility. Average borrowings for the six months ended August 31, 2007 were $251,673,913 and the average annualized interest rate was 6.16%, excluding other fees related to the entire facility.

NOTE 8 — SENIOR LOAN COMMITMENTS

As of August 31, 2007, the Fund had unfunded loan commitments pursuant to the terms of the following loan agreements:

| Advance Food Co. | | $ | 309,524 | | |

| Builders Firstsource, Inc. | | | 1,500,000 | | |

| Calpine Corp. | | | 2,700,000 | | |

| Cannery Casino Resorts | | | 1,228,347 | | |

| Cellular South, Inc. | | | 750,000 | | |

| Coach America Holdings, Inc. | | | 262,712 | | |

| Coleto Creek Power | | | 5,000,000 | | |

| Community Health Systems, Inc. | | | 3,031,709 | | |

| EPD, Inc. | | | 562,500 | | |

| FCH KFT - Term Loan B | | | 28,939 | | |

| FCH KFT - Term Loan C | | | 28,939 | | |

| Fender Musical Instruments Corp. | | | 1,166,667 | | |

Fleetcor Technologies

Operating Co., LLC | | | 133,333 | | |

| Fontainebleau Resorts, LLC | | | 1,333,333 | | |

| Golden Nugget, Inc. | | | 636,364 | | |

| Hearthstone Housing Partners II, LLC | | | 1,764,706 | | |

| Hub International Holdings, Inc. | | | 313,726 | | |

| Iasis Healthcare Corporation | | | 325,517 | | |

| Inventiv Health, Inc. | | | 85,714 | | |

| Isle of Capri Casinos, Inc. | | | 882,353 | | |

| Kerasotes Theatres, Inc. | | | 966,930 | | |

| Las Vegas Sands, LLC | | $ | 1,200,000 | | |

Levana Holding 4 GmbH -

Term Loan B | | | 175,404 | | |

Levana Holding 4 GmbH -

Term Loan C | | | 175,405 | | |

| Longview Power, LLC | | | 1,016,667 | | |

| Lucite International U.S. Finco Ltd. | | | 362,119 | | |

| MEG Energy Corp. | | | 4,200,000 | | |

| NRG Energy, Inc. | | | 6,250,862 | | |

| Seminole Tribe of Florida | | | 142,510 | | |

| Sturm Foods, Inc. | | | 500,000 | | |

| Sun Healthcare Group, Inc. | | | 87,356 | | |

Trump Entertainment Resorts

Holdings, L.P. | | | 4,353 | | |

United Surgical Partners

International, Inc. | | | 147,177 | | |

| Univision Communications, Inc. | | | 2,115,793 | | |

| UPC Broadband Holding | | | 1,741,434 | | |

| Valassis Communications, Inc. | | | 320,000 | | |

| Wastequip, Inc. | | | 186,765 | | |

| | | $ | 41,637,158 | | |

NOTE 9 — TRANSACTIONS WITH AFFILIATES AND RELATED PARTIES

At August 31, 2007, the Fund had the following amounts recorded in payable to affiliates on the accompanying Statement of Assets and Liabilities (see Notes 4 and 5):

Accrued Investment

Management Fees | | Accrued

Administrative Fees | | Accrued Distribution

and Service Fees | | Total | |

| $ | 1,630,587 | | | $ | 203,823 | | | $ | 851,683 | | | $ | 2,686,093 | | |

The Fund has adopted a Retirement Policy ("Policy") covering all independent trustees of the Fund who will have served as an independent trustee for at least five years at the time of retirement. Benefits under this Policy are based on an annual rate as defined in the Policy agreement, as amended.

19

ING Senior Income Fund

NOTES TO FINANCIAL STATEMENTS as of August 31, 2007 (Unaudited) (continued)

NOTE 10 — CUSTODIAL AGREEMENT

State Street Bank and Trust Company ("SSB") serves as the Fund's custodian and recordkeeper. Custody fees paid to SSB may be reduced by earnings credits based on the cash balances held by SSB for the Fund.

There were no earnings credits for the six months ended August 31, 2007.

NOTE 11 — SUBORDINATED LOANS AND UNSECURED LOANS

The primary risk arising from investing in subordinated loans or in unsecured loans is the potential loss in the event of default by the issuer of the loans. The Fund may invest up to 10% of its total assets, measured at the time of investment, in subordinated loans and up to 10% of its total assets, measured at the time of investment, in unsecured loans. As of August 31, 2007, the Fund held 0.2% of its total assets in subordinated loans and unsecured loans.

NOTE 12 — CAPITAL SHARES

Transactions in capital shares and dollars were as follows:

| | | Class A Shares | | Class B Shares | |

| | | Six Months

Ended

August 31,

2007 | | Year

Ended

February 28,

2007 | | Six Months

Ended

August 31,

2007 | | Year

Ended

February 28,

2007 | |

| Number of Shares | |

| Shares sold | | | 12,341,640 | | | | 32,168,921 | | | | 212,437 | | | | 887,201 | | |

| Dividends reinvested | | | 1,504,669 | | | | 2,946,341 | | | | 151,678 | | | | 312,109 | | |

| Shares redeemed | | | (15,295,853 | ) | | | (30,022,776 | ) | | | (825,035 | ) | | | (1,746,090 | ) | |

| Net increase (decrease) in shares outstanding | | | (1,449,544 | ) | | | 5,092,486 | | | | (460,920 | ) | | | (546,780 | ) | |

| Dollar Amount ($) | |

| Shares sold | | $ | 190,630,809 | | | $ | 498,004,945 | | | $ | 3,276,609 | | | $ | 13,712,848 | | |

| Dividends reinvested | | | 22,997,526 | | | | 44,687,774 | | | | 2,313,657 | | | | 4,755,391 | | |

| Shares redeemed | | | (234,128,941 | ) | | | (464,618,771 | ) | | | (12,647,073 | ) | | | (26,983,867 | ) | |

| Net increase (decrease) | | $ | (20,500,606 | ) | | $ | 78,073,948 | | | $ | (7,056,807 | ) | | $ | (8,515,628 | ) | |

| | | Class C Shares | | Class Q Shares | |

| | | Six Months

Ended

August 31,

2007 | | Year

Ended

February 28,

2007 | | Six Months

Ended

August 31,

2007 | | Year

Ended

February 28,

2007 | |

| Number of Shares | |

| Shares sold | | | 7,979,404 | | | | 19,971,910 | | | | 1,190,862 | | | | 6,177,228 | | |

| Dividends reinvested | | | 1,352,520 | | | | 2,633,036 | | | | 101,682 | | | | 145,573 | | |

| Shares redeemed | | | (10,330,137 | ) | | | (22,327,696 | ) | | | (2,873,875 | ) | | | (9,479,659 | ) | |

| Net increase (decrease) in shares outstanding | | | (998,213 | ) | | | 277,250 | | | | (1,581,331 | ) | | | (3,156,858 | ) | |

| Dollar Amount ($) | |

| Shares sold | | $ | 123,116,875 | | | $ | 308,955,952 | | | $ | 18,283,766 | | | $ | 95,128,042 | | |

| Dividends reinvested | | | 20,652,511 | | | | 39,969,119 | | | | 1,548,549 | | | | 2,242,825 | | |

| Shares redeemed | | | (157,980,804 | ) | | | (345,190,055 | ) | | | (43,402,028 | ) | | | (146,017,756 | ) | |

| Net increase (decrease) | | $ | (14,211,418 | ) | | $ | 3,735,016 | | | $ | (23,569,713 | ) | | $ | (48,646,889 | ) | |

NOTE 13 — FEDERAL INCOME TAXES

The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles for investment companies. These book/tax differences may be either temporary or permanent. Permanent differences are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences are not reclassified. Key differences include the treatment of short-term capital gains, foreign currency transactions, and wash sale deferrals. Distributions in excess of net investment income and/or net realized capital gains for tax purposes are reported as distributions of paid-in capital.

20

ING Senior Income Fund

NOTES TO FINANCIAL STATEMENTS as of August 31, 2007 (Unaudited) (continued)

NOTE 13 — FEDERAL INCOME TAXES (continued)

Dividends paid by the Fund from net investment income and distributions of net realized short-term capital gains are, for federal income tax purposes, taxable as ordinary income to shareholders.

The tax composition of dividends and distributions to shareholders was as follows:

| | Six Months Ended August 31, 2007 | | Year Ended February 28, 2007 | |

| | Ordinary Income | | Ordinary Income | |

| | $ | 70,731,389 | | | $ | 138,474,557 | | |

The tax-basis components of distributable earnings and the expiration dates of the capital loss carryforwards which may be used to offset future realized capital gains for federal income tax purposes as of February 28, 2007 were:

Unrealized

Appreciation/

Depreciation | | Post-October

Currency

Losses

Deferred | | Capital Loss

Carryforwards | | Expiration

Dates | |

| $ | 32,328,406 | | | $ | (2,222,078 | ) | | $ | (2,774,928 | ) | | | 2014 | | |

| | | | | | (823,036 | ) | | | 2015 | | |

| | | | | $ | (3,597,964 | ) | | | |

NOTE 14 — OTHER ACCOUNTING PRONOUNCEMENTS

In June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation No. 48 ("FIN 48"), "Accounting for Uncertainty in Income Taxes." This standard defines the threshold for recognizing the benefits of tax-return positions in the financial statements as "more-likely-than-not" to be sustained upon challenge by the taxing authority and requires measurement of a tax position meeting the more-likely-than-not criterion, based on the largest benefit that is more than 50 percent likely to be realized. FIN 48 was effective for fiscal years beginning after December 15, 2006, with early application permitted if no interim financial statements have been issued. However, acknowledging the unique issues that FIN 48 presents for investment companies that calculate NAVs, the U.S. Securities and Exchange Commission (the "SEC") has indicated that they would not object if a fund implements FIN 48 in its NAV calculation as late as its las t NAV calculation in the first required financial statement reporting period for its fiscal year beginning after December 15, 2006. For the February year-end closed-end funds, the August 31, 2007 NAV and this semi-annual report are required to reflect the effects of FIN 48. At adoption, companies must adjust their financial statements to reflect only those tax positions that are more likely-than-not to be sustained as of the adoption date. Management of the Fund has analyzed the tax positions of the Fund. Upon adoption of FIN 48, we identified no uncertain tax positions that have not met the more likely-than-not standard.

On September 15, 2006, the FASB issued Statement of Financial Accounting Standards No. 157 ("SFAS No. 157"), "Fair Value Measurements." The new accounting statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles ("GAAP"), and expands disclosures about fair value measurements. SFAS No. 157 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). SFAS No. 157 also stipulates that, as a market-based measurement, fair value measurement should be determined based on the assumptions that market participants would use in pricing the asset or liability, and establishes a fair value hierarchy that distinguishes between (a) market participant assumptions developed based on market data obtained from sources independent of the reporting entity (obse rvable inputs) and (b) the reporting entity's own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). SFAS No. 157 is effective for financial statements issued for fiscal years beginning after

21

ING Senior Income Fund

NOTES TO FINANCIAL STATEMENTS as of August 31, 2007 (Unaudited) (continued)

NOTE 14 — OTHER ACCOUNTING PRONOUNCEMENTS (continued)

November 15, 2007. As of August 31, 2007, management of the Fund is currently assessing the impact, if any, that will result from adopting SFAS No. 157.

NOTE 15 — INFORMATION REGARDING TRADING OF ING'S US MUTUAL FUNDS

As discussed in earlier supplements, ING Investments, LLC ("Investments"), the adviser to the ING Funds, has reported to the Boards of Directors/Trustees (the "Boards") of the ING Funds that, like many U.S. financial services companies, Investments and certain of its U.S. affiliates have received informal and formal requests for information since September 2003 from various governmental and self-regulatory agencies in connection with investigations related to mutual funds and variable insurance products. Investments has advised the Boards that it and its affiliates have cooperated fully with each request.

In addition to responding to regulatory and governmental requests, Investments reported that management of U.S. affiliates of ING Groep N.V., including Investments (collectively, "ING"), on their own initiative, have conducted, through independent special counsel and a national accounting firm, an extensive internal review of trading in ING insurance, retirement, and mutual fund products. The goal of this review was to identify any instances of inappropriate trading in those products by third parties or by ING investment professionals and other ING personnel. ING's internal review related to mutual fund trading is now substantially completed. ING has reported that, of the millions of customer relationships that ING maintains, the internal review identified several isolated arrangements allowing third parties to engage in frequent trading of mutual funds within ING's variable insurance and mutual fund products, and identified other circumstan ces where frequent trading occurred, despite measures taken by ING intended to combat market timing. ING further reported that each of these arrangements has been terminated and fully disclosed to regulators. The results of the internal review were also reported to the independent members of the Boards.

Investments has advised the Boards that most of the identified arrangements were initiated prior to ING's acquisition of the businesses in question in the U.S. Investments further reported that the companies in question did not receive special benefits in return for any of these arrangements, which have all been terminated.

Based on the internal review, Investments has advised the Boards that the identified arrangements do not represent a systemic problem in any of the companies that were involved.

Despite the extensive internal review conducted through independent special counsel and a national accounting firm, there can be no assurance that the instances of inappropriate trading reported to the Boards are the only instances of such trading respecting the ING Funds.

Investments reported to the Boards that ING is committed to conducting its business with the highest standards of ethical conduct with zero tolerance for noncompliance. Accordingly, Investments advised the Boards that ING management was disappointed that its voluntary internal review identified these situations. Viewed in the context of the breadth and magnitude of its U.S. business as a whole, ING management does not believe that ING's acquired companies had systemic ethical or compliance issues in these areas. Nonetheless, Investments reported that given ING's refusal to tolerate any lapses, it has taken the steps noted below, and will continue to seek opportunities to further strengthen the internal controls of its affiliates.

• ING has agreed with the ING Funds to indemnify and hold harmless the ING Funds from all damages resulting from wrongful conduct by ING or its employees or from ING's internal investigation, any investigations conducted by any governmental or self-regulatory

22

ING Senior Income Fund